form10k2013.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year ended December 28, 2013

OR

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________________ to _______________

Commission File Number 0-599

THE EASTERN COMPANY

(Exact name of registrant as specified in its charter)

|

Connecticut

|

06-0330020

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

112 Bridge Street, Naugatuck, Connecticut

|

06770

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (203) 729-2255

Securities registered pursuant to Section 12(b) of the Act: Common Stock No Par Value The NASDAQ Stock Market LLC

(Title of each class) (Name of each exchange

on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [X]

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [ ]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of June 29, 2013, the last day of registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was $89,106,240 (based on the closing sales price of the registrant’s common stock on the last trading date prior to that date). Shares of the registrant’s common stock held by each officer and director and shares held in trust by the pension plans of the Company have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 28, 2014, 6,222,168 shares of the registrant’s common stock, no par value per share, were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the annual proxy statement dated March 12, 2014 are incorporated by reference into Part III.

The Eastern Company

Form 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 28, 2013

TABLE OF CONTENTS

| |

|

Page

|

| |

Table of Contents

|

2.

|

| |

|

|

| |

Safe Harbor Statement

|

3.

|

| |

|

|

|

PART I

|

|

|

|

Item 1.

|

Business

|

4.

|

| |

|

|

|

Item 1A.

|

Risk Factors

|

6.

|

| |

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

10.

|

| |

|

|

|

Item 2.

|

Properties

|

10.

|

| |

|

|

|

Item 3.

|

Legal Proceedings

|

11.

|

| |

|

|

|

Item 4.

|

Mine Safety Disclosures

|

11.

|

| |

|

|

|

PART II

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related

|

|

| |

Stockholder Matters and Issuer Purchases of Equity Securities

|

12.

|

| |

|

|

|

Item 6.

|

Selected Financial Data

|

14.

|

| |

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial

|

|

| |

Condition and Results of Operations

|

14.

|

| |

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures

|

|

| |

About Market Risk

|

27.

|

| |

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

28.

|

| |

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on

|

|

| |

Accounting and Financial Disclosure

|

57.

|

| |

|

|

|

Item 9A.

|

Controls and Procedures

|

57.

|

| |

|

|

|

Item 9B.

|

Other Information

|

59.

|

| |

|

|

|

PART III

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

59.

|

| |

|

|

|

Item 11.

|

Executive Compensation

|

59.

|

| |

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management

|

|

| |

and Related Stockholder Matters

|

60.

|

| |

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director

|

|

| |

Independence

|

60.

|

| |

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

60.

|

| |

|

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

60.

|

| |

|

|

| |

Signatures

|

63.

|

| |

|

|

| |

Exhibit Index

|

64.

|

2

SAFE HARBOR STATEMENT

UNDER THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements reflect the Company’s current expectations regarding its products, its markets and its future financial and operating performance. These statements, however, are subject to risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from those expected. Such risks and uncertainties include, but are not limited to, unanticipated slowdowns in the Company’s major markets, changing customer preferences, lack of success of new products, loss of customers, competition, increased raw material prices, problems associated with foreign sourcing of parts and products, worldwide conditions and foreign currency fluctuations that may affect results of operations, and other factors discussed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company is not obligated to update or revise the aforementioned statements for those new developments.

3

PART I

(a) General Development of Business

The Eastern Company (the “Company”) was incorporated under the laws of the State of Connecticut in October, 1912, succeeding a co-partnership established in October, 1858.

The business of the Company is the manufacture and sale of industrial hardware, security products and metal products from four U.S. operations and seven wholly-owned foreign subsidiaries. The Company maintains eleven physical locations.

RECENT DEVELOPMENTS

In July 2013, the Board of Directors of the Company voted to increase the quarterly dividend by 10% effective in the third quarter of 2013.

In July 2013, the Company obtained a business license for a new subsidiary, Dongguan Reeworld Security Products Ltd. The subsidiary is located in Dongguan, China and was established to replace a contract manufacturer supplying lock products primarily for the Security Products segment of the Company.

On December 14, 2012 the Company paid a one-time extra dividend of $0.10 per share in addition to its 289th regular consecutive quarterly dividend of $0.10 per share.

In February 2012, the Board of Directors of the Company voted to increase the quarterly dividend by 11% effective in the first quarter of 2012.

On December 15, 2011 the Company voluntarily transferred its stock exchange listing from the NYSE Amex Exchange to The NASDAQ Stock Market LLC.

(b) Financial Information about Industry Segments

Financial information about industry segments is included in Note 10 to the Company’s financial statements, included at Item 8 of this Annual Report on Form 10-K.

(c) Narrative Description of Business

The Company operates in three business segments: Industrial Hardware, Security Products and Metal Products.

Industrial Hardware

The Industrial Hardware segment consists of Eberhard Manufacturing, Eberhard Hardware Manufacturing Ltd., Canadian Commercial Vehicles Corporation, Eastern Industrial Ltd. and Sesamee Mexicana, S.A. de C.V. The units design, manufacture and market a diverse product line of industrial and vehicular hardware throughout North America. The segment’s locks, latches, hinges, handles, lightweight honeycomb composite structures and related hardware can be found on tractor-trailer trucks, moving vans, off-road construction and farming equipment, school buses, military vehicles and recreational boats. They are also used on pickup trucks, sport utility vehicles and fire and rescue vehicles. In addition, the segment manufactures a wide selection of fasteners and other closure devices used to secure access doors on various types of industrial equipment such as metal cabinets, machinery housings and electronic instruments. Eastern Industrial expands the range of offerings of this segment to include plastic injection molding.

Typical products include passenger restraint locks, slam and draw latches, dead bolt latches, compression latches, cam-type vehicular locks, hinges, tool box locks, light-weight sleeper boxes and vents for Class 8 trucks and school bus door closure hardware. The products are sold directly to original equipment manufacturers and to distributors through a distribution channel consisting of in-house salesmen and outside sales representatives. Sales and customer service efforts are concentrated through in-house sales personnel where greater representation of our diverse product lines can be promoted across a variety of markets.

The Industrial Hardware segment sells its products to a diverse array of markets, such as the truck, bus and automotive industries as well as to the industrial equipment, military and marine sectors. Although service, quality and price are major

4

criteria for servicing these markets, the continued introduction of new or improved product designs and the acquisition of synergistic product lines are vital for maintaining and increasing market share.

