|

Barclays PLC One Churchill Place London E14 5HP

Tel: 020 7116 1000

www.barclays.com

18 February 2011 |

Michael Seaman

Special Counsel

Securities and Exchange Commission

Washington D.C. 20549

USA

Dear Mr Seaman,

Barclays PLC and Barclays Bank PLC

Form 20-F for the Fiscal Year Ended December 31, 2009

File No. 0-10257, 1-09246

This letter responds to the comment letter (the ‘Comment Letter’) from the Staff of the Securities and Exchange Commission (the ‘Commission’), dated 10 February 2011, concerning the Annual Report on Form 20-F for the fiscal year ended 31 December 2009 (the ‘2009 Form 20-F’) of Barclays PLC and Barclays Bank PLC (collectively, ‘Barclays’). In addition, it provides responses to additional questions that you have raised with us by email subsequent to the Comment Letter, or during our conference call of 14 February 2010.

Our responses to your comments are set out as an appendix to this letter. To facilitate the Staff’s review, Barclays has included in its responses the captions and numbered comments in bold text and has provided Barclays responses immediately following each numbered comment.

In some of the responses, and in light of the Staff’s comments, Barclays may provide further disclosures in our Annual Report on Form 20-F for 2010 (‘2010 Form 20-F’) that may differ from or supplement the corresponding disclosure in the Form 20-F for 2009. Barclays continues to believe its prior filings are in compliance with applicable disclosure rules and regulations promulgated by International Financial Reporting Standards and the Commission. Accordingly, any changes implemented in future filings should not be taken as an admission that prior disclosures were deficient or inaccurate.

In relation to Protium, the Board of Barclays continues to take the view that the accounting treatment applied is that required by accounting standards and best reflects the substance of the transaction. Prior to approval, the transaction was reviewed extensively and was subject to all appropriate governance processes. Accordingly, the Board and the relevant Board committees discussed and approved the transaction on the basis of its economic and commercial merits. Additionally, the Board Audit Committee and the full Board considered the accounting treatment with the benefit of specialist internal and external advice. The Board satisfied themselves that the treatment was appropriate, consistent with the commercial and economic rationale and reflected an arm’s length transaction to an independent entity that Barclays does not control.

Barclays Bank PLC. Authorised and regulated by the Financial Services Authority.

Barclays PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

We strongly believe that Barclays has applied the appropriate accounting treatment, in accordance with IFRS and in the context of our responsibility to ensure that the financial statements present a true and fair view of our results and financial position.

We trust that the information provided in this letter responds adequately to the questions you have raised. We would be pleased to provide any further information to the extent you would find this helpful.

| Yours sincerely, |

| /s/ C.G. Lucas |

| C.G. Lucas |

| Group Finance Director |

| cc |

Wayne Carnall | |

| Stephanie Hunsaker | ||

| David Irving | ||

| Sharon Blume | ||

| Eric Envall | ||

| (Securities and Exchange Commission) | ||

| George H White | ||

| John O’Connor | ||

| (Sullivan & Cromwell LLP) | ||

| Philip Rivett | ||

| Andrew Ratcliffe | ||

| (PricewaterhouseCoopers LLP, Barclays Audit Engagement Team) | ||

| Rob Enticott | ||

| (PricewaterhouseCoopers LLP, SEC Services) | ||

Barclays Bank PLC. Authorised and regulated by the Financial Services Authority.

Barclays PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

Mr M Seaman

Securities and Exchange Commission

Appendix

Form 20-F for the Fiscal Year Ended December 31, 2009

General

1. We note your response to prior comment 1 in our letter dated December 22, 2010. We do not agree with your conclusion that the opinions filed as Exhibits 5.1 and 5.2 to your shelf registration statement satisfy the exhibit requirement applicable to a shelf registration statement on Form F-3 in the context of a medium-term note program. Accordingly, please file clean legal opinions in connection with any takedowns from your shelf registration statement. Alternatively, you may amend your registration statement to file clean legal opinions that cover future takedowns. See Securities Act Compliance and Disclosure Interpretation 212.05 and Securities Act Forms Compliance and Disclosure Interpretation 118.02.

