UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended December 31

or

For the transition period from __________to__________

Commission File Number | Exact Name of Registrant as Specified in its Charter, Principal Office Address and Telephone Number | State of Incorporation or Organization | I.R.S. Employer Identification No. | ||||||||

( | |||||||||||

( | |||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||

| Dow Inc. | |||||||||||

| The Dow Chemical Company | |||||||||||

| The Dow Chemical Company | |||||||||||

| The Dow Chemical Company | |||||||||||

| The Dow Chemical Company | |||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Dow Inc. | ☑ | ☐ | No | ||||||||||||||

| The Dow Chemical Company | ☑ | ☐ | No | ||||||||||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Dow Inc. | ☐ | Yes | ☑ | ||||||||||||||

| The Dow Chemical Company | ☐ | Yes | ☑ | ||||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Dow Inc. | ☑ | ☐ | No | ||||||||||||||

| The Dow Chemical Company | ☑ | ☐ | No | ||||||||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| Dow Inc. | ☑ | ☐ | No | ||||||||||||||

| The Dow Chemical Company | ☑ | ☐ | No | ||||||||||||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Dow Inc. | ☑ | Accelerated filer | ¨ | Non- accelerated filer | ¨ | Smaller reporting company | Emerging growth company | ||||||||||||||||||||||||||||

| The Dow Chemical Company | Large accelerated filer | ¨ | Accelerated filer | ¨ | accelerated filer | ☑ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Dow Inc. | ☐ | ||||||||||

| The Dow Chemical Company | ☐ | ||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

| Dow Inc. | |||||||||||

| The Dow Chemical Company | |||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

| Dow Inc. | Yes | ☑ | No | ||||||||||||||

| The Dow Chemical Company | Yes | ☑ | No | ||||||||||||||

As of June 30, 2020, the aggregate market value of the common stock of Dow Inc. held by non-affiliates of Dow Inc. was approximately $29.6 billion based on the last reported closing price of $40.76 per share as reported on the New York Stock Exchange.

Dow Inc. had 743,914,560 shares of common stock, $0.01 par value, outstanding at January 31, 2021. The Dow Chemical Company had 100 shares of common stock, $0.01 par value, outstanding at January 31, 2021, all of which were held by the registrant’s parent, Dow Inc.

The Dow Chemical Company meets the conditions set forth in General Instruction I(1)(a) and (b) for Form 10-K and therefore is filing this form in the reduced disclosure format.

DOCUMENTS INCORPORATED BY REFERENCE

Dow Inc.: Portions of Dow Inc.'s Proxy Statement for the 2021 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of Dow Inc.'s fiscal year ended December 31, 2020.

The Dow Chemical Company: None.

Dow Inc. and Subsidiaries

The Dow Chemical Company and Subsidiaries

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2020

TABLE OF CONTENTS

| PAGE | ||||||||

| Dow Inc. and Subsidiaries: | ||||||||

| The Dow Chemical Company and Subsidiaries: | ||||||||

3

| Dow Inc. and Subsidiaries The Dow Chemical Company and Subsidiaries | ||||||||

This Annual Report on Form 10-K is a combined report being filed by Dow Inc. and The Dow Chemical Company and its consolidated subsidiaries (“TDCC” and together with Dow Inc., “Dow” or the "Company"). This Annual Report on Form 10-K reflects the results of Dow and its consolidated subsidiaries, after giving effect to the distribution to DowDuPont Inc. (“DowDuPont” and effective June 3, 2019, n/k/a DuPont de Nemours, Inc. or "DuPont") of TDCC’s agricultural sciences business (“AgCo”) and specialty products business (“SpecCo”) and the receipt of E. I. du Pont de Nemours and Company and its consolidated subsidiaries' (“Historical DuPont”) ethylene and ethylene copolymers business (other than its ethylene acrylic elastomers business) ("ECP"). The U.S. GAAP consolidated financial results of Dow Inc. and TDCC reflect the distribution of AgCo and SpecCo as discontinued operations for the applicable periods presented as well as the receipt of ECP as a common control transaction from the closing of the merger with Historical DuPont on August 31, 2017. As a result of the parent/subsidiary relationship between Dow Inc. and TDCC, and considering that the financial statements and disclosures of each company are substantially similar, the companies are filing a combined report for this Annual Report on Form 10-K. The information reflected in this report is equally applicable to both Dow Inc. and TDCC, except where otherwise noted. Each of Dow Inc. and TDCC is filing information in this report on its own behalf and neither company makes any representation to the information relating to the other company.

Background

On April 1, 2019, DowDuPont completed the separation of its materials science business and Dow Inc. became the direct parent company of TDCC and its consolidated subsidiaries, owning all of the outstanding common shares of TDCC. For filings relating to the period commencing April 1, 2019 and thereafter, TDCC was deemed the predecessor to Dow Inc., and the historical results of TDCC are deemed the historical results of Dow Inc. for periods prior to and including March 31, 2019.

The separation was contemplated by the merger of equals transaction effective August 31, 2017, under the Agreement and Plan of Merger, dated as of December 11, 2015, as amended on March 31, 2017. TDCC and Historical DuPont each merged with subsidiaries of DowDuPont and, as a result, TDCC and Historical DuPont became subsidiaries of DowDuPont (the “Merger”). Subsequent to the Merger, TDCC and Historical DuPont engaged in a series of internal reorganization and realignment steps to realign their businesses into three subgroups: agriculture, materials science and specialty products. Dow Inc. was formed as a wholly owned subsidiary of DowDuPont to serve as the holding company for the materials science business.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements often address expected future business and financial performance, financial condition, and other matters, and often contain words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “outlook,” “plan,” “project,” “seek,” “should,” “strategy,” "target," “will,” “will be,” “will continue,” “will likely result,” “would” and similar expressions, and variations or negatives of these words or phrases.

Forward-looking statements are based on current assumptions and expectations of future events that are subject to risks, uncertainties and other factors that are beyond Dow’s control, which may cause actual results to differ materially from those projected, anticipated or implied in the forward-looking statements and speak only as of the date the statements were made. These factors include, but are not limited to: sales of Dow’s products; Dow’s expenses, future revenues and profitability; the continuing global and regional economic impacts of the coronavirus disease 2019 (“COVID-19”) pandemic and other public health-related risks and events on Dow’s business; capital requirements and need for and availability of financing; size of the markets for Dow’s products and services and ability to compete in such markets; failure to develop and market new products and optimally manage product life cycles; the rate and degree of market acceptance of Dow’s products; significant litigation and environmental matters and related contingencies and unexpected expenses; the success of competing technologies that are or may become available; the ability to protect Dow’s intellectual property in the United States and abroad; developments related to contemplated restructuring activities and proposed divestitures or acquisitions such as workforce reduction, manufacturing facility and/or asset closure and related exit and disposal activities, and the benefits and costs associated with each of the foregoing; fluctuations in energy and raw material prices; management of process safety and product stewardship; changes in relationships with Dow’s significant customers and suppliers; changes in consumer preferences and demand; changes in laws and regulations, political conditions or industry

4

development; global economic and capital markets conditions, such as inflation, market uncertainty, interest and currency exchange rates, and equity and commodity prices; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war; weather events and natural disasters; and disruptions in Dow’s information technology networks and systems.

Risks related to Dow's separation from DowDuPont include, but are not limited to: (i) Dow's inability to achieve some or all of the benefits that it expects to receive from the separation from DowDuPont; (ii) certain tax risks associated with the separation; (iii) the failure of Dow's pro forma financial information to be a reliable indicator of Dow's future results; (iv) Dow's inability to receive third-party consents required under the separation agreement; (v) non-compete restrictions under the separation agreement; (vi) receipt of less favorable terms in the commercial agreements Dow entered into with DuPont and Corteva, Inc. (“Corteva”), including restrictions under intellectual property cross-license agreements, than Dow would have received from an unaffiliated third party; and (vii) Dow's obligation to indemnify DuPont and/or Corteva for certain liabilities.

Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. A detailed discussion of principal risks and uncertainties which may cause actual results and events to differ materially from such forward-looking statements is included in the section of this Annual Report on Form 10-K titled “Risk Factors.” These are not the only risks and uncertainties that Dow faces. There may be other risks and uncertainties that Dow is unable to identify at this time or that Dow does not currently expect to have a material impact on its business. If any of those risks or uncertainties develops into an actual event, it could have a material adverse effect on Dow’s business. Dow Inc. and TDCC assume no obligation to update or revise publicly any forward-looking statements whether because of new information, future events, or otherwise, except as required by securities and other applicable laws.

5

| Dow Inc. and Subsidiaries | ||||||||

| The Dow Chemical Company and Subsidiaries | ||||||||

| PART I | ||||||||

| ITEM 1. BUSINESS | ||

THE COMPANY

Dow Inc. was incorporated on August 30, 2018, under Delaware law, to serve as a holding company for The Dow Chemical Company and its consolidated subsidiaries ("TDCC" and together with Dow Inc., "Dow" or the "Company"). Dow Inc. operates all of its businesses through TDCC, a wholly owned subsidiary, which was incorporated in 1947 under Delaware law and is the successor to a Michigan corporation, of the same name, organized in 1897. The Company's principal executive offices are located at 2211 H.H. Dow Way, Midland, Michigan 48674.

Available Information

The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, are available free of charge at www.dow.com/investors, as soon as reasonably practicable after the reports are electronically filed or furnished with the U.S. Securities and Exchange Commission ("SEC"). The SEC maintains a website that contains these reports as well as proxy statements and other information regarding issuers that file electronically. The SEC's website is www.sec.gov. Dow's website and its content are not deemed incorporated by reference into this report.

MERGER AND SEPARATION

On April 1, 2019, DowDuPont Inc. (“DowDuPont” and effective June 3, 2019, n/k/a DuPont de Nemours, Inc. or "DuPont") completed the separation of its materials science business and Dow Inc. became the direct parent company of TDCC and its consolidated subsidiaries, owning all of the outstanding common shares of TDCC.

The separation was contemplated by the merger of equals transaction effective August 31, 2017, under the Agreement and Plan of Merger, dated as of December 11, 2015, as amended on March 31, 2017 (the "Merger Agreement"). TDCC and E. I. du Pont de Nemours and Company and its consolidated subsidiaries (“Historical DuPont”) each merged with subsidiaries of DowDuPont and, as a result, TDCC and Historical DuPont became subsidiaries of DowDuPont (the “Merger”). Subsequent to the Merger, TDCC and Historical DuPont engaged in a series of internal reorganization and realignment steps to realign their businesses into three subgroups: agriculture, materials science and specialty products. Dow Inc. was formed as a wholly owned subsidiary of DowDuPont to serve as the holding company for the materials science business.

The consolidated financial results of Dow for periods prior to April 1, 2019, reflect the distribution of TDCC’s agricultural sciences business (“AgCo”) and specialty products business (“SpecCo”) as discontinued operations for each period presented as well as reflect the receipt of Historical DuPont’s ethylene and ethylene copolymers businesses (other than its ethylene acrylic elastomers business) (“ECP”) as a common control transaction from the closing of the Merger on August 31, 2017. See Note 3 to the Consolidated Financial Statements and Dow Inc.'s Amendment No. 4 to the Registration Statement on Form 10 filed with the SEC on March 8, 2019, for additional information.

Throughout this Annual Report on Form 10-K, unless otherwise indicated, amounts and activity are presented on a continuing operations basis.

ABOUT DOW

Dow combines global breadth, asset integration and scale, focused innovation and leading business positions to achieve profitable growth. The Company’s ambition is to become the most innovative, customer centric, inclusive and sustainable materials science company, with a purpose to deliver a sustainable future for the world through our materials science expertise and collaboration with our partners. Dow’s portfolio of plastics, industrial intermediates, coatings and silicones businesses delivers a broad range of differentiated science-based products and solutions for its customers in high-growth market segments, such as packaging, infrastructure, mobility and consumer care. Dow operates 106 manufacturing sites in 31 countries and employs approximately 35,700 people.

6

BUSINESS SEGMENTS AND PRODUCTS

The Company conducts its worldwide operations through six global businesses which are organized into the following operating segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure and Performance Materials & Coatings. Corporate contains the reconciliation between the totals for the operating segments and the Company's totals. The Company did not aggregate any operating segments when determining its reportable segments. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 26 to the Consolidated Financial Statements for additional information concerning the Company’s operating segments.

PACKAGING & SPECIALTY PLASTICS

Packaging & Specialty Plastics consists of two highly integrated global businesses: Hydrocarbons & Energy and Packaging and Specialty Plastics. The segment employs the industry’s broadest polyolefin product portfolio, supported by the Company’s proprietary catalyst and manufacturing process technologies, to work at the customer’s design table throughout the value chain to deliver more reliable and durable, higher performing, and more sustainable plastics to customers in food and specialty packaging; industrial and consumer packaging; health and hygiene; caps, closures and pipe applications; consumer durables; mobility and transportation; and infrastructure.

The Company’s unique advantages compared with its competitors include: extensive low-cost feedstock positions around the world; unparalleled scale, global footprint and market reach; world-class manufacturing sites in every geographic region; deep customer and brand owner understanding; portfolio of higher-value functional polymers, such as polyolefin elastomers, semiconductive and jacketing compound solutions and wire and cable insulation; and market-driven application development and technical support.

The segment remains agile by participating in the entire ethylene-to-polyethylene chain integration, enabling the Company to manage market swings, and therefore optimize returns while reducing long-term earnings volatility. The Company’s unrivaled value chain ownership is further strengthened by its Pack Studio locations in every geographic region, which help customers and brand owners deliver faster and more efficient packaging product commercialization through a global network of laboratories, technical experts and testing equipment.

Hydrocarbons & Energy

Hydrocarbons & Energy is a leading global producer of ethylene, a key chemical building block that the Company consumes primarily within the Packaging & Specialty Plastics segment. Ethylene is transferred to downstream derivative businesses at market-based prices, which are generally equivalent to prevailing market prices for large volume purchases. In addition to ethylene, the business is a leading producer of propylene and aromatics products that are used to manufacture materials consumers use every day. The business also produces and procures the power and feedstocks used by the Company’s manufacturing sites.

Packaging and Specialty Plastics

Packaging and Specialty Plastics serves growing, high-value sectors using world-class technology, broad existing product lines, and a rich product pipeline that creates competitive advantages for the entire packaging value chain. The business is a recognized leader in the production, marketing and innovation of polyethylene. The business is also a leader in other ethylene derivatives, such as polyolefin elastomers, ethylene vinyl acetate and ethylene propylene diene monomer ("EPDM") rubber serving mobility and transportation, consumer, wire and cable and construction end-markets. Market growth is expected to be driven by major shifts in population demographics; improving socioeconomic status in emerging geographic regions; consumer and brand owner demand for increased functionality; global efforts to reduce food waste; growth in telecommunications networks; global development of electrical transmission and distribution infrastructure; and renewable energy applications.

