UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to______________.

Commission File Number: 001-09383

WESTAMERICA BANCORPORATION

(Exact name of the registrant as specified in its charter)

| CALIFORNIA | 94-2156203 |

| (State or Other Jurisdiction | (I.R.S. Employer |

| of Incorporation or Organization) | Identification Number) |

1108 FIFTH AVENUE, SAN RAFAEL, CALIFORNIA 94901

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (707) 863-6000

Securities registered pursuant to Section 12(b) of the Act:

| Title of class: | Name of each exchange on which registered: |

Common Stock, no par value

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark if whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | ||

| Smaller reporting company ☐ | Emerging growth company ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2018 as reported on the NASDAQ Global Select Market, was $1,072,647,598.47 . Shares of Common Stock held by each executive officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Number of shares outstanding of each of the registrant’s classes of common stock, as of the close of business on February 20, 2019: 26,889,495 Shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement relating to registrant’s Annual Meeting of Shareholders, to be held on April 25, 2019, are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III to the extent described therein.

TABLE OF CONTENTS

-1-

FORWARD-LOOKING STATEMENTS

This Report on Form 10-K contains forward-looking statements about Westamerica Bancorporation for which it claims the protection of the safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, future credit quality and performance, the appropriateness of the allowance for loan losses, loan growth or reduction, mitigation of risk in the Company’s loan and investment securities portfolios, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statements of plans, objectives and expectations of the Company or its management or board of directors, including those relating to products or services; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Words such as "believes", "anticipates", "expects", “estimates”, "intends", "targeted", "projected", “forecast”, "continue", "remain", "will", "should", "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

These forward-looking statements are based on Management’s current knowledge and belief and include information concerning the Company’s possible or assumed future financial condition and results of operations. A number of factors, some of which are beyond the Company’s ability to predict or control, could cause future results to differ materially from those contemplated. These factors include but are not limited to (1) the length and severity of any difficulties in the global, national and California economies and the effects of government efforts to address those difficulties; (2) liquidity levels in capital markets; (3) fluctuations in asset prices including, but not limited to stocks, bonds, real estate, and commodities; (4) the effect of acquisitions and integration of acquired businesses; (5) economic uncertainty created by terrorist threats and attacks on the United States, the actions taken in response, and the uncertain effect of these events on the national and regional economies; (6) changes in the interest rate environment; (7) changes in the regulatory environment; (8) competitive pressure in the banking industry; (9) operational risks including a failure or breach in data processing or security systems or those of third party vendors and other service providers, including as a result of cyber attacks or fraud; (10) volatility of interest rate sensitive loans, deposits and investments; (11) asset/liability management risks and liquidity risks; (12) the effect of natural disasters, including earthquakes, hurricanes, fire, flood, drought, and other disasters, on the uninsured value of the Company’s assets and of loan collateral, the financial condition of debtors and issuers of investment securities, the economic conditions affecting the Company’s market place, and commodities and asset values; (13) changes in the securities markets and (14) the outcome of contingencies, such as legal proceedings. However, the reader should not consider the above-mentioned factors to be a complete set of all potential risks or uncertainties.

Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to update any forward-looking statements in this report to reflect circumstances or events that occur after the date forward looking statements are made, except as may be required by law. See also “Risk Factors” in Item 1A and other risk factors discussed elsewhere in this report.

PART I

Westamerica Bancorporation (the “Company”) is a bank holding company registered under the Bank Holding Company Act of 1956, as amended (“BHCA”). Its legal headquarters are located at 1108 Fifth Avenue, San Rafael, California 94901. Principal administrative offices are located at 4550 Mangels Boulevard, Fairfield, California 94534 and its telephone number is (707) 863-6000. The Company provides a full range of banking services to individual and commercial customers in Northern and Central California through its subsidiary bank, Westamerica Bank (“WAB” or the “Bank”). The principal communities served are located in Northern and Central California, from Mendocino, Lake and Nevada Counties in the north to Kern County in the south. The Company’s strategic focus is on the banking needs of small businesses. In addition, the Bank owns 100% of the capital stock of Community Banker Services Corporation (“CBSC”), a company engaged in providing the Company and its subsidiaries with data processing services and other support functions.

The Company was incorporated under the laws of the State of California in 1972 as “Independent Bankshares Corporation” pursuant to a plan of reorganization among three previously unaffiliated Northern California banks. The Company operated as a multi-bank holding company until mid-1983, at which time the then six subsidiary banks were merged into a single bank named Westamerica Bank and the name of the holding company was changed to Westamerica Bancorporation.

The Company acquired five banks within its immediate market area during the early to mid 1990’s. In April 1997, the Company acquired ValliCorp Holdings, Inc., parent company of ValliWide Bank, the largest independent bank holding company headquartered in Central California. Under the terms of all of the merger agreements, the Company issued shares of its common stock in exchange for all of the outstanding shares of the acquired institutions. The subsidiary banks acquired were merged with and into WAB. These six aforementioned business combinations were accounted for as poolings-of-interests.

-2-

During the period 2000 through 2005, the Company acquired three additional banks. These acquisitions were accounted for using the purchase accounting method.

On February 6, 2009, Westamerica Bank acquired the banking operations of County Bank (“County”) from the Federal Deposit Insurance Corporation (“FDIC”). On August 20, 2010, Westamerica Bank acquired assets and assumed liabilities of the former Sonoma Valley Bank (“Sonoma”) from the FDIC. The County and Sonoma acquired assets and assumed liabilities were measured at estimated fair values, as required by FASB ASC 805, Business Combinations.

At December 31, 2018, the Company had consolidated assets of approximately $5.6 billion, deposits of approximately $4.9 billion and shareholders’ equity of approximately $616 million. The Company and its subsidiaries employed 762 full-time equivalent staff as of December 31, 2018.

The Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports as well as beneficial ownership reports on Forms 3, 4 and 5 are available through the SEC’s website (https://www.sec.gov). Such documents as well as the Company’s director, officer and employee Code of Conduct and Ethics are also available free of charge from the Company by request to:

Westamerica Bancorporation

Corporate Secretary A-2M

Post Office Box 1200

Suisun City, California 94585-1200

Supervision and Regulation

The following is not intended to be an exhaustive description of the statutes and regulations applicable to the Company’s or the Bank’s business. The description of statutory and regulatory provisions is qualified in its entirety by reference to the particular statutory or regulatory provisions. Moreover, major new legislation and other regulatory changes affecting the Company, the Bank, and the financial services industry in general have occurred in the last several years and can be expected to occur in the future. The nature, timing and impact of new and amended laws and regulations cannot be accurately predicted.

Regulation and Supervision of Bank Holding Companies

The Company is a bank holding company subject to the BHCA. The Company reports to, is registered with, and may be examined by, the Board of Governors of the Federal Reserve System (“FRB”). The FRB also has the authority to examine the Company’s subsidiaries. The Company is a bank holding company within the meaning of Section 3700 of the California Financial Code. As such, the Company and the Bank are subject to examination by, and may be required to file reports with, the Commissioner of the California Department of Business Oversight (the “Commissioner”).

