|

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. | |||||

|

Summary Prospectus September 28, 2018 |

||||||

|

Class Ticker A DTCAX | ||||||

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund, including the statement of additional information and most recent reports to shareholders, online at http://im.bnymellon.com/literaturecenter. You can also get this information at no cost by calling 1-800-DREYFUS or by sending an e-mail request to info@dreyfus.com. The fund's prospectus and statement of additional information, dated September 28, 2018 (each as revised or supplemented), are incorporated by reference into this summary prospectus.

The fund seeks long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or shares of other funds in the Dreyfus Family of Funds that are subject to a sales charge. More information about sales charges, including these and other discounts and waivers, is available from your financial professional and in the Shareholder Guide section beginning on page 12 of the prospectus and in the How to Buy Shares section and the Additional Information About How to Buy Shares section beginning on page II-1 and page III-1, respectively, of the fund's Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

||||||||||||

|

Class A |

Class C |

Class I |

Class Y |

Class Z | ||||||||

|

Maximum sales charge (load) imposed on purchases |

5.75 |

none |

none |

none |

none | |||||||

|

Maximum deferred sales charge (load) |

none* |

1.00 |

none |

none |

none | |||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||

|

Class A |

Class C |

Class I |

Class Y |

Class Z | ||||||||

|

Management fees |

.60 |

.60 |

.60 |

.60 |

.60 | |||||||

|

Distribution (12b-1) fees |

none |

.75 |

none |

none |

none | |||||||

|

Other expenses (including shareholder services fees) |

.51 |

.51 |

.21 |

.17 |

.27 | |||||||

|

Total annual fund operating expenses |

1.11 |

1.86 |

.81 |

.77 |

.87 | |||||||

|

Fee waiver and/or expense reimbursement** |

(.16) |

(.16) |

(.11) |

(.07) |

(.10) | |||||||

|

Total annual fund operating expenses |

|

|

|

|

| |||||||

* Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a deferred sales charge of 1.00% if redeemed within one year.

** The fund's investment adviser, The Dreyfus Corporation, has contractually agreed, until September 30, 2019, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .70%. On or after September 30, 2019, The Dreyfus Corporation may terminate this expense limitation at any time.

|

|

|

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. The one-year example and the first year of the three-, five- and ten-years examples are based on net operating expenses, which reflect the expense limitation agreement by The Dreyfus Corporation. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$666 |

$893 |

$1,137 |

$1,835 |

|

Class C |

$273 |

$569 |

$991 |

$2,167 |

|

Class I |

$72 |

$248 |

$439 |

$991 |

|

Class Y |

$72 |

$239 |

$421 |

$948 |

|

Class Z |

$79 |

$268 |

$472 |

$1,063 |

You would pay the following expenses if you did not redeem your shares:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$666 |

$893 |

$1,137 |

$1,835 |

|

Class C |

$173 |

$569 |

$991 |

$2,167 |

|

Class I |

$72 |

$248 |

$439 |

$991 |

|

Class Y |

$72 |

$239 |

$421 |

$948 |

|

Class Z |

$79 |

$268 |

$472 |

$1,063 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 49.82% of the average value of its portfolio.

To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities (or derivative instruments with similar economic characteristics) of U.S. companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable environmental, social and governance (ESG) issues. The fund's sub-adviser, Newton Investment Management (North America) Limited (Newton), an affiliate of The Dreyfus Corporation (Dreyfus), considers a company to engage in "sustainable business practices" if the company engages in such practices in an economic sense (i.e., the durability of the company's strategy, operations and finances), and takes appropriate account of material externalities caused by or affecting its business. Newton also may invest in companies where it believes it can promote sustainable business practices through ongoing company engagement and active proxy voting.

The fund invests principally in common stocks. The fund may invest in the stocks of companies with any market capitalization, but focuses on companies with market capitalizations of $5 billion or more at the time of purchase. The fund may invest up to 20% of its net assets in the stocks of foreign companies, including up to 10% of its net assets in the securities of issuers in emerging market countries, that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable ESG issues.

Newton seeks attractively-priced companies (determined using both quantitative and qualitative fundamental analysis) with good products, strong management and strategic direction that have adopted, or are making progress towards, a sustainable business approach. These are companies that Newton believes should benefit from favorable long-term trends. Newton uses an investment process that combines investment themes with fundamental research and analysis to select stocks for the fund's portfolio.

