Exhibit 99.1 | |||

Earnings Release FY17 Q2 | Investor Contact | ||

Gerry Gould, VP-Investor Relations | |||

(781) 356-9402 | |||

gerry.gould@haemonetics.com | |||

Media Contact | |||

Sandra Jesse, Executive VP | |||

(781) 356-9253 | |||

sandra.jesse@haemonetics.com | |||

Haemonetics Reports 2nd Quarter and 1st Half Fiscal 2017 Results and Reaffirms Full Year Fiscal 2017 Guidance

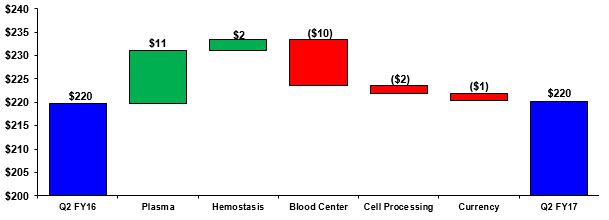

Braintree, MA, November 7, 2016 - Haemonetics Corporation (NYSE: HAE) reported second quarter fiscal 2017 revenue of $220.3 million, flat with the second quarter of fiscal 2016 as reported, and up 1% in constant currency.

The Company reported net income of $19.8 million and $0.38 per share, up 54% and 52%, respectively, in the second quarter of fiscal 2017 compared to the same period of the prior year. Excluding restructuring, turnaround and deal amortization expenses detailed below, adjusted net income was $23.5 million and adjusted earnings per share were $0.46, up 4% and 5%, respectively, compared to the prior year second quarter.1

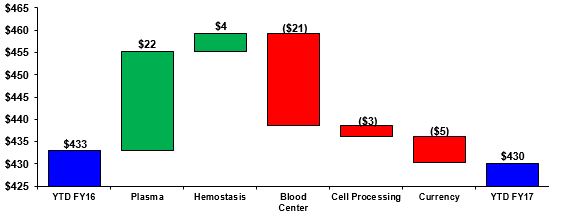

First half fiscal 2017 revenue was $430.2 million, down 1% as reported and up 1% in constant currency compared to the prior year first half. The Company reported first half net income of $9.5 million and net income per share of $0.18, both down 25% compared to the prior year first half. Exclusive of restructuring, turnaround and deal amortization expenses detailed below, adjusted net income was $36.4 million and adjusted earnings per share were $0.71, both down 10% compared to the prior year first half.1

Included in second quarter and first half fiscal 2017 results, both GAAP and adjusted, were $0.9 million or $0.02 per share and $4.3 million or $0.08 per share, respectively, of expenses related to a previously-reported leukoreduction filter recall.

Christopher Simon, Haemonetics’ CEO, stated: “Our first half revenue achievement and cost reduction initiatives position us well to achieve our full year projections. The June leukoreduction filter recall had a modest negative revenue impact in the second quarter and added $4 million of expenses in the first half.

1

Despite this challenge, our team delivered results in line with our expectations and we are reaffirming our full year guidance.”

Mr. Simon continued: “As we have said previously, this is a multi-year journey with all the associated challenges and uncertainties. We are implementing our strategic plan and we are gaining momentum in our businesses. Our focus for the first half of fiscal 2017 has been on stabilizing the company and we are on track to achieve our $40 million annual savings target. Going forward, we will increasingly pivot to transforming our business through product innovation and reallocation of resources to growth businesses. We are restructuring our operating model, streamlining our organization and driving productivity.”

SECOND QUARTER REVENUE

Plasma

Plasma franchise revenue was $103.6 million, up $10.5 million or 11% over the prior year second quarter and up 12% in constant currency. North America Plasma disposables revenue was up 14%, with 6% growth in plasma collection sets and the remainder from increased saline and sodium citrate solutions shipments. Plasma collection volume strength continued, reflecting robust end user markets for plasma-derived biopharmaceuticals. Outside North America, plasma collection growth was strong in Japan.