Security Products

The Security Products segment, made up of Greenwald Industries, Illinois Lock Company/CCL Security Products/Royal Lock, World Lock Company Ltd., Dongguan Reeworld Security Products Ltd. and World Security Industries Ltd., is a leading manufacturer of security products. This segment manufactures electronic and mechanical locking devices, both keyed and keyless, for the computer, electronics, vending and gaming industries. The segment also supplies its products to the luggage, furniture, laboratory equipment and commercial laundry industries. Greenwald manufactures and markets coin acceptors and other coin security products used primarily in the commercial laundry markets, as well as hardware and accessories for the appliance industry. In addition, the segment provides a new level of security for the access control, municipal parking and vending markets through the use of “smart card” technology.

Greenwald’s products include timers, drop meters, coin chutes, money boxes, meter cases, smart cards, value transfer stations, smart card readers, card management software, access control units, oven door latches, oven door switches and smoke eliminators. Illinois Lock Company/CCL Security Products/Royal Lock sales include cabinet locks, cam locks, electric switch locks, tubular key locks and combination padlocks. Many of the products are sold under the names SEARCHALERT™, PRESTOSEAL™, DUO, WARLOCK™, SESAMEE®, BIG TAG®, PRESTOLOCK® and HUSKI™. These products are sold to original equipment manufacturers, distributors, route operators, and locksmiths via in-house salesmen and outside sales representatives. Sales efforts are concentrated through national and regional sales personnel where greater representation of our diverse product lines can be promoted across a variety of markets.

The Security Products segment continuously seeks new markets where it can offer competitive pricing and provide customers with engineered solutions for their security needs.

Metal Products

The Metal Products segment, based at the Company’s Frazer & Jones facility, is the largest and most efficient producer of expansion shells for use in supporting the roofs of underground mines. This segment also manufactures specialty malleable and ductile iron castings.

Typical products include mine roof support anchors, couplers for railroad braking systems, adjustable clamps for construction and fittings for electrical installations. Mine roof support anchors are sold to distributors and directly to mines, while specialty castings are sold to original equipment manufacturers.

Although there has been strong demand for our mine roof support products in recent years, the Metal Products segment is actively developing new products to replace any softening in future sales volume of mining products that may result from the new EPA clean air regulations or competitive pricing from natural gas that may impact demand for coal.

General

Raw materials and outside services were readily available from domestic sources for all of the Company’s segments during 2013 and are expected to be readily available in 2014 and the foreseeable future. The Company also obtains materials from Asian affiliated and nonaffiliated sources. The Company has not experienced any significant problems obtaining material from its Asian sources in 2013 and does not expect any such problems in 2014. In 2011, 2012 and 2013, the Company experienced price increases for many of the raw materials used in producing its products, including: scrap iron, zinc, brass and stainless steel. The Company expects raw material prices to continue increasing as demand for raw materials increases as the world economy grows. These raw material cost increases could negatively impact the Company’s gross margin if raw material prices increase too rapidly for the Company to recover those cost increases through either price increases to our customers or cost reductions in other areas of the businesses.

Patent protection for the various product lines within the Company is limited, but is sufficient to protect the Company’s competitive positions. Foreign sales and license agreements are not significant.

None of the Company’s business segments are seasonal.

The Company, across all of its business segments, has increased its emphasis on sales and customer service by fulfilling the rapid delivery requirements of our customers. As a result, investments in additional inventories are made on a selective basis.

5

Customer lists for all business segments are broad-based geographically and by markets, and sales are generally not highly concentrated by customer. One customer of the Metal Products segment, Jennmar Corporation, accounted for 11.5% of the Company’s consolidated sales in 2013. No other customer exceeded 10% of total consolidated sales in 2013, 2012 or 2011.

The dollar amount of the backlog of orders received by the Company believed to be firm as of the fiscal year end December 28, 2013 is $21,494,000, as compared to $20,281,000 at December 29, 2012. The primary reasons for the increase from 2012 to 2013 was the timing of orders received from customers.

The Company encounters competition in all of its business segments. The Company has been successful in dealing with this competition by offering high quality diversified products with the flexibility of meeting customer needs on a timely basis. This is accomplished by effectively using internal engineering resources and cost effective manufacturing capabilities, expanding product lines through product development and acquisitions, and maintaining sufficient inventory for fast turnaround of customer orders. Imports from Asia and Latin America with favorable currency exchange rates and low cost labor have created additional competitive pressures. The Company currently utilizes four wholly-owned subsidiaries in Asia to help offset offshore competition.

Research and development expenditures in 2013 were $991,000 and represented less than 1% of gross revenues. In 2012 and 2011 they were $814,000 and $826,000, respectively. The research costs are primarily attributable to the Greenwald Industries and Eberhard Mfg. divisions. Greenwald performs ongoing research, in both the mechanical and smart card product lines, which is necessary in order to remain competitive and to continue to provide technologically advanced smart card systems. Eberhard develops new products for the various markets they serve based on changing customer requirements to remain competitive. Other research projects include the development of various locks, and transportation and industrial hardware products.

The Company does not anticipate that compliance with federal, state or local environmental laws or regulations will have a material effect on the Company’s capital expenditures, earnings or competitive position.

The average number of employees in 2013 was 737.

(d) Financial Information about Geographic Areas

The Company includes four separate operating divisions located within the United States, two wholly-owned Canadian subsidiaries (one located in Tillsonburg, Ontario, Canada, and one in Kelowna, British Columbia, Canada), a wholly-owned Taiwanese subsidiary located in Taipei, Taiwan, a wholly-owned subsidiary in Hong Kong, two wholly-owned Chinese subsidiaries (one located in Shanghai, China, and one located in Dongguan, China) and a wholly-owned subsidiary in Lerma, Mexico.

Individually, the Canadian, Taiwanese, Hong Kong, Chinese and Mexican subsidiaries’ revenue and assets are not significant. Substantially all other revenues are derived from customers located in the United States.

Financial information about foreign and domestic operations’ revenues and identifiable assets is included in Note 10 to the Company’s financial statements, included at Item 8 of this Annual Report on Form 10-K. Information about risks attendant to the Company’s foreign operations is set forth at Item 1A of this Annual Report on Form 10-K.

(e) Available Information

The Company makes available, free of charge through its Internet website at http://www.easterncompany.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room, 450 Fifth Street, N.W., Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. The Company’s reports filed with, or furnished to, the SEC are also available on the SEC’s website at www.sec.gov.

