Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-4694

R. R. DONNELLEY & SONS COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | 36-1004130 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 111 South Wacker Drive, Chicago, Illinois | 60606 | |

| (Address of principal executive offices) | (ZIP Code) | |

Registrant’s telephone number—(312) 326-8000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Name of each exchange on which registered | |

| Common Stock (Par Value $1.25) | NASDAQ and Chicago Stock Exchange |

Indicated by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the shares of common stock (based on the closing price of these shares on the NASDAQ Stock Exchange—Composite Transactions) on June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, held by nonaffiliates was $3,662,762,507.

As of February 17, 2012, 178,499,353 shares of common stock were outstanding.

Documents Incorporated By Reference

Portions of the Registrant’s proxy statement related to its annual meeting of stockholders scheduled to be held on May 17, 2012 are incorporated by reference into Part III of this Form 10-K.

Table of Contents

| Form 10-K Item No. |

Name of Item |

Page | ||||||

| Part I |

||||||||

| Item 1. | 3 | |||||||

| Item 1A. | 9 | |||||||

| Item 1B. | 13 | |||||||

| Item 2. | 13 | |||||||

| Item 3. | 14 | |||||||

| Item 4. | 14 | |||||||

| 15 | ||||||||

| Part II |

||||||||

| Item 5. | 16 | |||||||

| Item 6. | 18 | |||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||||

| Item 7A. | 53 | |||||||

| Item 8. | 54 | |||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

54 | ||||||

| Item 9A. | 54 | |||||||

| Item 9B. | 57 | |||||||

| Part III |

||||||||

| Item 10. | Directors and Executive Officers of R.R. Donnelley & Sons Company and Corporate Governance |

58 | ||||||

| Item 11. | 58 | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

58 | ||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

60 | ||||||

| Item 14. | 60 | |||||||

| Part IV |

||||||||

| Item 15. | 61 | |||||||

| 62 | ||||||||

2

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Company overview

R.R. Donnelley & Sons Company (“RR Donnelley,” the “Company,” “we,” “us,” and “our”) is a global provider of integrated communications. The Company works collaboratively with more than 60,000 customers worldwide to develop custom communications solutions that reduce costs, enhance return on investment and ensure compliance. Drawing on a range of proprietary and commercially available digital and conventional technologies deployed across four continents, the Company employs a suite of leading Internet-based capabilities and other resources to provide premedia, printing, logistics and business process outsourcing products and services to leading clients in virtually every private and public sector.

Business acquisitions

On November 21, 2011, the Company acquired StratusGroup, Inc. (“Stratus”), a full service manufacturer of custom pressure sensitive label and paperboard packaging products for health and beauty, food, beverage and other segments. Stratus’ operations are located in West Chester, Ohio and included in the U.S. Print and Related Services segment.

On September 6, 2011, the Company acquired Genesis Packaging & Design Inc. (“Genesis”), a full service provider of custom packaging, including designing, printing, die cutting, finishing and assembling. Genesis’ operations are located in Lemont, Illinois and included in the U.S. Print and Related Services segment.

On August 16, 2011, the Company acquired LibreDigital, Inc. (“LibreDigital”), a leading provider of digital content distribution, e-reading software, content conversion, data analytics and business intelligence services. LibreDigital’s operations are located in Austin, Texas and included in the U.S. Print and Related Services segment.

On August 15, 2011, the Company acquired Sequence Personal LLC (“Sequence”), a provider of proprietary software that enables readers to select relevant content to be digitally produced as specialized publications. Sequence’s operations are included in the U.S. Print and Related Services segment.

On June 21, 2011, the Company acquired Helium, Inc. (“Helium”), an online community offering publishers, catalogers and other customers stock and custom content, as well as a comprehensive range of editorial solutions, in which the Company previously held an equity investment. Helium’s operations are located in Andover, Massachusetts and included in the U.S. Print and Related Services segment.

On March 24, 2011, the Company acquired Journalism Online, LLC (“Journalism Online”), an online provider of tools that allow consumers to purchase online subscriptions from publishers. Journalism Online’s operations are located in New York, New York and included in the U.S. Print and Related Services segment.

On December 31, 2010, the Company acquired 8touches, an online provider of tools that allow real estate associates, brokers, Multiple Listing Service (MLS) associations and other marketers to create customized communications materials. 8touches’ operations are located in Sealy, Texas and included in the U.S. Print and Related Services segment.

On December 14, 2010, the Company acquired Nimblefish Technologies (“Nimblefish”), a provider of multi-channel marketing services to leading retail, technology, telecommunications, hospitality and other customers, located in San Francisco, California. Nimblefish’s operations are included in the U.S. Print and Related Services segment.

3

Table of Contents

On November 24, 2010, the Company acquired Bowne & Co., Inc. (“Bowne”), a provider of shareholder and marketing communication services located in New York, New York, with operations in North America, Latin America, Europe and Asia. Bowne’s operations are included in both the U.S. Print and Related Services and International segments.

On June 18, 2009, the Company acquired Prospectus Central, LLC (“Prospectus”), an e-delivery company located in Fitzgerald, Georgia. Prospectus’s operations are included in the U.S. Print and Related Services segment.

On January 2, 2009, the Company acquired PROSA, a web printing company located in Santiago, Chile. PROSA’s operations, which produce magazines, catalogs, retail inserts and soft-cover textbooks, are included in the International segment.

Segment descriptions

The Company operates primarily in the printing industry, with products and related service offerings designed to offer customers complete solutions for communicating their messages to target audiences. The Company’s segments and their products and service offerings are summarized below:

U.S. Print and Related Services

The U.S. Print and Related Services segment includes the Company’s U.S. printing operations, managed as one integrated platform, along with logistics, premedia, print management and other print related services. This segment’s products and related service offerings include magazines, catalogs, retail inserts, books, directories, financial printing and related services, direct mail, forms, labels, office products, statement printing, premedia and logistics services.

The U.S. Print and Related Services segment accounted for approximately 74% of the Company’s consolidated net sales in 2011.

International

The International segment includes the Company’s non-U.S. printing operations in Asia, Europe, Latin America and Canada. This segment’s products and related service offerings include magazines, catalogs, retail inserts, books, directories, financial printing and related services, direct mail, forms, labels, packaging, manuals, statement printing, premedia and logistics services. Additionally, this segment includes the Company’s business process outsourcing and Global Turnkey Solutions operations. Business process outsourcing provides transactional print and outsourcing services, statement printing, direct mail and print management services through its operations in Europe, Asia and North America. Global Turnkey Solutions provides outsourcing capabilities, including product configuration, customized kitting and order fulfillment for technology, medical device and other companies around the world through its operations in Europe, North America and Asia.

The International segment accounted for approximately 26% of the Company’s consolidated net sales in 2011.

Corporate

Corporate consists of unallocated general and administrative activities and associated expenses including, in part, executive, legal, finance, information technology, human resources, certain facility costs and LIFO inventory provisions. In addition, certain costs and earnings of employee benefit plans, primarily components of net pension and postretirement benefits expense other than service cost, are included in Corporate and not allocated to operating segments. In addition, Corporate manages the Company’s cash pooling structure, which enables participating international locations to draw on the Company’s overseas cash resources to meet local liquidity needs.

