Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

DEX ONE CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

DEX ONE CORPORATION

1001 Winstead Drive

Cary, North Carolina 27513

March 22, 2012

To Our Stockholders:

You are cordially invited to attend the 2012 Annual Meeting of Stockholders of Dex One Corporation to be held on Tuesday, May 8, 2012, at 9:00 a.m. local time, at the Embassy Suites Hotel, 201 Harrison Oaks Boulevard, Cary, North Carolina 27513.

The following pages contain the formal Notice of the Annual Meeting and the Proxy Statement. Please review this material for information concerning the business to be conducted at the meeting and the nominees for election as Directors.

We are pleased to once again furnish proxy materials to our stockholders on the Internet. We believe this approach provides our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting.

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares as soon as possible. You may vote your shares over the Internet, by telephone, by mail or in person at the meeting. If you plan to attend the meeting in person, you must provide proof of share ownership, such as an account statement, and a form of personal identification to be admitted.

Sincerely,

Alfred T. Mockett

Chief Executive Officer

and President

Table of Contents

DEX ONE CORPORATION

1001 Winstead Drive Cary, North Carolina 27513

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 8, 2012

To the Stockholders of

Dex One Corporation:

The 2012 Annual Meeting of Stockholders of Dex One Corporation will be held on Tuesday, May 8, 2012, at 9:00 a.m. local time, at the Embassy Suites Hotel, 201 Harrison Oaks Boulevard, Cary, North Carolina 27513 for the following purposes:

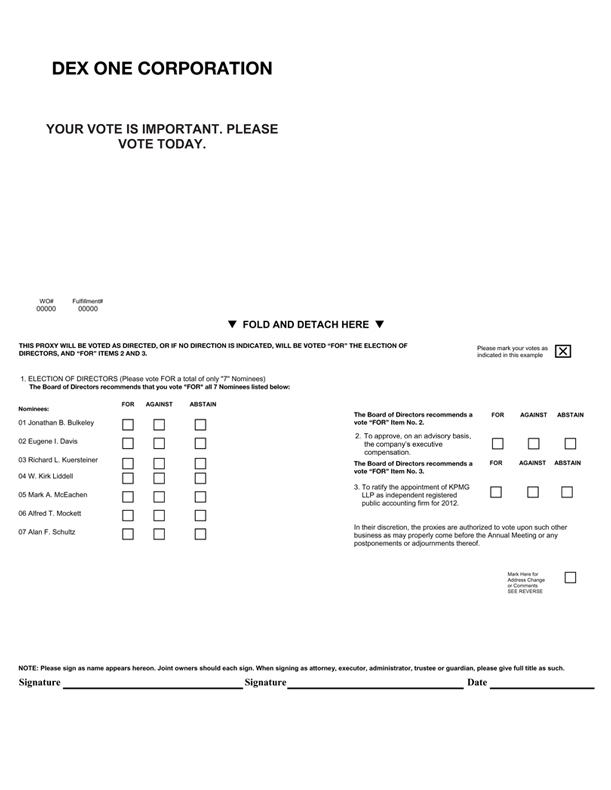

| 1. | to elect seven persons to our Board of Directors; |

| 2. | to approve, on an advisory basis, the Company’s executive compensation; |

| 3. | to ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2012; and |

| 4. | to transact such other business that may properly come before the meeting or any postponements or adjournments thereof. |

The Board of Directors has fixed the close of business on March 15, 2012 as the record date for the purpose of determining stockholders entitled to notice of, and to vote at, the meeting or any postponements or adjournments thereof. A list of such stockholders will be available at the meeting and, during the ten days prior to the meeting, at our executive offices located at the address above.

By Order of the Board of Directors,

Mark W. Hianik

Senior Vice President, General Counsel

and Chief Administrative Officer

Cary, North Carolina

March 22, 2012

IMPORTANT NOTICE

Please Vote Your Shares Promptly

Table of Contents

Table of Contents

DEX ONE CORPORATION

1001 Winstead Drive

Cary, North Carolina 27513

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Dex One Corporation (“Dex One”, the “Company”, “we”, “us” or “our”) of proxies for use at the Company’s 2012 Annual Meeting of Stockholders to be held on May 8, 2012 or at any adjournments or postponements thereof. On or about March 22, 2012, we will begin distributing a notice containing instructions on how to access this proxy statement and our Annual Report on Form 10-K online and how to vote your shares. This proxy statement and our 2011 Annual Report on Form 10-K are also available at http://ir.dexone.com/annual-proxy.cfm.

No business can be conducted at the meeting unless a majority of all shares entitled to vote are either present in person or represented by proxy at the meeting. As far as we know, the only matters to be brought before the meeting are those referred to in this proxy statement. If any additional matters are presented at the meeting, the persons named as proxies may vote your shares in their discretion.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What am I voting on at the meeting?

1. The election of seven persons to the Dex One Board of Directors;

2. the approval, on an advisory basis, of the Company’s executive compensation; and

3. the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2012.

What does the Board of Directors recommend with respect to the matters to be presented at the meeting?

The Board of Directors recommends a vote:

1. FOR the election of each of the seven nominees to the Dex One Board of Directors;

2. FOR the approval, on an advisory basis, of the Company’s executive compensation; and

3. FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2012.

Who is entitled to vote?

You are entitled to vote at the meeting if you owned Dex One shares (directly or in “street name”, as defined below) as of the close of business on March 15, 2012, the record date for the meeting. On that date, 50,817,058 shares of our common stock were outstanding and entitled to vote at the meeting and no shares of our preferred stock were outstanding. Each share of common stock is entitled to one vote on each proposal to properly come before the meeting.

1

Table of Contents

What is the difference between holding shares directly as a stockholder of record and holding shares in “street name”?

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are differences between shares held of record and those held beneficially or in “street name.”

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and a notice containing instructions on how to access our proxy statement and annual report online was sent directly to you. As the stockholder of record, you have the right to vote your shares as described herein.

Beneficial Stockholders. If your shares are held by a bank, broker or other agent as your nominee, you are considered the beneficial owner of shares held in “street name”, and the notice containing instructions on how to access our proxy statement and annual report online was forwarded to you by your bank, broker or agent who is considered the stockholder of record with respect to those shares.

How can I vote my shares?

Registered Stockholders. If you hold shares in your own name, you may vote by proxy before the annual meeting by signing and returning a completed proxy card.

Beneficial Stockholders. If you hold your shares in street name, your bank, broker or other agent will send you, as the beneficial owner, a separate package describing the procedure for voting your shares. You should follow the instructions provided by your bank, broker or agent to vote your shares.

Can I change my vote?

Registered Stockholders. Your proxy may be revoked at any time before it is voted at the meeting by (i) sending written notice of revocation to the Corporate Secretary (at the address of the Company set forth on the first page of this Proxy Statement), (ii) delivering another duly executed proxy bearing a later date or (iii) voting in person at the meeting.

Beneficial Stockholders. Beneficial stockholders should contact their bank, broker or other agent for instructions on how to change their vote.

Who will count the vote at the meeting?

Representatives of Computershare Shareowner Services LLC, the Company’s transfer agent, will tabulate the vote and serve as inspector of election at the Meeting.

What vote is required to approve each proposal?

