Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ Preliminary Proxy Statement |

| ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ Definitive Proxy Statement |

| ☐ Definitive Additional Materials |

| ☐ Soliciting Material under §240.14a-12 |

| Dollar General Corporation |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ No fee required. |

| ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

|

| ☐ Fee paid previously with preliminary materials. |

| ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid:

| |

| (2) | Form, Schedule or Registration Statement No.:

| |

| (3) | Filing Party:

| |

| (4) | Date Filed:

| |

Table of Contents

DEAR FELLOW SHAREHOLDER,

|

|

The 2019 Annual Meeting of Shareholders of Dollar General Corporation will be held on Wednesday, May 29, 2019, at 9:00 a.m., Central Time, at Goodlettsville City Hall Auditorium, 105 South Main Street, Goodlettsville, Tennessee. All shareholders of record at the close of business on March 21, 2019 are invited to attend the annual meeting. For security reasons, however, to gain admission to the meeting you may be required to present photo identification and comply with other security measures.

At this year’s meeting, you will have an opportunity to vote on the matters described in our accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. Our 2018 Annual Report also accompanies this letter.

Your interest in Dollar General and your vote are very important to us. We encourage you to read the Proxy Statement and vote your proxy as soon as possible so your vote can be represented at the annual meeting. You may vote your proxy via the Internet or telephone, or if you received a paper copy of the proxy materials by mail, you may vote by mail by completing and returning a proxy card.

On behalf of the Board of Directors, thank you for your continued support of Dollar General.

SINCERELY,

MICHAEL M. CALBERT CHAIRMAN OF THE BOARD

APRIL 4, 2019 |

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| DATE | TIME | PLACE | ||

|

|

| ||

| Wednesday May 29, 2019 |

9:00 a.m. Central Time |

Goodlettsville City Hall Auditorium 105 South Main Street Goodlettsville, Tennessee | ||

ITEMS OF BUSINESS:

| • To elect as directors the 8 nominees listed in the proxy statement

|

||||

| • To hold an advisory vote to approve our named executive officer compensation as disclosed in the proxy statement

|

||||

| • To ratify the appointment of our independent registered public accounting firm for fiscal 2019

|

||||

| • To transact any other business that may properly come before the annual meeting and any adjournments of that meeting

|

WHO MAY VOTE:

Shareholders of record at the close of business on March 21, 2019

| By Order of the Board of Directors, | ||||

| ||||

| Goodlettsville, Tennessee April 4, 2019 |

Christine L. Connolly Corporate Secretary |

| Please vote your proxy as soon as possible even if you expect to attend the annual meeting in person. You may vote your proxy via the Internet or by phone by following the instructions on the notice of internet availability or proxy card, or if you received a paper copy of these proxy materials by mail, you may vote by mail by completing and returning the enclosed proxy card in the enclosed reply envelope. No postage is necessary if the proxy is mailed within the United States. You may revoke your proxy by following the instructions listed on page 2 of the proxy statement. | ||||||

Table of Contents

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in the proxy statement or about Dollar General. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

HOW TO VOTE (p. 2)

| PHONE | INTERNET |

IN PERSON | ||||

|

|

|

| |||

| Mail your completed, signed, and dated proxy card or voting instruction form |

1-800-690-6903 |

www.proxyvote.com |

May 29, 2019 9:00 a.m., CT Goodlettsville City Hall Auditorium 105 South Main Street Goodlettsville, TN | |||

VOTING MATTERS (pp. 4, 45, and 47)

| 2019 PROPOSALS |

Board Recommends |

| ||

| Proposal 1: Election of Directors

|

|

|||

| Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation

|

|

|||

| Proposal 3: Ratification of Appointment of Auditors

|

|

|||

BOARD OF DIRECTORS GROUP DIVERSITY(pp 4-9)

Table of Contents

PROXY STATEMENT SUMMARY

PAY FOR PERFORMANCE (pp. 20 and 21)

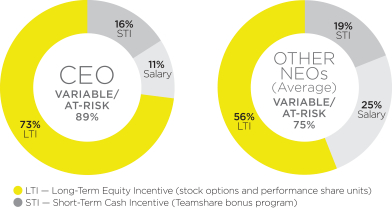

| Consistent with our philosophy, and as illustrated to the right, a significant portion of annualized target total direct compensation for our named executive officers in 2018 was performance-based and linked to changes in our stock price. |

|

|

|

The most recent shareholder advisory vote on our named executive officer compensation was held on May 30, 2018. Excluding abstentions and broker non-votes, 96.55% of total votes were cast in support of the program. |

DOLLAR GENERAL AT-A-GLANCE*

* Data as of March 21, 2019 unless otherwise noted.

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 29, 2019

This Proxy Statement, our 2018 Annual Report and a form of proxy card are available at www.proxyvote.com. You will need your Notice of Internet Availability or proxy card to access the proxy materials.

As permitted by rules adopted by the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials over the Internet to some of our shareholders. This means that some shareholders will not receive paper copies of these documents but instead will receive only a Notice of Internet Availability containing instructions on how to access the proxy materials over the Internet and how to request a paper copy of our proxy materials, including the Proxy Statement, our 2018 Annual Report, and a proxy card. Shareholders who do not receive a Notice of Internet Availability will receive a paper copy of the proxy materials by mail, unless they have previously requested delivery of proxy materials electronically.

Table of Contents

PROXY STATEMENT

This document is the proxy statement of Dollar General Corporation that we use to solicit your proxy to vote upon certain matters at our Annual Meeting of Shareholders to be held on Wednesday, May 29, 2019. We will begin mailing printed copies of this document and the form of proxy or the Notice of Internet Availability to shareholders on or about April 4, 2019.

SOLICITATION, MEETING, AND VOTING INFORMATION

|

2019 Proxy Statement 1 |

Table of Contents

SOLICITATION, MEETING, AND VOTING INFORMATION

| 2 2019 Proxy Statement |

|

Table of Contents

SOLICITATION, MEETING, AND VOTING INFORMATION

|

2019 Proxy Statement 3 |

Table of Contents

PROPOSAL 1: Election of Directors

|

Board of Directors Matrix

|

Total

| |||||||||||||||||||

| Retail Industry Experience |

|

|

|

|

|

|

|

7 | ||||||||||||

| Senior Leadership (C-Suite) Experience |

|

|

|

|

|

|

|

|

8 | |||||||||||

| Strategic Planning/M&A Experience |

|

|

|

|

|

|

6 | |||||||||||||

| Public Board Experience |

|

|

|

|

4 | |||||||||||||||

| Financial Expertise |

|

|

|

|

4 | |||||||||||||||

| General Independence |

|

|

|

|

|

|

|

7 | ||||||||||||

| Global/International Experience (Sourcing or Operations) |

|

|

|

|

|

5 | ||||||||||||||

| Branding/Marketing/Consumer Behavior Experience |

|

|

|

|

|

5 | ||||||||||||||

| Human Capital Experience |

|

1 | ||||||||||||||||||

| E-commerce/Digital Experience |

|

|

2 | |||||||||||||||||

| Risk Management Experience |

|

|

|

|

|

|

|

|

8 | |||||||||||

| Racial/Gender Diversity |

|

|

|

3 | ||||||||||||||||

| 4 2019 Proxy Statement |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

WARREN F. BRYANT

Age: 73

Director Since: 2009 |

Biography: Mr. Bryant served as the President and Chief Executive Officer of Longs Drug Stores Corporation from 2002 through 2008 and as its Chairman of the Board from 2003 through his retirement in 2008. Prior to joining Longs Drug Stores, he served as a Senior Vice President of The Kroger Co. from 1999 to 2002. Mr. Bryant has served as a director of Loblaw Companies Limited of Canada since May 2013 and served as a director of OfficeMax Incorporated from 2004 to 2013 and Office Depot, Inc. from November 2013 to July 2017.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. Bryant has over 40 years of retail experience, including experience in marketing, merchandising, operations, and finance. His substantial experience in leadership and policy-making roles at other retail companies, together with his current and former experience as a board member for other retailers, provides him with an extensive understanding of our industry, as well as with valuable executive management skills, global, strategic planning, and risk management experience, and the ability to effectively advise our CEO. | ||