7

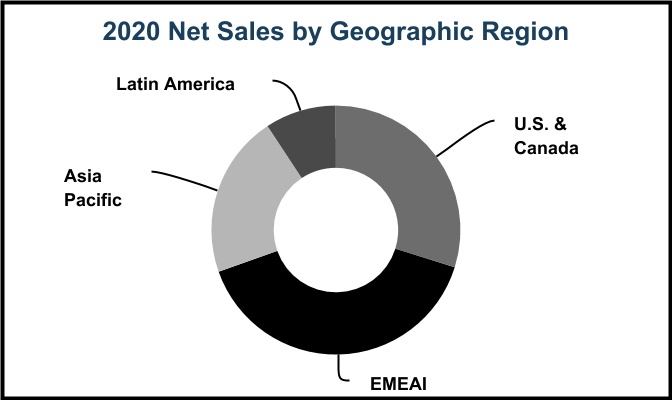

Details on Packaging & Specialty Plastics' 2020 net sales, by business and geographic region, are as follows:

* Europe, Middle East, Africa and India ("EMEAI")

Products

Major applications/market segments and products are listed below by business:

| Business | Applications/Market Segments | Major Products | Key Raw Materials | Key Competitors | ||||||||||

| Hydrocarbons & Energy | Purchaser of feedstocks; production of cost competitive hydrocarbon monomers utilized by Dow's derivative businesses; and energy, principally for use in Dow’s global operations | Ethylene, propylene, benzene, butadiene, octene, aromatics co-products, power, steam, other utilities | Butane, condensate, ethane, naphtha, natural gas, propane | Chevron Phillips Chemical, ExxonMobil, INEOS, LyondellBasell, SABIC, Shell, Sinopec | ||||||||||

| Packaging and Specialty Plastics | Adhesives; automotive; caps, closures and pipe applications; construction; cosmetics; electrical transmission and distribution; food and supply chain packaging; footwear; health and hygiene; housewares; industrial specialty applications using polyolefin elastomers, ethylene copolymers, and EPDM; irrigation pipe; mobility; photovoltaic encapsulants; sporting goods; telecommunications infrastructure; toys and infant products | Acrylics, bio-based plasticizers, copolymer, elastomers, ethylene copolymer resins, EPDM, ethylene vinyl acetate ("EVA"), methacrylic acid copolymer resins, polyethylene ("PE"), high-density polyethylene ("HDPE"), low-density polyethylene ("LDPE"), linear low-density polyethylene ("LLDPE"), polyolefin plastomers, resin additives and modifiers, semiconductive and jacketing compound solutions and wire and cable insulation | Aliphatic solvent, butene, ethylene, hexene, octene, propylene | Borealis, ExxonMobil, INEOS, Lanxess, LyondellBasell, Nova, SABIC | ||||||||||

Joint Ventures:

This segment includes a portion of the Company's share of the results of the following joint ventures:

•EQUATE Petrochemical Company K.S.C.C. (“EQUATE”) - a Kuwait-based company that manufactures ethylene, polyethylene and ethylene glycol, and manufactures and markets monoethylene glycol, diethylene glycol and polyethylene terephthalate resins; owned 42.5 percent by the Company.

•The Kuwait Olefins Company K.S.C.C. (“TKOC”) - a Kuwait-based company that manufactures ethylene and ethylene glycol; owned 42.5 percent by the Company.

•Map Ta Phut Olefins Company Limited (“Map Ta Phut”) - a Thailand-based company that manufactures propylene and ethylene; the Company has an effective ownership of 32.77 percent (of which 20.27 percent is owned directly by the Company and aligned with the Industrial Intermediates & Infrastructure segment and 12.5 percent is owned indirectly through the Company’s equity interest in Siam Polyethylene Company Limited, an entity that is part of The SCG-Dow Group and aligned with the Packaging & Specialty Plastics segment).

8

•Sadara Chemical Company ("Sadara") - a Saudi Arabian company that manufactures chlorine, ethylene, propylene and aromatics for internal consumption and manufactures and sells polyethylene, ethylene oxide and propylene oxide derivative products, and isocyanates; owned 35 percent by the Company. The Company is responsible for marketing a majority of Sadara products outside of the Middle East zone through the Company’s established sales channels. As part of this arrangement, the Company purchases and sells Sadara products for a marketing fee.

This segment also includes the Company's share of the results of the following joint ventures:

•The Kuwait Styrene Company K.S.C.C. - a Kuwait-based company that manufactures styrene monomer; owned 42.5 percent by the Company.

•The SCG-Dow Group - a group of Thailand-based companies (consisting of Siam Polyethylene Company Limited; Siam Polystyrene Company Limited; Siam Styrene Monomer Company Limited; and Siam Synthetic Latex Company Limited) that manufacture polyethylene, polystyrene, styrene, latex and specialty elastomers; owned 50 percent by the Company.

Current and Future Investments

In 2018, the Company started up its new LDPE production facility and its new NORDEL™ Metallocene EPDM production facility, both located in Plaquemine, Louisiana. These key milestones enable the Company to capture benefits from increasing supplies of U.S. shale gas to deliver differentiated downstream solutions in its core market verticals. The Company also completed debottlenecking of an existing bi-modal gas phase polyethylene production facility in St. Charles, Louisiana, and started up a new High Melt Index ("HMI") AFFINITY™ polymer production facility in Freeport, Texas, in the fourth quarter of 2018. In 2020, the Company's integrated world-scale ethylene production facility in Freeport, Texas, was expanded to a capacity of 2,000 kilotonnes per annum ("KTA"), making it the largest ethylene cracker in the world. Recognized for efficiency in construction time and cost as a newly designed cracker, this facility is also known for its low operating cost, excellent safety, reliability and asset utilization performance.

Additionally, the Company has announced investments over the next several years that are expected to enhance competitiveness. These include:

•Incremental debottleneck projects across its global asset network that will deliver approximately 350 KTA of additional polyethylene, the majority of which will be in the U.S. & Canada.

•Construction of a world-scale polyethylene unit on the U.S. Gulf Coast based on Dow’s proprietary process technologies, to meet consumer-driven demand in specialty packaging, health and hygiene, and industrial and consumer packaging applications.

•A new catalyst production facility for key catalysts licensed by Univation Technologies, LLC, a wholly owned subsidiary of the Company.

•Addition of a furnace to its ethylene production facility in Alberta, Canada, incrementally expanding capacity by approximately 130,000 metric tons. Dow will co-invest in the expansion with a regional customer, evenly sharing project costs and ethylene output, with the additional ethylene to be consumed by existing polyethylene manufacturing assets in the region. The expansion is expected to come online in the first half of 2021.

The Company's ambition includes becoming the most sustainable materials science company, with a strategy to advance the well-being of humanity by helping lead the transition to a sustainable planet and society. This includes lowering energy and greenhouse gas ("GHG") emissions and enabling a shift to a circular economy for plastics by focusing on resource efficiency and integrating recycled content and renewable feedstocks into its production processes. As part of that strategy, Dow announced the following:

•In 2020, Dow and waste-optimization specialist Avangard Innovative LP ("AI") announced that AI will supply post-consumer resin ("PCR") plastic film pellets to Dow, a significant addition to Dow’s plastic circularity portfolio. Dow will initially use the PCR pellets from AI to create linear low-density polyethylene and low-density polyethylene products.

•In 2020, Dow announced development and commercialization of a new formulated post-consumer plastic resin designed for collation shrink film applications in Asia Pacific and the U.S. & Canada. The new resin is designed with up to 40 percent PCR content and creates a film with performance comparable to those made with virgin resins, which expands Dow’s circular technology portfolio to help more customers and brands achieve their sustainability goals.

9

•In 2019, an agreement with the Fuenix Ecogy Group, based in Weert, The Netherlands, for the supply of pyrolysis oil feedstock, which is made from recycled plastic waste. The feedstock will be used to produce virgin polymers at Dow’s production facilities in Terneuzen, The Netherlands. In addition to increasing the Company's feedstock flexibility, this is an important step forward to increase feedstock recycling - the process of breaking down mixed waste plastics into their original form to manufacture new virgin polymers. The polymers produced from this pyrolysis oil will be identical to products produced from traditional feedstocks, and as such, they can be used in the same applications, including food packaging.

•In 2019, an agreement with UPM Biofuels, a producer of biofuels, for the supply and integration of wood-based UPM Bio Verno renewable naphtha - a key raw material used to develop plastics - into Dow's slate of raw materials, creating an alternative source for plastics production. Effectively increasing the Company's feedstock flexibility, the feedstock will be used to produce bio-based polyethylene at Dow's production facilities in Terneuzen, The Netherlands, for use in packaging applications such as food packaging, to reduce food waste.

•In 2019, the retrofit of one of its Louisiana steam crackers with Dow’s proprietary fluidized catalytic dehydrogenation ("FCDh") technology to produce on-purpose propylene. The FCDh technology retrofit further improves Dow’s ability to continue to source the most advantaged feedstocks, while also producing reliable and cost-efficient on-purpose propylene to supply its integrated derivative units in Louisiana. The technology reduces capital outlay by up to 25 percent and lowers energy usage and GHG emissions by up to 20 percent, thereby improving overall sustainability when compared with conventional propane dehydrogenation technologies. The project is expected to begin producing on-purpose propylene by the end of 2021.