Item No. 1 — Election of Directors. The Board of Directors has adopted a majority vote standard in uncontested director elections. Because this election is an uncontested election, each director will be elected by the vote of the majority of the votes cast when a quorum is present. A “majority of the votes cast” means that the number of votes cast “for” a director exceeds the number of votes cast “against” that director. “Votes cast” excludes abstentions and any votes withheld by banks and brokers in the absence of instructions from street name holders (“broker non-votes”).

Item No. 2 — Vote on Executive Compensation and Item No. 3 — Ratification of Appointment of KPMG LLP. The affirmative vote of a majority of the shares present at the meeting in person or by proxy is required to: approve, on an advisory basis, the Company’s executive compensation (Item No. 2); and ratify the appointment of our independent registered public accounting firm (Item No. 3). Abstentions have the same effect as votes cast against Item Nos. 2 and 3. Broker non-votes have no effect on the outcome of the vote on Item No. 2.

Although the advisory vote on Item No. 2 is non-binding as provided by law, our Board will review the results of the vote and, consistent with our record of stockholder engagement, will take it into account in making a determination concerning executive compensation.

Any other matter. Any other matter that properly comes before the meeting will require the approval of the majority of the shares present in person or represented by proxy and entitled to vote at the meeting.

2

Table of Contents

What constitutes a quorum for the meeting?

The presence of the holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting, present in person or represented by proxy, is necessary to constitute a quorum. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

What happens if I sign, date and return my proxy but do not specify how I want my shares voted on one or more of the proposals?

Regardless of your form of ownership, your proxy will be counted as a vote “FOR” all of the director nominees and “FOR” Item Nos. 2 and 3.

What happens if I do not vote my shares?

Registered Stockholders. Your shares will not be voted.

Beneficial Stockholders. Your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under New York Stock Exchange (“NYSE”) rules, your broker or nominee does not have discretion to vote your shares on non-routine matters such as the election of directors or Item No. 2. However, your broker or nominee does have discretion to vote your shares on routine matters such as Item No. 3.

How is my proxy voted on matters not identified on the proxy form or in this Proxy Statement?

Our board presently knows of no other matters to be presented for action at the meeting. Neither did we receive timely notice of any nomination for a director, nor did we receive timely notice of any other matter intended to be raised by any stockholder at the meeting. Accordingly, the proxy form confers upon the persons named on the proxy form authority to vote your shares in their discretion upon any other matter that may properly come before the meeting.

What do I need to do if I plan to attend the meeting in person?

If you plan to attend the annual meeting in person, you must provide proof of your ownership of our common stock and a form of personal identification for admission to the meeting. If you hold shares in street name and you also wish to be able to vote at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker. All stockholders as of the record date are invited to attend, although seating may be limited.

Who is bearing the cost of this proxy solicitation and how is the solicitation effected?

We will bear the cost of soliciting proxies, including expenses in connection with preparing and distributing this proxy statement. Our directors, officers and employees may solicit proxies on our behalf and no additional compensation will be paid for such solicitation. We have engaged Innisfree M&A Incorporated to assist us in the solicitation of proxies. We expect to pay Innisfree approximately $10,000 for these services plus expenses. In addition, we will reimburse banks, brokers and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of our stock and obtaining their proxies.

Under what circumstances can the meeting be adjourned?

Adjournments may be made for the purpose of, among other things, soliciting additional proxies. Any adjournment may be made from time to time by approval of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting (whether or not a quorum exists) without further notice other than by an announcement made at the meeting. We do not currently intend to seek an adjournment of the meeting.

When are stockholder proposals due for inclusion in the Company’s proxy statement for the 2013 Annual Meeting of Stockholders?

Stockholder proposals intended to be presented at our 2013 Annual Meeting of Stockholders must be received by us no later than November 22, 2012 to be considered for inclusion in our proxy statement and form of proxy relating to that meeting. Any proposal should be addressed to Mark W. Hianik, Senior Vice President, General Counsel and Chief Administrative Officer, Dex One Corporation, 1001 Winstead Drive, Cary, North Carolina 27513, and should be sent by certified mail, return receipt requested.

3

Table of Contents

Corporate Governance Principles

The Board of Directors has adopted policies and procedures to ensure effective governance of the Company. Our corporate governance materials, including our Corporate Governance Guidelines, the charters of each of the standing committees of the Board and our Code of Conduct for directors, finance employees and all employees, may be viewed in the corporate governance section of our website at http://ir.dexone.com/governance.cfm. We will also provide without charge copies of any of the foregoing information in print upon written request of our stockholders to the Office of the Corporate Secretary, Dex One Corporation, 1001 Winstead Drive, Cary, NC 27513.

The Corporate Governance Committee reviews our Corporate Governance Guidelines on a regular basis and proposes modifications to the principles and other key governance practices as warranted for adoption by the Board.

Board Composition, Responsibilities and Leadership Structure

The Board of Directors is responsible for overseeing the affairs of the Company. The Board held 22 meetings during 2011. Each director attended at least 90% of the meetings of the Board and at least 86% of the meetings of the standing committees on which he served during 2011. The Board currently consists of seven directors. Our Bylaws provide, however, that the Board may increase or decrease the size of the Board and fill any vacancies.

As reflected in our Corporate Governance Guidelines, while the Board does not presently require all its members to attend annual meetings of stockholders, it does encourage its members to do so and the non-executive Chairman is expected to attend all meetings of stockholders. The Board is sensitive to stockholder access concerns and will periodically monitor and reassess this policy to ensure it remains open and available for stockholder communications.

The Board has determined that the appropriate leadership structure for the Board at this time is for a non-management director to serve as Chairman of the Board. The Board reserves the right to review this policy from time to time to assess whether a non-executive Chairman continues to serve the best interests of the Company and our stockholders.

The non-executive Chairman is responsible for ensuring that the quality, quantity and timeliness of the flow of information between our management and the Board enables the Board to fulfill its functions and fiduciary duties in an efficient and effective manner. Our non-executive Chairman is elected annually by a majority of the independent directors upon a recommendation from the Corporate Governance Committee. Our non-executive Chairman presides over executive sessions of the nonemployee directors following every Board meeting (which sessions are not attended by management) and advises the Board, in consultation with the CEO and other independent directors, as to Board schedules and agendas. The Board has also determined that our non-executive Chairman shall be available to consult with shareholders and call meetings of the independent directors when appropriate. See our Corporate Governance Guidelines on our website for additional information on the leadership structure of the Board.

The Board maintains three standing committees — an Audit and Finance Committee, a Compensation and Benefits Committee and a Corporate Governance Committee. Each Committee operates under a charter that has been approved by the Board. A copy of each committee charter is posted in the corporate governance section of our website at http://ir.dexone.com/governance.cfm. Each Committee may delegate the authority granted to it under its charter to a subcommittee, in order to ensure compliance with legal and regulatory obligations, timely decision making or for other purposes. The biographical information of each of our directors beginning on page 9 includes the standing committees on which he serves.

Audit and Finance Committee

The Audit and Finance Committee has overall responsibility for the integrity of our financial reporting process, including oversight of the preparation of financial statements and related financial information and the

4

Table of Contents

annual independent audit of such statements, as well as responsibility for our system of internal controls, internal audit process, risk assessment and management processes and compliance function. In addition, the Audit and Finance Committee has responsibility for reviewing proposed and existing financing arrangements (and compliance with governing documents) and for making recommendations to the Board regarding financing requirements for the Company and sources for such financing.