4

Table of Contents

Financial and other information related to these segments is included in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in Note 18, Segment Information, to the Consolidated Financial Statements. Additional information related to the Company’s International operations is included in Note 19, Geographic Area and Products and Services Information, to the Consolidated Financial Statements.

Competition and strategy

The print and related services industry, in general, continues to have excess capacity and remains highly competitive. Despite some consolidation in recent years, the printing industry remains highly fragmented. Across the Company’s range of products and services, competition is based primarily on price, in addition to quality and the ability to service the special needs of customers. Management expects that prices for the Company’s products and services will continue to be a focal point for customers in coming years. Therefore, the Company believes it needs to continue to lower its cost structure and differentiate its products and service offerings.

Technological changes, including the electronic distribution of documents and data, online distribution and hosting of media content, advances in digital printing, print-on-demand and Internet technologies, continue to impact the market for the Company’s products and services. The Company seeks to leverage the distinctive capabilities of its products and services to improve its customers’ communications, whether in paper form or through electronic communications. The Company’s goal remains to help its customers succeed by delivering effective and targeted communications in the right format to the right audiences at the right time. Management believes that with the Company’s competitive strengths, including its broad range of complementary print-related services, strong logistics capabilities, technology leadership, depth of management experience, customer relationships and economies of scale, the Company has developed and can further develop valuable, differentiated solutions for its customers. The Company seeks to leverage its unified platform and strong customer relationships in order to serve a larger share of its customers’ print and related services needs.

As a substitute for print, the impact of digital technologies has been felt mainly in books, directories, forms and statement printing. Electronic communication and transaction technology has eliminated or reduced the role of many traditional paper products and has continued to accelerate electronic substitution in directory and statement printing, in part driven by environmental concerns and cost pressures at key customers. In addition, rapid growth in the adoption of e-books is having an increasing impact on consumer print book volume, though only a limited impact on educational and specialty books. The future impact of technology on the Company’s business is difficult to predict and could result in additional expenditures to restructure impacted operations or develop new technologies. In addition, the Company has made targeted acquisitions and investments in the Company’s existing business to offer customers innovative services and solutions that further secure the Company’s position as a technology leader in the industry.

The Company has implemented a number of strategic initiatives to reduce its overall cost structure and improve efficiency, including the restructuring, reorganization and integration of operations and streamlining of administrative and support activities. Future cost reduction initiatives could include the reorganization of operations and the consolidation of facilities. Implementing such initiatives might result in future restructuring or impairment charges, which may be substantial. Management also reviews the Company’s operations and management structure on a regular basis to balance appropriate risks and opportunities to maximize efficiencies and to support the Company’s long-term strategic goals.

Seasonality

Advertising and consumer spending trends affect demand in several of the end-markets served by the Company. Historically, demand for printing of magazines, catalogs, retail inserts and books is higher in the second half of the year driven by increased advertising pages within magazines, and holiday catalog, retail insert and book volumes. This typical seasonal pattern can be impacted by overall trends in the U.S. and world economy. The seasonal pattern in 2011 was in line with historical trends.

5

Table of Contents

Raw materials

The primary raw materials the Company uses in its print businesses are paper and ink. The Company negotiates with leading suppliers to maximize its purchasing efficiencies and uses a wide variety of paper grades, formats, ink formulations and colors. In addition, a substantial amount of paper used by the Company is supplied directly by customers. Variations in the cost and supply of certain paper grades and ink formulations used in the manufacturing process may affect the Company’s consolidated financial results. Paper prices fluctuated during 2011, and volatility in future years is expected. Generally, customers directly absorb the impact of changing prices on customer-supplied paper. With respect to paper purchased by the Company, the Company has historically passed most increases and decreases through to its customers. Contractual arrangements and industry practice should support the Company’s continued ability to pass on any future paper price increases, but there is no assurance that market conditions will continue to enable the Company to successfully do so. Management believes that paper supply is consolidating, and there may be shortfalls in the future in supplies necessary to meet the demands of the entire marketplace. Higher paper prices and tight paper supplies may have an impact on customers’ demand for printed products. Additionally, the Company has undertaken various strategic initiatives to mitigate any foreseeable supply disruptions with respect to the Company’s ink requirements.

The Company continues to monitor the impact of changes in the price of crude oil and other energy costs, which impacts the Company’s ink suppliers, logistics operations and manufacturing costs. Crude oil and energy prices continue to be volatile. The Company believes its logistics operations will continue to be able to pass a substantial portion of any increases in fuel prices directly to its customers in order to offset the impact of related cost increases. The Company generally cannot pass on to customers the impact of higher energy prices on its manufacturing costs. The Company cannot predict sudden changes in energy prices and the impact that possible future energy price increases or decreases might have upon either future operating costs or customer demand and the related impact either will have on the Company’s consolidated annual results of operations, financial position or cash flows.

Distribution

The Company’s products are distributed to end-users through the U.S. or foreign postal services, through retail channels, electronically or by direct shipment to customer facilities. Through its logistics operations, the Company manages the distribution of most customer products printed by the Company in the U.S. and Canada to maximize efficiency and reduce costs for customers.

Postal costs are a significant component of many customers’ cost structures and postal rate changes can influence the number of pieces that the Company’s customers are willing to print and mail. On January 22, 2012, the United States Postal Service (“USPS”) increased postage rates for certain types of first-class postage. The new rates increased the cost of mailing these classes of mail by approximately 2%, which is the cap under the Postal Accountability and Enhancement Act. Under this act, it is anticipated that postage will increase annually by an amount equal to or slightly less than the Consumer Price Index. As a leading provider of print logistics and the largest mailer of standard mail in the U.S., the Company works closely with the USPS and its customers to offer innovative products and services to minimize costs. While the Company does not directly absorb the impact of higher postal rates on its customers’ mailings, demand for products distributed through the U.S. or foreign postal services is expected to be impacted by changes in the postal rates.

Customers

For each of the years ended December 31, 2011, 2010 and 2009, no customer accounted for 10% or more of the Company’s consolidated net sales.

6

Table of Contents

Technology, Research and Development

The Company has a research facility in Grand Island, New York that supports the development and implementation of new technologies to meet customer needs and improve operating efficiencies. The Company’s cost for research and development activities is not material to the Company’s consolidated annual results of operations, financial position or cash flows.

Environmental Compliance

It is the Company’s policy to conduct its global operations in accordance with all applicable laws, regulations and other requirements. While it is not possible to quantify with certainty the potential impact of actions regarding environmental matters, particularly remediation and other compliance efforts that the Company may undertake in the future, in the opinion of management, compliance with the present environmental protection laws, before taking into account estimated recoveries from third parties, will not have a material adverse effect on the Company’s consolidated annual results of operations, financial position or cash flows.

Employees

As of December 31, 2011, the Company had approximately 58,000 employees.

