| Pricing Supplement No. 2658 (To the Prospectus dated August 1, 2019, the Prospectus Supplement dated August 1, 2019 and the Product Supplement EQUITY LIRN-1 dated August 26, 2019) |

Filed

Pursuant to Rule 424(b)(2) Registration Statement No. 333-232144 |

| 1,003,290 Units $10 principal amount per unit CUSIP No. 06747D858  |

Pricing Date Settlement Date Maturity Date |

October 11, 2019 October 18, 2019 October 25, 2024 |

|

Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket § Maturity of approximately five years § 150.65% leveraged upside exposure to increases in the Basket § A positive return equal to the absolute value of the percentage decline in the level of the Basket only if the Basket does not decline by more than 14.00% (e.g., if the negative return of the Basket is -10.00%, you will receive a positive return of +10.00%) § 1-to-1 downside exposure to decreases in the Basket beyond a 14.00% decline, with up to 86.00% of your principal at risk § The Basket is comprised of the S&P 500® Index, the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei 225 Index, the Swiss Market Index, the S&P/ASX 200 Index, and the Hang Seng® Index. The S&P 500® Index was given an initial weight of 60%, the EURO STOXX 50® Index was given an initial weight of 16%, each of the FTSE® 100 Index and the Nikkei 225 Index was given an initial weight of 8%, each of the Swiss Market Index and the S&P/ASX 200 Index was given an initial weight of 3%, and the Hang Seng® Index was given an initial weight of 2% § All payments occur at maturity and are subject to the credit risk of Barclays Bank PLC § No periodic interest payments § In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.075 per unit. See “Structuring the Notes” § Limited secondary market liquidity, with no exchange listing § The notes are our unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC. The notes are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom, or any other jurisdiction. |

The notes are being issued by Barclays Bank PLC (“Barclays”). There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factors” beginning on page TS-7 of this term sheet, beginning on page PS-7 of product supplement EQUITY LIRN-1 and beginning on page S-7 of the prospectus supplement.

Our initial estimated value of the notes, based on our internal pricing models, is $9.56 per unit on the pricing date, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet and “Structuring the Notes” on page TS-38 of this term sheet.

Notwithstanding any other agreements, arrangements or understandings between Barclays and any holder or beneficial owner of the notes, by acquiring the notes, each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. All payments are subject to the risk of exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page TS-3 and “Risk Factors” beginning on page TS-7 of this term sheet.

_________________________

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

| Per Unit | Total | |

| Public offering price(1) | $ 10.00 | $ 10,007,900.00 |

| Underwriting discount(1) | $ 0.25 | $ 225,822.50 |

| Proceeds, before expenses, to Barclays | $ 9.75 | $ 9,782,077.50 |

| (1) | The public offering price and the underwriting discount for an aggregate of 500,000 units purchased by an individual investor or in combined transactions with the investor's household of 500,000 units or more is $9.95 per unit and $0.20 per unit, respectively. See “Supplement to the Plan of Distribution” below. |

The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

BofA Merrill Lynch

October 11, 2019

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

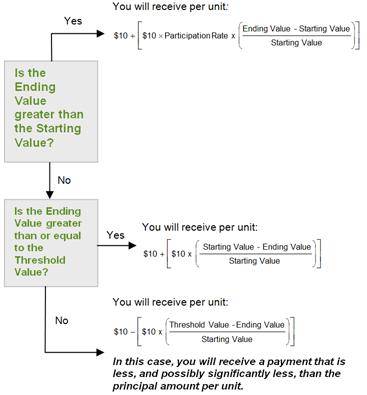

Summary

The Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 (the “notes”) are our unsecured and unsubordinated obligations and are not deposit liabilities of Barclays. The notes are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom or any other jurisdiction. The notes will rank equally with all of our other unsecured and unsubordinated debt. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of Barclays and to the risk of exercise of any U.K. Bail-in Power (as described herein) or any other resolution measure by any relevant U.K. resolution authority. The notes provide you with a leveraged return, if the Ending Value of the Market Measure, which is the Global Equity Basket (the “Basket”), is greater than its Starting Value. If the Ending Value is equal to or less than the Starting Value but greater than or equal to the Threshold Value, you will receive a positive return equal to the absolute value of the percentage decline in the Index from the Starting Value to the Ending Value (e.g., if the negative return of the Index is -10.00%, you will receive a positive return of +10.00%). If the Ending Value is less than the Threshold Value, you will lose a portion, which could be significant, of the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our credit risk. See “Terms of the Notes” below.

The Basket is comprised of the S&P 500® Index, the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei 225 Index, the Swiss Market Index, the S&P/ASX 200 Index, and the Hang Seng® Index (each a “Basket Component”). On the pricing date, the S&P 500® Index was given an initial weight of 60%, the EURO STOXX 50® Index was given an initial weight of 16%, each of the FTSE® 100 Index and the Nikkei 225 Index was given an initial weight of 8%, each of the Swiss Market Index and the S&P/ASX 200 Index was given an initial weight of 3%, and the Hang Seng® Index was given an initial weight of 2%.

On the cover page of this term sheet, we have provided the estimated value for the notes. This estimated value was determined based on our internal pricing models, which take into account a number of variables, including volatility, interest rates and our internal funding rates, which are our internally published borrowing rates, and the economic terms of certain related hedging arrangements. This estimated value is less than the public offering price.

The economic terms of the notes (including the Participation Rate) are based on our internal funding rates, which may vary from the levels at which our benchmark debt securities trade in the secondary market, and the economic terms of certain related hedging arrangements. The difference between these rates, as well as the underwriting discount, the hedging-related charge and other amounts described below, reduced the economic terms of the notes. For more information about the estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-38.

| Terms of the Notes | Redemption Amount Determination | |

| Issuer: | Barclays Bank PLC (“Barclays ”) | Notwithstanding anything to the contrary in the accompanying product supplement, the Redemption Amount will be determined as set forth in this term sheet. On the maturity date, you will receive a cash payment per unit determined as follows: |

| Principal Amount: | $10.00 per unit |  |

| Term: | Approximately five years | |

| Market Measure: | A global equity index basket comprised of the S&P 500® Index (Bloomberg symbol: “SPX”), the EURO STOXX 50® Index (Bloomberg symbol: “SX5E”), the FTSE® 100 Index (Bloomberg symbol: “UKX”), the Nikkei 225 Index (Bloomberg symbol: “NKY”), the Swiss Market Index (Bloomberg symbol: “SMI”), the S&P/ASX 200 Index (Bloomberg symbol: “AS51”) and the Hang Seng® Index (Bloomberg symbol: “HSI”). Each Basket Component is a price return index. | |

| Starting Value: | 100 | |

| Ending Value: | The average of the values of the Market Measure on each calculation day occurring during the Maturity Valuation Period. The scheduled calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-25 of product supplement EQUITY LIRN-1. | |

| Threshold Value: | 86 (86.00% of the Starting Value) | |

| Participation Rate: | 150.65% | |

| Maturity Valuation Period: | October 16, 2024, October 17, 2024, October 18, 2024, October 21, 2024 and October 22, 2024 | |

| Fees Charged: | The public offering price of the notes includes the underwriting discount of $0.25 per unit as listed on the cover page and a hedging-related charge of $0.075 per unit described in “Structuring the Notes” on page TS-38. | |

| Calculation Agents: | Barclays and BofA Securities, Inc. (“BofAS”). | |

TS-2

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

The terms and risks of the notes are contained in this term sheet and the documents listed below (together, the “Note Prospectus”). The documents have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated below or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322:

| § | Product supplement EQUITY LIRN-1 dated August 26, 2019: http://www.sec.gov/Archives/edgar/data/312070/000095010319011129/dp111576_424b2-equitylirn1.htm |

| § | Series A MTN prospectus supplement dated August 1, 2019: http://www.sec.gov/Archives/edgar/data/312070/000095010319010190/dp110493_424b2-prosupp.htm |

| § | Prospectus dated August 1, 2019: http://www.sec.gov/Archives/edgar/data/312070/000119312519210880/d756086d424b3.htm |

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement EQUITY LIRN-1. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our” or similar references are to Barclays.