The FRB has significant supervisory and regulatory authority over the Company and its affiliates. The FRB requires the Company to maintain certain levels of capital. See “Capital Standards.” The FRB also has the authority to take enforcement action against any bank holding company that commits any unsafe or unsound practice, or violates certain laws, regulations or conditions imposed in writing by the FRB. Under the BHCA, the Company is required to obtain the prior approval of the FRB before it acquires, merges or consolidates with any bank or bank holding company. Any company seeking to acquire, merge or consolidate with the Company also would be required to obtain the prior approval of the FRB.

The Company is generally prohibited under the BHCA from acquiring ownership or control of more than 5% of any class of voting shares of any company that is not a bank or bank holding company and from engaging directly or indirectly in activities other than banking, managing banks, or providing services to affiliates of the holding company. However, a bank holding company, with the approval of the FRB, may engage, or acquire the voting shares of companies engaged, in activities that the FRB has determined to be closely related to banking or managing or controlling banks. A bank holding company must demonstrate that the benefits to the public of the proposed activity will outweigh the possible adverse effects associated with such activity.

The FRB generally prohibits a bank holding company from declaring or paying a cash dividend that would impose undue pressure on the capital of subsidiary banks or would be funded only through borrowing or other arrangements which might adversely affect a bank holding company’s financial position. Under the FRB policy, a bank holding company should not continue its existing rate of cash dividends on its common stock unless its net income is sufficient to fully fund each dividend and its prospective rate of earnings retention appears consistent with its capital needs, asset quality and overall financial condition. See the section entitled “Restrictions on Dividends and Other Distributions” for additional restrictions on the ability of the Company and the Bank to pay dividends.

-3-

Transactions between the Company and the Bank are restricted under Regulation W. The regulation codifies prior interpretations of the FRB and its staff under Sections 23A and 23B of the Federal Reserve Act. In general, subject to certain specified exemptions, a bank or its subsidiaries are limited in their ability to engage in “covered transactions” with affiliates: (a) to an amount equal to 10% of the bank’s capital and surplus, in the case of covered transactions with any one affiliate; and (b) to an amount equal to 20% of the bank’s capital and surplus, in the case of covered transactions with all affiliates. The Company is considered to be an affiliate of the Bank. A “covered transaction” includes, among other things, a loan or extension of credit to an affiliate; a purchase of securities issued by an affiliate; a purchase of assets from an affiliate, with some exceptions; and the issuance of a guarantee, acceptance or letter of credit on behalf of an affiliate.

Federal regulations governing bank holding companies and change in bank control (Regulation Y) provide for a streamlined and expedited review process for bank acquisition proposals submitted by well-run bank holding companies. These provisions of Regulation Y are subject to numerous qualifications, limitations and restrictions. In order for a bank holding company to qualify as “well-run,” both it and the insured depository institutions which it controls must meet the “well capitalized” and “well managed” criteria set forth in Regulation Y.

The Gramm-Leach-Bliley Act (the “GLBA”), or the Financial Services Act of 1999, repealed provisions of the Glass-Steagall Act, which had prohibited commercial banks and securities firms from affiliating with each other and engaging in each other’s businesses. Thus, many of the barriers prohibiting affiliations between commercial banks and securities firms have been eliminated.

The BHCA was also amended by the GLBA to allow new “financial holding companies” (“FHCs”) to offer banking, insurance, securities and other financial products to consumers. Specifically, the GLBA amended section 4 of the BHCA in order to provide for a framework for the engagement in new financial activities. A bank holding company (“BHC”) may elect to become an FHC if all its subsidiary depository institutions are well capitalized and well managed. If these requirements are met, a BHC may file a certification to that effect with the FRB and declare that it elects to become an FHC. After the certification and declaration is filed, the FHC may engage either de novo or through an acquisition in any activity that has been determined by the FRB to be financial in nature or incidental to such financial activity. BHCs may engage in financial activities without prior notice to the FRB if those activities qualify under the list of permissible activities in section 4(k) of the BHCA. However, notice must be given to the FRB within 30 days after an FHC has commenced one or more of the financial activities. The Company has not elected to become an FHC.

Regulation and Supervision of Banks

The Bank is a California state-chartered Federal Reserve member bank and its deposits are insured by the FDIC. The Bank is subject to regulation, supervision and regular examination by the California Department of Business Oversight (“DBO”) and the FRB. The regulations of these agencies affect most aspects of the Bank’s business and prescribe permissible types of loans and investments, the amount of required reserves, requirements for branch offices, the permissible scope of its activities and various other requirements.

In addition to federal banking law, the Bank is also subject to applicable provisions of California law. Under California law, the Bank is subject to various restrictions on, and requirements regarding, its operations and administration including the maintenance of branch offices and automated teller machines, capital requirements, deposits and borrowings, shareholder rights and duties, and investment and lending activities.

In addition, the Federal Deposit Insurance Corporation Improvement Act (“FDICIA”) imposes limitations on the activities and equity investments of state chartered, federally insured banks. FDICIA also prohibits a state bank from making an investment or engaging in any activity as a principal that is not permissible for a national bank, unless the Bank is adequately capitalized and the FDIC approves the investment or activity after determining that such investment or activity does not pose a significant risk to the deposit insurance fund.

On July 21, 2010, financial regulatory reform legislation entitled the "Dodd-Frank Wall Street Reform and Consumer Protection Act" (the "Dodd-Frank Act") was signed into law. The Dodd-Frank Act implemented far-reaching changes across the financial regulatory landscape, including provisions that, among other things:

-4-

| • | Centralized responsibility for consumer financial protection by creating a new agency, the Consumer Financial Protection Bureau, responsible for implementing, examining and (as to banks with $10 billion or more in assets) enforcing compliance with federal consumer financial laws. |

| • | Restricted the preemption of state law by federal law and disallowed subsidiaries and affiliates of national banks from availing themselves of such preemption. |

| • | Applied the same leverage and risk-based capital requirements that would apply to insured depository institutions to most bank holding companies. |

| • | Required bank regulatory agencies to seek to make their capital requirements for banks countercyclical so that capital requirements increase in times of economic expansion and decrease in times of economic contraction. |

| • | Changed the assessment base for federal deposit insurance from the amount of insured deposits to consolidated assets less tangible capital, eliminated the ceiling on the size of the Deposit Insurance Fund ("DIF") and increased the floor of the size of the DIF. |

| • | Imposed comprehensive regulation of the over-the-counter derivatives market, which would include certain provisions that would effectively prohibit insured depository institutions from conducting certain derivatives businesses in the institution itself. |

| • | Required large, publicly traded bank holding companies to create a risk committee responsible for the oversight of enterprise risk management. |

| • | Implemented corporate governance revisions, including with regard to executive compensation and proxy access by shareholders, that would apply to all public companies, not just financial institutions. |

| • | Made permanent the $250 thousand limit for federal deposit insurance. |

| • | Repealed the federal prohibitions on the payment of interest on demand deposits, thereby permitting depository institutions to pay interest on business transaction and other accounts. |

| • | Amended the Electronic Fund Transfer Act ("EFTA") to, among other things, give the FRB the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer. While the Company’s assets are currently less than $10 billion, interchange fees charged by larger institutions may dictate the level of fees smaller institutions will be able to charge to remain competitive. |

Provisions in the legislation that affect the payment of interest on demand deposits and interchange fees may increase the costs associated with deposits as well as place limitations on certain revenues those deposits may generate.

