UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2019

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________.

Commission File Number 0-2585

The Dixie Group, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Tennessee | | 62-0183370 |

(State or other jurisdiction of incorporation of organization) | | (I.R.S. Employer Identification No.) |

| | |

475 Reed Road, Dalton, GA 30720 | | (706) 876-5800 |

(Address of principal executive offices and zip code) | | (Registrant's telephone number, including area code) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | |

Title of Class | | Name of each exchange on which registered |

Common Stock, $3.00 par value | | NASDAQ Stock Market, LLC |

| | |

Securities registered pursuant to Section 12(g) of the Act: | | |

Title of class | | |

None | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes þ No

The aggregate market value of the Common Stock held by non-affiliates of the registrant on June 29, 2019 (the last business day of the registrant's most recently completed fiscal second quarter) was $7,846,814. The aggregate market value was computed by reference to the closing price of the Common Stock on such date. In making this calculation, the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and holders of more than 10% of a class of outstanding Common Stock, and no other persons, are affiliates. No market exists for the shares of Class B Common Stock, which is neither registered under Section 12 of the Act nor subject to Section 15(d) of the Act.

Indicate the number of shares outstanding of each of the registrant's classes of Common Stock as of the latest practicable date.

|

| | | | | |

Class | | Outstanding as of February 21, 2020 |

Common Stock, $3.00 Par Value | | 14,983,013 |

| | shares |

Class B Common Stock, $3.00 Par Value | | 836,669 |

| | shares |

Class C Common Stock, $3.00 Par Value | | 0 |

| | shares |

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the following document are incorporated by reference:

Proxy Statement of the registrant for annual meeting of shareholders to be held May 6, 2020 (Part III).

THE DIXIE GROUP, INC.

Index to Annual Report

on Form 10-K for

Year Ended December 28, 2019

|

| | |

PART I | Page |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

PART II | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

PART III | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

PART IV | |

Item 15. | | |

Item 16. | | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

FORWARD-LOOKING INFORMATION

This Report contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include the use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "intends," and similar terms and phrases. Such forward-looking statements relate to, among other matters, our future financial performance, business prospects, growth strategies or liquidity. The following important factors may affect our future results and could cause those results to differ materially from our historical results; these factors include, in addition to those "Risk Factors" detailed in Item 1A of this report, and described elsewhere in this document, the cost and availability of capital, raw material and transportation costs related to petroleum price levels, the cost and availability of energy supplies, the loss of a significant customer or group of customers, the ability to attract, develop and retain qualified personnel, materially adverse changes in economic conditions generally in carpet, rug and floorcovering markets we serve and other risks detailed from time to time in our filings with the Securities and Exchange Commission.

PART I.

General

Our business consists principally of marketing, manufacturing and selling floorcovering products to high-end residential and commercial customers through our various sales forces and brands. We focus exclusively on the upper-end of the floorcovering market where we believe we have strong brands and competitive advantages with our style and design capabilities and customer relationships. Our Fabrica, Masland, and Dixie Home brands have a significant presence in the high-end residential floorcovering markets. Our Atlas | Masland Contract brand participates in the upper-end specified commercial marketplace. Dixie International sells all of our brands outside of the North American market.

Our business is primarily concentrated in areas of the soft floorcovering markets which include broadloom carpet, carpet tiles and rugs. However, over the past few years, there has been a significant shift in the flooring marketplace as hard surface products have grown at a rate much faster than soft surface products. We have responded to this accelerated shift to hard surface flooring by launching several initiatives in both our residential and commercial brands. Our commercial business offers luxury vinyl flooring (“LVF”) products under the Calibré brand in the commercial markets. Within the residential markets we launched TRUCOR™

and TRUCOR Prime™ offering LVF products. In 2020 we are increasing the number of items in our TRUCOR™ family of products by over 40%. We are featuring a new innovation in LVF tile with our “Integrated Grout Technology” where the locking system is engineered to simulate a real grout line. We are launching our new TRUCOR Prime™ WPC program, including 18 oversized planks, featuring our XXL plank, the longest and widest rigid core plank product on the market. We are expanding our Fabrica wood program with nine new products including European White Oak and American Hickory. We continue to innovate in our soft floorcovering residential markets with around 50 new styles launching in 2020, including STAINMASTER®, EnVision 6,6™, and Strongwool. We continue to be a leading manufacturer in STAINMASTER® carpet and are proud to launch some of the most unique and beautiful STAINMMASTER® products on the market. We are diversifying our product offering with our new EnVision 6,6™ program. We are featuring a patent pending yarn innovation, Colorplay, in a new PetProtect® product named Grace, in our Masland product line. This Colorplay innovation gives us a unique color story for solution dyed nylon, with natural striations across 16 different colors. We are very excited about a new tufting technology, “TECHnique”, which is being showcased in our Masland and Fabrica lines. TECHnique delivers a woven visual with a crisp clean finish and products that are more work of art than floor covering. In the soft floorcovering commercial market, we have introduced one of the most unique innovations: Crafted Collection with Sustaina™ backing. This environmentally conscious and installer friendly product line comes in a beautiful set of patterns. The Sustaina™ modular tile backing system is a PVC and polyurethane free cushion modular carpet tile backing with very high recycled content.

We have one reportable segment, Floorcovering, which is comprised of two operating segments, Residential and Commercial. We have aggregated the two operating segments into one reporting segment because they have similar economic characteristics, and the operating segments are similar in all of the following areas: (a) the nature of the products and services; (b) the nature of the production processes; (c) the type or class of customer for their products and services; (d) the methods used to distribute their products or provide their services; and (e) the nature of the regulatory environment.

Our Brands

Our brands are well known, highly regarded and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer.

Fabrica markets and manufactures luxurious residential carpet, custom rugs, and engineered wood at selling prices that we believe are approximately five times the average for the residential soft floorcovering industry. Its primary customers are interior decorators and designers, selected retailers and furniture stores, luxury home builders and manufacturers of luxury motor coaches and yachts. Fabrica is among the leading premium brands in the domestic marketplace and is known for styling innovation and unique colors and patterns. Fabrica consists of extremely high quality carpets and area rugs in both nylon and wool, with a wide variety of patterns and textures. Fabrica is viewed by the trade as the premier quality brand for very high-end carpet and enjoys an established reputation as a styling trendsetter and a market leader in providing both custom and designer products to the very high-end residential sector.

Masland Residential, founded in 1866, markets and manufactures design-driven specialty carpets and rugs for the high-end residential marketplace. In addition, it offers luxury vinyl flooring products to the marketplace it serves. Its residential and commercial broadloom carpet products are marketed at selling prices that we believe are over three times the average for the residential soft floorcovering industry. Its products are marketed through the interior design community, as well as to consumers through specialty floorcovering retailers. Masland Residential has strong brand recognition within the upper-end residential market. Masland Residential competes through innovative styling, color, product design, quality and service.

Dixie Home provides stylishly designed, differentiated products that offer affordable fashion to residential consumers. Dixie Home markets an array of residential tufted broadloom carpet and rugs to selected retailers and home centers under the Dixie Home and private label brands. In addition, it offers luxury vinyl flooring products to the marketplace it serves. Its objective is to make the Dixie

Home brand the choice for styling, service and quality in the more moderately priced sector of the high-end residential market. Its products are marketed at selling prices which we believe average two times the soft floorcovering industry's average selling price.

Atlas | Masland Contract is our combined brand of the former Atlas Carpet Mills and Masland Contract. We strategically re-aligned our business in 2018 by merging the two brands into one cohesive operating unit with a broader array of products but a single management, marketing, back office, manufacturing and sales structure to serve the specified commercial marketplace. Its commercial products are marketed to the architectural and specified design community and directly to commercial end users, as well as to consumers through specialty floorcovering retailers. Atlas | Masland Contract also sells to the hospitality market with both custom designed and running line products. Utilizing computerized yarn placement technology, as well as offerings utilizing our state of the art Infinity tufting technology, this brand provides excellent service and design flexibility to the hospitality market serving upper-end hotels, conference centers and senior living markets. Its broadloom, rug product and luxury vinyl flooring offerings are designed for the interior designer in the upper-end of the hospitality market who appreciates sophisticated texture, color and patterns with excellent service. Atlas | Masland Contract has strong brand recognition within the upper-end contract market, and competes through innovative styling, color, patterns, quality and service.