Available Information

The Company maintains an Internet website at www.rrdonnelley.com where our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports are available without charge, as soon as reasonably practicable following the time they are filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The Principles of Corporate Governance of the Company’s Board of Directors, the charters of the Audit, Human Resources and Corporate Responsibility & Governance Committees of the Board of Directors and the Company’s Principles of Ethical Business Conduct are also available on the Investor Relations portion of www.rrdonnelley.com, and will be provided, free of charge, to any shareholder who requests a copy. References to the Company’s website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

Special Note Regarding Forward-Looking Statements

We have made forward-looking statements in this Annual Report on Form 10-K that are subject to risks and uncertainties. These statements are based on the beliefs and assumptions of the Company. Generally, forward-looking statements include information concerning possible or assumed future actions, events, or results of operations of the Company.

These statements may include, or be preceded or followed by, the words “may,” “will,” “should,” “might,” “could,” “would,” “potential,” “possible,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “hope” or similar expressions. The Company claims the protection of the Safe Harbor for Forward-Looking Statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements.

Forward-looking statements are not guarantees of performance. The following important factors, in addition to those discussed elsewhere in this Annual Report on Form 10-K, could affect the future results of the Company and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

| • | the volatility and disruption of the capital and credit markets, and adverse changes in the global economy; |

| • | successful execution and integration of acquisitions; |

7

Table of Contents

| • | successful negotiation of future acquisitions; and the ability of the Company to integrate operations successfully and achieve enhanced earnings or effect cost savings; |

| • | the ability to implement comprehensive plans for the integration of sales forces, cost containment, asset rationalization, systems integration and other key strategies; |

| • | the ability to divest non-core businesses; |

| • | future growth rates in the Company’s core businesses; |

| • | competitive pressures in all markets in which the Company operates; |

| • | the Company’s ability to access unsecured debt in the capital markets and the participants’ ability to perform to our contractual lending and insurance agreements; |

| • | changes in technology, including the electronic substitution and migration of paper based documents to digital data formats; |

| • | factors that affect customer demand, including changes in postal rates and postal regulations, changes in the capital markets, changes in advertising markets, customers’ budgetary constraints and changes in customers’ short-range and long-range plans; |

| • | the ability to gain customer acceptance of the Company’s new products and technologies; |

| • | the ability to secure and defend intellectual property rights and, when appropriate, license required technology; |

| • | customer expectations and financial strength; |

| • | performance issues with key suppliers; |

| • | changes in the availability or costs of key materials (such as ink, paper and fuel) or in prices received for the sale of by-products; |

| • | changes in ratings of the Company’s debt securities; |

| • | the ability to generate cash flow or obtain financing to fund growth; |

| • | the effect of inflation, changes in currency exchange rates and changes in interest rates; |

| • | the effect of changes in laws and regulations, including changes in accounting standards, trade, tax, environmental compliance (including the emission of greenhouse gases and other air pollution controls), health and welfare benefits (including the Patient Protection and Affordable Care Act, as modified by the Health Care and Education Reconciliation Act, and further healthcare reform initiatives), price controls and other regulatory matters and the cost, which could be substantial, of complying with these laws and regulations; |

| • | contingencies related to actual or alleged environmental contamination; |

| • | the retention of existing, and continued attraction of additional customers and key employees; |

| • | the effect of a material breach of security of any of the Company’s systems; |

| • | the effect of labor disruptions or labor shortages; |

| • | the effect of economic and political conditions on a regional, national or international basis; |

| • | the effect of economic weakness and constrained advertising; |

| • | uncertainty about future economic conditions; |

| • | the possibility of future terrorist activities or the possibility of a future escalation of hostilities in the Middle East or elsewhere; |

| • | the possibility of a regional or global health pandemic outbreak; |

8

Table of Contents

| • | adverse outcomes of pending and threatened litigation; and |

| • | other risks and uncertainties detailed from time to time in the Company’s filings with the SEC. |

Because forward-looking statements are subject to assumptions and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Undue reliance should not be placed on such statements, which speak only as of the date of this document or the date of any document that may be incorporated by reference into this document.

Consequently, readers of this Annual Report on Form 10-K should consider these forward-looking statements only as our current plans, estimates and beliefs. We do not undertake and specifically decline any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We undertake no obligation to update or revise any forward-looking statements in this Annual Report on Form 10-K to reflect any new events or any change in conditions or circumstances.

| ITEM 1A. | RISK FACTORS |

The Company’s consolidated results of operations, financial position and cash flows can be adversely affected by various risks. These risks include, but are not limited to, the principal factors listed below and the other matters set forth in this Annual Report on Form 10-K. You should carefully consider all of these risks.

Risks Relating to the Businesses of the Company

Global market and economic conditions, as well as the effects of these conditions on our customers’ businesses, have adversely affected the Company and those effects could continue.

Global economic conditions affect our customers’ businesses and the markets they serve. Demand for advertising tends to correlate with changes in the level of economic activity in the markets our customers serve. Because a significant part of our business relies on our customers’ advertising spending, a prolonged downturn in the global economy and an uncertain economic outlook has and could further reduce the demand for printing and related services that we provide these customers. Economic weakness and constrained advertising spending have resulted, and may in the future result, in decreased revenue, operating margin, earnings and growth rates and difficulty in managing inventory levels and collecting accounts receivable. We have experienced, and expect to experience in the future, reduced demand for our products and services due to economic conditions and other macroeconomic factors affecting consumers’ and businesses’ spending behavior. In addition, customer difficulties have resulted in, and could result in, increases in bad debt write-offs and our allowance for doubtful accounts receivable. In particular, our exposure to certain industries currently experiencing financial difficulties and certain financially troubled customers could have an adverse effect on our results of operations. We also have experienced, and expect to experience in the future, operating margin declines in certain businesses, reflecting the effect of items such as competitive pricing pressures, inventory write-downs, cost increases for wages and materials, and increases in pension and postretirement funding requirements. Economic downturns may also result in restructuring actions and associated expenses and impairment of long-lived assets, including goodwill and other intangibles. Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. Delays or reductions in our customers’ spending are expected to have an adverse effect on demand for our products and services, and consequently our consolidated results of operations, financial position and cash flow and those adverse effects could be material.

Adverse credit market conditions may limit our ability to obtain future financing and the cost of any such capital may be higher than in past periods.

Our access to future financing will depend on a variety of factors such as market conditions, the general availability of credit, our credit ratings and our credit capacity at the time we pursue such financing. Uncertainty

9

Table of Contents

and volatility in global financial markets may cause financial markets institutions to fail or may cause lenders to hoard capital and reduce lending. The failure of a financial institution that supports our existing credit agreement would reduce the size of our committed facility unless a replacement institution were added. Our current credit ratings are below investment grade and, as a result, our borrowing costs have increased. Additionally, we may not be able to replace or renew our existing revolving credit facility and /or rollover other existing debt on favorable terms. If adequate capital is not available to us and our internal sources or liquidity prove to be insufficient, or if future financings require more restrictive covenants, such combination of events could adversely affect our ability to (i) acquire new businesses or enter new markets, (ii) service or refinance our existing debt, (iii) make necessary capital investments, and (iv) make other expenditures necessary for the ongoing conduct of our business.

Fluctuations in the costs of paper, ink, energy and other raw materials may adversely impact the Company.

Purchases of paper, ink, energy and other raw materials represent a large portion of the Company’s costs. Increases in the costs of these inputs may increase the Company’s costs, and the Company may not be able to pass these costs on to customers through higher prices. In addition, the Company may not be able to resell waste paper and other by-products or may be adversely impacted by decreases in the prices for these by-products. Increases in the cost of materials may adversely impact our customers’ demand for printing and related services.