Hospital: Hemostasis Management

Hemostasis Management franchise revenue was $16.5 million, up $2.1 million or 15% over the prior year second quarter and up 18% in constant currency. TEG disposables revenue was similarly up 15% and up 18% in constant currency, with strong growth in the U.S. and China.

The TEG installed base continued to increase, benefiting from expanded adoption in new and existing accounts. The TEG family of products - TEG 5000, TEG 6s and TEG Manager™ software - remains well positioned for continued revenue growth, consistent with the Company’s long term outlook.

Hospital: Cell Processing

Cell Processing (“surgical”) franchise revenue was $26.0 million, down $2.1 million or 8% versus the prior year second quarter and down 6% in constant currency. The revenue decline resulted primarily from continued OrthoPAT disposables volume decline, and was partly offset by Blood Track software growth.

2

Blood Center

Blood Center franchise revenue was $74.3 million, down $10.0 million or 12% versus the prior year second quarter with no effect from currency.

Platelet disposables revenue was $30.9 million, down 10% with no effect from currency. A continued market shift toward double dose collection techniques in Japan drove the decline.

Red cell disposables revenue was $7.4 million, down 20% with no effect from currency. Lower volume, as well as pricing and volume changes associated with previously announced U.S. customer contracts, accounted for the declines.

Whole blood disposables revenue was $26.5 million, down 13% and down 12% in constant currency. Declines in the U.S. whole blood collection market and global price erosion continued.

Geographic

Second quarter fiscal 2017 revenue was up 3% in North America with no currency effect. Revenue in Asia Pacific was up 3% or 6% in constant currency, Japan was up 1% or down 5% in constant currency and EMEA and global distribution markets revenue was down 9% or 5% in constant currency.

OPERATING RESULTS

Second quarter fiscal 2017 gross margin on a GAAP basis was 47.3%, down 60 basis points. Unfavorable currency, reduced pricing in U.S. red cells and unfavorable product mix were only partially offset by productivity benefits.

Operating expenses on a GAAP basis were $79.5 million and $86.1 million in the second quarters of fiscal 2017 and 2016, respectively, a decrease of $6.7 million. Restructuring, turnaround and deal amortization expenses decreased by $4.2 million to $8.6 million versus $12.8 million in the prior year second quarter. The benefit from cost reduction initiatives implemented earlier in fiscal 2017 and timing of R&D investments more than offset increased costs of variable compensation.

Second quarter fiscal 2017 GAAP operating income was $24.8 million, up $5.6 million or 29% over the second quarter of the prior year. Adjusted operating income was $33.4 million, up $0.3 million or 1% over the second quarter of the

3

prior year, and included $1.1 million of negative currency effects and $0.9 million of leukoreduction filter recall expenses.

The GAAP income tax provisions were 13.2% of the second quarter fiscal 2017 pre-tax income and 22.4% of the second quarter fiscal 2016 pre-tax income, while the income tax rates were 25.2% and 26.5% of adjusted pre-tax income in the second quarters of fiscal 2017 and 2016, respectively.

Balance Sheet and Cash Flow

Cash on hand was $139 million, an increase of $24 million during the first half of fiscal 2017. The Company utilized $20 million of cash for debt repayment in the first half of fiscal 2017 and expects to repay another $24 million of debt in the second half. The Company also utilized $18 million of cash, less $5 million of cash tax benefits, for restructuring and turnaround initiatives.

First half fiscal 2017 free cash flow was $28 million, inclusive of the aforementioned net restructuring funding requirements, and $41 million before such funding.

RESTRUCTURING AND TURNAROUND EXPENSES AND DEAL AMORTIZATION

The Company announced and has been implementing a turnaround plan to optimize growth and profitability. For fiscal 2017, that plan includes a repositioning of the Company’s organization and cost structure. The Company indicated that the plan includes, in fiscal 2017, charges and expenses that are expected to total $26 million pre-tax or $18 million net of tax benefit, representing approximately $0.35 per share impact on fiscal 2017 GAAP earnings. In the second quarter of fiscal 2017, the Company incurred $2 million of such expenses pre-tax, or approximately $0.02 per share. In the first half of fiscal 2017, the Company incurred $20 million of such expenses pre-tax, or $14 million net of tax benefit of such charges, approximately $0.27 per share.