INDUSTRIAL INTERMEDIATES & INFRASTRUCTURE

Industrial Intermediates & Infrastructure consists of two customer-centric global businesses - Industrial Solutions and Polyurethanes & Construction Chemicals - that develop important intermediate chemicals that are essential to manufacturing processes, as well as downstream, customized materials and formulations that use advanced development technologies. These businesses primarily produce and market ethylene oxide and propylene oxide derivatives that are aligned to market segments as diverse as appliances, coatings, electronics, surfactants for cleaning and sanitization, infrastructure and oil and gas. The global scale and reach of these businesses, world-class technology and R&D capabilities and materials science expertise enable the Company to be a premier solutions provider offering customers value-add sustainable solutions to enhance comfort, energy efficiency, product effectiveness and durability across a wide range of home comfort and appliances, building and construction, adhesives and lubricant applications, among others.

Industrial Solutions

Industrial Solutions provides a broad portfolio of solutions that enable and improve the manufacture of consumer and industrial goods and services. The business’ solutions minimize friction and heat in mechanical processes; manage the oil and water interface; deliver ingredients for maximum effectiveness; facilitate dissolvability; enable product identification; and provide the foundational building blocks for the development of chemical technologies. The business supports manufacturers associated with a large variety of end-markets, notably coatings, detergents and cleaners, crop protection, pharmaceuticals, electronics, oil and gas, inks and textiles. The business is a leading producer of purified ethylene oxide.

Polyurethanes & Construction Chemicals

Polyurethanes & Construction Chemicals consists of three businesses: Polyurethanes, Chlor-Alkali & Vinyl (“CAV”) and Construction Chemicals (“DCC”). The Polyurethanes business is the world’s largest producer of propylene oxide, propylene glycol and polyether polyols, and a leading producer of aromatic isocyanates and fully formulated polyurethane systems for rigid, semi-rigid and flexible foams, and coatings, adhesives, sealants, elastomers and composites that serve energy efficiency, consumer comfort, industrial and enhanced mobility market sectors. The CAV business provides chlorine and caustic soda supply and markets caustic soda, a valuable co-product of the chlor-alkali manufacturing process, and ethylene dichloride and vinyl chloride monomer. The CAV business' assets are predominantly in Western Europe and largely produce materials for internal consumption. The DCC business provides cellulose ethers, redispersible latex powders, and acrylic emulsions used as key building blocks for differentiated building and construction materials across many market segments and applications ranging from roofing and flooring to gypsum-, cement-, concrete- and dispersion-based building materials.

10

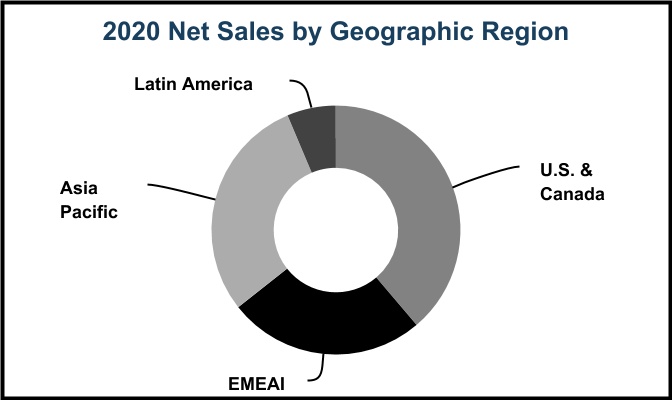

Details on Industrial Intermediates & Infrastructures' 2020 net sales, by business and geographic region, are as follows:

Products

Major applications/market segments and products are listed below by business:

| Business | Applications/Market Segments | Major Products | Key Raw Materials | Key Competitors | ||||||||||

| Industrial Solutions | Broad range of products for specialty applications, including pharmaceuticals, agriculture crop protection offerings, aircraft deicing, solvents for coatings, heat transfer fluids for concentrated solar power, construction, solvents for electronics processing, food preservation, fuel markers, industrial and institutional cleaning, infrastructure applications, lubricant additives, paper, transportation and utilities; products for energy markets including exploration, production, transmission, refining, mining and gas processing to optimize supply, improve efficiencies and manage emissions | Butyl glycol ethers, VERSENE™ Chelants, UCAR™ Deicing Fluids, ethanolamines, ethylene oxide ("EO"), ethyleneamines, UCON™ Fluids, DOWANOL™ glycol ethers, DOWTHERM™ Heat Transfer Fluids, higher glycols, isopropanolamines, low-VOC solvents, methoxypolyethylene glycol, methyl isobutyl, polyalkylene glycol, CARBOWAX™ SENTRY™ Polyethylene Glycol, TERGITOL™ and TRITON™ Surfactants, demulsifiers, drilling and completion fluids, heat transfer fluids, rheology modifiers, scale inhibitors, shale inhibitors, specialty amine solvents, surfactants, water clarifiers, frothing separating agents | Ethylene, propylene | BASF, Eastman, Hexion, Huntsman, INEOS, LyondellBasell, SABIC, Sasol, Shell | ||||||||||

| Polyurethanes & Construction Chemicals | Aircraft deicing fluids; alumina, pulp and paper; appliances; automotive; bedding; building and construction; flooring; footwear; heat transfer fluids; hydraulic fluids; infrastructure; mobility; packaging; textiles and transportation; construction; caulks and sealants; cement-based tile adhesives; concrete solutions; elastomeric roof coatings; industrial non-wovens; plasters and renders; roof tiles and siding; sport grounds and tape joint compounds | Aniline, caustic soda, ethylene dichloride ("EDC"), methylene diphenyl diisocyanate (“MDI”), polyether polyols, propylene glycol ("PG"), propylene oxide ("PO"), polyurethane systems, toluene diisocyanate (“TDI”), vinyl chloride monomer ("VCM"), AQUASET™ Acrylic Thermosetting Resins, DOW™ Latex Powder, RHOPLEX™ and PRIMAL™ Acrylic Emulsion Polymers, WALOCEL™ Cellulose Ethers | Aniline, benzene, carbon monoxide, caustic soda, cell effluent, cellulose, chlorine, electric power, ethylene, hydrogen peroxide, propylene, styrene | Arkema, Ashland, BASF, Covestro, Eastman, Huntsman, Wanhua | ||||||||||

Joint Ventures

This segment includes a portion of the Company's share of the results of EQUATE, TKOC, Map Ta Phut and Sadara.

11

Current and Future Investments

The Company expects to make investments over the next several years to enhance competitiveness in the Company’s Polyurethanes & Construction Chemicals and Industrial Solutions businesses. The investments will include alkoxylation capacity expansions and finishing capabilities; investments to support growth in polyurethane systems; and efficiency improvements around the world.

PERFORMANCE MATERIALS & COATINGS

Performance Materials & Coatings includes industry-leading franchises that deliver a wide array of solutions into consumer and infrastructure end-markets. The segment consists of two global businesses: Coatings & Performance Monomers and Consumer Solutions. These businesses primarily utilize the Company's acrylics-, cellulosics- and silicone-based technology platforms to serve the needs of the architectural and industrial coatings; home care and personal care; consumer and electronics; mobility and transportation; industrial and chemical processing; and building and infrastructure end-markets. Both businesses employ materials science capabilities, global reach and unique products and technology to combine chemistry platforms to deliver differentiated offerings to customers.

Coatings & Performance Monomers

Coatings & Performance Monomers consists of two businesses: Coating Materials and Performance Monomers. The Coating Materials business makes critical ingredients and additives that help advance the performance of paints and coatings. The business offers innovative and sustainable products to accelerate paint and coatings performance across diverse market segments, including architectural paints and coatings, as well as industrial coatings applications used in maintenance and protective industries, wood, metal packaging, traffic markings, thermal paper and leather. These products enhance coatings by improving hiding and coverage characteristics, enhancing durability against nature and the elements, lowering or eliminating volatile organic compounds (“VOC”) content, reducing maintenance and improving ease of application. The Performance Monomers business manufactures acrylics-based building blocks needed for the production of coatings, textiles, adhesives and home and personal care products.