The Audit and Finance Committee also prepares the Audit Committee Report that Securities and Exchange Commission, or SEC, rules require be included in our annual proxy statement. This report is on page 44 of this proxy statement.

The Board of Directors has unanimously determined that Jonathan B. Bulkeley, Eugene I. Davis and W. Kirk Liddell, each a present member of the Audit and Finance Committee, qualify as “audit committee financial experts” and possess “accounting or related financial management expertise” within the meaning of all applicable laws and regulations. In addition, the Board has unanimously determined that all present members of the Audit and Finance Committee are financially literate and, as stated below, independent as that term is used in Item 407(a) of regulation S-K. Mr. Davis presently serves on three or more public company audit committees. The Board of Directors has reviewed the abilities, education and experience of Mr. Davis, has considered Mr. Davis’s simultaneous service on the audit committees of other public companies and has unanimously determined that Mr. Davis’s simultaneous service on the audit committees of more than three public companies will not impair his ability to effectively serve on the Company’s Audit and Finance Committee.

The Audit and Finance Committee met seven times during 2011.

Compensation and Benefits Committee

The Compensation and Benefits Committee is responsible for the oversight of our executive and non-management director compensation practices and programs and the administration of our compensation and benefit plans for employees (including senior management) and non-management directors.

The Compensation and Benefits Committee is responsible for reviewing and approving all aspects of the compensation paid to our Chief Executive Officer, our Chief Financial Officer and the three other most highly paid executive officers and any other employees identified as Section 16(a) reporting persons. The Compensation and Benefits Committee also approves all arrangements providing for the payment of benefits following a change of control of the Company or severance following a termination of employment.

The Compensation and Benefits Committee also prepares the Compensation and Benefits Committee Report that SEC rules require be included in our annual proxy statement. This report is on page 22 of this proxy statement.

The Compensation and Benefits Committee is comprised entirely of directors who satisfy NYSE listing standards and the standards of independence established by our Board of Directors.

The Compensation and Benefits Committee met 16 times during 2011.

Corporate Governance Committee

The Corporate Governance Committee oversees the Board candidate selection, assessment and nomination process, makes recommendations to the Board regarding corporate governance policies, guidelines and procedures and in coordination with the Audit and Finance Committee, establishes and administers policies with respect to corporate responsibility and ethical business practices.

The Corporate Governance Committee is composed entirely of directors who satisfy NYSE listing standards and the standards of independence established by our Board of Directors.

The Corporate Governance Committee met three times during 2011.

Senior management is responsible for identifying and prioritizing enterprise risks facing Dex One. The Board of Directors, in turn, is responsible for ensuring that material risks are managed appropriately. The Board and its committees regularly review material strategic, operational, financial, compensation and

5

Table of Contents

compliance risks with senior management. The Audit and Finance Committee is responsible for discussing our overall risk assessment and risk management practices, as set forth in the Audit and Finance Committee’s charter. The Audit and Finance Committee also performs a central oversight role with respect to financial and compliance risks, and periodically reports on its findings to the full Board. In addition, the Audit and Finance Committee is responsible for assessing risk related to our capital structure, significant financial exposures and our risk management and major insurance programs, and regularly evaluates financial risks associated with such programs. The Compensation and Benefits Committee considers risk in connection with its design of compensation programs for our executives.

Our Board welcomes communications from stockholders and other interested parties. Interested parties may contact the Board by writing to Alfred T. Mockett, Chief Executive Officer and President, c/o Dex One Corporation, 1001 Winstead Drive, Cary, NC 27513. Interested parties may contact the independent members of our Board with any governance questions or other concerns by writing to Eugene I. Davis, Chairman of the Board, c/o Dex One Corporation, 1001 Winstead Drive, Cary, North Carolina 27513. In addition, any questions or concerns regarding financial reporting, internal controls, accounting or other financial matters may be forwarded to W. Kirk Liddell, Chair of the Audit and Finance Committee, c/o Dex One Corporation, 1001 Winstead Drive, Cary, North Carolina 27513. All appropriate inquiries will be forwarded directly to the addressee. Persons wishing to submit anonymous, confidential inquiries or comments regarding the Company may do so through www.dexone.ethicspoint.com, our web-based reporting system, by simply following the instructions on that site. These procedures for communications between independent members of our Board and interested parties were approved by the independent and non-management members of our Board.

Our Corporate Governance Guidelines state the Board’s objective that at least two-thirds of the members of the Board be independent under NYSE listing standards and applicable law. The Board of Directors has adopted Director Independence Standards to assist in determining whether a director does not have material relationships with Dex One and thereby qualifies as independent. The Director Independence Standards are based on NYSE “independent director” listing standards. To be considered “independent”, the Board of Directors must make an affirmative determination, by a resolution of the Board as a whole, that the director being reviewed has no material relationship with us other than as a director, either directly or indirectly (such as a partner, shareholder or executive officer of another entity that has a relationship with Dex One). In each case, the Board broadly considers all relevant facts and circumstances.

Under our Director Independence Standards:

1. No director will qualify as “independent” unless the Board of Directors affirmatively determines that the director has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company. The Company will identify which directors are independent and disclose these affirmative determinations.

2. No director can be independent if the director is, or has been within the last three years, an employee of the Company.

3. No director can be independent if an immediate family member of the director is or has been an executive officer of the Company within the last three years.

4. No director can be independent if the director received, or has an immediate family member who has received, during any twelve-month period within that last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

5. No director can be independent if:

a. the director or an immediate family member is a current partner of the Company’s internal or external auditor;

6

Table of Contents

b. the director is a current employee of the Company’s internal or external auditor;

c. the director has an immediate family member who is a current employee of the Company’s internal or external auditor and personally works on the Company’s audit; or

d. the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such auditor and personally worked on the Company’s audit within that time.

6. No director can be independent if the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executives at the same time serves or served on that company’s compensation committee.

7. No director can be independent if the director is a current employee, or an immediate family member is a current executive officer, of a company (excluding charitable organizations) that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues.

8. No director can be independent if the Company has made charitable contributions to any charitable organization in which such director serves as an executive officer if, within the preceding three years, contributions by the Company to such charitable organization in any single completed fiscal year of such charitable organization exceeded the greater of $1 million, or 2% of such charitable organization’s consolidated gross revenues.

The Board of Directors reviews all commercial and charitable relationships of directors on an annual basis. The mere ownership of a significant amount of stock is not in and of itself a bar to an independence determination but rather one factor that the Board considers.

The Board of Directors has unanimously determined that Jonathan B. Bulkeley, Eugene I. Davis, Richard L. Kuersteiner, W. Kirk Liddell, Mark A. McEachen and Alan F. Schultz are neither affiliated persons of the Company nor do they have any material relationship with the Company, and therefore qualify as independent directors within the meaning of all applicable laws and regulations, including the independence standards of the NYSE. As a result, independent directors constitute a majority of Dex One’s Board of Directors. In addition, all members of all committees qualify as independent within the meaning of all applicable laws and regulations, including the independence standards of the NYSE. Alfred T. Mockett is not an independent director because he is our CEO and President.

In making these independence determinations, the Board considered all of the automatic bars to independence specified in the respective independence standards of the SEC and the NYSE and definitively determined that none of those conditions existed. In addition, the Board considered whether any material relationship beyond the automatic bars existed between the Company and/or its management and/or any of their respective affiliates or family members, on the one hand, and each director or any family member of such director or any entity with which such director or family member of such director was employed or otherwise affiliated, on the other hand. For those directors for whom the Board determined there was a relationship, the Board then considered whether or not the relationship was material or did in fact, or could reasonably be expected to, compromise such director’s independence from management. The Board definitively determined for those directors identified as independent above that either no such relationship existed at all or that any relationship that existed was not material and/or did not so compromise such director’s independence from management.