Capital Standards

The federal banking agencies have risk-based capital adequacy guidelines intended to provide a measure of capital adequacy that reflects the degree of risk associated with a banking organization’s operations for both transactions resulting in assets being recognized on the balance sheet as assets, and the extension of credit facilities such as letters of credit and recourse arrangements, which are recorded as off balance sheet items. Under these guidelines, nominal dollar amounts of assets and credit equivalent amounts of off balance sheet items are multiplied by one of several risk adjustment percentages, which range from 0% for assets with low credit risk, such as certain U.S. government securities, to 1250% for assets with relatively higher credit risk, such as certain securitizations. A banking organization’s risk-based capital ratios are obtained by dividing its qualifying capital by its total risk-adjusted assets and off balance sheet items.

The federal banking agencies take into consideration concentrations of credit risk and risks from nontraditional activities, as well as an institution’s ability to manage those risks, when determining the adequacy of an institution’s capital. This evaluation is made as a part of the institution’s regular safety and soundness examination. The federal banking agencies also consider interest rate risk (related to the interest rate sensitivity of an institution’s assets and liabilities, and its off balance sheet financial instruments) in the evaluation of a bank’s capital adequacy.

As of December 31, 2018, the Company’s and the Bank’s respective ratios exceeded applicable regulatory requirements. See Note 9 to the consolidated financial statements for capital ratios of the Company and the Bank, compared to minimum capital requirements and for the Bank the standards for well capitalized depository institutions.

On July 2, 2013, the Federal Reserve Board approved a final rule that implements changes to the regulatory capital framework for all banking organizations over a transitional period 2015 through 2018.

See the sections entitled “Capital Resources and Capital to Risk-Adjusted Assets” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.

-5-

Prompt Corrective Action and Other Enforcement Mechanisms

FDICIA requires each federal banking agency to take prompt corrective action to resolve the problems of insured depository institutions, including but not limited to those that fall below one or more prescribed minimum capital ratios.

An institution that, based upon its capital levels, is classified as “well capitalized,” “adequately capitalized” or “undercapitalized” may be treated as though it were in the next lower capital category if the appropriate federal banking agency, after notice and opportunity for hearing, determines that an unsafe or unsound condition or an unsafe or unsound practice warrants such treatment. At each successive lower capital category, an insured depository institution is subject to more restrictions. In addition to measures taken under the prompt corrective action provisions, commercial banking organizations may be subject to potential enforcement actions by the federal banking agencies for unsafe or unsound practices in conducting their businesses or for violations of any law, rule, regulation or any condition imposed in writing by the agency or any written agreement with the agency.

Safety and Soundness Standards

FDICIA has implemented certain specific restrictions on transactions and required federal banking regulators to adopt overall safety and soundness standards for depository institutions related to internal control, loan underwriting and documentation, and asset growth. Among other things, FDICIA limits the interest rates paid on deposits by undercapitalized institutions, restricts the use of brokered deposits, limits the aggregate extensions of credit by a depository institution to an executive officer, director, principal shareholder or related interest, and reduces deposit insurance coverage for deposits offered by undercapitalized institutions for deposits by certain employee benefits accounts. The federal banking agencies may require an institution to submit an acceptable compliance plan as well as have the flexibility to pursue other more appropriate or effective courses of action given the specific circumstances and severity of an institution’s noncompliance with one or more standards.

Federal banking agencies require banks to maintain adequate valuation allowances for potential credit losses. The Company has an internal staff that continually reviews loan quality and reports to the Board of Directors. This analysis includes a detailed review of the classification and categorization of problem loans, assessment of the overall quality and collectability of the loan portfolio, consideration of loan loss experience, trends in problem loans, concentration of credit risk, and current economic conditions, particularly in the Bank’s market areas. Based on this analysis, Management, with the review and approval of the Board, determines the adequate level of allowance required. The allowance is allocated to different segments of the loan portfolio, but the entire allowance is available for the loan portfolio in its entirety.

Restrictions on Dividends and Other Distributions

The Company’s ability to pay dividends to its shareholders is subject to the restrictions set forth in the California General Corporation Law (“CGCL”). The CGCL provides that a corporation may make a distribution to its shareholders if (i) the corporation’s retained earnings equal or exceed the amount of the proposed distribution plus unpaid accrued dividends (if any) on securities with a dividend preference, or (ii) immediately after the dividend, the corporation’s total assets equal or exceed total liabilities plus unpaid accrued dividends (if any) on securities with a dividend preference.

The Company’s ability to pay dividends depends in part on the Bank’s ability to pay cash dividends to the Company. The power of the board of directors of an insured depository institution to declare a cash dividend or other distribution with respect to capital is subject to statutory and regulatory restrictions which limit the amount available for such distribution depending upon the earnings, financial condition and cash needs of the institution, as well as general business conditions. FDICIA prohibits insured depository institutions from paying management fees to any controlling persons or, with certain limited exceptions, making capital distributions, including dividends, if, after such transaction, the institution would be undercapitalized.

In addition to the restrictions imposed under federal law, banks chartered under California law generally may only pay cash dividends to the extent such payments do not exceed the lesser of retained earnings of the bank or the bank’s net income for its last three fiscal years (less any distributions to shareholders during this period). In the event a bank desires to pay cash dividends in excess of such amount, the bank may pay a cash dividend with the prior approval of the Commissioner in an amount not exceeding the greatest of the bank’s retained earnings, the bank’s net income for its last fiscal year or the bank’s net income for its current fiscal year.

The federal banking agencies also have the authority to prohibit a depository institution or its holding company from engaging in business practices which are considered to be unsafe or unsound, possibly including payment of dividends or other payments under certain circumstances even if such payments are not expressly prohibited by statute. The Federal Reserve Board has issued guidance indicating its expectations that a bank holding company will inform and consult with Federal Reserve supervisory staff sufficiently in advance of (i) declaring and paying a dividend that could raise safety and soundness concerns (e.g., declaring and paying a dividend that exceeds earnings for the period for which the dividend is being paid); (ii) redeeming or repurchasing regulatory capital instruments when the bank holding company is experiencing financial weaknesses; or (iii) redeeming or repurchasing common stock or perpetual preferred stock that would result in a net reduction as of the end of the quarter in the amount of such equity instruments outstanding compared with the beginning of the quarter in which the redemption or repurchase occurred.

-6-

Premiums for Deposit Insurance

Substantially all of the deposits of the Bank are insured up to applicable limits by the DIF of the FDIC and are subject to deposit insurance assessments to maintain the DIF. The FDIC utilizes a risk-based assessment system that imposes insurance premiums based upon a risk matrix that takes into account a bank's capital level, asset quality and supervisory rating ("CAMELS rating").

In July 2010, Congress in the Dodd-Frank Act increased the minimum for the DIF reserve ratio, the ratio of the amount in the fund to insured deposits, from 1.15% to 1.35% and required that the ratio reach that level by September 30, 2020. Further, the Dodd-Frank Act made banks with $10 billion or more in assets responsible for the increase from 1.15% to 1.35%, among other provisions.

In October 2010, the FDIC adopted a new DIF restoration plan to ensure the DIF reaching 1.35% by September 30, 2020. In assessing its progress in restoring the reserves, at least semi-annually, the FDIC updates its loss and income projections for the fund and, if needed, increases or decreases assessment rates, following notice-and-comment rulemaking, if required.