The Company excludes acquisition related amortization expenses from adjusted operating income and adjusted earnings per share. Excluded from second quarter pre-tax adjusted earnings were $7.0 million in fiscal 2017 and $7.4 million in fiscal 2016, or $0.10 per share in each second quarter. Excluded from first half pre-tax adjusted earnings were $14.1 million in fiscal 2017 and $14.8 million in fiscal 2016, or $0.20 per share in each first half.

4

Fiscal 2017 Guidance

The Company reaffirmed its previously provided fiscal 2017 guidance ranges, summarized as follows.

Revenue, including 1.7% impact of having one less week in the Company’s fiscal 2017 calendar than in the prior fiscal year:

• | Total revenue: $850-$875 million, down 4-7% vs. prior year on a reported basis and down 2-4% in constant currency. |

• | Plasma: 7-9% revenue growth as reported or 8-10% in constant currency. |

• | Hemostasis Management: 17-20% revenue growth as reported or 20-23% in constant currency. |

• | Cell Processing: approximately 10% revenue decline as reported, 6% in constant currency, with flat revenue in Cell Saver, growth in BloodTrack and a continuing decline in OrthoPAT. |

• | Blood Center (whole blood, red cell and platelet): 19-23% revenue decline as reported or 16-20% decline in constant currency. |

Operating margin: 6-7% of revenue and, exclusive of restructuring and related expenses, 13% adjusted operating margin.

Income taxes: 20-21% of pre-tax income (guidance originally issued was 17-18%) and 25-26% of adjusted pre-tax income.

Acquisition related amortization: $27 million pre-tax or $0.39 per share.

Earnings per share: $0.70-$0.80 and, exclusive of restructuring charges, turnaround expenses and acquisition related amortization, $1.40-$1.50 on an adjusted basis.

Free cash flow: $47-$52 million, including the funding of $18 million of after-tax restructuring charges and turnaround expenses; $65-$70 million before funding such charges and expenses.

CONFERENCE CALL AND ADDITIONAL COMMENTARY

Haemonetics will host a webcast to discuss second quarter results on Monday, November 7, 2016 at 8:00am Eastern Time. Interested parties may participate at: http://edge.media-server.com/m/p/wcn22ipf.

The Company is posting this press release and additional commentary to be discussed on the webcast entitled Comments on 2nd Quarter and Year-to-Date Fiscal 2017 Results to its Investor Relations website.

5

These comments can be accessed by the following direct link: http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzU2MzQ0fENoaWxkSUQ9LTF8VHlwZT0z&t=1&cb=636132771875970279.

About Haemonetics

Haemonetics (NYSE: HAE) is a global healthcare company dedicated to providing a suite of innovative hematology products and solutions for our customers, to help them improve patient care and reduce the cost of healthcare. Our technology addresses important medical markets: blood and plasma component collection, the surgical suite, and hospital transfusion services. To learn more about Haemonetics, visit www.haemonetics.com.

Forward Looking Statements

The Company provides forward-looking statements that could be influenced by risks and uncertainties, demand for whole blood and blood components, changes in executive management, changes in operations restructuring and turnaround plans, asset revaluations to reflect current business conditions, technological advances in the medical field and standards for transfusion medicine and our ability to successfully implement products that incorporate such advances and standards, product quality, market acceptance, regulatory uncertainties, including in the receipt or timing of regulatory approvals, the effect of economic and political conditions, the impact of competitive products and pricing, blood product reimbursement policies and practices, foreign currency exchange rates, changes in customers’ ordering patterns including single-source tenders, the effect of industry consolidation as seen in the plasma and blood center markets, the effect of communicable diseases and the effect of uncertainties in markets outside the U.S. (including Europe and Asia) in which we operate and other risks detailed in the Company's filings with the Securities and Exchange Commission.

The foregoing list should not be construed as exhaustive.

