| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

WISCONSIN

|

39-0561070

|

|

|

(State of Incorporation)

|

(IRS Employer Identification Number)

|

|

TITLE OF EACH CLASS

Common Stock, $0.10 par value

|

NAME OF EACH EXCHANGE

ON WHICH REGISTERED

|

|

|

New York Stock Exchange, Inc.

|

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

|

|

Smaller Reporting Company ☐

|

Emerging Growth Company ☐

|

|

3

|

|||

|

3

|

|||

|

3

|

|||

|

3

|

|||

|

4

|

|||

|

4

|

|||

|

4

|

|||

|

5

|

|||

|

5

|

|||

|

5

|

|||

|

5

|

|||

|

6

|

|||

|

6

|

|||

|

6

|

|||

|

6

|

|||

|

6

|

|||

|

6

|

|||

|

11

|

|||

|

11

|

|||

|

11

|

|||

|

12

|

|||

|

12

|

|||

|

13

|

|||

|

13

|

|||

|

14

|

|||

|

16

|

|||

|

27

|

|||

|

28

|

|||

|

28

|

|||

|

28

|

|||

|

29

|

|||

|

29

|

|||

|

29

|

|||

|

29

|

|||

|

29

|

|||

|

29

|

|||

|

29

|

|||

|

30

|

|||

|

30

|

|||

|

30

|

|||

|

30

|

|||

|

59

|

|||

|

30

|

|||

|

E-1

|

|||

|

S-1

|

|||

| ● |

flavors, flavor enhancers, ingredients, extracts, and bionutrients;

|

| ● |

fragrances, aroma chemicals, and essential oils;

|

| ● |

natural ingredients, including dehydrated vegetables and other food ingredients;

|

| ● |

natural and synthetic food and beverage colors;

|

| ● |

cosmetic colors and ingredients;

|

| ● |

pharmaceutical and nutraceutical excipients and ingredients; and

|

| ● |

technical colors, specialty inks and colors, and specialty dyes and pigments.

|

| ● |

Sensient Food Colors (food and beverage colors);

|

| ● |

Sensient Pharmaceutical Coating Systems (pharmaceutical and nutraceutical colors and coatings);

|

| ● |

Sensient Cosmetic Technologies (cosmetic colors, ingredients, and systems);

|

| ● |

Sensient Imaging Technologies/Sensient Inks (specialty inks); and

|

| ● |

Sensient Industrial Colors (paper colors; and industrial colors for plastics, leather, wood stains, antifreeze, landscaping, and other uses).

|

| · |

Flavors & Fragrances. Competition in the flavors and fragrances industries

continues to have an ever increasing global nature. Most of the Company’s customers do not buy their entire flavor and/or fragrance products from a single supplier and the Company does not compete with a single supplier in all product

categories. Competition for the supply of flavors and fragrances is based on the development of customized ingredients for new and reformulated customer products, as well as on quality, customer service, and price. Competition to supply dehydrated vegetable products is present through several large and small domestic competitors, as well as competitors from

other countries. Competition for the supply of dehydrated vegetables is based principally on product quality, customer service, and price.

|

| · |

Color. Competition in the color market is diverse, with the majority of the

Company’s competitors specializing in either synthetic dyes and pigments or natural colors or coloring foodstuffs (in Europe). The Company believes that it gains a competitive advantage as the only major basic manufacturer of a full

range of color products, including synthetic dyes and pigments as well as natural colors. Competition in the supply of cosmetic colors and ingredients, specialty inks, and pharmaceutical and nutraceutical ingredients and excipients is

based on the development of customized products and solutions as well as quality, customer service, and price. The Company believes that its reputation and capacity as a color producer as well as its product development and

applications expertise give it a competitive advantage in these markets.

|

| · |

Asia Pacific. The Company offers a broad array of products to customers through

the Asia Pacific Group. Competition is based upon reliability in product quality, service, and price as well as technical support available to customers.

|

| · |

Our recent restructurings may not be as effective as we anticipated and we may fail to

realize the expected cost savings.

|

| · |

The impact of currency exchange rate fluctuation may negatively affect our results.

|

| · |

Changes to LIBOR may negatively impact us.

|

| · |

In some product lines, most of our sales are made to a relatively small number of

customers; if we lose any of those customers, sales and operating results could decline.

|

| · |

Many of our products are used in items for human consumption and contact. We may be

subject to product liability claims and product recalls, which could negatively impact our profitability and corporate image.

|

| · |

Consolidation has resulted in customers with increased buying power, which can affect

our profitability.

|

| · |

Intense competition may result in reduced sales and profitability.

|

| · |

Our sales and profitability are affected by changing consumer preferences, changing

technologies, and our customers’ ability to make and sell to consumers in highly competitive markets.

|

| · |

If we do not maintain an efficient cost structure, our profitability could decrease.

|

| · |

Commodity, energy, and transportation price volatility and increases or material

shortages may reduce our profits.

|

| · |

There are an enormous number of laws and regulations applicable to us, our suppliers,

and our customers across all of our business lines. Compliance with these legal requirements is costly to us and can affect our operations as well as those of our suppliers and customers. Failure to comply could also be costly and

disruptive.

|

| · |

Environmental compliance may be costly to us.

|

| · |

Operating in foreign countries and emerging markets exposes us to increased risks,

including economic, political, and international operation risks.

|

| · |

Brexit may adversely impact the Company’s revenue and profits in the short term and

long term.

|

| · |

We depend on certain key personnel, and the loss of these persons may harm our

business.

|

| · |

We may not successfully complete and integrate past and future acquisitions, which

could adversely affect our operating results.

|

| · |

Our ability to successfully maintain and upgrade our information technology systems,

and to effectively respond to failures, disruptions, compromises, or breaches of our information technology systems, may affect our competitiveness and our profits could decrease.

|

| · |

World events and natural disasters are beyond our control and could affect our results.

|

| · |

Our ability to efficiently manage inventory may not be as effective as we anticipate

and may adversely impact our performance.

|

| · |

We could be

adversely affected by violations of anti-bribery and anti-corruption laws and regulations.

|

| · |

Our ability to protect our intellectual property rights is key to our performance.

|

|

Name

|

Age

|

Position

|

|

Paul Manning

|

44

|

Chairman, President and Chief Executive Officer

|

|

Amy M. Agallar

|

41

|

Vice President and Treasurer

|

|

Michael C. Geraghty

|

57

|

President, Color Group

|

|

Amy Schmidt Jones

|

49

|

Vice President, Human Resources and Senior Counsel

|

|

John J. Manning

|

50

|

Vice President, General Counsel and Secretary

|

|

E. Craig Mitchell

|

54

|

President, Flavors and Fragrances Group

|

|

Stephen J. Rolfs

|

54

|

Senior Vice President and Chief Financial Officer

|

|

Tobin Tornehl

|

45

|

Vice President, Controller and Chief Accounting Officer

|

| · |

Mr. Paul Manning has held his present office since April 21, 2016, and previously served as President and Chief Executive Officer (2014 – April 2016).

