Preliminary Pricing Supplement dated June 5, 2023

|

Preliminary Pricing Supplement

(To the Prospectus dated May 23, 2022 and the Prospectus Supplement dated June 27, 2022)

|

Filed Pursuant to Rule 424(b)(2)

Registration No. 333—265158

|

|

|

$[●]

Callable Contingent Coupon Notes due December 11, 2025

Linked to the Least Performing of Four Equity Securities

Global Medium-Term Notes, Series A

|

|

|

Issuer:

|

Barclays Bank PLC

|

|

Denominations:

|

Minimum denomination of $1,000, and integral multiples of $1,000 in excess thereof

|

|

Initial Valuation Date:

|

June 7, 2023

|

|

Issue Date:

|

June 12, 2023

|

|

Final Valuation Date:*

|

December 8, 2025

|

|

Maturity Date:*

|

December 11, 2025

|

|

Reference Assets:

|

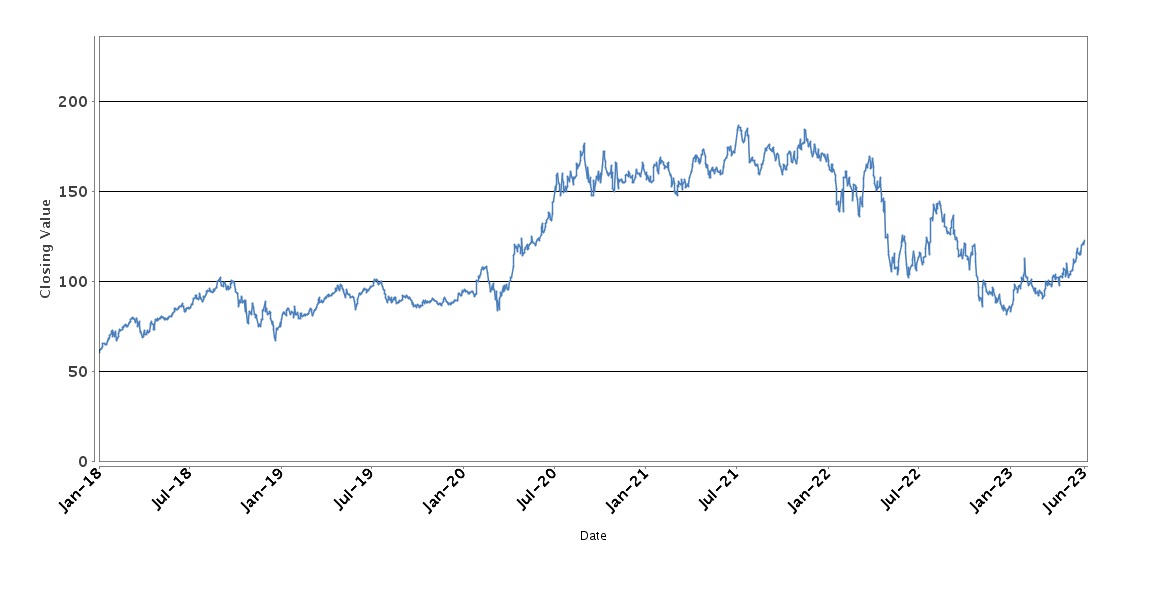

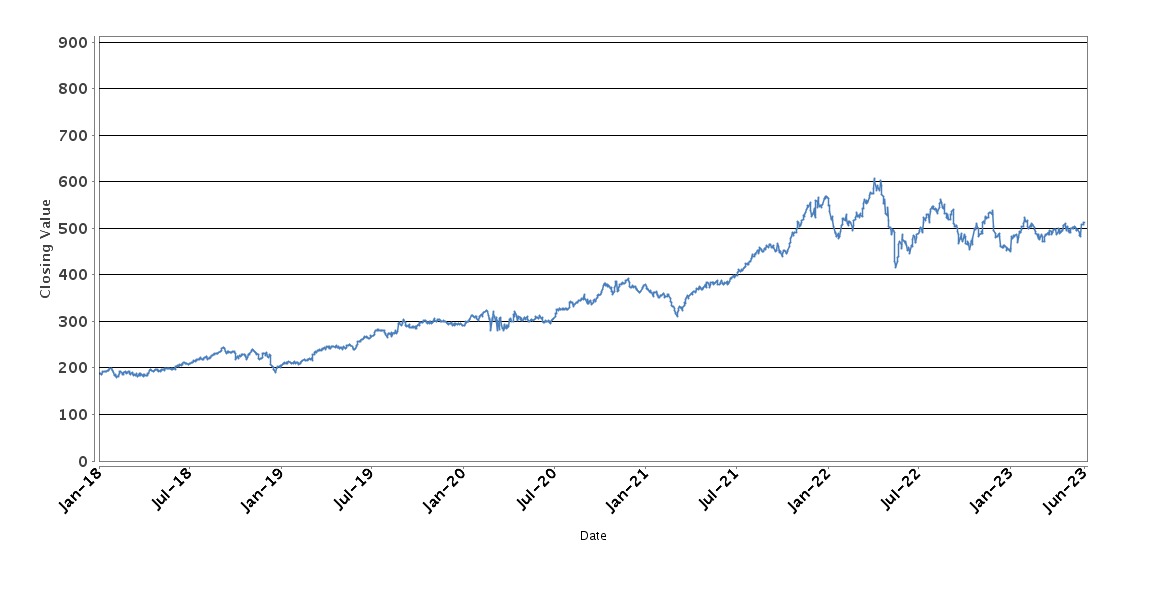

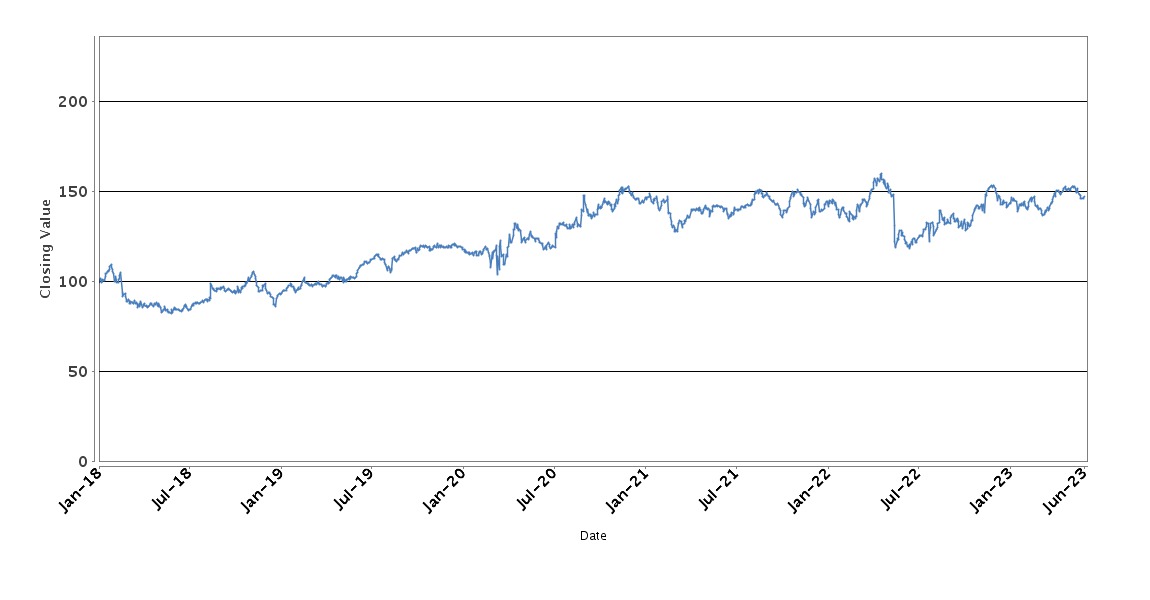

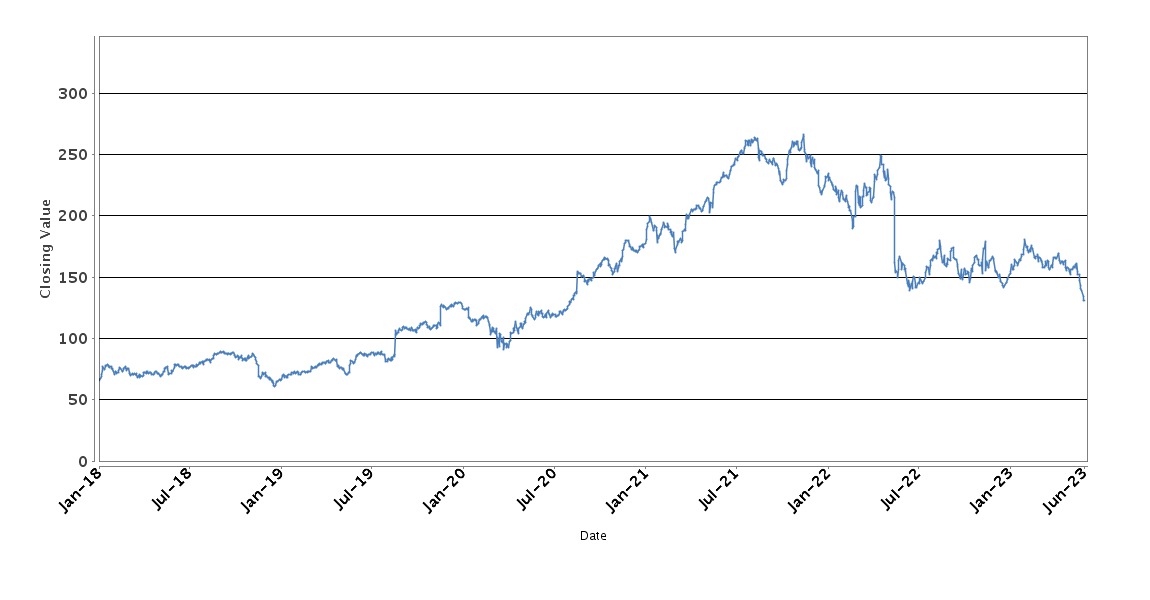

The Common Stock of Amazon.com, Inc. (“AMZN”), the Common Stock of Costco Wholesale Corporation (“COST”), the Common Stock of Walmart Inc. (“WMT”) and the Common Stock of Target Corporation (“TGT”), as set forth in the following table:

Reference Asset

Bloomberg Ticker

Initial Value

Coupon Barrier Value

Barrier Value

AMZN

AMZN UW <Equity>

[●]

[●]

[●]

COST

COST UW <Equity>

[●]

[●]

[●]

WMT

WMT UN <Equity>

[●]

[●]

[●]

TGT

TGT UN <Equity>

[●]

[●]

[●]

The securities set forth above are each referred to herein as a “Reference Asset” and, collectively, as the “Reference Assets.”

|

|

Payment at Maturity:

|

If the Notes are not redeemed prior to scheduled maturity, and if you hold the Notes to maturity, you will receive on the Maturity Date a cash payment per $1,000 principal amount Note that you hold (in each case, in addition to any Contingent Coupon and/or Unpaid Coupon Amounts that may be payable on such date) determined as follows:

■

If the Final Value of the Least Performing Reference Asset is greater than or equal to its Barrier Value, you will receive a payment of $1,000 per $1,000 principal amount Note.

■

If the Final Value of the Least Performing Reference Asset is less than its Barrier Value, you will receive an amount per $1,000 principal amount Note calculated as follows:

$1,000 + [$1,000 × Reference Asset Return of the Least Performing Reference Asset]

If the Notes are not redeemed prior to scheduled maturity, and if the Final Value of the Least Performing Reference Asset is less than its Barrier Value, your Notes will be fully exposed to the decline of the Least Performing Reference Asset from its Initial Value. You may lose up to 100.00% of the principal amount of your Notes at maturity.