Forward-looking statements are based on estimates and assumptions made by management of the Company and are believed to be reasonable, though inherently uncertain and difficult to predict. Actual results and experience could differ materially from the forward-looking statements. Information set forth in this press release is current as of today and the Company undertakes no duty or obligation to update this information.

1 A reconciliation of GAAP to adjusted financial results is included at the end of the financial sections of this press release as well as on the web at www.haemonetics.com.

6

Haemonetics Corporation Financial Summary | ||||||||||

Condensed Consolidated Statements of Income for the Second Quarter of FY17 and FY16 | ||||||||||

(Data in thousands, except per share data) | ||||||||||

10/1/2016 | 9/26/2015 | % Inc/(Dec) | ||||||||

vs Prior Year | ||||||||||

(unaudited) | ||||||||||

Net revenues | $ | 220,253 | $ | 219,693 | 0.3% | |||||

Gross profit | 104,248 | 105,297 | (1.0)% | |||||||

R&D | 8,336 | 11,553 | (27.8)% | |||||||

S,G&A | 71,118 | 74,565 | (4.6)% | |||||||

Operating expenses | 79,454 | 86,118 | (7.7)% | |||||||

Operating income | 24,794 | 19,179 | 29.3% | |||||||

Interest and other expense, net | (1,962 | ) | (2,606 | ) | (24.7)% | |||||

Income before taxes | 22,832 | 16,573 | 37.8% | |||||||

Tax expense | 3,007 | 3,710 | (18.9)% | |||||||

Net income | $ | 19,825 | $ | 12,863 | 54.1% | |||||

Net income per common share assuming dilution | $ | 0.38 | $ | 0.25 | 52.0% | |||||

Weighted average number of shares: | ||||||||||

Basic | 51,378 | 50,680 | ||||||||

Diluted | 51,701 | 51,187 | ||||||||

Profit Margins: | Inc/(Dec) vs prior year profit margin % | |||||||||

Gross profit | 47.3 | % | 47.9 | % | (0.6)% | |||||

R&D | 3.8 | % | 5.3 | % | (1.5)% | |||||

S,G&A | 32.3 | % | 33.9 | % | (1.6)% | |||||

Operating income | 11.3 | % | 8.7 | % | 2.6% | |||||

Income before taxes | 10.4 | % | 7.5 | % | 2.9% | |||||

Net income | 9.0 | % | 5.9 | % | 3.1% | |||||

7

Haemonetics Corporation Financial Summary | ||||||||||

Condensed Consolidated Statements of Income for Year-to-Date FY17 and FY16 | ||||||||||

(Data in thousands, except per share data) | ||||||||||

10/1/2016 | 9/26/2015 | % Inc/(Dec) | ||||||||

vs Prior Year | ||||||||||

(unaudited) | ||||||||||

Net revenues | $ | 430,209 | $ | 433,106 | (0.7)% | |||||

Gross profit | 195,304 | 207,836 | (6.0)% | |||||||

R&D | 19,773 | 22,874 | (13.6)% | |||||||

S,G&A | 158,618 | 162,177 | (2.2)% | |||||||

Operating expenses | 178,391 | 185,051 | (3.6)% | |||||||

Operating income | 16,913 | 22,785 | (25.8)% | |||||||

Interest and other expense, net | (4,139 | ) | (4,615 | ) | (10.3)% | |||||

Income before taxes | 12,774 | 18,170 | (29.7)% | |||||||

Tax expense | 3,295 | 5,574 | (40.9)% | |||||||

Net income | $ | 9,479 | $ | 12,596 | (24.7)% | |||||

Net income per common share assuming dilution | $ | 0.18 | $ | 0.24 | (25.0)% | |||||

