Chief Executive Officer’s Employment Agreement

Mr. Paul Manning is the only officer of the Company who currently has an employment agreement. A description of certain terms of Mr. Paul Manning’s employment agreement is provided below.

Compensation for Mr. Paul Manning

Mr. Paul Manning has an employment agreement with the Company that commenced on February 13, 2020. The initial term of employment was three years, commencing on the effective date, subject to automatic extension for additional one-year periods unless either party provides the other party with at least 12 months’ advance written notice that no such extension shall occur. The agreement provides for the payment of base salary (subject to annual adjustment by mutual agreement), bonus eligibility (with no guarantee that any bonus will be earned and paid), participation in incentive, savings, and retirement plans, and customary benefits. The agreement incorporates by reference a one-year non-competition covenant that will begin on the date Mr. Paul Manning ceases to serve as Chief Executive Officer.

For 2021 to 2023, Sensient’s principal corporate goals and objectives relevant to Mr. Paul Manning’s compensation were to achieve excellent overall financial performance and increased shareholder value by executing Sensient’s strategic plans, including strengthening Sensient’s management organization.

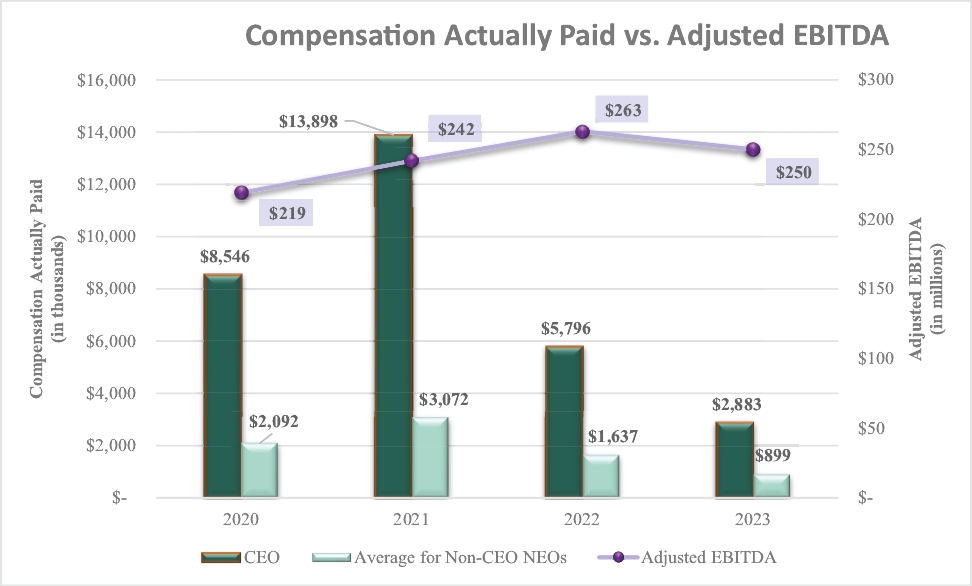

The Committee set Mr. Paul Manning’s base salary at $1,000,000, $1,040,000, and $1,080,000 in 2021, 2022, and 2023, respectively. Mr. Paul Manning’s base salary was selected based on the evaluations described above and on Sensient’s overall financial performance and Mr. Paul Manning’s leadership role. His potential annual cash incentive award was 100% of base salary at “target” performance. For 2021, the target awards were based on a weighted average of the Company’s achievement of adjusted EBITDA, adjusted revenue, and adjusted cash flow. In 2022 and 2023, the target award was based on a weighted average of the Company’s achievement of adjusted EBITDA and adjusted revenue.

Sensient granted Mr. Paul Manning 26,084 performance stock units and 17,390 shares of restricted stock in 2021, 35,160 performance stock units and 23,440 shares of restricted stock in 2022, and 42,442 performance stock units and 28,294 shares of restricted stock in 2023. The award for each year was based on Mr. Paul Manning’s performance with respect to the year in which the award was granted in accordance with the evaluation described above and to provide an appropriate incentive for accomplishment of future performance targets. The criteria for equity compensation awards are discussed in the subsection above entitled “Equity Awards.”

Mr. Paul Manning was also eligible to participate in the Company benefit plans available to and on the same basis as other executive officers of the Company, including the SERP, the supplemental benefit plan, and the deferred compensation plan.

Sensient’s Chief Executive Officer typically receives a higher salary, a higher potential bonus, and larger equity awards than our other executive officers, which is consistent with the practices of the companies included in the Comparable Company Data and most other public companies.

Because Sensient does not currently have a Chief Operating Officer or co-CEO, the difference between Mr. Paul Manning’s compensation and the compensation of the next four named executives is higher than at companies that employ a Chief Operating Officer or co-CEO.

Mr. Paul Manning’s employment agreement includes significant obligations upon early termination of employment (regardless of a change of control) without “cause” or for “good reason” as defined therein and as described below under “Potential Payments Upon Termination or Change of Control.”

Change of Control Agreements

The Company maintains change of control agreements with all of its executive officers, including the named executive officers. These agreements are customary in Sensient’s industry and help to attract and retain key executives in the event of a change of control. These agreements are not employment agreements and have no effect unless there is a change of control. For these purposes, a “change of control” ordinarily occurs if a person acquires 30% or more of Sensient’s Common Stock, a majority of Sensient’s Board consists of persons other than those nominated by the Board, or Sensient is a party to a merger, consolidation, or sale of assets, or acquires the assets of another entity, and Sensient’s shareholders have less than 50% of the Common Stock and voting power of the resulting entity.