We respectfully note your comment and position with regard to our response to prior comment 1. We understand that other similarly situated registrants may be receiving similar comments. We believe it would be appropriate to respond to your comment after consulting with other market participants so we can provide a response to you promptly that forms the means to resolve the comment on a common basis. We hope that this is acceptable to you and would be happy to discuss further.

Section 1. Business Review

Risk Management

Credit Risk Management

Barclays Capital Credit Market Exposures

2. We note your responses to prior comment 3 to our letter dated December 22, 2010 and prior comment 7 to our letter dated September 8, 2010 regarding the Protium transaction. Please respond to the following additional comments:

a. Your response indicates that the expected future cash flows significantly exceeds the asset fair values as the asset fair values were significantly impacted by non-cash flow factors, such as market liquidity. Tell us who would absorb the majority of the variability in cash flows if the cash flows were actually less than the asset fair values.

In accordance with paragraph 22 of IAS 39, the comparison of relative exposures to variability required us to estimate the expected future cash flows at the time the sale was transacted and then determine, and assign probabilities to, reasonable alternative upside and downside scenarios. Expected future cash flows were determined by reference to relevant internal cash flow models, which are calibrated against market data and external research.

At inception, Barclays was exposed to cash flow variability below current asset fair values. However, our analysis of expected future cash flows ascribed a low probability to such scenarios, since market prices for these assets classes were heavily discounted at the time. Indeed, that analysis identified expected future cash flows approximately $4bn greater than those required to repay our loan. Actual cash flows since the sale and subsequent expected cash flow analysis continues to support this assessment, i.e. that the majority of variability resides with the B and C noteholders.

Mr M Seaman

Securities and Exchange Commission

Appendix

b. Your response indicates that 83% of the estimated variability resided with the third party investors and fund management team, with 17% impacting on Barclays. However, the transfer of risks and rewards under IAS 39 is evaluated by comparing an entity’s exposure both before and after the transfer. Thus, please provide your analysis that compares your variability in the cash flows both before and after the transfer pursuant to the guidance in par. 21 of IAS 39.

Our analysis was conducted in accordance with paragraph 21 of IAS 39. Before the transaction, Barclays was exposed to 100% of the cash flow variability – post-sale, this had dropped to 17%. Third parties had no exposure before the sale, increasing to 83% afterwards.

We attach to this letter a summary of the variability analysis and would be happy to explain to you the detailed model that supports this summary.

c. Your response indicates that after the transfer, Barclays maintains 17% of the estimated variability of the cash flows. We note that par. 21 of IAS 39 indicates that an entity has transferred substantially all the risks and rewards of ownership of a financial asset if its exposure to such variability is no longer significant in relation to the total variability in the present value of the future net cash flows associated with the financial asset. Please provide your analysis supporting your conclusion that 17% of the estimated variability is not significant.

Barclays would generally view 90% of the cash flow variability of an asset as representing “substantially all” of its risks and rewards, in line with our understanding of market practice in this area. As noted in the analysis referred to in our response to comment b above, Barclays neither transferred nor retained substantially all of the risks and rewards of the sold assets (i.e., it transferred between 10% and 90% of the cash flow variability).

In such circumstances, derecognition is required (in accordance with paragraph 20(c) of IAS 39) when the transferor has not retained control of the relevant assets. In this context, control is the practical ability to sell the assets – Barclays has not retained control of the assets.

As noted in our response to comment b above, we have provided you with our analysis.

d. Tell us whether you believe a transferor that retains all of the risks of a transferred financial asset, but not all of the rewards, has retained substantially all of the risks and rewards of ownership of a financial asset.