|

| · |

Ms. Agallar has held her present office since January 9, 2019. Prior to joining the Company, Ms. Agallar was Director – Business Development CIS of Modine Manufacturing

(June 2018 – December 2018), and Director – Global Treasury Operations of Modine Manufacturing (2011– June 2018).

|

| · |

Ms. Jones has held her present office since April 2, 2018. Prior to joining the Company, Ms. Jones was a partner of Michael Best & Friedrich LLP (1998 – March 2018).

|

| · |

Mr. John J. Manning has held his present office since April 21, 2016, and previously served as Vice President and Assistant General Counsel (2013 – April 2016).

|

| · |

Mr. Mitchell has held his present office since September 17, 2018. Prior to joining the Company, Mr. Mitchell served as President and Chief Operating Officer of Sekisui

Specialty Chemical America, LLC (April 2016 – September 2018), and Vice President of Sales, Americas of Celanese Corporation (2013 – April 2016).

|

| · |

Mr. Rolfs has held his present position since February 7, 2015, and previously served as Senior Vice President, Administration (July 2013 – February 2015).

|

| · |

Mr. Tornehl has held his present office since November 10, 2018, and previously served as Director, Finance (2008 – November 2018).

|

|

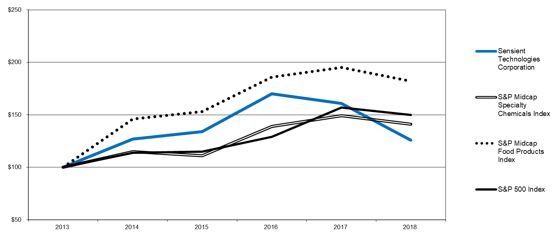

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|||||||||||||||||||

|

Sensient Technologies Corporation

|

$

|

100

|

$

|

127

|

$

|

134

|

$

|

170

|

$

|

161

|

$

|

126

|

||||||||||||

|

S&P Midcap Specialty Chemicals Index

|

100

|

115

|

111

|

139

|

149

|

141

|

||||||||||||||||||

|

S&P Midcap Food Products Index

|

100

|

146

|

153

|

186

|

195

|

182

|

||||||||||||||||||

|

S&P 500 Index

|

100

|

114

|

115

|

129

|

157

|

150

|

||||||||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Full

Year

|

||||||||||||||||

|

2018

|

||||||||||||||||||||

|

Revenue

|

$

|

356,477

|

$

|

363,041

|

$

|

342,734

|

$

|

324,563

|

$

|

1,386,815

|

||||||||||

|

Gross profit

|

123,071

|

121,470

|

115,573

|

106,015

|

466,129

|

|||||||||||||||

|

Net earnings

|

38,194

|

39,123

|

47,193

|

32,850

|

157,360

|

|||||||||||||||

|

Earnings per basic share

|

0.89

|

0.93

|

1.12

|

0.78

|

3.71

|

|||||||||||||||

|

Earnings per diluted share

|

0.89

|

0.92

|

1.12

|

0.78

|

3.70

|

|||||||||||||||

|

2017

|

||||||||||||||||||||

|

Revenue

|

$

|

341,397

|

$

|

338,475

|

$

|

353,519

|

$

|

328,874

|

$

|

1,362,265

|

||||||||||

|

Gross profit

|

120,945

|

119,225

|

122,735

|

112,585

|

475,490

|

|||||||||||||||

|

Net earnings

|

13,192

|

30,774

|

32,213

|

13,421

|

89,600

|

|||||||||||||||

|

Earnings per basic share

|

0.30

|

0.70

|

0.74

|

0.31

|

2.05

|

|||||||||||||||

|

Earnings per diluted share

|

0.30

|

0.69

|

0.73

|

0.31

|

2.03

|

|||||||||||||||

|

(in thousands except percentages, employee and per share data)

|

||||||||||||||||||||||||||||||||||||||||

|

Years ended December 31,

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||||||||

|

Summary of Operations

|

||||||||||||||||||||||||||||||||||||||||

|

Revenue

|

$

|

1,386,815

|

100.0

|

%

|

$

|

1,362,265

|

100.0

|

%

|

$

|

1,383,210

|

100.0

|

%

|

$

|

1,375,964

|

100.0

|

%

|

$

|

1,447,821

|

100.0

|

%

|

||||||||||||||||||||

|

Cost of products sold

|

920,686

|

66.4

|

886,775

|

65.1

|

907,783

|

65.6

|

921,531

|

67.0

|

959,311

|

66.3

|

||||||||||||||||||||||||||||||

|

Selling and administrative expenses

|

262,751

|

18.9

|

307,684

|

22.6

|

289,818

|

21.0

|

288,092

|

20.9

|

357,845

|

24.7

|

||||||||||||||||||||||||||||||

|

Operating income

|

203,378

|

14.7

|

%

|

167,806

|

12.3

|

%

|

185,609

|

13.4

|

%

|

166,341

|

12.1

|

%

|

130,665

|

9.0

|

%

|

|||||||||||||||||||||||||

|

Interest expense

|

21,853

|

19,383

|

18,324

|

16,945

|

16,067

|

|||||||||||||||||||||||||||||||||||

|

Earnings before income taxes

|

181,525

|

148,423

|

167,285

|

149,396

|

114,598

|

|||||||||||||||||||||||||||||||||||

|

Income taxes

|

24,165

|

58,823

|

44,372

|

42,149

|

32,827

|

|||||||||||||||||||||||||||||||||||

|

Earnings from continuing operations

|

157,360

|

89,600

|

122,913

|

107,247

|

81,771

|

|||||||||||||||||||||||||||||||||||

|

Gain (loss) from discontinued operations, net of tax

|

-

|

-

|

3,343

|

(462

|

)

|

(8,125

|

)

|

|||||||||||||||||||||||||||||||||

|

Net earnings

|

$

|

157,360

|

$

|

89,600

|

$

|

126,256

|

$

|

106,785

|

$

|

73,646

|

||||||||||||||||||||||||||||||

|

Earnings per basic share:

|

||||||||||||||||||||||||||||||||||||||||

|

Continuing operations

|

$

|

3.71

|

$

|

2.05

|

$

|

2.76

|

$

|

2.34

|

$

|

1.69

|

||||||||||||||||||||||||||||||

|

Discontinued operations

|

-

|

-

|

0.08

|

(0.01

|

)

|

(0.17

|

)

|

|||||||||||||||||||||||||||||||||

|

Earnings per basic share

|

$

|

3.71

|

$

|

2.05

|

$

|

2.84

|

$

|

2.33

|

$

|

1.52

|

||||||||||||||||||||||||||||||

|

Earnings per diluted share:

|

||||||||||||||||||||||||||||||||||||||||

|

Continuing operations

|

$

|

3.70

|

$

|

2.03

|

$

|

2.74

|

$

|

2.32

|

$

|

1.67

|

||||||||||||||||||||||||||||||

|

Discontinued operations

|

-

|

-

|

0.07

|

(0.01

|

)

|

(0.17

|

)

|

|||||||||||||||||||||||||||||||||

|

Earnings per diluted share

|

$

|

3.70

|

$

|

2.03

|

$

|

2.82

|

$

|

2.31

|

$

|

1.51

|

||||||||||||||||||||||||||||||

|

Other Related Data

|

||||||||||||||||||||||||||||||||||||||||

|

Dividends per share, declared and paid

|

$

|

1.35

|

$

|

1.23

|

$

|

1.11

|

$

|

1.04

|

$

|

0.98

|

||||||||||||||||||||||||||||||

|

Average common shares outstanding:

|

||||||||||||||||||||||||||||||||||||||||

|

Basic

|

42,404

|

43,780

|

44,523

|

45,910

|

48,525

|

|||||||||||||||||||||||||||||||||||

|

Diluted

|

42,499

|

44,031

|

44,843

|

46,204

|

48,819

|

|||||||||||||||||||||||||||||||||||

|

Book value per common share

|

$

|

20.34

|

$

|

19.70

|

$

|

18.83

|

$

|

18.78

|

$

|

21.94

|

||||||||||||||||||||||||||||||

|

Price range per common share

|

51.93- 78.40

|

71.21 -

84.98

|

52.69 -

83.38

|

56.71 -

70.53

|

46.08 -

63.35

|

|||||||||||||||||||||||||||||||||||

|

Share price at December 31

|

55.85

|

73.15

|

78.58

|

62.82

|

60.34

|

|||||||||||||||||||||||||||||||||||

|

Capital expenditures

|

50,740

|

56,344

|

81,216

|

79,941

|

79,398

|

|||||||||||||||||||||||||||||||||||

|

Depreciation

|

50,950

|

46,956

|

45,714

|

46,694

|

50,225

|

|||||||||||||||||||||||||||||||||||

|

Amortization

|

2,294

|

1,562

|

1,305

|

1,245

|

1,231

|

|||||||||||||||||||||||||||||||||||

|

Total assets

|

1,824,940

|

1,724,340

|

1,667,860

|

1,703,732

|

1,772,039

|

|||||||||||||||||||||||||||||||||||

|

Long-term debt

|

689,553

|

604,159

|

582,780

|

613,502

|

450,548

|

|||||||||||||||||||||||||||||||||||

|

Total debt

|

709,599

|

624,289

|

603,358

|

634,157

|

466,436

|

|||||||||||||||||||||||||||||||||||

|

Shareholders’ equity

|

859,947

|

852,301

|

835,741

|

845,127

|

1,046,935

|

|||||||||||||||||||||||||||||||||||

|

Return on average shareholders’ equity

|

18.8

|

%

|

10.3

|

%

|

14.7

|

%

|

11.6

|

%

|

6.4

|

%

|

||||||||||||||||||||||||||||||

|

Total debt to total capital

|

45.2

|

%

|

42.3

|

%

|

41.9

|

%

|

42.9

|

%

|

30.8

|

%

|

||||||||||||||||||||||||||||||

|

Employees

|

4,113

|

4,023

|

4,083

|

4,032

|

4,053

|

|||||||||||||||||||||||||||||||||||

|

2018

|

2017

|

|||||||

|

Rate before 2017 Tax Legislation, restructuring and discrete items

|

20.7

|

%

|

24.5

|

%

|

||||

|

2017 Tax Legislation

|

(3.7

|

%)

|

12.4

|

%

|

||||

|

Restructuring impact

|

-

|

3.9

|

%

|

|||||

|

Discrete items

|

(3.7

|

%)

|

(1.2

|

%)

|

||||

|

Reported effective tax rate

|

13.3

|

%

|

39.6

|

%

|

||||

|

Twelve Months Ended December 31,

|

||||||||||||

|

(In thousands except per share amounts)

|

2018

|

2017

|

% Change

|

|||||||||

|

Operating Income from continuing operations (GAAP)

|

$

|

203,378

|

$

|

167,806

|

21.2

|

%

|

||||||

|

Restructuring – Cost of products sold

|

-

|

2,889

|

||||||||||

|

Restructuring – Selling and administrative

|

-

|

33,627

|

||||||||||

|

Other – Selling and administrative (1)

|

-

|

11,555

|

||||||||||

|

Adjusted operating income

|

$

|

203,378

|

$

|

215,877

|

(5.8

|

%)

|

||||||

|

Net Earnings from continuing operations (GAAP)

|

$

|

157,360

|

$

|

89,600

|

75.6

|

%

|

||||||

|

Restructuring & other, before tax

|

-

|

48,071

|

||||||||||

|

Tax impact of restructuring & other

|

-

|

(5,602

|

)

|

|||||||||

|

2017 Tax Legislation

|

(6,634

|

)

|

18,446

|

|||||||||

|

Adjusted net earnings

|

$

|

150,726

|

$

|

150,515

|

0.1

|

%

|

||||||

|

Diluted EPS from continuing operations (GAAP)

|

$

|

3.70

|

$

|

2.03

|

82.3

|

%

|

||||||

|

Restructuring & other, net of tax

|

-

|

0.96

|

||||||||||

|

2017 Tax Legislation

|

(0.16

|

)

|

0.42

|

|||||||||

|

Adjusted diluted EPS

|

$

|

3.55

|

$

|

3.42

|

3.8

|

%

|

||||||

| (1) |

The other costs are for the divestiture related costs discussed under “Divestiture”

above.

|

|

Twelve Months Ended December 31, 2018

|

||||||||||||

|

Total

|

Foreign Exchange

Rates

|

Local Currency

|

||||||||||

|

Revenue

|

||||||||||||

|

Flavors & Fragrances

|

0.0

|

%

|

1.1

|

%

|

(1.1

|

%)

|

||||||

|

Color

|

5.2

|

%

|

0.4

|

%

|

4.8

|

%

|

||||||

|

Asia Pacific

|

0.0

|

%

|

(0.1

|

%)

|

0.1

|

%

|

||||||

|

Total Revenue

|

1.8

|

%

|

0.7

|

%

|

1.1

|

%

|

||||||

|

Operating Income From Continuing Operations

|

||||||||||||

|

Flavors & Fragrances

|

(15.7

|

%)

|

0.0

|

%

|

(15.7

|

%)

|

||||||

|

Color

|

1.4

|

%

|

1.1

|

%

|

0.3

|

%

|

||||||

|

Asia Pacific

|

0.4

|

%

|

1.3

|

%

|

(0.9

|

%)

|

||||||

|

Corporate & Other

|

(64.3

|

%)

|

1.4

|

%

|

(65.7

|

%)

|

||||||

|

Operating Income from continuing operations

|

21.2

|

%

|

0.2

|

%

|

21.0

|

%

|

||||||

|

Diluted EPS from continuing operations

|

82.3

|

%

|

0.0

|

%

|

82.3

|

%

|

||||||

|

Adjusted operating income (1)

|

(5.8

|

%)

|

0.7

|

%

|

(6.5

|

%)

|

||||||

|

Adjusted diluted EPS (1)

|

3.8

|

%

|

0.6

|

%

|

3.2

|

%

|

||||||

| (1) |

Refer to table above for a reconciliation of these non-GAAP measures.

