File No. 2-40341

811-2192

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. [__]

Post-Effective Amendment No. 70 [X]

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 [X]

Amendment No. 70 [X]

(Check appropriate box or boxes.)

The Dreyfus Third Century Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

c/o The Dreyfus Corporation

200 Park Avenue, New York, New York 10166

(Address of Principal Executive Offices) (Zip Code)

Registrant's Telephone Number, including Area Code: (212) 922-6000

John Pak, Esq.

200 Park Avenue

New York, New York 10166

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box)

__ immediately upon filing pursuant to paragraph (b)

X on October 1, 2014 pursuant to paragraph (b)

____ days after filing pursuant to paragraph (a)(1)

__ on (date) pursuant to paragraph (a)(1)

____ days after filing pursuant to paragraph (a)(2)

__ on (date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

__ this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

The Dreyfus Third Century Fund, Inc.

|

|

Prospectus October 1, 2014 |

||

|

Class |

Ticker |

|

A |

DTCAX |

|

C |

DTCCX |

|

I |

DRTCX |

|

Z |

DRTHX |

|

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved |

|

Contents

See back cover.

Fund Summary

The fund seeks to provide capital growth, with current income as a secondary goal.

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in certain funds in the Dreyfus Family of Funds. More information about these and other discounts is available from your financial professional and in the Shareholder Guide section beginning on page 8 of this prospectus and in the How to Buy Shares section and the Additional Information About How to Buy Shares section beginning on page II-1 and page III-1, respectively, of the fund's Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) | ||||

|

Class A |

Class C |

Class I |

Class Z | |

|

Maximum sales charge (load) imposed on purchases |

5.75 |

none |

none |

none |

|

Maximum deferred sales charge (load) |

none* |

1.00 |

none |

none |

|

Annual Fund Operating Expenses (expenses that you pay each year as percentage of the value of your investment) | ||||

|

Class A |

Class C |

Class I |

Class Z | |

|

Management fees |

.75 |

.75 |

.75 |

.75 |

|

Distribution (12b-1) fees |

none |

.75 |

none |

none |

|

Other expenses (including shareholder services fees) |

.47 |

.49 |

.16 |

.26 |

|

Total annual fund operating expenses |

1.22 |

1.99 |

.91 |

1.01 |

*Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a deferred sales charge of 1.00% if redeemed within one year.

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$692 |

$940 |

$1,207 |

$1,967 |

|

Class C |

$302 |

$624 |

$1,073 |

$2,317 |

|

Class I |

$93 |

$290 |

$504 |

$1,120 |

|

Class Z |

$103 |

$322 |

$558 |

$1,236 |

You would pay the following expenses if you did not redeem your shares:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$692 |

$940 |

$1,207 |

$1,967 |

|

Class C |

$202 |

$624 |

$1,073 |

$2,317 |

|

Class I |

$93 |

$290 |

$504 |

$1,120 |

|

Class Z |

$103 |

$322 |

$558 |

$1,236 |

1

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 34.37% of the average value of its portfolio.

To pursue its goals, the fund, under normal circumstances, invests at least 80% of its net assets in the common stocks of companies that, in the opinion of the fund's management, meet traditional investment standards and conduct their business in a manner that contributes to the enhancement of the quality of life in America.

The fund's investment strategy combines a disciplined investment process that consists of computer modeling techniques, fundamental analysis and risk management with a social investment process. In selecting stocks, the portfolio managers begin by using computer models to identify and rank stocks within an industry or sector, based on several characteristics, including value, growth and financial profile.

Next, based on fundamental analysis, the portfolio managers designate the most attractive of the higher ranked securities as potential purchase candidates, drawing on a variety of sources, including company management and internal as well as Wall Street research.

The portfolio managers then evaluate each stock to determine whether the company enhances the quality of life in America by considering its record in the areas of protection and improvement of the environment and the proper use of our natural resources, occupational health and safety, consumer protection and product purity and equal employment opportunity.

The portfolio managers then further examine the companies determined to be eligible for purchase, by industry or sector, and select investments from those companies the portfolio managers consider to be the most attractive based on financial considerations.

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Social investment risk. A socially responsible investment criteria may limit the number of investment opportunities available to the fund, and as a result, at times the fund's returns may be lower than those funds that are not subject to such special investment considerations.

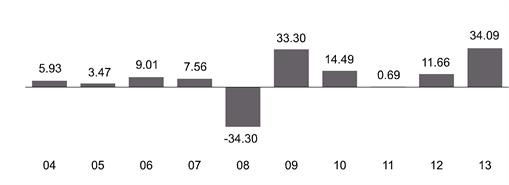

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Class Z shares from year to year. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. Sales charges, if any, are not reflected in the bar chart, and if those charges were included, returns would have been less than those shown. More recent performance information may be available at www.dreyfus.com.

2

|

Year-by-Year Total Returns as of 12/31 each year (%) Class Z | |

|

|

Best Quarter Worst Quarter |

The year-to-date total return of the fund's Class Z shares as of June 30, 2014 was 8.36%.

After-tax performance is shown only for Class Z shares. After tax performance of the fund's other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Total Returns (as of 12/31/13) | |||

|

1 Year |

5 Years |

10 Years | |

|

Class Z returns before taxes |

34.09% |

18.13% |

6.86% |

|

Class Z returns after taxes on distributions |

32.83% |

17.81% |

6.70% |

|

Class Z returns after taxes on distributions and sale of fund shares |

20.07% |

15.91% |

5.99% |

|

Class A returns before taxes |

26.11% |

16.44% |

5.95% |

|

Class C returns before taxes |

31.79% |

17.00% |

5.80% |

|

Class I returns before taxes |

34.26% |

18.30% |

6.93% |

|

S&P 500 Comp Stock Price Index |

32.37% |

17.93% |

7.40% |

The fund's investment adviser is The Dreyfus Corporation (Dreyfus). Investment decisions for the fund are made by the Active Equity Team of Mellon Capital Management Corporation (Mellon Capital), an affiliate of Dreyfus. The team members are C. Wesley Boggs, Warren Chiang, CFA and Ronald Gala, CFA, each of whom serves as portfolio manager of the fund. The team has managed the fund since May 2012. Mr. Boggs is a vice president and senior portfolio manager at Mellon Capital. Mr. Chiang is a managing director of active equity strategies at Mellon Capital. Mr. Gala is a director and senior portfolio manager at Mellon Capital. Each member of the team is also an employee of Dreyfus.

In general, for each share class, the fund's minimum initial investment is $1,000 and the minimum subsequent investment is $100. You may sell (redeem) your shares on any business day by calling 1-800-DREYFUS (inside the U.S. only) or by visiting www.dreyfus.com. If you invested in the fund through a third party, such as a bank, broker-dealer or financial adviser, or in a 401(k) or other retirement plan, you may mail your request to sell shares to Dreyfus Institutional Department, P.O. Box 9882, Providence, Rhode Island 02940-8082. If you invested directly through the fund, you may mail your request to sell shares to Dreyfus Shareholder Services, P.O. Box 9879, Providence, Rhode Island 02940-8079. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions.

The fund's distributions are taxable as ordinary income or capital gains, except when your investment is through an IRA, 401(k) plan or other tax-advantaged investment plan (in which case you may be taxed upon withdrawal of your investment from such account).

