Exhibit 99.1

Resource Center: 1-800-732-6643

| Contact: | Pete Bakel |

| 202-752-2034 |

| Date: | May 9, 2012 |

Fannie Mae Reports Net Income of $2.7 Billion for First-Quarter 2012

Total Loss Reserves Expected to Have Peaked as of December 31, 2011

Company Maintains Focus on Foreclosure Prevention Solutions and Providing Access to

Financing for New and Refinanced Mortgages

Fannie Mae Performance Snapshot*

| • | High-quality new book of business now accounts for 56 percent of single-family guaranty book of business. |

| • | Credit-related expenses decreased by nearly two-thirds, and total loss reserves are expected to have peaked as of December 31, 2011. |

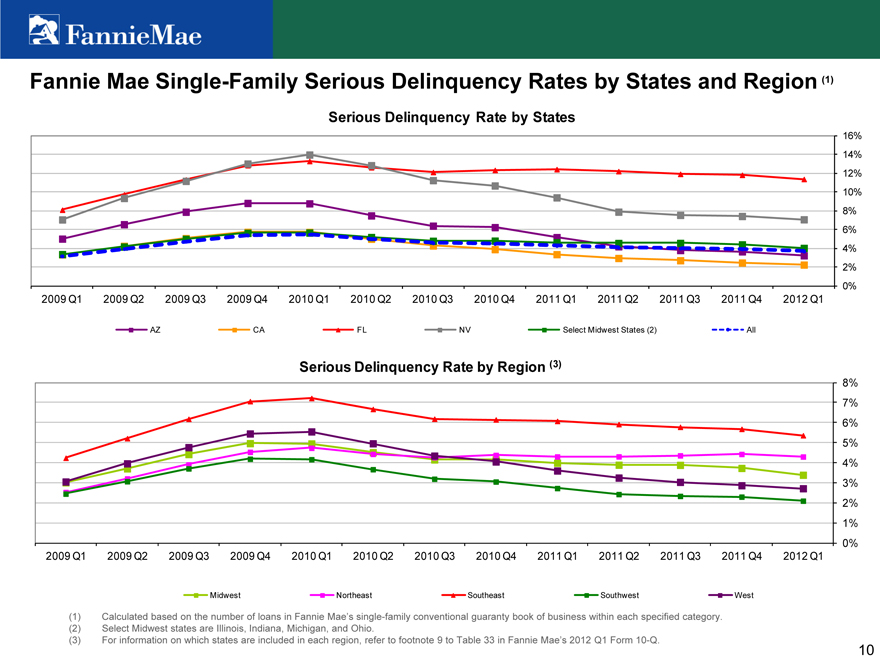

| • | Single-family serious delinquency (“SDQ”) rates declined eight consecutive quarters since the first quarter of 2010 and SDQ rates are substantially lower than private market levels. |

| • | Funded the mortgage market with approximately $2.6T in liquidity, providing access to financing for 2.1M households to purchase a home and financing for more than 1.2M units of quality rental housing. |

| • | Enabled more than 1M distressed homeowners to retain their homes or otherwise avoid foreclosure; completed 1.1M loan workouts, including more than 762,000 modifications; and refinanced 7.4M mortgages. |

*Fannie Mae data since January 1, 2009, unless otherwise noted.

WASHINGTON, DC – Fannie Mae (FNMA/OTC) today reported net income of $2.7 billion in the first quarter of 2012, compared to a net loss of $6.5 billion in the first quarter of 2011 and a net loss of $2.4 billion in the fourth quarter of 2011. The significant improvement in the company’s financial results in the first quarter of 2012 was due primarily to lower credit-related expenses, resulting from a less significant decline in home prices, a decline in the company’s inventory of single-family real-estate owned (“REO”) properties coupled with improved REO sales prices, and lower single-family serious delinquency rates. Fannie Mae does not require funding from Treasury for the first quarter of 2012. The company’s comprehensive income of $3.1 billion in the first quarter of 2012 is sufficient to pay the first-quarter dividend of $2.8 billion.

The company’s total loss reserves, which reflect its estimate of the probable losses the company has incurred on loans in its guaranty book of business, decreased to $74.6 billion as of March 31, 2012 from $76.9 billion as of December 31, 2011. The company expects its loss reserves to cover future credit losses on the pre-2009 legacy book of business have reached their peak.

“Today’s results exemplify the tremendous progress we have made since 2009,” said Michael J. Williams, president and chief executive officer. “Our financial performance has improved significantly and we successfully limited losses on the legacy book of business through our efforts to help

| First-Quarter 2012 Results | 1 |

homeowners avoid foreclosure. Our credit-related expenses have decreased substantially due in part to stabilizing home prices, lower delinquency rates, and selling foreclosed properties at market competitive prices. In tandem, we continue to be the primary source of funding in the mortgage market and our new book of business is growing, profitable, and built on strong lending standards. I’m proud of the people of Fannie Mae who have delivered this significant forward progress and are focused on maintaining this momentum.”

“We expect our financial results for 2012 to be significantly better than 2011,” said Susan McFarland, executive vice president and chief financial officer. “Our credit performance is headed in the right direction with significant improvement since 2009, and we expect that the reserves we have built to cover future credit losses on the pre-2009 legacy book of business have reached their peak. As our serious delinquency rate declines and home prices stabilize, we expect to reduce our reserves, which combined with revenue from our high-quality new book of business, will drive our future results. While external economic factors continue to create headwinds that affect our results, we are pleased with our credit performance and will continue our work to move the housing market forward.”

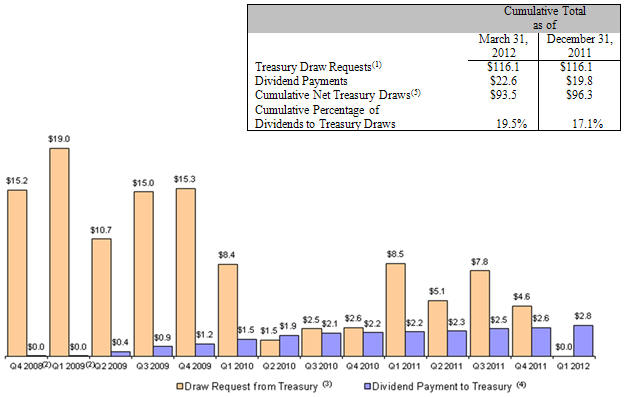

Fannie Mae’s net worth of $268 million as of March 31, 2012 reflects the company’s total comprehensive income of $3.1 billion, partially offset by its payment to Treasury of $2.8 billion in senior preferred stock dividends. As a result of the company’s positive net worth as of March 31, 2012, the company will not request a draw from Treasury for the quarter under the senior preferred stock purchase agreement. The total liquidation preference of Treasury’s senior preferred stock remains at $117.1 billion, which requires an annualized dividend payment of $11.7 billion. The table below shows the amount of Fannie Mae’s requested draws from Treasury and dividend payments to Treasury since entering into conservatorship on September 6, 2008.

Treasury Draw Requests and Dividend Payments

$ in Billions

| First-Quarter 2012 Results | 2 |

| (1) | Treasury draw requests do not include the initial $1.0 billion liquidation preference of Fannie Mae’s senior preferred stock, for which Fannie Mae did not receive any cash proceeds. |

| (2) | Fannie Mae paid dividends to Treasury of $31 million in the fourth quarter of 2008 and $25 million in the first quarter of 2009. |

| (3) | Represents the draw required and requested based on Fannie Mae’s net worth deficit for the quarters presented. Draw requests were funded in the quarter following each quarterly net worth deficit. |

| (4) | Represents quarterly cash dividends paid during the quarters presented by Fannie Mae to Treasury, based on an annual rate of 10% per year on the aggregate liquidation preference of the senior preferred stock. |

| (5) | Represents cumulative Treasury draws less senior preferred stock dividend payments to Treasury. |

PROVIDING LIQUIDITY AND SUPPORT TO THE MARKET

Fannie Mae has continued to provide liquidity and support to the U.S. mortgage market in a number of important ways:

| • | The company has served as a stable source of liquidity for purchases of homes and financing of multifamily rental housing, as well as for refinancing existing mortgages. Fannie Mae provided approximately $2.6 trillion in liquidity to the mortgage market from January 1, 2009 through March 31, 2012 through its purchases and guarantees of loans, which enabled borrowers to refinance 7.4 million mortgages and purchase 2.1 million homes, and provided financing for more than 1.2 million units of multifamily housing. |

| • | The company has strengthened its underwriting and eligibility standards to support sustainable homeownership, enabling borrowers to have access to a variety of conforming mortgage products, including long-term, fixed-rate mortgages, such as the prepayable 30-year fixed-rate mortgage that protects homeowners from interest rate swings. As a result, the company’s new single-family book of business has a strong credit risk profile. |

