| By: | /s/ John H. McCoy | |||

| John H. McCoy, President and Treasurer | ||||

| Date: | 4/25/12 | |||

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

||||

| By: | /s/ John H. McCoy | |||

| John H. McCoy, President and Treasurer | ||||

| Date: | 4/25/12 | |||

| By: | /s/ Edward Fackenthal | |||

| Edward Fackenthal, Counsel and Assistant Secretary | ||||

| Date: | 4/25/12 | |||

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

|

Page No.

|

|

|

Total Returns

|

2

|

|

Performance at a Glance

|

2

|

|

Advisor’s Report

|

2

|

|

Performance Summary

|

4

|

|

Financial Statements:

|

|

|

Schedule of Investments

|

6

|

|

Statement of Assets and Liabilities

|

10

|

|

Statement of Operations

|

11

|

|

Statement of Changes in Net Assets

|

12

|

|

Financial Highlights

|

13

|

|

Notes to Financial Statements

|

14

|

|

Fund’s Expenses

|

20

|

|

Statement Regarding Availability of Proxy Voting Policies and Procedures

|

22

|

|

Selection of Investment Advisor

|

23

|

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

|

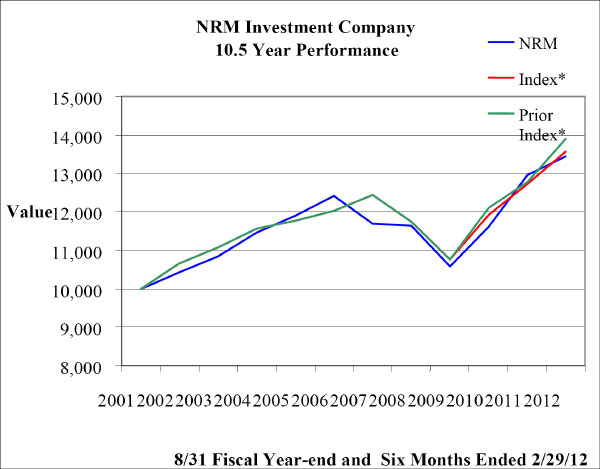

Total Return

|

||||

|

NRM Investment Company

|

3.83 | % | ||

|

Composite Index1

|

6.69 | % | ||

| Distributions Per Share | ||||||||||||||||

|

Starting

Share Price |

Ending

Share Price |

Income

Dividends |

Capital Gains

|

|||||||||||||

|

NRM Investment Company

|

$ | 3.53 | $ | 3.61 | $ | 0.054 | $ | 0.00 | ||||||||

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

|

PERIOD

|

ACTUAL

|

CURRENT INDEX

|

PRIOR

INDEX

|

|

08/31/02

|

4.40%

|

6.69%

|

6.69%

|

|

08/31/03

|

3.96%

|

3.70%

|

3.70%

|

|

08/31/04

|

5.59%

|

4.49%

|

4.49%

|

|

08/31/05

|

3.76%

|

1.76%

|

1.76%

|

|

08/31/06

|

4.40%

|

2.27%

|

2.27%

|

|

08/31/07

|

-5.79%

|

3.46%

|

3.46%

|

|

08/31/08

|

-.37%

|

-5.62%

|

-5.62%

|

|

08/31/09

|

-9.20%

|

-8.45%

|

-8.45%

|

|

08/31/10

|

9.71%

|

10.92%

|

12.65%

|

|

08/31/11

|

11.59%

|

6.64%

|

5.48%

|

|

02/29/12

|

3.83%

|

6.69%

|

8.83%

|

| NRM Investment Company |

| Schedule of Investments |

| February 29, 2012 |

|

Principal

Amount or Shares

|

Fair

Value

|

|||||||

|

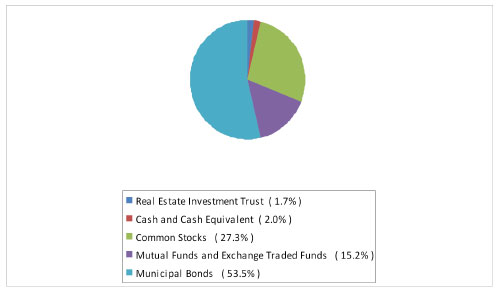

Municipal Bonds –53.5%

|

||||||||

|

General Obligation Bonds –11.1%

|

||||||||

|

Pittsburgh, Pennsylvania, 5.00%, due 9/1/12, callable 3/1/12 at 100 (AMBAC)

