Exhibit 99.1

CONTACT: | ||

Paul Goldberg | ||

Vice President - Investor Relations | ||

(212) 922-1640 | ||

DOVER REPORTS SECOND QUARTER 2013 RESULTS; PROVIDES FULL-YEAR OUTLOOK

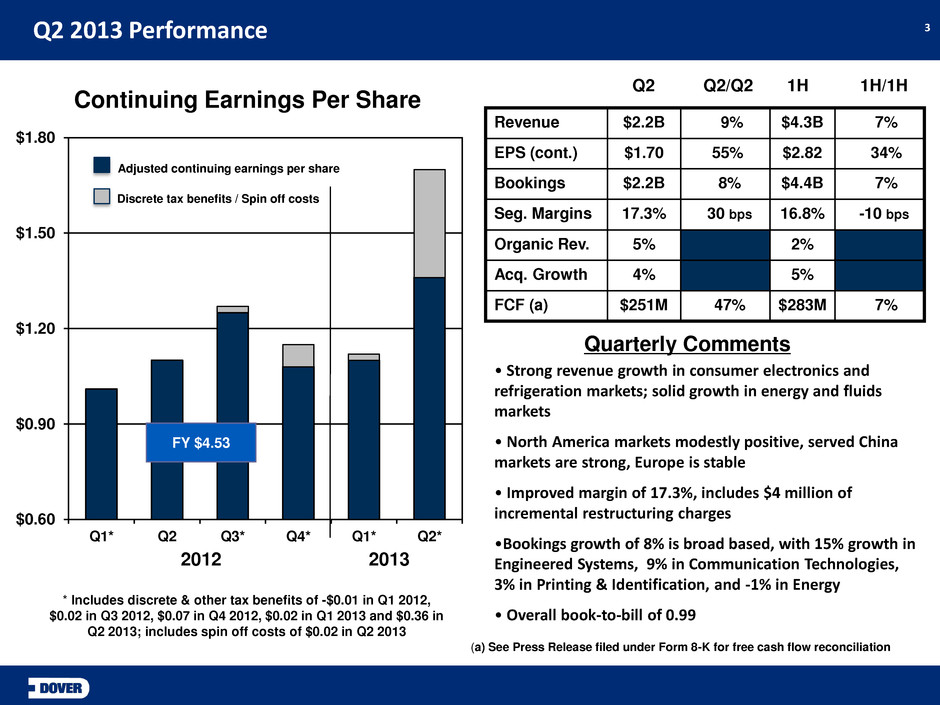

• | Reports quarterly revenue of $2.2 billion, an increase of 9% over the prior year |

• | Delivers quarterly diluted earnings per share from continuing operations of $1.70, an increase of 55% over last year |

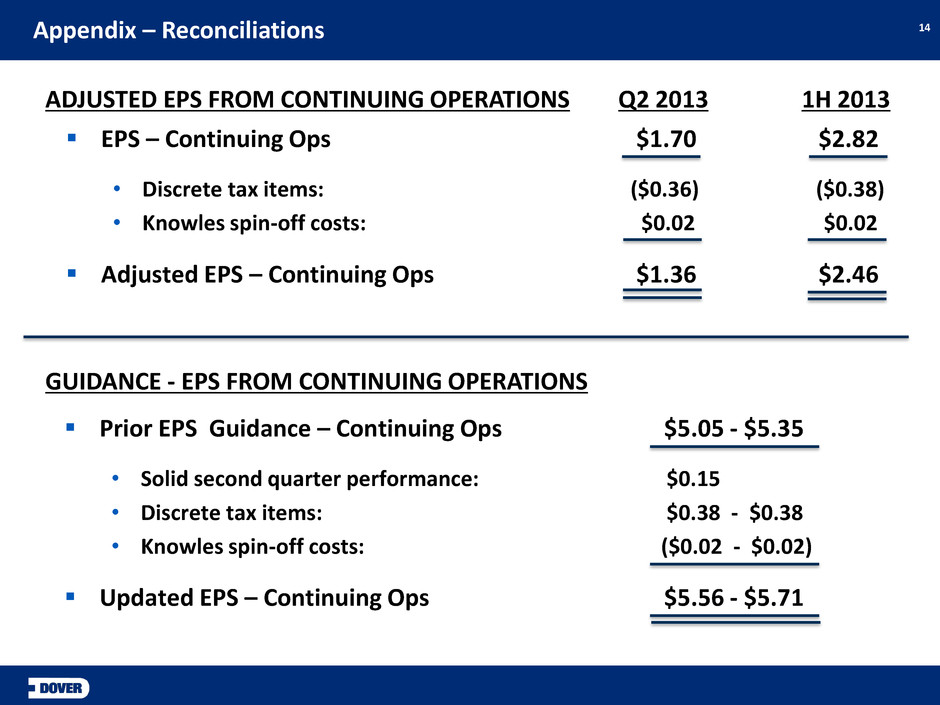

• | Achieves adjusted quarterly diluted earnings per share from continuing operations of $1.36, excluding tax benefits of $0.36 and Knowles spin off costs of $0.02, up 24% from an adjusted prior year |

• | Reaffirms outlook for full year revenue growth at 7% to 9% |

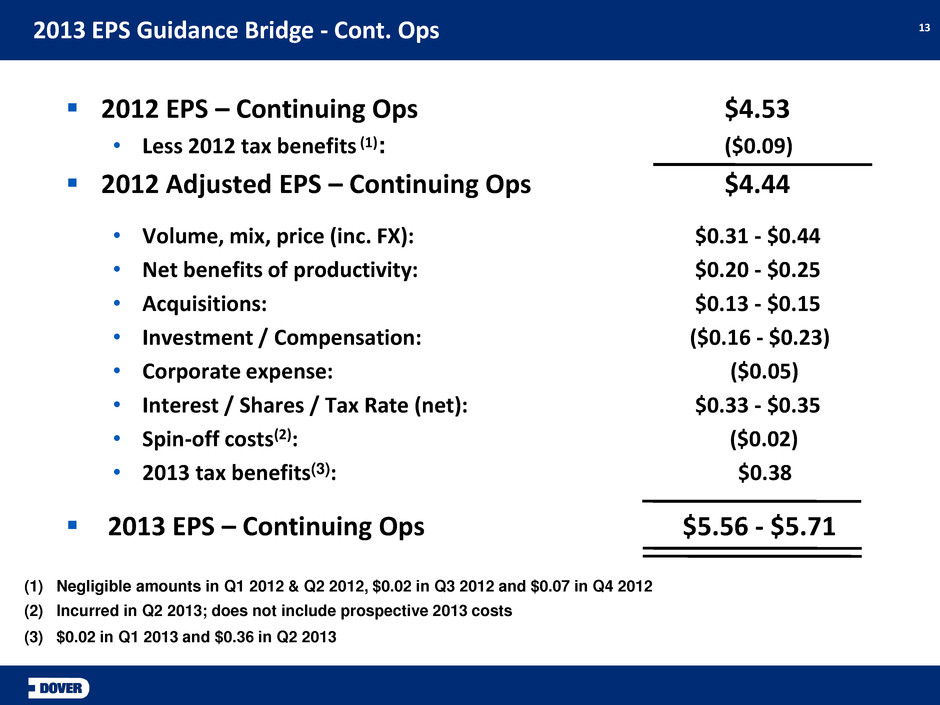

• | Expects diluted earnings per share from continuing operations to be in the range of $5.56 to $5.71 after raising the low end of the range, and including tax benefits and incurred spin off costs |

