[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Michigan | 38-1239739 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

2825 Airview Boulevard Kalamazoo, Michigan | 49002 | |

(Address of principal executive offices) | (Zip Code) | |

(269) 385-2600 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, $.10 par value | New York Stock Exchange | |

Floating Rate Notes due 2020 | New York Stock Exchange | |

1.125% Notes due 2023 | New York Stock Exchange | |

2.125% Notes due 2027 | New York Stock Exchange | |

2.625% Notes due 2030 | New York Stock Exchange | |

Large accelerated filer | [X] | Accelerated filer | [ ] | Emerging growth company | [ ] |

Non-accelerated filer | [ ] | Small reporting company | [ ] | ||

PART I | |||

Item 1. | Business | 1 | |

Item 1A. | Risk Factors | 3 | |

Item 1B. | Unresolved Staff Comments | 6 | |

Item 2. | Properties | 6 | |

Item 3. | Legal Proceedings | 6 | |

Item 4. | Mine Safety Disclosures | 6 | |

PART II | |||

Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 6 | |

Item 6. | Selected Financial Data | 7 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 8 | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 15 | |

Item 8. | Financial Statements and Supplementary Data | 16 | |

Report of Independent Registered Public Accounting Firm | 16 | ||

Consolidated Statements of Earnings | 17 | ||

Consolidated Statements of Comprehensive Income | 17 | ||

Consolidated Balance Sheets | 18 | ||

Consolidated Statements of Shareholders’ Equity | 19 | ||

Consolidated Statements of Cash Flows | 20 | ||

Notes to Consolidated Financial Statements | 21 | ||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 33 | |

Item 9A. | Controls and Procedures | 33 | |

Item 9B. | Other Information | 34 | |

PART III | |||

Item 10. | Directors, Executive Officers and Corporate Governance | 34 | |

Item 11. | Executive Compensation | 35 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 35 | |

Item 14. | Principal Accounting Fees and Services | 35 | |

PART IV | |||

Item 15. | Exhibits, Financial Statement Schedules | 36 | |

Item 16. | Form 10-K Summary | 39 | |

PART I |

ITEM 1. | BUSINESS. |

Net Sales by Reportable Segment | |||||||||||||||||

2018 | 2017 | 2016 | |||||||||||||||

Orthopaedics | $ | 4,991 | 37 | % | $ | 4,713 | 38 | % | $ | 4,422 | 39 | % | |||||

MedSurg | 6,045 | 44 | 5,557 | 45 | 4,894 | 43 | |||||||||||

Neurotechnology and Spine | 2,565 | 19 | 2,174 | 17 | 2,009 | 18 | |||||||||||

Total | $ | 13,601 | 100 | % | $ | 12,444 | 100 | % | $ | 11,325 | 100 | % | |||||

Composition of Orthopaedics Net Sales | |||||||||||||||||

2018 | 2017 | 2016 | |||||||||||||||

Knees | $ | 1,701 | 34 | % | $ | 1,595 | 34 | % | $ | 1,490 | 34 | % | |||||

Hips | 1,336 | 27 | 1,303 | 28 | 1,283 | 29 | |||||||||||

Trauma and Extremities | 1,580 | 32 | 1,478 | 31 | 1,364 | 31 | |||||||||||

Other | 374 | 7 | 337 | 7 | 285 | 6 | |||||||||||

Total | $ | 4,991 | 100 | % | $ | 4,713 | 100 | % | $ | 4,422 | 100 | % | |||||

Composition of MedSurg Net Sales | |||||||||||||||||

2018 | 2017 | 2016 | |||||||||||||||

Instruments | $ | 1,822 | 30 | % | $ | 1,678 | 30 | % | $ | 1,553 | 32 | % | |||||

Endoscopy | 1,846 | 31 | 1,652 | 30 | 1,470 | 30 | |||||||||||

Medical | 2,118 | 35 | 1,969 | 35 | 1,633 | 33 | |||||||||||

Sustainability | 259 | 4 | 258 | 5 | 238 | 5 | |||||||||||

Total | $ | 6,045 | 100 | % | $ | 5,557 | 100 | % | $ | 4,894 | 100 | % | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 1 |

Composition of Neurotechnology and Spine Net Sales | |||||||||||||||||

2018 | 2017 | 2016 | |||||||||||||||

Neurotechnology | $ | 1,737 | 68 | % | $ | 1,423 | 65 | % | $ | 1,255 | 62 | % | |||||

Spine | 828 | 32 | 751 | 35 | 754 | 38 | |||||||||||

Total | $ | 2,565 | 100 | % | $ | 2,174 | 100 | % | $ | 2,009 | 100 | % | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 2 |

As of January 31, 2019 | |||

Name | Age | Title | First Became an Executive Officer |

Kevin A. Lobo | 53 | Chairman and Chief Executive Officer | 2011 |

Yin C. Becker | 55 | Vice President, Communications, Public Affairs and Corporate Marketing | 2016 |

William E. Berry Jr. | 53 | Vice President, Corporate Controller and Principal Accounting Officer | 2014 |

Glenn S. Boehnlein | 57 | Vice President, Chief Financial Officer | 2016 |

M. Kathryn Fink | 49 | Vice President, Chief Human Resources Officer | 2016 |

Michael D. Hutchinson | 48 | Vice President, Chief Legal Officer | 2014 |

Viju Menon | 51 | Group President, Global Quality and Operations | 2018 |

Katherine A. Owen | 48 | Vice President, Strategy and Investor Relations | 2007 |

Bijoy S.N. Sagar | 50 | Vice President, Chief Digital Technology Officer | 2014 |

Timothy J. Scannell | 54 | President and Chief Operating Officer | 2008 |

ITEM 1A. | RISK FACTORS. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 3 |

Dollar amounts in millions except per share amounts or as otherwise specified. | 4 |

Dollar amounts in millions except per share amounts or as otherwise specified. | 5 |

ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

ITEM 2. | PROPERTIES. |

ITEM 3. | LEGAL PROCEEDINGS. |

ITEM 4. | MINE SAFETY DISCLOSURES. |

PART II |

ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

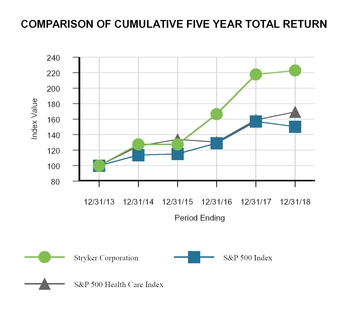

Company / Index | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||

Stryker Corporation | $ | 100.00 | $ | 127.41 | $ | 127.44 | $ | 166.51 | $ | 217.86 | $ | 223.13 | ||||||

S&P 500 Index | $ | 100.00 | $ | 113.69 | $ | 115.26 | $ | 129.05 | $ | 157.22 | $ | 150.33 | ||||||

S&P 500 Health Care Index | $ | 100.00 | $ | 125.34 | $ | 133.97 | $ | 130.37 | $ | 159.15 | $ | 169.44 | ||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 6 |

ITEM 6. | SELECTED FINANCIAL DATA. |

Statement of Earnings Data | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

Net sales | $ | 13,601 | $ | 12,444 | $ | 11,325 | $ | 9,946 | $ | 9,675 | ||||||||||

Cost of sales | 4,663 | 4,264 | 3,821 | 3,333 | 3,310 | |||||||||||||||

Gross profit | $ | 8,938 | $ | 8,180 | $ | 7,504 | $ | 6,613 | $ | 6,365 | ||||||||||

Research, development and engineering expenses | 862 | 787 | 715 | 625 | 614 | |||||||||||||||

Selling, general and administrative expenses | 5,099 | 4,552 | 4,137 | 3,610 | 3,547 | |||||||||||||||

Recall charges, net of insurance proceeds | 23 | 173 | 158 | 296 | 761 | |||||||||||||||

Amortization of intangible assets | 417 | 371 | 319 | 210 | 188 | |||||||||||||||

Total operating expenses | $ | 6,401 | $ | 5,883 | $ | 5,329 | $ | 4,741 | $ | 5,110 | ||||||||||

Operating income | $ | 2,537 | $ | 2,297 | $ | 2,175 | $ | 1,872 | $ | 1,255 | ||||||||||

Other income (expense), net | (181 | ) | (234 | ) | (254 | ) | (137 | ) | (95 | ) | ||||||||||

Earnings before income taxes | $ | 2,356 | $ | 2,063 | $ | 1,921 | $ | 1,735 | $ | 1,160 | ||||||||||

Income taxes | (1,197 | ) | 1,043 | 274 | 296 | 645 | ||||||||||||||

Net earnings | $ | 3,553 | $ | 1,020 | $ | 1,647 | $ | 1,439 | $ | 515 | ||||||||||

Net earnings per share of common stock: | ||||||||||||||||||||

Basic net earnings per share of common stock | $ | 9.50 | $ | 2.73 | $ | 4.40 | $ | 3.82 | $ | 1.36 | ||||||||||

Diluted net earnings per share of common stock | $ | 9.34 | $ | 2.68 | $ | 4.35 | $ | 3.78 | $ | 1.34 | ||||||||||

Dividends declared per share of common stock | $ | 1.93 | $ | 1.745 | $ | 1.565 | $ | 1.415 | $ | 1.26 | ||||||||||

Balance Sheet Data | ||||||||||||||||||||

Cash, cash equivalents and current marketable securities | $ | 3,699 | $ | 2,793 | $ | 3,384 | $ | 4,079 | $ | 5,000 | ||||||||||

Accounts receivable, less allowance | 2,332 | 2,198 | 1,967 | 1,662 | 1,572 | |||||||||||||||

Inventories | 2,955 | 2,465 | 2,030 | 1,639 | 1,588 | |||||||||||||||

Property, plant and equipment, net | 2,291 | 1,975 | 1,569 | 1,199 | 1,098 | |||||||||||||||

Total assets | 27,229 | 22,197 | 20,435 | 16,223 | 17,258 | |||||||||||||||

Accounts payable | 646 | 487 | 437 | 410 | 329 | |||||||||||||||

Total debt | 9,859 | 7,222 | 6,914 | 3,998 | 3,952 | |||||||||||||||

Shareholders’ equity | $ | 11,730 | $ | 9,980 | $ | 9,550 | $ | 8,511 | $ | 8,595 | ||||||||||

Cash Flow Data | ||||||||||||||||||||

Net cash provided by operating activities | $ | 2,610 | $ | 1,559 | $ | 1,915 | $ | 981 | $ | 1,858 | ||||||||||