|

|

2017

|

2016

|

|||||||

|

Rate before restructuring and discrete items

|

24.5

|

%

|

27.7

|

%

|

||||

|

2017 Tax Legislation

|

12.4

|

%

|

-

|

|

||||

|

Restructuring impact

|

3.9

|

%

|

1.0

|

%

|

||||

|

Discrete items

|

(1.2

|

%)

|

(2.2

|

%)

|

||||

|

Reported effective tax rate

|

39.6

|

%

|

26.5

|

%

|

||||

|

Twelve Months Ended December 31,

|

||||||||||||

|

(In thousands except per share amounts)

|

2017

|

2016

|

% Change

|

|||||||||

|

Operating Income from continuing operations (GAAP)

|

$

|

167,806

|

$

|

185,609

|

(9.6

|

%)

|

||||||

|

Restructuring - Cost of products sold

|

2,889

|

2,065

|

||||||||||

|

Restructuring - Selling and administrative

|

33,627

|

12,486

|

||||||||||

|

Other – Selling and administrative (1)

|

11,555

|

11,535

|

||||||||||

|

Adjusted operating income

|

$

|

215,877

|

$

|

211,695

|

2.0

|

%

|

||||||

|

Net Earnings from continuing operations (GAAP)

|

$

|

89,600

|

$

|

122,913

|

(27.1

|

%)

|

||||||

|

Restructuring & other, before tax

|

48,071

|

26,086

|

||||||||||

|

Tax impact of restructuring & other

|

(5,602

|

)

|

(4,999

|

)

|

||||||||

|

Impact of the 2017 Tax Legislature

|

18,446

|

-

|

||||||||||

|

Adjusted net earnings

|

$

|

150,515

|

$

|

144,000

|

4.5

|

%

|

||||||

|

Diluted EPS from continuing operations (GAAP)

|

$

|

2.03

|

$

|

2.74

|

(25.9

|

%)

|

||||||

|

Restructuring & other, net of tax

|

0.96

|

0.47

|

||||||||||

|

2017 Tax Legislation

|

0.42

|

-

|

||||||||||

|

Adjusted diluted EPS

|

$

|

3.42

|

$

|

3.21

|

6.5

|

%

|

||||||

| (1) |

The other costs in 2017 and 2016 are for the divestiture related costs discussed under “Divestiture” above.

|

|

Twelve Months Ended December 31, 2017

|

||||||||||||

|

Total

|

Foreign

Exchange Rates

|

Local Currency

|

||||||||||

|

Revenue

|

||||||||||||

|

Flavors & Fragrances

|

(6.1

|

%)

|

0.0

|

%

|

(6.1

|

%)

|

||||||

|

Color

|

4.4

|

%

|

0.9

|

%

|

3.5

|

%

|

||||||

|

Asia Pacific

|

1.6

|

%

|

0.8

|

%

|

0.9

|

%

|

||||||

|

Total Revenue

|

(1.5

|

%)

|

0.5

|

%

|

(2.0

|

%)

|

||||||

|

Operating Income From Continuing Operations

|

||||||||||||

|

Flavors & Fragrances

|

(7.8

|

%)

|

(0.4

|

%)

|

(7.4

|

%)

|

||||||

|

Color

|

7.2

|

%

|

0.6

|

%

|

6.5

|

%

|

||||||

|

Asia Pacific

|

(12.0

|

%)

|

1.1

|

%

|

(13.1

|

%)

|

||||||

|

Corporate & Other

|

18.9

|

%

|

0.1

|

%

|

18.7

|

%

|

||||||

|

Operating Income from continuing operations

|

(9.6

|

%)

|

0.2

|

%

|

(9.8

|

%)

|

||||||

|

Diluted EPS from continuing operations

|

(25.9

|

%)

|

0.0

|

%

|

(25.9

|

%)

|

||||||

|

Adjusted operating income (1)

|

2.0

|

%

|

0.2

|

%

|

1.8

|

%

|

||||||

|

Adjusted diluted EPS (1)

|

6.5

|

%

|

0.3

|

%

|

6.2

|

%

|

||||||

| (1) |

Refer to table above for a reconciliation of these non-GAAP measures.

|

|

(in thousands)

|

Total

|

1 year

|

2-3 years

|

4-5 years

|

> 5 years

|

|||||||||||||||

|

Long-term debt

|

$

|

689,553

|

$

|

10,963

|

$

|

27,393

|

$

|

464,008

|

$

|

187,189

|

||||||||||

|

Interest payments on long-term debt

|

85,401

|

19,069

|

36,642

|

21,736

|

7,954

|

|||||||||||||||

|

Operating lease obligations

|

30,535

|

9,749

|

10,604

|

5,921

|

4,261

|

|||||||||||||||

|

Manufacturing purchase commitments

|

107,962

|

72,375

|

35,587

|

-

|

-

|

|||||||||||||||

|

Pension funding obligations

|

23,732

|

1,532

|

3,099

|

5,534

|

13,567

|

|||||||||||||||

|

Total contractual obligations

|

$

|

937,183

|

$

|

113,688

|

$

|

113,325

|

$

|

497,199

|

$

|

212,971

|

||||||||||

| 1 and 2: |

Financial Statements and Financial Statement Schedule. See below for “List of Financial Statements and Financial Statement Schedule.”

|

| 3: |

See Exhibit Index following this report.

|

|

Report of Independent Registered Public Accounting Firm

|

57

|

|

|

Consolidated Balance Sheets – December 31, 2018 and 2017

|

33

|

|

|

Consolidated Statements of Earnings – Years ended December 31, 2018, 2017 and 2016

|

31

|

|

|

Consolidated Statements of Comprehensive Income – Years ended December 31, 2018, 2017 and 2016

|

32

|

|

|

Consolidated Statements of Shareholders’ Equity – Years ended December 31, 2018, 2017 and 2016

|

35

|

|

|

Consolidated Statements of Cash Flows – Years ended December 31, 2018, 2017 and 2016

|

34

|

|

|

Notes to Consolidated Financial Statements

|

36-56

|

|

Schedule II – Valuation and Qualifying Accounts

|

59

|

|

Years Ended December 31,

|

||||||||||||

|

(in thousands except per share amounts)