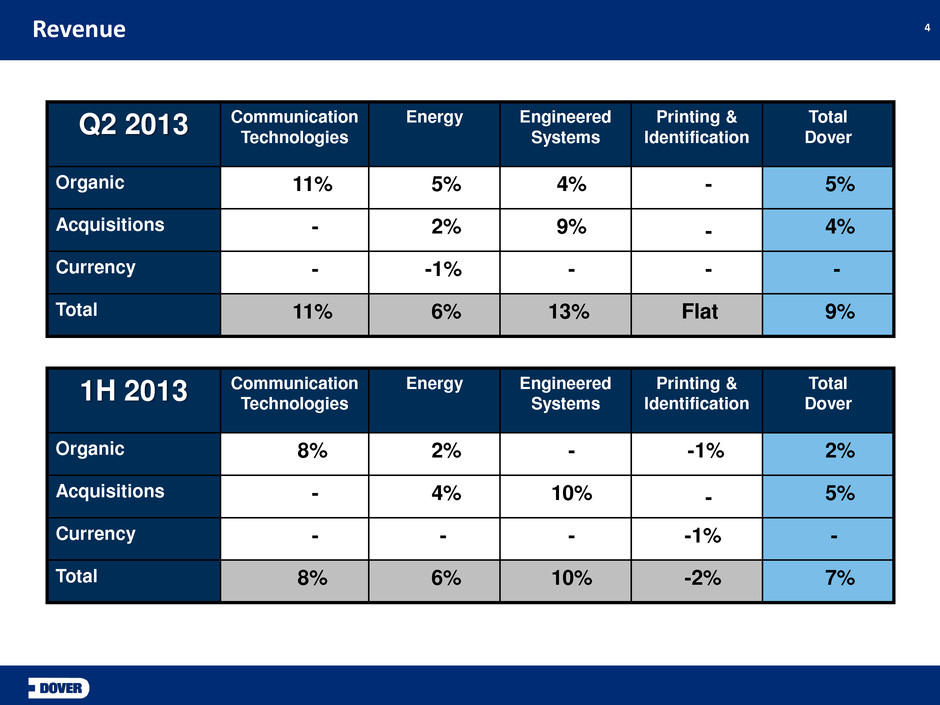

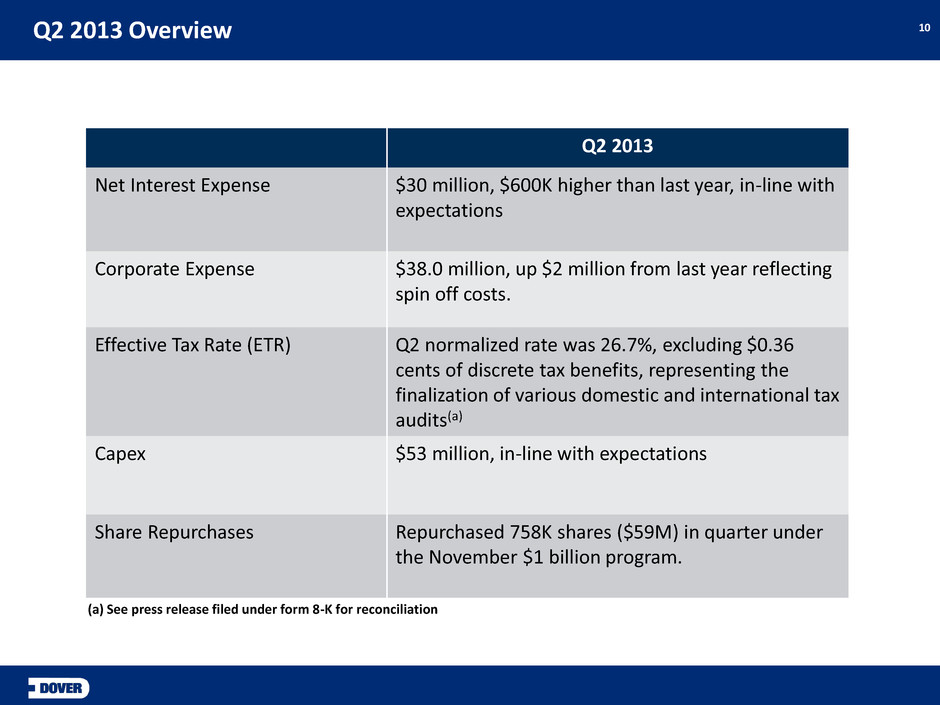

Downers Grove, Illinois, July 18, 2013 — Dover (NYSE: DOV) announced today that for the second quarter ended June 30, 2013, revenue was $2.2 billion, an increase of 9% over the prior year period. The revenue increase was driven by organic growth of 5%, an increase of 4% from acquisitions, and a minor impact from foreign exchange. Earnings from continuing operations were $294.4 million, or $1.70 diluted earnings per share (“EPS”), compared to $205.2 million, or $1.10 EPS, in the prior year period, representing increases of 43% and 55%, respectively. EPS from continuing operations includes discrete tax items of $0.36 EPS and Knowles spin off costs of $0.02 EPS recognized in the current quarter. Excluding these items, adjusted EPS from continuing operations for the second quarter of 2013 was $1.36, reflecting an increase of 24% over EPS of $1.10 in the prior year period.

Revenue for the six months ended June 30, 2013 was $4.3 billion, an increase of 7% over the prior year, reflecting organic growth of 2%, a 5% increase from acquisitions, and a minor impact from foreign exchange. Earnings from continuing operations for the six months ended June 30, 2013 were $491.3 million, or $2.82 EPS, compared to $391.6 million, or $2.10 EPS in the prior year period, representing increases of 25% and 34%, respectively. EPS from continuing operations during this period includes discrete tax items of $0.38 EPS and Knowles spin off costs of $0.02 EPS, compared to ($0.01) EPS of discrete tax items in the prior year. Excluding these items, adjusted EPS from continuing operations for the six months ended June 30, 2013 was $2.46, an increase of 17% over an adjusted EPS of $2.11 in the prior year.