Purchases of property, plant and equipment | 572 | 589 | 490 | 270 | 233 | |||||||||||||||

Depreciation | 306 | 271 | 227 | 187 | 190 | |||||||||||||||

Acquisitions, net of cash acquired | 2,451 | 831 | 4,332 | 153 | 916 | |||||||||||||||

Amortization of intangible assets | 417 | 371 | 319 | 210 | 188 | |||||||||||||||

Dividends paid | 703 | 636 | 568 | 521 | 462 | |||||||||||||||

Repurchase of common stock | $ | 300 | $ | 230 | $ | 13 | $ | 700 | $ | 100 | ||||||||||

Other Data | ||||||||||||||||||||

Number of shareholders of record | 2,732 | 2,850 | 3,010 | 3,118 | 3,305 | |||||||||||||||

Approximate number of employees | 36,000 | 33,000 | 33,000 | 27,000 | 26,000 | |||||||||||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 7 |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Percent Net Sales | Percentage Change | ||||||||||||||||||||

2018 | 2017 | 2016 | 2018 | 2017 | 2016 | Current Year End | Prior Year End | ||||||||||||||

Net sales | $ | 13,601 | $ | 12,444 | $ | 11,325 | 100.0 | % | 100.0 | % | 100.0 | % | 9.3 | % | 9.9 | % | |||||

Gross profit | 8,938 | 8,180 | 7,504 | 65.7 | 65.7 | 66.3 | 9.3 | 9.0 | |||||||||||||

Research, development and engineering expenses | 862 | 787 | 715 | 6.3 | 6.3 | 6.3 | 9.5 | 10.1 | |||||||||||||

Selling, general and administrative expenses | 5,099 | 4,552 | 4,137 | 37.5 | 36.6 | 36.5 | 12.0 | 10.0 | |||||||||||||

Recall charges, net of insurance proceeds | 23 | 173 | 158 | 0.2 | 1.4 | 1.4 | (86.7 | ) | 9.5 | ||||||||||||

Amortization of intangible assets | 417 | 371 | 319 | 3.1 | 3.0 | 2.8 | 12.4 | 16.3 | |||||||||||||

Other income (expense), net | (181 | ) | (234 | ) | (254 | ) | (1.3 | ) | (1.9 | ) | (2.2 | ) | (22.6 | ) | (7.9 | ) | |||||

Income taxes | (1,197 | ) | 1,043 | 274 | (214.8 | ) | 280.7 | ||||||||||||||

Net earnings | $ | 3,553 | $ | 1,020 | $ | 1,647 | 26.1 | % | 8.2 | % | 14.5 | % | 248.3 | % | (38.1 | )% | |||||

Net earnings per diluted share | $ | 9.34 | $ | 2.68 | $ | 4.35 | 248.5 | % | (38.4 | )% | |||||||||||

Adjusted net earnings per diluted share(1) | $ | 7.31 | $ | 6.49 | $ | 5.80 | 12.6 | % | 11.9 | % | |||||||||||

Geographic and Segment Net Sales | Percentage Change | ||||||||||||||||||

Current Year End | Prior Year End | ||||||||||||||||||

2018 | 2017 | 2016 | As Reported | Constant Currency | As Reported | Constant Currency | |||||||||||||

Geographic: | |||||||||||||||||||

United States | $ | 9,848 | $ | 9,059 | $ | 8,230 | 8.7 | % | 8.7 | % | 10.1 | % | 10.1 | % | |||||

International | 3,753 | 3,385 | 3,095 | 10.9 | 9.7 | 9.4 | 9.0 | ||||||||||||

Total | $ | 13,601 | $ | 12,444 | $ | 11,325 | 9.3 | % | 9.0 | % | 9.9 | % | 9.8 | % | |||||

Segment: | |||||||||||||||||||

Orthopaedics | $ | 4,991 | $ | 4,713 | $ | 4,422 | 5.9 | % | 5.4 | % | 6.6 | % | 6.5 | % | |||||

MedSurg | 6,045 | 5,557 | 4,894 | 8.8 | 8.7 | 13.6 | 13.4 | ||||||||||||

Neurotechnology and Spine | 2,565 | 2,174 | 2,009 | 18.0 | 17.4 | 8.2 | 8.3 | ||||||||||||

Total | $ | 13,601 | $ | 12,444 | $ | 11,325 | 9.3 | % | 9.0 | % | 9.9 | % | 9.8 | % | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 8 |

Supplemental Net Sales Growth Information | |||||||||||||||||||||||||||||||||

Percentage Change | Percentage Change | ||||||||||||||||||||||||||||||||

United States | International | United States | International | ||||||||||||||||||||||||||||||

2018 | 2017 | As Reported | Constant Currency | As Reported | As Reported | Constant Currency | 2017 | 2016 | As Reported | Constant Currency | As Reported | As Reported | Constant Currency | ||||||||||||||||||||

Orthopaedics: | |||||||||||||||||||||||||||||||||

Knees | $ | 1,701 | $ | 1,595 | 6.6 | % | 6.3 | % | 6.4 | % | 7.3 | % | 5.7 | % | $ | 1,595 | $ | 1,490 | 7.0 | % | 6.9 | % | 7.4 | % | 5.9 | % | 5.5 | % | |||||

Hips | 1,336 | 1,303 | 2.5 | 2.1 | 2.2 | 3.1 | 2.0 | 1,303 | 1,283 | 1.6 | 1.8 | 2.0 | 0.9 | 1.4 | |||||||||||||||||||

Trauma and Extremities | 1,580 | 1,478 | 6.9 | 6.2 | 5.4 | 9.7 | 7.4 | 1,478 | 1,364 | 8.3 | 8.2 | 11.0 | 3.8 | 3.5 | |||||||||||||||||||

Other | 374 | 337 | 11.0 | 11.0 | 8.7 | 21.3 | 21.3 | 337 | 285 | 18.0 | 17.6 | 17.9 | 18.6 | 16.4 | |||||||||||||||||||

$ | 4,991 | $ | 4,713 | 5.9 | % | 5.4 | % | 5.2 | % | 7.3 | % | 5.7 | % | $ | 4,713 | $ | 4,422 | 6.6 | % | 6.5 | % | 7.8 | % | 4.0 | % | 3.8 | % | ||||||

MedSurg: | |||||||||||||||||||||||||||||||||

Instruments | $ | 1,822 | $ | 1,678 | 8.6 | % | 8.4 | % | 9.2 | % | 6.4 | % | 6.0 | % | $ | 1,678 | $ | 1,553 | 8.1 | % | 8.0 | % | 8.1 | % | 7.9 | % | 7.5 | % | |||||

Endoscopy | 1,846 | 1,652 | 11.7 | 11.9 | 11.0 | 14.4 | 14.7 | 1,652 | 1,470 | 12.4 | 12.0 | 14.2 | 6.3 | 5.0 | |||||||||||||||||||

Medical | 2,118 | 1,969 | 7.6 | 7.5 | 6.9 | 9.9 | 9.4 | 1,969 | 1,633 | 20.5 | 20.4 | 17.7 | 31.4 | 30.4 | |||||||||||||||||||

Sustainability | 259 | 258 | 0.4 | 0.1 | — | 100.0 | 19.5 | 258 | 238 | 8.9 | 8.9 | 8.9 | 26.2 | 24.4 | |||||||||||||||||||

$ | 6,045 | $ | 5,557 | 8.8 | % | 8.7 | % | 8.4 | % | 10.2 | % | 10.0 | % | $ | 5,557 | $ | 4,894 | 13.5 | % | 13.4 | % | 13.2 | % | 15.1 | % | 14.1 | % | ||||||

Neurotechnology and Spine: | |||||||||||||||||||||||||||||||||

Neurotechnology | $ | 1,737 | $ | 1,423 | 22.1 | % | 21.4 | % | 23.9 | % | 18.9 | % | 17.2 | % | $ | 1,423 | $ | 1,255 | 13.4 | % | 13.4 | % | 11.2 | % | 17.4 | % | 17.3 | % | |||||

Spine | 828 | 751 | 10.3 | 9.9 | 6.9 | 20.8 | 19.1 | 751 | 754 | (0.4 | ) | (0.4 | ) | (0.6 | ) | 0.1 | 0.2 | ||||||||||||||||

$ | 2,565 | $ | 2,174 | 18.0 | % | 17.4 | % | 17.3 | % | 19.4 | % | 17.6 | % | $ | 2,174 | $ | 2,009 | 8.2 | % | 8.3 | % | 6.3 | % | 12.4 | % | 12.4 | % | ||||||

Total | $ | 13,601 | $ | 12,444 | 9.3 | % | 9.0 | % | 8.7 | % | 10.9 | % | 9.7 | % | $ | 12,444 | $ | 11,325 | 9.9 | % | 9.8 | % | 10.1 | % | 9.4 | % | 9.0 | % | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 9 |

Full Year | |||||||||||||||||||

Percentage Change Excluding ASC 606 Impact | |||||||||||||||||||

Percentage Change | International | ||||||||||||||||||

2018 | 2017 | As Reported | Excluding ASC 606 Impact | Constant Currency | United States | Excluding ASC 606 Impact | Constant Currency | ||||||||||||

Orthopaedics: | |||||||||||||||||||

Knees | $ | 1,701 | $ | 1,595 | 6.6 | % | 7.0 | % | 6.7 | % | 6.9 | % | 7.4 | % | 6.1 | % | |||

Hips | 1,336 | 1,303 | 2.5 | 2.8 | 2.3 | 2.5 | 3.3 | 2.2 | |||||||||||

Trauma and Extremities | 1,580 | 1,478 | 6.9 | 7.8 | 7.0 | 6.5 | 10.1 | 7.8 | |||||||||||

Other | 374 | 337 | 11.0 | 10.8 | 11.0 | 8.6 | 20.9 | 21.5 | |||||||||||

$ | 4,991 | $ | 4,713 | 5.9 | % | 6.4 | % | 5.9 | % | 5.8 | % | 7.6 | % | 6.1 | % | ||||

MedSurg: | |||||||||||||||||||

Instruments | $ | 1,822 | $ | 1,678 | 8.6 | % | 10.2 | % | 10.0 | % | 11.2 | % | 6.9 | % | 6.2 | % | |||

Endoscopy | 1,846 | 1,652 | 11.7 | 12.1 | 12.3 | 11.5 | 14.3 | 14.9 | |||||||||||

