DEF 14Afalse0000278166iso4217:USD00002781662023-04-022024-03-3000002781662022-04-032023-04-0100002781662021-04-042022-04-0200002781662020-03-292021-04-030000278166ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-04-022024-03-300000278166ecd:PeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2023-04-022024-03-300000278166ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-04-032023-04-010000278166ecd:PeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2022-04-032023-04-010000278166ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-04-042022-04-020000278166ecd:PeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2021-04-042022-04-020000278166ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-03-292021-04-030000278166ecd:PeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2020-03-292021-04-030000278166ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-04-022024-03-300000278166ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-04-022024-03-300000278166ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-04-022024-03-300000278166ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-04-022024-03-300000278166ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-04-032023-04-010000278166ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-04-032023-04-010000278166ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-04-032023-04-010000278166ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-04-032023-04-010000278166ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-04-042022-04-020000278166ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-04-042022-04-020000278166ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-04-042022-04-020000278166ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-04-042022-04-020000278166ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-03-292021-04-030000278166ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-03-292021-04-030000278166ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-03-292021-04-030000278166ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-04-022024-03-300000278166ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-04-032023-04-010000278166ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-04-042022-04-020000278166ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-03-292021-04-030000278166ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-03-292021-04-03000027816612023-04-022024-03-30000027816622023-04-022024-03-30000027816632023-04-022024-03-30000027816642023-04-022024-03-30000027816652023-04-022024-03-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material under Sec. 240.14a-12 |

Cavco Industries, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Fellow Stockholders:

Another fiscal year ends and as Chairman of the Board of Directors of Cavco Industries, Inc., it is my privilege to address you with an update on Cavco’s financial progress, achievements, and outlook. On behalf of the entire Board, Cavco thanks you for your continued support and interest in the Company. Your investment in Cavco has been instrumental in driving the Company’s success.

As your Board, we support the management team in achieving sustainable stockholder value by executing against a clear and focused strategy supported by prudent risk management, sound corporate governance, an executive compensation program aligned with the interests of our stockholders, and a focused approach to environmental, social, and governance (“ESG”) leadership and engagement. The Board would like to highlight a few areas of particular significance for the Company this past fiscal year:

•Revenue and Net Income: The Company achieved the second highest revenue total in the history of the Company and the third highest amount of net income.

•Profitability: The Company’s focus on operational efficiency and cost optimization resulted in gross profit as a percentage of net revenue of 23.8%.

•Health and Safety: Cavco has invested in its employees with training and workforce development programs that focus on safety first. As a result, the Company’s OSHA total recordable incident frequency rate for the calendar year dropped by 33% from the year prior even while adding four new manufacturing facilities to our system.

As the Company moves forward, we remain focused on our long-term strategic objectives and our commitment to sustainable growth. We recognize the challenges that lie ahead, including evolving market and financial dynamics. However, the Company is confident in its ability to navigate these obstacles and capitalize on opportunities.

The attached Notice of Annual Meeting of Stockholders and Definitive Proxy Statement provides all the requisite information concerning all business to be conducted at the upcoming annual meeting. It also describes how the Board operates, gives information about the director candidates, and provides other pertinent information. The Board thanks you for your continued confidence and we appreciate the opportunity to serve Cavco on your behalf.

| | | | | | | | |

| | Sincerely, |

| |

| Steven G. Bunger

Chairman of the Board of Directors |

| June 13, 2024 |

Notice of

2024 Annual Meeting of Stockholders of

Cavco Industries, Inc.

| | | | | | | | | | | |

Date: July 30, 2024 Time: 9:00 AM Local Time Place: Cavco Industries, Inc. 3636 North Central Avenue Phoenix, Arizona 85012 Voting Information To ensure representation of your shares at the Annual Meeting, you must vote in the manner described within the accompanying proxy. To vote before the Annual Meeting, you must vote by: | | Items of business to be voted on at the 2024 Annual Meeting of Stockholders: |

