CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities Offered |

Maximum Aggregate Offering Price |

Amount of Registration Fee(1) | ||

| Global Medium-Term Notes, Series A |

$1,350,000 | $96.26 |

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933 |

| Pricing Supplement dated June 4, 2010 (To the Prospectus dated February 10, 2009, the Prospectus Supplement dated March 1, 2010) |

Filed Pursuant to Rule 424(b)(2) Registration No. 333-145845 |

|

Buffered iSuperTrackSM Notes due June 11, 2012

Global Medium-Term Notes, Series A, No. E-5389 |

Terms used in this pricing supplement are described or defined in the prospectus supplement. The Buffered iSuperTrackSM Notes (the “Notes”) offered will have the terms described in the prospectus supplement and the prospectus, as supplemented by this pricing supplement. THE NOTES DO NOT GUARANTEE ANY RETURN OF PRINCIPAL AT MATURITY.

The Reference Asset below is in the form of a Linked Share and represents the Note offering. The purchaser of a Note will acquire a senior unsecured debt security linked to the performance of a single Linked Share. The following terms relate to the Note offering:

The terms of the Note are as follows:

| Note Issuance # |

Reference Asset (the “Linked Share”) |

Initial Price |

Ticker Symbol |

Principal Amount |

Quarterly Periodic Amount per $1,000 Note |

Buffer Percentage |

Performance Cap |

CUSIP/ISIN | |||||||||||||

| E-5389 |

iShares® Dow Jones U.S. Real Estate Index Fund | $ | 47.28 | IYR | $ | 1,350,000 | $ | 10.00 | 15 | % | 26.50 | % | 06740LM36 / US06740LM361 | ||||||||

| ‡ | The Notes are not rated by Standard & Poor’s Ratings Services (“S&P”) or Moody’s Investors Service (“Moody’s”) as a result of certain policy changes by these organizations. As announced in December 2009, S&P no longer rates obligations, such as the Notes, with variable principal payments linked commodity prices, equity prices or indices linked to either commodity or equity prices. However, the other senior unsecured debt securities of a maturity of more than one year of Barclays Bank PLC unaffected by this policy change are rated AA- by S&P. In addition, as announced in June 2009, Moody’s no longer issues public ratings of notes, such as the Notes, for which repayment of principal is dependent on the occurrence of a non-credit event. However, the other senior unsecured debt securities of Barclays Bank PLC unaffected by this policy change are rated Aa3 by Moody’s. The ratings mentioned in this paragraph are subject to downward revision, suspension or withdrawal at any time by the assigning rating organization and are not a recommendation to buy, sell or hold securities. |

| * | Subject to postponement in the event of a market disruption event and as described under “Reference Assets—Exchange-Traded Funds—Market Disruption Events for Securities with the Reference Asset Comprised of Shares or Other Interests in an Exchange-Traded Fund or Exchange-Traded Funds” in the prospectus supplement. |

Investing in the Notes involves a number of risks. See “Risk Factors” beginning on page S-5 of the prospectus supplement and “Selected Risk Considerations” beginning on page PS-3 of this pricing supplement.

We may use this pricing supplement in the initial sale of the Notes. In addition, Barclays Capital Inc. or another of our affiliates may use this pricing supplement in market resale transactions in any Notes after the initial sale. Unless we or our agent informs you otherwise in the confirmation of sale, this pricing supplement is being used in a market resale transaction.

The Notes will not be listed on any U.S. securities exchange or quotation system. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The Notes constitute our direct, unconditional, unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC and are not insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction.

| Note Issuance # |

Reference Asset (the “Linked Share”) |

Price to Public | Agent’s Commission‡‡‡‡ |

Proceeds to Barclays Bank PLC | ||||||||||||||||

| Per Note | Total | Per Note | Total | Per Note | Total | |||||||||||||||

| E-5389 |

iShares® Dow Jones U.S. Real Estate Index Fund | 100 | % | $ | 1,350,000 | 0 | % | $ | 0 | 100 | % | $ | 1,350,000 | |||||||

| ‡‡‡‡ | Barclays Capital Inc. will receive commissions from the Issuer equal to 0% of the principal amount of the notes, or $0 per $1,000 principal amount, and may retain all or a portion of these commissions or use all or a portion of these commissions to pay selling concessions or fees to other dealers. Accordingly, the percentage and total proceeds to Issuer listed herein is the minimum amount of proceeds that Issuer receives. |

