Use these links to rapidly review the document

Table of Contents

INDEX OF FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended February 2, 2013 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

||

Commission file number 1-6140

DILLARD'S, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE State or other jurisdiction of incorporation or organization |

71-0388071 (IRS Employer Identification No.) |

|

1600 CANTRELL ROAD, LITTLE ROCK, ARKANSAS (Address of principal executive offices) |

72201 (Zip Code) |

Registrant's telephone number, including area code (501) 376-5200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Class A Common Stock | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ý | Accelerated Filer o | Non-Accelerated Filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 28, 2012: $2,535,051,889.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of March 2, 2013:

| CLASS A COMMON STOCK, $0.01 par value | 43,285,017 | ||||

| CLASS B COMMON STOCK, $0.01 par value | 4,010,929 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 18, 2013 (the "Proxy Statement") are incorporated by reference into Part III of this Form 10-K.

Dillard's, Inc. ("Dillard's", the "Company", "we", "us", "our" or "Registrant") ranks among the nation's largest fashion apparel, cosmetics and home furnishing retailers. The Company, originally founded in 1938 by William T. Dillard, was incorporated in Delaware in 1964. As of February 2, 2013, we operated 302 Dillard's stores, including 18 clearance centers, and an Internet store offering a wide selection of merchandise including fashion apparel for women, men and children, accessories, cosmetics, home furnishings and other consumer goods. The Company also operates a general contracting construction company, CDI Contractors, LLC and CDI Contractors, Inc. ("CDI"), whose business includes constructing and remodeling stores for the Company.

The following table summarizes the percentage of net sales by segment and major product line:

| |

Percentage of Net Sales | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal 2012 |

Fiscal 2011 |

Fiscal 2010 |

|||||||

Retail operations segment: |

||||||||||

Cosmetics |

15 | % | 15 | % | 15 | % | ||||

Ladies' apparel |

22 | 23 | 23 | |||||||

Ladies' accessories and lingerie |

15 | 14 | 14 | |||||||

Juniors' and children's apparel |

8 | 8 | 8 | |||||||

Men's apparel and accessories |

17 | 17 | 17 | |||||||

Shoes |

16 | 16 | 15 | |||||||

Home and furniture |

5 | 6 | 6 | |||||||

|

98 | 99 | 98 | |||||||

Construction segment |

2 | 1 | 2 | |||||||

Total |

100 | % | 100 | % | 100 | % | ||||

Additional information regarding our business, results of operations and financial condition, including information pertaining to our reporting segments, can be found in Management's Discussion and Analysis of Financial Condition and Results of Operations in Item 7 hereof and in Note 2 of "Notes to Consolidated Financial Statements" in Item 8 hereof.

We operate retail department stores in 29 states, primarily in the southwest, southeast and midwest regions of the United States. Most of our stores are located in suburban shopping malls and open-air centers. Customers may also purchase our merchandise on-line at our website, www.dillards.com, which features on-line gift registries and a variety of other services.

Our retail merchandise business is conducted under highly competitive conditions. Although we are a large regional department store, we have numerous competitors at the national and local level that compete with our individual stores, including specialty, off-price, discount and Internet retailers. Competition is characterized by many factors including location, reputation, merchandise assortment, advertising, price, quality, operating efficiency, service and credit availability. We believe that our stores are in a strong competitive position with regard to each of these factors. Other retailers may compete for customers on some or all of these factors, or on other factors, and may be perceived by some potential customers as being better aligned with their particular preferences.

Our merchandise selections include, but are not limited to, Dillard's lines of exclusive brand merchandise such as Antonio Melani, Gianni Bini, Roundtree & Yorke and Daniel Cremieux. Dillard's exclusive brands/private label merchandise program provides benefits for Dillard's and our customers. Our customers receive fashionable, higher quality product often at a savings compared to national

1

brands. Dillard's private label merchandise program allows us to ensure Dillard's high standards are achieved, while minimizing costs and differentiating our merchandise offerings from other retailers.

We have made a significant investment in our trademark and license portfolio, in terms of design function, advertising, quality control and quick response to market trends in a quality manufacturing environment. Dillard's trademark registrations are maintained for as long as Dillard's holds the exclusive right to use the trademarks on the listed products.

Our merchandising, sales promotion and store operating support functions are conducted primarily at our corporate headquarters. Our back office sales support functions, such as accounting, product development, store planning and information technology, are also centralized.

We have developed a knowledge of each of our trade areas and customer bases for our stores. This knowledge is enhanced through regular store visits by senior management and merchandising personnel and through the use of on-line merchandise information and is supported by our regional merchandising offices. We will continue to use existing technology and research to edit merchandise assortments by store to meet the specific preference, taste and size requirements of each local operating area.

Certain departments in our stores are licensed to independent companies in order to provide high quality service and merchandise where specialization, focus and expertise are critical. The licensed departments vary by store to complement our own merchandising departments. The principal licensed department is an upscale women's apparel vendor in certain stores. The terms of the license agreements typically range between three and five years with one year renewals and require the licensee to pay for fixtures and to provide their own employees. We regularly evaluate the performance of the licensed departments and require compliance with established customer service guidelines.

GE Consumer Finance ("GE") owns and manages Dillard's proprietary credit cards ("proprietary cards") under a long-term marketing and servicing alliance ("Alliance") that expires in fiscal 2014. GE establishes and owns proprietary card accounts for our customers, retains the benefits and risks associated with the ownership of the accounts, provides key customer service functions, including new account openings, transaction authorization, billing adjustments and customer inquiries, receives the finance charge income and incurs the bad debts associated with those accounts. Pursuant to the Alliance, we receive on-going cash compensation from GE based upon the portfolio's earnings. The compensation earned on the portfolio is determined monthly and has no recourse provisions. Furthermore, pursuant to this agreement, we have no continuing involvement other than to honor the proprietary cards in our stores. Although not obligated to a specific level of marketing commitment, we participate in the marketing of the proprietary cards and accept payments on the proprietary cards in our stores as a convenience to customers who prefer to pay in person rather than by paying online or mailing their payments to GE.

We seek to expand the number and use of the proprietary cards by, among other things, providing incentives to sales associates to open new credit accounts, which generally can be opened while a customer is visiting one of our stores. Customers who open accounts are rewarded with discounts on future purchases. Proprietary card customers are sometimes offered private shopping nights, direct mail catalogs, special discounts and advance notice of sale events. GE has created various loyalty programs that reward customers for frequency and volume of proprietary card usage.

Our earnings depend to a significant extent on the results of operations for the last quarter of our fiscal year. Due to holiday buying patterns, sales for that period average approximately one-third of annual sales.

As of February 2, 2013, we employed approximately 38,000 full-time and part-time associates, of which approximately 27% were part-time. The number of associates varies during the year, especially during peak seasonal selling periods.

2

We purchase merchandise from many sources and do not believe that we are dependent on any one supplier. We have no long-term purchase commitments or arrangements with any of our suppliers and consider our relationships to be strong and mutually beneficial.

Our fiscal year ends on the Saturday nearest January 31 of each year. Fiscal year 2012 ended on February 2, 2013 and included 53 weeks, and fiscal years 2011 and 2010 ended on January 28, 2012 and January 29, 2011, respectively, and each included 52 weeks.