1.To elect two directors to the Class III Director group to serve until the Annual Meeting of Stockholders in 2027, or until their successors have been elected and qualified; 2.To hold an advisory vote to approve the compensation of the Company’s named executive officers; 3.To ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2025; and 4.To transact such other business as may properly come before the meeting or any adjournment thereof. |

| | | |

| (1) Telephone; | | Annual Report: |

| | | |

| (2) The Internet; or | | The Company’s Annual Report is available at www.ProxyVote.com and may also be viewed on the Company’s website at investor.cavco.com/annualmeeting |

| | | |

| (3) Mail. | | Who Can Vote: You can vote if you were a stockholder of record at the close of business on June 3, 2024. |

| | | |

The deadline for voting by telephone or online is 11:59 PM (EDT) on July 29, 2024. If voting by mail, all proxies must be received before the Annual Meeting. | | By Order of the Board of Directors |

| |

| Seth G. Schuknecht Executive Vice President, General Counsel, Corporate Secretary, & Chief Compliance Officer |

| | |

Cavco Industries, Inc. 2024 Proxy Statement |

Table of Contents

| | | | | |

| |

| |

| |

| |

ABOUT THE ANNUAL MEETING: FREQUENTLY ASKED QUESTIONS | |

| |

| |

| |

| |

| |

| |

| |

| |

| 13 |

| 14 |

| 15 |

| |

| |

| |

| |

| CORPORATE RESPONSIBILITY | |

| |

MANAGEMENT | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com i |

| | |

Cavco Industries, Inc. 2024 Proxy Statement |

CAVCO INDUSTRIES, INC.

PROXY STATEMENT

2024 Annual Meeting of Stockholders

to be held July 30, 2024

Proxy Summary

The 2024 Annual Meeting of Stockholders (the "Annual Meeting") of Cavco Industries, Inc., a Delaware corporation ("we," "our," "us," "Cavco," or the "Company") will be held in person on Tuesday, July 30, 2024, at 9:00 a.m. local time at our corporate headquarters located at 3636 North Central Avenue, Suite 1200, Phoenix, Arizona 85012 (the “Annual Meeting”).

The accompanying notice and proxy card, mailed together with this definitive proxy statement (the “Proxy Statement” and collectively, the “Proxy”), is solicited by and on behalf of the Board of Directors (each a "Director" and collectively, the “Board”) of Cavco for use by our stockholders at the Annual Meeting.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying Proxy:

| | | | | | | | | | | |

| PROPOSALS AND BOARD RECOMMENDATIONS | BOARD RECOMMENDATION | PAGE REFERENCE |

| 1. | Elect two Class III Directors to serve until the Annual Meeting of Stockholders in 2027, or until their successors have been elected and qualified; | FOR | 7 |

| 2. | Approve, on an advisory basis, the compensation of the Company’s named executive officers; | FOR | 46 |

| 3. | Ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2025. | FOR | 49 |

Our Board does not know of any additional matters that may be acted upon at the Annual Meeting other than those matters set forth above.

Our Board has set June 3, 2024, as our record date for this year’s Annual Meeting (the "Record Date"). Only stockholders that owned our common stock at the close of business on that date are entitled to notice of our Annual Meeting and may vote on the proposals presented at it or any adjournment of the meeting.

On or about June 13, 2024, we expect to mail to our stockholders either (1) a notice of internet availability of Proxy materials (the "Notice") or, (2) if you elected to receive them by mail, a proxy card with a printed copy of our Proxy materials (the "Proxy Card"). The Notice provides instructions on how to vote and get our Proxy materials electronically or have the materials mailed to you. Both the Notice and Proxy Card provide instructions on how to vote by telephone, by mail, or by the internet before the Annual Meeting. The Proxy and our 2024 Annual Report on Form 10-K, filed with the Securities and Exchange Commission ("SEC") on May 24, 2024 (the "Annual Report") can be accessed directly on our investor relations website at investor.cavco.com/annualmeeting, or at www.ProxyVote.com, where you will need your 16 digit control number found on your Notice or Proxy Card to access the materials.

| | |

YOUR VOTE IS IMPORTANT! YOU ARE URGED TO VOTE YOUR PROXY PROMPTLY BY MAIL, TELEPHONE, OR VIA THE INTERNET, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 1 |

| | |

Cavco Industries, Inc. 2024 Proxy Statement |

ABOUT OUR ANNUAL MEETING OF STOCKHOLDERS

| | |

| Commonly Asked Questions and Answers |

Why did I receive these materials?