IAS 39 requires an assessment of both risks and rewards. A transferor that retains all of the risks of a transferred financial asset, but not all of the rewards, does not necessarily retain substantially all of the risks and rewards of ownership of a financial asset. Such analyses depend on facts and circumstances and in any transaction the total variability of cashflows determines the overall assessment of risks and rewards. With regard to Protium, whilst Barclays is exposed to risk, being 17% of the cashflow variability of the assets, the B and C note holders are exposed to 83% of the expected variability. As such, and as noted in our response to comment e below, Barclays has not retained substantially all of the risks and rewards of the assets sold in the Protium transaction.

Mr M Seaman

Securities and Exchange Commission

Appendix

e. Tell us whether you believe you have retained substantially all of the risks of the assets transferred to Protium. Please ensure your response addresses the fact that only $520,000 of Notes issued by Protium rank junior to the Barclays loan.

Barclays did not retain substantially all of the risks of the sold assets. In a derecognition context, both risks and rewards are defined by reference to expected cash flow variability. Risk is the possibility that an asset will generate lower cash flows than expected, rewards being the possibility that an asset will generate higher cash flows than expected. The relative exposure to the risks and rewards of a transferred asset, as defined in paragraph 21 of IAS 39, is not affected by:

| (i) | how much each party paid for their interest; |

| (ii) | asset fair value on the date of sale; or |

| (iii) | pre-transaction carrying amount or accounting treatment (i.e., fair value vs amortised cost). |

Whilst the invested capital for the B and C notes represents a small proportion of the total capital structure, the large majority of the variability in expected cash flows and, therefore, the risks and rewards of the sold assets resides within the resulting interests – the management team’s performance-related fee (C notes) and the residual interest in the entity (B notes).

This analysis is required by IFRS and market interpretation thereof. It is also consistent with the substance of the transaction. After the sale, Barclays’ interest in the assets was fundamentally changed, becoming a LIBOR-based loan substantially over-collateralised from an expected cash flow perspective. Continued recognition would have resulted in a treatment whereby assets would be included on the balance sheet of an entity that cannot control them and has relatively little exposure to their risks and rewards. We did not consider that this would have been appropriate.

f. Tell us why the interest rate on the Class A notes, which rank senior to the Barclays loan, is 27% per annum for the first five years and 7% thereafter, and only LIBOR + 2.75 (approximately 4%) for the Barclays loan.

As part of the negotiations between Barclays and the other investors, we had to satisfy ourselves that our return for the funding we provided was appropriate for the risks to which we were exposed - based on the expected performance of Protium and where our loan was in the cash flow waterfall compared to other instruments.

Once we were satisfied that the return on our funding was appropriate based on the risk to which we were exposed, our main objective was to negotiate fee arrangements with the management team that were consistent with our objective of receiving full repayment of our loan.

The expected excess cash flows in the structure were effectively apportioned between the fund management team and the A and B noteholders through commercial negotiation with the affected parties. Once arm’s length, performance-related, fees had been agreed with the management team, the transaction was able to support a level of interest more senior to Barclays loan (the A notes) as well as the more junior residual interest (B notes). The final terms were those negotiated with the relevant parties in this context.

Mr M Seaman

Securities and Exchange Commission

Appendix

g. Tell us the nature of the creditor rights held by Barclays over activities that Protium may take with respect to the assets held. For example, tell us whether there are limits on the amount of loss that Protium can recognize on disposal of the asset (versus holding the asset) as well as any other creditor rights that exist.

Comparable with other lending arrangements, there are a number of protective rights (as outlined in our letter to you of 31 January 2011) and there are also some limited restrictions over Protium’s activities, which are noted below:

| • | A limitation on the size of the AMA ($1bn); |

| • | Concentration limits for AMA investments if the hurdle rate for C note distributions is not met after six years; |

| • | A cash sweep that necessitates the paydown of the Barclays loan; |

| • | Notification to Barclays of any equity investments, and the ability for Barclays to terminate early if holding the loan would result in a violation of the US Bank Holding Company Act; |

| • | Limitation on the exposure to loss that can be taken on when entering into particular hedging transactions. |

There is no specified limit on the amount of loss that Protium can recognise on disposal of an asset versus holding the asset.

h. Your response indicates that limitations on the activities of Protium, for example size and concentration limits on the Actively Managed Account (AMA), are not significant. Please provide further information regarding your conclusion that the limitations are not significant. As part of your response, please tell us the current balance on the AMA and tell us whether Protium has raised any third party financing to further increase its activities.

