Report to Shareholders for the second quarter ended June 30, 2017

REPORT TO SHAREHOLDERS FOR THE SECOND QUARTER OF 2017

![]()

All financial figures are unaudited and presented in Canadian dollars (Cdn$) unless noted otherwise. Production volumes are presented on a working-interest basis, before royalties, except for Libya, which is on an entitlement basis. Certain financial measures in this document are not prescribed by Canadian generally accepted accounting principles (GAAP). For a description of these non-GAAP financial measures, see the Non-GAAP Financial Measures Advisory section of Suncor's Management's Discussion and Analysis, dated July 26, 2017 (the MD&A). See also the Advisories section of the MD&A. References to Oil Sands operations exclude Suncor's interest in Syncrude's operations.

"Our integrated model and a continued focus on cost reduction supported our performance in the second quarter," said Steve Williams, president and chief executive officer. "Strong performance from our offshore and downstream businesses helped to offset the facility incident at Syncrude and major maintenance at the majority of our Oil Sands assets, generating cash flow in excess of our sustaining capital and dividend commitments."

- •

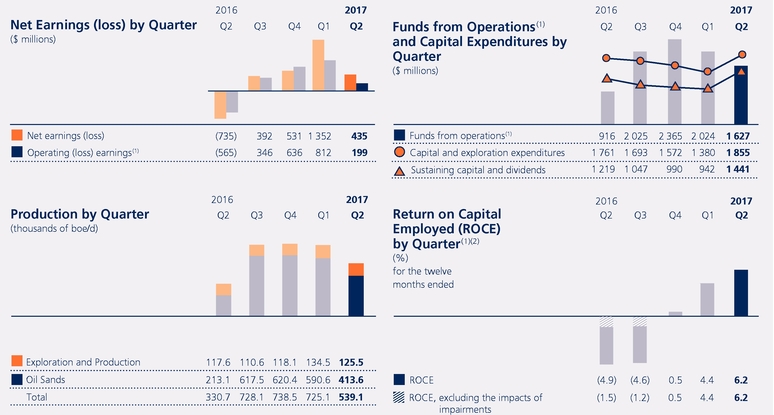

- Funds

from operations(1) of $1.627 billion ($0.98 per common share). Cash flow provided by operating activities, which includes changes in non-cash

working capital, was $1.671 billion ($1.00 per common share).

- •

- Operating

earnings(1) of $199 million ($0.12 per common share) and net earnings of $435 million ($0.26 per common share).

- •

- Total

Oil Sands production was 413,600 barrels per day (bbls/d) compared to 213,100 bbls/d in the prior year period, with the prior year quarter being

significantly impacted by the forest fires in the Fort McMurray area.

- •

- Oil

Sands operations cash operating costs per barrel(1) (bbl) were $27.80 for the second quarter of 2017, reflecting reduced production due to planned

maintenance and the positive impact of the company's cost reduction initiatives.

- •

- Exploration

and Production (E&P) production increased to 125,500 barrels of oil equivalent per day (boe/d) from 117,600 boe/d in the prior year quarter.

- •

- Refining

and Marketing (R&M) crude throughput improved to 435,500 bbls/d from 400,200 bbls/d in the prior year quarter.

- •

- The

Fort Hills project is 90% complete, with turnover of the ore processing and main primary extraction assets to operations in the period. The project cost estimate is on

track with first oil expected at the end of 2017. In addition, the East Tank Farm Development was commissioned subsequent to the end of the quarter and will support Fort Hills operations following

first oil at the end of 2017.

- •

- The

Hebron platform was successfully towed out to its final offshore location and safely positioned on the sea floor in the second quarter of 2017. Drilling activities are

on schedule and first oil remains on track for the end of 2017.

- •

- The West White Rose Project was sanctioned during the second quarter of 2017. Suncor is a non-operating partner with a blended working interest of approximately 26%. First oil is targeted for 2022, with the company's share of peak oil production estimated to be 20,000 boe/d.

|

- (1)

- Non-GAAP

financial measures. See page 4 for a reconciliation of net earnings (loss) to operating earnings (loss). ROCE excludes capitalized costs related to major projects in

progress. See the Non-GAAP Financial Measures Advisory section of the MD&A.

- (2)

- ROCE, excluding the impacts of impairments of $1.599 billion in the fourth quarter of 2015, would have been negative 1.5% and negative 1.2% for the second and third quarter of 2016, respectively.

Financial Results

Suncor recorded second quarter 2017 operating earnings(1) of $199 million ($0.12 per common share) compared to a $565 million operating loss ($0.36 per common share) in the prior year quarter. Highlights of the quarter included improved crude oil pricing, increased production from E&P and R&M, and continued focus on costs in all areas. Results in the current period were impacted by a facility incident at Syncrude occurring late in the first quarter of 2017 and planned maintenance at the majority of the company's Oil Sands assets. Results in the prior year period were impacted by production being shut in as a result of forest fires in the Fort McMurray area, partially offset by an R&M first-in, first-out gain.

Funds from operations(1) were $1.627 billion ($0.98 per common share) compared to $916 million ($0.58 per common share) in the second quarter of 2016 and were impacted by the same factors noted in operating earnings above.

Net earnings were $435 million ($0.26 per common share) in the second quarter of 2017, compared with a net loss of $735 million ($0.46 per common share) in the prior year quarter. Net earnings for the second quarter of 2017 included an unrealized after-tax foreign exchange gain of $278 million on the revaluation of U.S. dollar denominated debt, an after-tax charge of $10 million for early payment of debt, net of associated realized foreign currency hedge gains, and a non-cash after-tax loss of $32 million on forward interest rate swaps and foreign currency derivatives. The net loss in the prior year quarter included an unrealized after-tax foreign exchange loss of $27 million on the revaluation of U.S. dollar denominated debt, an after-tax charge of $73 million for early payment of debt and a non-cash after-tax loss of $70 million on forward interest rate swaps.

Operating Results

Operating, selling and general expense in the second quarter of 2017 included costs associated with the additional 5% Syncrude working interest acquired partway through the second quarter of 2016, and, in 2016, costs were avoided while operations were shut in as a result of forest fires in the Fort McMurray area. Excluding these two factors, total operating, selling and general expense was lower in the current quarter as controllable cost savings more than offset an increase in energy input costs that resulted from higher natural gas prices.

Suncor's total upstream production was 539,100 boe/d in the second quarter of 2017, compared with 330,700 boe/d in the prior year quarter.

Oil Sands operations production was 352,600 bbls/d in the second quarter of 2017, compared to 177,500 bbls/d in the prior year quarter, with the increase primarily due to production being shut in during the second quarter of 2016 as a result of the forest fires in the Fort McMurray area, as well as a turnaround of Upgrader 2 in the same period. Production in the second quarter of 2017 was impacted by the first five-year turnaround of the expanded Firebag central facilities, as well as planned upgrader maintenance, which was completed in the period. Although the ramp-up following the turnaround at Firebag was longer than anticipated, the extension of this turnaround cycle to five years has provided an overall net benefit to the company through the experience gained, which will be leveraged during future turnaround cycles. Production at Oil Sands operations returned to normal operating rates by the end of the quarter.

Oil Sands operations cash operating costs per barrel(1) were $27.80 in the second quarter of 2017, reflecting major maintenance in the period and the positive impact of the company's cost reduction initiatives, compared to $46.80 in the prior year quarter. The quarter-over-quarter improvement was primarily due to the increased production and lower controllable costs.

Suncor's share of Syncrude production was 61,000 bbls/d in the second quarter of 2017, compared to 35,600 bbls/d in the prior year quarter. The increase is attributed to the negative impact of the forest fires during the second quarter of 2016 combined with an additional working interest acquired partway through the second quarter of 2016. Production in the second quarter of 2017 was significantly impacted by a facility incident that occurred late in the first quarter of 2017, a planned upgrader turnaround and the advancement of coker maintenance originally planned for the fourth quarter of 2017, which was accelerated to coincide with the unplanned outage in an effort to maximize annual production. Syncrude cash operating costs per barrel(1) in the second quarter of 2017 were $97.80, a decrease from $113.55 in the prior year quarter, with both periods being impacted by the previously noted production outages. Syncrude has completed the required facility repairs and the planned upgrader turnaround and expects to return to normal operating rates by early August, following the completion of coker maintenance.

"Although the performance of some of our Oil Sands assets did not meet our expectations in the second quarter, we have full confidence in these assets," said Williams. "We have substantially completed extensive oil sands maintenance and anticipate strong performance going forward."

- (1)

- Non-GAAP financial measures. See the Non-GAAP Financial Measures Advisory section of the MD&A.

| 2 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Production volumes in E&P increased to 125,500 boe/d in the second quarter of 2017, compared to 117,600 boe/d in the prior year quarter, primarily due to lower planned maintenance at Terra Nova, production from new wells at Hibernia and production from Libya, partially offset by natural declines at Buzzard.