Consumer Solutions

Consumer Solutions consists of three businesses: Performance Silicones, Home & Personal Care and Silicone Feedstocks & Intermediates. Performance Silicones offers a portfolio of innovative, versatile silicone-based technology to provide ingredients and solutions to customers for addressing megatrends, including globalization, urbanization, sustainability and digitalization. The business serves customers in several global markets with strong growth opportunities, including: building and infrastructure; consumer and electronics; industrial and chemical processing; and mobility and transportation. Dow’s wide array of silicone-based products and solutions enables customers to: increase the appeal of their products; extend shelf life; improve performance of products under a wider range of conditions; and provide a more sustainable offering. The Home & Personal Care business collaborates closely with global and regional brand owners to deliver innovative solutions, leveraging acrylics, cellulosics and silicone technology platforms for creating new and unrivaled consumer benefits and experiences in cleaning, laundry and skin and hair care applications, among others. Silicone Feedstocks & Intermediates provides standalone silicone materials that are used as intermediates in a wide range of applications including adhesion promoters, coupling agents, crosslinking agents, dispersing agents and surface modifiers.

Details on Performance Materials & Coatings' 2020 net sales, by business and geographic region, are as follows:

12

Products

Major applications/market segments and products are listed below by business:

| Business | Applications/Market Segments | Major Products | Key Raw Materials | Key Competitors | ||||||||||

| Coatings & Performance Monomers | Acrylic binders for architectural paints and coatings, industrial coatings and paper; adhesives; dispersants; impact modifiers; inks and paints; opacifiers and surfactants for both architectural and industrial applications; plastics additives; processing aids; protective and functional coatings; rheology modifiers | ACOUSTICRYL™ Liquid-Applied Sound Damping Technology; acrylates; ACRYSOL™ Rheology Modifiers; AVANSE™ Acrylic Binders; EVOQUE™ Pre-Composite Polymer; foam cell promoters; FORMASHIELD™ Acrylic Binder; high-quality impact modifiers; MAINCOTE™ Acrylic Epoxy Hybrid; methacrylates; processing aids; RHOPLEX™ Acrylic Resin; TAMOL™ Dispersants; vinyl acetate monomers; weatherable acrylic capstock compounds for thermoplastic and thermosetting materials | Acetic acid, acetone, acrylic acid, butyl acrylate, methyl methacrylate, propylene, styrene | Arkema, BASF, Celanese, Evonik, LyondellBasell, Wacker Chemie | ||||||||||

| Consumer Solutions | Personal care, color cosmetics, baby care, home care and specialty applications with a key focus on hair care, skin care, sun care, cleansing, as well as fabric, dish, floor, hard surface and air care applications; commercial glazing; electrical and high-voltage insulation; lamp and luminaire modules assembly; mobility; oil and gas; paints and inks; release liners, specialty films and tapes; sporting goods; 3D printing | Adhesives and sealants; antifoams and surfactants; coatings and controlled release; coupling agents and crosslinkers; IMAGIN3D™ Printing Technology; fluids, emulsions and dispersions; formulating and processing aids; granulation and binders; oils; polymers and emollients; opacifiers; reagents; resins, gels and powders; rheology modifiers; rubber; solubility enhancers; aerospace composites; surfactants and solvents; SILASTIC™ Silicone Elastomers; DOWSIL™ Silicone Products; SYL-OFF™ Silicone Release Coatings; AMPLIFY™ Si PE 1000 Polymer System | Hydrochloric acid, methanol, platinum, silica, silicon metal | Elkem, Momentive, Shin-Etsu, Wacker Chemie | ||||||||||

Current and Future Investments

The Company continues to make incremental investments in low-capital, high-return projects in the silicones franchise to further enhance competitiveness. Investments include both debottleneck and efficiency projects across its global footprint, including expansion of silicone polymers, as well as investments in high-performance sealants.

CORPORATE

Corporate includes certain enterprise and governance activities (including insurance operations, environmental operations, etc.); non-business aligned joint ventures; non-business aligned litigation expenses; and discontinued or non-aligned businesses.

RAW MATERIALS

The Company operates in an integrated manufacturing environment. Basic raw materials are processed through many stages to produce a number of products that are sold as finished goods at various points in those processes. The major raw material stream that feeds the production of the Company's finished goods is hydrocarbon-based raw materials. The Company purchases hydrocarbon raw materials including ethane, propane, butane, naphtha and condensate as feedstocks. These raw materials are used in the production of both saleable products and energy. The Company also purchases certain monomers, primarily ethylene and propylene, to supplement internal production. The Company purchases natural gas, primarily to generate electricity, and purchases electric power to supplement internal generation. In addition, the Company produces a portion of its electricity needs in Louisiana and Texas; Alberta, Canada; The Netherlands; and Germany.

13

The Company's primary source of these raw materials are natural gas liquids ("NGLs"), which are derived from shale gas and crude oil production and naphtha, which is produced during the processing and refining of crude oil. Given recent advancements in shale gas, shale oil and conventional drilling techniques, the Company expects these raw materials to be in abundant supply. The Company's suppliers of these raw materials include regional, international and national oil and gas companies.

The Company purchases raw materials on both short- and long-term contracts. The Company had adequate supplies of raw materials in 2020 and expects to continue to have adequate supplies of raw materials in 2021.

INDUSTRY SEGMENTS AND GEOGRAPHIC REGION RESULTS

See Note 26 to the Consolidated Financial Statements for information regarding net sales, pro forma net sales, Operating EBIT, pro forma Operating EBIT and total assets by segment, as well as net sales and long-lived assets by geographic region.

SIGNIFICANT CUSTOMERS AND PRODUCTS

All products and services are marketed primarily through the Company’s sales force, although in some instances more emphasis is placed on sales through distributors. In 2020, no significant portion of the Company's sales was dependent upon a single customer.

PATENTS, LICENSES AND TRADEMARKS

The Company continually applies for and obtains U.S. and foreign patents and has a substantial number of pending patent applications throughout the world. At December 31, 2020, the Company owned approximately 3,500 active U.S. patents and 18,900 active foreign patents as follows:

| Remaining Life of Patents Owned at Dec 31, 2020 | United States | Rest of World | ||||||

| Within 5 years | 800 | 3,400 | ||||||

| 6 to 10 years | 1,000 | 6,500 | ||||||

| 11 to 15 years | 1,500 | 8,400 | ||||||

| 16 to 20 years | 200 | 600 | ||||||

| Total | 3,500 | 18,900 | ||||||

The Company’s primary purpose in obtaining patents is to protect the results of its research for use in operations and licensing. The Company is party to a substantial number of patent licenses, including intellectual property cross-license agreements and other technology agreements, and also has a substantial number of trademarks and trademark registrations in the United States and in other countries, including the “Dow in Diamond” trademark. Although the Company considers that its patents, licenses and trademarks in the aggregate constitute a valuable asset, it does not regard its business as being materially dependent on any single or group of related patents, licenses or trademarks.

14

PRINCIPAL PARTLY OWNED COMPANIES

The Company’s principal nonconsolidated affiliates at December 31, 2020, including direct and indirect ownership interest for each, are listed below:

| Principal Nonconsolidated Affiliate | Country | Ownership Interest | Business Description | ||||||||

| EQUATE Petrochemical Company K.S.C.C. | Kuwait | 42.50 | % | Manufactures ethylene, polyethylene and ethylene glycol, and manufactures and markets monoethylene glycol, diethylene glycol and polyethylene terephthalate resins | |||||||

| The Kuwait Olefins Company K.S.C.C. | Kuwait | 42.50 | % | Manufactures ethylene and ethylene glycol | |||||||

| The Kuwait Styrene Company K.S.C.C. | Kuwait | 42.50 | % | Manufactures styrene monomer | |||||||

Map Ta Phut Olefins Company Limited 1 | Thailand | 32.77 | % | Manufactures propylene and ethylene | |||||||

Sadara Chemical Company 2 | Saudi Arabia | 35.00 | % | Manufactures chlorine, ethylene, propylene and aromatics for internal consumption and manufactures and sells polyethylene, ethylene oxide and propylene oxide derivative products, and isocyanates | |||||||

| The SCG-Dow Group: | |||||||||||

| Siam Polyethylene Company Limited | Thailand | 50.00 | % | Manufactures polyethylene | |||||||

| Siam Polystyrene Company Limited | Thailand | 50.00 | % | Manufactures polystyrene | |||||||

| Siam Styrene Monomer Company Limited | Thailand | 50.00 | % | Manufactures styrene | |||||||

| Siam Synthetic Latex Company Limited | Thailand | 50.00 | % | Manufactures latex and specialty elastomers | |||||||

1.The Company's effective ownership of Map Ta Phut is 32.77 percent, of which the Company directly owns 20.27 percent and indirectly owns 12.5 percent through its equity interest in Siam Polyethylene Company Limited.