The information contained on our website is not incorporated by reference into this Form 10-K and should not be considered to be a part of this Form 10-K. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of changes in beneficial ownership of securities on Form 4 and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge (as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC) on the Dillard's, Inc. website: www.dillards.com.

We have adopted a Code of Conduct and Corporate Governance Guidelines, as required by the listing standards of the New York Stock Exchange and the rules of the SEC. We have posted on our website our Code of Conduct, Corporate Governance Guidelines, Social Accountability Policy, our most recent Social Accountability Report and committee charters for the Audit Committee of the Board of Directors and the Stock Option and Executive Compensation Committee.

Our corporate offices are located at 1600 Cantrell Road, Little Rock, Arkansas 72201, telephone: 501-376-5200.

The risks described in this Item 1A, Risk Factors, of this Annual Report on Form 10-K for the year ended February 2, 2013, could materially and adversely affect our business, financial condition and results of operations.

The Company cautions that forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995, contained in this Annual Report on Form 10-K are based on estimates, projections, beliefs and assumptions of management at the time of such statements and are not guarantees of future performance. The Company disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise. Forward-looking statements of the Company involve risks and uncertainties and are subject to change based on various important factors. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements made by the Company and its management as a result of a number of risks, uncertainties and assumptions.

The retail merchandise business is highly competitive, and that competition could lower our revenues, margins and market share.

We conduct our retail merchandise business under highly competitive conditions. Competition is characterized by many factors including location, reputation, fashion, merchandise assortment, advertising, operating efficiency, price, quality, customer service and credit availability. We have numerous competitors nationally, locally and on the Internet, including conventional department stores, specialty retailers, off-price and discount stores, boutiques, mass merchants, Internet and mail-order retailers. Although we are a large regional department store, some of our competitors are larger than us with greater financial resources and, as a result, may be able to devote greater resources to sourcing, promoting and selling their products. Additionally, we compete in certain markets with a substantial number of retailers that specialize in one or more types of merchandise that we sell. In recent years, competition has intensified as a result of reduced discretionary consumer spending, increased

3

promotional activity, deep price discounting, and few barriers to entry. Also, online retail shopping is rapidly evolving and we expect competition in the e-commerce market to intensify in the future as the Internet facilitates competitive entry and comparison shopping. We anticipate that intense competition will continue from both existing competitors and new entrants. If we are unable to maintain our competitive position, we could experience downward pressure on prices, lower demand for products, reduced margins, the inability to take advantage of new business opportunities and the loss of market share.

Changes in economic, financial and political conditions, and the resulting impact on consumer confidence and consumer spending, could have an adverse effect on our business and results of operations.

The retail merchandise business is highly sensitive to changes in overall economic and political conditions that impact consumer confidence and spending. Various economic conditions affect the level of disposable income consumers have available to spend on the merchandise we offer, including unemployment rates, interest rates, taxation, energy costs, the availability of consumer credit, the price of gasoline, consumer confidence in future economic conditions and general business conditions. Consumer purchases of discretionary items and other retail products generally decline during recessionary periods, and also may decline at other times when changes in consumer spending patterns affect us unfavorably. In addition, any significant decreases in shopping mall traffic, as a result of, among other things, higher gasoline prices, could also have an adverse effect on our results of operations.

In 2008 and 2009, the combination of these factors caused consumer spending in the U.S. to deteriorate significantly. While consumer spending began to improve in 2010 and continued to improve in 2011 and 2012, these factors may cause levels of spending to remain depressed relative to historical levels for the foreseeable future. In addition, these factors may cause consumers to purchase products from lower-priced competitors or to defer purchases of discretionary items altogether.

The ongoing global economic instability continues to cause a great deal of uncertainty domestically and abroad. Additional uncertainty has resulted from the ongoing debate in the United States regarding budgetary concerns, including the U.S. debt. This market uncertainty will likely continue to result in reduced consumer confidence and spending, which could have an adverse effect on our results of operations.

Our business is dependent upon our ability to accurately predict rapidly changing fashion trends, customer preferences, and other fashion-related factors.

Our sales and operating results depend in part on our ability to effectively predict and quickly respond to changes in fashion trends and customer preferences. We continuously assess emerging styles and trends and focus on developing a merchandise assortment to meet customer preferences at competitive prices. Even with these efforts, we cannot be certain that we will be able to successfully meet constantly changing fashion trends and customer preferences. If we are unable to successfully predict or respond to changing styles or preferences, we may be faced with lower sales, increased inventories, additional markdowns or promotional sales to dispose of excess or slow-moving inventory, and lower gross margins, all of which would have an adverse effect on our business, financial condition, and results of operations. Additionally, failure to respond rapidly to changing trends could impact our reputation with customers and diminish brand and customer loyalty.

Our failure to protect our reputation could have an adverse effect on our business.

We offer our customers quality products at competitive prices and a high level of customer service, resulting in a well-recognized brand and customer loyalty. Any significant damage to our brand or

4

reputation could negatively impact sales, diminish customer trust and generate negative sentiment, any of which would harm our business and results of operation.

Increases in the price of merchandise, raw materials, fuel and labor or their reduced availability could increase our cost of goods and negatively impact our financial results.

We have experienced and may continue to experience increases in our merchandise, raw materials, fuel and labor costs. Fluctuations in the price and availability of fuel, labor and raw materials, combined with the inability to mitigate or to pass cost increases on to our customers or to change our merchandise mix as a result of such cost increases, could have an adverse impact on our profitability. Attempts to pass such costs along to our customers, however, might cause a decline in our sales volume. Additionally, any decrease in the availability of raw materials could impair our ability to meet our purchasing requirements in a timely manner. Both the increased cost and lower availability of merchandise, raw materials, fuel and labor may also have an adverse impact on our cash and working capital needs.

Third party suppliers on whom we rely to obtain materials and provide production facilities may experience financial difficulties due to current and future economic and political conditions.

Our suppliers may experience financial difficulties due to a downturn in the industry or in other macroeconomic environments. Our suppliers' cash and working capital needs can be adversely impacted by the increased cost and lower availability of merchandise, raw materials, fuel and labor. Current and future economic conditions may prevent our suppliers from obtaining financing on favorable terms, which could impact their ability to supply us with merchandise on a timely basis. Similarly, political or financial instability, changes in U.S. and foreign laws and regulations affecting the importation and taxation of goods, including duties, tariffs and quotas, or changes in the enforcement of those laws and regulations, as well as currency exchange rates, transport capacity and costs and other factors relating to foreign trade and the inability to access suitable merchandise on acceptable terms could adversely impact our results of operations.

An increase in the cost or a disruption in the flow of our imported goods could decrease our sales and profits.

We source many of our products from vendors in countries outside of the United States. Any disruption in the flow of imported merchandise, including strikes at ports at home or abroad, or an increase in the cost of those goods may harm our business and decrease our profitability.

All of our suppliers must comply with our supplier compliance programs and applicable laws, including consumer and product safety laws, but we do not control our vendors or their labor and business practices. The violation of labor or other laws by one of our vendors could have an adverse effect on our business. Additionally, although we diversify our sourcing and production by country, the failure of any supplier to produce and deliver our goods on time, to meet our quality standards and adhere to our product safety requirements or to meet the requirements of our supplier compliance program or applicable laws, could impact our ability to flow merchandise to our stores or directly to consumers in the right quantities at the right time, which could adversely affect our profitability and could result in damage to our reputation and translate into sales losses.