Industry

We are a flooring manufacturer in an industry composed of a wide variety of companies from small privately held firms to large multinationals. In 2018, according to the most recent information available, the U.S. floorcovering industry reported $27.2 billion in sales, up approximately 5.7% over 2017's sales of $25.7 billion. In 2018, the primary categories of flooring in the U.S., based on sales dollars, were carpet and rug (43%), ceramic tile (14%), wood (13%), luxury vinyl flooring (LVF) (13%), vinyl (7%), stone (6%) and laminate and other (4%). In 2018, the primary categories of flooring in the U.S., based on square feet, were carpet and rug (48%), ceramic tile (14%), vinyl (12%), luxury vinyl flooring (12%), wood (7%), laminate (4%) and stone and other (3%). Each of these categories is influenced by the residential construction, commercial construction, and residential remodeling markets. These markets are influenced by many factors including consumer confidence, spending for durable goods, turnover in housing and the overall strength of the economy.

The carpet and rug category has two primary markets, residential and commercial, with the residential market making up the largest portion of the industry's sales. A substantial portion of industry shipments is made in response to replacement demand. Residential products consist of broadloom carpets and rugs in a broad range of styles, colors and textures. Commercial products consist primarily of broadloom carpet and modular carpet tile for a variety of institutional applications such as office buildings, restaurant chains, schools and other commercial establishments. The carpet industry also manufactures carpet for the automotive, recreational vehicle, small boat and other industries.

The Carpet and Rug Institute (the "CRI") is the national trade association representing carpet and rug manufacturers. Information compiled by the CRI suggests that the domestic carpet and rug industry is comprised of fewer than 100 manufacturers, with a significant majority of the industry's production concentrated in a limited number of manufacturers focused on the lower end of the price curve. We believe that this industry focus provides us with opportunities to capitalize on our competitive strengths in selected markets where innovative styling, design, product differentiation, focused service and limited distribution add value.

Competition

The floorcovering industry is highly competitive. We compete with other carpet, rug and hard surface manufacturers. In addition, the industry provides multiple floorcovering surfaces such as luxury vinyl tile and wood. Though soft floorcovering is still the dominant floorcovering surface, it has gradually lost market share to hard floorcovering surfaces over the last 25 years. We believe our products are among the leaders in styling and design in the high-end residential and high-end commercial carpet markets. However, a number of manufacturers produce competitive products and some of these manufacturers have greater financial resources than we do.

We believe the principal competitive factors in our primary floorcovering markets are styling, color, product design, quality and service. In the high-end residential and commercial markets, we compete with various other floorcovering suppliers. Nevertheless, we believe we have competitive advantages in several areas. We have an attractive portfolio of brands that we believe are well known, highly regarded by customers and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer. We believe our investment in new yarns, such as Stainmaster's® LiveWell™ and PetProtect™, and innovative tufting and dyeing technologies, strengthens our ability to offer product differentiation to our customers. In addition, we have established longstanding relationships with key suppliers, such as the providers of Stainmaster® for which we utilize both branded yarns and luxury vinyl flooring, and significant customers in most of our markets. Finally, our reputation for innovative design excellence and our experienced management team enhance our competitive position. See "Risk Factors" in Item 1A of this report.

Backlog

Sales order backlog is not material to understanding our business, due to relatively short lead times for order fulfillment in the markets for the vast majority of our products.

Trademarks

Our floorcovering businesses own a variety of trademarks under which our products are marketed. Among such trademarks, the names "Fabrica", "Masland", "Dixie Home", "Atlas", “Masland Contract” and "Masland Hospitality" are of greatest importance to our business. We believe that we have taken adequate steps to protect our interest in all significant trademarks.

Customer and Product Concentration

As a percentage of our net sales, one customer, a mass merchant, accounted for approximately 11% in 2019, 13% in 2018, and 14% in 2017 and as a percentage of our customer's trade accounts receivable, accounted for approximately 18% in 2019 and 34% in 2018. No other customer was more than 10 percent of our sales during the periods presented. During 2019, sales to our top ten customers accounted for approximately 15% of our sales and our top 20 customers accounted for approximately 18% of our sales. We do not make a material amount of sales in foreign countries.

We do not have any single class of products that accounts for more than 10 percent of our sales. However, sales of our floorcovering products may be classified by significant end-user markets into which we sell, and such information for the past three years is summarized as follows:

|

| | | | | | | | |

| 2019 |

| | 2018 |

| | 2017 |

|

Residential floorcovering products | 72 | % | | 72 | % | | 68 | % |

Commercial floorcovering products | 28 | % | | 28 | % | | 32 | % |

Seasonality

Our sales historically have normally reached their lowest level in the first quarter (approximately 24% of our annual sales), with the remaining sales being distributed relatively equally among the second, third and fourth quarters. Working capital requirements have normally reached their highest levels in the third and fourth quarters of the year.

Environmental

Our operations are subject to federal, state and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past. See "Risk Factors” in Item 1A of this report.

Raw Materials

Our primary raw material is bulk continuous filament for yarn. Nylon is the primary yarn we utilize and, to a lesser extent, wool and polyester yarn is used. Additionally, we utilize polypropylene carpet backing, latex, dyes and chemicals, and man-made topical applications in the construction of our products. Our synthetic yarns are purchased primarily from domestic fiber suppliers and wool is purchased from a number of international sources. Our other raw materials are purchased primarily from domestic suppliers, although the majority of our luxury vinyl tile is sourced outside the United States. Where possible, we pass raw material price increases through to our customers; however, there can be no assurance that price increases can be passed through to customers and that increases in raw material prices will not have an adverse effect on our profitability. See "Risk Factors” in Item 1A of this report. We purchase a significant portion of our primary raw material (nylon yarn) from one supplier. We believe there are other sources of nylon yarn; however, an unanticipated termination or interruption of our supply arrangements could adversely affect our supplies of raw materials and could have a material effect on our operations. See "Risk Factors” in Item 1A of this report.

Utilities

We use electricity as our principal energy source, with oil or natural gas used in some facilities for dyeing and finishing operations as well as heating. We have not experienced any material problem in obtaining adequate supplies of electricity, natural gas or oil. Energy shortages of extended duration could have an adverse effect on our operations, and price volatility could negatively impact future earnings. See "Risk Factors” in Item 1A of this report.

Working Capital

We are required to maintain significant levels of inventory in order to provide the enhanced service levels demanded by the nature of our business and our customers, and to ensure timely delivery of our products. Consistent and dependable sources of liquidity are required to maintain such inventory levels. Failure to maintain appropriate levels of inventory could materially adversely affect our relationships with our customers and adversely affect our business. See "Risk Factors” in Item 1A of this report.

Employment Level

At December 28, 2019, we employed 1,526 associates in our operations.

Available Information

Our internet address is www.thedixiegroup.com. We make the following reports filed by us with the Securities and Exchange Commission available, free of charge, on our website under the heading "Investor Relations":

| |

1. | annual reports on Form 10-K; |

| |

2. | quarterly reports on Form 10-Q; |

| |

3. | current reports on Form 8-K; and |

| |

4. | amendments to the foregoing reports. |

The contents of our website are not a part of this report.

Item 1A. RISK FACTORS

In addition to the other information provided in this Report, the following risk factors should be considered when evaluating the results of our operations, future prospects and an investment in shares of our Common Stock. Any of these factors could cause our actual financial results to differ materially from our historical results, and could give rise to events that might have a material adverse effect on our business, financial condition and results of operations.

The floorcovering industry is sensitive to changes in general economic conditions and a decline in residential or commercial construction activity or corporate remodeling and refurbishment could have a material adverse effect on our business.