2.The Company is responsible for marketing the majority of Sadara products outside of the Middle East zone through the Company's established sales channels. Under this arrangement, the Company purchases and sells Sadara products for a marketing fee.

See Note 12 to the Consolidated Financial Statements for additional information regarding nonconsolidated affiliates.

PROTECTION OF THE ENVIRONMENT

Matters pertaining to the environment are discussed in Part I, Item 1A. Risk Factors; Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; and Notes 1 and 16 to the Consolidated Financial Statements. In addition, detailed information on the Company's performance regarding environmental matters and goals is accessible through the Science & Sustainability webpage at www.dow.com/sustainability. Dow's website and its content are not deemed incorporated by reference into this report.

HUMAN CAPITAL

Dow’s ambition – to be the most innovative, customer-centric, inclusive and sustainable materials science company - starts with people. Dow employees create innovative and sustainable materials science solutions to advance the world. Every answer starts with asking the right questions. This is why the diverse, dedicated Dow team collaborates with customers and other stakeholders to find solutions to the world's toughest challenges. The Company's values of Respect for People, Integrity and Protecting Our Planet are fundamental beliefs that are ingrained in each action taken, can never be compromised and are the foundation of the Company's Code of Conduct.

The Company is dedicated to employee health and safety, and is invested in fostering a culture of inclusion and continuous learning to ensure all Dow employees are respected, valued and encouraged to make their fullest contribution.

15

Safety, Employee Health and Well-Being

A commitment to safety and employee health is engrained in Dow’s culture and central to how the Dow team works. Dow uses a comprehensive, integrated operating discipline management system that includes policies, requirements, best practices and procedures associated with health and safety. In 2020, the Company achieved an Occupational Safety and Health Administration ("OSHA") Total Recordable Injury and Illness Rate of 0.12, based upon the number of incidents per 200,000 work hours for employees and contractors globally. This measure, along with a consistent set of globally applied, as well as locally defined, leading indicators of safety performance, are cornerstones of Dow's worker protection program. The Company maintains a robust, globally tracked near-miss program for situations that did not result in an injury, but could have been high consequence had circumstances been slightly different. This data is reviewed regularly by management and the Environment, Health, Safety & Technology Committee of the Dow Inc. Board of Directors ("Board"), is visible to all employees and is built into digital dashboards that include actual injury information for every Dow location around the world.

As part of the Company’s total worker health strategy, employees have access to occupational health services at no cost through on-site, Company-managed clinics at its manufacturing locations or an offsite provider overseen by Dow Occupational Health. In addition to access for occupational health needs, the Company also maintains a comprehensive wellness program, recognizing the value of good physical as well as mental health to employees, families and communities. In 2020, the Company also initiated an offering of psychological safety training sessions to employees.

Dow maintains active Crisis Management Teams at the corporate level and in each region where the Company operates to ensure appropriate plans are in place in the event of natural disasters or other emergencies, and currently in response to the coronavirus disease 2019 ("COVID-19") pandemic. For additional information on the Company’s response to the COVID-19 pandemic, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Inclusion & Diversity

At Dow, inclusion and diversity (“I&D”) is a business imperative evidenced by inclusion serving as a core pillar of the Company's ambition statement. A strategic and intentional focus on I&D not only enhances the employee experience and satisfaction, but it also supports innovation, customer experience and understanding of the communities the Company serves. In 2020, Dow ranked #22 in the DiversityInc Top 50 Companies for Diversity.

Dow's strategic I&D efforts are directed by its Chief Inclusion Officer and Office of Inclusion, which supports implementation throughout Dow’s businesses, functions and regions. Three Inclusion Councils drive the I&D strategy from the top of the Company down and across the enterprise:

•The President’s Inclusion Council defines and supports the mandate from the top.

•A Senior Leaders’ Inclusion Council influences change through senior and mid-level business, geographic and functional leaders.

•A Joint Inclusion Council proactively engages with Dow’s Employee Resource Groups ("ERGs") to ensure employee engagement at all levels.

Dow’s 10 ERGs are representative of the Company’s diverse workforce and help foster an inclusive workplace. Dow’s ERGs are organized around historically underrepresented groups including women, people of color, LGBTQ+ individuals, people with disabilities and veterans, as well as groups both for professionals who are new to the Company and those who are later in their careers. Senior leaders serve as executive sponsors for each ERG. In 2020, 49 percent of Dow’s workforce and 98 percent of Dow leaders participated in at least one ERG.

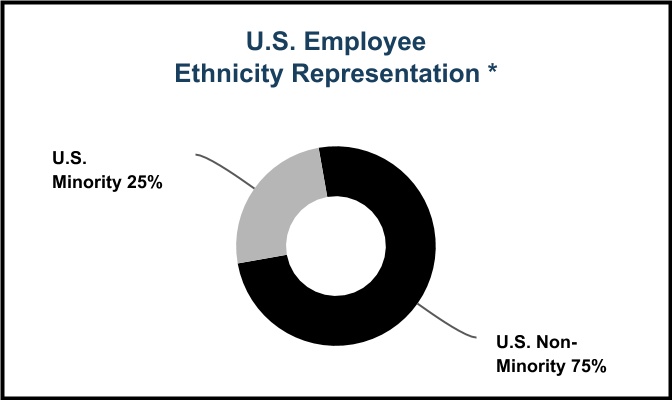

I&D metrics, including ERG participation, global representation of women and U.S. minority representation in the United States, are published internally on a quarterly basis, are embedded in the same scorecard where Dow’s financial and safety results are measured and are directly connected to leaders’ annual performance and compensation. This data is reviewed regularly by management and with the Compensation and Leadership Development Committee of the Board.

16

Employee Engagement, Learning and Development

Throughout an employee’s career, the Company supports development through a blend of learning approaches including in-person and virtual trainings, digital learning platforms, on-the-job training and a series of leadership development programs. Annually, all employees have the opportunity to provide feedback on employee experience and offer insights into how to improve Dow’s working culture through a global employee opinion survey. A key component of the survey is an opportunity for employees to provide feedback on the effectiveness of their direct leader. In 2020, 74 percent of employees responded to the annual survey. The feedback received through this annual survey and additional quarterly checkpoint surveys is used to drive actions to improve the overall Dow experience for employees across the Company, as well as to support continuous improvement in leader effectiveness.

At December 31, 2020, the Company permanently employed approximately 35,700 people on a full-time basis.

| * | U.S. Minority includes employees who self-identify as Hispanic or Latino, Black or African American, Asian, American Indian or Alaskan Native, Native Hawaiian or other Pacific Islander, or two or more races. Employees who self-identify as White are considered U.S. Non-Minority. | ||||

Additional information regarding Dow’s human capital measures can be found in the Company's annual Sustainability Report, accessible through the Science & Sustainability webpage at www.dow.com/sustainability, as well as Dow's annual Shine Inclusion Report and the U.S. Equal Employment Opportunity Report (EEO-1), accessible through the Inclusion & Diversity webpage at www.dow.com/diversity. Dow’s website and its contents are not deemed incorporated by reference into this report.

OTHER ACTIVITIES

The Company engages in property and casualty insurance and reinsurance primarily through its Liana Limited subsidiaries.

