EPG

Conference Bob Livingston

May 20, 2014

Exhibit 99.1 |

| 2

Forward looking statements

We want to remind everyone that our comments may contain forward-looking

statements that are inherently subject to uncertainties and risks. We caution

everyone to be guided in their analysis of Dover Corporation by referring to

the documents we file from time to time with the SEC, including our Form

10-K for 2013 and our Form 10-Q for the first quarter of 2014, for a

list of factors that could cause our results to differ from those

anticipated in any such forward- looking statements.

We would also direct your attention to our website, www.dovercorporation.com,

where considerably more information can be found.

2 |

3

Strategy

Our track record of success is based on:

–

Core technological advantages

–

Leading brands in the markets we serve

–

Commitment to industry leadership through innovation and scale

–

Strong focus on the customer

Our deep understanding of the customer and our exceptional capabilities in

providing solutions enable us to win

Our technologies and innovative products are enablers for our customers to

win Our focus on people drives our performance

–

Develop deep bench

–

Move talent through organization |

4

Recent activities support our underlying strategy & strengths

New segment structure to capture

growth opportunities

Building our industrial businesses

–

Continued to expand in our growth

areas

Energy, Fluids, Refrigeration,

Printing & ID all grew organically

and through acquisition

–

Anthony, Finder, KPS, Fibrelite

and MS all expand product

breadth and geographic reach

–

Our business profile is more

consistent and focused with

sustainable higher margins

4

Customer intimacy

–

Innovate for the customer

Recurring theme of delivering

efficiency and sustainability

–

Superior customer service

On-time delivery, quality, support

Leverage our scale

Generate cash

Market share leadership

–

Focus on technology and innovation

drive share gains and customer loyalty

Recent Activities

Underlying Strengths |

5

Dover has several levers for value creation

5

GROWTH

3% -

5% organically,

complemented by

acquisition growth

MARGIN

Expand segment

margin to 19%

CASH FLOW

Generate free cash flow in

excess of 10% of revenue

Substantial growth

opportunities

Accelerated

productivity initiatives

Significant balance

sheet optionality

Mid-term targets |

6

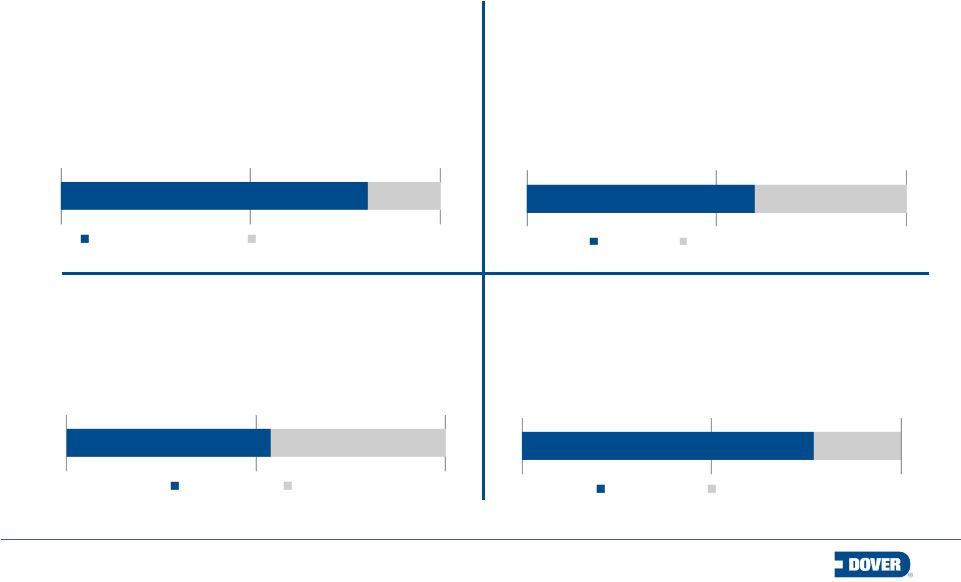

Our track record of success

Revenue

EBIT

EPS

Dividends

Note: Revenue and EBIT is in millions; adjusted EPS represents Dover’s

earnings from continuing operations per common share adjusted for gains from discrete and

other tax items of $0.17, $0.16, $0.23, $0.09 and $0.46 respectively, for 2009,

2010, 2011, 2012 and 2013, and other one-time gains of $0.02 in 2013.

$0

$325

$650

$975

$1,300

$0

$2,000

$4,000

$6,000

$8,000

2009

2010

2011

2012

2013

Revenue & EBIT

Revenue

EBIT

$1.00

$1.20

$1.40

$1.60

$0.00

$1.50

$3.00

$4.50

2009

2010

2011

2012

2013

Adj. EPS & Dividends Paid

Adj. EPS

Dividend per share |

7

Dover segments at a glance

Revenue Mix

Revenue Mix

Fluids

is focused on the safe handling of critical

fluids across the oil & gas, retail fueling,

chemical, hygienic and industrial end-markets.

Revenue Mix

Refrigeration & Food Equipment

is

the

leading

provider of energy efficient equipment and

systems serving the commercial refrigeration

and food service industries.

