| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

T. Rowe Price International Funds, Inc.

|

|

| Prospectus Date |

rr_ProspectusDate |

May 01, 2020

|

|

| T. Rowe Price Dynamic Global Bond Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

T. ROWE PRICE Dynamic Global Bond Fund Investor Class I Class Advisor Class Z Class SUMMARY

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective(s)

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The fund seeks high current income.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the fund. You may also incur brokerage commissions and other charges when buying or selling shares of the Investor Class or I Class which are not reflected in the table.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Fees and Expenses of the Fund Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 188.3% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

188.30%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that the fund’s operating expenses remain the same. The example also assumes that any current expense limitation arrangement remains in place for the period noted in the table above; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Investments, Risks, and Performance Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in bonds, and seeks to offer some protection against rising interest rates and provide a low correlation with the equity markets. For purposes of determining whether the fund invests at least 80% of its net assets in bonds, fund includes derivative instruments that are linked to, or provide investment exposure to, bonds. The fund may invest in a variety of debt securities, including obligations issued by U.S. and foreign governments and their agencies, bonds issued by U.S. and foreign corporations, and mortgage- and asset-backed securities, as well as bank loans, which represent amounts borrowed by companies from banks and other lenders. The fund normally invests at least 40% of its net assets in foreign securities, including securities of emerging market issuers, which may be denominated in U.S. dollars or non-U.S. dollar currencies. For purposes of determining whether a fund holding is a foreign security, the fund uses the country assigned to a security by Bloomberg or another third-party data provider. There is no limit on the fund’s investments in securities issued by foreign issuers, although the fund’s overall net exposure to non-U.S. currencies through direct holdings and derivatives is normally limited to 50% of its net assets.

The fund focuses mainly on holdings that are rated investment grade (AAA, AA, A, BBB, or an equivalent rating) by established credit rating agencies or, if unrated, deemed to be investment grade by T. Rowe Price. However, the fund may invest up to 30% of its net assets in high yield bonds, also known as junk bonds, and other holdings (such as bank loans) that are rated below investment grade (BB and lower, or an equivalent rating) by established credit rating agencies or, if unrated, deemed to be below investment grade by T. Rowe Price. If a security is split-rated (i.e., rated investment grade by at least one rating agency and below investment grade by another rating agency) at the time of purchase, the higher rating will be used for purposes of this limit.

When deciding whether to adjust duration (which measures the fund’s price sensitivity to interest rate changes) or allocations among the various sectors and asset classes (such as high yield corporate bonds, mortgage- and asset-backed securities, international bonds and emerging market bonds, and bank loans), the portfolio manager weighs such factors as expected interest rate movements and currency valuations, the outlook for inflation and the economy, and the yield advantage that lower rated bonds may offer over investment-grade bonds. The fund may invest in holdings of any maturity and does not attempt to maintain any particular weighted average maturity. The maturities of the fund’s holdings generally reflect the portfolio manager’s outlook for interest rates.

The fund’s investment approach allows the flexibility to invest across the global fixed income universe without constraints to particular benchmarks or asset classes in an effort to create a portfolio with low overall volatility and consistent income even in a rising interest rate environment. Although the fund has broad discretion in seeking fixed income investments that offer some downside risk protection and lower volatility, it is expected that the fund will normally maintain a relatively concentrated portfolio. As a result, the fund is “nondiversified,” meaning it may invest a greater portion of its assets in fewer issuers than is permissible for a “diversified” fund.

While most assets are typically invested in bonds and other debt instruments, the fund also uses interest rate futures, interest rate swaps, forward currency exchange contracts, and credit default swaps in keeping with the fund’s objective. Interest rate futures and interest rate swaps are primarily used to manage the fund’s exposure to interest rate changes and limit overall volatility by adjusting the portfolio’s duration and extending or shortening the overall maturity of the fund. Forward currency exchange contracts are used to limit overall volatility by protecting the fund’s non-U.S. dollar-denominated holdings from adverse currency movements relative to the U.S. dollar. However, such instruments may also be used to reduce volatility or generate returns by gaining long or short exposure to certain currencies expected to increase or decrease in value relative to other currencies. The fund may take a short position in a currency, which means that the fund could sell a currency in excess of its assets denominated in that currency (or the fund might sell a currency even if it doesn’t own any assets denominated in the currency). The fund may buy or sell credit default swaps involving a specific issuer or an index in order to adjust the fund’s overall credit quality, as well as to protect the value of certain portfolio holdings.

