Exhibit 99.1

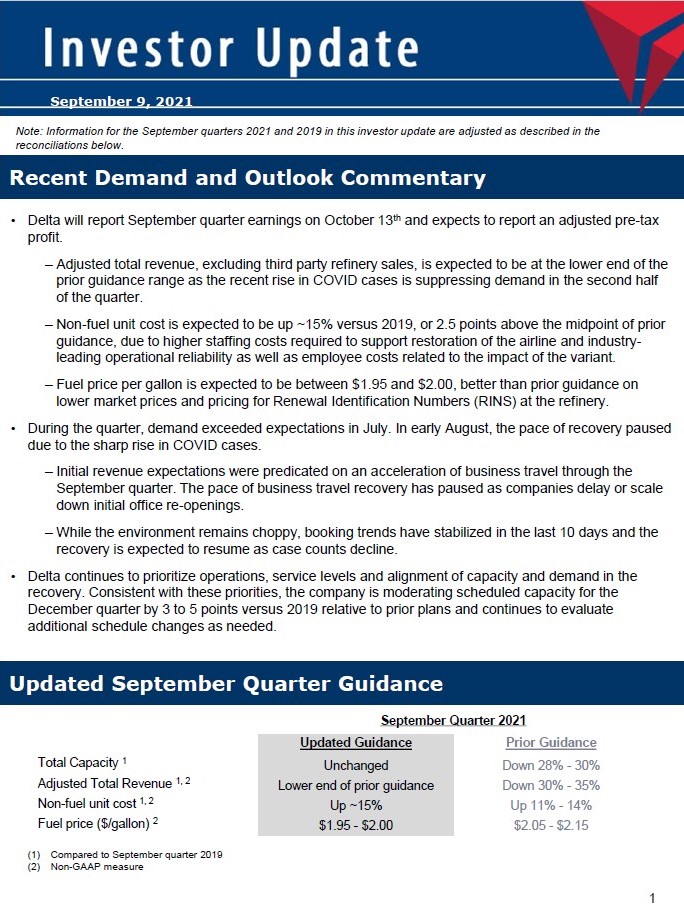

Recent Demand and Outlook Commentary • Delta will report September quarter earnings on October 13 th and expects to report an adjusted pre - tax profit. – Adjusted total revenue, excluding third party refinery sales, is expected to be at the lower end of the prior guidance range as the recent rise in COVID cases is suppressing demand in the second half of the quarter. – Non - fuel unit cost is expected to be up ~15% versus 2019, or 2.5 points above the midpoint of prior guidance, due to higher staffing costs required to support restoration of the airline and industry - leading operational reliability as well as employee costs related to the impact of the variant. – Fuel price per gallon is expected to be between $1.95 and $2.00, better than prior guidance on lower market prices and pricing for Renewal Identification Numbers (RINS) at the refinery. • During the quarter, demand exceeded expectations in July. In early August, the pace of recovery paused due to the sharp rise in COVID cases. – Initial revenue expectations were predicated on an acceleration of business travel through the September quarter. The pace of business travel recovery has paused as companies delay or scale down initial office re - openings. – While the environment remains choppy, booking trends have stabilized in the last 10 days and the recovery is expected to resume as case counts decline. • Delta continues to prioritize operations, service levels and alignment of capacity and demand in the recovery. Consistent with these priorities, the company is moderating scheduled capacity for the December quarter by 3 to 5 points versus 2019 relative to prior plans and continues to evaluate additional schedule changes as needed. September 9, 2021 Note: Information for the September quarters 2021 and 2019 in this investor update are adjusted as described in the reconciliations below. Updated September Quarter Guidance September Quarter 2021 Updated Guidance Prior Guidance Total Capacity 1 Unchanged Down 28% - 30% Adjusted Total Revenue 1, 2 Lower end of prior guidance Down 30% - 35% Non - fuel unit cost 1, 2 Up ~15% Up 11% - 14% Fuel price ($/gallon) 2 $1.95 - $2.00 $2.05 - $2.15 (1) Compared to September quarter 2019 (2) Non - GAAP measure 1