When considering such restrictions in an accounting context, their main significance is in determining whether the additional guidance of SIC 12 ‘Consolidation – Special Purpose Entities’ is relevant. There is very significant discretion over how C12’s management operates Protium and a great variety in the nature of the transactions it may enter into. Furthermore, at inception, Protium’s activities were managed by approximately 45 employees, with this rising to approximately 80 by the end of 2010.

In this context, we did not believe it appropriate to conclude that Protium was an entity “created to accomplish a narrow and well-defined objective.” (SIC 12, paragraph 1). Nevertheless, given the materiality of the transaction, we performed a SIC 12 analysis, which also concluded that Barclays should not consolidate Protium. This is principally because Barclays does not have decision-making power over the entity and is not exposed to the majority of its risks and benefits.

The balance of the AMA as at 31 December 2010 was $852m. We understand that Protium raises financing via repurchase agreements in the AMA.

i. Please clarify whether the assets held in the AMA also serve as collateral for the Barclays loan.

Yes, the assets held in the AMA also serve as collateral for our loan.

j. Please provide additional background regarding your discussions with the FSA and the fact that the loan would be subject to fixed risk weightings, as opposed to the underlying assets of Protium.

The discussion with the FSA was initially as to whether or not Protium was a securitisation for regulatory purposes. We were directed to treat the exposure as a securitisation exposure. Until June 2010, the securitisation treatment applied was to take capital on the assets collateralising the loan.

Mr M Seaman

Securities and Exchange Commission

Appendix

From June 2010, the FSA directed us to treat the first £2.2bn of the loan as a 1250% risk weighted asset, with the remainder of the loan treated as a 100% risk weighted asset.

As agreed, we would also like to respond to a number of points that were raised when SEC staff spoke with us on 14 February 2011:

k. An assessment of the impact of consolidation

The following analysis provides a summary estimate of the effect of Barclays restating its accounts as if the appropriate basis of preparation was for Protium to be consolidated1:

| (i) | Income statement |

2009 income statement:

| As reported |

Consolidated basis |

Impact | ||||||||||||||

| £m | £m | £m | % | |||||||||||||

| Net interest income |

11,918 | 11,832 | (86 | ) | (0.7 | ) | ||||||||||

| Net trading income |

7,001 | 6,916 | (85 | ) | (1.2 | ) | ||||||||||

| Impairment |

(8,071 | ) | (8,071 | ) | — | — | ||||||||||

| Administration and general expenses |

(5,561 | ) | (5,597 | ) | (36 | ) | 0.6 | |||||||||

| Profit before tax |

11,642 | 11,435 | (207 | ) | (1.8 | ) | ||||||||||

| PBT from continuing operations |

4,585 | 4,378 | (207 | ) | (4.5 | ) | ||||||||||

| Profit attributable to Equity Holders of the Parent |

9,393 | 9,393 | — | — | ||||||||||||

| 1 | The impact on PBT and on the impairment line can be reliably quantified. However, there is some estimation involved in the allocations between net interest income, net trading income and expenses, since we do not have access to full cash flow and income statement information for Protium. |