3

If you purchase shares through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

4

Fund Details

The fund seeks to provide capital growth, with current income as a secondary goal. To pursue its goals, the fund, under normal circumstances, invests at least 80% of its net assets in the common stocks of companies that, in the opinion of the fund's management, meet traditional investment standards determined as described below and conduct their business in a manner that contributes to the enhancement of the quality of life in America.

The fund's investment strategy combines a disciplined investment process that consists of computer modeling techniques, fundamental analysis and risk management with a social investment process. In selecting stocks, the portfolio managers begin by using computer models to identify and rank stocks within an industry or sector, based on several characteristics, including:

· value, or how a stock is priced relative to its perceived intrinsic worth

· growth, in this case the sustainability or growth of earnings

· financial profile, which measures the financial health of the company

Next, based on fundamental analysis, the portfolio managers designate the most attractive of the higher ranked securities as potential purchase candidates, drawing on a variety of sources, including company management and internal as well as Wall Street research.

The portfolio managers manage risk by diversifying across companies, industries and sectors, seeking to dilute the potential adverse impact from a decline in value of any one stock, industry or sector.

The portfolio managers then evaluate each stock considered to be a potential purchase candidate, by industry or sector, to determine whether the company enhances the quality of life in America by considering its record in the areas of:

· protection and improvement of the environment and the proper use of our natural resources

· occupational health and safety

· consumer protection and product purity

· equal employment opportunity

The portfolio managers use publicly available information, including reports prepared by "watchdog" groups and governmental agencies, as well as information obtained from research vendors, the media and the companies themselves, to assist them in the social screening process. Because there are few generally accepted standards for the portfolio managers to use in the evaluation, the portfolio managers will determine which research tools to use. The portfolio managers do not currently examine:

· corporate activities outside the U.S.

· nonbusiness activities

· secondary implications of corporate activities (such as the activities of a client or customer of the company being evaluated)

Consistent with its consumer protection screen, the fund will not purchase shares in a company that manufactures tobacco products.

If the portfolio managers determine that a company fails to meet the fund's social criteria, the stock will not be purchased, or if it is already owned, it will be sold as soon as reasonably possible, consistent with the best interests of the fund. If the portfolio managers' assessment does not reveal a negative pattern of conduct in these social areas, the company's stock is eligible for purchase or retention.

The portfolio managers then further examine the companies determined to be eligible for purchase, by industry or sector, and select investments from those companies the portfolio managers consider to be the most attractive based on financial considerations. If there is more than one company to choose from, the portfolio managers can select stocks of

5

companies that are considered to have records that exhibit positive accomplishments in the fund's areas of social concern.

The fund normally focuses on large-cap growth stocks. The portfolio managers may emphasize different types of growth-oriented stocks (such as those with pure growth characteristics or those that also have favorable value characteristics) and different market capitalizations within the large-capitalization range (such as mega cap or the low end of the large-capitalization range) as market conditions warrant. The fund also may invest in value-oriented stocks, mid-cap stocks and small-cap stocks. The fund also may invest in common stocks of foreign companies whose U.S. operations are evaluated in accordance with the social screens set forth above.

The fund also typically sells a stock when the portfolio managers believe there is a more attractive alternative, the stock's valuation is excessive or there are deteriorating fundamentals, such as a loss of competitive advantage, a failure in management execution or deteriorating capital structure.

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the FDIC or any other government agency. It is not a complete investment program. The value of your investment in the fund will fluctuate, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions that are not related to the particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally. A security's market value also may decline because of factors that affect the particular company, such as management performance, financial leverage, and reduced demand for the company's products or services, or factors that affect the company's industry, such as labor shortages or increased production costs and competitive conditions within an industry.

· Social investment risk. A socially responsible investment criteria may limit the number of investment opportunities available to the fund, and as a result, at times the fund's returns may be lower than those funds that are not subject to such special investment considerations.

In addition to the principal risks described above, the fund is subject to the following additional risks that are not anticipated to be principal risks of investing in the fund:

· Growth stock risk. Investors often expect growth companies to increase their earnings at a certain rate. If these expectations are not met, investors can punish the stocks inordinately, even if earnings do increase. In addition, growth stocks may lack the dividend yield that may cushion stock prices in market downturns.

· Value stock risk. Value stocks involve the risk that they may never reach their expected full market value, either because the market fails to recognize the stock's intrinsic worth or the expected value was misgauged. They also may decline in price even though in theory they are already undervalued.

· Market sector risk. The fund may significantly overweight or underweight certain companies, industries or market sectors, which may cause the fund's performance to be more or less sensitive to developments affecting those companies, industries or sectors.

· Other potential risks. The fund may lend its portfolio securities to brokers, dealers and other financial institutions. In connection with such loans, the fund will receive collateral from the borrower equal to at least 100% of the value of loaned securities. If the borrower of the securities fails financially, there could be delays in recovering the loaned securities or exercising rights to the collateral.

Under adverse market conditions, the fund could invest some or all of its assets in U.S. Treasury securities and money market securities. Although the fund would do this for temporary defensive purposes, it could reduce the benefit from any upswing in the market. During such periods, the fund may not achieve its investment objectives.

The investment adviser for the fund is The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Founded in 1947, Dreyfus manages approximately $253 billion in 167 mutual fund portfolios. For the past fiscal year, the fund paid Dreyfus a management fee at the annual rate of 0.75% of the fund's average daily net assets. A discussion regarding the basis for the board's approving the fund's management agreement with Dreyfus is available in the fund's semiannual report for the six-month period ended November 30, 2013. Dreyfus is the primary mutual fund business of

6

The Bank of New York Mellon Corporation (BNY Mellon), a global financial services company focused on helping clients manage and service their financial assets, operating in 35 countries and serving more than 100 markets. BNY Mellon is a leading investment management and investment services company, uniquely focused to help clients manage and move their financial assets in the rapidly changing global marketplace. BNY Mellon has $28.5 trillion in assets under custody and administration and $1.6 trillion in assets under management. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation. BNY Mellon Investment Management is one of the world's leading investment management organizations, and one of the top U.S. wealth managers, encompassing BNY Mellon's affiliated investment management firms, wealth management services and global distribution companies. Additional information is available at www.bnymellon.com.

The Dreyfus asset management philosophy is based on the belief that discipline and consistency are important to investment success. For each fund, Dreyfus seeks to establish clear guidelines for portfolio management and to be systematic in making decisions. This approach is designed to provide each fund with a distinct, stable identity.

Investment decisions for the fund are made by the Active Equity Team of Mellon Capital. The team members are C. Wesley Boggs, Warren Chiang, CFA and Ronald Gala, CFA, each of whom serves as portfolio manager of the fund and all of whom are jointly and primarily responsible for managing the fund's portfolio. The team has managed the fund since May 2012. Mr. Boggs is a vice president and senior portfolio manager at Mellon Capital, where he has been employed since 1993. He has also been employed by Dreyfus since 2007. Mr. Chiang is a managing director of active equity strategies at Mellon Capital, where he has been employed since 1997. He has also been employed by Dreyfus since 2007. Mr. Gala is a director and senior portfolio manager at Mellon Capital and has been employed by other current or predecessor BNY Mellon entities since 1993. He has also been employed by Dreyfus since 1998. There are no limitations on the role of a team member with respect to making investment decisions for the fund.

