CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

Title of Each Class of Securities Offered |

|

Maximum Aggregate Offering Price |

|

Amount of Registration Fee(1) |

|

|

|

|||

|

|

|

|

|

|

|

Medium-Term Notes, Series A |

|

$13,913,560 |

|

$992.04 |

|

|

|

|

|

October 2010 |

|

|

|

|

|

|

|

STRUCTURED INVESTMENTS |

|

|

Opportunities in U.S. Equities |

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

|

Performance Leveraged Upside SecuritiesSM |

|

|

|

|

|

Final TERMS |

|

|

Issuer: |

Barclays Bank PLC |

|

Maturity date: |

November 28, 2011 |

|

Underlying index: |

S&P 500® Index (the “Index”) |

|

Aggregate principal amount: |

$13,913,560 |

|

Payment at maturity: |

If final index value is greater than initial index value, |

|

|

$10 + leveraged upside payment |

|

|

In no event will the payment at maturity exceed the maximum payment at maturity. |

|

|

If final index value is less than or equal to initial index value, |

|

|

$10 x index performance factor |

|

|

This amount will be less than or equal to the stated principal amount of $10. |

|

|

You may lose some or all of your initial investment. Any payment on the PLUS is subject to the creditworthiness of the Issuer and is not guaranteed by any third party. For a description of risks with respect to the ability of Barclays Bank PLC to satisfy its obligations as they come due, see “Credit of Issuer” in this pricing supplement. |

|

Leveraged upside payment: |

$10 x leverage factor x index percent increase |

|

Index percent increase: |

(final index value – initial index value) / initial index value |

|

Initial index value: |

1,185.62 |

|

Final index value: |

The index closing value on the valuation date |

|

Valuation date: |

November 22, 2011, subject to postponement for certain market disruption events. |

|

Leverage factor: |

300% |

|

Index performance factor: |

final index value / initial index value |

|

Maximum payment at maturity: |

$11.465 (114.65% of the stated principal amount) per PLUS |

|

Stated principal amount: |

$10 per PLUS |

|

Issue price: |

$10 per PLUS (see “Commissions and Issue Price” below) |

|

Pricing date: |

October 25, 2010 |

|

Original issue date: |

October 28, 2010 (3 business days after the pricing date) |

|

CUSIP/ISIN: |

06740L154 / US06740L1540 |

|

Listing: |

We do not intend to list the PLUS on any securities exchange. |

|

Selected Dealer: |

Morgan Stanley Smith Barney LLC (“MSSB”) |

|

|

|

|

|

|

Commissions and Issue Price: |

Price to Public(1) |

Agent’s Commissions(1)(2) |

Proceeds to Issuer |

|

Per PLUS |

$10 |

$0.20 |

$9.80 |

|

Total |

$13,913,560 |

$278,271.20 |

$13,635,288.80 |

|

|

|

|

(1) |

The actual price to public and agent’s commissions for a particular investor may be reduced for volume purchase discounts depending on the aggregate amount of PLUS purchased by that investor. The lowest price payable by an investor is $9.9250 per PLUS. Please see “Syndicate Information” on page 7 for further details. |

|

|

|

|

(2) |

MSSB and its financial advisors will collectively receive from the Agent, Barclays Capital Inc., a fixed sales commission of $0.20 for each PLUS they sell. See “Supplemental Plan of Distribution.” |

|

|

|

|

|

YOU SHOULD READ THIS DOCUMENT TOGETHER WITH THE RELATED PROSPECTUS SUPPLEMENT, PROSPECTUS AND INDEX SUPPLEMENT, EACH OF WHICH CAN BE ACCESSED VIA THE HYPERLINKS BELOW. |

|

|

|

|

Prospectus dated August 31, 2010 |

|

See “Additional Terms of the PLUS” on page 2 of this pricing supplement. The PLUS will have the terms specified in the prospectus dated August 31, 2010, the prospectus supplement dated August 31, 2010, the index supplement dated August 31, 2010 and this pricing supplement. See “Risk Factors” beginning on page 10 of this pricing supplement and “Risk Factors” beginning on page S-5 of the prospectus supplement and “Risk Factors” beginning on page IS-2 of the index supplement for risks related to investing in the PLUS.

