UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 /X/

Pre-Effective Amendment No. //

Post-Effective Amendment No. //

(Check appropriate box or boxes)

T. ROWE PRICE INTERNATIONAL FUNDS, INC.

Exact Name of Registrant as Specified in Charter

100

East Pratt Street, Baltimore, Maryland 21202

Address of Principal Executive Offices

410-345-2000

Registrant’s

Telephone Number, Including Area Code

David Oestreicher

100 East Pratt Street, Baltimore, Maryland

21202

Name and Address of Agent for Service

Approximate Date of Proposed Public Offering As soon as practicable after this registration statement becomes effective under the Securities Act of 1933

Calculation of Registration Fee under the Securities Act of 1933:

Title of Securities Being Registered: Shares of common stock (par value $1.00 per share) of the Registrant

Amount Being Registered:

Proposed Maximum Offering Price per Unit:

Proposed Maximum Aggregate Offering Price:

Amount of Registration Fee:

It is proposed that this filing will become effective on August 31, 2018 pursuant to Rule 488.

The Registrant has registered an indefinite amount of securities pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended; accordingly, no filing fee is payable herewith in reliance upon Section 24(f).

Proxy Statement

This proxy statement concerns the:

T. Rowe Price Institutional International Bond Fund

September 13, 2018

Dear Shareholder:

We cordially invite you to attend a special meeting of shareholders of the T. Rowe Price Institutional International Bond Fund (the “Institutional Fund”) on Tuesday, October 23, 2018. The purpose of the meeting is to vote on a proposed transaction pursuant to which the Institutional Fund will be merged into the T. Rowe Price International Bond Fund (the “International Bond Fund” and together with the Institutional Fund, the “Funds”). The transaction was approved and recommended by the Institutional Fund’s Board of Directors. Under the proposed reorganization of the Institutional Fund into the International Bond Fund, you would become a shareholder of the I Class of the T. Rowe Price International Bond Fund (the “I Class”). The value of your account in the International Bond Fund will be the same as it was in the Institutional Fund on the date of the merger. The reasons the Board of Directors of the Institutional Fund approved this transaction are briefly summarized below. The accompanying combined proxy statement and prospectus contains detailed information on the transaction and comparisons of the Funds. We ask you to read the enclosed information carefully and to submit your vote.

The Funds have identical investment objectives and substantially similar investment programs. The primary difference between the Funds is that the International Bond Fund is offered in multiple share classes, including an Investor Class, I Class, and Advisor Class, each of which is available to a variety of investors and has a different investment minimum. The Institutional Fund is generally only available to institutional investors and requires an initial investment of $1,000,000, which is the same as the I Class’ investment minimum. The net expense ratio of the I Class, 0.54% as of June 30, 2018 (which includes the effect of an expense limitation agreement currently in place), is slightly lower than the Institutional Fund’s net expense ratio of 0.55% as of June 30, 2018. The I Class was launched on August 28, 2015 as a separate, lower cost share class of the International Bond Fund available to institutional and individual investors who meet the investment minimum. Since the International Bond Fund invests in a substantially similar portfolio to the Institutional Fund and has a slightly lower net expense ratio than the I Class of the International Bond Fund, it is no longer a financial benefit to a

high balance shareholder to choose the Institutional Fund over the I Class of the International Bond Fund. Accordingly, it no longer makes sense to offer the Institutional Fund.

If the transaction is approved at the shareholder meeting, your shares of the Institutional Fund will automatically be converted, on or around November 16, 2018, for I Class shares of equal value. Please note that the reorganization is not a taxable event, but redeeming or exchanging your shares prior to the reorganization may be a taxable event depending on your individual tax situation. The cost basis and holding periods of Institutional Fund shares will carry over to the I Class shares that you will receive in connection with the transaction.

We realize that it may be difficult for you to attend the meeting and vote your shares in person. However, we do need your vote. You can vote by mail, by telephone, or by Internet, as explained in the enclosed materials. By voting promptly, you can help the Funds avoid the expense of additional mailings.

If you have questions, please call one of our service representatives at 1-800-638-8790. Your participation in this vote is extremely important.

Sincerely,

Edward A. Wiese

Director and Head of T. Rowe Price Fixed Income

T. Rowe Price Institutional International Bond Fund

(a series of T. Rowe Price Institutional International Funds, Inc.)

Notice of Special Meeting of Shareholders

T. Rowe Price Funds

100 East Pratt Street

Baltimore,

Maryland 21202

Darrell N. Braman

Secretary

September 13, 2018

Notice is hereby given that a special meeting of shareholders (the “Shareholder Meeting”) of the T. Rowe Price Institutional International Bond Fund (the “Institutional Fund”), a series of T. Rowe Price Institutional International Funds, Inc., will be held on Tuesday, October 23, 2018, at 8:00 a.m., Eastern time, at the headquarters of T. Rowe Price at 100 East Pratt Street, Baltimore, Maryland 21202. The following matters will be considered and acted upon at that time:

1. A proposal to approve an Agreement and Plan of Reorganization (“Plan”) relating to the proposed reorganization of the Institutional Fund into the T. Rowe Price International Bond Fund (the “International Bond Fund”). The Plan provides for the transfer of substantially all of the assets and liabilities of the Institutional Fund to the International Bond Fund in exchange for I Class shares of the International Bond Fund, and the distribution of the I Class shares of the International Bond Fund to the shareholders of the Institutional Fund in liquidation of the Institutional Fund; and

2. Such other business as may properly come before the meeting and any adjournments thereof.

Only shareholders of record at the close of business on July 31, 2018 are entitled to notice of, and to vote at, this Shareholder Meeting or any adjournment thereof. The Board of Directors of the Institutional Fund recommends that you vote in favor of the proposal.

Darrell N. Braman

YOUR VOTE IS IMPORTANT |

Shareholders are urged to designate their choice on the matters to be acted upon by using one of the following three methods: 1. Vote online.* · Read the combined proxy statement and prospectus. · Go to the Internet voting site found on your proxy card. · Enter the control number found on your proxy card. · Follow the instructions using your proxy card as a guide. 2. Vote by telephone.* · Read the combined proxy statement and prospectus. · Call the toll-free number found on your proxy card. · Enter the control number found on your proxy card. · Follow the recorded instructions using your proxy card as a guide. 3. Vote by mail. · Date, sign, and return the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. *If you vote online or by telephone, your vote must be received no later than 7:59 a.m. on October 23, 2018. If you vote by mail, your vote must be received at the address referenced on the proxy card on or before October 22, 2018. Your prompt response will help to achieve a quorum at the Shareholder Meeting and avoid the potential for additional expenses to the Institutional Fund and its shareholders of further solicitation. |

PAGE 2

Acquisition of the Assets of the

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL BOND FUND

(a series of T. Rowe Price Institutional International Funds, Inc.)

By and in Exchange for Shares of the

T. ROWE PRICE INTERNATIONAL BOND FUND

(a series of T. Rowe Price International Funds, Inc.)

100 East Pratt Street

Baltimore, MD 21202

Special Meeting of Shareholders—October 23, 2018

COMBINED PROXY STATEMENT AND PROSPECTUS

September 13, 2018

This Combined Proxy Statement and Prospectus (“Statement”) was first delivered to shareholders on or about September 13, 2018.