Medical | 2,118 | 1,969 | 7.6 | 9.1 | 9.0 | 8.8 | 10.2 | 9.6 | |||||||||||

Sustainability | 259 | 258 | 0.4 | 3.1 | 3.1 | 3.0 | 19.7 | 19.5 | |||||||||||

$ | 6,045 | $ | 5,557 | 8.8 | % | 10.1 | % | 10.0 | % | 10.0 | % | 10.4 | % | 10.1 | % | ||||

Neurotechnology and Spine: | |||||||||||||||||||

Neurotechnology | $ | 1,737 | $ | 1,423 | 22.1 | % | 22.8 | % | 22.1 | % | 25.0 | % | 19.1 | % | 17.3 | % | |||

Spine | 828 | 751 | 10.3 | 10.7 | 10.3 | 7.2 | 21.5 | 19.8 | |||||||||||

$ | 2,565 | $ | 2,174 | 18.0 | % | 18.6 | % | 18.0 | % | 18.1 | % | 19.7 | % | 17.9 | % | ||||

Total | $ | 13,601 | $ | 12,444 | 9.3 | % | 10.2 | % | 9.8 | % | 9.8 | % | 11.1 | % | 9.9 | % | |||

Percent Net Sales | ||||||||||||||||

2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||

Reported | $ | 8,938 | $ | 8,180 | $ | 7,504 | 65.7 | % | 65.7 | % | 66.3 | % | ||||

Inventory stepped up to fair value | 16 | 22 | 36 | 0.1 | 0.2 | 0.3 | ||||||||||

Restructuring-related and other charges | 27 | 57 | 15 | 0.2 | 0.4 | — | ||||||||||

Medical device regulations | 2 | — | — | — | — | — | ||||||||||

Adjusted | $ | 8,983 | $ | 8,259 | $ | 7,555 | 66.0 | % | 66.3 | % | 66.7 | % | ||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 10 |

Percent Net Sales | ||||||||||||||||

2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||

Reported | $ | 5,099 | $ | 4,552 | $ | 4,137 | 37.5 | % | 36.6 | % | 36.5 | % | ||||

Other acquisition and integration-related | (108 | ) | (42 | ) | (95 | ) | (0.9 | ) | (0.4 | ) | (0.8 | ) | ||||

Restructuring-related and other charges | (192 | ) | (137 | ) | (110 | ) | (1.4 | ) | (1.1 | ) | (1.0 | ) | ||||

Regulatory and legal matters | (185 | ) | (39 | ) | 12 | (1.4 | ) | (0.3 | ) | 0.1 | ||||||

Adjusted | $ | 4,614 | $ | 4,334 | $ | 3,944 | 33.9 | % | 34.8 | % | 34.8 | % | ||||

Percent Net Sales | ||||||||||||||||

2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||

Reported | $ | 3,553 | $ | 1,020 | $ | 1,647 | 26.1 | % | 8.2 | % | 14.5 | % | ||||

Inventory stepped up to fair value | 9 | 20 | 23 | 0.1 | 0.2 | 0.2 | ||||||||||

Other acquisition and integration-related | 90 | 31 | 77 | 0.7 | 0.2 | 0.7 | ||||||||||

Amortization of intangible assets | 338 | 250 | 221 | 2.5 | 2.0 | 2.0 | ||||||||||

Restructuring-related and other charges | 179 | 155 | 98 | 1.3 | 1.2 | 0.9 | ||||||||||

Medical device regulations | 10 | — | — | 0.1 | — | — | ||||||||||

Recall-related matters | 18 | 131 | 127 | 0.1 | 1.1 | 1.1 | ||||||||||

Regulatory and legal matters | 141 | 25 | (7 | ) | 1.0 | 0.2 | (0.1 | ) | ||||||||

Tax matters | (1,559 | ) | 833 | 8 | (11.5 | ) | 6.7 | 0.1 | ||||||||

Adjusted | $ | 2,779 | $ | 2,465 | $ | 2,194 | 20.4 | % | 19.8 | % | 19.4 | % | ||||

1. | Acquisition and integration-related costs. Costs related to integrating recently acquired businesses and specific costs |

Dollar amounts in millions except per share amounts or as otherwise specified. | 11 |

2. | Amortization of purchased intangible assets. Periodic amortization expense related to purchased intangible assets. |

3. | Restructuring-related and other charges. Costs associated with the termination of sales relationships in certain countries, workforce reductions, elimination of product lines, weather-related asset impairments and associated costs and other restructuring-related activities. |

4. | Medical Device Regulations. Costs specific to updating our quality system, product labeling, asset write-offs and product remanufacturing to comply with the medical device reporting regulations and other requirements of the European Union and China regulations for medical devices. |

5. | Recall-related matters. Our best estimate of the minimum of the range of probable loss to resolve the Rejuvenate, LFIT V40 and other product recalls. |

6. | Regulatory and legal matters. Our best estimate of the minimum of the range of probable loss to resolve certain regulatory matters and other legal settlements. |

7. | Tax matters. Charges represent the impact of accounting for certain significant and discrete tax items, including adjustments related to the Tax Act. |

2018 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective Tax Rate | Diluted EPS | |||||||||||||

Reported | $ | 8,938 | $ | 5,099 | $ | 417 | $ | 2,537 | $ | 3,553 | (50.8 | )% | $ | 9.34 | ||||||

Acquisition and integration-related charges: | ||||||||||||||||||||

Inventory stepped up to fair value | 16 | — | — | 15 | 9 | 0.2 | 0.02 | |||||||||||||

Other acquisition and integration-related | — | (108 | ) | — | 108 | 90 | — | 0.24 | ||||||||||||

Amortization of purchased intangible assets | — | — | (417 | ) | 417 | 338 | 0.4 | 0.89 | ||||||||||||

Restructuring-related and other charges | 27 | (192 | ) | — | 220 | 179 | 0.1 | 0.47 | ||||||||||||

Medical device regulations | 2 | — | 12 | 10 | — | 0.03 | ||||||||||||||

Recall-related matters | — | — | — | 23 | 18 | — | 0.05 | |||||||||||||

Regulatory and legal matters | — | (185 | ) | — | 185 | 141 | 0.6 | 0.37 | ||||||||||||

Tax Matters | — | — | — | — | (1,559 | ) | 66.2 | (4.10 | ) | |||||||||||

Adjusted | $ | 8,983 | $ | 4,614 | $ | — | $ | 3,517 | $ | 2,779 | 16.7 | % | $ | 7.31 | ||||||

2017 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective Tax Rate | Diluted EPS | |||||||||||||

Reported | $ | 8,180 | $ | 4,552 | $ | 371 | $ | 2,297 | $ | 1,020 | 50.6 | % | $ | 2.68 | ||||||

Acquisition and integration-related charges: | ||||||||||||||||||||

Inventory stepped up to fair value | 22 | — | — | 22 | 20 | (0.1 | ) | 0.05 | ||||||||||||

Other acquisition and integration-related | — | (42 | ) | — | 42 | 31 | 0.2 | 0.09 | ||||||||||||

Amortization of purchased intangible assets | — | — | (371 | ) | 371 | 250 | 3.0 | 0.67 | ||||||||||||

Medical device regulations | — | — | — | — | — | — | — | |||||||||||||

Restructuring-related and other charges | 57 | (137 | ) | — | 194 | 155 | 0.4 | 0.41 | ||||||||||||

Recall-related matters | — | — | — | 173 | 131 | 0.7 | 0.34 | |||||||||||||

Regulatory and legal matters | — | (39 | ) | — | 39 | 25 | 0.4 | 0.06 | ||||||||||||

Tax Matters | — | — | — | — | 833 | (39.6 | ) | 2.19 | ||||||||||||

Adjusted | $ | 8,259 | $ | 4,334 | $ | — | $ | 3,138 | $ | 2,465 | 15.6 | % | $ | 6.49 | ||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 12 |

2016 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective Tax Rate | Diluted EPS | |||||||||||||

Reported | $ | 7,504 | $ | 4,137 | $ | 319 | $ | 2,175 | $ | 1,647 | 14.3 | % | $ | 4.35 | ||||||

Acquisition and integration-related charges: | ||||||||||||||||||||

Inventory stepped up to fair value | 36 | — | — | 36 | 23 | 0.4 | 0.06 | |||||||||||||

Other acquisition and integration-related | — | (95 | ) | — | 95 | 77 | 0.1 | 0.20 | ||||||||||||

Amortization of purchased intangible assets | — | — | (319 | ) | 319 | 221 | 2.2 | 0.59 | ||||||||||||

Restructuring-related and other charges | 15 | (110 | ) | — | 125 | 98 | 0.3 | 0.26 | ||||||||||||

Medical device regulations | — | — | — | — | — | — | — | |||||||||||||

Recall-related matters | — | — | — | 158 | 127 | 0.1 | 0.34 | |||||||||||||

Regulatory and legal matters | — | 12 | — | (12 | ) | (7 | ) | (0.2 | ) | (0.02 | ) | |||||||||

Tax Matters | — | — | — | — | 8 | 0.1 | 0.02 | |||||||||||||

Adjusted | $ | 7,555 | $ | 3,944 | $ | — | $ | 2,896 | $ | 2,194 | 17.3 | % | $ | 5.80 | ||||||

2018 | 2017 | 2016 | |||||||

Net cash provided by operating activities | $ | 2,610 | $ | 1,559 | $ | 1,915 | |||

Net cash used in investing activities | (2,857 | ) | (1,613 | ) | (4,191 | ) | |||

Net cash provided by (used in) financing activities | 1,329 | (794 | ) | 2,258 | |||||

Effect of exchange rate changes | (8 | ) | 74 | (45 | ) | ||||

Change in cash and cash equivalents | $ | 1,074 | $ | (774 | ) | $ | (63 | ) | |

2018 | 2017 | 2016 | |||||||

Dividends paid per common share | $ | 1.88 | $ | 1.70 | $ | 1.52 | |||

Total dividends paid to common shareholders | $ | 703 | $ | 636 | $ | 568 | |||

Total amount paid to repurchase common stock | $ | 300 | $ | 230 | $ | 13 | |||

Shares of repurchased common stock (in millions) | 1.9 | 1.9 | 0.1 | ||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 13 |

Contractual Obligations | |||||||||||||||

Total | 2019 | 2020 - 2021 | 2022 - 2023 | After 2023 | |||||||||||

Total debt | 9,952 | 1,373 | 1,594 | 630 | 6,355 | ||||||||||

Interest payments | 3,408 | 281 | 496 | 455 | 2,176 | ||||||||||

Unconditional purchase obligations | 1,411 | 1,306 | 80 | 13 | 12 | ||||||||||

Operating leases | 342 | 107 | 92 | 54 | 89 | ||||||||||

United States Tax Cuts and Jobs Act Transition Tax | 748 | 48 | 132 | 187 | 381 | ||||||||||

