|

SCHEDULE 14A INFORMATION |

||||

|

|

||||

|

PROXY STATEMENT PURSUANT TO SECTION 14(a) |

||||

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||

|

|

||||

|

|

Filed by the Registrant |

[X] |

||

|

|

Filed by a Party other than the Registrant |

[ ] |

||

|

|

||||

|

Check the appropriate box: |

||||

|

|

||||

|

[ ] |

Preliminary Proxy Statement |

|||

|

[ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

|

[X] |

Definitive Proxy Statement |

|||

|

[ ] |

Definitive Additional Materials |

|||

|

[ ] |

Soliciting Material under Rule 14a-12 |

|||

|

|

||||

|

|

Fidelity Advisor Series IV; Fidelity Boylston Street Trust; Fidelity California Municipal Trust; |

|||

|

|

(Name of Registrant as Specified In Its Charter) |

|||

|

|

||||

|

Payment of Filing Fee (Check the appropriate box): |

||||

|

|

||||

|

[X] |

No fee required. |

|||

|

[ ] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

|

(1) |

Title of each class of securities to which transaction applies: |

||

|

|

(2) |

Aggregate number of securities to which transaction applies: |

||

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

||

|

|

(4) |

Proposed maximum aggregate value of transaction: |

||

|

|

(5) |

Total Fee Paid: |

||

|

[ ] |

Fee paid previously with preliminary materials. |

|||

|

[ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

|

(1) |

Amount Previously Paid: |

||

|

|

(2) |

Form, Schedule or Registration Statement No.: |

||

|

|

(3) |

Filing Party: |

||

|

|

(4) |

Date Filed: |

||

I M P O R T A N T

Proxy Materials

(The chairman's photo appears here.)

PLEASE CAST YOUR VOTE NOW!

Funds of Fidelity Advisor Series IV, Fidelity Boylston Street Trust, Fidelity California Municipal Trust, Fidelity California Municipal Trust II, Fidelity Central Investment Portfolios II LLC, Fidelity Charles Street Trust, Fidelity Colchester Street Trust, Fidelity Commonwealth Trust II, Fidelity Court Street Trust, Fidelity Court Street Trust II, Fidelity Garrison Street Trust, Fidelity Hereford Street Trust, Fidelity Massachusetts Municipal Trust, Fidelity Merrimack Street Trust, Fidelity Municipal Trust, Fidelity Municipal Trust II, Fidelity New York Municipal Trust, Fidelity New York Municipal Trust II, Fidelity Oxford Street Trust, Fidelity Oxford Street Trust II, Fidelity Revere Street Trust, Fidelity School Street Trust, Fidelity Union Street Trust, and Fidelity Union Street Trust II

Dear Shareholder:

A special meeting of shareholders of the Fidelity funds mentioned above will be held on November 18, 2015. The purpose of the meeting is to provide you with the opportunity to vote on an important proposal that affects the funds and your investment in them. As a shareholder, you have the opportunity to voice your opinion on matters that affect your funds. This package contains information about the proposal and the materials to use when casting your vote.

Please read the enclosed materials and cast your vote on the proxy card(s). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

The proposal has been carefully reviewed by the Board of Trustees. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees believe this proposal is in the best interests of shareholders. They recommend that you vote for the proposal.

The following Q&A is provided to assist you in understanding the proposal. The proposal is described in greater detail in the enclosed proxy statement.

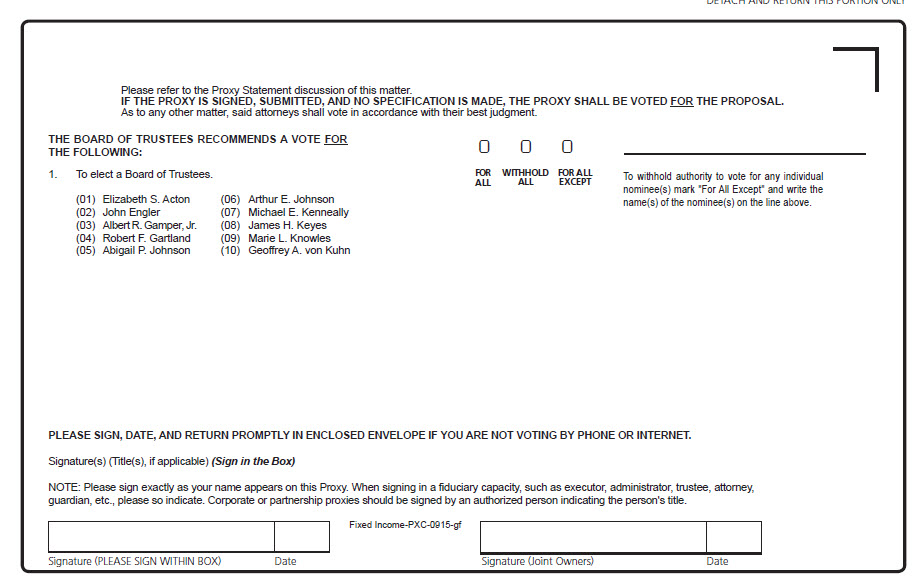

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign the card(s) before mailing them in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded or on-line instructions.

If you have any questions before you vote, please call Fidelity using the contact information applicable to your funds located in the table in the enclosed Q&A. We'll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Chairman

Important information to help you understand and vote on the proposal

Please read the full text of the proxy statement. Below is a brief overview of the proposal to be voted upon. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What proposal am I being asked to vote on?

You are being asked to elect a Board of Trustees.

What role does the Board play?

The Trustees serve as the fund shareholders' representatives. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders. The Trustees review fund performance, oversee fund activities, consider fund policy changes, and review contractual arrangements with companies that provide services to the funds.

What is the affiliation of the Board and Fidelity?

The purpose of the Board is to ensure that shareholders' best interests are protected in the operation of a mutual fund. The proxy statement describes the composition of each trust's board, including those trustees who are "interested" and those who are "independent." Trustees are determined to be "interested" by virtue of, among other things, their affiliation with the funds, Fidelity Management & Research Company (FMR), or other entities under common control with FMR. Interested Trustees are compensated by FMR. Independent Trustees have no affiliation with FMR and are compensated by each individual fund.

Are Board members paid?

Each Independent Trustee receives a fee for his or her service on the Board. You can find the compensation table, which details these fees, in the proxy statement.

Has the funds' Board of Trustees approved the proposal?

Yes. The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

Who is D.F. King & Co., Inc.?

D.F. King is a third party proxy vendor that Fidelity has hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not attained, the meeting may adjourn to a future date. Fidelity attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of each of the funds on the record date. The record date is September 21, 2015.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) and mailing them in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote through the internet by visiting the web site indicated on your proxy card and following the on-line instructions. If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call Fidelity. Please see the contact information located in the table below for each fund and class, as applicable.