|

250,000 | $ | 250,000 | |||||

|

Philadelphia, Pennsylvania School District, 5.625%, due 8/1/15, callable 8/1/12 at 100 (FGIC)

|

300,000 | 306,630 | ||||||

|

Pittsburgh, Pennsylvania, Refunding, 5.25%, due

9/1/16

|

100,000 | 115,467 | ||||||

|

Puerto Rico, 5.50%, due 7/1/17

|

250,000 | 284,875 | ||||||

|

Will County, Illinois, 5.0%, due 11/15/24

|

100,000 | 107,474 | ||||||

|

Richland County, South Carolina Broad River Sewer System, 5.375%, due 3/1/30, callable 3/1/13

|

250,000 | 260,230 | ||||||

|

Total General Obligation Bonds

|

1,324,676 | |||||||

|

Housing Finance Agency Bonds - 1.6%

|

||||||||

|

Louisiana LOC Government Environmental Facilities Community Development Authority, Multi-family Housing, 4.25%, due 4/15/39, put 4/15/16 at 100.00

|

180,000 | 190,001 | ||||||

|

Total Housing Finance Agency Bonds

|

190,001 | |||||||

|

Other Revenue Bonds – 40.8%

|

||||||||

|

Parkland, Pennsylvania School District, 5.375%, due 9/1/15 (FGIC)

|

170,000 | 196,199 | ||||||

|

Pennsylvania Infrastructure Investment Authority, 5.00%, due 9/1/12

|

500,000 | 511,845 | ||||||

|

Pennsylvania State Higher Educational Facilities Authority, 5.50%, prerefunded 1/01/16

|

350,000 | 365,201 | ||||||

|

Philadelphia, Pennsylvania Wastewater, 5.00%, due 7/1/14

|

250,000 | 273,257 | ||||||

|

Pennsylvania State Turnpike Commission, 5.25%, due 12/1/14, callable 12/1/10 at 100 (AMBAC)

|

155,000 | 155,518 | ||||||

|

Pennsylvania State Turnpike Commission, 5.25%, due 12/1/15, callable 12/1/10 at 100 (AMBAC)

|

140,000 | 140,462 | ||||||

|

Allegheny County Sanitation Authority, Sewer Revenue, 5.00%, due 12/1/23, callable 12/1/15 at 100

|

300,000 | 328,851 | ||||||

|

Allegheny County, Pennsylvania Higher Educational Building Authority, 5.50%, due 3/1/16, callable 6/15/12 at 100 (AMBAC)

|

150,000 | 171,270 | ||||||

|

Pennsylvania State Higher Educational Facilities Authority, 5.0%, due 6/15/16, callable 6/15/12 at 100 (AMBAC)

|

100,000 | 101,201 | ||||||

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

|

Principal

Amount

or Shares

|

Fair

Value

|

|||||||

| Municipal Bonds – 53.5% (Continued) | ||||||||

|

Other Revenue Bonds – 40.8% (Continued)

|

||||||||

|

Chester County, Pennsylvania Health and Educational Authority (Devereux), 5.00%, due 11/1/18

|

405,000 | $ | 435,922 | |||||

|

New York State Dorm Authority, 5.00%, due 7/01/17, Callable 7/01/16 at 100 (SIENA)

|

200,000 | 224,814 | ||||||

|

Pennsylvania State Public School Building Authority, 5.00%, due 5/15/22

|

150,000 | 158,019 | ||||||

|

Pennsylvania State Higher Educational Facilities Authority (University of Pennsylvania Health System), 4.75%, due 8/15/22, callable 8/15/19 at 100