In addition to the other information contained in this Form 10-K and the exhibits hereto and the Company’s other filings with the SEC, the following risk factors should be considered carefully in evaluating the Company’s business. The Company’s business, financial condition or results of operation could be materially adversely affected by any of these risks or additional

6

risks not presently known to the Company, or by risks the Company currently deems immaterial which may also adversely affect its business, financial condition, or results of operations, such as: changes in the economy, including changes in inflation, tax rates and interest rates; risk associated with possible disruption in the Company’s operations due to terrorism and other manmade or natural disasters; future regulatory actions, legal issues or environmental matters; loss of, or changes in, executive management; and changes in accounting standards which are adverse to the Company. Also, there can be no assurance that the Company has correctly identified and appropriately assessed all factors affecting its business or that information publicly available with respect to these matters is complete and correct.

The Company’s business is subject to risks associated with conducting business overseas.

International operations could be adversely affected by changes in political and economic conditions, trade protection measures, restrictions on repatriation of earnings, differing intellectual property rights, and changes in regulatory requirements that restrict the sales of products or increase costs. Changes in exchange rates between the U.S. dollar and other currencies could result in increases or decreases in earnings, and may adversely affect the value of the Company’s assets outside the United States. The Company’s operations are also subject to the effects of international trade agreements and regulations. Although generally these trade agreements have positive effects, they can also impose requirements that adversely affect the Company’s business, such as setting quotas on product that may be imported from a particular country into the Company’s key markets in North America.

The Company’s ability to import products in a timely and cost-effective manner may also be affected by conditions at ports or issues that otherwise affect transportation and warehousing providers, such as port and shipping capacity, labor disputes, severe weather or increased homeland security requirements in the United States or other countries. These issues could delay importation of products or require the Company to locate alternative ports or warehousing providers to avoid disruption to customers. These alternatives may not be available on short notice or could result in higher transit costs, which could have an adverse impact on the Company’s business, financial conditions or results of operations.

See also “ITEM 7A - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK” of this Form 10-K.

In addition, the Company’s growth strategy involves expanding sales of its products into foreign markets. There is no guarantee that the Company’s products will be accepted by foreign customers or how long it may take to develop sales of the Company’s products in these foreign markets.

Increases in the price or reduced availability of raw materials.

Raw materials needed to manufacture products are obtained from numerous suppliers. Under normal market conditions, these raw materials are readily available on the open market from a variety of producers. However, from time to time the prices and availability of these raw materials fluctuate, which could impair the Company’s ability to procure the required raw materials for its operations or increase the cost of manufacturing its products. If the price of raw materials increases, the Company may be unable to pass these increases on to its customers and could experience reduction to its profit margins. Also, any decrease in the availability of raw materials could impair the Company’s ability to meet production requirements in a timely manner.

Increased competition in the markets the Company services could impact revenues and earnings.

Any change in competition may result in lost market share or reduced prices, which could result in reduced profit margins. This may impair the ability to grow or even maintain current levels of revenues and earnings. While the Company has an extensive customer base, loss of certain customers could adversely affect the Company’s business, financial condition or results of operations until such business is replaced, and no assurances can be made that the Company would be able to regain or replace any lost customers.

The Company is required to evaluate its internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002.

The Company is an “accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, and is required to comply with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires the Company to include in its report management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of the end of the fiscal period for which the Company is filing its Form 10-K. This report must also include disclosure of any material

7

weaknesses in internal control over financial reporting that the Company has identified. Additionally, the Company’s independent registered public accounting firm is required to issue a report on the Company’s internal control over financial reporting and their evaluation of the operating effectiveness of the Company’s internal control over financial reporting. The Company’s assessment requires it to make subjective judgments, and the independent registered public accounting firm may not agree with the Company’s assessment. If the Company or its independent registered public accounting firm were unable to complete the assessments within the period prescribed by Section 404 and thus be unable to conclude that the internal control over financial reporting is effective, investors could lose confidence in the Company’s reported financial information, which could have an adverse effect on the market price of the Company’s common stock or impact the Company’s borrowing ability. In addition, changes in operating conditions and changes in compliance with policies and procedures currently in place may result in inadequate internal control over financial reporting in the future.

The inability to identify or complete acquisitions could limit future growth.

As part of its growth strategy, the Company continues to pursue acquisitions of complementary products or businesses. The ability to grow through acquisitions depends upon the Company’s ability to identify, negotiate, complete and integrate suitable acquisitions. The Company makes certain assumptions based on the information provided by potential acquisition candidates and also conducts due diligence to ensure the information provided is accurate and based on reasonable assumptions. However, the Company may be unable to realize the anticipated benefits from an acquisition or predict accurately how an acquisition will ultimately affect the business, financial condition or results of operations.

Demand for new products and the inability to develop and introduce new competitive products at favorable profit margins could adversely affect the Company’s performance and prospects for future growth, and the Company would not be positioned to maintain current levels of revenues and earnings.

The uncertainties associated with developing and introducing new products, such as the market demands and the costs of development and production, may impede the successful development and introduction of new products. Acceptance of the new products may not meet sales expectations due to several factors, such as the Company’s failure to accurately predict market demand or its inability to resolve technical issues in a timely and cost-effective manner. Additionally, the inability to develop new products on a timely basis could result in the loss of business to competitors.

The Company could be subject to litigation which could have a material impact on the Company’s business, financial condition or results of operations.

From time to time, the Company’s operations are parties to or targets of lawsuits, claims, investigations and proceedings, including product liability, personal injury, patent and intellectual property, commercial, contract, environmental and employment matters, which are defended and settled in the ordinary course of business. While the Company is unable to predict the outcome of any of these matters, it does not believe, based upon currently available information, that the resolution of any pending matter will have a material adverse effect on its business, financial condition or results of operations. See “ITEM 3 – LEGAL PROCEEDINGS” in this Form 10-K for a discussion of current litigation.

The Company could be subject to additional tax liabilities.

The Company is subject to income tax laws in the United States, its states and municipalities and those of other foreign jurisdictions in which the Company has business operations. These laws are complex and subject to interpretations by the taxpayer and the relevant governmental taxing authorities. Significant judgment and interpretation is required in determining the Company’s worldwide provision for income taxes. In the ordinary course of business, transactions arise where the ultimate tax determination is uncertain. Although the Company believes its tax estimates are reasonable, the final outcome of tax audits and any related litigation could be materially different from that which is reflected in historical income tax provisions and accruals. Based on the status of a given tax audit or related litigation, a material effect on the Company’s income tax provision or net income may result during the period or periods from the initial recognition of a particular matter in the Company’s reported financial results to the final closure of that tax audit or settlement of related litigation when the ultimate tax and related cash flow is known with certainty.

8

The Company’s goodwill or indefinite-lived intangible assets may become impaired, which could require a significant charge to earnings to be recognized.