We may use this pricing supplement in the initial sale of the PLUS. In addition, Barclays Capital Inc. or any of our affiliates may use this pricing supplement in market resale transactions in any PLUS after the initial sale. Unless we or our agent informs you otherwise in the confirmation of sale, this pricing supplement is being used in a market resale transaction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the PLUS or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

Morgan Stanley Smith Barney LLC |

Barclays Capital Inc. |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

Additional Terms of the PLUS

You should read this pricing supplement together with the prospectus dated August 31, 2010, as supplemented by the prospectus supplement dated August 31, 2010 and the index supplement dated August 31, 2010 relating to our Global Medium-Term Notes, Series A, of which these PLUS are a part. This pricing supplement, together with the documents listed below, contain the terms of the PLUS and supersede all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the prospectus supplement and the index supplement as the PLUS involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the PLUS.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

|

|

|

|

• |

Prospectus dated August 31, 2010: |

|

|

http://www.sec.gov/Archives/edgar/data/312070/000119312510201448/df3asr.htm |

|

|

|

|

• |

Prospectus supplement dated August 31, 2010: |

|

|

http://www.sec.gov/Archives/edgar/data/312070/000119312510201604/d424b3.htm |

|

|

|

|

• |

Index supplement dated August 31, 2010: |

|

|

http://www.sec.gov/Archives/edgar/data/312070/000119312510201630/d424b3.htm |

Our SEC file number is 1-10257. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Barclays Bank PLC.

The PLUS constitute Barclays Bank PLC’s direct, unconditional, unsecured and unsubordinated obligations and are not deposit liabilities and are not insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency of the United States, the United Kingdom or any other jurisdiction. In addition, the PLUS will not be guaranteed by the Federal Deposit Insurance Corporation under the FDIC’s temporary liquidity guarantee program.

In connection with this offering, Morgan Stanley Smith Barney LLC is acting in its capacity as a selected dealer.

|

|

|

|

October 2010 |

Page 2 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside SecuritiesSM |

|

|

|

|

|

|

|

Expected Key Dates |

|

|

|

|

|

Pricing date: |

|

Original issue date (settlement date): |

|

Maturity date: |

|

October 25, 2010 |

|

October 28, 2010 (3 business days after the pricing date) |

|

November 28, 2011, subject to postponement due to a market disruption event |

|

Key Terms |

|

|

||

|

Issuer: |

|

Barclays Bank PLC |

||

|

Underlying index: |

|

S&P 500® Index |

||

|

Underlying index publisher: |

|

Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc |

||

|

Issue price: |

|

$10 per PLUS (see “Syndicate Information” on page 7) |

||

|

Stated principal amount: |

|

$10 per PLUS |

||

|

Denominations: |

|

$10 per PLUS and integral multiples thereof |

||

|

Interest: |

|

None |

||

|

Bull market or bear market PLUS: |

|

Bull market PLUS |

||

|

Payment at maturity: |

|

If final index value is greater than initial index value, |

||

|

|

|

$10 + leveraged upside payment |

||

|

|

|

In no event will the payment at maturity exceed the maximum payment at maturity. |

||

|

|

|

If final index value is less than or equal to initial index value, |

||

|

|

|

$10 x index performance factor |

||

|

|

|

This amount will be less than or equal to the stated principal amount of $10. |

||

|

|

|

You may lose some or all of your initial investment. Any payment on the PLUS is subject to the creditworthiness of the Issuer and is not guaranteed by any third party. For a description of risks with respect to the ability of Barclays Bank PLC to satisfy its obligations as they come due, see “Credit of Issuer” in this pricing supplement. |