This Statement is being furnished to shareholders of the T. Rowe Price Institutional International Bond Fund (the “Institutional Fund”), a series of T. Rowe Price Institutional International Funds, Inc., for use at a special meeting of shareholders of the Institutional Fund to be held on Tuesday, October 23, 2018. At the meeting, shareholders of the Institutional Fund will be asked to approve an Agreement and Plan of Reorganization (the “Plan”) relating to the proposed reorganization (the “Reorganization”) of the Institutional Fund into the T. Rowe Price International Bond Fund (the “International Bond Fund”).

The Plan provides for the transfer of substantially all of the assets and liabilities of the Institutional Fund to the International Bond Fund (each, a “Fund” and together, the “Funds”), in exchange for I Class shares of the International Bond Fund (the “I Class” or the “International Bond Fund—I Class”). Following the transfer, the I Class shares received in the exchange

PAGE 3

will be distributed to Institutional Fund shareholders in complete liquidation of the Institutional Fund. Shareholders of the Institutional Fund will receive I Class shares having an aggregate net asset value equal to the aggregate net asset value of their Institutional Fund shares on the business day immediately preceding the closing date of the Reorganization.

If the transaction is approved by shareholders, you will become a shareholder in the International Bond Fund and the value of the share balance in your account will be the same as it was in the Institutional Fund on the business day preceding the day of the Reorganization.

The Funds have identical investment objectives and substantially similar investment programs, although two of the Funds’ investment restrictions are slightly different. See “Comparison of Investment Objectives, Policies and Restrictions.”

This Statement concisely sets forth the information you should know about the International Bond Fund and its classes and the Plan. Please read this Statement and keep it for future reference. It is both a proxy statement for the Institutional Fund and a prospectus for the International Bond Fund.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Statement by reference:

· The Statement of Additional Information dated September 13, 2018 relating to the Reorganization (“SAI”)

· The prospectus of the International Bond Fund dated May 1, 2018, as supplemented to date

· The prospectus of the Institutional Fund dated May 1, 2018, as supplemented to date

· The Statement of Additional Information of the International Bond Fund dated August 1, 2018

· The Statement of Additional Information of the Institutional Fund dated August 1, 2018

· The annual shareholder report of the International Bond Fund dated December 31, 2017

· [The semiannual shareholder report of the International Bond Fund dated June 30, 2018]

· The annual shareholder report of the Institutional Fund dated December 31, 2017

· [The semiannual shareholder report of the Institutional Fund dated June 30, 2018]

PAGE 4

The prospectuses include investment objectives, risks, fees, expenses, and other information that you should read and consider carefully. Each Statement of Additional Information, which contains additional detailed information about the relevant Fund, is not a prospectus but should be read in conjunction with the prospectus.

A copy of the International Bond Fund’s prospectus accompanies this Statement. The shareholder reports contain information about Fund investments, including a review of market conditions and the portfolio manager’s recent investment strategies and their impact on performance. Copies of the prospectus, annual and semiannual shareholder reports, Statements of Additional Information for both the International Bond Fund and Institutional Fund and the SAI are all available at no cost by calling 1-800-541-5910; by writing to T. Rowe Price, Three Financial Center, 4515 Painters Mill Road, Owings Mills, Maryland 21117; or by visiting our website at troweprice.com. All of the above-referenced documents are also on file with the SEC and available through its website at http://www.sec.gov. Copies of this information may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov, or by writing the Public Reference Room, Washington D.C. 20549-1520.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED PROXY STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

PAGE 5

TABLE OF CONTENTS

Summary | 7 |

Reasons for the Reorganization | 16 |

Information About the Reorganization | 18 |

Financial Statements | 24 |

Comparison of Investment Objectives, Policies, and Restrictions | 27 |

Additional Information About the Funds | 31 |

Further Information About Voting and the Special Meeting | 35 |

Legal Matters | 40 |

Exhibit A – Form of Agreement and Plan of Reorganization | 40 |

No person has been authorized to give any information or to make any representations other than what is in this Statement or in the materials expressly incorporated herein by reference. Any such other information or representation should not be relied upon as having been authorized by the Institutional Fund or International Bond Fund.

PAGE 6

SUMMARY

The information contained in this summary is qualified by reference to the more detailed information appearing elsewhere in this Statement, and in the Plan, a form of which is included as Exhibit A to this Statement.

What are shareholders being asked to vote on?

At a meeting held on July 24, 2018, the Boards of Directors of the Funds (the “Boards”), including a majority of the independent directors, approved the proposed reorganization of the Institutional Fund into the International Bond Fund and the submission of the Plan to shareholders. The Plan provides for the transfer of substantially all the assets and liabilities of the Institutional Fund to the International Bond Fund in exchange for I Class shares of the International Bond Fund. Following the transfer, the I Class shares received in the exchange will be distributed to shareholders of the Institutional Fund in complete liquidation of the Institutional Fund. As a result of the transaction: (1) you will cease being a shareholder of the Institutional Fund; (2) instead you will become an owner of I Class shares of the International Bond Fund; and (3) the value of your account in the International Bond Fund will equal the value of your account in the Institutional Fund as of the close of the business day immediately preceding the closing date of the transaction.

What vote is required to approve the Plan?

Approval of the Plan requires an affirmative vote of the lesser of: (a) 67% or more of the Institutional Fund’s shares represented at the meeting if the holders of more than 50% of the outstanding shares are present in person or by proxy; or (b) more than 50% of the Institutional Fund’s outstanding shares. The Board recommends that shareholders of the Institutional Fund vote FOR the proposal.

Will there be any tax consequences to the Institutional Fund or its shareholders?

The Reorganization will be structured to have no adverse tax consequences to the Institutional Fund or its shareholders. The Reorganization is conditioned upon the receipt of an opinion of tax counsel to the Funds that, for federal income tax purposes:

· no gain or loss will be recognized by the Institutional Fund, the International Bond Fund, or their shareholders as a result of the Reorganization;

· the holding period and adjusted basis of the I Class shares received by a shareholder will have the same holding period and adjusted basis of the shareholder’s shares of the Institutional Fund; and

PAGE 7

· the International Bond Fund will assume the holding period and adjusted basis of each asset (with certain exceptions) of the Institutional Fund that is transferred to the International Bond Fund that the asset had immediately prior to the Reorganization. See “Information About the Reorganization—Tax Considerations” for more information.

It should be noted, however, that the Institutional Fund is expected to close out any derivatives positions and sell any assets prior to the Reorganization that are deemed not acceptable to the International Bond Fund or inconsistent with the International Bond Fund’s investment program. It is anticipated that the Institutional Fund will distribute substantially all of its taxable income as a dividend to shareholders prior to the Reorganization. In addition, because the Institutional Fund may have net realized gains at the time of the Reorganization, it is anticipated that the Institutional Fund will also distribute capital gains to shareholders prior to the Reorganization. The sale of any holdings prior to the Reorganization may cause those capital gains to increase or decrease. In addition, because the International Bond Fund may have realized gains at the end of the year, Institutional Fund shareholders who receive I Class shares in connection with the Reorganization may, as shareholders of the International Bond Fund, receive a second capital gain distribution in December made by the International Bond Fund. In reporting tax information to their shareholders and the Internal Revenue Service (“IRS”), the Funds follow the IRS requirements. See “Information About the Reorganization—Tax Considerations” for more information.

What are the investment objectives and policies of the International Bond Fund and the Institutional Fund?