In February 2011, the FDIC adopted a final rule effective April 1, 2011 to:

| (1) | Redefine the deposit insurance assessment base from total domestic deposits to average total assets minus average tangible equity as required by the Dodd-Frank Act; |

| (2) | Change the deposit insurance assessment rates (which provide for progressively lower assessment rate schedules that will take effect when the reserve ratio exceeds 1.15%, 2%, and 2.5%) ; |

| (3) | Implement the Dodd-Frank Act DIF dividend provisions; and |

| (4) | Revise the risk-based assessment system for all “large” and “highly complex” insured depository institutions. “Large” depository institutions are defined generally as having more than $10 billion in assets and "highly complex" institutions have over $50 billion in assets and are fully owned by a parent with over $500 billion in assets. The Bank is neither a “large” nor “highly complex” institution. |

In March, 2016, the FDIC issued a final rule to increase the DIF reserve ratio to the statutory minimum level of 1.35%, effective July 1, 2016, if the reserve ratio reached 1.15% before that date.

In August, 2016, the FDIC announced the DIF reserve ratio surpassed the 1.15% reserve ratio target, triggering three major changes:

| (1) | The decline in the range of initial assessment rates for all banks from 5-35 basis points to 3-30 basis points; |

| (2) | The assessment of a quarterly surcharge on large banks equal to an annual rate of 4.5 basis points in addition to regular assessments; and |

| (3) | A revised method to calculate risk-based assessment rates for established small banks (under $1 billion in assets) pursuant to an FDIC final rule issued April, 2016. |

In September 2018, the FDIC issued a Financial Institutions Letter stating the Deposit Insurance Fund Reserve Ratio reached 1.36%, exceeding the statutorily required minimum reserve ratio of 1.35% ahead of the September 30, 2020, deadline required under the Dodd-Frank Act. FDIC regulations provide for two changes to deposit insurance assessments upon reaching the minimum: (1) surcharges on insured depository institutions with total consolidated assets of $10 billion or more (large banks) will cease; and (2) small banks will receive assessment credits for the portion of their assessments that contributed to the growth in the reserve ratio from between 1.15% and 1.35%, to be applied when the reserve ratio is at or above 1.38%. In January 2019, the Bank, which meets the definition of a “small Bank”, was advised by the FDIC its assessment credit to be applied when the reserve ratio is at or above 1.38% is $1.4 million which will reduce future assessment expenses. The Company cannot provide any assurance as to the effect of any future changes in its deposit insurance premium rates.

Community Reinvestment Act and Fair Lending Developments

The Bank is subject to certain fair lending requirements and reporting obligations involving home mortgage lending operations and Community Reinvestment Act (“CRA”) activities. The CRA generally requires the federal banking agencies to evaluate the record of financial institutions in meeting the credit needs of their local communities, including low and moderate income neighborhoods. In addition to substantive penalties and corrective measures that may be required for a violation of certain fair lending laws, the federal banking agencies may take compliance with such laws and CRA into account when regulating and supervising other activities including merger applications.

-7-

Financial Privacy Legislation and Customer Information Security

The GLBA, in addition to the previously described changes in permissible nonbanking activities permitted to banks, BHCs and FHCs, also required the federal banking agencies, among other federal regulatory agencies, to adopt regulations governing the privacy of consumer financial information. The Bank is subject to the FRB’s regulations in this area. The federal bank regulatory agencies have established standards for safeguarding nonpublic personal information about customers that implement provisions of the GLBA (the “Guidelines”). Among other things, the Guidelines require each financial institution, under the supervision and ongoing oversight of its Board of Directors or an appropriate committee thereof, to develop, implement and maintain a comprehensive written information security program designed to ensure the security and confidentiality of customer information, to protect against any anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use of such information that could result in substantial harm or inconvenience to any customer.

U.S.A. PATRIOT Act

Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (“USA Patriot Act”) is the International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001. It includes numerous provisions for fighting international money laundering and blocking terrorist access to the U.S. financial system. The goal of Title III is to prevent the U.S. financial system and the U.S. clearing mechanisms from being used by parties suspected of terrorism, terrorist financing and money laundering. The provisions of Title III of the USA Patriot Act which affect the Bank are generally set forth as amendments to the Bank Secrecy Act. These provisions relate principally to U.S. banking organizations’ relationships with foreign banks and with persons who are resident outside the United States. The USA Patriot Act does not impose any filing or reporting obligations for banking organizations, but does require certain additional due diligence and recordkeeping practices.

Sarbanes-Oxley Act of 2002

The stated goals of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. Sarbanes-Oxley generally applies to all companies, both U.S. and non-U.S., that file or are required to file periodic reports under the Securities Exchange Act of 1934 (the “Exchange Act”).

Sarbanes-Oxley includes very specific additional disclosure requirements and corporate governance rules, required the SEC and securities exchanges to adopt extensive additional disclosure, corporate governance and other related rules and mandates further studies of certain issues. Sarbanes-Oxley represents significant federal involvement in matters traditionally left to state regulatory systems, such as the regulation of the accounting profession, and to state corporate law, such as the relationship between a board of directors and management and between a board of directors and its committees and public company shareholders. Sarbanes-Oxley addresses, among other matters: (i) independent audit committees for reporting companies whose securities are listed on national exchanges or automated quotation systems and expanded duties and responsibilities for audit committees; (ii) certification of financial statements by the chief executive officer and the chief financial officer; (iii) the forfeiture of bonuses or other incentive-based compensation and profits from the sale of an issuer’s securities by directors and senior officers in the twelve month period following initial publication of any financial statements that later require restatement; (iv) a prohibition on insider trading during pension plan blackout periods; (v) disclosure of off-balance sheet transactions; (vi) a prohibition on personal loans to directors and officers under most circumstances with exceptions for certain normal course transactions by regulated financial institutions; (vii) expedited electronic filing requirements related to trading by insiders in an issuer’s securities on Form 4; (viii) disclosure of a code of ethics and filing a Form 8-K for a change or waiver of such code; (ix) accelerated filing of periodic reports; (x) the formation of the Public Company Accounting Oversight Board (“PCAOB”) to regulate public accounting firms and the audit of public companies that are subject to the securities laws; (xi) auditor independence; (xii) internal control evaluation and reporting; and (xiii) various increased criminal penalties for violations of securities laws.

Programs To Mitigate Identity Theft

In November 2007, federal banking agencies together with the National Credit Union Administration and Federal Trade Commission adopted regulations under the Fair and Accurate Credit Transactions Act of 2003 to require financial institutions and other creditors to develop and implement a written identity theft prevention program to detect, prevent and mitigate identity theft in connection with certain new and existing accounts. Covered accounts generally include consumer accounts and other accounts that present a reasonably foreseeable risk of identity theft. Each institution’s program must include policies and procedures designed to: (i) identify indicators, or “red flags,” of possible risk of identity theft; (ii) detect the occurrence of red flags; (iii) respond appropriately to red flags that are detected; and (iv) ensure that the program is updated periodically as appropriate to address changing circumstances. The regulations include guidelines that each institution must consider and, to the extent appropriate, include in its program.