Our Board has adopted a Code of Conduct applicable to our directors, senior management including the principal executive officer, principal financial officer and principal accounting officer, and all other employees. The Code of Conduct is available on our website at http://ir.dexone.com/governance.cfm. Any waiver of any provision of the Code of Conduct made with respect to any director or executive officer of the Company will be promptly posted on our website at the same link as the Code of Conduct itself and will be disclosed in the next periodic report required to be filed with the SEC.

7

Table of Contents

We or one of our subsidiaries may occasionally enter into transactions with certain “related persons.” Related persons include our executive officers, directors, nominees for directors, 5% or more beneficial owners of our common stock and immediate family members of these persons. We refer to transactions involving amounts in excess of $120,000 and in which the related person has a direct or indirect material interest as “related person transactions.” Each related person transaction must be approved or ratified in accordance with the Company’s written Related Person Transactions Policy by either the Audit and Finance Committee or the Corporate Governance Committee of the Board of Directors.

The reviewing committee considers all relevant factors when determining whether to approve a related person transaction including, without limitation, the following:

| • | the size of the transaction and the amount payable to a related person; |

| • | the nature of the interest of the related person in the transaction; |

| • | whether the transaction was undertaken in the ordinary course of business; and |

| • | whether the transaction involves the provision of goods or services to Dex One that are available from unrelated third parties and, if so, whether the transaction is on terms and made under circumstances that are at least as favorable to Dex One as would be available in comparable transactions with or involving unrelated third parties. |

We did not enter into any related person transactions in 2011. Our Related Person Transactions Policy is available on our website http://ir.dexone.com/governance.cfm.

8

Table of Contents

ELECTION OF DIRECTORS (ITEM NO. 1)

At the 2012 Annual Meeting of Stockholders, seven nominees stand for election as directors of Dex One for a one-year term. Each of the nominees currently serves as a Dex One director. Each director nominee in this uncontested election will be elected if he receives more “For” votes than “Against” votes. Each nominee elected as a director will continue in office until the 2013 Annual Meeting of Stockholders and until his successor has been duly elected and qualified or until his earlier resignation or removal. If any nominee becomes unable to serve, proxies will be voted for the election of such other person as the Board of Directors may designate, unless the Board chooses to reduce the number of directors.

The Corporate Governance Committee of the Board of Directors is responsible for making recommendations to the Board concerning nominees for election as directors and nominees for Board vacancies. When assessing a director candidate’s qualifications, the Corporate Governance Committee will consider the candidate’s expertise (including industry background), independence, and integrity, as well as skills relating to operations, finance, marketing and technology. In addition, the Committee looks at the overall composition of the Board and how a candidate would contribute to the overall synergy and collaborative process of the Board. The Committee has not established specific minimum eligibility requirements for candidates other than integrity, the commitment to act in the best interests of all stockholders and ensuring that a substantial majority of the Board remains independent. Our Corporate Governance Guidelines provide that the Corporate Governance Committee will consider director candidates recommended by stockholders provided such recommendations comply with our Bylaws and the process set forth in this proxy statement. In assessing such candidates, the Corporate Governance Committee will consider the same criteria described above. See our Corporate Governance Guidelines, which may be viewed in the corporate governance section of our website at http://ir.dexone.com/governance.cfm, for additional information on the selection of director candidates.

Our Board of Directors was substantially reconstituted as part of our restructuring. Pursuant to the terms of our confirmed Plan of Reorganization, our initial post-emergence Board of Directors was to be comprised of seven directors as follows: (i) the Chief Executive Officer of the Company, (ii) three directors selected by Franklin Advisers, Inc. and (iii) three directors selected by the group of noteholders holding in excess of a majority of the principal amount of pre-petition unsecured note debt who signed support agreements in favor of the pre-arranged restructuring plan that served as the basis for the Plan (the “Consenting Noteholders”). On January 29, 2010, directors Jonathan B. Bulkeley, Eugene I. Davis and W. Kirk Liddell were selected to serve as directors by the Consenting Noteholders and directors Richard L. Kuersteiner, Mark A. McEachen and Alan F. Schultz were selected to serve as directors by Franklin Advisers, Inc. Alfred T. Mockett, our current CEO and President, joined the Board upon becoming our CEO and President effective September 13, 2010.

The following descriptions of the business and public company director experience of our current directors include the principal positions held by them since March 1, 2007, their current public company board representations and their past public company board representations since March 1, 2007. We have been advised that there are no family relationships among any of our executive officers and directors.

JONATHAN B. BULKELEY

Mr. Bulkeley, 51, founded Blue Square Capital Management, LLC in March 2009 and has served as its Chief Investment Officer since inception. Blue Square Capital Management, LLC operates the Blue Square Small Cap Value Fund, a hedge fund investing in global small and micro cap equities. Mr. Bulkeley also served as Chief Executive Officer of Scanbuy Inc., a global leader in visual navigation for the wireless industry, from March 2006 to August 2010. Mr. Bulkeley also previously has served as Chief Executive Officer of barnesandnoble.com, and Chairman and Chief Executive Officer of Lifeminders, an online direct marketing company. Mr. Bulkeley has served as a Company director since January 2010 and currently serves on the board of Spark Networks, Inc. During the past five years, Mr. Bulkeley has also been a director of The Reader’s Digest Association, Inc. and Excelsior LaSalle Property Fund, Inc. Mr. Bulkeley brings to the Board management and operational experience with companies in all phases of business development.

Mr. Bulkeley currently serves as a member of the Audit and Finance Committee.

9

Table of Contents

EUGENE I. DAVIS

Mr. Davis, 57, has served as Chairman and Chief Executive Officer of Pirinate Consulting Group, L.L.C., a privately-held consulting firm specializing in crisis and turn-around management and strategic advisory services for public and private business entities, since 1999. Prior to joining Pirinate Consulting, Mr. Davis was Chief Operating Officer of Total-Tel USA Communications, Inc., and President of Emerson Radio Corp. Mr. Davis has served as director for numerous public and private companies across various industries. Mr. Davis has served as a Company director since January 2010 and currently serves on the boards of Atlas Air Worldwide Holdings, Inc., Global Power Equipment Group Inc., Spectrum Brands, Inc. and U.S. Concrete, Inc. Mr. Davis is expected to be named as a director of WMI Holdings Corp. upon its emergence from bankruptcy. Mr. Davis is also a director of Trump Entertainment Resorts, Inc. and Lumenis Ltd., whose common stock is registered under the Securities Exchange Act of 1934 but does not publicly trade. Mr. Davis is also on the board of Ambassadors International, Inc. On May 25, 2011, Ambassadors International sold substantially all of its assets through a Chapter 11 bankruptcy process and is winding up its activities, after which Ambassadors will no longer be a publicly traded company. Mr. Davis is also on the board of GSI Group, Inc., but is not standing for election as a director at the 2012 GSI Group annual meeting. During the past five years, Mr. Davis has also been a director of American Commercial Lines Inc., Delta Airlines, Foamex International Inc., Footstar, Inc., Granite Broadcasting Corporation, Ion Media Networks, Inc., Knology, Inc., Media General, Inc., Mosaid Technologies, Inc., Ogelbay Norton Company, Orchid Cellmark, Inc., PRG-Schultz International Inc., Roomstore, Inc., Rural/Metro Corp., SeraCare Life Sciences, Inc., Silicon Graphics International, Smurfit-Stone Container Corporation, Solutia Inc., Spansion, Inc., Tipperary Corporation, Viskase, Inc. and YRC Worldwide, Inc. Mr. Davis brings to the Board experience with companies emerging from chapter 11 restructuring processes and also has significant experience as a director of public companies.