Overall production guidance for 2017 remains unchanged as increased production from E&P is expected to offset the impact of the facility incident at Syncrude.

Strong operational performance contributed to increased refinery crude throughput of 435,500 bbls/d, compared to 400,200 bbls/d in the prior year quarter, and also reflected lower planned maintenance and improved crude availability. Average refinery utilization in the second quarter of 2017 was 94%, compared with 87% in the prior year quarter. Results in R&M also benefited from strong retail sales volumes in the second quarter of 2017, contributing to a year-to-date record for the first half of 2017.

Strategy Update

The disciplined execution of Suncor's 2017 capital program is focused on bringing Suncor's major growth projects, Fort Hills and Hebron, to first oil by the end of the year, while continuing to invest in the safety, reliability and efficiency of the company's operating assets.

Fort Hills project construction was 90% complete at the end of the second quarter of 2017, with turnover of the ore processing and main primary extraction assets to operations occurring in the period. Activity in the quarter also included the utilities plant entering into the completion and turnover to operations phase. Construction at the secondary extraction facility, which is the final area to be completed to bring the project to first oil, continued in the quarter, and the project remains on target to start production at the end of 2017. Expenditures in the second quarter of 2017 were also focused on early-works sustaining activities that will support the execution of the Fort Hills mine and tailings plan following the commencement of production. Subsequent to the end of the quarter, the company commissioned the East Tank Farm Development and will begin readying the terminal for the receipt of Fort Hills bitumen at the end of 2017.

The company continued to progress the sale of a combined 49% interest in the East Tank Farm Development with the Fort McKay and Mikisew Cree First Nations for estimated proceeds of approximately $500 million and expects to close the arrangement in the second half of 2017.

The Hebron project achieved a major milestone in the second quarter of 2017, with the platform towed out to its final offshore location and successfully positioned on the sea floor. Drilling activities at Hebron are on schedule, and first oil remains on track for late 2017. Activity in the second quarter in E&P also included continued development drilling at Hibernia and White Rose and development work on the Norwegian Oda project.

"Fort Hills and Hebron are on track for first oil at the end of 2017, with both projects achieving major milestones," said Williams. "Front end commissioning of several key assets at Fort Hills has begun and the completed Hebron platform has been successfully positioned at its final location, where drilling activities are on schedule."

The West White Rose Project was sanctioned during the second quarter of 2017. Suncor is a non-operating partner with a blended working interest of approximately 26%. First oil is targeted for 2022, with the company's share of peak oil production estimated to be 20,000 boe/d.

Syncrude sustaining capital in the second quarter of 2017 was primarily focused on the planned upgrader turnaround, advanced coker maintenance previously scheduled for the fourth quarter of 2017 and repairs associated with the facility incident from the first quarter of 2017. The company expects to receive insurance proceeds to offset a significant portion of the expenditures associated with the facility incident.

During the second quarter of 2017, the company continued efforts with Syncrude to drive operating efficiencies, improve performance and develop regional synergies through integration. In the second quarter of 2017, Suncor's logistics network continued to handle volumes of intermediate sour Syncrude production to assist in inventory management and allow certain Syncrude assets to run at partial rates to avoid a full shutdown and restart as a result of the facility incident.

Under the new Normal Course Issuer Bid, which commenced in the second quarter of 2017, the company bought back $296 million of its own shares for cancellation.

During the second quarter of 2017, Suncor repaid US$1.250 billion of 6.10% notes originally scheduled to mature on June 1, 2018, to reduce financing costs and provide ongoing balance sheet flexibility.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 3 |

Operating Earnings (Loss) Reconciliation(1)

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Net earnings (loss) |

435 | (735 | ) | 1 787 | (478 | ) | ||||

| | ||||||||||

Unrealized foreign exchange (gain) loss on U.S. dollar denominated debt |

(278 | ) | 27 | (381 | ) | (858 | ) | |||

| | ||||||||||

Non-cash mark to market loss on interest rate swaps and foreign currency derivatives(2) |

32 | 70 | 32 | 160 | ||||||

| | ||||||||||

Loss on early payment of long-term debt(3) |

10 | 73 | 10 | 73 | ||||||

| | ||||||||||

Gain on significant disposals(4) |

— | — | (437 | ) | — | |||||

| | ||||||||||

COS acquisition and integration costs(5) |

— | — | — | 38 | ||||||

| | | | | | | | | | | |

Operating earnings (loss)(1) |

199 | (565 | ) | 1 011 | (1 065 | ) | ||||

| | | | | | | | | | | |

- (1)

- Operating

earnings (loss) is a non-GAAP financial measure. All reconciling items are presented on an after-tax basis. See the Non-GAAP Financial Measures Advisory section of

the MD&A.

- (2)

- Non-cash

mark to market loss on forward interest rate swaps and foreign currency derivatives resulting from changes in long-term interest rates and foreign exchange rates in the

Corporate segment.

- (3)

- Charges

associated with the early repayment of debt, net of associated realized foreign currency hedge gains, in the Corporate segment.

- (4)

- Gain

of $354 million related to the sale of the company's lubricants business in the R&M segment, combined with a gain of $83 million related to the sale of the

company's interest in the Cedar Point wind facility in the Corporate segment.

- (5)

- Transaction and related charges associated with the acquisition of Canadian Oil Sands Limited (COS) in the Corporate segment.

Corporate Guidance

Suncor has updated its production, capital and other information in its 2017 corporate guidance, previously issued on April 26, 2017. The full year outlook for Syncrude production has been updated from 135,000 – 150,000 bbls/d to 130,000 – 145,000 bbls/d, and the full year outlook range for Syncrude cash operating costs has been updated from $36.00 – $39.00/bbl to $42.00 – $45.00/bbl, to reflect the extended return to operations following the facility incident that occurred late in the first quarter of 2017. In addition, the full year outlook range for E&P production has been updated from 110,000 – 120,000 boe/d to 115,000 – 125,000 boe/d due to improved asset performance, resulting in no change to the full year outlook range for total Suncor production.

The full year outlook range for Oil Sands operations cash operating costs has been updated from $24.00 – $27.00/bbl to $23.00 – $26.00/bbl to reflect lower natural gas and maintenance costs.

The updated full year outlook range for capital expenditures of $5.4 – $5.6 billion has increased from $4.8 – $5.2 billion to reflect an opportunity to accelerate the pace of work at Fort Hills, as well as increased costs at Syncrude related to the facility incident late in the first quarter of 2017 and its 2017 turnaround. The project cost estimate is on track with first oil expected at the end of 2017.

The following full year outlook assumptions have also been adjusted: Current income taxes to $600 – $900 million from $500 – $800 million, Brent Sollum Voe to US$49.00/bbl from US$53.00/bbl, WTI at Cushing to US$47.00/bbl from US$52.00/bbl, WCS at Hardisty to US$35.00/bbl from US$38.00/bbl, New York Harbor 3-2-1 crack to US$14.50/bbl from US$13.50/bbl and AECO – C Spot to $2.50/GJ from $3.00/GJ. For further details and advisories regarding Suncor's 2017 revised corporate guidance, see www.suncor.com/guidance.

Measurement Conversions

Certain natural gas volumes in this report to shareholders have been converted to boe on the basis of one bbl to six mcf. See the Advisories section of the MD&A.

| 4 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

MANAGEMENT'S DISCUSSION AND ANALYSIS

July 26, 2017

Suncor is an integrated energy company headquartered in Calgary, Alberta, Canada. We are strategically focused on developing one of the world's largest petroleum resource basins – Canada's Athabasca oil sands. In addition, we explore for, acquire, develop, produce and market crude oil and natural gas in Canada and internationally; we transport and refine crude oil, and we market petroleum and petrochemical products primarily in Canada. Periodically we market third-party petroleum products. We also conduct energy trading activities focused principally on the marketing and trading of crude oil, natural gas and byproducts.

For a description of Suncor's segments, refer to Suncor's Management's Discussion and Analysis for the year ended December 31, 2016, dated March 1, 2017 (the 2016 annual MD&A).

This Management's Discussion and Analysis (MD&A) should be read in conjunction with Suncor's unaudited interim Consolidated Financial Statements for the three-month and six-month periods ended June 30, 2017, Suncor's audited Consolidated Financial Statements for the year ended December 31, 2016 and the 2016 annual MD&A.

Additional information about Suncor filed with Canadian securities regulatory authorities and the United States Securities and Exchange Commission (SEC), including quarterly and annual reports and Suncor's Annual Information Form dated March 1, 2017 (the 2016 AIF), which is also filed with the SEC under cover of Form 40-F, is available online at www.sedar.com, www.sec.gov and our website www.suncor.com. Information contained in or otherwise accessible through our website does not form part of this document, and is not incorporated into this document by reference.

References to "we", "our", "Suncor", or "the company" mean Suncor Energy Inc., and the company's subsidiaries and interests in associates and jointly controlled entities, unless the context otherwise requires.