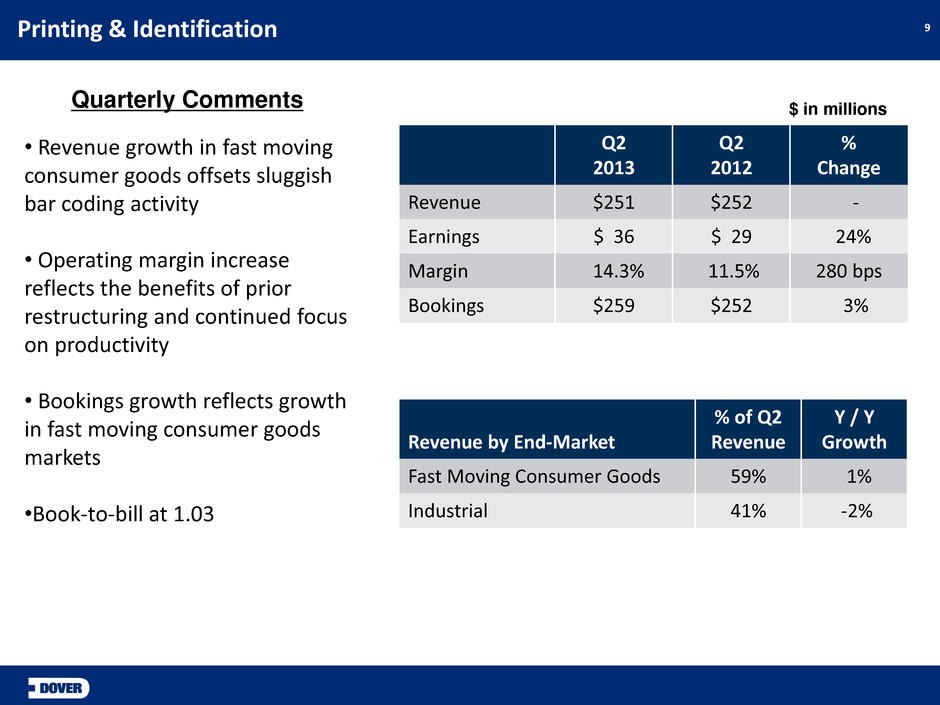

Commenting on the second quarter results, Dover's President and Chief Executive Officer, Robert A. Livingston, said, “I am very pleased with our results for the second quarter and the actions we've taken to strengthen our company. The quarter was driven by broad-based growth, particularly among our businesses serving the consumer electronics and refrigeration markets, with solid contribution from our energy and fluids businesses. In all, we posted strong revenue growth of 9%. Segment margin also expanded, where improved performance at Printing & Identification and Engineered Systems helped drive segment margin to 17.3%, a 30 basis point improvement over

last year.”

“We also made progress on several important strategic actions in the quarter. We continued to execute on our share repurchase program, completed four small synergistic acquisitions, and most importantly, announced our intention to spin off several businesses within our Communication Technologies segment to our shareholders, which is progressing as planned. Taken together, these actions demonstrate Dover's ongoing commitment to create significant shareholder value.”

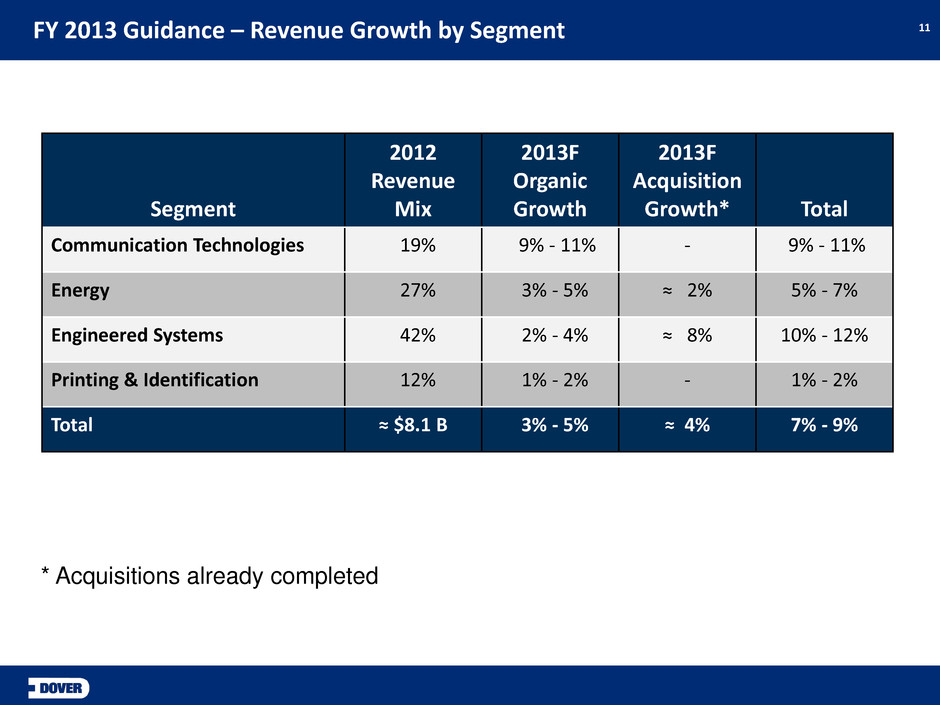

“Looking ahead, 2013 remains largely consistent with the view we previously shared. We continue to expect full year organic revenue growth of 3% to 5%, complemented by acquisition growth of 4%, resulting in total revenue growth of 7% to 9%. Based on our solid second quarter performance, we are taking up the low end of our earnings guidance range. In addition, we are adjusting full year guidance to include discrete tax benefits and incurred spin off costs. As a result, our revised guidance for full year EPS is now $5.56 to $5.71. This range does not include any prospective Knowles spin off costs to be incurred in the next several quarters.”

Net earnings for the second quarter of 2013 were $330.0 million or $1.91 EPS, including earnings from discontinued operations of $35.7 million, or $0.21 EPS, compared to net earnings of $214.1 million, or $1.15 EPS, for the same period of 2012, which included earnings from discontinued operations of $8.9 million, or $0.05 EPS. Reflected within discontinued operations was a goodwill impairment charge of $18.7 million, net of tax, or $0.11 EPS, connected with the anticipated sale of our electronic test and assembly businesses, and discrete tax benefits of $42.7 million, or $0.25 EPS.