The fund's Statement of Additional Information (SAI) provides additional portfolio manager information, including compensation, other accounts managed and ownership of fund shares.

MBSC Securities Corporation (MBSC), a wholly-owned subsidiary of Dreyfus, serves as distributor of the fund and of the other funds in the Dreyfus Family of Funds. Any Rule 12b-1 fees and shareholder services fees, as applicable, are paid to MBSC for financing the sale and distribution of fund shares and for providing shareholder account service and maintenance, respectively. Dreyfus or MBSC may provide cash payments out of its own resources to financial intermediaries that sell shares of funds in the Dreyfus Family of Funds or provide other services. Such payments are separate from any sales charges, 12b-1 fees and/or shareholder services fees or other expenses that may be paid by a fund to those intermediaries. Because those payments are not made by fund shareholders or the fund, the fund's total expense ratio will not be affected by any such payments. These payments may be made to intermediaries, including affiliates, that provide shareholder servicing, sub-administration, recordkeeping and/or sub-transfer agency services, marketing support and/or access to sales meetings, sales representatives and management representatives of the financial intermediary. Cash compensation also may be paid from Dreyfus' or MBSC's own resources to intermediaries for inclusion of a fund on a sales list, including a preferred or select sales list or in other sales programs. These payments sometimes are referred to as "revenue sharing." From time to time, Dreyfus or MBSC also may provide cash or non-cash compensation to financial intermediaries or their representatives in the form of occasional gifts; occasional meals, tickets or other entertainment; support for due diligence trips; educational conference sponsorships; support for recognition programs; technology or infrastructure support; and other forms of cash or non-cash compensation permissible under broker-dealer regulations. In some cases, these payments or compensation may create an incentive for a financial intermediary or its employees to recommend or sell shares of the fund to you. Please contact your financial representative for details about any payments they or their firm may receive in connection with the sale of fund shares or the provision of services to the fund.

The fund, Dreyfus and MBSC have each adopted a code of ethics that permits its personnel, subject to such code, to invest in securities, including securities that may be purchased or held by the fund. Each code of ethics restricts the personal securities transactions of employees, and requires portfolio managers and other investment personnel to comply with the code's preclearance and disclosure procedures. The primary purpose of the respective codes is to ensure that personal trading by employees does not disadvantage any fund managed by Dreyfus or its affiliates.

7

Shareholder Guide

The fund is designed primarily for people who are investing through a third party, such as a bank, broker-dealer or financial adviser, or in a 401(k) or other retirement plan. Third parties with whom you open a fund account may impose policies, limitations and fees that are different from those described in this prospectus. Consult a representative of your plan or financial institution for further information.

This prospectus offers Class A, C, I and Z shares of the fund.

Your financial representative may receive different compensation for selling one class of shares than for selling another class. It is important to remember that any contingent deferred sales charge (CDSC) or Rule 12b-1 fees have the same purpose as the front-end sales charge: to compensate the distributor for concessions and expenses it pays to dealers and financial institutions in connection with the sale of fund shares. A CDSC is not charged on fund shares acquired through the reinvestment of fund dividends. Because the Rule 12b-1 fee is paid out of the fund's assets on an ongoing basis, over time it will increase the cost of your investment and may cost you more than paying other types of sales charges.

The different classes of fund shares represent investments in the same portfolio of securities, but the classes are subject to different expenses and will likely have different share prices. When choosing a class, you should consider your investment amount, anticipated holding period, the potential costs over your holding period and whether you qualify for any reduction or waiver of the sales charge.

A complete description of these classes follows. You should review these arrangements with your financial representative before determining which class to invest in.

Class A Shares

When you invest in Class A shares, you pay the public offering price, which is the share price, or net asset value (NAV), plus the initial sales charge that may apply to your purchase. The amount of the initial sales charge is based on the size of your investment, as the following table shows. We also describe below how you may reduce or eliminate the initial sales charge (see "Sales Charge Reductions and Waivers"). Class A shares are subject to an annual shareholder services fee of .25% paid to the fund's distributor for shareholder account service and maintenance.

Since some of your investment goes to pay an up-front sales charge when you purchase Class A shares, you purchase fewer shares than you would with the same investment in Class C shares. Nevertheless, you are usually better off purchasing Class A shares, rather than Class C shares, and paying an up-front sales charge if you:

· plan to own the shares for an extended period of time, since the ongoing Rule 12b-1 fees on Class C shares may eventually exceed the cost of the up-front sales charge; and

· qualify for a reduced or waived sales charge

If you invest $1 million or more (and are not eligible to purchase Class I shares), Class A shares will always be the most advantageous choice. Shareholders who received Class A shares in exchange for Class T shares of the fund may be eligible for lower sales charges. See the SAI for further details.

8

|

Total Sales Load -- Class A Shares | ||

|

Amount of Transaction |

As a % of Offering |

As a % of Net Asset Value per Share |

|

Less than $50,000 |

5.75 |

6.10 |

|

$50,000 to less than $100,000 |

4.50 |

4.71 |

|

$100,000 to less than $250,000 |

3.50 |

3.63 |

|

$250,000 to less than $500,000 |

2.50 |

2.56 |

|

$500,000 to less than $1,000,000 |

2.00 |

2.04 |

|

$1,000,000 or more |

-0- |

-0- |

No sales charge applies on investments of $1 million or more, but a CDSC of 1% may be imposed on certain redemptions of such shares within one year of the date of purchase.

Sales Charge Reductions and Waivers

To receive a reduction or waiver of your initial sales charge, you must let your financial intermediary or the fund know at the time you purchase shares that you qualify for such a reduction or waiver. If you do not let your financial intermediary or the fund know that you are eligible for a reduction or waiver, you may not receive the reduction or waiver to which you are otherwise entitled. In order to receive a reduction or waiver, you may be required to provide your financial intermediary or the fund with evidence of your qualification for the reduction or waiver, such as records regarding shares of certain Dreyfus Funds held in accounts with that financial intermediary and other financial intermediaries. Additional information regarding reductions and waivers of sales loads is available, free of charge, at www.dreyfus.com and in the SAI.

You can reduce your initial sales charge in the following ways:

· Rights of accumulation. You can count toward the amount of your investment your total account value in all share classes of the fund and certain other Dreyfus Funds that are subject to a sales charge. For example, if you have $1 million invested in shares of certain other Dreyfus Funds that are subject to a sales charge, you can invest in Class A shares of any fund without an initial sales charge. We may terminate or change this privilege at any time on written notice.

· Letter of intent. You can sign a letter of intent, in which you agree to invest a certain amount (your goal) in the fund and certain other Dreyfus Funds over a 13-month period, and your initial sales charge will be based on your goal. A 90-day back-dated period can also be used to count previous purchases toward your goal. Your goal must be at least $50,000, and your initial investment must be at least $5,000. The sales charge will be adjusted if you do not meet your goal.