Mr. Davis currently serves as the non-executive Chairman of the Board and as a member of the Audit and Finance Committee.

RICHARD L. KUERSTEINER

Mr. Kuersteiner, 72, currently serves as Associate General Counsel for Franklin Resources, Inc., a global investment management organization known as Franklin Templeton Investments. Mr. Kuersteiner has served in various capacities at Franklin Resources, Inc., since 1990, including Director of Restructuring, Managing Corporate Counsel and Associate General Counsel. He has served as an officer of virtually all of the Franklin Templeton funds. Mr. Kuersteiner has served as a Company director since January 2010. Mr. Kuersteiner brings to the Board experience in complex restructuring transactions and the perspective of large institutional investors.

Mr. Kuersteiner currently serves as the Chairman of the Corporate Governance Committee and as a member of the Compensation and Benefits Committee.

W. KIRK LIDDELL

Mr. Liddell, 62, has served as President, Chief Executive Officer and Director of Irex Corporation, the parent corporation of a specialty contracting network serving commercial, industrial, marine and residential customers, since 1984. Prior to joining Irex Corporation, Mr. Liddell was an associate at Covington & Burling in Washington, D.C., where he practiced corporate law with a focus on bank regulation, securities and antitrust. Mr. Liddell has served as a Company director since January 2010. Mr. Liddell brings to the Board operational experience as the chief executive of a company directly interfacing with local businesses and consumers.

Mr. Liddell previously served as Lead Director and as interim Principal Executive Officer until Mr. Mockett’s appointment as CEO and President and currently serves as the Chairman of the Audit and Finance Committee.

MARK A. McEACHEN

Mr. McEachen, 54, has served as Executive Vice President, Chief Operating Officer and Chief Financial Officer of Freedom Communications, Inc., a media company with broadcast television and print publishing business segments, since April 2010. From May 2009 to April 2010, Mr. McEachen served as Freedom’s Senior

10

Table of Contents

Vice President and Chief Financial Officer. Freedom filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code on September 1, 2009 and emerged from bankruptcy protection under a confirmed plan of reorganization on April 30, 2010. From February 2008 to May 2009 Mr. McEachen served as Chief Financial Officer of Fabrik, Inc., a designer, manufacturer and marketer of online services solutions. Prior to that, Mr. McEachen served as interim Chief Executive Officer and Chief Operating and Financial Officer of BridgeCo Inc., a digital entertainment networking company. Mr. McEachen has served as a Company director since January 2010. Mr. McEachen brings to the Board experience as the chief operating and financial officer of a diversified media company facing many of the same economic and marketplace challenges as the Company. Mr. McEachen also has financial and operating experience with digital businesses.

Mr. McEachen currently serves as the Chairman of the Compensation and Benefits Committee and as a member of the Corporate Governance Committee.

ALFRED T. MOCKETT

Mr. Mockett, 63, joined Dex One as Chief Executive Officer and President and as a director on September 13, 2010. Prior to joining the Company, Mr. Mockett served as Chairman and CEO of Motive, Inc., a provider of software management services to communications providers from February 2006 until the company was sold in 2008. Mr. Mockett has more than 30 years experience in executive management and strategic decision-making at a number of leading technology, telecommunications and professional services companies including American Management Systems, a global business and information technology consulting firm for the U.S. and state governments, financial services and communications industries, BT Group (formerly British Telecom), a global provider of communications solutions and services, and Memorex Telex, a global provider of information technology solutions.

ALAN F. SCHULTZ

Mr. Schultz, 53, currently serves as non-executive Chairman of the Board of Valassis Communications, Inc., a marketing services company, following his retirement as President and Chief Executive Officer effective December 31, 2011. From 1998 through December 2011, Mr. Schultz served as Chairman, President and Chief Executive Officer of Valassis. Mr. Schultz has served as a Company director since May 2005 and currently serves on the board of Valassis Communications, Inc. Mr. Schultz brings to the Board experience as the chief executive officer of a publicly-held marketing services company servicing both national and local businesses. Our longest tenured director, Mr. Schultz also has significant experience with the Company’s business and industry.

Mr. Schultz previously served as non-executive Chairman of the Board during our search for a CEO in 2010 and currently serves as a member of the Compensation and Benefits and Corporate Governance Committees.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR”

ALL OF THE NOMINEES FOR DIRECTOR

11

Table of Contents

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

This discussion and analysis of our compensation program for named executive officers should be read in conjunction with the accompanying tables and text disclosing the compensation awarded to, earned by or paid to the named executive officers.

Compensation of the named executive officers is determined under the Company’s compensation program for senior executives. This program is governed by the Compensation and Benefits Committee of the Board of Directors, referred to as the “Committee.” While the Committee determines the compensation of all of the Company’s executive officers, this discussion and analysis focuses on those executive officers currently in office and listed in the Summary Compensation Table and other compensation tables that follow, referred to herein as the “NEOs”.

Executive Summary

Objectives of the Compensation Program for Named Executive Officers. The Company faces several critical strategic challenges. As an historic print-based advertising and media company, the Company, to be successful, must retain its legacy strength in print-based advertising while simultaneously introducing digital solutions that are relevant and valuable to its customers. The executive compensation objectives are designed to directly support this challenging strategic transformation. Specifically they:

| • | enable the Company to attract key leadership talent with technology and digital skills required to support the transformation; |

| • | reward executives based on the achievement of critical financial metrics consistent with the desired business transformation; and |

| • | recognize that the decline in shareholder value since the Company’s emergence from bankruptcy requires significant share price appreciation before executives realize the value of equity grants. |

In addition to these very specific objectives, we also strive to maintain an executive compensation program that:

| • | ensures internal equity, both as compared to other executives based upon position and contributions, and to the broader employee population; |

| • | keeps the executive compensation practices transparent, in line with best practices in corporate governance; and |

| • | administers executive compensation on a cost-effective and tax-efficient basis. |

2011 Compensation Design. In February 2011, prior to the 2011 Annual Meeting of Stockholders, the Committee approved a number of changes to the overall compensation design to better align the compensation structure with the Company’s strategy and to ensure continued and appropriate alignment with the interests of stockholders. Key changes for executive officers included:

| • | reducing annual incentive targets from 75% of base salary to 65% for executive vice presidents and from 60% of base salary to 50% for senior vice presidents (except for Mr. Mockett and one former named executive officer whose target annual incentives are or were contractually established in their employment agreements); |

| • | adding Digital Ad Sales as a corporate performance metric to the historical corporate performance metrics of Ad Sales, EBITDA and Free Cash Flow in the short-term incentive plan design; |

| • | replacing the Line of Sight performance metrics with Individual and/or Functional performance metrics in the executive short-term incentive plan design; and |

| • | shifting long-term incentive compensation from a cash-based design to an equity design and adding stock price vesting requirements for the majority of the 2011 equity grants. |

12

Table of Contents

2011 Stockholder Advisory Votes and Compensation Design Enhancements. At the 2011 Annual Meeting of Stockholders, the Company held its first stockholder advisory votes on the compensation of the named executive officers (the “Say-on-Pay Proposal”) and the frequency of such votes as required under the Dodd-Frank Act. The stockholders overwhelmingly endorsed the Board’s proposal to hold annual Say-on-Pay votes, with over 90% of the Company’s stockholders supporting annual votes. Of total shares voting on the 2011 Say-on-Pay Proposal, 48% supported the proposal and 52% voted against the proposal.