A decrease in cash flows from our operations and constraints to accessing other financing sources could limit our ability to fund our operations, capital projects, interest and debt repayments, stock repurchases and dividends.

Our business depends upon our operations to generate strong cash flow and to some extent upon the availability of financing sources to supply capital to fund our general operating activities, capital projects, interest and debt repayments, stock repurchases and dividends. Our inability to continue to

5

generate sufficient cash flows to support these activities or the lack of availability of financing in adequate amounts and on appropriate terms when needed could adversely affect our financial performance including our earnings per share.

Reductions in the income and cash flow from our long-term marketing and servicing alliance related to our proprietary credit cards could impact operating results and cash flows.

GE owns and manages our proprietary credit cards under the Alliance. The Alliance provides for certain payments to be made by GE to the Company, including a revenue sharing and marketing reimbursement. The income and cash flow that the Company receives from the Alliance is dependent upon a number of factors including the level of sales on GE accounts, the level of balances carried on the GE accounts by GE customers, payment rates on GE accounts, finance charge rates and other fees on GE accounts, the level of credit losses for the GE accounts, GE's ability to extend credit to our customers as well as GE's funding costs, all of which can vary based on changes in federal and state banking and consumer protection laws and from a variety of economic, legal, social and other factors that we cannot control. If the income or cash flow that the Company receives from the Alliance decreases, our operating results and cash flows could be adversely affected.

The Alliance expires in fiscal 2014. If, when the Alliance expires, GE is unable or unwilling to renew and continue owning and managing our proprietary credit cards on similar terms and conditions as exist today or we are unable to quickly and adequately contract with a comparable replacement vendor, then our operating results and cash flows could be adversely affected due to a decrease in credit card sales to our cardholding customers and a loss of revenues attributable to payments from GE. In addition, if our agreement with GE is terminated prior to 2014 under circumstances in which we are unable to quickly and adequately contract with a comparable replacement vendor, holders of our proprietary credit card will be unable to use their cards. This would likely result in a decrease in sales to such customers, a loss of the revenues attributable to the payments from GE and customer dissatisfaction, any or all of which could have an adverse effect on our business and results of operations.

Credit card operations are subject to numerous federal and state laws that impose disclosure and other requirements upon the origination, servicing, and enforcement of credit accounts, and limitations on the amount of finance charges and fees that may be charged by a credit card provider. GE may be subject to regulations that may adversely impact its operation of our proprietary credit card. To the extent that such limitations or regulations materially limit the availability of credit or increase the cost of credit to our cardholders or negatively impact provisions which affect our revenue streams associated with our proprietary credit card, our results of operations could be adversely affected. In addition, changes in credit card use, payment patterns, or default rates could be affected by a variety of economic, legal, social, or other factors over which we have no control and cannot predict with certainty. Such changes could also negatively impact our ability to facilitate consumer credit or increase the cost of credit to our cardholders.

Our business is seasonal, and fluctuations in our revenues during the last quarter of our fiscal year can have a disproportionate effect on our results of operations.

Our business, like many other retailers, is subject to seasonal influences, with a significant portion of sales and income typically realized during the last quarter of our fiscal year due to the holiday season. Our fiscal fourth-quarter results may fluctuate significantly, based on many factors, including holiday spending patterns and weather conditions, and any such fluctuation could have a disproportionate effect on our results of operations for the entire fiscal year. Because of the seasonality of our business, our operating results vary considerably from quarter to quarter, and results from any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year.

6

A shutdown of, or disruption in, any of the Company's distribution or fulfillment centers would have an adverse effect on the Company's business and operations.

Our business depends on the orderly operation of the process of receiving and distributing merchandise, which relies on adherence to shipping schedules and effective management of distribution centers. Although we believe that our receiving and distribution process is efficient and that we have appropriate contingency plans, unforeseen disruptions in operations due to fire, severe weather conditions, natural disasters, or other catastrophic events, labor disagreements, or other shipping problems may result in the loss of inventory and/or delays in the delivery of merchandise to our stores and customers.

Current store locations may become less desirable, and desirable new locations may not be available for a reasonable price, if at all, either of which could adversely affect our results of operations.

In order to generate customer traffic and for convenience of our customers, we locate our stores in desirable locations within shopping malls. Our stores benefit from our, other anchor tenants, and other area attractions' ability to generate consumer traffic. They also benefit from the continuing popularity of shopping malls as shopping destinations. Adverse changes in the development of new shopping malls in the United States, the availability or cost of appropriate locations within existing or new shopping malls, competition with other retailers for prominent locations, the success of individual shopping malls and the success of other anchor tenants, or the continued popularity of shopping malls may impact our ability to maintain or grow our sales in our existing stores, as well as our ability to open new stores, which could have an adverse effect on our financial condition or results of operations.

Many shopping mall operators have been severely impacted by the recent global economic downturn. The continuation of the economic slowdown in the United States could impact shopping mall operators' financial ability to develop new shopping malls and properly maintain existing shopping malls, which could adversely affect our sales.

Ownership and leasing of significant amounts of real estate exposes us to possible liabilities and losses.

We own the land and building, or lease the land and/or the building, for all of our stores. Accordingly, we are subject to all of the risks associated with owning and leasing real estate. In particular, the value of the assets could decrease, and their operating costs could increase, because of changes in the investment climate for real estate, demographic trends and supply or demand for the use of the store, which may result from competition from similar stores in the area, as well as liability for environmental conditions. If an existing owned store is not profitable, and we decide to close it, we may be required to record an impairment charge and/or exit costs associated with the disposal of the store. We generally cannot cancel our leases. If an existing or future store is not profitable, and we decide to close it, we may be committed to perform certain obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. In addition, as each of the leases expires, we may be unable to negotiate renewals, either on commercially acceptable terms or at all, which could cause us to close stores in desirable locations. We may not be able to close an unprofitable owned store due to an existing operating covenant which may cause us to operate the location at a loss and prevent us from finding a more desirable location. We have approximately 75 stores along the Gulf and Atlantic coasts that are covered by third party insurance but are self-insured for property and merchandise losses related to "named storms"; therefore, repair and replacement costs will be borne by us for damage to any of these stores from "named storms".

Litigation with customers, employees and others could harm our reputation and impact operating results.

In the ordinary course of business, we may be involved in lawsuits and regulatory actions. We are impacted by trends in litigation, including, but not limited to, class-action allegations brought under

7

various consumer protection and employment laws. Additionally, we may be subject to employment-related claims alleging, discrimination, harassment, wrongful termination and wage issues, including those relating to overtime compensation. We are also susceptible to claims filed by customers alleging responsibility for injury suffered during a visit to a store or from product defects. These types of claims, as well as other types of lawsuits to which we are subject from time to time, can distract management's attention from core business operations and impact operating results, particularly if a lawsuit results in an unfavorable outcome.

Our profitability may be adversely impacted by weather conditions.