-8-

Pending Legislation

Changes to state laws and regulations (including changes in interpretation or enforcement) can affect the operating environment of BHCs and their subsidiaries in substantial and unpredictable ways. From time to time, various legislative and regulatory proposals are introduced. These proposals, if codified, may change banking statutes and regulations and the Company’s operating environment in substantial and unpredictable ways. If codified, these proposals could increase or decrease the cost of doing business, limit or expand permissible activities or affect the competitive balance among banks, savings associations, credit unions and other financial institutions. The Company cannot accurately predict whether those changes in laws and regulations will occur, and, if those changes occur, the ultimate effect they would have upon our financial condition or results of operations. It is likely, however, that the current level of enforcement and compliance-related activities of federal and state authorities will continue and potentially increase.

Competition

The Bank’s principal competitors for deposits and loans are major banks and smaller community banks, savings and loan associations and credit unions. To a lesser extent, competitors include thrift and loans, mortgage brokerage companies and insurance companies. Other institutions, such as brokerage houses, mutual fund companies, credit card companies, and certain retail establishments offer investment vehicles that also compete with banks for deposit business. Federal legislation in recent years has encouraged competition between different types of financial institutions and fostered new entrants into the financial services market.

Legislative changes, as well as technological and economic factors, can be expected to have an ongoing impact on competitive conditions within the financial services industry. While the future impact of regulatory and legislative changes cannot be predicted with certainty, the business of banking will remain highly competitive.

Readers and prospective investors in the Company’s securities should carefully consider the following risk factors as well as the other information contained or incorporated by reference in this Report.

The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties that Management is not aware of or focused on or that Management currently deems immaterial may also impair the Company’s business operations. This Report is qualified in its entirety by these risk factors.

If any of the following risks actually occur, the Company’s financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of the company’s securities could decline significantly, and investors could lose all or part of their investment in the Company’s common stock.

-9-

Market and Interest Rate Risk

Changes in interest rates could reduce income and cash flow.

The Company’s income and cash flow depend to a great extent on the difference between the interest earned on loans and investment securities and the interest paid on deposits and other borrowings, and the Company’s success in competing for loans and deposits. The Company cannot control or prevent changes in the level of interest rates which fluctuate in response to general economic conditions, the policies of various governmental and regulatory agencies, in particular, the Federal Open Market Committee of the FRB, and pricing practices of the Company’s competitors. Changes in monetary policy, including changes in interest rates, will influence the origination of loans, the purchase of investments, the generation of deposits and other borrowings, and the rates received on loans and investment securities and paid on deposits and other liabilities. The discussion in this Report under “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations – Asset, Liability and Market Risk Management” and “- Liquidity and Funding” and “Item 7A Quantitative and Qualitative Disclosures About Market Risk” is incorporated by reference in this paragraph.

Changes in capital market conditions could reduce asset valuations.

Capital market conditions, including interest rates, liquidity, investor confidence, bond issuer credit worthiness, perceived counter-party risk, the supply of and demand for financial instruments, the financial strength of market participants, and other factors can materially impact the value of the Company’s assets. An impairment in the value of the Company’s assets could result in asset write-downs, reducing the Company’s asset values, earnings, and equity.

The value of securities in the Company’s investment securities portfolio may be negatively affected by disruptions in securities markets

The market for some of the investment securities held in the Company’s portfolio can be extremely volatile. Volatile market conditions may detrimentally affect the value of these securities, such as through reduced valuations due to the perception of heightened credit and liquidity risks. There can be no assurance that the declines in market value will not result in other than temporary impairments of these assets, which would lead to loss recognition that could have a material adverse effect on the Company’s net income and capital levels.

The weakness of other financial institutions could adversely affect the Company.

Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. The Company routinely executes transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, and other institutional clients. Many of these transactions expose the Company to credit risk in the event of default of the Company’s counterparty or client. In addition, the Company’s credit risk may be increased when the collateral the Company holds cannot be realized or is liquidated at prices not sufficient to recover the full amount of the secured obligation. There is no assurance that any such losses would not materially and adversely affect the Company’s results of operations or earnings.

Shares of Company common stock eligible for future sale or grant of stock options and other equity awards could have a dilutive effect on the market for Company common stock and could adversely affect the market price.

The Articles of Incorporation of the Company authorize the issuance of 150 million shares of common stock (and two additional classes of 1 million shares each, denominated “Class B Common Stock” and “Preferred Stock”, respectively) of which approximately 26.7 million shares of common stock were outstanding at December 31, 2018. Pursuant to its stock option plans, at December 31, 2018, the Company had outstanding options for 946 thousand shares of common stock, of which 457 thousand were currently exercisable. As of December 31, 2018, 713 thousand shares of Company common stock remained available for grants under the Company’s equity incentive plans. Sales of substantial amounts of Company common stock in the public market could adversely affect the market price of its common stock.

The Company’s payment of dividends on common stock could be eliminated or reduced.

Holders of the Company’s common stock are entitled to receive dividends only when, as and if declared by the Company’s Board of Directors. Although the Company has historically paid cash dividends on the Company’s common stock, the Company is not required to do so and the Company’s Board of Directors could reduce or eliminate the Company’s common stock dividend in the future.

-10-

The Company could repurchase shares of its common stock at price levels considered excessive.

The Company repurchases and retires its common stock in accordance with Board of Directors-approved share repurchase programs. At December 31, 2018, approximately 1.8 million shares remained available to repurchase under such plans. The Company has been active in repurchasing and retiring shares of its common stock when alternative uses of excess capital, such as acquisitions, have been limited. The Company could repurchase shares of its common stock at price levels considered excessive, thereby spending more cash on such repurchases as deemed reasonable and effectively retiring fewer shares than would be retired if repurchases were effected at lower prices.

Risks Related to the Nature and Geographical Location of the Company’s Business

The Company invests in loans that contain inherent credit risks that may cause the Company to incur losses.

The risk that borrowers may not pay interest or repay their loans as agreed is an inherent risk of the banking business. The company mitigates this risk by adhering to sound and proven underwriting practices, managed by experienced and knowledgeable credit professionals. Nonetheless, the Company may incur losses on loans that meet its underwriting criteria, and these losses may exceed the amounts set aside as reserves. The Company can provide no assurance that the credit quality of the loan portfolio will not deteriorate in the future and that such deterioration will not adversely affect the Company or its results of operations.

The Company’s operations are concentrated geographically in California, and poor economic conditions may cause the Company to incur losses.

Substantially all of the Company’s business is located in California. A portion of the loan portfolio of the Company is dependent on real estate. At December 31, 2018, real estate served as the principal source of collateral with respect to approximately 55% of the Company’s loan portfolio. The Company’s financial condition and operating results will be subject to changes in economic conditions in California. The California economy was severely affected by the recessionary period of 2008 to 2009. Much of the California real estate market experienced a decline in values of varying degrees. This decline had an adverse impact on the business of some of the Company’s borrowers and on the value of the collateral for many of the Company’s loans. Generally, the counties surrounding and near San Francisco Bay have recovered more soundly from the recent recession than counties in the California “Central Valley,” from Sacramento in the north to Bakersfield in the south. Approximately 22% of the Company’s loans are to borrowers in the California “Central Valley.” Economic conditions in California’s diverse geographic markets can be vastly different and are subject to various uncertainties, including the condition of the construction and real estate sectors, the effect of drought on the agricultural sector and its infrastructure, and the California state and municipal governments’ budgetary and fiscal conditions. The Company can provide no assurance that conditions in any sector or geographic market of the California economy will not deteriorate in the future and that such deterioration will not adversely affect the Company.