Contact Information for each Fund and Class (as applicable) |

|

|

Fund or Class |

Contact Information |

|

Retail funds and/or classes |

1-800-544-8544 |

|

Advisor or Institutional Classes |

1-877-208-0098 |

|

ETFs |

1-800-FIDELITY |

|

Fidelity® Institutional Money Market Funds |

1-877-297-2952 |

|

Class F |

1-800-835-5092 |

|

Strategic Advisers® Multi-Manager Target Date Funds (Plan accounts) |

1-800-835-5095 |

|

Strategic Advisers Multi-Manager Target Date Funds (All other accounts) |

1-800-544-3455 |

|

Strategic Advisers Multi-Manager Target Date Funds: Class L and Class N (Plan participants) |

1-800-835-5095 |

|

Strategic Advisers Multi-Manager Target Date Funds: Class L and Class N (Advisors and Investment Professionals) |

1-877-208-0098 |

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the card.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be held on November 18, 2015

The Letter to Shareholders, Notice of Meeting, and Proxy Statement are available at www.proxyvote.com/proxy.

FIDELITY ADVISOR SERIES IV, FIDELITY BOYLSTON STREET TRUST, FIDELITY CALIFORNIA MUNICIPAL TRUST, FIDELITY CALIFORNIA MUNICIPAL TRUST II, FIDELITY CENTRAL INVESTMENT PORTFOLIOS II LLC, FIDELITY CHARLES STREET TRUST, FIDELITY COLCHESTER STREET TRUST, FIDELITY COMMONWEALTH TRUST II, FIDELITY COURT STREET TRUST, FIDELITY COURT STREET TRUST II, FIDELITY GARRISON STREET TRUST, FIDELITY HEREFORD STREET TRUST, FIDELITY MASSACHUSETTS MUNICIPAL TRUST, FIDELITY MERRIMACK STREET TRUST, FIDELITY MUNICIPAL TRUST, FIDELITY MUNICIPAL TRUST II, FIDELITY NEW YORK MUNICIPAL TRUST, FIDELITY NEW YORK MUNICIPAL TRUST II, FIDELITY OXFORD STREET TRUST, FIDELITY OXFORD STREET TRUST II, FIDELITY REVERE STREET TRUST, FIDELITY SCHOOL STREET TRUST, FIDELITY UNION STREET TRUST, AND FIDELITY UNION STREET TRUST II

245 Summer Street, Boston, Massachusetts 02210

See Appendix A for contact information.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of the above-named trusts (the trusts) will be held at an office of the trusts, One Spartan Way, Merrimack, NH 03054 (Industrial Drive, Exit 10, off Rte 3) on November 18, 2015, at 8:30 a.m. Eastern Time (ET). Appendix B contains a list of the funds in the trusts (the funds).

The purpose of the Meeting is to consider and act upon the following proposal for each trust, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

1. To elect a Board of Trustees.

The Board of Trustees has fixed the close of business on September 21, 2015 as the record date for the determination of the shareholders entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

MARC R. BRYANT

Secretary

October 2, 2015

Your vote is important - please vote your shares promptly.

Shareholders are invited to attend the Meeting in person. Admission to the Meeting will be on a first-come, first-served basis and will require picture identification. Shareholders arriving after the start of the Meeting may be denied entry. Cameras, cell phones, recording equipment and other electronic devices will not be permitted. Fidelity reserves the right to inspect any persons or items prior to admission to the Meeting.

Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions that follow or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

1. Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration.

3. All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example:

|

|

|

REGISTRATION |

VALID SIGNATURE |

|

A. |

1) |

ABC Corp. |

John Smith, Treasurer |

|

|

2) |

ABC Corp. |

John Smith, Treasurer |

|

|

|

c/o John Smith, Treasurer |

|

|

B. |

1) |

ABC Corp. Profit Sharing Plan |

Ann B. Collins, Trustee |

|

|

2) |

ABC Trust |

Ann B. Collins, Trustee |

|

|

3) |

Ann B. Collins, Trustee |

Ann B. Collins, Trustee |

|

C. |

1) |

Anthony B. Craft, Cust. |

Anthony B. Craft |

|

|

|

f/b/o Anthony B. Craft, Jr. |

|

|

|

|

UGMA |

|

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE

OR THROUGH THE INTERNET

1. Read the proxy statement, and have your proxy card or notice handy.

2. Call the toll-free number or visit the web site indicated on your proxy card.

3. Enter the number found in the box on the front of your proxy card.

4. Follow the recorded or on-line instructions to cast your vote.

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY ADVISOR SERIES IV, FIDELITY BOYLSTON STREET TRUST, FIDELITY CALIFORNIA MUNICIPAL TRUST, FIDELITY CALIFORNIA MUNICIPAL TRUST II, FIDELITY CENTRAL INVESTMENT PORTFOLIOS II LLC, FIDELITY CHARLES STREET TRUST, FIDELITY COLCHESTER STREET TRUST, FIDELITY COMMONWEALTH TRUST II, FIDELITY COURT STREET TRUST, FIDELITY COURT STREET TRUST II, FIDELITY GARRISON STREET TRUST, FIDELITY HEREFORD STREET TRUST, FIDELITY MASSACHUSETTS MUNICIPAL TRUST, FIDELITY MERRIMACK STREET TRUST, FIDELITY MUNICIPAL TRUST, FIDELITY MUNICIPAL TRUST II, FIDELITY NEW YORK MUNICIPAL TRUST, FIDELITY NEW YORK MUNICIPAL TRUST II, FIDELITY OXFORD STREET TRUST, FIDELITY OXFORD STREET TRUST II, FIDELITY REVERE STREET TRUST, FIDELITY SCHOOL STREET TRUST, FIDELITY UNION STREET TRUST, AND FIDELITY UNION STREET TRUST II

TO BE HELD ON NOVEMBER 18, 2015

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of the above-named trusts (the trusts) to be used at the Special Meeting of Shareholders and at any adjournments thereof (the Meeting), to be held on November 18, 2015 at 8:30 a.m. Eastern Time (ET) at One Spartan Way, Merrimack, NH 03054.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy card on or about October 2, 2015. Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of the trust. In addition, D.F. King & Co., Inc. (D.F. King) may be paid on a per-call basis to solicit shareholders by telephone on behalf of the funds in the trusts. The funds may also arrange to have votes recorded by telephone. D.F. King may be paid on a per-call basis for vote-by-phone solicitations on behalf of the funds. The approximate anticipated total cost of these services is detailed in Appendix C.

If the funds record votes by telephone or through the internet, they will use procedures designed to authenticate shareholders' identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted at the Meeting.

Appendix B lists each fund's investment adviser and administrator, if applicable, and their principal business address, as well as each fund's auditor and fiscal year end. Each fund's sub-adviser and each sub-adviser's principal business address is included in Appendix D. The principal business address of Fidelity Distributors Corporation (FDC), each fund's (other than the Fidelity® Central Funds) principal underwriter and distribution agent, is 100 Salem Street, Smithfield, Rhode Island 02917.