Under accounting principles generally accepted in the United States, goodwill and indefinite-lived intangible assets are not amortized but are reviewed for impairment at least annually. Future operating results used in the assumptions, such as sales or profit forecasts, may not materialize, and the Company could be required to record a significant charge to earnings in the financial statements during the period in which any impairment is determined, resulting in an unfavorable impact on our results of operations. Numerous assumptions are used in the evaluation of impairment, and there is no guarantee that the Company’s independent registered public accounting firm would reach the same conclusion as the Company or an independent valuation firm, which could result in a disagreement between management and the independent registered public accounting firm.

The Company may need additional capital in the future, and it may not be available on acceptable terms, if at all.

From time-to-time, the Company has historically relied on outside financing to fund expanded operations, capital expenditure programs and acquisitions. The Company may require additional capital in the future to fund operations or strategic opportunities. The Company cannot be assured that additional financing will be available on favorable terms, or at all. In addition, the terms of available financing may place limits on the Company’s financial and operating flexibility. If the Company is unable to obtain sufficient capital in the future, the Company may not be able to expand or acquire complementary businesses and may not be able to continue to develop new products or otherwise respond to changing business conditions or competitive pressures.

The Company’s stock price is highly volatile due to low float, which is the number of shares of the Company’s common stock that are outstanding and available for trading by the public.

The Company’s stock price may change dramatically when buyers seeking to purchase shares of the Company’s common stock exceed the shares available on the market, or when there are no buyers to purchase shares of the Company’s common stock when shareholders are trying to sell their shares.

The Company may not be able to reach acceptable terms for contracts negotiated with its labor unions and be subject to work stoppages or disruption of production.

During 2014, union contracts covering approximately 3% of the total workforce of the Company will expire. The Company has been successful in negotiating new contracts over the years, but cannot guarantee that will continue. Failure to negotiate new union contracts could result in disruption of production, inability to deliver product or a number of unforeseen circumstances, any of which could have an unfavorable material impact on the Company’s results of operations or financial statements.

Deterioration in the creditworthiness of several major customers could have a material impact on the Company’s business, financial condition or results of operations.

Included as a significant asset on the Company’s balance sheet are accounts receivable from our customers. If several large customers become insolvent or otherwise unable to pay for products, or become unwilling or unable to make payments in a timely manner, it could have an unfavorable material impact on the Company’s results of operations or financial statements. Although the Company is not dependent on any one customer, deterioration in several large customers at the same time could have an unfavorable material impact on the Company’s results of operations or financial statements. No customers exceeded 10% of total accounts receivable for 2013 or 2012. At the end of 2011 only one customer had an outstanding accounts receivable balance that exceeded 10% of total accounts receivable.

The Company’s operating results may fluctuate, which makes the results of operations difficult to predict and could cause the results to fall short of expectations.

The Company’s operating results may fluctuate as a result of a number of factors, many outside of our control. As a result, comparing the Company’s operating results on a period-to-period basis may not be meaningful, and past results should not be relied upon as an indication of future performance. Quarterly, year to date and annual costs and expenses as a percentage of revenue may differ significantly from historical or projected rates. Future operating results may fall below expectations. These types of events could cause the price of the Company’s stock to fall.

9

New or existing U.S. or foreign laws could subject the Company to claims or otherwise impact the Company’s business, financial condition or results of operations.

The Company is subject to a variety of laws in both the U.S. and foreign countries that are costly to comply with, can result in negative publicity and diversion of management time and effort, and can subject the Company to claims or other remedies.

|

ITEM 1B

|

UNRESOLVED STAFF COMMENTS

|

None.

The corporate office of the Company is located in Naugatuck, Connecticut in a two-story 8,000 square foot administrative building on 3.2 acres of land.

All of the Company’s properties are owned or leased and are adequate to satisfy current requirements. All of the Company’s properties have the necessary flexibility to cover any long-term expansion requirements.

The Industrial Hardware Group includes the following:

The Eberhard Manufacturing Division in Strongsville, Ohio owns 9.6 acres of land and a building containing 157,580 square feet, located in an industrial park. The building is steel frame, one-story, having curtain walls of brick, glass and insulated steel panel. The building has two high bays, one of which houses two units of automated warehousing.

The Eberhard Hardware Manufacturing, Ltd., a wholly-owned Canadian subsidiary in Tillsonburg, Ontario, owns 4.4 acres of land and a building containing 31,000 square feet in an industrial park. The building is steel frame, one-story, having curtain walls of brick, glass and insulated steel panel. It is particularly suited for light fabrication, assembly and warehousing and is adequate for long-term expansion requirements.

The Canadian Commercial Vehicles Corporation (“CCV”), a wholly-owned subsidiary in Kelowna, British Columbia, leases 46,385 square feet of building space located in an industrial park. The building is made from brick and concrete, contains approximately 5,400 square feet of office space on two levels and houses a modern paint booth for finishing our products. The building is protected by a F1 rated fire suppression system and alarmed for fire and security. The current lease expires December 31, 2015 and is renewable.

The Eastern Industrial Ltd., a wholly-owned subsidiary in Shanghai, China, leases brick and concrete buildings containing approximately 47,500 square feet, located in both industrial and commercial areas. A five-year lease was signed in 2009, which expires on March 31, 2014 and is renewable.

The Sesamee Mexicana subsidiary leases 42,588 square feet in a facility located in an industrial park in Lerma, Mexico. The current lease expires November 30, 2015 and is renewable. The building is steel framed with concrete block and glass curtain walls.

The Security Products Group includes the following:

The Greenwald Industries Division in Chester, Connecticut owns 26 acres of land and a building containing 120,000 square feet. The building is steel frame, one story, having brick over concrete blocks.

The Illinois Lock Company/CCL Security Products/Royal Lock Division owns 2.5 acres of land and a building containing 44,000 square feet in Wheeling, Illinois. The building is brick and located in an industrial park.

The World Lock Co. Ltd. subsidiary leases 5,285 square feet located in Taipei, Taiwan. The building is made from brick and concrete and is protected by a fire alarm and sprinklers.

10

The Dongguan Reeworld Security Products Company Ltd. subsidiary was established in July 2013 to manufacture locks and hardware and leases 118,000 square feet of concrete buildings in an industrial park located in Dongguan, China. A five-year lease was signed in 2013, which expires June 30, 2018 and is renewable.

The Metal Products Group consists of:

The Frazer and Jones Division in Solvay, New York owns 17.9 acres of land and buildings containing 205,000 square feet constructed for foundry use. These facilities are well adapted to handle the division’s current and future casting requirements.