17

EXECUTIVE OFFICERS OF THE REGISTRANT

Set forth below is information related to the Company's executive officers as of February 5, 2021:

| Name, Age | Present Position with Registrant | Year Elected as Executive Officer of Dow Inc. | Other Business Experience since January 1, 2016 | ||||||||

| Jack Broodo, 62 | President, Feedstocks & Energy | 2020 | Dow Inc.: President, Feedstocks & Energy since February 2020; Business President, Feedstocks & Energy from April 2019 to February 2020. TDCC: President, Feedstocks & Energy since February 2020; Business President, Feedstocks & Energy from February 2016 to February 2020. Vice President, Investor Relations from November 2014 to January 2016. | ||||||||

| Karen S. Carter, 50 | Chief Human Resources Officer and Chief Inclusion Officer | 2019 | Dow Inc.: Chief Human Resources Officer and Chief Inclusion Officer since April 2019. TDCC: Chief Human Resources Officer since October 2018; Chief Inclusion Officer since July 2017; North America Commercial Vice President, Dow Packaging and Specialty Plastics from February 2016 to July 2017; Global Business Director, Low Density & Slurry Polyethylene, Packaging & Specialty Plastics from April 2015 to January 2016. | ||||||||

| Diego Donoso, 53 | President, Packaging & Specialty Plastics | 2020 | Dow Inc.: President, Packaging & Specialty Plastics since February 2020; Business President, Packaging & Specialty Plastics from April 2019 to February 2020. TDCC: President, Packaging & Specialty Plastics since February 2020; Business President, Packaging & Specialty Plastics from August 2012 to February 2020. | ||||||||

| Ronald C. Edmonds, 63 | Controller and Vice President of Controllers and Tax | 2019 | Dow Inc.: Controller and Vice President of Controllers and Tax since April 2019. TDCC: Controller and Vice President since November 2009; Vice President of Tax since January 2016. | ||||||||

| Jim Fitterling, 59 | Chairman and Chief Executive Officer | 2018 | Dow Inc.: Chairman since April 2020; Chief Executive Officer since August 2018. TDCC: Chairman since April 2020; Chief Executive Officer since July 2018; President and Chief Operating Officer from February 2016 to July 2018; Vice Chairman and Chief Operating Officer from October 2015 to February 2016. | ||||||||

| Mauro Gregorio, 58 | President, Performance Materials & Coatings | 2020 | Dow Inc.: President, Performance Materials & Coatings since February 2020; Business President, Performance Materials & Coatings from April 2019 to February 2020. TDCC: President, Performance Materials & Coatings since February 2020; Business President, Consumer Solutions from January 2016 to February 2020. | ||||||||

| Jane M. Palmieri, 51 | President, Industrial Intermediates & Infrastructure | 2020 | Dow Inc.: President, Industrial Intermediates & Infrastructure since February 2020; Business President, Polyurethanes and Chlor-Alkali & Vinyl from April 2019 to February 2020. TDCC: President, Industrial Intermediates & Infrastructure since February 2020; Business President, Polyurethanes and Chlor-Alkali & Vinyl from April 2018 to February 2020; Business President, Polyurethanes and Chlor-Alkali from October 2016 to April 2018; Business President, Building and Construction from June 2013 to April 2018. | ||||||||

| John M. Sampson, 60 | Senior Vice President, Operations, Manufacturing & Engineering | 2021 | Dow Inc.: Senior Vice President, Operations, Manufacturing & Engineering since October 2020. Olin Corporation: Executive Vice President, Business Operations from April 2019 to September 2020; Vice President, Business Operations from October 2015 to April 2019. | ||||||||

| A. N. Sreeram, 53 | Senior Vice President of Research & Development and Chief Technology Officer | 2019 | Dow Inc.: Senior Vice President of Research & Development and Chief Technology Officer since April 2019. TDCC: Chief Technology Officer since October 2015; Senior Vice President of Research & Development since August 2013. | ||||||||

| Howard Ungerleider, 52 | President and Chief Financial Officer | 2018 | Dow Inc.: President and Chief Financial Officer since August 2018. TDCC: Chief Financial Officer since October 2014; President since July 2018; Vice Chairman from October 2015 to July 2018. | ||||||||

| Amy E. Wilson, 50 | General Counsel and Corporate Secretary | 2018 | Dow Inc.: General Counsel and Corporate Secretary since April 2019; Secretary from August 2018 to April 2019. TDCC: General Counsel since October 2018; Corporate Secretary since February 2015; Associate General Counsel from April 2017 to September 2018; Assistant General Counsel from February 2015 to April 2017; Director of the Office of the Corporate Secretary from August 2013 to October 2018. | ||||||||

18

| ITEM 1A. RISK FACTORS | ||

The factors described below represent the Company's principal risks.

COVID-19 PANDEMIC - RELATED RISKS

Public Health Crisis: A public health crisis or global outbreak of disease, including the pandemic caused by coronavirus disease 2019 (“COVID-19”) has had, and could continue to have, a negative effect on the Company's manufacturing operations, supply chain and workforce, creating business disruptions that could continue to have a substantial negative impact on the Company’s results of operations, financial condition and cash flows.

The pandemic caused by COVID-19 has impacted all geographic regions where Dow products are produced and sold. The global, regional and local spread of COVID-19 has resulted in significant global mitigation measures, including government-directed quarantines, social distancing and shelter-in-place mandates, travel restrictions and/or bans, and restricted access to certain corporate facilities and manufacturing sites. Uncertainty with respect to the severity and duration of the COVID-19 pandemic, coupled with oil price fluctuations due in part to the global spread of COVID-19 and the continued increase in global cases, has contributed to the volatility of financial markets. While the severity and duration of the COVID-19 pandemic in key geographic regions and end-markets cannot be reasonably estimated at this time, impacts to the Company include, but are not limited to: fluctuations in the Company’s stock price due to market volatility; a decrease in demand for certain Company products; price declines; reduced profitability; supply chain disruptions impeding the Company’s ability to ship and/or receive product; temporary idling or permanent closure of select manufacturing facilities and/or manufacturing assets; asset impairment charges; interruptions or limitations to manufacturing operations imposed by local, state or federal governments; reduced market liquidity and increased borrowing costs; workforce absenteeism and distraction; labor shortages; customer credit concerns; increased cyber security risk and data accessibility disruptions due to remote working arrangements; workforce reductions and fluctuations in foreign currency markets. Additional risks may include, but are not limited to: shortages of key raw materials; potential impairment in the carrying value of goodwill; additional asset impairment charges; increased obligations related to the Company’s pension and other postretirement benefit plans; and tax valuation allowances. Business disruptions and market volatility resulting from the COVID-19 pandemic have had and could continue to have a substantial negative impact on the Company’s results of operations, financial condition and cash flows. The adverse impact of the COVID-19 pandemic on the Company may also have the effect of heightening many of the other risks described in this "Risk Factors" section.

MACROECONOMIC RISKS

Financial Commitments and Credit Markets: Market conditions could reduce the Company's flexibility to respond to changing business conditions or fund capital needs.

Adverse economic conditions could reduce the Company’s flexibility to respond to changing business and economic conditions or to fund capital expenditures or working capital needs. The economic environment could result in a contraction in the availability of credit in the marketplace and reduce sources of liquidity for the Company. This could result in higher borrowing costs.

Global Economic Considerations: The Company operates in a global, competitive environment which gives rise to operating and market risk exposure.

The Company sells its broad range of products and services in a competitive, global environment, and competes worldwide for sales on the basis of product quality, price, technology and customer service. Increased levels of competition could result in lower prices or lower sales volume, which could have a negative impact on the Company’s results of operations. Sales of the Company's products are also subject to extensive federal, state, local and foreign laws and regulations, trade agreements, import and export controls and duties and tariffs. The imposition of additional regulations, controls and duties and tariffs or changes to bilateral and regional trade agreements could result in lower sales volume, which could negatively impact the Company’s results of operations.

Economic conditions around the world, and in certain industries in which the Company does business, also impact sales price and volume. As a result, market uncertainty or an economic downturn driven by political tensions, war, terrorism, epidemics, pandemics or political instability in the geographic regions or industries in which the Company sells its products could reduce demand for these products and result in decreased sales volume, which could have a negative impact on the Company’s results of operations.