You received these Proxy materials because the Board is soliciting your proxy to vote at our 2024 Annual Meeting on July 30, 2024 (or at any postponement or adjournment of the meeting). You were a stockholder of Cavco as of June 3, 2024, the Record Date. Therefore, you are entitled to receive notice of the meeting and to vote on the matters presented at the Annual Meeting. You should review this Proxy Statement carefully as it gives important information about the proposals that will be voted on at the Annual Meeting, as well as other important information about Cavco.

Why did I receive a Notice instead of a full set of proxy materials?

The SEC allows Cavco to make these Proxy materials, including this Proxy Statement and our Annual Report available electronically via the internet at our website investor.cavco.com/annualmeeting or www.ProxyVote.com. On or about June 13, 2024, Cavco mailed to its stockholders a Proxy Card or a Notice containing instructions for accessing this Proxy Statement and our Annual Report over the internet. If you received the Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request them. If you would like a printed copy of Cavco’s Proxy materials, please follow the instructions for requesting printed materials in the Notice.

Can I access the Proxy materials electronically?

Yes. Your Notice or Proxy Card contain instructions on how to view our Proxy materials for the Annual Meeting online and how to instruct us to send our future proxy materials to you electronically by email. Our Proxy materials, including this Proxy Statement, are also available on our website at investor.cavco.com/annualmeeting or at www.ProxyVote.com, where you will need your 16 digit control number, provided in your Notice and Proxy Card. Proxy materials will be available during the voting period starting on June 13, 2024. Instead of receiving future copies of our proxy statements and annual reports by mail, stockholders of record and most beneficial owners can elect to receive an email that will provide an electronic link to these documents. Your election to receive future proxy materials by email will remain in effect until you revoke it. Please note that only one Notice will be sent to stockholders who are listed at the same address.

Who can vote on proposals presented at the Annual Meeting?

Stockholders who own shares of our common stock as of the close of business on the Record Date, June 3, 2024, are entitled to vote on proposals presented at the 2024 Annual Meeting. As of the Record Date, we had approximately 8,275,751 shares of common stock issued and outstanding. Each stockholder will be entitled to one vote per share on the election of Directors and each other matter that is described in this Proxy Statement or that may be properly brought before the meeting.

How do I cast my vote?

Most of Cavco’s stockholders hold their shares through a broker, bank, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between these shares owned by beneficial stockholders and shares owned by registered stockholders:

Beneficial Stockholders. If your shares are held in a brokerage account, bank, or by another nominee, you are with respect to those shares the “beneficial stockholder” of shares held in street name. As the beneficial stockholder, you have the right to direct your broker, bank, or other nominee on how to vote those shares at the Annual Meeting. You must follow the voting instructions provided by your broker, bank, or other nominee in order to instruct them on how to vote your shares. Beneficial stockholders should generally be able to vote by returning the voting instruction card to their broker, bank, or other nominee, or by telephone or via internet. However, the availability of telephone or internet voting will depend on the voting process of your broker, bank, or other nominee. Since you are not a stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank, or other nominee (who is the stockholder of record) giving you the right to vote the shares.

| | |

Cavco Industries, Inc. 2024 Proxy Statement |

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, Computershare, you are the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. Accordingly, for registered stockholders there are four ways to vote:

1.by internet at www.ProxyVote.com, 24 hours a day, seven days a week (have your Proxy Card or Notice in hand when you visit the website and follow the instructions to obtain your records and to create an electronic voting instruction form) prior to 11:59 p.m. EDT on July 29, 2024;

2.by toll-free telephone at 1-800-690-6903 (have your Proxy Card or Notice in hand when you call);

3.by completing and mailing your Proxy Card (if you received printed Proxy materials); or

4.by attending the Annual Meeting and voting in person during the meeting. To be admitted to the Annual Meeting and vote your shares you will need to have your voting card with you.