||

|

Leveraged upside payment: |

|

$10 x leverage factor x index percent increase |

||

|

Index percent increase: |

|

(final index value – initial index value) / initial index value |

||

|

Leverage factor: |

|

300% |

||

|

Index performance factor: |

|

final index value / initial index value |

||

|

Initial index value: |

|

1,185.62 |

||

|

Final index value: |

|

The index closing value on the valuation date. |

||

|

Valuation date: |

|

November 22, 2011, subject to postponement for certain market disruption events. |

||

|

Maximum payment at maturity: |

|

$11.465 (114.65% of the stated principal amount) per PLUS. |

||

|

Postponement of maturity date: |

|

If the scheduled valuation date is not an index business day or if a market disruption event occurs on that day so that the valuation date as postponed falls less than two scheduled index business days prior to the scheduled maturity date, the maturity date of the PLUS will be postponed until the second scheduled index business day following that valuation date as postponed. |

||

|

Index business day: |

|

A day, as determined by the calculation agent, on which trading is generally conducted on each of the relevant exchange(s) for the underlying index, other than a day on which trading on such exchange(s) is scheduled to close prior to the time of the posting of its regular final weekday closing price. |

||

|

Index closing value: |

|

For any index business day, the closing value of the underlying index as published by Bloomberg under ticker symbol “SPX” at the regular weekday close of trading on that index business day. In certain circumstances, the index closing value will be based on the alternate calculation of the underlying index as described in “Reference Assets—Adjustments Relating to Securities with the Reference Asset Comprised of an Index or Indices” starting on page S-90 of the accompanying prospectus supplement. |

||

|

Risk factors: |

|

Please see “Risk Factors” beginning on page 9. |

||

|

|

|

|

October 2010 |

Page 3 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

|

|

|

|

|

|

|

|

|

|

General Information |

|

|

|

|

|

Listing: |

We do not intend to list the PLUS on any securities exchange. |

|

|

|

|

CUSIP/ISIN: |

06740L154 / US06740L1540 |

|

|

|

|

Minimum ticketing size: |

100 PLUS |

|

|

|

|

Tax considerations: |

Some of the tax consequences of your investment in the PLUS are summarized below. The discussion below supplements the discussion under ‘‘Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. As described in the prospectus supplement, this section applies to you only if you are a U.S. holder (as defined in the accompanying prospectus supplement) and you hold your PLUS as capital assets for tax purposes and does not apply to you if you are a member of a class of holders subject to special rules or are otherwise excluded from the discussion in the prospectus supplement. |

|

|

|

|

|

The United States federal income tax consequences of your investment in the PLUS are uncertain and the Internal Revenue Service could assert that the PLUS should be taxed in a manner that is different than described below. Pursuant to the terms of the PLUS, Barclays Bank PLC and you agree, in the absence of a change in law or an administrative or judicial ruling to the contrary, to characterize your PLUS as a pre-paid cash-settled executory contract with respect to the Index. If the PLUS are so treated, the PLUS should generally be taxed in the same manner as an “open transaction”, and you should generally recognize capital gain or loss upon the sale or maturity of your PLUS in an amount equal to the difference between the amount you receive at such time and the amount you paid for your PLUS. Such gain or loss should generally be long-term capital gain or loss if you have held your PLUS for more than one year. |

|

|

|

|

|

In the opinion of our special tax counsel, Sullivan & Cromwell LLP, the PLUS should be treated in the manner described above. This opinion assumes that the description of the terms of the PLUS in this pricing supplement is materially correct. |

|

|

|

|

|

As discussed further in the accompanying prospectus supplement, the Treasury Department and the Internal Revenue Service are actively considering various alternative treatments that may apply to instruments such as the PLUS, possibly with retroactive effect. |