Net earnings for the six months ended June 30, 2013 were $540.1 million, or $3.10 EPS, including net earnings from discontinued operations of $48.7 million, or $0.28 EPS, compared to net earnings of $410.2 million, or $2.20 EPS, for the same period of 2012, which included net earnings from discontinued operations of $18.6 million or $0.10 EPS. Reflected within discontinued operations was a goodwill impairment charge of $18.7 million, net of tax, or $0.11 EPS, connected with the anticipated sale of our electronic test and assembly businesses, and discrete tax benefits of $52.4 million, or $0.30 EPS.

Dover will host a webcast of its second quarter 2013 conference call at 10:00 A.M. Eastern Time (9:00 A.M. Central Time) on Thursday, July 18, 2013. The webcast can be accessed on the Dover website at www.dovercorporation.com. The conference call will also be made available for replay on the website. Additional information on Dover’s second quarter results and its operating segments can also be found on the Company’s website.

About Dover:

Dover is a diversified global manufacturer with annual revenues of over $8 billion. For over 50 years, Dover has been delivering outstanding products and services that reflect its market leadership and commitment to operational and technical excellence. The Company's entrepreneurial business model encourages, promotes and fosters deep customer engagement which has led to Dover's well-established and valued reputation for providing superior customer service and industry-leading product innovation. Dover focuses on innovative equipment and components, specialty systems and support services through its four major operating segments: Communication Technologies, Energy, Engineered Systems and Printing & Identification. Headquartered in Downers Grove, Illinois, Dover employs 35,000 people worldwide. Dover is traded on the New York Stock Exchange under “DOV.” Additional information is available on our website at www.dovercorporation.com.

Forward-Looking Statement:

This press release contains “forward-looking” statements within the meaning of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements relate to, among other things, operating and strategic plans, income, earnings, cash flows, changes in operations, operating improvements, industries in which Dover businesses operate and the U.S. and global economies. Statements in this press release that are not historical are hereby identified as “forward-looking statements” and may be indicated by words or phrases such as “anticipates,” “expects,” “believes,” “indicates,” “suggests,” “will,” “plans,” “supports,” “projects,” “should,” “would,” “could,” “forecast” and “management is of the opinion,” or the use of the future tense and similar words or phrases. Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from current expectations, including, but not limited to, the state of the worldwide economy and sovereign credit, especially in Europe; political events that could impact the worldwide economy; the impact of natural disasters and their effect on global supply chains and energy markets; current economic conditions and uncertainties in the credit and capital markets; instability in countries where Dover conducts business; the ability of Dover's businesses to expand into new geographic markets and to anticipate and meet customer demands for new products and product enhancements; increased competition and pricing pressures in the markets served by Dover's businesses; the impact of the proposed spin off and our ability to consummate it on the anticipated time line or terms; the terms and timing of the sale of any business in discontinued operations; the impact of loss of a single-source manufacturing facility; changes in customer demand or loss of a significant customer; the relative mix of products and services which impacts margins and operating efficiencies; short-term capacity constraints; increases in the cost of raw materials; domestic and foreign governmental and public policy changes including environmental regulations, conflict minerals disclosure requirements, and tax policies (including domestic and international export subsidy programs, R&E credits and other similar programs); protection and validity of patent and other intellectual property rights; the ability to identify and successfully consummate value-adding acquisition opportunities; Dover's ability to achieve expected savings from integration, synergy and other cost-control initiatives; unforeseen developments in contingencies such as litigation; international economic conditions including interest rate and currency exchange rate fluctuations; possible future terrorist threats and their effect on the worldwide economy; and a downgrade in Dover's credit ratings. Dover refers you to the documents that it files from time to time with the Securities and Exchange Commission, such as its reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of these and other risks and uncertainties that could cause its actual results to differ materially from its current expectations and from the forward-looking statements contained in this press release. Dover undertakes no obligation to update any forward-looking statement, except as required by law.

INVESTOR SUPPLEMENT - SECOND QUARTER 2013

DOVER CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS

(unaudited)(in thousands, except per share data)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2013 | 2012 | 2013 | 2012 | ||||||||||||

Revenue | $ | 2,228,763 | $ | 2,038,289 | $ | 4,268,336 | $ | 3,992,903 | |||||||

Cost of goods and services | 1,372,811 | 1,261,187 | 2,635,762 | 2,469,721 | |||||||||||

Gross profit | 855,952 | 777,102 | 1,632,574 | 1,523,182 | |||||||||||

Selling and administrative expenses | 505,628 | 466,089 | 990,049 | 920,078 | |||||||||||

Operating earnings | 350,324 | 311,013 | 642,525 | 603,104 | |||||||||||

Interest expense, net | 30,280 | 29,715 | 60,524 | 59,746 | |||||||||||

Other expense (income), net | 2,543 | 364 | (2,176 | ) | 2,149 | ||||||||||

Earnings before provision for income taxes and discontinued operations | 317,501 | 280,934 | 584,177 | 541,209 | |||||||||||

Provision for income taxes | 23,149 | 75,778 | 92,836 | 149,644 | |||||||||||

Earnings from continuing operations | 294,352 | 205,156 | 491,341 | 391,565 | |||||||||||

Earnings from discontinued operations, net | 35,697 | 8,945 | 48,711 | 18,599 | |||||||||||

Net earnings | $ | 330,049 | $ | 214,101 | $ | 540,052 | $ | 410,164 | |||||||

Comprehensive earnings | $ | 332,989 | $ | 120,514 | $ | 511,713 | $ | 357,819 | |||||||

Basic earnings per common share: | |||||||||||||||

Earnings from continuing operations | $ | 1.72 | $ | 1.12 | $ | 2.85 | $ | 2.13 | |||||||

Earnings from discontinued operations, net | 0.21 | 0.05 | 0.28 | 0.10 | |||||||||||

Net earnings | 1.93 | 1.17 | 3.13 | 2.23 | |||||||||||

Weighted average shares outstanding | 171,111 | 183,494 | 172,273 | 183,625 | |||||||||||

Diluted earnings per common share: | |||||||||||||||

Earnings from continuing operations | $ | 1.70 | $ | 1.10 | $ | 2.82 | $ | 2.10 | |||||||

Earnings from discontinued operations, net | 0.21 | 0.05 | 0.28 | 0.10 | |||||||||||

Net earnings | 1.91 | 1.15 | 3.10 | 2.20 | |||||||||||

Weighted average shares outstanding | 173,097 | 185,780 | 174,325 | 186,171 | |||||||||||

Dividends paid per common share | $ | 0.35 | $ | 0.315 | $ | 0.70 | $ | 0.63 | |||||||

DOVER CORPORATION

QUARTERLY SEGMENT INFORMATION

(unaudited)(in thousands)