Other | 123 | 10 | 15 | 5 | 93 | ||||||||||

Total | $ | 15,984 | $ | 3,125 | $ | 2,409 | $ | 1,344 | $ | 9,106 | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 14 |

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 15 |

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

16 | |

2018 | 2017 | 2016 | |||||||||

Net sales | $ | 13,601 | $ | 12,444 | $ | 11,325 | |||||

Cost of sales | 4,663 | 4,264 | 3,821 | ||||||||

Gross profit | $ | 8,938 | $ | 8,180 | $ | 7,504 | |||||

Research, development and engineering expenses | 862 | 787 | 715 | ||||||||

Selling, general and administrative expenses | 5,099 | 4,552 | 4,137 | ||||||||

Recall charges, net of insurance proceeds | 23 | 173 | 158 | ||||||||

Amortization of intangible assets | 417 | 371 | 319 | ||||||||

Total operating expenses | $ | 6,401 | $ | 5,883 | $ | 5,329 | |||||

Operating income | $ | 2,537 | $ | 2,297 | $ | 2,175 | |||||

Other income (expense), net | (181 | ) | (234 | ) | (254 | ) | |||||

Earnings before income taxes | $ | 2,356 | $ | 2,063 | $ | 1,921 | |||||

Income taxes | (1,197 | ) | 1,043 | 274 | |||||||

Net earnings (loss) | $ | 3,553 | $ | 1,020 | $ | 1,647 | |||||

Net earnings (loss) per share of common stock: | |||||||||||

Basic | $ | 9.50 | $ | 2.73 | $ | 4.40 | |||||

Diluted | $ | 9.34 | $ | 2.68 | $ | 4.35 | |||||

Weighted-average shares outstanding: | |||||||||||

Basic | 374.1 | 374.0 | 374.1 | ||||||||

Effect of dilutive employee stock options | 6.2 | 6.1 | 4.4 | ||||||||

Diluted | 380.3 | 380.1 | 378.5 | ||||||||

2018 | 2017 | 2016 | |||||||||

Net earnings (loss) | $ | 3,553 | $ | 1,020 | $ | 1,647 | |||||

Other comprehensive income (loss), net of tax | |||||||||||

Marketable securities | — | (4 | ) | — | |||||||

Pension plans | (3 | ) | (2 | ) | (13 | ) | |||||

Unrealized gains (losses) on designated hedges | 22 | 4 | 20 | ||||||||

Financial statement translation | (97 | ) | 210 | (129 | ) | ||||||

Total other comprehensive income (loss), net of tax | $ | (78 | ) | $ | 208 | $ | (122 | ) | |||

Comprehensive income | $ | 3,475 | $ | 1,228 | $ | 1,525 | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 17 |

2018 | 2017 | ||||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | 3,616 | $ | 2,542 | |||

Marketable securities | 83 | 251 | |||||

Accounts receivable, less allowance of $64 ($59 in 2017) | 2,332 | 2,198 | |||||

Inventories: | |||||||

Materials and supplies | 606 | 528 | |||||

Work in process | 149 | 148 | |||||

Finished goods | 2,200 | 1,789 | |||||

Total inventories | $ | 2,955 | $ | 2,465 | |||

Prepaid expenses and other current assets | 747 | 537 | |||||

Total current assets | $ | 9,733 | $ | 7,993 | |||

Property, plant and equipment: | |||||||

Land, buildings and improvements | 1,041 | 936 | |||||

Machinery and equipment | 3,236 | 2,864 | |||||

Total property, plant and equipment | 4,277 | 3,800 | |||||

Less allowance for depreciation | 1,986 | 1,825 | |||||

Property, plant and equipment, net | $ | 2,291 | $ | 1,975 | |||

Goodwill | 8,563 | 7,168 | |||||

Other intangibles, net | 4,163 | 3,477 | |||||

Noncurrent deferred income tax assets | 1,678 | 283 | |||||

Other noncurrent assets | 801 | 1,301 | |||||

Total assets | $ | 27,229 | $ | 22,197 | |||

Liabilities and shareholders' equity | |||||||

Current liabilities | |||||||

Accounts payable | $ | 646 | $ | 487 | |||

Accrued compensation | 917 | 838 | |||||

Income taxes | 158 | 143 | |||||

Dividend payable | 192 | 178 | |||||

Accrued expenses and other liabilities | 1,521 | 1,207 | |||||

Current maturities of debt | 1,373 | 632 | |||||

Total current liabilities | $ | 4,807 | $ | 3,485 | |||

Long-term debt, excluding current maturities | 8,486 | 6,590 | |||||

Income taxes | 1,228 | 1,261 | |||||

Other noncurrent liabilities | 978 | 881 | |||||

Total liabilities | $ | 15,499 | $ | 12,217 | |||

Shareholders' equity | |||||||

Common stock, $0.10 par value | 37 | 37 | |||||

Additional paid-in capital | 1,559 | 1,496 | |||||

Retained earnings | 10,765 | 8,986 | |||||

Accumulated other comprehensive loss | (631 | ) | (553 | ) | |||

Total Stryker shareholders' equity | $ | 11,730 | $ | 9,966 | |||

Noncontrolling interest | — | 14 | |||||

Total shareholders' equity | $ | 11,730 | $ | 9,980 | |||

Total liabilities & shareholders' equity | $ | 27,229 | $ | 22,197 | |||

Dollar amounts in millions except per share amounts or as otherwise specified. | 18 |

2018 | 2017 | 2016 | |||||||||||||||

Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||

Common stock | |||||||||||||||||

Beginning | 374.4 | $ | 37 | 374.6 | $ | 37 | 373.0 | $ | 37 | ||||||||

Issuance of common stock under stock option and benefit plans | 1.9 | — | 1.7 | — | 1.7 | — | |||||||||||

Repurchase of common stock | (1.9 | ) | — | (1.9 | ) | — | (0.1 | ) | — | ||||||||

Ending | 374.4 | $ | 37 | 374.4 | $ | 37 | 374.6 | $ | 37 | ||||||||

Additional paid-in capital | |||||||||||||||||

Beginning | $ | 1,496 | $ | 1,432 | $ | 1,321 | |||||||||||

Issuance of common stock under stock option and benefit plans | (49 | ) | (42 | ) | 15 | ||||||||||||

Repurchase of common stock | (7 | ) | (7 | ) | (1 | ) | |||||||||||

Share-based compensation | 119 | 113 | 97 | ||||||||||||||

Ending | $ | 1,559 | $ | 1,496 | $ | 1,432 | |||||||||||

Retained earnings | |||||||||||||||||

Beginning | $ | 8,986 | $ | 8,842 | $ | 7,792 | |||||||||||

Cumulative effect of accounting changes | (759 | ) | — | — | |||||||||||||

Net earnings | 3,553 | 1,020 | 1,647 | ||||||||||||||

Repurchase of common stock | (293 | ) | (223 | ) | (12 | ) | |||||||||||

Cash dividends declared | (722 | ) | (653 | ) | (585 | ) | |||||||||||

Ending | $ | 10,765 | $ | 8,986 | $ | 8,842 | |||||||||||

Accumulated other comprehensive (loss) income | |||||||||||||||||

Beginning | $ | (553 | ) | $ | (761 | ) | $ | (639 | ) | ||||||||

Other comprehensive income (loss) | (78 | ) | 208 | (122 | ) | ||||||||||||

Ending | $ | (631 | ) | $ | (553 | ) | $ | (761 | ) | ||||||||

Total Stryker shareholders' equity | $ | 11,730 | $ | 9,966 | $ | 9,550 | |||||||||||

Non-controlling interest | |||||||||||||||||

Beginning | $ | 14 | $ | — | $ | — | |||||||||||

Acquisitions | — | 114 | — | ||||||||||||||

Interest purchased | (15 | ) | (99 | ) | — | ||||||||||||

Net earnings attributable to noncontrolling interest | — | — | — | ||||||||||||||

Foreign currency exchange translation adjustment | 1 | (1 | ) | — | |||||||||||||

Ending | $ | — | 14 | $ | — | ||||||||||||

Total shareholders' equity | $ | 11,730 | $ | 9,980 | $ | 9,550 | |||||||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 19 |

2018 | 2017 | 2016 | |||||||||

Operating activities | |||||||||||

Net earnings | $ | 3,553 | $ | 1,020 | $ | 1,647 | |||||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||||||

Depreciation | 306 | 271 | 227 | ||||||||

Amortization of intangible assets | 417 | 371 | 319 | ||||||||

Share-based compensation | 119 | 113 | 97 | ||||||||

Recall charges, net of insurance proceeds | 23 | 173 | 158 | ||||||||

Sale of inventory stepped up to fair value at acquisition | 16 | 22 | 36 | ||||||||

Deferred income tax (benefit) expense | (1,582 | ) | 36 | (46 | ) | ||||||

Changes in operating assets and liabilities: | |||||||||||

Accounts receivable | (60 | ) | (162 | ) | (192 | ) | |||||

Inventories | (385 | ) | (320 | ) | (299 | ) | |||||

Accounts payable | 116 | 21 | (16 | ) | |||||||

Accrued expenses and other liabilities | 289 | 90 | 241 | ||||||||

Recall-related payments | (90 | ) | (526 | ) | (190 | ) | |||||

Income taxes | (156 | ) | 704 | (128 | ) | ||||||

Other, net | 44 | (254 | ) | 61 | |||||||

Net cash provided by operating activities | $ | 2,610 | $ | 1,559 | $ | 1,915 | |||||

Investing activities | |||||||||||

Acquisitions, net of cash acquired | (2,451 | ) | (831 | ) | (4,332 | ) | |||||

Purchases of marketable securities | (226 | ) | (270 | ) | (151 | ) | |||||

Proceeds from sales of marketable securities | 394 | 87 | 785 | ||||||||

Purchases of property, plant and equipment | (572 | ) | (598 | ) | (490 | ) | |||||

Other investing, net | (2 | ) | (1 | ) | (3 | ) | |||||

Net cash used in investing activities | $ | (2,857 | ) | $ | (1,613 | ) | $ | (4,191 | ) | ||

Financing activities | |||||||||||

Proceeds and payments on short-term borrowings, net | (1 | ) | (200 | ) | 209 | ||||||