|

|

|

|

|

For a further discussion of the tax treatment of your PLUS as well as possible alternative characterizations, please see the discussion under the heading “Certain U.S. Federal Income Tax Considerations—Certain Notes Treated as Forward Contracts or Executory Contracts” in the accompanying prospectus supplement. You should consult your tax advisor as to the possible alternative treatments in respect of the PLUS. For additional, important considerations related to tax risks associated with investing in the PLUS, you should also examine the discussion about tax risks in “Risk Factors—Structure Specific Risk Factors”, in this pricing supplement. |

|

|

|

|

|

Recently Enacted Legislation. Under recently enacted legislation, individuals that own “specified foreign financial assets” with an aggregate value in excess of $50,000 in taxable years beginning after March 18, 2010 will generally be required to file an information report with respect to such assets with their tax returns. “Specified foreign financial assets” include any financial accounts maintained by foreign financial institutions, as well as any of the following (which may include your PLUS), but only if they are not held in accounts maintained by financial institutions: (i) stocks and securities issued by non-U.S. persons, (ii) financial instruments and contracts held for investment that have non-U.S. issuers or counterparties and (iii) interests in foreign entities. Individuals are urged to consult their tax advisors regarding the application of this legislation to their ownership of the PLUS. |

|

|

|

|

Trustee: |

The Bank of New York Mellon |

|

|

|

|

Calculation agent: |

Barclays Bank PLC |

|

|

|

|

Use of proceeds and hedging: |

The net proceeds we receive from the sale of the PLUS will be used for various corporate purposes as set forth in the prospectus and prospectus supplement and, in part, in connection with hedging our obligations under the PLUS through one or more of our subsidiaries. |

|

|

|

|

October 2010 |

Page 4 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

|

|

|

|

|

We, through our subsidiaries or others, hedged our anticipated exposure in connection with the PLUS by taking positions in futures and options contracts on the underlying index and any other securities or instruments we may wish to use in connection with such hedging. Trading and other transactions by us or our affiliates could affect the level, value or price of reference assets and their components, the market value of the PLUS or any amounts payable on your PLUS. For further information on our use of proceeds and hedging, see “Use of Proceeds and Hedging” in the prospectus supplement. |

|

|

|

|

ERISA: |

See “Employee Retirement Income Security Act” starting on page S-110 in the accompanying prospectus supplement. |

|

|

|

|

Contact: |

Morgan Stanley Smith Barney LLC (“MSSB”) clients may contact their MSSB sales representative or MSSB’s principal executive offices at 2000 Westchester Avenue, Purchase, New York 10577 (telephone number 800-869-3326). A copy of each of these documents may be obtained from Barclays Bank PLC or the agent Barclays Capital, at 1-888-227-2275 (Extension 2-3430) or 745 Seventh Avenue—Attn: US InvSol Support, New York, NY 10019. |

|

|

|

|

October 2010 |

Page 5 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

|

|

|

|

|

|

|

Syndicate Information |

||||

|

Issue price of the PLUS |

|

Selling concession |

|

Principal amount of

PLUS |

|

$10.0000 |

|

$0.2000 |

|

<$1MM |

|

$9.9625 |

|

$0.1625 |

|

>$1MM and <$3MM |

|

$9.9438 |

|

$0.1438 |

|

>$3MM and <$5MM |

|

$9.9250 |

|

$0.1250 |

|

>$5MM |

Selling concessions allowed to dealers in connection with the offering may be reclaimed by the agent, if, within 30 days of the offering, the agent repurchases the PLUS distributed by such dealers.