The investment objectives of the International Bond Fund and the Institutional Fund are identical. Both Funds seek to provide current income and capital appreciation. See “Comparison of Investment Objectives, Policies, and Restrictions.”

The Funds have substantially similar investment programs, although the Funds have slightly different investment restrictions. Both Funds normally invest at least 80% of their net assets (including any borrowings for investment purposes) in foreign bonds and 65% of their net assets in non-U.S. dollar-denominated foreign bonds that are rated investment grade (i.e., BBB- or equivalent, or better), as determined by at least one major credit rating agency or, if unrated, deemed to be of comparable quality by T. Rowe Price (as defined below). Both Funds expect to generally maintain an intermediate- to long-term weighted average maturity, and there are no maturity restrictions on the overall portfolio or on individual securities purchased by the Funds. Both Funds are registered as “non-diversified” funds with the SEC, which

PAGE 8

means that they each may invest a greater portion of their assets in fewer issuers than is permissible for a “diversified” fund.

The Institutional Fund may invest up to 25% of its total assets in “junk” bonds that have received a below investment-grade rating (i.e., BB or equivalent, or lower) from each of the rating agencies that has assigned a rating to the bond (or, if unrated, deemed to be below investment-grade quality by T. Rowe Price) while the International Bond Fund may invest up to 20% of its total assets in junk bonds. The Institutional Fund can invest without limit in U.S.-dollar denominated bonds while the International Bond Fund can invest up to 20% of its total assets in U.S.-dollar denominated bonds.

The post-Reorganization International Bond Fund (the “Combined Fund”) will continue to follow the current International Bond Fund investment program.

What are the Funds’ management arrangements?

Both the Institutional Fund and the International Bond Fund are advised and managed by T. Rowe Price Associates, Inc. (“T. Rowe Price”), 100 East Pratt Street, Baltimore, Maryland 21202. As of June 30, 2018, T. Rowe Price and its affiliates had approximately $1.04 trillion in assets under management and provided investment management for more than 7 million individual and institutional investor accounts.

T. Rowe Price has entered into subadvisory agreements with T. Rowe International Ltd (“T. Rowe Price International”) under which T. Rowe Price International is authorized to trade securities and make discretionary investment decisions on behalf of the Funds. Oversight of the portfolio and specific decisions regarding the purchase and sale of fund investments are made by each Fund’s portfolio managers. T. Rowe Price and T. Rowe Price International have established an Investment Advisory Committee with respect to each Fund, whose cochairmen have day-to-day responsibility for managing the portfolio and work with the committee in developing and executing each Fund’s investment program. Both the Institutional Fund and International Bond Fund are currently managed by Arif Husain and Kenneth A. Orchard. Mr. Husain has been a cochairman of the Investment Advisory Committee of each Fund since January 1, 2014, at which point he joined Christopher J. Rothery as cochairman of the Investment Advisory Committee of each Fund. On December 31, 2015, Mr. Orchard replaced Mr. Rothery as cochairman and has been jointly managing the Funds along with Mr. Husain since that time.

Mr. Husain joined T. Rowe Price in 2013 and his investment experience dates from 1995. For the past five years, he has served as a portfolio manager and as head of International Fixed Income. Mr. Orchard joined T. Rowe Price in 2010 and his experience dates from 2004. For the past five years, he has

PAGE 9

served as a portfolio manager and credit research analyst. After the Reorganization, Messrs. Husain and Orchard will continue to serve as cochairmen with respect to the Combined Fund. Each Fund’s Statement of Additional Information provides additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of the Funds’ shares.

Will the Reorganization result in higher fund expenses?

The Reorganization is not expected to result in higher net expenses. Although the gross expense annual operating ratio for the I Class after the Reorganization is expected to be higher than the Institutional Fund’s gross annual operating expense ratio, the net annual fund operating expense ratio for the I Class is expected to be lower than the Institutional Fund’s net annual operating expense ratio due to the I Class’ contractual expense limitation. As explained in more detail below, the Funds’ fees and expenses are structured differently, and the I Class’ net expense ratio includes the effect of a contractual expense limitation pursuant to which T. Rowe Price has agreed to waive the I Class’ operating expenses (through at least April 30, 2020) to the extent the I Class’ operating expenses exceed 0.05% of the class’ average daily net assets.

The Institutional Fund pays T. Rowe Price an annual all-inclusive management fee of 0.55% based on the Fund’s average daily net assets. This all-inclusive management fee includes investment management services and ordinary, recurring operating expenses, but does not cover interest, expenses related to borrowing, taxes, and brokerage and other transaction costs, or nonrecurring extraordinary expenses.

The International Bond Fund pays T. Rowe Price a management fee that consists of two components—an “individual fund fee,” which reflects the Fund’s particular characteristics, and a “group fee.” The group fee, which is designed to reflect the benefits of the shared resources of T. Rowe Price, is calculated daily based on the combined net assets of all T. Rowe Price Funds (except the funds-of-funds, TRP Reserve Funds, Multi-Sector Account Portfolios, and any index or private-label mutual funds). The group fee schedule is graduated, declining as the combined assets of the T. Rowe Price Funds rise, so shareholders benefit from the overall growth in mutual fund assets. On June 30, 2018, the annual group fee rate was 0.29%. The individual fund fee, also applied to the fund’s average daily net assets, is 0.20%. This fee was reduced from 0.35% to 0.20% on August 1, 2017. Based on the group fee rate and individual fund fee rate, the International Bond Fund’s overall management fee as of June 30, 2018 was 0.49%. In addition to the management fee, the I Class pays its pro rata portion of the International Bond Fund’s operating expenses. As noted above, T. Rowe Price has agreed (through April 30, 2020) to pay the operating expenses of the Fund’s I Class

PAGE 10

excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets.

After taking into account the effect of the I Class’ contractual expense limitation, the I Class’ net annual operating expense ratio is expected to be 0.01% lower than the Institutional Fund’s net annual operating expense ratio after the Reorganization (0.54%1 compared to 0.55%, respectively), through at least April 30, 2020. Although the gross operating expense ratio of the I Class, as of June 30, 2018, was 0.58%1, the I Class has frequently operated below its expense limitation in the past. As of December 31, 2017, for example, the I Class had a gross annual operating expense ratio of 0.53%1, which is below its expense cap.

Fees and Expenses

The following table further describes the fees and expenses that you may pay if you buy and hold shares of the Funds. The fees and expenses of the Funds set forth below are annualized based on the fees and expenses for the six-month period ended June 30, 2018, and the pro forma fees and expenses reflect the expected fees and expenses of the Combined Fund as of June 30, 2018, assuming the Reorganization takes place as proposed.

Fees and Expenses of the Funds

Institutional Fund | International Bond Fund— I Class | Pro Forma Combined | ||||

Shareholder fees (fees paid directly from your investment) | ||||||

Redemption fee (as a percentage of amount redeemed on shares held for 90 days or less) | 2.00 | % b | 2.00 | % | 2.00 | % |

Annual

fund operating expenses | ||||||

Management fees | 0.55 | % | 0.49 | %c | 0.49 | %c |

Other expenses | — | 0.09 | %d | 0.08 | %d | |

Total annual fund operating expenses | 0.55 | % | 0.58 | % | 0.57 | % |

Fee waiver/expense reimbursement | — | (0.04 | )%d | (0.03 | )%d | |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.55 | % | 0.54 | %d | 0.54 | %d |

a As a percentage of amount redeemed on shares held for 90 days or less.

b The redemption fee was eliminated effective July 27, 2018.

c Restated to reflect current fees.