|

150,000 | 167,500 | ||||||

|

Allegheny County, Pennsylvania Hospital Development Authority (University of Pittsburgh Medical School), 5.00%, due 8/15/23, callable 8/15/19 at 100

|

100,000 | 112,331 | ||||||

|

Jefferson County, Kentucky Capital Projects Corporation, 4.375%, due 6/01/26, callable 6/1/17 at 100

|

100,000 | 107,824 | ||||||

|

Spring Texas Independent School District, 5.00%, due 8/15/26, callable 08/15/14

|

280,000 | 302,590 | ||||||

|

North Carolina Medical Care Community Mortgage Revenue (Chatham Hospital), 5.25%, due 8/1/26, callable 2/1/17 at 100 (MBIA)

|

230,000 | 242,682 | ||||||

|

Virginia Port Facilities Authority, 4.50%, due 7/1/30, callable 7/1/19 at 100

|

200,000 | 215,220 | ||||||

|

Pennsylvania State Higher Educational Facilities Authority (St. Joseph University), 5.75%, due 11/1/30, callable 11/1/20 at 100

|

400,000 | 443,824 | ||||||

|

Delaware Valley, Pennsylvania Regional Finance Authority, 5.75%, due 7/01/32

|

200,000 | 229,280 | ||||||

|

Total Other Revenue Bonds

|

4,883,810 | |||||||

| Total Municipal Bonds (Cost $6,135,887) |

6,398,487

|

|||||||

| Common Stocks – 27.3% | ||||||||

| Consumer Discretionary – 4.7% | ||||||||

| Genuine Parts Co. |

1,700

|

106,556

|

||||||

| Heinz, HJ |

2,875

|

151,541

|

||||||

| Home Depot Inc. |

2,400

|

114,168

|

||||||

| McDonalds Corp. |

1,100

|

109,208

|

||||||

| Pepsico |

1,300

|

81,822

|

||||||

| Total Consumer Discretionary |

563,295

|

|||||||

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

|

Common Stocks (Continued) – 27.3%

|

||||||||

|

Consumer Staples – 3.3%

|

||||||||

|

Altria Group, Inc.

|

5,600 | $ | 168,560 | |||||

|

Kimberly Clark Corp.

|

1,950 | 142,116 | ||||||

|

Procter & Gamble Co.

|

1,250 | 84,525 | ||||||

|

Total Consumer Staples

|

395,201 | |||||||

|

Energy – 3.5%

|

||||||||

|

Conocophillips

|

1,550 | 118,653 | ||||||

|

Royal Dutch Shell, PLC, ADR

|

2,000 | 146,180 | ||||||

|

Total Fina Elf SA, ADR

|

2,750 | 154,192 | ||||||

|

Total Energy

|

419,025 | |||||||

|

Financials – 2.6%

|

||||||||

|

Blackrock, Inc.

|

500 | 99,500 | ||||||

|

M&T Bank Corp.

|

800 | 65,296 | ||||||

|

NYSE Euronext

|

5,100 | 151,827 | ||||||

|

Total Financials

|

316,623 | |||||||

|

Health Care – 3.9%

|

||||||||

|

Bristol Myers Squibb Co.

|

3,250 | 104,553 | ||||||

|

Glaxosmithkline PLC, ADR

|

3,200 | 141,792 | ||||||

|

Johnson & Johnson

|

1,200 | 78,096 | ||||||

|

Merck & Co., Inc.

|

3,700 | 141,229 | ||||||

|

Total Health Care

|

465,670 | |||||||

|

Industrials – 3.7%

|

||||||||

|

Caterpillar, Inc.

|

1,000 | 114,210 | ||||||

|

Eaton Corp.

|

2,500 | 130,475 | ||||||

|

General Electric Co.

|

3,600 | 68,580 | ||||||

|

United Parcel Service, Inc. Class B

|

150 | 11,548 | ||||||

|

Waste Management Inc.

|

3,400 | 118,932 | ||||||

|

Total Industrials

|

443,745 | |||||||

|

Information Technology – 1.4%

|

||||||||

|

Automatic Data Processing, Inc.

|

800 | 43,456 | ||||||

|

Intel Corp.