Our merchandise assortments reflect assumptions regarding expected weather patterns and our profitability depends on our ability to timely deliver seasonally appropriate inventory. Unexpected or unseasonable weather conditions could render a portion of our inventory incompatible with consumer needs. For example, extended periods of unseasonably warm temperatures during the winter season or cool weather during the summer season could render a portion of the Company's inventory incompatible with those unseasonable conditions. Additionally, extreme weather or natural disasters, particularly in the areas in which our stores are located, could also severely hinder our ability to timely deliver seasonally appropriate merchandise. For example, frequent or unusually heavy snowfall, ice storms, rainstorms or other extreme weather conditions over a prolonged period could make it difficult for the Company's customers to travel to its stores and thereby reduce the Company's sales and profitability. A reduction in the demand for or supply of our seasonal merchandise or reduced sales due to reduced customer traffic in our stores could have an adverse effect on our inventory levels, gross margins and results of operations.

Natural disasters, war, acts of terrorism, other armed conflicts, and public health issues may adversely impact our business.

The occurrence of, or threat of, a natural disaster, war, acts of terrorism, other armed conflicts, and public health issues could disrupt our operations, disrupt international trade and supply chain efficiencies, suppliers or customers, or result in political or economic instability. If commercial transportation is curtailed or substantially delayed our business may be adversely impacted, as we may have difficulty shipping merchandise to our distribution centers, fulfillment centers, stores, or directly to customers. As a result of the occurrence of, or threat of, a natural disaster or acts of terrorism in the United States, we may be required to suspend operations in some or all of our stores, which could have a material adverse impact on our business, financial condition, and results of operations.

Increases in the cost of employee benefits could impact the Company's financial results and cash flows.

The Company's expenses relating to employee health benefits are significant. Unfavorable changes in the cost of such benefits could impact the Company's financial results and cash flows. Healthcare costs have risen significantly in recent years, and recent legislative and private sector initiatives regarding healthcare reform could result in significant changes to the U.S. healthcare system. Many of our employees who currently choose not to participate in our healthcare plans may find it more advantageous to do so when recent changes to healthcare laws in the United States become effective in 2014. Such changes include potential fees to persons for not obtaining healthcare coverage and being ineligible for certain healthcare subsidies if an employee is eligible for healthcare coverage under an employer's plan. If a large portion of current eligible employees who currently choose not to participate in our plans choose to enroll when or after the law becomes effective, it may significantly increase our healthcare coverage costs or we may not be able to offer competitive health care benefits to attract and retain employees, either of which could have an adverse effect on our reputation and have a negative impact on our financial results.

8

The Company depends on its ability to attract and retain quality employees, and failure to do so could adversely affect our ability to execute our business strategy and our operating results.

The Company's business is dependent upon attracting and retaining quality employees. The Company has a large number of employees, many of whom are in entry level or part-time positions with historically high rates of turnover. The Company's ability to meet its labor needs while controlling the costs associated with hiring and training new employees is subject to external factors such as unemployment levels, prevailing wage rates, minimum wage legislation and changing demographics. In addition, as a complex enterprise operating in a highly competitive and challenging business environment, the Company is highly dependent upon management personnel to develop and effectively execute successful business strategies and tactics. Any circumstances that adversely impact the Company's ability to attract, train, develop and retain quality employees throughout the organization could adversely affect the Company's business and results of operations.

Variations in the amount of vendor allowances received could adversely impact our operating results.

We receive vendor allowances for advertising, payroll and margin maintenance that are a strategic part of our operations. A reduction in the amount of cooperative advertising allowances would likely cause us to consider other methods of advertising as well as the volume and frequency of our product advertising, which could increase/decrease our expenditures and/or revenue. Decreased payroll reimbursements would either cause payroll costs to rise, negatively impacting operating income, or cause us to reduce the number of employees, which may cause a decline in sales. A decline in the amount of margin maintenance allowances would either increase cost of sales, which would negatively impact gross margin and operating income, or cause us to reduce merchandise purchases, which may cause a decline in sales.

Our operations are dependent on information technology systems, and disruptions in those systems could have an adverse impact on our results of operations.

Our operations are dependent upon the integrity, security and consistent operation of various systems and data centers, including the point-of-sale systems in the stores, our Internet website, data centers that process transactions, communication systems and various software applications used throughout our Company to track inventory flow, process transactions and generate performance and financial reports. The Company's computer systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber-attack or other security breaches, catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes, acts of war or terrorism, and usage errors by the Company's employees. If the Company's computer systems are damaged or cease to function properly, the Company may have to make a significant investment to repair or replace them, and the Company may suffer loss of critical data and interruptions or delays in its operations in the interim. Any material interruption in the Company's computer systems could adversely affect its business or results of operations. Additionally, to keep pace with changing technology, we must continuously provide for the design and implementation of new information technology systems and enhancements of our existing systems. We could encounter difficulties in developing new systems or maintaining and upgrading existing systems. Such difficulties could lead to significant expenses or to losses due to disruption in business operations.

A privacy breach could adversely affect our business, reputation and financial condition.

The protection of customer, employee and Company data is critical to us. The regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. We receive certain personal information about our customers and employees. In addition, our online operations at www.dillards.com depend upon the secure transmission of confidential information over public networks, including information permitting

9

cashless payments. A compromise that results in personal information being obtained by unauthorized persons could adversely affect our reputation with our customers, employees and others, as well as our operations, results of operations, financial condition and liquidity, and could result in litigation against us or the imposition of penalties. In addition, a security breach could require that we expend significant additional resources related to our information security systems and could result in a disruption of our operations, particularly our online sales operations.

The percentage-of-completion method of accounting that we use to recognize contract revenues for our construction segment may result in material adjustments, which could result in a charge against our earnings.

Our construction segment recognizes contract revenues using the percentage-of-completion method. Under this method, estimated contract revenues are recognized by applying the percentage of completion of the project for the period to the total estimated revenues for the contract. Estimated contract losses are recognized in full when determined. Total contract revenues and cost estimates are reviewed and revised at a minimum on a quarterly basis as the work progresses and as change orders are approved. Adjustments based upon the percentage of completion are reflected in contract revenues in the period when these estimates are revised. To the extent that these adjustments result in an increase, a reduction or an elimination of previously reported contract profit, we are required to recognize a credit or a charge against current earnings, which could be material.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

All of our stores are owned by us or leased from third parties. At February 2, 2013, we operated 302 stores in 29 states totaling approximately 51.0 million square feet of which we owned approximately 44.7 million square feet. Our third-party store leases typically provide for rental payments based on a percentage of net sales with a guaranteed minimum annual rent. In general, the Company pays the cost of insurance, maintenance and real estate taxes related to the leases.

