UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Air Products and Chemicals, Inc.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

Generating a Cleaner Future

Proxy Statement for

2022 Annual Meeting of Shareholders

Thursday, February 3, 2022

2:00 p.m. (Eastern

Time)

Virtual Meeting: virtualshareholdermeeting.com/APD2022

| Table of Contents |

| Proxy Statement |

| We have provided you this Notice of Annual Meeting and proxy statement because the Board of Directors (the “Board”) of Air Products and Chemicals, Inc. (the “Company” or “Air Products”) is soliciting your proxy to vote at the Company’s 2022 Annual Meeting of Shareholders on February 3, 2022 (the “Annual Meeting”). This proxy statement contains information about the items to be voted on at the Annual Meeting and information about the Company. Instructions on how to access this proxy statement and our 2021 Annual Report to Shareholders on the Internet or paper copies of the proxy statement and Annual Report are first being sent to shareholders on or about December 15, 2021. |

| Message to Our Shareholders |

December 15, 2021

Dear Fellow Shareholder:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2022 Annual Meeting of Shareholders of Air Products and Chemicals, Inc. to be held on Thursday, February 3, 2022 at 2:00 p.m. (Eastern Time). This year’s Annual Meeting will be held in a virtual format through a live audio webcast, which can be accessed at www.virtualshareholdermeeting.com/APD2022. Shareholders participating in the meeting will have the ability to submit questions during the live audio webcast.

Attached you will find the Notice of Annual Meeting and proxy statement that contain additional information, including the items of business and methods you can use to vote your proxy. Your vote is very important. I encourage you to sign and return your proxy card or use Internet, mobile device or telephone voting prior to the meeting so that your shares of common stock will be represented and voted at the meeting even if you cannot attend.

We continue to demonstrate our higher purpose at Air Products – bringing people together to collaborate and innovate solutions to pressing energy and environmental challenges. This continues to drive sustainable growth opportunities that deliver value to our shareholders, customers, employees and communities around the world.

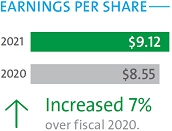

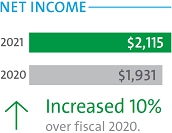

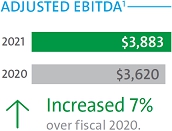

Thanks to the hard work of our more than 20,000 people around the globe, Air Products achieved strong financial performance in 2021 and increased its quarterly dividend for the 39th consecutive year. The committed, dedicated and motivated team at Air Products proved once again that they can deliver excellent results despite challenges posed by external factors. I am proud of how our team is developing and executing projects that will increase our and our customers’ sustainability and drive profitable growth in the future.

Air Products is at the forefront of the global energy transition. In line with our strategic Five-Point Plan, our industrial gases and technologies help our customers improve their sustainability performance, and we are pleased to support their continuous improvement journey. Meanwhile, our large-scale projects are designed to address urgent energy and environmental needs through large-scale gasification, carbon capture and hydrogen solutions. We are making significant investments around the world – projects that will provide real solutions towards a cleaner future.

For example, in fiscal 2021 we announced a $1.3 billion (Canadian) landmark net-zero hydrogen energy complex in Alberta, Canada, producing hydrogen and capturing carbon dioxide (CO2). The Alberta facility will deliver net-zero emissions and be capable of capturing over 95 percent of the carbon dioxide generated by the complex and permanently sequestering it safely underground, while hydrogen-fueled electricity will offset the remaining five percent of emissions.

We also recently announced a $4.5 billion investment in a world-scale clean energy complex in Louisiana where we will produce over 750 million standard cubic feet per day of blue hydrogen by 2026 and capture and permanently sequester over five million metric tons per year of CO2. This will be the largest carbon capture for sequestration facility in the world and will help advance the clean energy transition for the U.S. and for the world.

In addition, we are executing on large-scale gasification projects to enable the conversion of plentiful resources into high-value products. In October 2021 we completed the asset acquisition and financing for our $12 billion air separation unit, gasification and power joint venture in Jazan Economic City, Saudi Arabia.

I also am pleased that again this year, our team was recognized for sustainability performance by prestigious organizations, including EcoVadis, Barron’s 100 Most Sustainable Companies, 100 Best Corporate Citizens and Human Rights Campaign Foundation’s 2021 Corporate Equality Index, among others. In 2021, we hosted a Day of Understanding/Week of Inclusion, underpinning our goal to be the most diverse industrial gas company in the world. We work hard every day to build a culture where all are valued, respected and feel that they belong and matter.

There are many exciting opportunities ahead as we focus on driving our base business and creating and winning projects that help customers and countries meet their growing needs.

Thank you for your continued support of our Company, and I look forward to speaking with fellow shareholders in February. Until then, stay well and stay safe.

|

“The committed, dedicated and motivated team at Air Products proved once again that they can deliver excellent results despite challenges posed by external factors. I am proud of how our team is developing and executing projects that will increase our and our customers’ sustainability and drive profitable growth in the future.” All the best,

Seifi Ghasemi Chairman, President and Chief Executive Officer |

| |

2022 Proxy Statement 1

| Notice of Annual Meeting of Shareholders | |

|

Logistics

Date and Time Thursday, February 3, 2022 | |

Virtual Meeting To support the health and well-being of our employees and shareholders, the 2022 Annual Meeting of Shareholders will be conducted virtually at: www.virtualshareholdermeeting.com/APD2022. Procedures for attending and participating in the virtual meeting are explained on page 69. | |

Record Date Shareholders of record at the close of business on December 7, 2021 are entitled to receive this notice and to vote at the meeting. | |

Important Notice Regarding Internet Availability of Proxy Materials for the Air Products and Chemicals, Inc. 2022 Annual Meeting of Shareholders To Be Held on February 3, 2022: Our proxy statement and 2021 Annual Report to Shareholders are available at www.proxyvote.com. |

Items of Business

| Company Proposals | Board Vote Recommendation |

Votes Required | Page | ||||

| Proposal 1. Elect the seven nominees proposed by the Board of Directors as directors for a one-year term ending in 2022. |  |

FOR | Majority of Votes Cast | 8 | |||

| Proposal 2. Conduct an advisory vote on executive officer compensation. |  |

FOR | Majority of Votes Cast | 27 | |||

| Proposal 3. Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2022. |  |

FOR | Majority of Votes Cast | 61 | |||

Shareholders will also attend to such other business as may properly come before the meeting or any postponement or adjournment of the meeting.

How to Vote

Shareholders of Record (shares registered in your name with the Company’s transfer agent) and Retirement Savings Plan Participants:

|

|

|

|

| ||||

| Internet | Mobile Device | Telephone | Vote Online | |||||

| During the Meeting | ||||||||

| www.proxyvote.com |

Scan the QR Code to vote using

|

1-800-690-6903 | Complete, sign and mail your proxy card or voting instruction form in the self-addressed envelope provided. | For instructions on voting during the meeting please see page 69. |

Street Name Holders (shares held through a broker, bank or other nominee): refer to the voting instruction form provided by your broker, bank or other nominee.

Important

Whether you plan to attend the meeting or not, please submit your proxy as soon as possible in order to avoid additional soliciting expense to the Company. The proxy is revocable and will not affect your right to vote if you attend the meeting.

By order of the Board of Directors,

Sean D. Major

Executive Vice President, General Counsel and Secretary

December 15, 2021

2

| Fiscal 2021 Performance Overview |

Our Higher Purpose:

Bringing people together to collaborate and innovate solutions to the world’s most significant energy and environmental sustainability challenges.