The floorcovering industry, in which we participate, is highly dependent on general economic conditions, such as consumer confidence and income, corporate and government spending, interest rate levels, availability of credit and demand for housing. We derive a majority of our sales from the replacement segment of the market. Therefore, economic changes that result in a significant or prolonged decline in spending for remodeling and replacement activities could have a material adverse effect on our business and results of operations.

The floorcovering industry is highly dependent on construction activity, including new construction, which is cyclical in nature. The U.S. and global economies, along with the residential and commercial markets in such economies, can negatively impact the floorcovering industry and our business. Although the impact of a decline in new construction activity is typically accompanied by an increase in remodeling and replacement activity, these activities typically lag during a cyclical downturn. Although the difficult economic conditions have improved since the last cyclical downturn in 2008, there may be additional downturns that could cause the industry to deteriorate in the foreseeable future. A significant or prolonged decline in residential or commercial construction activity could have a material adverse effect on our business and results of operations.

We have significant levels of sales in certain channels of distribution and reduction in sales through these channels could adversely affect our business.

A significant amount of our sales are generated through a certain mass merchant retailer. A significant reduction of sales through this channel could adversely affect our business. Such a shift could occur if this retailer decided to reduce the amount of emphasis on soft surface flooring or determine that our concentration of better goods was not advantageous to their marketing program. We have seen a change in strategy by this customer to emphasize products at a lower price point than we currently offer.

We have significant levels of indebtedness that could result in negative consequences to us.

We have a significant amount of indebtedness relative to our equity. Insufficient cash flow, profitability, or the value of our assets securing our loans could have a material adverse effect on our ability to generate sufficient funds to satisfy the terms of our senior loan agreements and other debt obligations. Additionally, the inability to access debt or equity markets at competitive rates in sufficient amounts to satisfy our obligations could adversely impact our business. Further, our trade relations depend on our economic viability and insufficient capital could harm our ability to attract and retain customers and or supplier relationships.

Uncertainty in the credit market or downturns in the economy and our business could affect our overall availability and cost of credit.

Uncertainty in the credit markets could affect the availability and cost of credit. Despite recent improvement in overall economic conditions, market conditions could impact our ability to obtain financing in the future, including any financing necessary to refinance existing indebtedness. The cost and terms of such financing is uncertain. Continued operating losses could affect our ability to continue to access the credit markets under our current terms and conditions. These and other economic factors could have a material adverse effect on demand for our products and on our financial condition and operating results.

If our stock price were to fall below $1.00 for an extended time, our common stock may be subject to delisting from The NASDAQ Stock Market.

NASDAQ Marketplace Rule 5550(a)(2) requires that, for continued listing on the exchange, we must maintain a minimum bid price of $1 per share. Should the price of our stock close below $1 per share for 30 consecutive business days we will have 180 days to bring the price per share up above $1. If we are not able stay in compliance with the relevant NASDAQ bid price listing rule, there is a risk that our common stock may be delisted from NASDAQ, which would adversely impact liquidity of our common stock and potentially result in even lower bid process for our common stock.

Our stock price has been and could remain volatile, which could further adversely affect the market price of our stock, our ability to raise additional capital and/or cause us to be subject to securities class action litigation.

The market price of our common stock has historically experienced and may continue to experience significant volatility. Our progress in restructuring our business, our quarterly operating results, our perceived prospects, lack of securities analysts’ recommendations or earnings estimates, changes in general conditions in the economy or the financial markets, adverse events related to our strategic relationships, significant sales of our common stock by existing stockholders, and other developments affecting us or our competitors could cause the market price of our common stock to fluctuate substantially. In addition, in recent years, the stock market has experienced significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely affect the price of our common stock. Such market price volatility could adversely affect our ability to raise additional capital. In addition, we may be subject to securities class action litigation as a result of volatility in the price of our common stock, which could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business, prospects, results of operations and financial condition.

We face intense competition in our industry, which could decrease demand for our products and could have a material adverse effect on our profitability.

The floorcovering industry is highly competitive. We face competition from a number of domestic manufacturers and independent distributors of floorcovering products and, in certain product areas, foreign manufacturers. Significant consolidation within the floorcovering industry has caused a number of our existing and potential competitors to grow significantly larger and have greater access to resources and capital than we do. Maintaining our competitive position may require us to make substantial additional investments in our product development efforts, manufacturing facilities, distribution network and sales and marketing activities. These additional investments may be limited by our access to capital, as well as restrictions set forth in our credit facilities. Competitive pressures and the accelerated growth of hard surface alternatives, have resulted in decreased demand for our soft floorcovering products and in the loss of market share to hard surface products. As a result, competition from providers of other soft surfaces has intensified and may result in decreased demand for our products. In addition, we face, and will continue to face, competitive pressures on our sales price and cost of our products. As a result of any of these factors, there could be a material adverse effect on our sales and profitability.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative and updated products, we may not be able to maintain or increase our net revenues and profitability.

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our products are subject to changing consumer preferences that cannot be predicted with certainty. In addition, long lead times for certain products may make it hard for us to quickly respond to changes in consumer demands. Recently we have seen the supply of white dyeable yarns for the commercial business decline and that has forced us to transition to new products faster than was originally intended. If we fail to successfully replace those products with equally desirable products to the marketplace, we will lose sales volume. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of flooring products or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels, which could have a material adverse effect on our financial condition.

Raw material prices may vary and the inability to either offset or pass on such cost increases or avoid passing on decreases larger than the cost decrease to our customers could have a material adverse effect on our business, results of operations and financial condition.

We require substantial amounts of raw materials to produce our products, including nylon and polyester yarn, as well as wool yarns, synthetic backing, latex, and dyes. Substantially all of the raw materials we require are purchased from outside sources. The prices of raw materials and fuel-related costs vary significantly with market conditions. The fact that we source a significant amount of raw materials means that several months of raw materials and work in process are moving through our supply chain at any point in time. We are sourcing the majority of our new luxury vinyl flooring and wood product lines from overseas. We are not able to predict whether commodity costs will significantly increase or decrease in the future. If commodity costs increase in the future and we are not able to reduce or eliminate the effect of the cost increases by reducing production costs or implementing price increases, our

profit margins could decrease. If commodity costs decline, we may experience pressures from customers to reduce our selling prices. The timing of any price reductions and decreases in commodity costs may not align. As a result, our margins could be affected.

Unanticipated termination or interruption of our arrangements with third-party suppliers of nylon yarn could have a material adverse effect on us.

Nylon yarn is the principal raw material used in our floorcovering products. A significant portion of such yarn is purchased from one supplier. Our yarn supplier is one of the leading fiber suppliers within the industry and is the exclusive supplier of certain innovative branded fiber technology upon which we rely. We believe our offerings of this innovative fiber technology contribute materially to the competitiveness of our products. While we believe there are other sources of nylon yarns, an unanticipated termination or interruption of our current supply of branded nylon yarn could have a material adverse effect on our ability to supply our products to our customers and have a material adverse impact on our competitiveness if we are unable to replace our nylon supplier with another supplier that can offer similar innovative and branded fiber products. We have had a disruption in our supply of white dyeable yarns for the commercial market place which has resulted in our taking additional charges for the write down of certain inventories. An interruption in the supply of these or other raw materials or sourced products used in our business or in the supply of suitable substitute materials or products would disrupt our operations, which could have a material adverse effect on our business. We continually evaluate our sources of yarn for competitive costs, performance characteristics, brand value, and diversity of supply.

We rely on information systems in managing our operations and any system failure or deficiencies of such systems may have an adverse effect on our business.