Unless otherwise indicated in Appendix B, the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by each fund and class, as applicable, provided the expenses do not exceed any existing expense caps. See Appendix E for current expense cap information. Expenses exceeding an expense cap will be paid by the fund's investment adviser. The funds will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares. The costs will be allocated among the funds based upon the relative total net assets of each fund. The costs will be allocated on a pro rata basis to each class of a fund based on the net assets of each class relative to the total net assets of the fund.

For funds whose management contract with the investment adviser or administration agreement with the administrator, as applicable, obligates the investment adviser or the administrator to pay certain fund level expenses, the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by the investment adviser or the administrator listed in Appendix B. The investment adviser or the administrator will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later-dated proxy, by the trust's receipt of a subsequent valid internet or telephonic vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR the matters specified on the proxy. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity individual retirement accounts (including Traditional, Rollover, SEP, SARSEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted.

One-third of each trust's outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the proposed item are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to the item, unless directed to vote AGAINST the item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on the item in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate. Please visit www.fidelity.com/proxies to determine the status of this scheduled Meeting.

Information regarding the number of shares of each fund and class, if applicable, of each trust issued and outstanding is provided in Appendix F.

Information regarding record and/or beneficial ownership of each fund and class, as applicable, is included in Appendix G.

Certain shares are registered to Fidelity Management & Research Company (FMR) or an FMR affiliate. To the extent that FMR or an FMR affiliate has discretion to vote, these shares will be voted at the Meeting FOR each proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Shareholders of record at the close of business on September 21, 2015 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

For a free copy of each fund's annual and/or semiannual reports, call the applicable contact number noted in Appendix A, visit Fidelity's web sites at www.fidelity.com, www.advisor.fidelity.com, or www.401k.com, as applicable, or write to FDC at 100 Salem Street, Smithfield, Rhode Island 02917. For Fidelity Advisor® Multi-Asset Income Fund, a financial report will be available once the fund has completed its first fiscal period.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a plurality of the shares voted in person or by proxy. With respect to Proposal 1, votes to ABSTAIN and broker non-votes will have no effect.

PROPOSAL 1

TO ELECT A BOARD OF TRUSTEES

The purpose of this proposal is to elect a Board of Trustees. All nominees are currently Trustees or Advisory Board Members of each trust. Appendix H lists the length of service of each nominee with respect to each trust. Certain nominees were previously elected by shareholders to serve as Trustees of certain trusts, while other nominees were initially appointed by the Trustees and have not yet been elected by shareholders of all trusts. A third-party search firm retained by the Independent Trustees recommended Elizabeth S. Acton, John Engler, Albert R. Gartland, and Michael E. Kenneally, and an executive officer of FMR recommended Abigail P. Johnson and Geoffrey A. von Kuhn.

Except for Ms. Acton and Messrs. Engler and von Kuhn, each of the nominees oversees 235 funds. Ms. Acton and Mr. Engler each oversee 219 funds. Mr. von Kuhn oversees 96 funds. Ms. Acton and Mr. Engler are currently first-time nominees for Trustee for 16 funds. Mr. von Kuhn is currently a first-time nominee for Trustee for 139 funds. If elected, each Trustee will oversee 235 funds.

The nominees you are being asked to elect as Trustees of the funds are as follows:

Interested Nominees*:

Correspondence intended for each Interested Nominee (that is, the nominees that are interested persons (as defined in the Investment Company Act of 1940, as amended (the 1940 Act)) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

|

Name, Year of Birth; Principal Occupations and Other Relevant Experience** |

|

|

Abigail P. Johnson (1961) |

|

|

Chairman of the Board of Trustees (since 2014) |

|

|

|

Ms. Johnson also serves as Trustee of other Fidelity funds. Ms. Johnson serves as President (2013-present) and Chief Executive Officer (2014-present) of FMR LLC (diversified financial services company), President of Fidelity Financial Services (2012-present) and President of Personal, Workplace and Institutional Services (2005-present). Ms. Johnson is Chairman and Director of FMR Co., Inc. (investment adviser firm, 2011-present), Chairman and Director of FMR (investment adviser firm, 2011-present), and the Vice Chairman and Director (2007-present) of FMR LLC. Previously, Ms. Johnson served as President and a Director of FMR (2001-2005), a Trustee of other investment companies advised by FMR, Fidelity Investments Money Management, Inc. (investment adviser firm), and FMR Co., Inc. (2001-2005), Senior Vice President of the Fidelity funds (2001-2005), and managed a number of Fidelity funds. Ms. Abigail P. Johnson and Mr. Arthur E. Johnson are not related. |

|

Geoffrey A. von Kuhn (1951) |

|

|

|

Mr. von Kuhn also serves as Trustee or Member of the Advisory Board of other Fidelity funds. Mr. von Kuhn is Chief Administrative Officer for FMR LLC (diversified financial services company, 2013-present), a Director of Pembroke Real Estate, Inc. (2009-present), and a Director of Discovery Natural Resources LLC (2012-present). Previously, Mr. von Kuhn was a managing director of Crosby Group (private wealth management company, 2007-2013), a member of the management committee and senior executive in the Wealth Management Group of AmSouth Bank (2001-2006), and head of the U.S. private bank at Citigroup (2000-2001). |

* Nominees have been determined to be "interested" by virtue of, among other things, their affiliation with a trust or various entities under common control with FMR.

** The information above includes each nominee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each nominee's qualifications to serve as a Trustee, which led to the conclusion that each nominee should serve as a Trustee for each fund.

Independent Nominees:

Correspondence intended for each Independent Nominee (that is, the nominees that are not interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

|

Name, Year of Birth; Principal Occupations and Other Relevant Experience** |

|

|

Elizabeth S. Acton (1951) |

|

|

|

Ms. Acton also serves as Trustee or Member of the Advisory Board of other Fidelity funds. Prior to her retirement in April 2012, Ms. Acton was Executive Vice President, Finance (2011-2012), Executive Vice President, Chief Financial Officer (2002-2011), and Treasurer (2004-2005) of Comerica Incorporated (financial services). Prior to joining Comerica, Ms. Acton held a variety of positions at Ford Motor Company (1983-2002), including Vice President and Treasurer (2000-2002) and Executive Vice President and Chief Financial Officer of Ford Motor Credit Company (1998-2000). Ms. Acton currently serves as a member of the Board of Directors and Audit and Finance Committees of Beazer Homes USA, Inc. (homebuilding, 2012-present). |