The markets in which the Company operates are subject to the risk of earthquakes, fires, storms and other natural disasters.

All of the properties of the Company are located in California. Also, most of the real and personal properties which currently secure a majority of the Company’s loans are located in California. Further, the Company invests in securities issued by companies and municipalities operating throughout the United States, and in mortgage-backed securities collateralized by real property located throughout the United States. California and other regions of the United States are prone to earthquakes, brush and wildfires, flooding, drought and other natural disasters. In addition to possibly sustaining uninsured damage to its own properties, if there is a major earthquake, flood, drought, fire or other natural disaster, the Company faces the risk that many of its debtors may experience uninsured property losses, or sustained business or employment interruption and/or loss which may materially impair their ability to meet the terms of their debt obligations. A major earthquake, flood, prolonged drought, fire or other natural disaster in California or other regions of the United States could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows.

Adverse changes in general business or economic conditions could have a material adverse effect on the Company’s financial condition and results of operations.

A sustained or continuing weakness or weakening in business and economic conditions generally or specifically in the principal markets in which the Company does business could have one or more of the following adverse impacts on the Company’s business:

| · | a decrease in the demand for loans and other products and services offered by the Company; |

| · | an increase or decrease in the usage of unfunded credit commitments; |

| · | an increase or decrease in the amount of deposits; |

| · | a decrease in non-depository funding available to the Company; |

-11-

| · | an impairment of certain intangible assets, including goodwill; |

| · | an increase in the number of clients and counterparties who become delinquent, file for protection under bankruptcy laws or default on their loans or other obligations to the Company, which could result in a higher level of nonperforming assets, net charge-offs, provision for loan losses, reduced interest revenue and cash flows, and valuation adjustments on assets; |

| · | an impairment in the value of investment securities; |

| · | an impairment in the value of life insurance policies owned by the Company; |

| · | an impairment in the value of real estate owned by the Company. |

The 2008 - 2009 financial crisis led to the failure or merger of a number of financial institutions. Financial institution failures can result in further losses as a consequence of defaults on securities issued by them and defaults under contracts entered into with such entities as counterparties. The failure of institutions with FDIC insured deposits can cause the DIF reserve ratio to decline, resulting in increased deposit insurance assessments on surviving FDIC insured institutions. Weak economic conditions can significantly weaken the strength and liquidity of financial institutions.

The Company’s financial performance generally, and in particular the ability of borrowers to pay interest on and repay principal of outstanding loans and the value of collateral securing those loans, are highly dependent upon the business environment in the markets where the Company operates, in the State of California and in the United States as a whole. A favorable business environment is generally characterized by, among other factors, economic growth, healthy labor markets, efficient capital markets, low inflation, high business and investor confidence, and strong business earnings. Unfavorable or uncertain economic and market conditions can be caused by: declines in economic growth, high rates of unemployment, deflation, declines in business activity or consumer, investor or business confidence; limitations on the availability of or increases in the cost of credit and capital; increases in inflation; natural disasters; or a combination of these or other factors.

Such business conditions could adversely affect the credit quality of the Company’s loans, the demand for loans, loan volumes and related revenue, securities valuations, amounts of deposits, availability of funding, results of operations and financial condition.

Regulatory Risks

Restrictions on dividends and other distributions could limit amounts payable to the Company.

As a holding company, a substantial portion of the Company’s cash flow typically comes from dividends paid by the Bank. Various statutory provisions restrict the amount of dividends the Company’s subsidiaries can pay to the Company without regulatory approval. A reduction in subsidiary dividends paid to the Company could limit the capacity of the Company to pay dividends. In addition, if any of the Company’s subsidiaries were to liquidate, that subsidiary’s creditors will be entitled to receive distributions from the assets of that subsidiary to satisfy their claims against it before the Company, as a holder of an equity interest in the subsidiary, will be entitled to receive any of the assets of the subsidiary.

Adverse effects of changes in banking or other laws and regulations or governmental fiscal or monetary policies could adversely affect the Company.

The Company is subject to significant federal and state regulation and supervision, which is primarily for the benefit and protection of the Company’s customers and not for the benefit of investors. In the past, the Company’s business has been materially affected by these regulations.

Laws, regulations or policies, including accounting standards and interpretations currently affecting the Company and the Company’s subsidiaries, may change at any time. Regulatory authorities may also change their interpretation of these statutes and regulations. Therefore, the Company’s business may be adversely affected by any future changes in laws, regulations, policies or interpretations or regulatory approaches to compliance and enforcement including future acts of terrorism, major U.S. corporate bankruptcies and reports of accounting irregularities at U.S. public companies.

Additionally, the Company’s business is affected significantly by the fiscal and monetary policies of the federal government and its agencies. The Company is particularly affected by the policies of the FRB, which regulates the supply of money and credit in the United States of America. Among the instruments of monetary policy available to the FRB are (a) conducting open market operations in U.S. government securities, (b) changing the discount rates of borrowings by depository institutions, (c) changing interest rates paid on balances financial institutions deposit with the FRB, and (d) imposing or changing reserve requirements against certain borrowings by banks and their affiliates. These methods are used in varying degrees and combinations to directly affect the availability of bank loans and deposits, as well as the interest rates charged on loans and paid on deposits. The policies of the FRB may have a material effect on the Company’s business, results of operations and financial condition. Under long- standing policy of the FRB, a BHC is expected to act as a source of financial strength for its subsidiary banks. As a result of that policy, the Company may be required to commit financial and other resources to its subsidiary bank in circumstances where the Company might not otherwise do so.

-12-

Following the recessions of 2008 and 2009, the FRB provided vast amounts of liquidity into the banking system. The FRB purchased large quantities of U.S. government securities, including agency-backed mortgage securities, increasing the demand for such securities thereby reducing interest rates. Interest rates remained historically low through 2016 as the monetary policy of the Federal Open Market Committee (the “FOMC”) was highly accommodative. The FRB began reducing these asset purchase activities in the fourth quarter 2013 and the FOMC began removing monetary stimulus in December 2016 and has increased the federal funds rate by 2.00 percent to 2.50 percent through December 2018. The raised target range for the federal funds rate could reduce liquidity in the markets and cause interest rates to rise, thereby increasing funding costs to the Bank, reducing the availability of funds to the Bank to finance its existing operations, and causing fixed-rate investment securities and loans to decline in value.

Federal and state governments could pass legislation detrimental to the Company’s performance.

As an example, the Company could experience higher credit losses because of federal or state legislation or regulatory action that reduces the amount the Bank's borrowers are otherwise contractually required to pay under existing loan contracts. Also, the Company could experience higher credit losses because of federal or state legislation or regulatory action that limits or delays the Bank's ability to foreclose on property or other collateral or makes foreclosure less economically feasible. Federal, state and local governments could pass tax legislation causing the Company to pay higher levels of taxes.