Our businesses rely on sophisticated systems to obtain, rapidly process, analyze and manage data. We rely on these systems to, among other things, facilitate the purchase, manufacture and distribution of our products; receive, process and ship orders on a timely basis; and to maintain accurate and up-to-date operating and financial data for the compilation of management information. We rely on our computer hardware, software and network for the storage, delivery and transmission of data to our sales and distribution systems, and certain of our production processes are managed and conducted by computer. Any damage by unforeseen events or system failure which causes interruptions to the input, retrieval and transmission of data or increase in the service time, whether caused by human error, natural disasters, power loss, computer viruses, intentional acts of vandalism, various forms of cybercrimes including and not limited to hacking, intrusions and malware or otherwise, could disrupt our normal operations. There can be no assurance that we can effectively carry out our disaster recovery plan to handle the failure of our information systems, or that we will be able to restore our operational capacity within sufficient time to avoid material disruption to our business. The occurrence of any of these events could cause unanticipated disruptions in service, decreased customer service and customer satisfaction and harm to our reputation, which could result in loss of customers, increased operating expenses and financial losses. Any such events could in turn have a material adverse effect on our business, financial condition, results of operations, and prospects.

The long-term performance of our business relies on our ability to attract, develop and retain qualified personnel.

To be successful, we must attract, develop and retain qualified and talented personnel in management, sales, marketing, product design and operations. We compete with other floorcovering companies for these employees and invest resources in recruiting, developing, motivating and retaining them. The failure to attract, develop, motivate and retain key employees could negatively affect our business, financial condition and results of operations.

We are subject to various governmental actions that may interrupt our supply of materials.

We import most of our luxury vinyl flooring ("LVF"), some of our wood offering, some of our rugs and broadloom offerings. Though currently a small part of our business, the growth in LVF products is an important product offering to provide our customers a complete selection of flooring alternatives. Recently there have been trade proposals that threatened these product categories with added tariffs which would make our offerings less competitive compared to those manufactured in other countries or produced domestically. These proposals, if enacted, or if expanded, or imposed for a significant period of time, would materially interfere with our ability to successfully enter into these product categories and could have a material adverse effect upon the company's cost of goods and results of operations. Further, our suppliers have experienced disruptions relative to actions taken by the Chinese government to control the COVID-19 coronavirus.

We may experience certain risks associated with internal expansion, acquisitions, joint ventures and strategic investments.

We continually look for strategic and tactical initiatives, including internal expansion, acquisitions and investment in new products, to strengthen our future and to enable us to return to sustained growth and to achieve profitability. Growth through expansion and acquisition involves risks, many of which may continue to affect us after the acquisition or expansion. An acquired company, operation or internal expansion may not achieve the levels of revenue, profitability and production that we expect. The combination of an acquired company’s business with ours involves risks. Further, internally generated growth that involves expansion involves risks as well. Such risks include the integration of computer systems, alignment of human resource policies and the retention of valued talent. Reported earnings may not meet expectations because of goodwill and intangible asset impairment, other asset impairments, increased interest costs and issuance of additional securities or debt as a result of these acquisitions. We may also face challenges

in consolidating functions and integrating our organizations, procedures, operations and product lines in a timely and efficient manner.

The diversion of management attention and any difficulties encountered in the transition and integration process could have a material adverse effect on our revenues, level of expenses and operating results. Failure to successfully manage and integrate an acquisition with our existing operations or expansion of our existing operations could lead to the potential loss of customers of the acquired or existing business, the potential loss of employees who may be vital to the new or existing operations, the potential loss of business opportunities or other adverse consequences that could have a material adverse effect on our business, financial condition and results of operations. Even if integration occurs successfully, failure of the expansion or acquisition to achieve levels of anticipated sales growth, profitability or productivity, or otherwise perform as expected, may have a material adverse effect on our business, financial condition and results of operations.

We are subject to various environmental, safety and health regulations that may subject us to costs, liabilities and other obligations, which could have a material adverse effect on our business, results of operations and financial condition.

We are subject to various environmental, safety and health and other regulations that may subject us to costs, liabilities and other obligations which could have a material adverse effect on our business. The applicable requirements under these laws are subject to amendment, to the imposition of new or additional requirements and to changing interpretations of agencies or courts. We could incur material expenditures to comply with new or existing regulations, including fines and penalties and increased costs of our operations. Additionally, future laws, ordinances, regulations or regulatory guidelines could give rise to additional compliance or remediation costs that could have a material adverse effect on our business, results of operations and financial condition. For example, producer responsibility regulations regarding end-of-life disposal could impose additional cost and complexity to our business.

Various federal, state and local environmental laws govern the use of our current and former facilities. These laws govern such matters as:

| |

• | Discharge to air and water; |

| |

• | Handling and disposal of solid and hazardous substances and waste, and |

| |

• | Remediation of contamination from releases of hazardous substances in our facilities and off-site disposal locations. |

Our operations also are governed by laws relating to workplace safety and worker health, which, among other things, establish noise standards and regulate the use of hazardous materials and chemicals in the workplace. We have taken, and will continue to take, steps to comply with these laws. If we fail to comply with present or future environmental or safety regulations, we could be subject to future liabilities. However, we cannot ensure that complying with these environmental or health and safety laws and requirements will not adversely affect our business, results of operations and financial condition.

We may be exposed to litigation, claims and other legal proceedings in the ordinary course of business relating to our products or business, which could have a material adverse effect on our business, results of operations and financial condition.

In the ordinary course of business, we are subject to a variety of work-related and product-related claims, lawsuits and legal proceedings, including those relating to product liability, product warranty, product recall, personal injury, and other matters that are inherently subject to many uncertainties regarding the possibility of a loss to our business. Such matters could have a material adverse effect on our business, results of operations and financial condition if we are unable to successfully defend against or resolve these matters or if our insurance coverage is insufficient to satisfy any judgments against us or settlements relating to these matters. Although we have product liability insurance, the policies may not provide coverage for certain claims against us or may not be sufficient to cover all possible liabilities. Further, we may not be able to maintain insurance at commercially acceptable premium levels. Additionally, adverse publicity arising from claims made against us, even if the claims are not successful, could adversely affect our reputation or the reputation and sales of our products.

Our business operations could suffer significant losses from natural disasters, pandemics, catastrophes, fire or other unexpected events.

Many of our business activities involve substantial investments in manufacturing facilities and many products are produced at a limited number of locations. These facilities could be materially damaged by natural disasters, such as floods, tornadoes, hurricanes and earthquakes, or by fire or other unexpected events such as adverse weather conditions or other disruptions to our facilities, supply chain or our customer's facilities. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/or suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition and results of operations.

Our operations, suppliers, customers and the consumers and markets they serve could be disrupted by a pandemic, such as the COVID-19 coronavirus. Such a pandemic could adversely impact our business, directly or indirectly, through market disruption, supply chain interruption or reduced demand for our products. Our suppliers for a portion of our hard surface products have experienced disruptions in operations as a result of the COVID-19 coronavirus.

| |

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

The following table lists our facilities according to location, type of operation and approximate total floor space as of February 21, 2020:

|

| | | | | |

Location | | Type of Operation | | Approximate Square Feet |

Administrative: | | | | |

Saraland, AL* | | Administrative | | 29,000 |

|

Santa Ana, CA* | | Administrative | | 4,000 |

|

Calhoun, GA | | Administrative | | 10,600 |

|

Dalton, GA* | | Administrative | | 50,800 |

|

| | Total Administrative | | 94,400 |

|

| | | | |

Manufacturing and Distribution: | | |

Atmore, AL | | Carpet Manufacturing, Distribution | | 610,000 |

|

Roanoke, AL | | Carpet Yarn Processing | | 204,000 |

|

Saraland, AL* | | Carpet, Rug and Tile Manufacturing, Distribution | | 384,000 |

|

Porterville, CA* | | Carpet Yarn Processing | | 249,000 |

|

Santa Ana, CA* | | Carpet and Rug Manufacturing, Distribution | | 200,000 |

|

Adairsville, GA | | Samples and Rug Manufacturing, Distribution | | 292,000 |

|

Calhoun, GA * | | Distribution | | 99,000 |

|

Calhoun, GA | | Carpet Dyeing & Processing | | 193,300 |

|

Eton, GA | | Carpet Manufacturing, Distribution | | 408,000 |

|

Dalton, GA* | | Samples Warehouse and Distribution | | 40,000 |

|

| | Total Manufacturing and Distribution | | 2,679,300 |

|

| | | | |

* Leased properties | | TOTAL | | 2,773,700 |

|

In addition to the facilities listed above, we lease a small amount of office space in various locations.