All owned properties are free and clear of any encumbrances.

During 2010, the Company was contacted by the State of Illinois regarding potential ground contamination at our plant in Wheeling, Illinois. The Company enlisted into a voluntary remediation program in Illinois and has engaged an environmental clean-up company to perform testing and develop a remediation plan, if needed. No estimate for the cost of any potential remediation was available when this Form 10-K was filed with the SEC.

There are no other legal proceedings, other than ordinary routine litigation incidental to the Company’s business, to which either the Company or any of its subsidiaries is a party or to which any of their property is the subject.

|

ITEM 4

|

MINE SAFETY DISCLOSURES

|

Not applicable.

11

PART II

|

ITEM 5

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

The Company’s common stock is traded on the NASDAQ (ticker symbol EML). The approximate number of record holders of the Company common stock on December 28, 2013 was 436.

High and low stock prices and dividends for the last two years were:

| |

2013

|

|

|

2012

|

| |

Market Price

|

|

|

|

Market Price

|

|

|

Quarter

|

High

|

Low

|

Dividend

|

|

Quarter

|

High

|

Low

|

Dividend

|

|

First

|

$20.00

|

$14.91

|

$.10

|

|

First

|

$20.70

|

$18.45

|

$.10

|

|

Second

|

18.25

|

14.58

|

.10

|

|

Second

|

26.49

|

15.17

|

.10

|

|

Third

|

17.75

|

15.27

|

.11

|

|

Third

|

20.25

|

16.21

|

.10

|

|

Fourth

|

17.99

|

15.39

|

.11

|

|

Fourth

|

18.85

|

13.38

|

.20 #

|

# - The Company paid an additional one-time extra dividend of $0.10 in the fourth quarter of 2012.

The Company expects to continue its policy of paying regular cash dividends, although there is no assurance as to future dividends because they are dependent on future earnings, capital requirements, and financial conditions. The payment of dividends is subject to the restrictions of the Company’s loan agreement if such payment would result in an event of default. See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Note 4 to the Company’s financial statements included at Item 8 of this Annual Report on Form 10-K.

The following table sets forth information regarding securities authorized for issuance under the Company’s equity compensation plans as of December 28, 2013, including the Company’s 1995 and 2010 plans.

|

Equity Compensation Plan Information

|

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

|

Weighted-average exercise price of outstanding options, warrants and rights

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

| |

(a)

|

|

(b)

|

|

(c)

|

|

Equity compensation plans approved by security holders

|

20,0001

|

|

$13.58

|

|

500,0002

|

|

Equity compensation plans not approved by security holders

|

-

|

|

-

|

|

-

|

|

Total

|

20,000

|

|

13.58

|

|

500,000

|

1 Includes options outstanding under the 1995 plan.

2 Includes shares available for future issuance under the 2010 plan.

Each director who is not an employee of the Company (“Outside Director”) is paid a director’s fee for his services at the annual rate of $30,000. All annual fees paid to non-employee members of the Board of Directors of the Company are paid in common stock of the Company or cash, in accordance with the Directors Fee Program adopted by the shareholders on March 26, 1997 and amended on January 5, 2004. The directors make an annual election, within a reasonable time before their first quarterly payment, to receive their fees in the form of cash, stock or a combination thereof. The election remains in force for one year.

There were no issuer sales of any unregistered securities during fiscal years 2013, 2012 or 2011.

There were no issuer purchases of securities during the fourth quarter of 2013. The Company does not have any share repurchase plans or programs.

12

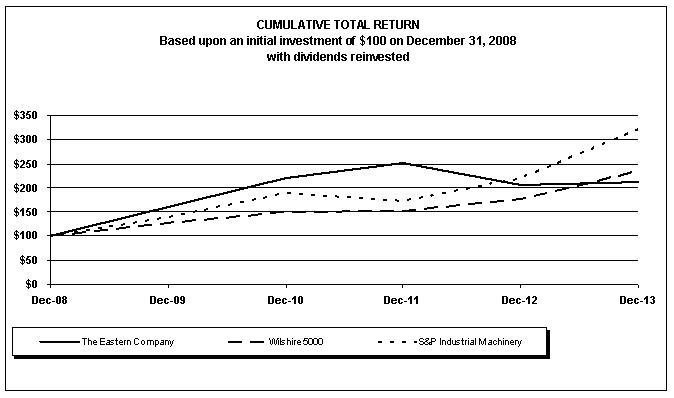

Stock Performance Graph

The following graph sets forth the Company’s cumulative total shareholder return based upon an initial $100 investment made on December 31, 2008 (i.e., stock appreciation plus dividends during the past five fiscal years) compared to the Wilshire 5000 Index and the S&P Industrial Machinery Index.

The Company manufactures and markets a broad range of locks, latches, fasteners and other security hardware that meets the diverse security and safety needs of industrial and commercial customers. Consequently, while the S&P Industrial Machinery Index being used for comparison is the standard index most closely related to the Company, it does not completely represent the Company’s products or market applications. The Wilshire 5000 is a market index made up of 5,000 publicly-traded companies, including those having both large and small capitalization.

| |

Dec. 08

|

Dec. 09

|

Dec. 10

|

Dec. 11

|

Dec. 12

|

Dec. 13

|

|

The Eastern Company

|

$100

|

$160

|

$220

|

$252

|

$205

|

$212

|

|

Wilshire 5000

|

$100

|

$128

|

$150

|

$152

|

$176

|

$234

|

|

S&P Industrial Machinery

|

$100

|

$140

|

$190

|

$172

|

$220

|

$320

|

|

Copyright© 2014 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. (www.researchdatagroup.com/S&P.htm)

|

13

|

ITEM 6

|

SELECTED FINANCIAL DATA

|

| |

2013

|

2012

|

2011

|

2010

|

2009

|

|

INCOME STATEMENT ITEMS (in thousands)

|

|

|

|

|

|

|

Net sales

|

$ 142,458

|

$ 157,509

|

$ 142,856

|

$ 130,130

|

$ 112,665

|

|

Cost of products sold

|

112,311

|

124,157

|

115,504

|

103,458

|

92,031

|

|

Depreciation and amortization

|

3,825

|

3,440

|

3,707

|

3,943

|

4,103

|

|

Interest expense

|

323

|

369

|

231

|

266

|

1,728

|

|

Income before income taxes

|

10,114

|

13,225

|

8,507

|

8,248

|

1,902

|

|

Income taxes

|

3,212

|

4,599

|

3,002

|

2,705

|

865

|

|

Net income

|

6,902

|

8,626

|

5,505

|

5,543

|

1,036

|

|

Dividends #

|

2,613

|

3,109

|

2,224

|

3,182

|

2,155

|

| |

|

|

|

|

|

|

BALANCE SHEET ITEMS (in thousands)