|

4,500 | 120,960 | ||||||

|

Total Information Technology

|

164,416 | |||||||

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

|

Common Stocks (Continued) – 27.3%

|

||||||||

|

Materials – 1.0%

|

||||||||

|

Air Products & Chemicals, Inc.

|

500 | $ | 45,120 | |||||

|

DuPont E.I. DeNemours & Co.

|

1,500 | 76,275 | ||||||

|

Total Materials

|

121,395 | |||||||

|

Telecommunications – 1.3%

|

||||||||

|

AT & T, Inc.

|

2,800 | 85,652 | ||||||

|

Verizon Communications

|

1,900 | 72,409 | ||||||

|

Total Telecommunications

|

158,061 | |||||||

|

Utilities – 1.9%

|

||||||||

|

Consolidated Edison, Inc.

|

2,350 | 136,535 | ||||||

|

Exelon Corp.

|

2,250 | 87,908 | ||||||

|

Total Utilities

|

224,443 | |||||||

|

Total Common Stocks (Cost $2,726,418)

|

3,271,874 | |||||||

|

Exchange Traded Funds – 9.2%

|

||||||||

|

Ishares Comex Gold Trust*

|

28,040 | 462,099 | ||||||

|

SPDR Gold Trust*

|

2,875 | 472,322 | ||||||

|

JPMorgan Chase & Co Aleran ML ETN

|

4,100 | 167,280 | ||||||

|

Total Exchange Traded Funds (Cost $803,815)

|

1,101,701 | |||||||

|

Mutual Funds – 6.0%

|

||||||||

|

Pimco Real Return Strategy Fund

|

45,538 | 321,504 | ||||||

|

Vanguard Precious Metals & Mining Fund

|

18,368 | 401,517 | ||||||

|

Total Mutual Funds (Cost $713,736)

|

723,021 | |||||||

|

Real Estate Investment Trusts – 2.0%

|

||||||||

|

Capital Trust, Inc.* (Cost $765,147)

|

70,000 | 238,000 | ||||||

|

Short-Term Investments - at Cost Approximating Fair Value - 2.0%

|

||||||||

|

Federated Pennsylvania Municipal Cash Trust #8 – (Cost $241,822)

|

241,822 | 241,822 | ||||||

|

Total Investments - 100% (Cost $11,386,825)

|

$ | 11,974,905 | ||||||

| NRM Investment Company |

| Statement of Assets and Liabilities |

| February 29, 2012 |

|

Assets

|

||||

|

Investments at fair value (cost $11,386,825)

|

$ | 11,974,905 | ||

|

Cash

|

1,400 | |||

|

Interest and dividends receivable

|

96,648 | |||

|

Prepaid expenses

|

1,500 | |||

|

Total Assets

|

12,074,453 | |||

|

Liabilities

|

||||

|

Dividends payable

|

69,686 | |||

|

Due to advisor

|

5,667 | |||

|

Accrued expenses and other liabilities

|

19,371 | |||

|

Total Liabilities

|

94,724 | |||

|

Net Assets, Applicable to 3,318,376 outstanding Shares, Equivalent to $3.61 a Share

|

$ | 11,979,729 | ||

|

Net Assets consist of:

|

||||

|

Capital Stock ( par value $.01/share, 10,000,000 shares authorized, 3,318,376 issued and outstanding)

|

$ | 33,184 | ||

|

Paid-in capital

|

13,067,037 | |||

| Accumulated undistributed net investment income | 11,620 | |||

|

Accumulated realized loss on investments

|

(1,720,192 | ) | ||

|

Unrealized appreciation of investments

|

588,080 | |||

|

Net Assets

|

$ | 11,979,729 | ||

| NRM Investment Company |

| Statement of Operations |

| Six-Month Period Ended February 29, 2011 |

|

Investment Income

|

||||

|

Interest

|

$ | 121,235 | ||

|

Dividends ( net of $1,035 foreign taxes withheld)