By living our higher purpose, we are creating sustainable growth opportunities that deliver value to our shareholders, customers, employees and communities around the world.

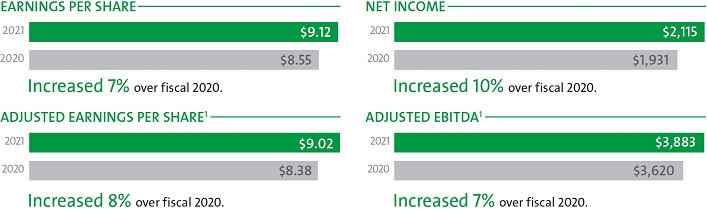

Financial and Operational Highlights

Financial Performance

|

|

|

|

|

Safety Performance Our safety performance is critical to our success and one of our goals is to be the safest industrial gas company in the world. Our safety record improved in fiscal 2021, and we have achieved a 75% improvement in the employee lost time injury rate and a 33% improvement in the employee recordable injury rate since fiscal 2014. |

| |

|

Operational Performance During 2021, the Company continued to execute its growth strategy, including a major gasification project in Saudi Arabia, and signed agreements to produce net-zero hydrogen in Edmonton, Alberta, Canada and a blue hydrogen complex in Louisiana, USA. Coupled with our NEOM project announced in 2020 to produce carbon-free hydrogen to power buses and trucks around the world, these multi-billion dollar clean hydrogen projects demonstrate our commitment to the production of no- and low-carbon hydrogen to advance the global energy transition. |

| |

|

Returns to Shareholders The Company returned approximately $1.3 billion to shareholders through dividends, increasing dividends for the 39th consecutive year. |

|

| 1 | This is a financial measure not calculated in accordance with United States generally accepted accounting principles (“GAAP”). See Appendix A for a reconciliation to the most directly comparable financial measure calculated under GAAP. |

2022 Proxy Statement 3

Providing innovative solutions through deeply-rooted values

In 2016, Air Products set 12 sustainability goals to be achieved by 2020. By the end of 2020, we met nearly all of the goals across our Grow-Conserve-Care framework. As our 2020 goals were nearing completion, Air Products developed new Sustainability Goals. These new goals reflect our priorities in sustainability and our ongoing stakeholder assessments. Several of the goals are continuations of our 2020 goals, while others are new commitments reflective of our sustainable growth strategy.

|

Grow |

Conserve |

Care |

|||||

|

|

|

|||||

|

Achievements ● Led the industrial gas industry in profitability, with the highest adjusted EBITDA margin* and adjusted operating margin* in the industry ● Enabled customers to avoid three times our own CO2 equivalent (“CO2e”) emissions while contributing 57% of revenues from sustainable offerings ● Announced landmark carbon capture and blue hydrogen projects in Canada and the United States to advance clean energy transition |

● Reduced GHG emissions intensity by 2.6%, surpassing our goal of 2% ● Improved distribution efficiency and reduced CO2 emissions intensity by 20%, exceeding our goal of 10% ● Conserved water and lowered use intensity by 26%, exceeding our goal of 5% |

● Led the industrial gas industry in safety as measured by our safety rates ● Contributed $6.4 million in donations to communities ● Air Products hosted a global Day of Understanding/Week of Inclusion, underpinning our announced diversity, inclusion and belonging goals |

|||||

New Goals |

|||||||

|

Economic Performance Lead the industrial gas industry in profitability |

|

CO2 Intensity Reduce our CO2 emissions intensity by one-third by 2030 |

|

Safety Lead the industrial gas industry in safety | ||

|

Customer Sustainability Annually increase the total CO2 emissions avoided by our customers |

|

Resource Conservation Increase energy efficiency and promote the responsible use of water |

|

Talent and Diversity Increase diversity in professional and managerial roles | ||

| * | Amounts are non-GAAP financial measures. See “Sustainability 2021 Reconciliation of Non-GAAP Financial Measures” for reconciliation to the comparable GAAP measures. |

4

|

||||||

|

Put simply, sustainability is our growth strategy at Air Products. Sustainability creates our growth opportunities, and our growth opportunities support our sustainability goals and focus. Seifi Ghasemi Chairman, President and CEO |

||||||

|

||||||

| Our

products enabled our customers and their customers to avoid 72 Million metric tons of CO2e, which is equivalent to the emissions from approximately 16 million cars and three times our own direct and indirect CO2 emissions. |

|

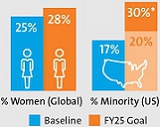

Our People We believe our employees are our most valuable asset and are critical to our success as an organization. Our goal is to be the safest, most diverse and most profitable industrial gas company in the world, providing excellent service to our customers. Integral to our success is the continued development of our 4S culture (Safety, Speed, Simplicity and Self-Confidence) and creating a work environment where all employees feel that they belong and matter. Our talent related initiatives, including employee recruitment and development, diversity and inclusion and compensation and benefit programs, are focused on building and retaining the world-class and talented staff that is needed to meet our goals. DIVERSITY IN PROFESSIONAL AND MANAGERIAL ROLES | |

|

* Air Products achieved its initial 20% goal set in October 2020 for minority representation in U.S. professional and managerial roles and in November 2021 set a new goal of 30% representation in those roles by 2025.

|

|

More Information Air Products has reported annually on its sustainability performance for 18 years, building on a decade of safety and environmental reporting. Our 2021 Sustainability Report, prepared in accordance with GRI, is available on the sustainability page of our website and includes details on our plans to reach our goals. We also provide summaries of how our sustainability efforts are aligned with the reporting recommendations of SASB and TCFD. | |

2021 Corporate Sustainability Report* www.airproducts.com/ company/sustainability.aspx |

|

* The information on our sustainability website is not incorporated by reference into, and does not form part of, this proxy statement. | |

Recognition

The Company was ranked as the top climate aligned company in Barron’s 2021 Ranking of the Most Sustainable Companies in America and 13th on Barron’s List of the 100 Most Sustainable Companies. In 2021 Air Products was named to the Dow Jones Sustainability Index (North America), ISS oekom Prime, FTSE4Good Index, Ethibel Sustainability Index (Excellence Global) and Corporate Responsibility Magazine’s 100 Best Corporate Citizens and received a gold rating from EcoVadis. The Company was selected as a Corporate Equality Index Best Place to Work for LGBT Equality in 2020 and 2021 for its diversity and inclusion initiatives and was named by Forbes in 2021 as a Best Employer for Diversity and also as a Best Employer for Women.