To the extent the determination of the Redemption Amount and other terms described in this term sheet are inconsistent with those described in the accompanying product supplement, prospectus supplement or prospectus, the determination of the Redemption Amount and other terms described in this term sheet shall control.

Consent to U.K. Bail-in Power

Notwithstanding any other agreements, arrangements or understandings between us and any holder or beneficial owner of the notes, by acquiring the notes, each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority.

Under the U.K. Banking Act 2009, as amended, the relevant U.K. resolution authority may exercise a U.K. Bail-in Power in circumstances in which the relevant U.K. resolution authority is satisfied that the resolution conditions are met. These conditions include that a U.K. bank or investment firm is failing or is likely to fail to satisfy the Financial Services and Markets Act 2000 (the “FSMA”) threshold conditions for authorization to carry on certain regulated activities (within the meaning of section 55B FSMA) or, in the case of a U.K. banking group company that is a European Economic Area (“EEA”) or third country institution or investment firm, that the relevant EEA or third country relevant authority is satisfied that the resolution conditions are met in respect of that entity.

The U.K. Bail-in Power includes any write-down, conversion, transfer, modification and/or suspension power, which allows for (i) the reduction or cancellation of all, or a portion, of the principal amount of, any interest on, or any other amounts payable on, the notes; (ii) the conversion of all, or a portion, of the principal amount of, any interest on, or any other amounts payable on, the notes into shares or other securities or other obligations of Barclays or another person (and the issue to, or conferral on, the holder or beneficial owner of the notes such shares, securities or obligations); and/or (iii) the amendment or alteration of the maturity of the notes, or amendment of the amount of any interest or any other amounts due on the notes, or the dates on which any interest or any other amounts become payable, including by suspending payment for a temporary period; which U.K. Bail-in Power may be exercised by means of a variation of the terms of the notes solely to give effect to the exercise by the relevant U.K. resolution authority of such U.K. Bail-in Power. Each holder and beneficial owner of the notes further acknowledges and agrees that the rights of the holders or beneficial owners of the notes are subject to, and will be varied, if necessary, solely to give effect to, the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. For the avoidance of doubt, this consent and acknowledgment is not a waiver of any rights holders or beneficial owners of the notes may have at law if and to the extent that any U.K. Bail-in Power is exercised by the relevant U.K. resolution authority in breach of laws applicable in England.

For more information, please see “Risk Factors” below as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in the accompanying prospectus supplement.

TS-3

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

Investor Considerations

| You may wish to consider an investment in the notes if: | The notes may not be an appropriate investment for you if: |

|

§ You anticipate that the value of the Basket will either increase from the Starting Value to the Ending Value or decrease from the Starting Value to an Ending Value that is equal to or above the Threshold Value.

§ You are willing to risk a loss of principal and return if the value of the Basket decreases from the Starting Value to an Ending Value that is below the Threshold Value.

§ You are willing to forgo the interest payments that are paid on traditional interest bearing debt securities.

§ You are willing to forgo dividends or other benefits of owning the stocks included in the Basket Components.

§ You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our actual and perceived creditworthiness, the inclusion in the public offering price of the underwriting discount, the hedging-related charge and other amounts, as described on page TS-2.

§ You are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount.

§ You are willing to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities. |

§ You believe that the value of the Basket will decrease from the Starting Value to an Ending Value that is below the Threshold Value or that it will not increase sufficiently over the term of the notes to provide you with your desired return.

§ You seek 100% principal repayment or preservation of capital.

§ You seek interest payments or other current income on your investment.

§ You want to receive dividends or other distributions paid on the stocks included in the Basket Components.

§ You seek an investment for which there will be a liquid secondary market.

§ You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes.

§ You are unwilling to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities. |

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

TS-4

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

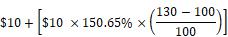

Hypothetical Payout Profile

Leveraged Index Return Notes with Absolute Return Buffer

|

This graph reflects the returns on the notes, based on the Participation Rate of 150.65% and the Threshold Value of 86% of the Starting Value. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the stocks included in the Basket Components, excluding dividends.

This graph has been prepared for purposes of illustration only. |

Hypothetical Payments at Maturity

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. The following table is based on the Starting Value of 100, the Threshold Value of 86 and the Participation Rate of 150.65%. It illustrates the effect of a range of hypothetical Ending Values on the Redemption Amount per unit of the notes and the total rate of return to holders of the notes. The actual amount you receive and the resulting total rate of return will depend on the actual Ending Value and term of your investment. The following examples do not take into account any tax consequences from investing in the notes.

For hypothetical historical values of the Basket, see “The Basket” section below. For recent actual levels of the Basket Components, see “The Basket Components” section below. Each Basket Component is a price return index and as such the Ending Value will not include any income generated by dividends paid on the stocks included in any of the Basket Components, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer credit risk.

|

Ending Value |

Percentage Change from the Starting Value to the Ending Value |

Redemption Amount per Unit |

Total Rate of Return on the Notes |

| 0.00 | -100.00% | $1.40000 | -86.0000% |

| 50.00 | -50.00% | $6.40000 | -36.0000% |

| 60.00 | -40.00% | $7.40000 | -26.0000% |

| 70.00 | -30.00% | $8.40000 | -16.0000% |

| 80.00 | -20.00% | $9.40000 | -6.0000% |

| 86.00(2) | -14.00% | $11.40000 | 14.0000% |

| 90.00 | -10.00% | $11.00000 | 10.0000% |

| 95.00 | -5.00% | $10.50000 | 5.0000% |

| 97.00 | -3.00% | $10.30000 | 3.0000% |

| 100.00(1) | 0.00% | $10.00000 | 0.0000% |

| 102.00 | 2.00% | $10.30130 | 3.0130% |

| 105.00 | 5.00% | $10.75325 | 7.5325% |

| 110.00 | 10.00% | $11.50650 | 15.0650% |

| 120.00 | 20.00% | $13.01300 | 30.1300% |

| 130.00 | 30.00% | $14.51950 | 45.1950% |

| 140.00 | 40.00% | $16.02600 | 60.2600% |

| 150.00 | 50.00% | $17.53250 | 75.3250% |

| 160.00 | 60.00% | $19.03900 | 90.3900% |

| (1) | The Starting Value was set to 100.00 on the pricing date. |

| (2) | This is the Threshold Value. |

TS-5

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

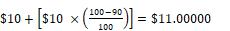

Redemption Amount Calculation Examples

| Example 1 | |

| The Ending Value is 50.00, or 50.00% of the Starting Value: | |

| Starting Value: 100.00 | |

| Threshold Value: 86.00 | |

| Ending Value: 50.00 | |

|

Redemption Amount per unit

|

| Example 2 |

| The Ending Value is 90.00, or 90.00% of the Starting Value: |

| Starting Value: 100.00 |

| Threshold Value: 86.00 |

| Ending Value: 90.00 |

Redemption Amount per unit Redemption Amount per unit |

| Since the Ending Value is less than the Starting Value but equal to or greater than the Threshold Value, the Redemption Amount for the notes will be the principal amount plus a positive return equal to the absolute value of the negative return of the Basket. |