Even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if

you decide not to attend the Annual Meeting.

Who can attend the Annual Meeting?

All stockholders as of the close of business on the Record Date, or their duly appointed proxies, may attend the Annual Meeting that will be held in person on July 30, 2024, at 9:00 a.m. (local time) at our corporate headquarters located at 3636 N. Central Avenue, Suite 1200, Phoenix, Arizona 85012.

What is a “Broker Non-Vote”?

Generally, a broker non-vote occurs when a broker, bank, or other nominee that holds shares in street name for a customer is precluded from exercising voting discretion on a particular proposal because the: (i) beneficial owner has not provided instructions on how to vote; and (ii) such broker, bank, or other nominee lacks discretionary voting power to vote on such issues. Accordingly, a broker, bank, or other nominee does not have discretionary voting power with respect to the approval of “non-routine” matters absent specific voting instructions from the beneficial owners of such shares.

What Constitutes a Quorum for the Annual Meeting?

The holders of a majority of shares entitled to vote on June 3, 2024, represented in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Cavco will count abstentions and broker non-votes as present for the purpose of determining the presence or absence of a quorum.

In the event the requisite votes for approval of the matters to be considered at the Annual Meeting are not received prior to the Annual Meeting date, the Company may postpone or adjourn the Annual Meeting in order to solicit additional votes. The form of proxy being solicited by this Proxy Statement provides the authority for the proxy holders, in their discretion, to vote the stockholders’ shares with respect to a postponement or adjournment of the Annual Meeting. At any postponed or adjourned meeting, proxies received pursuant to this Proxy Statement will be voted in the same manner described in this Proxy Statement with respect to the original meeting.

What will I be voting on at the Annual Meeting and what is required to approve each item?

Proposal No. 1 (Election of Directors): In order to be elected as a Director, a nominee must receive an affirmative vote of the majority of votes cast with respect to that Director nominee’s election, which means the number of votes cast “FOR” a Director nominee’s election must exceed the number of votes cast “AGAINST” that Director nominee’s election. Abstentions and broker non-votes are not treated as votes cast and will have no effect on Proposal No. 1.

Proposal No. 2 (Advisory Vote on the Compensation of the Named Executive Officers): The affirmative vote of the holders of a majority of the shares entitled to vote and represented by person or by proxy at the Annual Meeting is required for advisory approval. Abstentions will have the effect of a vote against Proposal No. 2. Broker non-votes will not be treated as entitled to vote on the proposal and will have no effect on Proposal No. 2.

Proposal No. 3 (Ratification of Appointment of Independent Registered Public Accounting Firm): The affirmative vote of the holders of a majority of the votes cast for the ratification of the appointment of the independent registered public accounting firm is required for approval. Abstentions are not treated as votes cast and will have no effect on Proposal No. 3. We do not expect there to be any broker non-votes for this proposal because brokers, banks, or other nominees that hold shares in street name may exercise discretionary voting authority for this proposal.

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 3 |

| | |

Cavco Industries, Inc. 2024 Proxy Statement |

Will there be other items to be voted on at the Annual Meeting?

Cavco is not aware of any other matters that may come before the Board at the Annual Meeting. If any other matters are properly presented at the Annual Meeting, your proxy authorizes the individuals named as proxies to vote, or otherwise act, in accordance with their discretion.

How will proxies be voted at the Annual Meeting?

Beneficial Stockholders. If you hold your shares in "street name", the record holder does not have discretionary voting power with respect to non-routine matters absent specific voting instructions from you. Other than the proposal to ratify the appointment of our independent registered public accounting firm, all of the proposals at this year’s Annual Meeting are considered non-routine matters. Therefore, your shares will not be voted without your specific instructions on those non-routine matters, resulting in a broker non-vote. If you provide voting instructions to the record holder of your shares, the record holder will vote in accordance with the instructions given. The record holder of your shares will, however, continue to have the ability to vote your shares in its discretion on the ratification of Proposal No. 3 (Ratification of Appointment of Independent Registered Public Accounting Firm) if you do not otherwise provide voting instructions.

