BNY Mellon Sustainable U.S. Equity Fund, Inc.

Summary Prospectus | September 29, 2023

Class Ticker

A DTCAX

C DTCCX

I DRTCX

Y DTCYX

Z DRTHX

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund, including the statement of additional information and most recent reports to shareholders, online at http://im.bnymellon.com/literaturecenter. You can also get this information at no cost by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com. The fund's prospectus and statement of additional information, dated September 29, 2023 (each as revised or supplemented), are incorporated by reference into this summary prospectus.

The fund seeks long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or shares of other funds in the BNY Mellon Family of Funds that are subject to a sales charge. More information about sales charges, including these and other discounts and waivers, is available from your financial professional and in the Shareholder Guide section beginning on page 13 of the prospectus, in the Appendix on page A-1 of the prospectus and in the How to Buy Shares section and the Additional Information About How to Buy Shares section beginning on page II-1 and page III-1, respectively, of the fund's Statement of Additional Information.

Shareholder Fees (fees paid directly from your investment) | ||||||||||||||

Class A | Class C | Class I | Class Y | Class Z | ||||||||||

Maximum

sales charge (load) imposed on purchases | 5.75 | none | none | none | none | |||||||||

Maximum

deferred sales charge (load) | none* | 1.00 | none | none | none | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||

Class A | Class C | Class I | Class Y | Class Z | ||||||||||

Management fees | .60 | .60 | .60 | .60 | .60 | |||||||||

Distribution (12b-1) fees | none | .75 | none | none | none | |||||||||

Other expenses: | ||||||||||||||

Shareholder services fees | .25 | .25 | none | none | .06 | |||||||||

Miscellaneous other expenses | .16 | .27 | .13 | .09 | .11 | |||||||||

Total other expenses | .41 | .52 | .13 | .09 | .17 | |||||||||

Total annual fund operating expenses | 1.01 | 1.87 | .73 | .69 | .77 | |||||||||

Fee waiver and/or expense reimbursement** | (.06) | (.17) | (.03) | - | (.01) | |||||||||

Total annual fund operating expenses (after fee waiver and/or expense reimbursement) | .95 | 1.70 | .70 | .69 | .76 | |||||||||

* Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a deferred sales charge of 1.00% if redeemed within one year.

** The fund's investment adviser, BNY Mellon Investment Adviser, Inc., has contractually agreed, until September 29, 2024, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund's share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .70%. On or after September 29, 2024, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. The one-year example and the first year of the three-, five- and ten-years examples are based on net operating expenses, which reflect the expense limitation agreement by BNY Mellon Investment Adviser, Inc. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 Year | 3 Years | 5 Years | 10 Years | |

Class A (with or without redemption at end of period) | $666 | $872 | $1,095 | $1,735 |

Class C (with redemption at end of period) | $273 | $571 | $995 | $2,177 |

Class C (without redemption at end of period) | $173 | $571 | $995 | $2,177 |

Class I (with or without redemption at end of period) | $72 | $230 | $403 | $904 |

Class Y (with or without redemption at end of period) | $70 | $221 | $384 | $859 |

Class Z (with or without redemption at end of period) | $78 | $245 | $427 | $953 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 21.98% of the average value of its portfolio.

To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of U.S. companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable environmental, social and governance (ESG) issues. The fund's sub-adviser, Newton Investment Management Limited (NIM), an affiliate of BNY Mellon Investment Adviser, Inc. (BNYM Investment Adviser), considers a company to be engaged in "sustainable business practices" if the company engages in business practices that are, in NIM's view, sustainable in an economic sense (i.e., the company's strategy, operations and finances are stable and durable), and takes appropriate measures to manage any material consequences or impact of its policies and operations in relation to ESG matters (e.g., the company's environmental footprint, labor standards, board structure, etc.). Companies engaged in sustainable business practices also may include companies that have committed explicitly to improving their environmental and/or social impacts that will lead to a transformation of their business models. No investment will be made in a company that is considered to be out of line with NIM's sustainable investment process. Examples of such companies may include: tobacco companies due to the health implications of smoking; a company with a large carbon footprint that has no emission reduction plan; or a company that is in direct conflict with the goals of the UN Global Compact (a voluntary corporate initiative that seeks to advance universal principles on human rights, labor, environment and anti-corruption).