Weighted average number of shares: | ||||||||||

Basic | 51,200 | 51,020 | ||||||||

Diluted | 51,463 | 51,638 | ||||||||

Profit Margins: | Inc/(Dec) vs prior year profit margin % | |||||||||

Gross profit | 45.4 | % | 48.0 | % | (2.6)% | |||||

R&D | 4.6 | % | 5.3 | % | (0.7)% | |||||

S,G&A | 36.9 | % | 37.4 | % | (0.5)% | |||||

Operating income | 3.9 | % | 5.3 | % | (1.4)% | |||||

Income before taxes | 3.0 | % | 4.2 | % | (1.2)% | |||||

Net Income | 2.2 | % | 2.9 | % | (0.7)% | |||||

8

Revenue Analysis for the Second Quarter of FY17 and FY16 | |||||||||||||||||

(Data in thousands) | |||||||||||||||||

Three Months Ended | |||||||||||||||||

10/1/2016 | 9/26/2015 | Percent change | Currency impact | Constant currency growth (1) | |||||||||||||

(unaudited) | |||||||||||||||||

Revenues by geography | |||||||||||||||||

United States | $ | 130,843 | $ | 127,031 | 3.0 | % | — | % | 3.0 | % | |||||||

International | 89,410 | 92,662 | (3.5 | )% | (1.7 | )% | (1.8 | )% | |||||||||

Net revenues | $ | 220,253 | $ | 219,693 | 0.3 | % | (0.7 | )% | 1.0 | % | |||||||

Revenues by franchise | |||||||||||||||||

Plasma | $ | 103,564 | $ | 93,036 | 11.3 | % | (0.7 | )% | 12.0 | % | |||||||

Blood Center | 74,270 | 84,235 | (11.8 | )% | (0.1 | )% | (11.7 | )% | |||||||||

Cell Processing | 25,955 | 28,105 | (7.6 | )% | (1.3 | )% | (6.3 | )% | |||||||||

Hemostasis Management | 16,464 | 14,317 | 15.0 | % | (2.6 | )% | 17.6 | % | |||||||||

Net revenues | $ | 220,253 | $ | 219,693 | 0.3 | % | (0.7 | )% | 1.0 | % | |||||||

(1) Constant currency growth, a non-GAAP financial measure, measures the change in sales between the current and prior year periods using a constant currency. See description of non-GAAP financial measures contained in this release.

Revenue Analysis for Year-to-Date FY17 and FY16 | |||||||||||||||||

(Data in thousands) | |||||||||||||||||

Six Months Ended | |||||||||||||||||

10/1/2016 | 9/26/2015 | Percent change | Currency impact | Constant currency growth (1) | |||||||||||||

(unaudited) | |||||||||||||||||

Revenues by geography | |||||||||||||||||

United States | $ | 256,543 | $ | 247,726 | 3.6 | % | — | % | 3.6 | % | |||||||

International | 173,666 | 185,380 | (6.3 | )% | (3.0 | )% | (3.3 | )% | |||||||||

Net revenues | $ | 430,209 | $ | 433,106 | (0.7 | )% | (1.4 | )% | 0.7 | % | |||||||

Revenues by franchise | |||||||||||||||||

Plasma | $ | 201,213 | $ | 181,563 | 10.8 | % | (1.3 | )% | 12.1 | % | |||||||

Blood Center | 145,213 | 167,318 | (13.2 | )% | (0.7 | )% | (12.5 | )% | |||||||||

Cell Processing | 52,031 | 55,918 | (7.0 | )% | (2.4 | )% | (4.6 | )% | |||||||||

Hemostasis Management | 31,752 | 28,307 | 12.2 | % | (2.4 | )% | 14.6 | % | |||||||||

Net revenues | $ | 430,209 | $ | 433,106 | (0.7 | )% | (1.4 | )% | 0.7 | % | |||||||

(1) Constant currency growth, a non-GAAP financial measure, measures the change in sales between the current and prior year periods using a constant currency. See description of non-GAAP financial measures contained in this release.