2022 Proxy Statement 5

This section summarizes information contained elsewhere in this proxy statement. These highlights do not contain all the information that you should consider before voting or provide a complete description of the topics covered. Please read this entire proxy statement before voting.

|

PROPOSAL

|

Elect the seven nominees proposed by the Board of Directors as directors for a one-year term ending in 2023. The individuals nominated for election to the Board are all current directors and possess a broad range of qualifications and skills that facilitate strong oversight of Air Products’ management and strategy. Our directors have diverse backgrounds and experiences and have demonstrated a commitment to strong corporate governance, shareholder engagement and sustainability. |

The Board recommends a vote “FOR” each of the seven nominees. è Page 8 | |||||

| Charles I. Cogut | Seifollah Ghasemi | Edward L. Monser | Wayne T. Smith | ||||

| Lisa A. Davis | David H.Y. Ho | Matthew H. Paull | |||||

| Independence | Diversity | Tenure | |||||

| 86% | 43% | 5.9 years | |||||

| Independent | Diverse | Average Tenure | |||||

|

|

|

|||||

| 6 Independent | 3 Diverse | 5 Medium-Tenured Directors (6 to 10 years) | |||||

| 1 Not Independent | 4 Other | 2 Newer Directors (5 years or less) | |||||

|

PROPOSAL

|

Conduct an advisory vote on executive officer compensation. As described in the Compensation Discussion and Analysis, our executive officer compensation program has been designed to support our long-term business strategies and drive creation of shareholder value. It is aligned with the competitive market for talent, sensitive to Company performance and oriented to long-term incentives to maintain and improve the Company’s long-term profitability. We believe our program delivers reasonable pay that is strongly linked to Company performance. |

The Board recommends a vote “FOR” this item. è Page 27 | |||

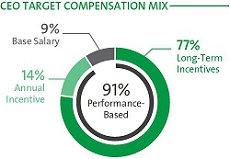

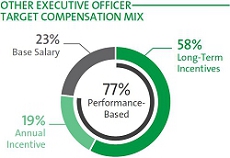

| The majority of compensation provided to the Company’s executive officers is dependent upon total returns delivered to shareholders and the achievement of performance objectives. Approximately 90% of the CEO’s total direct compensation opportunity is performance-based to ensure that compensation directly reflects the creation of shareholder value. | |||||

|

|

||||

| Say on Pay Support | |||||

| At the 2021 Annual Meeting of Shareholders, our shareholders supported the Company’s executive officer compensation program with approximately 94.55% of votes cast in favor of approval. | |||||

6

|

PROPOSAL

|

Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2022. The Audit and Finance Committee selected Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for fiscal 2022. The Board believes that the engagement of Deloitte as our independent registered public accounting firm for fiscal 2022 is in the best interests of the Company and is submitting the appointment of Deloitte to our shareholders for ratification as a matter of good corporate governance. |

The Board recommends a vote “FOR” this item. è Page 61 | |||

|

This proposal requests that our shareholders ratify the Audit and Finance Committee’s appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending September 30, 2022. Deloitte has served as our independent registered public accounting firm since fiscal 2019. |

|||||

2022 Proxy Statement 7

Selection of Directors

| Tenure (Full Years) |

Committees | ||||||

| Name and Current or Previous Position | Diverse | AF | CGN | E | MDC | ||

|

Charles I. Cogut - Independent Retired Partner, Simpson, Thacher & Bartlett LLP |

6 |  |

|

|||

|

Lisa A. Davis - Independent Former Member of the Managing Board for Siemens AG and Former Chair and CEO of Siemens Corporation USA |

|

1 |  |

|

| |

|

Seifollah Ghasemi Chairman, President and Chief Executive Officer of Air Products and Chemicals, Inc. |

|

8 |  |

|||

|

David H.Y. Ho - Independent Chairman and Founder of Kiina Investment Ltd. |

|

8 |  |

| ||

|

Edward L. Monser - Independent Retired President and Chief Operating Officer, Emerson Electric Co. |

8 |  1 1 |

|

| ||

|

Matthew H. Paull - Independent Retired Senior Executive Vice President and Chief Financial Officer of McDonald’s Corporation |

8 |  |

|

|

||

|

Wayne T. Smith - Independent Retired Chairman and Chief Executive Officer of BASF Corporation |

0 |  |

| |||

| AF | Audit and Finance | CGN | Corporate Governance and Nominating |  Chair

Chair |

| E | Executive | MDC | Management Development and Compensation |  Member Member |

1 Mr. Monser will become Chair of the CGN Committee effective at the conclusion of the Annual Meeting.

8

The Board is composed of a diverse group of leaders in their respective fields. Our directors have leadership experience at major domestic and international companies with operations inside and outside the United States. Our directors also have experience on other companies’ boards, which provides an understanding of different business processes, challenges, strategies and approaches to problem-solving. Our directors have substantial experience in key aspects of our operations, finance and capital management and government relations as well as in the market sectors we serve, including the energy, electronics and chemicals industries. Our directors also possess extensive experience in functional areas that are important to the execution of their oversight responsibilities, including corporate governance, accounting and financial reporting, information technology, mergers and acquisitions, investor relations and legal affairs. We believe all of our directors have personal traits such as candor, integrity, commitment and collegiality that are essential to effective corporate governance.

The Board believes its current members reflect a diverse array of skills, perspectives and experience as well as ethnic, gender and geographic diversity. For additional information, please refer to our directors’ skills matrix and other information below.

Board Snapshot

| Independence | Diversity | Tenure | ||||

| 86% | 43% | 5.9 years | ||||

| Independent | Diverse | Average Tenure | ||||

|

|

| ||||

| 6 Independent | 3 Diverse | 5 Medium-Tenured Directors (6 to 10 years) | ||||

| 1 Not Independent | 4 Other | 2 Newer Directors (5 years or less) |

Director Qualifications and Skills

The Board possesses a broad range of qualifications and skills that facilitate strong oversight of Air Products’ management and strategy. The following matrix identifies the primary skills that the Corporate Governance and Nominating Committee and the Board considered in connection with the re-nomination of seven incumbent directors.*

| Cogut | Davis | Ghasemi | Ho | Monser | Paull | Smith | ||

|

Accounting/Financial Reporting |  |

|

|

|

|

| |

|

Corporate Governance |  |

|

|

|

|

| |

|

Diverse Director |  |

|

|

||||

|

Executive Leadership |  |

|

|

|

|

| |

|

Finance and Capital Management |  |

|

|

|

| ||

|

Government Relations |  |

|

|

|

|||

|

Industry/Operations |  |

|

|

|

|

| |

|

Information Technology |  |

||||||

|

International Experience |  |

|

|

|

|

|

|

|

Investor Relations |  |

|

|

| |||

|

Large Industrial Projects |  |

|

|

|

|

|

|

|

Legal Affairs |  |

||||||

|

Logistics Experience |  |

|

|

||||

|

Mergers & Acquisitions |  |

|

|

|

|

| |

|

Oil and Gas Experience |  |

|

|

| |||

|

Technology |  |

|

|

|

* The absence of a mark does not necessarily indicate that the director does not possess that qualification or skill.

2022 Proxy Statement 9

Director Biographies

Information follows about the age and business experience of the director nominees and the particular experience, qualifications, attributes and skills that led the Board to conclude that each nominee should continue to serve as a director. All of the nominees are currently directors.