2013 | 2012 | |||||||||||||||||||||||||||

Q1 | Q2 | Q2 YTD | Q1 | Q2 | Q2 YTD | Q3 | Q4 | FY 2012 | ||||||||||||||||||||

REVENUE | ||||||||||||||||||||||||||||

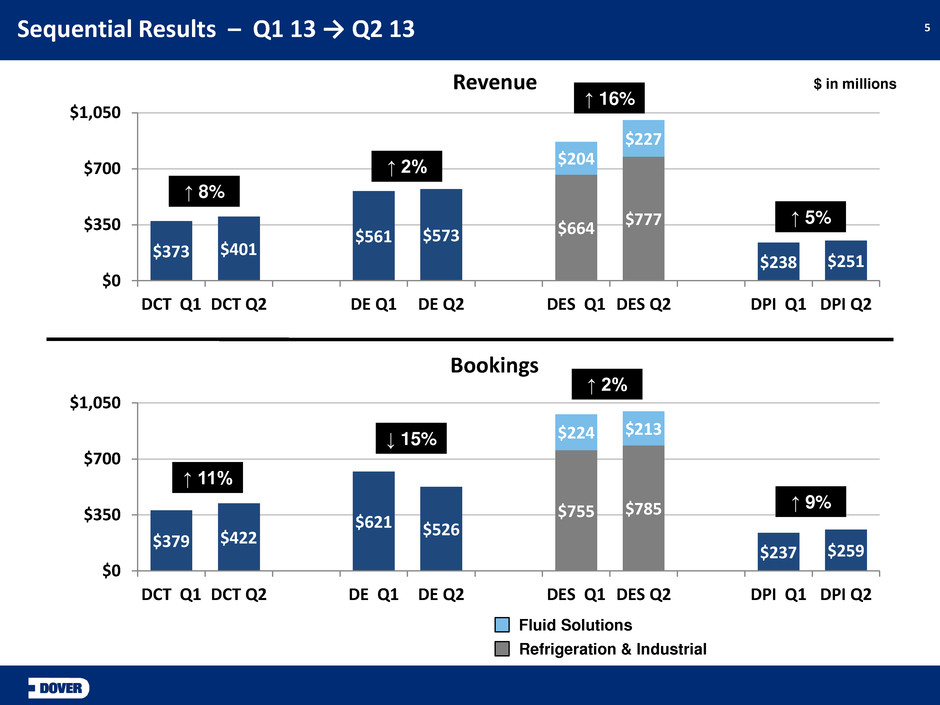

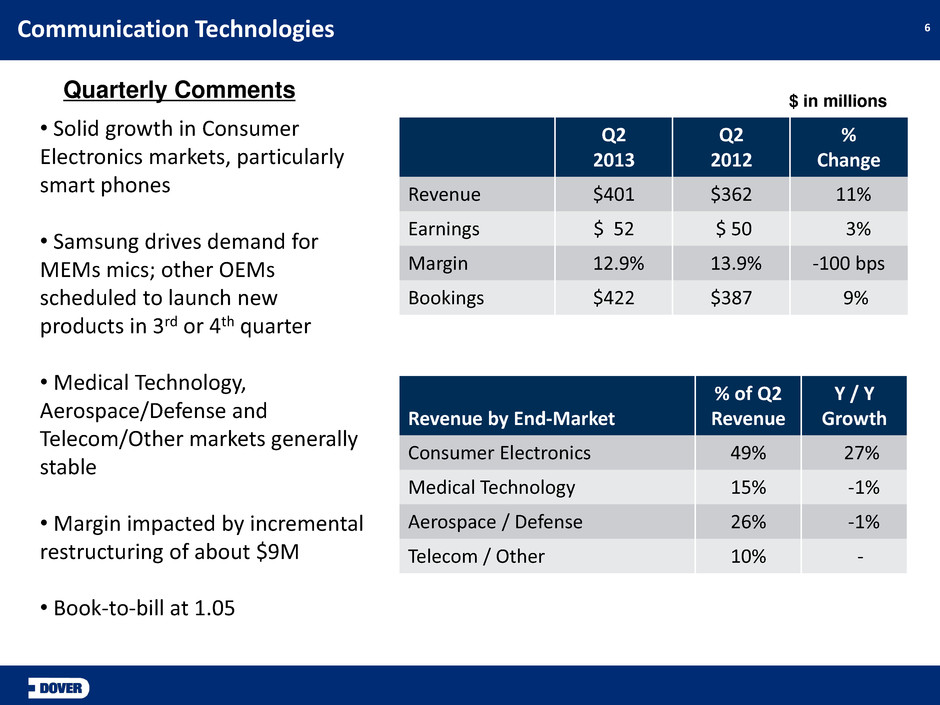

Communication Technologies | $ | 372,790 | $ | 401,477 | $ | 774,267 | $ | 357,575 | $ | 361,689 | $ | 719,264 | $ | 396,470 | $ | 400,851 | $ | 1,516,585 | ||||||||||

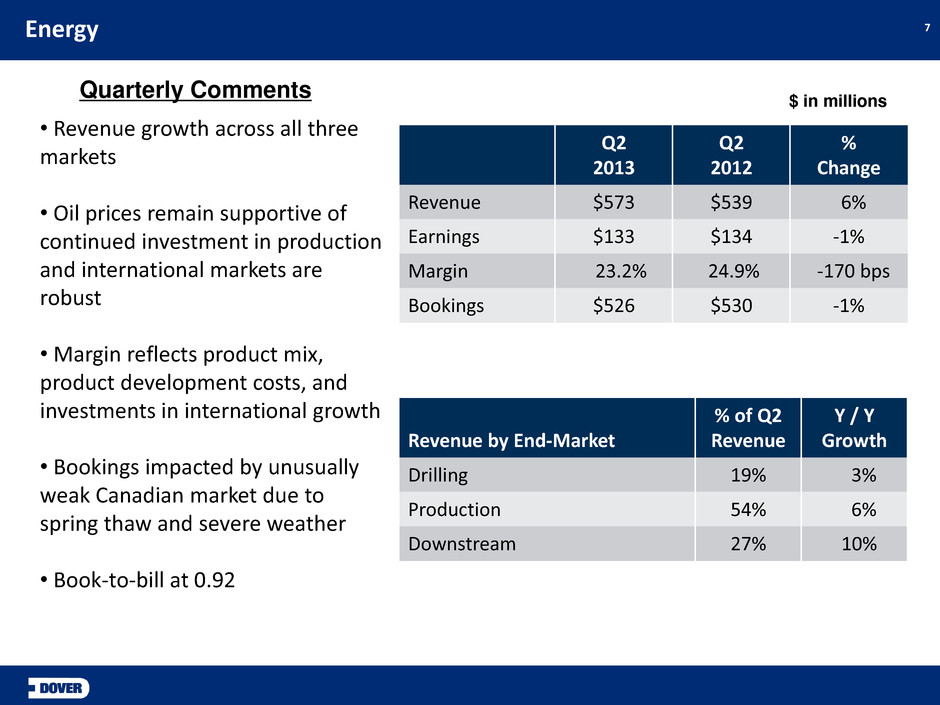

Energy | 561,198 | 573,471 | 1,134,669 | 531,570 | 538,786 | 1,070,356 | 562,263 | 539,985 | 2,172,604 | |||||||||||||||||||