|

|

|

|

|

|

|

Inventories

|

$ 30,658

|

$ 29,385

|

$ 29,793

|

$ 28,190

|

$ 24,520

|

|

Working capital

|

57,379

|

56,920

|

48,681

|

48,262

|

44,280

|

|

Property, plant and equipment, net

|

27,392

|

25,661

|

24,634

|

24,464

|

22,974

|

|

Total assets

|

113,858

|

115,854

|

106,700

|

102,353

|

100,872

|

|

Shareholders’ equity

|

81,505

|

71,582

|

69,158

|

70,044

|

66,597

|

|

Capital expenditures

|

5,524

|

4,217

|

3,395

|

4,733

|

2,226

|

|

Long-term obligations, less current portion

|

4,286

|

6,071

|

3,036

|

3,750

|

4,286

|

| |

|

|

|

|

|

|

PER SHARE DATA

|

|

|

|

|

|

|

Net income per share

|

|

|

|

|

|

|

Basic

|

$ 1.11

|

$ 1.39

|

$ .89

|

$ .91

|

$ .17

|

|

Diluted

|

1.11

|

1.38

|

.89

|

.90

|

.17

|

|

Dividends #

|

.42

|

.50

|

.36

|

.52

|

.36

|

|

Shareholders’ equity (Basic)

|

13.10

|

11.51

|

11.19

|

11.47

|

11.13

|

| |

|

|

|

|

|

|

Average shares outstanding:

|

Basic

|

6,220,928

|

6,216,931

|

6,178,664

|

6,104,711

|

5,985,640

|

| |

Diluted

|

6,237,758

|

6,233,375

|

6,216,193

|

6,192,019

|

6,241,780

|

# - 2012 dividends include a one-time extra payment of $0.10 per share distributed on 12/14/2012. 2010 dividends include a one-time extra payment of $0.16 per share distributed on 12/15/2010.

|

ITEM 7

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Net sales for 2013 decreased 10% to $142.5 million from $157.5 million in 2012. Net income for 2013 decreased 20% to $6.9 million, or $1.11 per diluted share, from $8.6 million, or $1.38 per diluted share in 2012. Net sales in the Industrial Hardware segment decreased approximately 17% in 2013, resulting primarily from weaker demand for lightweight composite products such as the sleeper boxes for the Class 8 truck market and panels used in the electronic white board market and lower demand for Industrial Hardware products sold to the distribution, trailer, truck accessory, service body and military markets. Net sales in the Security Products segment decreased approximately 3% in 2013, primarily due to lower sales volume of products sold to the cash management, computer and commercial laundry markets. The Metal Products segment net sales decreased approximately 5% in 2013, resulting primarily from a reduction in sales of a tie plate for the railroad industry.

14

|

|

Fourth Quarter 2013 Compared to Fourth Quarter 2012

|

The following table shows, for the fourth quarter of 2013 and 2012, selected line items from the consolidated statements of income as a percentage of net sales, by segment.

| |

|

2013 Fourth Quarter

|

|

| |

|

Industrial

|

Security

|

Metal

|

|

|

|

| |

|

Hardware

|

Products

|

Products

|

Total

|

|

|

Net sales

|

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

Cost of products sold

|

|

73.6

|

%

|

73.8

|

%

|

84.1

|

%

|

76.3

|

%

|

|

Gross margin

|

|

26.4

|

%

|

26.2

|

%

|

15.9

|

%

|

23.7

|

%

|

|

Selling and administrative expense

|

|

17.0

|

%

|

17.6

|

%

|

7.6

|

%

|

14.8

|

%

|

|

Operating profit

|

|

9.4

|

%

|

8.6

|

%

|

8.3

|

%

|

8.9

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

2012 Fourth Quarter

|

|

| |

|

Industrial

|

Security

|

Metal

|

|

|

|

| |

|

Hardware

|

Products

|

Products

|

Total

|

|

|

Net sales

|

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

Cost of products sold

|

|

77.2

|

%

|

77.5

|

%

|

82.1

|

%

|

78.4

|

%

|

|

Gross margin

|

|

22.8

|

%

|

22.5

|

%

|

17.9

|

%

|

21.6

|

%

|

|

Selling and administrative expense

|

|

14.2

|

%

|

17.0

|

%

|

6.9

|

%

|

13.5

|

%

|

|

Operating profit

|

|

8.6

|

%

|

5.5

|

%

|

11.0

|

%

|

8.1

|

%

|

The following table shows the amount of change from the fourth quarter of 2012 to the fourth quarter of 2013 in sales, cost of products sold, gross margin, selling and administrative expenses and operating profit, by segment (dollars in thousands).

| |

|

Industrial

|

|

Security

|

|

Metal

|

|

|

|

| |

|

Hardware

|

|

Products

|

|

Products

|

|

Total

|

|

|

Net sales

|

|

$

|

(2,973

|

)

|

$

|

655

|

|

$

|

770

|

|

$

|

(1,548

|

)

|

|

Volume

|

|

|

-21.0

|

%

|

|

4.2

|

%

|

|

5.6

|

%

|

|

-7.2

|

%

|

|

Prices

|

|

|

-0.1

|

%

|

|

0.7

|

%

|

|

1.8

|

%

|

|

0.6

|

%

|

|

New Products

|

|

|

3.3

|

%

|

|

0.8

|

%

|

|

2.6

|

%

|

|

2.3

|

%

|

| |

|

|

-17.8

|

%

|

|

5.7

|

%

|

|

10.0

|

%

|

|

-4.3

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

$

|

(2,790

|

)

|

$

|

55

|

|

$

|

806

|

|

$

|

(1,929

|

)

|

| |

|

|

-21.7

|

%

|

|

0.6

|

%

|

|

12.8

|

%

|

|

-6.9

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

$

|

(183

|

)

|

$

|

600

|

|

$

|

(36

|

)

|

$

|

381

|

|

| |

|

|

-4.8

|

%

|

|

23.3

|

%

|

|

-2.6

|

%

|

|

4.9

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses

|

|

$

|

(44

|

)

|

$

|

181

|

|

$

|

111

|

|

$

|

248

|

|

| |

|

|

-1.9

|

%

|

|

9.3

|

%

|

|

20.8

|

%

|

|

5.1

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

$

|

(139

|

)

|

$

|

419

|

|

$

|

(147

|

)

|

$

|

133

|

|

| |

|

|

-9.7

|

%

|

|

67.0

|

%

|

|

17.2

|

%

|

|

4.6

|

%

|

Net sales in the fourth quarter of 2013 decreased 4% to $34.3 million from $35.8 million a year earlier. The decrease in sales in the fourth quarter from 2012 to 2013 is primarily attributable to a drop in sales of our lightweight composite panels for use in the electronic white board industry and sleeper cabs of Class 8 trucks, as well as lower sales of Industrial Hardware products to the distribution, service body and military markets in 2013 compared to 2012. Net sales were favorably impacted by increased sales volume of existing products in many of the markets to which we sell, the introduction of new products and selective price increases to customers.