· Combine with family members. You can also count toward the amount of your investment all investments in certain other Dreyfus Funds, in any class of shares that is subject to a sales charge, by your spouse and your children under age 21 (family members), including their rights of accumulation and goals under a letter of intent. Certain other groups may also be permitted to combine purchases for purposes of reducing or eliminating sales charges. See "How to Buy Shares" in the SAI.

Class A shares may be purchased at NAV without payment of a sales charge by the following individuals and entities:

· full-time or part-time employees, and their family members, of Dreyfus or any of its affiliates

· board members of Dreyfus and board members of the Dreyfus Family of Funds

· full-time employees, and their family members, of financial institutions that have entered into selling agreements with the fund's distributor

· "wrap" accounts for the benefit of clients of financial institutions, provided they have entered into an agreement with the fund's distributor specifying operating policies and standards

· qualified separate accounts maintained by an insurance company; any state, county or city or instrumentality thereof; and charitable organizations investing $50,000 or more in fund shares and charitable remainder trusts, provided that such Class A shares are purchased directly through the fund's distributor

· investors who purchase Class A shares directly through the fund's distributor, and either (i) have, or whose spouse or minor children have, beneficially owned shares and continuously maintained an open account with the distributor in a Dreyfus-managed fund since on or before February 28, 2006, or (ii) such purchase is for a self-directed investment account that may or may not be subject to a transaction fee

9

· investors who participate in a self-directed investment brokerage account program offered by a financial intermediary that has entered into an agreement with the fund's distributor. Financial intermediaries offering self-directed investment brokerage accounts may or may not charge their customers a transaction fee

· investors with the cash proceeds from the investor's exercise of stock options and/or disposition of stock related to employment-based stock plans, whether invested in the fund directly or indirectly through an exchange from a Dreyfus money market fund, provided that the proceeds are processed through an entity that has entered into an agreement with the fund's distributor specifically relating to administering employment-based stock plans. Upon establishing the account in the fund or the Dreyfus money market fund, the investor and the investor's spouse and minor children become eligible to purchase Class A shares of the fund at NAV, whether or not the investor uses the proceeds of the employment-based stock plan to establish the account

· members of qualified affinity groups who purchase Class A shares directly through the fund's distributor, provided that the qualified affinity group has entered into an affinity agreement with the distributor

· investors who have continuously owned shares of the fund since before the imposition of a sales load

· charitable organizations investing $50,000 or more in fund shares and charitable remainder trusts, provided that such Class A shares are purchased directly through the fund's distributor

· employees participating in qualified or non-qualified employee benefit plans, including pension, profit-sharing and other deferred compensation plans, whether established by corporations, partnerships, non-profit entities, trade or labor unions, or state and local governments (Retirement Plans), but not including IRAs, IRA "Rollover Accounts" or IRAs set up under Simplified Employee Pension Plans (SEP-IRAs), Salary Reduction Simplified Employee Pension Plans (SARSEPs) or Savings Incentive Match Plans for Employees (SIMPLE IRAs)

· shareholders in Dreyfus-sponsored IRA rollover accounts funded with the distribution proceeds from Retirement Plans or a Dreyfus-sponsored 403(b)(7) plan, provided that, in the case of a Retirement Plan, the rollover is processed through an entity that has entered into an agreement with the fund's distributor specifically relating to processing rollovers. Upon establishing the Dreyfus-sponsored IRA rollover account in the fund, the shareholder becomes eligible to make subsequent purchases of Class A shares of the fund at NAV in such account

Class C Shares

Since you pay no initial sales charge, an investment of less than $1 million in Class C shares buys more shares than the same investment would in Class A shares. However, Class C shares are subject to an annual Rule 12b-1 fee of .75% and an annual shareholder services fee of .25%.. Because the Rule 12b-1 fees are paid out of the fund's assets attributable to Class C shares on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges, such as the initial sales charge on Class A shares. Class C shares redeemed within one year of purchase are subject to a 1% CDSC.

Because Class A shares will always be a more favorable investment than Class C shares for investments of $1 million or more, the fund will generally not accept a purchase order for Class C shares in the amount of $1 million or more. While the fund will take reasonable steps to prevent investments of $1 million or more in Class C shares, it may not be able to identify such investments made through certain financial intermediaries or omnibus accounts.

Class I Shares

Since you pay no initial sales charge, an investment of less than $1 million in Class I shares buys more shares than the same investment would in a class of shares subject to an initial sales charge. There is also no CDSC imposed on redemptions of Class I shares, and you do not pay any ongoing service or distribution fees.

Class I shares may be purchased by:

· bank trust departments, trust companies and insurance companies that have entered into agreements with the fund's distributor to offer Class I shares to their clients

· institutional investors acting in a fiduciary, advisory, agency, custodial or similar capacity for Retirement Plans and SEP-IRAs that have entered into agreements with the fund's distributor to offer Class I shares to such plans

· law firms or attorneys acting as trustees or executors/administrators

· foundations and endowments that make an initial investment in the fund of at least $1 million

· sponsors of college savings plans that qualify for tax-exempt treatment under Section 529 of the Internal Revenue Code, that maintain an omnibus account with the fund and do not require shareholder tax reporting or 529 account support responsibilities from the fund's distributor

10

· advisory fee-based accounts offered through financial intermediaries who, depending on the structure of the selected advisory platform, make Class I shares available

· certain institutional clients of a BNY Mellon investment advisory subsidiary, provided that such clients are approved by Dreyfus

· unaffiliated investment companies approved by the fund's distributor

Institutions purchasing fund shares on behalf of their clients determine whether Class I shares will be available for their clients. Accordingly, the availability of Class I shares of the fund will depend on the policies of the institutional investor.

Class Z Shares

Since you pay no initial sales charge, Class Z shares generally are offered only to shareholders of the fund who are holders of an account in the fund which existed on August 30, 1999 and continues to exist at the time of the current purchase of Class Z shares. Class Z shares are subject to an annual shareholder services fee of up to .25% to reimburse the fund's distributor for shareholder account service and maintenance expenses related to Class Z shares.

CDSC Waivers

The fund's CDSC on Class A and C shares may be waived in the following cases:

· permitted exchanges of shares, except if shares acquired by exchange are then redeemed within the period during which a CDSC would apply to the initial shares purchased

· redemptions made within one year of death or disability of the shareholder

· redemptions due to receiving required minimum distributions from retirement accounts upon reaching age 70½

· redemptions made through the fund's Automatic Withdrawal Plan, if such redemptions do not exceed 12% of the value of the account annually

· redemptions by Retirement Plans

Dreyfus calculates fund NAVs as of the close of trading on the New York Stock Exchange (NYSE) (usually 4:00 p.m. Eastern time) on days the NYSE is open for regular business. Your order will be priced at the next NAV calculated after your order is received in proper form by the fund's transfer agent or other authorized entity. When calculating NAVs, Dreyfus values equity investments on the basis of market quotations or official closing prices. Dreyfus generally values fixed-income investments based on values supplied by an independent pricing service approved by the fund's board. The pricing service's procedures are reviewed under the general supervision of the board. If market quotations or official closing prices or valuations from a pricing service are not readily available, or are determined not to reflect accurately fair value, the fund may value those investments at fair value as determined in accordance with procedures approved by the fund's board. Fair value of investments may be determined by the fund's board, its pricing committee or its valuation committee in good faith using such information as it deems appropriate under the circumstances. Under certain circumstances, the fair value of foreign equity securities will be provided by an independent pricing service. Using fair value to price investments may result in a value that is different from a security's most recent closing price and from the prices used by other mutual funds to calculate their net asset values. Foreign securities held by a fund may trade on days when the fund does not calculate its NAV and thus may affect the fund's NAV on days when investors will not be able to purchase or sell (redeem) fund shares.