10

The following table summarizes by state of operation the number of retail stores we operate and the corresponding owned and leased footprint at February 2, 2013:

Location

|

Number of stores |

Owned Stores |

Leased Stores |

Owned Building on Leased Land |

Partially Owned and Partially Leased |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Alabama |

10 | 10 | — | — | — | |||||||||||

Arkansas |

8 | 7 | — | — | 1 | |||||||||||

Arizona |

17 | 16 | — | 1 | — | |||||||||||

California |

3 | 3 | — | — | — | |||||||||||

Colorado |

8 | 8 | — | — | — | |||||||||||

Florida |

42 | 39 | — | 3 | — | |||||||||||

Georgia |

12 | 8 | 3 | 1 | — | |||||||||||

Iowa |

5 | 5 | — | — | — | |||||||||||

Idaho |

2 | 1 | 1 | — | — | |||||||||||

Illinois |

3 | 3 | — | — | — | |||||||||||

Indiana |

3 | 3 | — | — | — | |||||||||||

Kansas |

6 | 3 | 1 | 2 | — | |||||||||||

Kentucky |

6 | 5 | 1 | — | — | |||||||||||

Louisiana |

14 | 13 | 1 | — | — | |||||||||||

Missouri |

10 | 7 | 1 | 2 | — | |||||||||||

Mississippi |

6 | 4 | 1 | 1 | — | |||||||||||

Montana |

2 | 2 | — | — | — | |||||||||||

North Carolina |

16 | 14 | 1 | 1 | — | |||||||||||

Nebraska |

3 | 2 | 1 | — | — | |||||||||||

New Mexico |

6 | 3 | 3 | — | — | |||||||||||

Nevada |

4 | 4 | — | — | — | |||||||||||

Ohio |

15 | 10 | 5 | — | — | |||||||||||

Oklahoma |

10 | 6 | 4 | — | — | |||||||||||

South Carolina |

8 | 8 | — | — | — | |||||||||||

Tennessee |

10 | 8 | 1 | — | 1 | |||||||||||

Texas |

60 | 44 | 10 | 1 | 5 | |||||||||||

Utah |

6 | 4 | 2 | — | — | |||||||||||

Virginia |

6 | 4 | 1 | 1 | — | |||||||||||

Wyoming |

1 | 1 | — | — | — | |||||||||||

Total |

302 | 245 | 37 | 13 | 7 | |||||||||||

11

At February 2, 2013, we operated the following additional facilities:

Facility

|

Location | Square Feet | Owned / Leased |

||||

|---|---|---|---|---|---|---|---|

Distribution Centers: |

Mabelvale, AR | 400,000 | Owned | ||||

|

Gilbert, AZ | 295,000 | Owned | ||||

|

Valdosta, GA | 370,000 | Owned | ||||

|

Olathe, KS | 500,000 | Owned | ||||

|

Salisbury, NC | 355,000 | Owned | ||||

|

Ft. Worth, TX | 700,000 | Owned | ||||

Internet Fulfillment Center |

Maumelle, AR | 850,000 | Owned | ||||

Dillard's Executive Offices |

Little Rock, AR | 333,000 | Owned | ||||

CDI Contractors, LLC Executive Office |

Little Rock, AR | 25,000 | Owned | ||||

CDI Storage Facilities |

Maumelle, AR | 66,000 | Owned | ||||

Total |

3,894,000 | ||||||

Additional property information is contained in Notes 1, 12 and 13 of "Notes to Consolidated Financial Statements," in Item 8 hereof.

From time to time, the Company is involved in litigation relating to claims arising out of the Company's operations in the normal course of business. This may include litigation with customers, employment related lawsuits, class action lawsuits, purported class action lawsuits and actions brought by governmental authorities. As of March 28, 2013, the Company is not a party to any legal proceedings that, individually or in the aggregate, are reasonably expected to have a material adverse effect on the Company's business, results of operations, financial condition or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

12

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table lists the names and ages of all executive officers of the Registrant, the nature of any family relationship between them and all positions and offices with the Registrant presently held by each person named. Each is elected to serve a one-year term. There are no other persons chosen to become executive officers.

Name

|

Age | Position & Office | Held Present Office Since |

Family Relationship to CEO | |||||

|---|---|---|---|---|---|---|---|---|---|

William Dillard, II |

68 | Director; Chief Executive Officer | 1998 | Not applicable | |||||

Alex Dillard |

63 |

Director; President |

1998 |

Brother of William Dillard, II |

|||||

Mike Dillard |

61 |

Director; Executive Vice President |

1984 |

Brother of William Dillard, II |

|||||

Drue Matheny |

66 |

Director; Executive Vice President |

1998 |

Sister of William Dillard, II |

|||||

James I. Freeman |

63 |

Director; Senior Vice President; Chief Financial Officer |

1988 |

None |

|||||

Steven K. Nelson |

55 |

Vice President |

1988 |

None |

|||||

Robin Sanderford |

66 |

Vice President |

1998 |

None |

|||||

Burt Squires |

63 |

Vice President |

1984 |

None |

|||||

Julie A. Taylor |

61 |

Vice President |

1998 |

None |

|||||

Richard B. Willey* |

62 |

Vice President |

2010 |

None |

|||||

- *

- Mr. Willey joined the Company in 1987. He served as Regional Vice President of Stores from 1987 to 2001. From 2001 to 2010, he served as Vice President of Store Planning and Construction. In 2010, he was promoted to Corporate Vice President of Stores.

13

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market and Dividend Information for Common Stock

The Company's Class A Common Stock trades on the New York Stock Exchange under the Ticker Symbol "DDS". No public market currently exists for the Class B Common Stock.

The high and low sales prices of the Company's Class A Common Stock, and dividends declared on each class of common stock, for each quarter of fiscal 2012 and 2011 are presented in the table below:

| |

2012 | 2011 | Dividends per Share |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

High | Low | High | Low | 2012 | 2011 | |||||||||||||

First |

$ | 65.49 | $ | 43.70 | $ | 48.57 | $ | 37.87 | $ | 0.05 | $ | 0.04 | |||||||

Second |

72.46 | 60.76 | 61.08 | 45.27 | 0.05 | 0.05 | |||||||||||||

Third |

79.24 | 63.94 | 57.58 | 38.99 | 0.05 | 0.05 | |||||||||||||

Fourth |

89.98 | 75.11 | 56.30 | 42.54 | 5.05 | 0.05 | |||||||||||||

While the Company expects to continue paying quarterly cash dividends during fiscal 2013, all dividends will be reviewed quarterly and declared by the Board of Directors.

Stockholders

As of March 2, 2013, there were 3,236 holders of record of the Company's Class A Common Stock and 8 holders of record of the Company's Class B Common Stock.

Repurchase of Common Stock

Issuer Purchases of Equity Securities

Period

|

(a) Total Number of Shares Purchased |

(b) Average Price Paid per Share |

(c)Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

(d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 28, 2012 through November 24, 2012 |

— | $ | — | — | $ | 115,396,785 | |||||||

November 25, 2012 through December 29, 2012 |

— | — | — | 115,396,785 | |||||||||

December 30, 2012 through February 2, 2013 |

293,909 | 79.69 | 293,909 | 91,976,066 | |||||||||

Total |

293,909 | $ | 79.69 | 293,909 | $ | 91,976,066 | |||||||

In February 2012, the Company announced that the Board of Directors authorized the repurchase of up to $250 million of its Class A Common Stock. This authorization permits the Company to repurchase its Class A Common Stock in the open market, pursuant to preset trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934 ("Exchange Act") or through privately negotiated transactions. The plan has no expiration date, and remaining availability pursuant to the Company's share repurchase program was $92.0 million as of February 2, 2013. Reference is made to the discussion in "Note 9. Stockholders' Equity" in the "Notes to Consolidated Financial Statements" in Item 8 of this Report on Form 10-K, which information is incorporated by reference herein.

14

In March 2013, the Company completed the purchase of the $92.0 million outstanding at February 2, 2013 under the February 2012 plan. The Company also announced that the Board of Directors authorized the repurchase of up to an additional $250 million of its Class A Common Stock. This authorization permits the Company to repurchase its Class A Common Stock in the open market, pursuant to preset trading plans meeting the requirements of Rule 10b5-1 under the Exchange Act or through privately negotiated transactions. The plan has no expiration date.