1 The gross annual operating expense ratio for the I Class has been restated to reflect current fees. The International Bond Fund’s management fee was lowered on August 1, 2017.

PAGE 11

d T. Rowe Price Associates, Inc., has agreed (through April 30, 2020) to pay the operating expenses of the fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. Any expenses paid under this agreement (and a previous limitation of 0.05%) are subject to reimbursement to T. Rowe Price Associates, Inc., by the fund whenever the fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed both: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; and (2) the current expense limitation on I Class Operating Expenses.

Example. This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that each Fund’s operating expenses remain the same. The example also assumes that an expense limitation arrangement currently in place is not renewed; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Fund | 1 year | 3 years | 5 years | 10 years |

Institutional International Bond Fund | $56 | $176 | $307 | $689 |

International Bond Fund—I Class | $55 | $178 | $316 | $719 |

Pro Forma Combined | $55 | $177 | $313 | $708 |

A discussion about the factors and conclusions considered by the Boards in approving each Fund’s investment management contract with T. Rowe Price appears in each Fund’s semiannual report to shareholders for the period ended June 30.

What are the Funds’ policies for purchasing, redeeming, exchanging, and pricing shares?

The I Class and the Institutional Fund have substantially similar procedures for purchasing, redeeming, exchanging, and pricing shares. The I Class and the Institutional Fund both generally require a $1,000,000 minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum may be waived for certain types of accounts held through a retirement plan, financial advisor, or other financial intermediary. Both Funds currently charge a redemption fee of 2.00% (as a percentage of amount redeemed on shares held for 90 days or less); however, the

PAGE 12

Institutional Fund eliminated its redemption fee effective July 27, 2018. Shares of the Funds may be redeemed at their respective net asset values; however, large redemptions can adversely affect a portfolio manager’s ability to implement a Fund’s investment strategy by causing the premature sale of securities. Therefore, the Funds reserve the right (without prior notice) to pay all or part of redemption proceeds with securities from the Fund’s portfolio rather than in cash (redemption in-kind). The Funds’ procedures for pricing their shares are identical. Fund share prices are calculated at the close of the New York Stock Exchange (normally 4 p.m. ET) each day the exchange is open for business.

For more detailed information, please refer to the section 3 of each Fund’s prospectus, entitled “Information About Accounts in T. Rowe Price Funds.”

What are the Funds’ policies on dividends and distributions?

The Funds’ policies on dividends and distributions are identical. Each Fund has a policy of distributing, to the extent possible, all of its net investment income and realized capital gains to its respective shareholders. Dividends from net investment income for each Fund are declared daily and paid on the first business day of each month. Any capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you may be taxed upon withdrawal from such account).

What are the main risk factors of the Funds?

The principal risks of the Funds are identical. Both funds are exposed to various risks of bond investing, as described below. Any of the following could cause a decline in the price or income of either Fund.

Active management risks The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. The fund could underperform in comparison to other funds with a similar benchmark or similar objectives and investment strategies if the fund’s overall investment selections or strategies fail to produce the intended results.

Fixed income markets risks Economic and other market developments can adversely affect fixed income securities markets. At times, participants in these markets may develop concerns about the ability of certain issuers of debt instruments to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt instruments to facilitate an orderly market. Those concerns could cause increased volatility and

PAGE 13

reduced liquidity in particular securities or in the overall fixed income markets and the related derivatives markets. A lack of liquidity or other adverse credit market conditions may hamper the fund’s ability to sell the debt instruments in which it invests or to find and purchase suitable debt instruments.

International investing risks Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. International securities tend to be more volatile and less liquid than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, international investments are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S.

Emerging markets risks The risks of international investing are heightened for securities of issuers in emerging market countries. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to all of the risks of investing in international developed markets, emerging markets are more susceptible to governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less liquid and less efficient trading markets.

Currency risks Because the fund generally invests in securities issued in foreign currencies, the fund is subject to the risk that it could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar.

Hedging risks The fund’s attempts at hedging and taking long and short positions in currencies may not be successful and could cause the fund to lose money or fail to get the benefit of a gain on a hedged position. If expected changes to securities prices, interest rates, currency values and exchange rates, or the creditworthiness of an issuer are not accurately predicted, the fund could be in a worse position than if it had not entered into such transactions.

Credit risks An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (a failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation.

Junk investing risks The risks of default are much greater for emerging market bonds and securities rated below investment grade (“junk”

PAGE 14

bonds). The fund is exposed to greater credit risk than other bond funds because companies in emerging markets are usually not as strong financially and are more susceptible to economic downturns. Junk bonds should be considered speculative as they carry greater risks of default and erratic price swings due to real or perceived changes in the credit quality of the issuer.

Interest rate risks The prices of, and the income generated by, debt instruments held by the fund may be affected by changes in interest rates. A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. Generally, securities with longer maturities or durations, and funds with longer weighted average maturities or durations, carry greater interest rate risk. The fund may face a heightened level of interest rate risk due to historically low interest rates and the potential effect of any government fiscal policy initiatives; for example, the U.S. Federal Reserve System has ended its quantitative easing program and may continue to raise interest rates.

Liquidity risks The fund may not be able to sell a holding in a timely manner at a desired price. Reduced liquidity in the bond markets can result from a number of events, such as limited trading activity, reductions in bond inventory, and rapid or unexpected changes in interest rates. Less liquid markets could lead to greater price volatility and limit the fund’s ability to sell a holding at a suitable price.

Nondiversification risks As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a comparable diversified fund.

Derivatives risks The fund uses forward currency exchange contracts, swaps, options, or futures, and is therefore exposed to additional volatility in comparison to investing directly in bonds and other debt instruments. These instruments can be illiquid and difficult to value, may involve leverage so that small changes produce disproportionate losses for the fund and, if not traded on an exchange, are subject to the risk that a counterparty to the transaction will fail to meet its obligations under the derivatives contract. The fund’s principal use of derivatives involves the risk that anticipated changes in currency values, currency exchange rates, interest rates, or the creditworthiness of an issuer will not be accurately predicted, which could significantly harm the fund’s

PAGE 15

performance, and the risk that regulatory developments could negatively affect the fund’s investments in such instruments.

REASONS FOR THE REORGANIZATION

Reasons for the Reorganization and Liquidation

The Boards of Directors (“Boards”) of T. Rowe Price Institutional International Funds, Inc. and T. Rowe Price International Funds, Inc., including a majority of the independent directors, have determined that the Reorganization is in the best interests of the shareholders of the Institutional Fund and the International Bond Fund and that the interests of shareholders of the Institutional Fund and the International Bond Fund will not be diluted as a result of the proposed Reorganization.

In considering whether to recommend the approval of the Reorganization, the Boards reviewed the following matters and concluded that the Reorganization is in the best interest of the Funds for the reasons indicated below.

At a Board meeting held on July 24, 2018, the Institutional Fund’s Board approved the dissolution and liquidation of the Fund, subject to approval by the Fund’s shareholders.