Engineered Systems | ||||||||||||||||||||||||||||

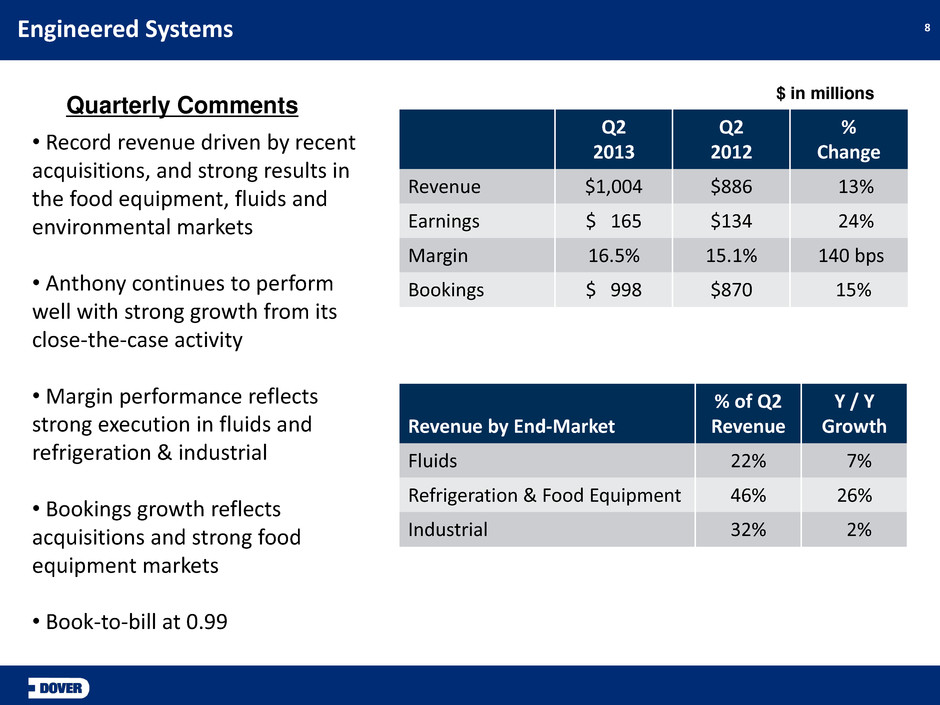

Fluid Solutions | 203,991 | 226,882 | 430,873 | 180,364 | 211,974 | 392,338 | 218,324 | 206,500 | 817,162 | |||||||||||||||||||

Refrigeration & Industrial | 664,294 | 777,396 | 1,441,690 | 642,213 | 674,501 | 1,316,714 | 674,116 | 613,012 | 2,603,842 | |||||||||||||||||||

Eliminations | (352 | ) | (383 | ) | (735 | ) | (453 | ) | (352 | ) | (805 | ) | (319 | ) | (336 | ) | (1,460 | ) | ||||||||||

867,933 | 1,003,895 | 1,871,828 | 822,124 | 886,123 | 1,708,247 | 892,121 | 819,176 | 3,419,544 | ||||||||||||||||||||

Printing & Identification | 237,877 | 250,646 | 488,523 | 243,570 | 251,875 | 495,445 | 246,945 | 254,141 | 996,531 | |||||||||||||||||||

Intra-segment eliminations | (225 | ) | (726 | ) | (951 | ) | (225 | ) | (184 | ) | (409 | ) | (194 | ) | (322 | ) | (925 | ) | ||||||||||

Total consolidated revenue | $ | 2,039,573 | $ | 2,228,763 | $ | 4,268,336 | $ | 1,954,614 | $ | 2,038,289 | $ | 3,992,903 | $ | 2,097,605 | $ | 2,013,831 | $ | 8,104,339 | ||||||||||

NET EARNINGS | ||||||||||||||||||||||||||||

Segment Earnings: | ||||||||||||||||||||||||||||

Communication Technologies | $ | 44,208 | $ | 51,789 | $ | 95,997 | $ | 46,556 | $ | 50,322 | $ | 96,878 | $ | 63,706 | $ | 58,376 | $ | 218,960 | ||||||||||

Energy | 139,545 | 132,926 | 272,471 | 132,115 | 133,936 | 266,051 | 139,038 | 133,561 | 538,650 | |||||||||||||||||||

Engineered Systems | 117,178 | 165,440 | 282,618 | 122,092 | 133,808 | 255,900 | 144,245 | 101,807 | 501,952 | |||||||||||||||||||

Printing & Identification | 29,752 | 35,967 | 65,719 | 26,089 | 28,918 | 55,007 | 39,502 | 40,650 | 135,159 | |||||||||||||||||||

Total Segments | 330,683 | 386,122 | 716,805 | 326,852 | 346,984 | 673,836 | 386,491 | 334,394 | 1,394,721 | |||||||||||||||||||

Corporate expense / other (1) | 33,763 | 38,341 | 72,104 | 36,546 | 36,335 | 72,881 | 32,001 | 31,127 | 136,009 | |||||||||||||||||||

Net interest expense | 30,244 | 30,280 | 60,524 | 30,031 | 29,715 | 59,746 | 30,399 | 30,996 | 121,141 | |||||||||||||||||||

Earnings from continuing operations before provision for income taxes | 266,676 | 317,501 | 584,177 | 260,275 | 280,934 | 541,209 | 324,091 | 272,271 | 1,137,571 | |||||||||||||||||||

Provision for income taxes | 69,687 | 23,149 | 92,836 | 73,866 | 75,778 | 149,644 | 90,761 | 64,047 | 304,452 | |||||||||||||||||||

Earnings from continuing operations | 196,989 | 294,352 | 491,341 | 186,409 | 205,156 | 391,565 | 233,330 | 208,224 | 833,119 | |||||||||||||||||||

Earnings (loss) from discontinued operations, net | 13,014 | 35,697 | 48,711 | 9,654 | 8,945 | 18,599 | 7,716 | (48,364 | ) | (22,049 | ) | |||||||||||||||||

Net earnings | $ | 210,003 | $ | 330,049 | $ | 540,052 | $ | 196,063 | $ | 214,101 | $ | 410,164 | $ | 241,046 | $ | 159,860 | $ | 811,070 | ||||||||||

SEGMENT OPERATING MARGIN | ||||||||||||||||||||||||||||

Communication Technologies | 11.9 | % | 12.9 | % | 12.4 | % | 13.0 | % | 13.9 | % | 13.5 | % | 16.1 | % | 14.6 | % | 14.4 | % | ||||||||||