The fund invests principally in common stocks. The fund may invest in the stocks of companies with any market capitalization, but focuses on companies with market capitalizations of $5 billion or more at the time of purchase. The fund may invest up to 20% of its net assets in the stocks of foreign companies, including up to 10% of its net assets in the securities of issuers in emerging market countries, that demonstrate attractive investment attributes and sustainable business practices and are considered to be in line with NIM's sustainable investment process. In addition, the fund may, from time to time, invest a significant portion (more than 20%) of its total assets in securities of companies in certain sectors. As of June 30, 2023, a significant portion of the fund's portfolio was invested in securities of companies in the technology sector.

NIM seeks attractively-priced companies (determined using both qualitative and quantitative fundamental analysis as described under "Fundamental Research and Analysis" below) that NIM believes are well-managed, have good products or services, have strategic direction, and have adopted, or are making progress towards, a sustainable business approach. These are companies that NIM believes should benefit from favorable long-term trends. When selecting stocks for the fund's portfolio, NIM uses an investment process that combines investment themes with fundamental research and analysis, with the consideration of ESG matters.

Investment Themes. Part of NIM's investment philosophy is the belief that no company, market or economy can be considered in isolation; each must be understood within a broader context. Therefore, NIM's global industry analysts and responsible investment team consider the context provided by a series of global investment themes, which are designed to define the broader social, financial and political environment as a framework for understanding events, trends and competitive pressures worldwide.

BNY Mellon Sustainable U.S. Equity Fund, Inc. Summary | 2 |

Fundamental Research and Analysis. NIM next conducts fundamental analysis of investment opportunities and uses cross comparisons of companies to identify securities that NIM believes will outperform. NIM investment professionals are responsible for idea generation and selection through investment analysis in a collaborative team environment. Investment professionals are expected to deliver clear and accountable investment recommendations supporting the portfolio construction efforts. NIM's multi-dimensional research platform plays an integral part in the fundamental investment process, delivering insights that NIM believes are key to navigating the fast-changing market environment. In reviewing potential investments, NIM may assess, among other factors, a company's price-to-earnings ratio, positive earnings momentum, earnings per share growth expectations, and earnings stability. NIM also utilizes a variety of valuation techniques, which may include earnings, asset value, cash flow and cost of capital measurements, in conducting its fundamental analysis. In addition, NIM integrates the consideration of material ESG issues through, among other aspects of its investment process, NIM's ESG review of each individual company, prior to an investment being made in an equity security of a company for the first time. NIM's ESG review is designed to identify potential ESG-related risks and opportunities, and incorporates qualitative and quantitative information and data from internal and external (e.g., index providers and consultants) sources, including research, reports, screenings, ratings and/or analysis.

Sustainable Investment Process. Following the fundamental research and analysis, NIM then employs a sustainable investment process that incorporate elements of negative screening alongside other general and security level (i.e., in terms of a company's activities) ESG-related analysis, using similar data sources as those in the ESG review. Ultimately, in keeping with the investment strategy of the fund, the sustainable investment process seeks to:

- identify and avoid companies that participate in specific areas of activity that NIM deems to be materially harmful from an environmental or social perspective, or do not follow good governance practices. For example, NIM could deem companies that have large carbon footprints without an emissions reduction plan, companies with poor labor standards, or companies that are in direct conflict with the goals of the UN Global Compact ineligible for investment.