9

Condensed Consolidated Balance Sheets | |||||||||

(Data in thousands) | |||||||||

As of | |||||||||

10/1/2016 | 4/2/2016 | ||||||||

(unaudited) | |||||||||

Assets | |||||||||

Cash and cash equivalents | $ | 138,870 | $ | 115,123 | |||||

Accounts receivable, net | 151,600 | 157,093 | |||||||

Inventories, net | 194,511 | 187,028 | |||||||

Other current assets | 27,406 | 28,842 | |||||||

Total current assets | 512,387 | 488,086 | |||||||

Property, plant & equipment, net | 339,843 | 337,634 | |||||||

Intangible assets, net | 192,451 | 204,458 | |||||||

Goodwill | 268,546 | 267,840 | |||||||

Other assets | 21,599 | 21,110 | |||||||

Total assets | $ | 1,334,826 | $ | 1,319,128 | |||||

Liabilities & Stockholders' Equity | |||||||||

Short-term debt & current maturities | $ | 51,549 | $ | 43,471 | |||||

Other current liabilities | 147,115 | 142,080 | |||||||

Total current liabilities | 198,664 | 185,551 | |||||||

Long-term debt | 336,505 | 364,529 | |||||||

Other long-term liabilities | 50,543 | 47,483 | |||||||

Stockholders' equity | 749,114 | 721,565 | |||||||

Total liabilities & stockholders' equity | $ | 1,334,826 | $ | 1,319,128 | |||||

10

Condensed Consolidated Statements of Cash Flows | |||||||

(Data in thousands) | |||||||

Six Months Ended | |||||||

10/1/2016 | 9/26/2015 | ||||||

(unaudited) | |||||||

Cash Flows from Operating Activities: | |||||||

Net income | $ | 9,479 | $ | 12,596 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 45,253 | 44,998 | |||||

Stock-based compensation expense | 4,235 | 3,883 | |||||

Provision for losses on accounts receivable and inventory | 6,902 | 3,080 | |||||

Change in other non-cash operating activities | 1,264 | 123 | |||||

Change in accounts receivable, net | 6,807 | (287 | ) | ||||

Change in inventories | (12,661 | ) | (40 | ) | |||

Change in other working capital | 8,681 | (27,592 | ) | ||||

Net cash provided by operating activities | 69,960 | 36,761 | |||||

Cash Flows from Investing Activities: | |||||||

Capital expenditures | (41,624 | ) | (50,130 | ) | |||

Proceeds from sale of property, plant and equipment | 197 | 293 | |||||

Other | — | (3,000 | ) | ||||

Net cash used in investing activities | (41,427 | ) | (52,837 | ) | |||

Cash Flows from Financing Activities: | |||||||

Change in (repayments) / borrowings, net | (20,086 | ) | 6,366 | ||||

Proceeds from employee stock programs | 15,511 | 10,637 | |||||

Share repurchases | — | (60,984 | ) | ||||

Net cash used in financing activities | (4,575 | ) | (43,981 | ) | |||

Effect of exchange rates on cash and cash equivalents | (211 | ) | (358 | ) | |||

Net Change in Cash and Cash Equivalents | 23,747 | (60,415 | ) | ||||

Cash and Cash Equivalents at Beginning of the Period | 115,123 | 160,662 | |||||

Cash and Cash Equivalents at End of Period | $ | 138,870 | $ | 100,247 | |||

Free Cash Flow Reconciliation*: | |||||||

Free cash flow after restructuring and turnaround costs | $ | 28,533 | $ | (13,076 | ) | ||

Restructuring and turnaround costs | 17,990 | 24,434 | |||||

Tax benefit on restructuring and turnaround costs | (5,213 | ) | (6,189 | ) | |||

Capital expenditures on VCC initiatives | — | 5,347 | |||||

Free cash flow before restructuring, turnaround costs and VCC capital expenditures | $ | 41,310 | $ | 10,516 | |||

* Free cash flow is defined as cash provided by operating activities less capital expenditures net of the proceeds from the sale of property, plant and equipment.

11

Haemonetics Corporation Financial Summary | ||||

Reconciliation of Non-GAAP Measures | ||||

Haemonetics has presented supplemental non-GAAP financial measures as part of this earnings release. A reconciliation is provided below that reconciles each non-GAAP financial measure with the most comparable GAAP measure. The presentation of non-GAAP financial measures should not be considered in isolation from, or as a substitute for, the most directly comparable GAAP measures. There are material limitations to the usefulness of non-GAAP measures on a standalone basis, including the lack of comparability to the GAAP financial results of other companies.