|

2018

|

2017

|

2016

|

|||||||||

|

Revenue

|

$

|

1,386,815

|

$

|

1,362,265

|

$

|

1,383,210

|

||||||

|

Cost of products sold

|

920,686

|

886,775

|

907,783

|

|||||||||

|

Selling and administrative expenses

|

262,751

|

307,684

|

289,818

|

|||||||||

|

Operating income

|

203,378

|

167,806

|

185,609

|

|||||||||

|

Interest expense

|

21,853

|

19,383

|

18,324

|

|||||||||

|

Earnings before income taxes

|

181,525

|

148,423

|

167,285

|

|||||||||

|

Income taxes

|

24,165

|

58,823

|

44,372

|

|||||||||

|

Earnings from continuing operations

|

157,360

|

89,600

|

122,913

|

|||||||||

|

Gain from discontinued operations, net of tax

|

-

|

-

|

3,343

|

|||||||||

|

Net earnings

|

$

|

157,360

|

$

|

89,600

|

$

|

126,256

|

||||||

|

Earnings per common share:

|

||||||||||||

|

Basic:

|

||||||||||||

|

Continuing operations

|

$

|

3.71

|

$

|

2.05

|

$

|

2.76

|

||||||

|

Discontinued operations

|

-

|

-

|

0.08

|

|||||||||

|

Earnings per common share

|

$

|

3.71

|

$

|

2.05

|

$

|

2.84

|

||||||

|

Diluted:

|

||||||||||||

|

Continuing operations

|

$

|

3.70

|

$

|

2.03

|

$

|

2.74

|

||||||

|

Discontinued operations

|

-

|

-

|

0.07

|

|||||||||

|

Earnings per common share

|

$

|

3.70

|

$

|

2.03

|

$

|

2.82

|

||||||

|

Weighted average number of common shares outstanding:

|

||||||||||||

|

Basic

|

42,404

|

43,780

|

44,523

|

|||||||||

|

Diluted

|

42,499

|

44,031

|

44,843

|

|||||||||

|

(in thousands)

|

Years Ended December 31,

|

|||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Net earnings

|

$

|

157,360

|

$

|

89,600

|

$

|

126,256

|

||||||

|

Cash flow hedges adjustment, net of tax of $32, $10 and $89, respectively

|

816

|

(584

|

)

|

(249

|

)

|

|||||||

|

Pension adjustment, net of tax of $347, $778 and $785, respectively

|

1,027

|

2,228

|

1,856

|

|||||||||

|

Foreign currency translation on net investment hedges

|

13,661

|

(28,871

|

)

|

6,989

|

||||||||

|

Tax effect of current year activity on net investment hedges

|

(3,393

|

)

|

10,812

|

(2,733

|

)

|

|||||||

|

Foreign currency translation on long-term intercompany loans

|

3,276

|

7,013

|

(494

|

)

|

||||||||

|

Tax effect of current year activity on intercompany long-term loans

|

(2,498

|

)

|

-

|

-

|

||||||||

|

Reclassification of cumulative translation to net earnings

|

-

|

6,782

|

(3,257

|

)

|

||||||||

|

Other foreign currency translation

|

(27,721

|

)

|

66,751

|

(45,515

|

)

|

|||||||

|

Total comprehensive income

|

$

|

142,528

|

$

|

153,731

|

$

|

82,853

|

||||||

|

(in thousands except share and per share amounts)

|

December 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

Assets

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

31,901

|

$

|

29,344

|

||||

|

Trade accounts receivable, less allowance for losses of $5,976 and $6,000, respectively

|

255,350

|

195,439

|

||||||

|

Inventories

|

490,757

|

463,517

|

||||||

|

Prepaid expenses and other current assets

|

44,857

|

43,206

|

||||||

|

Assets held for sale

|

-

|

1,969

|

||||||

|

Total current assets

|

822,865

|

733,475

|

||||||

|

Other assets

|

66,788

|

68,251

|

||||||

|

Deferred tax assets

|

9,189

|

7,885

|

||||||

|

Intangible assets – at cost, less accumulated amortization of $20,325 and $17,432, respectively

|

18,867

|

7,211

|

||||||

|

Goodwill

|

416,175

|

408,995

|

||||||

|

Property, Plant and Equipment:

|

||||||||

|

Land

|

36,787

|

35,198

|

||||||

|

Buildings

|

318,463

|

317,464

|

||||||

|

Machinery and equipment

|

688,003

|

687,896

|

||||||

|

Construction in progress

|

34,772

|

40,833

|

||||||

|

|

1,078,025

|

1,081,391

|

||||||

|

Less accumulated depreciation

|

(586,969

|

)

|

(582,868

|

)

|

||||

|

491,056

|

498,523

|

|||||||

|

Total assets

|

$

|

1,824,940

|

$

|

1,724,340

|

||||

|

Liabilities and Shareholders’ Equity

|

||||||||

|

Current Liabilities:

|

||||||||

|

Trade accounts payable

|

$

|

131,812

|

$

|

109,780

|

||||

|

Accrued salaries, wages and withholdings from employees

|

23,410

|

23,613

|

||||||

|

Other accrued expenses

|

31,198

|

51,764

|

||||||

|

Income taxes

|

8,234

|

11,036

|

||||||

|

Short-term borrowings

|

20,046

|

20,130

|

||||||

|

Total current liabilities

|

214,700

|

216,323

|

||||||

|

Deferred tax liabilities

|

28,976

|

18,724

|

||||||

|

Other liabilities

|

8,554

|

13,539

|

||||||

|

Accrued employee and retiree benefits

|

23,210

|

19,294

|

||||||

|

Long-term debt

|

689,553

|

604,159

|

||||||

|

Shareholders’ Equity:

|

||||||||

|

Common stock, par value $0.10 a share, authorized 100,000,000 shares; issued 53,954,874 shares

|

5,396

|

5,396

|

||||||

|

Additional paid‑in capital

|

101,663

|

107,176

|

||||||

|

Earnings reinvested in the business

|

1,516,243

|

1,414,485

|

||||||

|

Treasury stock, 11,731,223 and 10,759,291 shares, respectively, at cost

|

(597,800

|

)

|

(525,422

|

)

|

||||

|

Accumulated other comprehensive loss

|

(165,555

|

)

|

(149,334

|

)

|

||||

|

859,947

|

852,301

|

|||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,824,940

|

$

|

1,724,340

|

||||

|

(in thousands)

|

Years ended December 31,

|

|||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Cash Flows from Operating Activities

|

||||||||||||

|

Net earnings

|

$

|

157,360

|

$

|

89,600

|

$

|

126,256

|

||||||

|

Adjustments to arrive at net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