Revenue Mix

81%

19%

Drilling & Production

Bearings & Compression

60%

40%

Industrial

Printing & Identification

54%

46%

Fluid Transfer

Pumps

77%

23%

Refrigeration

Food Equipment

Energy

is

a

leading

provider

of

customer

driven solutions and services for safe and

efficient production and processing of oil & gas

worldwide, and has a strong presence in the

bearings and compression components market.

Engineered Systems

is focused on the design,

manufacture and service of critical equipment

and components serving the printing &

identification, vehicle service, waste handling,

and select niche industrial end-markets. |

8

Growth opportunities: A look forward

8

10%

15%

20%

25%

30%

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2011

2012

2013

2014F

$ in millions

Revenue & margin

Revenue

Margin

Energy

Grow core business

–

Leverage plunger and gas lift

technologies into international markets

–

Strengthen our position in faster

growing basins

–

Increase OEM share in bearings and

compression

Continue to expand geographical

presence

–

Significant investments in sales, field

engineering and facilities

–

Increase participation in global tenders

–

Seek additional industry partnership

opportunities

Fill in product gaps internally and through

acquisition |

9

Growth opportunities: A look forward

9

6%

10%

14%

18%

$1,200

$1,600

$2,000

$2,400

$2,800

2011

2012

2013

2014F

$ in millions

Revenue & margin

Revenue

Margin

–

Capitalize in fast growing textile market

–

Grow North American and China presence

in core markets

Make focused industrial investments

–

Concentrate on after-market customer

productivity solutions

–

Expand in high growth recycling and

waste-to energy markets

Extend geographic reach

–

Achieve YOY 10%+ growth outside the US

–

Growing middle class consumption and

higher operating costs driving automation

solutions in emerging markets

Engineered Systems

Expand and extend markets served in

Printing & Identification |

10

Growth opportunities: A look forward

10

6%

10%

14%

18%

22%

$400

$800

$1,200

$1,600

2011

2012

2013

2014F

$ in millions

Revenue & Margin

Revenue

Margin

Develop and acquire products that provide

complete solutions

–

Innovate around automation, energy

efficiency and compliance

Access new markets through recent

acquisitions

–

Complete “station in a box”

offering

worldwide with KPS and Fibrelite

–

Penetrate NA plastics and oil & gas

markets though European acquisitions

Leverage our global footprint to accelerate

growth

–

Grow presence in Middle East and China

through Maag and Finder channels

–

Expand in Australia through Ebsray’s

LPG and chemical pump technologies

Fluids |

11

Growth opportunities: A look forward

11

0%

6%

12%

18%

$500

$1,000

$1,500

$2,000

2011

2012

2013

2014F

$ in millions

Revenue & Margin

Revenue

Margin

Refrigeration & Food Equipment

Develop broader customer base

–

Build share with targeted accounts

Capitalize on secular

trends

–

Rising energy costs and increasing

government regulation are driving strong

demand for energy efficient solutions

Penetrate higher growth adjacent markets

–

C-store and small format stores expected

to continue above market growth rates

–

Capitalize on convergence of refrigeration

and food equipment in supermarkets

Acquire assets that expand technology and

geography

–

Build refrigeration capabilities in Brazil

and Europe; Add-ons in food equipment

|

12

Margin enhancement through productivity

Global supply chain

–

Program now in its 5

year

–

Continuing to leverage the scale of Dover

Many spend categories are being reviewed again

$90

-$120

million

in

savings

or

cost

avoidance

expected

over

the

next

3

years

Shared manufacturing

–

Several consolidation projects are near completion

Hill

Phoenix

will

consolidate

4

sites

in

Atlanta

area

~$3M

of

annualized

savings

*

Energy

will

combine

5

sites

in

Houston

~$1M

of

annualized

savings

*

More projects are on the way

Investing in Lean and Post-Merger Integration (“PMI”)

–

Adding lean resources across segments

–

PMI leaders driven to integrate faster with focus on near term accretion

12

*

Annualized

savings

over

3

years

(2014

–

2016)

th

|

13

Capital allocation 2014

Strong balance sheet

–

$486 million cash as of March 31, 2014 (primarily overseas)

–

$170 million in proceeds from DEK sale (expected mid-year)

–

Strong

FY

free

cash

flow

expected

( 11%

of

revenue)

We

expect

to

raise

the

dividend

for

59

consecutive

year

Capex expected to be roughly $200 million

Acquisitions

–

Pipeline is active

Completed $1 billion share repurchase program in Q1

–

Capacity to do more; largely dependent on how pipeline develops

13

th

|

14

Q1 revenue growth led by Fluids and Engineered Systems, also solid growth in

Energy

–

US markets were strong; Europe markets continue to grow; China markets

moderated

–

Bookings growth of 5% is broad-based

–

Margin

impacted

70

bps

by

acquisitions,

core

business

performing

well

Q2

activity

is

solid

across

all

segments;

targeting

the

high-end

of

our

$4.60

-

$4.80

EPS range

–

Energy, Engineered Systems and Fluids all performing well

–

Refrigeration & Food Equipment seasonally ramping as anticipated

–

Margin

will

sequentially

improve

in

the

seasonally

strong

second

quarter

Q1 2014 performance and Q2 commentary

14 |

|