Investment Themes. Part of Newton's investment philosophy is the belief that no company, market or economy can be considered in isolation; each must be understood within a broader context. Therefore, Newton's global industry analysts and responsible investment team begin their process by considering the context provided by a series of macroeconomic investment themes, which are designed to define the broader social, financial and political environment as a framework for understanding events, trends and competitive pressures worldwide.

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. Summary |

2 |

Fundamental Research and Analysis. Newton next conducts rigorous fundamental analysis of the competitive position and valuation of potential investments, systematically integrating the consideration of ESG issues through its proprietary ESG quality review, which is designed to ensure that Newton appropriately accounts for any material ESG issues of the company in determining the potential investment's valuation.

Ongoing ESG Monitoring and Engagement. In addition to investing in companies that Newton believes are "sustainable" after applying the fundamental analysis and ESG quality review rating, Newton may invest in companies where it believes it can promote sustainable business practices through ongoing company engagement and active proxy voting consistent with Newton's investment and engagement priorities. Newton monitors the fund's entire portfolio for emerging ESG controversies and issues and periodically reviews each company's ESG quality rating. This integrated investment process is intended to ensure that ESG issues are taken into account and that the fund invests in companies with attractive fundamental investment attributes that adopt, or are making progress towards, sustainable business practices. The fund will not invest in companies that Newton deems to have material unresolvable ESG issues (i.e., companies with material ESG issues that Newton believes cannot be corrected through ongoing company engagement and active proxy voting).

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Investment approach risk. The fund's investment approach may cause it to perform differently than mutual funds that invest in equity securities of U.S. companies, but that do not integrate consideration of ESG issues when selecting investments. The fund's investment approach that systematically integrates the consideration of ESG issues in the securities selection process may result in the fund forgoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities when it might otherwise be disadvantageous for the fund to do so. The fund will vote proxies in a manner that is consistent with its investment approach, which may not always be consistent with maximizing the performance of the issuer in the short-term.

· Large-cap stock risk. To the extent the fund invests in large capitalization stocks, the fund may underperform funds that invest primarily in the stocks of lower quality, smaller capitalization companies during periods when the stocks of such companies are in favor.

· Growth and value stock risk. By investing in a mix of growth and value companies, the fund assumes the risks of both. Investors often expect growth companies to increase their earnings at a certain rate. If these expectations are not met, investors can punish the stocks inordinately, even if earnings do increase. In addition, growth stocks may lack the dividend yield that may cushion stock prices in market downturns. Value stocks involve the risk that they may never reach their expected full market value, either because the market fails to recognize the stock's intrinsic worth or the expected value was misgauged. They also may decline in price even though in theory they are already undervalued.

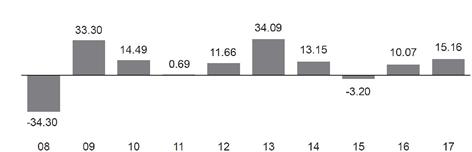

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Class Z shares from year to year. Sales charges, if any, are not reflected in the bar chart, and, if those charges were included, returns would have been less than those shown. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. More recent performance information may be available at www.dreyfus.com.

The fund changed its investment objective and strategy on May 1, 2017. Prior to May 1, 2017, the fund's investment objective was to provide capital growth, with current income as a secondary goal. To pursue these goals, until May 1, 2017, the fund, under normal circumstances, invested in the common stocks of companies that, in the opinion of the fund's management, met traditional investment standards and conducted their business in a manner that contributed to the enhancement of the quality of life in America. To determine whether a company contributed to the enhancement of the quality of life in America, the fund considered the company's record in the areas of (1) protection and improvement of the environment and the proper use of natural resources, (2) occupational health and safety, (3) consumer protection and product purity, and (4) equal employment

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. Summary |

3 |

opportunity. In addition, prior to May 1, 2017, investment decisions for the fund were made by members of the Active Equity Team of Mellon Capital Management Corporation, an affiliate of Dreyfus, who managed the fund as employees of Dreyfus.

|

Year-by-Year Total Returns as of 12/31 each year (%) Class Z | |

|

|

Best Quarter Worst Quarter |

The year-to-date total return of the fund's Class Z shares as of June 30, 2018 was 0.18%.