|

Age 74

Director Since 2015

Committees Audit and Finance

Corporate

|

Charles I. Cogut Independent Retired Partner, Simpson Thacher & Bartlett LLP Background Charles “Casey” I. Cogut is a retired partner of Simpson Thacher & Bartlett LLP (“STB”). Mr. Cogut joined the New York-based law firm in 1973 and served as a partner of STB from 1980 to 2012 and as a Senior Mergers and Acquisitions Counsel at STB from 2013 to 2016. For many years he was a leading member of STB’s merger and acquisitions and private equity practices. He specialized in domestic, international and cross-border mergers and acquisitions, the representation of special committees of boards of directors, buyouts and other transactions involving private equity firms. In addition, he regularly advised boards of directors with respect to corporate governance matters and fiduciary responsibilities. From 1990 to 1993, he served as senior resident partner in the firm’s London office. Mr. Cogut received his J.D. in 1973 from the University of Pennsylvania Law School after graduating summa cum laude from Lehigh University in 1969. He is a member of the Board of Advisors of the University of Pennsylvania Carey Law School. He also is a director of The Williams Companies, Inc. and a Vice Chair of the Board of Trustees and a member of the Executive Committee of Cold Spring Harbor Laboratory. He was formerly a director of Patheon N.V. Qualifications Mr. Cogut brings to the Board expertise in corporate governance and fiduciary responsibilities of directors. He also has extensive experience in multi-jurisdictional mergers and acquisitions and other complex transactions. He has been recognized as one of the leading corporate lawyers in the United States. |

|

Age 58

Director Since 2020

Committees Corporate

Executive

Management |

Lisa A. Davis Independent Former Member of the Managing Board and CEO of Gas and Power for Siemens AG Background Lisa A. Davis served from August 2014 to February 2020 as a member of the Managing Board for Siemens AG with responsibility as CEO for Siemens Gas and Power, which included Power Generation, Power Services, Oil and Gas, Transmission and New Fuels, and operated in over 80 countries. During her tenure at Siemens, she also served as Chair and Chief Executive Officer of Siemens Corporation USA and as a member of the Board of Directors of Siemens Gamesa Renewable Energy SA. From 2012 to August 2014, Ms. Davis served as Executive Vice President, Strategy, Portfolio & Alternative Energy of Royal Dutch Shell, UK. Prior to that, Ms. Davis served in various capacities and leadership positions with Royal Dutch Shell, Texaco USA and Exxon Corporation in upstream and downstream operations and project development. Ms. Davis currently serves on the Board of Directors of Penske Automotive Group, Inc., Kosmos Energy Ltd. and Phillips 66. Ms. Davis holds a Bachelor of Science degree in Chemical Engineering from the University of California, Berkeley. Qualifications Ms. Davis has significant experience leading large, multi-faceted international businesses. She also has extensive experience leading teams in developing world-scale energy and environmental projects as well as experience with public company board service in the U.S. and Europe. Ms. Davis will provide the Board with a solid understanding of these types of projects, which represent an important and growing portion of our business. |

10

Age 77

Director Since 2013

Committees

Executive (Chair)

|

Seifollah (“Seifi”) Ghasemi Chairman, President and Chief Executive Officer of the Company Background Seifi Ghasemi became Chairman, President and Chief Executive Officer of the Company in July 2014. In this role, he is focused on setting the strategy and policies of the Company, developing leadership and meeting shareholder commitments. Mr. Ghasemi is a member of The Business Council, an association of the chief executive officers of the world’s most important business enterprises. In 2020, he was appointed to the Board of Directors of the US-India Strategic Partnership Forum. In 2019 he was elected to the Board of Directors of the US-China Business Council. Mr. Ghasemi also was the recipient of the 2017 biennial International Palladium Medal from the Société de Chimie Industrielle for his distinguished contributions to the chemical industry. Prior to joining Air Products, from 2001 to 2014, Mr. Ghasemi served as Chairman and Chief Executive Officer of Rockwood Holdings, Inc., a global leader in lithium and advanced materials. From 1997 to 2001, he held leadership roles at GKN, a global industrial company, including positions as director of the Main Board of GKN, plc and Chairman and Chief Executive Officer of GKN Sinter Metals, Inc. and Hoeganes Corporation. Earlier in his career, Mr. Ghasemi spent nearly 20 years with The BOC Group in positions including director of the Main Board of BOC Group, plc, President of BOC Gases Americas and Chairman and Chief Executive Officer of BOC Process Plants, Ltd. and Cryostar. He served as non-executive Chairman of Versum Materials, Inc. until its acquisition by Merck KGaA in October 2019. Mr. Ghasemi earned his undergraduate degree from Abadan Institute of Technology and holds an M.S. degree in mechanical engineering from Stanford University. He also was awarded an honorary Doctor of Science degree from Lafayette College in 2017 and an honorary Doctor of Engineering degree from Stevens Institute of Technology in 2018. Qualifications Mr. Ghasemi brings to the Board strong leadership and extensive management and operating experience, including deep experience in the industrial gases and specialty chemicals industries, and a solid understanding of key end markets for the Company. His prior executive leadership of an international chemical company also provides substantial experience in governance and portfolio management, strategic planning, talent management and international operations. He provides the Board with candid insights into the Company’s industry, operations, management team and strategic opportunities and threats. |

2022 Proxy Statement 11

Age 62

Director Since 2013

Committees

Audit and Finance

Management

|

David H.Y. Ho Independent Chairman and Founder of Kiina Investment Ltd. Background David H.Y. Ho is Chairman and Founder of Kiina Investment Ltd., a venture capital firm that invests in start-up companies in the technology, media and telecommunications industries. Mr. Ho previously served as Chairman of Greater China for Nokia Siemens Networks, President of Greater China for Nokia Corporation and Senior Vice President of the Nokia Networks Business Group. He has also held senior leadership roles with Nortel Networks and Motorola in China and Canada. Mr. Ho currently serves as a member of the board of directors of Qorvo, Inc. and Sun Life Financial. He also serves as a member of the board of directors of a state-owned enterprise in China, China COSCO Shipping Corporation, and is on the board of directors of DBS Bank Hong Kong Limited, the Hong Kong subsidiary of DBS Group Holdings. Mr. Ho previously served as a director of nVent Electric plc, Pentair plc and Triquent Semiconductor, Inc. prior to its merger with R. F. Micro Devices to form Qorvo, Inc. He also served as a director of China Ocean Shipping Company prior to its merger with China Shipping Group. Mr. Ho also previously served as a director of China Mobile Communications Corporation, Dong Fang Electric Corporation and Owens Illinois, Inc. He holds a Bachelor’s degree in Engineering and a Master’s degree in Management Sciences from the University of Waterloo in Canada. Qualifications Mr. Ho has extensive experience establishing and building businesses in China and in international joint venture operations, government relations and Asian operations and marketing. His background brings significant value to the Company as we execute on our Asian strategy. He also has executive leadership experience in the electronics and technology industries, which are key customer segments for the Company. |

Age 71

Director Since 2013

Committees

Corporate

Executive

Management

|

Edward L. Monser Independent, Lead Director Retired President and Chief Operating Officer of Emerson Electric Co. Background Edward L. Monser was the President of Emerson Electric Co., a global industrial controls products company, from 2010 until his retirement in 2018. At the time of his retirement, Mr. Monser had more than 30 years of experience in senior operational positions at Emerson and played key roles in globalizing the company, having held increasingly senior positions, including Chief Operating Officer from 2001 to 2015 and President of its Rosemount Inc. subsidiary from 1996 to 2001 as well as holding various operations, new product development, engineering and technology positions. Mr. Monser currently serves as a director of Vertiv, a private company that provides equipment and services for datacenters, and Canadian Pacific Railway Ltd. He was Vice Chairman of the U.S.-India Strategic Partnership Forum and a member of the Economic Development Board for China’s Guangdong Province and a former director and Vice Chairman of the U.S.-China Business Council. He holds a Bachelor’s degree in Electrical Engineering from the Illinois Institute of Technology and a Bachelor’s degree in Education from Eastern Michigan University. Qualifications As former president and chief operating officer of a premier global industrial organization, Mr. Monser provides the Board with a solid understanding of industrial operations, supply chain optimization and continuous improvement, extensive experience in international business operations, particularly in emerging markets, and a demonstrated capability in strategic planning and organizational development. |