- identify and invest in companies that are proactively seeking to manage environmental and/or social factors to generate sustainable returns. This may also include those companies that are contributing to the development of solutions that seek to address environmental and/or social issues, examples of which could include more efficient or reduced use of natural resources or accessibility to healthcare.

There may be situations where the fund will invest in a security of a company that has been identified by NIM as having involvement in potentially harmful activities from an environmental or social perspective. This may arise for certain companies whose activities or operations, typically due to a legacy business mix, have created poor environmental or social outcomes, but are now investing and positively adapting to future needs (for example, this may include energy companies that are preparing for a transition to a lower carbon world). Similarly, in some instances, the fund may invest in a security of a company where NIM determines prevailing ESG information and data provided by external ESG rating providers have not fully captured positive environmental or social-related initiatives of the company.

Ongoing Monitoring. NIM monitors companies held in the fund's portfolio for emerging negative environmental, social or governance issues. This is done through a combination of ongoing qualitative and quantitative research. This research may be supported by engagement with a company's management, including discussion of material ESG issues where relevant. NIM may engage with selected companies to understand better a company's approach to managing emerging ESG issues. NIM may also specifically engage with companies identified as transitioning away from environmentally or socially harmful activities, to help determine the progress being made in achieving their objectives, supporting the changes being made or encouraging further enhancements. Engagement may also be undertaken in an effort to influence and to support change in the business practices or activities of a company and to obtain information that helps NIM achieve a better understanding of the company's circumstances. NIM also makes use of a variety of third-party data and research providers that allow it to monitor changes in the ESG characteristics of a company. NIM typically exercises voting rights at each shareholder meeting of companies held in the fund's portfolio. This activity is undertaken in-house to ensure that the opinions expressed through NIM's voting record are in line with NIM's investment and engagement priorities.

If the fund invests in a company that is subsequently considered to be out of line with NIM's sustainable investment process, NIM will sell the security in a prudent manner, within a predetermined timeframe. In addition, NIM typically will consider selling a security held by the fund as a result of one or more of the following:

· price movement and market activity have created an excessive valuation;

· the valuation of the company has become expensive relative to its peers;

· there has been a significant change in the prospects of the company;

· there has been a change in NIM's view of global investment themes (as described above); or

· profit-taking.

BNY Mellon Sustainable U.S. Equity Fund, Inc. Summary | 3 |

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Sustainable investment approach risk. The fund's sustainable investment approach may cause it to make different investments than funds that invest principally in equity securities of U.S. companies that do not incorporate sustainable investment criteria when selecting investments. Under certain economic conditions, this could cause the fund to underperform funds that do not incorporate similar criteria. For example, the incorporation of sustainable investment criteria may result in the fund forgoing opportunities to buy certain securities when it might otherwise be advantageous to do so or selling securities when it might otherwise be disadvantageous for the fund to do so. The incorporation of sustainable investment criteria may also affect the fund's exposure to certain sectors and/or types of investments, and may adversely impact the fund's performance depending on whether such sectors or investments are in or out of favor in the market. NIM's security selection process incorporates ESG data provided by third parties, which may be limited for certain companies and/or only take into account one or a few ESG related components. In addition, ESG data may include qualitative and/or quantitative measures, and consideration of this data may be subjective. Different methodologies may be used by the various data sources that provide ESG data. ESG data from third parties used by NIM as part of its sustainable investment process often lacks standardization, consistency and transparency, and for certain companies such data may not be available, complete or accurate. NIM's evaluation of ESG factors relevant to a particular company may be adversely affected in such instances. As a result, the fund's investments may differ from, and potentially underperform, funds that incorporate ESG data from other sources or utilize other methodologies.

· Large-cap stock risk. To the extent the fund invests in large capitalization stocks, the fund may underperform funds that invest primarily in the stocks of lower quality, smaller capitalization companies during periods when the stocks of such companies are in favor.