|

John Engler (1948) |

|

|

|

Mr. Engler also serves as Trustee or Member of the Advisory Board of other Fidelity funds. He serves as president of the Business Roundtable (2011-present), and on the board of directors/trustees for Universal Forest Products (manufacturer and distributor of wood and wood-alternative products, 2003-present), K12 Inc. (technology-based education company, 2012-present), and the Annie E. Casey Foundation (2004-present). Previously, Mr. Engler served as a trustee of The Munder Funds (2003-2014), president and CEO of the National Association of Manufacturers (2004-2011) and as governor of Michigan (1991-2003). He is a past chairman of the National Governors Association. |

|

Albert R. Gamper, Jr. (1942) |

|

|

|

Mr. Gamper also serves as Trustee of other Fidelity funds. Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). During his tenure with CIT Group Inc., Mr. Gamper served in numerous senior management positions, including Chairman (1987-1989; 1999-2001; 2002-2004), Chief Executive Officer (1987-2004), and President (2002-2003). Mr. Gamper currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2000-present), and Member of the Board of Trustees of Barnabas Health Care System (1997-present). Previously, Mr. Gamper served as Chairman (2012-2015) and Vice Chairman (2011-2012) of the Independent Trustees of certain Fidelity funds and as Chairman of the Board of Governors, Rutgers University (2004-2007). |

|

Robert F. Gartland (1951) |

|

|

|

Mr. Gartland also serves as Trustee of other Fidelity funds. Mr. Gartland is Chairman and an investor in Gartland and Mellina Group Corp. (consulting, 2009-present). Previously, Mr. Gartland served as a partner and investor of Vietnam Partners LLC (investments and consulting, 2008-2011). Prior to his retirement, Mr. Gartland held a variety of positions at Morgan Stanley (financial services, 1979-2007) including Managing Director (1987-2007). |

|

Arthur E. Johnson (1947) |

|

|

Vice Chairman of the Independent Trustees (since 2015) |

|

|

|

Mr. Johnson also serves as Trustee of other Fidelity funds. Mr. Johnson serves as a member of the Board of Directors of Eaton Corporation plc (diversified power management, 2009-present), AGL Resources, Inc. (holding company, 2002-present) and Booz Allen Hamilton (management consulting, 2011-present). Prior to his retirement, Mr. Johnson served as Senior Vice President of Corporate Strategic Development of Lockheed Martin Corporation (defense contractor, 1999-2009). He previously served on the Board of Directors of IKON Office Solutions, Inc. (1999-2008) and Delta Airlines (2005-2007). Mr. Arthur E. Johnson is not related to Ms. Abigail P. Johnson. |

|

Michael E. Kenneally (1954) |

|

|

|

Mr. Kenneally also serves as Trustee of other Fidelity funds. Mr. Kenneally served as a Member of the Advisory Board for certain Fidelity funds before joining the Board of Trustees (2008-2009). Prior to his retirement, Mr. Kenneally served as Chairman and Global Chief Executive Officer of Credit Suisse Asset Management. Before joining Credit Suisse, he was an Executive Vice President and Chief Investment Officer for Bank of America Corporation. Earlier roles at Bank of America included Director of Research, Senior Portfolio Manager and Research Analyst, and Mr. Kenneally was awarded the Chartered Financial Analyst (CFA) designation in 1991. |

|

James H. Keyes (1940) |

|

|

|

Mr. Keyes also serves as Trustee of other Fidelity funds. Mr. Keyes serves as a member of the Board and Non-Executive Chairman of Navistar International Corporation (manufacture and sale of trucks, buses, and diesel engines, since 2002). Previously, Mr. Keyes served as a member of the Board of Pitney Bowes, Inc. (integrated mail, messaging, and document management solutions, 1998-2013). Prior to his retirement, Mr. Keyes served as Chairman (1993-2002) and Chief Executive Officer (1988-2002) of Johnson Controls (automotive, building, and energy) and as a member of the Board of LSI Logic Corporation (semiconductor technologies, 1984-2008). |

|

Marie L. Knowles (1946) |

|

|

Chairman of the Independent Trustees (since 2015) |

|

|

|

Ms. Knowles also serves as Trustee of other Fidelity funds. Prior to Ms. Knowles' retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996-2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company. She served as a Director of ARCO from 1996 to 1998. Ms. Knowles currently serves as a Director and Chairman of the Audit Committee of McKesson Corporation (healthcare service, since 2002). Ms. Knowles is a member of the Board of the Catalina Island Conservancy and of the Santa Catalina Island Company (2009-present). She also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California. Previously, Ms. Knowles served as a Director of Phelps Dodge Corporation (copper mining and manufacturing, 1994-2007), URS Corporation (engineering and construction, 2000-2003) and America West (airline, 1999-2002). Ms. Knowles previously served as Vice Chairman of the Independent Trustees of certain Fidelity Funds (2012-2015). |

** The information above includes each nominee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each nominee's qualifications to serve as a Trustee, which led to the conclusion that each nominee should serve as a Trustee for each fund.

As of June 30, 2015, the nominees, Trustees and officers of the trusts and each fund owned, in the aggregate, less than 1% of each fund's outstanding shares.

During the period September 1, 2013 through June 30, 2015, Mr. von Kuhn exchanged shares of one class of FMR LLC stock for an equal number of shares of another class of FMR LLC stock.

If elected, the Trustees will hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Independent Trustee shall retire not later than the last day of the month in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at least two-thirds of the Trustees have been elected by shareholders. If, at any time, less than a majority of the Trustees holding office has been elected by the shareholders, the Trustees then in office will promptly call a shareholders' meeting for the purpose of electing a Board of Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees.

Appendix H shows the composition of the Board of Trustees of each Trust and the length of service of each Trustee (see Appendix B for a list of each fund's fiscal year end and Appendix I for the number of Board meetings held during each fund's last fiscal year end). Following the election, it is expected each fund's Board will include two interested Trustees and eight Independent Trustees, and will meet at least six times a year at regularly scheduled meetings. For additional information about the committees of the funds' Trustees, refer to the section entitled "Board Structure and Oversight Function and Standing Committees of the Trust's Current Trustees."

The dollar range of equity securities beneficially owned as of June 30, 2015 by each Trustee in each fund and in all funds in the aggregate within the same fund family overseen or to be overseen by the nominee is included in Appendix J.

Trustee compensation information for each fund of the current Board is included in Appendix K.

BOARD STRUCTURE AND OVERSIGHT FUNCTION AND

STANDING COMMITTEES OF THE TRUST'S CURRENT TRUSTEES

Correspondence intended for each Independent Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees at Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235. Correspondence intended for each interested Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees at Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. The current process for collecting and organizing shareholder communications requires that the Board of Trustees receive copies of all communications addressed to it. All communications addressed to the Board of Trustees or any individual Trustee are logged and sent to the Board or individual Trustee, respectively. The funds do not hold annual shareholder meetings and therefore do not have a policy with regard to Trustees' attendance at such meetings. However, as a matter of practice, at least one Trustee attends special meetings.