Following the 2011 Annual Meeting of Stockholders, the Committee and the Corporate Governance Committee held numerous meetings and carefully considered the results of the 2011 Say-on-Pay Proposal. The Company also engaged in a concerted outreach effort to seek direct feedback from the Company’s top stockholders to better understand their concerns with respect to the Company’s executive compensation program, particularly from stockholders who advised us that they did not support the 2011 Say-on-Pay Proposal. In the course of this effort, we spoke with the Company’s top holders controlling the vote of approximately 70% of the Company’s common stock.

During the latter part of 2011 and into 2012, the Committee took action to further improve the Company’s executive compensation program and the quality of the Company’s compensation disclosures. Specific actions included:

| • | implementing stock ownership guidelines applicable to both the Company’s executive officers and directors, copies of which may be viewed in the corporate governance section of our website at http://ir.dexone.com/governance.cfm; |

| • | implementing a compensation recovery (or “claw-back”) policy applicable to the Company’s executive officers requiring the repayment of incentive compensation based on the achievement of financial results that are later the subject of a material restatement of the Company’s financial statements, a copy of which may be viewed in the corporate governance section of our website at http://ir.dexone.com/governance.cfm; |

| • | implementing stricter computation parameters in the short-term incentive plan design (e.g., imposing higher threshold payout metrics for Print Ad Sales, EBITDA and Free Cash Flow and imposing an ad sales floor for above target payouts on the EBITDA and Free Cash Flow metrics); |

| • | shifting the category weightings of the short-term incentive plan applicable to the NEOs and other executive officers such that a more meaningful percentage of payouts under this plan are tied to corporate as opposed to individual and functional performance; |

| • | revising the Company’s peer group to include companies from the Advertising and Publishing sectors of Standard & Poor’s Global Industry Classification System (GICS) within the broader GICS Media classification with annual revenues more closely approximating those of the Company (this revision was studied during the fourth quarter of 2011 and was formally adopted in early 2012 and will impact 2012 compensation decision making); |

| • | maintaining the base salaries and annual incentive targets for all executive officers at 2011 levels; |

| • | further refining long-term incentive compensation for all executive officers (other than Messrs. Mockett and Freiberg who, as noted below, will not be receiving additional equity awards in 2012) by replacing time-vested restricted stock awards with performance shares tied to annual ad sales targets; and |

| • | revising this Compensation Discussion and Analysis to explain in greater detail the rationale for and operation of the Company’s compensation and benefits programs. |

With respect to two additional areas – CEO Annual Compensation and a 280G gross-up provision included in the CEO’s employment agreement – that were the subject of some criticism by proxy advisory firms in connection with the 2011 say on pay vote, we believe that the business rationale for our decisions was appropriate, although with hindsight, our 2011 CD&A may not have adequately explained our rationale. We hope the following explanations of these two areas of concern help all investors understand our rationale.

CEO Annual Compensation. We hired Alfred T. Mockett as CEO on September 13, 2010. As part of a compensation package that was targeted at the median of our peer group, we granted Mr. Mockett 1,000,000 shares of equity (600,000 premium-priced stock options, 200,000 shares of restricted stock and 200,000 time-

13

Table of Contents

vested stock options). Importantly, this equity grant covered a four year period. The value of this grant as reported in the Summary Compensation Table was $4.6 million with a per year value of $1.15 million. Some stockholders (and proxy advisory firms) treated 100% of this equity grant as annual compensation — versus spreading the value over the four year period as we intended when structuring this grant — thus significantly overstating Mr. Mockett’s 2010 compensation. For example, one advisory firm that treated Mr. Mockett’s equity grant as annual compensation reported Mr. Mockett’s compensation as equaling 273% of the peer group median — an alarming number. However, if the equity award was annualized (with one-fourth attributed to 2010), Mr. Mockett’s compensation would have fallen between 100-105% of the peer group, which was consistent with our own review and decision making. Since his time of hire, Mr. Mockett has not received any salary increase, any change to his target annual incentive opportunity or any additional equity grants (including any equity grants as part of the recent 2012 equity grants to other executive officers).

CEO 280G Gross-Up. As part of recruiting Mr. Mockett, we included a time limited 280G gross-up provision in his employment agreement that expires on December 31, 2012, a full two years prior to the December 31, 2014 expiration of his employment agreement. We appreciate and agree that 280G gross-ups, generally, are not “best practice.” In fact, none of the other Dex One executive officers has a 280G gross-up. However, the 280G gross-up was a valuable recruiting tool and helped us eliminate uncertainty in recruiting Mr. Mockett into Dex One, given that the Company had emerged from bankruptcy less than eight months prior to his joining the Company. We provided the 280G gross-up provision to Mr. Mockett for two primary reasons. First, if we had not provided the provision, we would have had to materially increase another part of his contract – and we were unwilling to do so. Second, the technical calculations involved in 280G payments penalize a late in the year hire. If we had not provided a 280G gross-up, we would have had to delay the start date of Mr. Mockett until early 2011, which would not have been in the best interests of stockholders. Mr. Mockett has not requested an extension of, nor does the Committee plan to extend, the term of the 280G gross-up provision included in Mr. Mockett’s employment agreement when it expires at the end of this year.

Other Compensation Matters. In addition to the compensation design elements and changes discussed above, Dex One’s executive compensation programs support the Company’s commitment to sound corporate governance.

| • | The Committee conducts a formal review of the risks associated with Dex One’s executive compensation practices, policies and programs on an annual basis and assesses risks as part of its regular decision making process. |

| • | The Company is phasing out the R.H. Donnelley Corporation Restoration Plan, a non-qualified supplemental 401(k) plan that provides for a Company match and transition credits on eligible compensation in excess of applicable Internal Revenue Service limits. |

| • | The Company no longer provides defined benefit retirement programs to its executives. Dex One does provide a 401(k) plan, and the executive officers participate on the same basis as all other participants. |

| • | Other than the limited 280G change-in-control gross-up provision included in Mr. Mockett’s employment agreement that expires on December 31, 2012, the Company does not have any other 280G change-in-control gross-up arrangements with any of its other executive officers nor does it intend to enter into any such arrangements in the future. |

| • | In 2011, the Committee renewed its relationship with Semler Brossy Consulting Group, LLC (“Semler Brossy”) to provide independent executive compensation advisory services. |

Roles of the Compensation and Benefits Committee, Management and Consultant

The Committee is responsible for determining the composition and levels of the Company’s non-CEO executive officer pay packages, and for developing a recommendation for the CEO’s compensation package, which is reviewed and approved by the independent directors of the full Board. The Committee receives assistance from two sources — its independent compensation consulting firm, Semler Brossy, and the Company’s internal executive compensation staff.