This pricing supplement represents a summary of the terms and conditions of the PLUS. We encourage you to read the accompanying prospectus, prospectus supplement and index supplement for this offering, which can be accessed via the hyperlinks on the front page of this document.

|

|

|

|

October 2010 |

Page 6 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

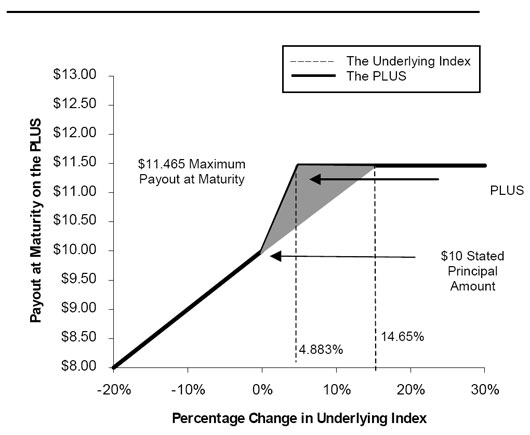

Payoff Diagram

The payoff diagram below illustrates the payment at maturity on the PLUS based on the following terms:

|

|

|

|

Stated principal amount: |

$10 |

|

|

|

|

Leverage factor: |

300% |

|

|

|

|

Maximum payment at maturity: |

$11.465 (114.65% of the stated principal amount) per PLUS |

|

|

|

PLUS Payoff Diagram |

|

|

|

|

|

|

|

§ |

If the final index value is greater than the initial index value, then investors receive the $10 stated principal amount plus 300% of the appreciation of the underlying index over the term of the PLUS, subject to the maximum payment at maturity. In the payoff diagram, an investor will realize the maximum payment at maturity at a final index value of approximately 104.88% of the initial index value. |

|

|

|

§ |

If the underlying index appreciates 5% at maturity, the investor would receive a 15% return, or $11.50. |

|

|

§ |

If the underlying index appreciates 30% at maturity, the investor would receive only the maximum payment of $11.465 or 114.65% of the stated principal amount. |

|

|

§ |

If the final index value is less than or equal to the initial index value, the investor would receive an amount less than or equal to the $10 stated principal amount, based on a 1% loss of principal for each 1% decline in the underlying index. |

|

|

§ |

If the underlying index depreciates 10% at maturity, the investor would lose 10% of their principal and receive only $9 at maturity, or 90% of the stated principal amount. |

|

|

|

|

October 2010 |

Page 7 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

Performance Leveraged Upside Securities |

Payment at Maturity

At maturity, investors will receive for each $10 stated principal amount of PLUS that they hold an amount in cash based upon the value of the underlying index, determined as follows:

If the final index value is greater than the initial index value:

$10 + Leveraged Upside Payment; subject to the maximum payment at maturity for each PLUS,

|

|

|

|

|

|

|

|

|

|

|

|

Leveraged Upside Payment |

|||||

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

Principal |

|

Leverage |

|

Index Percent Increase |

$10

+

$10

×

300%

×

final index value – initial index value

initial index value

If the final index value is less than or equal to the initial index value:

$10 × Index Performance Factor

|

|

|

|

|

Principal |

|

Index |

|

|

|

|

|

$10 |

× |

final index value |

|

initial index value |

Because the index performance factor will be less than or equal to 1.0, this payment will be less than or equal to $10.

|

|

|

|

October 2010 |

Page 8 |

|

|

|

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

|

Performance Leveraged Upside Securities |

|

Risk Factors

An investment in the PLUS involves significant risks. Investing in the PLUS is not equivalent to investing directly in the Index or any of the component stocks of the Index. The following is a non-exhaustive list of certain key risk factors for investors in the PLUS. For further discussion of these and other risks, you should read the sections entitled “Risk Factors” in the prospectus supplement and the index supplement. We also urge you to consult your investment, legal, tax, accounting and other advisors in connection with your investment in the PLUS.