The fund may sell holdings for a variety of reasons, such as to alter geographic or currency exposure, to adjust the portfolio’s average maturity, duration, or overall credit quality, or to shift assets into and out of higher- or lower-yielding securities.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

As with any fund, there is no guarantee that the fund will achieve its objective(s). The fund’s share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund, which may be even greater during periods of market disruption or volatility, are summarized as follows:

Market conditions The value of the fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the fund, particular industries, or the overall securities markets. A variety of factors can increase the volatility of the fund’s holdings and markets generally, including political or regulatory developments, recessions, inflation, rapid interest rate changes, war or acts of terrorism, natural disasters, and outbreaks of infectious illnesses or other widespread public health issues. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others. These adverse developments may cause broad declines in market value due to short-term market movements or for significantly longer periods during more prolonged market downturns.

International investing Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, investments outside the U.S. are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S. The risks of investing outside the U.S. are heightened for any investments in emerging markets, which are susceptible to greater volatility than investments in developed markets.

Emerging markets Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and developed markets. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to the risks associated with investing outside the U.S., emerging markets are more susceptible to governmental interference, political and economic uncertainty, local taxes and restrictions on the fund’s investments, less efficient trading markets with lower overall liquidity, and more volatile currency exchange rates.

Fixed income markets Economic and other market developments can adversely affect the fixed income securities markets. At times, participants in these markets may develop concerns about the ability of certain issuers of debt instruments to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt instruments to facilitate an orderly market. Those concerns could cause increased volatility and reduced liquidity in particular securities or in the overall fixed income markets and the related derivatives markets. A lack of liquidity or other adverse credit market conditions may hamper the fund’s ability to sell the debt instruments in which it invests or to find and purchase suitable debt instruments.

Derivatives The use of forward currency exchange contracts, interest rate futures, interest rate swaps, and credit default swaps exposes the fund to additional volatility in comparison to investing directly in bonds and other debt instruments. These instruments can be illiquid and difficult to value, may involve leverage so that small changes produce disproportionate losses for the fund and, if not traded on an exchange, are subject to the risk that a counterparty to the transaction will fail to meet its obligations under the derivatives contract. The fund’s principal use of derivatives involves the risk that anticipated interest rate movements, expected changes in currency values and currency exchange rates, or the creditworthiness of an issuer will not be accurately predicted, which could significantly harm the fund’s performance and impair the fund’s efforts to reduce its overall volatility.

Currency exposure Because the fund invests in securities issued in foreign currencies, the fund is subject to the risk that it could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar.

Hedging The fund’s attempts at hedging and taking long and short positions in currencies may not be successful and could cause the fund to lose money or fail to get the benefit of a gain on a hedged position. If expected changes to securities prices, interest rates, currency values and exchange rates, or the creditworthiness of an issuer are not accurately predicted, the fund could be in a worse position than if it had not entered into such transactions.

Interest rates The prices of, and the income generated by, debt instruments held by the fund may be affected by changes in interest rates. A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. Generally, funds with longer weighted average maturities and durations carry greater interest rate risk.

Prepayments and extensions The fund is subject to prepayment risks because the principal on mortgage-backed securities, other asset-backed securities, or any debt instrument with an embedded call option may be prepaid at any time, which could reduce the security’s yield and market value. The rate of prepayments tends to increase as interest rates fall, which could cause the average maturity of the portfolio to shorten. Extension risk may result from a rise in interest rates, which tends to make mortgage-backed securities, asset-backed securities, and other callable debt instruments more volatile.