Abigail P. Johnson is an interested person (as defined in the 1940 Act) and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the funds. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Marie L. Knowles serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity funds are overseen by different Boards of Trustees. The funds' Board oversees Fidelity's investment-grade bond, money market, asset allocation and certain equity funds, and other Boards oversee Fidelity's high income, sector and other equity funds. The asset allocation funds may invest in Fidelity funds that are overseen by such other Boards. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, each fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the funds' activities and associated risks. The Board, acting through its committees, has charged the adviser and FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the funds' business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the funds are carried out by or through the adviser, FMR and its affiliates, and other service providers, the funds' exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the funds' activities, oversight is exercised primarily through the Operations and Audit Committees. In addition, an ad hoc Board committee of Independent Trustees has worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. The Operations Committee also worked and continues to work with FMR to enhance the stress tests required under Securities and Exchange Commission (SEC) regulations for money market funds. Appropriate personnel, including but not limited to the funds' Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the funds' Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity funds.

The Board of Trustees has established various committees to support the Independent Trustees in acting independently in pursuing the best interests of the funds and their shareholders. Currently, the Board of Trustees has four standing committees. The members of each committee are Independent Trustees. See Appendix I for the number of meetings each standing committee held during each fund's last fiscal year.

The Operations Committee is composed of all of the Independent Trustees, with Ms. Knowles currently serving as Chair. The committee normally meets at least six times a year, or more frequently as called by the Chair, and serves as a forum for consideration of issues of importance to, or calling for particular determinations by, the Independent Trustees. The committee considers matters involving potential conflicts of interest between the funds and the adviser and between the funds and FMR and its affiliates and reviews proposed contracts and the proposed continuation of contracts between the funds and the adviser and between the funds and FMR and its affiliates, and annually reviews and makes recommendations regarding contracts with third parties unaffiliated with the adviser or FMR, including insurance coverage and custody agreements. The committee has oversight of compliance issues not specifically within the scope of any other committee. These matters include, but are not limited to, significant non-conformance with contract requirements and other significant regulatory matters and recommending to the Board of Trustees the designation of a person to serve as the funds' CCO. The committee (i) serves as the primary point of contact for the CCO with regard to Board-related functions; (ii) oversees the annual performance review of the CCO; (iii) makes recommendations concerning the CCO's compensation; and (iv) makes recommendations as needed in respect of the removal of the CCO. The committee is also responsible for definitive action on all compliance matters involving the potential for significant reimbursement by the adviser or FMR.

The Audit Committee is composed of all of the Independent Trustees, with Ms. Acton serving as Chair for each series of each trust except Fidelity Colchester Street Trust, Fidelity Court Street Trust, and Fidelity Court Street Trust II. Mr. Keyes serves as Chair for each series of Fidelity Colchester Street Trust, Fidelity Court Street Trust, and Fidelity Court Street Trust II. At least one committee member will be an "audit committee financial expert" as defined by the SEC. The committee normally meets four times a year, or more frequently as called by the Chair or a majority of committee members. The committee meets separately, at least annually, with the funds' Treasurer, with the funds' Chief Financial Officer, with personnel responsible for the internal audit function of FMR LLC, with the funds' outside auditors, and with the funds' CCO. The committee has direct responsibility for the appointment, compensation, and oversight of the work of the outside auditors employed by the funds. The committee assists the Trustees in overseeing and monitoring: (i) the systems of internal accounting and financial controls of the funds and the funds' service providers (to the extent such controls impact the funds' financial statements); (ii) the funds' auditors and the annual audits of the funds' financial statements; (iii) the financial reporting processes of the funds; (iv) whistleblower reports; and (v) the accounting policies and disclosures of the funds. The committee considers and acts upon (i) the provision by any outside auditor of any non-audit services for any fund, and (ii) the provision by any outside auditor of certain non-audit services to fund service providers and their affiliates to the extent that such approval (in the case of this clause (ii)) is required under applicable regulations of the SEC. It is responsible for approving all audit engagement fees and terms for the funds and for resolving disagreements between a fund and any outside auditor regarding any fund's financial reporting. Auditors of the funds report directly to the committee. The committee will obtain assurance of independence and objectivity from the outside auditors, including a formal written statement delineating all relationships between the auditor and the funds and any service providers consistent with the rules of the Public Company Accounting Oversight Board. The committee will receive reports of compliance with provisions of the auditor independence regulations relating to the hiring of employees or former employees of the outside auditors. It oversees and receives reports on the funds' service providers' internal controls and reviews the adequacy and effectiveness of the service providers' accounting and financial controls, including: (i) any significant deficiencies or material weaknesses in the design or operation of internal controls over financial reporting that are reasonably likely to adversely affect the funds' ability to record, process, summarize, and report financial data; (ii) any change in the fund's internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the fund's internal control over financial reporting; and (iii) any fraud, whether material or not, that involves management or other employees who have a significant role in the funds' or service providers' internal controls over financial reporting. The committee will also review any correspondence with regulators or governmental agencies or published reports that raise material issues regarding the funds' financial statements or accounting policies. These matters may also be reviewed by the Operations Committee. The committee reviews at least annually a report from each outside auditor describing any material issues raised by the most recent internal quality control, peer review, or Public Company Accounting Oversight Board examination of the auditing firm and any material issues raised by any inquiry or investigation by governmental or professional authorities of the auditing firm and in each case any steps taken to deal with such issues. The committee will oversee and receive reports on the funds' financial reporting process from the funds' Treasurer and outside auditors and will oversee the resolution of any disagreements concerning financial reporting among applicable parties. The committee will discuss with FMR, the funds' Treasurer, outside auditors and, if appropriate, internal audit personnel of FMR LLC their qualitative judgments about the appropriateness and acceptability of accounting principles and financial disclosure practices used or proposed for adoption by the funds. The committee will review with FMR, the funds' outside auditor, internal audit personnel of FMR LLC and legal counsel, as appropriate, matters related to the audits of the funds' financial statements. The committee will discuss regularly and oversee the review of the internal controls of the funds and their service providers with respect to accounting, financial matters and risk management programs related to the funds. The committee will review periodically the funds' major internal controls exposures and the steps that have been taken to monitor and control such exposures.

The Fair Valuation Committee is composed of all of the Independent Trustees, with Mr. Johnson currently serving as Chair. The Committee normally meets quarterly, or more frequently as called by the Chair. The Fair Valuation Committee reviews and approves annually Fair Value Committee Policies recommended by the FMR Fair Value Committee and oversees particular valuations or fair valuation methodologies employed by the FMR Fair Value Committee as circumstances may require. The Committee also reviews actions taken by the FMR Fair Value Committee. The Committee does not oversee the day-to-day operational aspects of the valuation and calculation of the net asset value of the funds, which have been delegated to the FMR Fair Value Committee and Fidelity Service Company, Inc. (FSC).