Registered Stockholders. If you are a registered owner, your shares represented by valid proxies received by telephone, via the Internet, or by mail will be voted at the Annual Meeting in accordance with the directions given. If no specific choice is indicated, the shares represented by all valid proxies received will be voted: (i) FOR the election of the two (2) nominees for director named in the proxy; (ii) FOR approval of the advisory vote to approve the compensation of our named executive officers; and (iii) FOR the ratification of the appointment of our independent registered public accounting firm for fiscal year 2025.

Can I change my mind after I vote?

You have the unconditional right to revoke your proxy at any time prior to tabulation.

Beneficial Stockholders. If you are a beneficial stockholder, your broker, bank, or other nominee can provide you with instructions on how to change your vote.

Registered Stockholders. If you are a registered stockholder, to revoke your proxy, you must:

•Submit a later-dated proxy over the Internet or by telephone in accordance with the instructions provided above under the question "How do I cast my vote";

•Mail a new proxy card dated after the date of the proxy you wish to revoke to Cavco’s Corporate Secretary at the address listed below;

•Submit written notice of revocation to Cavco’s Corporate Secretary at—Cavco Industries, Inc., Attn: General Counsel & Corporate Secretary/Change Proxy Vote, 3636 North Central Avenue, Suite 1200, Phoenix, Arizona 85012; or

•Attend and vote at the Annual Meeting in-person (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

If your proxy is not revoked, Cavco will vote your shares at the Annual Meeting in accordance with your instructions indicated on the proxy card or, if submitted over the Internet or by telephone, as indicated therein.

Who bears the expense of the proxy solicitation?

The Company will bear all proxy solicitation costs. In addition to solicitations by mail, Cavco’s Directors, officers, and employees, without additional remuneration, may solicit proxies by telephone, electronic transmission, and personal calls or interviews.

When will the results of the vote be announced?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be published in a current

report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

What do I need to do now?

You should carefully read and consider all the information contained in this Proxy Statement. It contains important information about Cavco that you should consider before voting.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The Company currently has a single class of common stock issued and outstanding. Unless otherwise stated, the table below sets forth certain ownership information with respect to our common stock beneficially owned by stockholders in the following groups as of June 3, 2024, or, in respect of any 5% Holder (as defined below), the date of such holder's most recent Schedule 13D or Schedule 13G filed with the SEC on or before the Record Date:

•each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock ("5% Holder");

•each of our named executive officers and Directors; and

•all of our current Directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. A person is a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of the security, or “investment power,” which includes the power to dispose of or to direct the disposition of the security or has the right to acquire such powers within 60 days. Unless otherwise noted in the footnotes to the following table, and subject to applicable community property laws, the persons and entities named in the table have sole voting and investment power with respect to their beneficially owned common stock. In computing the number of shares of our common stock beneficially owned by a party and the percentages of class amounts set forth in the table below, we have based these figures on 8,275,751 shares of common stock issued and outstanding on June 3, 2024, net of treasury shares.

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 5 |

| | | | | | | | |

| Cavco common stock |

| Name and address of beneficial owner | Amount and nature of beneficial ownership | Percent of class |

5% Holders (1) | | |

BlackRock, Inc. (2) 55 East 52nd Street New York, NY 10055 | 1,286,383 | 15.5% |

The Vanguard Group (3) 100 Vanguard Blvd. Malvern, PA 19355 | 795,771 | 9.6% |

Capital World Investors (4) 333 S. Hope St., 55th Fl. Los Angeles, CA 90071 | 588,800 | 7.1% |

Directors and Named Executive Officers (5) | | |

| William C. Boor | 67,758 | * |

| Steven G. Bunger | 9,492 | * |

Richard A. Kerley (6) | 7,883 | * |

| Susan L. Blount | 12,100 | * |

| David A. Greenblatt | 16,850 | * |

| Steven W. Moster | 1,650 | * |

| Julia W. Sze | 2,250 | * |

| Allison K. Aden | 2,740 | * |

| Brian R. Cira | 2,080 | * |

| Matthew A. Niño | 894 | * |

| Steve K. Like | 3,072 | * |

Mickey R. Dragash (7) | 7,594 | * |

All Directors, director nominees, and all executive officers of Cavco as a group

(13 individuals) | 129,832 | 1.6% |

*Less than 1%

(1)The Company makes no representations as to the accuracy or completeness of the information in the filings reported in footnotes (2) – (4) hereunder.