Any payment on the Notes, including any repayment of principal, is not guaranteed by any third party and is subject to (a) the creditworthiness of Barclays Bank PLC and (b) the risk of exercise of any U.K. Bail-in Power (as described on page PS-4 of this pricing supplement) by the relevant U.K. resolution authority. If Barclays Bank PLC were to default on its payment obligations or become subject to the exercise of any U.K. Bail-in Power (or any other resolution measure) by the relevant U.K. resolution authority, you might not receive any amounts owed to you under the Notes. See “Consent to U.K. Bail-in Power” and “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the accompanying prospectus supplement for more information.

|

|

Consent to U.K. Bail-in Power:

|

Notwithstanding and to the exclusion of any other term of the Notes or any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the Notes (or the Trustee on behalf of the holders of the Notes), by acquiring the Notes, each holder and beneficial owner of the Notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page PS-4 of this pricing supplement.

|

|

|

Initial Issue Price(1)(2)

|

Price to Public

|

Agent’s Commission(3)

|

Proceeds to Barclays Bank PLC

|

|

Per Note

|

$1,000

|

100.00%

|

0.75%

|

99.25%

|

|

Total

|

$[●]

|

$[●]

|

$[●]

|

$[●]

|

|

(1)

|

Because dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all selling concessions, fees or commissions, the public offering price for investors purchasing the Notes in such fee-based advisory accounts may be between $992.50 and $1,000 per Note. Investors that hold their Notes in fee-based advisory or trust accounts may be charged fees by the investment advisor or manager of such account based on the amount of assets held in those accounts, including the Notes.

|

|

(2)

|

Our estimated value of the Notes on the Initial Valuation Date, based on our internal pricing models, is expected to be between $947.30 and $967.30 per Note. The estimated value is expected to be less than the initial issue price of the Notes. See “Additional Information Regarding Our Estimated Value of the Notes” on page PS—5 of this pricing supplement.

|

|

(3)

|

Barclays Capital Inc. will receive commissions from the Issuer of up to $7.50 per $1,000 principal amount Note. Barclays Capital Inc. will use these commissions to pay variable selling concessions or fees (including custodial or clearing fees) to other dealers. The actual commission received by Barclays Capital Inc. will be equal to the selling concession paid to such dealers.

|

|

Terms of the Notes,

Continued |

|

|

Early Redemption at the Option of the Issuer:

|

The Notes cannot be redeemed for approximately the first three months after the Issue Date. We may redeem the Notes (in whole but not in part) at our sole discretion without your consent at the Redemption Price set forth below on any Call Valuation Date. No further amounts will be payable on the Notes after they have been redeemed.

|

|

Contingent Coupons and Unpaid Coupon Amounts:

|

$16.25 per $1,000 principal amount Note, which is 1.625% of the principal amount per Note (rounded to four decimal places, as applicable) (based on 19.50% per annum rate)

If the Closing Value of each Reference Asset on an Observation Date is greater than or equal to its respective Coupon Barrier Value, a Contingent Coupon will become payable on the related Contingent Coupon Payment Date.

If a Contingent Coupon does not become payable with respect to an Observation Date (i.e., because the Closing Value of any Reference Asset on such Observation Date is less than its respective Coupon Barrier Value), the Contingent Coupon that would have otherwise been payable with respect to such Observation Date will become an “Unpaid Coupon Amount”

On each Contingent Coupon Payment Date, if a Contingent Coupon is payable on such date, you will receive:

■

the Contingent Coupon that is payable on such Contingent Coupon Payment Date; plus

■

any Unpaid Coupon Amounts that have not already been paid on a previous Contingent Coupon Payment Date

If a Contingent Coupon is not payable with respect to an Observation Date, you will not receive a Contingent Coupon on the related Contingent Coupon Payment Date, nor will you receive any Unpaid Coupon Amounts that accrued on any prior Observation Date

|

|

Observation Dates:*

|

July 7, 2023, August 7, 2023, September 7, 2023, October 9, 2023, November 7, 2023, December 7, 2023, January 8, 2024, February 7, 2024, March 7, 2024, April 8, 2024, May 7, 2024, June 7, 2024, July 8, 2024, August 7, 2024, September 9, 2024, October 7, 2024, November 7, 2024, December 9, 2024, January 7, 2025, February 7, 2025, March 7, 2025, April 7, 2025, May 7, 2025, June 9, 2025, July 7, 2025, August 7, 2025, September 8, 2025, October 7, 2025, November 7, 2025 and the Final Valuation Date

|

|

Contingent Coupon Payment Dates:*

|

July 14, 2023, August 14, 2023, September 14, 2023, October 16, 2023, November 14, 2023, December 14, 2023, January 16, 2024, February 14, 2024, March 14, 2024, April 15, 2024, May 14, 2024, June 14, 2024, July 15, 2024, August 14, 2024, September 16, 2024, October 15, 2024, November 15, 2024, December 16, 2024, January 14, 2025, February 14, 2025, March 14, 2025, April 14, 2025, May 14, 2025, June 16, 2025, July 14, 2025, August 14, 2025, September 15, 2025, October 15, 2025, November 17, 2025 and the Maturity Date

|

|

Call Valuation Dates:*

|

September 7, 2023, October 9, 2023, November 7, 2023, December 7, 2023, January 8, 2024, February 7, 2024, March 7, 2024, April 8, 2024, May 7, 2024, June 7, 2024, July 8, 2024, August 7, 2024, September 9, 2024, October 7, 2024, November 7, 2024, December 9, 2024, January 7, 2025, February 7, 2025, March 7, 2025, April 7, 2025, May 7, 2025, June 9, 2025, July 7, 2025, August 7, 2025, September 8, 2025, October 7, 2025 and November 7, 2025. If we exercise our early redemption option on a Call Valuation Date, we will provide written notice to the trustee on such Call Valuation Date.