Table of Contents

Basis of Presentation

Unless otherwise noted, all financial information has been prepared in accordance with Canadian generally accepted accounting principles (GAAP), specifically International Accounting Standard (IAS) 34 Interim Financial Reporting as issued by the International Accounting Standards Board, which is within the framework of International Financial Reporting Standards (IFRS).

All financial information is reported in Canadian dollars, unless otherwise noted. Production volumes are presented on a working-interest basis, before royalties, unless otherwise noted. Certain prior year amounts in the Consolidated Statements of Comprehensive Income (Loss) have been reclassified to conform to the current year's presentation.

References to Oil Sands operations exclude Suncor's interest in Syncrude operations.

Non-GAAP Financial Measures

Certain financial measures in this MD&A – namely operating earnings (loss), funds from (used in) operations, return on capital employed (ROCE), Oil Sands operations cash operating costs, Syncrude cash operating costs, refining margin, refining operating expense, discretionary free cash flow, and last-in, first-out (LIFO) – are not prescribed by GAAP. Operating earnings (loss), Oil Sands operations cash operating costs, Syncrude cash operating costs and LIFO are defined in the Non-GAAP Financial Measures Advisory section of this MD&A and reconciled to GAAP measures in the

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 5 |

Consolidated Financial Information and Segment Results and Analysis sections of this MD&A. Funds from (used in) operations, ROCE, discretionary free cash flow, refining margin and refining operating expense are defined and reconciled to GAAP measures in the Non-GAAP Financial Measures Advisory section of this MD&A.

Risk Factors and Forward-Looking Information

The company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the Forward-Looking Information section of this MD&A. This MD&A contains forward-looking information based on Suncor's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the company's future plans and expectations and may not be appropriate for other purposes. Refer to the Forward-Looking Information section of this MD&A for information on the material risk factors and assumptions underlying our forward-looking information.

Measurement Conversions

Certain crude oil and natural gas liquids volumes have been converted to mcfe on the basis of one bbl to six mcf. Also, certain natural gas volumes have been converted to boe or mboe on the same basis. Any figure presented in mcfe, boe or mboe may be misleading, particularly if used in isolation. A conversion ratio of one bbl of crude oil or natural gas liquids to six mcf of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, conversion on a 6:1 basis may be misleading as an indication of value.

Common Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the Common Abbreviations section of this MD&A.

| 6 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

- •

- Second quarter financial results.

- •

- Net

earnings for the second quarter of 2017 were $435 million, compared to a net loss of $735 million in the prior year quarter. Net earnings for the second

quarter of 2017 were impacted by the same factors that influenced operating earnings described below and included an unrealized after-tax foreign exchange gain of $278 million on the

revaluation of U.S. dollar denominated debt, an after-tax charge of $10 million for early payment of debt, net of associated realized foreign currency hedge gains, and a non-cash

after-tax loss of $32 million on forward interest rate swaps and foreign currency derivatives. The net loss in the prior year quarter included an unrealized after-tax foreign exchange loss of

$27 million on the revaluation of U.S. dollar denominated debt, an after-tax charge of $73 million for early payment of debt and a non-cash after-tax loss of $70 million on

forward interest rate swaps.

- •

- Operating

earnings(1) for the second quarter of 2017 were $199 million, compared to an operating loss of $565 million for the prior year quarter,

with the increase attributed to increased Oil Sands production, as a result of the forest fires in the Fort McMurray area impacting the second quarter of 2016, improved crude oil pricing, increased

production from Exploration and Production (E&P) and Refining and Marketing (R&M), and continued focus on costs in all areas, partially offset by a first-in, first-out (FIFO) loss, compared to a FIFO

gain in the prior year period. Operating earnings in the second quarter of 2017 were impacted by a facility incident at Syncrude occurring late in the first quarter of 2017 and planned maintenance at

the majority of the company's Oil Sands assets.

- •

- Funds

from operations(1) were $1.627 billion for the second quarter of 2017, compared to $916 million for the second quarter of 2016, and were

impacted by the same factors noted in operating earnings above. Cash flow provided by operating activities, which includes changes in non-cash working capital, was $1.671 billion for the second

quarter of 2017, compared to $862 million for the second quarter of 2016.

- •

- Increased refinery crude throughput of 435,500 bbls/d, compared to 400,200 bbls/d in the prior year

quarter. The increase was due to strong reliability, lower planned maintenance and improved crude availability.

- •

- E&P increased production to 125,500 boe/d from 117,600 boe/d in the second quarter of 2016. Lower

planned maintenance at Terra Nova, production from new wells at Hibernia and production from Libya were partially offset by natural declines at Buzzard.

- •

- Total Oil Sands production increased to 413,600 bbls/d from 213,100 bbls/d in the prior year

quarter. Current period production was impacted by a facility incident at Syncrude occurring late in the first quarter of 2017 and planned maintenance at the

majority of the company's Oil Sands assets, compared to production being shut in during the second quarter of 2016 as a result of forest fires in the Fort McMurray area. A 5% working interest in

Syncrude acquired partway through the second quarter of 2016 also contributed to the increase in overall Oil Sands production.

- •

- Oil Sands operations cash operating costs(1) averaged $27.80/bbl for the quarter, a decrease from $46.80/bbl in the prior year

quarter. The improvement was primarily a result of the production outage associated with the forest fires in the prior year quarter. Current period Oil Sands

operations cash operating costs were impacted by planned major maintenance events, partially offset by the continued execution of cost reduction efforts.

- •

- Fort Hills project 90% complete, with turnover of the ore processing and main primary extraction assets to operations in the

period. In addition, the East Tank Farm Development was commissioned subsequent to the end of the quarter and will support Fort Hills operations following first

oil at the end of 2017.

- •

- The Hebron platform was successfully towed out to its final offshore location and safely positioned on the

sea floor. Drilling activities are on schedule and first oil remains on track for the end of 2017.

- •

- The West White Rose Project was sanctioned during the second quarter of 2017. Suncor is a

non-operating partner

with a blended working interest of approximately 26% and a share of peak oil production estimated to be 20,000 boe/d. First oil is targeted for 2022.

- •

- Repaid US$1.250 billion of 6.10% notes originally scheduled to mature on June 1, 2018. The

reduction in outstanding debt is expected to reduce financing costs and provide ongoing balance sheet flexibility.

- •

- Suncor continued to return value to shareholders. Suncor returned $533 million to shareholders through dividends and bought back $296 million of outstanding shares in the second quarter of 2017.

- (1)

- Operating earnings (loss), funds from (used in) operations, and Oil Sands operations cash operating costs are non-GAAP financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 7 |

3. CONSOLIDATED FINANCIAL INFORMATION

Financial Highlights

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Net earnings (loss) |

||||||||||

| | ||||||||||

Oil Sands |

(277 | ) | (1 063 | ) | 25 | (1 587 | ) | |||

| | ||||||||||

Exploration and Production |

182 | 26 | 354 | (8 | ) | |||||

| | ||||||||||

Refining and Marketing |

346 | 689 | 1 175 | 930 | ||||||

| | ||||||||||

Corporate, Energy Trading and Eliminations |

184 | (387 | ) | 233 | 187 | |||||

| | | | | | | | | | | |

Total |

435 | (735 | ) | 1 787 | (478 | ) | ||||

| | | | | | | | | | | |

Operating earnings (loss)(1) |

||||||||||

| | ||||||||||

Oil Sands |

(277 | ) | (1 063 | ) | 25 | (1 587 | ) | |||

| | ||||||||||

Exploration and Production |

182 | 26 | 354 | (8 | ) | |||||

| | ||||||||||

Refining and Marketing |

346 | 689 | 821 | 930 | ||||||

| | ||||||||||

Corporate, Energy Trading and Eliminations |

(52 | ) | (217 | ) | (189 | ) | (400 | ) | ||

| | | | | | | | | | | |

Total |

199 | (565 | ) | 1 011 | (1 065 | ) | ||||

| | | | | | | | | | | |

Funds from (used in) operations(1) |

||||||||||

| | ||||||||||

Oil Sands |

573 | (202 | ) | 1 682 | 61 | |||||

| | ||||||||||

Exploration and Production |

438 | 302 | 919 | 563 | ||||||

| | ||||||||||

Refining and Marketing |

504 | 885 | 1 079 | 1 289 | ||||||

| | ||||||||||

Corporate, Energy Trading and Eliminations |

112 | (69 | ) | (29 | ) | (315 | ) | |||

| | | | | | | | | | | |

Total |

1 627 | 916 | 3 651 | 1 598 | ||||||

| | | | | | | | | | | |

Capital and Exploration Expenditures(2) |

||||||||||

| | ||||||||||

Sustaining |

894 | 752 | 1 293 | 1 223 | ||||||

| | ||||||||||

Growth |

765 | 869 | 1 572 | 1 813 | ||||||

| | | | | | | | | | | |

Total |

1 659 | 1 621 | 2 865 | 3 036 | ||||||

| | | | | | | | | | | |

|

Three months ended June 30 |

Twelve months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Discretionary Free Cash Flow(1) |