Proceeds from issuance of long-term debt | 3,126 | 499 | 3,453 | ||||||||

Payments on long-term debt | (669 | ) | — | (750 | ) | ||||||

Dividends paid | (703 | ) | (636 | ) | (568 | ) | |||||

Repurchase of common stock | (300 | ) | (230 | ) | (13 | ) | |||||

Cash paid for taxes from withheld shares | (120 | ) | (95 | ) | (67 | ) | |||||

Payments to purchase noncontrolling interest | (14 | ) | (99 | ) | — | ||||||

Other financing, net | 10 | (33 | ) | (6 | ) | ||||||

Net cash provided by (used in) financing activities | $ | 1,329 | $ | (794 | ) | $ | 2,258 | ||||

Effect of exchange rate changes on cash and cash equivalents | (8 | ) | 74 | (45 | ) | ||||||

Change in cash and cash equivalents | $ | 1,074 | $ | (774 | ) | $ | (63 | ) | |||

Cash and cash equivalents at beginning of year | 2,542 | 3,316 | 3,379 | ||||||||

Cash and cash equivalents at end of year | $ | 3,616 | $ | 2,542 | $ | 3,316 | |||||

Supplemental cash flow disclosure: | |||||||||||

Cash paid for income taxes, net of refunds | $ | 539 | $ | 312 | $ | 510 | |||||

Cash paid for interest on debt | $ | 248 | $ | 231 | $ | 180 | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 20 |

Dollar amounts in millions except per share amounts or as otherwise specified. | 21 |

Dollar amounts in millions except per share amounts or as otherwise specified. | 22 |

Dollar amounts in millions except per share amounts or as otherwise specified. | 23 |

Segment Net Sales | |||||||||||

Orthopaedics: | 2018 | 2017 | 2016 | ||||||||

Knees | $ | 1,701 | $ | 1,595 | $ | 1,490 | |||||

Hips | 1,336 | 1,303 | 1,283 | ||||||||

Trauma and Extremities | 1,580 | 1,478 | 1,364 | ||||||||

Other | 374 | 337 | 285 | ||||||||

$ | 4,991 | $ | 4,713 | $ | 4,422 | ||||||

MedSurg: | |||||||||||

Instruments | $ | 1,822 | $ | 1,678 | $ | 1,553 | |||||

Endoscopy | 1,846 | 1,652 | 1,470 | ||||||||

Medical | 2,118 | 1,969 | 1,633 | ||||||||

Sustainability | 259 | 258 | 238 | ||||||||

$ | 6,045 | $ | 5,557 | $ | 4,894 | ||||||

Neurotechnology and Spine: | |||||||||||

Neurotechnology | $ | 1,737 | $ | 1,423 | $ | 1,255 | |||||

Spine | 828 | 751 | 754 | ||||||||

$ | 2,565 | $ | 2,174 | $ | 2,009 | ||||||

Total | $ | 13,601 | $ | 12,444 | $ | 11,325 | |||||

United States Net Sales | |||||||||||

Orthopaedics: | 2018 | 2017 | 2016 | ||||||||

Knees | $ | 1,244 | $ | 1,169 | $ | 1,087 | |||||

Hips | 838 | 820 | 804 | ||||||||

Trauma and Extremities | 1,001 | 950 | 856 | ||||||||

Other | 300 | 276 | 234 | ||||||||

$ | 3,383 | $ | 3,215 | $ | 2,981 | ||||||

MedSurg: | |||||||||||

Instruments | $ | 1,424 | $ | 1,304 | $ | 1,207 | |||||

Endoscopy | 1,432 | 1,290 | 1,130 | ||||||||

Medical | 1,630 | 1,525 | 1,296 | ||||||||

Sustainability | 257 | 257 | 236 | ||||||||

$ | 4,743 | $ | 4,376 | $ | 3,869 | ||||||

Neurotechnology and Spine: | |||||||||||

Neurotechnology | $ | 1,115 | $ | 900 | $ | 809 | |||||

Spine | 607 | 568 | 571 | ||||||||

$ | 1,722 | $ | 1,468 | $ | 1,380 | ||||||

Total | $ | 9,848 | $ | 9,059 | $ | 8,230 | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 24 |

International Net Sales | |||||||||||

Orthopaedics: | 2018 | 2017 | 2016 | ||||||||

Knees | $ | 457 | $ | 426 | $ | 403 | |||||

Hips | 498 | 483 | 479 | ||||||||

Trauma and Extremities | 579 | 528 | 508 | ||||||||

Other | 74 | 61 | 51 | ||||||||

$ | 1,608 | $ | 1,498 | $ | 1,441 | ||||||

MedSurg: | |||||||||||

Instruments | $ | 398 | $ | 374 | $ | 346 | |||||

Endoscopy | 414 | 362 | 341 | ||||||||

Medical | 488 | 444 | 337 | ||||||||

Sustainability | 2 | 1 | 1 | ||||||||

$ | 1,302 | $ | 1,181 | $ | 1,025 | ||||||

Neurotechnology and Spine: | |||||||||||

Neurotechnology | $ | 622 | $ | 523 | $ | 446 | |||||

Spine | 221 | 183 | 183 | ||||||||

$ | 843 | $ | 706 | $ | 629 | ||||||

Total | $ | 3,753 | $ | 3,385 | $ | 3,095 | |||||

Level 1 | Quoted market prices in active markets for identical assets or liabilities. |

Level 2 | Observable market-based inputs or unobservable inputs that are corroborated by market data. |

Level 3 | Unobservable inputs reflecting our assumptions or external inputs from active markets. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 25 |

Assets Measured at Fair Value | ||||||

2018 | 2017 | |||||

Cash and cash equivalents | $ | 3,616 | $ | 2,542 | ||

Trading marketable securities | 118 | 121 | ||||

Level 1 - Assets | $ | 3,734 | $ | 2,663 | ||

Available-for-sale marketable securities: | ||||||

Corporate and asset-backed debt securities | $ | 38 | $ | 125 | ||

Foreign government debt securities | — | 2 | ||||

United States agency debt securities | 11 | 27 | ||||

United States treasury debt securities | 23 | 70 | ||||

Certificates of deposit | 11 | 27 | ||||

Total available-for-sale marketable securities | $ | 83 | $ | 251 | ||

Foreign currency exchange forward contracts | 77 | 15 | ||||

Interest rate swap asset | — | 49 | ||||

Level 2 - Assets | $ | 160 | $ | 315 | ||

Total assets measured at fair value | $ | 3,894 | $ | 2,978 | ||

Liabilities Measured at Fair Value | ||||||

2018 | 2017 | |||||

Deferred compensation arrangements | $ | 118 | $ | 121 | ||

Level 1 - Liabilities | $ | 118 | $ | 121 | ||

Foreign currency exchange forward contracts | $ | 20 | $ | 37 | ||

Level 2 - Liabilities | $ | 20 | $ | 37 | ||

Contingent consideration: | ||||||

Beginning | $ | 32 | $ | 86 | ||

Additions | 77 | 3 | ||||

Change in estimate | 15 | 2 | ||||

Settlements | (7 | ) | (59 | ) | ||

Ending | $ | 117 | $ | 32 | ||

Level 3 - Liabilities | $ | 117 | $ | 32 | ||

Total liabilities measured at fair value | $ | 255 | $ | 190 | ||

Fair Value of Available for Sale Securities by Maturity | ||||||

2018 | 2017 | |||||

Due in one year or less | $ | 51 | $ | 107 | ||

Due after one year through three years | $ | 32 | $ | 144 | ||

Securities in a Continuous Unrealized Loss Position | ||||

Number of Investments | Fair Value | |||

Corporate and Asset-Backed | 75 | $ | 34 | |

Foreign government | 0 | — | ||

United States Agency | 8 | 10 | ||

United States Treasury | 17 | 19 | ||

Certificate of Deposit | 15 | 7 | ||

Total | 115 | $ | 70 | |

2018 | Designated | Non-Designated | Total | ||||||

Gross notional amount | $ | 870 | $ | 5,466 | $ | 6,336 | |||

Maximum term in days | 586 | ||||||||

Fair value: | |||||||||

Other current assets | $ | 15 | $ | 28 | $ | 43 | |||

Other noncurrent assets | 1 | 33 | 34 | ||||||

Other current liabilities | (5 | ) | (15 | ) | (20 | ) | |||

Other noncurrent liabilities | — | — | — | ||||||

Total fair value | $ | 11 | $ | 46 | $ | 57 | |||

2017 | |||||||||

Gross notional amount | $ | 1,104 | $ | 4,767 | $ | 5,871 | |||

Maximum term in days | 548 | ||||||||

Fair value: | |||||||||

Other current assets | $ | 11 | $ | 4 | $ | 15 | |||

Other noncurrent assets | 1 | — | 1 | ||||||

Other current liabilities | (7 | ) | (29 | ) | (36 | ) | |||

Other noncurrent liabilities | (1 | ) | — | (1 | ) | ||||

Total fair value | $ | 4 | $ | (25 | ) | $ | (21 | ) | |

Net Currency Exchange Rate Gains (Losses) | |||||||||

Recorded in: | 2018 | 2017 | 2016 | ||||||

Cost of sales | $ | 7 | $ | (6 | ) | $ | — | ||

Other income (expense), net | (6 | ) | (9 | ) | (19 | ) | |||

Total | $ | 1 | $ | (15 | ) | $ | (19 | ) | |

Dollar amounts in millions except per share amounts or as otherwise specified. | 26 |

Marketable Securities | Pension Plans | Hedges | Financial Statement Translation | Total | |||||||||||