Structure Specific Risk Factors

|

|

|

|

§ |

PLUS do not pay interest nor guarantee return of principal. The terms of the PLUS differ from those of ordinary debt securities in that the PLUS do not pay interest nor guarantee payment of the principal amount at maturity. If the final index value is less than the initial index value, the payout at maturity will be an amount in cash that is less than the $10 stated principal amount of each PLUS by an amount proportionate to the decrease in the value of the underlying index. |

|

|

|

|

§ |

Appreciation potential is limited. The appreciation potential of the PLUS is limited by the maximum payment at maturity of $11.465 (114.65%). Although the leverage factor provides 300% exposure to any increase in the value of the underlying index at maturity, because the payment at maturity will be limited to 114.65% of the stated principal amount for the PLUS, the percentage exposure provided by the leverage factor is progressively reduced as the final index value exceeds 104.88% of the initial index value. |

|

|

|

|

§ |

Market price influenced by many unpredictable factors. Several factors will influence the value of the PLUS in the secondary market and the price at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC may be willing to purchase or sell the PLUS in the secondary market, including: the value, volatility and dividend yield of the underlying index, interest and yield rates, time remaining to maturity, geopolitical conditions and economic, financial, political and regulatory or judicial events and any actual or anticipated changes in our credit ratings or credit spreads. You may receive less or possibly significantly less, than the stated principal amount per PLUS if you try to sell your PLUS prior to maturity. |

|

|

|

|

§ |

Credit of Issuer: The PLUS are senior unsecured debt obligations of the Issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the PLUS depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due and are not guaranteed by a third party. As a result, the actual and perceived creditworthiness of Barclays Bank PLC may affect the market value of the PLUS and, in the event Barclays Bank PLC were to default on its obligations, you may not receive the amounts owed to you under the terms of the PLUS. |

|

|

|

|

§ |

Not equivalent to investing in the underlying index. Investing in the PLUS is not equivalent to investing in the underlying index or its component stocks. Investors in the PLUS will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to stocks that constitute the underlying index. |

|

|

|

|

§ |

Adjustments to the underlying index could adversely affect the value of the PLUS. The underlying index publisher may discontinue or suspend calculation or publication of the underlying index at any time. In these circumstances, the calculation agent will have the sole discretion to substitute a successor index that is comparable to the discontinued underlying index and is not precluded from considering indices that are calculated and published by the calculation agent or any of its affiliates. |

|

|

|

|

§ |

The inclusion of commissions and projected profit from hedging in the original issue price is likely to adversely affect secondary market prices. Assuming no change in market conditions or any other relevant factors, the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC is willing to purchase the PLUS in any secondary market transactions will likely be lower than the original issue price since the original issue price includes, and secondary market prices are likely to exclude, commissions paid with respect to the PLUS, as well as the projected profit included in the cost of hedging the issuer’s obligations under the PLUS. In addition, any such prices may differ from values determined by pricing models used by Barclays Bank PLC, as a result of dealer discounts, mark-ups or other transaction costs. |

|

|

|

|

§ |

The U.S. federal income tax consequences of an investment in the PLUS are uncertain. The U.S. federal income tax treatment of the PLUS is uncertain and the Internal Revenue Service could assert that the PLUS should be taxed in a manner that is different than described above. As discussed further in the accompanying prospectus supplement, on December 7, 2007, the Internal Revenue Service issued a notice indicating that it and the Treasury Department are actively considering whether, among other issues, you should be required to accrue interest over the term of an instrument such as the PLUS even though you will not receive any payments with respect to the PLUS until maturity and whether all or part of the gain you may recognize upon the sale or maturity of an instrument such as the PLUS could be treated as ordinary income. The outcome of this process is uncertain and could apply on a retroactive basis. You should consult your tax advisor as to the possible alternative treatments in respect of the PLUS. |

|

|

|

|

Other Risk Factors |

|

|

|

|

|

§ |

The PLUS will not be listed on any securities exchange and secondary trading may be limited. There may be little or no secondary market for the PLUS. We do not intend to list the PLUS on any securities exchange. Barclays Capital Inc. and other affiliates of Barclays Bank PLC intend to offer to purchase the PLUS in the secondary market but are not required to do so and may cease any such market making activities at any time. Even if a secondary market develops, it may not provide enough liquidity to allow you to trade or sell the PLUS easily. Because other dealers are not likely to make a secondary market for the PLUS, the price, if any, at which you may be able to trade your PLUS is likely to depend on the price, if any, at which Barclays Capital Inc. and other affiliates of Barclays Bank PLC are willing to buy the PLUS. Accordingly, you should be willing to hold your PLUS to maturity. |