|

129,448 | |||

| 250,683 | ||||

|

Expenses

|

||||

|

Investment advisory fees

|

17,063 | |||

|

Custodian fees

|

8,925 | |||

|

Transfer and dividend disbursing agent fees

|

3,550 | |||

|

Legal and professional fees

|

22,200 | |||

|

Directors’ fees 1

|

5,333 | |||

|

Insurance

|

175 | |||

|

Capital stock tax2

|

5,667 | |||

|

Miscellaneous

|

3,333 | |||

|

Total Expenses

|

66,246 | |||

|

Net Investment Income

|

184,437 | |||

|

Realized and Unrealized Gain (Loss) on Investments

|

||||

|

Net realized gain from investment transactions

|

85,903 | |||

|

Capital gain distributions received from portfolio companies

|

26,557 | |||

|

Net unrealized appreciation of investments

|

150,016 | |||

|

Net Realized and Unrealized Gain on Investments

|

262,476 | |||

|

Net Increase in Net Assets Resulting from Operations

|

$ | 446,913 | ||

| NRM Investment Company |

| Statements of Changes in Net Assets |

| Period Year Ended February 29, 2012 and August 31, 2011 |

|

February 29, 2012

|

August 31,2011

|

|||||||

|

Increase (Decrease) in Net Assets from Operations

|

||||||||

|

Net investment income

|

$ | 184,437 | $ | 312,135 | ||||

|

Net realized gain(loss) from investment transactions

|

85,903 | 145,865 | ||||||

|

Capital gain distributions received from portfolio companies

|

26,557 | 4,345 | ||||||

|

Net unrealized appreciation (depreciation) of investments

|

150,016 | 783,362 | ||||||

|

Net Increase (Decrease) in Net Assets Resulting from Operations

|

446,913 | 1,245,707 | ||||||

|

Distributions to Shareholders from Net Investment Income

|

(179,205 | ) | (311,933 | ) | ||||

|

Capital Share Transactions

|

(130 | ) | (658,126 | ) | ||||

|

Total Increase in Net Assets

|

267,578 | 275,648 | ||||||

|

Net Assets - Beginning of Year

|

11,712,151 | 11,436,503 | ||||||

|

Net Assets - End of Year ( includes undistributed net investment income $11,620 and $6,388, respectively)

|

$ | 11,979,729 | $ | 11,712,151 | ||||

| NRM Investment Company |

| Financial Highlights |

| Period Ended February 29, 2012, August 31, 2011, 2010, 2009, 2008, and 2007 |

|

2/29/12

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||||||

|

Unaudited

|

||||||||||||||||||||||||

|

Per Share Data (for a share outstanding throughout the indicated period)

|

||||||||||||||||||||||||

|

Net asset value, beginning of year

|

$ | 3.53 | $ | 3.25 | $ | 3.069 | $ | 3.480 | $ | 3.551 | $ | 3.938 | ||||||||||||

|

Net investment income (loss) (a)

|

.055 | .094 | .114 | .138 | (.321 | ) | (.131 | ) | ||||||||||||||||

|

Net realized and unrealized gain (loss) on investments

|

.079 | .279 | (.181 | ) | (.454 | ) | (.336 | ) | (.088 | ) | ||||||||||||||

|

Total from Investment Operations

|

.134 | .373 | .295 | (.316 | ) | (.015 | ) | (.219 | ) | |||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Dividends from capital gains

|

- | - | - | - | - | (.025 | ) | |||||||||||||||||

|

Dividends from net tax-exempt income

|

(.026 | ) | (.053 | ) | (.052 | ) | (.045 | ) | (.024 | ) | (.064 | ) | ||||||||||||

|

Dividends from net taxable income

|

(.028 | ) | (.041 | ) | (.062 | ) | (.050 | ) | (.032 | ) | (.079 | ) | ||||||||||||

|

Total Distributions

|

(.054 | ) | (.097 | ) | (.114 | ) | (.095 | ) | (.056 | ) | (.168 | ) | ||||||||||||

|

Net Asset Value, End of Period

|

$ | 3.61 | $ | 3.53 | $ | 3.250 | $ | 3.069 | $ | 3.480 | $ | 3.551 | ||||||||||||