Investments in certain types of thinly traded securities may provide short-term traders arbitrage opportunities with respect to the fund's shares. For example, arbitrage opportunities may exist when trading in a portfolio security or securities is halted and does not resume, or the market on which such securities are traded closes before the fund calculates its NAV. If short-term investors in the fund were able to take advantage of these arbitrage opportunities, they could dilute the NAV of fund shares held by long-term investors. Portfolio valuation policies can serve to reduce arbitrage opportunities available to short-term traders, but there is no assurance that such valuation policies will prevent dilution of the fund's NAV by short-term traders. While the fund has a policy regarding frequent trading, it too may not be completely effective to prevent short-term NAV arbitrage trading, particularly in regard to omnibus accounts. Please see "Shareholder Guide — General Policies" for further information about the fund's frequent trading policy.

Orders to buy and sell shares received by an authorized entity (such as a bank, broker-dealer or financial adviser, or 401(k) or other retirement plan that has entered into an agreement with the fund's distributor) by the close of trading on the NYSE and transmitted to the distributor or its designee by the close of its business day (usually 5:15 p.m. Eastern time) will be based on the NAV determined as of the close of trading on the NYSE that day.

11

How to Buy Shares

By Mail.

Regular Accounts. To open a regular account, complete an application and mail it, together with a check payable to The Dreyfus Family of Funds, to the appropriate address below. To purchase additional shares in a regular account, mail a check payable to The Dreyfus Family of Funds (with your account number on your check), together with an investment slip, to the appropriate address below.

IRA Accounts. To open an IRA account or make additional investments in an IRA account, be sure to specify the fund name and the year for which the contribution is being made. When opening a new account include a completed IRA application, and when making additional investments include an investment slip. Make checks payable to The Dreyfus Family of Funds, and mail to the appropriate address below.

Mailing Address. If you are investing directly through the fund, mail to:

Dreyfus Shareholder Services

P.O. Box 9879

Providence, Rhode Island 02940-8079

If you are investing through a third party, such as a bank, broker-dealer or financial adviser, or in a 401(k) or other retirement plan, mail to:

Dreyfus Institutional Department

P.O. Box 9882

Providence, Rhode Island 02940-8082

If you are applying for an Institutional Direct account, please contact your BNY Mellon relationship manager for mailing instructions.

Electronic Check or Wire. To purchase shares in a regular or IRA account by wire or electronic check, please call 1-800-DREYFUS (inside the U.S. only) for more information.

Telephone or Online. To purchase additional shares by telephone or online, you can call 1-800-DREYFUS (inside the U.S. only) or visit www.dreyfus.com to request your transaction. In order to do so, you must have elected the Dreyfus TeleTransfer Privilege on your account application or a Shareholder Services Form. See "Services for Fund Investors — Wire Redemption and Dreyfus TeleTransfer Privileges" for more information. Institutional Direct accounts are not eligible for online services.

Automatically. You may purchase additional shares in a regular or IRA account by selecting one of Dreyfus' automatic investment services made available to the fund on your account application or service application. See "Services for Fund Investors."

The minimum initial and subsequent investment for regular accounts is $1,000 and $100, respectively. The minimum initial investment for IRAs is $750, with no minimum subsequent investment. The minimum initial investment for education savings accounts is $500, with no minimum subsequent investment. Subsequent investments made through Dreyfus TeleTransfer are subject to a $100 minimum and a $150,000 maximum. All investments must be in U.S. dollars. Third-party checks, cash, travelers' checks or money orders will not be accepted. You may be charged a fee for any check that does not clear.

How to Sell Shares

You may sell (redeem) shares at any time. Your shares will be sold at the next NAV calculated after your order is received in proper form by the fund's transfer agent or other authorized entity. Any certificates representing fund shares being sold must be returned with your redemption request. Your order will be processed promptly and you will generally receive the proceeds within a week.

To keep your CDSC as low as possible, each time you request to sell shares we will first sell shares that are not subject to a CDSC, and then those subject to the lowest charge. The CDSC is based on the lesser of the original purchase cost or the current market value of the shares being sold, and is not charged on fund shares you acquired by reinvesting your fund dividends. As described above in this prospectus, there are certain instances when you may qualify to have the CDSC waived. Consult your financial representative or refer to the SAI for additional details.

Before selling shares recently purchased by check, Dreyfus TeleTransfer or Automatic Asset Builder, please note that:

· if you send a written request to sell such shares, the fund may delay sending the proceeds for up to eight business days following the purchase of those shares

12

· the fund will not process wire, telephone, online or Dreyfus TeleTransfer redemption requests for up to eight business days following the purchase of those shares

By Mail.

Regular Accounts. To redeem shares in a regular account by mail, send a letter of instruction that includes your name, your account number, the name of the fund, the share class, the dollar amount to be redeemed and how and where to send the proceeds. Mail your request to the appropriate address below.

IRA Accounts. To redeem shares in an IRA account by mail, send a letter of instruction that includes all of the same information for regular accounts and indicate whether the distribution is qualified or premature and whether the 10% TEFRA should be withheld. Mail your request to the appropriate address below.

Mailing Address. If you invested directly through the fund, mail to:

Dreyfus Shareholder Services

P.O. Box 9879

Providence, Rhode Island 02940-8079

If you invested through a third party, such as a bank, broker-dealer or financial adviser, or in a 401(k) or other retirement plan, mail to:

Dreyfus Institutional Department

P.O. Box 9882

Providence, Rhode Island 02940-8082

If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for mailing instructions.

A medallion signature guarantee is required for some written sell orders. These include:

· amounts of $10,000 or more on accounts whose address has been changed within the last 30 days

· requests to send the proceeds to a different payee or address

· amounts of $100,000 or more

A medallion signature guarantee helps protect against fraud. You can obtain one from most banks or securities dealers, but not from a notary public. For joint accounts, each signature must be guaranteed. Please call to ensure that your medallion signature guarantee will be processed correctly.

Telephone or Online. To redeem shares by telephone or online, call 1-800-DREYFUS (inside the U.S. only) or, for regular accounts, visit www.dreyfus.com to request your transaction. Institutional Direct accounts are not eligible for online services.

By calling 1-800-DREYFUS (inside the U.S. only), you may speak to a Dreyfus representative and request that redemption proceeds be paid by check and mailed to your address of record (maximum $250,000 per day). For redemption requests made online through www.dreyfus.com or through Dreyfus Express® automated account access system, there is a $100,000 per day limit.

If the fund has your bank account information on file, you may request a wire via the Wire Redemption Privilege ($1,000 minimum) or electronic check via the Dreyfus TeleTransfer Privilege ($500 minimum) and proceeds will be wired or sent by electronic check, as applicable, to your bank account. See "Services for Fund Investors — Wire Redemption and Dreyfus TeleTransfer Privileges" for more information.