|

|

Call Settlement Date:*

|

The Contingent Coupon Payment Date following the Call Valuation Date on which we exercise our early redemption option

|

|

Initial Value:

|

With respect to each Reference Asset, the Closing Value on the Initial Valuation Date, as set forth in the table above

|

|

Coupon Barrier Value:

|

With respect to each Reference Asset, 70.00% of its Initial Value (rounded to two decimal places), as set forth in the table above

|

|

Barrier Value:

|

With respect to each Reference Asset, 60.00% of its Initial Value (rounded to two decimal places), as set forth in the table above

|

|

Final Value:

|

With respect to each Reference Asset, the Closing Value on the Final Valuation Date

|

|

Redemption Price:

|

$1,000 per $1,000 principal amount Note that you hold, plus (i) the Contingent Coupon that will otherwise be payable on the Call Settlement Date and (ii) any Unpaid Coupon Amounts that have accrued but have not yet been paid

|

|

Reference Asset Return:

|

With respect to each Reference Asset, the performance of such Reference Asset from its Initial Value to its Final Value, calculated as follows:

Final Value — Initial Value

Initial Value |

|

Least Performing Reference Asset:

|

The Reference Asset with the lowest Reference Asset Return, as calculated in the manner set forth above

|

|

Closing Value:

|

The term “Closing Value” means the closing price of one share of the applicable Reference Asset, as further described under “Reference Assets—Equity Securities—Special Calculation Provisions” in the prospectus supplement.

|

|

Calculation Agent:

|

Barclays Bank PLC

|

|

CUSIP / ISIN:

|

06745MHV3 / US06745MHV37

|

|

|

●

|

Prospectus dated May 23, 2022:

|

|

●

|

Prospectus Supplement dated June 27, 2022:

|

|

●

|

You do not seek an investment that produces fixed periodic interest or coupon payments or other non-contingent sources of current income, and you can tolerate receiving few or no Contingent Coupons over the term of the Notes in the event the Closing Value of any Reference Asset falls below its Coupon Barrier Value on one or more of the specified Observation Dates.

|

|

●

|

You understand and accept that you will not participate in any appreciation of any Reference Asset, which may be significant, and that your return potential on the Notes is limited to the Contingent Coupons and Unpaid Coupon Amounts, if any, paid on the Notes.

|

|

●

|

You can tolerate a loss of a significant portion or all of the principal amount of your Notes, and you are willing and able to make an investment that may have the full downside market risk of an investment in the Least Performing Reference Asset.

|

|

●

|

You do not anticipate that the Closing Value of any Reference Asset will fall below its Coupon Barrier Value on any Observation Date or below its Barrier Value on the Final Valuation Date.

|

|

●

|

You understand and accept that you will not be entitled to receive dividends or distributions that may be paid to holders of any Reference Asset or any securities to which any Reference Asset provides exposure, nor will you have any voting rights with respect to any Reference Asset or any securities to which any Reference Asset provides exposure.

|

|

●

|

You are willing and able to accept the individual market risk of each Reference Asset and understand that any decline in the value of one Reference Asset will not be offset or mitigated by a lesser decline or any potential increase in the value of any other Reference Asset.

|

|

●

|

You understand and accept the risks that (a) you will not receive a Contingent Coupon if the Closing Value of any Reference Asset is less than its Coupon Barrier Value on an Observation Date and (b) you will lose some or all of your principal at maturity if the Final Value of any Reference Asset is less than its Barrier Value.

|

|

●

|

You understand and accept the risk that you will not receive any Unpaid Coupon Amounts unless a Contingent Coupon becomes payable on a subsequent Observation Date.

|

|

●

|

You understand and accept the risk that, if the Notes are not redeemed prior to scheduled maturity, the payment at maturity, if any, will be based solely on the Reference Asset Return of the Least Performing Reference Asset.

|

|

●

|

You understand and are willing and able to accept the risks associated with an investment linked to the performance of the Reference Assets.

|

|

●

|

You are willing and able to accept the risk that the Notes may be redeemed prior to scheduled maturity and that you may not be able to reinvest your money in an alternative investment with comparable risk and yield.

|

|

●

|

You can tolerate fluctuations in the price of the Notes prior to scheduled maturity that may be similar to or exceed the downside fluctuations in the values of the Reference Assets.

|

|

●

|

You do not seek an investment for which there will be an active secondary market, and you are willing and able to hold the Notes to maturity if the Notes are not redeemed.

|

|

●

|

You are willing and able to assume our credit risk for all payments on the Notes.

|

|

●

|

You are willing and able to consent to the exercise of any U.K. Bail-in Power by any relevant U.K. resolution authority.

|

|

●

|

You seek an investment that produces fixed periodic interest or coupon payments or other non-contingent sources of current income, and/or you cannot tolerate receiving few or no Contingent Coupons over the term of the Notes in the event the Closing Value of any Reference Asset falls below its Coupon Barrier Value on one or more of the specified Observation Dates.

|

|

●

|

You seek an investment that participates in the full appreciation of any or all of the Reference Assets rather than an investment with a return that is limited to the Contingent Coupons and Unpaid Coupon Amounts, if any, paid on the Notes.

|

|

●

|

You seek an investment that provides for the full repayment of principal at maturity, and/or you are unwilling or unable to accept the risk that you may lose some or all of the principal amount of the Notes in the event that the Final Value of the Least Performing Reference Asset falls below its Barrier Value.

|

|

●

|

You anticipate that the Closing Value of at least one Reference Asset will decline during the term of the Notes such that the Closing Value of at least one Reference Asset will fall below its Coupon Barrier Value on one or more Observation Dates and/or the Final Value of at least one Reference Asset will fall below its Barrier Value.

|

|

●

|

You are unwilling or unable to accept the individual market risk of each Reference Asset and/or do not understand that any decline in the value of one Reference Asset will not be offset or mitigated by a lesser decline or any potential increase in the value of any other Reference Asset.

