UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||||||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended | ||||||||

| or | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the transition period from to . | ||||||||

Commission file number 1-6140

(Exact name of registrant as specified in its charter)

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices)

(Zip Code)

Registrant's telephone number, including area code (501 ) 376-5200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| | ||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ý | Accelerated filer | o | Smaller reporting company | ||||||||||||||

| Non-accelerated filer | o | Emerging growth company | |||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 31, 2021 was $2,274,005,736 .

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of February 26, 2022:

| CLASS A COMMON STOCK, $0.01 par value | |||||

| CLASS B COMMON STOCK, $0.01 par value | |||||

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 21, 2022 (the "Proxy Statement") are incorporated by reference into Part III of this Form 10-K.

Table of Contents

| Item No. | Page No. | |||||||

PART I

ITEM 1. BUSINESS.

Dillard's, Inc. ("Dillard's", the "Company", "we", "us", "our" or "Registrant") ranks among the nation's largest fashion apparel, cosmetics and home furnishing retailers. The Company, originally founded in 1938 by William T. Dillard, was incorporated in Delaware in 1964. As of January 29, 2022, we operated 280 Dillard's stores, including 30 clearance centers, and an Internet store offering a wide selection of merchandise including fashion apparel for women, men and children, accessories, cosmetics, home furnishings and other consumer goods. The Company also operates a general contracting construction company, CDI Contractors, LLC ("CDI"), a portion of whose business includes constructing and remodeling stores for the Company.

The following table summarizes the percentage of net sales by segment and major product line:

| Percentage of Net Sales | |||||||||||||||||

| Fiscal 2021 | Fiscal 2020 | Fiscal 2019 | |||||||||||||||

| Retail operations segment: | |||||||||||||||||

| Cosmetics | 14 | % | 15 | % | 14 | % | |||||||||||

| Ladies' apparel | 21 | 18 | 22 | ||||||||||||||

| Ladies' accessories and lingerie | 15 | 17 | 15 | ||||||||||||||

| Juniors' and children's apparel | 10 | 9 | 9 | ||||||||||||||

| Men's apparel and accessories | 19 | 18 | 18 | ||||||||||||||

| Shoes | 15 | 15 | 15 | ||||||||||||||

| Home and furniture | 4 | 5 | 4 | ||||||||||||||

| 98 | 97 | 97 | |||||||||||||||

| Construction segment | 2 | 3 | 3 | ||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | |||||||||||

Additional information regarding our business, results of operations and financial condition, including information pertaining to our reporting segments and the impact of COVID-19 on each of the foregoing, can be found in Management's Discussion and Analysis of Financial Condition and Results of Operations in Item 7 hereof and in Note 2 in the "Notes to Consolidated Financial Statements" in Item 8 hereof.

Customers may visit us in person at any of our retail stores located primarily in shopping malls and open-air centers throughout the southwest, southeast and midwest regions of the United States. Our customers may also visit us online at our e-Commerce site, dillards.com, gaining company-wide access to in-store merchandise selections across 29 states as well as in our fulfillment and distribution centers. Customers also have the option to buy online and pickup in store or have their orders shipped directly to their desired location. Dillards.com also serves as a key customer engagement tool with continually updated style and trend content to both educate and inspire our customers.

Our retail merchandise business is conducted under highly competitive conditions. Although we are a large regional department store, we have numerous competitors at the national and local level that compete with our individual stores, including specialty, off-price, discount and Internet retailers. Competition is characterized by many factors including location, reputation, merchandise assortment, advertising, price, quality, operating efficiency, service and credit availability. We believe that our stores are in a strong competitive position with regard to each of these factors. Other retailers may compete for customers on some or all of these factors, or on other factors, and may be perceived by some potential customers as being better aligned with their particular preferences.

Our merchandise selections include, but are not limited to, our lines of exclusive brand merchandise such as Antonio Melani, Gianni Bini, GB, Roundtree & Yorke and Daniel Cremieux. Our exclusive brands/private label merchandise program provides benefits for Dillard's and our customers. Our customers receive fashionable, higher quality product often at a savings compared to national brands. Our private label merchandise program allows us to ensure the Company's high standards are achieved, while minimizing costs and differentiating our merchandise offerings from other retailers.

We have made a significant investment in our trademark and license portfolio, in terms of design function, advertising, quality control and quick response to market trends in a quality manufacturing environment. Dillard's trademark registrations are maintained for as long as Dillard's holds the exclusive right to use the trademarks on the listed products.

1

Our merchandising, sales promotion and store operating support functions are conducted primarily at our corporate headquarters. Our back office sales support functions, such as accounting, product development, store planning and information technology, are also centralized.

We have developed a knowledge of each of our trade areas and customer bases for our stores. This knowledge is enhanced through regular store visits by senior management and merchandising personnel and through the use of online merchandise information and is supported by our regional merchandising offices. We will continue to use existing technology and research to edit merchandise assortments by store to meet the specific preference, taste and size requirements of each local operating area.

Wells Fargo Bank, N.A. ("Wells Fargo") owns and manages Dillard's private label credit cards, including credit cards co-branded with American Express (collectively "private label cards") under a long-term marketing and servicing alliance ("Wells Fargo Alliance"). Under the Wells Fargo Alliance, Wells Fargo establishes and owns private label card accounts for our customers, retains the benefits and risks associated with the ownership of the accounts, provides key customer service functions, including new account openings, transaction authorization, billing adjustments and customer inquiries, receives the finance charge income and incurs the bad debts associated with those accounts. Pursuant to the Wells Fargo Alliance, we receive on-going cash compensation from Wells Fargo based upon the portfolio's earnings. The compensation received from the portfolio is determined monthly and has no recourse provisions. We participate in the marketing of the private label cards, which includes the cost of customer reward programs. The Wells Fargo Alliance expires in November 2024.

We seek to expand the number and use of the private label cards by, among other things, providing incentives to sales associates to open new credit accounts, which generally can be opened while a customer is visiting one of our stores or online. Customers who open accounts are rewarded with discounts on future purchases. Private label card customers are sometimes offered private shopping nights, special discounts and advance notice of sale events. Wells Fargo administers the loyalty program that rewards customers for private label card usage.

Our earnings depend to a significant extent on the results of operations for the last quarter of our fiscal year. Due to holiday buying patterns, sales for that period average approximately one-third of annual sales. Additionally, working capital requirements fluctuate during the year, increasing during the second half of the year in anticipation of the holiday season.

We purchase merchandise from many sources and do not believe that we are dependent on any one supplier. We have no long-term purchase commitments or arrangements with any of our suppliers, but we consider our relationships to be strong and mutually beneficial.

Our fiscal year ends on the Saturday nearest January 31 of each year. Fiscal 2021, 2020 and 2019 ended on January 29, 2022, January 30, 2021 and February 1, 2020, respectively, and contained 52 weeks each.

Human Capital

As of December 25, 2021, the Company employed approximately 30,500 associates. Approximately 20,100 were full-time (greater than 35 hours per week) associates, 9,200 were part-time (20-35 hours per week) associates and 1,300 were limited status associates (less than 20 hours per week).1 None of our associates are represented by a union.

As a department store chain, the Company employs a wide range of associates, including sales associates, management professionals, maintenance professionals, call center associates, distribution center associates, buyers, advertising and back office personnel. Given the breadth of our employee base, we tailor our human capital management efforts with a view to specific associate populations.

Of the Company’s full-time associates, approximately 91% work in the retail stores. We focus on attracting and retaining excellent associates at the store level by providing compensation and benefits packages that are competitive within the applicable market.