Automatically. You may sell shares in a regular account by completing a Dreyfus Automatic Withdrawal Form which you can obtain by calling 1-800-DREYFUS (inside the U.S. only), visiting www.dreyfus.com or contacting your financial representative. For instructions on how to establish automatic withdrawals to sell shares in an IRA account, please call 1-800-DREYFUS (inside the U.S. only) or contact your financial representative. See "Services for Fund Investors — Automatic Services."

The fund and the fund's transfer agent are authorized to act on telephone or online instructions from any person representing himself or herself to be you and reasonably believed by the fund or the transfer agent to be genuine. You may be responsible for any fraudulent telephone or online order as long as the fund or the fund's transfer agent (as applicable) takes reasonable measures to confirm that the instructions are genuine.

13

The fund reserves the right to reject any purchase or exchange request in whole or in part. All shareholder services and privileges offered to shareholders may be modified or terminated at any time, except as otherwise stated in the fund's SAI. Please see the fund's SAI for additional information on buying and selling shares, privileges and other shareholder services.

The fund is designed for long-term investors. Frequent purchases, redemptions and exchanges may disrupt portfolio management strategies and harm fund performance by diluting the value of fund shares and increasing brokerage and administrative costs. As a result, Dreyfus and the fund's board have adopted a policy of discouraging excessive trading, short-term market timing and other abusive trading practices (frequent trading) that could adversely affect the fund or its operations. Dreyfus and the fund will not enter into arrangements with any person or group to permit frequent trading.

The fund also reserves the right to:

· change or discontinue fund exchanges, or temporarily suspend exchanges during unusual market conditions

· change its minimum or maximum investment amounts

· delay sending out redemption proceeds for up to seven days (generally applies only during unusual market conditions or in cases of very large redemptions or excessive trading)

· "redeem in kind," or make payments in securities rather than cash, if the amount redeemed is large enough to affect fund operations (for example, if it exceeds 1% of the fund's assets)

· refuse any purchase or exchange request, including those from any individual or group who, in Dreyfus' view, is likely to engage in frequent trading

More than four roundtrips within a rolling 12-month period generally is considered to be frequent trading. A roundtrip consists of an investment that is substantially liquidated within 60 days. Based on the facts and circumstances of the trades, the fund may also view as frequent trading a pattern of investments that are partially liquidated within 60 days.

Transactions made through Automatic Withdrawal Plans, Dreyfus Auto-Exchange Privileges, automatic investment plans (including Dreyfus Automatic Asset Builder®), automatic non-discretionary rebalancing programs, and minimum required retirement distributions generally are not considered to be frequent trading. For employer-sponsored benefit plans, generally only participant-initiated exchange transactions are subject to the roundtrip limit.

Dreyfus monitors selected transactions to identify frequent trading. When its surveillance systems identify multiple roundtrips, Dreyfus evaluates trading activity in the account for evidence of frequent trading. Dreyfus considers the investor's trading history in other accounts under common ownership or control, in other Dreyfus Funds and BNY Mellon Funds and, if known, in non-affiliated mutual funds and accounts under common control. These evaluations involve judgments that are inherently subjective, and while Dreyfus seeks to apply the policy and procedures uniformly, it is possible that similar transactions may be treated differently. In all instances, Dreyfus seeks to make these judgments to the best of its abilities in a manner that it believes is consistent with shareholder interests. If Dreyfus concludes the account is likely to engage in frequent trading, Dreyfus may cancel or revoke the purchase or exchange on the following business day. Dreyfus may also temporarily or permanently bar such investor's future purchases into the fund in lieu of, or in addition to, canceling or revoking the trade. At its discretion, Dreyfus may apply these restrictions across all accounts under common ownership, control or perceived affiliation.

Fund shares often are held through omnibus accounts maintained by financial intermediaries, such as brokers and retirement plan administrators, where the holdings of multiple shareholders, such as all the clients of a particular broker, are aggregated. Dreyfus' ability to monitor the trading activity of investors whose shares are held in omnibus accounts is limited. However, the agreements between the distributor and financial intermediaries include obligations to comply with the terms of this prospectus and to provide Dreyfus, upon request, with information concerning the trading activity of investors whose shares are held in omnibus accounts. If Dreyfus determines that any such investor has engaged in frequent trading of fund shares, Dreyfus may require the intermediary to restrict or prohibit future purchases or exchanges of fund shares by that investor.

Certain retirement plans and intermediaries that maintain omnibus accounts with the fund may have developed policies designed to control frequent trading that may differ from the fund's policy. At its sole discretion, the fund may permit such intermediaries to apply their own frequent trading policy. If you are investing in fund shares through an intermediary (or in the case of a retirement plan, your plan sponsor), please contact the intermediary for information on the frequent trading policies applicable to your account.

To the extent the fund significantly invests in foreign securities traded on markets that close before the fund calculates its NAV, events that influence the value of these foreign securities may occur after the close of these foreign markets and before the fund calculates its NAV. As a result, certain investors may seek to trade fund shares in an effort to

14

benefit from their understanding of the value of these foreign securities at the time the fund calculates its NAV (referred to as price arbitrage). This type of frequent trading may dilute the value of fund shares held by other shareholders. The fund has adopted procedures designed to adjust closing market prices of foreign equity securities under certain circumstances to reflect what it believes to be their fair value.

To the extent the fund significantly invests in thinly traded securities, certain investors may seek to trade fund shares in an effort to benefit from their understanding of the value of these securities (referred to as price arbitrage). Any such frequent trading strategies may interfere with efficient management of the fund's portfolio to a greater degree than funds that invest in highly liquid securities, in part because the fund may have difficulty selling these portfolio securities at advantageous times or prices to satisfy large and/or frequent redemption requests. Any successful price arbitrage may also cause dilution in the value of fund shares held by other shareholders.

Although the fund's frequent trading and fair valuation policies and procedures are designed to discourage market timing and excessive trading, none of these tools alone, nor all of them together, completely eliminates the potential for frequent trading.

Small Account Policy

If your account falls below $500, the fund may ask you to increase your balance. If it is still below $500 after 45 days, the fund may close your account and send you the proceeds.

The fund earns dividends, interest and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions. The fund normally pays dividends and capital gain distributions annually. Fund dividends and capital gain distributions will be reinvested in the fund unless you instruct the fund otherwise. There are no fees or sales charges on reinvestments.

Distributions paid by the fund are subject to federal income taxes, and may also be subject to state or local taxes (unless you are investing through a tax-advantaged retirement account). For federal tax purposes, in general, certain fund distributions, including distributions of short-term capital gains, are taxable as ordinary income. Other fund distributions, including dividends from certain U.S. companies and certain foreign companies and distributions of long-term capital gains, generally are taxable as qualified dividends and capital gains, respectively.

High portfolio turnover and more volatile markets can result in significant taxable distributions to shareholders, regardless of whether their shares have increased in value. The tax status of any distribution generally is the same regardless of how long you have been in the fund and whether you reinvest your distributions or take them in cash.

If you buy shares of a fund when the fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion back in the form of a taxable distribution.