Mr M Seaman

Securities and Exchange Commission

Appendix

2010 income statement:

| As reported |

Consolidated basis |

Impact | ||||||||||||||

| £m | £m | £m | % | |||||||||||||

| Net interest income |

12,523 | 12,222 | (301 | ) | (2.4 | ) | ||||||||||

| Net trading income |

8,078 | 8,204 | 126 | 1.6 | ||||||||||||

| Impairment |

(5,672 | ) | (5,140 | ) | 532 | (9.4 | ) | |||||||||

| Administration and general expenses |

(6,585 | ) | (6,679 | ) | (94 | ) | 1.4 | |||||||||

| Profit before tax |

6,065 | 6,329 | 264 | 4.3 | ||||||||||||

| Profit attributable to Equity Holders of the Parent |

3,564 | 3,564 | — | — | ||||||||||||

2009 and 2010 (combined pro-forma):

| As reported |

Consolidated basis |

Impact | ||||||||||||||

| £m | £m | £m | % | |||||||||||||

| Net interest income |

24,441 | 24,054 | (387 | ) | (1.6 | ) | ||||||||||

| Net trading income |

15,079 | 15,120 | 41 | 0.3 | ||||||||||||

| Impairment |

(13,743 | ) | (13,211 | ) | 532 | (3.9 | ) | |||||||||

| Administration and general expenses |

(12,146 | ) | (12,275 | ) | (129 | ) | 1.1 | |||||||||

| Profit before tax |

17,707 | 17,764 | 57 | 0.3 | ||||||||||||

| PBT from continuing operations |

10,650 | 10,707 | 57 | 0.5 | ||||||||||||

| Profit attributable to Equity Holders of the Parent |

12,957 | 12,957 | — | — | ||||||||||||

The preceding tables are translated into GBP at quarterly average exchange rates. There would be no tax impact.

Profit attributable to controlling interests (‘Profit attributable to Equity Holders of the Parent’) would be unaffected by consolidation. Under paragraphs 28 and BC33 to BC 40 of IAS 27, Protium’s gains and losses would have been attributed to non-controlling interests (i.e., the B note holders). The change in management expectations over the loan realisation period (as at 31 December 2010) would result in future gains and losses being attributed to controlling interests, for as long as asset fair value is less than the outstanding loan balance.

Mr M Seaman

Securities and Exchange Commission

Appendix

| (ii) | Balance sheet |

2009 balance sheet:

| As reported |

Consolidated basis |

Impact | ||||||||||||||

| £m | £m | £m | % | |||||||||||||

| Cash |

81,483 | 82,112 | 629 | 0.8 | ||||||||||||

| Trading portfolio assets |

151,344 | 156,525 | 5,181 | 3.4 | ||||||||||||

| Derivative assets |

416,815 | 418,853 | 2,038 | 0.5 | ||||||||||||

| Loans and advances to customers |

420,224 | 412,365 | (7,859 | ) | (1.9 | ) | ||||||||||

| Debt securities in issue |

(135,902 | ) | (136,098 | ) | (196 | ) | 0.1 | |||||||||

| Net assets |

58,478 | 58,271 | (207 | ) | (0.4 | ) | ||||||||||

2010 balance sheet:

| As reported |

Consolidated basis |

Impact | ||||||||||||||

| £m | £m | £m | % | |||||||||||||

| Cash |

97,630 | 98,713 | 1,083 | 1.1 | ||||||||||||

| Trading portfolio assets |

168,864 | 174,865 | 6,001 | 3.6 | ||||||||||||

| Derivative assets |

420,319 | 420,464 | 145 | 0.0 | ||||||||||||

| Loans and advances to customers |

428,423 | 421,396 | (7,027 | ) | (1.6 | ) | ||||||||||

| Debt securities in issue |

(156,623 | ) | (156,798 | ) | (175 | ) | 0.1 | |||||||||

| Net assets |

62,310 | 62,338 | 28 | 0.0 | ||||||||||||

As regards materiality in future periods, profit or loss would be determined by movements in the fair value of Protium’s assets under both a consolidated and non-consolidated (impairment-based) approach. A difference between the two would arise should asset fair value become equal to the outstanding loan balance, since any further increases in value would not be reflected under a non-consolidated approach. This difference would be consistent with the fact that Barclays has no entitlement to benefit from such increases in value.