| Example 3 | |

| The Ending Value is 130.00, or 130.00% of the Starting Value: | |

| Starting Value: 100.00 | |

| Ending Value: 130.00 | |

|

= $14.51950 Redemption Amount per unit |

TS-6

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product supplement EQUITY LIRN-1 and page S-7 of the Series A MTN prospectus supplement identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| § | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity. |

| § | Your potential for a positive return based on the depreciation of the Basket is limited and may be less than that of a comparable investment that takes a short position directly in the Basket (or the stocks included in the Basket Components). The absolute value return feature applies only if the Ending Value is less than the Starting Value but greater than or equal to the Threshold Value. Because the Threshold Value is 86.00% of the Starting Value, any positive return due to the depreciation of the Basket is limited to 14.00%. Any decline in the Ending Value from the Starting Value by more than 14.00% will result in a loss, rather than a positive return, on the notes. In contrast, for example, a short position in the Index (or the stocks included in the Basket Components) would allow you to receive the full benefit of any decrease in the level of the Basket (or the stocks included in the Basket Components). |

| § | Payments on the notes are subject to our credit risk, and any actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | Payments on the notes are subject to the exercise of U.K. Bail-in Power by the relevant U.K. resolution authority. As described above under “Consent to U.K. Bail-in Power,” the relevant U.K. resolution authority may exercise any U.K. Bail-in Power under the conditions described in such section of this term sheet. If any U.K. Bail-in Power is exercised, you may lose all or a part of the value of your investment in the notes or receive a different security, which may be worth significantly less than the notes and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the relevant U.K. resolution authority may exercise its authority to implement the U.K. Bail-in Power without providing any advance notice to the holders and beneficial owners of the notes. By your acquisition of the notes, you acknowledge, accept, agree to be bound by, and consent to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. The exercise of any U.K. Bail-in Power with respect to the notes will not be a default or an Event of Default (as each term is defined in the senior debt securities indenture relating to the notes). The trustee will not be liable for any action that the trustee takes, or abstains from taking, in either case, in accordance with the exercise of the U.K. Bail-in Power with respect to the notes. See “Consent to U.K. Bail-in Power” above as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in the accompanying prospectus supplement for more information. |

| § | Your investment return may be less than a comparable investment directly in the stocks included in the Basket Components. |

| § | The estimated value of your notes is based on our internal pricing models. Our internal pricing models take into account a number of variables and are based on a number of subjective assumptions, which may or may not materialize, typically including volatility, interest rates, and our internal funding rates. These variables and assumptions are not evaluated or verified on an independent basis and may prove to be inaccurate. Different pricing models and assumptions of different financial institutions could provide valuations for the notes that are different from our estimated value. |

| § | The estimated value is based on a number of variables, including volatility, interest rates and our internal funding rates. Our internal funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. As a result of this difference, the estimated value referenced in this term sheet may be lower if such estimated value was based on the levels at which our benchmark debt securities trade in the secondary market. |

| § | The estimated value of your notes is lower than the public offering price of your notes. This difference is a result of certain factors, such as the inclusion in the public offering price of the underwriting discount, the hedging-related charge, the estimated profit, if any, that we or any of our affiliates expect to earn in connection with structuring the notes, and the estimated cost which we may incur in hedging our obligations under the notes, as further described in “Structuring the Notes” on page TS-39. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for the notes and lower than the estimated value because the secondary market prices take into consideration the levels at which our debt securities trade in the secondary market but do not take into account such fees, charges and other amounts. |

| § | The estimated value of the notes is not a prediction of the prices at which MLPF&S, BofAS or its affiliates, or any of our affiliates or any other third parties may be willing to purchase the notes from you in secondary market transactions. The price at which you may be able to sell your notes in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar size trades, and may be substantially less than our estimated value of the notes. Any sale prior to the maturity date could result in a substantial loss to you. |

TS-7

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

| § | A trading market is not expected to develop for the notes. We, MLPF&S, BofAS and our respective affiliates are not obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. |

| § | Our business, hedging and trading activities, and those of MLPF&S, BofAS and our respective affiliates (including trading in securities of companies included in the Basket Components), and any hedging and trading activities we, MLPF&S, BofAS or our respective affiliates engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you. |

| § | Changes in the level of one of the Basket Components may be offset by changes in the levels of the other Basket Components. Due to the different Initial Component Weights, changes in the levels of some Basket Components will have a more substantial impact on the value of the Basket than similar changes in the levels of the other Basket Components. |

| § | An index sponsor may adjust the relevant Basket Component in a way that affects its level, and has no obligation to consider your interests. |

| § | You will have no rights of a holder of the securities included in the Basket Components, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities. |

| § | While we, MLPF&S, BofAS or our respective affiliates may from time to time own securities of companies included in the Basket Components, except to the extent that the common stock of Barclays PLC is included in the FTSE® 100 Index, we, MLPF&S, BofAS and our respective affiliates do not control any company included in any Basket Component, and have not verified any disclosure made by any other company. |

| § | Your return on the notes may be affected by factors affecting the international securities markets. In addition, you will not obtain the benefit of any increase in the value of any currency in which the securities included in the Basket Components are traded against the U.S. dollar, which you would receive if you had owned the securities included in the Basket Components during the term of your notes, although the value of the notes may be adversely affected by general exchange rate movements in the market. |

| § | There may be potential conflicts of interest involving the calculation agents, one of which is us and one of which is BofAS. We have the right to appoint and remove the calculation agents. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a U.S. investor of the notes. See “Tax Consequences” below. |

Other Terms of the Notes

Market Measure Business Day

The following definition shall supersede and replace the definition of “Market Measure Business Day” set forth in product supplement EQUITY LIRN-1.

A “Market Measure Business Day” means a day on which:

| (A) | each of the New York Stock Exchange and The Nasdaq Stock Market (as to the S&P 500® Index), the Eurex (as to the EURO STOXX 50® Index), the London Stock Exchange (as to the FTSE® 100 Index), the Tokyo Stock Exchange (as to the Nikkei 225 Index), the Geneva, Zurich and Basel Stock Exchanges (as to the Swiss Market Index), the Australian Stock Exchange (as to the S&P/ASX 200 Index), and the Hong Kong Stock Exchange (as to the Hang Seng® Index) (or any successor to the foregoing exchanges) are open for trading; and |

| (B) | the Basket Components or any successors thereto are calculated and published. |

TS-8

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

The Basket

The Basket is designed to allow investors to participate in the percentage changes in the levels of the Basket Components from the Starting Value to the Ending Value of the Basket. The Basket Components are described in the section “The Basket Components” below. Each Basket Component was assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of the Notes—Basket Market Measures” beginning on page PS-32 of product supplement EQUITY LIRN-1.