Energy | 24.9 | % | 23.2 | % | 24.0 | % | 24.9 | % | 24.9 | % | 24.9 | % | 24.7 | % | 24.7 | % | 24.8 | % | ||||||||||

Engineered Systems | 13.5 | % | 16.5 | % | 15.1 | % | 14.9 | % | 15.1 | % | 15.0 | % | 16.2 | % | 12.4 | % | 14.7 | % | ||||||||||

Printing & Identification | 12.5 | % | 14.3 | % | 13.5 | % | 10.7 | % | 11.5 | % | 11.1 | % | 16.0 | % | 16.0 | % | 13.6 | % | ||||||||||

Total Segment | 16.2 | % | 17.3 | % | 16.8 | % | 16.7 | % | 17.0 | % | 16.9 | % | 18.4 | % | 16.6 | % | 17.2 | % | ||||||||||

DEPRECIATION AND AMORTIZATION EXPENSE | ||||||||||||||||||||||||||||

Communication Technologies | $ | 35,501 | $ | 37,719 | $ | 73,220 | $ | 31,513 | $ | 32,828 | $ | 64,341 | $ | 32,997 | $ | 35,281 | $ | 132,619 | ||||||||||

Energy | 26,298 | 26,599 | 52,897 | 21,184 | 23,533 | 44,717 | 24,639 | 25,721 | 95,077 | |||||||||||||||||||

Engineered Systems | 31,551 | 32,282 | 63,833 | 19,582 | 23,913 | 43,495 | 23,060 | 27,066 | 93,621 | |||||||||||||||||||

Printing & Identification | 7,630 | 7,606 | 15,236 | 8,331 | 8,496 | 16,827 | 8,777 | 7,998 | 33,602 | |||||||||||||||||||

Corporate | 859 | 1,026 | 1,885 | 700 | 765 | 1,465 | 842 | 359 | 2,666 | |||||||||||||||||||

$ | 101,839 | $ | 105,232 | $ | 207,071 | $ | 81,310 | $ | 89,535 | $ | 170,845 | $ | 90,315 | $ | 96,425 | $ | 357,585 | |||||||||||

(1) Includes $3.3 million of incurred Knowles spin off costs in Q2 2013. | ||||||||||||||||||||||||||||

DOVER CORPORATION

QUARTERLY SEGMENT INFORMATION

(continued)

(unaudited)(in thousands)

2013 | 2012 | |||||||||||||||||||||||||||

Q1 | Q2 | Q2 YTD | Q1 | Q2 | Q2 YTD | Q3 | Q4 | FY 2012 | ||||||||||||||||||||

BOOKINGS | ||||||||||||||||||||||||||||

Communication Technologies | $ | 379,122 | $ | 422,293 | $ | 801,415 | $ | 347,291 | $ | 387,058 | $ | 734,349 | $ | 411,005 | $ | 363,624 | $ | 1,508,978 | ||||||||||

Energy | 620,640 | 525,612 | 1,146,252 | 585,775 | 530,352 | 1,116,127 | 526,824 | 550,091 | 2,193,042 | |||||||||||||||||||

Engineered Systems | ||||||||||||||||||||||||||||

Fluid Solutions | 223,764 | 213,359 | 437,123 | 184,711 | 204,139 | 388,850 | 197,767 | 209,872 | 796,489 | |||||||||||||||||||

Refrigeration & Industrial | 755,026 | 784,904 | 1,539,930 | 711,911 | 666,223 | 1,378,134 | 600,065 | 606,931 | 2,585,130 | |||||||||||||||||||

Eliminations | (373 | ) | (432 | ) | (805 | ) | (408 | ) | (376 | ) | (784 | ) | (258 | ) | (399 | ) | (1,441 | ) | ||||||||||

978,417 | 997,831 | 1,976,248 | 896,214 | 869,986 | 1,766,200 | 797,574 | 816,404 | 3,380,178 | ||||||||||||||||||||

Printing & Identification | 237,217 | 259,282 | 496,499 | 249,773 | 251,733 | 501,506 | 244,611 | 252,937 | 999,054 | |||||||||||||||||||

Intra-segment eliminations | (720 | ) | (137 | ) | (857 | ) | (609 | ) | (221 | ) | (830 | ) | (759 | ) | (1,020 | ) | (2,609 | ) | ||||||||||

Total consolidated bookings | $ | 2,214,676 | $ | 2,204,881 | $ | 4,419,557 | $ | 2,078,444 | $ | 2,038,908 | $ | 4,117,352 | $ | 1,979,255 | $ | 1,982,036 | $ | 8,078,643 | ||||||||||

BACKLOG | ||||||||||||||||||||||||||||

Communication Technologies | $ | 458,765 | $ | 480,426 | $ | 451,110 | $ | 476,745 | $ | 491,041 | $ | 453,172 | ||||||||||||||||

Energy | 311,793 | 255,544 | 296,360 | 282,364 | 248,233 | 256,093 | ||||||||||||||||||||||

Engineered Systems | ||||||||||||||||||||||||||||

Fluid Solutions | 178,854 | 184,142 | 191,327 | 172,300 | 156,191 | 160,890 | ||||||||||||||||||||||

Refrigeration & Industrial | 592,922 | 597,838 | 598,910 | 586,824 | 515,285 | 516,559 | ||||||||||||||||||||||

Eliminations | (178 | ) | (227 | ) | (132 | ) | (155 | ) | (94 | ) | (157 | ) | ||||||||||||||||

771,598 | 781,753 | 790,105 | 758,969 | 671,382 | 677,292 | |||||||||||||||||||||||

Printing & Identification | 95,353 | 103,864 | 102,117 | 98,216 | 98,356 | 97,857 | ||||||||||||||||||||||

Intra-segment eliminations | (886 | ) | (578 | ) | (986 | ) | (648 | ) | (324 | ) | (591 | ) | ||||||||||||||||

Total consolidated backlog | $ | 1,636,623 | $ | 1,621,009 | $ | 1,638,706 | $ | 1,615,646 | $ | 1,508,688 | $ | 1,483,823 | ||||||||||||||||

DOVER CORPORATION

QUARTERLY EARNINGS PER SHARE

(unaudited)(in thousands, except per share data*)

2013 | 2012 | |||||||||||||||||||||||||||

Q1 | Q2 | Q2 YTD | Q1 | Q2 | Q2 YTD | Q3 | Q4 | FY 2012 | ||||||||||||||||||||

Basic earnings (loss) per common share: | ||||||||||||||||||||||||||||

Continuing operations | $ | 1.14 | $ | 1.72 | $ | 2.85 | $ | 1.01 | $ | 1.12 | $ | 2.13 | $ | 1.28 | $ | 1.17 | $ | 4.59 | ||||||||||