186 | (303 | ) | 3 621 | 99 | |||||

| | | | | | | | | | | |

- (1)

- Non-GAAP

financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

- (2)

- Excludes capitalized interest.

| 8 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Operating Highlights

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

|

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Production volumes by segment |

||||||||||

| | ||||||||||

Oil Sands (mbbls/d) |

413.6 | 213.1 | 501.6 | 389.4 | ||||||

| | ||||||||||

Exploration and Production (mboe/d) |

125.5 | 117.6 | 130.0 | 121.6 | ||||||

| | | | | | | | | | | |

Total (mboe/d) |

539.1 | 330.7 | 631.6 | 511.0 | ||||||

| | | | | | | | | | | |

Production mix |

||||||||||

| | ||||||||||

Crude oil and liquids / natural gas (%) |

99/1 | 99/1 | 99/1 | 99/1 | ||||||

| | | | | | | | | | | |

Refinery utilization (%) |

94 | 87 | 94 | 89 | ||||||

| | ||||||||||

Refinery crude oil processed (mbbls/d) |

435.5 | 400.2 | 432.7 | 410.5 | ||||||

| | | | | | | | | | | |

Net Earnings

Suncor's consolidated net earnings for the second quarter of 2017 were $435 million, compared with a net loss of $735 million for the prior year quarter. Net earnings were primarily affected by the same factors that influenced operating earnings described subsequently in this section of this MD&A. Other items affecting net earnings over these periods included:

- •

- The

after-tax unrealized foreign exchange impact on the revaluation of U.S. dollar denominated debt was a gain of $278 million for the second quarter of 2017;

the after-tax unrealized foreign exchange loss on the revaluation of U.S. dollar denominated debt was $27 million for the second quarter of 2016.

- •

- In

the second quarter of 2017, the company recognized a non-cash after-tax loss on forward interest rate swaps and foreign currency derivatives of $32 million in the

Corporate segment due to a decline in long-term interest rates and changes in foreign exchange rates; the non-cash after-tax loss on forward interest rate swaps due to a decline in long-term interest

rates was $70 million in the second quarter of 2016.

- •

- The company recorded an after-tax charge of $10 million in the Corporate segment for the early payment of debt in the second quarter of 2017, which included realized after-tax gains of $54 million on associated foreign currency hedges; the after-tax charge for early payment of debt was $73 million in the second quarter of 2016.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 9 |

Operating Earnings (Loss) Reconciliation(1)

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Net earnings (loss) |

435 | (735 | ) | 1 787 | (478 | ) | ||||

| | ||||||||||

Unrealized foreign exchange (gain) loss on U.S. dollar denominated debt |

(278 | ) | 27 | (381 | ) | (858 | ) | |||

| | ||||||||||

Non-cash mark to market loss on interest rate swaps and foreign currency derivatives(2) |

32 | 70 | 32 | 160 | ||||||

| | ||||||||||

Loss on early payment of long-term debt(3) |

10 | 73 | 10 | 73 | ||||||

| | ||||||||||

Gain on significant disposal(4) |

— | — | (437 | ) | — | |||||

| | ||||||||||

COS acquisition and integration costs(5) |

— | — | — | 38 | ||||||

| | | | | | | | | | | |

Operating earnings (loss)(1) |

199 | (565 | ) | 1 011 | (1 065 | ) | ||||

| | | | | | | | | | | |

- (1)

- Operating

earnings (loss) is a non-GAAP financial measure. All reconciling items are presented on an after-tax basis. See the Non-GAAP Financial Measures Advisory section of

this MD&A.

- (2)

- Non-cash

mark to market loss on interest rate swaps and foreign currency derivatives resulting from changes in long-term interest rates and foreign exchange rates in the Corporate

segment.

- (3)

- Charges

associated with the early repayment of debt, net of associated realized foreign currency hedge gains, in the Corporate segment.

- (4)

- Gain

of $354 million related to the sale of the company's lubricants business in the R&M segment, combined with a gain of $83 million on the sale of the company's

interest in the Cedar Point wind facility in the Corporate segment.

- (5)

- Transaction and related charges associated with the acquisition of Canadian Oil Sands Limited (COS) in the Corporate segment.

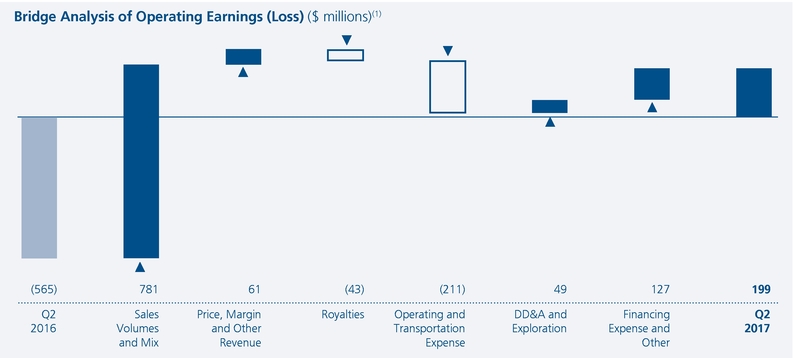

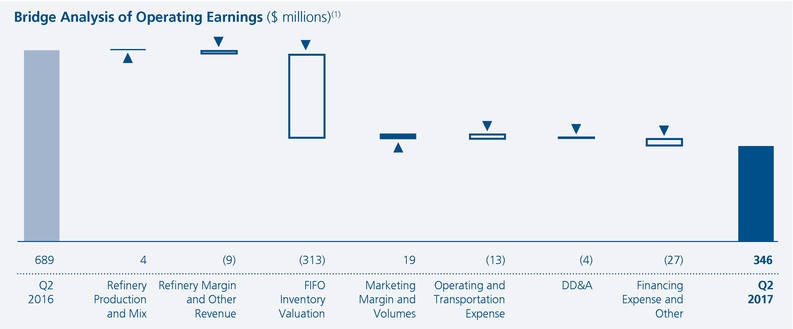

|

- (1)

- For an explanation of this bridge analysis, see the Non-GAAP Financial Measures Advisory section of this MD&A.

Suncor's consolidated operating earnings for the second quarter of 2017 were $199 million, compared to an operating loss of $565 million in the prior year quarter, with the improvement attributed to increased Oil Sands production, higher crude oil pricing and increased production from E&P and R&M, partially offset by a FIFO loss as compared to a FIFO gain in the prior period, and the production impacts associated with the facility incident at Syncrude and planned major maintenance at the majority of the company's oil sands assets. Operating earnings in the prior year quarter were significantly impacted by the production shut-in associated with the forest fires in the Fort McMurray area.

| 10 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Suncor's consolidated operating earnings were $1.011 billion for the first six months of 2017, compared to an operating loss of $1.065 billion in the prior year period. The increase was attributable to improved crude price realizations, higher upstream production and R&M throughput, partially offset by a smaller FIFO gain in the current year period.

After-Tax Share-Based Compensation Expense by Segment

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Oil Sands |

6 | 11 | 21 | 33 | ||||||

| | ||||||||||

Exploration and Production |

1 | 1 | 3 | 3 | ||||||

| | ||||||||||

Refining and Marketing |

3 | 6 | 12 | 22 | ||||||

| | ||||||||||

Corporate, Energy Trading and Eliminations |

9 | 11 | 55 | 73 | ||||||

| | | | | | | | | | | |

Total share-based compensation expense |

19 | 29 | 91 | 131 | ||||||

| | | | | | | | | | | |

The after-tax share-based compensation expense decreased to $19 million during the second quarter of 2017, compared to $29 million during the prior year quarter, as a result of a greater share price decrease during the current period when compared to the share price decrease in the prior year quarter.