2016 | $ | — | $ | (132 | ) | $ | 24 | $ | (653 | ) | $ | (761 | ) | ||

OCI | (7 | ) | (27 | ) | (4 | ) | 163 | 125 | |||||||

Income taxes | 1 | 19 | 4 | 47 | 71 | ||||||||||

Reclassifications to: | |||||||||||||||

Cost of Sales | — | 8 | 6 | — | 14 | ||||||||||

Other income | 2 | — | — | — | 2 | ||||||||||

Income taxes | — | (2 | ) | (2 | ) | — | (4 | ) | |||||||

Net OCI | (4 | ) | (2 | ) | 4 | 210 | 208 | ||||||||

2017 | $ | (4 | ) | $ | (134 | ) | $ | 28 | $ | (443 | ) | $ | (553 | ) | |

OCI | 2 | (16 | ) | 36 | (115 | ) | (93 | ) | |||||||

Income taxes | — | 1 | (9 | ) | 18 | 10 | |||||||||

Reclassifications to: | |||||||||||||||

Cost of Sales | — | 9 | (7 | ) | — | 2 | |||||||||

Other Income | (2 | ) | 1 | — | — | (1 | ) | ||||||||

Income taxes | — | 2 | 2 | — | 4 | ||||||||||

Net OCI | — | (3 | ) | 22 | (97 | ) | (78 | ) | |||||||

2018 | $ | (4 | ) | $ | (137 | ) | $ | 50 | $ | (540 | ) | $ | (631 | ) | |

Purchase Price Allocation of Acquired Net Assets | ||||||||||

2018 | 2017 | |||||||||

K2M | Entellus | NOVADAQ | ||||||||

Tangible assets acquired: | ||||||||||

Accounts receivable | 67 | 17 | 11 | |||||||

Inventory | 136 | 14 | 25 | |||||||

Other assets | 118 | 72 | 7 | |||||||

Contingent consideration | — | (78 | ) | — | ||||||

Liabilities | (247 | ) | (92 | ) | (56 | ) | ||||

Intangible assets: | ||||||||||

Customer relationship | 34 | 33 | 18 | |||||||

Distributor relationship | 1 | — | — | |||||||

Trade name | 10 | — | 1 | |||||||

Developed technology and patents | 473 | 256 | 141 | |||||||

Internally developed software | 2 | — | — | |||||||

Goodwill | 786 | 475 | 527 | |||||||

Purchase price, net of cash acquired | $ | 1,380 | $ | 697 | $ | 674 | ||||

Weighted average life of intangible assets | 14 | 16 | 15 | |||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 27 |

Future Obligations | ||||||||||||||||||

2019 | 2020 | 2021 | 2022 | 2023 | Thereafter | |||||||||||||

Debt repayments | $ | 1,373 | $ | 844 | $ | 750 | $ | — | $ | 630 | $ | 6,355 | ||||||

Purchase obligations | $ | 1,306 | $ | 74 | $ | 6 | $ | 6 | $ | 7 | $ | 12 | ||||||

Minimum lease payments | $ | 107 | $ | 53 | $ | 39 | $ | 30 | $ | 24 | $ | 89 | ||||||

Summary of Other Intangible Assets | ||||||||||

Weighted Average Amortization Period (Years) | Gross Carrying Amount | Less Accumulated Amortization | Net Carrying Amount | |||||||

Developed technologies | ||||||||||

2018 | 13 | $ | 3,426 | $ | 1,115 | $ | 2,311 | |||

2017 | 12 | 2,416 | 917 | 1,499 | ||||||

Customer relationships | ||||||||||

2018 | 15 | $ | 2,155 | $ | 703 | $ | 1,452 | |||

2017 | 15 | 2,088 | 561 | 1,527 | ||||||

Patents | ||||||||||

2018 | 12 | $ | 332 | $ | 231 | $ | 101 | |||

2017 | 10 | 340 | 227 | 113 | ||||||

Trademarks | ||||||||||

2018 | 18 | $ | 349 | $ | 108 | $ | 241 | |||

2017 | 18 | 352 | 84 | 268 | ||||||

In-process research and development | ||||||||||

2018 | N/A | $ | 6 | — | $ | 6 | ||||

2017 | N/A | 25 | — | 25 | ||||||

Other | ||||||||||

2018 | 11 | $ | 128 | $ | 76 | $ | 52 | |||

2017 | 9 | 93 | 48 | 45 | ||||||

Total | ||||||||||

2018 | 14 | $ | 6,396 | $ | 2,233 | $ | 4,163 | |||

2017 | 14 | $ | 5,314 | $ | 1,837 | $ | 3,477 | |||

Changes in the Net Carrying Value of Goodwill by Segment | ||||||||||||

Orthopaedics | MedSurg | Neurotechnology and Spine | Total | |||||||||

2016 | $ | 2,372 | $ | 2,934 | $ | 1,050 | $ | 6,356 | ||||

Additions and adjustments | 2 | 553 | 109 | 664 | ||||||||

Foreign exchange | 52 | 22 | 74 | 148 | ||||||||

2017 | $ | 2,426 | $ | 3,509 | $ | 1,233 | $ | 7,168 | ||||

Additions and adjustments | 4 | 100 | 1,366 | 1,470 | ||||||||

Foreign exchange | (31 | ) | (28 | ) | (16 | ) | (75 | ) | ||||

2018 | $ | 2,399 | $ | 3,581 | $ | 2,583 | $ | 8,563 | ||||

Estimated Amortization Expense | ||||||||||||||

2019 | 2020 | 2021 | 2022 | 2023 | ||||||||||

$ | 438 | $ | 413 | $ | 400 | $ | 392 | $ | 372 | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 28 |

Option Value and Assumptions | |||||||||||

2018 | 2017 | 2016 | |||||||||

Weighted-average fair value per share | $ | 28.52 | $ | 22.43 | $ | 17.73 | |||||

Assumptions: | |||||||||||

Risk-free interest rate | 2.7 | % | 2.0 | % | 1.3 | % | |||||

Expected dividend yield | 1.2 | % | 1.5 | % | 1.6 | % | |||||

Expected stock price volatility | 16.8 | % | 19.4 | % | 20.5 | % | |||||

Expected option life (years) | 6.0 | 6.0 | 6.1 | ||||||||

2018 Stock Option Activity | ||||||||||||

Shares (in millions) | Weighted Average Exercise Price | Weighted-Average Remaining Term (in years) | Aggregate Intrinsic Value | |||||||||

Outstanding January 1 | 14.7 | $ | 83.71 | |||||||||

Granted | 2.4 | 154.50 | ||||||||||

Exercised | (2.5 | ) | 66.98 | |||||||||

Canceled | (0.5 | ) | 114.98 | |||||||||

Outstanding December 31 | 14.1 | $ | 97.69 | 6.1 | $ | 834.5 | ||||||

Exercisable December 31 | 7.3 | $ | 74.10 | 4.4 | $ | 598.4 | ||||||

Options expected to vest | 6.2 | $ | 121.48 | 7.8 | $ | 220.7 | ||||||

Restricted Stock Units (RSUs) and Performance Stock Units (PSUs) Activity | |||||||||||||

Shares (in millions) | Weighted Average Grant Date Fair Value | ||||||||||||

RSUs | PSUs | RSUs | PSUs | ||||||||||

Nonvested on January 1 | 1.0 | 0.3 | $ | 104.85 | $ | 104.51 | |||||||

Granted | 0.5 | 0.1 | 150.23 | 153.67 | |||||||||

Vested | (0.5 | ) | (0.1 | ) | 100.32 | 92.96 | |||||||

Canceled or forfeited | (0.1 | ) | — | 117.86 | — | ||||||||

Nonvested on December 31 | 0.9 | 0.3 | $ | 129.90 | $ | 122.39 | |||||||

Summary of Total Debt | |||||||||||

2018 | 2017 | ||||||||||

Senior unsecured notes: | |||||||||||

Rate | Due | ||||||||||

1.300% | April 1, 2018 | $ | — | $ | 600 | ||||||

1.800% | January 15, 2019 | 500 | 499 | ||||||||

2.000% | March 8, 2019 | 750 | 748 | ||||||||

4.375% | January 15, 2020 | 499 | 498 | ||||||||

Variable | November 30, 2020 | 343 | — | ||||||||

2.625% | March 15, 2021 | 747 | 746 | ||||||||

1.125% | November 30, 2023 | 627 | — | ||||||||

3.375% | May 15, 2024 | 584 | 598 | ||||||||

3.375% | November 1, 2025 | 746 | 745 | ||||||||

3.500% | March 15, 2026 | 990 | 988 | ||||||||

2.125% | November 30, 2027 | 853 | — | ||||||||

3.650% | March 7, 2028 | 595 | — | ||||||||

2.625% | November 30, 2030 | 733 | — | ||||||||

4.100% | April 1, 2043 | 391 | 391 | ||||||||

4.375% | May 15, 2044 | 395 | 394 | ||||||||

4.625% | March 15, 2046 | 980 | 980 | ||||||||

Commercial paper | — | — | |||||||||

Other | 126 | 35 | |||||||||

Total debt | $ | 9,859 | $ | 7,222 | |||||||

Less current maturities | 1,373 | 632 | |||||||||

Total long-term debt | $ | 8,486 | $ | 6,590 | |||||||

Unamortized debt issuance costs | $ | 50 | $ | 39 | |||||||

Borrowing capacity on existing facilities | $ | 1,548 | $ | 1,547 | |||||||

Fair value of senior unsecured notes | $ | 9,746 | $ | 7,521 | |||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 29 |

Effective Income Tax Rate Reconciliation | ||||||||

2018 | 2017 | 2016 | ||||||

United States federal statutory rate | 21.0 | % | 35.0 | % | 35.0 | % | ||

United States state and local income taxes, less federal deduction | 0.4 | 1.2 | 1.7 | |||||

Foreign income tax at rates other than 21% | (6.5 | ) | (21.0 | ) | (22.2 | ) | ||

Tax Cuts and Jobs Act of 2017 transition tax | 2.2 | 38.0 | — | |||||

Tax Cuts and Jobs Act of 2017 deferred tax changes | (0.6 | ) | 2.3 | — | ||||

Tax related to repatriation of foreign earnings | 0.5 | — | (0.3 | ) | ||||

Intellectual property transfer | (63.8 | ) | — | — | ||||

Other | (4.0 | ) | (4.9 | ) | 0.1 | |||

Effective income tax rate | (50.8 | )% | 50.6 | % | 14.3 | % | ||

Earnings Before Income Taxes | |||||||||||

2018 | 2017 | 2016 | |||||||||

United States | $ | 509 | $ | 499 | $ | 542 | |||||

International | 1,847 | 1,564 | 1,379 | ||||||||

Total | $ | 2,356 | $ | 2,063 | $ | 1,921 | |||||

Components of Income Tax Expense (Benefit) | |||||||||||

Current income tax expense: | 2018 | 2017 | 2016 | ||||||||

United States federal | $ | 178 | $ | 836 | $ | 94 | |||||

United States state and local | 30 | 38 | 50 | ||||||||

International | 177 | 133 | 176 | ||||||||

Total current income tax expense | $ | 385 | $ | 1,007 | $ | 320 | |||||

Deferred income tax (benefit) expense: | |||||||||||

United States federal | $ | (44 | ) | $ | 84 | $ | (17 | ) | |||

United States state and local | (20 | ) | (9 | ) | (12 | ) | |||||

International | (1,518 | ) | (39 | ) | (17 | ) | |||||

Total deferred income tax (benefit) expense | $ | (1,582 | ) | $ | 36 | $ | (46 | ) | |||