|

|

●

|

You do not understand and/or are unwilling or unable to accept the risks associated with an investment linked to the performance of the Reference Assets.

|

|

●

|

You are unwilling or unable to accept the risk that the negative performance of only one Reference Asset may cause you to not receive Contingent Coupons (and thus, Unpaid Coupon Amounts) and/or suffer a loss of principal at maturity, regardless of the performance of any other Reference Asset.

|

|

●

|

You are unwilling or unable to accept the risk that the Notes may be redeemed prior to scheduled maturity.

|

|

●

|

You seek an investment that entitles you to dividends or distributions on, or voting rights related to any Reference Asset or any securities to which any Reference Asset provides exposure.

|

|

●

|

You cannot tolerate fluctuations in the price of the Notes prior to scheduled maturity that may be similar to or exceed the downside fluctuations in the values of the Reference Assets.

|

|

●

|

You seek an investment for which there will be an active secondary market, and/or you are unwilling or unable to hold the Notes to maturity if the Notes are not redeemed.

|

|

●

|

You prefer the lower risk, and therefore accept the potentially lower returns, of fixed income investments with comparable maturities and credit ratings.

|

|

●

|

You are unwilling or unable to assume our credit risk for all payments on the Notes.

|

|

●

|

You are unwilling or unable to consent to the exercise of any U.K. Bail-in Power by any relevant U.K. resolution authority.

|

|

Example 1: A Contingent Coupon is payable with respect to each Observation Date.

Observation Date

Is the Closing Value of Any Reference Asset Less Than its Coupon Barrier Value?

Contingent Coupon

Unpaid Coupon Amount

Total Payment on Related Contingent Coupon Payment Date (per $1,000 Principal Amount Note)

1

No

$16.25

N/A

$16.25

2

No

$16.25

N/A

$16.25

3 - 29

With respect to each Observation Date, No

$16.25

N/A

$16.25

30

No

$16.25

N/A

$16.25

Because the Closing Value of each Reference Asset on each Observation Date is greater than or equal to its Coupon Barrier Value, a Contingent Coupon becomes payable on each Contingent Coupon Payment Date. The total amount of Contingent Coupons that you receive is $487.50 per $1,000 principal amount Note, the maximum possible amount of Contingent Coupons that you may receive.

|

|

Example 2: A Contingent Coupon is payable with respect to some Observation Dates but not with respect to other Observation Dates.

Observation Date

Is the Closing Value of Any Reference Asset Less Than its Coupon Barrier Value?

Contingent Coupon

Unpaid Coupon Amount

Total Payment on Related Contingent Coupon Payment Date (per $1,000 Principal Amount Note)

1

Yes

$0.00

$16.25

$0.00

2

No

$16.25

N/A

$32.50

3 - 29

With respect to each Observation Date, No

$16.25

N/A

$16.25

30

Yes

$0.00

$16.25

$0.00

The total amount of Contingent Coupons that you receive is $471.25 per $1,000 principal amount Note, which includes an Unpaid Coupon Amount of $16.25 accrued in respect of the first Observation Date and payable on the second Contingent Coupon Payment Date.

This example is intended to illustrate how Unpaid Coupon Amounts may or may not become payable during the term of the Notes. No Contingent Coupons are payable with respect to the first and thirtieth Observation Dates because the Closing Value of at least one Reference Asset on each such date is less than its Coupon Barrier Value. Because no Contingent Coupon ever becomes payable after the thirtieth Observation Date, you will never receive the related Unpaid Coupon Amounts for the remaining Observation Dates after the thirtieth Observation Date.

|

|

Example 3: No Contingent Coupons are payable with respect any Observation Dates.

Observation Date

Is the Closing Value of Any Reference Asset Less Than its Coupon Barrier Value?

Contingent Coupon

Unpaid Coupon Amount

Total Payment on Related Contingent Coupon Payment Date (per $1,000 Principal Amount Note)

1

Yes

$0.00

$16.25

$0.00

2

Yes

$0.00

$16.25

$0.00

3 - 29

With respect to each Observation Date, Yes

$0.00

$16.25

$0.00

30

Yes

$0.00

$16.25

$0.00

The total amount of Contingent Coupons that you receive during the term of the Notes is $0.00. Because no Contingent Coupon is payable on any Contingent Coupon Payment Date, you will not receive any Contingent Coupons, nor will you receive any Unpaid Coupon Amounts that have accrued.

This example demonstrates that you may not receive any Contingent Coupons during the term of the Notes.

|

|

■

|

Hypothetical Initial Value of each Reference Asset: 100.00*

|

|

■

|

Hypothetical Coupon Barrier Value for each Reference Asset: 70.00 (70.00% of the hypothetical Initial Value set forth above)*

|

|

■

|

Hypothetical Barrier Value for each Reference Asset: 60.00 (60.00% of the hypothetical Initial Value set forth above)*

|

|

■

|

You hold the Notes to maturity, and the Notes are NOT redeemed prior to scheduled maturity.

|

|

Final Value

|

|

Reference Asset Return

|

|

|

|||||||

|

AMZN

(Reference Asset A)

|

COST

(Reference Asset B)

|

WMT

(Reference Asset C)

|

TGT

(Reference Asset D)

|

|

AMZN

(Reference Asset A)

|

COST

(Reference Asset B)

|

WMT

(Reference Asset C)

|

TGT

(Reference Asset D)