On the pricing date, for each Basket Component, the Initial Component Weight, the closing level, the Component Ratio and the initial contribution to the Basket value were as follows:

| Basket Component | Bloomberg Symbol | Initial Component Weight | Closing Level(1) | Component Ratio(2) | Initial Basket Value Contribution | |||||

| S&P 500® Index | SPX | 60.00% | 2,970.27 | 0.02020018 | 60.00 | |||||

| EURO STOXX 50® Index | SX5E | 16.00% | 3,569.92 | 0.00448189 | 16.00 | |||||

| FTSE® 100 Index | UKX | 8.00% | 7,247.08 | 0.00110389 | 8.00 | |||||

| Nikkei 225 Index | NKY | 8.00% | 21,798.87 | 0.00036699 | 8.00 | |||||

| Swiss Market Index | SMI | 3.00% | 10,017.39 | 0.00029948 | 3.00 | |||||

| S&P/ASX 200 Index | AS51 | 3.00% | 6,606.807 | 0.00045408 | 3.00 | |||||

| Hang Seng® Index | HSI | 2.00% | 26,308.44 | 0.00007602 | 2.00 | |||||

| Starting Value | 100.00 |

| (1) | These were the closing levels of the Basket Components on the pricing date. |

| (2) | Each Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied by 100, and then divided by the closing level of that Basket Component on the pricing date and rounded to eight decimal places. |

The calculation agents will calculate the value of the Basket by summing the products of the closing level for each Basket Component on the calculation day and the Component Ratio applicable to such Basket Component. If a Market Disruption Event occurs as to any Basket Component on the scheduled calculation day, the closing level of that Basket Component will be determined as more fully described in the section entitled “Description of the Notes—Basket Market Measures—Ending Value of the Basket” beginning on page PS-35 of product supplement EQUITY LIRN-1.

TS-9

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

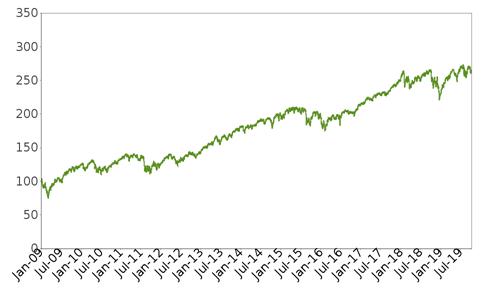

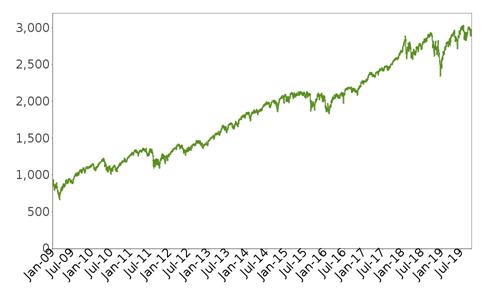

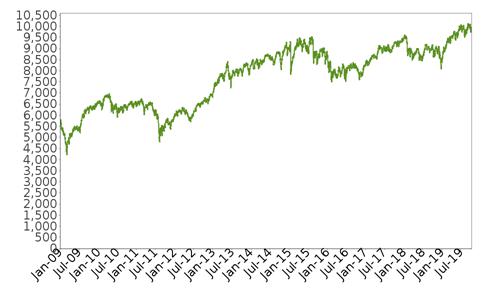

While actual historical information on the Basket did not exist before the pricing date, the following graph sets forth the hypothetical historical performance of the Basket from January 1, 2009 through October 11, 2019. The graph is based upon actual daily historical levels of the Basket Components, hypothetical Component Ratios based on the closing levels of the Basket Components as of December 31, 2008, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

TS-10

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

The Basket Components

All disclosures contained in this term sheet regarding the Basket Components, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly available sources without independent verification. The information reflects the policies of, and is subject to change by each of S&P Dow Jones Indices LLC with respect to the S&P 500® Index, STOXX Limited with respect to the EURO STOXX 50® Index, FTSE Russell (“FTSE”) with respect to the FTSE® 100 Index, Nikkei Inc. with respect to the Nikkei 225 Index, SIX Swiss Exchange Ltd (“SSE”) with respect to the Swiss Market Index, S&P Dow Jones Indices LLC (“S&P Dow Jones”) with respect to the S&P/ASX 200 Index and Hang Seng Indexes Company Limited (“HSI Company Limited”) with respect to the Hang Seng® Index (STOXX, FTSE, Nikkei Inc., SSE, S&P Dow Jones and HSI Company Limited together, the “Index sponsors”). The Index sponsors have no obligation to continue to publish, and may discontinue or suspend the publication of any Basket Component at any time. The consequences of any Index sponsor discontinuing publication of a Basket Component are discussed in the section entitled “Description of LIRNs—Discontinuance of an Index” beginning on page PS-27 of product supplement EQUITY LIRN-1. None of us, the calculation agents, MLPF&S or BofAS accepts any responsibility for the calculation, maintenance or publication of any Basket Component or any successor index.

The S&P 500® Index

The S&P 500® Index (the “SPX”) consists of stocks of 500 companies selected to provide a performance benchmark for the U.S. equity markets. The SPX is reported by Bloomberg L.P. under the ticker symbol “SPX.”

Composition of the SPX

Changes to the SPX are made as needed, with no annual or semi-annual reconstitution. Constituent changes are typically announced with at least three business days advance notice. Less than three business days’ notice may be given at the discretion of the S&P Dow Jones’s U.S. index committee.

Additions to the SPX are evaluated based on the following eligibility criteria:

| · | Market Capitalization. The unadjusted company market capitalization should be within a specified range. This range is reviewed from time to time to assure consistency with market conditions. A company meeting the unadjusted company market capitalization criteria is also required to have a security level float-adjusted market capitalization that is at least 50% of the SPX’s unadjusted company level minimum market capitalization threshold. For spin-offs, SPX membership eligibility is determined using when-issued prices, if available. |

| · | Liquidity. Using composite pricing and volume, the ratio of annual dollar value traded (defined as average closing price over the period multiplied by historical volume) to float-adjusted market capitalization should be at least 1.00, and the stock should trade a minimum of 250,000 shares in each of the six months leading up to the evaluation date. |

| · | Domicile. The company should be a U.S. company, meaning a company that has the following characteristics: |

| · | the company should file 10-K annual reports; |

| · | the U.S. portion of fixed assets and revenues should constitute a plurality of the total, but need not exceed 50%. When these factors are in conflict, assets determine plurality. Revenue determines plurality when there is incomplete asset information. If this criteria is not met or is ambiguous, S&P Dow Jones may still deem the company to be a U.S. company for SPX purposes if its primary listing, headquarters and incorporation are all in the United States and/or “a domicile of convenience” (Bermuda, Channel Islands, Gibraltar, islands in the Caribbean, Isle of Man, Luxembourg, Liberia or Panama); and |

| · | the primary listing must be on an eligible U.S. exchange as described under “Eligible Securities” below. |

In situations where the only factor suggesting that a company is not a U.S. company is its tax registration in a “domicile of convenience” or another location chosen for tax-related reasons, S&P Dow Jones normally determines that the company is still a U.S. company. The final determination of domicile eligibility is made by the S&P Dow Jones’s U.S. index committee.