Mr M Seaman

Securities and Exchange Commission

Appendix

l A quarterly summary of capital raising pursuant to our shelf registration statement

The following table summarises the volume of term capital raising in 2010 by quarter and in January 2011 pursuant to our SEC shelf registration statement:

| $bn | Details | |||||

| Q1 2010 |

3.0 | $3bn 5.125% Senior Notes due 2020 | ||||

| Q2 2010 |

1.0 | $1bn 3.90% Senior Notes due 2015 | ||||

| Q4 2010 |

1.25 | $1.25bn 5.140% Subordinated Notes due 2020 | ||||

| Q1 2011 |

2.0 | $1.25bn 2.375% Senior Notes due 2014 $0.75bn Floating Rate Notes due 2014 | ||||

This summary does not include (large volume, small issue size) short-term liquidity and customer-driven medium-term note issuances pursuant to the shelf registration statement. We have also registered equity securities for employee plans on Form S-8.

m An explanation of the basis for impairment

Whilst the cash flows that are expected to be generated by Protium’s assets over the loan term would be sufficient to enable repayment, Barclays now thinks it more likely that the loan will be repaid from the sale proceeds of those assets over a shorter period. In such circumstances, it is appropriate to use current fair value as the best estimate of recoverable amount, consistent with paragraph AG84 of IAS 39.

The reasons for this change in Barclays approach to the realisation of the loan are as follows:

| • | An increase in the capital charge applied to the Protium loan (notified by the FSA in June 2010), which will become more detrimental going forward as the loan repays while the fixed regulatory capital requirement remains unchanged; |

| • | Continuing internal business review, with a focus on the return on equity for Protium becoming increasingly unattractive; |

| • | The issue of sub-market returns on different assets has been under consideration by the Board as part of the overall Medium Term Plan review, with a preferred direction to reduce those assets where possible (November 2010 Board meeting); and |

| • | The C12 principals’ original business plan beyond Protium (to enter into similar arrangements with other European financial institutions) has not come to fruition, as a result of which the long term stability of the principals’ relationship has become doubtful. |

The combination of these factors led us to conclude as part of our year-end financial close process that it was appropriate to record an impairment of £532m in the period ended 31 December 2010. In future periods, impairment will continue to be measured by reference to the fair value of underlying collateral. Should fair value become equal to the outstanding loan balance, further increases will not be reflected in the income statement or balance sheet.

Barclays has approached C12’s management with a view to attempting to renegotiate the terms of the existing loan and management agreement. The form of any new arrangement could include delivery of the underlying collateral assets to Barclays to satisfy the loan (rather than repayment of principal and interest), or an agreement for C12 to sell the assets over a shorter period of time. Management’s expectation is that an agreement can be reached. However, any new arrangement is subject to negotiation and therefore there is no certainty that such an arrangement can be achieved.

n Impact of consolidation on risk weighted assets (RWAs)

Mr M Seaman

Securities and Exchange Commission

Appendix

The existing capital treatment does not depend on whether Protium is consolidated for accounting purposes. The loan is treated as a securitisation exposure and many such positions are subject to accounting consolidation. If the FSA was to change the treatment it might be necessary to calculate RWAs based on the underlying assets, thus reducing RWAs. However, we currently have no reason to believe the treatment would be changed if accounting consolidation were appropriate.

Section 3. Financial Statements

Consolidated income Statement, page 178

3 We note your response to prior comment 4 to our letter dated December 22, 2010 regarding the title “net income” on the income statement. The staff does not disagree with your conclusion that “profit before tax” is the primary measure of profit or loss and one that is well understood. However, the staff continues to believe that the title “net income,” which is shown prior to the inclusion of most operating expenses, may be confusing to some readers, and the practice does not appear to be widespread in the industry. Thus, please consider re-naming the title of this line item to be more descriptive of the measure that reflects income prior to most operating expenses.

In light of your continuing comments on this title, we propose to amend it to “Net operating income” in our 2010 Form 20-F filing, and subsequent filings.