The Company may be adversely affected by a decline in the availability of raw materials.

The Company is dependent on the availability of paper, ink and other raw materials to support its operations. Unforeseen developments in these markets could result in a decrease in the supply of paper, ink or other raw materials and could cause a decline in the Company’s revenues.

The financial condition of our customers may deteriorate.

Many of our customers participate in highly competitive markets, and their financial condition may deteriorate as a result. A decline in the financial condition of our customers would hinder the Company’s ability to collect amounts owed by customers. In addition, such a decline would result in lower demand for the Company’s products and services. A lack of liquidity in the capital markets or a sustained period of unfavorable economic conditions will increase our exposure to credit risks and result in increases in bad debt write-offs and our allowance for doubtful accounts.

The Company may be unable to improve its operating efficiency rapidly enough to meet market conditions.

Because the markets in which the Company competes are highly competitive, the Company must continue to improve its operating efficiency in order to maintain or improve its profitability. There is no assurance that the Company will be able to do so in the future. In addition, the need to reduce ongoing operating costs may result in significant up-front costs to reduce workforce, close or consolidate facilities, or upgrade equipment and technology.

The Company may be unable to successfully integrate the operations of acquired businesses and may not achieve the cost savings and increased revenues anticipated as a result of these acquisitions.

Achieving the anticipated benefits of acquisitions will depend in part upon the Company’s ability to integrate these businesses in an efficient and effective manner. The integration of companies that have previously operated independently may result in significant challenges, and the Company may be unable to accomplish the integration smoothly or successfully. In particular, the coordination of geographically dispersed organizations with differences in corporate cultures and management philosophies may increase the difficulties of integration. The integration of acquired businesses may also require the dedication of significant management resources, which may temporarily distract management’s attention from the day-to-day operations of the Company. In

10

Table of Contents

addition, the process of integrating operations may cause an interruption of, or loss of momentum in, the activities of one or more of the Company’s businesses and the loss of key personnel from the Company or the acquired businesses. Further, employee uncertainty and lack of focus during the integration process may disrupt the businesses of the Company or the acquired businesses. The Company’s strategy is, in part, predicated on our ability to realize cost savings and to increase revenues through the acquisition of businesses that add to the breadth and depth of the Company’s products and services. Achieving these cost savings and revenue increases is dependent upon a number of factors, many of which are beyond our control. In particular, the Company may not be able to realize the benefits of more comprehensive product and service offerings, anticipated integration of sales forces, asset rationalization and systems integration.

The Company may be unable to hire and retain talented employees, including management.

The Company’s success depends, in part, on our general ability to attract, develop, motivate and retain highly skilled employees. The loss of a significant number of the Company’s employees or the inability to attract, hire, develop, train and retain additional skilled personnel could have a serious negative effect on the Company. Various locations may encounter competition with other manufacturers for skilled labor. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices than the Company offers. In addition, many members of the Company’s management have significant industry experience that is valuable to the Company’s competitors. The Company enters into non-solicitation and, as appropriate, non-competition agreements with its executive officers, prohibiting them contractually from soliciting the Company’s customers and employees and from leaving and joining a competitor within a specified period. If one or more members of our senior management team leave and we cannot replace them with a suitable candidate quickly, we could experience difficulty in managing our business properly, which could harm our business prospects and consolidated results of operations.

The trend of increasing costs to provide health care and other benefits to the Company’s employees and retirees may continue.

The Company provides health care and other benefits to both employees and retirees. In recent years, costs for health care have increased more rapidly than general inflation in the U.S. economy. If this trend in health care costs continues, the Company’s cost to provide such benefits could increase, adversely impacting the Company’s profitability. Changes to health care regulations in the U.S. may also increase the Company’s cost of providing such benefits. In addition, the funded status of the Company’s pension and postretirement plans is dependent upon many factors, including returns on invested assets and the level of certain market interest rates. Declines in the market value of the securities held by plans, as experienced in prior years, have reduced and could again in the future materially reduce the funded status of the plans. These reductions have increased the level of expected required pension and postretirement contributions in future years and further increases could occur. Market conditions may lead to changes in the discount rate used to value the year-end benefit obligations of the plans, which could partially mitigate or worsen the effects of the lower asset returns. If an economic crisis were to continue for an extended period of time, our costs and required cash contributions associated with pension and postretirement plans may substantially increase in future periods.

There are risks associated with operations outside the United States.

The Company has significant operations outside the United States. Revenues from the Company’s operations outside the United States accounted for approximately 24% of the Company’s consolidated net sales for the year ended December 31, 2011. As a result, the Company is subject to the risks inherent in conducting business outside the United States, including the impact of economic and political instability of those countries in which we operate. The volatile economic environment has increased the risk of disruption and losses resulting from hyper-inflation, currency devaluation and tax or regulatory changes in certain countries in which the Company has operations.

11

Table of Contents

The Company is exposed to significant risks related to potential adverse changes in currency exchange rates.

The Company is exposed to market risks resulting from changes in the currency exchange rates of the currencies in the countries in which it does business. Although operating in local currencies may limit the impact of currency rate fluctuations on the operating results of our non-U.S. subsidiaries, fluctuations in such rates may affect the translation of these results into the Company’s consolidated financial statements. To the extent revenues and expenses are not in the applicable local currency, the Company may enter into foreign currency forward contracts to hedge the currency risk. We cannot be sure, however, that the Company’s efforts at hedging will be successful and could, in certain circumstances, lead to losses.

A decline in expected profitability of the Company or individual reporting units of the Company could result in the impairment of assets, including goodwill, other long-lived assets and deferred tax assets.

The Company holds material amounts of goodwill, other long-lived assets and deferred tax assets on its balance sheet. A decline in expected profitability, particularly if there is a decline in the global economy, could call into question the recoverability of our related goodwill, other long-lived tangible and intangible assets or deferred tax assets and require us to write down or write off these assets or, in the case of deferred tax assets, recognize a valuation allowance through a charge to income. Such an occurrence could have a material adverse effect on our consolidated annual results of operations, financial position and cash flows.

Risks Related to Our Industry

The highly competitive market for the Company’s products and industry consolidation may continue to create adverse pricing pressures.

The markets for the majority of the Company’s product categories are highly fragmented and the Company has a large number of competitors. We believe that excess capacity in the Company’s markets has caused downward pricing pressure and that this trend is likely to continue. In addition, consolidation in the markets in which the Company competes may increase competitive pricing pressures due to competitors lowering prices as a result of synergies achieved.

The substitution of electronic delivery for printed materials may continue adversely to affect our businesses.

Electronic delivery of documents and data, including the online distribution and hosting of media content, offer alternatives to traditional delivery of printed documents. Consumers continue to accept electronic substitution in directory and statement printing and are replacing traditional reading of print materials with online, hosted media content or other e-reading devices. The extent to which consumers will continue to accept electronic delivery is uncertain and it is difficult to predict future rates of acceptance of these alternatives. Electronic delivery has negatively impacted our products, such as books, directories, forms and statement printing, and to the extent that consumers, our customers and regulators continue to accept these alternatives, our products will be adversely affected.