These measures are used by management to monitor the financial performance of the business, make informed business decisions, establish budgets and forecast future results. Performance targets for management are established based upon these non-GAAP measures. In the reconciliations below, we have removed restructuring, turnaround and other costs from our GAAP expenses. Our restructuring and turnaround costs for the periods reported are principally related to employee severance and retention, product line simplification, accelerated depreciation and other costs associated with the fiscal 2017 restructuring initiative announced May 9, 2016.

In addition to restructuring and turnaround costs, we are reporting adjusted earnings before deal amortization and asset impairments.

We believe this information is useful to investors because it allows for an evaluation of the Company with a focus on the performance of our core operations.

12

Reconciliation of Non-GAAP Measures for the Second Quarter of FY17 and FY16 | |||||||

(Data in thousands except per share data) | |||||||

Three Months Ended | |||||||

10/1/2016 | 9/26/2015 | ||||||

(unaudited) | |||||||

GAAP operating income | $ | 24,794 | $ | 19,179 | |||

Restructuring and turnaround costs (1) | 1,637 | 6,531 | |||||

Deal amortization (2) | 7,006 | 7,399 | |||||

Non-GAAP operating income | $ | 33,437 | $ | 33,109 | |||

GAAP net income | 19,825 | 12,863 | |||||

Restructuring and turnaround costs (1) | 1,597 | 6,652 | |||||

Deal amortization (2) | 7,006 | 7,399 | |||||

Tax benefit associated with non-GAAP adjustments | (4,911 | ) | (4,373 | ) | |||

Non-GAAP net income | $ | 23,517 | $ | 22,541 | |||

GAAP net income per common share | $ | 0.38 | $ | 0.25 | |||

Non-GAAP items after tax per common share assuming dilution | $ | 0.08 | $ | 0.19 | |||

Non-GAAP net income per common share assuming dilution | $ | 0.46 | $ | 0.44 | |||

(1) Includes restructuring and turnaround costs included in gross profit of $0.1M and $1.2M for the three months ended October 1, 2016 and September 26, 2015, respectively. | |||||||

(2) Deal amortization is included within operating expenses. | |||||||

13

Reconciliation of Non-GAAP Measures for Year-to-Date FY17 and FY16 | |||||||

(Data in thousands except per share data) | |||||||

Six Months Ended | |||||||

10/1/2016 | 9/26/2015 | ||||||

(unaudited) | |||||||

GAAP operating income | $ | 16,913 | $ | 22,785 | |||

Restructuring and turnaround costs (1) | 20,453 | 21,347 | |||||

Asset impairments (2) | 1,315 | — | |||||

Deal amortization (3) | 14,081 | 14,804 | |||||

Non-GAAP operating income | $ | 52,762 | $ | 58,936 | |||

GAAP net income | 9,479 | 12,596 | |||||

Restructuring and turnaround costs (1) | 20,413 | 21,468 | |||||

Asset impairments (2) | 1,315 | — | |||||

Deal amortization (3) | 14,081 | 14,804 | |||||

Tax benefit associated with non-GAAP adjustments | (8,874 | ) | (8,343 | ) | |||

Non-GAAP net income | $ | 36,414 | $ | 40,525 | |||

GAAP net income per common share | $ | 0.18 | $ | 0.24 | |||

Non-GAAP items after tax per common share assuming dilution | $ | 0.53 | $ | 0.55 | |||

Non-GAAP net income per common share assuming dilution | $ | 0.71 | $ | 0.79 | |||

(1) Includes restructuring and turnaround costs included in gross profit of $0.3M and $2.2M for the six months ended October 1, 2016 and September 26, 2015, respectively. | |||||||

(2) Includes impairment charges included in gross profit of $0.9M for the six months ended October 1, 2016. There were no impairment charges included in gross profit during the six months ended September 26, 2015. | |||||||

(3) Deal amortization is included within operating expenses. | |||||||

14