|

2019 Proxy Statement 5 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

MICHAEL M. CALBERT

Age: 56

Director Since: 2007 |

Biography: Mr. Calbert has served as our Chairman of the Board since January 2016. He joined the private equity firm KKR & Co. L.P. (“KKR”) in January 2000 and was directly involved with several KKR portfolio companies until his retirement in January 2014. Mr. Calbert led the Retail industry team within KKR’s Private Equity platform prior to his retirement and served as a consultant to KKR from his retirement until June 2015. Mr. Calbert joined Randall’s Food Markets beginning in 1994 and served as the Chief Financial Officer from 1997 until it was sold in September 1999. Mr. Calbert also previously worked as a certified public accountant and consultant with Arthur Andersen Worldwide from 1985 to 1994, where his primary focus was the retail and consumer industry. He previously served as our Chairman of the Board from July 2007 until December 2008 and as our lead director from March 2013 until his re-appointment as our Chairman of the Board in January 2016.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. Calbert has considerable experience in managing private equity portfolio companies and is experienced with corporate finance and strategic business planning activities. As the former head of KKR’s Retail industry team, Mr. Calbert has a strong background and extensive experience in advising and managing companies in the retail industry, including evaluating business strategies, financial plans and structures, risk, and management teams. His former service on various private company boards in the retail industry further strengthens his knowledge and experience within our industry. Mr. Calbert also has a significant financial and accounting background evidenced by his prior experience as the chief financial officer of a retail company and his 10 years of practice as a certified public accountant. | ||

|

SANDRA B. COCHRAN

Age: 60

Director Since: 2012 |

Biography: Ms. Cochran has served as a director and as President and Chief Executive Officer of Cracker Barrel Old Country Store, Inc., a restaurant and retail concept with locations throughout the United States, since September 2011. She joined Cracker Barrel in April 2009 as Executive Vice President and Chief Financial Officer, and was named President and Chief Operating Officer in November 2010. She was previously Chief Executive Officer at Books-A-Million, Inc. from February 2004 to April 2009. She also served as that company’s President (August 1999 – February 2004), Chief Financial Officer (September 1993 – August 1999) and Vice President of Finance (August 1992 – September 1993). Ms. Cochran has served as a director of Lowe’s Companies, Inc. since January 2016.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Ms. Cochran brings over 25 years of retail experience to Dollar General as a result of her current and former roles at Cracker Barrel Old Country Store and her former roles at Books-A-Million. This experience allows her to provide additional support and perspective to our CEO and our Board. In addition, Ms. Cochran’s industry, executive, and other public company board experience provides leadership, consensus-building, strategic planning, risk management, and budgeting skills. Ms. Cochran also has significant financial experience, having served as the chief financial officer of two public companies and as vice president, corporate finance of SunTrust Securities, Inc., and our Board has determined that she qualifies as an audit committee financial expert. | ||

| 6 2019 Proxy Statement |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

PATRICIA D. FILI-KRUSHEL

Age: 65

Director Since: 2012 |

Biography: Ms. Fili-Krushel has served as Chief Executive Officer of the Center for Talent Innovation, a non-profit think tank that focuses on helping global corporations leverage talent across the divides of culture, gender, geography, and generation, since January 2019 after serving as the organization’s Interim Chief Executive Officer since September 2018. She is the former Executive Vice President for NBCUniversal, one of the world’s leading media and entertainment companies, where she served as a strategist and key advisor to the CEO of NBCUniversal from April 2015 to November 2015. She served as Chairman of NBCUniversal News Group, a division of NBCUniversal Media, LLC, composed of NBC News, CNBC and MSNBC, from July 2012 until April 2015. She previously served as Executive Vice President of NBCUniversal (January 2011 – July 2012) with a broad portfolio of functions reporting to her, including operations and technical services, business strategy, human resources and legal. Prior to NBCUniversal, Ms. Fili-Krushel was Executive Vice President of Administration at Time Warner Inc. (July 2001 – December 2010) where her responsibilities included oversight of philanthropy, corporate social responsibility, human resources, worldwide recruitment, employee development and growth, compensation and benefits, and security. Before joining Time Warner in July 2001, Ms. Fili-Krushel had been Chief Executive Officer of WebMD Health Corp. since April 2000. From July 1998 to April 2000, Ms. Fili-Krushel was President of the ABC Television Network. Ms. Fili-Krushel has served as a director of Chipotle Mexican Grill, Inc. since March 2019.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Ms. Fili-Krushel’s background increases the breadth of experience of our Board as a result of her extensive executive experience overseeing the business strategy, philanthropy, corporate social responsibility, human resources, recruitment, employee growth and development, compensation and benefits, and legal functions, along with associated risks, at large public companies in the media industry. She also brings valuable oversight experience in diversity-related workplace matters from her leadership position at the Center for Talent Innovation, as well as digital and e-commerce experience gained while serving as CEO of WebMD Health Corp. In addition, her understanding of consumer behavior based on her knowledge of viewership patterns and preferences provides additional perspective to our Board in understanding our customer base, and her other public company board experience will bring additional perspective to our Board. | ||

|

TIMOTHY I. MCGUIRE

Age: 58

Director Since: 2018 |

Biography: Mr. McGuire has served as a director and Chief Executive Officer of Mobile Service Center Canada, Ltd. (d/b/a Mobile Klinik), a chain of professional smartphone repair stores specializing in professional “while you wait” repair and care of smartphones and tablets, since October 2018. He also served as Mobile Klinik’s Chairman of the Board from June 2017 until October 2018. He retired from McKinsey & Company, a worldwide management consulting firm, in August 2017 after serving as a leader of its global retail and consumer practice for almost 28 years, including leading the Americas retail practice for five years. While at McKinsey, Mr. McGuire led consulting efforts with major retail, telecommunications, consumer service, and marketing organizations in Canada, the United States, Latin America, Europe, and Australia. He also co-founded McKinsey Analytics, a global group of consultants bringing advanced analytics capabilities to clients to help make better business decisions. Mr. McGuire began his career with Procter & Gamble in 1983 where he served in various positions until October 1989, with his final role being Marketing Director for the Canadian Food & Beverage division.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. McGuire brings almost 30 years of valuable retail experience to our company, recently as Chief Executive Officer of Mobile Klinik and having served as a leader of McKinsey’s global retail and consumer practice for almost 28 years. He has expertise in strategy, new store/concept development, marketing and sales, operations, international expansion, big data and advanced analytics, as well as risk management experience. In addition, Mr. McGuire’s focus while at McKinsey on use of advanced analytics in retail, developing and implementing growth strategies for consumer services, food, general-merchandise and multi-channel retailers, developing new retail formats, the application of lean operations techniques, the redesign of merchandise flows, supply-chain optimization efforts, and the redesign of purchasing and supplier-management approaches, brings new and extensive relevant perspectives to our Board as it seeks to consult and advise our CEO and to shape our corporate strategy. | ||

|

2019 Proxy Statement 7 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

WILLIAM C. RHODES, III

Age: 53

Director Since: 2009 |

Biography: Mr. Rhodes was elected Chairman of AutoZone, Inc., a specialty retailer and distributor of automotive replacement parts and accessories, in June 2007. He has served as President and Chief Executive Officer and as a director of AutoZone since 2005. Prior to his appointment as President and Chief Executive Officer, Mr. Rhodes was Executive Vice President – Store Operations and Commercial. Prior to 2004, he had been Senior Vice President – Supply Chain and Information Technology since 2002, and prior thereto had been Senior Vice President – Supply Chain since 2001. Prior to that time, he served in various capacities with AutoZone since 1994, including Vice President—Stores in 2000, Senior Vice President – Finance and Vice President – Finance in 1999, and Vice President – Operations Analysis and Support from 1997 to 1999. Prior to 1994, Mr. Rhodes was a manager with Ernst & Young LLP.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. Rhodes has nearly 25 years of experience in the retail industry, including extensive experience in operations, supply chain, and finance, among other areas. This background serves as a strong foundation for offering invaluable perspective and expertise to our CEO and our Board. In addition, his experience as a board chairman and chief executive officer of a public retail company provides leadership, consensus-building, strategic planning, and budgeting skills, as well as international experience and an extensive understanding of both short- and long-term issues confronting the retail industry. Mr. Rhodes also has a strong financial background, and our Board has determined that he qualifies as an audit committee financial expert. | ||

|

RALPH E. SANTANA

Age: 51

Director Since: 2018 |

Biography: Mr. Santana has served as Executive Vice President and Chief Marketing Officer of Harman International Industries, a wholly-owned subsidiary of Samsung Electronics Co., Ltd. focused on designing and engineering connected products and solutions for automakers, consumers and enterprises worldwide, since April 2013, with responsibility for all aspects of Harman’s worldwide marketing strategy. He is also responsible for Harman’s e-commerce business and runs its global design group which entails 6 design studios around the world and full P&L accountability. Before joining Harman, Mr. Santana served as Senior Vice President and Chief Marketing Officer, North America, for Samsung Electronics Co., Ltd. from June 2010 to September 2012. In that role, he was responsible for launching Samsung’s U.S. e-commerce business and building out branding strategies to drive visibility. Mr. Santana also served 16 years at PepsiCo Inc. from June 1994 to May 2010, holding positions spanning multiple international and domestic leadership roles in marketing. In his last assignment at PepsiCo, Mr. Santana served as Vice President of Marketing, North American Beverages, Pepsi-Cola, where he spearheaded a creative overhaul and re-launch of Pepsi-Cola. While at PepsiCo, Inc. he also held positions with its Frito-Lay’s international and North America operations. Mr. Santana began his career as a Senior Marketing Associate at Beverage Marketing Corporation (July 1989-June 1992).