Business Environment

Commodity prices, refining crack spreads and foreign exchange rates are important factors that affect the results of Suncor's operations.

|

Average for the three months ended June 30 |

Average for the six months ended June 30 |

||||||||||

|

2017 | 2016 | 2017 | 2016 | ||||||||

| | | | | | | | | | | | | |

WTI crude oil at Cushing |

US$/bbl | 48.30 | 45.60 | 50.05 | 39.55 | |||||||

| | ||||||||||||

Dated Brent crude |

US$/bbl | 49.85 | 45.60 | 51.80 | 39.75 | |||||||

| | ||||||||||||

Dated Brent/Maya crude oil FOB price differential |

US$/bbl | 5.80 | 7.65 | 7.40 | 8.30 | |||||||

| | ||||||||||||

MSW at Edmonton |

Cdn$/bbl | 62.30 | 55.80 | 63.25 | 45.15 | |||||||

| | ||||||||||||

WCS at Hardisty |

US$/bbl | 37.20 | 32.30 | 37.25 | 25.80 | |||||||

| | ||||||||||||

Light/heavy differential for WTI at Cushing less WCS at Hardisty |

US$/bbl | 11.10 | 13.30 | 12.80 | 13.75 | |||||||

| | ||||||||||||

Condensate at Edmonton |

US$/bbl | 48.45 | 44.10 | 50.30 | 39.30 | |||||||

| | ||||||||||||

Natural gas (Alberta spot) at AECO |

Cdn$/mcf | 2.80 | 1.40 | 2.75 | 1.60 | |||||||

| | ||||||||||||

Alberta Power Pool Price |

Cdn$/MWh | 19.30 | 14.90 | 20.85 | 16.50 | |||||||

| | ||||||||||||

New York Harbor 3-2-1 crack(1) |

US$/bbl | 16.35 | 16.10 | 14.45 | 13.95 | |||||||

| | ||||||||||||

Chicago 3-2-1 crack(1) |

US$/bbl | 14.40 | 16.65 | 12.80 | 12.90 | |||||||

| | ||||||||||||

Portland 3-2-1 crack(1) |

US$/bbl | 21.25 | 19.30 | 19.85 | 16.15 | |||||||

| | ||||||||||||

Gulf Coast 3-2-1 crack(1) |

US$/bbl | 16.80 | 14.85 | 15.40 | 12.95 | |||||||

| | ||||||||||||

Exchange rate |

US$/Cdn$ | 0.74 | 0.78 | 0.75 | 0.75 | |||||||

| | ||||||||||||

Exchange rate (end of period) |

US$/Cdn$ | 0.77 | 0.77 | 0.77 | 0.77 | |||||||

| | | | | | | | | | | | | |

- (1)

- 3-2-1 crack spreads are indicators of the refining margin generated by converting three barrels of WTI into two barrels of gasoline and one barrel of diesel. The crack spreads presented here generally approximate the regions into which the company sells refined products through retail and wholesale channels.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 11 |

Suncor's sweet SCO price realizations are influenced primarily by the price of WTI at Cushing and by the supply and demand for sweet SCO from Western Canada. Price realizations in the second quarter of 2017 for sweet SCO were positively impacted by a higher WTI price of US$48.30/bbl, compared to US$45.60/bbl in the prior year quarter, as well as a favourable differential for SCO relative to WTI. Suncor produces sour SCO, the price of which is influenced by various crude benchmarks, including, but not limited to, MSW at Edmonton and WCS at Hardisty, and which can also be affected by prices negotiated for spot sales. Prices for MSW at Edmonton increased to $62.30/bbl compared to $55.80/bbl in the prior year quarter and prices for WCS at Hardisty increased to US$37.20/bbl from US$32.30 in the second quarter of 2016.

Bitumen production that Suncor does not upgrade is blended with diluent or SCO to facilitate delivery on pipeline systems. Net bitumen price realizations are therefore influenced by both prices for Canadian heavy crude oil (WCS at Hardisty is a common reference), prices for diluent (Condensate at Edmonton) and SCO. Bitumen price realizations can also be affected by bitumen quality and spot sales.

Suncor's price realizations for production from East Coast Canada and International assets are influenced primarily by the price for Brent crude. Brent crude pricing increased to an average of US$49.85/bbl in the second quarter of 2017, compared to US$45.60/bbl in the prior year quarter.

Natural gas used in Suncor's Oil Sands and Refining operations is primarily referenced to Alberta spot prices at AECO. The average AECO benchmark increased to $2.80/mcf in the second quarter of 2017, from $1.40/mcf in the prior year quarter.

Suncor's refining margins are influenced primarily by 3-2-1 crack spreads, which are industry indicators approximating the gross margin on a barrel of crude oil that is refined to produce gasoline and distillates, and by light/heavy and light/sour crude differentials. More complex refineries can earn greater refining margins by processing less expensive, heavier crudes. Crack spreads do not necessarily reflect the margins of a specific refinery. Crack spreads are based on current crude feedstock prices whereas actual refining margins are based on FIFO inventory accounting, where a delay exists between the time that feedstock is purchased and when it is processed and sold to a third party. A FIFO loss normally reflects a declining price environment for crude oil and finished products, whereas FIFO gains reflect an increasing price environment for crude oil and finished products. Specific refinery margins are further impacted by actual crude purchase costs, refinery configuration, production mix and realized prices for refined products sales in markets unique to each refinery.

Excess electricity produced in Suncor's Oil Sands operations business is sold to the Alberta Electric System Operator (AESO), with the proceeds netted against the Oil Sands operations cash operating cost per barrel metric. The Alberta power pool price increased to an average of $19.30/MWh in the second quarter of 2017, compared with $14.90/MWh in the prior year quarter.

The majority of Suncor's revenues from the sale of oil and natural gas commodities are based on prices that are determined by or referenced to U.S. dollar benchmark prices. The majority of Suncor's expenditures are realized in Canadian dollars. In the second quarter of 2017, the Canadian dollar weakened in relation to the U.S. dollar as the average exchange rate decreased to US$0.74 per one Canadian dollar from US$0.78 per one Canadian dollar in the prior year quarter. This rate decrease had a positive impact on price realizations for the company during the second quarter of 2017 when compared to the prior year quarter.

Suncor also has assets and liabilities, notably approximately 70% of the company's debt, which are denominated in U.S. dollars and translated to Suncor's reporting currency (Canadian dollars) at each balance sheet date. An increase in the value of the Canadian dollar relative to the U.S. dollar from the previous balance sheet date decreases the amount of Canadian dollars required to settle U.S. dollar denominated obligations.

| 12 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

4. SEGMENT RESULTS AND ANALYSIS

OIL SANDS

Financial Highlights

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Gross revenues |

2 498 | 1 160 | 5 788 | 3 199 | ||||||

| | ||||||||||

Less: Royalties |

(37 | ) | (9 | ) | (98 | ) | (28 | ) | ||

| | | | | | | | | | | |

Operating revenues, net of royalties |

2 461 | 1 151 | 5 690 | 3 171 | ||||||

| | | | | | | | | | | |

Net (loss) earnings |

(277 | ) | (1 063 | ) | 25 | (1 587 | ) | |||

| | | | | | | | | | | |

Operating (loss) earnings(1) |

(277 | ) | (1 063 | ) | 25 | (1 587 | ) | |||

| | ||||||||||

Oil Sands operations |

37 | (797 | ) | 330 | (1 314 | ) | ||||

| | ||||||||||

Oil Sands ventures |

(314 | ) | (266 | ) | (305 | ) | (273 | ) | ||

| | | | | | | | | | | |

Funds from (used in) operations(1) |

573 | (202 | ) | 1 682 | 61 | |||||

| | | | | | | | | | | |

- (1)

- Non-GAAP

financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

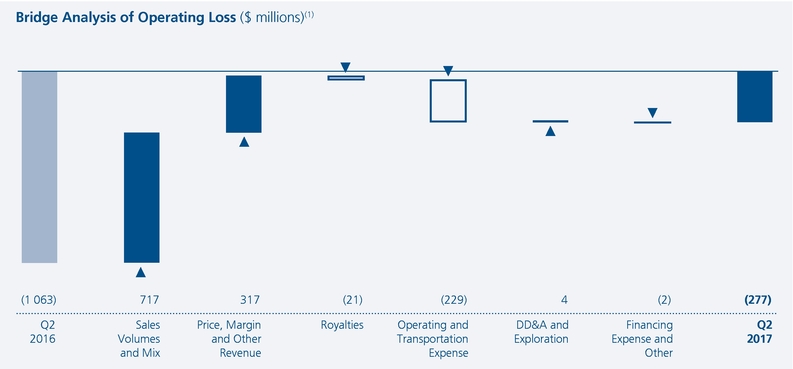

|

- (1)

- For an explanation of this bridge analysis, see the Non-GAAP Financial Measures Advisory section of this MD&A.

Operating earnings for Oil Sands operations were $37 million in the second quarter of 2017, compared to an operating loss of $797 million in the prior year quarter. The improvement was due to increased crude oil production combined with higher crude price realizations, consistent with increased benchmark pricing, partially offset by the avoidance of operating costs during the second quarter of 2016 while operations were shut in and higher natural gas costs in the second quarter of 2017.

The operating loss for Oil Sands ventures was $314 million in the second quarter of 2017, compared to an operating loss of $266 million in the prior year quarter, with higher crude oil production and price realizations being more than offset by the impact of increased repair costs associated with the Syncrude Mildred Lake facility incident occurring near the end of the first quarter of 2017, the avoidance of operating costs while operations were shut in during the second quarter of 2016 and higher natural gas costs in the second quarter of 2017.