14

Table of Contents

Semler Brossy has been retained by, and reports directly to the Committee, and does not have any other consulting engagements with management or Dex One. Specifically, the Committee regularly seeks independent advice from Semler Brossy on current trends in compensation design, including overall levels of compensation, the appropriateness of peer group companies, the relative weightings of compensation elements and the value of particular performance measures on which to base compensation. Within this framework, Semler Brossy has been directed to work collaboratively with management to ensure sufficient understanding of Dex One’s business and compensation programs.

With respect to compensation for Dex One’s CEO, Semler Brossy provides competitive CEO market compensation data for the Committee’s consideration. In accumulating this relevant data, Semler Brossy relies on its understanding of Dex One’s business and compensation programs, and its independent research and analysis. Semler Brossy does not meet with the CEO with respect to his compensation.

For other executive officers, the chief human resources officer works with the CEO to develop the CEO’s compensation recommendations to the Committee. In developing these recommendations, the CEO considers the Company’s overall performance, each individual’s scope of responsibility, competitive market compensation data, individual performance, and the CEO’s assessment of the individual’s current and future potential contribution, as well as the individual’s contribution relative to the other executive officers. Semler Brossy provides the Committee with its independent view of the CEO’s compensation recommendations.

The Committee presents its final determinations regarding executive officer compensation to the independent members of the full Board for its review and, in the case of the CEO, for approval.

Compensation Positioning

Peer Group Companies. The Committee intends that the levels of compensation available to executive officers be competitive with the compensation offered by similar publicly held companies. In early 2010, the Committee reexamined the peer group, considering the following factors:

| • | the Company has only one direct competitor that is also a stand-alone public company; |

| • | other companies in the yellow pages and local commercial search industries have very different business models and financial characteristics, thereby making peer comparisons difficult; and |

| • | the Company’s relatively high margins in recent years significantly differentiated Dex One from potential peer companies. |

The peer companies, as a group, are headquartered in the United States, are identified as Media companies by Standard & Poor’s Global Industry Classification System (GICS Industry 254010), and are generally comparable to the Company’s business in terms of revenues. Based on these criteria, the Committee utilized the following peer group for 2011.

| Cinemark Holdings, Inc. | Regal Entertainment Group | |

| Clear Channel Outdoor Holdings, Inc. | Scholastic Corporation | |

| Discovery Communications, Inc. | Scripps Networks Interactive, Inc. | |

| John Wiley and Sons, Inc. | Sirius XM Radio Inc. | |

| Lamar Advertising Company | SuperMedia Inc. | |

| The McClatchy Company | Valassis Communications, Inc. | |

| Meredith Corporation | The Washington Post Company | |

| The New York Times Company |

Target Marketplace Positioning. The Committee’s stated objective was to position an executive’s total direct remuneration opportunity over time for target performance between the median and the median plus 15% for the executive’s position. Actual total direct remuneration levels will vary from year to year and may be below or above target based on the Company’s performance relative to the Company’s objectives.

15

Table of Contents

Although the Committee uses peer group data for context and a frame of reference for decision-making, the Committee did not rely exclusively on peer group data in setting the terms of the 2011 compensation programs. Likewise, the Committee did not set total direct remuneration or its component parts at levels designed to achieve a mathematically precise market position, nor is there a commitment or understanding to provide executives with compensation at any specific level, or within any specific range with respect to the peer group.

As noted above, the Committee reexamined the Company’s peer group in late 2011/early 2012 identifying companies in the Advertising (GICS Industry 25401010) and Publishing (GICS Industry 25401040) subcategories of Media companies with trailing four quarter revenues between $500 million to $2.5 billion, to better reflect the current size and business of the Company. This new peer group will be in place for 2012.

Elements of Compensation

Total direct remuneration for Dex One’s executive officers is comprised of base salary, annual incentive compensation and long-term incentive compensation.

Consistent with the principles of Dex One’s executive officer compensation outlined above, an executive officer’s total direct compensation is based upon the Company’s performance as well as the performance of the individual executive officer. Dex One does not have a pre-established policy or target for allocating between fixed and variable compensation or among the different types of variable compensation, although the allocation is influenced by the Committee’s assessment of compensation practices of the peer group as well as Dex One’s short-term and long-term strategic objectives. Variable compensation generally consists of annual cash incentive compensation and long-term equity-based incentive awards.

Base Salary. Dex One provides its executive officers an annual base salary to compensate them for services rendered during the year, and is essential for the attraction and retention of talented executive officers. The executive officers’ base salaries are reviewed annually by the Compensation Committee, but do not automatically increase each year.

In February 2011, the Committee set base salaries for senior executives for 2011, with no increase in base salary for any continuing executive officer in 2011. Messrs. Hanna’s and Freiberg’s base salaries were set in connection with their respective hiring in April and September, 2011. Annual base salaries for each of the NEOs for 2011 were:

| Name |

Salary | |||

| Alfred T. Mockett |

$ | 975,000 | ||

| Gregory W. Freiberg |

$ | 425,000 | ||

| Richard J. Hanna |

$ | 500,000 | ||

| Atish Banerjea |

$ | 400,000 | ||

| Mark W. Hianik |

$ | 400,000 | ||

Annual Incentive Compensation. Dex One provides its executive officers with the opportunity to earn variable cash compensation under the Company’s short-term incentive plans. The purpose of the short-term incentive plans is to reward executive officers for performance during a single fiscal year, and to provide incentives for them to achieve Dex One’s annual financial and operational goals, as measured against specific performance criteria relative to Dex One’s overall business results as well as individual performance and contribution. Executive officers who are senior vice presidents and above participate in the Annual Incentive Plan (AIP). Payouts under the AIP are determined annually based on the executive officer’s target bonus and performance against each of the measures described below.

Annual incentive opportunities for executive officers are expressed as a percentage of base salary. In February 2011, the Committee reduced the annual incentive opportunities for executive vice presidents from 75% of base salary to 65% and for senior vice presidents from 60% of base salary to 50%. These changes were designed to bring annual compensation opportunities more in line with peer group practices. Mr. Mockett’s annual incentive opportunity stayed at 100% of base salary at time of hire, as provided in his employment

16

Table of Contents

agreement. The Committee may reassess the target bonuses for each executive officer from time to time. Annual incentive opportunities for the NEOs for 2011were:

| Name |

Annual Incentive | |||

| Alfred T. Mockett |

100 | % | ||

| Gregory W. Freiberg |

65 | % | ||

| Richard J. Hanna |

65 | % | ||

| Atish Banerjea |

50 | % | ||

| Mark W. Hianik |

50 | % | ||

For 2011, the Committee redesigned the annual cash incentive for executive officers to reward Company financial performance and individual contribution in 2011 through an integrated suite of Corporate, Function and Individual Performance Metrics. This design was intended to provide greater line of sight (and control) for participants to achieve their established goals, creating clear links between a participant’s individual contribution, his or her function’s contribution and the achievement of the Company’s financial goals.

Achievement between specified performance levels would result in a payout based on straight-line interpolation. There is no payout with respect to any performance metric for which actual performance does not meet the 50%, or threshold, level. If the level of performance under any of the Corporate Performance Metrics were to exceed the 200% level, the corresponding payout also would exceed 200% based on straight-line interpolation, but the maximum payout under the AIP for all four Corporate Performance Metrics combined may not exceed 200% of the executive officer’s aggregate Corporate Performance Metric target. The annual incentive award payable under the AIP with respect to the achievement of each performance metric within the Function and Individual categories will range from a minimum of 0% to a maximum of 120% of target; provided, however, that the Ad Sale threshold must be achieved for any payout based on achievement of Function and/or Individual targets.