In our opinion, our manufacturing facilities are well maintained and our machinery is efficient and competitive. Operations of our facilities generally vary between 120 and 168 hours per week. Substantially all of our owned properties are subject to mortgages, which secure the outstanding borrowings under our senior credit facilities.

| |

Item 3. | LEGAL PROCEEDINGS |

We have been sued, together with 3M Company and approximately 30 other named defendants and unnamed "fictitious defendants" including various carpet manufacturers and suppliers, in four lawsuits whereby the plaintiffs seek monetary damages and injunctive relief related to the manufacture, supply, and/or use of certain chemical products in the manufacture, finishing, and treatment of carpet products in the Dalton, Georgia area. These chemical products allegedly include without limitation perflourinated compounds ("PFC") such as perflourinated acid ("PFOA") and perfluorooctane sulfonate ("PFOS"). In each lawsuit, the plaintiff(s) alleges that, as a consequence of these actions, these chemical compounds discharge or leach into the water systems around Dalton and then flow into the waters in or near the water bodies from which the plaintiff(s) draw for drinking water.

Two of these lawsuits were filed in Alabama. The first lawsuit in Alabama was filed on September 22, 2016 by The Water Works and Sewer Board of the City of Gadsden (Alabama) in the Circuit Court of Etowah County, Alabama (styled The Water Works and Sewer Board of the City of Gadsden v. 3A1 Company, et al., Civil Action No. 31-CV-2016-900676.00). The second lawsuit in Alabama was filed on May 15, 2017 by The Water Works and Sewer Board of the Town of Centre (Alabama) in the Circuit Comi of Cherokee County, Alabama (styled The Water Works and Sewer Board of the Town of Centre v. 3M Company, et al., Civil Action No. 13-CV- 2017-900049.00). In each of these Alabama lawsuits, the plaintiff seeks damages that include but are not limited to the expenses associated with the future installation and operation of a filtration system capable of removing from the water the chemicals that are allegedly present as a result of the manufacturing and treatment process described above. Each plaintiff requests a jury trial, does not specify an amount of damages other than an assertion that its damages exceed $10,000.00, and requests

injunctive relief. We have answered the complaint in each of these lawsuits, intend to defend those matters vigorously, and are unable to estimate our potential exposure to loss, if any, for these lawsuits at this time.

The other two lawsuits were filed in Georgia. The first lawsuit in Georgia was filed on November 19, 2019 by the City of Rome (Georgia) in the Superior Court of Floyd County, Georgia (styled The City of Rome, Georgia v. 3A1 Company, et al., No. 19CV02405JFL003). The plaintiff in that case also seeks damages that include without limitation the expenses associated with the future installation and operation of a filtration system capable of removing from the water the chemicals that are allegedly present as a result of the manufacturing and treatment process described above. The plaintiff requests a jury trial and also seeks injunctive relief. While the amount of damages is unspecified, the plaintiff asserts it has spent "tens of millions" to remove the chemicals from the county's water supply and will incur additional costs related to removing such chemicals in the future. We have answered the complaint, intend to defend the matter vigorously, and are unable to estimate our potential exposure to loss, if any, at this time.

The second lawsuit in Georgia was filed on November 26, 2019 and is presented as a class action lawsuit by and on behalf of a class of persons who obtain drinking water from the City of Rome, Georgia and the Floyd County Water Department (and similarly situated persons) (generally, for these purposes, residents of Floyd County) (styled Jarrod Johnson v. 3M Company, et al., Civil Action No. 19-CV-02448-JFL-003) (the "Class Action Lawsuit"). The plaintiffs in this case allege their damages include without limitation the surcharges incurred for the costs of partially filtering the chemicals from their drinking water. The Complaint requests a jury trial and asserts damages unspecified in amount, in addition to requests for injunctive relief.

The Canyons Grand Summit Resort Hotel Owner's Association, Inc. has filed a lawsuit against us in the state of Utah (styled The Canyons Grand Summit Resort Hotel Owners Association, Inc. v. The Dixie Group Inc. dba Masland Contract Carpet, in the Third District Court, State of Utah, Summit County, Silver Summit Department, Civil No. 190500139) regarding a large quantity of carpet purchased for a hotel. The claim asserts that we manufactured and delivered carpet that did not meet the proper specifications. The plaintiff seeks damages "in an amount not less than $500,000" and does not request a jury trial. We have answered the complaint, intend to defend the matter vigorously, and are unable to estimate our potential exposure to loss, if any, at this time.

On November 16, 2018 the Superior Court of the State of California granted preliminary approval of a class action settlement in the matter of Carlos Garcia v. Fabrica International, Inc. et al Orange County Superior Court Case No. 30-2017-00949461-CU-OE-CXC. The court further approved the procedures for Settlement Class Members to opt-out of or object to the Settlement. The terms of the settlement provide that Fabrica, a wholly owned subsidiary of ours, has agreed to pay $1,514,000 (the “Gross Settlement Amount”) to fully resolve all claims in the Lawsuit, including payments to Settlement Class Members, Class Counsel’s attorneys’ fees and expenses, settlement administration costs, and the Class Representative’s Service Award. The amount of the proposed settlement was recorded during the quarter ended June 30, 2018. The deadline for class members to opt-out was February 1, 2019. The deadline for the plaintiff to file a motion for final approval of the class action settlement was March 29, 2019. The final fairness hearing took place on April 12, 2019 with final approval being granted. The payment of the settlement occurred in October, 2019.

We are one of multiple parties to three lawsuits filed in Madison County Illinois, styled Brenda Bridgeman, Individually and as Special Administrator of the Estate of Robert Bridgeman, Deceased, vs. American Honda Motor Co., Inc., f/k/a Metropolitan Life Insurance Co., et al No. 15-L-374, styled Charles Anderson, Pltf., vs. 3M Company, et al, No. 17-L-525 and styled Danny Atkins and Pamela Atkins, Pltfs., vs. Aurora Pump Company, et al. No. 18-L-2. All three lawsuits entail a claim for damages to be determined in excess of $50,000 filed on behalf of either a former employee or the estate of an individual which alleges that the deceased contracted mesothelioma as a result of exposure to asbestos while employed by us. Discovery in each matter is ongoing, and a tentative trial date has been set for one of the cases. We have denied liability, are defending the matters vigorously and are unable to estimate our potential exposure to loss, if any, at this time. In August of 2017, the lawsuit styled Sandra D. Watts, Individually and as Special Administrator of the Estate of Dianne Averett, Deceased vs. 4520 Corp., Inc. f/k/a Benjamin F. Shaw Company, et al No. 12-L-2032 was placed in the category of "special closed with settlements and bankruptcy claims pending" to all remaining defendants. In March 2018, the lawsuit styled Charles Anderson, Individually and as Special Administrator of the Estate of Charles Anderson, Deceased vs. 3M Company, et al, No. 17-L-525 was dismissed without prejudice. In October 2018, the lawsuit styled Danny Atkins and Pamela Atkins, Pltfs., vs. Aurora Pump Company, et al. No. 18-L-2 was dismissed without prejudice.

See Note 21 under the Notes to Consolidated Financial Statements for discussion of a series of workers compensation claims filed related to the closure of manufacturing facilities in California.

| |

Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

Pursuant to instruction G of Form 10-K the following is included as an unnumbered item to PART I.