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. Santana has over 25 years of marketing experience spanning multiple technology and food & beverage consumer packaged goods categories. His deep understanding of digital marketing and retail shopper marketing, particularly in the area of consumer packaged goods, and his extensive experience in shaping multi-cultural strategy, executing marketing programs, and making brands culturally relevant further enhances our Board’s ability to provide oversight and thoughtful counsel to management in these important and evolving areas of our business. His executive position also provides risk management experience. | ||

| 8 2019 Proxy Statement |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

TODD J. VASOS

Age: 57

Director Since: 2015 |

Biography: Mr. Vasos has served as Chief Executive Officer and a member of our Board since June 2015. He joined Dollar General in December 2008 as Executive Vice President, Division President and Chief Merchandising Officer. He was promoted to Chief Operating Officer in November 2013. Prior to joining Dollar General, Mr. Vasos served in executive positions with Longs Drug Stores Corporation for seven years, including Executive Vice President and Chief Operating Officer (February 2008 – November 2008) and Senior Vice President and Chief Merchandising Officer (2001 – 2008), where he was responsible for all pharmacy and front-end marketing, merchandising, procurement, supply chain, advertising, store development, store layout and space allocation, and the operation of three distribution centers. He also previously served in leadership positions at Phar-Mor Food and Drug Inc. and Eckerd Corporation.

| |

| Specific Experience, Qualifications, Attributes, and Skills: Mr. Vasos has extensive retail experience, including over 10 years with Dollar General. His experience overseeing the merchandising, operations, marketing, advertising, global procurement, supply chain, store development, store layout and space allocation functions of other retail companies bolsters Mr. Vasos’s thorough understanding of all key areas of our business. In addition, Mr. Vasos’s service in leadership and policy-making positions of other retail companies has provided him with the necessary leadership skills to effectively guide and oversee the direction of Dollar General and with the consensus-building skills required to lead our management team. | ||

Can shareholders recommend or nominate directors?

|

2019 Proxy Statement 9 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

The Board of Directors unanimously recommends that Shareholders vote FOR the election of each of the 8 nominees named in this proposal. | |||

| 10 2019 Proxy Statement |

|

Table of Contents

What governance practices are in place to promote effective independent Board leadership?

The Board of Directors has adopted a number of governance practices to promote effective independent Board leadership, such as:

|

Independent Board Chairman Mr. Calbert, an independent director, serves as our Chairman of the Board. In this role, Mr. Calbert serves as a liaison between the Board and our CEO, approves Board meeting agendas, leads the annual Board self-evaluation, and participates with the Compensation Committee in the annual CEO performance evaluation. This decision affords our CEO the opportunity to focus his time and energy on managing our business, while our Chairman devotes his time and attention to matters of Board oversight and governance. The Board, however, recognizes that no single leadership model is right for all companies and at all times, and the Board will review its leadership structure as appropriate to ensure it continues to be in the best interests of Dollar General and our shareholders.

| |

|

Annual Self-Evaluations and Board Succession Planning The Board and each standing committee annually perform self-evaluations using a process approved by the Nominating Committee. In addition, directors are asked to provide candid feedback on individual Board members to the Chairperson of the Nominating Committee or the Chairman of the Board, who then meet to discuss individual director performance and succession considerations and any necessary follow-up actions.

| |

|

|

Regularly Scheduled Independent Director Sessions Opportunity is available at each regularly scheduled Board meeting for executive sessions of the non-management directors (all of whom are currently independent). Mr. Calbert, as Chairman, presides over all executive sessions of the non-management and the independent directors.

| |

|

Annual CEO Performance Evaluations Each year, the Compensation Committee meets to evaluate the CEO’s performance prior to making CEO compensation decisions. All independent directors, including the Chairman of the Board, are invited to provide input into this discussion. |

What is the Board’s role in risk oversight?

|

2019 Proxy Statement 11 |

Table of Contents

CORPORATE GOVERNANCE

What functions are performed by the Audit, Compensation, and Nominating Committees?

| Name of Committee & Members

|

Committee Functions

| |

| AUDIT: Mr. Rhodes, Chairperson Mr. Bryant Ms. Cochran |

• Selects the independent auditor

• Annually evaluates the independent auditor’s qualifications, performance, and independence, as well as the lead audit partner; periodically considers the advisability of audit firm rotation; and reviews the annual report on the independent auditor’s internal quality control procedures and any material issues raised by its most recent review of internal quality controls

• Pre-approves audit engagement fees and terms and all permitted non-audit services and fees, and discusses the audit scope and any audit problems or difficulties

• Sets policies regarding the hiring of current and former employees of the independent auditor

• Discusses the annual audited and quarterly unaudited financial statements with management and the independent auditor

• Reviews CEO/CFO disclosures regarding any significant deficiencies or material weaknesses in our internal control over financial reporting, and establishes procedures for receipt, retention and treatment of complaints regarding accounting or internal controls

• Discusses the types of information to be disclosed in earnings press releases and provided to analysts and rating agencies

• Discusses policies governing the process by which risk assessment and risk management are undertaken

• Reviews internal audit activities, projects and budget

• Discusses with our general counsel legal matters having an impact on financial statements

• Furnishes the committee report required in our proxy statement | |

| 12 2019 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

| Name of Committee & Members

|

Committee Functions

| |

|

COMPENSATION: Ms. Fili-Krushel, Chairperson Mr. Bryant Mr. McGuire |

• Reviews and approves corporate goals and objectives relevant to CEO compensation

• Determines executive officer compensation (with an opportunity for the independent directors to ratify CEO compensation) and recommends Board compensation for Board approval

• Oversees overall compensation philosophy and principles

• Establishes short-term and long-term incentive compensation programs for senior officers and approves all equity awards

• Oversees share ownership guidelines and holding requirements for Board members and senior officers

• Oversees the performance evaluation process for senior officers

• Reviews and discusses disclosure regarding executive compensation, including Compensation Discussion and Analysis and compensation tables (in addition to preparing the report on executive compensation for our proxy statement)

• Selects and determines fees and scope of work of its compensation consultant

• Oversees and evaluates the independence of its compensation consultant and other advisors | |

| NOMINATING AND GOVERNANCE: Ms. Cochran, Chairperson Ms. Fili-Krushel Mr. Rhodes Mr. Santana |

• Develops and recommends criteria for selecting new directors

• Screens and recommends to our Board individuals qualified to serve on our Board

• Recommends Board committee structure and membership

• Recommends persons to fill Board and committee vacancies

• Develops and recommends Corporate Governance Guidelines and corporate governance practices

• Oversees the process governing annual Board, committee and director evaluations | |

|

2019 Proxy Statement 13 |

Table of Contents

CORPORATE GOVERNANCE

| 14 2019 Proxy Statement |

|

Table of Contents

The following table and text summarize the compensation earned by or paid to each person who served as a non-employee member of our Board of Directors during all or part of fiscal 2018. Mr. Vasos was not separately compensated for his service on the Board, and his executive compensation is discussed under “Executive Compensation” below. In addition, we will reimburse directors for certain fees and expenses incurred in connection with continuing education seminars and for travel and related expenses related to Dollar General business. We have omitted the columns pertaining to non-equity incentive plan compensation and change in pension value and nonqualified deferred compensation earnings because they are inapplicable.