In addition, volatility and disruption of financial markets could limit customers’ ability to obtain adequate financing to maintain operations, which could result in a decrease in sales volume and have a negative impact on the Company’s results of operations. The Company’s global business operations also give rise to market risk exposure

19

related to changes in foreign currency exchange rates, interest rates, commodity prices and other market factors such as equity prices. To manage such risks, the Company enters into hedging transactions pursuant to established guidelines and policies. If the Company fails to effectively manage such risks, it could have a negative impact on its results of operations.

Pension and Other Postretirement Benefits: Increased obligations and expenses related to the Company's defined benefit pension plans and other postretirement benefit plans could negatively impact its financial condition and results of operations.

The Company has defined benefit pension plans and other postretirement benefit plans (the “plans”) in the United States and a number of other countries. The assets of the Company's funded plans are primarily invested in fixed income securities, equity securities of U.S. and foreign issuers and alternative investments, including investments in real estate, private equity and absolute return strategies. Changes in the market value of plan assets, investment returns, discount rates, mortality rates, regulations and the rate of increase in compensation levels may affect the funded status of the Company's plans and could cause volatility in the net periodic benefit cost, future funding requirements of the plans and the funded status of the plans. A significant increase in the Company's obligations or future funding requirements could have a negative impact on the Company's results of operations and cash flows for a particular period and on the Company's financial condition.

Supply/Demand Balance: Earnings generated by the Company's products vary based in part on the balance of supply relative to demand within the industry.

The balance of supply relative to demand within the industry may be significantly impacted by the addition of new capacity, especially for basic commodities where capacity is generally added in large increments as world-scale facilities are built. This may disrupt industry balances and result in downward pressure on prices due to the increase in supply, which could negatively impact the Company’s results of operations.

LEGAL AND REGULATORY RISKS

Environmental Compliance: The costs of complying with evolving regulatory requirements could negatively impact the Company's financial results. Actual or alleged violations of environmental laws or permit requirements could result in restrictions or prohibitions on plant operations, substantial civil or criminal sanctions, as well as the assessment of strict liability and/or joint and several liability.

The Company is subject to extensive federal, state, local and foreign laws, regulations, rules and ordinances relating to pollution, protection of the environment, climate change, greenhouse gas emissions, and the generation, storage, handling, transportation, treatment, disposal and remediation of hazardous substances and waste materials. In addition, the Company may have costs related to environmental remediation and restoration obligations associated with past and current sites as well as related to its past or current waste disposal practices or other hazardous materials handling. Although management will estimate and accrue liabilities for these obligations, it is reasonably possible that the Company’s ultimate cost with respect to these matters could be significantly higher, which could negatively impact the Company’s financial condition and results of operations. Costs and capital expenditures relating to environmental, health or safety matters are subject to evolving regulatory requirements and depend on the timing of the promulgation and enforcement of specific standards which impose the requirements. Moreover, changes in environmental regulations could inhibit or interrupt the Company’s operations, or require modifications to its facilities. Accordingly, environmental, health or safety regulatory matters could result in significant unanticipated costs or liabilities. For additional information, see Part II, Item 7. Other Matters, Environmental Matters in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Health and Safety: Increased concerns regarding the safe use of chemicals and plastics in commerce and their potential impact on the environment has resulted in more restrictive regulations and could lead to new regulations.

Concerns regarding the safe use of chemicals and plastics in commerce and their potential impact on health and the environment reflect a growing trend in societal demands for increasing levels of product safety and environmental protection. These concerns could manifest themselves in stockholder proposals, preferred purchasing, delays or failures in obtaining or retaining regulatory approvals, delayed product launches, lack of market acceptance and continued pressure for more stringent regulatory intervention and litigation. These concerns could also influence public perceptions, the viability or continued sales of certain of the Company's products, its reputation and the cost to comply with regulations. In addition, terrorist attacks and natural disasters have increased concerns about the security and safety of chemical production and distribution. These concerns could have a negative impact on the Company's results of operations.

20

Local, state, federal and foreign governments continue to propose new regulations related to the security of chemical plant locations and the transportation of hazardous chemicals, which could result in higher operating costs.

Litigation: The Company is party to a number of claims and lawsuits arising out of the normal course of business with respect to product liability, patent infringement, employment matters, governmental tax and regulation disputes, contract and commercial litigation, and other actions.

Certain of the claims and lawsuits facing the Company purport to be class actions and seek damages in very large amounts. All such claims are contested. With the exception of the possible effect of the asbestos-related liability of Union Carbide Corporation (“Union Carbide”) and Chapter 11 related matters of Dow Silicones Corporation ("Dow Silicones") as described below, it is the opinion of the Company’s management that the possibility is remote that the aggregate of all such claims and lawsuits will have a material adverse impact on the Company’s consolidated financial statements.

Union Carbide is and has been involved in a large number of asbestos-related suits filed primarily in state courts during the past four decades. At December 31, 2020, Union Carbide's total asbestos-related liability, including future defense and processing costs, was $1,098 million ($1,165 million at December 31, 2019).

In 1995, Dow Silicones, a former 50:50 joint venture, voluntarily filed for protection under Chapter 11 of the U.S. Bankruptcy Code in order to resolve breast implant liabilities and related matters (the “Chapter 11 Proceeding”). Dow Silicones emerged from the Chapter 11 Proceeding on June 1, 2004, and is implementing the Joint Plan of Reorganization (the “Plan”). The Plan provides funding for the resolution of breast implant and other product liability litigation covered by the Chapter 11 Proceeding. Dow Silicones’ liability for breast implant and other product liability claims was $160 million at December 31, 2020 ($165 million at December 31, 2019). See Note 16 to the Consolidated Financial Statements for additional information on litigation matters.

Plastic Waste: Increased concerns regarding plastic waste in the environment, consumers selectively reducing their consumption of plastic products due to recycling concerns, or new or more restrictive regulations and rules related to plastic waste could reduce demand for the Company’s plastic products and could negatively impact the Company’s financial results.

Local, state, federal and foreign governments have been increasingly proposing and in some cases approving bans on certain plastic-based products including single-use plastics, plastic straws and utensils. In addition, plastics have faced increased public scrutiny due to negative coverage of plastic waste in the environment, including the world’s oceans. As Dow is one of the world’s largest producers of plastics, increased regulation on the use of plastics could cause reduced demand for the Company’s polyethylene products which could negatively impact the Company’s financial condition, results of operations and cash flows.

OPERATIONAL AND STRATEGIC RISKS

Company Strategy: Implementing certain elements of the Company's strategy could negatively impact its financial results.

The Company currently has manufacturing operations, sales and marketing activities, and joint ventures in emerging geographic regions. Activities in these geographic regions are accompanied by uncertainty and risks including: navigating different government regulatory environments; relationships with new, local partners; project funding commitments and guarantees; expropriation, military actions, war, terrorism and political instability; sabotage; uninsurable risks; suppliers not performing as expected resulting in increased risk of extended project timelines; and determining raw material supply and other details regarding product movement. If the manufacturing operations, sales and marketing activities, and/or implementation of these projects is not successful, it could adversely affect the Company’s financial condition, cash flows and results of operations.

Cyber Threat: The risk of loss of the Company’s intellectual property, trade secrets or other sensitive business information or disruption of operations could negatively impact the Company’s financial results.

Cyber-attacks or security breaches could compromise confidential, business critical information, cause a disruption in the Company’s operations or harm the Company's reputation. The Company has attractive information assets, including intellectual property, trade secrets and other sensitive, business critical information. While the Company has a comprehensive cyber-security program that is continuously reviewed, maintained and upgraded, a significant cyber-attack could result in the loss of critical business information and/or could negatively impact operations, which could have a negative impact on the Company’s financial results.

21

Goodwill: An impairment of goodwill could negatively impact the Company’s financial results.

At least annually, the Company assesses goodwill for impairment. If testing indicates that goodwill is impaired, the carrying value is written down based on fair value with a charge against earnings. Where the Company utilizes a discounted cash flow methodology in determining fair value, continued weak demand for a specific product line or business could result in an impairment. Accordingly, any determination requiring the write-off of a significant portion of goodwill could negatively impact the Company's results of operations. See Note 13 to the Consolidated Financial Statements for additional information regarding the Company's goodwill impairment testing.