EXECUTIVE OFFICERS OF THE REGISTRANT

The names, ages, positions and offices held by the executive officers of the registrant as of February 21, 2020, are listed below along with their business experience during the past five years.

|

| | |

Name, Age and Position | | Business Experience During Past Five Years |

| | |

Daniel K. Frierson, 78 Chairman of the Board, and Chief Executive Officer, Director | | Director since 1973, Chairman of the Board since 1987 and Chief Executive Officer since 1980. He is the Chairman of the Company's Executive Committee. He is past Chairman of The Carpet and Rug Institute. He serves as Director of Astec Industries, Inc. headquartered in Chattanooga, Tennessee. |

| | |

D. Kennedy Frierson, Jr., 52 Vice President and Chief Operating Officer, Director | | Director since 2012 and Vice President and Chief Operating Officer since August 2009. Vice President and President Masland Residential from February 2006 to July 2009. President Masland Residential from December 2005 to January 2006. Executive Vice President and General Manager, Dixie Home, 2003 to 2005. Business Unit Manager, Bretlin, 2002 to 2003. |

| | |

Allen L. Danzey, 50 Chief Financial Officer | | Chief Financial Officer since January 2020. Director of Accounting from May 2018 to December 2019. Commercial Division Controller from July 2009 to May 2018. Residential Division Controller and Senior Accountant from February 2005 to July 2009.

|

| | |

Jon A. Faulkner, 59

Vice President Strategic Initiatives | | Vice President Strategic Initiatives since January 2020. Vice President and Chief Financial Officer from October 2009 to December 2019. Vice President of Planning and Development from February 2002 to September 2009. Executive Vice President of Sales and Marketing for Steward, Inc. from 1997 to 2002. |

| | |

Thomas M. Nuckols, 52

Vice President and President, Dixie Residential | | Vice President and President of Dixie Residential since November 2017. Executive Vice President, Dixie Residential from February 2017 to November 2017. Dupont/Invista, from 1989 to 2017, Senior Director of Mill Sales and Product Strategy from 2015 to 2017. |

| | |

W. Derek Davis, 69 Vice President, Human Resources and Corporate Secretary | | Vice President of Human Resources since January 1991 and Corporate Secretary since January 2016. Corporate Employee Relations Director, 1988 to 1991. |

The executive officers of the registrant are generally elected annually by the Board of Directors at its first meeting held after each annual meeting of our shareholders.

PART II.

| |

Item 5. | MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Common Stock trades on the NASDAQ Global Market under the symbol DXYN. No market exists for our Class B Common Stock.

As of February 21, 2020, the total number of holders of our Common Stock was approximately 2,800 including an estimated 2,400 shareholders who hold our Common Stock in nominee names. The total number of holders of our Class B Common Stock was 10.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

|

| | | | | | | | | | | | | | |

| | | | | | | | |

Fiscal Month Ending | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number (or approximate dollar value) of Shares That May Yet Be Purchased Under Plans or Programs |

November 2, 2019 | | 83,527 |

| * | $ | 1.92 |

| | 83,527 |

| | |

November 30, 2019 | | 263,485 |

| * | 1.58 |

| | 263,485 |

| | |

December 28, 2019 | | 153,042 |

| * | 1.46 |

| | 153,042 |

| | |

Three Fiscal Months Ended December 28, 2019 | | 500,054 |

| | $ | 1.60 |

| | 500,054 |

| | $ | 5,085,356 |

|

*During the fourth quarter of 2019, the Company's previously announced stock repurchase authorization became effective upon completion of the sale of the Susan Street facility. Pursuant to the previously announced authorization, the Company is authorized to purchase up to $5,900 of its shares during a period beginning with the date of the completion of the sale and ending in March 2020. All shares repurchased during the fourth quarter were related to this authorization. This plan has superseded all other previously announced plans.

Quarterly Financial Data, Dividends and Price Range of Common Stock

Following are quarterly financial data, dividends and price range of Common Stock for the four quarterly periods in the years ended December 28, 2019 and December 29, 2018. Due to rounding, the totals of the quarterly information for each of the years reflected below may not necessarily equal the annual totals. There is a restriction on the payment of dividends under our revolving credit facility and we have not paid any dividends in the years ended December 28, 2019 and December 29, 2018.

|

| | | | | | | | | | | | | | | | |

THE DIXIE GROUP, INC. |

QUARTERLY FINANCIAL DATA, DIVIDENDS AND PRICE RANGE OF COMMON STOCK |

(unaudited) (dollars in thousands, except per share data) |

2019 | | 1ST | | 2ND | | 3RD | | 4TH |

Net sales | | $ | 88,606 |

| | $ | 100,394 |

| | $ | 95,447 |

| | $ | 90,135 |

|

Gross profit | | 18,919 |

| | 23,493 |

| | 21,074 |

| | 22,719 |

|

Operating income (loss) | | (4,863 | ) | | 574 |

| | (1,042 | ) | | 26,680 |

|

Income (loss) from continuing operations | | (6,641 | ) | | (1,181 | ) | | (2,577 | ) | | 26,018 |

|

Income (loss) from discontinued operations | | (31 | ) | | (35 | ) | | 23 |

| | (305 | ) |

Net income (loss) | | $ | (6,672 | ) | | $ | (1,216 | ) | | $ | (2,554 | ) | | $ | 25,713 |

|

Basic earnings (loss) per share: | | | | | | | | |

Continuing operations | | $ | (0.42 | ) | | $ | (0.07 | ) | | $ | (0.16 | ) | | $ | 1.61 |

|

Discontinued operations | | (0.00 | ) | | (0.00 | ) | | (0.00 | ) | | (0.02 | ) |

Net income (loss) | | $ | (0.42 | ) | | $ | (0.07 | ) | | $ | (0.16 | ) | | $ | 1.59 |

|

Diluted earnings (loss) per share: | | | | | | | | |

Continuing operations | | $ | (0.42 | ) | | $ | (0.07 | ) | | $ | (0.16 | ) | | $ | 1.60 |

|

Discontinued operations | | (0.00 | ) | | (0.00 | ) | | (0.00 | ) | | (0.02 | ) |

Net income (loss) | | $ | (0.42 | ) | | $ | (0.07 | ) | | $ | (0.16 | ) | | $ | 1.58 |

|

| | | | | | | | |

Common Stock Prices: | | | | | | | | |

High | | $ | 1.47 |

| | $ | 0.97 |

| | $ | 1.50 |

| | $ | 2.09 |

|

Low | | 0.70 |

| | 0.34 |

| | 0.51 |

| | 1.04 |

|

| | | | | | | | |

2018 | | 1ST | | 2ND | | 3RD | | 4TH |

Net sales | | $ | 98,858 |

| | $ | 106,438 |

| | $ | 101,562 |

| | $ | 98,175 |

|

Gross profit | | 21,580 |

| | 25,144 |

| | 21,887 |

| | 18,380 |

|

Operating loss | | (1,515 | ) | | (355 | ) | | (1,179 | ) | | (12,765 | ) |

Loss from continuing operations | | (2,884 | ) | | (1,972 | ) | | (2,922 | ) | | (13,700 | ) |

Income (loss) from discontinued operations | | (23 | ) | | 157 |

| | (40 | ) | | 1 |

|

Net loss | | $ | (2,907 | ) | | $ | (1,815 | ) | | $ | (2,962 | ) | | $ | (13,699 | ) |

Basic earnings (loss) per share: | | | | | | | | |

Continuing operations | | $ | (0.18 | ) | | $ | (0.13 | ) | | $ | (0.19 | ) | | $ | (0.87 | ) |

Discontinued operations | | (0.00 | ) | | 0.01 |

| | (0.00 | ) | | 0.00 |

|

Net loss | | $ | (0.18 | ) | | $ | (0.12 | ) | | $ | (0.19 | ) | | $ | (0.87 | ) |

Diluted earnings (loss) per share: | | | | | | | | |

Continuing operations | | $ | (0.18 | ) | | $ | (0.13 | ) | | $ | (0.19 | ) | | $ | (0.87 | ) |