The FDIC insures deposits at insured financial institutions up to certain limits. The FDIC charges insured financial institutions premiums to maintain the Deposit Insurance Fund. The FDIC may increase premium assessments to maintain adequate funding of the Deposit Insurance Fund.

The behavior of depositors in regard to the level of FDIC insurance could cause our existing customers to reduce the amount of deposits held at the Bank, and could cause new customers to open deposit accounts at the Bank. The level and composition of the Bank's deposit portfolio directly impacts the Bank's funding cost and net interest margin.

Systems, Accounting and Internal Control Risks

The accuracy of the Company’s judgments and estimates about financial and accounting matters will impact operating results and financial condition.

The discussion under “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies” in this Report and the information referred to in that discussion is incorporated by reference in this paragraph. The Company makes certain estimates and judgments in preparing its financial statements. The quality and accuracy of those estimates and judgments will have an impact on the Company’s operating results and financial condition.

A new accounting standard will significantly change the manner in which the Company recognizes credit losses and may have a material impact on the Company’s results of operations, financial condition or liquidity.

In June 2016, the Financial Accounting Standards Board (“FASB”) issued a new accounting update, FASB ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The ASU changes the accounting for estimates for credit losses related to financial assets measured at amortized cost and certain other contracts. The ASU replaces the currently incurred loss model with model based on current expected credit loss (“CECL”), which will accelerate recognition of credit losses. Additionally credit losses relating to debt securities available-for-sale will be recorded through an allowance for credit losses under the new standard. The Company will be required to adopt the ASU provisions on January 1, 2010. The ASU will significantly change the manner in which the Company determines the adequacy of its allowance for loan losses. The Company is evaluating the impact the CECL model will have, but the Company may recognize a one-time cumulative-effect adjustment to its allowance for loan losses as of the beginning of the first reporting period in which the new standard is effective. Any required adjustment to the allowance for loan losses resulting from this change in methodology will be accomplished through an offsetting after-tax-adjustment to shareholders’ equity. Moreover, the CECL model may create more volatility in the level of the allowance for loan losses after adoption. If the Company is required to materially increase the level of its allowance for loan losses for any reason, such increase could adversely affect its business, financial condition and results of operations.

-13-

The Company’s information systems may experience an interruption or breach in security.

The Company relies heavily on communications and information systems, including those of third party vendors and other service providers, to conduct its business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in the Company’s data processing, accounting, customer relationship management and other systems. Communication and information systems failures can result from a variety of risks including, but not limited to, events that are wholly or partially out of the Company’s control, such as telecommunication line integrity, weather, terrorist acts, natural disasters, accidental disasters, unauthorized breaches of security systems, energy delivery systems, cyber attacks, and other events. Although the Company devotes significant resources to maintain and regularly upgrade its systems and processes that are designed to protect the security of the Company’s computer systems, software, networks and other technology assets and the confidentiality, integrity and availability of information belonging to the Company and its customers, there is no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately corrected by the Company or its vendors. The occurrence of any such failures, interruptions or security breaches could damage the Company’s reputation, result in a loss of customer business, subject the Company to additional regulatory scrutiny, or expose the Company to litigation and possible financial liability, any of which could have a material adverse effect on the Company’s financial condition and results of operations.

The Company’s controls and procedures may fail or be circumvented.

Management regularly reviews and updates the Company’s internal control over financial reporting, disclosure controls and procedures, and corporate governance policies and procedures. The Company maintains controls and procedures to mitigate against risks such as processing system failures and errors, and customer or employee fraud, and maintains insurance coverage for certain of these risks. Any system of controls and procedures, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Events could occur which are not prevented or detected by the Company’s internal controls or are not insured against or are in excess of the Company’s insurance limits or insurance underwriters’ financial capacity. Any failure or circumvention of the Company’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Company’s business, results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

Branch Offices and Facilities

Westamerica Bank is engaged in the banking business through 80 branch offices in 21 counties in Northern and Central California. WAB believes all of its offices are constructed and equipped to meet prescribed security requirements.

The Company owns 28 banking office locations and one centralized administrative service center facility and leases 58 facilities. Most of the leases contain renewal options and provisions for rental increases, principally for changes in the cost of living index, and for changes in other operating costs such as property taxes and maintenance.

Due to the nature of its business, the Company is subject to various threatened or filed legal cases. Based on the advice of legal counsel, the Company does not expect such cases will have a material, adverse effect on its financial position or results of operations. Legal liabilities are accrued when obligations become probable and the amount can be reasonably estimated. In the third quarter 2018, the Company achieved a mediated settlement to dismiss a lawsuit, subject to court approval, and accrued a liability for $3,500 thousand.

The Company has determined that it will be obligated to provide refunds of revenue recognized in years prior to 2017 to some customers. The Company estimates the probable amount of these obligations will be $5,542 thousand and accrued a liability for such amount in 2017; the estimated liability is subject to revision.

-14-

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is traded on the NASDAQ Stock Market (“NASDAQ”) under the symbol “WABC”. The following table shows the high and the low sales prices for the common stock, for each quarter, as reported by NASDAQ:

| High | Low | |||||||

| 2018: | ||||||||

| First quarter | $ | 62.52 | $ | 55.72 | ||||

| Second quarter | 60.68 | 55.81 | ||||||

| Third quarter | 64.52 | 57.56 | ||||||

| Fourth quarter | 63.20 | 52.75 | ||||||

| 2017: | ||||||||

| First quarter | $ | 64.07 | $ | 54.12 | ||||

| Second quarter | 57.78 | 51.31 | ||||||

| Third quarter | 59.54 | 49.54 | ||||||

| Fourth quarter | 63.03 | 53.96 | ||||||

As of January 31, 2019, there were approximately 5,500 shareholders of record of the Company’s common stock.

The Company has paid cash dividends on its common stock in every quarter since its formation in 1972. See Item 8, Financial Statements and Supplementary Data, Note 20 to the consolidated financial statements for recent quarterly dividend information. It is currently the intention of the Board of Directors of the Company to continue payment of cash dividends on a quarterly basis. There is no assurance, however, that any dividends will be paid since they are dependent upon earnings, cash balances, financial condition and capital requirements of the Company and its subsidiaries as well as policies of the FRB pursuant to the BHCA. See Item 1, “Business - Supervision and Regulation.”

The notes to the consolidated financial statements included in this Report contain additional information regarding the Company’s capital levels, capital structure, regulations affecting subsidiary bank dividends paid to the Company, the Company’s earnings, financial condition and cash flows, and cash dividends declared and paid on common stock.