Changes in the rules and regulations to which the Company is subject may increase the Company’s costs.

The Company is subject to numerous rules and regulations, including, but not limited to, product safety, environmental and health and welfare benefit regulations. These rules and regulations may be changed by local, state or federal governments in countries in which the Company operates. Changes in these regulations may result in a significant increase in the Company’s costs to comply. Compliance with changes in rules and regulations could require increases to the Company’s workforce, increased cost for compensation and benefits, or investments in new or upgraded equipment. In addition, growing concerns about climate change, including the impact of global warming, may result in new regulations with respect to greenhouse gas emissions (including carbon dioxide) and/or “cap and trade” legislation. Compliance with this legislation could result in additional costs to the Company.

12

Table of Contents

Declines in general economic conditions may adversely impact the Company’s business.

In general, demand for our products and services are highly correlated with general economic conditions. Declines in economic conditions in the U.S. or in other countries in which the Company operates may adversely impact the Company’s consolidated financial results. Because such declines in demand are difficult to predict, the Company or the industry may have increased excess capacity as a result. An increase in excess capacity may result in declines in prices for the Company’s products and services. The overall business climate may also be impacted by wars or acts of terrorism. Such acts may have sudden and unpredictable adverse impacts on demand for the Company’s products and services.

Changes in the rules and regulations to which our customers are subject may impact demand for the Company’s products and services.

Many of the Company’s customers are subject to rules and regulations requiring certain printed or electronic communications, governing the form of such communications, and protecting the privacy of consumers. Changes in these regulations may impact our customers’ business practices and could reduce demand for printed products and related services. Changes in such regulations could eliminate the need for certain types of printed communications altogether or such changes may impact the quantity or format of printed communications.

Changes in postal rates and regulations may adversely impact demand for the Company’s products and services.

Postal costs are a significant component of many of our customers’ cost structures and postal rate changes can influence the number of pieces and types of mailings that the Company’s customers mail. In addition, the United States Postal Service has incurred significant financial losses in recent years and may, as a result, implement significant changes to the breadth or frequency of its mail delivery. If implemented, such changes could impact our customers’ ability or willingness to communicate by mail. Declines in print volumes mailed could have an adverse effect on the Company’s business.

Changes in the advertising, retail and capital markets may impact the demand for printing and related services.

Many of the end markets in which our customers compete are experiencing changes due to technological progress and changes in consumer preferences. The Company cannot predict the impact that these changes will have on demand for the Company’s products and services. Such changes may decrease demand, increase pricing pressures, require investment in updated equipment and technology, or cause other adverse impacts to the Company’s business. In addition, the Company must monitor changes in our customers’ markets and develop new solutions to meet customers’ needs. The development of such solutions may be costly, and there is no assurance that these solutions will be accepted by customers.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

The Company has no unresolved written comments from the SEC staff regarding its periodic or current reports under the Securities Exchange Act of 1934.

| ITEM 2. | PROPERTIES |

The Company’s corporate office is located in leased office space in Chicago, Illinois. In addition, as of December 31, 2011, the Company leases or owns 335 U.S. facilities, some of which have multiple buildings and warehouses, and these U.S. facilities encompass approximately 39.5 million square feet. The Company leases or owns 161 international facilities encompassing approximately 9.7 million square feet in Canada, Latin America, South America, Europe, and Asia. Of our U.S. and international facilities, approximately 31.3 million square feet of space is owned, while the remaining 17.9 million square feet of space is leased.

13

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

The Company is subject to laws and regulations relating to the protection of the environment. The Company provides for expenses associated with environmental remediation obligations when such amounts are probable and can be reasonably estimated. Such accruals are adjusted as new information develops or circumstances change. The Company has been designated as a potentially responsible party in eleven active federal and state Superfund and other multiparty remediation sites. In addition to these sites, the Company may also have the obligation to remediate nine other previously owned facilities and four other currently owned facilities. At the Superfund sites, the Comprehensive Environmental Response, Compensation and Liability Act provides that the Company’s liability could be joint and several, meaning that the Company could be required to pay an amount in excess of its proportionate share of the remediation costs. The Company’s understanding of the financial strength of other potentially responsible parties at the multiparty sites and of other liable parties at the previously owned facilities has been considered, where appropriate, in the determination of the Company’s estimated liability. The Company has established reserves, recorded in accrued liabilities and other noncurrent liabilities, that it believes are adequate to cover its share of the potential costs of remediation at each of the multiparty sites and the previously and currently owned facilities. While it is not possible to quantify with certainty the potential impact of actions regarding environmental matters, particularly remediation and other compliance efforts that the Company may undertake in the future, in the opinion of management, compliance with the present environmental protection laws, before taking into account estimated recoveries from third parties, will not have a material effect on the Company’s consolidated annual results of operations, financial position or cash flows.

From time to time, the Company’s customers and others file voluntary petitions for reorganization under United States bankruptcy laws. In such cases, certain pre-petition payments received by the Company from these parties could be considered preference items and subject to return. In addition, the Company may be party to certain litigation arising in the ordinary course of business. Management believes that the final resolution of these preference items and litigation will not have a material effect on the Company’s consolidated annual results of operations, financial position or cash flows.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

14

Table of Contents

EXECUTIVE OFFICERS OF R.R. DONNELLEY & SONS COMPANY

| Name, Age and Positions with the Company |

Officer Since |

Business Experience During Past Five Years | ||||

| Thomas J. Quinlan, III 49, President and Chief Executive Officer |

2004 | Served as RR Donnelley’s President and Chief Executive Officer since April 2007. Prior to this, served as Group President, Global Services since October 2006 and Chief Financial Officer since April 2006. Prior to this, served as Executive Vice President, Operations since February 2004. | ||||

| Suzanne S. Bettman 47, Executive Vice President, General Counsel, Corporate Secretary & Chief Compliance Officer |

2004 | Served as RR Donnelley’s Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer since January 2007. Served previously as Senior Vice President, General Counsel since March 2004. | ||||

| Andrew B. Coxhead 43, Senior Vice President, Controller and Chief Accounting Officer |

2007 | Served as RR Donnelley’s Senior Vice President, Controller since October 2007. Prior to this, served as Vice President, Assistant Controller since September 2006. Prior to this, from 1995 until 2006, served in various capacities with RR Donnelley in financial planning, accounting, manufacturing management, operational finance and mergers and acquisitions. | ||||

| Dan L. Knotts 47, Group President |

2007 | Served as RR Donnelley’s Group President since April 2007. Prior to this, served as Chief Operating Officer, Global Print Solutions since January 2007. Prior to this, from 1986 until 2007, served in various capacities with RR Donnelley, including Group Executive Vice President, Operations, Publishing and Retail Services and President, Catalog/Retail/Magazine Solutions, RR Donnelley Print Solutions. | ||||

| Daniel N. Leib 45, Executive Vice President and Chief Financial Officer |

2009 | Served as RR Donnelley’s Executive Vice President and Chief Financial Officer since May 2011. Prior to this, served as Group Chief Financial Officer and Senior Vice President, Mergers and Acquisitions since August 2009 and Treasurer from June 2008 to February 2010. Prior to this, served as RR Donnelley’s Senior Vice President, Treasurer, Mergers and Acquisitions and Investor Relations since July 2007. Prior to this, from May 2004 to 2007, served in various capacities in financial management, corporate strategy and investor relations. | ||||

| John R. Paloian 53, Chief Operating Officer |

2004 | Served as RR Donnelley’s Chief Operating Officer since April 2007. Served previously as Group President, Global Print Solutions since March 2004. | ||||

15

Table of Contents

PART II

| ITEM 5. | MARKET FOR R.R. DONNELLEY & SONS COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF SECURITIES |

RR Donnelley’s common stock is listed and traded on the NASDAQ Stock Market and the Chicago Stock Exchange.