(2)Information regarding BlackRock, Inc. (“BlackRock”) is based solely upon a Schedule 13G/A filed with the SEC on January 22, 2024. BlackRock reported having sole voting power with respect to 1,273,974 shares and sole dispositive power with respect to 1,273,974 shares.

(3)Information regarding The Vanguard Group (“Vanguard”) is based solely upon a Schedule 13G/A filed with the SEC on February 13, 2024. Vanguard reported that it possessed sole dispositive power with respect to 771,685 shares, shared voting power with respect to 15,926 shares and shared dispositive power with respect to 24,086 shares.

(4)Information regarding Capital World Investors (“Capital World”) is based solely upon a Schedule 13G filed with the SEC on February 9, 2024. Capital World reported having sole voting power with respect to 588,800 shares and sole dispositive power with respect to 588,800 shares.

(5)The business address of each of the individuals listed in this part of the table is c/o Cavco Industries, Inc., 3636 North Central Avenue, Suite 1200, Phoenix, Arizona 85012, and the listed amounts include the following:

•shares that may be acquired upon exercise of stock options within 60 days of June 3, 2024: Ms. Blount – 10,000 shares; Mr. Boor – 38,100 shares; Mr. Bunger – 4,000 shares; Mr. Cira – 1,000 shares; Mr. Greenblatt – 4,000 shares; Mr. Like – 2,100 shares; and all Directors, Director nominees and executive officers of Cavco as a group (13 individuals) – 62,200 shares;

•shares that may be acquired upon vesting of restricted stock units within 60 days of June 3, 2024: Ms. Blount – 400 shares; Mr. Boor – 392 shares; Mr. Bunger – 600 shares; Mr. Greenblatt – 400 shares; Mr. Kerley – 400 shares; Mr. Moster – 400 shares; Ms. Sze – 400 shares; Ms. Aden - 59 shares; and all Directors, Director nominees, and executive officers of Cavco as a group (13 individuals) – 3,114 shares; and

•shares to be acquired upon retirement from the Board under a restricted stock unit deferral election: Mr. Greenblatt – 2,150 shares

(6)Includes 7,483 shares held by the Kerley Family Trust.

(7)Mr. Dragash served as our General Counsel until February 12, 2024, and is a named executive officer for fiscal year 2024, but his amounts are not included in the totals of all Directors, director nominees, and all executive officers as a group.

PROPOSAL NO. 1:

Election of Directors

The Company’s Restated Certificate of Incorporation, as amended and Fourth Amended and Restated Bylaws (the “Bylaws”) provide for the division of the Board into three classes, with the Directors in each class holding office for staggered terms of three years each. Each class of Directors is to consist, as nearly as possible, of one-third of the total number of Directors constituting the entire Board. There are presently two Directors in Class III whose terms expire at the 2024 Annual Meeting. Each Director holds office until his or her successor has been elected and qualified or until the Director’s resignation or removal.

Mr. Bunger and Mr. Moster, members of the Board whose terms expire at the Annual Meeting, will stand for re-election. They have been nominated for service as Directors by our Corporate Governance and Nominating Committee and the full Board pursuant to the procedures described under “Corporate Governance Overview—Director Nominating Process” herein. Unless contrary instructions are indicated in the Proxy, it is intended that the shares represented by the accompanying Proxy will be voted for the election of these nominees or, if a nominee becomes unavailable (which the Company does not anticipate), for such substitute nominee as the Board shall designate.

In order to be elected as a Director, a nominee must receive an affirmative vote of the majority of votes cast with respect to that Director nominee’s election, which means the number of votes cast “FOR” a Director nominee’s election must exceed the number of votes cast “AGAINST” that Director nominee’s election.