As explained in this Statement, the Institutional Fund and the International Bond Fund offer a substantially similar investment program, and the I Class of the International Bond Fund, which was launched in August 2015, is available at a slightly lower net expense ratio than the Institutional Fund (as of June 30, 2018, the net expense ratio of the I Class was 0.54%, and the net expense ratio of the Institutional Fund was 0.55%). In addition, as explained in this Statement, both Funds invest at least 80% of their net assets in foreign bonds and 65% of their net assets in non-U.S. dollar-denominated foreign bonds that are rated investment grade, although the Funds have a few slightly different investment restrictions. Both the Institutional Fund and the I Class are offered to institutional shareholders (and, with respect to the I Class, high net worth individuals) with at least a $1 million initial investment minimum and waivers of the minimum for similar types of accounts. We believe that offering a single fund with this investment program to a wide variety of investors will allow all shareholders to take advantage of potential economies of scale and reduce inefficiencies that can result from offering two substantially similar funds.

Recently, the Institutional Fund’s assets have declined significantly from more than $424 million to approximately $31 million as of June 30, 2018. The majority of these assets were redeemed by several large shareholders. The reduced size of the Institutional Fund presents challenges to managing the Fund effectively.

PAGE 16

The Board also considered the Funds’ performance. The average annual total returns of the Funds as of December 31, 2017 are set forth below.

Average Annual Total Returns | |||||||||||

Periods ended December 31, 2017 | |||||||||||

| 1 Year | 5 Years | 10 Years | Since I Class | Inception Date | ||||||

| Institutional Fund | 05/31/2007 | |||||||||

| Returns before taxes | 11.40% | 0.13% | 2.48% | 5.36%a | ||||||

| Returns after taxes on distributions | 11.05% | -0.03% | 1.35% | 5.21%a |

| |||||

| Returns after taxes on distributions |

| |||||||||

| and sale of fund shares | 6.53% | 0.06% | 1.50% | 4.08%a |

| |||||

International Bond Fund —I Class | 08/28/2015 | ||||||||||

Returns before taxes | 11.29% | — | — | 5.28%a | |||||||

Returns after taxes on distributions | 10.43% | — | — | 4.88%a | |||||||

Returns after taxes on distributions | |||||||||||

and sale of fund shares | 6.50% | — | — | 3.92%a | |||||||

a Return as of 8/28/15.

The performance of the two Funds has been relatively similar over longer time periods, although the Institutional Fund has historically experienced slightly more volatility due to its smaller asset base and, more recently, greater price volatility due to the significant decrease in assets. Because bonds can only be bought in certain lot sizes, each Fund’s concentration in any given bond has always differed to a certain degree, and these weighting differences have had a greater impact on the Institutional Fund’s performance relative to the International Bond Fund. The weighting differences were further magnified when the Institutional Fund needed to sell a number of its bond holdings in the second quarter of 2018 to fund the above-referenced shareholder redemptions.

The exchange of shares is not expected to create any tax liabilities for you as the exchange of shares will not be a taxable event. As a shareholder in the Institutional Fund, the cost basis and holding periods of your shares will carry over to the I Class shares that a shareholder will receive as a result of the Reorganization.

PAGE 17

In approving the proposed Reorganization, the Board of the Institutional Fund also considered that Institutional Fund shareholders have the ability to redeem their shares at any time up to the date of the Reorganization without redemption or other fees, although some shareholders could incur a taxable gain.

The Institutional Fund and the International Bond Fund use identical pricing methodologies to value their respective assets. The assets of the Institutional Fund will be transferred to the International Bond Fund at their fair market value on the valuation date of the transaction. Many of these assets are securities already held by the International Bond Fund and therefore valued using the same pricing sources and methodologies. Shares of the International Bond Fund equal in value to the assets will be received by the Institutional Fund in exchange. The expenses incurred to execute the Reorganization (other than brokerage, taxes, and any non-recurring extraordinary items) will be paid by T. Rowe Price, not by the Funds or their shareholders. For these reasons, the Board believes that the Institutional Fund and its shareholders will not be diluted as a result of the transaction.

Therefore, in consideration of these factors, coupled with the fact the Funds have substantially similar portfolios, the Boards concluded that the Reorganization is in the best interests of the shareholders of the Institutional Fund and the International Bond Fund. T. Rowe Price and the Directors of the Funds believe that shareholders’ interests will be better served over time by completing this transaction.

INFORMATION ABOUT THE REORGANIZATION

The following summary of the terms and conditions of the Plan is qualified by reference to the Plan, which is included as Exhibit A to this Statement.

Plan of Reorganization

The Reorganization will be consummated on or about November 16, 2018, or such other date as is agreed to by the Institutional Fund and the International Bond Fund (“Closing Date”). The parties may postpone the Closing Date until a later date on which all of the conditions to the obligations of each party under the Plan are satisfied, provided that the Plan may be terminated by either party if the Closing Date does not occur on or before December 31, 2018. See “Conditions to Closing.”

On the Closing Date, the Institutional Fund will transfer substantially all of its assets to the International Bond Fund in exchange for I Class shares of the International Bond Fund having an aggregate net asset value equal to the aggregate value of the assets so transferred as of the close of regular trading on the New York Stock Exchange on the business day immediately preceding the Closing Date (“Valuation Date”). The International Bond Fund will assume or

PAGE 18

otherwise be responsible for any liabilities of the Institutional Fund existing on the Valuation Date. The number of I Class shares of the International Bond Fund issued in the exchange will be determined by dividing the aggregate value of the assets of the Institutional Fund transferred (computed in accordance with the policies and procedures set forth in the current prospectus of the International Bond Fund, subject to review and approval by the Institutional Fund) by the net asset value per share of the International Bond Fund as of the close of regular trading on the Valuation Date. While it is not possible to determine the exact exchange ratio until the Valuation Date, due to, among other matters, market fluctuations and differences in the relative performance of the Institutional Fund and the International Bond Fund, if the Valuation Date had been June 30, 2018, shareholders of the Institutional Fund would have received 0.984 shares of the International Bond Fund for each of their Institutional Fund shares held.

As soon as practicable after the Closing Date, the Institutional Fund will distribute, in liquidation of the Institutional Fund, pro rata to its shareholders of record as of the close of business on the Valuation Date, the full and fractional shares of the International Bond Fund received in the exchange. The Institutional Fund will accomplish this distribution by transferring the International Bond Fund shares then credited to the account of the Institutional Fund on the books of the International Bond Fund to open accounts on the share records of I Class shares of the International Bond Fund in the names of the Institutional Fund’s shareholders, and representing the respective pro rata number of the I Class shares of the International Bond Fund due such shareholders. All issued and outstanding shares of the Institutional Fund will then be simultaneously canceled.

The stock transfer books of the Institutional Fund will be permanently closed as of the close of business on the Valuation Date. The Institutional Fund will only accept redemption requests received prior to the close of regular trading on the New York Stock Exchange on the Valuation Date. Redemption requests received thereafter will be deemed to be requests for redemption of the International Bond Fund shares to be distributed to Institutional Fund shareholders pursuant to the Plan.

Conditions to Closing

The obligation of the Institutional Fund to transfer its assets to the International Bond Fund pursuant to the Plan is subject to the satisfaction of certain conditions precedent, including performance by the International Bond Fund in all material respects of its agreements and undertakings under the Plan, receipt of certain documents from the International Bond Fund, receipt of an opinion of counsel to the International Bond Fund, and approval of the Plan by the shareholders of the Institutional Fund as previously described. The obligation of the International Bond Fund to consummate the

PAGE 19

Reorganization is subject to the satisfaction of certain conditions precedent, including performance by Institutional Fund of its agreements and undertakings under the Plan, receipt of certain documents and financial statements from the Institutional Fund, and receipt of an opinion of counsel to the Institutional Fund.