Barclays Bank PLC has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (“SEC”) for the offering to which this pricing supplement relates. Before you invest, you should read the prospectus dated February 10, 2009, the prospectus supplement dated March 1, 2010 and other documents Barclays Bank PLC has filed with the SEC for more complete information about Barclays Bank PLC and this offering. Buyers should rely upon the prospectus, prospectus supplement and any relevant free writing prospectus or pricing supplement for complete details. You may get these documents and other documents Barclays Bank PLC has filed for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Barclays Bank PLC or any agent or dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and final pricing supplement (when completed) and this pricing supplement if you request it by calling your Barclays Bank PLC sales representative, such dealer or 1-888-227-2275 (Extension 3430). A copy of the prospectus may be obtained from Barclays Capital Inc., 745 Seventh Avenue—Attn: US InvSol Support, New York, NY 10019.

You may revoke your offer to purchase the Notes at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase the Notes prior to their issuance. In the event of any changes to the terms of the Notes, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

GENERAL TERMS FOR THE NOTES OFFERING

This pricing supplement relates to the Note offering. The purchaser of a Note will acquire a security linked to the Linked Share identified on the cover page. Although the Note offering relates to the linked share identified on the cover page, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the linked share or as to the suitability of an investment in the Notes.

You should read this pricing supplement together with the prospectus dated February 10, 2009, as supplemented by the prospectus supplement dated March 1, 2010 relating to our Global Medium-Term Notes, Series A, of which these Notes are a part. This pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the prospectus supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Prospectus dated February 10, 2009: |

http://www.sec.gov/Archives/edgar/data/312070/000119312509023285/dposasr.htm

| • | Prospectus Supplement dated March 1, 2010: |

http://www.sec.gov/Archives/edgar/data/312070/000119312510043357/d424b3.htm

Our SEC file number is 1-10257. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Barclays Bank PLC.

PROGRAM CREDIT RATING

The Notes are not rated by Standard & Poor’s Ratings Services (“S&P”) or Moody’s Investors Service (“Moody’s”) as a result of certain policy changes by these organizations. As announced in December 2009, S&P no longer rates obligations, such as the Notes, with variable principal payments linked to commodity prices, equity prices or indices linked to either commodity or equity prices. However, the other senior unsecured debt securities of a maturity of more than one year of Barclays Bank PLC unaffected by this policy change are rated AA- by S&P. An AA rating from S&P generally indicates that the issuer’s capacity to meet its financial commitment on the obligations is very strong. In addition, as announced in June 2009, Moody’s no longer issues public ratings of notes, such as the Notes, for which repayment of principal is dependent on the occurrence of a non-credit event. However, the other senior unsecured debt securities of Barclays Bank PLC unaffected by this policy change are rated Aa3 by Moody’s. An Aa3 rating by

PS–2

Moody’s indicates that the rated securities are currently judged by Moody’s to be obligations of high quality and are subject to very low credit risk. The ratings mentioned in this paragraph are a statement of opinion and not a statement of fact and are subject to downward revisions, suspension or withdrawal at any time by the assigning rating agency and are not a recommendation to buy, sell or hold securities.

We urge you to read the section “Risk Factors” beginning on page S-5 of the prospectus supplement as the following highlights some, but not all, of the risk considerations relevant to investing in the Notes. In particular we urge you to read the risk factors discussed under the following headings:

| • | “Risk Factors—Risks Relating to All Securities”; |

| • | “Risk Factors—Additional Risks Relating to Securities with Reference Assets That Are Equity Securities or Shares or Other Interests in Exchange-Traded Funds, That Contain Equity Securities or Shares or Other Interests in Exchange-Traded Funds or That Are Based in Part on Equity Securities or Shares or Other Interests in Exchange-Traded Funds”; |

| • | “Risk Factors—Additional Risks Relating to Notes Which Are Not Fully Principal Protected or Are Contingently Protected”; and |

| • | “Risk Factors—Additional Risks Relating to Securities with a Maximum Return, Maximum Rate, Ceiling or Cap”. |