Operating earnings at both Oil Sands ventures and Oil Sands operations in the second quarter of 2016 were significantly impacted by the production shut-in associated with the forest fires in the Fort McMurray area.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 13 |

Production Volumes(1)

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

(mbbls/d) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Upgraded product (SCO and diesel) |

288.6 | 86.4 | 310.6 | 204.3 | ||||||

| | ||||||||||

Non-upgraded bitumen |

64.0 | 91.1 | 89.7 | 110.9 | ||||||

| | | | | | | | | | | |

Oil Sands operations |

352.6 | 177.5 | 400.3 | 315.2 | ||||||

| | ||||||||||

Oil Sands ventures – Syncrude |

61.0 | 35.6 | 101.3 | 74.2 | ||||||

| | | | | | | | | | | |

Total |

413.6 | 213.1 | 501.6 | 389.4 | ||||||

| | | | | | | | | | | |

- (1)

- Bitumen production from Oil Sands Base operations is upgraded, while bitumen production from In Situ operations is either upgraded or sold directly to customers, including Suncor's own refineries. Yields of SCO and diesel from Suncor's upgrading process are approximately 79% of bitumen feedstock input. All of the bitumen produced at Syncrude is upgraded to sweet SCO.

Oil Sands operations production was 352,600 bbls/d in the second quarter of 2017, compared to 177,500 bbls/d in the prior year quarter, with the increase primarily driven by the loss of production associated with the forest fires in the Fort McMurray area in the prior year quarter. Production in the second quarter of 2017 was impacted by planned upgrader maintenance completed in the period, as well as a planned turnaround at Firebag. Upgrader utilization at Oil Sands operations in the second quarter of 2017 was 83%, compared to 25% in the prior year quarter. Production at Oil Sands operations returned to normal operating rates by the end of the quarter.

Sales Volumes

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

(mbbls/d) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Oil Sands operations sales volumes |

||||||||||

| | ||||||||||

Sweet SCO |

104.4 | 29.0 | 114.6 | 80.6 | ||||||

| | ||||||||||

Diesel |

29.6 | 3.4 | 29.9 | 14.1 | ||||||

| | ||||||||||

Sour SCO |

160.1 | 76.3 | 169.8 | 124.5 | ||||||

| | | | | | | | | | | |

Upgraded product |

294.1 | 108.7 | 314.3 | 219.2 | ||||||

| | ||||||||||

Non-upgraded bitumen |

86.0 | 108.1 | 95.4 | 121.3 | ||||||

| | | | | | | | | | | |

Oil Sands operations |

380.1 | 216.8 | 409.7 | 340.5 | ||||||

| | ||||||||||

Oil Sands ventures – Syncrude |

61.0 | 35.6 | 101.3 | 74.2 | ||||||

| | | | | | | | | | | |

Total |

441.1 | 252.4 | 511.0 | 414.7 | ||||||

| | | | | | | | | | | |

Sales volumes for Oil Sands operations increased to 380,100 bbls/d in the second quarter of 2017 from 216,800 bbls/d in the prior year quarter due to the same factors noted above.

Suncor's share of Syncrude production was 61,000 bbls/d in the second quarter of 2017, compared to 35,600 bbls/d in the prior year quarter. The increase is attributed to production being shut in during the second quarter of 2016 due to the forest fires in the Fort McMurray area and an additional 5% working interest acquired partway through the second quarter of 2016, partially offset by the facility incident late in the first quarter of 2017 and completion of the planned upgrader turnaround in the second quarter of 2017. Syncrude upgrader reliability was 33% in the second quarter of 2017, compared to 25% in the prior year quarter.

| 14 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Bitumen Production

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

|

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Oil Sands Base |

||||||||||

| | ||||||||||

Bitumen production (mbbls/d) |

293.1 | 66.8 | 298.2 | 185.4 | ||||||

| | ||||||||||

Bitumen ore mined (thousands of tonnes per day) |

448.3 | 106.1 | 458.7 | 277.7 | ||||||

| | ||||||||||

Bitumen ore grade quality (bbls/tonne) |

0.65 | 0.63 | 0.65 | 0.67 | ||||||

| | | | | | | | | | | |

In Situ |

||||||||||

| | ||||||||||

Bitumen production – Firebag (mbbls/d) |

110.9 | 121.8 | 156.6 | 160.4 | ||||||

| | ||||||||||

Bitumen production – MacKay River (mbbls/d) |

30.0 | 13.1 | 32.8 | 25.0 | ||||||

| | | | | | | | | | | |

Total In Situ bitumen production (mbbls/d) |

140.9 | 134.9 | 189.4 | 185.4 | ||||||

| | | | | | | | | | | |

Total Oil Sands Operations Bitumen production (mbbls/d) |

434.0 | 201.7 | 487.6 | 370.8 | ||||||

| | | | | | | | | | | |

Steam-to-oil ratio – Firebag |

2.6 | 2.6 | 2.6 | 2.6 | ||||||

| | ||||||||||

Steam-to-oil ratio – MacKay River |

3.2 | 3.2 | 3.1 | 3.0 | ||||||

| | | | | | | | | | | |

Bitumen production at Oil Sands operations in the second quarter of 2017 increased to 434,000 bbls/d, compared to 201,700 bbls/d in the prior year quarter, due to production being shut in during the second quarter of 2016 in response to the forest fires in the Fort McMurray area. Production in the second quarter of 2017 was impacted by planned upgrader maintenance, which was completed in the period, as well as the first five-year turnaround of the expanded Firebag central facilities and unplanned maintenance at MacKay River.

Price Realizations

Net of transportation costs, but before royalties |

Three months ended June 30 |

Six months ended June 30 |

||||||||

($/bbl) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Oil Sands operations |

||||||||||

| | ||||||||||

SCO and diesel |

60.48 | 47.51 | 61.50 | 41.44 | ||||||

| | ||||||||||

Bitumen |

30.55 | 18.21 | 29.41 | 11.67 | ||||||

| | ||||||||||

Crude sales basket (all products) |

53.71 | 32.90 | 53.99 | 30.83 | ||||||

| | ||||||||||

Crude sales basket, relative to WTI |

(11.56 | ) | (25.56 | ) | (12.74 | ) | (21.90 | ) | ||

| | | | | | | | | | | |

Oil Sands ventures |

||||||||||

| | ||||||||||

Syncrude – sweet SCO |

60.44 | 57.64 | 64.31 | 51.02 | ||||||

| | ||||||||||

Syncrude, relative to WTI |

(4.83 | ) | (0.82 | ) | (2.42 | ) | (1.71 | ) | ||

| | | | | | | | | | | |

Average price realizations from Oil Sands operations increased to $53.71/bbl in the second quarter of 2017 from $32.90/bbl in the prior year quarter, due to higher WTI benchmark prices, improved SCO and heavy crude differentials, and a higher proportion of SCO production in the second quarter of 2017.

Average price realizations at Syncrude increased to $60.44/bbl in the second quarter of 2017 from $57.64/bbl in the prior year quarter due to the increase in the WTI benchmark price and improved SCO differentials, partially offset by the sale of intermediate sour product to maintain minimum production rates and avoid a full shutdown and restart as a result of the facility incident.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 15 |

Royalties

Royalties for the Oil Sands segment were higher in the second quarter of 2017 compared to the prior year quarter, primarily due to higher production and improved bitumen pricing.

Expenses and Other Factors

Operating and transportation expenses for the second quarter of 2017 increased from the prior year quarter as a result of costs avoided during the second quarter of 2016 at both Oil Sands operations and Syncrude while operations were shut in, increased repair costs at Syncrude due to the facility incident late in the first quarter of 2017, increased natural gas pricing and consumption, and the additional 5% Syncrude working interest acquired in the second quarter of 2016, partially offset by the impact of Suncor's cost reduction initiatives at Oil Sands operations. See the reconciliation in the Cash Operating Costs section below for further details regarding cash operating costs and non-production costs for Oil Sands operations.

DD&A and exploration expenses for the second quarter of 2017 were lower in comparison to the same period of 2016, due to lower depreciation associated with a reduced asset cost base at Oil Sands operations and a decrease in exploration expense more than offsetting the increased working interest in Syncrude.

Cash Operating Costs

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Oil Sands operations cash operating cost(1) reconciliation |

||||||||||

| | ||||||||||

Operating, selling and general expense (OS&G) |

1 575 | 1 288 | 3 128 | 2 723 | ||||||

| | ||||||||||

Syncrude OS&G |

(551 | ) | (364 | ) | (1 134 | ) | (698 | ) | ||

| | ||||||||||

Non-production costs(2) |

(11 | ) | (32 | ) | (32 | ) | (65 | ) | ||

| | ||||||||||

Excess power capacity and other(3) |

(73 | ) | (50 | ) | (122 | ) | (81 | ) | ||

| | ||||||||||

Inventory changes |

(47 | ) | (87 | ) | (36 | ) | (125 | ) | ||

| | | | | | | | | | | |

Oil Sands operations cash operating costs(1) |

893 | 755 | 1 804 | 1 754 | ||||||

| | ||||||||||

Oil Sands operations cash operating costs ($/bbl)(1) |

27.80 | 46.80 | 24.90 | 30.60 | ||||||

| | | | | | | | | | | |

Syncrude cash operating costs(1) reconciliation |

||||||||||

| | ||||||||||

Syncrude OS&G |

551 | 364 | 1 134 | 698 | ||||||

| | ||||||||||

Non-production costs(2) |

(8 | ) | 3 | (14 | ) | (9 | ) | |||

| | | | | | | | | | | |

Syncrude cash operating costs(1) |

543 | 367 | 1 120 | 689 | ||||||

| | ||||||||||

Syncrude cash operating costs ($/bbl)(1) |

97.80 | 113.55 | 61.05 | 51.20 | ||||||

| | | | | | | | | | | |

- (1)

- Non-GAAP

financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

- (2)

- Significant

non-production costs include, but are not limited to, share-based compensation expense and research expenses.