|

Total Return (Loss) (b)

|

3.83 | % | 11.59 | % | 9.71 | % | (9.20 | %) | (0.37 | %) | (5.79 | %) | ||||||||||||

|

Ratios/Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period/year (in thousands)

|

$ | 11,980 | $ | 11,712 | $ | 11,437 | $ | 10,797 | $ | 12,557 | $ | 12,815 | ||||||||||||

|

Ratio of expenses to average net assets

|

.57 | % | 1.17 | % | 1.39 | % | 1.40 | % | 1.33 | %* | 8.62 | % | ||||||||||||

|

Ratio of net investment income (loss) to average net assets

|

1.58 | % | 2.73 | % | 3.58 | % | 4.70 | % | 9.23 | % | (3.43 | %) | ||||||||||||

|

portfolio turnover rate

|

5.84 | % | 19.58 | % | 38.07 | % | 17.27 | % | 9.27 | % | 18.00 | % | ||||||||||||

| NRM Investment Company |

| February 29, 2012 |

|

Notes to Financial Statements

|

|

Note 1 - Nature of Business and Significant Accounting Policies

|

|

|

Nature of Business

|

|

|

Valuation of Investments

|

|

|

Investment Transactions and Related Investment Income

|

|

|

Transactions with Shareholders

|

|

|

Federal Income Taxes

|

| NRM Investment Company |

| February 29, 2012 |

|

Notes to Financial Statements

|

|

Note 1 - Nature of Business and Significant Accounting Policies - Continued

|

|

|

Federal Income Taxes - Continued

|

|

|

Estimates

|

|

Note 2 - Investment Advisor and Management Fees and Other Transactions with Affiliates

|

|

Note 3 - Purchases and Sales of Investment Securities

|

| NRM Investment Company |

| February 29, 2012 |

|

Notes to Financial Statements

|

|

Note 4 –Fair Value Measurements

|

|

Description

|

Total

|

(Level 1-

Quoted

Prices in

Active

Markets for

Identical

Assets)

|

(Level 2-

Significant

Other

Observable

Inputs)

|

(Level 3-

Significant

Unobservable

Inputs)

|

||||||||||||

|

Municipal Bonds

|

$ | 6,398,487 | $ | - | $ | 6,398,487 | $ | - | ||||||||

|

Common Stocks

|

3,271,874 | 3,271,874 | - | - | ||||||||||||

|

Exchange Traded Funds

|

1,101,701 | 1,101,701 | - | - | ||||||||||||

|

Mutual Funds

|

723,021 | 723,021 | - | - | ||||||||||||

|

Real Estate Investment Trusts

|

238,000 | 238,000 | - | - | ||||||||||||

|

Short-Term Investments

|

241,822 | 241,822 | - | - | ||||||||||||

|

Total

|

$ | 11,974,905 | $ | 5,576,418 | $ | 6,398,487 | $ | - | ||||||||

| NRM Investment Company |

| February 29, 2012 |

|

Period Ended

|

Year Ended

|

|||||||||||||||

|

February 29, 2012

|

August 31, 2011

|

|||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Shares issued

|

0 | $ | 0 | 63 | $ | 216 | ||||||||||

|

Shares issued in reinvestment of dividends

|

9 | 31 | 12 | 41 | ||||||||||||

|

Shares redeemed

|

(47 | ) | (165 | ) | (200,110 | ) | (658,383 | |||||||||

|

Net (Decrease) Increase

|

(38 | ) | $ | (134 | ) | (200,035 | ) | $ | (658,126 | ) | ||||||

| NRM Investment Company |

| February 29, 2012 |

|

Undistributed ordinary income

|

$

|

11,620

|

||

|

Capital loss carry forward*

|

||||

|

Expiring 8/31/2017

|

$

|

(734,473

|

)

|

|

|

Expiring 8/31/2018

|

(985,719

|

)

|

||

|

$

|

(1,720,192

|

)

|

||

|

Gross unrealized appreciation on investment securities

|

$

|

1,147,303

|

||

|

Gross unrealized depreciation on investment securities

|

(559,223

|

)