|

|

|

|

October 2010 |

Page 9 |

|

|

|

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

|

Performance Leveraged Upside Securities |

|

|

|

|

|

|

|

|

§ |

Hedging and trading activity by the calculation agent and its affiliates could potentially adversely affect the value of the PLUS. The hedging or trading activities of the issuer’s affiliates and of any other hedging counterparty with respect to the PLUS on or prior to the pricing date and prior to maturity could adversely affect the value of the underlying index and, as a result, could decrease the amount an investor may receive on the PLUS at maturity. Any of these hedging or trading activities on or prior to the pricing date could have affected the initial index value and, therefore, could have increased the value at which the underlying index must close before an investor receives a payment at maturity that exceeds the issue price of the PLUS. Additionally, such hedging or trading activities during the term of the PLUS, including on the valuation date, could potentially affect the value of the underlying index on the valuation date and, accordingly, the amount of cash an investor will receive at maturity. |

|

|

|

|

§ |

Potential adverse economic interest of the calculation agent. The economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the PLUS and the calculation agent will make determinations with respect to the PLUS. The calculation agent has determined the initial index value and the final index value, and calculate the amount of cash you will receive at maturity. Determinations made by the calculation agent, including with respect to the occurrence or non-occurrence of market disruption events and the selection of a successor index or calculation of the final index value in the event of a discontinuance of the underlying index, may adversely affect the payout to you at maturity. |

Information about the Underlying Index

The S&P 500® Index. The S&P 500® Index (the “S&P 500 Index”) is calculated, maintained and published by Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc (“S&P”). The S&P 500 Index is intended to provide an indication of the pattern of stock price movement in the U.S. equities market. The daily calculation of the level of the S&P 500 Index, discussed below in further detail, is based on the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943. The underlying index does not reflect the payment of dividends on the component stocks included in the index. Because of this, the calculation of the final index value will not reflect the payment of dividends on these stocks that investors would receive if they were to purchase these stocks and hold them for a period equal to the term of the PLUS. The information on the S&P 500 Index provided in this pricing supplement should be read together with the section entitled “Non-Proprietary Indices—Equity Indices—S&P 500® Index” in the index supplement.

Historical Information

The following table sets forth the published high and low closing values, as well as end-of-quarter closing values, of the underlying index for each quarter in the period from January 2, 2004 through October 25, 2010. The closing value of the underlying index on October 25, 2010 was 1,185.62. We obtained the closing levels of the S&P 500 Index below from Bloomberg, L.P. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg, L.P. The historical levels of the S&P 500 Index should not be taken as an indication of future performance, and no assurance can be given as to the closing level on the valuation date. We cannot give you assurance that the performance of the S&P 500 Index will result in the return of any of your initial investment.