12

Age 70

Director Since 2013

Committees

Audit

and Finance

Corporate

Executive

|

Matthew H. Paull Independent Retired Senior Executive Vice President and Chief Financial Officer of McDonald’s Corporation Background Matthew H. Paull was Senior Executive Vice President and Chief Financial Officer of McDonald’s Corporation from 2001 until he retired from that position in 2008. Prior to joining McDonald’s in 1993, he was a partner at Ernst & Young where he managed a variety of financial practices during his 18-year career and consulted with many leading multinational corporations. Mr. Paull currently serves as a director of Canadian Pacific Railway Ltd. He was formerly a director of Chipotle Mexican Grill Inc., KapStone Paper and Packaging Corporation, WMS Industries Inc. and the lead director of Best Buy Co. He is a member of the Advisory Board of Pershing Square Capital Management, L.P. He also served as an advisory council member for the Federal Reserve Bank of Chicago. He holds a Master’s degree in Accounting and a Bachelor’s degree from the University of Illinois. He is a Certified Public Accountant. Qualifications Mr. Paull brings to the Board significant financial expertise with a deep understanding of financial markets, corporate finance, accounting and controls and investor relations. As a former chief financial officer of a multinational corporation, he also has extensive experience in international operations and marketing. |

Age 61

Director Since 2021

Committees

Audit and Finance

Management

|

Wayne T. Smith Independent Retired Chairman and Chief Executive Officer of BASF Corporation Background Wayne T. Smith is the retired Chairman and Chief Executive Officer of BASF Corporation. Mr. Smith served in this role from May 2015 through May 2021 and served as a member of the Board of Management Directors of the parent company, BASF SE, from 2012 through May 2021. Prior to his tenure at BASF, which began in 2004, Mr. Smith was vice president and general manager of Specialty Construction Chemicals at W.R. Grace and Company, where he led the strategy development, growth and profitability of that unit worldwide. Before joining W.R. Grace, Mr. Smith served in positions of increasing responsibility with The BOC Group, culminating as vice president and general manager of the company’s Packaged Products business. He is a former director of Inter Pipeline. Mr. Smith holds a Bachelor of Science degree in Chemical Engineering from Syracuse University and a Master’s in Business Administration from the Wharton School of the University of Pennsylvania. Qualifications Mr. Smith brings decades of general management experience in the chemicals and industrial manufacturing sectors, including extensive industrial gases leadership and operational experience, to the Air Products Board. |

2022 Proxy Statement 13

Director Independence

The Board has affirmatively determined that all of the Company’s directors, except Mr. Ghasemi, qualify as independent under New York Stock Exchange (“NYSE”) corporate governance listing standards. In determining independence, the Board determines whether directors have a material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of directors. When assessing materiality, the Board considers all relevant facts and circumstances, including transactions between the Company and the director, family members of directors and organizations with which the director is affiliated. The Board further considers the frequency of and dollar amounts associated with these transactions and whether the transactions were in the ordinary course of business and were consummated on terms and conditions similar to those with unrelated parties.

In making its independence determination, the Board considers the specific tests for independence included in the NYSE listing standards. In addition, the Company’s Corporate Governance Guidelines (the “Guidelines”) provide standards to assist in determining each director’s independence that meet or exceed the NYSE independence requirements. The Guidelines provide that the following categories of relationships are immaterial for purposes of making an independence determination:

| • | sales or purchases of goods or services between the Company and a director’s employer or an employer of a director’s family member, which occurred more than three years prior to the independence determination or involved less than 1% of such employer’s annual consolidated gross revenues, took place on the same terms and conditions offered to third parties or on terms and conditions established by competitive bid and that did not affect the director’s or family member’s compensation; | |

| • | charitable contributions by the Company to an organization for which the director or his or her immediate family member serves as an executive officer, director or trustee that occurred more than three years prior to the independence determination, were made pursuant to the Air Products Foundation’s matching contributions program or were less than the greater of $1 million or 2% of the organization’s gross revenues; | |

| • | membership of a director in the same professional association, social, fraternal or religious organization or club as an executive officer of the Company; | |

| • | a director’s past matriculation at the same educational institution as an executive officer of the Company; | |

| • | a director’s service on the board of directors of another public company for which an executive officer of the Company also serves as a director, except for prohibited compensation committee interlocks; and | |

| • | a director’s service as a director, trustee or executive officer of a charitable or educational organization for which an executive officer of the Company also serves as a director or trustee. |

In accordance with NYSE listing standards, in affirmatively determining the independence of any director who will serve on the Management Development and Compensation Committee, the Board also specifically considers factors relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in making judgments about the Company’s executive compensation, including sources of the director’s compensation and relationships of the director to the Company or senior management.

In addition, the Guidelines provide that no director may serve on the Audit and Finance Committee or Management Development and Compensation Committee if he or she has received within the past or preceding fiscal year any compensatory fee from the Company other than for Board or committee service; and no director may serve on the Management Development and Compensation Committee.

On an annual basis, each member of the Board is required to complete a questionnaire designed in part to provide information to assist the Board in determining whether the director is independent under NYSE rules and the Guidelines. In addition, each director or potential director has an affirmative duty to disclose to the Corporate Governance and Nominating Committee any relationship he or she has (or any of his or her immediate family members have) with the Company or the executive officers of the Company.

The Corporate Governance and Nominating Committee reviews director relationships and transactions for compliance with the standards described above and makes a recommendation to the Board, which makes the independence determination. For those directors identified as independent, the Company and the Board are aware of no relationships or transactions with the Company or management that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

14

The Board has established the following minimum qualifications for all non-management directors:

|

|

|

|

While the Board has not adopted a formal policy on diversity, the Guidelines provide that, as a whole, the Board should include individuals committed to the highest ethical standards who have a diverse range of skills, competencies, backgrounds and experiences to give the Board depth and breadth in the mix of skills represented. The Board seeks to include an array of skills, perspectives and experience in its overall composition. This mandate is implemented by seeking to identify candidates that bring diverse skill sets, backgrounds and experiences, including gender, racial, ethnic and geographic diversity, to the Board when director candidates are needed. The Corporate Governance and Nominating Committee is committed to actively seeking highly qualified women and minorities to include in the pool from which director nominees are selected and requires that diverse candidates be included in its initial director search lists.

Board Refreshment

|

Ongoing Assessment of Board Composition The qualities and skills necessary for a specific director nominee are governed by the needs of the Company at the time the Corporate Governance and Nominating Committee determines to add a director to the Board. The specific requirements of the Company are determined by the Committee and are based on, among other things, the Company’s current business, market, geographic and regulatory environments; the mix of perspectives, experience, backgrounds and competencies currently represented by the other Board members; diversity considerations; and the CEO’s views as to areas in which management desires additional advice and counsel. Identification of Candidates When the need to recruit a non-management director arises, the Corporate Governance and Nominating Committee’s standard process is to consult the other directors, the CEO and sometimes a third-party recruiting firm to identify potential candidates. Once a candidate is identified, the candidate screening process typically is conducted initially through an interview by one or more members of the Committee and the CEO. Candidate Selection After initial interviews, the candidate may be considered by the Corporate Governance and Nominating Committee or directly by the Board. Prior to nomination or election, an investigation is conducted to verify the candidate’s reputation and background, the candidate’s independence as measured by the Board’s independence standards and other factors that the Committee deems appropriate at the time. |

Board Tenure Policy To enable Board succession planning and refreshment, the Board has adopted a policy that a non-employee director may not continue to serve on the Board after the Annual Meeting following the earlier of his or her completion of 15 full years of service on the Board or attainment of age 75. The Board retains the flexibility to waive this policy, including in response to events or recruiting realities. At the time Mr. Ghasemi was recruited to become the Company’s Chairman and CEO in 2014, the Board determined it would waive the age limit for him to enable him to remain a director during his employment. |