Securities Authorized for Issuance under Equity Compensation Plans

The information concerning the Company's equity compensation plans is incorporated by reference here to Item 12 of this Annual Report on Form 10-K under the heading "Equity Compensation Plan Information".

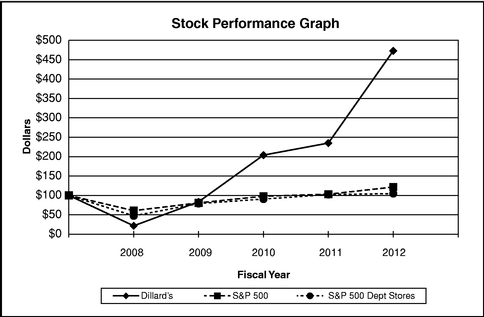

Company Performance

For each of the last five fiscal years, the graph below compares the cumulative total returns on the Company's Class A Common Stock, the Standard & Poor's 500 Index and the Standard & Poor's 500 Department Stores Index. The cumulative total return assumes $100 invested in the Company's Class A Common Stock and each of the indices at market close on February 1, 2008 (the last trading day prior to the start of fiscal 2008) and assumes reinvestment of dividends.

The table below shows the dollar value of the respective $100 investments, with the assumptions noted above, in each of the Company's Class A Common Stock, the Standard & Poor's 500 Index and the Standard & Poor's 500 Department Stores Index as of the last day of each of the Company's last five fiscal years.

| |

2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dillard's, Inc. |

$ | 21.59 | $ | 83.47 | $ | 203.93 | $ | 234.99 | $ | 472.84 | ||||||

S&P 500 |

60.63 | 80.72 | 97.88 | 103.09 | 121.54 | |||||||||||

S&P 500 Department Stores |

47.23 | 78.96 | 90.56 | 102.25 | 104.73 | |||||||||||

15

ITEM 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our "Management's Discussion and Analysis of Financial Condition and Results of Operations", our consolidated audited financial statements and notes thereto and the other information contained elsewhere in this report.

(Dollars in thousands of dollars, except per share data) |

2012(1) | 2011 | 2010 | 2009 | 2008 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net sales |

$ | 6,593,169 | $ | 6,263,600 | $ | 6,120,961 | $ | 6,094,948 | $ | 6,830,543 | ||||||

Percent change |

5 | % | 2 | % | 0 | % | -11 | % | -5 | % | ||||||

Cost of sales |

4,247,108 | 4,047,269 | 3,980,873 | 4,109,618 | 4,833,791 | |||||||||||

Percent of sales |

64.4 | % | 64.6 | % | 65.0 | % | 67.4 | % | 70.8 | % | ||||||

Interest and debt expense, net |

69,596 | 72,059 | 73,792 | 74,003 | 88,821 | |||||||||||

Income (loss) before income taxes and income on (equity in losses of) joint ventures |

479,750 | 396,669 | 268,716 | 84,525 | (380,005 | ) | ||||||||||

Income taxes (benefit) |

145,060 | (62,518 | ) | 84,450 | 12,690 | (140,520 | ) | |||||||||

Income on (equity in losses of) joint ventures |

1,272 | 4,722 | (4,646 | ) | (3,304 | ) | (1,580 | ) | ||||||||

Net income (loss) |

335,962 | 463,909 | 179,620 | 68,531 | (241,065 | ) | ||||||||||

Net income (loss) per diluted common share |

6.87 | 8.52 | 2.67 | 0.93 | (3.25 | ) | ||||||||||

Dividends per common share |

5.20 | 0.19 | 0.16 | 0.16 | 0.16 | |||||||||||

Book value per common share |

41.24 | 41.50 | 34.79 | 31.21 | 30.65 | |||||||||||

Average number of diluted shares outstanding |

48,910,946 | 54,448,065 | 67,174,163 | 73,783,960 | 74,278,461 | |||||||||||

Accounts receivable |

31,519 | 28,708 | 25,950 | 63,222 | 87,998 | |||||||||||

Merchandise inventories |

1,294,581 | 1,304,124 | 1,290,147 | 1,300,680 | 1,374,394 | |||||||||||

Property and equipment, net |

2,287,015 | 2,440,266 | 2,595,514 | 2,780,837 | 2,973,151 | |||||||||||

Total assets |

4,048,744 | 4,306,137 | 4,374,166 | 4,606,327 | 4,745,844 | |||||||||||

Long-term debt |

614,785 | 614,785 | 697,246 | 747,587 | 757,689 | |||||||||||

Capital lease obligations |

7,524 | 9,153 | 11,383 | 22,422 | 24,116 | |||||||||||

Other liabilities |

233,492 | 245,218 | 205,916 | 213,471 | 220,911 | |||||||||||

Deferred income taxes |

255,652 | 314,598 | 341,689 | 349,722 | 378,348 | |||||||||||

Subordinated debentures |

200,000 | 200,000 | 200,000 | 200,000 | 200,000 | |||||||||||

Total stockholders' equity |

1,970,175 | 2,052,019 | 2,086,720 | 2,304,103 | 2,251,115 | |||||||||||

Number of stores |

||||||||||||||||

Opened(2) |

0 | 0 | 2 | 0 | 10 | |||||||||||

Closed |

2 | 4 | 3 | 6 | 21 | |||||||||||

Total—end of year |

302 | 304 | 308 | 309 | 315 | |||||||||||

- (1)

- Fiscal

2012 contains 53 weeks.

- (2)

- One store in Biloxi, Mississippi, not in operation during fiscal 2007 due to the hurricanes of 2005, was re-opened in early fiscal 2008.

16

The items below are included in the Selected Financial Data.

2012

The items below amount to a net $9.8 million pretax gain ($26.2 million after tax gain or $0.54 per share).

- •

- an $11.4 million pretax gain ($7.4 million after tax or $0.15 per share) related to the sale of three former

retail store locations.

- •

- a $1.6 million pretax charge ($1.0 million after tax or $0.02 per share) for asset impairment and store

closing charges related to the write-down of a property held for sale and of an operating property (see Note 13 of Notes to Consolidated Financial Statements).

- •

- a $1.7 million income tax benefit ($0.03 per share) due to a reversal of a valuation allowance related to a

deferred tax asset consisting of a capital loss carryforward (see Note 6 of Notes to Consolidated Financial Statements).

- •

- an $18.1 million income tax benefit ($0.37 per share) due to a one-time deduction related to dividends paid to the Dillard's, Inc. Investment and Employee Stock Ownership Plan (see Note 6 of Notes to Consolidated Financial Statements).

2011

The items below amount to a net $50.9 million pretax gain ($234.5 million after tax gain or $4.31 per share).

- •

- a $201.6 million income tax benefit ($3.70 per share) due to a reversal of a valuation allowance related to the

amount of the capital loss carryforward used to offset the capital gain income recognized on the taxable transfer of properties to our REIT (see Note 6 of Notes to Consolidated Financial

Statements).

- •

- a $44.5 million pretax gain ($28.7 million after tax or $0.53 per share), net of settlement related

expenses, related to the settlement of a lawsuit with JDA Software Group for $57.0 million.

- •

- a $4.2 million pretax gain ($2.7 million after tax or $0.05 per share) related to a distribution from a mall

joint venture (see Note 1 of Notes to Consolidated Financial Statements).