Fiscal 2018 Director Compensation

| Name |

Fees Earned or ($)(2) |

Stock Awards ($)(3) |

Option Awards ($)(4) |

All Other Compensation ($)(5) |

Total ($) |

|||||||||||||||

| Warren F. Bryant |

95,500 | 150,475 | — | 1,915 | 247,890 | |||||||||||||||

| Michael M. Calbert |

95,000 | 352,804 | — | 4,375 | 452,179 | |||||||||||||||

| Sandra B. Cochran |

112,063 | 150,475 | — | 1,915 | 264,453 | |||||||||||||||

| Patricia D. Fili-Krushel |

114,500 | 150,475 | — | 1,915 | 266,890 | |||||||||||||||

| Timothy I. McGuire(1) |

92,625 | 150,475 | — | 1,360 | 244,460 | |||||||||||||||

| Paula A. Price(1) |

30,638 | — | — | 185,160 | 215,798 | |||||||||||||||

| William C. Rhodes, III |

112,500 | 150,475 | — | 1,915 | 264,890 | |||||||||||||||

| David B. Rickard(1) |

38,575 | — | — | 185,160 | 223,735 | |||||||||||||||

| Ralph E. Santana(1) |

92,625 | 150,475 | — | 1,360 | 244,460 | |||||||||||||||

| (1) | Messrs. McGuire and Santana joined our Board on February 12, 2018. Ms. Price and Mr. Rickard served on our Board until May 30, 2018. |

| (2) | In addition to the annual Board retainer, Messrs. Bryant, Rhodes, and Rickard and Mss. Cochran and Fili-Krushel also earned pro-rated annual retainers for service as committee chairpersons during fiscal 2018. |

| (3) | Represents the grant date fair value of restricted stock units (“RSUs”) awarded to Mr. Calbert on February 5, 2018 ($202,330) for his annual Chairman of the Board retainer, as well as to each director (including Mr. Calbert) other than Ms. Price and Mr. Rickard on May 30, 2018 ($150,475), in each case computed in accordance with FASB ASC Topic 718. Information regarding assumptions made in the valuation of these awards is included in Note 8 of the annual consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended February 1, 2019, filed with the SEC on March 22, 2019 (our “2018 Form 10-K”). As of February 1, 2019, each of the persons listed in the table above had the following total unvested RSUs outstanding (including additional unvested RSUs credited as a result of dividend equivalents earned with respect to such RSUs): each of Messrs. Bryant, McGuire, Rhodes, and Santana and Mss. Cochran and Fili-Krushel (1,572); Mr. Calbert (3,707); and each of Ms. Price and Mr. Rickard (0). |

| (4) | There were no stock options awarded to any director listed in the table above during fiscal 2018, as the Board chose to eliminate stock option awards as part of director compensation beginning in fiscal 2015. As of February 1, 2019, each of the persons listed in the table above had the following total unexercised stock options outstanding (whether or not then exercisable): Mr. Bryant (16,207); each of Messrs. Calbert and Rhodes (21,756); Ms. Cochran (13,120); Ms. Fili-Krushel (12,892); and each of Messrs. McGuire, Santana, and Rickard and Ms. Price (0). |

| (5) | Represents the dollar value of dividends paid, accumulated, or credited on unvested RSUs and, for each of Ms. Price and Mr. Rickard: (a) $182,905, which is the fair market value of the accelerated vesting of RSUs upon ceasing to serve as directors, as determined based on the closing stock price on the vesting acceleration date, and (b) cash reimbursement of $1,700 to offset the estimated federal income tax obligation on a retirement gift. Perquisites and personal benefits, if any, totaled less than $10,000 per director and therefore are not included in the table. |

|

2019 Proxy Statement 15 |

Table of Contents

DIRECTOR COMPENSATION

Each non-employee director receives payment (prorated as applicable) for a fiscal year in quarterly installments of the following cash compensation, as applicable, along with an annual award of RSUs, payable in shares of our common stock, under our Amended and Restated 2007 Stock Incentive Plan (our “Stock Incentive Plan”) having the estimated value listed below:

| Fiscal Year |

Board ($) |

Audit ($) |

Compensation ($) |

Nominating ($) |

Estimated ($) |

|||||||||||||||

| 2018 |

95,000 | 25,000 | 20,000 | 17,500 | 150,000 | |||||||||||||||

| 16 2019 Proxy Statement |

|

Table of Contents

Table of Contents

Table of Contents

This section provides details of fiscal 2018 compensation for our named executive officers: Todd J. Vasos, Chief Executive Officer; John W. Garratt, Executive Vice President and Chief Financial Officer; Jeffery C. Owen, Executive Vice President, Store Operations; Robert D. Ravener, Executive Vice President and Chief People Officer; and Jason S. Reiser, Executive Vice President and Chief Merchandising Officer.

Compensation Discussion and Analysis

Overview

Our executive compensation program is designed to serve the long-term interests of our shareholders. To deliver superior shareholder returns, we believe it is critical to offer a competitive compensation package that will attract, retain, and motivate experienced executives with the requisite expertise. Our program is designed to balance the short-term and long-term components and thus incent achievement of our annual and long-term business strategies, to pay for performance, and to maintain our competitive position in the market in which we compete for executive talent.

Compensation Best Practices

We strive to align our executives’ interests with those of our shareholders and to follow sound corporate governance practices.

| Compensation Practice

|

Dollar General Policy

| |

| Pay for performance |

A significant portion of targeted direct compensation is linked to the financial performance of key metrics. All of our annual bonus compensation and equity incentive compensation is performance based. See “Pay for Performance.”

| |

| Robust share ownership guidelines and holding requirements |

Our share ownership guidelines and holding requirements create further alignment with shareholders’ long-term interests. See “Share Ownership Guidelines and Holding Requirements.”

| |

| Clawback policy |

Beginning with the 2017 annual equity awards and Teamshare bonus program, the clawback of performance-based incentive compensation paid or awarded to a named executive officer is allowed in the case of a material financial restatement of our consolidated financial statements resulting from fraud or intentional misconduct on the part of the executive officer.

| |

| No hedging or pledging Dollar General securities or holding Dollar General securities in margin accounts |

Our policy prohibits executive officers and Board members from hedging their ownership of our stock, pledging our securities as collateral, and holding our securities in a margin account. See “Hedging and Pledging Policies.”

| |

| No excise tax gross-ups and minimal income tax gross-ups |

We do not provide tax gross-up payments to named executive officers other than on relocation-related items.

| |

| Double-trigger provisions |

All equity awards granted to named executive officers since March 2016 include a “double-trigger” vesting provision upon a change in control.

| |

| No repricing or cash buyout of underwater stock options without shareholder approval |

Our equity incentive plan prohibits repricing underwater stock options, reducing the exercise price of stock options or replacing awards with cash or another award type, without shareholder approval.

| |

| Annual compensation risk assessment |

At least annually, our Compensation Committee assesses the risk of our compensation program.

| |

|

2019 Proxy Statement 19 |

Table of Contents

EXECUTIVE COMPENSATION

Significant Compensation-Related Actions

The most significant recent compensation-related actions pertaining to our named executive officers include:

| To further increase the focus on multi-year performance as a counterbalance to short-term incentives, beginning with the March 2018 equity grant, one-half of the vesting of performance share units is based upon the achievement of a three-year financial performance goal. |

Beginning in 2018, our annual Teamshare bonus program allows for the Committee to adjust payments upward or downward within certain limitations depending upon the named executive officer’s performance rating (in prior years, only downward adjustments were allowed within certain limitations). | In 2018, we entered into new employment agreements with our named executive officers, each of which have a three-year term and are subject to certain automatic extensions. We have employment agreements with the named executive officers to promote executive continuity, aid in retention, and secure valuable protections for Dollar General, such as non-compete, non-solicitation, and confidentiality obligations, as well as to facilitate implementation of our clawback policy.