|

|

Reference Asset Return of the Least Performing Reference Asset

|

Payment at Maturity**

|

|

$140.00

|

$145.00

|

$150.00

|

$160.00

|

|

40.00%

|

45.00%

|

50.00%

|

60.00%

|

|

40.00%

|

$1,000.00

|

|

$135.00

|

$130.00

|

$140.00

|

$145.00

|

|

35.00%

|

30.00%

|

40.00%

|

45.00%

|

|

30.00%

|

$1,000.00

|

|

$120.00

|

$125.00

|

$122.00

|

$130.00

|

|

20.00%

|

25.00%

|

22.00%

|

30.00%

|

|

20.00%

|

$1,000.00

|

|

$112.00

|

$110.00

|

$115.00

|

$135.00

|

|

12.00%

|

10.00%

|

15.00%

|

35.00%

|

|

10.00%

|

$1,000.00

|

|

$100.00

|

$105.00

|

$120.00

|

$130.00

|

|

0.00%

|

5.00%

|

20.00%

|

30.00%

|

|

0.00%

|

$1,000.00

|

|

$140.00

|

$90.00

|

$105.00

|

$115.00

|

|

40.00%

|

-10.00%

|

5.00%

|

15.00%

|

|

-10.00%

|

$1,000.00

|

|

$80.00

|

$102.00

|

$105.00

|

$145.00

|

|

-20.00%

|

2.00%

|

5.00%

|

45.00%

|

|

-20.00%

|

$1,000.00

|

|

$70.00

|

$105.00

|

$115.00

|

$125.00

|

|

-30.00%

|

5.00%

|

15.00%

|

25.00%

|

|

-30.00%

|

$1,000.00

|

|

$75.00

|

$70.00

|

$65.00

|

$60.00

|

|

-25.00%

|

-30.00%

|

-35.00%

|

-40.00%

|

|

-40.00%

|

$1,000.00

|

|

$135.00

|

$50.00

|

$110.00

|

$100.00

|

|

35.00%

|

-50.00%

|

10.00%

|

0.00%

|

|

-50.00%

|

$500.00

|

|

$150.00

|

$40.00

|

$100.00

|

$120.00

|

|

50.00%

|

-60.00%

|

0.00%

|

20.00%

|

|

-60.00%

|

$400.00

|

|

$40.00

|

$30.00

|

$90.00

|

$125.00

|

|

-60.00%

|

-70.00%

|

-10.00%

|

25.00%

|

|

-70.00%

|

$300.00

|

|

$20.00

|

$55.00

|

$50.00

|

$115.00

|

|

-80.00%

|

-45.00%

|

-50.00%

|

15.00%

|

|

-80.00%

|

$200.00

|

|

$50.00

|

$10.00

|

$55.00

|

$100.00

|

|

-50.00%

|

-90.00%

|

-45.00%

|

0.00%

|

|

-90.00%

|

$100.00

|

|

$0.00

|

$105.00

|

$80.00

|

$110.00

|

|

-100.00%

|

5.00%

|

-20.00%

|

10.00%

|

|

-100.00%

|

$0.00

|

|

●

|

Your Investment in the Notes May Result in a Significant Loss — The Notes differ from ordinary debt securities in that the Issuer will not necessarily repay the full principal amount of the Notes at maturity. If the Notes are not redeemed prior to scheduled maturity, and if the Final Value of the Least Performing Reference Asset is less than its Barrier Value, your Notes will be fully exposed to the decline of the Least Performing Reference Asset from its Initial Value. You may lose up to 100.00% of the principal amount of your Notes.

|

|

●

|

Potential Return is Limited to the Contingent Coupons, If Any, and You Will Not Participate in Any Appreciation of Any Reference Asset — The potential positive return on the Notes is limited to the Contingent Coupons, if any, that may be payable during the term of the Notes (whether paid as Contingent Coupons on the Contingent Coupon Payment Date following an Observation Date or as Unpaid Coupon Amounts on a subsequent Contingent Coupon Payment Date). You will not participate in any appreciation in the value of any Reference Asset, which may be significant, even though you will be exposed to the depreciation in the value of the Least Performing Reference Asset if the Notes are not redeemed and the Final Value of the Least Performing Reference Asset is less than its Barrier Value.

|

|

●

|

You May Not Receive Any Contingent Coupon Payments on the Notes — The Issuer will not necessarily make periodic coupon payments on the Notes. You will receive a Contingent Coupon on a Contingent Coupon Payment Date only if the Closing Value of each Reference Asset on the related Observation Date is greater than or equal to its respective Coupon Barrier Value. If the Closing Value of any Reference Asset on an Observation Date is less than its Coupon Barrier Value, you will not receive a Contingent Coupon on the related Contingent Coupon Payment Date and you will only receive the related Unpaid Coupon Amount if a Contingent Coupon becomes payable on a future Observation Date. If a Contingent Coupon fails to become payable on an Observation Date (and instead becomes an Unpaid Coupon Amount), and no Contingent Coupon becomes payable on any future Observation Date, you will never receive payment of the Unpaid Coupon Amount(s). If the Closing Value of at least one Reference Asset is less than its respective Coupon Barrier Value on each Observation Date, you will not receive any Contingent Coupons during the term of the Notes.

|

|

●

|

Because the Notes Are Linked to the Least Performing Reference Asset, You Are Exposed to Greater Risks of No Contingent Coupons (or Unpaid Coupon Amount(s)) and Sustaining a Significant Loss of Principal at Maturity Than If the Notes Were Linked to a Single Reference Asset — The risk that you will not receive any Contingent Coupons (or Unpaid Coupon Amount(s)) and lose a significant portion or all of your principal amount in the Notes at maturity is greater if you invest in the Notes as opposed to substantially similar securities that are linked to the performance of a single Reference Asset. With multiple Reference Assets, it is more likely that the Closing Value of at least one Reference Asset will be less than its Coupon Barrier Value on the specified Observation Dates or less than its Barrier Value on the Final Valuation Date, and therefore, it is more likely that you will not receive any Contingent Coupons (or Unpaid Coupon Amount(s)) and that you will suffer a significant loss of principal at maturity. Further, the performance of the Reference Assets may not be correlated or may be negatively correlated. The lower the correlation between multiple Reference Assets, the greater the potential for one of those Reference Assets to close below its Coupon Barrier Value or Barrier Value on an Observation Date or the Final Valuation Date, respectively.