The Governance and Nominating Committee is composed of Ms. Knowles (Chair) and Messrs. Johnson (Vice Chair) and Kenneally. The committee meets as called by the Chair. With respect to fund governance and board administration matters, the committee periodically reviews procedures of the Board of Trustees and its committees (including committee charters) and periodically reviews compensation of Independent Trustees. The committee monitors corporate governance matters and makes recommendations to the Board of Trustees on the frequency and structure of the Board of Trustee meetings and on any other aspect of Board procedures. It acts as the administrative committee under the retirement plan for Independent Trustees who retired prior to December 30, 1996 and under the fee deferral plan for Independent Trustees. It reviews the performance of legal counsel employed by the funds and the Independent Trustees. On behalf of the Independent Trustees, the committee will make such findings and determinations as to the independence of counsel for the Independent Trustees as may be necessary or appropriate under applicable regulations or otherwise. The committee is also responsible for Board administrative matters applicable to Independent Trustees, such as expense reimbursement policies and compensation for attendance at meetings, conferences and other events. The committee monitors compliance with, acts as the administrator of, and makes determinations in respect of, the provisions of the code of ethics and any supplemental policies regarding personal securities transactions applicable to the Independent Trustees. The committee monitors the functioning of each Board committee and makes recommendations for any changes, including the creation or elimination of standing or ad hoc Board committees. The committee monitors regulatory and other developments to determine whether to recommend modifications to the committee's responsibilities or other Trustee policies and procedures in light of rule changes, reports concerning "best practices" in corporate governance and other developments in mutual fund governance. The committee meets with Independent Trustees at least once a year to discuss matters relating to fund governance. The committee recommends that the Board establish such special or ad hoc Board committees as may be desirable or necessary from time to time in order to address ethical, legal, or other matters that may arise. The committee also oversees the annual self-evaluation of the Board of Trustees and establishes procedures to allow it to exercise this oversight function. In conducting this oversight, the committee shall address all matters that it considers relevant to the performance of the Board of Trustees and shall report the results of its evaluation to the Board of Trustees, including any recommended amendments to the principles of governance, and any recommended changes to the funds' or the Board of Trustees' policies, procedures, and structures. The committee reviews periodically the size and composition of the Board of Trustees as a whole and recommends, if necessary, measures to be taken so that the Board of Trustees reflects the appropriate balance of knowledge, experience, skills, expertise, and diversity required for the Board as a whole and contains at least the minimum number of Independent Trustees required by law. The committee makes nominations for the election or appointment of Independent Trustees and non-management Members of any Advisory Board, and for membership on committees. The committee has the authority to retain and terminate any third-party advisers, including authority to approve fees and other retention terms. Such advisers may include search firms to identify Independent Trustee candidates and board compensation consultants. The committee may conduct or authorize investigations into or studies of matters within the committee's scope of responsibilities, and may retain, at the funds' expense, such independent counsel or other advisers as it deems necessary. The committee will consider nominees to the Board of Trustees recommended by shareholders based upon the criteria applied to candidates presented to the committee by a search firm or other source. Recommendations, along with appropriate background material concerning the candidate that demonstrates his or her ability to serve as an Independent Trustee of the funds, should be submitted to the Chair of the committee at the address maintained for communications with Independent Trustees. If the committee retains a search firm, the Chair will generally forward all such submissions to the search firm for evaluation. With respect to the criteria for selecting Independent Trustees, it is expected that all candidates will possess the following minimum qualifications: (i) unquestioned personal integrity; (ii) not an interested person of the funds within the meaning of the 1940 Act; (iii) does not have a material relationship (e.g., commercial, banking, consulting, legal, or accounting) with the adviser, any sub-adviser or their affiliates that could create an appearance of lack of independence in respect of the funds; (iv) has the disposition to act independently in respect of the adviser, FMR and their respective affiliates and others in order to protect the interests of the funds and all shareholders; (v) ability to attend regularly scheduled Board meetings during the year; (vi) demonstrates sound business judgment gained through broad experience in significant positions where the candidate has dealt with management, technical, financial, or regulatory issues; (vii) sufficient financial or accounting knowledge to add value in the complex financial environment of the funds; (viii) experience on corporate or other institutional oversight bodies having similar responsibilities, but which board memberships or other relationships could not result in business or regulatory conflicts with the funds; and (ix) capacity for the hard work and attention to detail that is required to be an effective Independent Trustee in light of the funds' complex regulatory, operational, and marketing setting. The Governance and Nominating Committee may determine that a candidate who does not have the type of previous experience or knowledge referred to above should nevertheless be considered as a nominee if the Governance and Nominating Committee finds that the candidate has additional qualifications such that his or her qualifications, taken as a whole, demonstrate the same level of fitness to serve as an Independent Trustee. A current copy of the Governance and Nominating Committee Charter is available at http://www.fidelity.com and is attached as Exhibit 1.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

The firm of PricewaterhouseCoopers LLP (PwC) or Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, "Deloitte Entities"), have been selected as the independent registered public accounting firms for each fund, as indicated in Appendix B. PwC and Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, have confirmed to each trust's Audit Committee that they are the independent registered public accounting firms with respect to the funds.

The independent registered public accounting firms examine annual financial statements for the funds and provide other audit-related, non-audit, and tax-related services to the funds. Representatives of PwC and Deloitte Entities are not expected to be present at the Meeting, but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence.

Each trust's Audit Committee must pre-approve all audit and non-audit services provided by the applicable independent registered public accounting firm relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

Each trust's Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee's consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to each trust and any non-audit service provided by a fund auditor to the investment adviser, as indicated in Appendix B, and entities controlling, controlled by, or under common control with the investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the funds ("Fund Service Providers") that relate directly to the operations and financial reporting of each trust ("Covered Service") are subject to approval by the Audit Committee before such service is provided. All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee; or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair's absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of each trust ("Non-Covered Service") are reported to the Audit Committee on a periodic basis.

Each trust's Audit Committee has considered non-audit services that were not pre-approved and that were provided by PwC and Deloitte Entities to Fund Service Providers to be compatible with maintaining the independence of PwC and Deloitte Entities in their audit of the funds taking into account representations from PwC and Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, regarding their independence from the funds and their related entities and FMR's review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund Service Providers.

Fees and Services

Appendix L presents fees billed by PwC and Deloitte Entities in each of the last two fiscal years for services rendered to the funds.

Appendix M presents fees billed by PwC and Deloitte Entities that were required to be approved by each trust's Audit Committee for services that relate directly to the operations and financial reporting of the funds and that are rendered on behalf of Fund Service Providers.

Appendix N presents the aggregate non-audit fees billed by PwC and Deloitte Entities for services rendered to the funds and any Fund Service Provider for each of the last two fiscal years of the funds.

There were no non-audit services approved or required to be approved by each trust's Audit Committee pursuant to the "de minimis" exception during the funds' last two fiscal years relating to services provided to (i) the funds or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the funds.