53,244

|

48,518

|

47,019

|

|||||||||

|

Share-based compensation

|

503

|

5,855

|

7,709

|

|||||||||

|

Net loss on assets

|

63

|

2,552

|

9,755

|

|||||||||

|

Loss on divestiture of business

|

—

|

33,160

|

—

|

|||||||||

|

Liquidation of foreign entity

|

—

|

—

|

(3,257

|

)

|

||||||||

|

Deferred income taxes

|

9,844

|

17,414

|

10,428

|

|||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Trade accounts receivable

|

(96,638

|

)

|

(130,835

|

)

|

(4,270

|

)

|

||||||

|

Inventories

|

(34,114

|

)

|

(47,345

|

)

|

(20,064

|

)

|

||||||

|

Prepaid expenses and other assets

|

(12,544

|

)

|

14,072

|

(4,096

|

)

|

|||||||

|

Accounts payable and other accrued expenses

|

7,457

|

4,804

|

2,332

|

|||||||||

|

Accrued salaries, wages and withholdings from employees

|

599

|

(4,361

|

)

|

3,347

|

||||||||

|

Income taxes

|

(7,335

|

)

|

2,846

|

5,959

|

||||||||

|

Other liabilities

|

5,081

|

27

|

2,521

|

|||||||||

|

Net cash provided by operating activities

|

83,520

|

36,307

|

183,639

|

|||||||||

|

Cash Flows from Investing Activities

|

||||||||||||

|

Acquisition of property, plant and equipment

|

(50,740

|

)

|

(56,344

|

)

|

(81,216

|

)

|

||||||

|

Cash receipts on sold receivables

|

91,142

|

141,465

|

35,414

|

|||||||||

|

Proceeds from sale of assets

|

2,615

|

10,485

|

6,254

|

|||||||||

|

Proceeds from divesture of business

|

—

|

12,457

|

—

|

|||||||||

|

Acquisition of new business

|

(31,100

|

)

|

—

|

—

|

||||||||

|

Other investing activities

|

2,916

|

2,319

|

3,184

|

|||||||||

|

Net cash provided by (used in) investing activities

|

14,833

|

110,382

|

(36,364

|

)

|

||||||||

|

Cash Flows from Financing Activities

|

||||||||||||

|

Proceeds from additional borrowings

|

322,529

|

231,174

|

222,562

|

|||||||||

|

Debt payments

|

(284,332

|

)

|

(239,950

|

)

|

(247,092

|

)

|

||||||

|

Purchase of treasury stock

|

(76,734

|

)

|

(87,217

|

)

|

(50,100

|

)

|

||||||

|

Dividends paid

|

(57,410

|

)

|

(54,038

|

)

|

(49,635

|

)

|

||||||

|

Other financing activities

|

(2,777

|

)

|

(3,383

|

)

|

(3,706

|

)

|

||||||

|

Net cash used in financing activities

|

(98,724

|

)

|

(153,414

|

)

|

(127,971

|

)

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents

|

2,928

|

10,204

|

(5,436

|

)

|

||||||||

|

Net increase in cash and cash equivalents

|

2,557

|

3,479

|

13,868

|

|||||||||

|

Cash and cash equivalents at beginning of year

|

29,344

|

25,865

|

11,997

|

|||||||||

|

Cash and cash equivalents at end of year

|

$

|

31,901

|

$

|

29,344

|

$

|

25,865

|

||||||

|

Cash paid during the year for:

|

||||||||||||

|

Interest

|

$

|

21,567

|

$

|

19,523

|

$

|

18,474

|

||||||

|

Income taxes

|

24,089

|

29,261

|

29,217

|

|||||||||

|

Capitalized interest

|

604

|

486

|

1,061

|

|||||||||

|

(in thousands except share and per share amounts)

|

Common

|

Additional

Paid-in

|

Earnings

Reinvested

in the

|

Treasury Stock

|

Accumulated

Other

Comprehensive

|

|||||||||||||||||||

|

Stock

|

Capital

|

Business

|

Shares

|

Amount

|

(Loss) Income

|

|||||||||||||||||||

|

Balances at December 31, 2015

|

$

|

5,396

|

$

|

109,974

|

$

|

1,302,302

|

9,174,843

|

$

|

(402,483

|

)

|

$

|

(170,062

|

)

|

|||||||||||

|

Net earnings

|

126,256

|

|||||||||||||||||||||||

|

Other comprehensive income (loss)

|

(43,403

|

)

|

||||||||||||||||||||||

|

Cash dividends paid – $1.11 per share

|

(49,635

|

)

|

||||||||||||||||||||||

|

Share-based compensation

|

7,709

|

|||||||||||||||||||||||

|

Stock options exercised

|

(650

|

)

|

(30,500

|

)

|

1,354

|

|||||||||||||||||||

|

Non-vested stock issued upon vesting

|

(7,769

|

)

|

(172,147

|

)

|

7,769

|

|||||||||||||||||||

|

Benefit plans

|

229

|

(15,839

|

)

|

698

|

||||||||||||||||||||

|

Purchase of treasury stock

|

702,698

|

(47,534

|

)

|

|||||||||||||||||||||

|

Other

|

(1,807

|

)

|

57,449

|

(2,603

|

)

|

|||||||||||||||||||

|

Balances at December 31, 2016

|

5,396

|

107,686

|

1,378,923

|

9,716,504

|

(442,799

|

)

|

(213,465

|

)

|

||||||||||||||||

|

Net earnings

|

89,600

|

|||||||||||||||||||||||

|

Other comprehensive income

|

64,131

|

|||||||||||||||||||||||

|

Cash dividends paid – $1.23 per share

|

(54,038

|

)

|

||||||||||||||||||||||

|

Share-based compensation

|

5,855

|

|||||||||||||||||||||||

|

Stock options exercised

|

(202

|

)

|

(10,667

|

)

|

499

|

|||||||||||||||||||

|

Non-vested stock issued upon vesting

|

(5,478

|

)

|

(114,393

|

)

|

5,478

|

|||||||||||||||||||

|

Benefit plans

|

445

|

(12,999

|

)

|

596

|

||||||||||||||||||||

|

Purchase of treasury stock

|

1,139,734

|

(87,217

|

)

|

|||||||||||||||||||||

|

Other

|

(1,130

|

)

|

41,112

|

(1,979

|

)

|

|||||||||||||||||||

|

Balances at December 31, 2017

|

5,396

|

107,176

|

1,414,485

|

10,759,291

|

(525,422

|

)

|

(149,334

|

)

|

||||||||||||||||

|

Net earnings

|

157,360

|

|||||||||||||||||||||||

|

Other comprehensive income (loss)

|

(14,832

|

)

|

||||||||||||||||||||||

|

Cash dividends paid – $1.35 per share

|

(57,410

|

)

|

||||||||||||||||||||||

|

Share-based compensation

|

503

|

|||||||||||||||||||||||

|

Stock options exercised

|

(80

|

)

|

(4,000

|

)

|

200

|

|||||||||||||||||||

|

Non-vested stock issued upon vesting

|

(5,454

|

)

|

(111,185

|

)

|

5,454

|

|||||||||||||||||||

|

Benefit plans

|

350

|

(15,126

|

)

|

769

|

||||||||||||||||||||

|

Purchase of treasury stock

|

1,060,000

|

(76,734

|

)

|

|||||||||||||||||||||

|

Other

|

(832

|

)

|

1,808

|

42,243

|

(2,067

|

)