| · | Public Float. There should be a public float of at least 50% of the company’s stock. |

| · | Sector Classification. The company is evaluated for its contribution to sector balance maintenance, as measured by a comparison of each GICS® sector’s weight in the SPX with its weight in the S&P Total Market Index, in the market capitalization range. The S&P Total Market Index is a float-adjusted, market-capitalization weighted index designed to track the broad equity market, including large-, mid-, small- and micro-cap stocks. |

| · | Financial Viability. The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (“GAAP”) earnings (net income excluding discontinued operations) should be positive as should the most recent quarter. For equity real estate investment trusts (“REITs”), financial viability is based on GAAP earnings and/or Funds From Operations (“FFO”), if reported. |

| · | Treatment of IPOs. Initial public offerings should be traded on an eligible exchange for at least 12 months before being considered for addition to the SPX. Spin-offs or in-specie distributions from existing constituents do not need to be seasoned for 12 months prior to their inclusion in the SPX. |

TS-11

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

| · | Eligible Securities. Eligible securities are the common stock of U.S. companies with a primary listing on the New York Stock Exchange, NYSE Arca, NYSE American, Nasdaq Global Select Market, Nasdaq Select Market, Nasdaq Capital Market, Cboe BZX, Cboe BYX, Cboe EDGA, Cboe EDGX or IEX exchanges. Ineligible exchanges include the OTC Bulletin Board and Pink Sheets. Eligible organizational structures and share types are corporations (including equity and mortgage REITS) and common stock (i.e. shares). Ineligible organizational structures and share types include business development companies, limited partnerships, master limited partnerships, limited liability companies, closed-end funds, exchange-traded funds, exchange-traded notes, royalty trusts, special purposes acquisition companies, tracking stocks, preferred and convertible preferred stock, unit trusts, equity warrants, convertible bonds, investment trusts, rights and American Depositary Receipts. |

As of July 2017, the securities of companies with multiple share class structures (including companies with listed and unlisted share classes) are no longer eligible to be added to the SPX, but securities already included in the SPX have been grandfathered and are not affected by this change.

Removals from the SPX are evaluated based as follows:

| · | Companies that are involved in mergers, acquisitions or significant restructuring such that they no longer meet inclusion criteria. Companies delisted as a result of merger, acquisition or other corporate action are removed at a time announced by S&P Dow Jones, normally at the close of the last day of trading or expiration of a tender offer. Constituents that are halted from trading may be kept in the SPX until trading resumes, at the discretion of S&P Dow Jones. If a stock is moved to the pink sheets or the bulletin board, the stock is removed. |

Any company that is removed from the SPX (including discretionary and bankruptcy/exchange delistings) must wait a minimum of one year from its index removal date before being reconsidered as a replacement candidate.

| · | Companies that substantially violate one or more of the addition criteria. S&P Dow Jones believes turnover in SPX membership should be avoided when possible. At times a stock may appear to temporarily violate one or more of the addition criteria. However, the addition criteria are for addition to the SPX, not for continued membership. As a result, an SPX constituent that appears to violate criteria for addition to the SPX is not deleted unless ongoing conditions warrant an SPX change. When a stock is removed from the SPX, S&P Dow Jones explains the basis for the removal. |

Current constituents of an S&P Composite 1500® component index (i.e., the SPX, the S&P MidCap 400® Index and the S&P SmallCap 600® Index) can be migrated from one S&P Composite 1500® component index to another without meeting the financial viability, public float and/or liquidity eligibility criteria if the S&P Dow Jones’s U.S. index committee decides that such a move will enhance the representativeness of the relevant index as a market benchmark.

Companies that are spun-off from current SPX constituents do not need to meet the outside addition criteria, but they should have a total market cap representative of the SPX.

Calculation of the SPX

The SPX is a float-adjusted market capitalization-weighted index. On any given day, the value of the SPX is the total float-adjusted market capitalization of its constituents divided by its divisor. The float-adjusted market capitalization reflects the price of each stock in the SPX multiplied by the number of shares used in the index value calculation.

Float Adjustment. Float adjustment means that the number of shares outstanding is reduced to exclude closely held shares from the calculation of the index value because such shares are not available to investors. The goal of float adjustment is to distinguish between long-term, strategic shareholders, whose holdings depend on concerns such as maintaining control rather than the shorter term economic fortunes of the company, and shareholders who are considered more short-term in nature. Generally, these long-term strategic shareholders include, but are not limited to, officers and directors, private equity, venture capital & special equity firms, asset managers and insurance companies with board of director representation, other publicly traded companies that hold shares, holders of restricted shares, company-sponsored employee share plans/trusts, defined contribution plans/savings, and investment plans, foundations or family trusts associated with the company, government entities at all levels (other than government retirement/pension funds), sovereign wealth funds and any individual person who controls a 5% or greater stake in a company as reported in regulatory filings. Restricted shares are generally not included in total shares outstanding except for shares held as part of a lock-up agreement. Shares that are not considered outstanding are also not included in the available float. These generally include treasury stock, stock options, equity participation units, warrants, preferred stock, convertible stock and rights.

For each component, S&P Dow Jones calculates an Investable Weight Factor (“IWF”), which represents the portion of the total shares outstanding that are considered part of the public float for purposes of the SPX.

Divisor. Continuity in index values of the SPX is maintained by adjusting its divisor for all changes in its constituents’ share capital after its base date. This includes additions and deletions to the SPX, rights issues, share buybacks and issuances and non-zero price spin-offs. The value of the SPX’s divisor over time is, in effect, a chronological summary of all changes affecting the base capital of the SPX. The divisor of the SPX is adjusted such that the index value of the SPX at an instant just prior to a change in base capital equals the index value of the SPX at an instant immediately following that change.

Maintenance of the SPX

Changes in response to corporate actions and market developments can be made at any time. Constituent changes are typically announced one to five days before they are scheduled to be implemented.

TS-12

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

Share Updates. Changes in a company’s shares outstanding and IWF due to its acquisition of another public company are made as soon as reasonably possible. At S&P Dow Jones’ discretion, de minimis merger and acquisition share changes are accumulated and implemented with the quarterly share rebalancing. All other changes of less than 5% are accumulated and made quarterly on the third Friday of March, June, September and December.

5% Rule. Changes in a company’s total shares outstanding of 5% or more due to public offerings are made as soon as reasonably possible. Other changes of 5% or more (for example, due to tender offers, Dutch auctions, voluntary exchange offers, company stock repurchases, private placements, acquisitions of private companies or non-SPX companies that do not trade on a major exchange, redemptions, exercise of options, warrants, conversion of preferred stock, notes, debt, equity participations, at-the-market stock offerings or other recapitalizations) are made weekly, and are announced on Fridays for implementation after the close of trading the following Friday (one week later). If an exchange holiday/closure falls on a Friday, the weekly share change announcement will be made the day before the exchange holiday/closure, and the implementation date will remain after the close of trading the following Friday (i.e. one week later).

If a 5% or more share change causes a company’s IWF to change by five percentage points or more (for example from 0.80 to 0.85), the IWF is updated at the same time as the share change. IWF changes resulting from partial tender offers are considered on a case-by-case basis.

For weekly share reviews involving companies with multiple share classes, the 5% share change threshold is based on each individual share class rather than total company shares.

