Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under §240.14a-12 |

Diebold Nixdorf, Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check all boxes that apply):

| ☑ | No fee required. | |||

|

☐ |

Fee paid previously with preliminary materials. | |||

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

Table of Contents

Table of Contents

50 Executive Pkwy

P.O. Box 2520 • Hudson, Ohio 44236

March 24, 2022

Dear Shareholder:

The 2022 Annual Meeting of Shareholders of Diebold Nixdorf, Incorporated will be held on Friday, May 6, 2022 at 8:00 a.m. EDT. We are pleased to utilize a virtual format for our Annual Meeting again this year in order to provide a consistent experience to all shareholders regardless of location. You will be able to attend and vote at the 2022 Annual Meeting via live webcast by visiting www.proxydocs.com/DBD.

As described in the accompanying Notice and Proxy Statement, at the Annual Meeting, you will be asked to (1) elect twelve directors, (2) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022, (3) approve, on an advisory basis, named executive officer compensation, and (4) approve an amendment to the Diebold Nixdorf, Incorporated 2017 Equity and Performance Incentive Plan.

We are pleased to continue to take advantage of the Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our Annual Meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our 2022 Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021, and to vote online or by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials on the Notice of Internet Availability of Proxy Materials.

All holders of record of Diebold Nixdorf, Incorporated common shares at the close of business on March 8, 2022 are entitled to vote at the 2022 Annual Meeting. You may vote online prior to the meeting at www.proxydocs.com/DBD. If you received a paper copy of the proxy card by mail, you may also vote by signing, dating and mailing the proxy card promptly in the return envelope or by calling a toll-free number.

Details regarding how to attend the virtual meeting online are more fully described in the Proxy Statement. If you are unable to attend the meeting, you may listen to a replay that will be available on our investor relations website at investors.dieboldnixdorf.com. The replay may be accessed on our website soon after the meeting and shall remain available for up to three months.

We look forward to you joining us at the virtual meeting.

Sincerely,

|

GARY G. GREENFIELD

Chairman of the Board

|

|

OCTAVIO MARQUEZ

President and Chief Executive Officer

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on May 6, 2022.

This Proxy Statement, along with our Annual Report on Form 10-K for the year ended December 31, 2021, including exhibits,

are available free of charge at www.proxydocs.com/DBD (you will need to reference the 12-digit control number

found on your proxy card or Notice of Internet Availability of Proxy Materials in order to vote).

Table of Contents

50 Executive Pkwy

P.O. Box 2520 • Hudson, Ohio 44236

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

|

DATE: May 6, 2022

TIME: 8:00 a.m. EDT

LOCATION: Virtual Shareholders Meeting www.proxydocs.com/DBD |

ITEMS TO BE DISCUSSED:

| |||||

| 1. |

To elect twelve directors; | |||||

| 2. |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022; | |||||

| 3. |

To approve, on an advisory basis, named executive officer compensation; and | |||||

| 4. |

To approve an amendment to the Diebold Nixdorf, Incorporated 2017 Equity and Performance Incentive Plan.

| |||||

Your attention is directed to the attached Proxy Statement, which fully describes these items.

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Holders of record of Diebold Nixdorf, Incorporated common shares at the close of business on March 8, 2022 will be entitled to vote at the 2022 Annual Meeting.

The enclosed proxy card is solicited, and the persons named therein have been designated, by Diebold Nixdorf’s Board of Directors.

| By Order of the Board of Directors

| ||

|

JONATHAN B. LEIKEN Executive Vice President, Chief Legal Officer and Corporate Secretary |

March 24, 2022

(approximate mailing date)

You are requested to cooperate in assuring a quorum by voting online at www.proxypush.com/DBD

or, if you received a paper copy of the proxy materials, by filling in, signing and dating the

enclosed proxy and promptly mailing it in the return envelope.

Table of Contents

DIEBOLD NIXDORF, INCORPORATED

50 Executive Pkwy

P.O. Box 2520 • Hudson, Ohio 44236

PROXY STATEMENT

2022 ANNUAL MEETING OF SHAREHOLDERS

The full text of the 2017 Equity and Performance Incentive Plan, as proposed to be amended to reflect the changes described in this Proxy Statement, is attached as Appendix A to this Proxy Statement.

| PROXY SUMMARY | 1 | |||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| VOTING INFORMATION | 5 | |||

| CORPORATE GOVERNANCE | 7 | |||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| People and Compensation Committee Interlocks and Insider Participation |

13 | |||

| 13 | ||||

| 13 | ||||

| COMPENSATION OF DIRECTORS | 18 | |||

| 19 | ||||

| 20 | ||||

| IDENTIFYING AND EVALUATING DIRECTOR NOMINEES | 21 | |||

| 22 | ||||

| 23 | ||||

|

2022 PROXY STATEMENT | | i |

Table of Contents

|

TABLE OF CONTENTS

|

| 45 | ||||

| 45 | ||||

| Existing Plan Benefits to Named Executive Officers and Others |

45 | |||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| EXECUTIVE COMPENSATION MATTERS | 49 | |||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 56 | ||||

| 58 | ||||

| 66 | ||||

| 66 | ||||

| 68 | ||||

| ii | | 2022 PROXY STATEMENT |

|

Table of Contents

This Proxy Statement is furnished to shareholders of Diebold Nixdorf, Incorporated (“Diebold Nixdorf,” the “Company,” “we,” “our,” and “us”) in connection with the solicitation by the Board of Directors of proxies to be used at our 2022 Annual Meeting of Shareholders, and any postponements or adjournments of the meeting.

These proxy materials are being sent to our shareholders on or about March 24, 2022.

This proxy summary is intended to provide an overview of the information you can find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the Proxy Statement in its entirety for more information about these topics before voting.

|

TIME AND DATE

8:00 a.m. EDT, May 6, 2022 |

PLACE

Virtual Meeting www.proxydocs.com/DBD

|

RECORD DATE

Close of Business on March 8, 2022 |

||||||||||||||||||

PROPOSALS FOR YOUR VOTE AND BOARD RECOMMENDATIONS

| PROPOSAL |

|

BOARD RECOMMENDATION | PAGE REFERENCES (FOR MORE DETAIL) |

|||||

| 1. To elect twelve directors |

|

FOR EACH BOARD NOMINEE |

24 | |||||

| 2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm |

|

FOR | 34 | |||||

| 3. To approve, on an advisory basis, named executive officer compensation |

|

FOR | 36 | |||||

| 4. To approve an amendment to the Diebold Nixdorf, Incorporated 2017 Equity and Performance Incentive Plan |

|

FOR | 37 | |||||

Information on voting mechanics, approval requirements and related matters can be found in the “Voting Information” and “Other Matters” sections starting on pages 5 and 87, respectively.

|

2022 PROXY STATEMENT | | 1 |

Table of Contents

|

PROXY SUMMARY

|

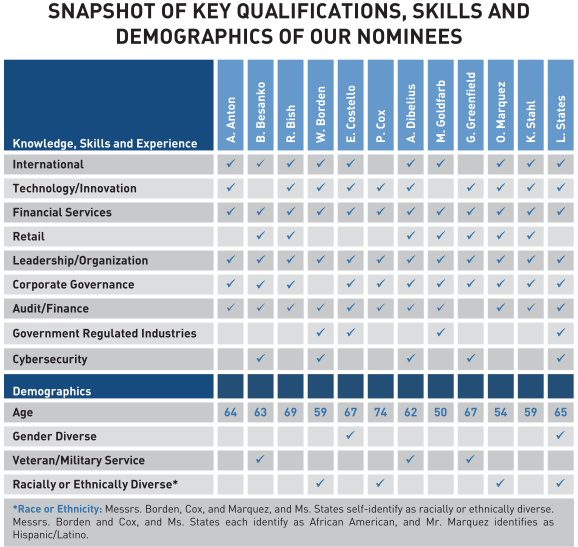

OVERVIEW OF OUR BOARD NOMINEES

You are being asked to vote to elect each of the following nominees to our Board of Directors. The tables that follow provide summary information about our nominees, and detailed information about each director nominee’s background, skills and expertise can be found in Proposal 1: Election of Directors on pages 24-30.

|

|

COMMITTEE MEMBERSHIP | |||||||||||||||

| NAME AND OCCUPATION / CAREER HIGHLIGHTS | AGE | DIRECTOR SINCE |

INDEPENDENT | AUDIT | BOARD GOV. |

PEOPLE & COMP. |

FIN. | TECH. | ||||||||

| Arthur F. Anton Retired Chairman and Chief Executive Officer, Swagelok Company |

64 | 2019 | Yes | · |

|

|

Chair |

| ||||||||

| Bruce H. Besanko Retired Chief Financial Officer, Kohl’s Corporation |

63 | 2018 | Yes | Chair |

|

|

|

· | ||||||||

| Reynolds C. Bish Chief Executive Officer, Kofax Limited |

69 | 2019 | Yes |

|

· |

|

|

Chair | ||||||||

| William A. Borden Corporate Vice President of Worldwide Financial Services, Microsoft Corporation |

59 | 2021 | Yes | · |

|

|

|

· | ||||||||

| Ellen M. Costello Retired Chief Executive Officer, BMO Financial Corporation |

67 | 2018 | Yes | · |

|

Chair |

|

| ||||||||

| Phillip R. Cox President and Chief Executive Officer, Cox Financial Corporation |

74 | 2005 | Yes |

|

Chair | · |

|

| ||||||||

| Dr. Alexander Dibelius Managing Partner, CVC Capital Partners (Deutschland) GmbH |

62 | 2016 | Yes |

|

|

· | · |

| ||||||||

| Matthew Goldfarb Special Advisor to the Chairman, LICT Corporation |

50 | 2019 | Yes |

|

|

· | · |

| ||||||||

| Gary G. Greenfield Non-executive Chairman of the Board, Diebold Nixdorf, Incorporated; Executive Advisor, Court Square Capital Partners |

67 | 2014 | Yes |

|

|

|

|

· | ||||||||

| Octavio Marquez President and Chief Executive Officer, Diebold Nixdorf, Incorporated |

54 | 2022 | No |

|

|

|

|

| ||||||||

| Kent M. Stahl Retired Partner, Chief Investment Strategist and Director of Investment Strategy and Risk Management, Wellington Management Company, LLP |

59 | 2019 | Yes |

|

· |

|

· |

| ||||||||

| Lauren C. States Retired Vice President, Strategy and Transformation, IBM Corporation |

65 | 2020 | Yes | · |

|

|

|

· | ||||||||

| 2 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

PROXY SUMMARY

|

|

|

2022 PROXY STATEMENT | | 3 |

Table of Contents

|

PROXY SUMMARY

|

PARTICIPATING IN THE ANNUAL MEETING

This year’s Annual Meeting will again be accessible through the Internet. We have adopted a virtual format for our Annual Meeting to make participation accessible for shareholders from any geographic location with Internet connectivity. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings while further enhancing the online experience available to all shareholders regardless of their location. The accompanying proxy materials include instructions on how to participate in the meeting and how you may vote your common shares.

You are entitled to participate in the Annual Meeting if you were a shareholder as of the close of business on March 8, 2022, the record date, or hold a valid proxy for the meeting. In order to attend the Annual Meeting, you must register at www.proxydocs.com/DBD. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting. As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

Whether or not you participate in the Annual Meeting, it is important that your shares be part of the voting process. You may log on to www.proxydocs.com/DBD and enter your control number.

This year’s shareholder question and answer session will include questions submitted in advance of the Annual Meeting. You may submit a question in advance of the meeting at www.proxydocs.com/DBD after logging in with your control number. We will post questions and answers if applicable to our business on our Investor Relations website after the meeting.

We encourage you to access the Annual Meeting before it begins. Online check-in will start shortly before the meeting on May 6, 2022. We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting platform, including any difficulties voting, you may call the technical support number that will be included in your instructional email.

| 4 | | 2022 PROXY STATEMENT |

|

Table of Contents

| Q: | What items will be voted on at the Annual Meeting and how does the Board recommend I vote? |

| A: | You are being asked to vote on the proposals outlined above in the proxy summary on page 1. The Board recommends a vote FOR each of the Board’s nominees for director, and FOR each of Proposals 2, 3 and 4. |

| Q: | What happens if other matters are properly presented at the Annual Meeting? |

| A: | If a permissible proposal other than the listed proposals is presented at the Annual Meeting, your proxy gives authority to the individuals named in the proxy to vote on any such proposal in accordance with their best judgment, including if a nominee for director is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies may use the proxy to vote for a replacement nominee recommended by the Board whether or not any other nominations are properly made. We have not received notice of other matters that may be properly presented at the Annual Meeting. |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | Our record date for the 2022 Annual Meeting is March 8, 2022. Each shareholder of record of our common shares as of the close of business on March 8, 2022 is entitled to one vote for each common share held. As of the record date, there were 78,927,434 common shares outstanding and entitled to vote at the Annual Meeting. |

| Q: | How do I vote? |

| A: | If you were a shareholder on the record date and you held shares in your own name, you have three ways to vote and submit your proxy before the 2022 Annual Meeting: |

| • | By mail—If you received a printed copy of the Proxy Materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope; |

| • | By Internet—If you received the Notice or a printed copy of the Proxy Materials, follow the instructions in the Notice or on the proxy card; or |

| • | By telephone—If you received a printed copy of the Proxy Materials, follow the instructions on the proxy card. |

| If you hold your shares through a broker, bank or other nominee (that is, in street name), you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions |

| and have your shares voted at the Annual Meeting. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxydocs.com/DBD. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process. |

| Q: | Can I change my vote after I have voted? |

| A: | You may change your vote at any time before your proxy is voted at the 2022 Annual Meeting by: |

| • | Revoking your proxy by sending written notice or submitting a later dated, signed proxy before the 2022 Annual Meeting to our Corporate Secretary at the Company’s address above; |

| • | Submitting a later dated, signed proxy before the start of the 2022 Annual Meeting; |

| • | If you have voted by the Internet or by telephone, you may vote again over the Internet or by telephone up until 11:59 p.m. EDT on May 5, 2022; or |

| • | Attending the 2022 Annual Meeting on the Internet, withdrawing your earlier proxy and voting at the Annual Meeting via the Internet. |

| Q: | Can I cumulate my votes for the election of directors? |

| A: | No. At the 2017 Annual Meeting, our Shareholders approved an amendment to our Amended Articles of Incorporation to eliminate cumulative voting in director elections. |

| Q: | How many votes are required to adopt each proposal? |

| A: | With respect to Proposal 1, the number of votes cast “for” the director nominee’s election must exceed the number of votes cast “against” his or her election. For each of Proposals 2, 3, and 4, the affirmative vote of the holders of a majority of the votes cast, whether in person or by proxy, is required for approval. The results of the voting at the meeting will be tabulated by the inspectors of election appointed for the Annual Meeting. |

| Q: | What is the Majority Voting Policy? |

| A: | Our Board of Directors has adopted a policy that any nominee for director who is elected but receives a greater number of votes “against” his or her election than votes “for” his or her election, in an election that is not a contested election, is expected to tender his or her |

|

2022 PROXY STATEMENT | | 5 |

Table of Contents

|

VOTING INFORMATION

|

| resignation following certification of the shareholder vote, as described in greater detail below under “Majority Voting Policy.” |

| Q: | What is a “broker non-vote”? |

| A: | If your shares are held in the name of a brokerage firm, your shares may be voted even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under the New York Stock Exchange, or NYSE, rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter under NYSE rules and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is referred to as a “broker non-vote.” |

Proposal 2, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022, is the only routine matter for which the brokerage firm who holds your shares can vote your shares on these proposals without your instructions. Accordingly, there should be no broker non-votes with respect to Proposal 2. Broker non-votes will have no effect on the outcome of Proposals 1, 3 and 4.

| Q: | How many shares must be present to constitute a quorum and conduct the Annual Meeting? |

| A: | A quorum is necessary to hold the Annual Meeting. A majority of the outstanding shares present or represented by proxy constitutes a quorum for the purpose of adopting a proposal at the Annual Meeting. If you are present and vote at the Annual Meeting, or vote on the Internet, by telephone or by submitting a properly executed proxy card, you will be considered part of the quorum. Broker non-votes will not be part of the voting power present, but will be counted to determine whether or not a quorum is present. |

| Q: | What happens if I abstain? |

| A: | For all proposals except Proposal 4, a share voted “abstain” with respect to any proposal is considered as present and entitled to vote with respect to the proposal, but is not considered a vote cast with respect to the proposal. For Proposal 4, abstentions are considered votes cast for purposes of shareholder approval of an amendment to an equity plan. Accordingly, abstentions will have no effect on Proposal 1, the election of directors, and will not be counted for determining the outcome of Proposals 2 and 3. |

| Q: | Why did I receive a one-page notice in the mail regarding Internet availability of proxy materials instead of a full set of proxy materials? |

| A: | Under rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending you a Notice of Internet Availability of Proxy Materials. The instructions found in the Notice explain that all shareholders will have the ability to access the proxy materials on www.proxydocs.com/DBD or request to receive a printed copy of the proxy materials. You may also request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage you to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our Annual Meeting materials. |

| Q: | What shares are included on my proxy card or Notice of Internet Availability of Proxy Materials? |

| A: | The number of shares printed on your proxy card(s) represents all of your shares under a particular registration. Receipt of more than one proxy card or Notice of Internet Availability of Proxy Materials means that certain of your shares are registered differently and are in more than one account. If you receive more than one proxy card, sign and return all of your proxy cards to ensure that all of your shares are voted. If you receive more than one Notice, reference the distinct 12-digit control number on each Notice when voting by Internet. |

| 6 | | 2022 PROXY STATEMENT |

|

Table of Contents

Our Board is committed to strong corporate governance principles and practices to ensure that the Board most effectively and efficiently serves in its oversight obligations.

This section provides an overview of the organization of the Board, its committees, responsibilities and other related topics and initiatives.

Our Board is committed to strong leadership and currently maintains separate roles of our CEO and our Chairman of the Board. We believe this structure is effective for our current circumstances and a good governance practice. The Board does not have a specific policy with respect to separating or

combining these roles, or whether the Chairman should be an employee or non-employee director, and will continue to periodically review our leadership structure in light of corporate governance standards, market practices and our specific circumstances and needs.

BOARD AND DIRECTOR ASSESSMENTS

The Board Governance Committee leads the Board and director assessment program, as noted below in “Board Committees and Composition.” During the last few years, the Governance Committee has enhanced its Board assessment process. Board members were asked to complete questionnaires and engaged in an extensive live question and answer session conducted by an independent outside counsel with expertise in corporate governance best practices. As in prior years, the assessment program includes a full board self-assessment, committee assessments, a chairman assessment and individual director assessments. The full board self-assessment includes comprehensive questions designed to provide an all-inclusive evaluation of the performance of the Board in light of our needs and strategies.

The committee, chairman, and individual director assessments are more specifically tailored. When taken together, the assessment program provides a holistic review of the role, performance and function of the full Board, the Chairman and each director in relation to the Company’s needs, challenges and opportunities. Our Board and director assessments have helped to inform our recent refreshment efforts, including with one new director in each of 2021 and 2020, four new directors in 2019, and three new directors in 2018. The assessment results are shared with our Chairman, and applicable directors, committee members, and the full Board as appropriate, and action plans are prepared and executed as necessary.

BOARD MEETINGS AND EXECUTIVE SESSIONS

The Board held five regular meetings during 2021. The Board felt it was important, even in light of the COVID-19 pandemic, to conduct in person meetings and did so three times during the year. The Company’s response to the challenges presented by the COVID-19 pandemic has been a focus of the Board at its meetings throughout the year. All of our current directors attended 93% or more of the aggregate of all meetings of the Board and the Board committees on which they served during 2021.

In accordance with the NYSE’s corporate governance standards, our independent directors regularly meet in executive session without management present, generally following each regularly-scheduled Board meeting. In addition, on occasion, our independent directors will meet in

executive session prior to the start of or following a Board meeting. Gary Greenfield, the Chairman of our Board, presides over these meetings in executive session. The executive sessions of each Board committee are overseen by the respective committee chair.

While we do not have a formal policy regarding directors’ attendance at the Annual Meeting of Shareholders, it is expected that all directors attend the Annual Meeting unless there are extenuating circumstances for non-attendance. All directors standing for re-election who were serving as directors as of the 2021 annual meeting of shareholders attended the 2021 annual meeting.

|

2022 PROXY STATEMENT | | 7 |

Table of Contents

|

CORPORATE GOVERNANCE

|

The Board and the Board committees collectively play an active role in overseeing management of our risks and in helping establish an appropriate risk tolerance. The Board oversees our risk strategy and effectiveness; however, management is responsible for execution of our global Enterprise Risk Management (ERM) program, which identifies risks inherent in our business, as well as implementing and supervising day-to-day risk management. Our Board Governance Committee oversees and provides input regarding the general operation of the ERM program. In addition to discussion of the overall ERM program with the full Board, the Board and the appropriate committees receive regular reports from our senior management on areas of material risk to us, including operational, financial, strategic, compliance, cybersecurity, competitive, reputational, and legal and regulatory risks. The Board also meets with senior management as part of each Board meeting, and more frequently as needed, to discuss strategic planning, including the key risks inherent in our short- and long-term strategies. Senior management then provides the Board with periodic updates throughout the year with respect to these strategic initiatives and the impact and management of these key risks.

The Board and various levels of management participate in, and thereafter discuss, an annual survey of risks to provide guidance and input regarding the appropriate level of risk appetite for the various risks faced by the Company. In addition, each Board committee is responsible for evaluating certain risks within its area of responsibility and overseeing the management of such risks. The entire Board is then informed about such risks and management’s response to

each risk through regular committee reports delivered by the committee chairs. Our People and Compensation Committee performs an annual compensation risk assessment, and we believe that our compensation practices are not reasonably likely to have a material adverse effect on the Company.

We also have robust internal dialogue among our operations, information security, technology, finance, compliance, treasury, tax, legal and internal audit departments, among others, whenever a potential risk arises, and include such risks in our tracking of enterprise risks as part of the Company’s ERM program. These discussions are escalated to our President and Chief Executive Officer, Chief Financial Officer, Corporate Controller, Chief Legal Officer, Chief Ethics and Compliance Officer, Chief People Officer, and/or Chief Information Security Officer, Vice President, Internal Audit and other Vice Presidents of our various divisions and regions, as appropriate, with open lines of communication among them, the various committees of the Board and the entire Board.

We believe that the Board’s approach and continued evaluation of its risk oversight, as described above, enhances its ability to assess the various risks, make informed cost-benefit decisions, and approach emerging risks in a proactive manner for the Company. We also believe that our Board leadership structure complements our risk management structure because it allows our independent directors to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

| 8 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

CORPORATE GOVERNANCE

|

|

BOARD COMMITTEES AND COMPOSITION

The Board’s current standing committees are the Audit Committee, Board Governance Committee, People and Compensation Committee, Finance Committee and Technology Committee. Each committee’s members and meetings during 2021 and functions are described below. The Board reviews committee membership, charters and responsibilities every year and will do so in 2022 following the Annual Meeting.

| AUDIT COMMITTEE* |

| |

|

Members:

Bruce H. Besanko (Chair), Arthur F. Anton, William A. Borden, Ellen M. Costello and Lauren C. States.

All members of this committee qualify as independent.

Meetings:

This committee met in person or via video conference six times during 2021, and had informal communications with management, as well as with our independent auditors, at various other times during the year.

Contact:

auditchair@dieboldnixdorf.com

Committee Report: See page 85.

|

Primary Duties and Responsibilities:

• Monitors the adequacy of our financial reporting process and systems of internal controls regarding finance, accounting and ethics and compliance.

• Monitors the independence and performance of our independent auditors and performance and controls of our internal audit department.

• Provides an avenue of communication among the independent auditors, management, the internal audit department and the Board.

Financial Experts:

The Board has determined that each of Mr. Besanko, Mr. Anton and Ms. Costello is an audit committee financial expert within the meaning of such term under Item 407(d)(5) of Regulation S-K.

| |

| * | This committee is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the Exchange Act). |

| BOARD GOVERNANCE COMMITTEE |

| |

|

Members:

Phillip R. Cox (Chair), Reynolds C. Bish and Kent M. Stahl.

All members of this committee qualify as independent.

Meetings:

This committee met in person or via video conference four times during 2021, and had informal communications with management at various other times during the year.

Contact:

bdgovchair@dieboldnixdorf.com

|

Primary Duties and Responsibilities:

• Reviews qualifications of potential director candidates.

• Makes recommendations to the Board to fill vacancies or consider the appropriate size of the Board.

• Makes recommendations regarding corporate governance principles, Board committee composition, and the directors’ compensation for their services on the Board and on Board committees.

• Leads Board and committee assessments.

• Oversees director orientation and education, as described in “Director Orientation and Education” below.

• Ensures Board oversight of our enterprise risk management process and of our environmental, social and governance program.

| |

|

2022 PROXY STATEMENT | | 9 |

Table of Contents

|

CORPORATE GOVERNANCE

|

| PEOPLE AND COMPENSATION COMMITTEE |

| |

|

Members:

Ellen M. Costello (Chair), Phillip R. Cox, Dr. Alexander Dibelius and Matthew Goldfarb.

All members of this committee qualify as independent.

Meetings:

This committee met in person or via video conference five times during 2021, and had informal communications with management, as well as the committee’s independent compensation consultant, at various other times during the year.

Contact:

compchair@dieboldnixdorf.com

Committee Report: See page 49. |

Primary Duties and Responsibilities:

• Monitors and evaluates the general compensation philosophy of the Company.

• Administers our executive compensation program as well as our benefit plans for all employees with the goals of ensuring that (a) the benefits and compensation practices of the Company are competitive and sufficient to attract, motivate and retain quality professional staff and (b) the Company’s compensation programs adhere to a “pay for performance” philosophy.

• Oversees our equity plans (including reviewing and approving equity grants to executive officers).

• Annually reviews and approves all pay decisions relating to executive officers.

• Determines and measures achievement of corporate and individual goals, as applicable, by our executive officers under our short- (annual) and long-term incentive plans, and makes recommendations to the Board for ratification of such achievements.

• Oversees the development of executive succession plans and talent management policies and programs, as well as reviews measures of employee engagement and plans related to employee engagement and diversity initiatives.

• Reviews proposed changes to any of our benefit plans, such as retirement plans, deferred compensation plans and 401(k) plans.

• For additional discussion of the committee’s role, processes and procedures in connection with executive compensation, see “Compensation Discussion and Analysis—Role of the People and Compensation Committee” below.

| |

| FINANCE COMMITTEE |

| |

|

Members:

Arthur F. Anton (Chair), Dr. Alexander Dibelius, Matthew Goldfarb and Kent M. Stahl.

All members of this committee qualify as independent.

Meetings:

This committee met in person or via video conference two times during 2021, and had informal communications with management at various other times during the year. |

Primary Duties and Responsibilities:

• Makes recommendations to the Board with respect to material or other significant transactions.

• Oversees the Company’s borrowing structures and credit facilities.

• Establishes investment policies, including asset allocation, for our cash, short-term securities and retirement plan assets and oversees the management of those assets.

• Reviews our financial exposure and liabilities, including the use of derivatives and other risk management techniques.

• Makes recommendations to the Board related to customer financing activities and funding plans for our Company.

| |

| 10 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

CORPORATE GOVERNANCE

|

|

| TECHNOLOGY COMMITTEE |

| |

|

Members:

Reynolds C. Bish (Chair), Bruce H. Besanko, William A. Borden, Gary G. Greenfield and Lauren C. States.

All members of this committee qualify as independent.

Meetings:

This committee met in person or via video conference four times during 2021, and had informal communications with management at various other times during the year.

|

Primary Duties and Responsibilities:

• Provides oversight and guidance regarding the strategy and management of our information technology infrastructure and security.

• Provides oversight and guidance regarding our intellectual property, including our software portfolio and research and development activities.

| |

CORPORATE GOVERNANCE MATERIALS AVAILABLE ON OUR WEBSITE

Copies of the following documents, among others, are available on our investor relations website (investors.dieboldnixdorf.com) in the Governance section under the Policies and Charters tab:

| • | Current Charters for our Audit, Board Governance, People and Compensation, Finance, and Technology Committees; |

| • | Our Categorical Independence Standards for Directors; |

| • | Our Corporate Governance Guidelines; and |

| • | Our Code of Business Ethics. |

Information on our website is not, and will not be deemed to be, a part of or incorporated into this Proxy Statement.

For a discussion of our Insider Trading Policy, which prohibits hedging or pledging of our stock by our directors, officers and employees, see “Compensation Discussion and Analysis—Insider Trading Policy” below.

The Board determined that each of Arthur F. Anton, Bruce H. Besanko, Reynolds C. Bish, William A. Borden, Ellen M. Costello, Phillip R. Cox, Dr. Alexander Dibelius, Matthew Goldfarb, Gary G. Greenfield, Kent M. Stahl and Lauren C. States has no material relationship with the Company and is independent under our director independence standards, the NYSE director independence standards, and the SEC independence requirements, as applicable and as currently in effect. Octavio Marquez does not meet these independence standards because he is employed by us as our President and CEO, and Gerrard B. Schmid did not meet these independence standards during his service on the Board while he was employed by us as our President and CEO.

In making the independence determinations, the Board considered the following business, professional or familial relationships and determined, in each instance, that the relationship was not material or did not impair the independence of the respective directors:

| • | Mr. Greenfield serves on the board of directors of Donnelley Financial Solutions, Inc., which provided SEC filing and printing services in 2021 related to our proxy statement for our 2021 annual meeting of shareholders for a fee of approximately $75,889. The Board determined that Mr. Greenfield did not have any indirect, material interest in these transactions. |

| • | Ms. Costello serves on the board of directors of Citigroup, Inc., which is our customer and part of our lending syndicate. Ms. Costello recuses herself from all Board and committee discussions regarding Citigroup, Inc. and similarly recuses herself from any discussions regarding the Company that may arise during Citigroup, Inc. meetings. |

| • | Ms. States serves on the board of directors of Webster Financial Corporation, which is our customer. Ms. States recuses herself from all Board and committee discussions regarding Webster Financial Corporation and similarly recuses herself from any discussions regarding the Company that may arise during Webster Financial Corporation meetings. |

| • | Mr. Greenfield owns equity interests (less than 1%) in ACTV8, Inc., from which we license software used in certain of our products. No fees were paid to ACTV8, Inc. in 2021. The Board determined that Mr. Greenfield did not have any indirect, material interest in these transactions. |

| • | Mr. Bish is the Chief Executive Officer of Kofax Limited. The Company purchased certain products from Kofax Deutschland AG, a subsidiary of Kofax Limited, in the amount of approximately $975,806 in 2021. The Board determined that Mr. Bish did not have any indirect, material interest in these transactions. |

|

2022 PROXY STATEMENT | | 11 |

Table of Contents

|

CORPORATE GOVERNANCE

|

| • | Mr. Greenfield’s daughter, Brittany Greenfield, is the founder and Chief Executive Officer of Wabbi Inc., from which we license certain software used in connection with our compliance programs. Fees in the amount of approximately $113,100 were paid to Wabbi Inc. in 2021. The Board determined that Mr. Greenfield did not have any indirect, material interest in these transactions. |

| • | Mr. Borden is the corporate vice president of worldwide financial services for Microsoft Corporation. The Company purchased certain products and services from Microsoft Corporation in the amount of approximately $11,934,713 in 2021. The Board determined that Mr. Borden did not have any indirect, material interest in these transactions. |

| • | Mr. Goldfarb is the special advisor to the chairman for LICT Corporation, an affiliate of GAMCO Investors, Inc. The entities of GAMCO Investors, Inc., et al., reported their beneficial ownership of our common shares as currently over 5%, which is discussed in more detail below under “Beneficial Ownership of Shares.” The entities of GAMCO Investors, Inc., et al., did not purchase or supply products or services to or from the Company in 2021. Mr. Goldfarb recuses himself from all Board and committee discussions regarding GAMCO Investors, Inc. and its affiliates and similarly recuses himself from any discussions regarding the Company that may arise during LICT Corporation meetings. |

RELATED PERSON TRANSACTION POLICY

Pursuant to our director independence standards, discussed above, and our Corporate Governance Guidelines, discussed below in “Director Qualifications,” we do not engage in transactions with non-employee directors or their affiliates if a transaction would cause an independent director to no longer be deemed independent, would present the appearance of a conflict of interest or is otherwise prohibited by law, rule or regulation. This includes, directly or indirectly, any extension, maintenance or renewal of an extension of credit to any of our directors. This prohibition also includes significant business

dealings with directors or their affiliates, charitable contributions that would require disclosure in our proxy statement under the rules of the NYSE, and consulting contracts with, or other indirect forms of compensation to, a director. Any waiver of this policy may be made only by the Board and must be promptly disclosed to our shareholders.

In 2021, we did not engage in any related person transaction(s) requiring disclosure under Item 404 of Regulation S-K.

The Company’s Board of Directors provides a process for shareholders to send communications to the Board. Shareholders and interested parties may communicate with our Audit, Board Governance, and People and Compensation Committee Chairs by sending an email to the address provided in the applicable committee description above or with our non-employee directors as a group by sending an email to boardlogistics@dieboldnixdorf.com.

Communications may also be directed in writing to such person or group at Diebold Nixdorf, Incorporated, Attention:

Corporate Secretary, 50 Executive Pkwy, P.O. Box 2520, Hudson, Ohio 44236. The independent members of the Board have approved a process for handling communications we receive that are addressed to non-employee members of the Board. Under that process, the Corporate Secretary will review all such communications and determine whether communications require immediate attention. The Corporate Secretary will forward communications, or a summary of communications, to the appropriate director or directors.

All of our directors, executive officers and employees are required to comply with certain policies and protocols concerning business ethics and conduct as provided in our Code of Business Ethics. The Code of Business Ethics ties our core values to the ethical principles that must guide our business decisions. The Code of Business Ethics also provides clear information on the resources available for directors, executive officers and employees to ask questions and report

unethical behavior. All members of the Board have received training specific to the Code of Business Ethics.

The Code of Business Ethics applies to us, including all of our domestic and international affiliates and subsidiaries. The Code of Business Ethics describes certain responsibilities that our directors, executive officers and employees have to the Company, to each other and to our global partners and

| 12 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

CORPORATE GOVERNANCE

|

|

communities. It covers many topics, including compliance with laws, including the Foreign Corrupt Practices Act and relevant global anti-corruption laws, conflicts of interest, intellectual property and the protection of competitive and confidential information, as well as maintaining a respectful and non-retaliatory workplace. The Code of Business Ethics also includes and links to our Conflicts of Interest Policy, which further details the requirements for our officers, directors and employees to avoid and disclose potential conflicts, including

those that may result from related party transactions. In addition, our employees are required to report any conduct that they believe in good faith to be a violation of the Code of Business Ethics. Our Audit Committee has procedures to receive, retain and treat complaints regarding accounting, internal financial controls or auditing matters, and to allow for the confidential and anonymous submission of concerns regarding questionable practices or potential violations of our policies, including the Code of Business Ethics.

PEOPLE AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of our People and Compensation Committee during the year ended December 31, 2021 were Ellen M. Costello, Phillip R. Cox, Dr. Alexander Dibelius and Matthew Goldfarb. No member of the People and Compensation Committee has had any relationships requiring disclosure by us under the SEC’s rules requiring disclosure of certain

relationships and related person transactions. No officer or employee of the Company has served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director of the Company or member of the People and Compensation Committee during 2021.

DIRECTOR ORIENTATION AND EDUCATION

All new directors participate in a director orientation program. The Board Governance Committee oversees this introduction and orientation process during which the new director meets with key senior management personnel and takes a tour through our facilities to improve his or her understanding of our business and global products and solutions. In addition,

the orientation program educates the new director on his or her obligations as a director, the history of the Company, our strategic plans, significant financial matters, core values, including ethics and compliance programs (and also including our Code of Business Ethics), corporate governance practices and other key policies and practices.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a global company, we are committed to protecting the environment, caring for our people and the communities in which we live and work, and continually enhancing our governance to ensure best practices in all we do as an organization. We strive to advance solutions and practices that are sustainable, equitable and best in class as a corporate citizen. Our environmental, social and governance initiatives are among our highest priorities as a company.

Our ESG initiatives include the following categories:

| ➣ | Planet (Environmental) topics include climate change, sustainable products, sustainable field operations, materials used, waste produced, and resource management; |

| ➣ | People (Social) topics include responding to COVID-19, global citizenship, financial inclusion, diversity and inclusion, human rights, health and safety, and human capital management; and |

| ➣ | Performance (Governance) topics include best practices in Board and Corporate governance, our code of business ethics, enterprise risk management and business resiliency and cybersecurity and data privacy. |

We will be publishing our annual ESG Report later this year, which will include a comprehensive overview of our accomplishments for the year. We made good progress in advancing our goals regarding sustainability and diversity and inclusion in 2021, for example, we:

| ➣ | Reduced Scope 1 and Scope 2 carbon emissions by 6%; |

| ➣ | Completed a two-year partnership program through our long-standing connection with our ATM thermal receipt paper provider, Telemark Diversified Graphics (TDG) and the Arbor Day Foundation. We planted one new tree for every 115 pounds of |

|

2022 PROXY STATEMENT | | 13 |

Table of Contents

|

CORPORATE GOVERNANCE

|

| paper purchased and planted over 6,500 trees, offsetting those used in the production of each receipt paper order since 2020. This year, through our renewed partnership with the Arbor Day Foundation, The Diebold Nixdorf Foundation is proud to have planted more than 21,500 trees worldwide; |

| ➣ | Increased the gender diversity of our workforce with women accounting for over 60% of new senior management (vice president and above) hires; |

| ➣ | Earned strong marks in Human Rights Campaign (HRC) Foundation’s 2022 Annual Corporate Equality Index (CEI). Over the past several years we have adopted and implemented non-discriminatory policies across business entities, established the CARE council to work cross-functionally through employees around the globe, established several Employee Resource Groups and continue to focus on supporting an inclusive culture. This has resulted in the Company receiving a score of 90 out of 100 on the CEI, the nation’s foremost benchmarking survey and report measuring corporate policies and practices related to LGBTQ+ workplace equality. Our score outpaces the average score of all Fortune 500 companies evaluated by the HRC; |

| ➣ | Established four new employee resource groups to provide leadership and other opportunities to employees and allies aligned with those groups: Multicultural Connections, Pride@DN, Veterans@DN and Women@DN; and |

| ➣ | Increased the diversity of our Board as part of our continual Board refreshment program. |

Planet (Environmental)

We proactively pursue sustainability initiatives by analyzing the global footprint of our operations and product lifecycles. Our Global Sustainability Policy and the Global Environmental, Health and Safety (EHS) Policy informs our company-wide environmental program. The program covers carbon emissions, water consumption, energy usage, recycling efforts, supply chain management, and sustainable products and solutions.

Together, our programs and policies allow us as an organization to create value in a sustainable way for our stakeholders.

In furtherance of the foregoing, we have defined the following Planet Key Performance Indicators:

| ➣ | Carbon Footprint: Continually assess our operations, processes, and global supply chain to determine the environmental impact and implement improvements from greenhouse gas (GHG) emission controls to product lifecycle assessments (LCAs). |

| ➣ | Green Products and Solutions: Focus on using environmentally sustainable materials in our supply chain, which have a positive impact on our operational efficiency and also benefit our customers. We look at the entire lifecycle of our solutions, which includes design and development, the manufacturing process, the operational life, ongoing support and finally product recycling and reuse at the end of its lifecycle. Our solutions can make the difference in our customers operations to become greener and enhance efficiency. For example: |

| • | Three years ago, we introduced our new innovative ATM line, DN Series™. The DN Series family is made of recycled and recyclable materials and is 25% lighter than most traditional ATMs. This reduces CO2 emissions, both in the manufacturing processing and transportation of components and terminals. In addition, all DN Series ATMs use state-of-the-art LED technology and highly efficient electrical systems, overall allowing for up to 50% power savings versus traditional ATMs. |

| • | Two years ago, we introduced DN Series™ BEETLE, a unified Retail platform of all-in-one Point-of-Sale and touch display solutions that offers a shining example of our focus on sustainable sourcing and design. Over 90% of the materials used in the DN Series BEETLE can be recycled, making it an environmentally friendly point-of-sale solution. |

| ➣ | Sustainable Supply Chain: Conduct due diligence on our supply chain to enhance transparency and identify the country and smelter or refiner of origin of the conflict minerals that may be used in our products. Suppliers must participate in our due diligence processes, provide complete and accurate information when requested, and perform similar due diligence on their own supply chains. We are committed to ensuring that we work with ethical suppliers who adhere to high standards of human rights and ethical business practices. We hold our suppliers to high standards on both people and planet related factors. Suppliers certify to our Supplier Code of Conduct, which requires all suppliers to: |

| • | Comply with all applicable laws (including anti-corruption laws); |

| • | Meet and exceed environmental, health, and safety standards; |

| • | Reduce waste, prevent pollution, and promote recycling; |

| 14 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

CORPORATE GOVERNANCE

|

|

| • | Prohibit materials that directly or indirectly benefit armed groups in designated countries (conflict minerals); |

| • | Protect human rights; and |

| • | Promote diversity and good corporate citizenship. |

| ➣ | Waste Management: Recycling and waste management are key employee-led initiatives at Diebold Nixdorf. By following our Global Waste Management Policy, we practice the “ARRR” principle: avoid before reduce before reuse before recycle, and only then dispose—to decrease and divert the amount of material that must be disposed in a landfill or otherwise treated. |

| • | We maintain a program to recycle out-of-use ATMs and other electronic hardware to ensure they do not go to landfills, including active recycling programs in the Americas and throughout Europe. |

| ➣ | Water Conservation: We use water during our manufacturing process, R&D process, and in our offices. As water scarcity can present a critical risk to production and surrounding communities, we strive to improve our water use efficiency. We believe that sound water stewardship makes our operations more resilient while reducing any potential impacts on the communities in which we operate. |

| • | We believe that access to water and sanitation is a Human Right and will continue to provide our employees with access to clean drinking water. In some instances, we are working with our community members where we operate to donate water supplies in regions that are considered “water stressed.” |

| ➣ | In addition, we maintain rigorous programs to comply with all applicable environmental, health, and safety-related regulations and are committed to our employees, neighbors, and the environment to minimize environmental risks and conserve resources. This responsibility is a team effort, delivered collectively through the management activities of our workforce around the globe. |

| ➣ | In furtherance of the above, we maintain global policies that support our commitment to these values, including our: |

| • | Environmental, Health and Safety Policy; |

| • | Responsible Chemicals Management Policy; |

| • | Waste Management Policy; and |

| • | Physical and Environmental Security Policy. |

| ➣ | Across the organization as a whole, we have adopted a Global Sustainability Policy. The Global Sustainability Policy applies to all directors, officers, and employees of Diebold Nixdorf, along with subsidiary companies, partners, vendors, suppliers, and contractors. Our Global Sustainability Policy emphasizes our sustainability principles and clearly spells out the roles of different groups within Diebold Nixdorf. |

| ➣ | At the executive level, our cross functional DN Sustainability Council participates and provides input on our sustainability and corporate social responsibility strategies, policies, and programs. The Council also reports progress on key performance indicators (KPIs) and other developments directly to the executive leadership team at these meetings. |

People (Social)

In 2020 and 2021, the health and safety of our people remained our highest commitment and our first priority. We implemented a comprehensive Pandemic Response Plan (PRP) to ensure the continuity of our operations to deliver products and services to our customers, while protecting the health and safety of our people. In addition to implementing robust safety protocols around the world, we created an employee crisis reserve fund, offered incremental bonuses for front line technicians, and worked to avoid COVID-19 related employee reductions.

We are committed to ensuring our employees have a safe workplace with a zero injury, incident, and health impact goal. Therefore, proactive management of issues relating to Environmental, Health & Safety (EHS) factors is a core component of our company strategy and corporate culture. We are also aware of our place in the global community and have an increased awareness on responsible resource consumption, which has a positive impact on waste generation and potential climate and environmental impacts and is a core component of our sustainability strategy.

|

2022 PROXY STATEMENT | | 15 |

Table of Contents

|

CORPORATE GOVERNANCE

|

We take social responsibility in the local communities in which we operate very seriously and supporting the communities in which we live and work has always been an important part of how we uphold our company values. Each year, our employees give back to their communities and support countless nonprofit organizations whose missions align with our values and whose work enhances the quality of life for people in need. In addition, we have two charitable giving groups: The Diebold Nixdorf Foundation and The Diebold Nixdorf Employee Charitable Fund. Our charitable giving philosophy requires that disbursements to non-profit organizations meet the following criteria:

| Ø | The organization’s mission aligns with our company values, as expressed on our website under “Who We Are” and in our Code of Business Ethics; |

| Ø | The organization’s work enhances the quality of life for people in need in the communities in which we operate and do business globally; and |

| Ø | The organization encourages and supports our employees’ involvement. |

The Diebold Nixdorf Foundation partners with non-profit organizations such as United Way and Habitat for Humanity on community projects to help those in need. In addition, as part of our commitment to help promote financial inclusion and literacy for underserved communities around the world, The Diebold Nixdorf Foundation extended and increased its previous commitment to the nonprofit organization Operation HOPE, Inc. in 2020. These efforts provide consumers that live in rural locations or regions without the structures of a modern economy with access to and training regarding financial products and services. Together with Operation HOPE, we are working to create a world where no one is excluded from the global financial system.

We are also proud to be a founding member of the Consumer Choice in Payment Coalition (CCPC)—a group of businesses and consumer groups that have come together to advocate for consumer choice and for preserving the fundamental right of all consumers, including those in vulnerable, disadvantaged communities, to use cash to pay for goods and services in the marketplace.

At Diebold Nixdorf, we are also committed to a culture of diversity and inclusion where everyone is accepted, valued and encouraged to thrive. We are one global team, grounded in mutual trust and respect, and we are stronger together because of our differences.

In 2020, we established our CARE council—making an explicit commitment to CARE-ing for each other by focusing on being Considerate, Aware, Responsible and Empathetic—four behaviors that we encourage all employees to remember and consciously think about. The vision of the CARE Council is to have all employees feel appreciated, involved, heard, connected and supported, and have equal opportunity to succeed. We continue to drive our cultural evolution through our Diversity & Inclusion programs, employee resource groups, robust internal communications and performance management process.

As a global company, we support diverse customers in diverse markets with diverse needs. Diversity within our own company—whether cultural, gender, racial, or other—means we value the many different and varying perspectives and solutions that our people bring to the table—and we believe this can have a positive impact on how we innovate and how we grow. We value the diverse, individual characteristics and backgrounds that make each person unique. Respect for, and sensitivity toward, each employee’s individuality is central to our culture of diversity and inclusion, so that we are a desirable workplace for everyone. Inclusion of diverse talent is also important to our business strategy because it ensures we are able to meet the needs of the diverse communities and customers we serve. Our Supplier Diversity and Inclusion Excellence Program also encourages our team members to seek out meaningful business opportunities with suppliers who share the same commitment to diversity.

Performance (Governance)

We are committed to conducting our business according to the highest governance and ethical standards. The foundation of our corporate governance principles and practices are built on integrity and accountability. Our code of business ethics provides everyone at Diebold Nixdorf, from the Board of Directors across our leadership and our employee base, suppliers and partners with a guiding framework on how to conduct ourselves on a daily basis. At Diebold Nixdorf, we make sure we conduct our business and serve our customers as efficiently, creatively, and professionally as possible, according to the highest standards of ethics and transparency. Having a strong code of business ethics enables us to provide reliable and consistent services to our customers in a fair and transparent manner, enhancing business sustainability and resiliency.

| 16 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

CORPORATE GOVERNANCE

|

|

As described above, at the Board level, we follow best practices in corporate governance through our annual Board review and refreshment process to ensure that our Board has the requisite diversity and experience to guide our corporation. Our Board of Directors conducts a rigorous Board of Directors self-evaluation process including detailed analysis and discussion of ways to improve our Board activities to guide the corporation in the interests of shareholders and other stakeholders. Our Governance Committee receives updates from our ELT and provides feedback on all aspects of our governance work including in the areas of enterprise risk management and sustainability. Our Board of Directors also regularly receives training and education in key areas of focus and risk including cybersecurity and shareholder rights.

Our commitment to a culture of diversity and inclusion extends to the boardroom as well. Two women, Ms. Ellen Costello and Ms. Lauren States, are being nominated for re-election to our Board of Directors at the Annual Meeting this year. In addition, four of our director nominees identify as racially or ethnically diverse, including Ms. States, Mr. Phillip Cox and Mr. William Borden, who identify as African American, and Mr. Marquez who identifies as Hispanic/Latino. The perspectives of these leaders, along with those of our full slate of director nominees this year, furthers our goal to maintain a well-balanced Board that combines broad business and industry experience with comprehensive diversity characteristics and professional viewpoints.

|

2022 PROXY STATEMENT | | 17 |

Table of Contents

Director compensation is determined by the Board at the recommendation of the Board Governance Committee. With respect to the Company’s non-employee directors, it is our goal to provide directors with fair and competitive compensation which aligns their interests with shareholders.

The annual cash retainer received by our non-employee directors during 2021 remained the same as that paid in 2020. Accordingly, during 2021, our non-employee directors received an annual cash retainer of $75,000 for their service as directors. Our non-executive Chairman of the Board received an additional annual cash retainer of $100,000.

In addition, each non-employee director may receive equity awards under our Diebold Nixdorf, Incorporated 2017 Equity and Performance Incentive Plan (as amended), which we refer to as the 2017 Plan. We aim to provide a balanced mix of cash

and equity compensation to our directors that targets the directors’ total pay at the median of a peer group of companies in similar industries and of comparable size and revenue. This peer group is the same one used by our People and Compensation Committee for benchmarking executive compensation, which is discussed in more detail below in “Role of Peer Companies and Competitive Market Data” under “Compensation Discussion and Analysis.” As such, in 2021, the Company awarded RSUs to each non-employee director that approximated $146,374 in value at the time of grant. Each award provides for dividend equivalent payments in cash during the restricted period. We believe these awards strengthen the directors’ ties to shareholder interests by aligning their long-term economic interests and that these awards provide effective ways to help our directors build stock ownership.

Our non-employee directors also received the following annual committee fees for their participation as members or as chairs of one or more Board committees:

|

MEMBER

|

CHAIR

|

|||||||

|

Audit Committee

|

|

$12,500

|

|

|

$25,000

|

| ||

|

People and Compensation Committee

|

|

$10,000

|

|

|

$20,000

|

| ||

|

Board Governance Committee

|

|

$ 7,500

|

|

|

$15,000

|

| ||

|

Finance Committee

|

|

$ 7,500

|

|

|

$15,000

|

| ||

|

Technology Committee

|

|

$ 7,500

|

|

|

$15,000

|

| ||

The varying fee amounts are intended to reflect differing levels of responsibility and meeting requirements. The fees for a director who joins or leaves the Board or assumes additional responsibilities during the year are pro-rated for his or her

period of actual service. A director may elect to defer receipt of all or a portion of his or her compensation pursuant to the Deferred Compensation Plan No. 2 for Directors, as amended.

| 18 | | 2022 PROXY STATEMENT |

|

Table of Contents

|

|

COMPENSATION OF DIRECTORS

|

|

The following table details the compensation of our non-employee directors for 2021:

| NAME | FEES EARNED CASH1 ($) |

STOCK AWARDS2 ($) |

ALL OTHER COMPENSATION3 ($) |

TOTAL ($) |

||||||||||

|

Arthur F. Anton

|

|

102,500

|

|

|

146,374

|

|

—

|

|

248,874

|

| ||||

|

Bruce H. Besanko

|

|

107,500

|

|

|

146,374

|

|

—

|

|

253,874

|

| ||||

|

Reynolds C. Bish

|

|

97,500

|

|

|

146,374

|

|

—

|

|

243,874

|

| ||||

|

William A. Borden

|

|

15,833

|

|

|

47,205

|

|

—

|

|

63,038

|

| ||||

|

Ellen M. Costello

|

|

107,500

|

|

|

146,374

|

|

—

|

|

253,874

|

| ||||

|

Phillip R. Cox

|

|

100,000

|

|

|

146,374

|

|

—

|

|

246,374

|

| ||||

|

Dr. Alexander Dibelius

|

|

92,500

|

|

|

146,374

|

|

—

|

|

238,874

|

| ||||

|

Matthew Goldfarb

|

|

92,500

|

|

|

146,374

|

|

—

|

|

238,874

|

| ||||

|

Gary G. Greenfield

|

|

182,500

|

|

|

146,374

|

|

—

|

|

328,874

|

| ||||

|

Kent M. Stahl

|

|

90,000

|

|

|

146,374

|

|

—

|

|

236,374

|

| ||||

|

Lauren C. States

|

|

95,000

|

|

|

146,374

|

|

—

|

|

241,374

|

| ||||

| 1 | This column reports the amount of cash compensation earned in 2021 for Board and committee service, including Board retainer amounts and committee fees earned in 2021. Mr. Borden joined the Board, along with the Audit Committee and the Technology Committee, in November 2021. The below table reflects the current committee membership and corresponding fees as of December 31, 2021. |

| NAME | AUDIT COMMITTEE ($) |

BOARD GOVERNANCE COMMITTEE ($) |

PEOPLE AND COMPENSATION COMMITTEE ($) |

FINANCE COMMITTEE ($) |

TECHNOLOGY COMMITTEE ($) | ||||||||||||||||||||

|

Arthur F. Anton

|

|

12,500 |

|

|

— |

|

|

— |

|

|

15,000 |

|

|

— |

| ||||||||||

|

Bruce H. Besanko

|

|

25,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

7,500 |

| ||||||||||

|

Reynolds C. Bish

|

|

— |

|

|

7,500 |

|

|

— |

|

|

— |

|

|

15,000 |

| ||||||||||

|

William A. Borden

|

|

2,083 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,250 |

| ||||||||||

|

Ellen M. Costello

|

|

12,500 |

|

|

— |

|

|

20,000 |

|

|

— |

|

|

— |

| ||||||||||

|

Phillip R. Cox

|

|

— |

|

|

15,000 |

|

|

10,000 |

|

|

— |

|

|

— |

| ||||||||||

|

Dr. Alexander Dibelius

|

|

— |

|

|

— |

|

|

10,000 |

|

|

7,500 |

|

|

— |

| ||||||||||

|

Matthew Goldfarb

|

|

— |

|

|

— |

|

|

10,000 |

|

|

7,500 |

|

|

— |

| ||||||||||

|

Gary G. Greenfield

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7,500 |

| ||||||||||

|

Kent M. Stahl

|

|

— |

|

|

7,500 |

|

|

— |

|

|

7,500 |

|

|

— |

| ||||||||||

|

Lauren C. States

|

|

12,500 |

|

|

— |

|

|

— |

|

|

— |

|

|

7,500 |

| ||||||||||

| 2 | This column represents the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 718 for RSUs granted to our non-employee directors in 2021, as further described above. Mr. Anton, Mr. Besanko, Mr. Bish, Ms. Costello, Mr. Cox, Dr. Dibelius, Mr. Goldfarb, Mr. Greenfield, Mr. Stahl and Ms. States each received 10,692 RSUs as of May 7, 2021, valued based on the closing price of our common shares on that date of $13.69. Mr. Borden received 5,346 RSUs as of November 16, 2021, valued based on the closing price of our common shares on that date of $8.83. |

| 3 | No dividend equivalents were paid in cash on shares deferred by our directors in 2021. |

|

2022 PROXY STATEMENT | | 19 |

Table of Contents

|

COMPENSATION OF DIRECTORS

|

DIRECTOR STOCK OWNERSHIP GUIDELINES

The Board has adopted stock ownership guidelines to align with the practices of our peer group (discussed further below under “Role of Peer Companies and Competitive Market Data” under “Compensation Discussion and Analysis”). Each non-employee director is expected to own common shares of the Company valued at least five times the annual retainer, and the directors are not permitted to sell any vested shares prior to meeting this ownership level. We count the deferred

shares held by the directors for purposes of these guidelines, which are intended to build stock ownership among non-employee directors and ensure that their long-term economic interests are aligned with those of other shareholders. The majority of our directors have exceeded these ownership guidelines or are on track to achieve the ownership guidelines within the next few years.

| 20 | | 2022 PROXY STATEMENT |

|

Table of Contents

DIRECTOR NOMINEES

The last few years reflect the ongoing efforts by our Board Governance Committee to identify talented nominees and directors that bring skills and strategic vision to the Company. This includes the addition of Mr. Marquez, who joined the Board in March 2022, Mr. Borden, who joined the Board in November 2021, Ms. States, who joined the Board at the 2020 annual meeting, Messrs. Anton, Bish, Goldfarb and Stahl, who joined the Board at the 2019 annual meeting, as well as Ms. Costello and Mr. Besanko, who joined the Board during the course of 2018. We have also engaged with shareholders for their input and views regarding our Board succession planning.

In November 2021, the Board determined to increase the size of our Board to 12 members and appointed Mr. Borden to fill the vacancy created by the increase. In February 2022, the Board determined to increase the size of our Board to 13 members and appointed Mr. Marquez to fill the vacancy, effective March 11, 2022. As Mr. Schmid is not standing for re-election at the 2022 Annual Meeting, the Board has determined to decrease the size of our Board to 12 members and views this number of directors as the correct balance of new perspectives with the experience and historical knowledge of the Company and its markets held by our continuing directors. The Board Governance Committee and the Board have determined that this is the appropriate size for our Board as we continue our director succession planning efforts, focusing on bringing the skills necessary to support our strategic initiatives and considering the overall diversity of our Board. The Board Governance Committee will continue to evaluate the Board size commensurate with evolving needs of the Company.

IDENTIFICATION AND EVALUATION OF DIRECTOR NOMINEES