Training and talent development. The Company develops talent by investing in both formalized classroom training, specialized training for our sales management team, ongoing mentorship programs and on-the-job experience. We seek to create an engaged workforce through open door policies and promotion opportunities. The Company’s philosophy is to develop talent and promote from within our organization, thus providing a better customer service model due to a deeper understanding of the overall business and our customers’ expectations. Career paths and opportunities for promotion are discussed with associates from the first day of training and on an ongoing basis. As of December 25, 2021, approximately 71% of the salaried managers at our stores were promoted from hourly store positions (increased from 63% as of the end of calendar 2020).

1 For purposes of this section, all figures are based on calendar year 2021.

2

Diversity and inclusion. The Company has a diverse customer base and seeks to achieve that same diversity in its workforce. As of December 25, 2021, approximately 75% of our store associates were women, and approximately 55% of our store associates were non-white.

In its efforts to promote diversity within our store positions, the Company has developed and made available to store level hiring managers a Diversity and Inclusion training curriculum. In addition, in order to ensure that all qualified candidates are aware of store promotion opportunities, each store posts promotion opportunities for supervisory positions.

Available Information

The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K (this "Annual Report") and should not be considered to be a part of this Annual Report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of changes in beneficial ownership of securities on Form 4 and Form 5 and amendments to those reports filed or furnished with the SEC pursuant to Sections 13(a), 15(d) or 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as applicable, are available free of charge (as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC) on the Dillard's, Inc. investor relations website: investor.dillards.com. Copies may also be obtained through the SEC's EDGAR website: sec.gov.

We have adopted a Code of Conduct and Corporate Governance Guidelines, as required by the listing standards of the New York Stock Exchange and the rules of the SEC. We have posted on our investor relations website our Code of Conduct, Corporate Governance Guidelines, Social Accountability Policy, our most recent Social Accountability Report, our most recent report on climate change mitigation efforts and committee charters for the Audit Committee of the Board of Directors and the Stock Option and Executive Compensation Committee of the Board of Directors.

Our corporate offices are located at 1600 Cantrell Road, Little Rock, Arkansas 72201, telephone: 501-376-5200.

3

ITEM 1A. RISK FACTORS.

The risks described in this Item 1A, Risk Factors, of this Annual Report could materially and adversely affect our business, financial condition and results of operations.

The Company cautions that forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995, contained in this Annual Report on Form 10-K are based on estimates, projections, beliefs and assumptions of management at the time of such statements and are not guarantees of future performance. The Company disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise. Forward-looking statements of the Company involve risks and uncertainties and are subject to change based on various important factors. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements made by the Company and its management as a result of a number of risks, uncertainties and assumptions.

Risks Related to the COVID-19 Pandemic

The COVID-19 pandemic and its effects on public health, our supply chain, the health and well-being of our employees and customers, and the retail industry in general, has had, and could continue to have, a material adverse effect on our business, financial condition and results of operations.

In December 2019, a strain of coronavirus, now known as COVID-19, was reported to have surfaced in Wuhan, China. Since that time, the virus has rapidly spread to other countries around the world, including the United States. In response to the pandemic, national and local governments, including those in the regions in which we operate, have taken various measures to attempt to slow the spread of the virus, including travel bans; prohibitions on group events and large gatherings; extended shutdowns of schools, government offices and certain businesses; curfews and recommendations to practice “social distancing.” Accordingly, the Company began closing its stores on March 19, 2020, and all store locations were temporarily closed by April 9, 2020. The Company reopened all stores as of June 2, 2020.

The Company sources a significant portion of its private label and exclusive brand merchandise from countries that have experienced widespread transmission of the virus, including China. Additionally, many of the Company’s branded merchandise vendors may also source a significant portion of their merchandise from these same countries. Manufacturing capacity in those countries has been materially impacted by the pandemic, which has negatively impacted our supply chain. If this continues, we cannot guarantee that we will be able to locate alternative sources of supply for our merchandise on acceptable terms, or at all. If we are unable to adequately source our merchandise or purchase appropriate amounts of merchandise from branded vendors, our business and results of operations may be materially and adversely affected.

Risks Related to Retail Operations

The retail merchandise business is highly competitive, and that competition could lower our revenues, margins and market share.

We conduct our retail merchandise business under highly competitive conditions. Competition is characterized by many factors including location, reputation, fashion, merchandise assortment, advertising, operating efficiency, price, quality, customer service and credit availability. We have numerous competitors nationally, locally and on the Internet, including conventional department stores, specialty retailers, off-price and discount stores, boutiques, mass merchants, and Internet and mail-order retailers. Although we are a large regional department store, some of our competitors are larger than us with greater financial resources and, as a result, may be able to devote greater resources to sourcing, promoting and selling their products. Additionally, we compete in certain markets with a substantial number of retailers that specialize in one or more types of merchandise that we sell. Also, online retail shopping continues to rapidly evolve, and we continue to expect competition in the e-commerce market to intensify in the future as the Internet facilitates competitive entry and comparison shopping. We anticipate that intense competition will continue from both existing competitors and new entrants. If we are unable to maintain our competitive position, we could experience downward pressure on prices, lower demand for products, reduced margins, the inability to take advantage of new business opportunities and the loss of market share.

Our business is seasonal, and fluctuations in our revenues during the last quarter of our fiscal year can have a disproportionate effect on our results of operations.

Our business, like many other retailers, is subject to seasonal influences, with a significant portion of sales and income typically realized during the last quarter of our fiscal year due to the holiday season. Our fiscal fourth-quarter results may fluctuate significantly, based on many factors, including holiday spending patterns and weather conditions, and any such fluctuation could have a disproportionate effect on our results of operations for the entire fiscal year. Because of the seasonality

4

of our business, our operating results vary considerably from quarter to quarter, and results from any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year.

A shutdown of, or disruption in, any of the Company's distribution or fulfillment centers would have an adverse effect on the Company's business and operations.

Our business depends on the orderly operation of the process of receiving and distributing merchandise, which relies on adherence to shipping schedules and effective management of distribution or fulfillment centers. Although we believe that our receiving and distribution process is efficient and that we have appropriate contingency plans, unforeseen disruptions in operations due to fire, severe weather conditions, natural disasters or other catastrophic events, labor disagreements or other shipping problems may result in the loss of inventory and/or delays in the delivery of merchandise to our stores and customers.

Current store locations may become less desirable, and desirable new locations may not be available for a reasonable price, if at all, either of which could adversely affect our results of operations.

In order to generate customer traffic and for convenience of our customers, we attempt to locate our stores in desirable locations within shopping malls and open air centers. Our stores benefit from the abilities that our Company, other anchor tenants and other area attractions have to generate consumer traffic. Adverse changes in the development of new shopping malls in the United States, the availability or cost of appropriate locations within existing or new shopping malls, competition with other retailers for prominent locations, the success of individual shopping malls and the success or failure of other anchor tenants, the continued proper management and development of existing malls, or the continued popularity of shopping malls may continue to impact our ability to maintain or grow our sales in our existing stores, as well as our ability to open new stores, which could have an adverse effect on our financial condition or results of operations.

Ownership and leasing of significant amounts of real estate exposes us to possible liabilities and losses.

We own the land and building, or lease the land and/or the building, for all of our stores. Accordingly, we are subject to all of the risks associated with owning and leasing real estate. In particular, the value of our real estate assets could decrease, and their operating costs could increase, because of changes in the investment climate for real estate, demographic trends and supply or demand for the use of the store, which may result from competition from similar stores in the area. Additionally, we are subject to potential liability for environmental conditions on the property that we own or lease. If an existing owned store is not profitable, and we decide to close it, we may be required to record an impairment charge and/or exit costs associated with the disposal of the store. We generally cannot cancel our leases. If an existing or future store is not profitable, and we decide to close it, we may be committed to perform certain obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. In addition, as each of the leases expires, we may be unable to negotiate renewals, either on commercially acceptable terms or at all, which could cause us to close stores in desirable locations. We may not be able to close an unprofitable owned store due to an existing operating covenant which may cause us to operate the location at a loss and prevent us from finding a more desirable location. We have approximately 74 stores along the Gulf and Atlantic coasts that are covered by third-party insurance but are self-insured for property and merchandise losses related to "named storms." As a result, the repair and replacement costs will be borne by us for damage to any of these stores from "named storms," which could have an adverse effect on our financial condition or results of operations.