Total income tax (benefit) expense | $ | (1,197 | ) | $ | 1,043 | $ | 274 | ||||

Deferred Income Tax Assets and Liabilities | |||||||

Deferred income tax assets: | 2018 | 2017 | |||||

Inventories | $ | 390 | $ | 480 | |||

Product-related liabilities | 60 | 34 | |||||

Other accrued expenses | 222 | 204 | |||||

Depreciation and amortization | 1,504 | — | |||||

State income taxes | 70 | 46 | |||||

Share-based compensation | 47 | 46 | |||||

Net operating loss carryforwards | 134 | 52 | |||||

Other | 177 | 105 | |||||

Total deferred income tax assets | $ | 2,604 | $ | 967 | |||

Less valuation allowances | (66 | ) | (49 | ) | |||

Net deferred income tax assets | $ | 2,538 | $ | 918 | |||

Deferred income tax liabilities: | |||||||

Depreciation and amortization | $ | (865 | ) | $ | (598 | ) | |

Undistributed earnings | (46 | ) | (81 | ) | |||

Other | (3 | ) | (3 | ) | |||

Total deferred income tax liabilities | $ | (914 | ) | $ | (682 | ) | |

Net deferred income tax assets | $ | 1,624 | $ | 236 | |||

Reported as: | |||||||

Noncurrent deferred income tax assets | $ | 1,678 | $ | 283 | |||

Noncurrent liabilities—Other liabilities | (54 | ) | (47 | ) | |||

Total | $ | 1,624 | $ | 236 | |||

Dollar amounts in millions except per share amounts or as otherwise specified. | 30 |

Uncertain Income Tax Positions | |||||||

2018 | 2017 | ||||||

Beginning uncertain tax positions | $ | 540 | $ | 287 | |||

Increases related to current year income tax positions | 22 | 123 | |||||

Increases related to prior year income tax positions | 25 | 131 | |||||

Decreases related to prior year income tax positions: | |||||||

Settlements and resolutions of income tax audits | (37 | ) | (9 | ) | |||

Statute of limitations expirations | (14 | ) | (4 | ) | |||

Foreign currency translation | (8 | ) | 12 | ||||

Ending uncertain tax positions | $ | 528 | $ | 540 | |||

Reported as: | |||||||

Noncurrent liabilities—Income taxes | 528 | 540 | |||||

Total | $ | 528 | $ | 540 | |||

2018 | 2017 | 2016 | |||||||||

Plan expense | $ | 180 | $ | 181 | $ | 166 | |||||

Expense funded with Stryker common stock | 29 | 25 | 22 | ||||||||

Stryker common stock held by plan: | |||||||||||

Dollar amount | 358 | 353 | 272 | ||||||||

Shares (in millions) | 2.3 | 2.3 | 2.3 | ||||||||

Value as a percentage of total plan assets | 12 | % | 11 | % | 11 | % | |||||

Components of Net Periodic Pension Cost | |||||||||||

Net periodic benefit cost: | 2018 | 2017 | 2016 | ||||||||

Service cost | $ | (44 | ) | $ | (42 | ) | $ | (33 | ) | ||

Interest cost | (11 | ) | (10 | ) | (11 | ) | |||||

Expected return on plan assets | 12 | 11 | 10 | ||||||||

Amortization of prior service credit | 1 | 1 | 1 | ||||||||

Recognized actuarial loss | (11 | ) | (9 | ) | (9 | ) | |||||

Net periodic benefit cost | $ | (53 | ) | $ | (49 | ) | $ | (42 | ) | ||

Changes in assets and benefit obligations recognized in OCI: | |||||||||||

Net actuarial gain (loss) | $ | 11 | $ | (25 | ) | $ | (26 | ) | |||

Recognized net actuarial loss | 10 | 9 | 9 | ||||||||

Prior service (credit) cost and transition amount | (1 | ) | (1 | ) | (1 | ) | |||||

Total recognized in other comprehensive income (loss) | $ | 20 | $ | (17 | ) | $ | (18 | ) | |||

Total recognized in net periodic benefit cost and OCI | $ | (33 | ) | $ | (66 | ) | $ | (60 | ) | ||

Weighted-average rates used to determine net periodic benefit cost: | |||||||||||

Discount rate | 1.8 | % | 1.8 | % | 2.1 | % | |||||

Expected return on plan assets | 3.3 | % | 3.3 | % | 3.6 | % | |||||

Rate of compensation increase | 2.8 | % | 2.8 | % | 2.3 | % | |||||

Weighted-average discount rate used to determine projected benefit obligations | 1.9 | % | 1.8 | % | 1.8 | % | |||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 31 |

2018 | 2017 | ||||||

Fair value of plan assets | $ | 376 | $ | 370 | |||

Benefit obligations | (735 | ) | (708 | ) | |||

Funded status | $ | (359 | ) | $ | (338 | ) | |

Reported as: | |||||||

Current liabilities—accrued compensation | $ | (2 | ) | $ | (2 | ) | |

Noncurrent liabilities—other liabilities | (339 | ) | (336 | ) | |||

Pre-tax amounts recognized in AOCI: | |||||||

Unrecognized net actuarial loss | (168 | ) | (189 | ) | |||

Unrecognized prior service credit | 11 | 12 | |||||

Total | $ | (157 | ) | $ | (177 | ) | |

Change in Benefit Obligations | |||||||

2018 | 2017 | ||||||

Beginning projected benefit obligations | $ | 708 | $ | 588 | |||

Service cost | 44 | 42 | |||||

Interest cost | 11 | 10 | |||||

Foreign exchange impact | (16 | ) | 60 | ||||

Employee contributions | 6 | 6 | |||||

Actuarial (gains) losses | (1 | ) | 19 | ||||

Acquisition | — | — | |||||

Benefits paid | (17 | ) | (17 | ) | |||

Ending projected benefit obligations | $ | 735 | $ | 708 | |||

Ending accumulated benefit obligations | $ | 702 | $ | 675 | |||

Change in Plan Assets | |||||||

2018 | 2017 | ||||||

Beginning fair value of plan assets | $ | 370 | $ | 308 | |||

Actual return | (2 | ) | 21 | ||||

Employer contributions | 22 | 23 | |||||

Employee contributions | 6 | 6 | |||||

Foreign exchange impact | (6 | ) | 26 | ||||

Acquisition | — | — | |||||

Benefits paid | (14 | ) | (14 | ) | |||

Ending fair value of plan assets | $ | 376 | $ | 370 | |||

Allocation of Plan Assets | |||||||

2019 Target | 2018 Actual | 2017 Actual | |||||

Equity securities | 26 | % | 26 | % | 28 | % | |

Debt securities | 45 | 46 | 45 | ||||

Other | 29 | 28 | 27 | ||||

Total | 100 | % | 100 | % | 100 | % | |

Valuation of Plan Assets | ||||||||||||

2018 | Level 1 | Level 2 | Level 3 | Total | ||||||||

Cash and cash equivalents | $ | 10 | $ | — | $ | — | $ | 10 | ||||

Equity securities | 20 | 85 | — | 105 | ||||||||

Corporate debt securities | 2 | 153 | — | 155 | ||||||||

Other | 7 | 43 | 56 | 106 | ||||||||

Total | $ | 39 | $ | 281 | $ | 56 | $ | 376 | ||||

2017 | ||||||||||||

Cash and cash equivalents | $ | 4 | $ | — | $ | — | $ | 4 | ||||

Equity securities | 28 | 92 | — | 120 | ||||||||

Corporate debt securities | 2 | 148 | — | 150 | ||||||||

Other | 2 | 45 | 49 | 96 | ||||||||

Total | $ | 36 | $ | 285 | $ | 49 | $ | 370 | ||||

Estimated Future Benefit Payments | |||||||||||||||||

2019 | 2020 | 2021 | 2022 | 2023 | 2024-2028 | ||||||||||||

$ | 18 | $ | 17 | $ | 17 | $ | 18 | $ | 18 | $ | 106 | ||||||

2018 Quarters | Mar 31 | Jun 30 | Sep 30 | Dec 31 | ||||||||

Net sales | $ | 3,241 | $ | 3,322 | $ | 3,242 | $ | 3,796 | ||||

Gross profit | 2,137 | 2,190 | 2,155 | 2,456 | ||||||||

Earnings before income taxes | 542 | 623 | 534 | 657 | ||||||||

Net earnings | 443 | 452 | 590 | 2,068 | ||||||||

Net earnings per share of common stock: | ||||||||||||

Basic | $ | 1.18 | $ | 1.21 | $ | 1.58 | $ | 5.52 | ||||

Diluted | $ | 1.16 | $ | 1.19 | $ | 1.55 | $ | 5.44 | ||||

Market price of common stock: | ||||||||||||

High | $ | 170.00 | $ | 179.84 | $ | 177.76 | $ | 178.90 | ||||

Low | $ | 146.80 | $ | 153.76 | $ | 163.16 | $ | 144.75 | ||||

Dividends declared per share of common stock | $ | 0.47 | $ | 0.47 | $ | 0.47 | $ | 0.52 | ||||

2017 Quarters | Mar 31 | Jun 30 | Sep 30 | Dec 31 | ||||||||

Net sales | $ | 2,955 | $ | 3,012 | $ | 3,006 | $ | 3,471 | ||||

Gross profit | 1,964 | 1,991 | 1,984 | 2,241 | ||||||||

Earnings before income taxes | 499 | 444 | 471 | 649 | ||||||||

Net earnings | 444 | 391 | 434 | (249 | ) | |||||||

Net earnings per share of common stock: | ||||||||||||

Basic | $ | 1.19 | $ | 1.04 | $ | 1.16 | $ | (0.66 | ) | |||

Diluted | $ | 1.17 | $ | 1.03 | $ | 1.14 | $ | (0.66 | ) | |||

Market price of common stock: | ||||||||||||

High | $ | 133.59 | $ | 145.62 | $ | 148.84 | $ | 160.62 | ||||

Low | $ | 116.50 | $ | 129.82 | $ | 137.70 | $ | 141.68 | ||||

Dividends declared per share of common stock | $ | 0.425 | $ | 0.425 | $ | 0.425 | $ | 0.47 | ||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 32 |