The consummation of the proposed transaction is subject to a number of conditions set forth in the Plan, some of which may be waived by the Boards of the Funds. The Plan may be terminated and the proposed transaction abandoned at any time, before or after approval by the shareholders of the Institutional Fund, prior to the Closing Date. In addition, the Plan may be amended in any mutually agreeable manner, except that no amendment may be made subsequent to the approval of the Reorganization by shareholders of the Institutional Fund that would materially and adversely affect the rights of such shareholders without their further approval.

Expenses of Reorganization

T. Rowe Price estimates that expenses related to the Reorganization will be approximately $18,662. These costs, which will be borne by T. Rowe Price, represent management’s estimate of professional services and fees, and any costs related to printing, mailing, and soliciting shareholders for the Reorganization. The Combined Fund will pay for any brokerage, taxes, and nonrecurring extraordinary items related to the Reorganization, which are expected to be de minimis. The sale of any assets that are not acceptable to the International Bond Fund will result in brokerage expenses.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a)(1)(C) of the IRC, with no gain or loss recognized as a consequence of the Reorganization by the International Bond Fund and Institutional Fund or their shareholders.

The consummation of the transaction contemplated under the Plan is conditioned upon receipt of an opinion from Willkie Farr & Gallagher LLP, counsel to both Funds, to the effect that, on the basis of certain representations of fact by officers of the Institutional Fund and the International Bond Fund, the existing provisions of the IRC, current administrative rules and court decisions, for federal income tax purposes:

· No gain or loss will be recognized by the International Bond Fund or the Institutional Fund or their shareholders as a result of the Reorganization.

· Institutional Fund shareholders will carry over the cost basis and holding periods of their Institutional Fund shares to their new I Class shares.

PAGE 20

· The International Bond Fund will assume the bases and holding periods of the Institutional Fund’s assets (other than certain assets, if any, subject to mark to market treatment under special tax rules).

To ensure that the transaction qualifies as a tax-free reorganization, it must meet certain requirements — the most important of which are that substantially all of the assets of the Institutional Fund are transferred and that the International Bond Fund will maintain the historical business (as defined by the IRS) of the Institutional Fund. In the opinion of counsel and to the best knowledge of the Funds’ officers, the proposed transaction will comply with these and all other relevant requirements.

Other tax consequences to shareholders of the Institutional Fund are:

· Although unlikely, certain securities held by the Institutional Fund may be sold prior to the transaction and not acquired by the International Bond Fund. It is possible that any such sales will increase or decrease the expected distributions to shareholders of the Institutional Fund prior to the Reorganization. The exact amount of such sales and whether and to what extent they will result in taxable distributions to shareholders of the Institutional Fund will be influenced by a variety of factors and cannot be determined with certainty at this time.

· Since the cost bases of the Institutional Fund’s assets which are transferred will remain the same (other than certain assets, if any, subject to mark to market treatment under special tax rules), gains or losses on their subsequent sale by the International Bond Fund will be shared with the shareholders of the International Bond Fund. The potential shifting of tax consequences related to this has been estimated by T. Rowe Price and is expected to be minor.

· The Institutional Fund declares dividends daily and pays any taxable dividends on the first business day of each month. Any taxable dividends of the Institutional Fund available for distribution prior to the Reorganization will be distributed immediately prior to the closing of the transaction.

Based on the information available at the time of this Statement, it is anticipated that at the date of the Reorganization, the Institutional Fund will not have any tax basis net realized capital losses. Any tax basis net realized capital losses of the Institutional Fund could be carried forward indefinitely to the International Bond Fund, although there may be certain limitations under the Code as to the amount that could be used each year by the Combined Fund to offset future tax basis net realized capital gains. In addition, based on the information available at the time of this Statement, it is anticipated that any tax basis net capital losses of the International Bond Fund at the date of

PAGE 21

the Reorganization can be carried forward indefinitely without annual limitation as to the amount that can be used to offset future tax basis net realized capital gains of the Combined Fund. As of June 30, 2018, neither Fund had any tax basis capital loss carry forwards.

It should be noted, however, that the Institutional Fund will close out any derivatives positions and sell any assets prior to the Reorganization that are deemed not acceptable to the International Bond Fund or inconsistent with the International Bond Fund’s investment program, which may affect the amount of income and capital gains that are required to be distributed. Because the Institutional Fund is expected to have realized gains at the time of the Reorganization, it is anticipated that the Institutional Fund will distribute taxable income (including the realized gains) as a taxable dividend and taxable capital gains to shareholders prior to the Reorganization. In addition, because the International Bond Fund may have realized gains that are required to be distributed by the end of the year, Institutional Fund shareholders may, as shareholders of the International Bond Fund, receive another taxable capital gain distribution in December (made by the International Bond Fund) that they otherwise would not incur. In reporting tax information to their shareholders and the Internal Revenue Service (“IRS”), the Funds follow the IRS requirements.

Shareholders should recognize that an opinion of counsel is not binding on the IRS or on any court. The Funds do not expect to obtain a ruling from the IRS regarding the consequences of the Reorganization. Accordingly, if the IRS sought to challenge the tax treatment of the Reorganization and was successful, neither of which is anticipated, the Reorganization would be treated as a taxable sale of assets of the Institutional Fund, followed by the taxable liquidation of the Institutional Fund.

Other Matters

To the extent permitted by law, the Boards of the Funds may amend the Plan without shareholder approval or may waive any default by the Institutional Fund or the International Bond Fund or the failure to satisfy any of the conditions of their obligations, provided that no such amendment or waiver may be made if it would adversely affect shareholders of the Institutional Fund or the International Bond Fund. The Plan may be terminated and the Reorganization abandoned at any time before or, to the extent permitted by law, after the approval of shareholders of the Institutional Fund by action of the Boards of the Funds. The Boards of the Funds may, at their election, terminate the Plan in the event that the Reorganization has not closed on or before December 31, 2018.

PAGE 22

Description of International Bond Fund—I Class Shares

Full and fractional I Class shares of the International Bond Fund will be issued to shareholders of the Institutional Fund in accordance with the procedures under the Plan as previously described. Each International Bond Fund share will be fully paid and nonassessable when issued, will have no preemptive or conversion rights, and will be transferrable on its books. Ownership of I Class shares of the International Bond Fund by former shareholders of the Institutional Fund will be recorded electronically and the International Bond Fund will issue a confirmation to such shareholders relating to those shares acquired as a result of the Reorganization.

The voting rights of the Institutional Fund and the International Bond Fund are the same. As shareholders of the International Bond Fund, former shareholders of the Institutional Fund will have the same voting rights with respect to the International Bond Fund as they currently have with respect to the Institutional Fund. Neither the Institutional Fund nor the International Bond Fund routinely holds meetings of shareholders. Both the Institutional Fund and the International Bond Fund are organized as series of a Maryland corporation. To hold a shareholders’ meeting for a Maryland corporation, one-third of the corporation’s shares entitled to be voted must have been received by proxy or be present in person at the meeting.

Accounting Survivor and Performance Reporting

The International Bond Fund will be the surviving fund for accounting, tax, and performance reporting purposes. The International Bond Fund’s historical financial statements will be utilized for all financial reporting after the Reorganization and the performance of the Institutional Fund will no longer be used.