In addition to the risks discussed under the headings above, you should consider the following:

| • | Your Investment in the Notes May Result in a Loss—The Notes do not guarantee any return of principal, even if the Notes are held to maturity. Periodic Amounts will be payable on the dates set forth on the cover page of this pricing supplement, including the Maturity Date. However, the payment at maturity (in addition to the final Periodic Amount payable on the Maturity Date) is linked to the performance of the Reference Asset and will depend on whether, and the extent to which, the Reference Asset Return is positive or negative. If the Final Price declines from the Initial Price by more than 15%, you will lose 1% of the principal amount of your Notes for every 1% that the Reference Asset declines beyond -15%. You may lose up to 77% of your initial investment, with all Periodic Amounts included. |

| • | Credit of Issuer—The Notes are senior unsecured debt obligations of the issuer, Barclays Bank PLC and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes, including any principal protection provided at maturity, depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due. In the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes. |

| • | Your Maximum Gain on the Notes Is Limited to the Performance Cap Plus Return Consisting of Periodic Amounts Received Prior to and on the Maturity Date—If the Final Price is greater than the Initial Price, for each $1,000 principal amount, you will receive, in addition to the final Periodic Amount payable on the Maturity Date, a payment at maturity of $1,000 plus an additional amount that will not exceed a predetermined percentage of the principal amount, regardless of the appreciation of the Reference Asset, which may be significant. We refer to this percentage as the Performance Cap, which is 26.50%. In addition, you will receive quarterly Periodic Amounts payable on the dates set forth on the cover page of this pricing supplement. Therefore the maximum total return on the Notes will be limited to the Performance Cap plus return consisting of Periodic Amounts paid prior to and on the Maturity Date. |

| • | Certain Features of Exchange-Traded Funds Will Impact the Value of the Notes—The performance of the iShares® Dow Jones U.S. Real Estate Index Fund (the “ETF”) does not fully replicate the performance of the Dow Jones U.S. Real Estate Index (the “Underlying Index”), and the ETF may hold securities not included in the Underlying Index. The value of the ETF to which your Notes is linked is subject to: |

| • | Management risk. This is the risk that BlackRock Fund Advisors’ investment strategy for the ETF, the implementation of which is subject to a number of constraints, may not produce the intended results. |

PS–3

| • | Derivatives risk. The ETF may invest in futures contracts, option on futures contracts, options, swaps and other derivatives. A derivative is a financial contract, the value of which depends on, or is derived from, the value of an underlying asset such as a security or an index. Compared to conventional securities, derivatives can be more sensitive to changes in interest rates or to sudden fluctuations in market prices, and thus the ETF’s losses, and, as a consequence, the losses of your Notes, may be greater than if the ETF invested only in conventional securities. |

| • | The Reference Asset May Underperform its Underlying Index—The performance of the iShares® Dow Jones U.S. Real Estate Index Fund may not replicate the performance of, and may underperform, its underlying index. Unlike its underlying index, the iShares® Dow Jones U.S. Real Estate Index Fund will reflect transaction costs and fees that will reduce its relative performance. Moreover, it is also possible that the iShares® Dow Jones U.S. Real Estate Index Fund may not fully replicate or may, in certain circumstances, diverge significantly from the performance of its underlying index; for example, due to the temporary unavailability of certain securities in the secondary market, asset valuations, corporate actions (such as mergers and spin-offs), timing variances, legal restrictions (such as diversification requirements) that apply to the iShares® Dow Jones U.S. Real Estate Index Fund but not to its underlying index, or due to other circumstances. Because the payment at maturity of your Notes is linked to the performance of the iShares® Dow Jones U.S. Real Estate Index Fund and not to the underlying index of the iShares® Dow Jones U.S. Real Estate Index Fund, the return on your Notes may be less than that of an alternative investment linked directly to such index. |

| • | No Dividend Payments or Voting Rights—As a holder of the Notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of the Linked Share would have. |