|

(1,389

|

)

|

||||||||||||||||

|

Balances at December 31, 2018

|

$

|

5,396

|

$

|

101,663

|

$

|

1,516,243

|

11,731,223

|

$

|

(597,800

|

)

|

$

|

(165,555

|

)

|

|||||||||||

| · |

Identification of the contract, or contracts, with a customer

|

| · |

Identification of the performance obligations in the contract

|

| · |

Determination of the transaction price

|

| · |

Allocation of the transaction price to the performance obligations in the contract

|

| · |

Recognition of revenue when, or as, the Company satisfies the performance obligations

|

|

Years Ended December 31,

|

||||||||||||

|

(in thousands except per share amounts)

|

2018

|

2017

|

2016

|

|||||||||

|

Numerator:

|

||||||||||||

|

Net earnings from continuing operations

|

$

|

157,360

|

$

|

89,600

|

$

|

122,913

|

||||||

|

Denominator:

|

||||||||||||

|

Denominator for basic EPS - weighted average common shares

|

42,404

|

43,780

|

44,523

|

|||||||||

|

Effect of dilutive securities

|

95

|

251

|

320

|

|||||||||

|

Denominator for diluted EPS - diluted weighted average shares outstanding

|

42,499

|

44,031

|

44,843

|

|||||||||

|

EPS from continuing operations

|

||||||||||||

|

Basic

|

$

|

3.71

|

$

|

2.05

|

$

|

2.76

|

||||||

|

Diluted

|

$

|

3.70

|

$

|

2.03

|

$

|

2.74

|

||||||

|

2018

|

2017

|

|||||||||||||||||||

|

(In thousands except weighted average amortization years)

|

Weighted

Average

Amortization

Years

|

Cost

|

Accumulated

Amortization

|

Cost

|

Accumulated

Amortization

|

|||||||||||||||

|

Technological know-how

|

18.9

|

$

|

14,570

|

$

|

(6,768

|

)

|

$

|

7,510

|

$

|

(6,505

|

)

|

|||||||||

|

Customer relationships

|

17.4

|

8,761

|

(5,673

|

)

|

6,869

|

(5,244

|

)

|

|||||||||||||

|

Patents, trademarks, non-compete agreements, and other

|

15.4

|

15,861

|

(7,884

|

)

|

10,264

|

(5,683

|

)

|

|||||||||||||

|

Total finite-lived intangibles

|

17.2

|

$

|

39,192

|

$

|

(20,325

|

)

|

$

|

24,643

|

$

|

(17,432

|

)

|

|||||||||

|

(In thousands)

|

Flavors &

Fragrances

|

Color

|

Asia Pacific

|

Corporate &

Other

|

Consolidated

|

|||||||||||||||

|

Balance as of December 31, 2016

|

$

|

109,369

|

$

|

272,006

|

$

|

2,193

|

$

|

-

|

$

|

383,568

|

||||||||||

|

Currency translation impact

|

5,624

|

18,883

|

920

|

-

|

25,427

|

|||||||||||||||

|

Balance as of December 31, 2017

|

114,993

|

290,889

|

3,113

|

-

|

408,995

|

|||||||||||||||

|

Currency translation impact

|

(891

|

)

|

(8,269

|

)

|

52

|

-

|

(9,108

|

)

|

||||||||||||

|

Acquisitions

|

-

|

7,434

|

-

|

8,854

|

16,288

|

|||||||||||||||

|

Balance as of December 31, 2018

|

$

|

114,102

|

$

|

290,054

|

$

|

3,165

|

$

|

8,854

|

$

|

416,175

|

||||||||||

|

(in thousands)

|

2018

|

2017

|

||||||

|

3.66% senior notes due November 2023

|

$

|

75,000

|

$

|

75,000

|

||||

|

3.65% senior notes due May 2024

|

27,000

|

27,000

|

||||||

|

4.19% senior notes due November 2025

|

25,000

|

-

|

||||||

|

1.27% Euro-denominated senior notes due May 2024

|

57,333

|

60,024

|

||||||

|

1.71% Euro-denominated senior notes due May 2027

|

45,866

|

48,019

|

||||||

|

3.06% Euro-denominated senior notes due November 2023

|

43,856

|

45,914

|

||||||

|

1.85% Euro-denominated senior notes due November 2022

|

76,662

|

80,260

|

||||||

|

4.47% senior notes due November 2018

|

-

|

25,000

|

||||||

|

2.53% British Pound-denominated notes due November 2023

|

31,884

|

-

|

||||||

|

2.76% British Pound-denominated notes due November 2025

|

31,884

|

-

|

||||||

|

Term loan

|

132,313

|

141,375

|

||||||

|

Long-term revolving credit facility

|

142,061

|

100,712

|

||||||

|

Various other notes

|

923

|

1,068

|

||||||

|

689,782

|

604,372

|

|||||||

|

Less debt fees

|

(229

|

)

|

(213

|

)

|

||||

|

Total long-term debt

|

$

|

689,553

|

$

|

604,159

|

||||

|

Actual

|

Required

|

|||||||

|

Debt to EBITDA(1)

(Maximum)

|

2.79 |

<3.50

|

||||||

|

Interest Coverage (Minimum)

|

6.15 |

>2.00

|

||||||

|

(1)

|

Debt to EBITDA is defined in the Company’s debt covenants as total funded debt divided by the Company’s consolidated operating income

excluding non-operating gains and losses and depreciation and amortization.

|

|

(in thousands)

|

2018

|

2017

|

||||||

|

Uncommitted loans

|

$

|

19,768

|

$

|

19,192

|

||||

|

Loans of foreign subsidiaries

|

278

|

938

|

||||||

|

Total

|

$

|

20,046

|

$

|

20,130

|

||||

|

(In thousands except fair value)

|

Shares

|

Grant Date

Weighted Average

Fair Value

|

Aggregate Intrinsic

Value

|

|||||||||

|

Outstanding at December 31, 2015

|

542

|

$

|

48.94

|

$

|

34,063

|

|||||||

|

Granted

|

119

|

69.92

|

||||||||||

|

Vested

|

(172

|

)

|

43.42

|

|||||||||

|

Cancelled

|

(54

|

)

|

52.41

|

|||||||||

|

Outstanding at December 31, 2016

|

435

|

56.44

|

34,184

|

|||||||||

|

Granted

|

115

|

74.26

|

||||||||||

|

Vested

|

(114

|

)

|

39.75

|

|||||||||

|

Cancelled

|

(24

|

)

|

63.62

|

|||||||||

|

Outstanding at December 31, 2017

|

412

|

65.64

|

30,113

|

|||||||||

|

Granted

|

142

|

59.45

|

||||||||||

|

Vested

|

(111

|

)

|

56.91

|

|||||||||

|

Cancelled

|

(63

|

)

|

64.71

|

|||||||||

|

Outstanding at December 31, 2018

|

380

|

$

|

66.02

|

$

|

21,239

|

|||||||

|

(in thousands)