Discontinued operations | | (0.00 | ) | | 0.01 |

| | (0.00 | ) | | 0.00 |

|

Net loss | | $ | (0.18 | ) | | $ | (0.12 | ) | | $ | (0.19 | ) | | $ | (0.87 | ) |

| | | | | | | | |

Common Stock Prices: | | | | | | | | |

High | | $ | 4.05 |

| | $ | 3.27 |

| | $ | 2.40 |

| | $ | 1.85 |

|

Low | | 2.60 |

| | 2.20 |

| | 1.40 |

| | 0.62 |

|

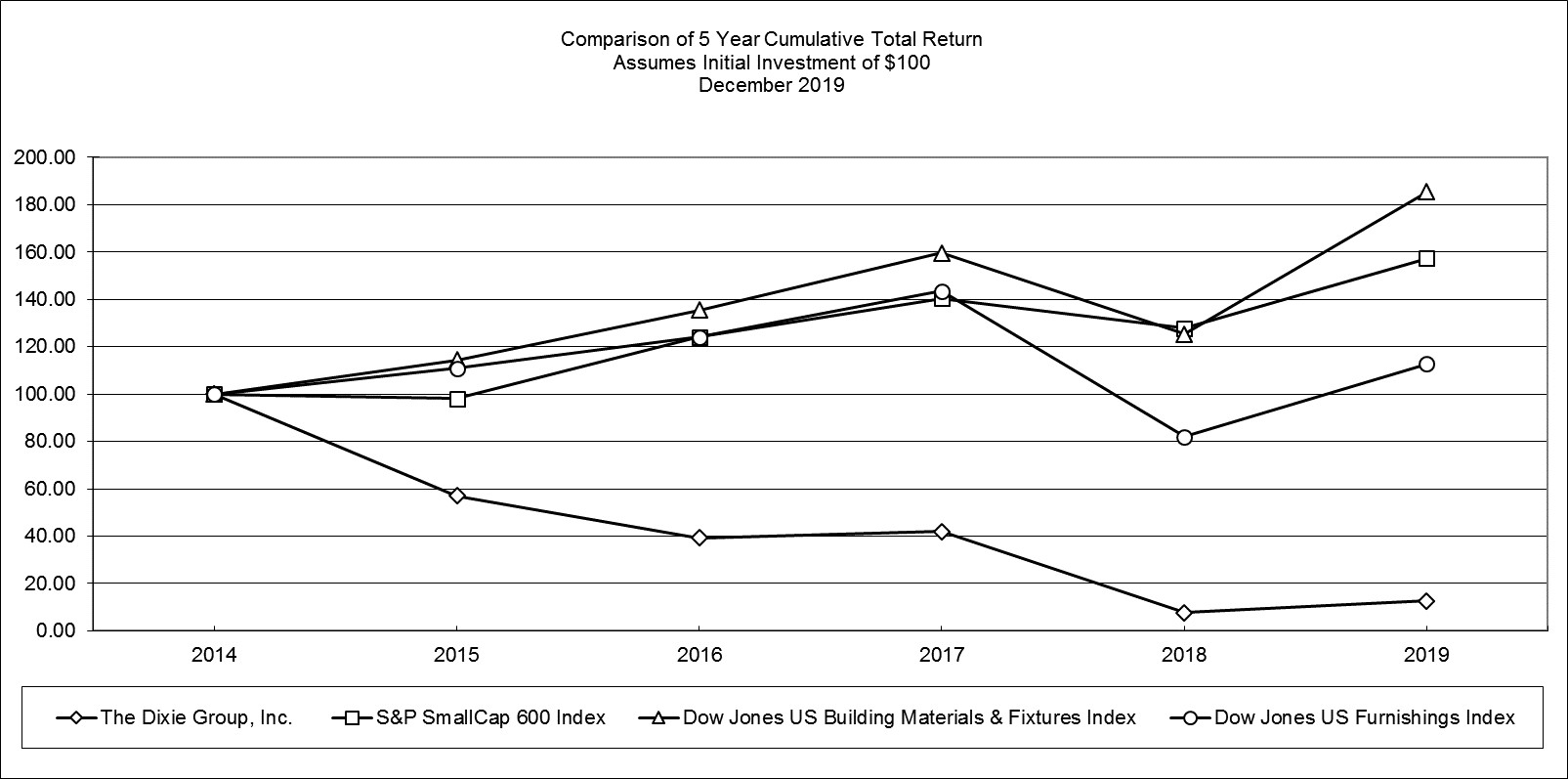

Shareholder Return Performance Presentation

We compare our performance to two different industry indices published by Dow Jones, Inc. The first of these is the Dow Jones US Furnishings Index, which is composed of publicly traded companies classified by Dow Jones in the furnishings industry. The second is the Dow Jones US Building Materials & Fixtures Index, which is composed of publicly traded companies classified by Dow Jones in the building materials and fixtures industry.

In accordance with SEC rules, set forth below is a line graph comparing the yearly change in the cumulative total shareholder return on our Common Stock against the total return of the Standard & Poor's Small Cap 600 Stock Index, plus both the Dow Jones US Furnishings Index and the Dow Jones US Building Materials & Fixtures Index, in each case for the five year period ended December 31, 2019. The comparison assumes that $100.00 was invested on December 31, 2014, in our Common Stock, the S&P Small Cap 600 Index, and each of the two Peer Groups, and assumes the reinvestment of dividends.

The foregoing shareholder performance presentation shall not be deemed "soliciting material" or to be "filed" with the Commission subject to Regulation 14A, or subject to the liabilities of Section 18 of the Exchange Act.

| |

Item 6. | SELECTED FINANCIAL DATA |

|

| | | | | | | | | | | | | | | | | | | | |

The Dixie Group, Inc. |

Historical Summary |

(dollars in thousands, except share and per share data) |

| | | | | | | | | | |

FISCAL YEARS | | 2019 (1) | | 2018 (2) | | 2017 (3) | | 2016 (4) | | 2015 (5)(6) |

OPERATIONS | | | | | | | | | | |

Net sales | | $ | 374,582 |

| | $ | 405,033 |

| | $ | 412,462 |

| | $ | 397,453 |

| | $ | 422,483 |

|

Gross profit | | 86,205 |

| | 86,991 |

| | 101,213 |

| | 95,425 |

| | 106,230 |

|

Operating income (loss) | | 21,349 |

| | (15,816 | ) | | 3,947 |

| | (3,436 | ) | | 1,882 |

|

Income (loss) from continuing operations before taxes | | 14,962 |

| | (22,310 | ) | | (1,813 | ) | | (8,829 | ) | | (2,992 | ) |

Income tax provision (benefit) | | (657 | ) | | (831 | ) | | 7,509 |

| | (3,622 | ) | | (714 | ) |

Income (loss) from continuing operations | | 15,619 |

| | (21,479 | ) | | (9,322 | ) | | (5,207 | ) | | (2,278 | ) |

Depreciation and amortization | | 11,440 |

| | 12,653 |

| | 12,947 |

| | 13,515 |

| | 14,119 |

|

Dividends | | — |

| | — |

| | — |

| | — |

| | — |

|

Capital expenditures | | 4,235 |

| | 4,052 |

| | 12,724 |

| | 4,904 |

| | 6,826 |

|

Assets purchased under capital leases & notes, including deposits utilized and accrued purchases | | 240 |

| | 389 |

| | 859 |

| | 427 |

| | 5,403 |

|

FINANCIAL POSITION | | | | | | | | | | |

Total assets | | $ | 247,659 |

| | $ | 252,778 |

| | $ | 283,907 |

| | 268,987* |

| | 298,218* |

|

Working capital | | 88,237 |

| | 96,534 |

| | 105,113 |

| | 81,727 |

| | 98,632 |

|

Long-term debt | | 81,667 |

| | 120,251 |

| | 123,446 |

| | 98,256 |

| | 115,907 |

|

Stockholders' equity | | 73,211 |

| | 58,984 |

| | 79,263 |

| | 87,122 |

| | 90,804 |

|

PER SHARE | | | | | | | | | | |

Income (loss) from continuing operations: | | | | | | | | | | |

Basic | | $ | 0.96 |

| | $ | (1.36 | ) | | $ | (0.59 | ) | | $ | (0.33 | ) | | $ | (0.15 | ) |

Diluted | | 0.95 |

| | (1.36 | ) | | (0.59 | ) | | (0.33 | ) | | (0.15 | ) |

Dividends: | | | | | | | | | | |

Common Stock | | — |

| | — |

| | — |

| | — |

| | — |

|

Class B Common Stock | | — |

| | — |

| | — |

| | — |

| | — |

|

Book value | | 4.62 |

| | 3.60 |

| | 4.91 |

| | 5.40 |

| | 5.67 |

|

GENERAL | | | | | | | | | | |

Weighted-average common shares outstanding: | | | | | | | | | | |

Basic | | 15,821,574 |

| | 15,763,890 |

| | 15,698,915 |

| | 15,638,112 |

| | 15,535,980 |

|

Diluted | | 15,925,822 |

| | 15,763,890 |

| | 15,698,915 |

| | 15,638,112 |

| | 15,535,980 |

|

Number of shareholders (7) | | 2,800 |

| | 2,800 |

| | 2,800 |

| | 3,000 |

| | 3,000 |

|

Number of associates | | 1,526 |

| | 1,646 |

| | 1,930 |

| | 1,746 |

| | 1,822 |

|

*These periods do not have prior period adoption adjustment or the right to return asset for the ASC 606 adoption.