Recommendation of the Board

| | | | | |

| The Board recommends that the shareholders vote “FOR” the election of Mr. Bunger and Mr. Moster to serve as Class III Directors until the 2027 Annual Meeting. |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 7 |

Nominees for Director Standing for Election

Class III Directors — Current Terms Expiring upon 2024 Annual Meeting

| | | | | | | | | | | | | | |

| Steven G. Bunger Age 63 Chairman of the Board since April 2019; Director since April 2004 Committees: None | | Mr. Bunger is our Non-Executive Chairman of the Board. Since 2014, Mr. Bunger has served as President and CEO of Pro Box Portable Storage, Inc., a provider of portable storage solutions in Arizona, Oklahoma, and Colorado. From 2001 to 2012, he served as Chairman of the Board of Mobile Mini, Inc. (“Mobile Mini”), one of the nation’s largest providers of portable storage containers and mobile offices in the U.S., Canada, and the U.K. Mr. Bunger joined Mobile Mini in 1983 and served as its President and CEO from 1997 to 2012. He also held numerous executive roles with Mobile Mini including Vice-President of Operations and Marketing and Executive Vice President and Chief Operating Officer. |

| | Qualifications: Mr. Bunger brings to the Company’s Board a breadth of operational, managerial, and marketing experience from running one of the world’s leading providers of portable storage solutions. Additionally, Mr. Bunger has extensive acquisition experience which he uses to guide our management team and Board in evaluating growth opportunities. |

| | | |

| Steven W. Moster Age 54 Director since January 2020 Committees: Compensation (Chair) | | Mr. Moster is Chairman of the Board’s Compensation Committee and a member of the Board’s Corporate Governance and Nominating Committee. Since 2014, Mr. Moster has served as the CEO and Executive Director of Viad Corp (“Viad”) (NYSE: VVI). He has served in various executive management roles within Global Experience Specialists (a division of Viad), including Executive Vice President– Chief Sales & Marketing Officer from 2008 to February 2010, Executive Vice President– Products and Services from 2006 to 2008 and Vice President– Products & Services Business from 2005 to 2006. Prior to his work at Viad, Mr. Moster was an Engagement Manager for McKinsey & Co., a top-tier management consulting firm, in Atlanta, Georgia and a Research Scientist with Kimberley-Clark Corporation (NYSE: KMB), a Fortune 500 company, also in Atlanta, Georgia. |

| | Qualifications: Mr. Moster brings to our Board successful experience leading a well-established public company, executing growth strategies and improving operating efficiencies. |

Continuing Directors

Class I Directors — Terms Expiring in 2025

| | | | | | | | | | | | | | |

| David A. Greenblatt Age 62 Director since October 2008 Committees: Audit / Corporate Governance and Nominating (Chair) / Legal and Compliance Oversight | | Mr. Greenblatt is Chairman of the Board’s Corporate Governance and Nominating Committee and a member of the Board’s Audit Committee and Legal and Compliance Oversight Committee. Mr. Greenblatt is the retired Senior Vice President and Deputy General Counsel for Eagle Materials, Inc. (“Eagle Materials”) (NYSE: EXP), a company specializing in construction products and building materials headquartered in Dallas, Texas, where he worked from 2005 to 2012. He currently is a licensed practicing attorney in Texas and is the President of White Sand Investments, LLC, a privately-held real estate investment and management company. From 2000 to 2002, he was Senior Vice President – Mergers & Acquisitions for Eagle Materials. Mr. Greenblatt also held various roles with Centex Corporation (“Centex”) (NYSE: CTX), a Dallas based homebuilder (now a part of PulteGroup, Inc.) (NYSE: PHM), including Vice President and General Counsel of its Investment Real Estate Group, Vice President and Assistant General Counsel of Centex and General Counsel of Cavco. Prior to joining Centex, Mr. Greenblatt was an associate in the corporate and securities group at the law firm of Hughes & Luce, LLP (now K&L Gates, LLP) in Dallas, Texas. |

| | Qualifications: In addition to his executive management and legal experience, Mr. Greenblatt brings to the Company’s Board his knowledge of the Company and industry by having served as the Company’s General Counsel while he was employed by Centex. |

