EXHIBIT 3.5

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Ohio | 34-0183970 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

5995 Mayfair Road, PO Box 3077, North Canton, Ohio | 44720-8077 | |

(Address of principal executive offices) | (Zip Code) | |

Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer (Do not check if a smaller reporting company) | o |

Smaller reporting company | o | Emerging growth company | o | ||

March 31, 2017 | December 31, 2016 | |||||||

(Unaudited) | ||||||||

ASSETS | ||||||||

Current assets | ||||||||

Cash and cash equivalents | $ | 490.1 | $ | 652.7 | ||||

Short-term investments | 77.7 | 64.1 | ||||||

Trade receivables, less allowances for doubtful accounts of $58.1 and $50.4, respectively | 880.6 | 835.9 | ||||||

Inventories | 761.1 | 737.7 | ||||||

Prepaid expenses | 63.6 | 60.7 | ||||||

Income taxes | 122.5 | 85.2 | ||||||

Other current assets | 205.9 | 183.3 | ||||||

Total current assets | 2,601.5 | 2,619.6 | ||||||

Securities and other investments | 94.5 | 94.7 | ||||||

Property, plant and equipment, net of accumulated depreciation and amortization of $491.5 and $477.0, respectively | 382.2 | 387.0 | ||||||

Goodwill | 1,011.7 | 998.3 | ||||||

Deferred income taxes | 312.3 | 309.5 | ||||||

Finance lease receivables | 22.9 | 25.2 | ||||||

Customer relationships, net | 587.5 | 596.3 | ||||||

Other intangible assets, net | 166.0 | 176.6 | ||||||

Other assets | 66.0 | 63.1 | ||||||

Total assets | $ | 5,244.6 | $ | 5,270.3 | ||||

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | ||||||||

Current liabilities | ||||||||

Notes payable | $ | 77.7 | $ | 106.9 | ||||

Accounts payable | 541.2 | 560.5 | ||||||

Deferred revenue | 490.0 | 404.2 | ||||||

Payroll and other benefits liabilities | 169.0 | 172.5 | ||||||

Other current liabilities | 568.3 | 580.4 | ||||||

Total current liabilities | 1,846.2 | 1,824.5 | ||||||

Long-term debt | 1,689.7 | 1,691.4 | ||||||

Pensions, post-retirement and other benefits | 292.6 | 297.2 | ||||||

Deferred income taxes | 290.3 | 300.6 | ||||||

Other liabilities | 108.0 | 87.7 | ||||||

Commitments and contingencies | ||||||||

Redeemable noncontrolling interests | 449.9 | 44.1 | ||||||

Equity | ||||||||

Diebold Nixdorf, Incorporated shareholders' equity | ||||||||

Preferred shares, no par value, 1,000,000 authorized shares, none issued | — | — | ||||||

Common shares, $1.25 par value, 125,000,000 authorized shares, 90,403,524 and 89,924,378 issued shares, 75,461,453 and 75,144,784 outstanding shares, respectively | 113.0 | 112.4 | ||||||

Additional capital | 687.2 | 720.0 | ||||||

Retained earnings | 596.3 | 662.7 | ||||||

Treasury shares, at cost (14,942,071 and 14,779,597 shares, respectively) | (567.0 | ) | (562.4 | ) | ||||

Accumulated other comprehensive loss | (296.4 | ) | (341.3 | ) | ||||

Total Diebold Nixdorf, Incorporated shareholders' equity | 533.1 | 591.4 | ||||||

Noncontrolling interests | 34.8 | 433.4 | ||||||

Total equity | 567.9 | 1,024.8 | ||||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 5,244.6 | $ | 5,270.3 | ||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Net sales | ||||||||

Services and software | $ | 683.6 | $ | 341.1 | ||||

Systems | 419.2 | 168.5 | ||||||

1,102.8 | 509.6 | |||||||

Cost of sales | ||||||||

Services and software | 505.5 | 230.9 | ||||||

Systems | 354.8 | 139.9 | ||||||

860.3 | 370.8 | |||||||

Gross profit | 242.5 | 138.8 | ||||||

Selling and administrative expense | 247.0 | 125.6 | ||||||

Research, development and engineering expense | 41.4 | 18.5 | ||||||

Impairment of assets | 3.1 | — | ||||||

(Gain) loss on sale of assets, net | (0.4 | ) | 0.4 | |||||

291.1 | 144.5 | |||||||

Operating profit (loss) | (48.6 | ) | (5.7 | ) | ||||

Other income (expense) | ||||||||

Interest income | 6.4 | 4.9 | ||||||

Interest expense | (30.8 | ) | (11.5 | ) | ||||

Foreign exchange gain (loss), net | (3.1 | ) | (2.4 | ) | ||||

Miscellaneous, net | 1.3 | 34.6 | ||||||

Income (loss) from continuing operations before taxes | (74.8 | ) | 19.9 | |||||

Income tax (benefit) expense | (22.6 | ) | (0.8 | ) | ||||

Income (loss) from continuing operations, net of tax | (52.2 | ) | 20.7 | |||||

Income (loss) from discontinued operations, net of tax | — | 147.8 | ||||||

Net income (loss) | (52.2 | ) | 168.5 | |||||

Net income attributable to noncontrolling interests | 6.6 | 0.3 | ||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (58.8 | ) | $ | 168.2 | |||

Basic weighted-average shares outstanding | 75.3 | 65.1 | ||||||

Diluted weighted-average shares outstanding | 75.3 | 65.7 | ||||||

Basic earnings (loss) per share | ||||||||

Income (loss) from continuing operations, net of tax | $ | (0.78 | ) | $ | 0.31 | |||

Income (loss) from discontinued operations, net of tax | — | 2.27 | ||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (0.78 | ) | $ | 2.58 | |||

Diluted earnings (loss) per share | ||||||||

Income (loss) from continuing operations, net of tax | $ | (0.78 | ) | $ | 0.31 | |||

Income (loss) from discontinued operations, net of tax | — | 2.25 | ||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (0.78 | ) | $ | 2.56 | |||

Amounts attributable to Diebold Nixdorf, Incorporated | ||||||||

Income (loss) before discontinued operations, net of tax | $ | (58.8 | ) | $ | 20.4 | |||

Income (loss) from discontinued operations, net of tax | — | 147.8 | ||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (58.8 | ) | $ | 168.2 | |||

Common dividends declared and paid per share | $ | 0.1000 | $ | 0.2875 | ||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Net income (loss) | $ | (52.2 | ) | $ | 168.5 | |||

Other comprehensive income (loss), net of tax | ||||||||

Translation adjustment | 49.3 | 32.8 | ||||||

Foreign currency hedges (net of tax of $1.2 and $1.9, respectively) | (2.2 | ) | (3.6 | ) | ||||

Interest rate hedges | ||||||||

Net gain recognized in other comprehensive income (net of tax of $(0.8) for the three months ended March 31, 2017) | 2.0 | — | ||||||

Reclassification adjustment for amounts recognized in net income | (0.3 | ) | (0.1 | ) | ||||

1.7 | (0.1 | ) | ||||||

Pension and other post-retirement benefits | ||||||||

Net actuarial loss amortization (net of tax of $1.5 and $(0.5), respectively) | (3.9 | ) | 0.9 | |||||

Other comprehensive income (loss), net of tax | 44.9 | 30.0 | ||||||

Comprehensive income (loss) | (7.3 | ) | 198.5 | |||||

Less: comprehensive income (loss) attributable to noncontrolling interests | 6.6 | 0.4 | ||||||

Comprehensive income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (13.9 | ) | $ | 198.1 | |||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Cash flow from operating activities | ||||||||

Net income (loss) | $ | (52.2 | ) | $ | 168.5 | |||

Income (loss) from discontinued operations, net of tax | — | 147.8 | ||||||

Income (loss) from continuing operations, net of tax | (52.2 | ) | 20.7 | |||||

Adjustments to reconcile net income (loss) to cash flow used by operating activities: | ||||||||

Depreciation and amortization | 58.6 | 15.0 | ||||||

Share-based compensation | 6.8 | 5.6 | ||||||

Excess tax benefits from share-based compensation | (0.1 | ) | — | |||||

(Gain) loss on sale of assets, net | (0.4 | ) | 0.4 | |||||

Impairment of assets | 3.1 | — | ||||||

Equity in earnings of investees | 0.8 | — | ||||||

Gain on foreign currency option contracts, net | — | (36.5 | ) | |||||

Changes in certain assets and liabilities | ||||||||

Trade receivables | (36.8 | ) | (36.6 | ) | ||||

Inventories | (16.9 | ) | (31.9 | ) | ||||

Prepaid expenses | (2.6 | ) | 0.1 | |||||

Prepaid income taxes | (37.2 | ) | (13.3 | ) | ||||

Other current assets | (28.6 | ) | (9.7 | ) | ||||

Accounts payable | (22.4 | ) | (37.3 | ) | ||||

Deferred revenue | 82.0 | 3.8 | ||||||

Deferred income taxes | (8.7 | ) | 4.6 | |||||

Certain other assets and liabilities | (11.8 | ) | 5.2 | |||||

Net cash used by operating activities - continuing operations | (66.4 | ) | (109.9 | ) | ||||

Net cash used by operating activities - discontinued operations | — | (5.3 | ) | |||||

Net cash used by operating activities | (66.4 | ) | (115.2 | ) | ||||

Cash flow from investing activities | ||||||||

Proceeds from maturities of investments | 84.9 | 35.1 | ||||||

Payments for purchases of investments | (95.1 | ) | (39.5 | ) | ||||

Proceeds from sale of assets | 2.0 | 0.2 | ||||||

Capital expenditures | (12.1 | ) | (4.7 | ) | ||||

Increase in certain other assets | (8.7 | ) | (4.9 | ) | ||||

Net cash used by investing activities - continuing operations | (29.0 | ) | (13.8 | ) | ||||

Net cash provided by investing activities - discontinued operations | — | 365.1 | ||||||

Net cash provided (used) by investing activities | (29.0 | ) | 351.3 | |||||

Cash flow from financing activities | ||||||||

Dividends paid | (7.6 | ) | (18.8 | ) | ||||

Debt issuance costs | — | (0.8 | ) | |||||

Restricted cash, net | — | (116.1 | ) | |||||

Revolving credit facility borrowings (repayments), net | 20.0 | 73.1 | ||||||

Other debt borrowings | 19.1 | 17.3 | ||||||

Other debt repayments | (84.0 | ) | (198.0 | ) | ||||

Distributions and payments to noncontrolling interest holders | (15.7 | ) | (2.0 | ) | ||||

Excess tax benefits from share-based compensation | 0.1 | — | ||||||

Issuance of common shares | 0.3 | — | ||||||

Repurchase of common shares | (4.6 | ) | (1.7 | ) | ||||

Net cash used by financing activities | (72.4 | ) | (247.0 | ) | ||||

Effect of exchange rate changes on cash and cash equivalents | 5.2 | 3.4 | ||||||

Increase (decrease) in cash and cash equivalents | (162.6 | ) | (7.5 | ) | ||||

Add: Cash overdraft included in assets held for sale at beginning of period | — | (1.5 | ) | |||||

Cash and cash equivalents at the beginning of the period | 652.7 | 313.6 | ||||||

Cash and cash equivalents at the end of the period | $ | 490.1 | $ | 304.6 | ||||

Cash paid | $ | 995.3 | ||

Less: cash acquired | (110.7 | ) | ||

Payments for acquisition, net of cash acquired | 884.6 | |||

Common shares issued to Diebold Nixdorf AG shareholders | 279.7 | |||

Other consideration | (9.3 | ) | ||

Total preliminary consideration, net of cash acquired | $ | 1,155.0 | ||

Preliminary amounts recognized as of: | ||||

March 31, 2017 | ||||

Trade receivables | $ | 474.1 | ||

Inventories | 487.2 | |||

Prepaid expenses | 39.3 | |||

Current assets held for sale | 106.6 | |||

Other current assets | 79.9 | |||

Property, plant and equipment | 247.1 | |||

Intangible assets | 802.1 | |||

Deferred income taxes | 109.7 | |||

Other assets | 27.0 | |||

Total assets acquired | 2,373.0 | |||

Notes payable | 159.8 | |||

Accounts payable | 321.5 | |||

Deferred revenue | 158.0 | |||

Payroll and other benefits liabilities | 191.6 | |||

Current liabilities held for sale | 56.6 | |||

Other current liabilities | 196.3 | |||

Pensions and other benefits | 103.2 | |||

Other noncurrent liabilities | 458.9 | |||

Total liabilities assumed | 1,645.9 | |||

Redeemable noncontrolling interest | (46.8 | ) | ||

Fair value of noncontrolling interest | (407.9 | ) | ||

Total identifiable net assets acquired, including noncontrolling interest | 272.4 | |||

Total preliminary consideration, net of cash acquired | 1,155.0 | |||

Goodwill | $ | 882.6 | ||

Weighted-average useful lives | August 15, 2016 | |||||

Trade name | 3.0 years | $ | 30.1 | |||

Technologies | 4.0 years | 107.2 | ||||

Customer relationships | 9.5 years | 658.5 | ||||

Other | various | 6.3 | ||||

Intangible assets | $ | 802.1 | ||||

Three Months Ended March 31, 2017 | |||

Net sales | $ | 623.6 | |

Income (loss) from continuing operations before taxes | $ | (29.6 | ) |

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (24.4 | ) |

Unaudited pro forma information | ||||

March 31, 2016 | ||||

Net sales | $ | 1,158.5 | ||

Gross profit | $ | 294.6 | ||

Operating profit | $ | 35.3 | ||

Net income (loss) attributable to Diebold Nixdorf, Incorporated (1) | $ | 185.0 | ||

Net income (loss) attributable to Diebold Nixdorf, Incorporated per share - basic (1) | 2.47 | |||

Net income (loss) attributable to Diebold Nixdorf, Incorporated per share - diluted (1) | 2.45 | |||

Basic weighted-average shares outstanding | 75.0 | |||

Diluted weighted-average shares outstanding | 75.6 | |||

• | Additional depreciation and amortization expenses that would have been recognized assuming preliminary fair value adjustments to the existing Diebold Nixdorf AG assets acquired and liabilities assumed, including intangible assets, fixed assets and expense associated with the valuation of inventory acquired. |

• | Increased interest expense due to additional borrowings to fund the Acquisition. |

Redeemable Noncontrolling Interests | |||

Balance at December 31, 2016 | $ | 44.1 | |

Other comprehensive income (loss) | (18.6 | ) | |

Redemption value adjustment | 39.4 | ||

Redemption of shares | (1.7 | ) | |

Reclassification of noncontrolling interest | 386.7 | ||

Balance at March 31, 2017 | $ | 449.9 | |

Three Months Ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Numerator | |||||||

Income (loss) used in basic and diluted earnings (loss) per share | |||||||

Income (loss) from continuing operations, net of tax | $ | (52.2 | ) | $ | 20.7 | ||

Net income attributable to noncontrolling interests | 6.6 | 0.3 | |||||

Income (loss) before discontinued operations, net of tax | (58.8 | ) | 20.4 | ||||

Income (loss) from discontinued operations, net of tax | — | 147.8 | |||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (58.8 | ) | $ | 168.2 | ||

Denominator | |||||||

Weighted-average number of common shares used in basic earnings (loss) per share | 75.3 | 65.1 | |||||

Effect of dilutive shares (1) | — | 0.6 | |||||

Weighted-average number of shares used in diluted earnings (loss) per share | 75.3 | 65.7 | |||||

Basic earnings (loss) per share | |||||||

Income (loss) from continuing operations, net of tax | $ | (0.78 | ) | $ | 0.31 | ||

Income (loss) from discontinued operations, net of tax | — | 2.27 | |||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (0.78 | ) | $ | 2.58 | ||

Diluted earnings (loss) per share | |||||||

Income (loss) from continuing operations, net of tax | $ | (0.78 | ) | $ | 0.31 | ||

Income (loss) from discontinued operations, net of tax | — | 2.25 | |||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (0.78 | ) | $ | 2.56 | ||

Anti-dilutive shares | |||||||

Anti-dilutive shares not used in calculating diluted weighted-average shares | 1.9 | 1.9 | |||||

(1) | Incremental shares of 0.9 shares were excluded from the computation of diluted earnings (loss) per share for the three months ended March 31, 2017 because their effect is anti-dilutive due to the net loss attributable to Diebold Nixdorf, Incorporated. |

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Diebold Nixdorf, Incorporated shareholders' equity | ||||||||

Balance at beginning of period | $ | 591.4 | $ | 412.4 | ||||

Comprehensive income (loss) attributable to Diebold Nixdorf, Incorporated | (13.9 | ) | 198.1 | |||||

Common shares | 0.6 | 0.3 | ||||||

Additional capital (1) | (32.8 | ) | 5.3 | |||||

Treasury shares | (4.6 | ) | (1.7 | ) | ||||

Dividends paid | (7.6 | ) | (18.8 | ) | ||||

Balance at end of period | $ | 533.1 | $ | 595.6 | ||||

Noncontrolling interests | ||||||||

Balance at beginning of period | $ | 433.4 | $ | 23.1 | ||||

Comprehensive income attributable to noncontrolling interests, net | 6.6 | 0.4 | ||||||

Reclassification to redeemable noncontrolling interest | (386.7 | ) | — | |||||

Reclassification of guaranteed dividend to accrued liabilities | (5.7 | ) | — | |||||

Distributions to noncontrolling interest holders | (12.8 | ) | — | |||||

Balance at end of period | $ | 34.8 | $ | 23.5 | ||||

(1) | The decrease for the three months ended March 31, 2017 is primarily attributable to the redemption value adjustment to the redeemable noncontrolling interest. |

Translation | Foreign Currency Hedges | Interest Rate Hedges | Pension and Other Post-retirement Benefits | Other | Accumulated Other Comprehensive Income (Loss) | |||||||||||||||||||

Balance at January 1, 2017 | $ | (251.2 | ) | $ | (5.7 | ) | $ | 4.6 | $ | (89.3 | ) | $ | 0.3 | $ | (341.3 | ) | ||||||||

Other comprehensive income (loss) before reclassifications | 49.3 | (2.2 | ) | 2.0 | — | — | 49.1 | |||||||||||||||||

Amounts reclassified from AOCI | — | — | (0.3 | ) | (3.9 | ) | — | (4.2 | ) | |||||||||||||||

Net current-period other comprehensive income (loss) | 49.3 | (2.2 | ) | 1.7 | (3.9 | ) | — | 44.9 | ||||||||||||||||

Balance at March 31, 2017 | $ | (201.9 | ) | $ | (7.9 | ) | $ | 6.3 | $ | (93.2 | ) | $ | 0.3 | $ | (296.4 | ) | ||||||||

Translation | Foreign Currency Hedges | Interest Rate Hedges | Pension and Other Post-retirement Benefits | Other | Accumulated Other Comprehensive Income (Loss) | |||||||||||||||||||

Balance at January 1, 2016 | $ | (215.6 | ) | $ | 5.0 | $ | (0.1 | ) | $ | (107.8 | ) | $ | 0.4 | $ | (318.1 | ) | ||||||||

Other comprehensive income (loss) before reclassifications (1) | 32.6 | (3.6 | ) | — | — | — | 29.0 | |||||||||||||||||

Amounts reclassified from AOCI | — | — | (0.1 | ) | 0.9 | — | 0.8 | |||||||||||||||||

Net current-period other comprehensive income (loss) | 32.6 | (3.6 | ) | (0.1 | ) | 0.9 | — | 29.8 | ||||||||||||||||

Balance at March 31, 2016 | $ | (183.0 | ) | $ | 1.4 | $ | (0.2 | ) | $ | (106.9 | ) | $ | 0.4 | $ | (288.3 | ) | ||||||||

(1) | Other comprehensive income (loss) before reclassifications within the translation component excludes $0.2 of translation attributable to noncontrolling interests. |

Three Months Ended | Affected Line Item in the Statement of Operations | |||||||||

2017 | 2016 | |||||||||

Interest rate hedges | $ | (0.3 | ) | $ | (0.1 | ) | Interest expense | |||

Pension and post-retirement benefits: | ||||||||||

Net actuarial loss amortization (net of tax of $1.5 and $(0.5), respectively) | (3.9 | ) | 0.9 | (1) | ||||||

Total reclassifications for the period | $ | (4.2 | ) | $ | 0.8 | |||||

(1) | Pension and other post-retirement benefits AOCI components are included in the computation of net periodic benefit cost (refer to note 14). |

Number of Shares | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term | Aggregate Intrinsic Value (1) | ||||||||||

(per share) | (in years) | ||||||||||||

Outstanding at January 1, 2017 | 1.7 | $ | 31.98 | ||||||||||

Expired or forfeited | (0.2 | ) | $ | 39.41 | |||||||||

Granted | 0.8 | $ | 26.60 | ||||||||||

Outstanding at March 31, 2017 | 2.3 | $ | 29.70 | 8 | $ | 4.8 | |||||||

Options exercisable at March 31, 2017 | 1.1 | $ | 32.13 | 7 | $ | 0.7 | |||||||

Options vested and expected to vest at March 31, 2017 (2) | 2.2 | $ | 29.80 | 8 | $ | 4.5 | |||||||

(1) | The aggregate intrinsic value (the difference between the closing price of the Company’s common shares on the last trading day of the first quarter of 2017 and the exercise price, multiplied by the number of “in-the-money” options) that would have been received by the option holders had all option holders exercised their options on March 31, 2017. The amount of aggregate intrinsic value will change based on the fair market value of the Company’s common shares. |

(2) | The options expected to vest are the result of applying the pre-vesting forfeiture rate assumption to total outstanding non-vested options. |

Number of Shares | Weighted-Average Grant-Date Fair Value | ||||||

(per share) | |||||||

RSUs: | |||||||

Non-vested at January 1, 2017 | 1.2 | $ | 29.50 | ||||

Forfeited | (0.1 | ) | $ | 29.64 | |||

Vested | (0.4 | ) | $ | 30.73 | |||

Granted | 0.6 | $ | 26.63 | ||||

Non-vested at March 31, 2017 | 1.3 | $ | 27.96 | ||||

Performance Shares: | |||||||

Non-vested at January 1, 2017 | 1.2 | $ | 31.77 | ||||

Forfeited | (0.2 | ) | $ | 39.66 | |||

Vested | (0.2 | ) | $ | 23.64 | |||

Granted | 1.7 | $ | 31.22 | ||||

Non-vested at March 31, 2017 | 2.5 | $ | 31.30 | ||||

Cost Basis | Unrealized Gain | Fair Value | ||||||||||

As of March 31, 2017 | ||||||||||||

Short-term investments | ||||||||||||

Certificates of deposit | $ | 77.7 | $ | — | $ | 77.7 | ||||||

Long-term investments | ||||||||||||

Assets held in a rabbi trust | $ | 8.0 | $ | 0.9 | $ | 8.9 | ||||||

As of December 31, 2016 | ||||||||||||

Short-term investments | ||||||||||||

Certificates of deposit | $ | 64.1 | $ | — | $ | 64.1 | ||||||

Long-term investments | ||||||||||||

Assets held in a rabbi trust | $ | 7.9 | $ | 0.6 | $ | 8.5 | ||||||

Finance Leases | Notes Receivable | Total | ||||||||||

Allowance for credit losses | ||||||||||||

Balance at January 1, 2017 and March 31, 2017 | $ | 0.3 | $ | 4.1 | $ | 4.4 | ||||||

Balance at January 1, 2016 and March 31, 2016 | $ | 0.5 | $ | 4.1 | $ | 4.6 | ||||||

March 31, 2017 | December 31, 2016 | |||||||

30-59 days past due | $ | — | $ | 0.1 | ||||

60-89 days past due | — | — | ||||||

> 89 days past due (1) | 4.0 | 3.9 | ||||||

Total past due | $ | 4.0 | $ | 4.0 | ||||

(1) | Past due notes receivable balances greater than 89 days are fully reserved. |

March 31, 2017 | December 31, 2016 | |||||||

Finished goods | $ | 341.4 | $ | 330.5 | ||||

Service parts | 247.9 | 235.2 | ||||||

Raw materials and work in process | 171.8 | 172.0 | ||||||

Total inventories | $ | 761.1 | $ | 737.7 | ||||

Services | Software | Systems | Total | ||||||||||||

Goodwill | $ | 452.2 | $ | — | $ | — | $ | 452.2 | |||||||

Accumulated impairment losses | (290.7 | ) | — | — | (290.7 | ) | |||||||||

Balance at January 1, 2016 | $ | 161.5 | $ | — | $ | — | $ | 161.5 | |||||||

Goodwill acquired | 459.1 | 238.7 | 184.8 | 882.6 | |||||||||||

Goodwill adjustment | (0.5 | ) | — | — | (0.5 | ) | |||||||||

Currency translation adjustment | (20.8 | ) | (13.8 | ) | (10.7 | ) | (45.3 | ) | |||||||

Goodwill | $ | 890.0 | $ | 224.9 | $ | 174.1 | $ | 1,289.0 | |||||||

Accumulated impairment losses | (290.7 | ) | — | — | (290.7 | ) | |||||||||

Balance at December 31, 2016 | $ | 599.3 | $ | 224.9 | $ | 174.1 | $ | 998.3 | |||||||

Currency translation adjustment | 8.3 | 2.9 | 2.2 | 13.4 | |||||||||||

Goodwill | 898.3 | 227.8 | 176.3 | 1,302.4 | |||||||||||

Accumulated impairment losses | (290.7 | ) | — | — | (290.7 | ) | |||||||||

Balance at March 31, 2017 | $ | 607.6 | $ | 227.8 | $ | 176.3 | $ | 1,011.7 | |||||||

Services | Software | Systems | ||

EMEA | EMEA | EMEA | ||

Americas | Americas | Americas | ||

AP | AP | AP | ||

March 31, 2017 | December 31, 2016 | ||||||||||||||||||||||

Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||

Internally-developed software | $ | 159.0 | $ | (64.2 | ) | $ | 94.8 | $ | 151.0 | $ | (53.2 | ) | $ | 97.8 | |||||||||

Development costs non-software | 48.7 | (15.7 | ) | 33.0 | 48.4 | (9.7 | ) | 38.7 | |||||||||||||||

Customer relationships | 629.1 | (41.6 | ) | 587.5 | 621.7 | (25.4 | ) | 596.3 | |||||||||||||||

Other intangibles | 87.0 | (48.8 | ) | 38.2 | 85.3 | (45.2 | ) | 40.1 | |||||||||||||||

Total | $ | 923.8 | $ | (170.3 | ) | $ | 753.5 | $ | 906.4 | $ | (133.5 | ) | $ | 772.9 | |||||||||

March 31, 2017 | December 31, 2016 | |||||||

Notes payable | ||||||||

Uncommitted lines of credit | $ | 42.9 | $ | 9.4 | ||||

Term Loan A Facility | 18.7 | 17.3 | ||||||

Term Loan B Facility - USD | 10.0 | 10.0 | ||||||

Term Loan B Facility - Euro | 3.7 | 3.7 | ||||||

European Investment Bank | — | 63.1 | ||||||

Other | 2.4 | 3.4 | ||||||

$ | 77.7 | $ | 106.9 | |||||

Long-term debt | ||||||||

Term Loan A Facility | $ | 195.5 | $ | 201.3 | ||||

Term Loan B Facility - USD | 785.0 | 787.5 | ||||||

Term Loan B Facility - Euro | 367.6 | 363.5 | ||||||

2024 Senior Notes | 400.0 | 400.0 | ||||||

Other | 0.7 | 0.8 | ||||||

1,748.8 | 1,753.1 | |||||||

Long-term deferred financing fees | (59.1 | ) | (61.7 | ) | ||||

$ | 1,689.7 | $ | 1,691.4 | |||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Revolving credit facility borrowings (repayments), net | $ | 20.0 | $ | 73.1 | ||||

Other debt borrowings | ||||||||

International short-term uncommitted lines of credit borrowings | $ | 19.1 | $ | 17.3 | ||||

Other debt repayments | ||||||||

Payments on 2006 Senior Notes | $ | — | $ | (175.0 | ) | |||

Payments on Term Loan A Facility under the Credit Agreement | (4.3 | ) | (2.9 | ) | ||||

Payments on Term Loan B Facility - USD under the Credit Agreement | (2.5 | ) | — | |||||

Payments on Term Loan B Facility - Euro under the Credit Agreement | (1.0 | ) | — | |||||

Payments on European Investment Bank | (63.1 | ) | — | |||||

International short-term uncommitted lines of credit and other repayments | (13.1 | ) | (20.1 | ) | ||||

$ | (84.0 | ) | $ | (198.0 | ) | |||

• | a maximum total net debt to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) leverage ratio of 4.50 for the three months ended March 31, 2017 (reducing to 4.25 on December 31, 2017, further reduced to 4.00 on December 31, 2018, and further reduced to 3.75 on June 30, 2019); and |

• | a minimum adjusted EBITDA to net interest expense coverage ratio of not less than 3.00 |

Financing and Replacement Facilities | Interest Rate Index and Margin | Maturity/Termination Dates | Term (Years) | |||

Credit Agreement facilities | ||||||

Revolving Facility | LIBOR + 1.75% | December 2020 | 5 | |||

Term Loan A Facility | LIBOR + 1.75% | December 2020 | 5 | |||

Delayed Draw Term Loan A | LIBOR + 1.75% | December 2020 | 5 | |||

Term Loan B Facility ($1,000.0) | LIBOR(i) + 4.50% | November 2023 | 7.5 | |||

Term Loan B Facility (€350.0) | EURIBOR(ii) + 4.25% | November 2023 | 7.5 | |||

2024 Senior Notes | 8.5% | April 2024 | 8 | |||

(i) | LIBOR with a floor of 0.75%. |

(ii) | EURIBOR with a floor of 0.75%. |

• | In Germany, post-employment benefit plans are set up as employer funded pension plans and deferred compensation plans. The employer funded pension commitments in Germany are based upon direct performance-related commitments in terms of defined contribution plans. Each beneficiary receives, depending on individual pay-scale grouping, contractual classification, or income level, different yearly contributions. The contribution is multiplied by an age factor appropriate to the respective pension plan and credited to the individual retirement account of the employee. The retirement accounts may be used up at retirement by either a one-time lump-sum payout or payments of up to ten years. Insured events include disability, death and reaching of retirement age. |

• | In Switzerland, the post-employment benefit plan is required due to statutory provisions. The employees receive their pension payments as a function of contributions paid, a fixed interest rate and annuity factors. Insured events are disability, death and reaching of retirement age. |

• | In the Netherlands, there is an average career salary plan, which is employer- and employee-financed and handled by an external fund. Insured events are disability, death and reaching of retirement age. In the Netherlands, the plan assets are currently invested in a company pension fund. |

Pension Benefits | Other Benefits | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Components of net periodic benefit cost | ||||||||||||||||

Service cost | $ | 3.6 | $ | 0.9 | $ | — | $ | — | ||||||||

Interest cost | 7.9 | 6.2 | 0.1 | 0.1 | ||||||||||||

Expected return on plan assets | (8.6 | ) | (6.7 | ) | — | — | ||||||||||

Recognized net actuarial loss | 1.4 | 1.4 | — | 0.1 | ||||||||||||

Net periodic pension benefit cost (1) | $ | 4.3 | $ | 1.8 | $ | 0.1 | $ | 0.2 | ||||||||

2017 | 2016 | |||||||

Balance at January 1 | $ | 99.4 | $ | 73.6 | ||||

Current period accruals | 5.7 | 1.7 | ||||||

Current period settlements | (12.8 | ) | (10.7 | ) | ||||

Currency translation adjustment | 0.8 | 4.0 | ||||||

Balance at March 31 | $ | 93.1 | $ | 68.6 | ||||

Derivative instrument | Classification on condensed consolidated statements of operations | Three Months Ended | ||||||||

March 31, | ||||||||||

2017 | 2016 | |||||||||

Non-designated hedges and interest rate swaps | Interest expense | $ | (0.8 | ) | $ | (1.0 | ) | |||

Gain (loss) on foreign currency option contracts - acquisition related | Miscellaneous, net | — | 36.5 | |||||||

Foreign exchange forward contracts and cash flow hedges | Foreign exchange gain (loss), net | 1.2 | (3.8 | ) | ||||||

Total | $ | 0.4 | $ | 31.7 | ||||||

Foreign Currency Derivative | Number of Instruments | Notional Sold | Notional Purchased | ||||||||

Currency forward agreements (EUR-USD) | 17 | 82.2 | USD | 74.5 | EUR | ||||||

Currency forward agreements (EUR-GBP) | 13 | 34.5 | GBP | 41.0 | EUR | ||||||

Currency forward agreements (EUR-CAD) | 1 | 4.5 | CAD | 3.2 | EUR | ||||||

Currency forward agreements (EUR-CZK) | 1 | 144.0 | CZK | 5.4 | EUR | ||||||

March 31, 2017 | December 31, 2016 | |||||||||||||||||||||||||

Fair Value Measurements Using | Fair Value Measurements Using | |||||||||||||||||||||||||

Classification on condensed consolidated Balance Sheets | Fair Value | Level 1 | Level 2 | Fair Value | Level 1 | Level 2 | ||||||||||||||||||||

Assets | ||||||||||||||||||||||||||

Short-term investments | ||||||||||||||||||||||||||

Certificates of deposit | Short-term investments | $ | 77.7 | $ | 77.7 | $ | — | $ | 64.1 | $ | 64.1 | $ | — | |||||||||||||

Assets held in rabbi trusts | Securities and other investments | 8.9 | 8.9 | — | 8.5 | 8.5 | — | |||||||||||||||||||

Foreign exchange forward contracts | Other current assets | 2.9 | — | 2.9 | 7.2 | — | 7.2 | |||||||||||||||||||

Internal currency swap | Other current assets | 2.8 | — | 2.8 | — | — | — | |||||||||||||||||||

Interest rate swaps | Securities and other investments | 8.6 | — | 8.6 | 8.4 | — | 8.4 | |||||||||||||||||||

Internal currency swap | Other assets | 1.7 | — | 1.7 | — | — | — | |||||||||||||||||||

Total | $ | 102.6 | $ | 86.6 | $ | 16.0 | $ | 88.2 | $ | 72.6 | $ | 15.6 | ||||||||||||||

Liabilities | ||||||||||||||||||||||||||

Foreign exchange forward contracts | Other current liabilities | $ | 7.5 | $ | — | $ | 7.5 | $ | 7.7 | $ | — | $ | 7.7 | |||||||||||||

Interest rate swaps | Other current liabilities | 6.6 | — | 6.6 | 6.9 | — | 6.9 | |||||||||||||||||||

Internal currency swap | Other current liabilities | 2.8 | — | 2.8 | — | — | — | |||||||||||||||||||

Internal currency swap | Other liabilities | 1.7 | — | 1.7 | — | — | — | |||||||||||||||||||

Deferred compensation | Other liabilities | 8.9 | 8.9 | — | 8.5 | 8.5 | — | |||||||||||||||||||

Total | $ | 27.5 | $ | 8.9 | $ | 18.6 | $ | 23.1 | $ | 8.5 | $ | 14.6 | ||||||||||||||

March 31, 2017 | December 31, 2016 | |||||||||||||||

Fair Value | Carrying Value | Fair Value | Carrying Value | |||||||||||||

Notes payable | $ | 77.7 | $ | 77.7 | $ | 106.9 | $ | 106.9 | ||||||||

Term Loan A Facility | 195.5 | 195.5 | 201.3 | 201.3 | ||||||||||||

Term Loan B Facility - USD | 785.0 | 785.0 | 787.5 | 787.5 | ||||||||||||

Term Loan B Facility - Euro | 367.6 | 367.6 | 363.5 | 363.5 | ||||||||||||

2024 Senior Notes | 442.0 | 400.0 | 426.0 | 400.0 | ||||||||||||

Other | 0.7 | 0.7 | 0.8 | 0.8 | ||||||||||||

Long-term deferred financing fees | (59.1 | ) | (59.1 | ) | (61.7 | ) | (61.7 | ) | ||||||||

Long-term debt | 1,731.7 | 1,689.7 | 1,717.4 | 1,691.4 | ||||||||||||

Total debt instruments | $ | 1,809.4 | $ | 1,767.4 | $ | 1,824.3 | $ | 1,798.3 | ||||||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Cost of sales – services and software | $ | 3.0 | $ | 0.3 | ||||

Cost of sales – systems | 0.6 | — | ||||||

Selling and administrative expense | 8.4 | 0.1 | ||||||

Research, development and engineering expense | 0.9 | — | ||||||

Total | $ | 12.9 | $ | 0.4 | ||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Severance | ||||||||

Services | $ | 4.7 | $ | — | ||||

Software | 0.1 | 0.3 | ||||||

Systems | 1.8 | 0.1 | ||||||

Corporate | 6.3 | — | ||||||

Total severance | $ | 12.9 | $ | 0.4 | ||||

DN2020 Plan | Delta Program | Strategic Alliance | Total | ||||||||||||

Services | $ | 26.1 | $ | 0.1 | $ | 2.0 | $ | 28.2 | |||||||

Software | 5.3 | 1.8 | 0.1 | 7.2 | |||||||||||

Systems | 15.9 | — | 3.6 | 19.5 | |||||||||||

Corporate | 8.4 | 1.3 | — | 9.7 | |||||||||||

Total | $ | 55.7 | $ | 3.2 | $ | 5.7 | $ | 64.6 | |||||||

2017 | 2016 | |||||||

Balance at January 1 | $ | 89.9 | $ | 4.7 | ||||

Liabilities incurred | 12.9 | 0.4 | ||||||

Liabilities paid/settled | (27.2 | ) | (1.3 | ) | ||||

Balance at March 31 | $ | 75.6 | $ | 3.8 | ||||

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Revenue summary by segment | ||||||||

Services | $ | 573.2 | $ | 318.7 | ||||

Software | 110.4 | 22.4 | ||||||

Systems | 419.2 | 168.5 | ||||||

Total revenue | $ | 1,102.8 | $ | 509.6 | ||||

Segment operating profit | ||||||||

Services | $ | 81.2 | $ | 64.0 | ||||

Software | 5.3 | (8.3 | ) | |||||

Systems | (3.9 | ) | (16.9 | ) | ||||

Total segment operating profit | 82.6 | 38.8 | ||||||

Corporate charges not allocated to segments (1) | (40.9 | ) | (30.0 | ) | ||||

Restructuring charges | (12.9 | ) | (0.4 | ) | ||||

Net non-routine expense | (77.4 | ) | (14.1 | ) | ||||

(131.2 | ) | (44.5 | ) | |||||

Operating profit (loss) | (48.6 | ) | (5.7 | ) | ||||

Other income (expense) | (26.2 | ) | 25.6 | |||||

Income (loss) from continuing operations before taxes | $ | (74.8 | ) | $ | 19.9 | |||

(1) | Corporate charges not allocated to segments include headquarter-based costs associated with procurement, human resources, compensation and benefits, finance and accounting, global development/engineering, global strategy/mergers and acquisitions, global information technology, tax, treasury and legal. |

Three Months Ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Banking | ||||||||

Services and software | $ | 545.9 | $ | 341.1 | ||||

Systems | 273.7 | 166.5 | ||||||

Total banking | 819.6 | 507.6 | ||||||

Retail | ||||||||

Services and software | 137.7 | — | ||||||

Systems | 145.5 | 2.0 | ||||||

Total retail | $ | 283.2 | $ | 2.0 | ||||

$ | 1,102.8 | $ | 509.6 | |||||

Three Months Ended | ||||

March 31, 2016 | ||||

Net sales | ||||

Services and software | $ | 8.5 | ||

Systems | 16.3 | |||

24.8 | ||||

Cost of sales | ||||

Services and software | 6.9 | |||

Systems | 15.1 | |||

22.0 | ||||

Gross profit | 2.8 | |||

Selling and administrative expense | 4.8 | |||

Income from discontinued operations before taxes | (2.0 | ) | ||

Income tax benefit | (0.7 | ) | ||

(1.3 | ) | |||

Gain on sale of discontinued operations before taxes | 243.3 | |||

Income tax expense | 94.2 | |||

Gain on sale of discontinued operations, net of tax | 149.1 | |||

Income from discontinued operations, net of tax | $ | 147.8 | ||

(i) | Diebold Nixdorf, Incorporated (the Parent Company), the issuer of the guaranteed obligations; |

(ii) | Guarantor Subsidiaries, on a combined basis, as specified in the indenture governing the Company's obligations under the 2024 Senior Notes; |

(iii) | Consolidating entries and eliminations representing adjustments to (a) eliminate intercompany transactions between the Parent Company, the Guarantor Subsidiaries and the Non-guarantor Subsidiaries, (b) eliminate the investments in its subsidiaries, and (c) record consolidating entries; and |

(iv) | Diebold Nixdorf, Incorporated and Subsidiaries on a consolidated basis. |

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

ASSETS | |||||||||||||||||||

Current assets | |||||||||||||||||||

Cash and cash equivalents | $ | 19.0 | $ | 2.2 | $ | 468.9 | $ | — | $ | 490.1 | |||||||||

Short-term investments | — | — | 77.7 | — | 77.7 | ||||||||||||||

Trade receivables, net | 143.2 | 0.4 | 737.0 | — | 880.6 | ||||||||||||||

Intercompany receivables | 755.4 | 925.1 | 1,782.8 | (3,463.3 | ) | — | |||||||||||||

Inventories | 150.3 | — | 610.8 | — | 761.1 | ||||||||||||||

Prepaid expenses | 11.9 | 1.1 | 50.6 | — | 63.6 | ||||||||||||||

Income taxes | 20.3 | 4.1 | 102.2 | (4.1 | ) | 122.5 | |||||||||||||

Other current assets | 3.9 | 1.4 | 200.6 | — | 205.9 | ||||||||||||||

Total current assets | 1,104.0 | 934.3 | 4,030.6 | (3,467.4 | ) | 2,601.5 | |||||||||||||

Securities and other investments | 94.5 | — | — | — | 94.5 | ||||||||||||||

Property, plant and equipment, net | 101.1 | 3.7 | 277.4 | — | 382.2 | ||||||||||||||

Goodwill | 55.5 | — | 956.2 | — | 1,011.7 | ||||||||||||||

Deferred income taxes | 167.4 | 7.8 | 137.1 | — | 312.3 | ||||||||||||||

Finance lease receivables | — | 4.1 | 18.8 | — | 22.9 | ||||||||||||||

Intangible assets, net | 1.0 | 12.3 | 740.2 | — | 753.5 | ||||||||||||||

Investment in subsidiary | 2,645.4 | — | 16.3 | (2,661.7 | ) | — | |||||||||||||

Other assets | 4.6 | 0.1 | 61.3 | — | 66.0 | ||||||||||||||

Total assets | $ | 4,173.5 | $ | 962.3 | $ | 6,237.9 | $ | (6,129.1 | ) | $ | 5,244.6 | ||||||||

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | |||||||||||||||||||

Current liabilities | |||||||||||||||||||

Notes payable | $ | 52.4 | $ | 1.0 | $ | 24.3 | $ | — | $ | 77.7 | |||||||||

Accounts payable | 96.9 | 0.4 | 443.9 | — | 541.2 | ||||||||||||||

Intercompany payable | 1,313.3 | 181.4 | 1,968.6 | (3,463.3 | ) | — | |||||||||||||

Deferred revenue | 119.2 | 0.5 | 370.3 | — | 490.0 | ||||||||||||||

Payroll and other benefits liabilities | 19.9 | 0.8 | 148.3 | — | 169.0 | ||||||||||||||

Other current liabilities | 113.2 | 2.7 | 456.5 | (4.1 | ) | 568.3 | |||||||||||||

Total current liabilities | 1,714.9 | 186.8 | 3,411.9 | (3,467.4 | ) | 1,846.2 | |||||||||||||

Long-term debt | 1,689.0 | 0.3 | 0.4 | — | 1,689.7 | ||||||||||||||

Pensions, post-retirement and other benefits | 211.8 | — | 80.8 | — | 292.6 | ||||||||||||||

Deferred income taxes | 13.4 | — | 276.9 | — | 290.3 | ||||||||||||||

Other liabilities | 11.3 | — | 96.7 | — | 108.0 | ||||||||||||||

Commitments and contingencies | |||||||||||||||||||

Redeemable noncontrolling interests | — | — | 449.9 | — | 449.9 | ||||||||||||||

Total Diebold Nixdorf, Incorporated shareholders' equity | 533.1 | 775.2 | 1,886.5 | (2,661.7 | ) | 533.1 | |||||||||||||

Noncontrolling interests | — | — | 34.8 | — | 34.8 | ||||||||||||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 4,173.5 | $ | 962.3 | $ | 6,237.9 | $ | (6,129.1 | ) | $ | 5,244.6 | ||||||||

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

ASSETS | |||||||||||||||||||

Current assets | |||||||||||||||||||

Cash and cash equivalents | $ | 138.4 | $ | 2.3 | $ | 512.0 | $ | — | $ | 652.7 | |||||||||

Short-term investments | — | — | 64.1 | — | 64.1 | ||||||||||||||

Trade receivables, net | 119.0 | — | 717.5 | (0.6 | ) | 835.9 | |||||||||||||

Intercompany receivables | 883.0 | 783.7 | 480.1 | (2,146.8 | ) | — | |||||||||||||

Inventories | 110.5 | 16.2 | 611.0 | — | 737.7 | ||||||||||||||

Prepaid expenses | 14.7 | 0.8 | 45.2 | — | 60.7 | ||||||||||||||

Income taxes | 0.3 | 25.4 | 84.9 | (25.4 | ) | 85.2 | |||||||||||||

Other current assets | 3.2 | 1.6 | 178.5 | — | 183.3 | ||||||||||||||

Total current assets | 1,269.1 | 830.0 | 2,693.3 | (2,172.8 | ) | 2,619.6 | |||||||||||||

Securities and other investments | 94.7 | — | — | — | 94.7 | ||||||||||||||

Property, plant and equipment, net | 102.7 | 9.0 | 275.3 | — | 387.0 | ||||||||||||||

Goodwill | 55.5 | — | 942.8 | — | 998.3 | ||||||||||||||

Deferred income taxes | 173.1 | 7.8 | 128.6 | — | 309.5 | ||||||||||||||

Finance lease receivables | — | 4.8 | 20.4 | — | 25.2 | ||||||||||||||

Intangible assets, net | 1.8 | 13.6 | 757.5 | — | 772.9 | ||||||||||||||

Investment in subsidiary | 2,619.6 | — | 9.3 | (2,628.9 | ) | — | |||||||||||||

Other assets | 2.9 | 0.1 | 60.1 | — | 63.1 | ||||||||||||||

Total assets | $ | 4,319.4 | $ | 865.3 | $ | 4,887.3 | $ | (4,801.7 | ) | $ | 5,270.3 | ||||||||

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | |||||||||||||||||||

Current liabilities | |||||||||||||||||||

Notes payable | $ | 30.9 | $ | 1.3 | $ | 74.7 | $ | — | $ | 106.9 | |||||||||

Accounts payable | 101.6 | 1.1 | 458.4 | (0.6 | ) | 560.5 | |||||||||||||

Intercompany payable | 1,376.6 | 175.9 | 594.3 | (2,146.8 | ) | — | |||||||||||||

Deferred revenue | 114.7 | 0.7 | 288.8 | — | 404.2 | ||||||||||||||

Payroll and other benefits liabilities | 21.0 | 1.4 | 150.1 | — | 172.5 | ||||||||||||||

Other current liabilities | 156.1 | 3.9 | 445.8 | (25.4 | ) | 580.4 | |||||||||||||

Total current liabilities | 1,800.9 | 184.3 | 2,012.1 | (2,172.8 | ) | 1,824.5 | |||||||||||||

Long-term debt | 1,690.5 | 0.4 | 0.5 | — | 1,691.4 | ||||||||||||||

Pensions, post-retirement and other benefits | 212.6 | — | 84.6 | — | 297.2 | ||||||||||||||

Deferred income taxes | 13.4 | — | 287.2 | — | 300.6 | ||||||||||||||

Other liabilities | 10.6 | — | 77.1 | — | 87.7 | ||||||||||||||

Commitments and contingencies | |||||||||||||||||||

Redeemable noncontrolling interests | — | — | 44.1 | — | 44.1 | ||||||||||||||

Total Diebold Nixdorf, Incorporated shareholders' equity | 591.4 | 680.6 | 1,948.3 | (2,628.9 | ) | 591.4 | |||||||||||||

Noncontrolling interests | — | — | 433.4 | — | 433.4 | ||||||||||||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 4,319.4 | $ | 865.3 | $ | 4,887.3 | $ | (4,801.7 | ) | $ | 5,270.3 | ||||||||

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

Net sales | $ | 251.2 | $ | 4.9 | $ | 851.0 | $ | (4.3 | ) | $ | 1,102.8 | ||||||||

Cost of sales | 199.8 | 5.9 | 658.9 | (4.3 | ) | 860.3 | |||||||||||||

Gross profit | 51.4 | (1.0 | ) | 192.1 | — | 242.5 | |||||||||||||

Selling and administrative expense | 67.1 | 2.9 | 177.0 | — | 247.0 | ||||||||||||||

Research, development and engineering expense | (0.1 | ) | 9.8 | 31.7 | — | 41.4 | |||||||||||||

Impairment of assets | 3.1 | — | — | — | 3.1 | ||||||||||||||

(Gain) loss on sale of assets, net | — | 0.1 | (0.5 | ) | — | (0.4 | ) | ||||||||||||

70.1 | 12.8 | 208.2 | — | 291.1 | |||||||||||||||

Operating profit (loss) | (18.7 | ) | (13.8 | ) | (16.1 | ) | — | (48.6 | ) | ||||||||||

Other income (expense) | |||||||||||||||||||

Interest income | 0.5 | 0.1 | 5.8 | — | 6.4 | ||||||||||||||

Interest expense | (30.0 | ) | — | 0.2 | (1.0 | ) | (30.8 | ) | |||||||||||

Foreign exchange gain (loss), net | — | — | (3.1 | ) | — | (3.1 | ) | ||||||||||||

Equity in earnings of subsidiaries | (26.4 | ) | — | — | 26.4 | — | |||||||||||||

Miscellaneous, net | 0.7 | 1.9 | (1.3 | ) | — | 1.3 | |||||||||||||

Income (loss) from continuing operations before taxes | (73.9 | ) | (11.8 | ) | (14.5 | ) | 25.4 | (74.8 | ) | ||||||||||

Income tax (benefit) expense | (15.1 | ) | (4.1 | ) | (3.4 | ) | — | (22.6 | ) | ||||||||||

Income (loss) from continuing operations, net of tax | (58.8 | ) | (7.7 | ) | (11.1 | ) | 25.4 | (52.2 | ) | ||||||||||

Income (loss) from discontinued operations, net of tax | — | — | — | — | — | ||||||||||||||

Net income (loss) | (58.8 | ) | (7.7 | ) | (11.1 | ) | 25.4 | (52.2 | ) | ||||||||||

Net income attributable to noncontrolling interests | — | — | 6.6 | — | 6.6 | ||||||||||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (58.8 | ) | $ | (7.7 | ) | $ | (17.7 | ) | $ | 25.4 | $ | (58.8 | ) | |||||

Comprehensive income (loss) | $ | (13.9 | ) | $ | (7.7 | ) | $ | 46.2 | $ | (31.9 | ) | $ | (7.3 | ) | |||||

Less: comprehensive income (loss) attributable to noncontrolling interests | — | — | 6.6 | — | 6.6 | ||||||||||||||

Comprehensive income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (13.9 | ) | $ | (7.7 | ) | $ | 39.6 | $ | (31.9 | ) | $ | (13.9 | ) | |||||

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

Net sales | $ | 261.3 | $ | 25.7 | $ | 247.9 | $ | (25.3 | ) | $ | 509.6 | ||||||||

Cost of sales | 190.7 | 26.9 | 178.1 | (24.9 | ) | 370.8 | |||||||||||||

Gross profit | 70.6 | (1.2 | ) | 69.8 | (0.4 | ) | 138.8 | ||||||||||||

Selling and administrative expense | 78.1 | 2.6 | 44.9 | — | 125.6 | ||||||||||||||

Research, development and engineering expense | 1.3 | 12.1 | 5.1 | — | 18.5 | ||||||||||||||

(Gain) loss on sale of assets, net | — | 0.1 | 0.3 | — | 0.4 | ||||||||||||||

79.4 | 14.8 | 50.3 | — | 144.5 | |||||||||||||||

Operating profit (loss) | (8.8 | ) | (16.0 | ) | 19.5 | (0.4 | ) | (5.7 | ) | ||||||||||

Other income (expense) | |||||||||||||||||||

Interest income | 0.1 | 0.2 | 4.6 | — | 4.9 | ||||||||||||||

Interest expense | (11.3 | ) | (0.1 | ) | (0.1 | ) | — | (11.5 | ) | ||||||||||

Foreign exchange gain (loss), net | (1.7 | ) | — | (0.7 | ) | — | (2.4 | ) | |||||||||||

Equity in earnings of subsidiaries | 15.7 | — | — | (15.7 | ) | — | |||||||||||||

Miscellaneous, net | 33.2 | 1.5 | (0.1 | ) | — | 34.6 | |||||||||||||

Income (loss) from continuing operations before taxes | 27.2 | (14.4 | ) | 23.2 | (16.1 | ) | 19.9 | ||||||||||||

Income tax (benefit) expense | (3.0 | ) | (2.8 | ) | 5.0 | — | (0.8 | ) | |||||||||||

Income (loss) from continuing operations, net of tax | 30.2 | (11.6 | ) | 18.2 | (16.1 | ) | 20.7 | ||||||||||||

Income (loss) from discontinued operations, net of tax | 138.0 | — | 9.8 | — | 147.8 | ||||||||||||||

Net income (loss) | 168.2 | (11.6 | ) | 28.0 | (16.1 | ) | 168.5 | ||||||||||||

Net income attributable to noncontrolling interests | — | — | 0.3 | — | 0.3 | ||||||||||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | 168.2 | $ | (11.6 | ) | $ | 27.7 | $ | (16.1 | ) | $ | 168.2 | |||||||

Comprehensive income (loss) | $ | 196.0 | $ | (9.4 | ) | $ | 60.7 | $ | (48.8 | ) | $ | 198.5 | |||||||

Less: comprehensive income (loss) attributable to noncontrolling interests | — | — | 0.4 | — | 0.4 | ||||||||||||||

Comprehensive income (loss) attributable to Diebold Nixdorf, Incorporated | $ | 196.0 | $ | (9.4 | ) | $ | 60.3 | $ | (48.8 | ) | $ | 198.1 | |||||||

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

Net cash used by operating activities | $ | (111.5 | ) | $ | (2.2 | ) | $ | 4.2 | $ | 43.1 | $ | (66.4 | ) | ||||||

Cash flow from investing activities | |||||||||||||||||||

Proceeds from maturities of investments | 0.8 | — | 84.1 | — | 84.9 | ||||||||||||||

Payments for purchases of investments | — | — | (95.1 | ) | — | (95.1 | ) | ||||||||||||

Proceeds from sale of assets | — | — | 2.0 | — | 2.0 | ||||||||||||||

Capital expenditures | (1.8 | ) | — | (10.3 | ) | — | (12.1 | ) | |||||||||||

Increase in certain other assets | (4.9 | ) | 4.2 | (8.0 | ) | — | (8.7 | ) | |||||||||||

Capital contributions and loans paid | (164.7 | ) | — | — | 164.7 | — | |||||||||||||

Proceeds from intercompany loans | 162.3 | — | — | (162.3 | ) | — | |||||||||||||

Net cash (used) provided by investing activities - continuing operations | (8.3 | ) | 4.2 | (27.3 | ) | 2.4 | (29.0 | ) | |||||||||||

Net cash provided by investing activities - discontinued operations | — | — | — | — | — | ||||||||||||||

Net cash (used) provided by investing activities | (8.3 | ) | 4.2 | (27.3 | ) | 2.4 | (29.0 | ) | |||||||||||

Cash flow from financing activities | |||||||||||||||||||

Dividends paid | (7.6 | ) | — | — | — | (7.6 | ) | ||||||||||||

Debt issuance costs | — | — | — | — | — | ||||||||||||||

Revolving credit facility borrowings (repayments), net | 20.0 | — | — | — | 20.0 | ||||||||||||||

Other debt borrowings | — | — | 62.2 | (43.1 | ) | 19.1 | |||||||||||||

Other debt repayments | (7.8 | ) | (0.3 | ) | (75.9 | ) | — | (84.0 | ) | ||||||||||

Distributions to noncontrolling interest holders | — | — | (15.7 | ) | — | (15.7 | ) | ||||||||||||

Excess tax benefits from share-based compensation | 0.1 | — | — | — | 0.1 | ||||||||||||||

Issuance of common shares | 0.3 | — | — | — | 0.3 | ||||||||||||||

Repurchase of common shares | (4.6 | ) | — | — | — | (4.6 | ) | ||||||||||||

Capital contributions received and loans incurred | — | 17.8 | 146.9 | (164.7 | ) | — | |||||||||||||

Payments on intercompany loans | — | (19.6 | ) | (142.7 | ) | 162.3 | — | ||||||||||||

Net cash provided (used) by financing activities | 0.4 | (2.1 | ) | (25.2 | ) | (45.5 | ) | (72.4 | ) | ||||||||||

Effect of exchange rate changes on cash and cash equivalents | — | — | 5.2 | — | 5.2 | ||||||||||||||

Increase (decrease) in cash and cash equivalents | (119.4 | ) | (0.1 | ) | (43.1 | ) | — | (162.6 | ) | ||||||||||

Cash and cash equivalents at the beginning of the period | 138.4 | 2.3 | 512.0 | — | 652.7 | ||||||||||||||

Cash and cash equivalents at the end of the period | $ | 19.0 | $ | 2.2 | $ | 468.9 | $ | — | $ | 490.1 | |||||||||

Parent | Combined Guarantor Subsidiaries | Combined Non-Guarantor Subsidiaries | Reclassifications/ Eliminations | Consolidated | |||||||||||||||

Net cash used by operating activities | $ | (113.2 | ) | $ | (23.4 | ) | $ | 21.4 | $ | — | $ | (115.2 | ) | ||||||

Cash flow from investing activities | |||||||||||||||||||

Proceeds from maturities of investments | 1.0 | — | 34.1 | — | 35.1 | ||||||||||||||

Payments for purchases of investments | — | — | (39.5 | ) | — | (39.5 | ) | ||||||||||||

Proceeds from sale of assets | — | — | 0.2 | — | 0.2 | ||||||||||||||

Capital expenditures | (1.4 | ) | (0.4 | ) | (2.9 | ) | — | (4.7 | ) | ||||||||||

Increase in certain other assets | (12.2 | ) | (1.5 | ) | 8.8 | — | (4.9 | ) | |||||||||||

Capital contributions and loans paid | (53.0 | ) | — | — | 53.0 | — | |||||||||||||

Proceeds from intercompany loans | 47.1 | — | — | (47.1 | ) | — | |||||||||||||

Net cash (used) provided by investing activities - continuing operations | (18.5 | ) | (1.9 | ) | 0.7 | 5.9 | (13.8 | ) | |||||||||||

Net cash provided by investing activities - discontinued operations | 365.1 | — | — | — | 365.1 | ||||||||||||||

Net cash (used) provided by investing activities | 346.6 | (1.9 | ) | 0.7 | 5.9 | 351.3 | |||||||||||||

Cash flow from financing activities | |||||||||||||||||||

Dividends paid | (18.8 | ) | — | — | — | (18.8 | ) | ||||||||||||

Debt issuance costs | (0.8 | ) | — | — | — | (0.8 | ) | ||||||||||||

Restricted cash, net | (116.1 | ) | — | — | — | (116.1 | ) | ||||||||||||

Revolving credit facility borrowings (repayments), net | 73.1 | — | — | — | 73.1 | ||||||||||||||

Other debt borrowings | — | — | 17.3 | — | 17.3 | ||||||||||||||

Other debt repayments | (177.7 | ) | (0.2 | ) | (20.1 | ) | — | (198.0 | ) | ||||||||||

Distributions to noncontrolling interest holders | — | — | (2.0 | ) | — | (2.0 | ) | ||||||||||||

Repurchase of common shares | (1.7 | ) | — | — | — | (1.7 | ) | ||||||||||||

Capital contributions received and loans incurred | — | 49.9 | 3.1 | (53.0 | ) | — | |||||||||||||

Payments on intercompany loans | — | (29.5 | ) | (17.6 | ) | 47.1 | — | ||||||||||||

Net cash provided (used) by financing activities | (242.0 | ) | 20.2 | (19.3 | ) | (5.9 | ) | (247.0 | ) | ||||||||||

Effect of exchange rate changes on cash and cash equivalents | — | — | 3.4 | — | 3.4 | ||||||||||||||

(Decrease) increase in cash and cash equivalents | (8.6 | ) | (5.1 | ) | 6.2 | — | (7.5 | ) | |||||||||||

Add: Cash overdraft included in assets held for sale at beginning of period | (1.5 | ) | — | — | — | (1.5 | ) | ||||||||||||

Cash and cash equivalents at the beginning of the period | 20.3 | 7.9 | 285.4 | — | 313.6 | ||||||||||||||

Cash and cash equivalents at the end of the period | $ | 10.2 | $ | 2.8 | $ | 291.6 | $ | — | $ | 304.6 | |||||||||

• | The DPLTA became effective on February 14, 2017 |

• | Launched DN2020 transformation program on February 28, 2017 |

• | Announced plans on March 9, 2017 to close its manufacturing facility located near Budapest in Gyál, Hungary |

• | Renewed outsourcing contracts with TD Bank Group, one of the largest financial institutions in North America, and Hamburger Sparkasse, Germany's largest savings bank |

• | Launched extreme self-checkout concept and Essence ATM concept |

• | Realizing volume discounts on direct materials |

• | Harmonizing the solutions set |

• | Increasing utilization rates of the service technicians |

• | Rationalizing facilities in the regions |

• | Streamlining corporate and general and administrative functions |

• | Harmonizing back office solutions. |

• | mobile technologies to support advanced connectivity including contactless transactions, |

• | new sensors and the Internet of Things to support real-time monitoring activities, |

• | miniaturization technologies needed for branch/store transformation, and |

• | advanced security capabilities including anti-skimming card readers and biometric authentication. |

• | leveraging the purchasing power of the Company through a new procurement partnership program |

• | streamlining the product portfolio - including terminals, core technologies and components |

• | developing a partner ecosystem to complement the Company's core technologies |

• | consolidating manufacturing capacity to optimize fixed costs, and |

• | re-allocating R&D spend to areas of innovation. |

• | demand for services on distributed IT assets such as ATMs, POS and self-checkout systems, including managed services and professional services; |

• | timing of system upgrades and/or replacement cycles for ATMs, POS and self-checkout systems; |

• | demand for security products and services for the financial, retail and commercial sectors; |

• | integration of legacy salesforce, business processes, procurement, and internal IT systems; and |

• | realization of cost synergies, which leverage the Company's global scale, reduce overlap and improve operating efficiencies. |

Three Months Ended | ||||||||||||||

March 31, | ||||||||||||||

2017 | 2016 | |||||||||||||

Amount | % of Net sales | Amount | % of Net sales | |||||||||||

Net sales | $ | 1,102.8 | 100.0 | $ | 509.6 | 100.0 | ||||||||

Gross profit | $ | 242.5 | 22.0 | $ | 138.8 | 27.2 | ||||||||

Operating expenses | $ | 291.1 | 26.4 | $ | 144.5 | 28.4 | ||||||||

Operating profit (loss) | $ | (48.6 | ) | (4.4 | ) | $ | (5.7 | ) | (1.1 | ) | ||||

Net income (loss)(1) | $ | (52.2 | ) | (4.7 | ) | $ | 168.5 | 33.1 | ||||||

Net income attributable to noncontrolling interests | $ | 6.6 | 0.6 | $ | 0.3 | 0.1 | ||||||||

Net income (loss) attributable to Diebold Nixdorf, Incorporated | $ | (58.8 | ) | (5.3 | ) | $ | 168.2 | 33.0 | ||||||

Three Months Ended | Percent of Total Net Sales for the Three Months Ended | |||||||||||||||

March 31, | March 31, | |||||||||||||||

2017 | 2016 | % Change | % Change in CC (1) | 2017 | 2016 | |||||||||||

Segments | ||||||||||||||||

Services | $ | 573.2 | $ | 318.7 | 79.9 | 77.8 | 52.0 | 62.5 | ||||||||

Software | 110.4 | 22.4 | 392.9 | 373.8 | 10.0 | 4.4 | ||||||||||

Systems | 419.2 | 168.5 | 148.8 | 146.0 | 38.0 | 33.1 | ||||||||||

Net Sales | $ | 1,102.8 | $ | 509.6 | 116.4 | 113.7 | 100.0 | 100.0 | ||||||||

Geographic Regions | ||||||||||||||||

Americas | $ | 396.2 | $ | 342.5 | 15.7 | 12.8 | 35.9 | 67.2 | ||||||||

EMEA | 562.0 | 85.9 | 554.2 | 559.6 | 51.0 | 16.9 | ||||||||||

AP | 144.6 | 81.2 | 78.1 | 81.4 | 13.1 | 15.9 | ||||||||||

Net Sales | $ | 1,102.8 | $ | 509.6 | 116.4 | 113.7 | 100.0 | 100.0 | ||||||||

Solutions | ||||||||||||||||

Banking | $ | 819.6 | $ | 507.6 | 61.5 | 59.5 | 74.3 | 99.6 | ||||||||

Retail | 283.2 | 2.0 | N/M | N/M | 25.7 | 0.4 | ||||||||||

Net Sales | $ | 1,102.8 | $ | 509.6 | 116.4 | 113.7 | 100.0 | 100.0 | ||||||||

• | Services net sales increased $254.5, with $262.8 attributable to the Acquisition and included an unfavorable impact of $5.2 related to purchase accounting adjustments. Excluding the impact of the Acquisition, services sales decreased $8.4 primarily due to a large NA project in the prior year period that did not recur and lower volume in China. |

• | Software net sales increased $88.0, with $84.1 attributable to the Acquisition. Excluding the impact of the Acquisition, software sales increased $3.9 primarily due to higher banking and retail sales in Brazil. |

• | Systems net sales increased $250.7, with $276.7 attributable to the Acquisition and included an unfavorable impact of $5.2 related to purchase accounting adjustments. Excluding the impact of the Acquisition, systems sales decreased $26.0 driven by EMEA due to a large project in the prior year period that did not recur as well as lower distributor sales. In addition, lower demand in China also contributed to the decline. |

• | Americas net sales increased $53.7 or 15.7 percent, with $52.9 attributable to the Acquisition. Excluding the impact of the Acquisition, net sales were relatively flat as increased volume of services and software sales in Latin America, primarily in Brazil and Colombia, partially offset by a large NA project in the prior year period that did not recur. |

• | EMEA net sales increased $476.1 or 554.2 percent, with $495.2 attributable to the Acquisition. Excluding the impact of the Acquisition, net sales decreased driven by lower systems sales in Switzerland, distributor channels and Spain as well as lower volume of digital pin pad sales. |

• | AP net sales increased $63.4 or 78.1 percent, with $75.5 attributable to the Acquisition. Excluding the impact of the Acquisition, net sales decreased primarily due to lower services and systems sales in China, Thailand and Philippines. |

• | Banking net sales increased $312.0 or 61.5 percent, with $346.7 attributable to the Acquisition and included an unfavorable impact of $6.2 related to purchase accounting adjustments. Excluding the impact of the Acquisition, net sales decreased due to lower systems sales in EMEA and AP as well as a decrease in services revenue, mainly in NA. |

• | Retail net sales increased $281.2, which was attributable to the Acquisition and included an unfavorable impact of $4.2 related to purchase accounting adjustments. Retail net sales includes the Brazil other business. |

Three Months Ended | ||||||||||

March 31, | ||||||||||

2017 | 2016 | % Change | ||||||||

Gross profit - services and software | $ | 178.1 | $ | 110.2 | 61.6 | |||||

Gross profit - systems | 64.4 | 28.6 | 125.2 | |||||||

Total gross profit | $ | 242.5 | $ | 138.8 | 74.7 | |||||

Gross margin - services and software | 26.1 | % | 32.3 | % | ||||||

Gross margin - systems | 15.4 | % | 17.0 | % | ||||||

Total gross margin | 22.0 | % | 27.2 | % | ||||||

Three Months Ended | |||||||||||

March 31, | |||||||||||

2017 | 2016 | % Change | |||||||||

Selling and administrative expense | $ | 247.0 | $ | 125.6 | 96.7 | ||||||

Research, development and engineering expense | 41.4 | 18.5 | 123.8 | ||||||||

Impairment of assets | 3.1 | — | N/M | ||||||||

(Gain) loss on sale of assets, net | (0.4 | ) | 0.4 | (200.0 | ) | ||||||

Total operating expenses | $ | 291.1 | $ | 144.5 | 101.5 | ||||||

Three Months Ended | |||||||||||

March 31, | |||||||||||

2017 | 2016 | % Change | |||||||||

Operating profit (loss) | $ | (48.6 | ) | $ | (5.7 | ) | (752.6 | ) | |||

Operating profit margin | (4.4 | )% | (1.1 | )% | |||||||

Three Months Ended | |||||||||||

March 31, | |||||||||||

2017 | 2016 | % Change | |||||||||

Interest income | $ | 6.4 | $ | 4.9 | 30.6 | ||||||

Interest expense | (30.8 | ) | (11.5 | ) | (167.8 | ) | |||||

Foreign exchange gain (loss), net | (3.1 | ) | (2.4 | ) | (29.2 | ) | |||||

Miscellaneous, net | 1.3 | 34.6 | (96.2 | ) | |||||||

Other income (expense), net | $ | (26.2 | ) | $ | 25.6 | (202.3 | ) | ||||

Three Months Ended | |||||||||||

March 31, | |||||||||||

2017 | 2016 | % Change | |||||||||

Income (loss) from continuing operations, net of tax | $ | (52.2 | ) | $ | 20.7 | (352.2 | ) | ||||

Percent of net sales | (4.7 | )% | 4.1 | % | |||||||

Effective tax rate | 30.2 | % | (4.0 | )% | |||||||

Three Months Ended | ||||||||||

March 31, | ||||||||||

Services: | 2017 | 2016 | % Change | |||||||

Revenue | $ | 573.2 | $ | 318.7 | 79.9 | |||||

Segment operating profit (loss) | $ | 81.2 | $ | 64.0 | 26.9 | |||||

Segment operating profit margin | 14.2 | % | 20.1 | % | ||||||

Three Months Ended | ||||||||||

March 31, | ||||||||||

Software: | 2017 | 2016 | % Change | |||||||

Revenue | $ | 110.4 | $ | 22.4 | 392.9 | |||||

Segment operating profit (loss) | $ | 5.3 | $ | (8.3 | ) | 163.9 | ||||

Segment operating profit margin | 4.8 | % | (37.1 | )% | ||||||

Three Months Ended | ||||||||||

March 31, | ||||||||||

Systems: | 2017 | 2016 | % Change | |||||||

Revenue | $ | 419.2 | $ | 168.5 | 148.8 | |||||

Segment operating profit (loss) | $ | (3.9 | ) | $ | (16.9 | ) | 76.9 | |||

Segment operating profit margin | (0.9 | )% | (10.0 | )% | ||||||

March 31, 2017 | December 31, 2016 | |||||||

Cash and cash equivalents | $ | 490.1 | $ | 652.7 | ||||

Additional cash availability from | ||||||||

Uncommitted lines of credit | 183.6 | 69.0 | ||||||

Revolving credit facility | 520.0 | 352.0 | ||||||

Short-term investments | 77.7 | 64.1 | ||||||

Total cash and cash availability | $ | 1,271.4 | $ | 1,137.8 | ||||

Summary of cash flows: | 2017 | 2016 | ||||||

Net cash used by operating activities - continuing operations | $ | (66.4 | ) | $ | (109.9 | ) | ||

Net cash used by investing activities - continuing operations | (29.0 | ) | (13.8 | ) | ||||

Net cash used by financing activities | (72.4 | ) | (247.0 | ) | ||||

Discontinued operations, net | — | 359.8 | ||||||

Effect of exchange rate changes on cash and cash equivalents | 5.2 | 3.4 | ||||||

Increase (decrease) in cash and cash equivalents | $ | (162.6 | ) | $ | (7.5 | ) | ||

• | The net aggregate of trade accounts receivable, inventories and accounts payable used $76.1 in operating cash flows during the three months ended March 31, 2017, compared to $105.8 used during the same period of 2016. In general, the amount of cash flow provided or used by the aggregate of trade accounts payable, inventories and trade accounts receivable depends upon how effectively the Company manages the cash conversion cycle, which represents the number of days that elapse from the day it pays for the purchase of raw materials and components to the collection of cash from its customers and can be significantly impacted by the timing of collections and payments in a period. Accounts receivable remained relatively consistent compared to prior year same period. Inventory use decreased compared to prior year due to normalization of inventory in the United States, primarily due to working capital initiatives, and in Europe offset by a ramp up in inventory in Brazil. The accounts payable use is lower due to a decrease in payments compared to the prior year same period. |

• | In the aggregate the other combined certain assets and liabilities used $6.9 of operating cash during the three months ended March 31, 2017, compared to a use of $9.3 provided in the same period of 2016. The decrease in use is primarily due to an increase in deferred revenue cash provided by the timing of customer prepayments, mainly on service contracts compared to the prior year. This was offset by cash uses related to interest paid, restructuring charges, VAT payments and a transition service netting settlement with Securitas AB. Additionally, there were non-cash uses related to taxes payable and long term receivables, offset by non-cash sources of interest accrual, Diebold Nixdorf AG option fair value adjustment and noncontrolling interest dividend. |

• | Net income for the three months ended March 31, 2017 decreased $220.7, which is primarily due to integration, restructuring and interest costs compared to March 31, 2016. Additionally, the three months ended March 31, 2016 included a gain on the sale of the NA electronic security business. |

Three Months Ended | ||||||||

March 31, 2017 | March 31, 2016 | |||||||

Revolving credit facility borrowings (repayments), net | $ | 20.0 | $ | 73.1 | ||||

Other debt borrowings | ||||||||

International short-term uncommitted lines of credit borrowings | $ | 19.1 | $ | 17.3 | ||||

Other debt repayments | ||||||||

Payments on 2006 Senior Notes | $ | — | $ | (175.0 | ) | |||

Payments on Term Loan A Facility under the Credit Agreement | (4.3 | ) | (2.9 | ) | ||||

Payments on Term Loan B Facility - USD under the Credit Agreement | (2.5 | ) | — | |||||

Payments on Term Loan B Facility - Euro under the Credit Agreement | (1.0 | ) | — | |||||

Payments on European Investment Bank | (63.1 | ) | — | |||||

International short-term uncommitted lines of credit and other repayments | (13.1 | ) | (20.1 | ) | ||||

$ | (84.0 | ) | $ | (198.0 | ) | |||

• | a maximum total net debt to adjusted EBITDA leverage ratio of 4.50 for the three months ended March 31, 2017 (reducing to 4.25 on December 31, 2017, further reduced to 4.00 on December 31, 2018, and further reduced to 3.75 on June 30, 2019); and |

• | a minimum adjusted EBITDA to net interest expense coverage ratio of not less than 3.00 |

Financing and Replacement Facilities | Interest Rate Index and Margin | Maturity/Termination Dates | Term (Years) | |||

Credit Agreement facilities | ||||||

Revolving Facility | LIBOR + 1.75% | December 2020 | 5 | |||

Term Loan A Facility | LIBOR + 1.75% | December 2020 | 5 | |||

Delayed Draw Term Loan A | LIBOR + 1.75% | December 2020 | 5 | |||

Term Loan B Facility ($1,000.0) | LIBOR(i) + 4.50% | November 2023 | 7.5 | |||

Term Loan B Facility (€350.0) | EURIBOR(ii) + 4.25% | November 2023 | 7.5 | |||

2024 Senior Notes | 8.5% | April 2024 | 8 | |||

(i) | LIBOR with a floor of 0.75%. |

(ii) | EURIBOR with a floor of 0.75%. |

• | the ultimate impact of the review of the Acquisition by the Competition and Markets Authority in the United Kingdom including the Company's ability to successfully divest its legacy Diebold business in the United Kingdom; |

• | the implementation and ultimate impact of the DPLTA with Diebold Nixdorf AG; |

• | the ultimate outcome and results of integrating the operations of the Company and Diebold Nixdorf AG, the ultimate outcome of the Company’s pricing, operating and tax strategies applied to Diebold Nixdorf AG and the ultimate ability to realize synergies; |

• | the Company's ability to successfully operate its joint ventures in China with the Inspur Group and Aisino Corp.; |

• | competitive pressures, including pricing pressures and technological developments; |

• | changes in the Company's relationships with customers, suppliers, distributors and/or partners in its business ventures; |

• | changes in political, economic or other factors such as currency exchange rates, inflation rates, recessionary or expansive trends, taxes and regulations and laws affecting the worldwide business in each of the Company's operations; |

• | global economic conditions, including any additional deterioration and disruptions in the financial markets, including bankruptcies, restructurings or consolidations of financial institutions or otherwise, which could reduce the Company's customer base and/or adversely affect its customers’ ability to make capital expenditures, as well as adversely impact the availability and cost of credit; |

• | acceptance of the Company's product and technology introductions in the marketplace; |

• | the Company’s ability to maintain effective internal controls over financial reporting; |

• | changes in the Company’s intention to further repatriate cash and cash equivalents and short-term investments residing in international tax jurisdictions could negatively impact foreign and domestic taxes; |

• | unanticipated litigation, claims or assessments, as well as the outcome/impact of any current/pending litigation, claims or assessments; |

• | variations in consumer demand for banking technologies, products and services; |

• | potential disruptions, breaches or other violations of the Company's information technology systems; |

• | the investment performance of the Company’s pension plan assets, which could require the Company to increase its pension contributions, and significant changes in healthcare costs, including those that may result from government action; |

• | the amount and timing of repurchases of the Company’s common shares, if any; and |

• | the Company's ability to achieve benefits from its cost-reduction initiatives and other strategic changes associated with DN2020. |

Period | Total Number of Shares Purchased (1) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans (2) | Maximum Number of Shares that May Yet Be Purchased Under the Plans (2) | |||||||||

January | 1,005 | $ | 26.35 | — | 2,426,177 | ||||||||

February | 158,268 | $ | 28.23 | — | 2,426,177 | ||||||||

March | 2,557 | $ | 26.30 | — | 2,426,177 | ||||||||

Total | 161,830 | $ | 28.18 | — | |||||||||

(1) | All shares were surrendered or deemed surrendered to the Company in connection with the Company’s share-based compensation plans. |

(2) | The total number of shares repurchased as part of the publicly announced share repurchase plan since its inception was 13,450,772 as of March 31, 2017. The plan was approved by the Board of Directors in 1997. The Company may purchase shares from time to time in open market purchases or privately negotiated transactions. The Company may make all or part of the purchases pursuant to accelerated share repurchases or Rule 10b5-1 plans. The plan has no expiration date. The following table provides a summary of Board of Directors approvals to repurchase the Company’s outstanding common shares: |

Total Number of Shares Approved for Repurchase | ||

1997 | 2,000,000 | |

2004 | 2,000,000 | |

2005 | 6,000,000 | |

2007 | 2,000,000 | |

2011 | 1,876,949 | |

2012 | 2,000,000 | |

15,876,949 | ||

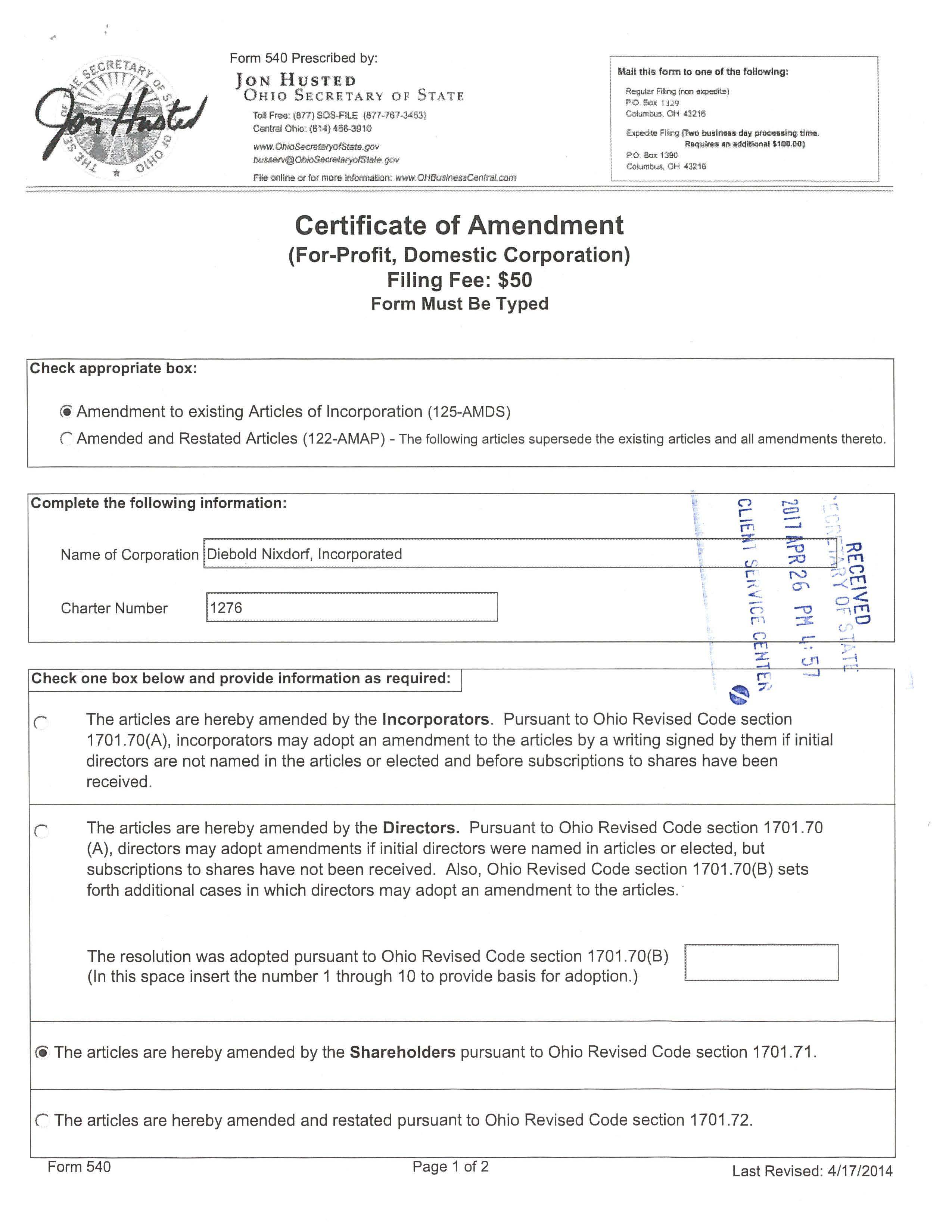

3.1(i) | Amended and Restated Articles of Incorporation of Diebold, Incorporated – incorporated by reference to Exhibit 3.1(i) to Registrant’s Annual Report on Form 10-K for the year ended December 31, 1994 (Commission File No. 1-4879) | |

3.1(ii) | Amended and Restated Code of Regulations - incorporated by reference to Exhibit 3.1(ii) to Registrant’s Current Report on Form 8-K filed on February 17, 2017 (Commission File No. 1-4879) | |

3.2 | Certificate of Amendment by Shareholders to Amended Articles of Incorporation of Diebold, Incorporated – incorporated by reference to Exhibit 3.2 to Registrant’s Form 10-Q for the quarter ended March 31, 1996 (Commission File No. 1-4879) | |

3.3 | Certificate of Amendment to Amended Articles of Incorporation of Diebold, Incorporated – incorporated by reference to Exhibit 3.3 to Registrant’s Form 10-K for the year ended December 31, 1998 (Commission File No. 1-4879) | |

3.4 | Certificate of Amendment to Amended Articles of Incorporation of Diebold Nixdorf, Incorporated - incorporated by reference to Exhibit 3.1(i) to Registrant’s Form 8-K filed on December 12, 2016 (Commission File No. 1-4879) | |

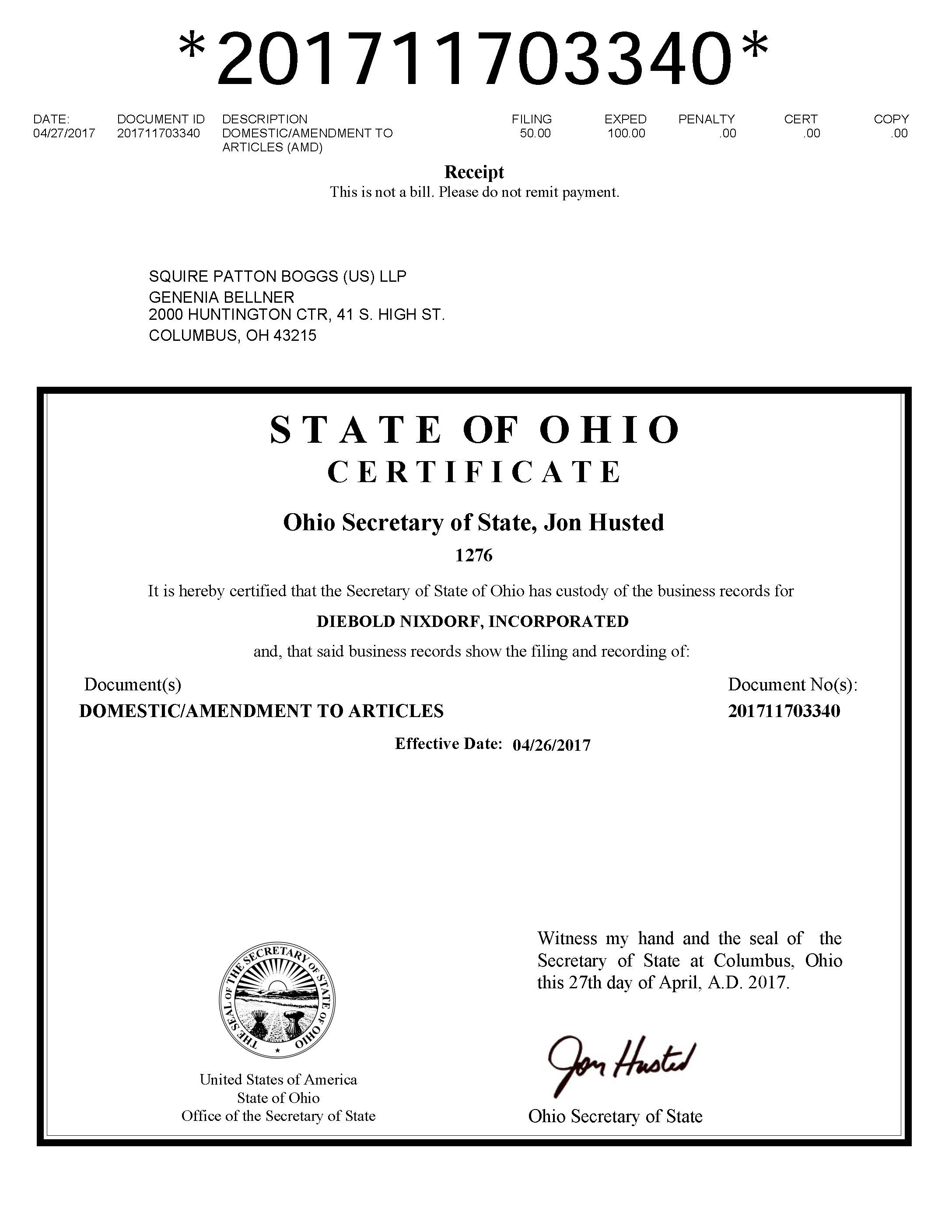

3.5 | Certificate of Amendment to the Amended Articles of Incorporation of Diebold Nixdorf, Incorporated, effective April 26, 2017 | |

10.1 | Offer Letter - Jürgen Wunram | |

10.2 | Offer Letter - Olaf Heyden | |

10.3 | Offer Letter - Ulrich Näher | |

10.4 | Jürgen Wunram Amended Service Agreement | |

10.5 | Olaf Heyden Amended Service Agreement | |

10.6 | Ulrich Näher Amended Service Agreement | |

10.7 | Christopher Chapman Service Agreement | |

10.8 | Diebold Nixdorf, Incorporated 2017 Equity and Performance Incentive Plan - incorporated by reference to Exhibit 4.6 to Registrant’s Form S-8 filed on April 26, 2017 (Registration Statement No. 333-217476) | |

10.9 | Form of Non-Qualified Stock Option Agreement (2017 Plan) - incorporated by reference to Exhibit 10.1 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.1 | Form of Restricted Share Agreement (2017 Plan) - incorporated by reference to Exhibit 10.2 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.11 | Form of Restricted Stock Unit Agreement - Cliff Vest (2017 Plan) - incorporated by reference to Exhibit 10.3 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.12 | Form of Restricted Stock Unit Agreement - Ratable Vest (2017 Plan) - incorporated by reference to Exhibit 10.4 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.13 | Form of Restricted Stock Unit Agreement - Non-employee Directors (2017 Plan) - incorporated by reference to Exhibit 10.5 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.14 | Form of Stock Appreciation Rights Agreement (2017 Plan) - incorporated by reference to Exhibit 10.6 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.15 | Form of Performance Shares Agreement (2017 Plan) - incorporated by reference to Exhibit 10.7 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.16 | Form of Performance Units Agreement (2017 Plan) - incorporated by reference to Exhibit 10.8 to Registrant’s Form 8-K filed on April 28, 2017 (Commission File No. 1-4879) | |

10.17 | Form of Synergy Grant Performance Share Agreement - incorporated by reference to Exhibit 10.1 to Registrant’s Form 8-K filed on February 13, 2017 (Commission File No. 1-4879) | |

31.1 | Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

31.2 | Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

32.1 | Certification of Chief Executive Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C. Section 1350. | |

32.2 | Certification of Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C. Section 1350. | |

101.INS | XBRL Instance Document | |

101.SCH | XBRL Taxonomy Extension Schema Document | |