- •

- a $2.1 million pretax gain ($1.4 million after tax or $0.03 per share) related to the sale of an interest in

a mall joint venture (see Note 1 of Notes to Consolidated Financial Statements).

- •

- a $1.3 million pretax gain ($0.9 million after tax or $0.02 per share) related to the sale of two former

retail store locations.

- •

- a $1.2 million pretax charge ($0.8 million after tax or $0.01 per share) for asset impairment and store closing charges related to the write-down of one property held for sale (see Note 13 of the Notes to Consolidated Financial Statements).

2010

The items below amount to a net $10.4 million pretax gain ($16.4 million after tax gain or $0.24 per share).

- •

- a $2.2 million pretax charge ($1.4 million after tax or $0.02 per share) for asset impairment and store closing charges related to the write-down of one property held for sale (see Note 13 of the Notes to Consolidated Financial Statements).

17

- •

- a $7.5 million pretax gain ($4.8 million after tax or $0.07 per share) on proceeds received for final

payment related to hurricane losses.

- •

- a $5.1 million pretax gain ($3.3 million after tax or $0.05 per share) related to the sale of five retail

store locations.

- •

- a $9.7 million income tax benefit ($0.14 per share) primarily related to net decreases in unrecognized tax benefits, interest and penalties due to resolutions of federal and state examinations; decreases in state net operating loss valuation allowances; and a decrease in a capital loss valuation allowance.

2009

The items below amount to a net $6.6 million pretax gain ($14.7 million after tax gain or $0.19 per share).

- •

- a $3.1 million pretax charge ($2.0 million after tax or $0.03 per share) for asset impairment and store

closing charges related to certain stores.

- •

- a $5.7 million pretax gain ($3.6 million after tax or $0.05 per share) related to proceeds received from

settlement of the Visa Check/Mastermoney Antitrust litigation.

- •

- a $10.6 million income tax benefit ($0.14 per share) primarily due to state administrative settlement and a

decrease in a capital loss valuation allowance.

- •

- a $1.7 million pretax gain ($1.0 million after tax or $0.01 per share) on the early extinguishment of debt

related to the repurchase of certain unsecured notes.

- •

- a $2.3 million pretax gain ($1.5 million after tax or $0.02 per share) related to the sale of a vacant store location in Kansas City, Missouri.

2008

The items below amount to a net $180.4 million pretax charge ($125.5 million after tax charge or $1.69 per share).

- •

- a $197.9 million pretax charge ($136.5 million after tax or $1.84 per share) for asset impairment and store

closing charges related to certain stores.

- •

- a $7.3 million pretax charge ($4.6 million after tax or $0.06 per share) related to hurricane losses and

remediation expenses incurred during the 2008 hurricane season.

- •

- a $24.8 million pretax gain ($15.6 million after tax or $0.21 per share) related to the sale of an aircraft and the sale of a store located in San Antonio, Texas.

18

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

EXECUTIVE OVERVIEW

Dillard's, Inc. operates 302 retail department stores spanning 29 states and an Internet store. Our retail stores are located in fashion-oriented shopping malls and open-air centers and offer a broad selection of fashion apparel, cosmetics and home furnishings. We offer an appealing and attractive assortment of merchandise to our customers at a fair price, including national brand merchandise as well as our exclusive brand merchandise. We seek to enhance our income by maximizing the sale of this merchandise to our customers by promoting and advertising our merchandise and by making our stores an attractive and convenient place for our customers to shop.

The Company also operates CDI, a general contractor whose business includes constructing and remodeling stores for the Company, which is a reportable segment separate from our retail operations.

In accordance with the National Retail Federation fiscal reporting calendar, the fiscal 2012 reporting period presented and discussed below ended February 2, 2013 and contained 53 weeks. The fiscal 2011 and 2010 reporting periods presented and discussed below ended January 28, 2012 and January 29, 2011, respectively, and each contained 52 weeks. For comparability purposes, where noted, some of the information discussed below is based upon comparison of the 52 weeks ended February 2, 2013 to the 52 weeks ended February 4, 2012.

Fiscal 2012

Our operating performance continued to improve during fiscal 2012. Retail sales were higher than last year, as we ended the year with our 10th consecutive quarter of comparable store sales increases. Gross margin improved over last year, mainly from progress in the second half of the year, and operating spending was leveraged. We repurchased $185.5 million, or 2.8 million shares, of our Class A Common Stock during the year. Net income was $336.0 million, or $6.87 per share, for the year, and operating cash flow increased $21.6 million over last year, further enabling the Company to return $252.3 million of dividends to our shareholders, including a special dividend of $5.00 per share.

Included in net income for fiscal 2012 are:

- •

- an $11.4 million pretax gain ($7.4 million after tax or $0.15 per share) related to the sale of three former

retail store locations.

- •

- a $1.6 million pretax charge ($1.0 million after tax or $0.02 per share) for asset impairment and store

closing charges related to the write-down of a property held for sale and of an operating property.

- •

- a $1.7 million income tax benefit ($0.03 per share) due to a reversal of a valuation allowance related to a

deferred tax asset consisting of a capital loss carryforward.

- •

- an $18.1 million income tax benefit ($0.37 per share) due to a one-time deduction related to dividends paid to the Dillard's, Inc. Investment and Employee Stock Ownership Plan.

Included in net income of $463.9 million ($8.52 per share) for fiscal 2011 are:

- •

- a $201.6 million income tax benefit ($3.70 per share) due to a reversal of a valuation allowance related to the

amount of the capital loss carryforward used to offset the capital gain income recognized on the taxable transfer of properties to our REIT.

- •

- a $44.5 million pretax gain ($28.7 million after tax or $0.53 per share), net of settlement related expenses, related to the settlement of a lawsuit with JDA Software Group for $57.0 million.

19

- •

- a $4.2 million pretax gain ($2.7 million after tax or $0.05 per share) related to a distribution from a mall

joint venture.

- •

- a $2.1 million pretax gain ($1.4 million after tax or $0.03 per share) related to the sale of an interest in

a mall joint venture.

- •

- a $1.3 million pretax gain ($0.9 million after tax or $0.02 per share) related to the sale of two former

retail store locations.

- •

- a $1.2 million pretax charge ($0.8 million after tax or $0.01 per share) for asset impairment and store closing charges related to the write-down of one property held for sale.

Highlights of fiscal 2012 include:

- •

- A comparable store sales increase of 4% over the prior year based on comparable 52-week periods;

- •

- Retail operations gross margin improvement of 30 basis points of sales over the prior year. Retail operations gross margin

as a percent of sales were 36.1% and 35.8% for fiscal 2012 and fiscal 2011, respectively;

- •

- Operating expense leverage of 60 basis points of sales over the prior year. Operating expenses as a percent of sales were

25.4% and 26.0% for fiscal 2012 and fiscal 2011, respectively;

- •

- Net income of $336.0 million ($6.87 per share);

- •

- Cash flow from operations increase of $21.6 million over the prior year. Operating cash flows were

$522.7 million during fiscal 2012 compared to $501.1 million during fiscal 2011;

- •

- Repurchase of $185.5 million (or 2.8 million shares) of the Company's Class A Common Stock; and

- •

- Payment of $252.3 million in dividends during fiscal 2012 (including a special dividend of $5.00 per share) compared to dividends of $10.0 million paid during fiscal 2011.