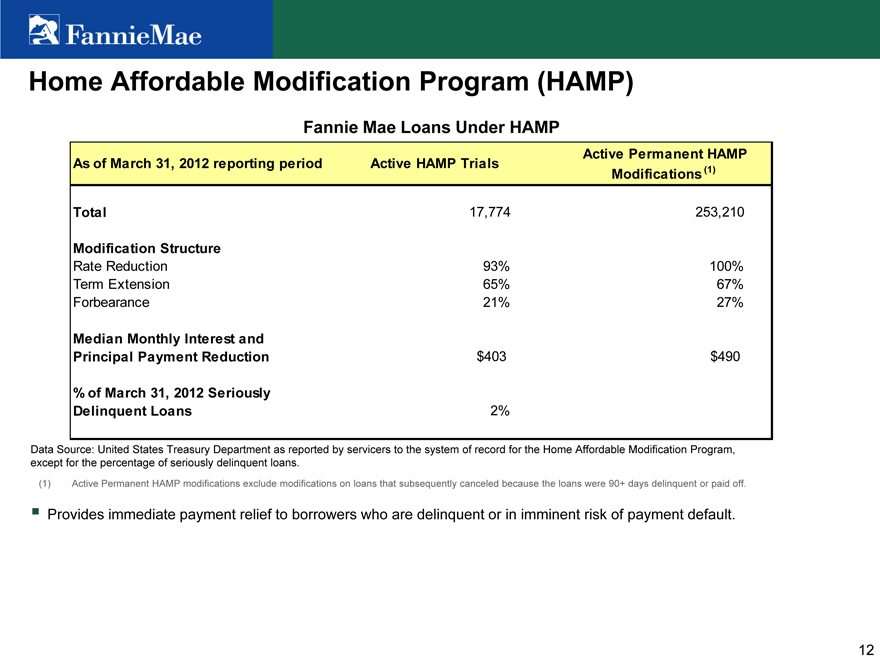

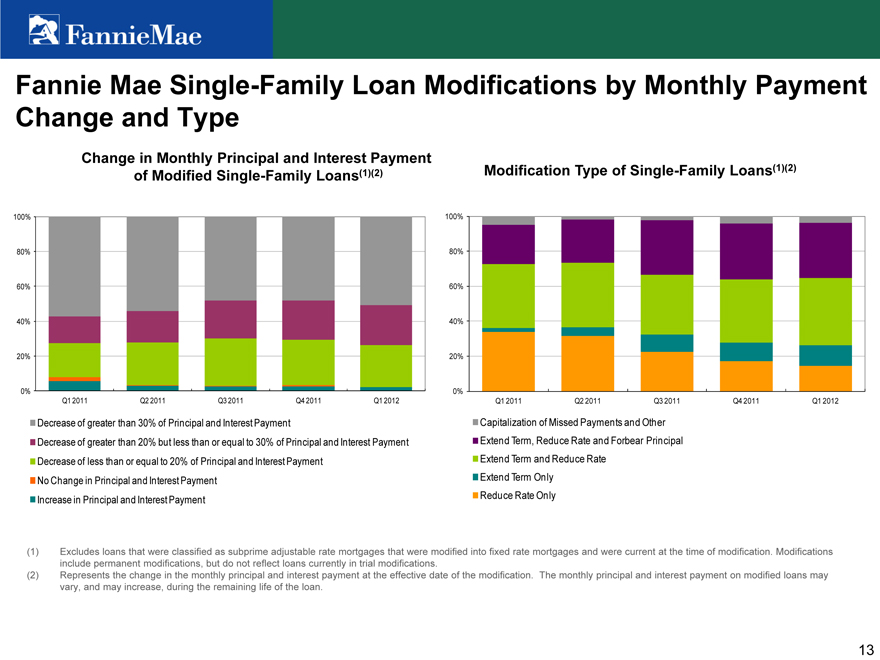

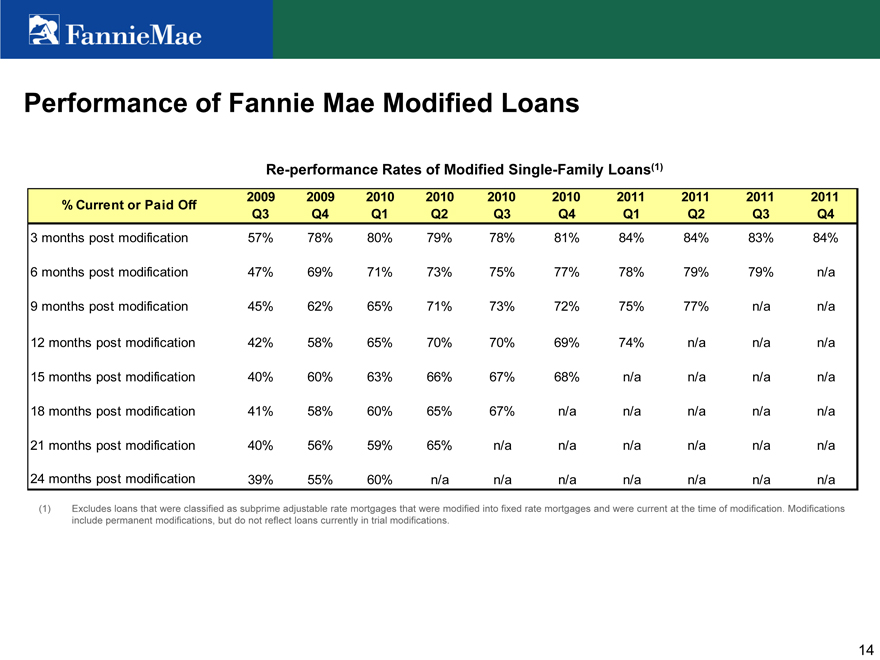

| • | The company helped more than 1,000,000 homeowners retain their homes or otherwise avoid foreclosure from January 1, 2009 through March 31, 2012, which helped to support neighborhoods, home prices and the housing market. Moreover, borrowers’ ability to pay their modified loans has improved in recent periods as the company has enhanced the structure of its modifications. One year after modification, 74 percent of the modifications the company made in the first quarter of 2011 were current or paid off, compared with 65 percent of modifications the company made in the first quarter of 2010. |

| • | The company helped borrowers refinance loans through its Refi Plus™ initiative, which includes loans refinanced under the Administration’s Home Affordable Refinance Program (“HARP”). The Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borrowers. From April 1, 2009, the date the company began accepting delivery of Refi Plus loans, through March 31, 2012, the company has acquired approximately 2,000,000 loans refinanced under its Refi Plus initiative. Refinances delivered to Fannie Mae through Refi Plus in the first quarter of 2012 reduced borrowers’ monthly mortgage payments by an average of $191. Some borrowers’ monthly payments increased as they took advantage of the ability to refinance through Refi Plus to reduce the term of their loan, to switch from an adjustable-rate mortgage to a fixed-rate mortgage, or to switch from an interest-only mortgage to a fully amortizing mortgage. |

| First-Quarter 2012 Results | 3 |

| • | The company supports affordability in the multifamily rental market. More than 85 percent of the multifamily units it financed from 2009 through 2011 were affordable to families earning at or below the median income in their area. |

| • | The company remained the largest single issuer of mortgage-related securities in the secondary market in the first quarter of 2012, with an estimated market share of new single-family mortgage-related securities issuances of 51 percent, compared to 54 percent in the fourth quarter of 2011 and 49 percent in the first quarter of 2011. Fannie Mae also remained a constant source of liquidity in the multifamily market. As of December 31, 2011 (the latest date for which information was available), the company owned or guaranteed approximately 21 percent of the outstanding debt on multifamily properties. |

| • | During the first quarter of 2012, Fannie Mae purchased or guaranteed approximately $221 billion in loans, measured by unpaid principal balance. These activities enabled its lender customers to finance approximately 934,000 single-family conventional loans and loans for approximately 117,000 units in multifamily properties during the first quarter of 2012. |