|

| 20 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

|

2019 Proxy Statement 21 |

Table of Contents

EXECUTIVE COMPENSATION

| 22 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

Our peer group consists of companies selected according to their similarity to our operations, services, revenues, markets, availability of information, and any other information the Committee deems appropriate. Such companies are likely to have executive positions comparable in breadth, complexity, and scope of responsibility to ours. Thus, our peer group for 2018 compensation decisions consisted of:

| Aramark | Dollar Tree | Rite Aid | Sysco | |||

| AutoZone | Kohl’s | Ross Stores | TJX Companies | |||

| Bed, Bath & Beyond | L Brands | Staples | Tractor Supply | |||

| Best Buy | Office Depot | Starbucks | Yum! Brands | |||

| Dicks Sporting Goods

|

|

2019 Proxy Statement 23 |

Table of Contents

EXECUTIVE COMPENSATION

| 24 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

|

2019 Proxy Statement 25 |

Table of Contents

EXECUTIVE COMPENSATION

| Adjusted EBITDA (2018) | ||||||||||||

| Level* |

Result v. Target (%) |

EBITDA (in billions) |

PSUs Earned (% of Target) |

|||||||||

| Below Threshold |

<90 | <2.383 | 0 | |||||||||

| Threshold |

90 | 2.383 | 50 | |||||||||

| Target |

100 | 2.647 | 100 | |||||||||

| Maximum |

120 | 3.177 | 300 | |||||||||

| 2018 Results |

99.6 | 2.637 | 98.1 | |||||||||

| * | PSUs earned for performance between threshold, target, and maximum levels are interpolated in a manner similar to that used for our 2018 Teamshare bonus program. |

| Name |

2018 PSUs Earned (Adjusted EBITDA) |

|||

| Mr. Vasos |

20,073 | |||

| Mr. Garratt |

3,513 | |||

| Mr. Owen |

3,764 | |||

| Mr. Ravener |

3,764 | |||

| Mr. Reiser |

3,262 | |||

| Adjusted ROIC (2018-2020) | ||||||||||||

| Level* |

Result v. Target (%) |

ROIC Result (%) |

PSUs Earned (% of Target) |

|||||||||

| Below Threshold |

<94.8 | <18.30 | 0 | |||||||||

| Threshold |

94.8 | 18.30 | 50 | |||||||||

| Target |

100.0 | 19.30 | 100 | |||||||||

| Maximum |

105.2 | 20.30 | 300 | |||||||||

| * | PSUs earned for performance between threshold, target, and maximum levels are interpolated in a manner similar to that used for our 2018 Teamshare bonus program. |

| 26 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

| Adjusted ROIC (2017-2018) | ||||||||||||

| Level* |

Result v. Target (%) |

ROIC Result (%) |

PSUs Earned (% of Target) |

|||||||||

| Below Threshold |

<94.5 | <17.18 | 0 | |||||||||

| Threshold |

94.5 | 17.18 | 50 | |||||||||

| Target |

100.0 | 18.18 | 100 | |||||||||

| Maximum |

105.5 | 19.18 | 300 | |||||||||

| 2017-2018 Results |

101.4 | 18.44 | 152.0 | |||||||||

| * | PSUs earned for performance between threshold, target, and maximum levels are interpolated in a manner similar to that used for our 2018 Teamshare bonus program. |

| Name |

2017-2018 PSUs Earned (Adjusted ROIC) | |||

| Mr. Vasos |

10,207 | |||

| Mr. Garratt |

2,380 | |||

| Mr. Owen |

2,380 | |||

| Mr. Ravener |

2,551 | |||

(d) Share Ownership Guidelines and Holding Requirements

Our senior officers are subject to share ownership guidelines and holding requirements. The share ownership guideline is a multiple of annual base salary as in effect from time to time and is to be achieved within a five-year time period.

| Officer Level |

Multiple of Base Salary | |||

| CEO |

6X | |||

| EVP |

3X | |||

| SVP |

2X | |||

|

2019 Proxy Statement 27 |

Table of Contents

EXECUTIVE COMPENSATION

| 28 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

The following table summarizes compensation paid to or earned by our named executive officers in each of the 2018, 2017, and 2016 fiscal years. We have omitted from this table the columns for “Bonus” and “Change in Pension Value and Nonqualified Deferred Compensation Earnings” because they are inapplicable.

| Name and Principal Position(1) |

Year | Salary ($)(2) |

Stock Awards ($)(3) |

Option Awards ($)(4) |

Non-Equity Incentive Plan Compensation ($)(5) |

All Other Compensation ($)(6) |

Total ($) |

|||||||||||||||||||||

| Todd J. Vasos, |

2018 | 1,188,879 | 3,805,114 | 3,793,604 | 1,717,068 | 97,852 | 10,602,517 | |||||||||||||||||||||

| 2017 | 1,127,543 | 2,847,697 | 2,827,461 | 1,921,028 | 82,680 | 8,806,409 | ||||||||||||||||||||||

| 2016 | 1,083,375 | 2,317,164 | 4,194,777 | 915,411 | 82,561 | 8,593,288 | ||||||||||||||||||||||

| John W. Garratt, |

2018 | 706,511 | 665,923 | 663,893 | 518,698 | 63,316 | 2,618,341 | |||||||||||||||||||||

| 2017 | 597,256 | 664,463 | 659,739 | 520,441 | 60,636 | 2,502,535 | ||||||||||||||||||||||

| 2016 | 511,603 | 637,226 | 655,955 | 277,981 | 47,247 | 2,130,012 | ||||||||||||||||||||||

| Jeffery C. Owen, |

2018 | 652,662 | 713,436 | 711,314 | 469,697 | 60,267 | 2,607,376 | |||||||||||||||||||||

| 2017 | 630,529 | 664,463 | 659,739 | 536,861 | 64,747 | 2,556,339 | ||||||||||||||||||||||

| 2016 | 613,924 | 637,226 | 655,955 | 333,578 | 55,863 | 2,296,546 | ||||||||||||||||||||||

| Robert D. Ravener, |

2018 | 578,875 | 713,436 | 711,314 | 416,595 | 57,157 | 2,477,377 | |||||||||||||||||||||

| 2017 | 558,365 | 711,960 | 706,865 | 476,167 | 58,040 | 2,511,397 | ||||||||||||||||||||||

| 2016 | 538,841 | 637,226 | 655,955 | 293,012 | 50,734 | 2,175,768 | ||||||||||||||||||||||

| Jason S. Reiser, |

2018 | 664,488 | 618,317 | 616,472 | 477,456 | 168,661 | 2,545,394 | |||||||||||||||||||||

| (1) | Mr. Reiser joined Dollar General in July 2017 but was not a named executive officer for 2017. |

| (2) | Each named executive officer deferred under the CDP and contributed to our 401(k) Plan a portion of salary earned in each of the fiscal years for which salaries are reported above for the applicable named executive officer. The amounts of the fiscal 2018 salary deferrals under the CDP are included in the Nonqualified Deferred Compensation Table. |

| (3) | The amounts reported represent the aggregate grant date fair value of PSUs awarded in each fiscal year for which compensation is required to be reported in the table for each named executive officer, in each case computed in accordance with FASB ASC Topic 718. The PSUs are subject to performance conditions, and the reported value at the grant date is based upon the probable outcome of such conditions on such date. The values of the PSUs at the grant date assuming that the highest level of performance conditions will be achieved are as follows for each fiscal year required to be reported for each applicable named executive officer: |

| Fiscal |

Mr. Vasos ($) |

Mr. Garratt ($) |

Mr. Owen ($) |

Mr. Ravener ($) |

Mr. Reiser ($) |

|||||||||||||||

| 2018 |

11,415,341 | 1,997,768 | 2,140,307 | 2,140,307 | 1,854,951 | |||||||||||||||

| 2017 |

8,543,092 | 1,993,388 | 1,993,388 | 2,135,879 | — | |||||||||||||||

| 2016 |

6,951,492 | 1,911,679 | 1,911,679 | 1,911,679 | — | |||||||||||||||

| Information regarding the assumptions made in the valuation of these awards is set forth in Note 8 of the annual consolidated financial statements in our 2018 Form 10-K. |

| (4) | The amounts reported represent the aggregate grant date fair value of stock options awarded in each fiscal year for which compensation is required to be reported in the table for each named executive officer, in each case computed in accordance with FASB ASC Topic 718. Information regarding assumptions made in the valuation of these awards is set forth in Note 8 of the annual consolidated financial statements in our 2018 Form 10-K. |

| (5) | Represents amounts earned pursuant to our Teamshare bonus program for each fiscal year reported. See the discussion of the “Short-Term Cash Incentive Plan” in “Compensation Discussion and Analysis” above. Messrs. Vasos, Garratt and Reiser deferred 5%, 5% and 7%, respectively, of his fiscal 2018 Teamshare bonus payment reported above under the CDP. Mr. Vasos deferred 5% of his fiscal 2017 Teamshare bonus payment reported above under the CDP. Messrs. Vasos and Garratt each deferred 5% of his fiscal 2016 Teamshare bonus payment reported above under the CDP. |