Your sale of shares, including exchanges into other funds, may result in a capital gain or loss for tax purposes. A capital gain or loss on your investment in the fund generally is the difference between the cost of your shares and the amount you receive when you sell them.

The tax status of your distributions will be detailed in your annual tax statement from the fund. Because everyone's tax situation is unique, please consult your tax adviser before investing.

Automatic Services

Buying or selling shares automatically is easy with the services described below. With each service, you select a schedule and amount, subject to certain restrictions. If you purchase shares through a third party, the third party may impose different restrictions on these services and privileges, or may not make them available at all. For information, call 1-800-DREYFUS (inside the U.S. only) or your financial representative.

Dreyfus Automatic Asset Builder® permits you to purchase fund shares (minimum of $100 and maximum of $150,000 per transaction) at regular intervals selected by you. Fund shares are purchased by transferring funds from the bank account designated by you.

Dreyfus Payroll Savings Plan permits you to purchase fund shares (minimum of $100 per transaction) automatically through a payroll deduction.

15

Dreyfus Government Direct Deposit permits you to purchase fund shares (minimum of $100 and maximum of $50,000 per transaction) automatically from your federal employment, Social Security or other regular federal government check.

Dreyfus Dividend Sweep permits you to automatically reinvest dividends and distributions from the fund into another Dreyfus Fund (not available for IRAs).

Dreyfus Auto-Exchange Privilege permits you to exchange at regular intervals your fund shares for shares of other Dreyfus Funds.

Dreyfus Automatic Withdrawal Plan permits you to make withdrawals (minimum of $50) on a specific day each month, quarter or semi-annual or annual period, provided your account balance is at least $5,000. Any CDSC will be waived, as long as the amount of any withdrawal does not exceed on an annual basis 12% of the greater of the account value at the time of the first withdrawal under the plan, or at the time of the subsequent withdrawal.

Fund Exchanges

Generally, you can exchange shares worth $500 or more (no minimum for retirement accounts) into shares of the same class, or another class in which you are eligible to invest, of another fund in the Dreyfus Family of Funds. You can request your exchange by calling 1-800-DREYFUS (inside the U.S. only) or your financial representative. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions. Be sure to read the current prospectus for any fund into which you are exchanging before investing. Any new account established through an exchange generally will have the same privileges as your original account (as long as they are available). There is currently no fee for exchanges, although you may be charged a sales load when exchanging into any fund that has one.

Your exchange request will be processed on the same business day it is received in proper form, provided that each fund is open at the time of the request. If the exchange is accepted at a time of day after one or both of the funds is closed (i.e., at a time after the NAV for the fund has been calculated for that business day), the exchange will be processed on the next business day. See the SAI for more information regarding exchanges.

Wire Redemption and Dreyfus TeleTransfer Privileges

To redeem shares from your Dreyfus Fund account with a phone call (for regular or IRA accounts) or online (for regular accounts only), use the Wire Redemption Privilege or the Dreyfus TeleTransfer Privilege. To purchase additional shares of your Dreyfus Fund account with a phone call (for regular or IRA accounts) or online (for regular accounts only), use the Dreyfus TeleTransfer Privilege. You can set up the Wire Redemption Privilege and Dreyfus TeleTransfer Privilege on your account by providing bank account information and following the instructions on your application or, if your account has already been established, a Shareholder Services Form which you can obtain by calling 1-800-DREYFUS (inside the U.S. only), visiting www.dreyfus.com or by contacting your financial representative. Shares held in an education savings account may not be redeemed through the Wire Redemption or Dreyfus TeleTransfer Privileges. Institutional Direct accounts are not eligible for the Wire Redemption or Dreyfus TeleTransfer Privileges initiated online.

Account Statements

Every Dreyfus Fund investor automatically receives regular account statements. You will also be sent a yearly statement detailing the tax characteristics of any dividends and distributions you have received.

Reinvestment Privilege

If you redeem Class A shares of the fund, you can reinvest in the same account of the fund up to the number of Class A shares you redeemed at the current share price without paying a sales charge. If you paid a CDSC, it will be credited back to your account. This privilege may be used only once and your reinvestment request must be received in writing by the fund within 45 days of the redemption.

Dreyfus Express® Voice-Activated Account Access

You can check your Dreyfus account balances, get fund price and performance information, order documents and much more, by calling 1-800-DREYFUS (inside the U.S. only) and using the Dreyfus Express® Voice-Activated System. You may also be able to purchase fund shares and/or transfer money between your Dreyfus Funds using Dreyfus Express®. Certain requests require the services of a representative.

16

These financial highlights describe the performance of the fund's shares for the fiscal periods indicated. "Total return" shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These financial highlights have been derived from the fund's financial statements, which have been audited by Ernst & Young LLP, an independent registered public accounting firm, whose report, along with the fund's financial statements, is included in the annual report, which is available upon request.

|

|

Year Ended May 31, | ||||

|

Class A Shares |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Per Share Data ($): |

|

|

| ||

|

Net asset value, beginning of period |

12.76 |

10.24 |

10.61 |

8.36 |

7.08 |

|

Investment Operations: |

|

|

| ||

|

Investment income--neta |

.10 |

.13 |

.05 |

.03 |

.03 |

|

Net realized and unrealized gain (loss) on investments |

2.45 |

2.46 |

(.38) |

2.24 |

1.25 |

|

Total from Investment Operations |

2.55 |

2.59 |

(.33) |

2.27 |

1.28 |

|

Distributions: |

|

|

| ||

|

Dividends from investment income--net |

(.14) |

(.05) |

(.04) |

(.02) |

- |

|

Dividends from net realized gain on investments |

(.35) |

(.02) |

- |

- |

- |

|

Total Distributions |

(.49) |

(.07) |

(.04) |

(.02) |

- |

|

Net asset value, end of period |

14.82 |

12.76 |

10.24 |

10.61 |

8.36 |

|

Total Return (%)b |

20.37 |

25.47 |

(3.13) |

27.18 |

18.08 |

|

Ratios/Supplemental Data (%): |

|

|

| ||

|

Ratio of total expenses to average net assets |

1.22 |

1.25 |

1.31 |

1.39 |

1.35 |

|

Ratio of net expenses to average net assets |

1.22 |

1.25 |

1.31 |

1.39 |

1.35 |

|

Ratio of net investment income to average net assets |

.70 |

1.11 |

.46 |

.32 |

.40 |

|

Portfolio Turnover Rate |

34.37 |

48.33 |

64.12 |

50.46 |

35.17 |

|

Net Assets, end of period ($ x 1,000) |

24,320 |

17,562 |

14,469 |

15,154 |

13,252 |

|

aBased on average shares outstanding at each month end. | |||||

|

bExclusive of sales charge. | |||||

|

|

Year Ended May 31, | ||||

|

Class C Shares |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Per Share Data ($): |