Segment Results | |||||||||

2018 | 2017 | 2016 | |||||||

Orthopaedics | $ | 4,991 | $ | 4,713 | $ | 4,422 | |||

MedSurg | $ | 6,045 | 5,557 | 4,894 | |||||

Neurotechnology & Spine | 2,565 | 2,174 | 2,009 | ||||||

Net sales | $ | 13,601 | $ | 12,444 | $ | 11,325 | |||

Orthopaedics | $ | 350 | $ | 337 | $ | 317 | |||

MedSurg | 285 | 315 | 249 | ||||||

Neurotechnology & Spine | 176 | 142 | 140 | ||||||

Segment depreciation and amortization | $ | 811 | $ | 794 | $ | 706 | |||

Corporate and Other | 155 | 65 | 46 | ||||||

Total depreciation and amortization | $ | 966 | $ | 859 | $ | 752 | |||

Orthopaedics | $ | 1,804 | $ | 1,681 | $ | 1,602 | |||

MedSurg | 1,444 | 1,228 | 1,087 | ||||||

Neurotechnology & Spine | 700 | 631 | 559 | ||||||

Segment operating income | $ | 3,948 | $ | 3,540 | $ | 3,248 | |||

Items not allocated to segments: | |||||||||

Corporate and Other | $ | (431 | ) | $ | (402 | ) | $ | (352 | ) |

Acquisition & integration-related charges | (123 | ) | (64 | ) | (131 | ) | |||

Amortization of intangible assets | (417 | ) | (371 | ) | (319 | ) | |||

Restructuring related-charges | (220 | ) | (194 | ) | (125 | ) | |||

Medical device regulations | (12 | ) | — | — | |||||

Recall-related matters | (23 | ) | (173 | ) | (158 | ) | |||

Regulatory and legal matters | (185 | ) | (39 | ) | 12 | ||||

Consolidated operating income | $ | 2,537 | $ | 2,297 | $ | 2,175 | |||

Segment Assets and Capital Spending | |||||||||

Assets: | 2018 | 2017 | 2016 | ||||||

Orthopaedics | $ | 8,873 | $ | 7,486 | $ | 7,048 | |||

MedSurg | 10,417 | 9,759 | 8,553 | ||||||

Neurotechnology & Spine | 7,260 | 4,105 | 4,129 | ||||||

Total segment assets | $ | 26,550 | $ | 21,350 | $ | 19,730 | |||

Corporate and Other | 679 | 847 | 705 | ||||||

Total assets | $ | 27,229 | $ | 22,197 | $ | 20,435 | |||

Capital spending: | |||||||||

Orthopaedics | $ | 134 | $ | 138 | $ | 153 | |||

MedSurg | 217 | 194 | 129 | ||||||

Neurotechnology & Spine | 31 | 50 | 25 | ||||||

Total segment capital spending | $ | 382 | $ | 382 | $ | 307 | |||

Corporate and Other | 190 | 216 | 183 | ||||||

Total capital spending | $ | 572 | $ | 598 | $ | 490 | |||

Geographic Information | ||||||||||||||||

Net Sales | Net Property, Plant and Equipment | |||||||||||||||

2018 | 2017 | 2016 | 2018 | 2017 | ||||||||||||

United States | $ | 9,848 | $ | 9,059 | $ | 8,230 | $ | 1,348 | $ | 1,102 | ||||||

Europe, Middle East, Africa | 1,793 | 1,567 | 1,437 | 669 | 718 | |||||||||||

Asia Pacific | 1,532 | 1,413 | 1,325 | 96 | 107 | |||||||||||

Other countries | 428 | 405 | 333 | 178 | 48 | |||||||||||

Total | $ | 13,601 | $ | 12,444 | $ | 11,325 | $ | 2,291 | $ | 1,975 | ||||||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

ITEM 9A. | CONTROLS AND PROCEDURES. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 33 |

ITEM 9B. | OTHER INFORMATION. |

PART III |

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 34 |

ITEM 11. | EXECUTIVE COMPENSATION. |

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

Plan | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding shares reflected in the first column) | ||||

2006 Long-Term Incentive Plan | 3,708,137 | $ | 56.44 | — | |||

2008 Employee Stock Purchase Plan | N/A | N/A | 4,749,789 | ||||

2011 Long-Term Incentive Plan(1) | 11,562,321 | $ | 112.38 | 33,077,550 | |||

2011 Performance Incentive Award Plan | N/A | N/A | 332,505 | ||||

Total | 38,159,844.0 | ||||||

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

Dollar amounts in millions except per share amounts or as otherwise specified. | 35 |

PART IV |

ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES. |

(a) 1. | Financial Statements | ||||||||||||||||||||

The following Consolidated Financial Statements are set forth in Part II, Item 8 of this report. | |||||||||||||||||||||

Report of Independent Registered Public Accounting Firm | 16 | ||||||||||||||||||||

Consolidated Statements of Earnings for 2018, 2017, and 2016 | 17 | ||||||||||||||||||||

Consolidated Statements of Comprehensive Income for 2018, 2017, and 2016 | 17 | ||||||||||||||||||||

Consolidated Balance Sheets on 2018 and 2017 | 18 | ||||||||||||||||||||

Consolidated Statements of Shareholders’ Equity for 2018, 2017, and 2016 | 19 | ||||||||||||||||||||

Consolidated Statements of Cash Flows for 2018, 2017, and 2016 | 20 | ||||||||||||||||||||

Notes to Consolidated Financial Statements | 21 | ||||||||||||||||||||

(a) 2. | Financial Statement Schedules | ||||||||||||||||||||

The Consolidated Financial Statement schedule of Stryker Corporation and its subsidiaries is: | |||||||||||||||||||||

SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS | |||||||||||||||||||||

Additions | Deductions | ||||||||||||||||||||

Description | Balance at Beginning of Period | Charged to Costs & Expenses | Uncollectible Amounts Written Off, Net of Recoveries | Effect of Changes in Foreign Currency Exchange Rates | Balance at End of Period | ||||||||||||||||

DEDUCTED FROM ASSET ACCOUNTS | |||||||||||||||||||||

Allowance for Doubtful Accounts: | |||||||||||||||||||||

Year ended December 31, 2018 | $ | 59 | $ | 20 | $ | 14 | $ | 1 | $ | 64 | |||||||||||

Year ended December 31, 2017 | $ | 56 | $ | 15 | $ | 14 | $ | (2 | ) | $ | 59 | ||||||||||

Year ended December 31, 2016 | $ | 61 | $ | 10 | $ | 14 | $ | 1 | $ | 56 | |||||||||||

All other schedules for which provision is made in the applicable accounting regulation of the U.S. Securities and Exchange Commission are not required under the related instructions or are inapplicable and, therefore, have been omitted. | |||||||||||||||||||||

(a) 3. | Exhibits | ||||||||||||||||||||

Dollar amounts in millions except per share amounts or as otherwise specified. | 36 |

Exhibit 2— | Plan of Acquisition, Reorganization, Arrangement, Liquidation or Succession | |

(i) | ||

(ii) | ||

(iii) | ||

Exhibit 3— | Articles of Incorporation and By-Laws | |

(i) | ||

(ii) | ||

Exhibit 4— | Instruments defining the rights of security holders, including indentures—We agree to furnish to the Commission upon request a copy of each instrument pursuant to which long-term debt of Stryker Corporation and its subsidiaries not exceeding 10% of the total assets of Stryker Corporation and its consolidated subsidiaries is authorized. | |

(i) | ||

(ii) | ||

(iii) | ||

(iv) | ||

(v) | ||

(vi) | ||

(vii) | ||

(viii) | ||

(ix) | ||

(x) | ||

(xi) | ||

(xii) | ||

(xiii) | ||

(xiv) | ||

(xv) | ||

(xvi) | ||

(xvii) | ||

37 | |

Exhibit 10— | Material contracts | |

(i)* | ||

(ii)* | † | |

(iii)* | † | |

(iv)* | † | |

(v)* | ||

(vi)* | ||

(vii)* | ||

(viii)* | ||

(ix)* | ||

(x)* | ||

(xi)* | ||

(xii)* | ||

(xiii)* | ||

(xiv)* | ||

(xv)* | ||

(xvi)* | ||

(xvii)* | ||

(xviii)* | ||

(xix)* | ||

(xx)* | ||

(xxi)* | ||

(xxii)* | ||

(xxiii) | ||

(xxiv) | ||

(xxv) | ||

(xxvi)* | ||

(xxvii)* | ||

(xxviii)* | ||

38 | |

(xxix)* | ||

(xxx)* | ||

Exhibit 21— | Subsidiaries of the registrant | |

(i) | † | |

Exhibit 23— | Consent of experts and counsel | |

(i) | † | |

Exhibit 31— | Rule 13a-14(a) Certifications | |

(i) | † | |

(ii) | † | |

Exhibit 32— | 18 U.S.C. Section 1350 Certifications | |

(i) | † | |

(ii) | † | |

Exhibit 101— | XBRL (Extensible Business Reporting Language) Documents | |

101.INS | XBRL Instance Document | |

101.SCH | XBRL Schema Document | |

101.CAL | XBRL Calculation Linkbase Document | |

101.DEF | XBRL Definition Linkbase Document | |

101.LAB | XBRL Label Linkbase Document | |

101.PRE | XBRL Presentation Linkbase Document | |

* | Compensation arrangement |

† | Furnished with this Form 10-K |

© | Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Stryker hereby agrees to furnish supplementally a copy of any omitted schedule upon request by the U.S. Securities and Exchange Commission. |

ITEM 16. | FORM 10-K SUMMARY. |

39 | |

/s/ KEVIN A. LOBO | /s/ GLENN S. BOEHNLEIN | |

Kevin A. Lobo | Glenn S. Boehnlein | |

Chairman and Chief Executive Officer | Vice President, Chief Financial Officer | |

(Principal Executive Officer) | (Principal Financial Officer) | |

/s/ WILLIAM E. BERRY JR. | ||

William E. Berry, Jr. | ||

Vice President, Corporate Controller | ||

(Principal Accounting Officer) | ||

/s/ MARY K. BRAINERD | /s/ SHERILYN S. MCCOY | |

Mary K. Brainerd | Sherilyn S. McCoy | |

Director | Director | |

/s/ SRIKANT M. DATAR | /s/ ANDREW K. SILVERNAIL | |

Srikant M. Datar, Ph.D. | Andrew K. Silvernail | |

Director | Director | |

/s/ LOUISE L. FRANCESCONI | /s/ RONDA E. STRYKER | |

Louise L. Francesconi | Ronda E. Stryker | |

Director | Director | |

/s/ ALLAN C. GOLSTON | /s/ RAJEEV SURI | |

Allan C. Golston | Rajeev Suri | |

Director | Director | |

40 | |