Share/IWF Freeze. A share/IWF freeze period is implemented during each quarterly rebalancing. The freeze period begins after the market close on the Tuesday preceding the second Friday of each rebalancing month (i.e., March, June, September, and December) and ends after the market close on the third Friday of a rebalancing month. Pro-forma files are normally released after the market close on the second Friday, one week prior to the rebalancing effective date. In September, preliminary share and float data are released on the first Friday of the month, but the share freeze period for September will follow the same schedule as the other three quarterly share freeze periods. For illustration purposes, if rebalancing pro-forma files are scheduled to be released on Friday, March 13, the share/IWF freeze period will begin after the close of trading on Tuesday, March 10 and will end after the close of trading the following Friday, March 20 (i.e. the third Friday of the rebalancing month).

During the share/IWF freeze period, shares and IWFs are not changed except for certain corporate action events (such as merger activity, stock splits, rights offerings). Share/IWF changes for SPX constituents resulting from secondary public offerings that would otherwise be eligible for next day implementation are instead collected during the freeze period and added to the weekly share change announcement on the third Friday of the rebalancing month for implementation the following Friday night. There is no weekly share change announcement on the first and second Fridays of a rebalancing month.

Corporate Actions. Corporate actions (such as stock splits, stock dividends, non-zero price spin-offs and rights offerings) are applied after the close of trading on the day prior to the ex-date.

Other Adjustments. In cases where there is no achievable market price for a stock being deleted, it can be removed at a zero or minimal price at the S&P Dow Jones’s U.S. index committee’s discretion.

The table below summarizes types of index maintenance adjustments and indicates whether or not a divisor adjustment is required.

|

Type

of |

Comments |

Divisor |

| Company added/deleted | Net change in market value determines divisor adjustment. | Yes |

| Change in shares outstanding | Any combination of secondary issuance, share repurchase or buy back – share counts revised to reflect change. | Yes |

| Stock split | Share count revised to reflect new count. Divisor adjustment is not required since the share count and price changes are offsetting. | No |

| Spin-off | The spin-off is added to the SPX on the ex-date at a price of zero. | No |

| Change in IWF | Increasing (decreasing) the IWF increases (decreases) the total market value of the SPX. The divisor change reflects the change in market value caused by the change to an IWF. | Yes |

| Special dividend | When a company pays a special dividend, the share price is assumed to drop by the amount of the dividend; the divisor adjustment reflects this drop in SPX market value. | Yes |

| Rights offering | Each shareholder receives the right to buy a proportional number of additional shares at a set (often discounted) price. The calculation assumes that the offering is fully subscribed. Divisor adjustment reflects increase in market capitalization measured as the shares issued multiplied by the price paid. | Yes |

TS-13

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

Stock splits and stock dividends do not affect the divisor, because following a split or dividend, both the stock price and number of shares outstanding are adjusted by S&P Dow Jones so that there is no change in the market value of the relevant component. All stock split and dividend adjustments are made after the close of trading on the day before the ex-date.

Governance of the SPX

The SPX is maintained by S&P Dow Jones’s U.S. index committee. All index committee members are full-time professional members of S&P Dow Jones’ staff. The index committee meets monthly. At each meeting, the index committee reviews pending corporate actions that may affect SPX constituents, statistics comparing the composition of the SPX to the market, companies that are being considered as candidates for addition to the SPX, and any significant market events. In addition, the index committee may revise SPX policy covering rules for selecting companies, treatment of dividends, share counts or other matters.

TS-14

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

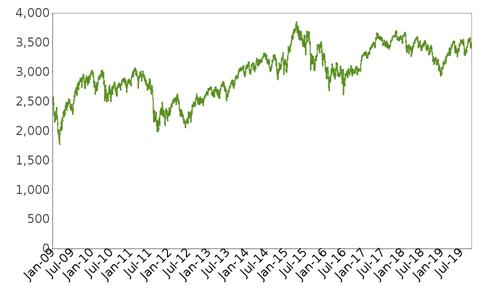

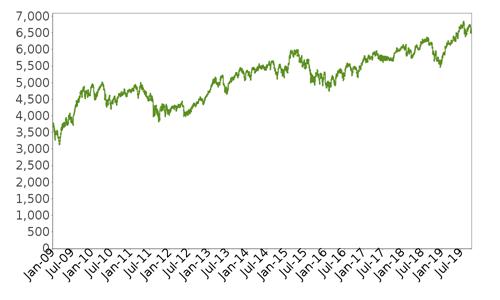

The following graph shows the daily historical performance of the SPX in the period from January 1, 2009 through October 11, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the SPX was 2,970.27.

Historical Performance of the S&P 500® Index

This historical data on the Index is not necessarily indicative of the future performance of the Index or what the value of the notes may be. Any historical upward or downward trend in the level of the Index during any period set forth above is not an indication that the level of the Index is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the levels of the Index.

TS-15

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

License Agreement

The SPX is a product of S&P Dow Jones, and has been licensed for use by Barclays Bank PLC. “Standard & Poor’s,” “S&P” and “S&P 500” are registered trademarks of Standard & Poor’s Financial Services LLC (“SPFS”). These trademarks have been licensed to S&P Dow Jones and its affiliates and sublicensed to Barclays Bank PLC for certain purposes.

The notes are not sponsored, endorsed, sold or promoted by S&P Dow Jones, SPFS or any of their respective affiliates (collectively, “S&P”). S&P does not make any representation or warranty, express or implied, to the owners of the notes or any member of the public regarding the advisability of investing in securities generally or in the notes particularly or the ability of the SPX to track general market performance. S&P’s only relationship to Barclays Bank PLC with respect to the SPX is the licensing of the SPX and certain trademarks, service marks and/or trade names of S&P and/or its licensors. The SPX is determined, composed and calculated by S&P without regard to Barclays Bank PLC or the notes. S&P has no obligation to take the needs of Barclays Bank PLC or the owners of the notes into consideration in determining, composing or calculating the SPX. S&P is not responsible for and has not participated in the determination of the prices, and amount of the notes or the timing of the issuance or sale of the notes or in the determination or calculation of the equation by which the notes are to be converted into cash, surrendered or redeemed, as the case may be. S&P has no obligation or liability in connection with the administration, marketing or trading of the notes. There is no assurance that investment products based on the SPX will accurately track the performance of the SPX or provide positive investment returns. S&P Dow Jones is not an investment advisor. Inclusion of a security within the SPX is not a recommendation by S&P to buy, sell, or hold such security, nor is it considered to be investment advice. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the SPX. It is possible that this trading activity will affect the level of the SPX and the value of the notes.

S&P DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS

AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION (INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN

COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS)) WITH RESPECT THERETO. S&P SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY

FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES,

OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY BARCLAYS BANK PLC, OWNERS OF THE

NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY

OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL

DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF

THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES

OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P AND BARCLAYS BANK PLC, OTHER THAN THE LICENSORS OF S&P.

The EURO STOXX 50® Index

The EURO STOXX 50® Index (the “SX5E”) was created and is calculated, maintained and published by STOXX Limited, a wholly owned subsidiary of Deutsche Börse AG. The euro price return version of the SX5E is reported by Bloomberg L.P. under the ticker symbol “SX5E.”