| • | Certain Built-In Costs Are Likely to Adversely Affect the Value of the Notes Prior to Maturity—While the Payment at Maturity described in this pricing supplement is based on the full principal amount of your Notes, the original issue price of the Notes includes the agent’s commission and the cost of hedging our obligations under the Notes through one or more of our affiliates. As a result, the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC will be willing to purchase Notes from you in secondary market transactions will likely be lower than the original issue price, and any sale prior to the maturity date could result in a substantial loss to you. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity. |

| • | Lack of Liquidity—The Notes will not be listed on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to offer to purchase the Notes in the secondary market but are not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC are willing to buy the Notes. |

| • | Potential Conflicts—We and our affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. |

| • | Many Economic and Market Factors Will Impact the Value of the Notes—In addition to the price of the Reference Asset on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| • | the expected volatility of the Reference Asset, its underlying index and securities comprising such underlying index; |

| • | the time to maturity of the Notes; |

| • | the dividend rate underlying the Linked Share; |

| • | interest and yield rates in the market generally; |

| • | a variety of economic, financial, political, regulatory or judicial events; and |

| • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| • | Real Estate Investment Risks—The iShares® Dow Jones U.S. Real Estate Index Fund invests in companies that invest in real estate (“Real Estate Companies”), such as REITs or real estate holding companies. Real estate is highly sensitive to general and local economic conditions and developments, and characterized by intense competition and periodic overbuilding. Real Estate Companies may lack diversification due to ownership of a limited number of properties and concentration in a particular geographic region or property type. Rising interest rates could result in higher costs of capital for Real Estate Companies, which could negatively impact a Real Estate Company’s ability to meet its payment obligations. Real Estate Companies may use leverage (and some may be highly leveraged), which |

PS–4

| increases investment risk and the risks normally associated with debt financing and could adversely affect a Real Estate Company’s operations and market value in periods of rising interest rates. Investing in Real Estate Companies may involve risks similar to those associated with investing in small capitalization companies. There may be less trading in Real Estate Company shares. Real estate is relatively illiquid and, therefore, a Real Estate Company may have a limited ability to vary or liquidate properties in response to changes in economic or other conditions. Real Estate Companies may be subject to risks relating to functional obsolescence or reduced desirability of properties; extended vacancies due to economic conditions and tenant bankruptcies; catastrophic events such as earthquakes, hurricanes and terrorist acts; and casualty or condemnation losses. Real estate income and values also may be greatly affected by demographic trends, such as population shifts or changing tastes and values, or increasing vacancies or declining rents resulting from legal, cultural, technological, global or local economic developments. The prices of real estate company securities may drop because of the failure of borrowers to repay their loans, poor management, and the inability to obtain financing either on favorable terms or at all. Real estate income and values may be adversely affected by such factors as applicable domestic and foreign laws (including tax laws). Government actions, such as tax increases, zoning law changes or environmental regulations, also may have a major impact on real estate. |

| • | Taxes—The U.S. federal income tax treatment of the Notes is uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described herein. As discussed further in the accompanying prospectus supplement, on December 7, 2007, the Internal Revenue Service issued a notice indicating that it and the Treasury Department are actively considering whether, among other issues, you should be required to accrue interest over the term of an instrument such as the Notes at a rate that may exceed the Periodic Amounts you receive during the term of the Notes and whether all or part of the gain you may recognize upon the sale or maturity of an instrument such as the Notes could be treated as ordinary income. The outcome of this process is uncertain and could apply on a retroactive basis. You should consult your tax advisor as to the possible alternative treatments in respect of the Notes. |

SELECTED PURCHASE CONSIDERATIONS

| • | Market Disruption Events and Adjustments—The final valuation date, the maturity date and the payment at maturity are subject to adjustment as described in the following sections of the prospectus supplement: |

| • | For a description of what constitutes a market disruption event as well as the consequences of that market disruption event, see “Reference Assets—Exchange-Traded Funds—Market Disruption Events for Securities with the Reference Asset Comprised of Shares or Other Interests in an Exchange-Traded Fund or Exchange-Traded Funds” with respect to the reference asset; and |

| • | For a description of further adjustments that may affect the reference asset, see “Reference Assets—Equity Exchange-Traded Fund—Share Adjustments Relating to Securities with the Reference Asset Comprised of an Exchange-Traded Fund or Exchange-Traded Funds”. |