- (3)

- Excess power capacity and other includes, but is not limited to, the operational revenue impacts of excess power from a cogeneration unit and the natural gas expense recorded as part of a non-monetary arrangement involving a third-party processor.

| 16 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

In the second quarter of 2017, Oil Sands operations cash operating costs per barrel decreased to $27.80, compared to $46.80 in the prior year quarter, primarily as a result of higher production, which was due to the outage in response to the forest fires during the prior year quarter. Total Oil Sands operations cash operating costs increased to $893 million from $755 million in the prior year quarter, with lower costs in the second quarter of 2016 attributed to the avoidance of certain operating expenses while production was shut in. Costs in the second quarter of 2017 reflect the continued impact of the company's cost reduction initiatives.

In the second quarter of 2017, non-production costs, which are excluded from Oil Sands operations cash operating costs, were lower than the prior year quarter, primarily due to a decrease in share-based compensation expense when compared to the prior year quarter as well as the prior period including a charge associated with an early termination of a third-party operating arrangement.

Excess power capacity and other for the second quarter of 2017 represents a larger reduction to Oil Sands operations cash operating costs than the second quarter of 2016, primarily attributed to higher non-monetary expenses related to a gas swap arrangement with a third-party processor due to increased production.

Inventory changes in the second quarter of 2017 represent a smaller draw of inventory than in the prior year quarter, due to the increased draw of inventory associated with the production shut-in during the second quarter of 2016.

In the second quarter of 2017, Syncrude cash operating costs per barrel were $97.80 compared to $113.55 in the prior year period with the production shut-in associated with the forest fires in 2016 having a greater impact than the combination of the facility incident and major maintenance activities in the current period. Suncor's share of Syncrude cash operating costs increased to $543 million from $367 million in the previous year quarter due to repairs associated with the facility incident late in the first quarter of 2017, costs avoided during the second quarter of 2016 while operations were shut in, additional Syncrude working interest acquired in the second quarter of 2016, and increased natural gas pricing and consumption.

Results for the First Six Months of 2017

Oil Sands segment operating earnings for the first six months of 2017 were $25 million, compared to an operating loss of $1.587 billion for the same period in 2016. Operating earnings improved as a result of higher production due to the impact of the forest fires in the Fort McMurray area during the second quarter of 2016, higher crude price realizations and lower Oil Sands operations operating expenses attributed to the company's continued cost reduction initiatives, partially offset by the impact of major maintenance events at the majority of the company's Oil Sands assets, the facility incident at Syncrude, increased operating and maintenance expenses at Syncrude, and higher natural gas costs due to an increase in natural gas benchmark pricing and consumption.

Funds from operations for the first six months of 2017 were $1.682 billion for the segment, compared to $61 million for the same period in 2016, with the increase primarily due to the same factors that influenced operating earnings noted above.

Oil Sands operations cash operating costs per barrel averaged $24.90 for the first six months of 2017, a decrease from an average of $30.60 for the first six months of 2016. The decrease was largely driven by higher production due to the impact of the forest fires in the Fort McMurray area in the prior year, as well as the company's cost reduction initiatives, partially offset by the impact of planned maintenance activities in the second quarter of 2017 and higher natural gas pricing and consumption.

Syncrude cash operating costs per barrel averaged $61.05 for the first six months of 2017, an increase from an average of $51.20 for the first six months of 2016, due to increased operating and maintenance costs and the production impacts of the facility incident and the planned upgrader turnaround combined with accelerated coker maintenance originally scheduled for the fourth quarter of 2017, partially offset by higher overall production due to the impact of the forest fires in the Fort McMurray area during the second quarter of 2016.

Planned Maintenance

The company plans to commence maintenance at Upgrader 1 in the third quarter of 2017. The anticipated impact of this maintenance has been reflected in the company's 2017 guidance.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 17 |

EXPLORATION AND PRODUCTION

Financial Highlights

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Gross revenues |

852 | 624 | 1 772 | 1 155 | ||||||

| | ||||||||||

Less: Royalties |

(121 | ) | (45 | ) | (244 | ) | (74 | ) | ||

| | | | | | | | | | | |

Operating revenues, net of royalties |

731 | 579 | 1 528 | 1 081 | ||||||

| | | | | | | | | | | |

Net earnings (loss) |

182 | 26 | 354 | (8 | ) | |||||

| | | | | | | | | | | |

Operating earnings (loss)(1) |

182 | 26 | 354 | (8 | ) | |||||

| | ||||||||||

E&P Canada |

43 | 40 | 60 | 21 | ||||||

| | ||||||||||

E&P International |

139 | (14 | ) | 294 | (29 | ) | ||||

| | | | | | | | | | | |

Funds from operations(1) |

438 | 302 | 919 | 563 | ||||||

| | | | | | | | | | | |

- (1)

- Non-GAAP financial measures. See also the Non-GAAP Financial Measures Advisory section of this MD&A.

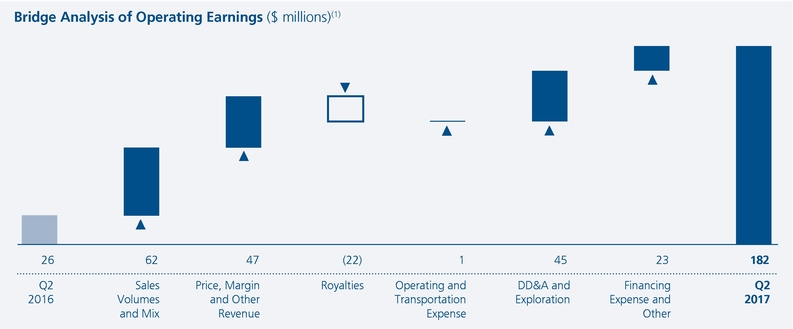

|

- (1)

- For an explanation of the construction of this bridge analysis, see the Non-GAAP Financial Measures Advisory section of this MD&A.

Operating earnings of $43 million for E&P Canada increased from $40 million in the prior year quarter, as a result of higher production and improved crude price realizations, partially offset by higher DD&A and royalties due to the increase in production, and the prior year quarter including insurance proceeds related to Terra Nova property damage.

Operating earnings of $139 million for E&P International improved from an operating loss of $14 million in the prior year quarter, which included the impairment of the Beta development in Norway. Current quarter earnings were also improved by lower DD&A, increased crude price realizations and production from Libya, partially offset by lower production at Buzzard.

| 18 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Production Volumes

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

(mbbls/d) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

E&P Canada |

||||||||||

| | ||||||||||

Terra Nova (mbbls/d) |

11.0 | 5.4 | 12.9 | 9.0 | ||||||

| | ||||||||||

Hibernia (mbbls/d) |

30.0 | 24.6 | 30.1 | 24.4 | ||||||

| | ||||||||||

White Rose (mbbls/d) |

12.9 | 11.7 | 13.0 | 12.7 | ||||||

| | ||||||||||

North America Onshore (mboe/d) |

1.8 | 2.7 | 2.3 | 2.9 | ||||||

| | | | | | | | | | | |

|

55.7 | 44.4 | 58.3 | 49.0 | ||||||

| | ||||||||||

E&P International |

||||||||||

| | ||||||||||

Buzzard (mboe/d) |

45.3 | 52.7 | 47.1 | 53.0 | ||||||

| | ||||||||||

Golden Eagle (mboe/d) |

20.1 | 20.5 | 20.2 | 19.6 | ||||||

| | | | | | | | | | | |

United Kingdom (mboe/d) |

65.4 | 73.2 | 67.3 | 72.6 | ||||||

| | ||||||||||

Libya (mbbls/d) |

4.4 | — | 4.4 | — | ||||||

| | | | | | | | | | | |

|

69.8 | 73.2 | 71.7 | 72.6 | ||||||

| | | | | | | | | | | |

Total Production (mboe/d) |

125.5 | 117.6 | 130.0 | 121.6 | ||||||

| | ||||||||||

Production mix (liquids/gas) (%) |

97/3 | 98/2 | 97/3 | 98/2 | ||||||

| | | | | | | | | | | |

E&P Canada production averaged 55,700 boe/d in the second quarter of 2017, compared to 44,400 boe/d in the prior year quarter. The increase was primarily due to planned maintenance at Terra Nova in the prior year quarter and higher production at Hibernia, with new wells being brought online subsequent to the second quarter of 2016.

E&P International production averaged 69,800 boe/d in the second quarter of 2017, compared to 73,200 boe/d in the prior year quarter, with natural declines at Buzzard being partially offset by production from Libya.