AIP Payouts for the NEOs for 2011 were based on the following performance metrics and weightings:

Category Weighting

| Percent of Total Incentive Target | ||||||

| Organization Level |

Corporate | Function | Individual | |||

| Chief Executive Officer |

80% | 0% | 20% | |||

| All Other NEOs |

60% | 20% | 20% | |||

Corporate Performance Metrics

| • | Ad Sales Growth: This performance metric supports the Company’s mandate to continue expansion of its service offerings and market presence. |

| • | Digital Ad Sales: This performance metric reinforces the strategic imperative to grow digital revenue and increase the Company’s digital presence. |

| • | EBITDA: This performance metric (defined as EBITDA adjusted to exclude the impact of fresh start and purchase accounting adjustments, impairment charges, reorganization costs, stock-based compensation expense, long-term incentive plan expense and restructuring costs) is designed to reinforce the Company’s focus on profitable growth. |

| • | Free Cash Flow: This performance metric (defined as cash flow from operations, less capital expenditures adjusted to exclude the impact of stock compensation expense, long-term incentive plan expense, cash restructuring payments, cash reorganization costs and fresh start and purchase accounting adjustments) is designed to reinforce the need to generate cash to build the business, while continuing to meet all debt requirements. |

17

Table of Contents

| Incentive Award Based on Performance | ||||||

| Metric and Weighting |

50% of target | 100% of target | 200% of target | |||

| Ad Sales (40%) |

-12% | -10% | -8% | |||

| Digital Ad Sales (20%) |

$188.1 million | $209.0 million | $250.8 million | |||

| EBITDA (20%) |

$594.0 million | $660.0 million | $792.0 million | |||

| Free Cash Flow (20%) |

$301.5 million | $335.0 million | $402.0 million | |||

Function Performance Metrics

| • | This performance category captures each leadership team member’s (i.e. those executive officers reporting to the CEO) performance against strategic initiatives specific to the individual’s function. |

| Incentive Award Based on Performance | ||||||

| Metric and Weighting |

50% of target | 100% of target | 120% of target | |||

| Varies by executive officer function |

Varies by executive officer function | |||||

Individual Performance Metrics

| • | This performance category captures the CEO’s and each leadership team member’s overall effectiveness as a senior executive. |

| Incentive Award Based on Performance (1) | ||||||

| Metric and Weighting |

50% of target | 100% of target | 120% of target | |||

| Teamwork and collaboration (25%) |

3.0 | 4.0 | 5.0 | |||

| Coaching and mentoring (25%) |

3.0 | 4.0 | 5.0 | |||

| Communication (25%) |

3.0 | 4.0 | 5.0 | |||

| Consistency of feedback from superiors, subordinates and peers (25%) |

3.0 | 4.0 | 5.0 | |||

| (1) | Using scores from 360 talent reviews |

In February 2012, the Committee determined that: (i) there should be no payout on the Ad Sales performance metric as the actual Ad Sales decline for the year was less than the 50% threshold level; (ii) Digital Ad Sales for AIP calculation purposes of $204.5 million represented 89.3% of target performance; (iii) EBITDA for AIP calculation purposes of $656.8 million represented 97.6% of target performance; (iv) Adjusted Free Cash Flow for AIP calculation purposes of $417.3 million represented 222.8% of target performance; and (v) there should be no payout on the Function or Individual metrics since the Ad Sales threshold was not achieved. Weighting these performance/payout levels as described above, the Committee approved the following AIP payouts for the NEOs for 2011:

| Name |

Paid in March 2012 | |||

| Alfred T. Mockett |

$ | 639,210 | ||

| Gregory W. Freiberg |

$ | 41,307 | (1) | |

| Richard J. Hanna |

$ | 119,085 | (1) | |

| Atish Banerjea |

$ | 95,912 | (1) | |

| Mark W. Hianik |

$ | 98,340 | ||

| (1) | Prorated for partial year. |

18

Table of Contents

In February 2012, the Committee approved the plan design and performance metrics for the 2012 AIP. The 2012 AIP operates in much the same fashion as the 2011 AIP with the following modifications:

| • | Changes in AIP design and performance metrics for all executive officers reporting to the CEO: |

| • | Corporate Performance Metrics (80% weighting for EVPs and 70% weighting for SVPs). Print Ad Sales replaces Ad Sales as a Corporate Performance Metric, with the threshold achievement level set at 98% of target and the maximum achievement level set at 110% of target. Print Ad Sales and Digital Ad Sales will both be ascribed 30% weightings within the Corporate Performance Metric category. The EBITDA and Free Cash Flow Metrics will retain their 20% weightings, but with the threshold achievement level for each of these metrics increasing to 95% of target and the maximum achievement levels set at 117% and 113% of each target, respectively. These changes in the Corporate Performance Metrics were designed to reflect the continuing significance of the print products’ contribution to the financial performance of the Company as the Company continues its transition to digital. The annual incentive opportunity with respect to the achievement of each performance metric within the Corporate Performance Metrics category, as well as the achievement of the aggregate of the performance metrics within this category, will range from a minimum of 0% to a maximum of 200% of target. |

| • | Individual Performance Metrics (20% weighting for EVPs and 30% weighting for SVPs). The Functional Performance Metrics that were part of the 2011 AIP design have been effectively eliminated with the new Individual Performance Metrics intended to include both individual and functional metrics designed for each leadership team member’s role and function. The annual incentive opportunity with respect to the achievement of each performance metric within the Individual Performance Metrics category will range from a minimum of 0% to a maximum of 150% of target. |

| • | The 2012 AIP metrics for the CEO will consist solely of the revised Corporate Performance Metrics described above (100% weighting) with no Individual Performance Metric component. This change is intended to directly link the CEO’s annual incentive opportunity directly to Company performance. |

| • | For all leadership team members, in order to earn an above target payout on either of the EBITDA or Free Cash Flow metrics of the Corporate Performance Metrics category, total Company ad sales must exceed the sum of the Print Ad Sales and Digital Ad Sales threshold achievement levels. |

Long-Term Incentive Compensation. Dex One also provides its executive officers with the opportunity to earn variable long-term equity and/or cash compensation under its various long-term incentive plans. The purpose of these long-term awards is to reward executive officers for performance over a longer time horizon and to provide incentives for them to achieve Dex One’s long-term financial and operational goals.

Historically, target long-term incentive awards for executive officers were expressed as a percentage of base salary. In early 2011, the Committee spent a considerable amount of time evaluating the desired approach to long-term compensation and decided to move away from the historical approach for the 2011 equity grants given the then current stock price level and desired plan design changes. For the 2011 long-term incentive awards, the total number of shares to be granted to each executive officer was subjectively determined based on an analysis of the potential future value of the equity assuming successful execution of the Company’s business strategy.

The 2011 equity grants are composed of three different types of equity: (i) time-vested restricted stock which vest over three years based on continued employment; (ii) time-vested stock options which vest over four years based on continued employment; and (iii) price-vested stock options, 50% which vest when the stock reaches a specified threshold stock price and 50% which will vest when the stock reaches a slightly higher specified threshold stock price, however, in no event can the stock price hurdle condition be satisfied in the initial six months from date of grant.