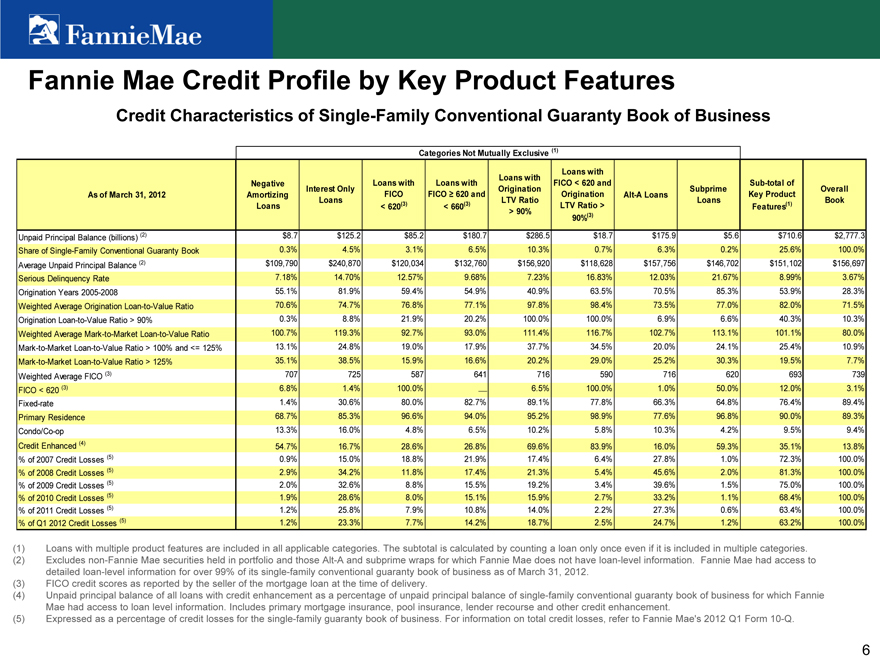

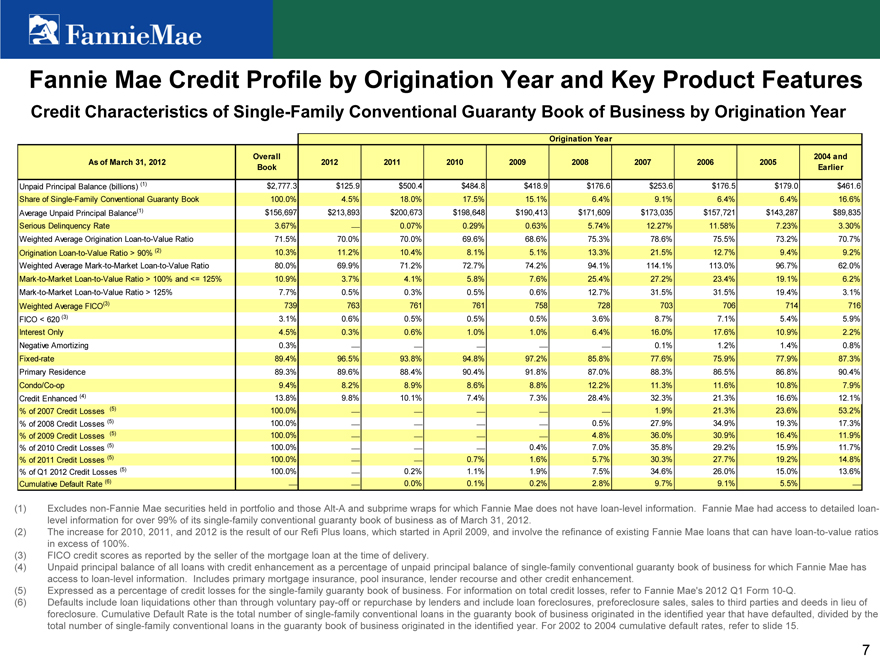

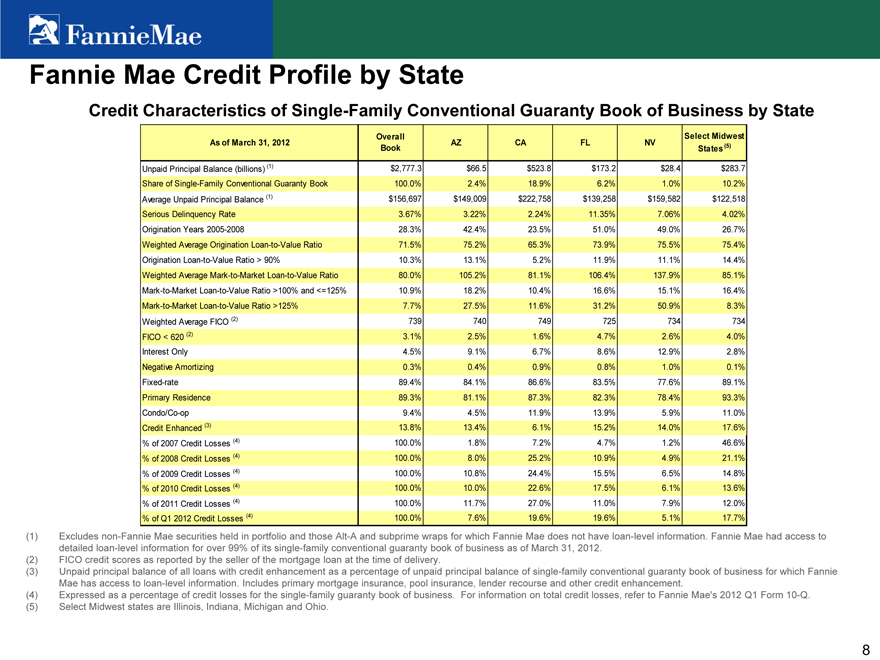

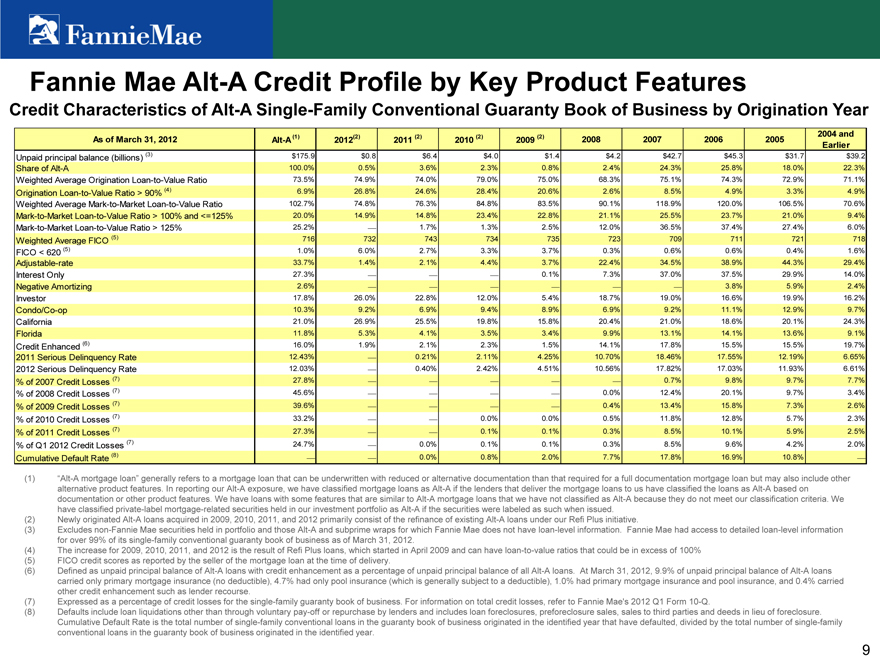

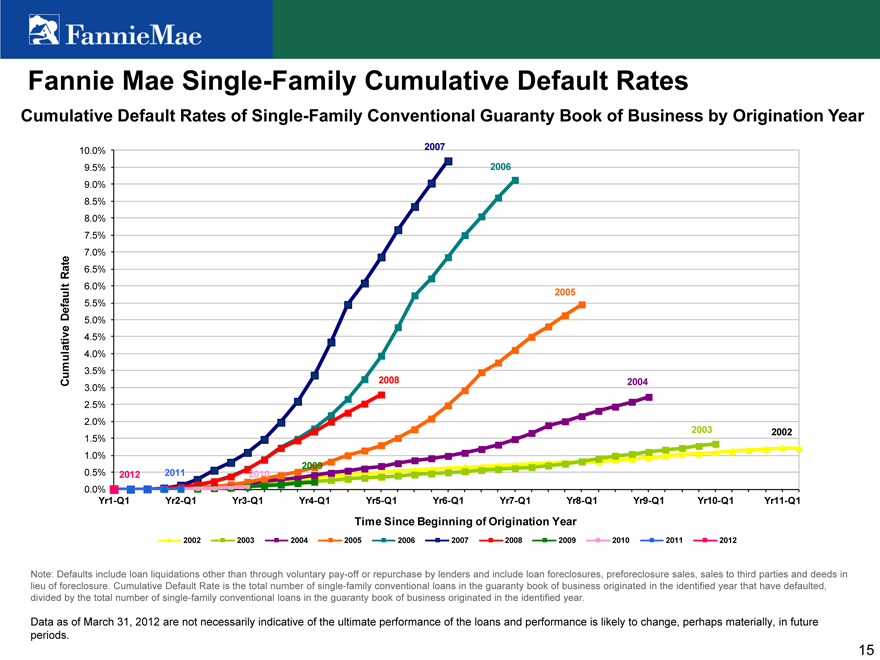

CREDIT QUALITY

New Single-Family Book of Business: Since 2009, Fannie Mae has seen the effect of the actions it took, beginning in 2008, to significantly strengthen its underwriting and eligibility standards, and change its pricing to promote sustainable homeownership and stability in the housing market. Fifty-six percent of Fannie Mae’s single-family guaranty book of business as of March 31, 2012 consisted of loans it had purchased or guaranteed since the beginning of 2009. Given their strong credit risk profile and based on their performance so far, the company expects that these loans will be profitable over their lifetime, meaning the company’s fee income on these loans will exceed the company’s credit losses and administrative costs for them. If future macroeconomic conditions turn out to be more adverse than the company’s expectations, these loans could become unprofitable.