OFFICERS OF THE TRUST

The executive officers of the trust include: Elizabeth Paige Baumann, Marc R. Bryant, Jonathan Davis, Adrien E. Deberghes, Stephanie J. Dorsey, Howard J. Galligan III, Scott C. Goebel, Thomas C. Hense, Timothy Huyck, Vince Gubitosi, Chris Maher, Jason P. Pogorelec, Nancy D. Prior, Kenneth B. Robins, Stephen Sadoski, Stacie M. Smith, Renee Stagnone, Christine J. Thompson, Michael H. Whitaker, Derek L. Young, and Joseph F. Zambello. Additional information about the executive officers of the trust can be found in the following table.

The executive officers hold office without limit in time, except that any officer may resign, or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Correspondence intended for each officer may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. Officers appear below in alphabetical order.

|

Name, Year of Birth; Principal Occupation |

|

|

Elizabeth Paige Baumann (1968) |

|

|

Year of Election or Appointment: 2012 Anti-Money Laundering (AML) Officer |

|

|

|

Ms. Baumann also serves as AML Officer of other funds. She is Chief AML Officer of FMR LLC (diversified financial services company, 2012-present) and is an employee of Fidelity Investments. Previously, Ms. Baumann served as Vice President and Deputy Anti-Money Laundering Officer (2007-2012). |

|

Marc R. Bryant (1966) |

|

|

Year of Election or Appointment: 2015 Secretary and Chief Legal Officer (CLO) |

|

|

|

Mr. Bryant also serves as Secretary and CLO of other funds. He is Senior Vice President and Deputy General Counsel of FMR LLC (diversified financial services company). Previously, Mr. Bryant served as Secretary and Chief Legal Officer of Fidelity Rutland Square Trust II (2010-2014) and Assistant Secretary of Fidelity's Fixed Income and Asset Allocation Funds (2013-2015). Prior to joining Fidelity Investments, Mr. Bryant served as a Senior Vice President and the Head of Global Retail Legal for AllianceBernstein L.P. (2006-2010), and as the General Counsel for ProFund Advisors LLC (2001-2006). |

|

Jonathan Davis (1968) |

|

|

Year of Election or Appointment: 2010 Assistant Treasurer |

|

|

|

Mr. Davis also serves as Assistant Treasurer of other funds and is an employee of Fidelity Investments. Previously, Mr. Davis served as Vice President and Associate General Counsel of FMR LLC (diversified financial services company, 2003-2010). |

|

Adrien E. Deberghes (1967) |

|

|

Year of Election or Appointment: 2010 Assistant Treasurer |

|

|

|

Mr. Deberghes also serves as an officer of other funds. He is an employee of Fidelity Investments (2008-present). Prior to joining Fidelity Investments, Mr. Deberghes was Senior Vice President of Mutual Fund Administration at State Street Corporation (2007-2008), Senior Director of Mutual Fund Administration at Investors Bank & Trust (2005-2007), and Director of Finance for Dunkin' Brands (2000-2005). |

|

Stephanie J. Dorsey (1969) |

|

|

Year of Election or Appointment: 2013 President and Treasurer |

|

|

|

Ms. Dorsey also serves as an officer of other funds. She is an employee of Fidelity Investments (2008-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Dorsey served as Treasurer (2004-2008) of the JPMorgan Mutual Funds and Vice President (2004-2008) of JPMorgan Chase Bank. |

|

Howard J. Galligan III (1966) |

|

|

Year of Election or Appointment: 2014 Chief Financial Officer |

|

|

|

Mr. Galligan also serves as Chief Financial Officer of other funds. Mr. Galligan serves as President of Fidelity Pricing and Cash Management Services (FPCMS) (2014-present) and as a Director of Strategic Advisers, Inc. (investment adviser firm, 2008-present). Previously, Mr. Galligan served as Chief Administrative Officer of Asset Management (2011-2014) and Chief Operating Officer and Senior Vice President of Investment Support for Strategic Advisers, Inc. (2003-2011). |

|

Scott C. Goebel (1968) |

|

|

Year of Election or Appointment: 2015 Vice President |

|

|

|

Mr. Goebel serves as an officer of other funds and is an employee of Fidelity Investments (2001-present). Mr. Goebel also serves as Secretary of Fidelity SelectCo, LLC (investment adviser firm, 2013-present), Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2010-present) and Fidelity Research and Analysis Company (FRAC) (investment adviser firm, 2010-present); General Counsel, Secretary, and Senior Vice President of FMR (investment adviser firm, 2008-present) and FMR Co., Inc. (investment adviser firm, 2008-present); Chief Legal Officer of Fidelity Management & Research (Hong Kong) Limited (investment adviser firm, 2008-present); and Assistant Secretary of Fidelity Management & Research (Japan) Limited (investment adviser firm, 2008-present) and FMR Investment Management (U.K.) Limited (investment adviser firm, 2008-present). Previously, Mr. Goebel served as Secretary and CLO of certain Fidelity funds (2008-2015), Assistant Secretary of FIMM (2008-2010), FRAC (2008-2010), and certain funds (2007-2008); and as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (2005-2007). |

|

Thomas C. Hense (1964) |

|

|

Year of Election or Appointment: 2008/2010/2015 Vice President |

|

|

|

Mr. Hense serves as Vice President of Fidelity Advisor® Multi-Asset Income Fund (2015) and of other funds (High Income (2008), Small Cap (2008), and Value (2010) funds) and is an employee of Fidelity Investments (1993-present). Previously, Mr. Hense serves as a portfolio manager for Fidelity's Institutional Money Management Group (Pyramis) (2003-2008). |

|

Timothy Huyck (1964) |

|

|

Year of Election or Appointment: 2015 Vice President of Fidelity's Money Market Funds |

|

|

|

Mr. Huyck also serves as Vice President of other funds. Mr. Huyck serves as Chief Investment Officer of Fidelity's Money Market Funds (2015-present) and is an employee of Fidelity Investments (1990-present). |

|

Vince Gubitosi (1972) |

|

|

Year of Election or Appointment: 2012 Vice President |

|

|

|

Mr. Gubitosi is the President and Chief Investment Officer of Geode Capital Management, LLC (Geode). Mr. Gubitosi was an employee of Geode from 2002 to 2005, and rejoined Geode in 2007. |

|

Chris Maher (1972) |

|

|

Year of Election or Appointment: 2013 Assistant Treasurer |

|

|

|

Mr. Maher serves as Assistant Treasurer of other funds. Mr. Maher is Vice President of Valuation Oversight and is an employee of Fidelity Investments. Previously, Mr. Maher served as Vice President of Asset Management Compliance (2013), Vice President of the Program Management Group of FMR (investment adviser firm, 2010-2013), and Vice President of Valuation Oversight (2008-2010). |

|

Jason P. Pogorelec (1975) |

|

|

Year of Election or Appointment: 2015 Assistant Secretary |

|

|

|

Mr. Pogorelec also serves as Assistant Secretary of other funds. Mr. Pogorelec serves as Vice President, Associate General Counsel (2010-present) and is an employee of Fidelity Investments (2006-present). |