As of February 10, 2012, there were approximately 8,259 stockholders of record of our common stock. Quarterly closing prices of the Company’s common stock, as reported on NASDAQ, and dividends paid per share during the years ended December 31, 2011 and 2010, are contained in the chart below:

| Dividends Paid | Closing Common Stock Prices | |||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||

| 2011 | 2010 | High | Low | High | Low | |||||||||||||||||||

| First Quarter |

$ | 0.26 | $ | 0.26 | $ | 19.39 | $ | 17.49 | $ | 23.19 | $ | 19.02 | ||||||||||||

| Second Quarter |

0.26 | 0.26 | 21.34 | 18.58 | 22.60 | 16.37 | ||||||||||||||||||

| Third Quarter |

0.26 | 0.26 | 20.44 | 13.33 | 18.05 | 14.96 | ||||||||||||||||||

| Fourth Quarter |

0.26 | 0.26 | 16.65 | 13.27 | 18.82 | 15.76 | ||||||||||||||||||

ISSUER PURCHASES OF EQUITY SECURITIES

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Dollar

Value of Shares that May Yet be Purchased Under the Plans or Programs |

||||||||||||

| October 1, 2011–October 31, 2011 |

— | $ | — | — | $ | 600,000,000 | ||||||||||

| November 1, 2011–November 30, 2011 |

9,252,810 | $ | 17.13 | 9,252,810 | $ | 500,000,000 | ||||||||||

| December 1, 2011–December 31, 2011 |

— | — | — | $ | 500,000,000 | |||||||||||

|

|

|

|

|

|||||||||||||

| Total |

9,252,810 | $ | 17.13 | 9,252,810 | ||||||||||||

|

|

|

|

|

|||||||||||||

On May 3, 2011, the Board of Directors of the Company approved a program that authorizes the repurchase of up to $1.0 billion of the Company’s common stock through December 31, 2012 and terminated its existing authorization of October 29, 2008 for the repurchase of up to 10 million shares. Share repurchases under the program may be made from time to time through a variety of methods as determined by the Company’s management.

As part of the share repurchase program, on May 5, 2011, the Company entered into an accelerated share repurchase agreement (“ASR”) with an investment bank under which the Company agreed to repurchase $500.0 million of its common stock. On May 10, 2011, the Company paid the $500.0 million purchase price and received an initial delivery of 19.9 million shares from the investment bank. The shares delivered were subject to a 20%, or $100.0 million holdback, which resulted in the Company receiving an additional 9.3 million shares on November 17, 2011. The additional shares received were calculated based upon the $17.13 volume weighted average price of the Company’s common stock over an averaging period, subject to a discount agreed upon with the investment bank. The averaging period ended on November 14, 2011.

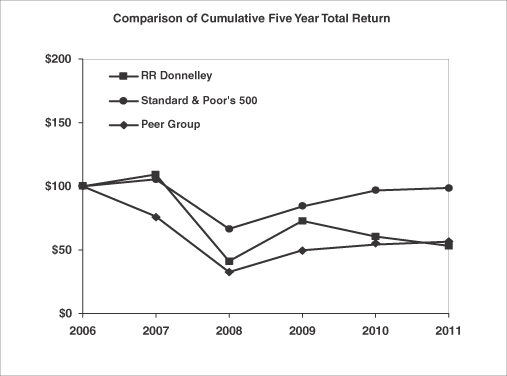

PEER PERFORMANCE TABLE

The graph below compares five-year returns of the Company’s common stock with those of the S&P 500 Index and a selected peer group of companies. The comparison assumes all dividends have been reinvested, and an initial investment of $100 on December 31, 2006. The returns of each company in the peer group have been weighted to reflect their market capitalizations.

16

Table of Contents

Because our services and customers are so diverse, the Company does not believe that any single published industry index is appropriate for comparing stockholder return. Therefore, the peer group used in the performance graph combines two industry groups identified by Value Line Publishing, Inc., the publishing group (including printing companies) and the newspaper group. The Company itself has been excluded, and its contributions to the indices cited have been subtracted out. Changes in the peer group from year to year result from companies being added to or deleted from the Value Line publishing group or newspaper group.

Comparison of Five-Year Cumulative Total Return Among RR Donnelley, S&P 500 Index and Peer Group*

| Base Period 2006 |

Fiscal Years Ended December 31, | |||||||||||||||||||||||

| Company Name / Index |

2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| RR Donnelley |

100 | 109.13 | 41.09 | 72.66 | 60.43 | 53.13 | ||||||||||||||||||

| Standard & Poor’s 500 |

100 | 105.49 | 66.46 | 84.05 | 96.71 | 98.76 | ||||||||||||||||||

| Peer Group |

100 | 76.36 | 32.54 | 49.69 | 54.17 | 56.52 | ||||||||||||||||||

Below are the specific companies included in the peer group.

| *Peer Group Companies |

||

| A.H. Belo Corp. American Greetings Consolidated Graphics Inc. Deluxe Corp. EW Scripps Gannett Co. Journal Communications Inc. McClatchy Co. |

McGraw-Hill Companies Media General Meredith Corp. New York Times Co. Scholastic Corp. Washington Post Wiley (John) & Sons |

17

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

SELECTED FINANCIAL DATA

(in millions, except per share data)

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Net sales |

$ | 10,611.0 | $ | 10,018.9 | $ | 9,857.4 | $ | 11,581.6 | $ | 11,587.1 | ||||||||||

| Net earnings (loss) from continuing operations attributable to RR Donnelley common shareholders |

(122.6 | ) | 221.7 | (27.3 | ) | (191.7 | ) | (48.4 | ) | |||||||||||

| Net earnings (loss) from continuing operations attributable to RR Donnelley common shareholders per diluted share |

(0.63 | ) | 1.06 | (0.13 | ) | (0.91 | ) | (0.22 | ) | |||||||||||

| Income (loss) from discontinued operations, net of tax |

— | — | — | 1.8 | (0.5 | ) | ||||||||||||||

| Net earnings (loss) attributable to RR Donnelley common shareholders |

(122.6 | ) | 221.7 | (27.3 | ) | (189.9 | ) | (48.9 | ) | |||||||||||

| Net earnings (loss) attributable to RR Donnelley common shareholders per diluted share |