|

2019 Proxy Statement 29 |

Table of Contents

EXECUTIVE COMPENSATION

| (6) | Includes the following amounts for each named executive officer: |

| Name |

Company Match CDP ($) |

Company Match 401(k) ($) |

Premiums for ($) |

Tax Gross-Ups ($) |

Aggregate Incremental ($) |

|||||||||||||||

| Mr. Vasos |

45,665 | 14,015 | 2,491 | — | 35,681 | |||||||||||||||

| Mr. Garratt |

21,363 | 14,190 | 1,488 | — | 26,275 | |||||||||||||||

| Mr. Owen |

19,036 | 13,842 | 1,368 | — | 26,021 | |||||||||||||||

| Mr. Ravener |

15,358 | 13,832 | 1,213 | — | 26,754 | |||||||||||||||

| Mr. Reiser |

22,101 | 10,567 | 1,392 | 5,645 | 128,956 | |||||||||||||||

| * | Except for Mr. Reiser, whose aggregate incremental cost of providing perquisites and personal benefits included $106,290 for costs associated with relocation, none of the named executive officers received any perquisite or personal benefit for which the aggregate incremental cost individually equaled or exceeded the greater of $25,000 or 10% of total perquisites. The aggregate incremental cost of providing perquisites and personal benefits related to: (1) for each named executive officer, financial and estate planning services, entertainment events, miscellaneous gifts, premiums paid under our group long-term disability program and our accidental death and dismemberment policy, and an administrative fee for coverage under our short-term disability program; (2) for Messrs. Garratt, Owen, Ravener, and Reiser, an executive physical medical examination; (3) for Messrs. Vasos, Garratt, Owen, and Ravener, one or more directed charitable donations; (4) for Messrs. Vasos, Owen, and Ravener, limited personal travel expenses, most often associated with a guest’s attendance at business events; and (5) for Mr. Vasos, a security assessment. We also provide each named executive officer with certain perquisites and personal benefits at no aggregate incremental cost to Dollar General, including access to participation in a group umbrella liability insurance program through a third party vendor at a group rate paid by the executive and coverage under our business travel accident insurance for which Dollar General pays a flat fee for the eligible employee population. The aggregate incremental cost associated with Mr. Reiser’s relocation included expenses associated with physical movement of his household goods (including automobile), costs incurred in connection with the sale of his former home (such as appraisals, inspections, pre-title expenses, title and deed costs, broker’s commission, document preparation fees, recording fees and legal fees), and final move expenses. |

| 30 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

Grants of Plan-Based Awards in Fiscal 2018

The table below shows each named executive officer’s fiscal 2018 Teamshare bonus opportunity under “Estimated Possible Payouts Under Non-Equity Incentive Plan Awards.” Actual amounts earned under the fiscal 2018 Teamshare program are shown in the Summary Compensation Table and, for those who received such payments, represent prorated payment on a graduated scale for financial performance between the threshold and target performance levels. See “Short-Term Cash Incentive Plan” in “Compensation Discussion and Analysis” for discussion of such Teamshare program.

The table below also shows information regarding equity awards made to our named executive officers for fiscal 2018, all of which were granted pursuant to our Stock Incentive Plan. The awards listed under “Estimated Future Payouts Under Equity Incentive Plan Awards” include the threshold, target, and maximum number of PSUs which could be earned by each named executive officer based upon the level of achievement of the applicable financial performance measures. The awards listed under “All Other Option Awards” include non-qualified stock options that vest over time based upon the applicable named executive officer’s continued employment by Dollar General. See “Long-Term Equity Incentive Program” in “Compensation Discussion and Analysis” above for further discussion of these awards. We have omitted from this table the column for “All Other Stock Awards” because it is inapplicable.

| Estimated Possible

Payouts Under Non-Equity Incentive Plan Awards |

Estimated Future Payouts Under Equity Incentive Plan Awards |

All Other Option Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Sh)(1) |

Grant Date Fair Value of Stock and Option Awards ($)(2) |

||||||||||||||||||||||||||||||||||||

| Name |

Grant Date |

Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

|||||||||||||||||||||||||||||||||

| Mr. Vasos |

— | 900,000 | 1,800,000 | 5,400,000 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | — | — | — | 157,197 | 92.98 | 3,793,604 | |||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | 20,462 | 40,924 | 122,772 | — | — | 3,805,114 | |||||||||||||||||||||||||||||||

| Mr. Garratt |

— | 271,875 | 543,750 | 1,631,250 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | — | — | — | 27,510 | 92.98 | 663,893 | |||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | 3,581 | 7,162 | 21,486 | — | — | 665,923 | |||||||||||||||||||||||||||||||

| Mr. Owen |

— | 246,191 | 492,383 | 1,477,148 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | — | — | — | 29,475 | 92.98 | 711,314 | |||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | 3,837 | 7,673 | 23,019 | — | — | 713,436 | |||||||||||||||||||||||||||||||

| Mr. Ravener |

— | 218,358 | 436,716 | 1,310,148 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | — | — | — | 29,475 | 92.98 | 711,314 | |||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | 3,837 | 7,673 | 23,019 | — | — | 713,436 | |||||||||||||||||||||||||||||||

| Mr. Reiser |

— | 250,258 | 500,516 | 1,501,549 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | — | — | — | 25,545 | 92.98 | 616,472 | |||||||||||||||||||||||||||||||

| 03/21/18 | — | — | — | 3,325 | 6,650 | 19,950 | — | — | 618,317 | |||||||||||||||||||||||||||||||

| (1) | The per share exercise price was calculated based on the closing market price of one share of our common stock on the date of grant as reported by the NYSE. |

| (2) | Represents the aggregate grant date fair value of each equity award, computed in accordance with FASB ASC Topic 718. For equity awards that are subject to performance conditions, the value at the grant date is based upon the probable outcome of such conditions. For information regarding the assumptions made in the valuation of these awards, see Note 8 of the annual consolidated financial statements included in our 2018 Form 10-K. |

|

2019 Proxy Statement 31 |

Table of Contents

EXECUTIVE COMPENSATION

Outstanding Equity Awards at 2018 Fiscal Year-End

The table below sets forth information regarding awards granted under our Stock Incentive Plan and held by our named executive officers as of the end of fiscal 2018. We have omitted from this table the column for “Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options” because it is inapplicable. All awards included in the table, to the extent they have not vested, are subject to certain accelerated vesting provisions as described in “Potential Payments upon Termination or Change in Control.” PSUs reported in the table are payable in shares of our common stock on a one-for-one basis.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

| Name |

Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($)(9) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(9) |

|||||||||||||||||||||||||||

| Mr. Vasos |

03/20/2012 | 37,440 | (1) | — | 45.25 | 03/20/2022 | — | — | — | — | ||||||||||||||||||||||||||

| 03/18/2013 | 27,492 | (1) | — | 48.11 | 03/18/2023 | — | — | — | — | |||||||||||||||||||||||||||

| 12/03/2013 | 2,880 | (1) | — | 56.48 | 12/03/2023 | — | — | — | — | |||||||||||||||||||||||||||

| 03/18/2014 | 37,926 | (1) | — | 57.91 | 03/18/2024 | — | — | — | — | |||||||||||||||||||||||||||

| 03/17/2015 | 33,590 | (2) | 11,196 | (2) | 74.72 | 03/17/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 06/03/2015 | 85,562 | (3) | 171,120 | (3) | 76.00 | 06/03/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 03/16/2016 | 59,801 | (2) | 59,798 | (2) | 84.67 | 03/16/2026 | — | — | — | — | ||||||||||||||||||||||||||

| 03/16/2016 | — | 85,759 | (3) | 84.67 | 03/16/2026 | — | — | — | — | |||||||||||||||||||||||||||

| 03/22/2017 | 40,378 | (2) | 121,134 | (2) | 70.68 | 03/22/2027 | — | — | — | — | ||||||||||||||||||||||||||

| 03/21/2018 | — | 157,197 | (2) | 92.98 | 03/21/2028 | — | — | — | — | |||||||||||||||||||||||||||

| 03/16/2016 | — | — | — | — | 8,119 | (4) | 934,010 | — | — | |||||||||||||||||||||||||||

| 03/22/2017 | — | — | — | — | 24,737 | (5) | 2,845,744 | 20,145 | (6) | 2,317,481 | ||||||||||||||||||||||||||

| 03/21/2018 | — | — | — | — | 20,073 | (7) | 2,309,198 | 61,386 | (8) | 7,061,845 | ||||||||||||||||||||||||||

| Mr. Garratt |

12/03/2014 | 5,031 | (1) | — | 66.69 | 12/03/2024 | — | — | — | — | ||||||||||||||||||||||||||

| 03/17/2015 | 7,502 | (2) | 2,500 | (2) | 74.72 | 03/17/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 12/02/2015 | 5,872 | (1) | 1,957 | (1) | 65.35 | 12/02/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 03/16/2016 | 16,446 | (2) | 16,444 | (2) | 84.67 | 03/16/2026 | — | — | — | — | ||||||||||||||||||||||||||