| • | Appreciation Potential—The Notes provide the opportunity to access equity returns. If the Reference Asset Return is positive, on the Maturity Date, you will be entitled to receive, per $1,000 principal amount Note, an amount equal to $1,000 plus $1,000 multiplied by the Reference Asset Return, subject to the Performance Cap. In addition, you will receive quarterly Periodic Amounts payable on the dates set forth on the cover page of this pricing supplement. Because the Notes are our senior unsecured obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| • | Limited Protection Against Loss—Payment at maturity of the principal amount of the Notes is protected against a decline in percentage terms in the Final Price, as compared to the Initial Price, by a percentage up to the Buffer Percentage. If the Final price declines from the Initial Price by more than 15%, you will lose 1% of the principal amount of your Notes for every 1% that the Reference Asset declines beyond -15%. You may lose up to 77% of your initial investment, with all Periodic Amounts included. |

| • | Certain U.S. Federal Income Tax Considerations—Some of the tax consequences of your investment in the Notes are summarized below. The discussion below supplements the discussion under “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. As described in the prospectus supplement, this section applies to you only if you are a U.S. holder (as defined in the accompanying prospectus supplement) and you hold your Notes as capital assets for tax purposes and does not apply to you if you are a member of a class of holders subject to special rules or are otherwise excluded from the discussion in the prospectus supplement. |

PS–5

The United States federal income tax consequences of your investment in the Notes are uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different than described below. Pursuant to the terms of the Notes, Barclays Bank PLC and you agree, in the absence of a change in law or an administrative or judicial ruling to the contrary, to characterize your Notes as a pre-paid income-bearing cash-settled executory contract with respect to the Linked Share. If your Notes are so treated, you will likely be taxed on the Periodic Amounts as ordinary income in accordance with your regular method of accounting for United States federal income tax purposes and, subject to the discussion of Section 1260 below, you should generally recognize capital gain or loss upon the sale or maturity of your Notes in an amount equal to the difference between the amount you receive at such time (other than the amount attributable to the Periodic Amount, which will likely be treated as ordinary income) and the amount you paid for your Notes (excluding amounts paid in respect of accrued but unpaid Periodic Amounts). Such capital gain or loss should generally be long-term capital gain or loss if you have held your Notes for more than one year.

In the opinion of our special tax counsel, Sullivan & Cromwell LLP, it would be reasonable to treat your Notes in the manner described above. This opinion assumes that the description of the terms of the Notes in this pricing supplement is materially correct.

As discussed further in the accompanying prospectus supplement, the Treasury Department and the Internal Revenue Service are actively considering various alternative treatments that may apply to instruments such as the Notes, possibly with retroactive effect. Other alternative treatments for your Notes may also be possible under current law.

Although not entirely clear, it is possible that the purchase and ownership of the Notes could be treated as a “constructive ownership transaction” with respect to the Linked Share that is subject to the rules of Section 1260 of the Internal Revenue Code. If your Notes were subject to the constructive ownership rules, then any long-term capital gain that you realize upon the sale or maturity of your Notes that is attributable to the appreciation of the shares of the Linked Share over the term of your Notes would be recharacterized as ordinary income (and you would be subject to an interest charge on deferred tax liability with respect to such capital gain) to the extent that such capital gain exceeds the amount of long-term capital gain that you would have realized had you purchased the actual shares of the Linked Share on the date that you purchased your Notes and sold such shares on the date of the sale or maturity of the Notes (the “Excess Gain Amount”). If the ownership of the Notes is treated as a constructive ownership transaction, we believe it is more likely than not that the Excess Gain Amount will be equal to zero and that the application of the constructive ownership rules will accordingly not have any adverse effects to you. Because the application of the constructive ownership rules is unclear, however, you are strongly urged to consult your tax advisor with respect to the possible application of the constructive ownership rules to your investment in the Notes. It is also possible that your Notes could be treated as an investment unit consisting of an executory contract in respect of the Linked Share and a debt instrument, in which case you could be required to accrue interest at a rate that exceeds the Periodic Amounts you receive over the term of the Notes. You should consult your tax advisor with respect to this possible alternative treatment.