Variations in the amount of vendor allowances received could adversely impact our operating results.

We receive vendor allowances for advertising, payroll and margin maintenance that are a strategic part of our operations. A reduction in the amount of cooperative advertising allowances would likely cause us to consider other methods of advertising as well as the volume and frequency of our product advertising, which could increase/decrease our expenditures and/or revenue. Decreased payroll reimbursements would either cause payroll costs to rise, negatively impacting operating income, or cause us to reduce the number of employees, which may cause a decline in sales. A decline in the amount of margin maintenance allowances would either increase cost of sales, which would negatively impact gross margin and operating income, or cause us to reduce merchandise purchases, which may cause a decline in sales.

A decrease in cash flows from our operations and constraints to accessing other financing sources could limit our ability to fund our operations, capital projects, interest and debt repayments, stock repurchases and dividends.

Our business depends upon our operations to generate strong cash flow and to some extent upon the availability of financing sources to supply capital to fund our general operating activities, capital projects, interest and debt repayments, stock repurchases and dividends. Our inability to continue to generate sufficient cash flows to support these activities or the lack of available financing in adequate amounts and on appropriate terms when needed could adversely affect our financial performance including our earnings per share.

5

Our profitability may be adversely impacted by weather conditions.

Our merchandise assortments reflect assumptions regarding expected weather patterns and our profitability depends on our ability to timely deliver seasonally appropriate inventory. Unexpected or unseasonable weather conditions could render a portion of our inventory incompatible with consumer needs. For example, extended periods of unseasonably warm temperatures during the winter season or cool weather during the summer season could render a portion of the Company's inventory incompatible with those unseasonable conditions. Additionally, extreme weather or natural disasters, particularly in the areas in which our stores are located, could also severely hinder our ability to timely deliver seasonally appropriate merchandise. For example, frequent or unusually heavy snowfall, ice storms, rainstorms, hurricanes or other extreme weather conditions over a prolonged period could make it difficult for the Company's customers to travel to its stores and thereby reduce the Company's sales and profitability. A reduction in the demand for or supply of our seasonal merchandise or reduced sales due to reduced customer traffic in our stores could have an adverse effect on our inventory levels, gross margins and results of operations.

Natural disasters, war, acts of violence, acts of terrorism, other armed conflicts, and public health issues may adversely impact our business.

The occurrence of, or threat of, a natural disaster, war (including the recent conflict in Ukraine and the resulting sanctions imposed on Russia by the U.S. and other countries), acts of violence, acts of terrorism, other armed conflicts, and public health issues (including the recent COVID-19 pandemic) could disrupt our operations, disrupt international trade and supply chain efficiencies, suppliers or customers, or result in political or economic instability. If commercial transportation is curtailed or substantially delayed, our business may be adversely impacted, as we may have difficulty shipping merchandise to our distribution centers, fulfillment centers, stores or directly to customers. As a result of the occurrence of, or threat of, a natural disaster, war, acts of violence or acts of terrorism, other armed conflicts, and public health issues (including the recent COVID-19 pandemic) in the United States, we may be required to suspend operations in some or all of our stores, which could have a material adverse impact on our business, financial condition and results of operations.

Risks Related to Consumer Demand

Changes in economic, financial and political conditions, and the resulting impact on consumer confidence and consumer spending, could have an adverse effect on our business and results of operations.

The retail merchandise business is highly sensitive to changes in overall economic and political conditions that impact consumer confidence and spending. Various economic conditions affect the level of disposable income consumers have available to spend on the merchandise we offer, including unemployment rates, inflation, interest rates, taxation, energy costs, the availability of consumer credit, the price of gasoline, consumer confidence in future economic conditions and general business conditions. Due to the Company's concentration of stores in energy producing regions, volatile conditions in these regions could adversely affect the Company's sales. Consumer purchases of discretionary items and other retail products generally decline during recessionary periods, and also may decline at other times when changes in consumer spending patterns affect us unfavorably. In addition, any significant decreases in shopping mall traffic could also have an adverse effect on our results of operations.

Our business is dependent upon our ability to accurately predict rapidly changing fashion trends, customer preferences and other fashion-related factors.

Our sales and operating results depend in part on our ability to effectively predict and quickly respond to changes in fashion trends and customer preferences. We continuously assess emerging styles and trends and focus on developing a merchandise assortment to meet customer preferences at competitive prices. Even with these efforts, we cannot be certain that we will be able to successfully meet constantly changing fashion trends and customer preferences. If we are unable to successfully predict or respond to changing styles or preferences, we may be faced with lower sales, increased inventories, additional markdowns or promotional sales to dispose of excess or slow-moving inventory and lower gross margins, all of which would have an adverse effect on our business, financial condition and results of operations.

Risks Related to our Brand and Product Offerings

Our failure to protect our reputation could have an adverse effect on our business.

We offer our customers quality products at competitive prices and a high level of customer service, resulting in a well-recognized brand and customer loyalty. As discussed in the immediately preceding risk factor, our brand and customer loyalty depend, in part, on our ability to predict or respond to changes in fashion trends and consumer preferences in a timely manner. Failure to respond rapidly to changing trends could diminish brand and customer loyalty and impact our reputation with customers.

6

Additionally, the value of our reputation is based, in part, on subjective perceptions of the quality of our merchandise selections. Isolated incidents involving us or our merchandise that erode trust or confidence could adversely affect our reputation and our business, particularly if the incidents result in significant adverse publicity or governmental investigation or inquiry. Similarly, information posted about us, including our lines of exclusive brand merchandise, on the Internet, including social media platforms that allow individuals access to a wide audience of consumers and other interested persons, may adversely affect our reputation, even if the information is inaccurate.

Any significant damage to our brand or reputation could negatively impact sales, diminish customer trust and generate negative sentiment, any of which would harm our business and results of operation.

Risks associated with our private label merchandise program could adversely affect our business.

Our merchandise selections include our lines of exclusive brand merchandise, such as Antonio Melani, Gianni Bini, GB, Roundtree & Yorke and Daniel Cremieux. We expect to grow our private label merchandise program and have invested in our development and procurement resources and marketing efforts related to these exclusive brand offerings. The expansion of our private label merchandise subjects us to certain additional risks. These include, among others, risks related to: our failure to comply with government and industry safety standards; our ability to successfully protect our trademark and license portfolio and our other proprietary rights in our exclusive brands/private label merchandise program; and risks associated with overseas sourcing and manufacturing. In addition, damage to the reputation of our private label trade names may generate negative customer sentiment. Our failure to adequately address some or all of these risks could have a material adverse effect on our business, results of operations and financial condition.

Risks Related to Material Sourcing and Supply

Fluctuations in the price of merchandise, raw materials, fuel and labor or their reduced availability could increase our cost of goods and negatively impact our financial results.

Fluctuations in the price and availability of fuel, labor and raw materials as a result of inflation and other factors, combined with the inability to mitigate or to pass cost increases on to our customers or to change our merchandise mix as a result of such cost increases, could have an adverse impact on our profitability. Vendors and other suppliers of the Company may experience similar fluctuations, which may subject us to the effects of their price increases. For example, we have recently experienced significant inflation causing increases in fuel, materials and shipping costs. We may or may not be able to pass such costs along to our customers. Even when successful, attempts to pass such costs along to our customers might cause a decline in our sales volume. Additionally, any decrease in the availability of raw materials could impair our ability and the ability of our branded vendors to meet purchasing requirements in a timely manner. A decrease in domestic transportation capacity could impair our ability and the ability of our branded vendors to timely deliver merchandise to our distribution centers and stores. For instance, the United States is currently experiencing a shortage of truck drivers and trucks and truck parts, which may impact overall costs of transportation and the timely delivery of merchandise to our stores. Both the increased cost and lower availability of merchandise, raw materials, fuel and labor may also have an adverse impact on our cash and working capital needs.

Third party suppliers on whom we rely to obtain materials and provide production facilities and other third parties with whom we do business may experience financial difficulties due to current and future economic conditions, which may subject them to insolvency risk or may result in their inability or unwillingness to perform the obligations they owe us.

Our suppliers may experience financial difficulties due to a downturn in the industry or in other macroeconomic environments. Our suppliers’ cash and working capital needs can be adversely impacted by the increased cost and lower availability of merchandise, raw materials, fuel and labor as a result of inflation and other factors. Current and future economic conditions may prevent our suppliers from obtaining financing on favorable terms, which could impact their ability to supply us with merchandise on a timely basis.

We are also party to contractual and business relationships with various other parties, including vendors and service providers, pursuant to which such parties owe performance, payment and other obligations to us. In some cases, we depend upon such third parties to provide essential products, services or other benefits, such as advertising, software development and support, logistics and other goods and services necessary to operate our business. Economic, industry and market conditions could result in increased risks to us associated with the potential financial distress of such third parties.

If any of the third parties with which we do business become subject to insolvency, bankruptcy, receivership or similar proceedings, our rights and benefits in relation to, contractual and business relationships with such third parties could be terminated, modified in a manner adverse to us or otherwise materially impaired. There can be no assurances that we would be able to arrange for alternate or replacement contractual or business relationships on terms as favorable as our existing ones, if at all. Any inability on our part to do so could negatively affect our cash flows, financial condition and results of operations.

7

The Company and third-party suppliers on whom we rely source a significant portion of the merchandise we sell from foreign countries, which exposes us to certain risks that include political and economic conditions and supply chain disruptions.

Political discourse in the United States continues to focus on ways to discourage corporations in the United States from outsourcing manufacturing and production activities to foreign jurisdictions. Since 2018, the United States has imposed additional tariffs on certain items sourced from foreign countries, including China, and has modified, withdrawn from and renegotiated some of its trade agreements with foreign countries. While recent tariffs and modifications to trade agreements have not resulted in a material impact on our cash flows, financial condition and results of operations, any additional actions, if ultimately enacted, could negatively impact our ability and the ability of our third-party vendors and suppliers to source products from foreign jurisdictions and could lead to an increase in the cost of goods and adversely affect our profitability.

Other trade restrictions imposed by the United States Government, including increased tariffs or quotas, embargoes, safeguards, and customs restrictions against apparel items, as well as United States or foreign labor strikes, work stoppages, or boycotts, could increase the cost or reduce the supply of merchandise available to us or may require us to modify our current business practices, any of which could adversely affect our profitability. For example, beginning in Fiscal 2020, the United States Government took significant steps to address the forced labor concerns in the Xinjiang Uyghur Autonomous Region of China ("Xinjiang Region"), including withhold release orders (“WROs") issued by United States Customs and Border Protection (“CBP”). The WROs allow CBP to detain and deny entry of imports suspected of containing cotton from Xinjiang, regardless of the origin of the finished products. This affected global supply chains, including our own supply chains for cotton-containing products. In late Fiscal 2021, the United States Government enacted the Uyghur Forced Labor Prevention Act (“UFLPA”), which presumes goods produced in the Xinjiang Region, or with labor linked to specified Chinese government-sponsored labor programs, were produced using forced labor and prohibits importation of such goods into the United States absent clear and convincing evidence proving otherwise. Compliance with UFLPA could lead to an increase in the cost of goods and adversely affect our profitability.

Our timely receipt of merchandise in the United States is dependent on an efficient global supply chain. Disruptions in the supply chain could adversely impact our ability to obtain adequate inventory on a timely basis and result in lost sales, increased costs and an overall decrease in our profits. For example, many disruptions in the global transportation network have occurred in Fiscal 2020 and 2021 due to the impact of COVID-19 and other factors, including increased shipping costs resulting from increased demand for shipping capacity and the increased cost of fuel. The California ports of Los Angeles and Long Beach, which together handle a significant portion of United States merchandise imports including our own imports, have experienced and are expected to continue experiencing delays in processing imported merchandise, thereby resulting in untimely deliveries of merchandise and additional freight costs.

Moreover, our third-party suppliers in foreign jurisdictions are subject to political and economic uncertainty. As a result, we are subject to risks and uncertainties associated with changing economic and political conditions in foreign countries where our suppliers are located, including increased import duties, tariffs, trade restrictions and quotas; human rights concerns; working conditions and other labor rights and conditions; the environmental impact in foreign countries where merchandise is produced and raw materials or products are sourced; adverse foreign government regulations; wars, fears of war, terrorist attacks and organizing activities; inflation and adverse fluctuations of foreign currencies; and political unrest. We cannot predict when, or the extent to which, the countries in which our products are manufactured will experience any of the foregoing events. Any event causing a disruption or delay of imports from foreign locations would likely increase the cost or reduce the supply of merchandise available to us and would adversely affect our operating results.

Failure by third party suppliers to comply with our supplier compliance programs or applicable laws could have a material adverse effect on our business.

All of our suppliers must comply with our supplier compliance programs and applicable laws, including consumer and product safety laws, but we do not control our vendors or their labor and business practices. The violation of labor or other laws by one or more of our vendors could have an adverse effect on our business. Additionally, although we diversify our sourcing and production, the failure of any supplier to produce and deliver our goods on time, to meet our quality standards and adhere to our product safety requirements or to meet the requirements of our supplier compliance program or applicable laws, could impact our ability to flow merchandise to our stores or directly to consumers in the right quantities at the right time, which could adversely affect our profitability and could result in damage to our reputation and translate into sales losses.

8

Risks Related to our Long-Term Marketing and Servicing Alliance

Reductions in the income and cash flow from our long-term marketing and servicing alliance related to the private label credit cards could impact operating results and cash flows.

Wells Fargo owns and manages the private label credit cards under the Wells Fargo Alliance. The Wells Fargo Alliance provides for certain payments to be made by Wells Fargo to the Company, including the Company's share of earnings under this alliance. The income and cash flow that the Company receives from the Wells Fargo Alliance is dependent upon a number of factors including the level of sales on Wells Fargo accounts, the level of balances carried on the Wells Fargo accounts by Wells Fargo customers, payment rates on Wells Fargo accounts, finance charge rates and other fees on Wells Fargo accounts, the level of credit losses for the Wells Fargo accounts, Wells Fargo's ability to extend credit to our customers as well as the cost of customer rewards programs, all of which can vary based on changes in federal and state banking and consumer protection laws and from a variety of economic, legal, social and other factors that we cannot control. If the income or cash flow that the Company receives from the Wells Fargo Alliance decreases, our operating results and cash flows could be adversely affected.

Credit card operations are subject to numerous federal and state laws that impose disclosure and other requirements upon the origination, servicing, and enforcement of credit accounts, and limitations on the amount of finance charges and fees that may be charged by a credit card provider. Wells Fargo may be subject to regulations that may adversely impact its operation of the private label credit card. To the extent that such limitations or regulations materially limit the availability of credit or increase the cost of credit to the cardholders or negatively impact provisions which affect our earnings associated with the private label credit card, our results of operations could be adversely affected. In addition, changes in credit card use, payment patterns, or default rates could be affected by a variety of economic, legal, social, or other factors over which we have no control and cannot predict with certainty. Such changes could also negatively impact Wells Fargo's ability to facilitate consumer credit or increase the cost of credit to the cardholders.

The Wells Fargo Alliance expires in November 2024. If, when the Wells Fargo Alliance expires, Wells Fargo is unable or unwilling to renew and continue owning and managing our proprietary credit cards on similar terms and conditions as exist today or we are unable to quickly and adequately contract with a comparable replacement vendor, then our operating results and cash flows could be adversely affected due to a decrease in private label credit card sales to our cardholding customers and a loss of revenues attributable to payments from Wells Fargo.

We are subject to customer payment-related risks that could increase our operating costs, expose us to fraud or theft, subject us to potential liability and potentially disrupt our business operations.

We accept payments using a variety of methods, including cash, checks, debit cards, credit cards (including the private label credit cards), gift cards and other alternative payment channels. As a result, we are subject to rules, regulations, contractual obligations and compliance requirements, including payment network rules and operating guidelines, data security standards and certification requirements, and rules governing electronic funds transfers. The payment methods that we offer also subject us to potential fraud and theft by persons who seek to obtain unauthorized access to or exploit any weaknesses that may exist in the payment systems.

The regulatory environment related to information security and privacy is increasingly rigorous, with new and constantly changing requirements applicable to our business, and compliance with those requirements could result in additional costs or accelerate these costs. For certain payment methods, including credit and debit cards, we pay interchange and other fees, which could increase over time and raise our operating costs. We rely on third parties to provide payment processing services, including the processing of credit cards, debit cards, and other forms of electronic payment. If these companies become unable to provide these services to us, or if their systems are compromised, it could disrupt our business.

Risks Related to Information Technology and Information Security Risks

A significant disruption in our information technology systems and network and our inability to adequately maintain and update those systems could materially adversely affect our operations and financial condition.

Our operations are largely dependent upon the integrity, security and consistent operation of various systems and data centers, including the point-of-sale systems in the stores, our Internet website, data centers that process transactions, communication systems and various software applications used throughout our Company to order merchandise, track inventory flow, process transactions and generate performance and financial reports.

Our information technology systems are also subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyberattacks and ransomware attacks, usage errors by our employees and other items discussed previously in Item 1A, catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes and acts of war or terrorism. We rely on third-party service providers to provide hardware, software and services necessary to operate our

9

information technology systems. Outages, failures, viruses, attacks, catastrophic events, acts of war or terrorism, and usage errors by third-party service providers (or their vendors) could also affect our information technology systems. If our information technology systems are damaged or cease to function properly, we may have to make a significant investment to repair or replace them, and we may suffer loss of critical data and interruptions or delays in our operations in the interim, which could adversely affect our business and operating results.

Additionally, to keep pace with changing technology, we must continuously provide for the design and implementation of new information technology systems and enhancements of our existing systems. We could encounter difficulties in developing new systems or maintaining and upgrading existing systems. Such difficulties could lead to significant expenses or to losses due to disruption in our business.

Any failure to maintain the security of the information related to our Company, customers, employees and vendors or the information technology systems on which we rely for our operations could adversely affect our operations, damage our reputation, result in litigation or other legal actions against us, increase our operating costs and materially adversely affect our business and operating results.

We receive and store certain personal information about our employees and our customers, including information permitting cashless payments, both in our stores and through our online operations at dillards.com. In addition, our operations depend upon the secure transmission of confidential information over public networks. Further, our ability to supply merchandise to and operate our stores, process transactions and generate performance and financial reports are largely dependent on the security and integrity of our information technology network.

We, like other companies, face a risk of unauthorized access to devices and technology assets, as well as computer viruses, worms, bot attacks, ransomware and other destructive or disruptive software and attempts to misappropriate customer or employee information and cause system failures and disruptions. Such events can result in theft, alteration, deletion or encryption of data, or disruption of services provided by the devices and assets, as well as demands to pay a third party to regain access to encrypted files and prevent publication of stolen data. In addition, employee error, malfeasance or security lapses could result in exposure of confidential information or otherwise adversely disrupt or affect our operations. We rely on third-party service providers to provide hardware, software and services necessary to operate our information technology systems, and the same issues could occur at those third parties and have an effect on our operational technology or data. Such attacks, if successful, have the potential for creating a loss of sales, business disruption, reputational impact, litigation, liability to consumers, regulatory investigations, or otherwise adversely affect our ability to operate our business.

We have a longstanding Information Security program committed to regular risk assessment and risk mitigation practices surrounding the protection of confidential data and our information technology systems and network. Our security controls include network segmentation, firewalls, identity and access controls, endpoint protection solutions, as well as specific measures like point-to-point encryption and tokenization solutions for payment card data. We also maintain data breach preparedness plans, conduct exercises to test response plans, and employ other methods to protect our data and networks, and promote security awareness. Our Senior Management and Board of Directors exercise oversight of our security measures through various methods, including participation in response preparedness discussions and discussions regarding assessments, expenditures related to security and security controls.

It is possible that unauthorized persons might defeat our security measures, those of third-party service providers or vendors, and obtain personal information of customers, employees or others, or compromise our information technology systems. A breach, whether in our information technology systems or those of our third-party service providers or vendors, resulting in personal information being obtained by or exposed to unauthorized persons, could adversely affect our operations, results of operations, financial condition and liquidity, and could result in litigation against us or the imposition of penalties. Our reputation and our ability to attract new customers could be adversely impacted if we fail, or are perceived to have failed, to properly prevent and respond to these incidents. In addition, a security breach could require that we expend significant additional resources related to our information security systems and could result in a disruption of our operations, particularly our online sales operations. A ransomware attack may also result in exposure to business interruption and lost sales, ransom payments, costs associated with recovery of data and replacement of systems, exposure to customer and employee litigation from disclosure of confidential information, fines and penalties.

A security breach also could result in a violation attributable to the Company of applicable privacy and other laws, and subject us to litigation by private customers, business partners, or securities litigation and regulatory investigations and proceedings, any of which could result in our exposure to civil or criminal liability. The regulatory environment surrounding information security, cybersecurity, and privacy is increasingly demanding, with new and changing requirements, such as the California Consumer Privacy Act. Security breaches, cyber incidents or allegations that we used personal information in violation of applicable privacy and other laws could result in significant legal and financial exposure.

10

Legal and Compliance Risks

Litigation with customers, employees and others could harm our reputation and impact operating results.

In the ordinary course of business, we may be involved in lawsuits and regulatory actions. We are impacted by trends in litigation, including, but not limited to, class-action allegations brought under various consumer protection, employment and privacy and information security laws. Additionally, we may be subject to employment-related claims alleging discrimination, harassment, wrongful termination and wage issues, including those relating to overtime compensation. We are susceptible to claims filed by customers alleging responsibility for injury suffered during a visit to a store or from product defects and to lawsuits filed by patent holders alleging patent infringement. We are also subject to claims filed under our employee stock ownership plan alleging failure to properly manage the plan. These types of claims, as well as other types of lawsuits to which we are subject from time to time, can distract management's attention from core business operations and impact operating results, particularly if a lawsuit results in an unfavorable outcome.

Risks Related to Construction Operations

The cost-to-cost method of accounting that we use to recognize contract revenues for our construction segment may result in material adjustments, which could result in a credit or a charge against our earnings.

Our construction segment recognizes contract revenues based on the cost-to-cost method. Under this method, estimated contract revenues are measured based on the ratio of costs incurred to total estimated contract costs. Estimated contract losses are recognized in full when determined. Total contract revenues and cost estimates are reviewed and revised at a minimum on a quarterly basis as the work progresses and as change orders are approved. Adjustments are reflected in contract revenues in the period when these estimates are revised. To the extent that these adjustments result in an increase, a reduction or an elimination of previously reported contract profit, we are required to recognize a credit or a charge against current earnings, which could be material.

Risks Related to Employees

The Company depends on its ability to attract and retain quality employees, and failure to do so could adversely affect our ability to execute our business strategy and our operating results.

The Company's business is dependent upon attracting and retaining quality employees. The Company has a large number of employees, many of whom are in positions with historically high rates of turnover. The Company's ability to meet its labor needs while controlling the costs associated with hiring and training new employees is subject to external factors such as unemployment levels, changing demographics, prevailing wage rates and current or future minimum wage and healthcare reform legislation. In addition, as a complex enterprise operating in a highly competitive and challenging business environment, the Company is highly dependent upon management personnel to develop and effectively execute successful business strategies and tactics. Any circumstances that adversely impact the Company's ability to attract, train, develop and retain quality employees throughout the organization could adversely affect the Company's business and results of operations.

Increases in employee wages and the cost of employee benefits could impact the Company’s financial results and cash flows.

The Company’s expenses relating to employee wages and health benefits are significant. Increases in employee wages, including the minimum wage, or unfavorable changes in the cost of healthcare benefits could impact the Company’s financial results and cash flows. Healthcare costs have risen significantly in recent years, and recent legislative and private sector initiatives regarding healthcare reform have resulted and could continue to result in significant changes to the U.S. healthcare system. Due to the breadth and complexity of the U.S. healthcare system, and uncertainty regarding legislative or regulatory changes, the Company is not able to fully determine the impact that future healthcare reform will have on our company sponsored medical plans.

11

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

All of our stores are owned by us or leased from third parties. At January 29, 2022, we operated 280 stores in 29 states totaling approximately 47.7 million square feet of which we owned approximately 43.4 million square feet. Our third-party store leases typically provide for rental payments based on a percentage of net sales with a guaranteed minimum annual rent. In general, the Company pays the cost of insurance, maintenance and real estate taxes related to the leases.

The following table summarizes by state of operation the number of retail stores we operate and the corresponding owned and leased footprint at January 29, 2022:

| Location | Number of stores | Owned Stores | Leased Stores | Owned Building on Leased Land | Partially Owned and Partially Leased | ||||||||||||||||||||||||

| Alabama | 9 | 9 | — | — | — | ||||||||||||||||||||||||

| Arkansas | 8 | 8 | — | — | — | ||||||||||||||||||||||||

| Arizona | 15 | 14 | — | 1 | — | ||||||||||||||||||||||||

| California | 3 | 3 | — | — | — | ||||||||||||||||||||||||

| Colorado | 8 | 8 | — | — | — | ||||||||||||||||||||||||

| Florida | 42 | 38 | 2 | 2 | — | ||||||||||||||||||||||||

| Georgia | 12 | 9 | 3 | — | — | ||||||||||||||||||||||||

| Iowa | 3 | 3 | — | — | — | ||||||||||||||||||||||||

| Idaho | 2 | 2 | — | — | — | ||||||||||||||||||||||||

| Illinois | 3 | 3 | — | — | — | ||||||||||||||||||||||||

| Indiana | 3 | 3 | — | — | — | ||||||||||||||||||||||||

| Kansas | 5 | 3 | — | 2 | — | ||||||||||||||||||||||||

| Kentucky | 6 | 5 | 1 | — | — | ||||||||||||||||||||||||

| Louisiana | 14 | 13 | 1 | — | — | ||||||||||||||||||||||||

| Missouri | 9 | 6 | 1 | 2 | — | ||||||||||||||||||||||||

| Mississippi | 6 | 4 | 1 | 1 | — | ||||||||||||||||||||||||

| Montana | 2 | 2 | — | — | — | ||||||||||||||||||||||||

| North Carolina | 13 | 13 | — | — | — | ||||||||||||||||||||||||

| Nebraska | 3 | 2 | 1 | — | — | ||||||||||||||||||||||||

| New Mexico | 5 | 3 | 2 | — | — | ||||||||||||||||||||||||

| Nevada | 5 | 5 | — | — | — | ||||||||||||||||||||||||

| Ohio | 12 | 10 | 2 | — | — | ||||||||||||||||||||||||

| Oklahoma | 7 | 6 | 1 | — | — | ||||||||||||||||||||||||

| South Carolina | 7 | 7 | — | — | — | ||||||||||||||||||||||||

| Tennessee | 10 | 9 | 1 | — | — | ||||||||||||||||||||||||

| Texas | 56 | 46 | 6 | — | 4 | ||||||||||||||||||||||||

| Utah | 5 | 5 | — | — | — | ||||||||||||||||||||||||

| Virginia | 6 | 5 | — | 1 | — | ||||||||||||||||||||||||

| Wyoming | 1 | 1 | — | — | — | ||||||||||||||||||||||||

| Total | 280 | 245 | 22 | 9 | 4 | ||||||||||||||||||||||||

12

At January 29, 2022, we operated the following additional facilities:

| Facility | Location | Square Feet | Owned / Leased | ||||||||||||||

| Distribution Centers: | Mabelvale, Arkansas | 400,000 | Owned | ||||||||||||||

| Gilbert, Arizona | 295,000 | Owned | |||||||||||||||

| Valdosta, Georgia | 370,000 | Owned | |||||||||||||||

| Olathe, Kansas | 500,000 | Owned | |||||||||||||||

| Salisbury, North Carolina | 355,000 | Owned | |||||||||||||||

| Ft. Worth, Texas | 700,000 | Owned | |||||||||||||||

| Internet Fulfillment Center | Maumelle, Arkansas | 850,000 | Owned | ||||||||||||||

| Dillard's Executive Offices | Little Rock, Arkansas | 333,000 | Owned | ||||||||||||||

| CDI Contractors, LLC Executive Office | Little Rock, Arkansas | 25,000 | Owned | ||||||||||||||

| CDI Storage Facilities | Maumelle, Arkansas | 66,000 | Owned | ||||||||||||||

| Total | 3,894,000 | ||||||||||||||||

Additional property information is contained in Notes 1, 12, 13 and 14 in the "Notes to Consolidated Financial Statements," in Item 8 hereof.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, the Company is involved in litigation relating to claims arising out of the Company's operations in the normal course of business. This may include litigation with customers, employment related lawsuits, class action lawsuits, purported class action lawsuits and actions brought by governmental authorities. As of March 29, 2022, neither the Company nor any of its subsidiaries is a party to, nor is any of their property the subject of, any material legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

13

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table lists the names and ages of all executive officers of the Company, the nature of any family relationship between them and the Company's CEO and all positions and offices with the Company presently held by each person named. Each is elected to serve a one-year term. There are no other persons chosen to become executive officers.

| Name | Age | Position & Office | Held Present Office Since | Family Relationship to CEO | ||||||||||||||||||||||

| William Dillard, II | 77 | Director; Chief Executive Officer | 1998 | Not applicable | ||||||||||||||||||||||

| Alex Dillard | 72 | Director; President | 1998 | Brother of William Dillard, II | ||||||||||||||||||||||

| Mike Dillard | 70 | Director; Executive Vice President | 1984 | Brother of William Dillard, II | ||||||||||||||||||||||

| Drue Matheny | 75 | Director; Executive Vice President | 1998 | Sister of William Dillard, II | ||||||||||||||||||||||

| William Dillard, III | 51 | Director; Senior Vice President | 2015 | Son of William Dillard, II | ||||||||||||||||||||||

| Denise Mahaffy | 64 | Director; Senior Vice President | 2015 | Sister of William Dillard, II | ||||||||||||||||||||||

| Chris B. Johnson | 50 | Senior Vice President; Co-Principal Financial Officer | 2015 | None | ||||||||||||||||||||||

| Phillip R. Watts | 59 | Senior Vice President; Co-Principal Financial Officer and Principal Accounting Officer | 2015 | None | ||||||||||||||||||||||

| Tony Bolte (1) | 63 | Senior Vice President | 2021 | None | ||||||||||||||||||||||

| Dean L. Worley | 56 | Vice President; General Counsel | 2012 | None | ||||||||||||||||||||||

| Brant Musgrave | 49 | Vice President | 2014 | None | ||||||||||||||||||||||

| Mike Litchford | 56 | Vice President | 2016 | None | ||||||||||||||||||||||

| Tom Bolin | 59 | Vice President | 2016 | None | ||||||||||||||||||||||

| Annemarie Jazic (2) | 38 | Vice President | 2017 | Niece of William Dillard, II | ||||||||||||||||||||||

| Alexandra Lucie (3) | 38 | Vice President | 2017 | Niece of William Dillard, II | ||||||||||||||||||||||

| James D. Stockman (4) | 65 | Vice President | 2017 | None | ||||||||||||||||||||||

_______________________________________________________________________________

(1) Mr. Bolte served as Vice President of Logistics from 2007 to 2017. In 2017, he was promoted to Vice President of Information Technology and Logistics. In 2021, he was promoted to Senior Vice President of Information Technology and Logistics.

(2) Mrs. Jazic served as Director of Contemporary Sportswear from 2006 to 2013 and Director of Online Experience from 2013 to 2017. In 2017, she was promoted to Vice President of Online Experience.

(3) Mrs. Lucie served as a Divisional Merchandise Manager of Ladies', Juniors' and Children's Exclusive Brands from 2010 to 2014 and served as a General Merchandise Manager of Ladies', Juniors' and Children's Exclusive Brands from 2014 to 2017. In 2017, she was promoted to Corporate Vice President of Ladies', Juniors' and Children's Exclusive Brands.

(4) Mr. Stockman served as General Merchandise Manager of Exclusive Brands from 2004 to 2017. In 2017, he was promoted to Corporate Vice President of Ladies' Apparel.

14

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market and Dividend Information for Common Stock

The Company's Class A Common Stock trades on the New York Stock Exchange under the Ticker Symbol "DDS". No public market currently exists for the Company's Class B Common Stock.

While the Company currently expects to continue paying quarterly cash dividends during fiscal 2022, all prospective dividends are subject to and conditional upon the review and approval of and declaration by the Board of Directors.

Stockholders

As of February 26, 2022, there were 2,229 holders of record of the Company's Class A Common Stock and 4 holders of record of the Company's Class B Common Stock.

Repurchase of Common Stock

| Issuer Purchases of Equity Securities | ||||||||||||||||||||||||||

| Period | (a) Total Number of Shares Purchased(1) | (b) Average Price Paid per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||||||||||||

| October 31, 2021 through November 27, 2021 | — | $ | — | — | $ | 262,859,316 | ||||||||||||||||||||

| November 28, 2021 through January 1, 2022 | 66,546 | 248.28 | 66,546 | 246,337,105 | ||||||||||||||||||||||

| January 2, 2022 through January 29, 2022 | 548,602 | 244.83 | 548,602 | 112,022,064 | ||||||||||||||||||||||

| Total | 615,148 | $ | 245.20 | 615,148 | $ | 112,022,064 | ||||||||||||||||||||

(1) The total number of shares purchased consists of shares purchased under the Board of Directors' authorized repurchase plan described below.

In May 2021, the Company's Board of Directors authorized the repurchase of up to $500 million of the Company's Class A Common Stock under an open-ended stock repurchase plan ("May 2021 Stock Plan"). This repurchase plan permits the Company to repurchase its Class A Common Stock in the open market, pursuant to preset trading plans meeting the requirements of Rule 10b5-1 under the Exchange Act or through privately negotiated transactions. The repurchase plan has no expiration date. There was $112.0 million in remaining availability pursuant to the May 2021 Stock Plan as of January 29 , 2022

On February 24, 2022, the Company announced that the Company's Board of Directors approved a new stock repurchase program authorizing the Company to repurchase up to $500 million of its Class A Common Stock. The repurchase plan has no expiration date.

Reference is made to the discussion in Note 9 in the "Notes to Consolidated Financial Statements" in Item 8 of this Annual Report, which information is incorporated by reference herein.

Securities Authorized for Issuance under Equity Compensation Plans

The information concerning the Company's equity compensation plans is incorporated herein by reference from Item 12 of this Annual Report under the heading "Equity Compensation Plan Information".

15

Company Performance

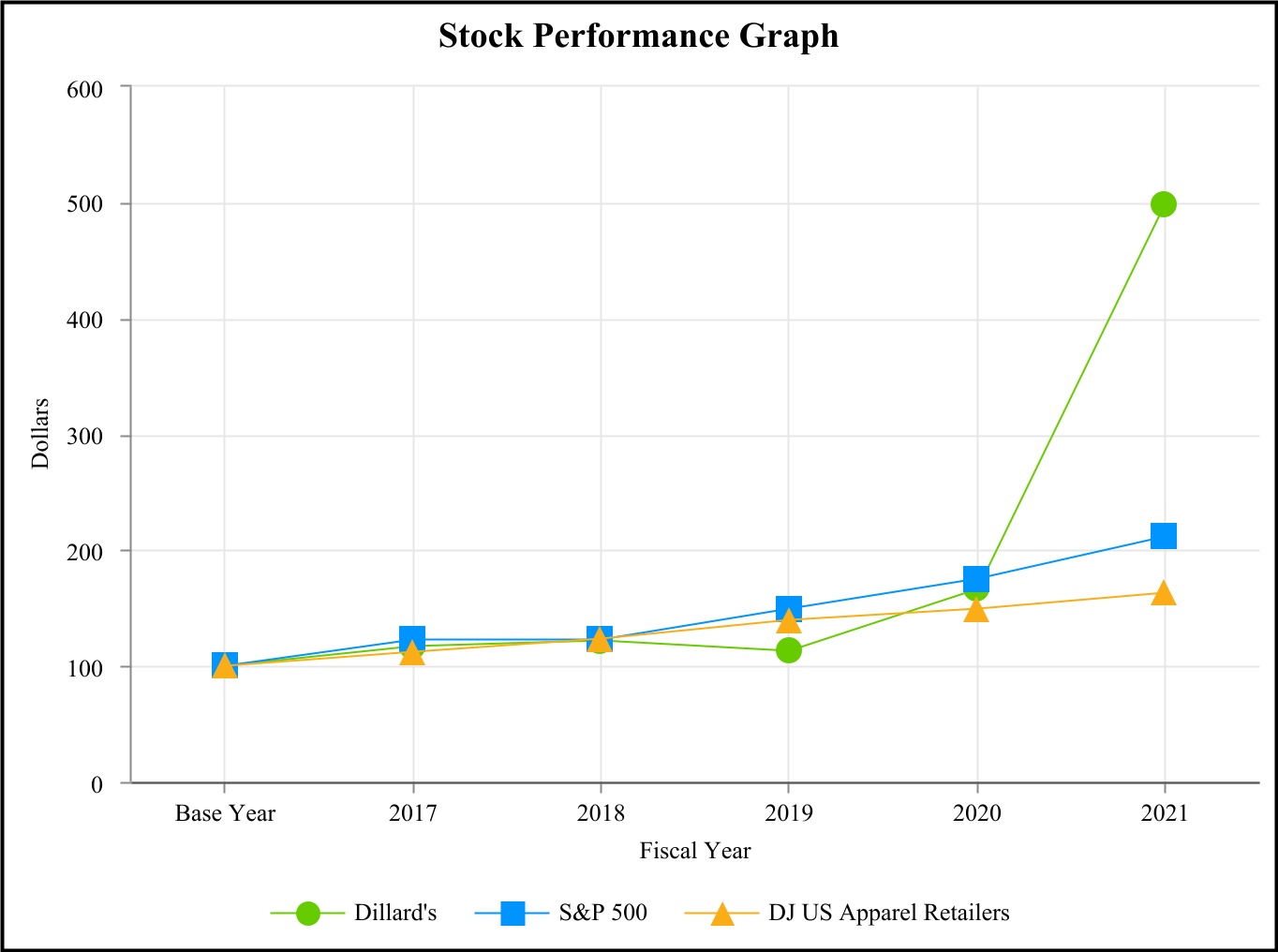

The graph below compares the cumulative total returns on the Company's Class A Common Stock, the Standard & Poor's 500 Index and the Dow Jones U.S. Apparel Retailers Index for each of the last five fiscal years to the extent available. The cumulative total return assumes $100 invested in the Company's Class A Common Stock and each of the indices at market close on January 27, 2017 (the last trading day prior to the start of fiscal 2017) and assumes reinvestment of dividends.

The table below the graph shows the dollar value of the respective $100 investments, with the assumptions noted above, in each of the Company's Class A Common Stock, the Standard & Poor's 500 Index and the Dow Jones U.S. Apparel Retailers Index as of the last day of each of the Company's last five fiscal years.

| 2017 | 2018 | 2019 | 2020 | 2021 | |||||||||||||||||||||||||

| Dillard's, Inc. | $ | 117.22 | $ | 121.40 | $ | 113.19 | $ | 166.36 | $ | 498.61 | |||||||||||||||||||

| S&P 500 | 122.83 | 122.76 | 149.23 | 174.97 | 211.71 | ||||||||||||||||||||||||

| DJ US Apparel Retailers | 111.79 | 123.61 | 139.67 | 149.32 | 163.30 | ||||||||||||||||||||||||

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Dillard's, Inc. operates 280 retail department stores spanning 29 states and an Internet store. The Company also operates a general contracting construction company, CDI, a portion of whose business includes constructing and remodeling stores for the Company, which is a reportable segment separate from our retail operations.

In accordance with the National Retail Federation fiscal reporting calendar and our bylaws, the Company's fiscal year ends on the Saturday nearest January 31 of each year. Fiscal 2021, 2020 and 2019 ended on January 29, 2022, January 30, 2021 and February 1, 2020, respectively, and contained 52 weeks each.

A discussion regarding results of operations and analysis of financial condition for the year ended January 30, 2021, as compared to the year ended February 1, 2020 is included in Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended January 30, 2021.

Due to the significant impact of COVID-19 on prior year figures, the information that follows will include certain comparisons to 2019 to provide additional context.

EXECUTIVE OVERVIEW

Fiscal 2021

In March 2020, the World Health Organization declared the outbreak of a novel coronavirus (COVID-19) as a pandemic, which continues to impact the United States and global economies. The COVID-19 pandemic has had a significant impact on the Company's business, results of operations and financial position. The Company began closing stores on March 19, 2020 as mandated by state and local governments, and by April 9, 2020, all of the Company's brick-and-mortar store locations were temporarily closed to the public. Our eCommerce capabilities allowed us to use our closed store locations (with limited staffing) to fill orders from our Internet store.

During the month ended May 30, 2020 (fiscal May), we re-opened most of our full-line stores, and by June 2, 2020 all Dillard's store locations had been re-opened. All stores remained open throughout the fiscal year ended January 29, 2022, although operating at reduced hours compared to fiscal 2019.

Our results for fiscal 2021 improved significantly over fiscal 2020 and 2019. Beginning in the first quarter of 2021, as COVID-19 vaccines were rolled out, stimulus checks were released and warmer weather arrived, we began to experience improving sales, with momentum continuing throughout the year. Total retail sales increased 53% compared to fiscal 2020. The Company is not reporting comparable store retail sales for the 2021 fiscal year compared to fiscal 2020 due to the aforementioned COVID-19 store closures during the first half of fiscal 2020. Compared to fiscal 2019, comparable store retail sales increased 8%.

Gross margin improved significantly in fiscal 2021 compared to fiscal 2020 and 2019 primarily as a result of stronger consumer demand combined with our continued efforts to control inventory. Both factors resulted in less promotional activity and decreased markdowns compared to fiscal 2020 and 2019. Consolidated gross margin improved to a record 42.3% of sales during fiscal 2021 from 28.6% of sales in fiscal 2020. Retail gross margin for fiscal 2021 improved to a record 42.9% of sales from 29.4% of sales and 32.6% of sales for fiscal 2020 and 2019, respectively. Inventory at January 29, 2022 decreased 1% compared to January 30, 2021.

Consolidated selling, general and administrative (“SG&A”) expenses for fiscal 2021 increased to $1,536.6 million compared to $1,211.5 million for fiscal 2020. The increase of $325.1 million is primarily a result of COVID-19 related disruption in fiscal 2020 marked by temporary store closures and SG&A expense saving measures. Improved sales during 2021 provided support for the increased SG&A expenses which decreased approximately 450 basis points to 23.7% of sales from 28.2% of sales in fiscal 2020. Compared to fiscal 2019, consolidated SG&A expenses decreased $154.5 million to $1,536.6 million from $1,691.0 million, improving approximately 360 basis points of sales. The decrease is primarily due to decreased payroll and payroll-related taxes as we operated with reduced hours and fewer associates during fiscal 2021 compared to fiscal 2019.

Dillard's reported record net income for fiscal 2021 of $862.5 million ($41.88 per share) compared to a net loss of $71.7 million ($3.16 per share) for fiscal 2020.

Included in net income for fiscal 2021 is a pretax gain of $24.7 million ($19.5 million after tax or $0.95 per share) primarily related to the sale of three store properties and a net tax benefit of $18.0 million ($0.88 per share) due to the deduction related to that portion of a special dividend of $15 per share that was paid to the Dillard's, Inc. Investment and Employee Stock Ownership Plan during the year.

17

Included in the net loss for fiscal 2020 is a pretax loss of $2.2 million ($1.4 million after tax or $0.06 per share) primarily related to the sale of a store property and $10.7 million ($8.4 million after tax or $0.37 per share) in asset impairment charges. Also included in the net loss for fiscal 2020 is a net tax benefit of $45.2 million ($1.99 per share) related to The Coronavirus Aid, Relief and Economic Security ("CARES") Act.

We reported record cash flow provided by operations for fiscal 2021 of $1,280.0 million compared to $252.9 million for fiscal 2020. During fiscal 2021, we purchased $561.1 million (approximately 3.2 million shares) of Class A Common Stock under our share repurchase programs. As of January 29, 2022, authorization of $112.0 million remained under the May 2021 Stock Plan. During fiscal 2021, we paid $305.2 million in dividends including a special dividend of $15 per share in December of 2021. On February 24, 2022, we announced a new $500 million share repurchase program.

As of January 29, 2022, we had working capital of $948.5 million (including cash and cash equivalents of $716.8 million) and $566.0 million of total debt outstanding, excluding operating lease liabilities, and including one scheduled debt maturity of $44.8 million at the end of fiscal 2022.

Key Performance Indicators

We use a number of key indicators of financial condition and operating performance to evaluate our business, including the following:

| Fiscal 2021 | Fiscal 2020 | Fiscal 2019 | ||||||||||||||||||

| Net sales (in millions) | $ | 6,493.0 | $ | 4,300.9 | $ | 6,203.5 | ||||||||||||||

| Gross margin (in millions) | $ | 2,745.3 | $ | 1,231.8 | $ | 1,967.5 | ||||||||||||||

| Gross margin as a percentage of net sales | 42.3 | % | 28.6 | % | 31.7 | % | ||||||||||||||

| Retail gross margin as a percentage of retail net sales | 42.9 | % | 29.4 | % | 32.6 | % | ||||||||||||||