2022 Proxy Statement 15

Shareholder Nominations

The Corporate Governance and Nominating Committee has adopted a policy regarding its consideration of director candidates recommended by shareholders for nomination by the Board at an annual meeting of shareholders and a procedure for submission of such candidates. The policy provides that candidates recommended by shareholders will be reviewed by the Corporate Secretary to determine satisfaction of minimum qualifications for director candidates adopted by the Committee and consistency of the candidacy with current recruiting objectives of the Committee. Candidates determined by the Corporate Secretary to possess minimum qualifications and to have characteristics not inconsistent with current recruiting objectives will be sent to the Committee for evaluation. Submissions of candidates must be made in writing and received not later than 90 days prior to the anniversary date of the prior annual meeting. The submission must also provide certain information concerning the candidate and the recommending shareholder(s), a statement explaining why the candidate has the qualifications required and consent of the candidate to a background check and to be interviewed by the Chairman of the Board and the Corporate Governance and Nominating Committee and to serve if elected. A copy of the policy and procedure is available upon request from the Corporate Secretary’s Office. Candidates recommended by shareholders in accordance with these procedures will be screened and evaluated by the Corporate Governance and Nominating Committee in the same manner as other candidates recommended by the Board. In addition to these procedures, our Bylaws contain procedures that must be followed by a shareholder or group of shareholders seeking to nominate candidates to the Board without the Board’s recommendation.

In addition to the foregoing procedures for shareholder nomination, our Bylaws permit “shareholder proxy access”, which allows a shareholder or group of shareholders meeting certain conditions to nominate director candidates for election at annual meetings of shareholders using our proxy statement. This provision allows a shareholder, or group of up to 20 shareholders, to nominate up to two director candidates or, if greater, up to 20% of the number of directors then serving on our Board. The shareholder or group must have owned continuously for at least three years a number of shares equal to at least 3% of our outstanding common stock measured as of the date we receive the nomination. A proxy access nomination must be made not earlier than 150 days and not later than 120 days prior to the anniversary date of the proxy statement for the prior annual meeting and contain certain information described above concerning the candidate and the nominating shareholder(s) as well as certain additional information required by our proxy access bylaw. The number of director candidates who may be nominated under our proxy access bylaw will be reduced by the number of director nominations made using the shareholder nomination process described above.

Overview

Our business is managed by our employees under the direction and oversight of the Board. Among other responsibilities discussed below, the Board reviews, monitors and, where appropriate, approves fundamental financial and business strategies and major corporate actions. The Board is elected by shareholders to provide advice and counsel to and oversee management to ensure that the interests of the shareholders and other corporate constituents are being served with a view toward maximizing our long-term value.

Directors exercise their oversight responsibilities through discussions with management, review of materials management provides to them, visits to our offices and facilities and their participation in Board and committee meetings.

16

Strategy and Risk Oversight

The CEO and other members of senior management are responsible for assessing and managing the Company’s risk exposure, and the Board and its committees provide oversight in connection with those efforts.

|

The Board of Directors Responsibility for risk oversight rests with the Board. The Board formally reviews the Company’s risk management processes and policies periodically, including identification of key risks and associated monitoring, control and mitigation activities. The Board primarily exercises its risk oversight responsibility through meetings, discussions and review of management reports and proposals. Evaluation of risk is inherent in the Board’s consideration of the Company’s long-term strategies and in the transactions and other matters presented to the Board, including large capital expenditures, acquisitions and divestitures and updates on cybersecurity and environmental, health and safety compliance. Committees help the Board carry out this responsibility by focusing on specific key areas of risk inherent in our business. All Board members are invited to attend most committee meetings, and Board members who do not attend committee meetings receive information about committee activities and deliberations. |

|

Audit and Finance Committee The Audit and Finance Committee oversees risks associated with financial and accounting matters, including legal and regulatory compliance, financial instruments, financial transactions, financial policies and strategies, pension funding, capital structure and the Company’s financial reporting and internal control systems. The Audit and Finance Committee also has oversight of the Company’s risk assessment and management process, including oversight of cybersecurity risk and associated monitoring, control and mitigation activities. |

Corporate Governance and Nominating Committee The Corporate Governance and Nominating Committee oversees risks associated with corporate governance, including Board structure, director succession planning, the allocation of authority between management and the Board and the Company’s response to public policy issues, including areas of social responsibility, corporate citizenship and sustainability. |

Management Development and Compensation Committee The Management Development and Compensation Committee helps ensure that the Company’s executive compensation policies and practices support the retention and development of executive talent with the experience required to manage risks inherent to the business, while at the same time not encouraging or rewarding excessive risk-taking by our executives. | ||

|

Management Management is responsible for assessing and managing the Company’s various risk exposures on a day-to-day basis, including through the creation of appropriate risk management programs and policies. | ||||

2022 Proxy Statement 17

|

Board Oversight of Cybersecurity Risk |

| Information security and privacy are of utmost importance to the Company to maintain the trust and confidence of our customers, employees and other stakeholders. Our Chief Information Officer and Chief Information Security Officer advise the Board of Directors at least quarterly on our cybersecurity risk management strategy and overall program status. The Company continuously assesses industry best practices and standards and leverages them to continually advance its cybersecurity risk management maturity with a focus on utilizing such practices and standards to predict, prevent, detect and respond to potential security threats. As part of the Company’s information security training program, all employees participate in various cybersecurity awareness activities, including formal training exercises and simulated phishing events. We maintain an updated information security policy and incident response plan. In 2021 we achieved our primary cybersecurity risk management objective of no material cybersecurity incidents. Over the past three years we have not incurred material expenses from cybersecurity incidents. | |

|

Board Oversight of Sustainability |

| The Board of Directors has accountability for oversight of our environmental, health and safety performance, which it reviews at least quarterly. The Corporate Governance and Nominating Committee has responsibility for monitoring our response to important public policy issues, including sustainability, which is reviewed on a routine basis. Business ethics, climate change, diversity and talent management are key subjects related to sustainability that are discussed by the Board. The Board also reviews our progress against our “Third by ’30” carbon intensity goal, which was established in 2020 for achievement by 2030. This sustainability goal is focused on reducing our CO2 emissions intensity (kg/CO2/MM BTU) by one-third by the year 2030 from a 2015 baseline. We set this new target in 2020 after successfully attaining nearly all of our 2020 Sustainability Goals. We also have established new goals related to diversity. We are dedicated to achieving at least 28% female representation in the professional and managerial population globally by 2025 as well as at least 30% minority representation in the same population in the United States by 2025 (increased in November 2021 from 20% based on success achieved since the goal was initially established in October 2020). We also developed sustainability goals in other areas related to our Grow-Conserve-Care sustainability framework. In addition, the Management Development and Compensation Committee has structured our executive compensation program to balance financial results with other Company values such as sustainability, safety, diversity and ethical conduct. We also engage with our shareholders on sustainability matters. | |

18

Management Succession Planning

The Management Development and Compensation Committee, the CEO and our Human Resources organization maintain an ongoing focus on executive development and succession planning to prepare the Company for future success. The Board reviews organization and succession plans with our CEO at least annually. In addition, the Company has an emergency succession procedure for the CEO that is reviewed annually by the Board.