For a further discussion of the tax treatment of your Notes as well as other possible alternative characterizations, please see the discussion under the heading “Certain U.S. Federal Income Tax Considerations—Certain Notes Treated as Forward Contracts or Executory Contracts” in the accompanying prospectus supplement. For additional, important considerations related to tax risks associated with investing in the Notes, you should also examine the discussion in “Selected Risk Considerations—Taxes”, in this pricing supplement.

Recently Enacted Legislation. Under recently enacted legislation, individuals that own “specified foreign financial assets” with an aggregate value in excess of $50,000 in taxable years beginning after March 18, 2010 will generally be required to file an information report with respect to such assets with their tax returns. “Specified foreign financial assets” include any financial accounts maintained by foreign financial institutions, as well as any of the following (which will include the Notes), but only if they are not held in accounts maintained by financial institutions: (i) stocks and securities issued by non-U.S. persons, (ii) financial instruments and contracts held for investment that have non-U.S. issuers or counterparties and (iii) interests in foreign entities. Individuals are urged to consult their tax advisors regarding the application of this legislation to their ownership of the Notes.

PS–6

LINKED SHARE ISSUER AND LINKED SHARE INFORMATION

We urge you to read the following section in the accompanying prospectus supplement: “Reference Assets—Exchange-Traded Funds—Reference Asset Investment Company and Reference Asset Information”. Companies with securities registered under the Securities Exchange Act of 1934, as amended, which is commonly referred to as the “Exchange Act”, and the Investment Company Act of 1940, as amended, which is commonly referred to as the “’40 Act”, are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC electronically can be accessed through a website maintained by the SEC. The address of the SEC’s website is http://www.sec.gov. Information provided to or filed with the SEC pursuant to the Exchange Act or the ’40 Act by the company issuing the ETF can be located by reference to the ETF SEC file number specified below.

The summary information below regarding the company issuing the ETF comes from the issuer’s SEC filings and has not been independently verified by us. We do not make any representations as to the accuracy or completeness of such information or of any filings made by the issuer of the ETF with the SEC. You are urged to refer to the SEC filings made by the issuer and to other publicly available information (such as the issuer’s annual report) to obtain an understanding of the issuer’s business and financial prospects. The summary information contained below is not designed to be, and should not be interpreted as, an effort to present information regarding the financial prospects of any issuer or any trends, events or other factors that may have a positive or negative influence on those prospects or as an endorsement of any particular issuer.

iShares® Dow Jones U.S. Real Estate Index Fund

According to publicly available information, iShares® Dow Jones U.S. Real Estate Index Fund (the “ETF”) is an exchange-traded fund. Shares of the fund are listed and trade at market prices on NYSE Arca, Inc.

The ETF seeks to provide investment results that correspond generally to the price and yield performance of the Dow Jones U.S. Real Estate Index (the “Index”). The Index measures the performance of the real estate sector of the U.S. equity market. The Index includes companies in the following industry groups: Real Estate holding and development and real estate investment trusts The ETF generally invests at least 90% of its assets in securities of the Index and in depositary receipts representing securities of the Index.

Information provided to or filed with the Commission by the ETF pursuant to the Securities Act of 1933 and the Investment Company Act of 1940 can be located by reference to Commission file number 811-09729.

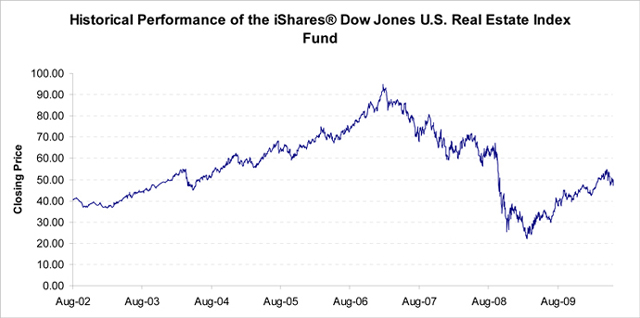

Historical Performance of the Linked Share

The following graph sets forth the historical performance of the Linked Share based on the daily closing share price from August 16, 2002 through June 4, 2010. The closing share price of the Linked Share on June 4, 2010 was $47.28.