(0.63 | ) | 1.06 | (0.13 | ) | (0.90 | ) | (0.22 | ) | |||||||||||

| Total assets |

8,281.7 | 9,083.2 | 8,747.6 | 9,494.3 | 12,086.7 | |||||||||||||||

| Long-term debt |

3,416.8 | 3,398.6 | 2,982.5 | 3,203.3 | 3,601.9 | |||||||||||||||

| Cash dividends per common share |

1.04 | 1.04 | 1.04 | 1.04 | 1.04 | |||||||||||||||

| Reflects | results of acquired businesses from the relevant acquisition dates. |

Includes the following significant items:

| • | For 2011: Pre-tax restructuring and impairment charges of $667.8 million, $74.8 million recognition of income tax benefits due to the expiration of U.S. federal statutes of limitations for certain years, $69.9 million pre-tax loss on the repurchases of $427.8 million of senior notes, $38.7 million pre-tax gain on pension curtailment, $15.3 million pre-tax contingent compensation related to the Journalism Online acquisition, $9.8 million pre-tax gain on Helium investment and $2.2 million of acquisition-related expenses; |

| • | For 2010: Pre-tax restructuring and impairment charges of $157.9 million, $13.5 million of acquisition-related expenses, $8.9 million pre-tax loss on the currency devaluation in Venezuela, including an increase in loss attributable to noncontrolling interests of $3.6 million; and a pre-tax $1.1 million write-down of affordable housing investments; |

| • | For 2009: Pre-tax restructuring and impairment charges of $382.7 million, $15.6 million of income tax expense due to the reorganization of entities within the International segment, a $10.3 million pre-tax loss on the repurchases of $640.6 million of senior notes, reclassification of a pre-tax loss of $2.7 million from accumulated other comprehensive income to loss on debt extinguishment due to the change in the hedged forecasted interest payments resulting from the repurchase of senior notes, a $2.4 million write-down of affordable housing investments and $1.6 million of acquisition-related expenses; |

| • | For 2008: Pre-tax restructuring and impairment charges of $1,184.7 million, a $9.9 million pre-tax loss associated with the termination of cross-currency swaps, a tax benefit of $228.8 million related to the decline in value and reorganization of certain entities within the International segment and a tax benefit of $38.0 million from the recognition of uncertain tax positions upon settlement of certain U.S. federal tax audits for the years 2000 – 2002; and |

| • | For 2007: Pre-tax restructuring and impairment charges of $839.0 million and a tax benefit of $9.3 million from the reduction in net deferred tax liabilities due to a decrease in the statutory tax rate in the United Kingdom. |

18

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion of RR Donnelley’s financial condition and results of operations should be read together with our consolidated financial statements and notes to those statements included in Item 15 of Part IV of this Annual Report on Form 10-K.

Business

R.R. Donnelley & Sons Company (“RR Donnelley,” the “Company,” “we,” “us,” and “our”) is a global provider of integrated communications. The Company works collaboratively with more than 60,000 customers worldwide to develop custom communications solutions that reduce costs, enhance return on investment and ensure compliance. Drawing on a range of proprietary and commercially available digital and conventional technologies deployed across four continents, the Company employs a suite of leading Internet-based capabilities and other resources to provide premedia, printing, logistics and business process outsourcing products and services to leading clients in virtually every private and public sector.

The Company operates primarily in the commercial print portion of the printing industry, with related products and service offerings designed to offer customers complete solutions for communicating their messages to target audiences. The Company’s reportable segments reflect the management reporting structure of the organization and the manner in which the chief operating decision maker regularly assesses information for decision-making purposes, including the allocation of resources. The reporting structure includes two segments: “U.S. Print and Related Services” and “International.”

The U.S. Print and Related Services segment includes the Company’s U.S. printing operations, managed as one integrated platform, along with logistics, premedia, print management and other print related services. This segment’s products and related service offerings include magazines, catalogs, retail inserts, books, directories, financial printing and related services, direct mail, forms, labels, office products, statement printing, premedia and logistics services.

The International segment includes the Company’s non-U.S. printing operations in Asia, Europe, Latin America and Canada. This segment’s products and related service offerings include magazines, catalogs, retail inserts, books, directories, financial printing and related services, direct mail, forms, labels, packaging, manuals, statement printing, premedia and logistics services. Additionally, this segment includes the Company’s business process outsourcing and Global Turnkey Solutions operations. Business process outsourcing provides transactional print and outsourcing services, statement printing, direct mail and print management services through its operations in Europe, Asia and North America. Global Turnkey Solutions provides outsourcing capabilities, including product configuration, customized kitting and order fulfillment for technology, medical device and other companies around the world through its operations in Europe, North America and Asia.

The Company separately reports its net sales and related costs of sales for its products and service offerings. The Company’s product offerings primarily consist of magazines, catalogs, retail inserts, books, directories, direct mail, financial print, forms, labels, statement printing, commercial print, office products and print management. The Company’s service offerings primarily consist of logistics, premedia, EDGAR-related and XBRL financial services and certain business process outsourcing services.

19

Table of Contents

Executive Overview

2011 FINANCIAL PERFORMANCE

The changes in the Company’s income from operations, operating margin, net earnings (loss) attributable to RR Donnelley common shareholders and net earnings (loss) attributable to RR Donnelley common shareholders per diluted share for the year ended December 31, 2011, from the year ended December 31, 2010, were due to the following (in millions, except margin and per share data):

| Income from Operations |

Operating Margin |

Net Earnings (Loss) Attributable to RR Donnelley Common Shareholders |

Net Earnings (Loss) Attributable to RR Donnelley Common Shareholders per Diluted Share |

|||||||||||||

| For the year ended December 31, 2010 |

$ | 555.5 | 5.5 | % | $ | 221.7 | $ | 1.06 | ||||||||

| 2011 restructuring and impairment charges |

(667.8 | ) | (6.3 | %) | (532.8 | ) | (2.75 | ) | ||||||||

| 2010 restructuring and impairment charges |

157.9 | 1.6 | % | 130.0 | 0.62 | |||||||||||

| Acquisition-related expenses |

11.3 | 0.1 | % | 9.8 | 0.05 | |||||||||||

| 2011 gain on Helium investment |

— | — | 9.5 | 0.05 | ||||||||||||

| 2011 loss on debt extinguishment |

— | — | (44.1 | ) | (0.23 | ) | ||||||||||

| 2011 gain on pension curtailment |

38.7 | 0.4 | % | 24.3 | 0.13 | |||||||||||

| 2011 Journalism Online contingent compensation |

(15.3 | ) | (0.1 | %) | (9.7 | ) | (0.05 | ) | ||||||||

| 2010 Venezuela devaluation |

— | — | 4.5 | 0.02 | ||||||||||||

| Recognition of income tax benefits |

— | — | 74.8 | 0.39 | ||||||||||||

| Operations |

(15.1 | ) | (0.6 | %) | (10.6 | ) | 0.08 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| For the year ended December 31, 2011 |

$ | 65.2 | 0.6 | % | $ | (122.6 | ) | $ | (0.63 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

2011 restructuring and impairment charges: included charges of $392.3 million and $90.7 million for the impairment of goodwill and intangible assets, respectively; $76.7 million for employee termination costs; $59.6 million of other restructuring costs, including lease termination costs and multi-employer pension plan partial withdrawal charges of $15.1 million due to the closing of three manufacturing facilities within the U.S. Print and Related Services segment; and $48.5 million for impairment of other long-lived assets, primarily for land, buildings, machinery and equipment and leasehold improvements associated with facility closures.