Bank loans Investments in bank loans expose the fund to additional risks beyond those normally associated with more traditional debt instruments. The fund’s ability to receive payments in connection with the loan depends primarily on the financial condition of the borrower and whether or not a loan is secured by collateral, although there is no assurance that the collateral securing a loan will be sufficient to satisfy the loan obligation. In addition, bank loans often have contractual restrictions on resale, which can delay the sale and adversely impact the sale price. Transactions involving bank loans may have significantly longer settlement periods than more traditional investments (settlement can take longer than 7 days) and often involve borrowers whose financial condition is troubled or highly leveraged, which increases the risk that the fund may not receive its proceeds in a timely manner or that the fund may incur losses in order to pay redemption proceeds to its shareholders. In addition, loans are not registered under the federal securities laws like stocks and bonds, so investors in loans have less protection against improper practices than investors in registered securities.

Junk investing Investments in bonds that are rated below investment grade, commonly referred to as junk bonds, and loans that are rated below investment grade, expose the fund to greater volatility and credit risk than investments in securities that are rated investment-grade. Issuers of junk bonds and loans are usually not as strong financially and are more likely to suffer an adverse change in financial condition that would result in the inability to meet a financial obligation. As a result, bonds and loans rated below investment grade carry a higher risk of default and should be considered speculative.

Credit quality An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation. Securities that are rated below investment grade carry greater risk of default and should be considered speculative.

Liquidity The fund may not be able to meet requests to redeem shares issued by the fund without significant dilution of the remaining shareholders’ interest in the fund. In addition, the fund may not be able to sell a holding in a timely manner at a desired price. Reduced liquidity in the bond markets can result from a number of events, such as limited trading activity, reductions in bond inventory, and rapid or unexpected changes in interest rates. Markets with lower overall liquidity could lead to greater price volatility and limit the fund’s ability to sell a holding at a suitable price.

Nondiversification As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a similar fund that is more broadly diversified.

Portfolio turnover High portfolio turnover may adversely affect the fund’s performance and increase transaction costs, which could increase the fund’s expenses. High portfolio turnover may also result in the distribution of higher capital gains when compared to a fund with less active trading policies, which could have an adverse tax impact if the fund’s shares are held in a taxable account.

Active management The fund’s overall investment program and holdings selected by the fund’s investment adviser may underperform the broad markets, relevant indices, or other funds with similar objectives and investment strategies.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

The fund’s share price fluctuates, which means you could lose money by investing in the fund.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Nondiversification As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a similar fund that is more broadly diversified.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following performance information provides some indication of the risks of investing in the fund. The fund’s performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

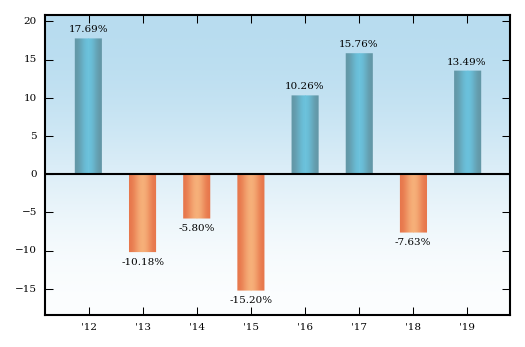

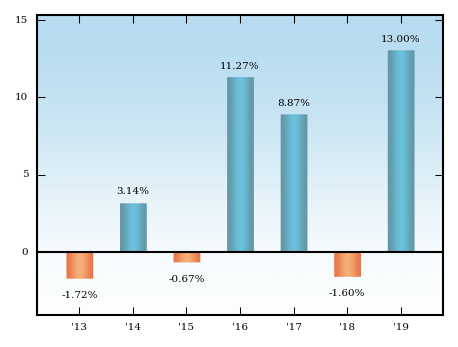

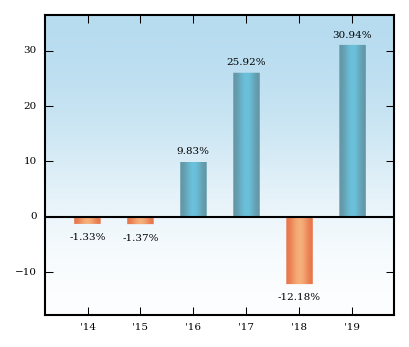

The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following performance information provides some indication of the risks of investing in the fund. The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have different expenses. The following table shows the average annual total returns for each class of the fund that has been in operation for at least one full calendar year, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

troweprice.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The fund’s performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