We obtained the daily closing share prices below from Bloomberg, L.P. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg, L.P. The historical closing share prices of the Linked Share should not be taken as an indication of future performance, and no assurance can be given as to the Final Price on the Final Valuation Date. We cannot give you assurance that the performance of the Linked Share will result in the return of any of your initial investment.

PS–7

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

HYPOTHETICAL EXAMPLES

If the Final Price is greater than the Initial Price (i.e., the Reference Asset Return is greater than 0%), on the Maturity Date, you will receive, in addition to the final Periodic Amount, a cash payment per $1,000 principal amount equal to $1,000 plus $1,000 multiplied by the Reference Asset Return, subject to the Performance Cap as indicated in the table on the cover page of this pricing supplement. If the Reference Asset Return is less than or equal to 0% but equal to or greater than –15%, you will receive the principal amount of your Notes in addition to the final Periodic Amount payable on the Maturity Date. However, if the Reference Asset Return is less than –15%, you will receive, in addition to the final Periodic Amount, a cash payment equal to (a) the principal amount of your Notes plus (b) the principal amount of your Notes multiplied by the sum of (i) the Reference Asset Return and (ii) the Buffer Percentage of 15%. The quarterly Periodic Amounts will be payable on the dates set forth in the cover page of this pricing supplement. If the Final Price declines from the Initial Price by more than 15%, you will lose 1% of the principal amount of your Notes for every 1% that the Reference Asset declines beyond -15%. You may lose up to 77% of your initial investment, with all Periodic Amounts included.

The following table below illustrates the hypothetical total return on the Notes. The “total return” as used in this pricing supplement is the number, expressed as a percentage, which results from comparing (a) the Payment at Maturity per $1,000 principal amount plus Periodic Amounts paid prior to and on the Maturity Date, to (b) $1,000.

All hypothetical total returns are for illustrative purposes only and may not be the actual total returns applicable to a purchaser of the Notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

The Initial Price and the Final Price of the Linked Share and the associated Reference Asset Return have been chosen arbitrarily for the purpose of these examples and should not be taken as indicative of the future performance of the Linked Share. Some amounts are rounded and actual returns may be different.

PS–8

Assumptions

| • | Investor purchases $1,000 principal amount of Notes on the Issue Date at the Price to the Public indicated on the cover of this pricing supplement and holds the Notes to maturity. |

| • | No market disruption events, reorganization events or events of default occur during the term of the Notes. |