| 03/22/2017 | 9,423 | (2) | 28,263 | (2) | 70.68 | 03/22/2027 | — | — | — | — | ||||||||||||||||||||||||||

| 03/21/2018 | — | 27,510 | (2) | 92.98 | 03/21/2028 | — | — | — | — | |||||||||||||||||||||||||||

| 03/16/2016 | — | — | — | — | 2,232 | (4) | 256,769 | — | — | |||||||||||||||||||||||||||

| 03/22/2017 | — | — | — | — | 5,770 | (5) | 663,781 | 4,698 | (6) | 540,458 | ||||||||||||||||||||||||||

| 03/21/2018 | — | — | — | — | 3,513 | (7) | 404,136 | 10,743 | (8) | 1,235,875 | ||||||||||||||||||||||||||

| Mr. Owen |

08/25/2015 | 26,778 | (1) | 8,925 | (1) | 73.73 | 08/25/2025 | — | — | — | — | |||||||||||||||||||||||||

| 03/16/2016 | 16,446 | (2) | 16,444 | (2) | 84.67 | 03/16/2026 | — | — | — | — | ||||||||||||||||||||||||||

| 03/22/2017 | 9,423 | (2) | 28,263 | (2) | 70.68 | 03/22/2027 | — | — | — | — | ||||||||||||||||||||||||||

| 03/21/2018 | — | 29,475 | (2) | 92.98 | 03/21/2028 | — | — | — | — | |||||||||||||||||||||||||||

| 03/16/2016 | — | — | — | — | 2,232 | (4) | 256,769 | — | — | |||||||||||||||||||||||||||

| 03/22/2017 | — | — | — | — | 5,770 | (5) | 663,781 | 4,698 | (6) | 540,458 | ||||||||||||||||||||||||||

| 03/21/2018 | — | — | — | — | 3,764 | (7) | 433,011 | 11,508 | (8) | 433,011 | ||||||||||||||||||||||||||

| 32 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

| Name |

Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($)(9) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(9) |

|||||||||||||||||||||||||||

| Mr. Ravener |

03/18/2014 | 27,812 | (1) | — | 57.91 | 03/18/2024 | — | — | — | — | ||||||||||||||||||||||||||

| 03/17/2015 | 24,633 | (2) | 8,210 | (2) | 74.72 | 03/17/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 03/16/2016 | 16,446 | (2) | 16,444 | (2) | 84.67 | 03/16/2026 | — | — | — | — | ||||||||||||||||||||||||||

| 03/22/2017 | 10,096 | (2) | 30,282 | (2) | 70.68 | 03/22/2027 | — | — | — | — | ||||||||||||||||||||||||||

| 03/21/2018 | — | 29,475 | (2) | 92.98 | 03/21/2028 | — | — | — | — | |||||||||||||||||||||||||||

| 03/16/2016 | — | — | — | — | 2,232 | (4) | 256,769 | — | — | |||||||||||||||||||||||||||

| 03/22/2017 | — | — | — | — | 6,183 | (5) | 711,292 | 5,034 | (6) | 579,111 | ||||||||||||||||||||||||||

| 03/21/2018 | — | — | — | — | 3,764 | (7) | 433,011 | 11,508 | (8) | 433,011 | ||||||||||||||||||||||||||

| Mr. Reiser |

08/29/2017 | 11,516 | (1) | 34,545 | (1) | 76.89 | 08/29/2027 | — | — | — | — | |||||||||||||||||||||||||

| 03/21/2018 | — | 25,545 | (2) | 92.98 | 03/21/2028 | — | — | — | — | |||||||||||||||||||||||||||

| 03/21/2018 | — | — | — | — | 3,262 | (7) | 375,260 | 9,975 | (8) | 1,147,524 | ||||||||||||||||||||||||||

| (1) | Part of a time-based options grant with a vesting schedule of 25% per year on each of the first four anniversaries of the grant date. |

| (2) | Part of a time-based options grant with a vesting schedule of 25% per year on each of the first four anniversaries of the April 1 following the grant date. |

| (3) | Part of a time-based options grant with a vesting schedule of 33 1/3% per year on each of the third, fourth, and fifth anniversaries of the grant date. |

| (4) | Part of PSUs earned as a result of our fiscal 2016 adjusted EBITDA and adjusted ROIC performance and scheduled to vest on April 1, 2019. |

| (5) | Part of a PSU grant, 59% of which were earned as a result of our fiscal 2017 adjusted EBITDA performance and are scheduled to vest 50% per year on each of April 1, 2019 and April 1, 2020 and 41% of which were earned as a result of our fiscal 2017-2018 adjusted ROIC performance and are scheduled to vest on April 1, 2019. |

| (6) | Part of a PSU grant that is scheduled to vest on April 1, 2020 if the adjusted ROIC performance goal is achieved for fiscal years 2017-2019. The number of PSUs reported in this column assumes achievement of the maximum level of adjusted ROIC performance for the performance period. The actual number of PSUs earned, if any, will be determined based on the actual level of adjusted ROIC performance achieved for the performance period. |

| (7) | Part of a PSU grant that was earned as a result of our fiscal 2018 adjusted EBITDA performance and is scheduled to vest 33 1/3% per year on each of the first three anniversaries of the April 1 following the grant date. |

| (8) | Part of a PSU grant that is scheduled to vest on April 1, 2021 if the adjusted ROIC performance goal is achieved for fiscal years 2018-2020. The number of PSUs reported in this column assumes achievement of the maximum level of adjusted ROIC performance for the performance period. The actual number of PSUs earned, if any, will be determined based on the actual level of adjusted ROIC performance achieved for the performance period. |

| (9) | Computed by multiplying the number of shares or units by the closing market price of one share of our common stock on February 1, 2019 as reported by the NYSE. |

|

2019 Proxy Statement 33 |

Table of Contents

EXECUTIVE COMPENSATION

Option Exercises and Stock Vested During Fiscal 2018

| Option Awards | Stock Awards | |||||||||||||||||

| Name |

Number of Shares Acquired on Exercise (#)(1) |

Value Realized on Exercise ($)(2) |

Number of Shares Acquired on Vesting (#)(3) |

Value Realized on Vesting ($)(4) |

||||||||||||||

| Mr. Vasos |

— | — | 32,770 | 3,065,634 | ||||||||||||||

| Mr. Garratt |

— | — | 7,949 | 743,629 | ||||||||||||||

| Mr. Owen |

— | — | 7,127 | 666,731 | ||||||||||||||

| Mr. Ravener |

87,107 | 5,659,045 | 10,179 | 952,245 | ||||||||||||||

| Mr. Reiser |

— | — | — | — | ||||||||||||||

| (1) | Represents the gross number of option shares exercised, without deduction for shares that may have been surrendered or withheld to satisfy the exercise price or applicable tax withholding obligations. |

| (2) | Value realized is calculated by multiplying the gross number of options exercised by the difference between the market price of our common stock at exercise as reported by the NYSE and the exercise price. |

| (3) | Represents the gross number of shares acquired upon vesting of PSUs and RSUs, as applicable, without deduction for shares that may have been withheld to satisfy applicable tax withholding obligations. |

| (4) | Value realized is calculated by multiplying the gross number of shares vested by the closing market price of our common stock on the vesting date as reported by the NYSE. |

We have omitted the Pension Benefits table because it is inapplicable.