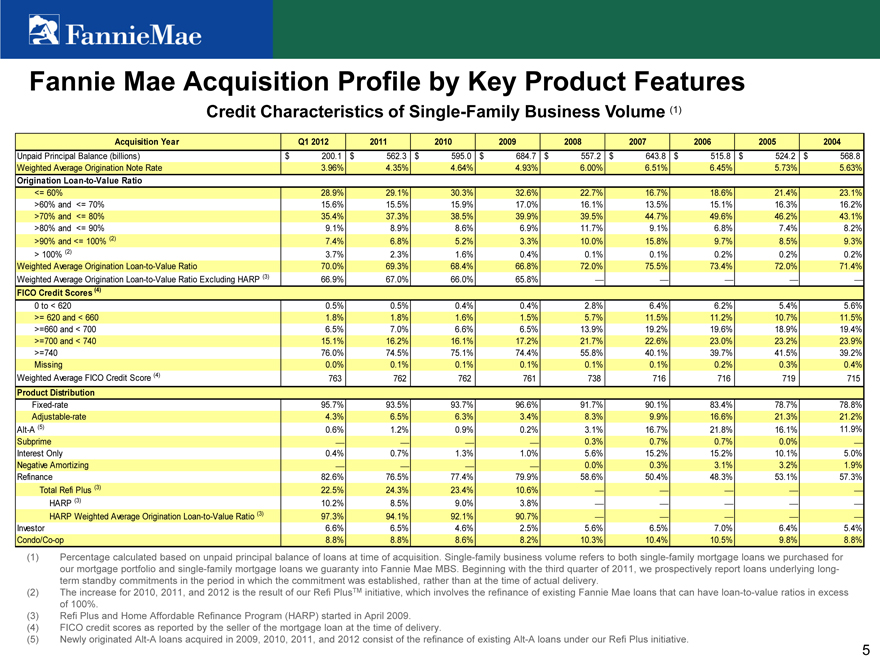

Single-family conventional loans acquired by Fannie Mae in the first quarter of 2012 had a weighted average FICO credit score at origination of 763 and an average original loan-to-value ratio of 70 percent.

Fannie Mae’s Expectations Regarding Future Loss Reserves and Credit-Related Expenses: The company’s total loss reserves decreased to $74.6 billion as of March 31, 2012 from $76.9 billion as of December 31, 2011. The company expects the trends of stabilizing home prices and declining single-family serious delinquency rates to continue. As a result, the company expects that its total loss reserves peaked as of December 31, 2011; thus, the company does not expect total loss reserves to increase above $76.9 billion in the foreseeable future. The company expects that its credit-related expenses will continue to be high in 2012 but that, overall, its credit-related expenses will be lower in 2012 than in 2011.

Although the company expects these positive trends to continue, the amount of credit-related expenses the company incurs in future periods could vary significantly from period to period, and may be affected by many different factors, including mortgage market and other macroeconomic factors, loss mitigation activity, legislative or regulatory requirements, changes in borrower behavior, such as an increasing number of underwater borrowers who strategically default on their mortgage loan; and changes in accounting policy. Due to the large size of the company’s guaranty book of business, even

| First-Quarter 2012 Results | 4 |

small changes in these factors could have a significant impact on the company’s financial results for a particular period. Moreover, although the company expects that its total loss reserves peaked as of December 31, 2011, it expects that its loss reserves will remain significantly elevated relative to historical levels for an extended period because (1) it expects future defaults on loans in its legacy (pre-2009) book of business and the resulting charge-offs will occur over a period of years and (2) a significant portion of its reserves represents concessions granted to borrowers upon modification of their loans and will remain in the company’s reserves until the loans are fully repaid or default.

Fannie Mae’s single-family serious delinquency rate has declined steadily each quarter since the first quarter of 2010, and was 3.67 percent as of March 31, 2012, compared to 5.47 percent as of March 31, 2010. This decrease is primarily the result of home retention solutions, foreclosure alternatives, and completed foreclosures, as well as the company’s acquisition of loans with a stronger credit profile since the beginning of 2009, as these loans are now 56 percent of the single-family guaranty book of business, resulting in a smaller percentage of the company’s loans becoming seriously delinquent. The company expects serious delinquency rates will continue to be affected in the future by home price changes, changes in other macroeconomic conditions, the length of the foreclosure process, the volume of loan modifications, and the extent to which borrowers with modified loans continue to make timely payments. In addition, due to circumstances in the foreclosure environment, foreclosures are proceeding at a slow pace, which has resulted in loans remaining seriously delinquent in the company’s book of business for a longer time. The company expects the number of its single-family loans that are seriously delinquent to remain well above pre-2008 levels for years. In addition, given the large existing and anticipated supply of single-family homes in the market, the company anticipates that it will take a significant amount of time before its REO inventory is reduced to pre-2008 levels.

STRATEGIES TO REDUCE CREDIT LOSSES ON THE LEGACY BOOK

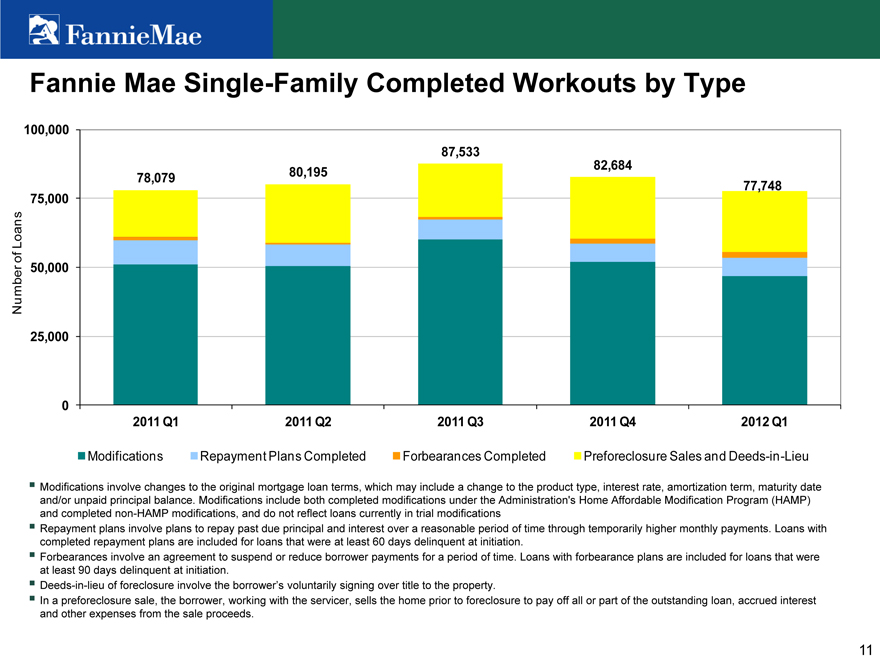

To reduce the credit losses Fannie Mae ultimately incurs on its legacy book of business, the company has been focusing its efforts on several strategies, including reducing defaults by offering home retention solutions, such as loan modifications. Fannie Mae completed approximately 46,700 loan modifications during the first quarter of 2012, bringing the total number of loan modifications the company has completed since January 1, 2009 to more than 762,000.

As the company works to reduce credit losses, it also seeks to assist struggling borrowers, help stabilize communities, and support the housing market. In dealing with struggling borrowers, Fannie Mae first seeks home retention solutions that enable them to keep their homes before turning to foreclosure alternatives. If the company is unable to provide a viable home retention solution for a struggling borrower, the company seeks to offer a foreclosure alternative and complete it in a timely manner. From January 1, 2009 through March 31, 2012, the company completed approximately 217,000 preforeclosure sales (also known as short sales) and deeds-in-lieu of foreclosure. When there is no viable home retention solution or foreclosure alternative that can be applied, the company seeks to move to foreclosure expeditiously. The goal of these efforts is to help minimize delinquencies that can adversely impact local home values and destabilize communities, as well as lower costs to Fannie Mae.

HOME RETENTION SOLUTIONS AND FORECLOSURE ALTERNATIVES

Loan Workouts: During the first quarter of 2012, Fannie Mae completed more than 77,000 single-family loan workouts, including more than 55,000 home-retention solutions (modifications, repayment

| First-Quarter 2012 Results | 5 |

plans, and forbearances). Details of the company’s home-retention solutions and foreclosure alternatives include:

| • | Loan modifications, which consist of permanent modifications under HAMP and Fannie Mae’s own modification options, were 46,671 in the first quarter of 2012, compared to 51,936 in the fourth quarter of 2011 and 51,043 in the first quarter of 2011. The volume of modifications completed in the first quarter of 2012 decreased compared to the first quarter of 2011, primarily driven by a decline in the number of seriously delinquent loans in 2012. |

| • | Repayment plans/forbearances were 8,864 in the first quarter of 2012, compared to 8,517 in the fourth quarter of 2011 and 9,916 in the first quarter of 2011. |

| • | Short sales and deeds-in-lieu of foreclosure were 22,213 in the first quarter of 2012, compared to 22,231 in the fourth quarter of 2011 and 17,120 in the first quarter of 2011. |

Homeowner Initiatives: Fannie Mae continued to maintain programs and invest in initiatives designed to help keep people in homes, assist prospective homeowners, and support the mortgage and housing markets overall. As of March 31, 2012, Fannie Mae had established 12 Mortgage Help Centers across the nation to accelerate the response time for struggling borrowers with loans owned by Fannie Mae; these centers helped borrowers obtain nearly 9,200 home retention plans. The company’s Mortgage Help Centers are complemented in their efforts by partnerships with 17 local non-profit organizations in 16 cities, collectively known as its Mortgage Help Network. The Mortgage Help Network represents a contractual relationship with select not-for-profit counseling agencies located in the company’s top delinquent mortgage markets to provide borrowers with loans owned by Fannie Mae foreclosure prevention counseling, documentation assistance, and assistance with pending loan workout solutions. The company also uses direct mail, phone calls, and some advertising to encourage homeowners to visit KnowYourOptions.com to pursue home retention solutions and foreclosure alternatives.