Initial Price: $47.28

Buffer Percentage: 15%

Periodic Amounts: $10 per $1,000 principal amount Note quarterly

Performance Cap: 26.50%

| Final Price |

Reference Asset Return |

Payment at Maturity (excluding Periodic Amounts) |

Total Return on the Notes (including Periodic Amounts) | |||

| 94.56 |

100.00% | $1,265.00 | 34.50% | |||

| 89.83 |

90.00% | $1,265.00 | 34.50% | |||

| 85.10 |

80.00% | $1,265.00 | 34.50% | |||

| 80.38 |

70.00% | $1,265.00 | 34.50% | |||

| 75.65 |

60.00% | $1,265.00 | 34.50% | |||

| 70.92 |

50.00% | $1,265.00 | 34.50% | |||

| 66.19 |

40.00% | $1,265.00 | 34.50% | |||

| 61.46 |

30.00% | $1,265.00 | 34.50% | |||

| 56.74 |

20.00% | $1,200.00 | 28.00% | |||

| 52.01 |

10.00% | $1,100.00 | 18.00% | |||

| 50.83 |

7.50% | $1,075.00 | 15.50% | |||

| 49.64 |

5.00% | $1,050.00 | 13.00% | |||

| 48.46 |

2.50% | $1,025.00 | 10.50% | |||

| 47.28 |

0.00% | $1,000.00 | 8.00% | |||

| 44.92 |

-5.00% | $1,000.00 | 8.00% | |||

| 42.55 |

-10.00% | $1,000.00 | 8.00% | |||

| 40.19 |

-15.00% | $1,000.00 | 8.00% | |||

| 37.82 |

-20.00% | $950.00 | 3.00% | |||

| 33.10 |

-30.00% | $850.00 | -7.00% | |||

| 28.37 |

-40.00% | $750.00 | -17.00% | |||

| 23.64 |

-50.00% | $650.00 | -27.00% | |||

| 18.91 |

-60.00% | $550.00 | -37.00% | |||

| 14.18 |

-70.00% | $450.00 | -47.00% | |||

| 9.46 |

-80.00% | $350.00 | -57.00% | |||

| 4.73 |

-90.00% | $250.00 | -67.00% | |||

| 0.00 |

-100.00% | $150.00 | -77.00% |

Hypothetical Examples of Amounts Payable at Maturity

The following examples illustrate how the total returns set forth in the tables above are calculated.

Example 1: The Reference Asset Return is 2%.

On the Final Valuation Date, the Final Price of $48.23 was greater than the Initial Price of $47.28 resulting in a Reference Asset Return of 2%. Because the Reference Asset Return of 2% does not exceed the hypothetical Performance Cap of 26.50%, on the Maturity Date, the investor receives, in addition to the final Periodic Amount, a payment at maturity of $1,020 per $1,000 principal amount Note, calculated as follows:

Reference Asset Return = (48.23 – 47.28) / 47.28 = 2%

Payment at Maturity = $1,000 + [$1,000 × (2%)] = $1,020

The investor will have received the Periodic Amounts in the total amount of $80, including the final Periodic Amount payable on the Maturity Date.

PS–9

The total return on the Notes (including return consisting of Periodic Amounts) will be 10% (2% + 8%).

Example 2: The Reference Asset Return is 30%.

On the Final Valuation Date, the Final Price of $61.46 was greater than the Initial Price of $47.28, resulting in a Reference Asset Return of 30%. Because the Reference Asset Return of 30% does exceed the hypothetical Performance Cap of 26.50%, on the Maturity Date, the investor receives, in addition to the final Periodic Amount, a payment at maturity of $1,265 per $1,000 principal amount Note, calculated as follows:

Reference Asset Return = (61.46 – 47.28) / 47.28 = 30%

Payment at Maturity = $1,000 + [$1,000 × (26.50%)] = $1,265

The investor will have received the Periodic Amounts in the total amount of $80, including the final Periodic Amount payable on the Maturity Date.

The total return on the Notes (including return consisting of Periodic Amounts) will be 34.50% (26.50% + 8%).

Example 3: The Reference Asset Return is –10%.

On the Final Valuation Date, the Final Price of $42.55 was less than the Initial Price of $47.28, resulting in a Reference Asset Return of –10%. Because the Reference Asset Return of –10% is less than 0% but greater than –15%, on the Maturity Date, the investor receives, in addition to the final Periodic Amount, a payment at maturity of $1,000 per $1,000 principal amount Note, calculated as follows:

Reference Asset Return = (42.55 – 47.28) / 47.28 = -10%

Payment At Maturity = $1,000

The investor will have received the Periodic Amounts in the total amount of $80, including the final Periodic Amount payable on the Maturity Date.

The total return on the Notes (including return consisting of Periodic Amounts) will be 8% (0% + 8%).

Example 4: The Reference Asset Return is –30%.

On the Final Valuation Date, the Final Price of $33.10 was less than the Initial Price of $47.28, resulting in a Reference Asset Return of –30%. Because the Reference Asset Return of –30% is less than –15%, on the Maturity Date, the investor receives, in addition to the final Periodic Amount, a payment at maturity of $850 per $1,000 principal amount Note, calculated as follows:

Reference Asset Return = (33.10 – 47.28) / 47.28 = -30%

Payment at Maturity = $1,000 + [$1,000 × (–30% + 15%)] = $850

The investor will have received the Periodic Amounts in the total amount of $80, including the final Periodic Amount payable on the Maturity Date.

The total return on the Notes (including return consisting of Periodic Amounts) will be -7% (-15% + 8%).

SUPPLEMENTAL PLAN OF DISTRIBUTION

We have agreed to sell to Barclays Capital Inc. (the “Agent”), and the Agent has agreed to purchase from us, the principal amount of the Notes, and at the price, specified on the cover of this pricing supplement. The Agent is committed to take and pay for all of the Notes, if any are taken.

PS–10