|

|

●

|

You Are Exposed to the Market Risk of Each Reference Asset — Your return on the Notes is not linked to a basket consisting of the Reference Assets. Rather, it will be contingent upon the independent performance of each Reference Asset. Unlike an instrument with a return linked to a basket of underlying assets in which risk is mitigated and diversified among all the components of the basket, you will be exposed to the risks related to each Reference Asset. Poor performance by any Reference Asset over the term of the Notes may negatively affect your return and will not be offset or mitigated by any increases or lesser declines in the value of any other Reference Asset. To receive a Contingent Coupon, the Closing Value of each Reference Asset must be greater than or equal to its Coupon Barrier Value on the applicable Observation Date. In addition, if the Notes have not been redeemed prior to scheduled maturity, and if the Final Value of any Reference Asset is less than its Barrier Value, you will be exposed to the full decline in the Least Performing Reference Asset from its Initial Value. Accordingly, your investment is subject to the market risk of each Reference Asset.

|

|

●

|

The Notes Are Subject to Volatility Risk — Volatility is a measure of the degree of variation in the price of an asset (or level of an index) over a period of time. The amount of any coupon payments that may be payable under the Notes is based on a number of factors, including the expected volatility of the Reference Assets. The amount of such coupon payments will be paid

|

|

●

|

Early Redemption and Reinvestment Risk — While the original term of the Notes is as indicated on the cover of this pricing supplement, the Notes may be redeemed prior to maturity, as described above, and the holding period over which you may receive any coupon payments that may be payable under the Notes could be as short as approximately three months.

|

|

●

|

Any Payment on the Notes Will Be Determined Based on the Closing Values of the Reference Assets on the Dates Specified — Any payment on the Notes will be determined based on the Closing Values of the Reference Assets on the dates specified. You will not benefit from any more favorable values of the Reference Assets determined at any other time.

|

|

●

|

Contingent Repayment of Any Principal Amount Applies Only at Maturity or upon Any Redemption — You should be willing to hold your Notes to maturity or any redemption. Although the Notes provide for the contingent repayment of the principal amount of your Notes at maturity, provided that the Final Value of the Least Performing Reference Asset is greater than or equal to its Barrier Value, or upon any redemption, if you sell your Notes prior to such time in the secondary market, if any, you may have to sell your Notes at a price that is less than the principal amount even if at that time the value of each Reference Asset has increased from its Initial Value. See “Many Economic and Market Factors Will Impact the Value of the Notes” below.

|

|

●

|

Owning the Notes is Not the Same as Owning Any Reference Asset or Any Securities to which Any Reference Asset Provides Exposure — The return on the Notes may not reflect the return you would realize if you actually owned any Reference Asset or any securities to which any Reference Asset provides exposure. As a holder of the Notes, you will not have voting rights or rights to receive dividends or other distributions or any other rights that holders of any Reference Asset or any securities to which any Reference Asset provides exposure may have.

|

|

●

|

Tax Treatment — Significant aspects of the tax treatment of the Notes are uncertain. You should consult your tax advisor about your tax situation. See “Tax Considerations” below.

|

|

●

|

Credit of Issuer — The Notes are unsecured and unsubordinated debt obligations of the Issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes, including any repayment of principal, is subject to the ability of Barclays Bank PLC to satisfy its obligations as they come due and is not guaranteed by any third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the Notes, and in the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes.

|

|

●

|

You May Lose Some or All of Your Investment If Any U.K. Bail-in Power Is Exercised by the Relevant U.K. Resolution Authority — Notwithstanding and to the exclusion of any other term of the Notes or any other agreements, arrangements or understandings between Barclays Bank PLC and any holder or beneficial owner of the Notes (or the Trustee on behalf of the holders of the Notes), by acquiring the Notes, each holder and beneficial owner of the Notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority as set forth under “Consent to U.K. Bail-in Power” in this pricing supplement. Accordingly, any U.K. Bail-in Power may be exercised in such a manner as to result in you and other holders and beneficial owners of the Notes losing all or a part of the value of your investment in the Notes or receiving a different security from the Notes, which may be worth significantly less than the Notes

|

|

●

|

Historical Performance of the Reference Assets Should Not Be Taken as Any Indication of the Future Performance of the Reference Assets Over the Term of the Notes — The value of each Reference Asset has fluctuated in the past and may, in the future, experience significant fluctuations. The historical performance of a Reference Asset is not an indication of the future performance of that Reference Asset over the term of the Notes. The historical correlation among the Reference Assets is not an indication of the future correlation among them over the term of the Notes. Therefore, the performance of the Reference Assets individually or in comparison to each other over the term of the Notes may bear no relation or resemblance to the historical performance of any Reference Asset.

|

|

●

|

Single Equity Risk — The values of the Reference Assets can rise or fall sharply due to factors specific to each Reference Asset and its issuer, such as stock price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock market volatility and levels, interest rates and economic and political conditions. We urge you to review financial and other information filed periodically with the SEC by the issuers of the Reference Assets. We have not undertaken any independent review or due diligence of the SEC filings of the issuers of the Reference Assets or of any other publicly available information regarding any such issuer.

|

|

●

|

Anti-Dilution Protection Is Limited, and the Calculation Agent Has Discretion to Make Anti-Dilution Adjustments — The Calculation Agent may in its sole discretion make adjustments affecting the amounts payable on the Notes upon the occurrence of certain corporate events (such as stock splits or extraordinary or special dividends) that the Calculation Agent determines have a diluting or concentrative effect on the theoretical value of any Reference Asset. However, the Calculation Agent might not make such adjustments in response to all events that could affect any Reference Asset. The occurrence of any such event and any adjustment made by the Calculation Agent (or a determination by the Calculation Agent not to make any adjustment) may adversely affect any amounts payable on the Notes. See “Reference Assets—Equity Securities—Share Adjustments Relating to Securities with an Equity Security as a Reference Asset” in the accompanying prospectus supplement.