| |

(1) | 2019 results include expenses of $5,019 for facility consolidation and severance expenses and a gain of $25,121 for the sale of the Susan Street facility, see Note 20. |

| |

(2) | 2018 results include expenses of $3,167 for facility consolidation and severance expenses and $6,709 for the impairment of tangible and intangible assets. |

| |

(3) | Includes expenses of $636 for facility consolidation and severance expenses in 2017. |

| |

(4) | Includes expenses of $1,456, or $859 net of tax, for facility consolidation expenses in 2016. |

| |

(5) | Includes expenses of $2,946, or $1,915 net of tax, for facility consolidation expenses in 2015. |

| |

(6) | Includes the results of operations of Atlas Carpet Mills, Inc. and Burtco Enterprises, Inc. subsequent to their acquisitions on March 19, 2014 and September 22, 2014, respectively. |

| |

(7) | The approximate number of record holders of our Common Stock for 2015 through 2019 includes Management's estimate of shareholders who held our Common Stock in nominee names as follows: 2015 - 2,550 shareholders; 2016 - 2,600 shareholders; 2017 - 2,400 shareholders; 2018 - 2,400 shareholders; 2019 - 2,400 shareholders. |

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this report.

OVERVIEW

Our business consists principally of marketing, manufacturing and selling floorcovering products to high-end residential and commercial customers through our various sales forces and brands. We focus exclusively on the upper-end of the floorcovering market where we believe we have strong brands and competitive advantages with our style and design capabilities and customer relationships. Our Fabrica, Masland, and Dixie Home brands have a significant presence in the high-end residential floorcovering markets. Our Atlas | Masland Contract brand participates in the upper-end specified commercial marketplace. Dixie International sells all of our brands outside of the North American market.

Our business is primarily concentrated in areas of the soft floorcovering markets which include broadloom carpet, carpet tiles and rugs. However, in response to a significant shift in the flooring marketplace toward hard surface products, we have launched multiple hard surface initiatives in both our residential and commercial brands over the last few years. Our commercial brands offer Luxury Vinyl Flooring (“LVF”) products under the Calibré brand in the commercial markets. Our residential brands, Dixie Home and Masland Residential, offer Stainmaster® PetProtect™ Luxury Vinyl Flooring and our premium residential brand, Fabrica, offers a high-end engineered wood line. In 2019, we successfully launched TRUCOR™, our new solid polymer core or “SPC” Luxury Vinyl Flooring line. This latest addition to our rigid core Luxury Vinyl Flooring offering is designed to create an extremely durable and waterproof Luxury Vinyl Flooring product with a broader range of price points to meet the needs of various consumers. To build on the momentum of TRUCOR™ in 2020 we have planned a significant increase in the product offerings of this line. Additional hard surface initiatives planned in 2020 include the introduction of new styles in the Fabrica line of wood products, new LVF tiles utilizing "Integrated Grout Technology", and a TRUCOR PRIME WPC program to include oversize planks in contemporary styles. In addition to our hard surface initiatives, we continue to grow our soft surface business through innovative product offerings such as the Crafted Collection of modular tile featuring our Sustaina backing. Our Sustaina cushion backing for modular tile is PVC and polyurethane free and it is composed of 81.5% total recycled content allowing us to offer an appealing set of patterns to our environmentally conscious customers.

During 2019, our net sales decreased 7.5% compared with net sales in 2018. Sales of residential products decreased 7.2% in 2019 versus 2018. Residential soft surface sales were down 8.8% in 2019 as compared to 2018, while, we estimate, the industry was down in the mid to upper single digits. Our residential soft surface sales in 2019 were negatively impacted by a change in emphasis to hard surfaces by certain mass merchant customers. Residential hard surface sales increased by 47% in 2019 relative to sales in 2018. Despite recent slow activity, we anticipate the residential housing market will have steady but moderate growth over the next several years. Commercial product sales decreased 9.4% during 2019. Soft surface sales of commercial products were down 12.4%, while, we believe, the industry was down marginally. We anticipate the commercial market to be relatively flat in 2020.

In 2019, we had an operating income of $21.3 million compared with an operating loss of $15.8 million in 2018. In 2019, we recorded a $25.1 million gain on the sale of our building in Santa Ana, California. Without this gain on sale we had an operating loss of $3.8 million. Gross profit as a percent of sales improved year over year despite the reduced sales volume in 2019 and the resulting under absorbed manufacturing costs. This was primarily the result of non-recurring costs incurred in the prior year and improvements in operations, both related to the Profit Improvement Plan (the "Plan"). We also reduced plant running schedules in the fourth quarter to reduce inventories to a more appropriate level. We incurred $5 million in restructuring expenses related to the Plan and an additional $572 thousand in cost of sales for inventory write downs related to the Plan. Since inception, the Plan has resulted in the reduction of over 300 associates. The Plan, begun in the fourth quarter of 2017, was completed at the end of 2019. Our debt declined by $39.7 million over the course of 2019.

Expenses related to the Plan totaled approximately $5.6 million in 2019. The Plan expenses included inventory write downs, restructuring costs, and asset impairments as we re-configured our commercial business and right sized our residential manufacturing operations for lower unit demand. Total cost reductions as a result of the Plan are expected to be in excess of $18 million on an annual basis when compared to the 2017 cost structure. We began the structural consolidation of our commercial business with the closure of our Chickamauga tufting operation as we moved the equipment to other facilities. This plant closure, complete at the end of 2018, lowered our cost and improved our response time to this segment of the marketplace. We exited our Commerce, California Atlas tufting facilities in 2019. The bulk of the Atlas equipment was transferred to our Atmore, Alabama commercial tufting operation with various other items moved to our Santa Ana, California and Eton, Georgia operations. We moved our commercial rug operation and commercial samples support function from California to our Saraland facility near Mobile, Alabama. We reduced our staffing to better match production to meet our demand in our Atmore, Eton, Adairsville and Roanoke facilities as we were able to take advantage of the increased productivity of our associates in these operations. In addition to the physical movement of equipment and inventory, we consolidated our commercial design functions in Saraland as well as consolidated our entire sales support functions. Our sales forces were merged to create Atlas | Masland Contract, now equipped with a much broader product line and providing modular carpet tile, broadloom carpet, luxury vinyl flooring, and commercial wool and nylon rugs. This combined sales force has the added benefit of not only a broad product line but distinct design capabilities in custom products as well.

RESULTS OF OPERATIONS

Fiscal Year Ended December 28, 2019 Compared with Fiscal Year Ended December 29, 2018

|

| | | | | | | | | | | | | | | | | |

| Fiscal Year Ended (amounts in thousands) | | | |

| December 28, 2019 | % of Net Sales | | December 29, 2018 | % of Net Sales | | Increase (Decrease) | % Change |

Net sales | $ | 374,582 |

| 100.0 | % | | $ | 405,033 |

| 100.0 | % | | $ | (30,451 | ) | (7.5 | )% |

Cost of sales | 288,377 |

| 77.0 | % | | 318,042 |

| 78.5 | % | | (29,665 | ) | (9.3 | )% |

Gross profit | 86,205 |

| 23.0 | % | | 86,991 |

| 21.5 | % | | (786 | ) | (0.9 | )% |