TS-16

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

EURO STOXX 50® Index Composition

The SX5E is a free-float market-capitalization weighted index composed of 50 of the largest stocks in terms of free-float market capitalization traded on the major exchanges of 11 Eurozone countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. At any given time, some eligible countries may not be represented in the SX5E.

The selection list for the SX5E includes the top 60% of the free-float market capitalization of each of the 19 EURO STOXX® Supersector indices and all current SX5E component stocks. All the stocks on the selection list are ranked in terms of free-float market capitalization. The largest 40 stocks on the selection list are selected for inclusion in the SX5E; the remaining 10 stocks are selected from the largest remaining current stocks ranked between 41 and 60. If the number of stocks selected is still below 50, then the largest remaining stocks are selected until there are 50 stocks.

The composition of the SX5E is reviewed annually in September. The review cut-off date is the last trading day of August. The composition of the SX5E is also reviewed monthly and components that rank 75 or below are replaced and non-component stocks that rank 25 or above are added.

EURO STOXX 50® Index Maintenance

The SX5E is also reviewed on an ongoing basis. Corporate actions (including initial public offerings, mergers and takeovers, spin-offs, delistings, bankruptcy, and price and share adjustments) that affect the composition of the SX5E are immediately reviewed. Any changes are announced, implemented and effective in line with the type of corporate action and the magnitude of the effect.

To maintain the number of components constant, a removed company is replaced by the highest-ranked non-component on the selection list. The selection list is updated on a monthly basis according to the review component selection process.

The free-float factors for each component stock used to calculate the SX5E are reviewed, calculated and implemented on a quarterly basis and are fixed until the next quarterly review.

EURO STOXX 50® Index Calculation

The SX5E is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed base quantity weight. The formula for calculating the value of the SX5E can be expressed as follows:

| Index = |

free-float market capitalization of the SX5E | |

| divisor | ||

The “free-float market capitalization of the SX5E” is equal to the sum of the products, for each component stock, of the price, number of shares, free-float factor, weighting cap factor and, if applicable, the exchange rate from the local currency into the index currency of the SX5E as of the time that the SX5E is being calculated. The weighting cap factor limits the weight of each component stock within the SX5E to a maximum of 10% at the time of each review.

The free-float factor of each component stock is intended to reduce the number of shares to the actual amount available on the market. All fractions of the total number of shares that are larger than 5% and whose holding is of a long-term nature are excluded from the calculation of the SX5E, including: cross-ownership (stock owned either by the company itself, in the form of treasury shares, or owned by other companies); government ownership (stock owned by either governments or their agencies); private ownership (stock owned by either individuals or families); and restricted shares that cannot be traded during a certain period or have a foreign ownership restriction. Block ownership is not applied for holdings of custodian nominees, trustee companies, mutual funds, investment companies with short-term investment strategies, pension funds and similar entities.

The SX5E is also subject to a divisor, which is adjusted to maintain the continuity of the values of the SX5E despite changes due to corporate actions. The following is a summary of the adjustments to any component stock of the SX5E made for corporate actions and the effect of such adjustment on the divisor of the SX5E, where shareholders of the component stock will receive “B” number of shares for every “A” share held (where applicable).

| (1) Special cash dividend: |

TS-17

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

|

Cash distributions that are outside the scope of the regular dividend policy or that the company defines as an extraordinary distribution Adjusted price = closing price – dividend announced by the company × (1 – withholding tax if applicable) Divisor: decreases | |

|

(2) Split and reverse split: Adjusted price = closing price × A / B New number of shares = old number of shares × B / A Divisor: unchanged | |

|

(3) Rights offering: If the subscription price is not available or if the subscription price is equal to or greater than the closing price on the day before the effective date, then no adjustment is made. In case the share increase is greater than or equal to 100% (B / A ≥ 1), the adjustment of the shares and weight factors are delayed until the new shares are listed. Adjusted price = (closing price × A + subscription price × B) / (A + B) New number of shares = old number of shares × (A + B) / A Divisor: increases | |

|

(4) Stock dividend: Adjusted price = closing price × A / (A + B) New number of shares = old number of shares × (A + B) / A Divisor: unchanged |

(5) Stock dividend (from treasury stock): Adjusted only if treated as extraordinary dividend. Adjusted close = close – close × B / (A + B) Divisor: decreases |

|

(6) Stock dividend of another company: Adjusted price = (closing price × A – price of other company × B) / A Divisor: decreases |

(7) Return of capital and share consolidation: Adjusted price = (closing price – capital return announced by company × (1-withholding tax)) × A / B New number of shares = old number of shares × B / A Divisor: decreases |

|

(8) Repurchase of shares / self-tender: Adjusted price = ((price before tender × old number of shares) – (tender price × number of tendered shares)) / (old number of shares – number of tendered shares) New number of shares = old number of shares – number of tendered shares Divisor: decreases |

(9) Spin-off: Adjusted price = (closing price × A – price of spun-off shares × B) / A Divisor: decreases |

|

(10) Combination stock distribution (dividend or split) and rights offering: For this corporate action, the following additional assumptions apply: Shareholders receive B new shares from the distribution and C new shares from the rights offering for every A share held. If A is not equal to one share, all the following “new number of shares” formulae need to be divided by A: | |

|

- If rights are applicable after stock distribution (one action applicable to other):

Adjusted price = (closing price × A + subscription price × C × (1 + B / A)) / ((A + B) × ( 1 + C / A)) New number of shares = old number of shares × ((A + B) × (1 + C / A)) / A Divisor: increases |

- If stock distribution is applicable after rights (one action applicable to other): Adjusted price = (closing price × A + subscription price × C) /((A + C) × (1 + B / A)) New number of shares = old number of shares × ((A + C) × (1 + B / A)) Divisor: increases |

|

- Stock distribution and rights (neither action is applicable to the other): | |

TS-18

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

|

Adjusted price = (closing price × A + subscription price × C) / (A + B + C) New number of shares = old number of shares × (A + B + C) / A Divisor: increases | |

|

(11) Addition / deletion of a company: No price adjustments are made. The net change in market capitalization determines the divisor adjustment. |

(12) Free-float and shares changes: No price adjustments are made. The net change in market capitalization determines the divisor adjustment. |

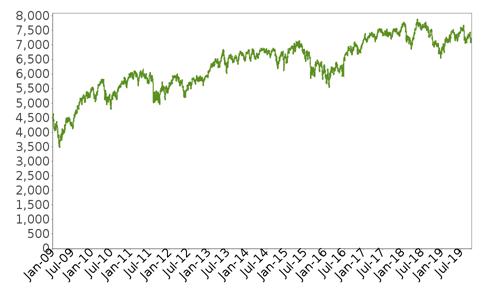

The following graph shows the daily historical performance of the SX5E in the period from January 1, 2009 through October 11, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the SX5E was 3,569.92.

Historical Performance of the EURO STOXX 50® Index

This historical data on the SX5E is not necessarily indicative of the future performance of the SX5E or what the value of the notes may be. Any historical upward or downward trend in the level of the SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the SX5E.

TS-19

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

License Agreement

We have entered into a non-exclusive license agreement with STOXX Limited whereby we, in exchange for a fee, are permitted to use the SX5E in connection with the notes. STOXX Limited and its licensors (the “Licensors”) have no relationship to Barclays Bank PLC, other than the licensing of indices and the related trademarks for use in connection with the notes.