|

Nancy D. Prior (1967) |

|

|

Year of Election or Appointment: 2014 Vice President |

|

|

|

Ms. Prior also serves as Vice President of other funds. Ms. Prior serves as a Director of Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2014-present), President, Fixed Income (2014-present), Vice Chairman of Pyramis Global Advisors, LLC (investment adviser firm, 2014-present), and is an employee of Fidelity Investments (2002-present). Previously, Ms. Prior served as Vice President of Fidelity's Money Market Funds (2012-2014), President, Money Market and Short Duration Bond of FMR (investment adviser firm, 2013-2014), President, Money Market Group of FMR (2011-2014), Managing Director of Research (2009-2011), Senior Vice President and Deputy General Counsel (2007-2009), and Assistant Secretary of other Fidelity funds (2008-2009). |

|

Kenneth B. Robins (1969) |

|

|

Year of Election or Appointment: 2009 Assistant Treasurer |

|

|

|

Mr. Robins also serves as an officer of other funds. Mr. Robins serves as Executive Vice President of Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2013-present) and is an employee of Fidelity Investments (2004-present). Previously, Mr. Robins served in other fund officer roles. |

|

Stephen Sadoski (1971) |

|

|

Year of Election or Appointment: 2013 Deputy Treasurer |

|

|

|

Mr. Sadoski also serves as Deputy Treasurer of other funds. He is an employee of Fidelity Investments (2012-present) and has served in another fund officer role. Prior to joining Fidelity Investments, Mr. Sadoski served as an assistant chief accountant in the Division of Investment Management of the Securities and Exchange Commission (SEC) (2009-2012) and as a senior manager at Deloitte & Touche LLP (1997-2009). |

|

Stacie M. Smith (1974) |

|

|

Year of Election or Appointment: 2013 Assistant Treasurer |

|

|

|

Ms. Smith also serves as an officer of other funds. She is an employee of Fidelity Investments (2009-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Smith served as Senior Audit Manager of Ernst & Young LLP (1996-2009). |

|

Renee Stagnone (1975) |

|

|

Year of Election or Appointment: 2013 Deputy Treasurer |

|

|

|

Ms. Stagnone also serves as Deputy Treasurer of other funds. Ms. Stagnone is an employee of Fidelity Investments (1997-present). |

|

Christine J. Thompson (1958) |

|

|

Year of Election or Appointment: 2015 Vice President of Fidelity's Bond Funds |

|

|

|

Ms. Thompson also serves as Vice President of other funds. Ms. Thompson also serves as Chief Investment Officer of FMR's Bond Group (2010-present) and is an employee of Fidelity Investments (1985-present). Previously, Ms. Thompson served as Vice President of Fidelity's Bond Funds (2010-2012). |

|

Michael H. Whitaker (1967) |

|

|

Year of Election or Appointment: 2008 Chief Compliance Officer |

|

|

|

Mr. Whitaker also serves as Chief Compliance Officer of other funds. Mr. Whitaker also serves as Compliance Officer of FMR Co., Inc. (investment adviser firm, 2014-present), FMR (investment adviser firm, 2014-present), Fidelity Investments Money Management, Inc. (investment adviser firm, 2014-present), and is an employee of Fidelity Investments (2007-present). Prior to joining Fidelity Investments, Mr. Whitaker worked at MFS Investment Management where he served as Senior Vice President and Chief Compliance Officer (2004-2006), and Assistant General Counsel. |

|

Derek L. Young (1964) |

|

|

Year of Election or Appointment: 2009 Vice President of Fidelity's Asset Allocation Funds |

|

|

|

Mr. Young also serves as Trustee or an officer of other funds. He is President and a Director of Strategic Advisers, Inc. (investment adviser firm, 2011-present), President of Fidelity Global Asset Allocation (GAA) (2011-present), and Vice Chairman of Pyramis Global Advisors, LLC (investment adviser firm, 2011-present). Previously, Mr. Young served as Chief Investment Officer of GAA (2009-2011) and as a portfolio manager. |

|

Joseph F. Zambello (1957) |

|

|

Year of Election or Appointment: 2011 Deputy Treasurer |

|

|

|

Mr. Zambello also serves as Deputy Treasurer of other funds. Mr. Zambello is an employee of Fidelity Investments (1991-present). Previously, Mr. Zambello served as Vice President of the Program Management Group of FMR (investment adviser firm, 2009-2011) and Vice President of the Transfer Agent Oversight Group (2005-2009). |

The Board of Trustees unanimously recommends that shareholders vote FOR Proposal 1.

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

SUBMISSION OF CERTAIN SHAREHOLDER PROPOSALS

The trust does not hold annual shareholder meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of the funds, attention "Fund Shareholder Meetings," 245 Summer Street, Mailzone V10A, Boston, Massachusetts 02210. Proposals must be received a reasonable time before a fund begins to print and send its proxy materials to be considered for inclusion in the proxy materials for the meeting. Timely submission of a proposal does not, however, necessarily mean the proposal will be included. With respect to proposals submitted on an untimely basis and presented at a shareholder meeting, persons named as proxy agents will vote in their discretion.

NOTICE TO BANKS, BROKER-DEALERS AND

VOTING TRUSTEES AND THEIR NOMINEES

Please advise the trust, in care of Fidelity Investments Institutional Operations Company, Inc., 245 Summer Street, Boston, Massachusetts, 02210, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the Proxy Statement and Annual Reports you wish to receive in order to supply copies to the beneficial owners of the respective shares.

EXHIBIT 1

FIXED INCOME AND ASSET ALLOCATION FUNDS

Governance and Nominating Committee Charter

I. Background

The investment companies managed by Fidelity Management & Research Company or its affiliates (collectively, "FMR") comprising the Fixed Income and Asset Allocation Funds of the Fidelity Funds are referred to as the "Funds"1; the Boards of Trustees of the Funds are referred to collectively as the "Board of Trustees" and the members are referred to as the "Trustees"; Trustees who are not "interested persons" (as such term is defined in the Investment Company Act of 1940) of the Funds are referred to as the "Independent Trustees"; and committees of the Boards of Trustees are referred to as "Board Committees." The Board of Trustees, including at least a majority of the Independent Trustees, have adopted this Charter, which may from time to time be amended or supplemented by vote of Board of Trustees, including at least a majority of the Independent Trustees, upon the recommendation of the Governance and Nominating Committee.

II. Organization

This Section II describes the organization and governance functions of the Governance and Nominating Committee (the "Committee").

A. Composition of the Committee

The Committee shall be comprised solely of Independent Trustees and will have not less than three members. The members of the Committee will be determined annually, other than the Chair of the Committee, by vote of the Independent Trustees upon the recommendation of the Committee.

B. Chair; Functions of the Chair