2 Forward Looking Statements Statements made in this investor update that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments or strategies for the future, should be consi der ed “forward - looking statements” under the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements are not guarantees or promised outcomes and should not be construed as such. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections, goal s, aspirations, commitments and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limited to, the material adverse effect that the COVID - 19 pandemic is having on our business; the impact of incurring significant debt in response to the pandemic; failure to comply with the financial and othe r covenants in our financing agreements; the possible effects of accidents involving our aircraft; breaches or security lapses in our information technology systems; breaches or lapses in the security of technology systems on which we rely; disruptions in our information technology infrastructure; our dependence on technology in our operations; our commercial relationships with airlines in other parts of the world and the investments we have in certain of those airlines; the effects of a significant disruption in the operations or performance of third parties on which we rely; failure to realize the full value of intangibl e o r long - lived assets; labor issues; the effects of weather, natural disasters and seasonality on our business; the cost of aircraft fuel; the availability of aircraft fuel; failure or inability of insurance to cover a significant liability at Monroe’s Train er refinery; the impact of environmental regulation on the Trainer refinery, including costs related to renewable fuel standard regulations; o ur ability to retain senior management, key employees and our culture; significant damage to our reputation and brand, including from exposure to significant adverse publicity; the effects of terrorist attacks or geopolitical conflict; competitive condit ion s in the airline industry; interruptions or disruptions in service at major airports at which we operate or significant problems associated with types of aircraft or engines we operate; the effects of extensive government regulation on our business; the impact of environmental regulation and climate change risks on our business; and unfavorable economic or political conditions in the markets in which we operate. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - looking statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended December 31, 2020 and our Quarterly Report for the quarterly period ended June 30, 2021. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of the date of this investor update, and which we undertake no obligation to update except to the extent required by law. Non - GAAP Financial Measures Delta sometimes uses information ("non - GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non - GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non - GAAP financial measures used in this update to the most directly comparable GAAP financial measures. Reconciliations may not calculate due to rounding. Delta is not able to reconcile forward looking non - GAAP financial measures because the adjusting items such as those used in the reconciliations below will not be known until the end of the period and could be significant. Non - GAAP Reconciliations

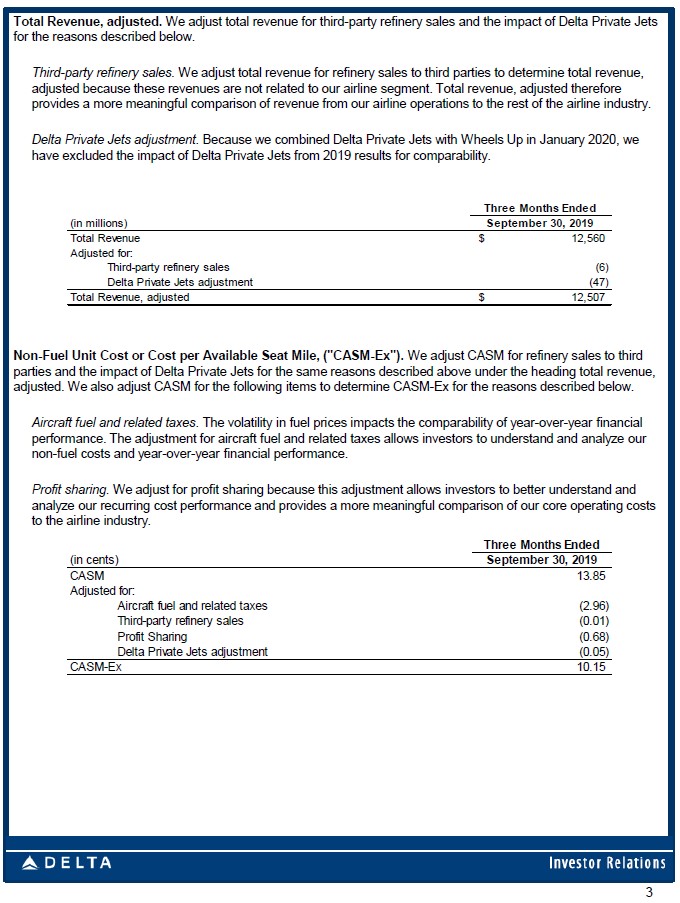

3 Total Revenue, adjusted. We adjust total revenue for third - party refinery sales and the impact of Delta Private Jets for the reasons described below. Third - party refinery sales. We adjust total revenue for refinery sales to third parties to determine total revenue, adjusted because these revenues are not related to our airline segment. Total revenue, adjusted therefore provides a more meaningful comparison of revenue from our airline operations to the rest of the airline industry. Delta Private Jets adjustment. Because we combined Delta Private Jets with Wheels Up in January 2020, we have excluded the impact of Delta Private Jets from 2019 results for comparability. Three Months Ended (in millions) September 30, 2019 12,560$ Third-party refinery sales (6) Delta Private Jets adjustment (47) 12,507$ Total Revenue, adjusted Adjusted for: Total Revenue Non - Fuel Unit Cost or Cost per Available Seat Mile, ("CASM - Ex"). We adjust CASM for refinery sales to third parties and the impact of Delta Private Jets for the same reasons described above under the heading total revenue, adjusted. We also adjust CASM for the following items to determine CASM - Ex for the reasons described below. Aircraft fuel and related taxes. The volatility in fuel prices impacts the comparability of year - over - year financial performance. The adjustment for aircraft fuel and related taxes allows investors to understand and analyze our non - fuel costs and year - over - year financial performance. Profit sharing. We adjust for profit sharing because this adjustment allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. (in cents) 13.85 Aircraft fuel and related taxes (2.96) Third-party refinery sales (0.01) Profit Sharing (0.68) Delta Private Jets adjustment (0.05) 10.15 CASM-Ex Three Months Ended September 30, 2019 CASM Adjusted for: