EX-99.2

Exhibit 99.2

PLEASE NOTE THAT THIS TRANSLATION OF THE

GERMAN CONTRACT REPORT IS FOR CONVENIENCE PURPOSES ONLY. IN CASE OF

DISCREPANCIES BETWEEN THE GERMAN ORIGINAL AND THE ENGLISH TRANSLATION ONLY THE

GERMAN VERSION SHALL PREVAIL. NEITHER DIEBOLD GERMAN HOLDINGS INC. & CO. KGAA

NOR WINCOR NIXDORF AG ASSUMES RESPONSIBILITY FOR ANY MISTAKES, OMISSIONS OR OTHER

INACCURACIES CONTAINED IN THIS TRANSLATION.

CONTRACT REPORT

JOINT REPORT

of the

management board of

Wincor Nixdorf Aktiengesellschaft, Paderborn,

and

the management of

Diebold Holding Germany Inc. & Co. KGaA, Eschborn,

pursuant to Section 293a of the German Stock Corporation Act (Aktiengesetz)

concerning the Domination and Profit-and-Loss Transfer Agreement between

Wincor Nixdorf Aktiengesellschaft and Diebold Holding Germany Inc. & Co. KGaA

August 16, 2016

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Table of Contents

|

|

|

|

|

|

|

| I. |

|

INTRODUCTION |

|

|

1 |

|

|

|

|

| II. |

|

THE PARTIES |

|

|

3 |

|

|

|

|

| 1. |

|

Wincor Nixdorf AG and the Wincor Nixdorf Group |

|

|

3 |

|

|

|

|

| 1.1 |

|

Overview |

|

|

3 |

|

|

|

|

| 1.2 |

|

Corporate history and development |

|

|

4 |

|

|

|

|

| 1.3 |

|

Legal form, registered office, fiscal year and corporate purpose |

|

|

5 |

|

|

|

|

| 1.4 |

|

Share capital, shareholders and trading on the stock exchange |

|

|

6 |

|

|

|

|

| 1.5 |

|

Boards of Wincor Nixdorf AG |

|

|

11 |

|

|

|

|

| 1.6 |

|

Structure of the Wincor Nixdorf Group |

|

|

13 |

|

|

|

|

| 1.7 |

|

Business activities of the Wincor Nixdorf Group |

|

|

13 |

|

|

|

|

| 1.8 |

|

Development of the business and earnings situation of Wincor Nixdorf Group |

|

|

14 |

|

|

|

|

| 1.9 |

|

Employees and co-determination |

|

|

19 |

|

|

|

|

| 2. |

|

Diebold Inc. and the Diebold Group |

|

|

19 |

|

|

|

|

| 2.1 |

|

Overview |

|

|

19 |

|

|

|

|

| 2.2 |

|

Corporate history and development |

|

|

21 |

|

|

|

|

| 2.3 |

|

Legal form, registered office, fiscal year and corporate purpose |

|

|

23 |

|

|

|

|

| 2.4 |

|

Share Capital, shareholders and trading on the stock exchange |

|

|

24 |

|

|

|

|

| 2.5 |

|

Corporate bodies of Diebold Inc. |

|

|

26 |

|

|

|

|

| 2.6 |

|

Structure of the Diebold Group |

|

|

28 |

|

|

|

|

| 2.7 |

|

Business activities of the Diebold Group |

|

|

29 |

|

|

|

|

| 2.8 |

|

Development of the business and earnings situation of the Diebold Group |

|

|

30 |

|

|

|

|

| 2.9 |

|

Employees |

|

|

35 |

|

|

|

|

| 2.10 |

|

Takeover Offer and further acquisitions of the Diebold Group |

|

|

35 |

|

|

|

|

| 3. |

|

Diebold KGaA |

|

|

37 |

|

|

|

|

| 3.1 |

|

Overview |

|

|

37 |

|

|

|

|

| 3.2 |

|

Legal form, registered office, fiscal year and corporate purpose |

|

|

37 |

|

|

|

|

| 3.3 |

|

Limited partner’s capital contribution and general partner |

|

|

38 |

|

|

|

|

| 3.4 |

|

Corporate bodies and representation |

|

|

38 |

|

i

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

|

|

|

|

|

|

|

| 3.5 |

|

Business activities and participations |

|

|

39 |

|

|

|

|

| 3.6 |

|

Earnings situation and financial position of Diebold KGaA as of December 31, 2015 |

|

|

39 |

|

|

|

|

| 3.7 |

|

Employees and employee representation |

|

|

40 |

|

|

|

|

| 3.8 |

|

Financial funding of Diebold KGaA for fulfilment of its obligations under the Agreement |

|

|

40 |

|

|

|

|

| III. |

|

REASONS FOR ENTERING INTO THE DOMINATION AND PROFIT-AND-LOSS TRANSFER AGREEMENT |

|

|

42 |

|

|

|

|

| 1. |

|

Economic and legal reasons |

|

|

42 |

|

|

|

|

| 1.1 |

|

Aiming to create a joint company |

|

|

42 |

|

|

|

|

| 1.2 |

|

Limits and restrictions on cooperation in the current de facto corporate group |

|

|

44 |

|

|

|

|

| 1.3 |

|

Creation of a contractual corporate group by concluding the domination and profit-and-loss transfer agreement |

|

|

45 |

|

|

|

|

| 2. |

|

Tax reasons |

|

|

48 |

|

|

|

|

| 3. |

|

Alternatives |

|

|

49 |

|

|

|

|

| 3.1 |

|

Entering into an isolated domination agreement or an isolated profit-and-loss transfer agreement |

|

|

50 |

|

|

|

|

| 3.2 |

|

Entering into a domination and profit-and-loss transfer agreement with Diebold Inc. |

|

|

50 |

|

|

|

|

| 3.3 |

|

Exclusion of the minority shareholders (squeeze-out) |

|

|

51 |

|

|

|

|

| 3.4 |

|

Integration |

|

|

51 |

|

|

|

|

| 3.5 |

|

Merger |

|

|

52 |

|

|

|

|

| 3.6 |

|

Change of legal form |

|

|

52 |

|

|

|

|

| 4. |

|

Conclusion |

|

|

53 |

|

|

|

|

| IV. |

|

DOMINATION AND PROFIT-AND-LOSS TRANSFER AGREEMENT |

|

|

53 |

|

|

|

|

| 1. |

|

Explanation of the content of the contract |

|

|

53 |

|

|

|

|

| 1.1 |

|

Managerial control (Article 1 of the Agreement) |

|

|

53 |

|

|

|

|

| 1.2 |

|

Transfer of profit (Article 2 of the Agreement) |

|

|

55 |

|

|

|

|

| 1.3 |

|

Assumption of losses (Article 3 of the Agreement) |

|

|

57 |

|

|

|

|

| 1.4 |

|

Recurring Compensation (Article 4 of the Agreement) |

|

|

58 |

|

|

|

|

| 1.5 |

|

Exit Compensation (Article 5 of the Agreement) |

|

|

68 |

|

|

|

|

| 1.6 |

|

Right to Information (Article 6 of the Agreement) |

|

|

73 |

|

|

|

|

| 1.7 |

|

Effectiveness and term (Article 7 of the Agreement) |

|

|

74 |

|

ii

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

|

|

|

|

|

|

|

| 1.8 |

|

Guarantee (Article 8 of the Agreement) |

|

|

77 |

|

|

|

|

| 1.9 |

|

Miscellaneous (Article 9 of the Agreement) |

|

|

79 |

|

|

|

|

| 2. |

|

Payment of the Recurring Compensation and the Exit Compensation (technical processing by the banks) |

|

|

80 |

|

|

|

|

| 3. |

|

Legal effects on outside Wincor Nixdorf Shareholders |

|

|

80 |

|

|

|

|

| 3.1 |

|

Legal effects |

|

|

80 |

|

|

|

|

| 3.2 |

|

Protection of outside shareholders |

|

|

85 |

|

|

|

|

| 4. |

|

Tax effects on outside Wincor Nixdorf Shareholders |

|

|

88 |

|

|

|

|

| 4.1 |

|

Preliminary remarks |

|

|

88 |

|

|

|

|

| 4.2 |

|

Taxation of Recurring Compensation Payments at the level of shareholders |

|

|

89 |

|

|

|

|

| 4.3 |

|

Taxation of Exit Compensation at the level of shareholders |

|

|

91 |

|

|

|

|

| 5. |

|

Tax effects on Wincor Nixdorf AG |

|

|

95 |

|

|

|

|

| 6. |

|

Cost of the domination and profit-and-loss transfer agreement |

|

|

96 |

|

|

|

|

| V. |

|

TYPE AND AMOUNT OF THE RECURRING COMPENSATION AND THE EXIT COMPENSATION PURSUANT TO SECTIONS 304 AND 305 OF THE STOCK CORPORATION ACT |

|

|

96 |

|

|

|

|

| 1. |

|

Overview |

|

|

96 |

|

|

|

|

| 2. |

|

Determination and setting of the amount of the adequate Recurring Compensation Payment pursuant to Section 304 of the Stock Corporation Act |

|

|

100 |

|

|

|

|

| 3. |

|

Determination and setting of the amount of the adequate Exit Compensation pursuant to Section 305 of the Stock Corporation Act |

|

|

101 |

|

|

|

|

| VI. |

|

CONTRACT AUDIT |

|

|

102 |

|

iii

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

List of Annexes

|

|

|

| Annex 1: |

|

List of shareholdings of the Wincor Nixdorf Group as of December 31, 2015 pursuant to Section 313 para. 2 of the German Commercial Code |

|

|

| Annex 2: |

|

List of shareholdings of the Diebold Group as of December 31, 2015 |

|

|

| Annex 3: |

|

Final draft of the Domination and Profit-and-Loss Transfer Agreement between Wincor Nixdorf Aktiengesellschaft and Diebold Holding Germany Inc. & Co. KGaA together with the Guarantee from Diebold, Incorporated |

|

|

| Annex 4: |

|

Order by the District Court (Landgericht) of Dortmund dated June 1, 2016 on the appointment of ADKL AG Wirtschaftsprüfungsgesellschaft as expert auditor (Contract Auditor) within the meaning of Section 293b (1) of the

Stock Corporation Act |

|

|

| Annex 5: |

|

Expert opinion of PricewaterhouseCoopers Aktiengesellschaft Wirtschaftsprüfungsgesellschaft, Frankfurt am Main of August 16, 2016 on the calculation of the value of Wincor Nixdorf Aktiengesellschaft as of September 26,

2016 |

iv

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

The management board of Wincor Nixdorf Aktiengesellschaft (“Wincor Nixdorf

AG” and together with the subsidiaries affiliated with Wincor Nixdorf AG pursuant to Section 17 of the German Stock Corporation Act (Aktiengesetz, “Stock Corporation Act”), the “Wincor Nixdorf

Group” (Wincor Nixdorf-Konzern)) and the management of Diebold Holding Germany Inc. & Co. KGaA (“Diebold KGaA”) are jointly issuing the following report (Vertragsbericht, “Report”)

pursuant to Section 293a of the Stock Corporation Act with regards to the proposed domination and profit-and-loss transfer agreement (Beherrschungs- und Gewinnabführungsvertrag) (in its final draft and as executed copy, each the

“Agreement”) between Diebold KGaA as the controlling company and Wincor Nixdorf AG as the controlled company (together the “Parties” (Vertragsparteien)), the final draft of which as to be presented to the

extraordinary shareholders’ meetings of both Wincor Nixdorf AG and Diebold KGaA is attached to this Report as Annex 3.

On November 23, 2015, Diebold, Incorporated with its registered seat

in North Canton, Ohio, United States of America (“Diebold Inc.”, together with the dependent group companies of Diebold Inc. within the meaning of Section 17 of the Stock Corporation Act , excluding the Wincor Nixdorf Group,

the “Diebold Group” (Diebold-Gruppe)), the sole general partner and limited liability shareholder of Diebold KGaA, published its decision to launch a voluntary public takeover offer to all shareholders of Wincor Nixdorf AG

(Wincor Nixdorf-Aktionäre, “Wincor Nixdorf Shareholders”). Previously on the same day, Wincor Nixdorf AG and Diebold Inc. entered into a business combination agreement (Grundsatzvereinbarung, “Business

Combination Agreement”). On February 5, 2016, Diebold Inc. published a voluntary public takeover offer (Übernahmeangebot, “Takeover Offer”) to all Wincor Nixdorf Shareholders for the acquisition of their

ordinary bearer shares without par value, each representing a notional value of €1.00 in the share capital of Wincor Nixdorf (Wincor Nixdorf-Aktien, “Wincor Nixdorf Shares”). The settlement of the Takeover Offer was,

inter alia, subject to the condition that a minimum acceptance level of at least 22,362,159 Wincor Nixdorf Shares (this corresponds to about 67.6% of all Wincor Nixdorf Shares existing as of the date of approval of publishing the offer document by

the Federal Financial Supervisory Authority (BaFin), which corresponds to a threshold of more than 75% of the voting rights of Wincor Nixdorf AG excluding treasury shares of Wincor Nixdorf AG) would be met.

-1-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

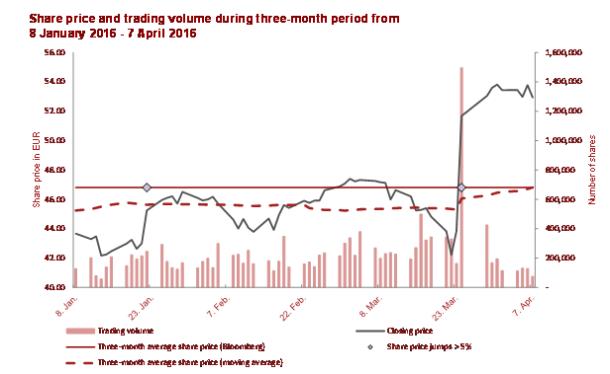

The acceptance period expired on March 22, 2016 at 24:00 hours. The additional

acceptance period commenced on March 30, 2016 and expired on April 12, 2016 at 24:00 hours. Until expiration of the additional acceptance period, the Takeover Offer has been accepted for 22,876,760 Wincor Nixdorf Shares in total, which

corresponds to 69.1% of the share capital of Wincor Nixdorf AG. In addition, 241,324 voting rights of Wincor Nixdorf Shares were attributed to Diebold KGaA pursuant to Section 30 of the German Takeover Act (WpÜG) at the end of the

additional acceptance period, which were counted when calculating the acceptance level. In total, this is equivalent to about 69.9% of the share capital of Wincor Nixdorf AG (including the Wincor Nixdorf Treasury Shares held indirectly by Wincor

Nixdorf AG).

In the course of the settlement of the Takeover Offer, the tendered Wincor Nixdorf Shares were, in accordance with the terms

and conditions of the Takeover Offer, transferred directly into a securities deposit account of Diebold KGaA without any prior acquisition or temporary purchase (Vor- oder Durchgangserwerb) by Diebold Inc. As of the date of signing of this

Report, Diebold KGaA and Diebold Inc. directly and indirectly hold 22,876,760 Wincor Nixdorf Shares in total. This corresponds to a direct and indirect participation of 69.1% of the current share capital of Wincor Nixdorf AG, which is divided

into 33,084,988 shares, and to a proportion of 76.7% of the voting rights of Wincor Nixdorf AG (excluding the Wincor Nixdorf Treasury Shares, which carry no voting rights pursuant to Section 71b of the Stock Corporation Act).

On April 8, 2016, Diebold Inc. and Diebold KGaA announced that they intend to enter into a domination and profit-and-loss transfer

agreement with Diebold KGaA as controlling company and Wincor Nixdorf AG as controlled company. By the resolution dated May 2, 2016, the management board of Wincor Nixdorf AG formally resolved to enter into negotiations with Diebold Inc. and Diebold

KGaA regarding such an agreement.

In response to a joint application by the management board of Wincor Nixdorf AG and the management of

Diebold KGaA, the District Court (Landgericht) of Dortmund by order dated June 1, 2016, selected and appointed ADKL AG Wirtschaftsprüfungsgesellschaft, Breite Straße 29-31, 40213 Düsseldorf, Germany, as joint contract

auditor (Vertragsprüfer) (the “Contract Auditor” or “ADKL”) for the examination of the Agreement.

-2-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Subject to the approval of the shareholder meetings of both Parties, this Agreement, which is

the subject matter of the Report at hand, is expected be entered into on September 26, 2016. The management of Diebold KGaA and both the management and supervisory board of Wincor Nixdorf AG have approved the final draft of the Agreement on August

16, 2016. At the time the resolution was adopted, the final draft of the Agreement, a final draft of this Report, the expert opinion (Bewertungsgutachten) (the “Valuation Report”) by PricewaterhouseCoopers Aktiengesellschaft

Wirtschaftsprüfungsgesellschaft, Frankfurt am Main, Germany (the “Valuation Expert” (Bewertungsgutachter) or “PwC”) dated August 16, 2016, and report by the Contract Auditor concerning the examination of

the Agreement (Prüfbericht) (the “Audit Report”) were available to the supervisory board of Wincor Nixdorf AG. Diebold Inc. issued a guarantee regarding the Agreement to Wincor Nixdorf AG on August 16, 2016, a copy of

which was likewise made available to the supervisory board in its meeting held on August 16, 2016.

According to the Agreement, Wincor

Nixdorf AG subordinates its management to Diebold KGaA and undertakes to transfer all of its profits to Diebold KGaA. Diebold KGaA undertakes to compensate any loss incurred by Wincor Nixdorf AG and to grant an adequate recurring compensation

(Ausgleich) and an adequate exit compensation payment (Abfindung) to outside shareholders.

Pursuant to Section 293

para. 1 and para. 2 of the Stock Corporation Act, the effectiveness of the Agreement is subject to the approval of the shareholders’ meetings of both Parties. The shareholders’ meetings of both Diebold KGaA and Wincor Nixdorf AG

are expected to resolve on the approval of the Agreement on September 26, 2016. The same applies to Diebold Inc.’s consent pursuant to Section 285 para. 2 clause 1 of the Stock Corporation Act, as to be granted in its role as general

partner of Diebold KGaA. Pursuant to Section 294 para. 2 of the Stock Corporation Act, the Agreement will become effective upon its registration with the commercial register (Handelsregister) at the registered office of Wincor

Nixdorf.

| 1. |

Wincor Nixdorf AG and the Wincor Nixdorf Group |

Wincor Nixdorf AG is a listed stock corporation (Aktiengesellschaft)

with its registered seat in Paderborn, Germany. Wincor Nixdorf AG is the holding company of the Wincor Nixdorf Group consisting of Wincor Nixdorf AG itself as well as its subsidiaries. The Wincor Nixdorf Group is a global leading provider of IT

solutions and services for retail banks and trading companies.

-3-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

The business of Wincor Nixdorf Group is divided into the operative segments retail banks

(“Banking”) and trading companies (“Retail”). The business model aims at efficiently assisting banks and trading companies with the successful adjustment of their businesses to the demands of the digital age and at

supporting the continuous improvement of their business processes by implementing reliable IT solutions. In this context, one of the key responsibilities is to link digital and stationary distribution channels in order to promote business. For this

purpose, the Wincor Nixdorf Group offers a comprehensive spectrum of automated and electronic solutions in the banking and trading markets, which covers the key steps in the process of change affecting business systems. This selection is supported

by product-related services and concepts involving the operation of specific branch IT processes by the Wincor Nixdorf Group, and outsourcing services where the Wincor Nixdorf Group is responsible for the correct operation of those systems. In this

manner, the Wincor Nixdorf Group helps its customers to be more efficient and user-friendly while reducing their process costs.

On

June 30, 2016, the Wincor Nixdorf Group employed worldwide 9,643 full-time employees, of which approximately 75% are located in Europe. The Wincor Nixdorf Group is acting directly or through affiliates in more than 130 countries throughout the

world. The production sites are located in Germany and China. Research and development primarily takes place in Germany, Poland, Singapore, and China.

The webpage of Wincor Nixdorf AG is available at http://www.wincor-nixdorf.com.

| 1.2 |

Corporate history and development |

The roots of the current business activity of

today’s Wincor Nixdorf Group date back to the year 1952 when Heinz Nixdorf laid the foundation for Nixdorf Computer AG. In the time leading up to the mid-1980’s, he grew his company into the fourth-largest computer group in Europe.

In 1990, four years after Nixdorf’s death, Nixdorf Computer AG was taken over by Siemens AG, and the company “Siemens Nixdorf

Informationssysteme AG” was born. The “Retail Solutions” and “Banking Solutions” divisions were integrated into the Siemens organization. Following

-4-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

reorganizations and rationalization within Siemens Nixdorf Informationssysteme AG from 1992

to 1994, the first great wave of expansion followed in 1995. The range of products and services was extended and internationalization was driven further forward. In 1996 and 1997, the company experienced massive growth and business segments such as

Enterprise Solutions and product solutions for lottery companies came into being.

1998 saw the formation of the independent company

“Siemens Nixdorf Retail and Banking Systems GmbH” as a wholly-owned subsidiary of Siemens Nixdorf Informationssysteme AG. Increasing emphasis was placed on the development of software solutions for the retail and banking segment, as well

as the production of associated systems and equipment.

The carve-out from Siemens group occurred in 1999 in the wake of the sale to

private equity firms Kohlberg Kravis Roberts and Goldman Sachs Capital Partners. The current Wincor Nixdorf AG was founded as a limited liability company under the company name of “AB 9916 Vermögensverwaltungs GmbH” with its

registered office in Munich, Germany on the basis of its articles of association which have been enacted on July 2, 1999. As of October 1, 1999, the company commenced its business operations. In the same year, the company changed its legal

name to “Wincor Nixdorf 1. Beteiligungsgesellschaft mbH” and the registered office was moved to Paderborn, Germany. In 2000, the company’s legal name was changed to “WINCOR NIXDORF Holding GmbH”.

On May 5, 2004, the company was converted into a stock corporation (Aktiengesellschaft) under the legal name of “Wincor

Nixdorf Aktiengesellschaft”. The initial public offering took place on May 19, 2004. Since then, the shares are traded on Frankfurt Stock Exchange’s Prime Standard.

| 1.3 |

Legal form, registered office, fiscal year and corporate purpose |

Wincor Nixdorf AG is a

German stock corporation (Aktiengesellschaft) with its registered seat in Paderborn, Germany, registered in the commercial register (Handelsregister) of the local court (Amtsgericht) of Paderborn under docket number

HRB 6846. The domestic business address is Heinz-Nixdorf-Ring 1, 33106 Paderborn, Germany. The fiscal year of Wincor Nixdorf AG commences on October 1 of each calendar year and ends on September 30 of each subsequent calendar year.

The management board and the supervisory board of Wincor Nixdorf AG consider to recommend resolving on a harmonization of the fiscal year with the calendar year to the shareholders of Wincor Nixdorf AG in the next ordinary general shareholders’

meeting.

-5-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Section 2 of the articles of association of Wincor Nixdorf AG describes the corporate

purpose of Wincor Nixdorf AG as follows:

| |

(1) |

The object of the company is to manage a group of associated companies based both within and outside of Germany that operate in research, development, production, sales, installation and leasing in connection with

products and solutions in the fields of electronic information processing, information transfer and other innovative technology systems and also provide consulting, training and other services related to this business. |

| |

(2) |

The company may itself operate in the aforementioned areas or restrict its activities to the management of its holdings. |

| |

(3) |

The company may conduct any business or undertake any actions that are appropriate for directly or indirectly fulfilling the object of the company. In this respect, the company may found, take over or acquire an

interest in other companies. The company may set up other branches under the same or a different name within or outside of Germany. |

| 1.4 |

Share capital, shareholders and trading on the stock exchange |

The issued share capital amounts to €33,084,988.00 and is divided

into 33,084,988 bearer shares without par value with each share representing a notional value in the share capital of €1.00.

The management board of Wincor Nixdorf AG is authorized, with the

consent of the supervisory board, to increase the share capital of Wincor Nixdorf AG by up to a total of €16,542,494.00 on one or several occasions by issuing new no-par-value bearer shares against cash contributions and/or contributions in

kind (Genehmigtes Kapital 2014, “Authorized Capital 2014”) on or before January 19, 2019. The shareholders shall be granted pre-emptive subscription rights.

-6-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

However, the management board of Wincor Nixdorf AG is authorized, with the consent of the

supervisory board

| |

• |

|

to exclude fractions from the subscription rights of the shareholders. |

| |

• |

|

to exclude the subscription right of shareholders if the issue amount of the new shares is not significantly less than the stock market price. This authorization, however, is only valid with the stipulation that the

stocks issued with the exclusion of the subscription right in accordance with Section 186 para. 3, sentence 4 of the Stock Corporation Act may not exceed a total of 10% of the existing share capital at the time of the resolution or

– insofar as this is less – at the time of the use of the authorization. As far as shares or rights that entitle to the subscription of shares of Wincor Nixdorf are issued or sold since the granting of the authorization, that is, since

January 20, 2014, with the exclusion of the subscription rights in accordance with Section 186 para. 3, sentence 4 of the Stock Corporation Act, these are taken into account in respect of the limitation of 10% of the share

capital. |

| |

• |

|

to exclude the subscription rights of the shareholders with the approval of the supervisory board for issuing shares against contributions in kind for the purposes of (also indirect) acquisition of companies, parts of

companies or investments in companies, whereby in this case the exclusion of the subscription right is restricted to a maximum of 20% of the share capital of Wincor Nixdorf at the time of the resolution or – insofar as this is less – at

the time of the use of the authorization. |

The authorizations for the exclusion of subscription rights described above are

only valid with the stipulation that since the granting of these authorizations on January 20, 2014, on the basis of this or other authorizations for the issuance or sale of shares of Wincor Nixdorf or of rights that entitle to the subscription

of shares of Wincor Nixdorf AG, shares issued with the exclusion of the subscription right in accordance with or in corresponding application of Section 186 para. 3 of the Stock Corporate Act may, in total, not amount to more than 20%

of the existing share capital at the time of the resolution or – insofar as this is less – at the time of the use of the authorization.

-7-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

| 1.4.3 |

Conditional Capital |

| (i) |

Conditional Capital 2013 |

The share capital of Wincor Nixdorf AG is conditionally increased by

up to €10,000,000.00 and is divided into up to 10,000,000 bearer shares (Bedingtes Kapital 2013, “Conditional Capital 2013”). The conditional capital increase is to be used to grant option rights or option obligations,

in accordance with the option conditions, to the holders of warrants from participatory certificates with warrants and/or bonds with warrants or to grant conversion rights or conversion obligations, in accordance with the conversion conditions, to

the holders of convertible participatory certificates and/or convertible bonds that are issued by Wincor Nixdorf AG or a dependent group company of Wincor Nixdorf AG within the meaning of Section 17 of the Stock Corporation Act by

January 20, 2018, pursuant to the authorization adopted by the general shareholders’ meeting of Wincor Nixdorf AG on January 21, 2013 under item 7(a). The new shares shall be issued at the option or conversion price to be defined in

accordance with the above authorization adopted. The conditional capital increase shall be carried out only in the event of the issuing of participatory certificates with warrants and/or convertible participatory certificates and/or bonds with

warrants and/or convertible bonds insofar as the holders of participatory certificates with warrants and/or convertible participatory certificates and/or bonds with warrants and/or convertible bonds make use of their option or conversion rights or,

if they have conversion/option obligations, fulfill their conversion/option obligation and if the conditional capital is required under the terms and conditions of the participatory certificates with warrants and/or convertible participatory

certificates and/or bonds with warrants and/or convertible bonds. The new shares issued pursuant to exercise of the option or conversion right shall carry dividend rights from the beginning of the fiscal year in which they are issued. If they are

issued before the general shareholders’ meeting, the new shares shall be entitled to dividends for the previous fiscal year as well. The management board of Wincor Nixdorf AG is authorized, with the consent of the supervisory board, to further

define the details of the conditional capital increase. The supervisory board of Wincor Nixdorf AG is further authorized to amend the wording of Section 4 para. 8 of the Articles of Association of Wincor Nixdorf AG in accordance with the

respective issue of shares and make all connected adaptations to the Articles of Association of Wincor Nixdorf AG that only relate to the wording. The same shall apply if the authorization to issue participatory certificates with warrants or

convertible participatory certificates or bonds with warrants or convertible bonds is not used after expiration of the period of authorization and if the conditional capital is not used after expiration of the periods for exercising option or

conversion rights.

-8-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

As of the date of signing of this Report, neither Wincor Nixdorf AG nor any of its dependent

subsidiaries issued any such equity-linked securities or warrants.

| (ii) |

Conditional Capital 2014 |

The share capital of Wincor Nixdorf AG is conditionally increased by

up to €1,654,249.00 through the issuance of up to 1,654,249 new bearer shares, without par value (Bedingtes Kapital 2014, “Conditional Capital 2014”).

This conditional capital is to be used exclusively to cover stock options issued to members of the management board of Wincor Nixdorf AG,

board members of subordinate affiliated companies within and outside of Germany and to other executives and employees of Wincor Nixdorf AG and its subordinate affiliated companies, as specified in detail in the authorization resolved by the general

shareholders’ meeting on January 20, 2014 and in accordance with the authorization by the general shareholders’ meeting on January 20, 2014 as amended by the general shareholders’ meeting on January 25, 2016. It will

only be used to the extent that holders of share options exercise their right to subscribe for Wincor Nixdorf Shares and Wincor Nixdorf AG does not provide the consideration in cash or by means of its own shares. The new shares will carry dividend

rights from the beginning of the fiscal year in which they are issued. Should the issuance take place before the ordinary general shareholders’ meeting, the new shares will be entitled to dividends for the previous fiscal year as well.

As of June 30, 2016 Wincor Nixdorf AG had issued a total of 2,684,455 stock options as part of several stock option plans (Wincor

Nixdorf-Aktienoptionspläne) (the “Wincor Nixdorf Stock Option Plans”). In case stock options under the Wincor Nixdorf Stock Option Plans are being exercised, Wincor Nixdorf AG may, at its election, deliver shares or make

cash payments to settle the options.

In light of the Takeover Offer, the general shareholders’ meeting of Wincor Nixdorf AG resolved

on January 25, 2016 to authorize the management board and the supervisory board to make certain changes to the terms of the outstanding stock options and the stock options to be granted in the future

-9-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Currently, Wincor Nixdorf AG indirectly holds a total of 3,268,777

Wincor Nixdorf Shares (approximately 9.88%) from prior fiscal years’ buyback programs as treasury shares through its wholly owned, indirect subsidiary Wincor Nixdorf Facility GmbH (the “Wincor Nixdorf Treasury Shares”). The

repurchased shares are to be used for all legitimate purposes and for those covered by the authorization issued by the general shareholders’ meeting, in particular for the purpose of settling obligations arising from share options already

issued or to be issued to members of the management board, other managers or staff members of Wincor Nixdorf AG and/or subordinated affiliated entities on the basis of the authorization granted for the issuance of share options.

According to the notifications regarding voting rights

(Stimmrechtsmitteilungen) as submitted in accordance with the provisions of the German Securities Trading Act (Wertpapierhandelsgesetz) by August 10, 2016, the following shareholders held (directly or indirectly) no less than 3% in the

share capital of Wincor Nixdorf AG:

|

|

|

|

|

|

|

|

|

|

|

| Title of Class |

|

Name of Notifying Person |

|

Number of Voting

Rights Disclosed 1 |

|

|

Stake Attributable

to Voting Rights as

Disclosed

(accounting for

treasury shares in

the denominator)1 |

|

| No par value shares |

|

Kiltearn Limited, Edinburgh, Great Britain |

|

|

3,341,590 |

|

|

|

10.10 |

% |

| No par value shares |

|

Kiltearn Global Equity Fund, Pittsburgh, Pennsylvania, USA |

|

|

1,667,024 |

|

|

|

5.04 |

% |

| No par value shares |

|

Morgan Stanley, Wilmington, Delaware, USA |

|

|

1,551,930 |

|

|

|

4.69 |

% |

| No par value shares |

|

Syquant Capital, Paris, France |

|

|

1,131,607 |

|

|

|

3.42 |

% |

| No par value shares |

|

Deutsche Asset & Wealth Management Investment GmbH, Frankfurt, Germany |

|

|

992,980 |

|

|

|

3.001 |

% |

From August 15, 2016 on, Diebold KGaA holds 22,876,760 Wincor Nixdorf Shares. This ownership corresponds with a

stake of 69.1% in the total share capital of Wincor Nixdorf AG and to 76.7% of the voting rights of Wincor Nixdorf AG (excluding Wincor Nixdorf Treasury Shares, which carry no voting rights pursuant to Section 71b of the Stock Corporation Act).

| 1 |

Statements relate to the voting rights disclosed pursuant to Sec. 21, 22 German Securities Trading Act (including voting rights granted pursuant to Section 22 German Securities Trading Act); multiple accounting for

voting rights can therefore not be ruled out. |

-10-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

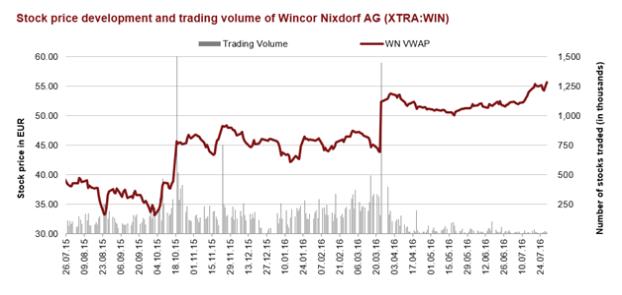

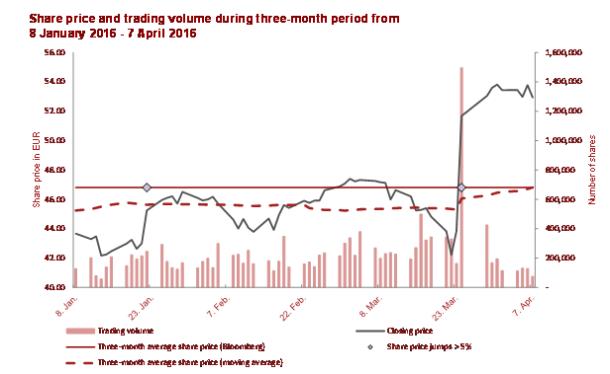

| 1.4.6 |

Trading on the stock exchange |

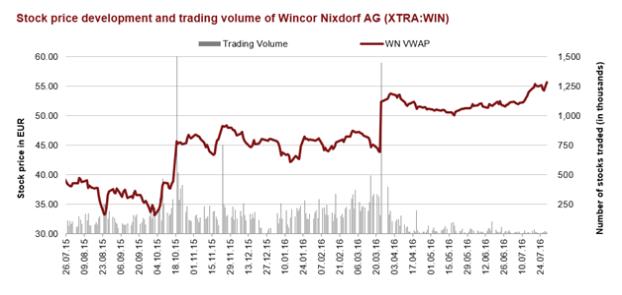

Wincor Nixdorf Shares are currently admitted to trading

on the regulated market (Regulierter Markt) of the Frankfurt Stock Exchange with additional post-admission obligations (Prime Standard) under the International Securities Identification Number (ISIN) DE000A0CAYB2 and the securities

identification number (Wertpapierkennnummer) (WKN) A0CAYB and were listed in the MDAX of the German Stock Exchange (Deutsche Börse) until June 19, 2016. As of June 20, 2016 Wincor Nixdorf Shares are listed in the SDAX of the

German Stock Exchange (Deutsche Börse).

| 1.5 |

Boards of Wincor Nixdorf AG |

Pursuant to Section 5 of the Articles of Association of Wincor

Nixdorf AG, the management board of Wincor Nixdorf AG consists of two or more members with the exact number to be specified by the supervisory board. The management board of Wincor Nixdorf AG currently consists of the following persons:

| |

• |

|

Dr. Jürgen Wunram (CFO, Deputy Chairman of the Management Board) |

| |

• |

|

Olaf Heyden (Executive Vice President, Services / Member of the Management Board) |

| |

• |

|

Dr. Ulrich Näher (Executive Vice President, Business Unit Systems / Member of the Management Board) |

The supervisory board of Wincor Nixdorf AG plans to expand the management board of Wincor Nixdorf AG to six members and to appoint Mr. Stefan

E. Merz and one other representative of Diebold Inc. as regular members of the management board following the approval of the general shareholders’ meeting to entering into the domination and profit-and-loss transfer agreement.

Pursuant to Section 6 of the Articles of Association of Wincor Nixdorf AG, Wincor Nixdorf AG is represented by two members of the

management board or jointly by one member of the management board and an authorized

-11-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

signatory (Prokurist). The supervisory board is entitled to waive the legal

prohibition to represent multiple parties as lined out in Section 181 alt. 2 of the German Civil Code (Bürgerliches Gesetzbuch, BGB) for all or individual members of the board as well as for any authorized signatory who

is authorized to sign jointly with a board member for Wincor Nixdorf AG.

Pursuant to Section 7 of the Articles of Association of Wincor

Nixdorf AG, the supervisory board is composed of twelve members, six of which are elected by the shareholders’ meeting. Pursuant to the German Act on Co-determination of Employees (Mitbestimmungsgesetz, “Co-Determination

Act”), the other six members represent the employees. As of the date of signing of this Report, the supervisory board of Wincor Nixdorf AG consists of the following persons:

| |

• |

|

Dr. Alexander Dibelius (Chairman) |

| |

• |

|

Michael Schild (Deputy Chairman) |

| |

• |

|

Dr. Valerie Julia Barth |

Zvezdana Seeger, Prof. Dr. Achim Bachem and Hans-Ulrich Holdenried have

resigned from the supervisory board with effect from September 30, 2016. The supervisory board of Wincor Nixdorf AG proposed to the extraordinary general meeting to be held on September 26, 2016, to elect Andreas W. Mattes, Christopher A. Chapman

and Elizabeth C. Radigan to join the supervisory board with effect from October 1, 2016.

-12-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

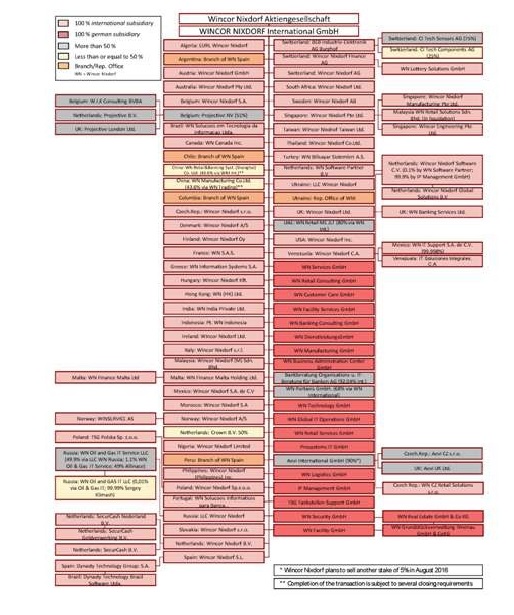

| 1.6 |

Structure of the Wincor Nixdorf Group |

| 1.6.1 |

Operative and legal structure |

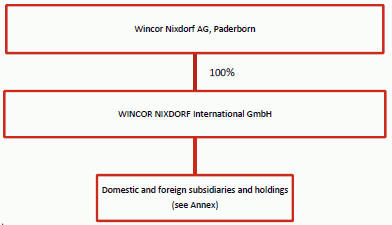

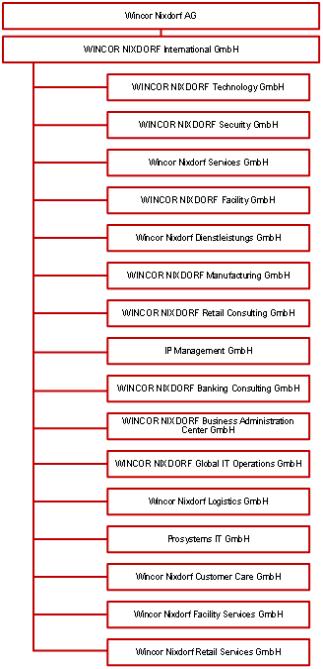

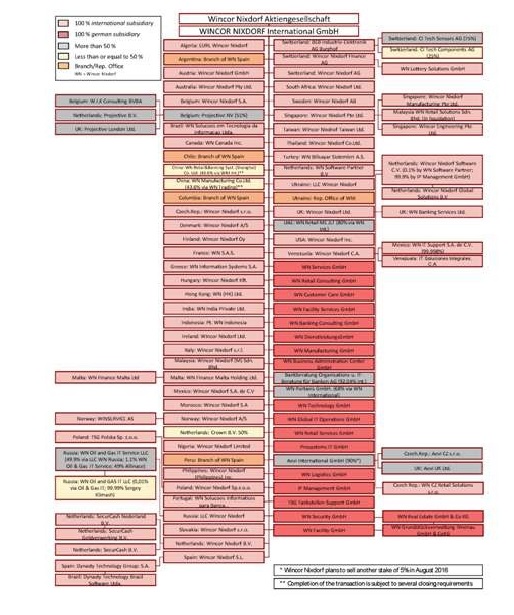

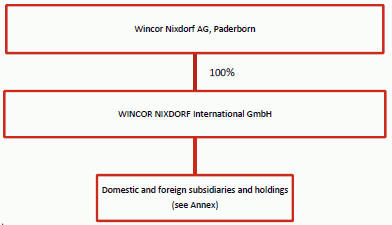

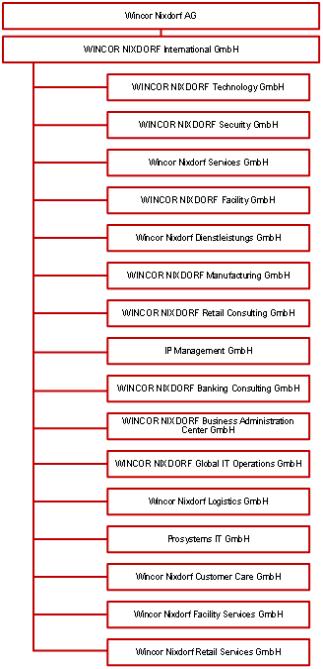

Wincor Nixdorf AG is the holding company of the Wincor

Nixdorf Group. It runs the business of the Group and performs the typical administrative tasks of a group holding company. As of June 30, 2016, Wincor Nixdorf AG held a total of 94 direct and indirect participations in other companies which are

included in the interim consolidated financial statements.

The operative business is divided into the segments Banking and Retail, which

also apply for reporting (Berichterstattung).

| 1.6.2 |

Significant subsidiaries; consolidated companies |

As of December 31, 2015, the total of

fully consolidated companies (including Wincor Nixdorf AG) amounted to 92.

A comprehensive overview of the investments of Wincor Nixdorf

AG within the meaning of Section 313 para. 2 of the German Commercial Code (Handelsgesetzbuch, “German Commercial Code”) as of December 31, 2015 has been attached to this Report as Annex 1.

| 1.7 |

Business activities of the Wincor Nixdorf Group |

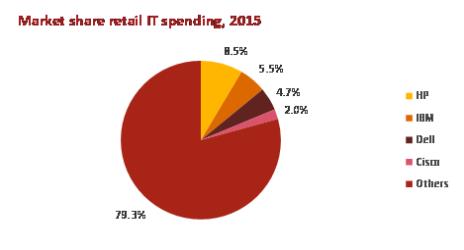

Wincor Nixdorf Group is one of the

world’s leading providers of IT solutions and services to retail banks and trade companies. The comprehensive service portfolio is designed to optimize business processes within branches of banks and trading companies. This is essentially about

reducing complexity and cost, and improving service to the end customer. The Wincor Nixdorf Group also applies its expertise to related industries such as postal services and service station networks.

The Banking segment’s proposition includes hardware, software, IT services, and consulting services. Key elements of the hardware

portfolio are ATMs, cash recycling systems, automated teller safes and transaction terminals. Besides software for the operating systems, the Wincor Nixdorf Group offers within the Banking segment software by means of which banks are able to manage

processes throughout all distribution channels.

-13-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

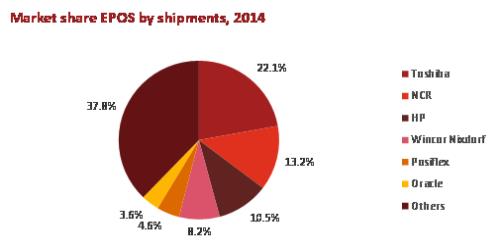

Through the Retail segment, the Wincor Nixdorf Group also provides hardware, software, IT

services, and consulting services. Key elements are programmable ePOS systems or self-checkout systems and relate to the checkout area. The software portfolio allows the entire control of all processes and systems within the branch.

The whole service portfolio is supported by product-related services and concepts involving the operation of specific branch IT processes by

the Wincor Nixdorf Group as well as outsourcing services, where the Wincor Nixdorf Group takes over responsibility for the correct operation of those systems.

| 1.8 |

Development of the business and earnings situation of Wincor Nixdorf Group |

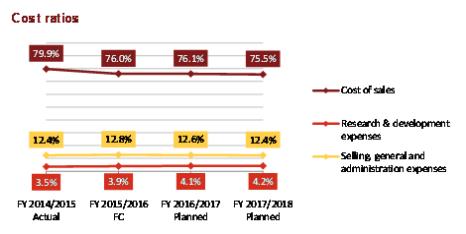

The

following selected consolidated financial data for the fiscal years 2012/2013, 2013/2014 and 2014/2015 and for the balance sheet dates of September 30, 2013, 2014 and 2015 have been taken or derived from the consolidated financial statements of

Wincor Nixdorf AG for the respective fiscal year. The consolidated financial statements of Wincor Nixdorf AG have been prepared in accordance with the International Financial Reporting Standards (IFRS) as applicable in the European Union and the

supplementary commercial regulations applicable under Section 315a para. 1 of the German Commercial Code. The selected consolidated financial data as of June 30, 2016 and for the period from October 1, 2015, to June 30, 2016

have been derived from the unaudited interim financial statements of Wincor Nixdorf AG which have been prepared in accordance with IFRS as applicable in the European Union and the supplementary commercial regulations applicable under

Section 315a para. 1 of the German Commercial Code.

| 1.8.1 |

Financial information for the fiscal years 2012/2013, 2013/2014 and 2014/2015 |

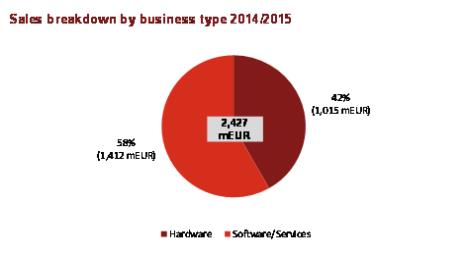

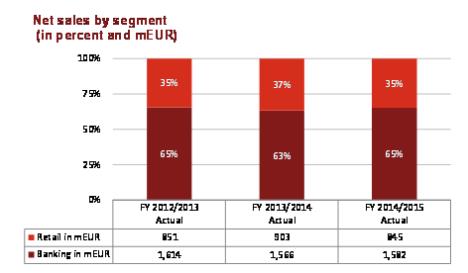

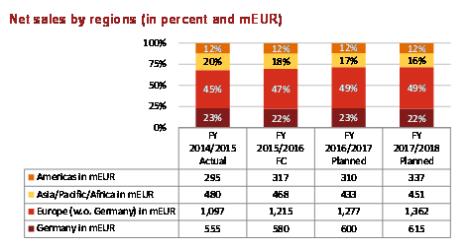

Pursuant

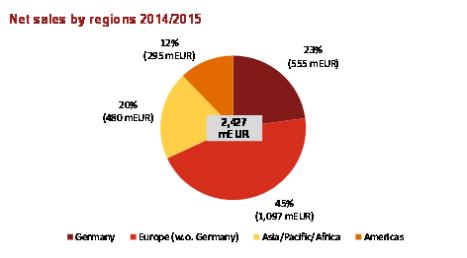

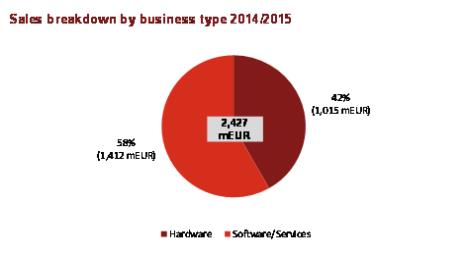

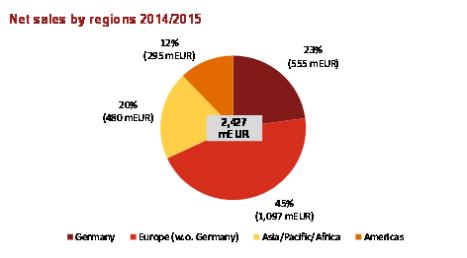

to the consolidated profit-and-loss statement of Wincor Nixdorf AG for the fiscal year ended September 30, 2015, issued in accordance with the IFRS, the revenue amounted to approximately €2.4 billion.

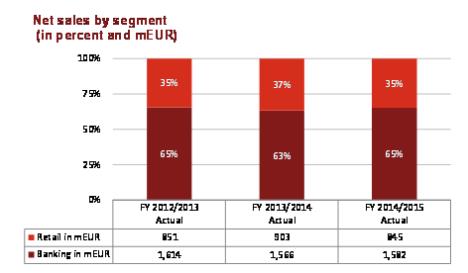

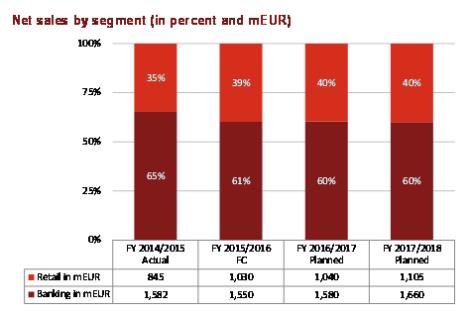

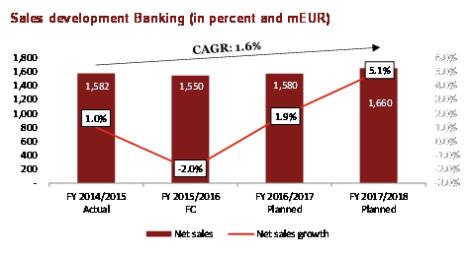

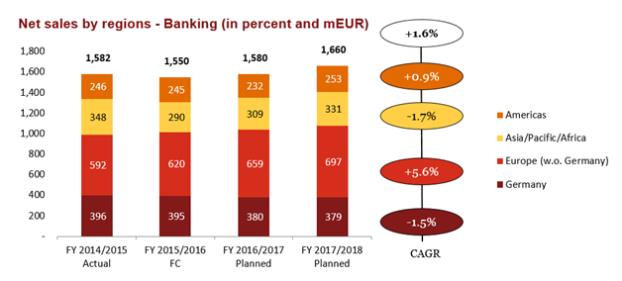

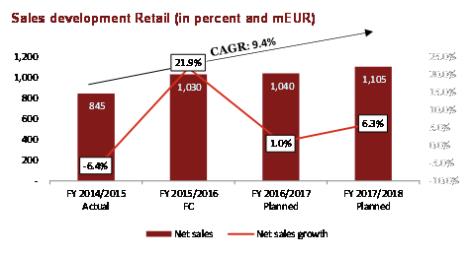

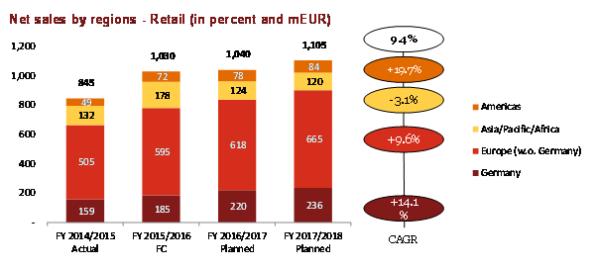

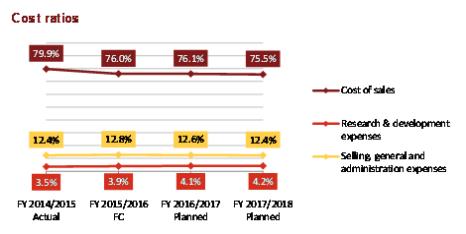

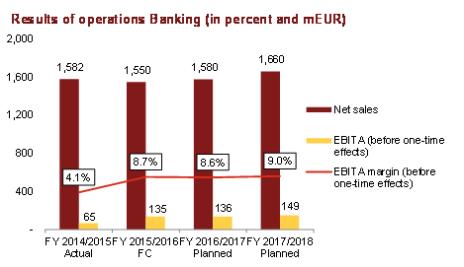

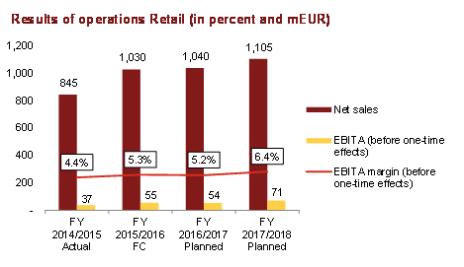

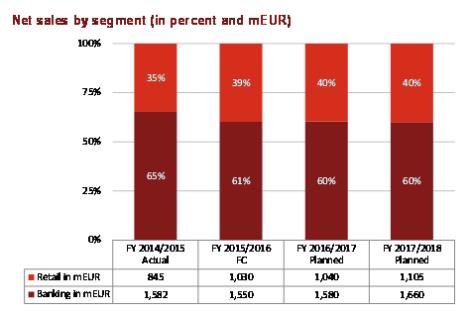

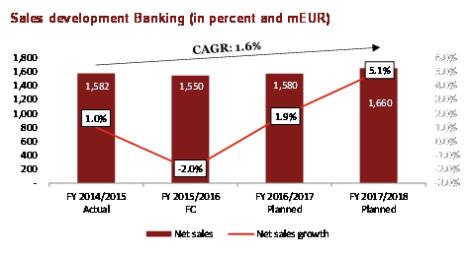

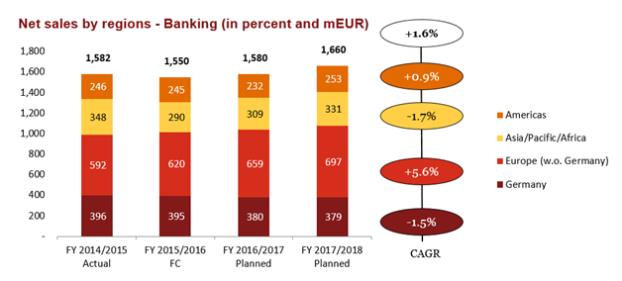

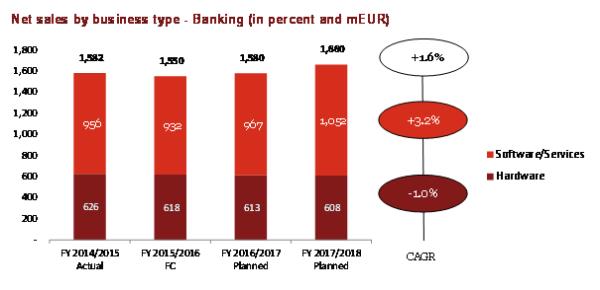

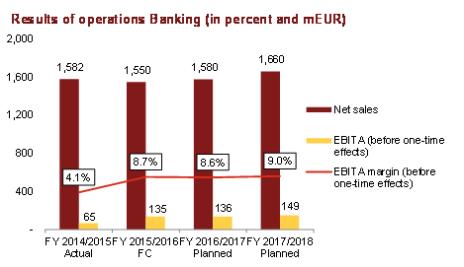

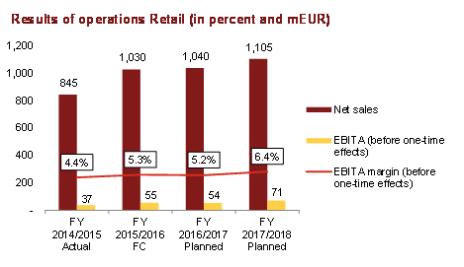

While revenues in the banking segment increased by 1% to €1,582 million (previous year period: €1,566 million), the revenues in the

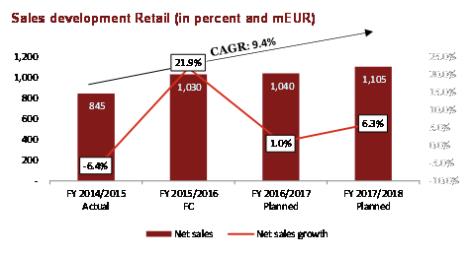

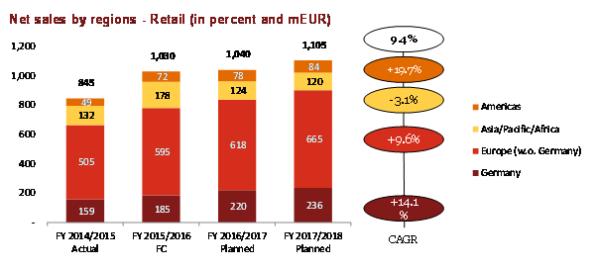

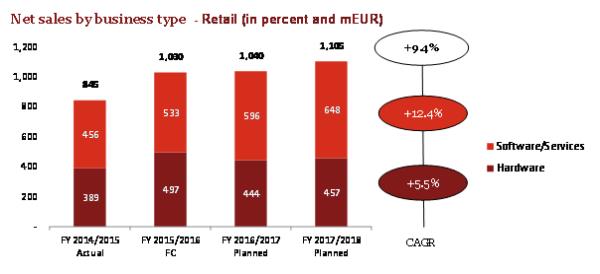

retail segment decreased by 6% to €845 million (previous year period: €903 million). In the fiscal year 2014/2015 operative earnings (earnings from operations before interest, taxes and amortization of goodwill (“EBITA”))

amounted to €22 million after restructuring expenses. These earnings include restructuring

-14-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

expenses of €80 million. Accordingly, the EBITA before restructuring expenses amounted

to €102 million. The EBITA of the previous fiscal year 2013/2014 in the amount of €155 million included special effects due to the sale of real estate in Singapur in the amount of €20 million. The EBITA margin (EBITA in percent of

revenues) before restructuring expenses decreased by 2.1 percentage points to 4.2% (previous year period: 6.3%). After deduction of restructuring expenses the EBITA margin was 0.9% (previous year period: 6.3%). The earnings before taxes after

restructuring expenses decreased by 90% and amounted to €15 million (previous year period: €146 million).

The consolidated

earnings per share amounted to €0.22 for fiscal year 2014/2015 and to €3.39 for fiscal year 2013/2014.

Selected data of

the consolidated profit-and-loss statement

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal year ended September 30 |

|

| |

|

2015 |

|

|

2014 |

|

|

2013 |

|

| |

|

(in thousands, except share data) |

|

| Net sales |

|

€ |

2,426,995 |

|

|

€ |

2,469,418 |

|

|

€ |

2,465,004 |

|

| Cost of sales |

|

€ |

(1,993,415 |

) |

|

€ |

(1,925,675 |

) |

|

€ |

(1,922,312 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

€ |

433,580 |

|

|

€ |

543,743 |

|

|

€ |

542,692 |

|

| Net profit (loss) on operating activities |

|

€ |

21,851 |

|

|

€ |

154,962 |

|

|

€ |

131,531 |

|

| Profit before income taxes |

|

€ |

14,913 |

|

|

€ |

146,348 |

|

|

€ |

124,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

€ |

7,772 |

|

|

€ |

104,100 |

|

|

€ |

87,849 |

|

| Net income (loss) attributable to non-controlling interests |

|

€ |

1,306 |

|

|

€ |

3,215 |

|

|

€ |

721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to equity holders of Wincor Nixdorf AG |

|

€ |

6,466 |

|

|

€ |

100,885 |

|

|

€ |

87,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares for calculation of basic earnings per share |

|

|

29,816 |

|

|

|

29,796 |

|

|

|

29,776 |

|

| Shares for calculation of diluted earnings per share |

|

|

29,816 |

|

|

|

29,796 |

|

|

|

29,776 |

|

| Basic earnings per share |

|

€ |

0.22 |

|

|

€ |

3.39 |

|

|

€ |

2.93 |

|

| Diluted earnings per share |

|

€ |

0.22 |

|

|

€ |

3.39 |

|

|

€ |

2.93 |

|

Selected balance sheet data

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of September 30 |

|

| |

|

2015 |

|

|

2014 |

|

|

2013 |

|

| |

|

(in thousands) |

|

| Cash and cash equivalents |

|

€ |

37,838 |

|

|

€ |

43,584 |

|

|

€ |

43,174 |

|

| Current assets |

|

€ |

931,701 |

|

|

€ |

979,641 |

|

|

€ |

853,302 |

|

| Total assets |

|

€ |

1,507,234 |

|

|

€ |

1,539,940 |

|

|

€ |

1,405,954 |

|

| Share capital of Wincor Nixdorf AG |

|

€ |

33,085 |

|

|

€ |

33,085 |

|

|

€ |

33,085 |

|

| Equity (incl. non-controlling interests) |

|

€ |

391,440 |

|

|

€ |

426,809 |

|

|

€ |

382,861 |

|

| Current liabilities |

|

€ |

919,055 |

|

|

€ |

887,345 |

|

|

€ |

804,971 |

|

| Total equity and liabilities |

|

€ |

1,507,234 |

|

|

€ |

1,539,940 |

|

|

€ |

1,405,954 |

|

-15-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Other data (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal year ended September 30 |

|

| |

|

2015 |

|

|

2014 |

|

|

2013 |

|

| Dividends declared and payable per share |

|

|

|

|

|

|

|

|

|

|

|

|

| in Euros |

|

€ |

0.00 |

|

|

€ |

1.75 |

|

|

€ |

1.48 |

|

| In $U.S. (1) |

|

$ |

0.00 |

|

|

$ |

2.36 |

|

|

$ |

1.95 |

|

| (1) |

Calculated based on the average U.S. dollar exchange rate as published in the consolidated financial statements of Wincor Nixdorf AG. |

| 1.8.2 |

Financial information as of June 30, 2016 or for the period from October 1, 2015 until June 30, 2016 respectively |

Pursuant to the unaudited consolidated profit-and-loss-statement of Wincor Nixdorf AG for the period from October 1, 2015 until June 30, 2016, prepared

according to IFRS, the sales revenue amounted to approximately €1.9 billion, the earnings from operating activity before financial revenues and expenses and taxes (EBIT) to €129.5 million and the earnings before income taxes to €125.8

million.

Selected data of the consolidated profit-and-loss statement

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine-month period ended June 30 |

|

| |

|

2016 |

|

|

2015 |

|

|

2014(1) |

|

| |

|

(in thousands, except share data) |

|

| Net sales |

|

€ |

1,938,356 |

|

|

€ |

1,768,072 |

|

|

€ |

1,802,731 |

|

| Cost of sales |

|

€ |

(1,475,413 |

) |

|

€ |

(1,421,641 |

) |

|

€ |

(1,405,552 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

€ |

462,943 |

|

|

€ |

346,431 |

|

|

€ |

397,179 |

|

| Net profit (loss) on operating activities |

|

€ |

129,529 |

|

|

€ |

39,792 |

|

|

€ |

91,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

€ |

89,054 |

|

|

€ |

24,749 |

|

|

€ |

60,469 |

|

| Net income (loss) attributable to non-controlling interests |

|

€ |

919 |

|

|

€ |

1,105 |

|

|

€ |

2,027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to equity holders of Wincor Nixdorf AG |

|

€ |

88,135 |

|

|

€ |

23,644 |

|

|

€ |

58,442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares for calculation of basic earnings per share |

|

|

29,816 |

|

|

|

29,816 |

|

|

|

29,790 |

|

| Shares for calculation of diluted earnings per share |

|

|

29,816 |

|

|

|

29,816 |

|

|

|

29,790 |

|

| Basic earnings per share |

|

€ |

2.96 |

|

|

€ |

0.79 |

|

|

€ |

1.96 |

|

| Diluted earnings per share |

|

€ |

2.96 |

|

|

€ |

0.79 |

|

|

€ |

1.96 |

|

| (1) |

Derived from the nine-month report for the year 2014/2015 |

-16-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Selected balance sheet data

|

|

|

|

|

|

|

|

|

| |

|

Nine-month period ended June 30 |

|

| |

|

2016 |

|

|

2015(1) |

|

| |

|

(in thousands) |

|

| Cash and cash equivalents |

|

€ |

86,580 |

|

|

€ |

46,557 |

|

| Current assets |

|

€ |

1,031,976 |

|

|

€ |

937,763 |

|

| Total assets |

|

€ |

1,637,468 |

|

|

€ |

1,499,516 |

|

| Share capital of Wincor Nixdorf AG |

|

€ |

33,085 |

|

|

€ |

33,085 |

|

| Equity (incl. non-controlling interests) |

|

€ |

452,965 |

|

|

€ |

418,201 |

|

| Current liabilities |

|

€ |

928,984 |

|

|

€ |

876,537 |

|

| Total equity and liabilities |

|

€ |

1,637,468 |

|

|

€ |

1,499,516 |

|

| (1) |

Derived from the nine-month report for the year 2014/2015 |

| 1.8.3 |

Development of the business and earnings situation for the period from October 1, 2015 until June 30, 2016 |

After a declining trend in the previous fiscal year Wincor Nixdorf Group has re-entered a phase of recovery during the current fiscal year,

capitalizing on restructuring and realignment measures in respect of its business as initiated in the context of its so-called Delta program.

Developments in the first nine months of the fiscal year 2015/2016 have confirmed the positive expectations communicated at the beginning of

the year. During this period Wincor Nixdorf Group increased revenue by 10%. In particular sales revenue amounted to €1,938 million (previous year period €1,768 million). The earnings before interest, taxes, depreciation and amortization of

goodwill, product know-how and tangible assets and licenses („EBITDA“) amounted to €191 million before transaction expenses from the business combination with Diebold Inc. and €174 million after transaction expenses from

the business combination with Diebold Inc. (previous year period €80 million).

Revenue in the banking segment increased by 1% to

€1,164 million (previous year period €1,149 million). After one-time effects, the banking segment EBITA amounted to €99 million. Excluding expenses from one-time effects of €9 million, the segment EBITA increased to €108

million (previous year period €52 million).

In the retail segment revenue increased by 25% in the first nine months of the ongoing

fiscal year, which amounted to €774 million (previous year: €619 million). The segment EBITDA, which includes offsetting one-time effects, increased by €24 million in the reporting period compared with the same period of the previous

year to €47 million (previous year period €23 million).

-17-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

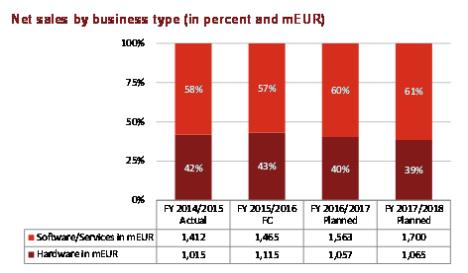

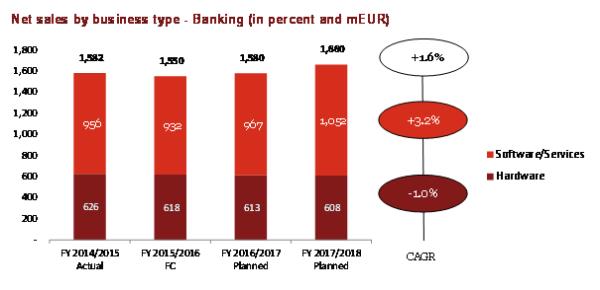

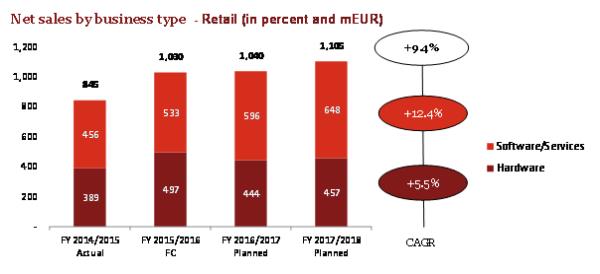

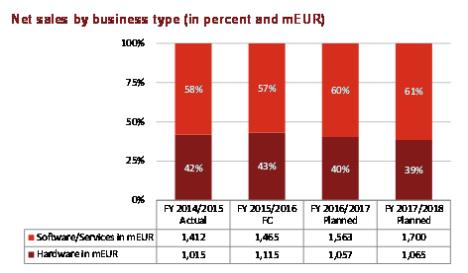

In the first nine months of the fiscal year sales revenue attributable to the hardware

business increased in the reporting period compared with the same period of the previous year by 17% to €851 million (previous year: €726 million). Sales revenue from the software/services business increased by 4% to €1,087 million

(previous year period €1,042 million). The share of sales revenue generated by the hardware business could be increased to 44% during the reporting period (previous year period 41%). Correspondingly, the proportion software/services business

share decreased to 56% (previous year period 59%).

During the ongoing fiscal year Wincor Nixdorf AG expanded its software-related services

business in the scope of acquisition activity, in particular, by acquiring 51% of the shares in Projective NV, Belgium, a company specializing in program and project management for the financial services sector, and by acquiring the joint venture

Winservice AS, Oslo. Prior to this, the IT services business was expanded by acquiring the Netherland activities of Brink’s. In addition, Wincor Nixdorf AG entered into an agreement with a mineral oil group regarding the provision of

information technology services for more than 15,000 gas stations. In this context two gas station support companies domiciled in Cologne and Cracow, Poland, were acquired. These entities are, amongst other things, responsible for operating and

updating the software applied to the processing of payment transactions at gas stations throughout Europe.

| |

(i) |

Results of operations |

Results of operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine-month period ended June 30 |

|

| |

|

2016 |

|

|

2015 |

|

|

Change |

|

| |

|

(in thousands) |

|

| Net sales |

|

€ |

1,938,356 |

|

|

€ |

1,768,072 |

|

|

|

9.6 |

% |

| Cost of sales |

|

€ |

(1,475,413 |

) |

|

€ |

(1,421,641 |

) |

|

|

3.8 |

% |

| Gross profit |

|

€ |

462,943 |

|

|

€ |

346,431 |

|

|

|

33.6 |

% |

| Net profit (loss) on operating activities |

|

€ |

129,529 |

|

|

€ |

39,792 |

|

|

|

225.5 |

% |

| Net income (loss) attributable to equity holders of Wincor Nixdorf AG |

|

€ |

88,135 |

|

|

€ |

23,644 |

|

|

|

272.8 |

% |

-18-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Assets (significant items)

|

|

|

|

|

|

|

|

|

| |

|

As of June 30 |

|

| |

|

2016 |

|

|

2015(1) |

|

| |

|

(in millions) |

|

| Intangible assets |

|

€ |

373 |

|

|

€ |

355 |

|

| Property, plant and equipment and investments |

|

€ |

126 |

|

|

€ |

127 |

|

| Non-current receivables and assets |

|

€ |

106 |

|

|

€ |

79 |

|

| Balance sheet total |

|

€ |

1,637 |

|

|

€ |

1,500 |

|

| (1) |

Derived from the nine-month report for the year 2014/2015 |

Liabilities

(significant items)

|

|

|

|

|

|

|

|

|

| |

|

As of June 30 |

|

| |

|

2016 |

|

|

2015(1) |

|

| |

|

(in millions) |

|

| Equity (including non-controlling interests) |

|

€ |

453 |

|

|

€ |

418 |

|

| Non-current liabilities |

|

€ |

255 |

|

|

€ |

205 |

|

| Current liabilities |

|

€ |

929 |

|

|

€ |

877 |

|

| Balance sheet total |

|

€ |

1,637 |

|

|

€ |

1,500 |

|

| (1) |

Derived from the nine-month report for the year 2014/2015 |

| 1.9 |

Employees and co-determination |

As of June 30 2016, Wincor Nixdorf Group employed 9,643 employees in

total, with 3,601 in Germany, 4,060 in other parts of Europe, 1,428 in the Asia/Pacific/Africa region and 554 in the Americas.

The supervisory board of Wincor Nixdorf AG is composed in accordance

with the provisions of the Co-Determination Act. It consists of twelve members, six of whom are elected by the employees pursuant to the provisions of the Co-Determination Act.

| 2. |

Diebold Inc. and the Diebold Group |

The Diebold Group provides the services, software and technology that connect

people around the world with their cash flows—bridging the physical and digital worlds of cash conveniently, securely and efficiently. Diebold Inc. was incorporated under the laws of the state of Ohio in August 1876, succeeding a proprietorship

established in 1859. Since then the Diebold Group has become a leading provider of exceptional self-service innovation, security and services to financial, retail, commercial and other markets. The Diebold Group has approximately 15,000 employees

and does business in more than 90 countries worldwide.

-19-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Diebold Inc. initiated a multi-year transformation, “Diebold 2.0”, with the primary

objective of transforming itself into a worldwide leading, services-led and software-enabled company, supported by innovative hardware, which automates the way people connect with their money.

Diebold 2.0 consists of four pillars:

| |

• |

|

Cost—Streamline the cost structure and improve near-term delivery and execution. |

| |

• |

|

Cash—Generate increased free cash flow in order to fund the investments necessary to drive profitable growth, while preserving the ability to return value to shareholders in the form of secure dividends and,

as appropriate, share repurchases. |

| |

• |

|

Talent—Attract and retain the talent necessary to drive innovation and the focused execution of the transformation strategy. |

| |

• |

|

Growth—Return Diebold to a sustainable, profitable growth trajectory. |

Diebold 2.0

is supposed to occur in three phases: 1) Crawl, 2) Walk, and 3) Run. As part of the transformation, Diebold Inc. has identified targeted savings of $200 million that are expected to be fully realized by the end of 2017 and plans to reinvest

approximately 50% of the cost savings to drive long-term growth.

During the “Crawl” phase, Diebold Inc. was primarily focused on

taking costs out of the business and reallocating a portion of these savings as reinvestments in systems and processes. Diebold Inc. engaged Accenture in a multi-year outsourcing agreement to provide finance, accounting and procurement business

process services. Cost savings, along with working capital improvements, resulted in a significant increase of free cash flow. With respect to human resources, Diebold Inc. attracted new leaders from top technology and services companies. Through

increased collaboration with customers, Diebold Inc. has also improved its growth trajectories in its FSS (financial self-service) and Security businesses.

-20-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Since the middle of 2015, Diebold Inc. has been in the “Walk” phase of Diebold 2.0

whereby Diebold Inc. will continue to build on each pillar of cost, cash, talent and growth. The main difference in the “Walk” phase is a greater emphasis on the increase of the mix of revenue from services and software, as well as shaping

the business activities of Diebold Inc.

The website of Diebold Inc. can be accessed at http://www.dieboldnixdorf.com.

| 2.2 |

Corporate history and development |

Diebold Inc. was founded as a proprietorship in 1859

in Cincinnati, Ohio producing safes and vaults and was known at the time as the Diebold Bahmann Safe Company. After relocating to Canton, Ohio in 1872, Diebold, Inc. was incorporated in August 1876 as the successor of the proprietorship. In 1936,

Diebold Inc. expanded its product line by acquiring companies that specialized in products such as rotary, visible and indexing files, and microfilming systems. Diebold Inc. became a publicly traded company in the 1930s and was listed on the New

York Stock Exchange in 1964. In 1973, Diebold Inc. introduced its Total Automatic Banking System 500 (TABS 500).

In January 1994, as part

of the strategy of Diebold Inc. to develop its international competitiveness by actively seeking acquisitions, joint ventures and strategic alliances throughout the world, Diebold Inc. acquired the ATM distribution and certain affiliated businesses

of Hidromex, S.A. de C.V., to form Diebold Mexico, S.A. de C.V., which is engaged in the distribution and service of ATMs and certain other products in the Mexican market. Diebold Inc. also acquired a 50% interest in OLTP ATM Systems, C.A., which

distributes, installs and services ATMs and certain other products in Venezuela. OLTP ATM Systems, C.A. was divested in 2015.

In October

1999, Diebold Inc. acquired Procomp Amazonia Industria Eletronica, S.A., a Brazilian manufacturer and marketer of innovative technical solutions, including personal computers, servers, software, professional services and retail and banking

automation equipment, for a consideration of approximately $222 million. In April 2000, Diebold Inc. acquired the financial self-service assets and related development activities of Groupe Bull based in France and Getronics N.V. based in the

Netherlands, with businesses including ATMs, cash dispensers, other self-service terminals and related services primarily for the global banking industry, for a consideration of approximately $147.6 million. As part of the acquisition of Groupe Bull

and Getronics N.V., Diebold Inc. further expanded its service and manufacturing capabilities in the financial industry and added approximately 1,300 employees in the areas of sales, service, management and manufacturing.

-21-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Since 2000, Diebold Inc. has made investments and acquisitions primarily in network and

hardware service solutions, ATM and hardware maintenance and services, electronic voting terminals, security solutions for customers including U.S. federal government agencies, state and municipal government agencies. Notably, Diebold Inc. expanded

its businesses in security and currency processing systems through the acquisition of Mosler Inc. in October 2001, and in network and hardware service solutions through the acquisition of TFE Technology Holdings, LLC in June 2004. In August 2012

Diebold Inc. acquired GAS Tecnologia for a consideration of approximately $39 million to further expand in the Brazilian internet banking, online payment and mobile banking security market.

In the third quarter of 2014, Diebold Inc. acquired Cryptera, a supplier of the encrypting PIN pad technology of Diebold Inc. and a leader in

the research and development of secure payment technologies, for a consideration of approximately $13 million. On March 13, 2015, Diebold Inc. acquired all of the equity interests of Phoenix for a total purchase price of approximately $72.9

million, including approximately $12.6 million of deferred cash payments payable over the next three years. Acquiring Phoenix, a leader in developing innovative multi-vendor software solutions for ATMs and a host of other FSS (financial

self-service) applications, is a foundational move to accelerate the growth of Diebold Inc. in the fast-growing managed services and branch automation spaces.

As it relates to shaping the portfolio of businesses, the announcements of Diebold Inc. subsequent to the third quarter of 2015 are consistent

with its strategy of transforming into a world-class services-led, software-enabled company, supported by innovative hardware. On October 25, 2015, Diebold Inc. announced a definitive asset purchase agreement to divest its North America-based

electronic security business for an aggregate purchase price of approximately $350 million in cash. Based on the successful transition of certain customer relationships, 10% of the purchase price is contingent and payable over a twelve-month period

after closing. Diebold Inc. has also agreed to provide certain transition services for a $6.0 million credit. The sale was completed on February 1, 2016. Additionally, Diebold Inc. is narrowing its scope in the

Brazil-Other business to primarily focus on lottery and elections to help rationalize its solution set in that market. These decisions enable Diebold Inc. to refocus its resources and better position itself to

pursue growth opportunities in the dynamic self-service industry.

-22-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

Today, the Diebold Group has become a leading provider of exceptional self-service

innovation, security and services to financial, retail, commercial and other markets.

| 2.3 |

Legal form, registered office, fiscal year and corporate purpose |

Diebold Inc. is a

stock corporation under the laws of the U.S. state of Ohio, United States of America, with its registered office in North Canton, Ohio, United States of America, and the holding company of a group consisting of Diebold Inc. and affiliated companies

in terms of Section 15 et seq. of the Stock Corporation Act, which is active within the areas of financial self-service and security solutions. Its entity number registered with the Ohio Secretary of State is 1276. The fiscal year of Diebold

Inc. ends on December 31, of each calendar year.

The business purpose of Diebold Inc. is to carry on a general manufacturing

business, including, but not limited to, the manufacture, sale, erection, disposal of and dealing in and with all kinds of safes, locks, vaults, office equipment and systems, burglar-resistant, fire-resistant and protective materials, equipment and

devices, structural materials, metal houses and all manner of steel and other metal products; to carry on any of said kinds of business, or any other, either as a manufacturer or as a wholesale or retail dealer; to acquire, by purchase, lease or in

any other manner, and to construct, equip, maintain, use and operate stores, storehouses, offices, shops, factories or other works or places of business, or any property, real or personal, necessary or convenient for any purpose or business of

Diebold Inc., and freely to dispose of any thereof in any lawful manner; to apply for, acquire, register, adopt, own, hold, control and operate under, and to sell, grant or assign, or grant, lease or assign licenses or rights under, any patents,

patent rights, licenses, shop rights, trademarks, trade names, copyrights, formulas, or any other rights of like nature, in connection with or for the purposes of any business of Diebold Inc.; to acquire, hold and freely dispose of, or otherwise use

or deal with, shares or securities of other corporations; to make payment for any property, real or personal, or any estates or interests, therein, acquired in any manner, either with cash or with shares, bonds, or other securities of Diebold Inc.,

or with other property, or with any or all thereof; to render financial assistance to any other corporation in which Diebold Inc. is interested, or which is interested in Diebold Inc., and in connection therewith, to any extent not expressly

-23-

NON-BINDING ENGLISH CONVENIENCE TRANSLATION

prohibited by law, to guarantee or become surety or indemnitor for or of the performance or

payment of any obligation or undertaking or the discharge of any liability of any such affiliated corporation; to act as agent, factor, jobber or broker for the manufacture or sale of any goods, merchandise or products of any kind whatsoever, of

others; and generally to do any and all things, properly incident to or convenient for or in connection with any of the businesses, purposes or activities hereinabove enumerated or any other business in which Diebold Inc. may engage. However,

neither the foregoing enumeration of purposes and powers, nor any other enumeration of powers elsewhere in the articles of incorporation contained, shall be deemed exclusive, nor a limitation of these powers which may be possessed or exercised by

Diebold Inc., nor shall any of the particular purposes or powers be deemed to limit, restrain, restrict or exclude any other purposes or powers, which Diebold Inc. might otherwise have, possess or exercise; but Diebold Inc. shall have and possess,

and may exercise, all powers that a corporation may lawfully have, possess and exercise under the laws of the State of Ohio, and, to the extent authorized or permitted by said laws, shall have and possess, and may exercise, all capacity and powers

possessed by natural persons to carry on business and perform all acts, within or without the State of Ohio.

| 2.4 |

Share Capital, shareholders and trading on the stock exchange |

As of the date of signing of this Report, Diebold Inc. had issued a total

of 89,907,516 common shares each with a par value of $1.25 (Diebold-Aktien, “Diebold Shares”).

As of the date of signing of this Report, Diebold Inc. is authorized

to issue up to 125,000,000 common shares each with a par value of $1.25 (the “Authorized Shares”) (Genehmigte Gesamtaktienanzahl) of which a total of 89,907,516 common shares have been issued.

The Ohio Revised Code provides that the authorized number of shares of an Ohio corporation must be set forth in the articles of incorporation.

Under the amended and restated articles of incorporation (Satzung) of Diebold Inc. (as amended and restated, the “Articles of Incorporation”), Diebold Inc. was authorized to issue 26,000,000 shares consisting of 1,000,000

serial preferred shares without par value and 25,000,000 common shares each with a par value of $1.25. A meeting of the shareholders of Diebold Inc. held on April 3, 1996 resolved to amend the Articles of Incorporation to increase the