Refinancing Initiatives: Through the company’s Refi PlusTM initiative, which provides expanded refinance opportunities for eligible Fannie Mae borrowers and includes the Administration’s HARP loans, the company acquired approximately 239,000 loans in the first quarter of 2012. Some borrower’s monthly payments increased as they took advantage of the ability to refinance through Refi Plus to reduce the term of their loan, to switch from an adjustable-rate mortgage to a fixed rate mortgage, or to switch from an interest-only mortgage to a fully amortizing mortgage. Even taking these refinancings into account, refinances delivered to Fannie Mae through Refi Plus in the first quarter of 2012 reduced borrowers’ monthly mortgage payments by an average of $191.

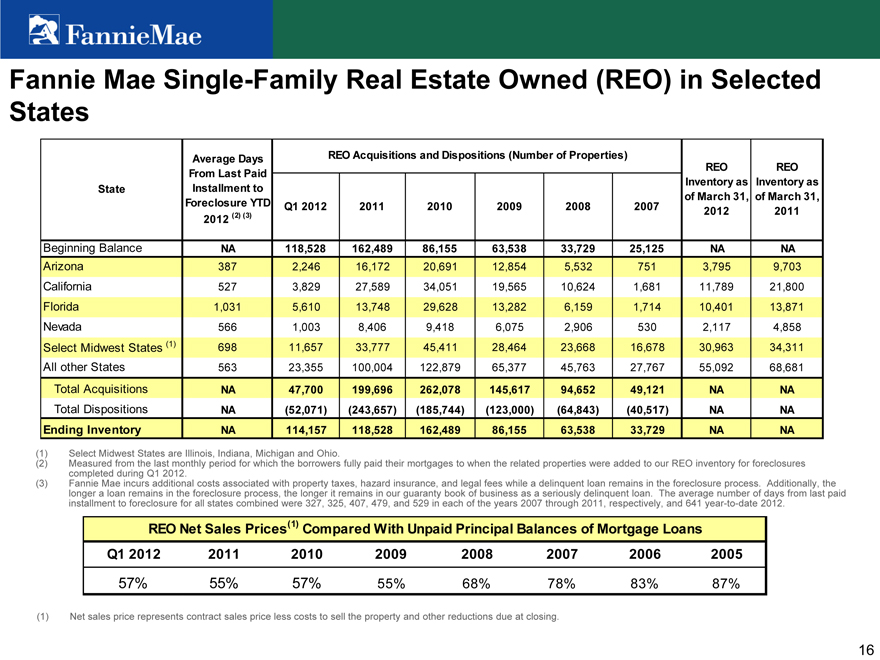

FORECLOSURES AND REO

Fannie Mae acquired 47,700 single-family REO properties, primarily through foreclosure, in the first quarter of 2012, compared to 47,256 in the fourth quarter of 2011 and 53,549 in the first quarter of 2011. Fannie Mae disposed of 52,071 single-family REO in the first quarter of 2012, compared to 51,344 in the fourth quarter of 2011 and 62,814 in the first quarter of 2011. As of March 31, 2012, the company’s inventory of single-family REO properties was 114,157, compared to 118,528 as of December 31, 2011, and 153,224 as of March 31, 2011. The carrying value of the company’s single-family REO was $9.7 billion as of March 31, 2012, compared to $9.7 billion as of December 31, 2011, and $14.1 billion as of March 31, 2011.

The company’s single-family foreclosure rate was 1.07 percent in the first quarter of 2012, compared to 1.13 percent in 2011. This reflects the annualized number of single-family properties acquired

| First-Quarter 2012 Results | 6 |

through foreclosure or deeds-in-lieu of foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family guaranty book of business.

SUMMARY OF FIRST-QUARTER 2012 RESULTS

Fannie Mae reported net income of $2.7 billion for the first quarter of 2012, compared to a net loss of $2.4 billion in the fourth quarter of 2011 and $6.5 billion in the first quarter of 2011. As a result of the company’s positive net worth as of March 31, 2012, which takes into account dividends paid on senior preferred stock held by Treasury, the company will not request a draw for the quarter from Treasury under the senior preferred stock purchase agreement.

| (Dollars in millions) |

1Q12 | 4Q11 | Variance | 1Q12 | 1Q11 | Variance | ||||||||||||||||||

| Net interest income |

$ | 5,197 | $ | 4,163 | $ | 1,034 | $ | 5,197 | $ | 4,960 | $ | 237 | ||||||||||||

| Fee and other income |

375 | 370 | 5 | 375 | 237 | 138 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net revenues |

5,572 | 4,533 | 1,039 | 5,572 | 5,197 | 375 | ||||||||||||||||||

| Investment gains, net |

116 | 187 | (71 | ) | 116 | 75 | 41 | |||||||||||||||||

| Net other-than-temporary impairments |

(64 | ) | 54 | (118 | ) | (64 | ) | (44 | ) | (20 | ) | |||||||||||||

| Fair value gains (losses), net |

283 | (751 | ) | 1,034 | 283 | 289 | (6 | ) | ||||||||||||||||

| Administrative expenses |

(564 | ) | (605 | ) | 41 | (564 | ) | (605 | ) | 41 | ||||||||||||||

| Credit-related expenses |

||||||||||||||||||||||||

| Provision for credit losses |

(2,000 | ) | (5,476 | ) | 3,476 | (2,000 | ) | (10,554 | ) | 8,554 | ||||||||||||||

| Foreclosed property expense |

(339 | ) | (37 | ) | (302 | ) | (339 | ) | (488 | ) | 149 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total credit-related expenses |

(2,339 | ) | (5,513 | ) | 3,174 | (2,339 | ) | (11,042 | ) | 8,703 | ||||||||||||||

| Other non-interest expenses(1) |

(286 | ) | (311 | ) | 25 | (286 | ) | (339 | ) | 53 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net losses and expenses |

(2,854 | ) | (6,939 | ) | 4,085 | (2,854 | ) | (11,666 | ) | 8,812 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before federal income taxes |

2,718 | (2,406 | ) | 5,124 | 2,718 | (6,469 | ) | 9,187 | ||||||||||||||||

| Provision for federal income taxes |

— | (1 | ) | 1 | — | (2 | ) | 2 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

2,718 | (2,407 | ) | 5,125 | 2,718 | (6,471 | ) | 9,189 | ||||||||||||||||

| Less: Net loss attributable to the noncontrolling interest |

1 | 1 | — | 1 | — | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) attributable to Fannie Mae |

$ | 2,719 | $ | (2,406 | ) | $ | 5,125 | $ | 2,719 | $ | (6,471 | ) | $ | 9,190 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income (loss) attributable to Fannie Mae |

$ | 3,081 | $ | (1,945 | ) | $ | 5,026 | $ | 3,081 | $ | (6,290 | ) | $ | 9,371 | ||||||||||

| Preferred stock dividends |

$ | (2,817 | ) | $ | (2,622 | ) | $ | (195 | ) | $ | (2,817 | ) | $ | (2,216 | ) | $ | (601 | ) | ||||||

|

|

||||||||||||||||||||||||

| (1) Consists of debt extinguishment (losses) gains, net and other expenses.

|

| |||||||||||||||||||||||

Net revenues were $5.6 billion in the first quarter of 2012, up 23 percent from $4.5 billion in the fourth quarter of 2011 and up seven percent from $5.2 billion in the first quarter of 2011. Net interest income was $5.2 billion, up 25 percent from $4.2 billion in the fourth quarter of 2011 and up five percent from $5.0 billion in the first quarter of 2011. The increase in net interest income compared to the fourth quarter of 2011 was due primarily to an out-of-period adjustment recorded in the fourth quarter of 2011 that reduced net interest income $1.2 billion.

| First-Quarter 2012 Results | 7 |

Credit-related expenses, which consist of the provision for credit losses and foreclosed property expense, were $2.3 billion in the first quarter of 2012, down from $5.5 billion in the fourth quarter of 2011 and $11.0 billion in the first quarter of 2011. Lower credit-related expenses were due primarily to a less significant decline in home prices, a decline in our inventory of single-family REO properties coupled with improved REO sales prices, and lower single-family serious delinquency rates.

Credit losses, which the company defines as net charge-offs plus foreclosed property expense, excluding the effect of certain fair-value losses, were $5.1 billion in the first quarter of 2012, compared to $4.7 billion in the fourth quarter of 2011 and $5.7 billion in the first quarter of 2011.

Total loss reserves, which reflect an estimate of the probable losses the company has incurred in its guaranty book of business, including concessions it granted borrowers upon modification of their loans, were $74.6 billion as of March 31, 2012, compared to $76.9 billion as of December 31, 2011 and $72.1 billion as of March 31, 2011. The total loss reserve coverage to total nonperforming loans was 30 percent as of March 31, 2012, compared to 31 percent as of December 31, 2011 and 35 percent as of March 31, 2011. The company believes that its loss reserves peaked as of December 31, 2011.

Net fair value gains were $283 million in the first quarter of 2012, compared to net fair value losses of $751 million in the fourth quarter of 2011 and net fair value gains of $289 million in the first quarter of 2011. The increase in the first quarter of 2012 from the fourth quarter of 2011 was driven primarily by improvement in the fair value of our risk management derivatives as interest rates rose in the first quarter of 2012, compared to a decline in interest rates in the fourth quarter of 2011. The estimated fair value of our trading securities and derivatives may fluctuate substantially from period-to-period because of changes in interest rates, credit spreads, and interest rate volatility, as well as activity related to these financial instruments.

NET WORTH AND U.S. TREASURY FUNDING

As a result of Fannie Mae’s positive net worth as of March 31, 2012, the company does not require funds under the senior preferred stock purchase agreement between Fannie Mae and Treasury.

Fannie Mae’s first-quarter 2012 dividend of $2.8 billion on its senior preferred stock held by Treasury was declared by FHFA and paid by the company on March 30, 2012. The aggregate liquidation preference of the senior preferred stock remains at $117.1 billion as of March 31, 2012, which requires an annualized dividend payment of $11.7 billion. The amount of this dividend payment exceeds the company’s reported annual net income for every year since its inception.

As of March 31, 2012, Fannie Mae has paid an aggregate of $22.6 billion to Treasury in dividends on the senior preferred stock.

BUSINESS SEGMENT RESULTS

The business groups running Fannie Mae’s three reporting segments – its Single-Family business, its Multifamily business, and its Capital Markets group – engage in complementary business activities in pursuing the company’s mission of providing liquidity, stability, and affordability to the U.S. housing market. The company’s Single-Family and Multifamily businesses work with Fannie Mae’s lender customers, who deliver mortgage loans that the company purchases and securitizes into Fannie Mae MBS. The Capital Markets group manages the company’s investment activity in mortgage-related assets and other interest-earning non-mortgage investments, funding investments in mortgage-related assets primarily with proceeds received from the issuance of Fannie Mae debt securities in the

| First-Quarter 2012 Results | 8 |

domestic and international capital markets. The Capital Markets group also provides liquidity to the mortgage market through short-term financing and other activities.

Single-Family guaranty book of business was $2.86 trillion as of March 31, 2012, compared to $2.84 trillion as of December 31, 2011 and $2.90 trillion as of March 31, 2011. Single-Family guaranty fee income was $1.9 billion for the first quarter of 2012 and for the fourth and first quarters of 2011. The Single-Family business lost $1.3 billion in the first quarter of 2012, compared to a loss of $4.5 billion in the fourth quarter of 2011 and a loss of $10.7 billion in the first quarter of 2011, due primarily to credit-related expenses of $2.4 billion, the substantial majority of which were attributable to loans purchased or guaranteed prior to 2009.

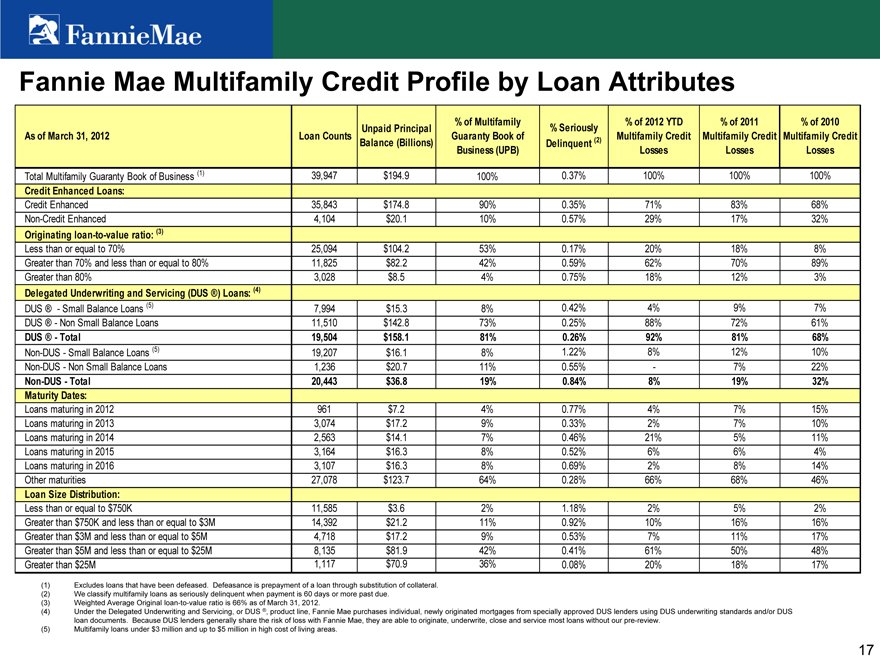

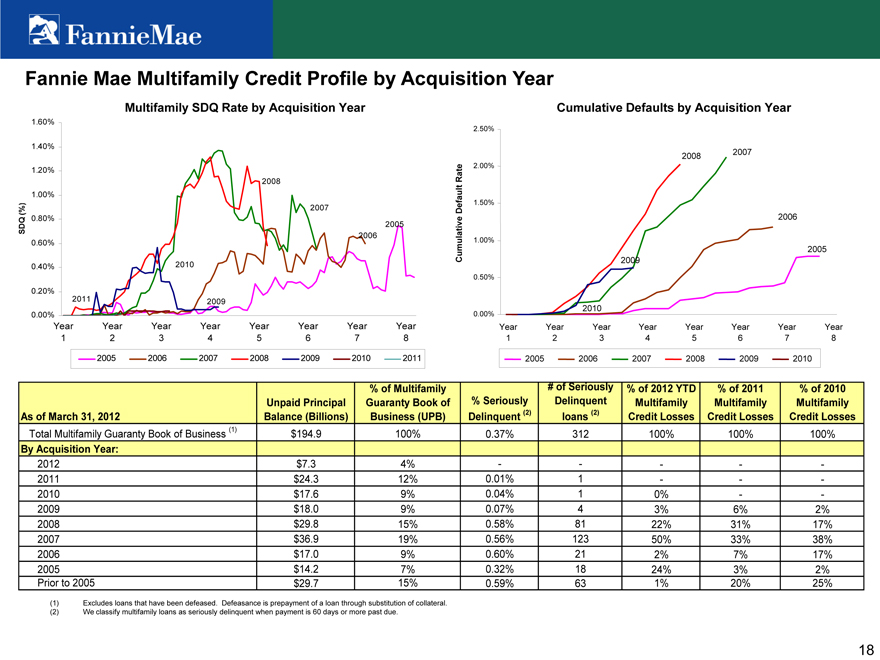

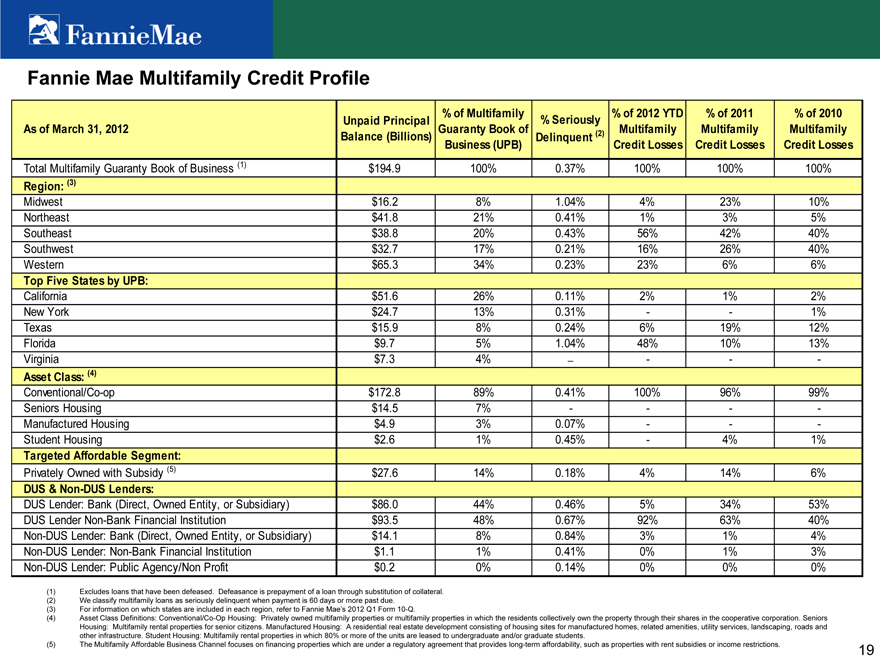

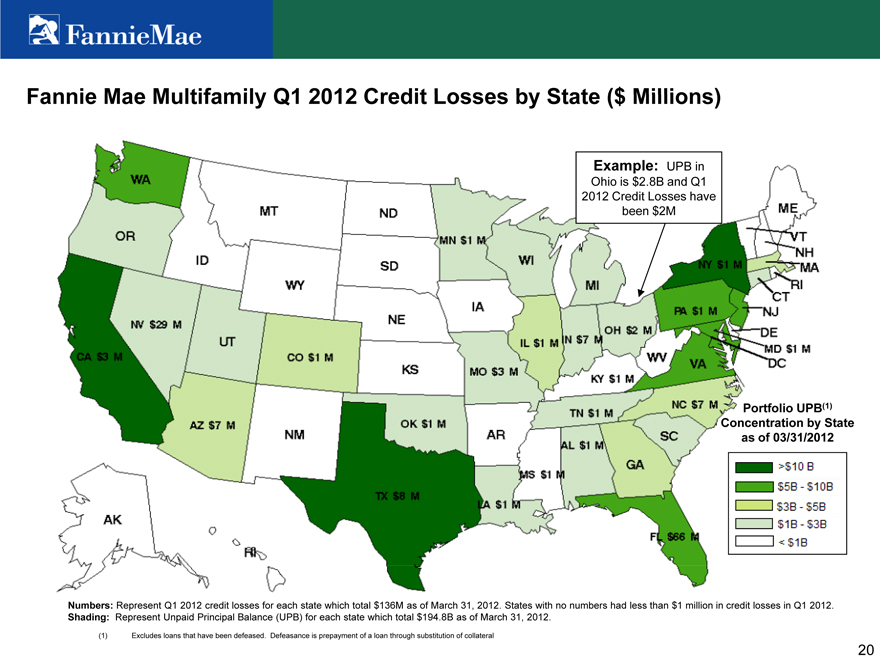

Multifamily guaranty book of business was $196.9 billion as of March 31, 2012, compared to $195.2 billion as of December 31, 2011 and $190.6 billion as of March 31, 2011. Multifamily recorded credit-related income of $46 million in the first quarter of 2012, compared to credit-related expenses of $116 million in the fourth quarter of 2011 and credit-related income of $64 million in the first quarter of 2011. Multifamily earned $279 million in the first quarter of 2012, compared to $177 million in the fourth quarter of 2011 and $247 million in the first quarter of 2011.

Capital Markets’ net interest income for the first quarter of 2012 was $3.5 billion, compared to $2.4 billion for the fourth quarter of 2011 and $3.7 billion for the first quarter of 2011. Fair value gains were $170 million, compared to fair value losses of $637 million in the fourth quarter of 2011 and gains of $218 million in the first quarter of 2011. The Capital Markets mortgage investment portfolio balance decreased to $691.7 billion as of March 31, 2012, compared to $708.4 billion as of December 31, 2011, resulting from purchases of $58.9 billion, liquidations of $34.4 billion, and sales of $41.2 billion during the quarter. The Capital Markets group earned $4.3 billion in the first quarter of 2012, compared to $2.6 billion in the fourth quarter of 2011 and $4.3 billion in the first quarter of 2011.

The company provides further discussion of its financial results and condition, credit performance, fair value balance sheets, and other matters in its quarterly report on Form 10-Q for the quarter ended March 31, 2012, which was filed today with the Securities and Exchange Commission. Further information about the company’s credit performance, the characteristics of its guaranty book of business, the drivers of its credit losses, its foreclosure-prevention efforts, and other measures is contained in the “2012 First-Quarter Credit Supplement” on Fannie Mae’s Web site, www.fanniemae.com.

# # #

In this release, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements regarding the company’s future loss reserves, future financial results; the profitability of its loans; Fannie Mae’s future credit performance, serious delinquency rates, number of delinquent loans, REO inventory, credit losses, credit-related expenses, defaults, and charge-offs; its draws from and dividends to be paid to Treasury; the growth, performance, profitability and caliber of loans it is acquiring; the trend of stabilizing home prices; the impact of the company’s actions on its future losses, delinquencies, defaults, loss severities, costs and credit losses; future volatility in the fair value of the company’s trading securities and derivatives, and the future performance of modifications and factors that could influence that performance;. These estimates, forecasts, expectations, and statements are forward-looking statements and are based on the company’s current assumptions regarding numerous factors, including assumptions about future home prices and the future performance of its loans. Actual results, and future projections, could be materially different from what is set forth in the forward-looking statements as a result of home price changes, interest rate changes, unemployment, other macroeconomic variables, government policy matters, credit availability, social behaviors, including increases in the number of underwater borrowers who strategically default on their mortgage loan, the volume of loans it modifies, the nature, volume and effectiveness of its loss mitigation strategies and activities, management of its real estate owned inventory and pursuit of contractual remedies, changes in the fair value of its assets and liabilities, impairments of its assets, the adequacy of its loss reserves, future legislative or regulatory requirements that have a significant impact on the company’s business such as a requirement that the company implement a principal forgiveness program, future updates to the company’s models relating to loss reserves, including the assumptions used by these models; changes in generally accepted accounting principles, changes to the company’ accounting policies, failures by its mortgage seller-servicers to fulfill their repurchase obligations to it, its ability to maintain a positive net worth, effects from activities the company takes to support the mortgage market and help homeowners, the conservatorship and its effect on the company’s business, the investment by Treasury and its effect on the company’s business, changes in the structure and regulation of the financial services industry, the company’s ability to access the debt markets, disruptions in the

| First-Quarter 2012 Results | 9 |

housing, credit, and stock markets, government investigations and litigation, the performance of the company’s servicers, conditions in the foreclosure environment, and many other factors. Changes in the company’s underlying assumptions and actual outcomes, which could be affected by the economic environment, government policy, and many other factors, including those discussed in the “Risk Factors” section of and elsewhere in the company’s quarterly report on Form 10-Q for the quarter ended March 31, 2012 and its annual report on Form 10-K for the year ended December 31, 2011, and elsewhere in this release.

Fannie Mae provides Web site addresses in its news releases solely for readers’ information. Other content or information appearing on these Web sites is not part of this release.

Fannie Mae exists to expand affordable housing and bring global capital to local communities in order to serve the U.S. housing market. Fannie Mae has a federal charter and operates in America’s secondary mortgage market to enhance the liquidity of the mortgage market by purchasing or guaranteeing mortgage loans originated by mortgage bankers and other lenders so that they may lend to home buyers. Our job is to help those who house America.

| First-Quarter 2012 Results | 10 |

ANNEX I

FANNIE MAE

(In conservatorship)

Condensed Consolidated Balance Sheets—(Unaudited)

(Dollars in millions, except share amounts)

| As of | ||||||||

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| ASSETS |

| |||||||

| Cash and cash equivalents |

$ | 22,049 | $ | 17,539 | ||||

| Restricted cash (includes $51,347 and $45,900, respectively, related to consolidated trusts) |

55,921 | 50,797 | ||||||

| Federal funds sold and securities purchased under agreements to resell or similar arrangements |

15,000 | 46,000 | ||||||

| Investments in securities: |

||||||||

| Trading, at fair value |

75,806 | 74,198 | ||||||

|

Available-for-sale, at fair value (includes $1,091 and $1,191, respectively, related to consolidated trusts) |

73,779 | 77,582 | ||||||

|

|

|

|

|

|||||

| Total investments in securities |

149,585 | 151,780 | ||||||

|

|

|

|

|

|||||

| Mortgage loans: |

||||||||

| Loans held for sale, at lower of cost or fair value (includes $56 and $66, respectively, related to consolidated trusts) |

282 | 311 | ||||||

| Loans held for investment, at amortized cost: |

||||||||

| Of Fannie Mae |

377,031 | 380,134 | ||||||

| Of consolidated trusts (includes $4,292 and $3,611, respectively, at fair value and loans pledged as collateral that may be sold or repledged of $749 and $798, respectively) |

2,616,521 | 2,590,332 | ||||||

|

|

|

|

|

|||||

| Total loans held for investment |

2,993,552 | 2,970,466 | ||||||

| Allowance for loan losses |

(70,109 | ) | (72,156 | ) | ||||

|

|

|

|

|

|||||

| Total loans held for investment, net of allowance |

2,923,443 | 2,898,310 | ||||||

|

|

|

|

|

|||||

| Total mortgage loans |

2,923,725 | 2,898,621 | ||||||

| Accrued interest receivable, net (includes $8,416 and $8,466, respectively, related to consolidated trusts) |

10,018 | 10,000 | ||||||

| Acquired property, net |

10,619 | 11,373 | ||||||

| Other assets (includes cash pledged as collateral of $1,159 and $1,109, respectively) |

23,023 | 25,374 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 3,209,940 | $ | 3,211,484 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND EQUITY (DEFICIT) |

| |||||||

| Liabilities: |

||||||||

| Accrued interest payable (includes $9,227 and $9,302, respectively, related to consolidated trusts) |