|

|

| ||

|

Net asset value, beginning of period |

11.72 |

9.43 |

9.80 |

7.75 |

6.63 |

|

Investment Operations: |

|

|

| ||

|

Investment income (loss)--neta |

(.01) |

.04 |

(.03) |

(.03) |

(.03) |

|

Net realized and unrealized gain (loss) on investments |

2.23 |

2.27 |

(.34) |

2.08 |

1.17 |

|

Total from Investment Operations |

2.22 |

2.31 |

(.37) |

2.05 |

1.14 |

|

Distributions: |

|

|

| ||

|

Dividends from investment income--net |

(.07) |

- |

- |

- |

(.02) |

|

Dividends from net realized gain on investments |

(.35) |

(.02) |

- |

- |

- |

|

Total Distributions |

(.42) |

(.02) |

- |

- |

(.02) |

|

Net asset value, end of period |

13.52 |

11.72 |

9.43 |

9.80 |

7.75 |

|

Total Return (%)b |

19.33 |

24.55 |

(3.78) |

26.45 |

17.16 |

|

Ratios/Supplemental Data (%): |

|

|

| ||

|

Ratio of total expenses to average net assets |

1.99 |

2.00 |

2.05 |

2.00 |

2.09 |

|

Ratio of net expenses to average net assets |

1.99 |

2.00 |

2.05 |

2.00 |

2.09 |

|

Ratio of net investment income (loss) to average net assets |

(.07) |

.35 |

(.27) |

(.29) |

(.39) |

|

Portfolio Turnover Rate |

34.37 |

48.33 |

64.12 |

50.46 |

35.17 |

|

Net Assets, end of period ($ x 1,000) |

5,800 |

4,332 |

3,313 |

2,944 |

2,652 |

|

aBased on average shares outstanding at each month end. | |||||

|

bExclusive of sales charge. | |||||

17

|

|

Year Ended May 31, | ||||

|

Class I Shares |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Per Share Data ($): |

|

|

| ||

|

Net asset value, beginning of period |

12.95 |

10.39 |

10.77 |

8.48 |

7.23 |

|

Investment Operations: |

|

| |||

|

Investment income--neta |

.14 |

.17 |

.09 |

.08 |

.06 |

|

Net realized and unrealized gain (loss) on investments |

2.48 |

2.51 |

(.38) |

2.28 |

1.27 |

|

Total from Investment Operations |

2.62 |

2.68 |

(.29) |

2.36 |

1.33 |

|

Distributions: |

|

| |||

|

Dividends from investment income--net |

(.18) |

(.10) |

(.09) |

(.07) |

(.08) |

|

Dividends from net realized gain on investments |

(.35) |

(.02) |

- |

- |

- |

|

Total Distributions |

(.53) |

(.12) |

(.09) |

(.07) |

(.08) |

|

Net asset value, end of period |

15.04 |

12.95 |

10.39 |

10.77 |

8.48 |

|

Total Return (%) |

20.65 |

25.98 |

(2.72) |

27.87 |

18.43 |

|

Ratios/Supplemental Data (%): |

|

| |||

|

Ratio of total expenses to average net assets |

.91 |

.90 |

.92 |

.89 |

1.01 |

|

Ratio of net expenses to average net assets |

.91 |

.90 |

.92 |

.89 |

1.01 |

|

Ratio of net investment income to average net assets |

1.01 |

1.46 |

.86 |

.83 |

.71 |

|

Portfolio Turnover Rate |

34.37 |

48.33 |

64.12 |

50.46 |

35.17 |

|

Net Assets, end of period ($ x 1,000) |

8,629 |

4,558 |

2,766 |

2,043 |

1,651 |

|

aBased on average shares outstanding at each month end. | |||||

|

|

Year Ended May 31, | ||||

|

Class Z Shares |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Per Share Data ($): |

|

|

| ||

|

Net asset value, beginning of period |

12.94 |

10.38 |

10.76 |

8.48 |

7.22 |

|

Investment Operations: |

|

| |||

|

Investment income--neta |

.13 |

.15 |

.07 |

.07 |

.05 |

|

Net realized and unrealized gain (loss) on investments |

2.47 |

2.51 |

(.38) |

2.27 |

1.28 |

|

Total from Investment Operations |

2.60 |

2.66 |

(.31) |

2.34 |

1.33 |

|

Distributions: |

|

| |||

|

Dividends from investment income--net |

(.16) |

(.08) |

(.07) |

(.06) |

(.07) |

|

Dividends from net realized gain on investments |

(.35) |

(.02) |

- |

- |

- |

|

Total Distributions |

(.51) |

(.10) |

(.07) |

(.06) |

(.07) |

|

Net asset value, end of period |

15.03 |

12.94 |

10.38 |

10.76 |

8.48 |

|

Total Return (%) |

20.50 |

25.80 |

(2.86) |

27.61 |

18.40 |

|

Ratios/Supplemental Data (%): |

|

| |||

|

Ratio of total expenses to average net assets |

1.01 |

1.03 |

1.07 |

1.03 |

1.10 |

|

Ratio of net expenses to average net assets |

1.01 |

1.03 |

1.07 |

1.03 |

1.10 |

|

Ratio of net investment income to average net assets |

.91 |

1.32 |

.71 |

.68 |

.60 |

|

Portfolio Turnover Rate |

34.37 |

48.33 |

64.12 |

50.46 |

35.17 |

|

Net Assets, end of period ($ x 1,000) |

283,351 |

255,298 |

221,387 |

247,051 |

210,701 |

|

aBased on average shares outstanding at each month end. | |||||

18

NOTES

19

NOTES

20

NOTES

21

For More Information

The Dreyfus Third Century Fund, Inc.

SEC file number: 811-2192

More information on this fund is available free upon request, including the following:

Annual/Semiannual Report

Describes the fund's performance, lists portfolio holdings and contains a letter from the fund's manager discussing recent market conditions, economic trends and fund strategies that significantly affected the fund's performance during the last fiscal year. The fund's most recent annual and semiannual reports are available at www.dreyfus.com.

Statement of Additional Information (SAI)

Provides more details about the fund and its policies. A current SAI is available at www.dreyfus.com and is on file with the Securities and Exchange Commission (SEC). The SAI is incorporated by reference (and is legally considered part of this prospectus).

Portfolio Holdings

Dreyfus funds generally disclose their complete schedule of portfolio holdings monthly with a 30-day lag at www.dreyfus.com under Products and Performance. Complete holdings as of the end of the calendar quarter are disclosed 15 days after the end of such quarter. Dreyfus money market funds generally disclose their complete schedule of holdings daily. The schedule of holdings for a fund will remain on the website until the fund files its Form N-Q or Form N-CSR for the period that includes the dates of the posted holdings.

A complete description of the fund's policies and procedures with respect to the disclosure of the fund's portfolio securities is available in the fund's SAI and at www.dreyfus.com.

To Obtain Information

By telephone. Call 1-800-DREYFUS (inside the U.S. only)

By mail.

The Dreyfus Family of Funds

144 Glenn Curtiss Boulevard

Uniondale, NY 11556-0144

By E-mail. Send your request to info@dreyfus.com

On the Internet. Certain fund documents can be viewed online or downloaded from:

SEC: http://www.sec.gov

Dreyfus: http://www.dreyfus.com

You can also obtain copies, after paying a duplicating fee, by visiting the SEC's Public Reference Room in Washington, DC (for information, call 1-202-551-8090) or by E-mail request to publicinfo@sec.gov, or by writing to the SEC's Public Reference Section, Washington, DC 20549-1520.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

Printed on recycled paper.

50% post-consumer.

Process chlorine free.

Vegetable-based ink.

|