Project Carbon

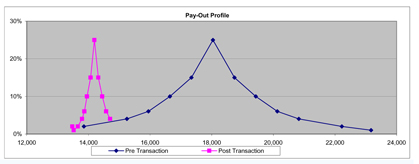

Risk and Reward Analysis

| Probability Distribution |

| |||||

| Barcap ## -30% |

2 | % | ||||

| Barcap ## -20% |

4 | % | ||||

| Barcap ## -15% |

6 | % | ||||

| Barcap ## -10% |

10 | % | ||||

| Barcap ## -5% |

15 | % | ||||

| Barcap ## |

25 | % | ||||

| Barcap ## +5% |

15 | % | ||||

| Barcap ## +10% |

10 | % | ||||

| Barcap ## +15% |

6 | % | ||||

| Barcap ## +20% |

4 | % | ||||

| Barcap ## +30% |

2 | % | ||||

| Barcap ## +40% |

1 | % | ||||

| 100 | % |

Derecognition Test

| Anticipated Future Cashflows on Underlying Assets |

|

|||||||||||||||||||||||||||||||||

| RMBS Portfolio PV |

Loan Portfolio PV |

CDO Portfolio PV |

Total PV |

Prob % |

Prob Weighted PV |

Variation From Expected |

Prob Weighted Variability |

|||||||||||||||||||||||||||

| 1 | Barcap ## -30% | 4,390 | 2,012 | 7,453 | 13,855 | 2 | % | 277 | (4,235 | ) | (85 | ) | ||||||||||||||||||||||

| 2 | Barcap ## -20% | 5,017 | 2,299 | 7,933 | 15,249 | 4 | % | 610 | (2,840 | ) | (114 | ) | ||||||||||||||||||||||

| 3 | Barcap ## -15% | 5,331 | 2,443 | 8,173 | 15,946 | 6 | % | 957 | (2,143 | ) | (129 | ) | ||||||||||||||||||||||

| 4 | Barcap ## -10% | 5,644 | 2,587 | 8,413 | 16,644 | 10 | % | 1,664 | (1,446 | ) | (145 | ) | ||||||||||||||||||||||

| 5 | Barcap ## -5% | 5,958 | 2,730 | 8,653 | 17,341 | 15 | % | 2,601 | (749 | ) | (112 | ) | ||||||||||||||||||||||

| 6 | Barcap ## | 6,272 | 2,874 | 8,893 | 18,038 | 25 | % | 4,510 | (51 | ) | (13 | ) | ||||||||||||||||||||||

| 7 | Barcap ## +5% | 6,585 | 3,018 | 9,132 | 18,735 | 15 | % | 2,810 | 646 | 97 | ||||||||||||||||||||||||

| 8 | Barcap ## +10% | 6,899 | 3,161 | 9,372 | 19,432 | 10 | % | 1,943 | 1,343 | 134 | ||||||||||||||||||||||||

| 9 | Barcap ## +15% | 7,212 | 3,305 | 9,612 | 20,130 | 6 | % | 1,208 | 2,040 | 122 | ||||||||||||||||||||||||

| 10 | Barcap ## +20% | 7,526 | 3,449 | 9,852 | 20,827 | 4 | % | 833 | 2,737 | 109 | ||||||||||||||||||||||||

| 11 | Barcap ## +30% | 8,153 | 3,736 | 10,332 | 22,221 | 2 | % | 444 | 4,132 | 83 | ||||||||||||||||||||||||

| 12 | Barcap ## +40% | 8,780 | 4,024 | 10,368 | 23,172 | 1 | % | 232 | 5,082 | 51 | ||||||||||||||||||||||||

| 100 | % | |||||||||||||||||||||||||||||||||

| Expected Value | 18,089 | (0 | ) | |||||||||||||||||||||||||||||||

| Anticipated Future Cashflows on AssetCo Loan |

|

|||||||||||||||||||||||||||||

| Loan Final Repayment Date |

Loan Unpaid Balance |

Total PV |

Prob % |

Prob Weighted PV |

Variation From Expected |

Prob Weighted Variability |

||||||||||||||||||||||||

| 1 | Barcap ## -30% | 16-Sep-19 | 2,224 | 13,479 | 2 | % | 270 | (694 | ) | (14 | ) | |||||||||||||||||||