15

Cost of products sold in the fourth quarter decreased $1.9 million or 7% from 2012 to 2013. The most significant factors resulting in changes in cost of products sold in the fourth quarter of 2013 compared to 2012 fourth quarter included:

|

§

|

an increase of $0.2 million or 32% in utilities;

|

|

§

|

an increase of $0.1 million or 1% in costs for payroll and payroll related charges;

|

|

§

|

an increase of $0.1 million or 71% for miscellaneous expenses;

|

|

§

|

a decrease of $2.2 million or 15% in raw materials;

|

|

§

|

and a decrease of $0.1 million or 7% in costs for supplies and tools.

|

Gross margin as a percentage of net sales for the fourth quarter of 2013 was 24% compared to 22% in the fourth quarter of 2012. The increase is primarily the result of the changes in cost of products sold enumerated above, the mix of products produced, the introduction of new products and selective price increases to customers.

Selling and administrative expenses for the fourth quarter of 2013 increased $0.2 million or 5% compared to the prior year quarter. The most significant factors resulting in changes in selling and administrative expenses in the fourth quarter of 2013 compared to 2012 fourth quarter included:

|

§

|

an increase of $0.1 million or 4% in payroll and payroll related charges;

|

|

§

|

and an increase of $0.1 million or 37% in travel expenses.

|

Net income for the fourth quarter of 2013 increased 12% to $1.9 million (or $.31 per diluted share) from $1.7 million (or $.28 per diluted share) a year earlier.

Authoritative Accounting Guidance

In May 2011, the FASB issued authoritative guidance which clarifies the concepts related to highest and best use and valuation premise, blockage factors and other premiums and discounts, the fair value measurement of financial instruments held in a portfolio and of those instruments classified as a component of shareowners’ equity. The guidance includes enhanced disclosure requirements about recurring Level 3 fair value measurements, the use of non-financial assets, and the level in the fair value hierarchy of assets and liabilities not recorded at fair value. This guidance became effective for the Company on January 1, 2012. This guidance did not have an impact on our consolidated financial statements or disclosures, as there are presently no recurring Level 3 fair value measurements.

In June 2011, the FASB issued authoritative guidance aimed at increasing the prominence of items reported in other comprehensive income in the financial statements. In December 2011, the FASB also issued an accounting standards update that indefinitely deferred certain financial statement presentation provisions contained in its original June 2011 guidance. The guidance requires companies to present comprehensive income in a single statement below net income or in a separate statement of comprehensive income immediately following the income statement. Companies will no longer be allowed to present comprehensive income on the statement of changes in shareholders' equity. In both options, companies must present the components of net income, total net income, the components of other comprehensive income, total other comprehensive income and total comprehensive income. This update does not change which items are reported in other comprehensive income or the requirement to report reclassifications of items from other comprehensive income to net income. This guidance became effective for the Company on January 1, 2012 and required retrospective application for all periods presented. The adoption of this guidance did not impact the presentation of the consolidated financial statements of the Company.

In September 2011, the FASB issued authoritative guidance on testing goodwill for impairment. This guidance provides an entity the option to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If an entity determines that the fair value of a reporting unit is less than its carrying amount, it is required to perform the currently prescribed two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit, if any. The Company adopted this guidance effective January 1, 2012 and it had no impact on the consolidated financial statements of the Company.

In July 2012, the FASB issued authoritative guidance to amend previous guidance on the annual and interim testing of indefinite-lived intangible assets for impairment. The guidance provides entities with the option of first assessing qualitative factors to determine whether it is more likely than not that the fair value of an indefinite-lived intangible asset is less than its carrying amount. If it is determined, on the basis of qualitative factors, that the fair value of the indefinite-lived intangible asset

16

is more likely than not less than the carrying amount, a quantitative impairment test would still be required. The Company adopted this guidance effective December 30, 2012 and it had no impact on the consolidated financial statements of the Company.

In February 2013, the FASB issued authoritative guidance which adds new disclosure requirements for items reclassified out of Accumulated Other Comprehensive Income. The guidance requires that an entity present either in a single note or parenthetically on the face of the financial statements, the effect of significant amounts reclassified from each component of Accumulated Other Comprehensive Income based on its source and the income statement line items affected by the reclassification. The guidance is effective for interim and annual reporting periods beginning on or after December 15, 2012. The Company adopted this guidance effective December 30, 2012 and it had no impact on the consolidated financial statements of the Company.

In July 2013, the FASB issued authoritative guidance that requires an entity to net its liability for unrecognized tax positions against a net operating loss carryforward, a similar tax loss or a tax credit carryforward when settlement in this manner is available under the tax law. The guidance is effective for interim and annual reporting periods beginning on or after December 15, 2013. The Company adopted this guidance effective December 29, 2013 and it had no impact on the consolidated financial statements of the Company.

The Company has implemented all new accounting pronouncements that are in effect and that could impact its consolidated financial statements and does not believe that there are any other new accounting pronouncements that have been issued, but are not yet effective, that might have a material impact on the consolidated financial statements of the Company.

Critical Accounting Policies and Estimates

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) requires management to make judgments, estimates and assumptions regarding uncertainties that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses. Areas of uncertainty that require judgments, estimates and assumptions include items such as the accounting for derivatives; environmental matters; the testing of goodwill and other intangible assets for impairment; proceeds on assets to be sold; pensions and other postretirement benefits; and tax matters. Management uses historical experience and all available information to make its estimates and assumptions, but actual results will inevitably differ from the estimates and assumptions that are used to prepare the Company’s financial statements at any given time. Despite these inherent limitations, management believes that Management’s Discussion and Analysis of Financial Condition and Results of Operations and the financial statements and related footnotes provide a meaningful and fair presentation of the Company.