· Growth and value stock risk. By investing in a mix of growth and value companies, the fund assumes the risks of both. Investors often expect growth companies to increase their earnings at a certain rate. If these expectations are not met, investors can punish the stocks inordinately, even if earnings do increase. Value stocks involve the risk that they may never reach their expected full market value, either because the market fails to recognize the stock's intrinsic worth or the expected value was misgauged.

· Technology company risk. The technology sector has been among the most volatile sectors of the stock market. Technology companies involve greater risk because their revenue and/or earnings tend to be less predictable (and some companies may be experiencing significant losses) and their share prices tend to be more volatile. Certain technology companies may have limited product lines, markets or financial resources, or may depend on a limited management group. In addition, these companies are strongly affected by worldwide technological developments, and their products and services may not be economically successful or may quickly become outdated. Investor perception may play a greater role in determining the day-to-day value of tech stocks than it does in other sectors. Fund investments made in anticipation of future products and services may decline dramatically in value if the anticipated products or services are delayed or cancelled.

· Market risk. The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

· Management risk. The investment process used by the fund's sub-adviser could fail to achieve the fund's investment goal and cause your fund investment to lose value.

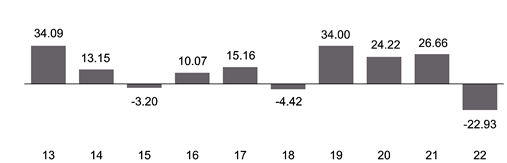

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Class Z shares from year to year. Sales charges, if any, are not reflected in the bar chart, and, if those charges were included, returns would have been less than those shown. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance (before and after taxes) is

BNY Mellon Sustainable U.S. Equity Fund, Inc. Summary | 4 |

not necessarily an indication of how the fund will perform in the future. More recent performance information may be available at www.im.bnymellon.com.

The fund changed its investment objective and strategy on May 1, 2017. Prior to May 1, 2017, the fund's investment objective was to provide capital growth, with current income as a secondary goal. To pursue these goals, until May 1, 2017, the fund, under normal circumstances, invested in the common stocks of companies that, in the opinion of the fund's management, met traditional investment standards and conducted their business in a manner that contributed to the enhancement of the quality of life in America. To determine whether a company contributed to the enhancement of the quality of life in America, the fund considered the company's record in the areas of (1) protection and improvement of the environment and the proper use of natural resources, (2) occupational health and safety, (3) consumer protection and product purity, and (4) equal employment opportunity. In addition, prior to May 1, 2017, investment decisions for the fund were made by investment professionals of another affiliate of BNYM Investment Adviser, who managed the fund as employees of BNYM Investment Adviser.

Year-by-Year Total Returns as of 12/31 each year (%) Class Z | |

| During the periods shown in the chart: Best Quarter Worst

Quarter |

The year-to-date total return of the fund's Class Z shares as of June 30, 2023 was 14.94%.

After-tax performance is shown only for Class Z shares. After-tax performance of the fund's other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through U.S. tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Returns after taxes on distributions and sale of fund shares may be higher than returns before taxes or returns after taxes on distributions due to an assumed tax benefit from losses on a sale of the fund's shares at the end of the period.

For the fund's Class Y shares, periods prior to the inception date reflect the performance of the fund's Class Z shares. Such performance figures have not been adjusted to reflect applicable class fees and expenses. Each share class is invested in the same portfolio of securities, and the annual returns would have differed only to the extent that the classes have different expenses.

Average Annual Total Returns (as of 12/31/22) | |||

Class (Inception Date) | 1 Year | 5 Years | 10 Years |

Class Z returns before taxes | -22.93% | 9.21% | 11.20% |

Class Z returns after taxes on distributions | -24.96% | 7.89% | 8.98% |

Class Z returns after taxes on distributions and sale of fund shares | -12.02% | 7.24% | 8.67% |

Class A returns before taxes | -27.50% | 7.70% | 10.33% |

Class C returns before taxes | -24.28% | 8.19% | 10.15% |

Class I returns before taxes | -22.83% | 9.29% | 11.30% |

Class Y (9/30/2016) returns before taxes | -22.86% | 9.29% | 11.26% |

S&P 500® Index reflects no deductions for fees, expenses or taxes | -18.10% | 9.42% | 12.55% |

The fund's investment adviser is BNY Mellon Investment Adviser, Inc. (BNYM Investment Adviser). BNYM Investment Adviser has engaged its affiliate, Newton Investment Management Limited (NIM), to serve as the fund's sub-investment adviser.