| 2 | Barcap ## -20% | 16-Sep-19 | 0 | 14,708 | 4 | % | 588 | 535 | 21 | |||||||||||||||||||||

| 3 | Barcap ## -15% | 16-Sep-19 | 0 | 14,579 | 6 | % | 875 | 405 | 24 | |||||||||||||||||||||

| 4 | Barcap ## -10% | 16-Sep-19 | 0 | 14,450 | 10 | % | 1,445 | 277 | 28 | |||||||||||||||||||||

| 5 | Barcap ## -5% | 16-Sep-19 | 0 | 14,322 | 15 | % | 2,148 | 149 | 22 | |||||||||||||||||||||

| 6 | Barcap ## | 16-Sep-19 | 0 | 14,196 | 25 | % | 3,549 | 22 | 6 | |||||||||||||||||||||

| 7 | Barcap ## +5% | 16-Sep-19 | 0 | 14,070 | 15 | % | 2,110 | (104 | ) | (16 | ) | |||||||||||||||||||

| 8 | Barcap ## +10% | 31-Mar-18 | 0 | 13,956 | 10 | % | 1,396 | (217 | ) | (22 | ) | |||||||||||||||||||

| 9 | Barcap ## +15% | 30-Jun-17 | 0 | 13,871 | 6 | % | 832 | (302 | ) | (18 | ) | |||||||||||||||||||

| 10 | Barcap ## +20% | 31-Mar-17 | 0 | 13,795 | 4 | % | 552 | (378 | ) | (15 | ) | |||||||||||||||||||

| 11 | Barcap ## +30% | 30-Jun-16 | 0 | 13,656 | 2 | % | 273 | (518 | ) | (10 | ) | |||||||||||||||||||

| 12 | Barcap ## +40% | 31-Dec-14 | 0 | 13,521 | 1 | % | 135 | (652 | ) | (7 | ) | |||||||||||||||||||

| Expected Value | 14,173 | (0 | ) | |||||||||||||||||||||||||||

| Change in Variability |

|

|||||||||||||||||

| Probability Weighted Variability (ABS) |

Probability Weighted Variability (SQ) |

|||||||||||||||||

| Pre | Post | Pre | Post | |||||||||||||||

| 1 | Barcap ## -30% | 85 | 14 | 7,173 | 193 | |||||||||||||

| 2 | Barcap ## -20% | 114 | 21 | 12,906 | 458 | |||||||||||||

| 3 | Barcap ## -15% | 129 | 24 | 16,532 | 591 | |||||||||||||

| 4 | Barcap ## -10% | 145 | 28 | 20,902 | 766 | |||||||||||||

| 5 | Barcap ## -5% | 112 | 22 | 12,607 | 499 | |||||||||||||

| 6 | Barcap ## | 13 | 6 | 165 | 31 | |||||||||||||

| 7 | Barcap ## +5% | 97 | 16 | 9,386 | 241 | |||||||||||||

| 8 | Barcap ## +10% | 134 | 22 | 18,038 | 472 | |||||||||||||

| 9 | Barcap ## +15% | 122 | 18 | 14,986 | 329 | |||||||||||||

| 10 | Barcap ## +20% | 109 | 15 | 11,990 | 229 | |||||||||||||

| 11 | Barcap ## +30% | 83 | 10 | 6,829 | 107 | |||||||||||||

| 12 | Barcap ## +40% | 51 | 7 | 2,583 | 43 | |||||||||||||

| Total | 1,193 | 203 | 134,097 | 3,959 | ||||||||||||||

| SQRT | 366 | 63 | ||||||||||||||||

| Variability of Post Transaction Cashflows compared to Variability of Pre Transaction Cashflows | 17 | % | ||||||||||||||||