After-tax performance is shown only for Class Z shares. After-tax performance of the fund's other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through U.S. tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Returns after taxes on distributions and sale of fund shares may be higher than returns before taxes or returns after taxes on distributions due to an assumed tax benefit from losses on a sale of the fund's shares at the end of the period.

For the fund's Class Y shares, periods prior to the inception date reflect the performance of the fund's Class Z shares. Such performance figures have not been adjusted to reflect applicable class fees and expenses. Each share class is invested in the same portfolio of securities, and the annual returns would have differed only to the extent that the classes do not have the same expenses.

|

Average Annual Total Returns (as of 12/31/17) | |||||

|

Class (Inception Date) |

1 Year |

5 Years |

10 Years | ||

|

Class Z returns before taxes |

15.16% |

13.24% |

7.70% | ||

|

Class Z returns after taxes on distributions |

8.48% |

10.08% |

6.13% | ||

|

Class Z returns after taxes on distributions and sale of fund shares |

12.45% |

10.13% |

6.02% | ||

|

Class A returns before taxes |

8.33% |

11.69% |

6.80% | ||

|

Class C returns before taxes |

13.16% |

12.14% |

6.64% | ||

|

Class I returns before taxes |

15.27% |

13.36% |

7.83% | ||

|

Class Y (9/30/2016) returns before taxes |

15.31% |

13.26% |

7.71% | ||

|

S&P 500® Index reflects no deductions for fees, expenses or taxes |

21.82% |

15.78% |

8.49% | ||

The fund's investment adviser is Dreyfus and the fund's sub-adviser is Newton, an affiliate of Dreyfus.

John Gilmore and Jeff Munroe are the fund's primary portfolio managers, positions they have held since May 2017. Mr. Gilmore, the fund's lead portfolio manager, is the lead manager of Newton's sustainable U.S. equity model and a member of its global equities team providing specialist insight into the North American market. Mr. Munroe is the investment leader of the global equities team at Newton.

In general, for each share class, other than Class Y, the fund's minimum initial investment is $1,000 and the minimum subsequent investment is $100. For Class Y shares, the minimum initial investment generally is $1,000,000, with no minimum subsequent investment. Class Z shares generally are not available for new accounts. You may sell (redeem) your shares on any business day by calling 1-800-DREYFUS (inside the U.S. only) or by visiting www.dreyfus.com. If you invested in the fund through a third party, such as a bank, broker-dealer or financial adviser, or through a Retirement Plan (as defined below), you may mail your request to sell shares to Dreyfus Institutional Department, P.O. Box 9882, Providence, Rhode Island 02940-8082. If you invested directly through the fund, you may mail your request to sell shares to Dreyfus Shareholder Services, P.O. Box 9879, Providence,

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. Summary |

4 |

Rhode Island 02940-8079. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions.

Retirement Plans include qualified or non-qualified employee benefit plans, such as 401(k), 403(b)(7), Keogh, pension, profit-sharing and other deferred compensation plans, whether established by corporations, partnerships, sole proprietorships, non-profit entities, trade or labor unions, or state and local governments, but do not include IRAs (including, without limitation, traditional IRAs, Roth IRAs, Coverdell Education Savings Accounts, IRA "Rollover Accounts" or IRAs set up under Simplified Employee Pension Plans (SEP-IRAs), Salary Reduction Simplified Employee Pension Plans (SARSEPs) or Savings Incentive Match Plans for Employees (SIMPLE IRAs)).

The fund's distributions are taxable as ordinary income or capital gains, except when your investment is through an IRA, Retirement Plan or other U.S. tax-advantaged investment plan (in which case you may be taxed upon withdrawal of your investment from such account).

If you purchase shares (other than Class Y shares) through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. To the extent that the intermediary may receive lesser or no payments in connection with the sale of other investments, the payments from the fund and its related companies may create a potential conflict of interest by influencing the broker-dealer or other intermediary and your financial representative to recommend the fund over the other investments. This potential conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments or the provision of related services, the compensation rates and other payment arrangements that may apply to a financial intermediary and its representatives may vary by intermediary. Ask your financial representative or visit your financial intermediary's website for more information.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. Summary |

5 |

|

|

Printed on recycled paper. 50% post-consumer. Process chlorine free. Vegetable-based ink. |

|

The Dreyfus Sustainable U.S. Equity Fund, Inc. Summary |

6 |