|

2018

|

2017

|

||||||

|

Benefit obligation at beginning of year

|

$

|

37,757

|

$

|

41,691

|

||||

|

Service cost

|

1,465

|

1,939

|

||||||

|

Interest cost

|

1,137

|

1,222

|

||||||

|

Foreign currency exchange rate changes

|

(761

|

)

|

1,607

|

|||||

|

Benefits paid

|

(2,480

|

)

|

(9,633

|

)

|

||||

|

Amendments

|

145

|

-

|

||||||

|

Actuarial (gain) loss

|

(3,111

|

)

|

931

|

|||||

|

Benefit obligation at end of year

|

34,152

|

37,757

|

||||||

|

Plan assets at beginning of year

|

31,768

|

36,141

|

||||||

|

Company contributions

|

886

|

1,195

|

||||||

|

Foreign currency exchange rate changes

|

(1,315

|

)

|

2,318

|

|||||

|

Benefits paid

|

(2,480

|

)

|

(9,633

|

)

|

||||

|

Actual (loss) gain on plan assets

|

(560

|

)

|

1,747

|

|||||

|

Plan assets at end of year

|

28,299

|

31,768

|

||||||

|

Funded status

|

$

|

(5,853

|

)

|

$

|

(5,989

|

)

|

||

|

Accumulated benefit obligation

|

$

|

33,562

|

$

|

36,951

|

||||

|

(in thousands)

|

2018

|

2017

|

||||||

|

Accrued employee and retiree benefits

|

$

|

(15,245

|

)

|

$

|

(13,304

|

)

|

||

|

Other accrued expenses

|

(779

|

)

|

(2,731

|

)

|

||||

|

Other assets

|

10,171

|

10,046

|

||||||

|

Net liability

|

$

|

(5,853

|

)

|

$

|

(5,989

|

)

|

||

|

(In thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Service cost

|

$

|

1,465

|

$

|

1,939

|

$

|

2,091

|

||||||

|

Interest cost

|

1,137

|

1,222

|

1,669

|

|||||||||

|

Expected return on plan assets

|

(896

|

)

|

(892

|

)

|

(1,141

|

)

|

||||||

|

Recognized actuarial (gain) loss

|

(141

|

)

|

(187

|

)

|

193

|

|||||||

|

Settlement (income) expense

|

(179

|

)

|

3,796

|

543

|

||||||||

|

Defined benefit expense

|

$

|

1,386

|

$

|

5,878

|

$

|

3,355

|

||||||

|

2018

|

2017

|

|||||||

|

Discount rate

|

3.80

|

%

|

3.16

|

%

|

||||

|

Expected return on plan assets

|

3.21

|

%

|

3.03

|

%

|

||||

|

Rate of compensation increase

|

0.31

|

%

|

0.33

|

%

|

||||

|

2018

|

2017

|

|||||||

|

Discount rate

|

3.16

|

%

|

3.48

|

%

|

||||

|

Expected return on plan assets

|

3.03

|

%

|

2.85

|

%

|

||||

|

Rate of compensation increase

|

0.33

|

%

|

0.43

|

%

|

||||

|

(In thousands)

|

2018

|

2017

|

||||||

|

Unrecognized net actuarial (gain) loss

|

$

|

(901

|

)

|

$

|

1,112

|

|||

|

Prior service cost

|

145

|

-

|

||||||

|

Total before tax effects

|

$

|

(756

|

)

|

$

|

1,112

|

|||

|

(In thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Net actuarial gain arising during the period

|

$

|

1,257

|

$

|

921

|

$

|

1,312

|

||||||

|

Prior service cost

|

(127

|

)

|

-

|

-

|

||||||||

|

Amortization of actuarial (gain) loss, included in defined benefit expense

|

(103

|

)

|

1,307

|

544

|

||||||||

|

Pension adjustment, net of tax

|

$

|

1,027

|

$

|

2,228

|

$

|

1,856

|

||||||

|

Fair Value

as of

December 31,

|

Fair Value Measurements at

December 31, 2018

Using Fair Value Hierarchy

|

Fair Value

as of

December 31,

|

Fair Value Measurements at

December 31, 2017

Using Fair Value Hierarchy

|

|||||||||||||||||||||||||||||

|

(in thousands)

|

2018

|

Level 1

|

Level 2

|

Level 3

|

2017

|

Level 1

|

Level 2

|

Level 3

|

||||||||||||||||||||||||

|

Equity Funds

|

||||||||||||||||||||||||||||||||

|

Domestic

|

$

|

5,385

|

$

|

5,385

|

$

|

—

|

$

|

—

|

$

|

6,226

|

$

|

6,226

|

$

|

—

|

$

|

—

|

||||||||||||||||

|

International

|

83

|

—

|

83

|

—

|

101

|

—

|

101

|

—

|

||||||||||||||||||||||||

|

International Fixed Income Funds

|

22,703

|

1,111

|

21,592

|

—

|

25,340

|

934

|

24,406

|

—

|

||||||||||||||||||||||||

|

Other investments

|

128

|

47

|

81

|

—

|

101

|

44

|

57

|

—

|

||||||||||||||||||||||||

|

Total assets at fair value

|

$

|

28,299

|

$

|

6,543

|

$

|

21,756

|

$

|

—

|

$

|

31,768

|

$

|

7,204

|

$

|

24,564

|

$

|

—

|

||||||||||||||||

| Level 1: |

Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

| Level 2: |

Inputs other than quoted prices included in Level 1 that are observable for the asset or liability through corroboration with observable market data.

|

| Level 3: |

Unobservable inputs that reflect the reporting entity’s own assumptions.

|

|

(In thousands)

|

Cash Flow

Hedges (a)

|

Pension

Items (a)

|

Foreign Currency

Items

|

Total

|

||||||||||||

|

Balance as of December 31, 2015

|

$

|

164

|

$

|

(4,393

|

)

|

$

|

(165,833

|

)

|

$

|

(170,062

|

)

|

|||||

|

Other comprehensive income (loss) before reclassifications

|

(1,094

|

)

|

1,312

|

(41,753

|

)

|

(41,535

|

)

|

|||||||||

|

Amounts reclassified from OCI

|

845

|

544

|

(3,257

|

)

|

(1,868

|

)

|

||||||||||

|

Balance as of December 31, 2016

|

$

|

(85

|

)

|

$

|

(2,537

|

)

|

$

|

(210,843

|

)

|

$

|

(213,465

|

)

|

||||

|

Other comprehensive income (loss) before reclassifications

|

(768

|

)

|

921

|

55,705

|

55,858

|

|||||||||||

|

Amounts reclassified from OCI

|

184

|

1,307

|

6,782

|

8,273

|

||||||||||||

|

Balance as of December 31, 2017

|

$

|

(669

|

)

|

$

|

(309

|

)

|

$

|

(148,356

|

)

|

$

|

(149,334

|

)

|

||||

|