Management believes that the application of these estimates and assumptions on a consistent basis enables the Company to provide the users of the financial statements with useful and reliable information about the Company’s operating results and financial condition.

Allowance for Doubtful Accounts

The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. The Company reviews the collectibility of its receivables on an ongoing basis taking into account a combination of factors. The Company reviews potential problems, such as past due accounts, a bankruptcy filing or deterioration in the customer’s financial condition, to ensure the Company is adequately accrued for potential loss. Accounts are considered past due based on when payment was originally due. If a customer’s situation changes, such as a bankruptcy or creditworthiness, or there is a change in the current economic climate, the Company may modify its estimate of the allowance for doubtful accounts. The Company will write off accounts receivable after reasonable collection efforts have been made and the accounts are deemed uncollectible.

Inventory Reserve

Inventories are valued at the lower of cost or market. Cost is determined by the last-in, first-out (“LIFO”) method at the Company’s U.S. facilities. Accordingly, a LIFO valuation reserve is calculated using the dollar value link chain method.

We review the net realizable value of inventory in detail on an ongoing basis, giving consideration to deterioration, obsolescence and other factors. Based on these assessments, we provide for an inventory reserve in the period in which an impairment is identified. The reserve fluctuates with market conditions, design cycles and other economic factors.

17

Goodwill and Other Intangible Assets

Intangible assets with finite useful lives are amortized generally on a straight-line basis over the periods benefited. Goodwill and other intangible assets with indefinite useful lives are not amortized. During the third quarter of 2012 the Company elected to change its annual impairment testing of goodwill and trademarks from the second quarter of its fiscal year to the fourth quarter of its fiscal year. The Company discussed this change in accounting principle with its Independent Registered Public Accounting Firm and attached their Preference Letter as an exhibit to the Form 10-Q for the quarter ending September 29, 2012. The Company performed its most recent qualitative assessment as of the end of fiscal 2013 and determined it is more likely than not that no impairment of goodwill existed at the end of 2013. The Company will perform annual qualitative assessments in subsequent years as of the end of each fiscal year. Additionally, the Company will perform interim analysis whenever conditions warrant.

Pension and Other Postretirement Benefits

The amounts recognized in the consolidated financial statements related to pension and other postretirement benefits are determined from actuarial valuations. Inherent in these valuations are assumptions about such factors as expected return on plan assets, discount rates at which liabilities could be settled, rate of increase in future compensation levels, mortality rates, and trends in health insurance costs. These assumptions are reviewed annually and updated as required. In accordance with U.S. GAAP, actual results that differ from the assumptions are accumulated and amortized over future periods and, therefore, affect the expense recognized and obligations recorded in future periods.

The discount rate used is based on a single equivalent discount rate derived with the assistance of our actuaries by matching expected future benefit payments in each year to the corresponding spot rates from the Citigroup Pension Liability Yield Curve, comprised of high quality (rated AA or better) corporate bonds. The expected long-term rate of return on assets is also developed with input from the Company’s actuarial firms. We consider the Company’s historical experience with pension fund asset performance, the current and expected allocation of our plan assets, and expected long-term rates of return. The long-term rate-of-return assumption used for determining net periodic pension expense for 2013 was 8.0%. The Company reviews the long-term rate of return each year. Future actual pension income and expense will depend on future investment performance, changes in future discount rates, and various other factors related to the population of participants in the Company’s pension plans.

The Company expects to make cash contributions of approximately $2.5 million and $63,000 to its pension plans and postretirement plan, respectively, in 2014.

RESULTS OF OPERATIONS

Fiscal 2013 Compared to Fiscal 2012

The following table shows, for 2013 and 2012, selected line items from the consolidated statements of income as a percentage of net sales, by segment.

| |

|

Industrial

|

Security

|

Metal

|

|

|

| |

|

Hardware

|

Products

|

Products

|

Total

|

| |

|

2013

|

|

Net sales

|

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

Cost of products sold

|

|

76.4

|

%

|

78.0

|

%

|

84.5

|

%

|

78.8

|

%

|

|

Gross margin

|

|

23.6

|

%

|

22.0

|

%

|

15.5

|

%

|

21.2

|

%

|

|

Selling and administrative expense

|

|

15.7

|

%

|

16.3

|

%

|

7.1

|

%

|

13.9

|

%

|

|

Operating profit

|

|

7.9

|

%

|

5.7

|

%

|

8.4

|

%

|

7.3

|

%

|

| |

|

|

|

|

|

|

|

|

|

| |

|

2012

|

|

Net sales

|

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

Cost of products sold

|

|

76.0

|

%

|

76.3

|

%

|

88.2

|

%

|

78.8

|

%

|

|

Gross margin

|

|

24.0

|

%

|

23.7

|

%

|

11.8

|

%

|

21.2

|

%

|

|

Selling and administrative expense

|

|

13.5

|

%

|

15.5

|

%

|

6.5

|

%

|

12.6

|

%

|

|

Operating profit

|

|

10.5

|

%

|

8.2

|

%

|

5.3

|

%

|

8.6

|

%

|

18

The following table shows the amount of change from 2012 to 2013 in sales, cost of products sold, gross margin, selling and administrative expenses, and operating profit, by segment (dollars in thousands):

| |

|

Industrial

|

|

Security

|

|

Metal

|

|

|

|

| |

|

Hardware

|

|

Products

|

|

Products

|

|

Total

|

|

|

Net sales

|

|

$

|

(11,901

|

)

|

$

|

(1,387

|

)

|

$

|

(1,763

|

)

|

$

|

(15,051

|

)

|

|

Volume

|

|

|

-20.4

|

%

|

|

-4.9

|

%

|

|

-8.5

|

%

|

|

-12.8

|

%

|

|

Prices

|

|

|

0.0

|

%

|

|

0.7

|

%

|

|

1.6

|

%

|

|

0.6

|

%

|

|

New Products

|

|

|

3.9

|

%

|

|

1.4

|

%

|

|

1.9

|

%

|

|

2.6

|

%

|

| |

|

|

-16.5

|

%

|

|

-2.8

|

%

|

|

-5.0

|

%

|

|

-9.6

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

$

|

(8,844

|

)

|

$

|

(206

|

)

|

$

|

(2,808

|

)

|

$

|

(11,858

|

)

|

| |

|

|

-16.1

|

%

|

|

-0.5

|

%

|

|

-9.1

|

%

|

|

-9.5

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

$

|

(3,057

|

)

|

$

|

(1,181

|

)

|

$

|

1,045

|

|

$

|

(3,193

|

)

|

| |

|

|

-17.7

|

%