[The remainder of this page intentionally left blank]

-15-

Stock performance

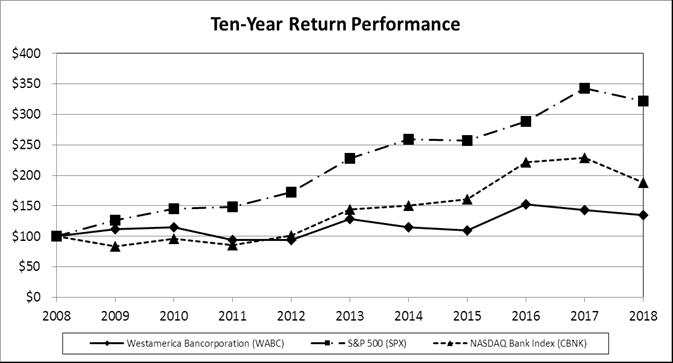

The following chart compares the cumulative return on the Company’s stock during the ten years ended December 31, 2018 with the cumulative return on the S&P 500 composite stock index and NASDAQ’S Bank Index. The comparison assumes $100 invested in each on December 31, 2008 and reinvestment of all dividends.

| December 31, | ||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |||||||||||||||||||

| Westamerica Bancorporation (WABC) | $ | 100.00 | $ | 111.42 | $ | 114.64 | $ | 93.54 | $ | 93.76 | $ | 128.29 | ||||||||||||

| S&P 500 (SPX) | 100.00 | 126.47 | 145.55 | 148.59 | 172.34 | 228.11 | ||||||||||||||||||

| NASDAQ Bank Index (CBNK) | 100.00 | 83.71 | 95.57 | 85.53 | 101.55 | 143.89 | ||||||||||||||||||

| December 31, | ||||||||||||||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||||||

| Westamerica Bancorporation (WABC) | $ | 114.86 | $ | 109.95 | $ | 152.39 | $ | 143.47 | $ | 134.59 | ||||||||||

| S&P 500 (SPX) | 259.26 | 257.61 | 288.10 | 343.35 | 322.05 | |||||||||||||||

| NASDAQ Bank Index (CBNK) | 150.96 | 161.07 | 221.80 | 228.93 | 188.40 | |||||||||||||||

[The remainder of this page intentionally left blank]

-16-

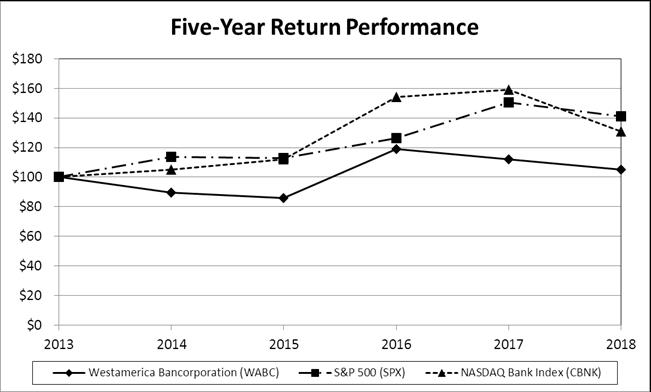

The following chart compares the cumulative return on the Company’s stock during the five years ended December 31, 2018 with the cumulative return on the S&P 500 composite stock index and NASDAQ’S Bank Index. The comparison assumes $100 invested in each on December 31, 2013 and reinvestment of all dividends.

| December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||||||||

| Westamerica Bancorporation (WABC) | $ | 100.00 | $ | 89.53 | $ | 85.71 | $ | 118.79 | $ | 111.83 | $ | 104.91 | ||||||||||||

| S&P 500 (SPX) | 100.00 | 113.65 | 112.93 | 126.30 | 150.52 | 141.18 | ||||||||||||||||||

| NASDAQ Bank Index (CBNK) | 100.00 | 104.91 | 111.94 | 154.15 | 159.10 | 130.93 | ||||||||||||||||||

ISSUER PURCHASES OF EQUITY SECURITIES

The table below sets forth the information with respect to purchases made by or on behalf of Westamerica Bancorporation or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934), of common stock during the quarter ended December 31, 2018 (in thousands, except per share data).

| 2018 | ||||||||||||||||

| Period | (a) Total Number of shares Purchased | (b) Average Price Paid per Share | (c) Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||

| (In thousands, except exercise price) | ||||||||||||||||

| October 1 through October 31 | - | $ | - | - | 1,750 | |||||||||||

| November 1 through November 30 | - | - | - | 1,750 | ||||||||||||

| December 1 through December 31 | - | - | - | 1,750 | ||||||||||||

| Total | - | $ | - | - | 1,750 | |||||||||||

The Company repurchases shares of its common stock in the open market to optimize the Company’s use of equity capital and enhance shareholder value and with the intention of lessening the dilutive impact of issuing new shares under stock option plans, and other ongoing requirements.

-17-

No shares were repurchased during the period from October 1, 2018 through December 31, 2018. A program approved by the Board of Directors on July 26, 2018 authorizes the purchase of up to 1,750 thousand shares of the Company’s common stock from time to time prior to September 1, 2019.

[The remainder of this page intentionally left blank]

-18-

ITEM 6. SELECTED FINANCIAL DATA

The following financial information for the five years ended December 31, 2018 has been derived from the Company’s audited consolidated financial statements. This information should be read in conjunction with those statements, notes and other information included elsewhere herein.

WESTAMERICA BANCORPORATION

FINANCIAL SUMMARY

| For the Years Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| (In thousands, except per share data and ratios) | ||||||||||||||||||||

| Interest and loan fee income | $ | 151,723 | $ | 138,312 | $ | 135,919 | $ | 136,529 | $ | 140,209 | ||||||||||

| Interest expense | 1,959 | 1,900 | 2,116 | 2,424 | 3,444 | |||||||||||||||

| Net interest and loan fee income | 149,764 | 136,412 | 133,803 | 134,105 | 136,765 | |||||||||||||||

| (Reversal of) provision for loan losses | - | (1,900 | ) | (3,200 | ) | - | 2,800 | |||||||||||||

| Noninterest income: | ||||||||||||||||||||

| Equity securities (losses) gains | (52 | ) | 7,955 | - | - | - | ||||||||||||||

| Other noninterest income | 48,201 | 48,673 | 46,574 | 47,867 | 51,787 | |||||||||||||||

| Total noninterest income | 48,149 | 56,628 | 46,574 | 47,867 | 51,787 | |||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Loss contingency | 3,500 | 5,542 | 3 | - | - | |||||||||||||||

| Other noninterest expense | 103,416 | 102,226 | 103,617 | 105,300 | 106,799 | |||||||||||||||

| Total noninterest expense | 106,916 | 107,768 | 103,620 | 105,300 | 106,799 | |||||||||||||||

| Income before income taxes | 90,997 | 87,172 | 79,957 | 76,672 | 78,953 | |||||||||||||||

| Income tax provision | 19,433 | 37,147 | 21,104 | 17,919 | 18,307 | |||||||||||||||

| Net income | $ | 71,564 | $ | 50,025 | $ | 58,853 | $ | 58,753 | $ | 60,646 | ||||||||||

| Average common shares outstanding | 26,649 | 26,291 | 25,612 | 25,555 | 26,099 | |||||||||||||||

| Average diluted common shares outstanding | 26,756 | 26,419 | 25,678 | 25,577 | 26,160 | |||||||||||||||

| Common shares outstanding at December 31, | 26,730 | 26,425 | 25,907 | 25,528 | 25,745 | |||||||||||||||

| Per common share: | ||||||||||||||||||||

| Basic earnings | $ | 2.69 | $ | 1.90 | $ | 2.30 | $ | 2.30 | $ | 2.32 | ||||||||||

| Diluted earnings | 2.67 | 1.89 | 2.29 | 2.30 | 2.32 | |||||||||||||||

| Book value at December 31, | 23.03 | 22.34 | 21.67 | 20.85 | 20.45 | |||||||||||||||

| Financial ratios: | ||||||||||||||||||||