| A comprehensive review of executive talent determines readiness to take on additional leadership roles and identifies developmental and coaching opportunities needed to prepare our executives for greater responsibilities. | In addition to preparing for CEO succession, the succession planning process includes other senior management positions. | |

| Succession planning is a responsibility of the entire Board, and all directors participate in this process. | The CEO makes a formal succession planning presentation to the Board annually. |

Shareholder Engagement

The Board believes that fostering long-term relationships with shareholders, listening to their concerns and maintaining their trust and goodwill is a prerequisite to good governance.

| Management conducts extensive engagements with key shareholders. | These engagements include discussions about governance, compensation, sustainability and safety, as well as financial and operational matters, to ensure that management and the Board understand and address the issues that are important to our shareholders. | The Board oversees the discharge by management of shareholder communication and engagement and receives regular reports on shareholder comments and feedback. The Board encourages dialogue on issues of interest to shareholders. | The Board also specifically seeks to understand any significant voting trends regarding the Company’s executive officer compensation program and other governance matters. |

Shareholder Communications

Shareholders and other interested parties may communicate with the independent directors by sending a written communication in care of the Corporate Secretary to:

|

Air Products and Chemicals, Inc. 1940 Air Products Boulevard |

The Board has adopted a written procedure for collecting, organizing and forwarding direct communications from shareholders and other interested parties to the independent directors. A copy of the procedure is available upon request from the Corporate Secretary’s Office.

2022 Proxy Statement 19

Board Leadership Structure

The Board does not have a policy on whether the roles of Chairman of the Board and CEO should be separate or whether the Chairman of the Board should be independent. The Board determines which structure is in the best interests of the Company at any given time.

At present Mr. Ghasemi serves as both CEO and Chairman of the Board, and the Board has an independent Lead Director. The Board decided to combine the CEO and Chairman roles because it has a high level of confidence in Mr. Ghasemi’s leadership and willingness to work closely and transparently with the independent directors. The Board believes the Company is best served at this time by unified leadership of operations and oversight of the Company, which ensures that the Board and management act with common purpose. Finally, the Board is satisfied that the independent directors have ample opportunities to execute their responsibilities independently through numerous executive sessions held throughout the year at both the Board and committee levels. The independent directors also have substantial interactions with members of the management team other than the CEO and operate under the leadership of the Lead Director and the committee Chairs. The responsibilities of the Lead Director are described below.

Lead Director

The Lead Director is elected annually by majority vote of the Board upon the nomination of the Corporate Governance and Nominating Committee.

Mr. Monser is serving as our Lead Director. In November 2021, the Board, considering Mr. Monser’s tenure on the Board, prior experience and the leadership he has displayed, reelected Mr. Monser as Lead Director effective at the conclusion of the Annual Meeting. Mr. Monser is an independent director.

| The Guidelines provide that the Lead Director’s responsibilities include: | |

| • | presiding at executive sessions of the Board and any other time the Chairman is not present and communicating feedback to the CEO; |

| • | determining the agenda for executive sessions of non-management directors; and |

| • | possessing the principal authority to convene a meeting of independent directors. |

Executive Sessions

The independent directors regularly meet without the CEO and other members of management in executive sessions that are scheduled to occur at each Board meeting. In addition, the CEO’s performance review is conducted in executive session and the Board committees regularly meet in executive session. Board executive sessions are led by the Lead Director.

Standing Committees of the Board

The Board has three standing committees, which operate under written charters approved by the Board: Audit and Finance; Corporate Governance and Nominating; and Management Development and Compensation. In accordance with NYSE listing standards, none of the directors who serve on these committees have ever been employed by the Company, and the Board has determined in its business judgment that all of them are “independent” from the Company and its management in accordance with the Guidelines described above in “Director Independence” as well as with additional NYSE listing criteria and SEC requirements that are applicable to members of the Audit and Finance and Management Development and Compensation Committees. Our Bylaws also provide for an Executive Committee, which is described below.

| The charters of the Audit and Finance Committee, the Corporate Governance and Nominating Committee and the Management Development and Compensation Committee can be viewed on the Company’s website at www.airproducts.com/company/governance/board-of-directors/standing-committees.aspx and are available in print to any shareholder upon request. |

20

Audit and Finance Committee

|

Members • Matthew H. Paull (Chair) • Charles I. Cogut • David H.Y. Ho • Wayne T. Smith The Board has determined that all of the Audit and Finance Committee members are “financially literate” and that Mr. Paull qualifies as an “audit committee financial expert” as defined by NYSE listing standards and U.S. Securities and Exchange Commission (“SEC”) regulations, respectively. Fiscal 2021 Meetings: 8 Committee Report: Page 62 |

Primary Responsibilities • The Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit the Company’s financial statements. • The Committee provides oversight of the Company’s external financial reporting process, all systems and processes relating to the integrity of financial statements, internal audit process, programs for compliance with laws and regulations and our Code of Conduct and Business Ethics (the “Code of Conduct”) and enterprise processes for risk assessment and management. • The Committee discusses with the Company’s Internal Audit function and independent registered public accounting firm the overall scope and plans for their respective audits. In addition, the Committee regularly meets with Internal Audit and the Company’s independent registered public accounting firm, with and without management present, to discuss the results of their respective audits, their respective evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. Audit and Finance Committee Charter • The Audit and Finance Committee operates under a written charter that is available on our website at the address provided on page 20. |

Corporate Governance and Nominating Committee

|

Members • Chadwick C. Deaton (Chair) • Charles I. Cogut • Lisa A. Davis • Edward L. Monser • Matthew H. Paull Fiscal 2021 Meetings: 3 As a result of his retirement effective at the conclusion of the Annual Meeting, Mr. Deaton will no longer be a member of the Corporate Governance and Nominating Committee and Mr. Monser will become Chair of the Committee. |

Primary Responsibilities • The Committee monitors and makes recommendations to the Board about corporate governance matters, including the Guidelines, the Code of Conduct, Board structure and operation, Board policies on director compensation and tenure, the meeting schedules of the Board and its committees, the charters and composition of the committees and the annual Board and committee performance assessment process. • The Committee has primary responsibility for identifying, recommending and recruiting nominees for election to the Board and recommending candidates for election as Lead Director. • The Committee also reviews and monitors the Company’s crisis management procedures, government relations activities and response to significant public policy issues, including sustainability and other social responsibility matters. Corporate Governance and Nominating Committee Charter • The Corporate Governance and Nominating Committee operates under a written charter that is available on our website at the address provided on page 20. |

2022 Proxy Statement 21

Executive Committee

|

Members • Seifi Ghasemi (Chair) • Lisa A. Davis • Chadwick C. Deaton • Edward L. Monser • Matthew H. Paull As a result of his retirement effective at the conclusion of the Annual Meeting, Mr. Deaton will no longer be a member of the Executive Committee. Fiscal 2021 Meetings: 1 |

Primary Responsibilities • The Executive Committee has the authority of the Board to act on most matters during intervals between Board meetings and meets as needed for this purpose. • Actions taken by the Executive Committee since the last meeting of the Board are reported to the Board at its next meeting. The Executive Committee does not have a written charter. In fiscal 2021, the Executive Committee met to discuss a variety of matters. |

Management Development and Compensation Committee

|

Members • Lisa A. Davis (Chair) • Chadwick C. Deaton • David H.Y. Ho • Edward L. Monser • Wayne T. Smith Fiscal 2021 Meetings: 3 Committee Report: Page 28 As a result of his retirement effective at the conclusion of the Annual Meeting, Mr. Deaton will no longer be a member of the Management Development and Compensation Committee. |