Discontinued operations | 0.08 | 0.21 | 0.28 | 0.05 | 0.05 | 0.10 | 0.04 | (0.27 | ) | (0.12 | ) | |||||||||||||||||

Net earnings | 1.21 | 1.93 | 3.13 | 1.07 | 1.17 | 2.23 | 1.33 | 0.90 | 4.47 | |||||||||||||||||||

Diluted earnings (loss) per common share: | ||||||||||||||||||||||||||||

Continuing operations | $ | 1.12 | $ | 1.70 | $ | 2.82 | $ | 1.00 | $ | 1.10 | $ | 2.10 | $ | 1.27 | $ | 1.16 | $ | 4.53 | ||||||||||

Discontinued operations | 0.07 | 0.21 | 0.28 | 0.05 | 0.05 | 0.10 | 0.04 | (0.27 | ) | (0.12 | ) | |||||||||||||||||

Net earnings | 1.20 | 1.91 | 3.10 | 1.05 | 1.15 | 2.20 | 1.31 | 0.89 | 4.41 | |||||||||||||||||||

Adjusted diluted earnings per common share (calculated below): | ||||||||||||||||||||||||||||

Continuing operations | $ | 1.10 | $ | 1.36 | $ | 2.46 | $ | 1.01 | $ | 1.10 | $ | 2.11 | $ | 1.25 | $ | 1.09 | $ | 4.44 | ||||||||||

Net earnings (loss) and average shares used in calculated earnings (loss) per share amounts are as follows: | ||||||||||||||||||||||||||||

Net earnings (loss): | ||||||||||||||||||||||||||||

Continuing operations | $ | 196,989 | $ | 294,352 | $ | 491,341 | $ | 186,409 | $ | 205,156 | $ | 391,565 | $ | 233,330 | $ | 208,224 | $ | 833,119 | ||||||||||

Discontinued operations | 13,014 | 35,697 | 48,711 | 9,654 | 8,945 | 18,599 | 7,716 | (48,364 | ) | (22,049 | ) | |||||||||||||||||

Net earnings | 210,003 | 330,049 | 540,052 | 196,063 | 214,101 | 410,164 | 241,046 | 159,860 | 811,070 | |||||||||||||||||||

Average shares outstanding: | ||||||||||||||||||||||||||||

Basic | 173,448 | 171,111 | 172,273 | 183,737 | 183,494 | 183,625 | 181,763 | 177,257 | 181,551 | |||||||||||||||||||

Diluted | 175,567 | 173,097 | 174,325 | 186,706 | 185,780 | 186,171 | 183,932 | 179,365 | 183,993 | |||||||||||||||||||

Note: | ||||||||||||||||||||||||||||

Earnings from continuing operations are adjusted by discrete tax items and incurred Knowles spin off costs to derive adjusted earnings from continuing operations and adjusted diluted earnings per common share as follows: | ||||||||||||||||||||||||||||

2013 | 2012 | |||||||||||||||||||||||||||

Q1 | Q2 | Q2 YTD | Q1 | Q2 | Q2 YTD | Q3 | Q4 | FY 2012 | ||||||||||||||||||||

Adjusted earnings from continuing operations: | ||||||||||||||||||||||||||||

Earnings from continuing operations | $ | 196,989 | $ | 294,352 | $ | 491,341 | $ | 186,409 | $ | 205,156 | $ | 391,565 | $ | 233,330 | $ | 208,224 | $ | 833,119 | ||||||||||

Gains (losses) from discrete and other tax items | 4,525 | 61,477 | 66,002 | (1,610 | ) | (372 | ) | (1,982 | ) | 4,513 | 13,606 | 16,137 | ||||||||||||||||

Knowles spin off costs | — | (3,322 | ) | (3,322 | ) | — | — | — | — | — | — | |||||||||||||||||

Adjusted earnings from continuing operations | $ | 192,464 | $ | 236,197 | $ | 428,661 | $ | 188,019 | $ | 205,528 | $ | 393,547 | $ | 228,817 | $ | 194,618 | $ | 816,982 | ||||||||||

Adjusted diluted earnings per common share: | ||||||||||||||||||||||||||||

Earnings from continuing operations | $ | 1.12 | $ | 1.70 | $ | 2.82 | $ | 1.00 | $ | 1.10 | $ | 2.10 | $ | 1.27 | $ | 1.16 | $ | 4.53 | ||||||||||

Gains (losses) from discrete and other tax items | 0.02 | 0.36 | 0.38 | (0.01 | ) | — | (0.01 | ) | 0.02 | 0.07 | 0.09 | |||||||||||||||||

Knowles spin off costs | — | (0.02 | ) | (0.02 | ) | — | — | — | — | — | — | |||||||||||||||||

Adjusted earnings from continuing operations | $ | 1.10 | $ | 1.36 | $ | 2.46 | $ | 1.01 | $ | 1.10 | $ | 2.11 | $ | 1.25 | $ | 1.09 | $ | 4.44 | ||||||||||

* Per share data may not add due to rounding. | ||||||||||||||||||||||||||||

DOVER CORPORATION

QUARTERLY FREE CASH FLOW

(unaudited)(in thousands)

2013 | 2012 | |||||||||||||||||||||||||||

Q1 | Q2 | Q2 YTD | Q1 | Q2 | Q2 YTD | Q3 | Q4 | FY 2012 | ||||||||||||||||||||

Cash flow from operating activities | $ | 78,326 | $ | 304,729 | $ | 383,055 | $ | 161,327 | $ | 243,363 | $ | 404,690 | $ | 285,811 | $ | 570,659 | $ | 1,261,160 | ||||||||||

Less: Additions to property, plant and equipment | (47,153 | ) | (53,284 | ) | (100,437 | ) | (68,249 | ) | (72,758 | ) | (141,007 | ) | (67,842 | ) | (88,163 | ) | (297,012 | ) | ||||||||||

Free cash flow | $ | 31,173 | $ | 251,445 | $ | 282,618 | $ | 93,078 | $ | 170,605 | $ | 263,683 | $ | 217,969 | $ | 482,496 | $ | 964,148 | ||||||||||

Free cash flow as a percentage of earnings from continuing operations | 15.8 | % | 85.4 | % | 57.5 | % | 49.9 | % | 83.2 | % | 67.3 | % | 93.4 | % | 231.7 | % | 115.7 | % | ||||||||||

Free cash flow as a percentage of revenue | 1.5 | % | 11.3 | % | 6.6 | % | 4.8 | % | 8.4 | % | 6.6 | % | 10.4 | % | 24.0 | % | 11.9 | % | ||||||||||