|

|

|

|

|

|

|

|

|

|

|

|

|

S&P 500® Index |

|

High |

|

Low |

|

Period End |

|

|||

|

2004 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,157.76 |

|

|

1,091.33 |

|

|

1,126.21 |

|

|

Second Quarter |

|

|

1,150.57 |

|

|

1,084.10 |

|

|

1,140.84 |

|

|

Third Quarter |

|

|

1,129.30 |

|

|

1,063.23 |

|

|

1,114.58 |

|

|

Fourth Quarter |

|

|

1,213.55 |

|

|

1,094.81 |

|

|

1,211.92 |

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,225.31 |

|

|

1,163.75 |

|

|

1,180.59 |

|

|

Second Quarter |

|

|

1,216.96 |

|

|

1,137.50 |

|

|

1,191.33 |

|

|

Third Quarter |

|

|

1,245.04 |

|

|

1,194.44 |

|

|

1,228.81 |

|

|

Fourth Quarter |

|

|

1,272.74 |

|

|

1,176.84 |

|

|

1,248.29 |

|

|

2006 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,307.25 |

|

|

1,254.78 |

|

|

1,294.83 |

|

|

Second Quarter |

|

|

1,325.76 |

|

|

1,223.69 |

|

|

1,270.20 |

|

|

Third Quarter |

|

|

1,339.15 |

|

|

1,234.49 |

|

|

1,335.85 |

|

|

Fourth Quarter |

|

|

1,427.09 |

|

|

1,331.32 |

|

|

1,418.30 |

|

|

2007 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,459.68 |

|

|

1,374.12 |

|

|

1,420.86 |

|

|

Second Quarter |

|

|

1,539.18 |

|

|

1,424.55 |

|

|

1,503.35 |

|

|

Third Quarter |

|

|

1,553.08 |

|

|

1,406.70 |

|

|

1,526.75 |

|

|

Fourth Quarter |

|

|

1,565.15 |

|

|

1,407.22 |

|

|

1,468.36 |

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,447.16 |

|

|

1,273.37 |

|

|

1,322.70 |

|

|

Second Quarter |

|

|

1,426.63 |

|

|

1,278.38 |

|

|

1,280.00 |

|

|

Third Quarter |

|

|

1,305.32 |

|

|

1,106.39 |

|

|

1,166.36 |

|

|

Fourth Quarter |

|

|

1,161.06 |

|

|

752.44 |

|

|

903.25 |

|

2009 |

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

934.70 |

|

|

676.53 |

|

|

797.87 |

|

Second Quarter |

|

|

946.21 |

|

|

811.08 |

|

|

919.32 |

|

Third Quarter |

|

|

1,071.66 |

|

|

879.13 |

|

|

1,057.08 |

|

Fourth Quarter |

|

|

1,127.78 |

|

|

1,025.21 |

|

|

1,115.10 |

|

2010 |

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

1,174.17 |

|

|

1,056.74 |

|

|

1,169.43 |

|

Second Quarter |

|

|

1,217.28 |

|

|

1,030.71 |

|

|

1,030.71 |

|

Third Quarter |

|

|

1,148.67 |

|

|

1,022.58 |

|

|

1,141.20 |

|

Fourth Quarter (through October 25, 2010) |

|

|

1,185.62 |

|

|

1,137.03 |

|

|

1,185.62 |

|

|

|

|

|

October 2010 |

Page 10 |

|

|

|

|

|

|

|

PLUS Based on the Value of the S&P 500® Index due November 28, 2011 |

|

|

Performance Leveraged Upside Securities |

|

The following graph sets forth the historical performance of the S&P 500 Index based on the weekly closing levels of the S&P 500 Index from January 2, 2004 through October 25, 2010. The closing level of the S&P 500 Index on October 25, 2010 was 1,185.62.

We obtained the closing levels of the S&P 500 Index below from Bloomberg, L.P. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg, L.P. The historical levels of the S&P 500 Index should not be taken as an indication of future performance, and no assurance can be given as to the closing level on the valuation date. We cannot give you assurance that the performance of the S&P 500 Index will result in the return of any of your initial investment.

|

|

|

Underlying

Index Historical Performance— |

Supplemental Plan of Distribution

MSSB and its financial advisors will collectively receive from the Agent, Barclays Capital Inc., a fixed sales commission of $0.20 for each PLUS they sell.

We expect that delivery of the PLUS will be made against payment for the PLUS on or about the issue date indicated on the cover of this pricing supplement, which will be the third business day following the expected pricing date (this settlement cycle being referred to as “T+3”). See “Plan of Distribution” in the prospectus supplement.

|

|

|

|

October 2010 |

Page 11 |