|

||

|

Net unrealized appreciation on investment securities

|

$

|

588,080

|

||

|

Cost of investment securities (including short-term investments)

|

$

|

11,386,825

|

|

2/29/2012

|

08/31/2011

|

|||||||

|

Distributions paid from:

|

||||||||

|

Tax-exempt interest and dividends

|

$ | 86,661 | $ | 173,638 | ||||

|

Taxable qualified dividends

|

43,814 | 72,357 | ||||||

|

Taxable ordinary dividends

|

48,717 | 65,938 | ||||||

|

Long-term capital gains

|

- | - | ||||||

|

|

$ | 179,192 | $ | 401,100 | ||||

|

Management has evaluated the impact of all subsequent events through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in these financial statements.

|

| NRM Investment Company |

| February 29, 2012 |

|

Notes to Financial Statements

|

|

Note 10 - Cash and Cash Equivalents

|

| NRM Investment Company |

| February 29, 2012 |

| (Fees paid directly from your investment) | |

|

Sales Charge (Load) imposed on Purchases

|

None

|

|

Purchase Fee

|

None

|

|

Sales Charge (Load) imposed on Reinvested Dividends

|

None

|

|

Redemption Fees

|

None

|

|

Account Service Fees

|

None

|

| (Expenses deducted from the Fund’s assets) | |

|

Management Expenses

|

.15%

|

|

Other Expenses

|

.42%

|

|

Aquired Fund Fees and Expenses

|

.02%

|

|

Total Annual Fund Operating Expenses

|

.59%

|

|

|

1.

|

Based on actual Fund return. This helps you estimate the actual expenses you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with a $1,000 in the Fund. You may use the information here, together with the amount you invested to estimate the expenses that you paid over the period.

|

| NRM Investment Company |

| February 29, 2012 |

|

|

2.

|

Based on hypothetical 5% yearly return. This is intended to help you compare your Fund’s cost with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expenses ratio is unchanged. In this case, because the return used is not the Fund’s actual returns, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing the hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

|

|

Beginning

|

Ending

|

Expenses

|

||||||||||

|

Account Value

|

Account Value

|

Paid During

|

||||||||||

|

08/31/11

|

02/29/12

|

Period

|

||||||||||

|

Based on Actual Fund Return

|

$ | 1,000.00 | $ | 1,038.30 | $ | 5.98 | ||||||

|

Based on Hypothetical 5% Yearly Return

|

$ | 1,000.00 | $ | 1,019.40 | $ | 6.01 | ||||||

|

|

1.

|

Proxies for which HFS has ultimate voting authority are voted consistently and solely in the best economic interests of the beneficiaries of these equity investments, and not in the interests of HFS or any associated parties other than the clients.

|

|

|

2.

|

Any real or perceived material conflicts that may arise between the interests of HFS or any of its associate parties and those of the clients are properly addressed and resolved.

|

|

|

1.

|

HFS will vote client proxies in line with the recommendations made by Institutional Shareholder Services (Egan-Jones), except in circumstances detailed in (2) of this section. Institutional Shareholder Services’ recommendations focus on voting proxies in the best economic interest of shareholders, and as such align well with the goals of HFS’ clients. Institutional Shareholder Services’ specific proxy voting policies are available upon request.

|

|

|

2.

|

HFS’ Investment Committee reserves the right to vote a proxy contrary to Egan-Jones’s recommendation with a majority vote. Issues that can trigger a review by the committee for the purpose of voting against Egan-Jones are (but are not limited to):

|

|

|

a.

|

Mergers and acquisitions

|

|

|

b.

|

Spin-offs, split-offs, or IPOs

|

|

|

c.

|

Significant alterations of the capital structure of the company

|

|

|

d.

|

Other significant corporate actions

|

|

|

e.

|

Employee compensation and benefits

|

|

|

3.

|

Should any real or perceived material conflicts arise between the interests of HFS or any of its associated parties and those of its clients, HFS’ Investment Committee forgoes its right to vote a proxy contrary to Egan-Jones’s recommendation.

|