2010 restructuring and impairment charges: included $61.0 million and $26.9 million of non-cash charges for the impairment of goodwill and intangible assets, respectively; charges of $35.9 million for employee termination costs; $29.5 million of other restructuring costs, of which $13.6 million related to multi-employer pension plan partial withdrawal charges primarily attributable to two closed manufacturing facilities within the U.S. Print and Related Services segment; and $4.6 million for impairment of other long-lived assets.

Acquisition-related expenses: included pre-tax charges of $2.2 million ($2.0 million after-tax) related to legal, accounting and other expenses for the year ended December 31, 2011 associated with acquisitions completed or contemplated. For the year ended December 31, 2010, these pre-tax charges were $13.5 million ($11.8 million after-tax).

2011 gain on Helium investment: included a pre-tax gain of $9.8 million as a result of the acquisition of Helium, in which the Company previously held an equity investment. The pre-tax gain is net of the Company’s portion of the transaction costs incurred by Helium as a result of the acquisition.

2011 loss on debt extinguishment: included a pre-tax loss of $69.9 million on the repurchases of $227.8 million of the 11.25% senior notes due February 1, 2019, $100 million of the 6.125% senior notes due January 15, 2017 and $100 million of the 5.50% senior notes due May 15, 2015. The $69.9 million pre-tax

20

Table of Contents

loss also included the reclassification of a $0.5 million pre-tax loss from accumulated other comprehensive loss to loss on debt extinguishment due to the change in the hedged forecasted interest payments resulting from the repurchase of the 5.50% senior notes.

2011 gain on pension curtailment: included a pre-tax gain of $38.7 million related to the remeasurement of the plans’ assets and obligations that was required with the announced freeze on further benefit accruals under all of the Company’s U.S. pension plans as of December 31, 2011.

2011 Journalism Online contingent compensation: included pre-tax expense of $15.3 million related to contingent compensation earned by the prior owners, based on achieving certain volume milestones for Journalism Online’s business following its acquisition by the Company.

2010 Venezuela devaluation: currency devaluation in Venezuela resulted in a pre-tax loss of $8.9 million ($8.1 million after-tax) and an increase in loss attributable to noncontrolling interests of $3.6 million.

Recognition of income tax benefits: included the recognition of previously unrecognized tax benefits due to the expiration of U.S. federal statutes of limitations for certain years. See discussion in Note 12 to the Consolidated Financial Statements.

Operations: reflected a net decrease in volume within the U.S. Print and Related Services segment, higher pension and other benefits-related expenses and continued price pressures. These decreases were partially offset by higher volume in the International segment, higher recovery on by-products, cost savings from restructuring actions, productivity efforts and lower incentive compensation expense. Income tax expense also decreased due to the recognition of previously unrecognized tax benefits related to certain state tax matters. In addition, purchases of shares pursuant to the Company’s share repurchase program resulted in higher interest expense and fewer weighted average shares outstanding. See further details in the review of operating results by segment that follows below.

2011 Overview

Although net sales increased during 2011 compared to 2010, due to the acquisition of Bowne, the Company’s net sales declined by approximately 0.6% on a pro forma basis (See Note 2 to the Consolidated Financial Statements). Changes in foreign exchange rates increased net sales by approximately 0.7%. The net sales decline on a pro forma basis resulted from lower overall volume and ongoing price pressure driven by worldwide market volatility, continued economic uncertainty and the increasing impact of electronic substitution on certain products. Despite this difficult environment, the International segment, along with certain products and services within the U.S. Print and Related Services segment, achieved organic growth for the year. In particular, the Company had organic growth in Latin America and Asia, as well as in its logistics and commercial print offerings. The largest organic net sales declines were experienced in books and directories, due mostly to electronic substitution, variable print, due to the production and distribution of materials for the U.S. Census in 2010, and financial printing and related services, due to the 2011 decline in capital markets transactions activity.

The Company continued to focus on productivity improvements throughout the year, and achieved significant savings from acquisition synergies, facility closures and continued cost management actions. The Company continued to make significant progress in the integration of Bowne, which included restructuring actions to eliminate duplicate facilities and personnel throughout the affected operations. In addition, amounts earned under the Company’s 2011 employee incentive compensation plans declined, reducing expenses by $74.5 million compared to amounts earned in 2010.

The Company’s operating cash flow for the year ended December 31, 2011 increased by approximately $193.8 million from 2010, reflecting improvements in working capital management, including the benefits of process and systems integration efforts related to the Bowne acquisition, improved credit and collection efforts, inventory reductions and increased standardization of vendor payment terms. The improvement to operating cash flow was also due to lower cash payments for restructuring and occurred despite a significant increase in cash payments for incentive compensation plans related to amounts earned in 2009 and 2010.

21

Table of Contents

On November 2, 2011, the Company announced a freeze on further benefit accruals under all of its U.S. pension plans as of December 31, 2011. Beginning January 1, 2012, participants ceased earning additional benefits under the plans and no new participants will enter these plans. The plan freeze required a remeasurement of the plans’ funded status as of November 2, 2011, which resulted in a non-cash curtailment gain of $38.7 million recognized in the fourth quarter of 2011. Also effective January 1, 2012, the Company instituted a defined contribution matching program for most U.S. employees. This program includes a Company match equal to 40% of contributions on up to 6% of eligible compensation on a pay period basis. The cost of the Company match will be determined by the level of eligible employee contributions made to the plan and the related expense will be recognized as incurred.

On May 3, 2011, the Board of Directors of the Company approved a program that authorized the repurchase of up to $1.0 billion of the Company’s common stock through December 31, 2012. Share repurchases under the program may be made from time to time through a variety of methods as determined by the Company’s management. As part of the share repurchase program, on May 5, 2011, the Company entered into an ASR with an investment bank under which the Company agreed to repurchase $500.0 million of its common stock. On May 10, 2011, the Company paid the $500.0 million purchase price and received an initial delivery of 19.9 million shares from the investment bank. The shares delivered were subject to a 20%, or $100.0 million holdback, which resulted in the Company receiving an additional 9.3 million shares on November 17, 2011. The additional shares received were calculated based upon the $17.13 volume weighted average price of the Company’s common stock over an averaging period, subject to a discount agreed upon with the investment bank. The averaging period ended on November 14, 2011.

OUTLOOK

Vision and Strategy

RR Donnelley’s vision is to improve on our existing position as a global provider of integrated communications by providing our customers with the highest quality products and services.

The Company’s long-term strategy is focused on maximizing long-term shareholder value by driving profitable growth, continuing its focus on productivity and maintaining a disciplined approach to capital deployment. To increase shareholder value, the Company pursues three major strategic objectives. These objectives are summarized below, along with more specific areas of focus.

| Strategic Objective |

2012 Priorities | |

| Profitable growth |

—New product development —Leverage existing customer base to generate organic growth —Targeted mergers and acquisitions | |

| Productivity and cost control |

—Disciplined cost management —Flexible cost structure | |

| Cash flow and liquidity |

—Prudent capital investment —Disciplined approach to mergers and acquisitions | |