STOXX Limited and its Licensors do not:

| · | sponsor, endorse, sell or promote the notes; |

| · | recommend that any person invest in the notes or any other securities; |

| · | have any responsibility or liability for or make any decisions about the timing, amount or pricing of the notes. |

| · | have any responsibility or liability for the administration, management or marketing of the notes; or |

| · | consider the needs of the notes or the owners of the notes in determining, composing or calculating the SX5E or have any obligation to do so. |

STOXX Limited and its Licensors will not have any liability in connection with the notes. Specifically,

| · | STOXX Limited and its Licensors do not make any warranty, express or implied and disclaim any and all warranty about: |

| · | the results to be obtained by the notes, the owner of the notes or any other person in connection with the use of the SX5E and the data included in the SX5E; |

| · | the accuracy or completeness of the SX5E and its data; or |

| · | the merchantability and the fitness for a particular purpose or use of the SX5E and its data; |

STOXX Limited and its Licensors will have no liability for any errors, omissions or interruptions in the SX5E or its data; and

Under no circumstances will STOXX Limited or its Licensors be liable for any lost profits or indirect, punitive, special or consequential damages or losses, even if STOXX Limited or its Licensors knows that they might occur.

The licensing agreement between Barclays Bank PLC and STOXX Limited is solely for their benefit and not for the benefit of the owners of the notes or any other third parties.

TS-20

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

The FTSE® 100 Index

The FTSE® 100 Index (the “UKX”) is an index calculated, published and disseminated by FTSE, a wholly owned subsidiary of London Stock Exchange Group plc (the “LSEG”). The UKX measures the composite price performance of the 100 largest companies (determined on the basis of market capitalization) traded on the London Stock Exchange (the “LSE”). Publication of the UKX began in January 1984. The UKX is reported by Bloomberg L.P. under the ticker symbol “UKX.”

Composition of the FTSE® 100 Index

The 100 stocks included in the UKX (the “UKX Underlying Stocks”) were selected from a reference group of stocks trading on the LSE that were selected by excluding certain stocks that have low liquidity, public float accuracy, and reliability of prices, or size or have limited voting right by unrestricted shareholders or foreign ownership restrictions. The UKX Underlying Stocks were selected from this reference group by selecting 100 stocks with the largest market value. Where there are multiple lines of listed equity capital in a company, all are included and priced separately, provided that the secondary line’s full market capitalization (i.e. before the application of any investability weightings) is greater than 25% of the full market capitalization of the company’s principal line and the secondary line satisfies the eligibility rules and screens in its own right in all respects. A list of the issuers of the UKX Underlying Stocks is available from FTSE.

Companies are required to have greater than 5% of the company’s voting rights (aggregated across all of its equity securities, including, where identifiable, those that are not listed or trading) in the hands of unrestricted shareholders in order to be eligible for index inclusion. Companies already included in the UKX have a five-year grandfathering period to comply or they will be removed from the UKX in September 2022.

The UKX is overseen and reviewed quarterly by the FTSE Russell Europe, Middle East & Africa Regional Equity Advisory Committee (the “Index Steering Committee”) in order to maintain continuity in the level. The Index Steering Committee undertakes the reviews of the UKX and ensures that constituent changes and index calculations are made in accordance with the ground rules of the UKX. The UKX is reviewed on a quarterly basis in March, June, September and December. Each review is based on data from the close of business on the Tuesday before the first Friday of the review month. Any constituent changes are implemented after the close of business on the third Friday of the review month (i.e. effective Monday), following the expiry of the ICE Futures Europe futures and options contracts.

The UKX Underlying Stocks may be replaced, if necessary, in accordance with deletion/addition rules that provide generally for the removal and replacement of a stock from the UKX if such stock is delisted or its issuer is subject to a takeover offer that has been declared unconditional or it has ceased, in the opinion of the Index Steering Committee, to be a viable component of the UKX. To maintain continuity, a stock will be added at the quarterly review if it has risen to 90th place or above and a stock will be deleted if at the quarterly review it has fallen to 111th place or below, in each case ranked on the basis of market capitalization. A constant number of constituents will be maintained for the UKX. Where a greater number of companies qualify to be inserted in the UKX than those qualifying to be deleted, the lowest ranking constituents presently included in the UKX will be deleted to ensure that an equal number of companies are inserted and deleted at the periodic review. Likewise, where a greater number of companies qualify to be deleted than those qualifying to be inserted, the securities of the highest ranking companies which are presently not included in the UKX will be inserted to match the number of companies being deleted at the periodic review.

Companies that are large enough to be constituents of the UKX but do not pass the liquidity test are excluded. They will remain ineligible until the next annual review in June when they will be re-tested against all eligibility screens.

Calculation of the FTSE® 100 Index

The UKX is an arithmetic weighted index where the weights are the market capitalization of each company. The UKX is calculated by summing the free float adjusted market values (or capitalizations) of all companies within the UKX divided by the divisor. On the base date, the divisor is calculated as the sum of the market capitalizations of the UKX constituents divided by the initial index value of 1,000. The divisor is subsequently adjusted for any capital changes in the UKX constituents. In order to prevent discontinuities in the UKX in the event of a corporate action or change in constituents, it is necessary to make an adjustment to the prices used to calculate the UKX to ensure that the change in index between two consecutive dates reflects only market movements rather than including change due to the impact of corporate actions or constituent changes. This ensures that the UKX values remain comparable over time and that changes in the UKX level properly reflect the change in value of a portfolio of index constituents with weights the same as in the UKX.

TS-21

| Leveraged Index Return Notes with Absolute Return Buffer Linked to a Global Equity Index Basket, due October 25, 2024 |

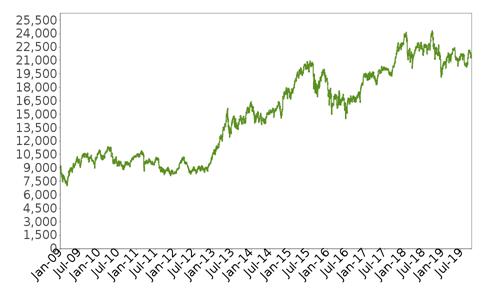

The following graph shows the daily historical performance of the UKX in the period from January 1, 2009 through October 11, 2019. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level of the UKX was 7,247.08.

Historical Performance of the FTSE® 100 Index

This historical data on the UKX is not necessarily indicative of the future performance of the UKX or what the value of the notes may be. Any historical upward or downward trend in the level of the UKX during any period set forth above is not an indication that the level of the UKX is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the UKX.

License Agreement

We have entered into a non-exclusive license agreement with FTSE whereby we, in exchange for a fee, are permitted to use the UKX in connection with certain securities, including the notes. We are not affiliated with FTSE; the only relationship between FTSE and us is any licensing of the use of FTSE’s indices and trademarks relating to them.

The notes are not in any way sponsored, endorsed, sold or promoted by FTSE or by the London Stock Exchange Group companies (“LSEG”) (together the “Licensor Parties”) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as (i) to the results to be obtained from the use of the UKX, (ii) the figure at which the UKX stands at any particular time on the particular day or otherwise, or (iii) the suitability of the UKX for the purpose to which it is being put in connection with the notes. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the UKX to Barclays Bank PLC or to its clients. The UKX is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the UKX or (b) be under any obligation to advise any person of any error therein.