NIM has engaged its affiliate, Newton Investment Management North America, LLC (NIMNA), to provide certain advisory services to NIM for the benefit of the fund, including, but not limited to, portfolio management services.

Nick Pope and Julianne McHugh are the fund's primary portfolio managers. Mr. Pope and Ms. McHugh have been primary portfolio managers of the fund since January 2022 and March 2023, respectively. Mr. Pope is a portfolio manager on the

BNY Mellon Sustainable U.S. Equity Fund, Inc. Summary | 5 |

Sustainable Equity strategy at NIM. Ms. McHugh is Head of Sustainable Equities and a senior portfolio manager at NIMNA. NIM's Responsible Investment team provides input to the portfolio managers, including supporting fundamental research and company-level ESG analysis, which helps to identify sustainable investment themes, as well as controversy monitoring, company engagement and active proxy voting.

In general, for each share class, other than Class Y, the fund's minimum initial investment is $1,000 and the minimum subsequent investment is $100. For Class Y shares, the minimum initial investment generally is $1,000,000, with no minimum subsequent investment. Class Z shares generally are not available for new accounts. You may sell (redeem) your shares on any business day by calling 1-800-373-9387 (inside the U.S. only) or by visiting www.im.bnymellon.com. If you invested in the fund through a third party, such as a bank, broker-dealer or financial adviser, or through a Retirement Plan (as defined below), you may mail your request to sell shares to BNY Mellon Institutional Department, P.O. Box 534442, Pittsburgh, Pennsylvania 15253-4442. If you invested directly through the fund, you may mail your request to sell shares to BNY Mellon Shareholder Services, P.O. Box 534434, Pittsburgh, Pennsylvania 15253-4434. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions.

Retirement Plans include qualified or non-qualified employee benefit plans, such as 401(k), 403(b)(7), Keogh, pension, profit-sharing and other deferred compensation plans, whether established by corporations, partnerships, sole proprietorships, non-profit entities, trade or labor unions, or state and local governments, but do not include IRAs (including, without limitation, traditional IRAs, Roth IRAs, Coverdell Education Savings Accounts, IRA "Rollover Accounts" or IRAs set up under Simplified Employee Pension Plans (SEP-IRAs), Salary Reduction Simplified Employee Pension Plans (SARSEPs) or Savings Incentive Match Plans for Employees (SIMPLE IRAs)).

The fund's distributions are taxable as ordinary income or capital gains, except when your investment is through an IRA, Retirement Plan or other U.S. tax-advantaged investment plan (in which case you may be taxed upon withdrawal of your investment from such account).

If you purchase shares through a broker-dealer or other financial intermediary (such as a bank), the fund's distributor and its related companies may pay the intermediary for the sale of fund shares and related services. To the extent that the intermediary may receive lesser or no payments in connection with the sale of other investments, the payments from the fund's distributor and its related companies may create a potential conflict of interest by influencing the broker-dealer or other intermediary and your financial representative to recommend the fund over the other investments. This potential conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments or the provision of related services, the compensation rates and other payment arrangements that may apply to a financial intermediary and its representatives may vary by intermediary. Ask your financial representative or visit your financial intermediary's website for more information.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

Printed on recycled paper.

Printed on recycled paper.

50% post-consumer.

Process

chlorine free.

Vegetable-based ink.

BNY Mellon Sustainable U.S. Equity Fund, Inc. Summary | 6 |