Price Realizations

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

Net of transportation costs, but before royalties |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Exploration and Production |

||||||||||

| | ||||||||||

E&P Canada – Crude oil and natural gas liquids ($/bbl) |

64.65 | 60.30 | 66.34 | 51.35 | ||||||

| | ||||||||||

E&P Canada – Natural gas ($/mcfe) |

2.62 | 1.14 | 2.55 | 1.26 | ||||||

| | ||||||||||

E&P International ($/boe) |

61.81 | 53.43 | 63.86 | 47.30 | ||||||

| | | | | | | | | | | |

Price realizations for crude oil from E&P Canada and E&P International were higher in the second quarter of 2017, compared to the prior year quarter, primarily due to an increase in benchmark crude pricing and favourable foreign exchange rates.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 19 |

Royalties

Royalties were higher in the second quarter of 2017, compared with the prior year quarter, due to increased production from E&P Canada combined with improved crude prices.

Expenses and Other Factors

Operating and transportation expenses were comparable to the prior year quarter. Continued focus on cost reduction and favourable foreign exchange that reduced expenses in the U.K. were partially offset by increased activity in Libya.

DD&A expense decreased in the second quarter of 2017, compared to the prior year quarter, due to lower depletion rates at Buzzard and the absence of impairment charges in the current period, partially offset by higher East Coast Canada production. The second quarter of 2016 included an impairment charge for the Beta development in Norway.

Results for the First Six Months of 2017

Operating earnings for E&P in the first six months of 2017 were $354 million, compared to an operating loss of $8 million for the first six months of 2016. The increase was primarily due to higher crude price realizations, increased production, lower DD&A and decreased operating costs, partially offset by higher royalties, attributed to crude pricing and production increases, and additional costs associated with drilling at the Shelburne Basin off the east coast of Canada, which predominantly took place late in 2016.

Funds from operations were $919 million for the first six months of 2017, compared to $563 million for the same period in 2016, and increased due to higher price realizations, increased production and lower operating costs, partially offset by higher royalties.

Planned Maintenance Update for Operated Assets

A planned three-week maintenance event at Terra Nova has been scheduled to commence in the third quarter of 2017. The anticipated impact of this maintenance has been reflected in the company's 2017 guidance.

| 20 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

REFINING AND MARKETING

Financial Highlights

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

($ millions) |

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Operating revenues |

4 744 | 4 590 | 9 397 | 8 181 | ||||||

| | | | | | | | | | | |

Net earnings |

346 | 689 | 1 175 | 930 | ||||||

| | ||||||||||

Adjusted for: |

||||||||||

| | ||||||||||

Gain on significant disposal(1) |

— | — | (354 | ) | — | |||||

| | | | | | | | | | | |

Operating earnings(2) |

346 | 689 | 821 | 930 | ||||||

| | ||||||||||

Refining and Supply |

262 | 581 | 656 | 756 | ||||||

| | ||||||||||

Marketing |

84 | 108 | 165 | 174 | ||||||

| | | | | | | | | | | |

Funds from operations(2) |

504 | 885 | 1 079 | 1 289 | ||||||

| | | | | | | | | | | |

- (1)

- After-tax

gain related to the sale of the company's lubricants business.

- (2)

- Non-GAAP financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

|

- (1)

- For an explanation of this bridge analysis, see the Non-GAAP Financial Measures Advisory section of this MD&A.

R&M operating earnings on a FIFO basis were $346 million, compared to $689 million in the prior year quarter, with the decrease explained below. Using a LIFO(1) method of inventory valuation, which management uses to assess performance, earnings were $384 million compared to $413 million in the prior year quarter and improved after removing the impact of the disposal of the lubricants business in the first quarter of 2017.

Refining and Supply operating earnings were $262 million in the second quarter of 2017, compared to $581 million in the prior year quarter. The decrease was primarily due to realizing a FIFO loss of $38 million, as compared to a FIFO gain in the prior year period of $275 million, for a quarter-over-quarter impact of $313 million. In addition, improved benchmark cracking margins and product location differentials were more than offset by narrower crude differentials.

- (1)

- Non-GAAP financial measure. See the Non-GAAP Financial Measures Advisory section of this MD&A.

| | | SUNCOR ENERGY INC. 2017 SECOND QUARTER 21 |

Marketing activities contributed $84 million to operating earnings in the second quarter of 2017, compared to $108 million in the prior year quarter, which included $38 million of operating earnings from the lubricants business disposed of in the first quarter of 2017. After removing the impact of the lubricants business, marketing operating earnings improved due to higher wholesale and retail margins, as well as strong retail and wholesale sales volumes.

During the first quarter of 2017, Suncor completed the sale of its Petro-Canada lubricants business, which contributed $45 million in net earnings and $72 million in funds from operations in the second quarter of 2016. The impact of the lubricants sale has been reflected in Financing Expense and Other in the bridge analysis above.

Volumes

|

Three months ended June 30 |

Six months ended June 30 |

||||||||

|

2017 | 2016 | 2017 | 2016 | ||||||

| | | | | | | | | | | |

Crude oil processed (mbbls/d) |

||||||||||

| | ||||||||||

Eastern North America |

208.6 | 181.7 | 211.6 | 196.9 | ||||||

| | ||||||||||

Western North America |

226.9 | 218.5 | 221.1 | 213.6 | ||||||

| | | | | | | | | | | |

Total |

435.5 | 400.2 | 432.7 | 410.5 | ||||||

| | | | | | | | | | | |

Refinery utilization(1) (%) |

||||||||||

| | ||||||||||

Eastern North America |

94 | 82 | 95 | 89 | ||||||

| | ||||||||||

Western North America |

95 | 91 | 92 | 89 | ||||||

| | | | | | | | | | | |

Total |

94 | 87 | 94 | 89 | ||||||

| | | | | | | | | | | |

Refined product sales (mbbls/d) |

||||||||||

| | ||||||||||

Gasoline |

236.8 | 251.3 | 233.4 | 240.6 | ||||||

| | ||||||||||

Distillate |

191.2 | 190.0 | 191.7 | 181.1 | ||||||

| | ||||||||||

Other |

93.9 | 91.2 | 89.9 | 89.3 | ||||||

| | | | | | | | | | | |

Total |

521.9 | 532.5 | 515.0 | 511.0 | ||||||

| | | | | | | | | | | |

Refining margin(2) ($/bbl) |

18.85 | 21.65 | 20.55 | 20.35 | ||||||

| | ||||||||||

Refining operating expense(2) ($/bbl) |

5.05 | 5.40 | 5.25 | 5.25 | ||||||

| | | | | | | | | | | |

- (1)

- Refinery

utilization is the amount of crude oil and natural gas plant liquids run through crude distillation units, expressed as a percentage of the capacity of these units.

- (2)

- Non-GAAP financial measures. See the Non-GAAP Financial Measures Advisory section of this MD&A.

Refinery crude throughput in the second quarter of 2017 improved to 435,500 bbls/d, compared to 400,200 bbls/d in the prior year quarter. In Eastern North America, the average volume of crude oil processed increased in the second quarter of 2017 to 208,600 bbls/d compared to 181,700 bbls/d during the same period in 2016, due to lower planned maintenance activity at both the Sarnia and Montreal refineries in the second quarter of 2017 combined with improved crude availability. The average volume of crude oil processed in Western North America increased to 226,900 bbls/d in the second quarter of 2017 from 218,500 bbls/d in the prior year quarter, primarily due to lower planned maintenance at the Commerce City refinery and improved crude availability.

Total refined product sales were 521,900 bbls/d in the second quarter of 2017, compared to 532,500 bbls/d in the prior year quarter, with increases in wholesale and retail volumes being more than offset by a decrease in third-party gasoline purchases for resale.

| 22 SUNCOR ENERGY INC. 2017 SECOND QUARTER | | |

Prices and Margins

Refined product margins in Refining and Supply were lower in the second quarter of 2017 compared with the prior year quarter, and were impacted primarily by the following factors:

- •

- In

the second quarter of 2017, the impact of the FIFO method of inventory valuation, as used by the company, relative to an estimated LIFO(1) method, had a

negative impact on operating earnings of $38 million after-tax, compared to a positive impact on operating earnings of $275 million after-tax in the prior year quarter, which was driven

by an increasing crude price environment.

- •

- Improved benchmark refining crack spreads and product location differentials were more than offset by narrower crude differentials.

Marketing margins in the second quarter of 2017, excluding the impact of the sale of the lubricants business in the first quarter of 2017, were higher than margins in the prior year quarter, primarily due to increased wholesale and retail sales volumes and margins.

Expenses and Other Factors

After removing the impact of the lubricants business, which was sold in the first quarter of 2017, operating expenses in the second quarter of 2017 were higher than the prior year quarter, with reduced refinery operating costs being more than offset by higher energy input prices and increased variable selling costs associated with the increase in retail sales volumes.

Financing Expense and Other includes the net impact of the sale of the lubricants business in the first quarter of 2017.

Results for the First Six Months of 2017