Capitalization

The following table shows the unaudited capitalization of the Institutional Fund and the International Bond Fund as of July 31, 2018, and on a pro forma basis as of that date giving effect to the proposed acquisition of fund assets. The actual net assets of the Institutional Fund and the International Bond Fund on the Valuation Date will differ due to fluctuations in net asset values, subsequent purchases, and redemptions of shares.

PAGE 23

| Fund | Net Asset (000’s) | Net Asset Value Per Share | Shares Outstanding (000’s) |

| ||||

| Institutional Fund | |||

International Bond Fund— Investor Class | ||||

International Bond Fund— Advisor Class | ||||

International Bond Fund—I Class | ||||

Pro Forma Combined |

FINANCIAL STATEMENTS

The Financial Highlights tables, which provide information about the financial history for the Institutional Fund and the I Class, are based on a single share outstanding throughout the periods shown. The tables are part of each Fund’s financial statements, which are included in each Fund’s respective annual report and are incorporated by reference into the Statement of Additional Information (available upon request). The total returns in the tables represent the rate that an investor would have earned or lost on an investment in the fund (assuming reinvestment of all dividends and distributions and no payment of any applicable account or redemption fees). The financial statements in each Fund’s annual report were audited by each Fund’s independent registered public accounting firm, PricewaterhouseCoopers LLP.

PAGE 24

Financial Highlights

Institutional Fund | Year ended December 31 | |||||||||

2013 | 2014 | 2015 | 2016 | 2017 | ||||||

Net asset value, | $9.91 | $9.32 | $8.79 | $8.14 | $8.17 | |||||

Income From Investment Operations | ||||||||||

Net investment incomea | 0.24 | 0.24 | 0.18 | 0.17 | 0.16 | |||||

Net gains or losses on securities (both realized and unrealized) | (0.59 | ) | (0.53 | ) | (0.65 | ) | 0.03 | 0.77 | ||

Total from investment | (0.35 | ) | (0.29 | ) | (0.47 | ) | 0.20 | 0.93 | ||

Less Distributions | ||||||||||

Dividends (from net | (0.03 | ) | (0.04 | ) | — | — | (0.05 | ) | ||

Distributions (from | (0.04 | ) | (0.02 | ) | — | (0.02 | ) | (0.03 | ) | |

Returns of capital | (0.17 | ) | (0.18 | ) | (0.18 | ) | (0.15 | ) | (0.09 | ) |

Total distributions | (0.24 | ) | (0.24 | ) | (0.18 | ) | (0.17 | ) | (0.17 | ) |

Net asset

value, | $9.32 | $8.79 | $8.14 | $8.17 | $8.93 | |||||

Total return | (3.52 | )% | (3.27 | )% | (5.37 | )% | 2.33 | % | 11.40 | % |

Ratios/Supplemental Data | ||||||||||

Net assets, end of period (in thousands) | $263,228 | $287,080 | $346,398 | $311,757 | $404,787 | |||||

Ratio of expenses to | 0.55 | % | 0.55 | % | 0.55 | % | 0.55 | % | 0.55 | % |

Ratio of net income to average net assets | 2.54 | % | 2.53 | % | 2.13 | % | 1.98 | % | 1.84 | % |

Portfolio turnover rate | 82.8 | % | 90.4 | % | 63.2 | % | 76.2 | % | 47.1 | % |

a Per share amounts calculated using average shares outstanding method.

PAGE 25

Financial Highlights

International Bond Fund— I Class | 8/28/15* | Year ended December 31 | ||||

2016 | 2017 | |||||

Net asset value, | $8.42 | $8.28 | $8.32 | |||

Income From Investment Operations | ||||||

Net investment incomea | 0.02 | b | 0.18 | 0.18 | ||

Net gains or losses on securities (both realized and unrealized) | (0.10 | ) | 0.02 | 0.75 | ||

Total from investment operations | (0.08 | ) | 0.20 | 0.93 | ||

Less Distributions | ||||||

Dividends (from net investment income) | — | — | (0.14 | ) | ||

Distributions (from capital gains) | (0.02 | ) | (0.03 | ) | (0.04 | ) |

Returns of capital | (0.04 | ) | (0.13 | ) | — | |

Total distributions | (0.06 | ) | (0.16 | ) | (0.18 | ) |

Net asset value, | $8.28 | $8.32 | $9.07 | |||

Total return | (0.98 | )%b | 2.36 | % | 11.29 | % |

Ratios/Supplemental Data | ||||||

Net assets, end of period (in thousands) | $6,195 | $551,632 | $689,693 | |||

Ratio of expenses to average net assets | 0.69 | %b,c | 0.69 | % | 0.61 | % |

Ratio of net income to average net assets | 1.24 | %b,c | 2.01 | % | 1.99 | % |

Portfolio turnover rate | 60.0 | % | 72.9 | % | 58.1 | % |

* Inception date.

a Per share amounts calculated using average shares outstanding method.

b Excludes expenses in excess of a 0.05% contractual operating expense limitation in effect through April 30, 2018.

c Annualized.

PAGE 26

COMPARISON OF INVESTMENT OBJECTIVES,

POLICIES, AND RESTRICTIONS

The investment objectives, policies, and restrictions of the Funds are described in greater detail in their respective prospectuses.

What are the Funds’ investment objectives and policies?

The investment objectives of the International Bond Fund and the Institutional Fund are identical. Both Funds seek to provide current income and capital appreciation. Prior to August 1, 2018, the International Bond Fund sought to provide high current income and capital appreciation by investing primarily in high-quality, nondollar-denominated bonds outside the U.S. The shareholders of the International Bond Fund approved changing the Fund’s objective (effective August 1, 2018) to match the Institutional Fund’s objective at a shareholder meeting held on July 25, 2018.

In seeking to achieve their respective investment objectives, the Funds are guided by substantially similar investment policies and restrictions, although a few of the Funds’ restrictions differ slightly. Unless otherwise specified, the investment policies and restrictions of the International Bond Fund and the Institutional Fund described below may be changed without shareholder approval.

The following describes both Funds’ principal investment strategies:

Normally, each Fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in foreign bonds and 65% of its net assets in non-U.S. dollar-denominated foreign bonds that are rated investment-grade (i.e., BBB- or equivalent, or better), as determined by at least one major credit rating agency or, if unrated, deemed to be of comparable quality by T. Rowe Price. If a bond is split-rated (i.e., assigned different ratings by different credit rating agencies), the higher rating will be used. The International Bond Fund and the Institutional Fund may invest up to 20% and 25%, respectively, of each Fund’s total assets in “junk” bonds that have received a below investment-grade rating (i.e., BB or equivalent, or lower) from each of the rating agencies that has assigned a rating to the bond (or, if unrated, deemed to be below investment-grade quality by T. Rowe Price), including those in default or with the lowest rating. Up to 20% of the International Bond Fund’s total assets may be invested in U.S. dollar-denominated bonds, and there is no limit on the Institutional Fund’s investments in investment-grade bonds of emerging markets.

Although each Fund expects to generally maintain an intermediate- to long-term weighted average maturity, there are no maturity restrictions on the overall portfolio or on individual securities purchased by each

PAGE 27

Fund. Through the use of futures contracts and interest rate swaps, the Funds may either extend or shorten the overall maturity of the Funds, adjust their exposure with respect to particular countries or bond markets, and take long or short positions in particular countries or bond markets. A short position in a bond market means that a Fund, for example, could sell interest rate futures with respect to bonds of a particular market and the value of the futures contract would exceed the value of the bonds held by the Fund (or the Fund could sell futures with respect to a particular bond market without owning any bonds in that market).