$ | 12,442 | $ | 12,648 | ||||

| Debt: |

||||||||

| Of Fannie Mae (includes $825 and $838, respectively, at fair value) |

685,974 | 732,444 | ||||||

| Of consolidated trusts (includes $4,279 and $3,939, respectively, at fair value) |

2,498,233 | 2,457,428 | ||||||

| Other liabilities (includes $581 and $629, respectively, related to consolidated trusts) |

13,023 | 13,535 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

3,209,672 | 3,216,055 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 13) |

— | — | ||||||

| Fannie Mae stockholders' equity (deficit): |

||||||||

| Senior preferred stock, 1,000,000 shares issued and outstanding |

117,149 | 112,578 | ||||||

| Preferred stock, 700,000,000 shares are authorized—555,374,922 shares issued and outstanding |

19,130 | 19,130 | ||||||

| Common stock, no par value, no maximum authorization—1,308,762,703 shares issued, and; |

687 | 687 | ||||||

| Accumulated deficit |

(128,482 | ) | (128,381 | ) | ||||

| Accumulated other comprehensive loss |

(873 | ) | (1,235 | ) | ||||

| Treasury stock, at cost, 150,693,004 and 150,995,303 shares, respectively |

(7,401 | ) | (7,403 | ) | ||||

|

|

|

|

|

|||||

| Total Fannie Mae stockholders’ equity (deficit) |

210 | (4,624 | ) | |||||

| Noncontrolling interest |

58 | 53 | ||||||

|

|

|

|

|

|||||

| Total equity (deficit) |

268 | (4,571 | ) | |||||

|

|

|

|

|

|||||

| Total liabilities and equity (deficit) |

$ | 3,209,940 | $ | 3,211,484 | ||||

|

|

|

|

|

|||||

See Notes to Condensed Consolidated Financial Statements

| First-Quarter 2012 Results | 11 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)—(Unaudited)

(Dollars and shares in millions, except per share amounts)

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| Interest income: |

||||||||

| Trading securities |

$ | 449 | $ | 284 | ||||

| Available-for-sale securities |

727 | 1,213 | ||||||

| Mortgage loans (includes $29,001 and $31,865, respectively, related to consolidated trusts) |

32,570 | 35,590 | ||||||

| Other |

38 | 28 | ||||||

|

|

|

|

|

|||||

| Total interest income |

33,784 | 37,115 | ||||||

|

|

|

|

|

|||||

| Interest expense: |

||||||||

| Short-term debt (includes $1 and $3, respectively, related to consolidated trusts) |

42 | 107 | ||||||

| Long-term debt (includes $25,360 and $27,852, respectively, related to consolidated trusts) |

28,545 | 32,048 | ||||||

|

|

|

|

|

|||||

| Total interest expense |

28,587 | 32,155 | ||||||

|

|

|

|

|

|||||

| Net interest income |

5,197 | 4,960 | ||||||

| Provision for credit losses |

(2,000 | ) | (10,554 | ) | ||||

|

|

|

|

|

|||||

| Net interest income (loss) after provision for credit losses |

3,197 | (5,594 | ) | |||||

|

|

|

|

|

|||||

| Investment gains, net |

116 | 75 | ||||||

| Other-than-temporary impairments |

(80 | ) | (57 | ) | ||||

| Noncredit portion of other-than-temporary impairments recognized in other comprehensive income |

16 | 13 | ||||||

|

|

|

|

|

|||||

| Net other-than-temporary impairments |

(64 | ) | (44 | ) | ||||

| Fair value gains, net |

283 | 289 | ||||||

| Debt extinguishment (losses) gains, net |

(34 | ) | 13 | |||||

| Fee and other income |

375 | 237 | ||||||

|

|

|

|

|

|||||

| Non-interest income |

676 | 570 | ||||||

|

|

|

|

|

|||||

| Administrative expenses: |

||||||||

| Salaries and employee benefits |

306 | 320 | ||||||

| Professional services |

168 | 189 | ||||||

| Occupancy expense |

43 | 42 | ||||||

| Other administrative expenses |

47 | 54 | ||||||

|

|

|

|

|

|||||

| Total administrative expenses |

564 | 605 | ||||||

| Foreclosed property expense |

339 | 488 | ||||||

| Other expenses |

252 | 352 | ||||||

|

|

|

|

|

|||||

| Total expenses |

1,155 | 1,445 | ||||||

|

|

|

|

|

|||||

| Income (loss) before federal income taxes |

2,718 | (6,469 | ) | |||||

| Provision for federal income taxes |

— | 2 | ||||||

|

|

|

|

|

|||||

| Net income (loss) |

2,718 | (6,471 | ) | |||||

| Other comprehensive income: |

||||||||

| Changes in unrealized losses on available-for-sale securities, net of reclassification adjustments and taxes |

355 | 179 | ||||||

| Other |

7 | 2 | ||||||

|

|

|

|

|

|||||

| Total other comprehensive income |

362 | 181 | ||||||

|

|

|

|

|

|||||

| Total comprehensive income (loss) |

3,080 | (6,290 | ) | |||||

| Less: Comprehensive loss attributable to the noncontrolling interest |

1 | — | ||||||

|

|

|

|

|

|||||

| Total comprehensive income (loss) attributable to Fannie Mae |

$ | 3,081 | $ | (6,290 | ) | |||

|

|

|

|

|

|||||

| Net income (loss) |

$ | 2,718 | $ | (6,471 | ) | |||

| Less: Net loss attributable to the noncontrolling interest |

1 | — | ||||||

|

|

|

|

|

|||||

| Net income (loss) attributable to Fannie Mae |

2,719 | (6,471 | ) | |||||

| Preferred stock dividends |

(2,817 | ) | (2,216 | ) | ||||

|

|

|

|

|

|||||

| Net loss attributable to common stockholders |

$ | (98 | ) | $ | (8,687 | ) | ||

|

|

|

|

|

|||||

| Loss per share—Basic and Diluted |

$ | (0.02 | ) | $ | (1.52 | ) | ||

| Weighted-average common shares outstanding—Basic and Diluted |

5,761 | 5,698 | ||||||

See Notes to Condensed Consolidated Financial Statements

| First-Quarter 2012 Results | 12 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Cash Flows—(Unaudited)

(Dollars in millions)

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| Net cash (used in) provided by operating activities |

$ | (114 | ) | $ | 2,566 | |||

| Cash flows provided by investing activities: |

||||||||

| Purchases of trading securities held for investment |

(226 | ) | (185 | ) | ||||

| Proceeds from maturities and paydowns of trading securities held for investment |

756 | 522 | ||||||

| Proceeds from sales of trading securities held for investment |

413 | 409 | ||||||

| Purchases of available-for-sale securities |

(9 | ) | (44 | ) | ||||

| Proceeds from maturities and paydowns of available-for-sale securities |

2,929 | 3,851 | ||||||

| Proceeds from sales of available-for-sale securities |

401 | 498 | ||||||

| Purchases of loans held for investment |

(38,276 | ) | (15,745 | ) | ||||

| Proceeds from repayments of loans held for investment of Fannie Mae |

6,856 | 5,381 | ||||||

| Proceeds from repayments of loans held for investment of consolidated trusts |

174,954 | 121,533 | ||||||

| Net change in restricted cash |

(5,124 | ) | 26,948 | |||||

| Advances to lenders |

(26,131 | ) | (15,646 | ) | ||||

| Proceeds from disposition of acquired property and short sales |

10,195 | 10,979 | ||||||

| Net change in federal funds sold and securities purchased under agreements to resell or similar agreements |

31,000 | (14,499 | ) | |||||

| Other, net |

(208 | ) | (163 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by investing activities |

157,530 | 123,839 | ||||||

| Cash flows used in financing activities: |

||||||||

| Proceeds from issuance of debt of Fannie Mae |

167,848 | 163,776 | ||||||

| Payments to redeem debt of Fannie Mae |

(214,701 | ) | (183,073 | ) | ||||

| Proceeds from issuance of debt of consolidated trusts |

80,933 | 72,567 | ||||||

| Payments to redeem debt of consolidated trusts |

(188,730 | ) | (177,551 | ) | ||||

| Payments of cash dividends on senior preferred stock to Treasury |

(2,819 | ) | (2,216 | ) | ||||

| Proceeds from senior preferred stock purchase agreement with Treasury |

4,571 | 2,600 | ||||||

| Net change in federal funds purchased and securities sold under agreements to repurchase |

— | 26 | ||||||

| Other, net |

(8 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(152,906 | ) | (123,871 | ) | ||||

| Net increase in cash and cash equivalents |

4,510 | 2,534 | ||||||

| Cash and cash equivalents at beginning of period |

17,539 | 17,297 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 22,049 | $ | 19,831 | ||||

|

|

|

|

|

|||||

| Cash paid during the period for interest |

$ | 30,590 | $ | 32,689 | ||||

See Notes to Condensed Consolidated Financial Statements

| First-Quarter 2012 Results | 13 |