Primary Responsibilities • The Committee establishes the executive officer compensation philosophy, design and strategy for the Company consistent with Company objectives and shareholder interests, determining CEO compensation and approving other executive officer compensation. • The Committee approves performance objectives relevant to the compensation of the CEO, establishing the process for and leading the Board in evaluation of the performance of the CEO and providing oversight of the CEO’s evaluation of the performance of our other executive officers. • The Committee oversees CEO succession planning and the development and evaluation of potential candidates for other executive officer positions. • The Committee oversees the Company’s overall management compensation program, the design and administration of management incentive compensation plans, including equity programs and the design and administration of the Company’s retirement and welfare benefit plans. • The Committee periodically reviews and makes recommendations to the Board regarding progress with diversity practices and programs as applied to management development and performance. The Committee’s charter permits it to delegate all or a portion of the authority granted to it by the Board to one or more Committee members, senior executives or subcommittees to the extent consistent with applicable laws, regulations and listing standards. The Company’s Delegation of Authority Policy reserves for the Board and the Committee all compensation and staffing decisions with respect to executive officers except as specifically delegated. The Committee charter also permits the Committee to retain a third party compensation consultant as needed. Management Development and Compensation Committee Charter • The Management Development and Compensation Committee operates under a written charter that is available on our website at the address provided on page 20. |

22

Board Practices, Processes and Policies

Board Meetings and Attendance

During fiscal 2021, there were 12 meetings of the Board. No director attended fewer than 75% of the combined total of meetings of the Board and the committees on which he or she was serving during the time in which they served as a director (including Wayne T. Smith with respect to the three meetings of the Board held during fiscal 2021 after he became a director of the Company). In accordance with the Guidelines, all directors are expected to attend the Annual Meeting unless they have an emergency or unavoidable schedule conflict. All directors who were serving at the time attended the 2021 Annual Meeting of Shareholders.

Board Performance Evaluation

Each year the Board and its committees conduct self-evaluations of their performance. The evaluation format is established by the Corporate Governance and Nominating Committee. The Committee utilizes a survey format for performing Board and committee self-evaluations. The surveys are tailored to the Board and each committee and address, among other things, the responsibilities set forth in our Corporate Governance Guidelines and the charters of the respective committees. The results of these surveys were discussed by the Board and committees, respectively, and the committee Chairs discuss the results of their respective committee surveys with the Board. Individual directors are evaluated by the Corporate Governance and Nominating Committee at the time of nomination for reelection. This evaluation is conducted by a member of the Corporate Governance and Nominating Committee after soliciting input from other directors.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines for the Company in order to establish and maintain practices to govern the Company in accordance with the interests of our shareholders. The Guidelines set forth the governance practices the Board follows, including regarding Board leadership, director independence and qualifications, nomination and election of directors, director responsibilities, access to management, authority to retain independent advisors, director compensation and director orientation and education as well as the CEO performance assessment, management succession planning and assessment of Board and committee performance.

The Board regularly reviews corporate governance developments and modifies the Guidelines as warranted.

| The Guidelines are available on the Company’s website at: www.airproducts.com/company/governance/board-of-directors/governance-guidelines.aspx and are available in print upon request. |

Code of Conduct and Business Ethics

Our Code of Conduct and Business Ethics applies to all full and part-time employees of the Company and its subsidiaries and other affiliates, including our principal executive officer, principal financial officer and principal accounting officer, as well as our directors. The Code of Conduct addresses such topics as conflicts of interest, confidentiality, protection and proper use of Company assets and compliance with laws and regulations. The Code of Conduct was most recently amended in 2021. We will post any amendments or waivers to the Code of Conduct on our website. Directors, officers and employees certify annually that they will comply with the Code of Conduct.

We achieved 100% training and certification in the Code of Conduct in 2021.

| The Code of Conduct can be found on the Company’s website at www.airproducts.com/company/governance/code-of-conduct.aspx and is available in print upon request. |

2022 Proxy Statement 23

Transactions with Related Persons

The Board recognizes that transactions with related persons can present actual or potential conflicts of interest and wants to ensure that Company transactions are based solely on the best interests of the Company. Accordingly, the Board has delegated responsibility to the Audit and Finance Committee to review transactions between the Company and related persons. The Audit and Finance Committee has adopted a written policy establishing procedures for the review of related person transactions.

A related person transaction is a transaction between the Company and a director, executive officer or 5% or more shareholder, any of their respective immediate family members or a company or other entity in which any of these persons has a direct or indirect material interest. The policy specifically excludes certain types of transactions, which the Audit and Finance Committee deems to be immaterial. Pursuant to the Audit and Finance Committee policy, related person transactions must be preapproved by the Committee or, in the event of an inadvertent failure to bring the transaction to the Committee for preapproval, ratified by the Committee. In deciding whether to approve or ratify a related person transaction, the Committee considers the benefits of the transaction to the Company, the impact on a director’s independence if a director or a director’s family member or affiliate is involved, the availability of comparable sources for products and services, the terms of the transaction and terms available to third parties for similar transactions. The Audit and Finance Committee Chair is authorized to approve related person transactions when it is impractical or undesirable to wait until the next Committee meeting for approval. Such Chair-approved transactions must be reported to the Committee at its next meeting. Since the beginning of fiscal 2021 we have not engaged in any transactions for which approval is required under our related person transaction policy.

In fiscal 2021, our directors received compensation as set forth in the chart below.

| Director Compensation Program | ($) | ||

| Annual Deferred Stock Award (made immediately following annual meeting)(1) | 150,000 | ||

| Annual Cash Retainer | 120,000 | ||

| Lead Director Retainer | 25,000 | ||

| Audit and Finance Committee Chair Retainer | 25,000 | ||

| Management Development and Compensation Committee Chair Retainer | 20,000 | ||

| Corporate Governance and Nominating Committee Chair | 15,000 |

| (1) | Directors elected to the Board after an annual meeting receive a prorated grant of deferred stock units based on the number of months remaining until the next annual meeting. |

24

| Our Corporate Governance and Nominating Committee periodically undertakes a review of non-employee director compensation. The most recent review was completed in fiscal 2019 when the Committee reviewed a competitive assessment of directors’ compensation levels and practices among the Peer Reference Group at the time described on pages 44-45 as well as a broader industry component and survey data of companies with annual revenues between $2.5 billion and $10 billion. In connection with this review the Committee retained an external compensation consultant, Pearl Meyer & Partners, LLC (“Pearl Meyer”), to provide independent advice and benchmarking with respect to director compensation practices. | ||

| Prior to retaining Pearl Meyer, the Committee assessed its independence and concluded that there were no conflicts of interest that would prevent Pearl Meyer from independently advising the Committee. In making this determination, the Committee considered, among other things, the fees to be paid as a percentage of Pearl Meyer’s consolidated revenues, policies and procedures established by Pearl Meyer to mitigate conflicts of interest and the lack of business and personal relationships between Pearl Meyer team members and the Company’s executive officers and Committee members. | ||

| As a result of this compensation review, the Committee determined that cash compensation, which was last adjusted in fiscal 2013, paid to the Company’s directors was significantly below the median of the Peer Reference Group on both an individual and aggregated basis and that, as a result, total compensation was significantly below the median as well. The Committee recommended, and the Board approved, an increase in the directors’ annual cash retainer to $120,000, beginning in fiscal 2020, which positioned cash and total compensation closer to, but still below, the median of the Peer Reference Group. This action is expected to maintain the competitiveness of the Company’s director compensation program and accordingly strengthen our ability to recruit and retain qualified directors. | ||