Non qualified Deferred Compensation Fiscal 2018

Information regarding each named executive officer’s participation in our CDP is included in the following table. The material terms of the CDP are described after the table. Please also see “Benefits and Perquisites” in “Compensation Discussion and Analysis” above. We have omitted from this table the column pertaining to “Aggregate Withdrawals/Distributions” during the fiscal year because it is inapplicable.

| Name |

Executive Contributions in Last FY ($)(1) |

Registrant Contributions in Last FY ($)(2) |

Aggregate Earnings in Last FY ($)(3) |

Aggregate Balance at Last FYE ($)(4) |

||||||||||||

| Mr. Vasos |

155,495 | 45,665 | 2,251 | 1,231,374 | ||||||||||||

| Mr. Garratt |

35,326 | 21,363 | (2,090 | ) | 169,431 | |||||||||||

| Mr. Owen |

32,633 | 19,036 | (2,852 | ) | 166,067 | |||||||||||

| Mr. Ravener |

28,944 | 15,358 | (4,716 | ) | 595,322 | |||||||||||

| Mr. Reiser |

33,224 | 22,101 | (316 | ) | 60,356 | |||||||||||

| (1) | Of the reported amounts, the following are reported in the Summary Compensation Table as “Salary” for 2018: Mr. Vasos ($59,444); Mr. Garratt ($35,326); Mr. Owen ($32,633); Mr. Ravener ($28,944); and Mr. Reiser ($33,224). |

| (2) | Reported as “All Other Compensation” in the Summary Compensation Table. |

| (3) | The amounts shown are not reported in the Summary Compensation Table because they do not represent above-market or preferential earnings. |

| (4) | Of the amounts reported, the following were previously reported as compensation for years prior to 2018 in a Summary Compensation Table: Mr. Vasos ($836,633); Mr. Garratt ($99,643); Mr. Owen ($97,556); Mr. Ravener ($112,887); and Mr. Reiser ($0). |

| 34 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

|

2019 Proxy Statement 35 |

Table of Contents

EXECUTIVE COMPENSATION

| 36 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

|

2019 Proxy Statement 37 |

Table of Contents

EXECUTIVE COMPENSATION

| 38 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

|

2019 Proxy Statement 39 |

Table of Contents

EXECUTIVE COMPENSATION

| 40 2019 Proxy Statement |

|

Table of Contents

EXECUTIVE COMPENSATION

Potential Payments to Named Executive Officers Upon Occurrence of

Various Termination Events or Change in Control as of February 1, 2019

| Name/Item |

Death ($)(3) |

Disability ($)(3) |

Retirement ($)(4) |

Voluntary ($) |

Involuntary ($) |

Involuntary With Cause ($) |

Change in Control ($) |

Change in Control With Qualifying Termination ($) |

||||||||||||||||||||||||

| Mr. Vasos |

||||||||||||||||||||||||||||||||

| Equity Vesting Due to Event(1) |

28,297,377 | 28,297,377 | n/a | n/a | n/a | n/a | 7,131,948 | 27,425,489 | ||||||||||||||||||||||||

| Cash Severance |

1,717,068 | n/a | n/a | n/a | 7,717,068 | n/a | n/a | 7,717,068 | ||||||||||||||||||||||||

| Health Payment |

n/a | n/a | n/a | n/a | 13,060 | n/a | n/a | 13,060 | ||||||||||||||||||||||||

| Outplacement(2) |

n/a | n/a | n/a | n/a | 8,500 | n/a | n/a | 8,500 | ||||||||||||||||||||||||

| Life Insurance Proceeds |

3,000,000 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total |

33,014,445 | 28,297,377 | n/a | n/a | 7,738,628 | n/a | 7,131,948 | 35,164,117 | ||||||||||||||||||||||||

| Mr. Garratt |

||||||||||||||||||||||||||||||||

| Equity Vesting Due to Event(1) |

4,260,312 | 4,260,312 | n/a | n/a | n/a | n/a | 198,043 | 4,054,390 | ||||||||||||||||||||||||

| Cash Severance |

518,698 | n/a | n/a | n/a | 2,517,132 | n/a | n/a | 2,517,132 | ||||||||||||||||||||||||

| Health Payment |

n/a | n/a | n/a | n/a | 21,639 | n/a | n/a | 21,639 | ||||||||||||||||||||||||

| Outplacement(2) |

n/a | n/a | n/a | n/a | 8,500 | n/a | n/a | 8,500 | ||||||||||||||||||||||||

| Life Insurance Proceeds |

1,813,000 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total |

6,592,010 | 4,260,312 | n/a | n/a | 2,547,271 | n/a | 198,043 | 6,601,661 | ||||||||||||||||||||||||

| Mr. Owen |

||||||||||||||||||||||||||||||||

| Equity Vesting Due to Event(1) |

4,512,962 | 4,512,962 | n/a | n/a | n/a | n/a | 368,692 | 4,307,615 | ||||||||||||||||||||||||

| Cash Severance |

469,697 | n/a | n/a | n/a | 2,279,341 | n/a | n/a | 2,279,341 | ||||||||||||||||||||||||

| Health Payment |

n/a | n/a | n/a | n/a | 21,639 | n/a | n/a | 21,639 | ||||||||||||||||||||||||

| Outplacement(2) |

n/a | n/a | n/a | n/a | 8,500 | n/a | n/a | 8,500 | ||||||||||||||||||||||||

| Life Insurance Proceeds |

1,642,000 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total |

6,624,659 | 4,512,962 | n/a | n/a | 2,309,480 | n/a | 368,692 | 6,617,095 | ||||||||||||||||||||||||

| Mr. Ravener |

||||||||||||||||||||||||||||||||

| Equity Vesting Due to Event(1) |

4,629,512 | 4,629,512 | n/a | n/a | n/a | n/a | 331,027 | 4,408,866 | ||||||||||||||||||||||||

| Cash Severance |

416,595 | n/a | n/a | n/a | 2,021,649 | n/a | n/a | 2,021,649 | ||||||||||||||||||||||||

| Health Payment |

n/a | n/a | n/a | n/a | 21,639 | n/a | n/a | 21,639 | ||||||||||||||||||||||||

| Outplacement(2) |

n/a | n/a | n/a | n/a | 8,500 | n/a | n/a | 8,500 | ||||||||||||||||||||||||

| Life Insurance Proceeds |

1,456,000 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total |

6,502,107 | 4,629,512 | n/a | n/a | 2,051,789 | n/a | 331,027 | 6,460,654 | ||||||||||||||||||||||||

| Mr. Reiser |

||||||||||||||||||||||||||||||||

| Equity Vesting Due to Event(1) |

2,384,139 | 2,384,139 | n/a | n/a | n/a | n/a | n/a | 2,391,387 | ||||||||||||||||||||||||

| Cash Severance |

477,456 | n/a | n/a | n/a | 2,466,226 | n/a | n/a | 2,466,226 | ||||||||||||||||||||||||

| Health Payment |

n/a | n/a | n/a | n/a | 21,639 | n/a | n/a | 21,639 | ||||||||||||||||||||||||

| Outplacement(2) |

n/a | n/a | n/a | n/a | 8,500 | n/a | n/a | 8,500 | ||||||||||||||||||||||||

| Life Insurance Proceeds |

1,669,000 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total |

4,530,595 | 2,384,139 | n/a | n/a | 2,496,365 | n/a | n/a | 4,887,752 | ||||||||||||||||||||||||

| (1) | For the portion of the 2017 and 2018 PSUs that are subject to performance for periods ending after February 1, 2019, the value included in the Death and Disability columns assumes a maximum payout of 300%, prorated for a death or disability termination scenario occurring on February 1, 2019. |

| (2) | Estimated based on information provided by our outplacement services provider. |

| (3) | In addition to the amounts reported above, dependent upon the cause of death or the loss suffered, a named executive officer also may be eligible to receive payment of up to $50,000 under our group accidental death & dismemberment program. |

| (4) | None of the named executive officers were eligible for retirement on February 1, 2019. |

|

2019 Proxy Statement 41 |

Table of Contents

EXECUTIVE COMPENSATION

| 42 2019 Proxy Statement |

|

Table of Contents

The following tables show the amount of our common stock beneficially owned by the listed persons as of March 21, 2019. For purposes of such tables, a person “beneficially owns” a security if that person has or shares voting or investment power or has the right to acquire beneficial ownership within 60 days. Unless otherwise noted, to our knowledge these persons have sole voting and investment power over the shares listed. Percentage computations are based on 259,178,169 shares of our common stock outstanding as of March 21, 2019.

Security Ownership of Certain Beneficial Owners

The following table pertains to beneficial ownership by those known by us to beneficially own more than 5% of our common stock.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class | ||||||

| T. Rowe Price Associates, Inc.(1) |

25,102,029 | 9.7 | % | |||||

| BlackRock, Inc.(2) |

22,207,042 | 8.6 | % | |||||

| The Vanguard Group(3) |

19,414,565 | 7.5 | % | |||||

| Barrow, Hanley, Mewhinney & Strauss, LLC(4) |

14,226,902 | 5.5 | % | |||||

| (1) | T. Rowe Price Associates, Inc. has sole power to vote or direct the vote of 9,222,624 shares and sole power to dispose or direct the disposition of 25,102,029 shares. The address of T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. All information is based solely on Amendment No. 3 to Statement on Schedule 13G filed on February 14, 2019. |

| (2) | BlackRock, Inc., through various subsidiaries, has sole power to vote or direct the vote of 19,842,840 shares and sole power to dispose or direct the disposition of 22,207,042 shares. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. All information is based solely on Amendment No. 4 to Statement on Schedule 13G filed on February 4, 2019. |