Each Fund normally purchases bonds issued in foreign currencies which may include bonds issued in emerging markets currencies. Each Fund’s currency positions will vary with its outlook on the strength or weakness of one currency (such as the U.S. dollar or another foreign currency) compared to another currency and the relative value of various foreign currencies to one another. Forward currency exchange contracts and other currency derivatives, such as swaps, options and futures, may be used to help protect each Fund’s holdings from unfavorable changes in currency exchange rates, and each Fund has wide flexibility to purchase and sell currencies independently of whether the Fund owns bonds in those currencies and to engage in currency hedging transactions. Currency hedging is permitted and each Fund is likely to be heavily exposed to foreign currencies. The Funds may take a short position in a currency, which means that each Fund could sell a currency in excess of its assets denominated in that currency (or the Fund might sell a currency even if it doesn’t own any assets denominated in the currency).

Each Fund may use credit default swaps to buy or sell credit protection on individual bond issuers or sectors of the bond markets. Credit default swaps may be used to replicate the exposure of a bond or portfolio of bonds and as a hedge against a default or other credit event involving one of the Fund’s holdings. However, they may also be used to enhance returns by selling protection in situations where the adviser has a positive view on an issuer’s credit quality or by buying protection in situations where the adviser has a negative view on an issuer’s credit quality. If a Fund buys protection, it effectively takes a short position, and if the Fund sells protection, it effectively takes a long position, with respect to the creditworthiness of the issuer or sector.

Investment decisions are based on fundamental market factors, such as yield and credit quality differences among bonds as well as supply and demand trends and currency values. The Funds generally invest in securities where the combination of fixed-income returns and currency exchange rates appears attractive or, if the currency trend is unfavorable,

PAGE 28

where T. Rowe Price believes the currency risk can be minimized through hedging. The Funds sell holdings for a variety of reasons, such as to adjust the portfolio’s average maturity or credit quality, to shift assets into and out of higher-yielding securities, or to alter geographic or currency exposure.

Both Funds are “nondiversified,” meaning each Fund may invest a greater portion of its assets in fewer issuers than is permissible for a “diversified” Fund.

What are the main risks of investing in these two Funds?

The principal risks of the Funds are identical. Any of the following could cause a decline in the price or income of either Fund.

Active management risks The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the Fund’s investments may prove to be incorrect. The Fund could underperform in comparison to other funds with a similar benchmark or similar objectives and investment strategies if the Fund’s overall investment selections or strategies fail to produce the intended results.

Fixed income markets risks Economic and other market developments can adversely affect fixed income securities markets. At times, participants in these markets may develop concerns about the ability of certain issuers of debt instruments to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt instruments to facilitate an orderly market. Those concerns could cause increased volatility and reduced liquidity in particular securities or in the overall fixed income markets and the related derivatives markets. A lack of liquidity or other adverse credit market conditions may hamper the Fund’s ability to sell the debt instruments in which it invests or to find and purchase suitable debt instruments.

International investing risks Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. International securities tend to be more volatile and less liquid than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, international investments are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S.

Emerging markets risks The risks of international investing are heightened for securities of issuers in emerging market countries.

PAGE 29

Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to all of the risks of investing in international developed markets, emerging markets are more susceptible to governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less liquid and less efficient trading markets.

Currency risks Because the Fund generally invests in securities issued in foreign currencies, the Fund is subject to the risk that it could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar.

Hedging risks The Fund’s attempts at hedging and taking long and short positions in currencies may not be successful and could cause the Fund to lose money or fail to get the benefit of a gain on a hedged position. If expected changes to securities prices, interest rates, currency values and exchange rates, or the creditworthiness of an issuer are not accurately predicted, the Fund could be in a worse position than if it had not entered into such transactions.

Credit risks An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (a failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation.

Junk investing risks The risks of default are much greater for emerging market bonds and securities rated below investment grade (“junk” bonds). The Fund is exposed to greater credit risk than other bond funds because companies in emerging markets are usually not as strong financially and are more susceptible to economic downturns. Junk bonds should be considered speculative as they carry greater risks of default and erratic price swings due to real or perceived changes in the credit quality of the issuer.

Interest rate risks The prices of, and the income generated by, debt instruments held by the Fund may be affected by changes in interest rates. A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. Generally, securities with longer maturities or durations, and funds with longer weighted average maturities or durations, carry greater interest rate risk. The Fund may face a heightened level of interest rate risk due to historically low interest rates and the potential effect of any government fiscal policy initiatives; for example, the U.S.

PAGE 30

Federal Reserve System has ended its quantitative easing program and may continue to raise interest rates.

Liquidity risks The Fund may not be able to sell a holding in a timely manner at a desired price. Reduced liquidity in the bond markets can result from a number of events, such as limited trading activity, reductions in bond inventory, and rapid or unexpected changes in interest rates. Less liquid markets could lead to greater price volatility and limit the Fund’s ability to sell a holding at a suitable price.

Nondiversification risks As a nondiversified Fund, the Fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect Fund performance more than if the Fund were invested in a larger number of issuers. The Fund’s share price can be expected to fluctuate more than that of a comparable diversified fund.

Derivatives risks The Fund uses forward currency exchange contracts, swaps, options, or futures, and is therefore exposed to additional volatility in comparison to investing directly in bonds and other debt instruments. These instruments can be illiquid and difficult to value, may involve leverage so that small changes produce disproportionate losses for the Fund and, if not traded on an exchange, are subject to the risk that a counterparty to the transaction will fail to meet its obligations under the derivatives contract. The Fund’s principal use of derivatives involves the risk that anticipated changes in currency values, currency exchange rates, interest rates, or the creditworthiness of an issuer will not be accurately predicted, which could significantly harm the Fund’s performance, and the risk that regulatory developments could negatively affect the Fund’s investments in such instruments.

As with any mutual fund, there is no guarantee that the Funds will achieve their objective.

ADDITIONAL INFORMATION ABOUT THE FUNDS

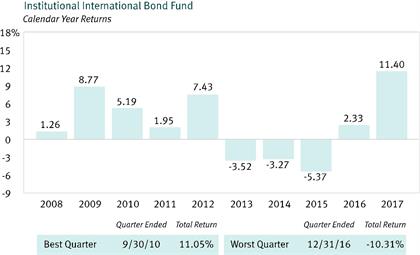

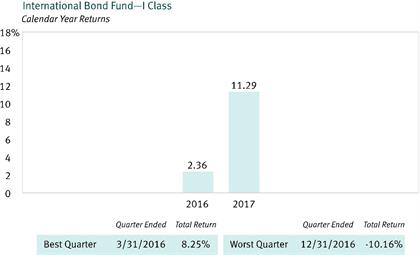

How has each Fund performed?

The following performance information provides some indication of the risks of investing in the Funds. The Funds’ performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

The following bar charts illustrate how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter

PAGE 31

returns during those years for the Institutional Fund and the International Bond Fund—I Class, respectively. Returns for other share classes of the International Bond Fund vary since they have different expenses.

The fund’s return for the six months ended 6/30/2018 was -2.48%.

The fund’s return for the six months ended 6/30/2018 was -2.36%.

PAGE 32