|

|

●

|

Reorganization Or Other Events Could Adversely Affect the Value of the Notes Or Result in the Notes Being Accelerated — Upon the occurrence of certain reorganization events or a nationalization, expropriation, liquidation, bankruptcy, insolvency or de-listing of any Reference Asset, the Calculation Agent will make adjustments to that Reference Asset that may result in payments on the Notes being based on the performance of shares, cash or other assets distributed to holders of that Reference Asset upon the occurrence of such event or, in some cases, the Calculation Agent may accelerate the maturity date for a payment determined by the Calculation Agent. Any of these actions could adversely affect the value of any Reference Asset and, consequently, the value of the Notes. Any amount payable upon acceleration could be significantly less than the amount(s) that would be due on the Notes if they were not accelerated. See “Reference Assets—Equity Securities—Share Adjustments Relating to Securities with an Equity Security as a Reference Asset” in the accompanying prospectus supplement.

|

|

●

|

We and Our Affiliates May Engage in Various Activities or Make Determinations That Could Materially Affect the Notes in Various Ways and Create Conflicts of Interest — We and our affiliates play a variety of roles in connection with the issuance of the Notes, as described below. In performing these roles, our and our affiliates’ economic interests are potentially adverse to your interests as an investor in the Notes.

|

|

●

|

The Estimated Value of Your Notes is Expected to be Lower Than the Initial Issue Price of Your Notes — The estimated value of your Notes on the Initial Valuation Date is expected to be lower, and may be significantly lower, than the initial issue price of your Notes. The difference between the initial issue price of your Notes and the estimated value of the Notes is a result of certain factors, such as any sales commissions to be paid to Barclays Capital Inc. or another affiliate of ours, any selling concessions, discounts, commissions or fees (including any structuring or other distribution related fees) to be allowed or paid to non-affiliated intermediaries, the estimated profit that we or any of our affiliates expect to earn in connection with structuring the Notes, the estimated cost which we may incur in hedging our obligations under the Notes, and estimated development and other costs which we may incur in connection with the Notes.

|

|

●

|

The Estimated Value of Your Notes Might be Lower if Such Estimated Value Were Based on the Levels at Which Our Debt Securities Trade in the Secondary Market — The estimated value of your Notes on the Initial Valuation Date is based on a number of variables, including our internal funding rates. Our internal funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. As a result of this difference, the estimated value referenced above might be lower if such estimated value were based on the levels at which our benchmark debt securities trade in the secondary market.

|

|

●

|

The Estimated Value of the Notes is Based on Our Internal Pricing Models, Which May Prove to be Inaccurate and May be Different from the Pricing Models of Other Financial Institutions — The estimated value of your Notes on the Initial Valuation Date is based on our internal pricing models, which take into account a number of variables and are based on a number of subjective assumptions, which may or may not materialize. These variables and assumptions are not evaluated or verified on an independent basis. Further, our pricing models may be different from other financial institutions’ pricing models and the methodologies used by us to estimate the value of the Notes may not be consistent with those of other financial institutions which may be purchasers or sellers of Notes in the secondary market. As a result, the secondary market price of your Notes may be materially different from the estimated value of the Notes determined by reference to our internal pricing models.

|

|

●

|

The Estimated Value of Your Notes Is Not a Prediction of the Prices at Which You May Sell Your Notes in the Secondary Market, if any, and Such Secondary Market Prices, If Any, Will Likely be Lower Than the Initial Issue Price of Your Notes and May be Lower Than the Estimated Value of Your Notes — The estimated value of the Notes will not be a prediction of the prices at which Barclays Capital Inc., other affiliates of ours or third parties may be willing to purchase the Notes from you in secondary market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell your Notes in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than our estimated value of the Notes. Further, as secondary market prices of your Notes take into account the levels at which our debt securities trade in the secondary market, and do not take into account our various costs related to the Notes such as fees, commissions, discounts, and the costs of hedging our obligations under the Notes, secondary market prices of your Notes will likely be lower than the initial issue price of your Notes. As a result, the price at which Barclays Capital Inc., other affiliates of ours or third parties may be willing to purchase the Notes from you in secondary market transactions, if any, will likely be lower than the price you paid for your Notes, and any sale prior to the Maturity Date could result in a substantial loss to you.

|

|

●

|

The Temporary Price at Which We May Initially Buy The Notes in the Secondary Market And the Value We May Initially Use for Customer Account Statements, If We Provide Any Customer Account Statements At All, May Not Be Indicative of Future Prices of Your Notes — Assuming that all relevant factors remain constant after the Initial Valuation Date, the price at which Barclays Capital Inc. may initially buy or sell the Notes in the secondary market (if Barclays Capital Inc. makes a market in the Notes, which it is not obligated to do) and the value that we may initially use for customer account statements, if we provide any customer account statements at all, may exceed our estimated value of the Notes on the Initial Valuation Date, as well as the secondary market value of the Notes, for a temporary period after the initial Issue Date of the Notes. The price at which Barclays Capital Inc. may initially buy or sell the Notes in the secondary market and the value that we may initially use for customer account statements may not be indicative of future prices of your Notes.

|

|

●

|

Lack of Liquidity — The Notes will not be listed on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to make a secondary market for the Notes but are not required to do so, and may discontinue any

|

|

●

|

Many Economic and Market Factors Will Impact the Value of the Notes — The value of the Notes will be affected by a number of economic and market factors that interact in complex and unpredictable ways and that may either offset or magnify each other, including:

|

|

o

|

the market price of, dividend rate on and expected volatility of the Reference Assets or the components of the Reference Assets, if any;

|

|

o

|

correlation (or lack of correlation) of the Reference Assets;

|

|

o

|

the time to maturity of the Notes;

|

|

o

|

interest and yield rates in the market generally;

|

|

o

|

a variety of economic, financial, political, regulatory or judicial events;

|

|

o

|

supply and demand for the Notes; and

|

|

o

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|