As of February 2, 2013, we had working capital of $724.9 million (including cash and cash equivalents of $124.1 million) and $814.8 million of total debt outstanding, with no scheduled maturities until late fiscal 2017. We operated 302 total stores as of February 2, 2013, a decrease of two stores from the same period last year.

20

Key Performance Indicators

We use a number of key indicators of financial condition and operating performance to evaluate the performance of our business, including the following:

| |

Fiscal 2012 |

Fiscal 2011 |

Fiscal 2010 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Net sales (in millions) |

$ | 6,593.2 | $ | 6,263.6 | $ | 6,121.0 | ||||

Gross profit (in millions) |

$ | 2,346.1 | $ | 2,216.3 | $ | 2,140.1 | ||||

Gross profit as a percentage of net sales |

35.6 | % | 35.4 | % | 35.0 | % | ||||

Retail gross profit as a percentage of net sales |

36.1 | % | 35.8 | % | 35.5 | % | ||||

Selling, general and administrative expenses as a percentage of net sales |

25.4 | % | 26.0 | % | 26.6 | % | ||||

Cash flow from operations (in millions) |

$ | 522.7 | $ | 501.1 | $ | 512.9 | ||||

Total retail store count at end of period |

302 | 304 | 308 | |||||||

Retail sales per square foot |

$ | 129 | $ | 121 | $ | 116 | ||||

Retail stores sales trend |

3 | %** | 3 | % | 2 | % | ||||

Comparable retail store sales trend |

4 | %** | 4 | % | 3 | % | ||||

Comparable retail store inventory trend |

(1 | )% | 3 | % | (2 | )% | ||||

Retail merchandise inventory turnover |

2.9 | 2.8 | 2.8 | |||||||

- **

- Based upon the 52 weeks ended February 2, 2013 and 52 weeks ended February 4, 2012

Trends and Uncertainties

Fluctuations in the following key trends and uncertainties may have a material effect on our operating results.

- •

- Cash flow—Cash from operating activities is a primary source of liquidity that is adversely affected when the

industry faces economic challenges. Furthermore, operating cash flow can be negatively affected when new and existing competitors seek areas of growth to expand their businesses.

- •

- Pricing—If our customers do not purchase our merchandise offerings in sufficient quantities, we respond by

taking markdowns. If we have to reduce our retail selling prices, the cost of sales on our consolidated statement of income will correspondingly rise, thus reducing our income and cash flow.

- •

- Success of brand—The success of our exclusive brand merchandise as well as merchandise we source from national

vendors is dependent upon customer fashion preferences and how well we can predict and anticipate trends.

- •

- Sourcing—Our store merchandise selection is dependent upon our ability to acquire appealing products from a

number of sources. Our ability to attract and retain compelling vendors as well as in-house design talent, the adequacy and stable availability of materials and production facilities from

which we source our merchandise and the speed at which we can respond to customer trends and preferences all have a significant impact on our merchandise mix and, thus, our ability to sell merchandise

at profitable prices.

- •

- Store growth—Our ability to open new stores is dependent upon a number of factors, such as the identification of suitable markets and locations and the availability of shopping developments, especially in a weak economic environment. Store growth can be further hindered by mall attrition and subsequent closure of underperforming properties.

21

Seasonality and Inflation

Our business, like many other retailers, is subject to seasonal influences, with a significant portion of sales and income typically realized during the last quarter of our fiscal year due to the holiday season. Because of the seasonality of our business, results from any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year.

We do not believe that inflation has had a material effect on our results during the periods presented; however, our business could be affected by such in the future.

2013 Guidance

A summary of estimates on key financial measures for fiscal 2013 is shown below.

(in millions of dollars)

|

Fiscal 2013 Estimated |

Fiscal 2012 Actual |

|||||

|---|---|---|---|---|---|---|---|

Depreciation and amortization |

$ | 261 | $ | 260 | |||

Rentals |

27 | 35 | |||||

Interest and debt expense, net |

65 | 70 | |||||

Capital expenditures |

175 | 137 | |||||

General

Net sales. Net sales include merchandise sales of comparable and non-comparable stores and revenue recognized on contracts of CDI, the Company's general contracting construction company. Comparable store sales include sales for those stores which were in operation for a full period in both the current month and the corresponding month for the prior year. Comparable store sales exclude the change in the allowance for sales returns. Non-comparable store sales include: sales in the current fiscal year from stores opened during the previous fiscal year before they are considered comparable stores; sales from new stores opened during the current fiscal year; sales in the previous fiscal year for stores closed during the current or previous fiscal year that are no longer considered comparable stores; sales in clearance centers; and changes in the allowance for sales returns.

Service charges and other income. Service charges and other income include income generated through the Alliance with GE. Other income includes rental income, shipping and handling fees, gift card breakage and lease income on leased departments.

Cost of sales. Cost of sales includes the cost of merchandise sold (net of purchase discounts and non-specific margin maintenance allowances), bankcard fees, freight to the distribution centers, employee and promotional discounts, and direct payroll for salon personnel. Cost of sales also includes CDI contract costs, which comprise all direct material and labor costs, subcontract costs and those indirect costs related to contract performance, such as indirect labor, employee benefits and insurance program costs.

Selling, general and administrative expenses. Selling, general and administrative expenses include buying, occupancy, selling, distribution, warehousing, store and corporate expenses (including payroll and employee benefits), insurance, employment taxes, advertising, management information systems, legal and other corporate level expenses. Buying expenses consist of payroll, employee benefits and travel for design, buying and merchandising personnel.

Depreciation and amortization. Depreciation and amortization expenses include depreciation and amortization on property and equipment.

Rentals. Rentals include expenses for store leases, including contingent rent, and data processing and other equipment rentals.

22

Interest and debt expense, net. Interest and debt expense includes interest, net of interest income, relating to the Company's unsecured notes, mortgage note, term note, subordinated debentures and borrowings under the Company's credit facility. Interest and debt expense also includes gains and losses on note repurchases, if any, amortization of financing costs and interest on capital lease obligations.

Gain on litigation settlement. Gain on litigation settlement includes the proceeds received, net of related expenses, from the settlement of a lawsuit with JDA Software Group.

Gain on disposal of assets. Gain on disposal of assets includes the net gain or loss on the sale or disposal of property and equipment and the gain on the sale of an interest in a mall joint venture, if any.

Asset impairment and store closing charges. Asset impairment and store closing charges consist of write-downs to fair value of under-performing or held for sale properties and exit costs associated with the closure of certain stores. Exit costs include future rent, taxes and common area maintenance expenses from the time the stores are closed.

Income on (equity in losses of) joint ventures. Income on (equity in losses of) joint ventures includes the Company's portion of the income or loss of the Company's unconsolidated joint ventures as well as a distribution of excess cash from one of the Company's mall joint ventures.

Critical Accounting Policies and Estimates

The Company's significant accounting policies are also described in Note 1 of Notes to Consolidated Financial Statements. As disclosed in that note, the preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions about future events that affect the amounts reported in the consolidated financial statements and accompanying notes. The Company evaluates its estimates and judgments on an ongoing basis and predicates those estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances. Since future events and their effects cannot be determined with absolute certainty, actual results could differ from those estimates.

Management of the Company believes the following critical accounting policies, among others, affect its more significant judgments and estimates used in preparation of the Consolidated Financial Statements.