DYNAMIC GLOBAL BOND FUND Calendar Year Returns

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | Quarter Ended | Total Return | | Quarter Ended | Total Return | | Best Quarter | 12/31/19 | 1.69% | Worst Quarter | 9/30/19 | -2.39% |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns Periods ended December 31, 2019

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

The following table shows the average annual total returns for each class of the fund that has been in operation for at least one full calendar year, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

In addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

Updated performance information is available through troweprice.com.

|

|

| T. Rowe Price Dynamic Global Bond Fund | Investor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum account fee |

rr_MaximumAccountFee |

$ 20

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.49%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.65%

|

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

|

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

0.65%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 66

|

|

| 3 years |

rr_ExpenseExampleYear03 |

208

|

|

| 5 years |

rr_ExpenseExampleYear05 |

362

|

|

| 10 years |

rr_ExpenseExampleYear10 |

$ 810

|

|

| 2016 |

rr_AnnualReturn2016 |

4.62%

|

|

| 2017 |

rr_AnnualReturn2017 |

(1.90%)

|

|

| 2018 |

rr_AnnualReturn2018 |

0.87%

|

|

| 2019 |

rr_AnnualReturn2019 |

(0.40%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Dec. 31, 2019

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

1.69%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2019

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(2.39%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.40%)

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.43%

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | I Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum account fee |

rr_MaximumAccountFee |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.49%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.02%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.51%

|

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

|

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

0.51%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 52

|

|

| 3 years |

rr_ExpenseExampleYear03 |

164

|

|

| 5 years |

rr_ExpenseExampleYear05 |

285

|

|

| 10 years |

rr_ExpenseExampleYear10 |

$ 640

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.26%)

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.05%

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Aug. 28, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | Advisor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum account fee |

rr_MaximumAccountFee |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.49%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.47%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.21%

|

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.31%)

|

[2] |

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

0.90%

|

[2] |

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

April 30, 2021

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 92

|

|

| 3 years |

rr_ExpenseExampleYear03 |

353

|

|

| 5 years |

rr_ExpenseExampleYear05 |

635

|

|

| 10 years |

rr_ExpenseExampleYear10 |

$ 1,438

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.66%)

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.18%

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | Z Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum account fee |

rr_MaximumAccountFee |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.49%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.02%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.51%

|

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.51%)

|

[3] |

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

none

|

[3] |

| 1 year |

rr_ExpenseExampleYear01 |

none

|

|

| 3 years |

rr_ExpenseExampleYear03 |

none

|

|

| 5 years |

rr_ExpenseExampleYear05 |

none

|

|

| 10 years |

rr_ExpenseExampleYear10 |

none

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Mar. 16, 2020

|

|

| T. Rowe Price Dynamic Global Bond Fund | Returns after taxes on distributions | Investor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.58%)

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

0.33%

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | Returns after taxes on distributions and sale of fund shares | Investor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.19%)

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

0.63%

|

|

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | 3 Month LIBOR in USD (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

2.36%

|

|

| T. Rowe Price Dynamic Global Bond Fund | 3 Month LIBOR in USD (reflects no deduction for fees, expenses, or taxes) | Investor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.42%

|

[4] |

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | 3 Month LIBOR in USD (reflects no deduction for fees, expenses, or taxes) | I Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.58%

|

[5] |

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Aug. 28, 2015

|

|

| T. Rowe Price Dynamic Global Bond Fund | 3 Month LIBOR in USD (reflects no deduction for fees, expenses, or taxes) | Advisor Class |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Since inception |

rr_AverageAnnualReturnSinceInception |

1.42%

|

[4] |

| Inception date |

rr_AverageAnnualReturnInceptionDate |

Jan. 22, 2015

|

|

|

|