| | | | |

| Richard A. Kerley Age 74 Director since February 2019 Committees: Audit (Chair) / Corporate Governance and Nominating / Legal and Compliance Oversight | | Mr. Kerley is Chairman of the Board’s Audit Committee, and a member of the Board’s Corporate Governance and Nominating Committee and Legal & Compliance Oversight Committee. Since 2010, Mr. Kerley has been a Director with ModivCare Inc. (Nasdaq: MODV), a technology-enabled healthcare services company that provides a platform of integrated supportive care solutions for public and private payors and their patients in the United States, where he serves as Audit Committee Chairman and Compensation Committee Chairman. From 2014 until May 31, 2019, Mr. Kerley was a Director of The Joint Corp. (Nasdaq: JYNT), a rapidly growing franchisor and operator of chiropractic clinics, where he served as Compensation Committee Chairman and a member of the Audit Committee. From 2008 to 2014, he was Chief Financial Officer and a Director of Peter Piper, Inc., a privately held pizza and entertainment restaurant chain until it was acquired by CEC Entertainment in 2014. From 2005 to 2008, Mr. Kerley was Chief Financial Officer of Fender Musical Instruments Corporation, a privately held manufacturer and wholesaler of musical instruments and equipment. Mr. Kerley spent over 30 years at Deloitte & Touche LLP, a multinational accounting and professional services firm, where he served as an audit partner from 1981 to 2005. |

| | Qualifications: Mr. Kerley brings to our Board valuable insight with his extensive audit, financial, and operational expertise. |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 9 |

Continuing Directors

Class I Directors — Terms Expiring in 2025

| | | | | | | | | | | | | | |

| Julia W. Sze Age 57 Director since May 2019 Committees: Audit / Compensation | | Ms. Sze is a member of the Board’s Audit Committee and a member of the Board’s Compensation Committee. Ms. Sze is a Chartered Financial Analyst charterholder with over 25 years of experience in the investment management field. She has been an Impact Investment Strategy Advisor with Julia W. Sze Consulting, since 2017. From 2004 until 2011, Ms. Sze served as Chief Investment Officer for families and foundations at two major U.S. banks. From 1991 until 2003, she was a fundamental analyst and portfolio manager leading funds in the Asia Pacific equity markets. Since 2018, Ms. Sze has been a lecturer at UC Berkeley’s Haas School of Business and in 2022, she joined the faculty at the University of New Mexico’s Anderson School of Management. At both business schools, she teaches sustainable investment management and impact investing. In 2022, Ms. Sze joined Laird Norton Wealth Management, a Registered Investment Advisor. Also in 2022, Ms. Sze joined the Board of Directors of Turtle Beach Corporation (Nasdaq: HEAR), a leading provider of gaming accessories. Since 2018, Ms. Sze has served as a director of Tern Bicycles, a privately-held, Taiwan-based, urban transport business. Ms. Sze previously served as a member of the Board of Directors and Chair of the Assets and Liabilities Committee of New Resource Bank (OTC: NRBC) from 2016 until it merged with Amalgamated Bank in 2017. From 2006 to 2017, Ms. Sze served on the Investment Committee and Board of Trustees of the Marin Community Foundation that manages over $5 billion in philanthropic capital on behalf of donors. |

| | Qualifications: Ms. Sze brings to our Board significant experience in strategic planning, financial oversight, and business development as well as with best practices in sustainability and corporate governance. |

Continuing Directors

Class II Directors — Terms Expiring in 2026

| | | | | | | | | | | | | | |

| Susan L. Blount Age 66 Director since January 2019 Committees: Compensation / Corporate Governance and Nominating / Legal and Compliance Oversight (Chair) | | Ms. Blount is the Chair of the Board’s Legal and Compliance Oversight Committee and a member of the Board’s Compensation Committee and Corporate Governance and Nominating Committee. From 2005 to 2015, Ms. Blount served as Senior and then Executive Vice President and General Counsel for Prudential Financial, Inc. (“Prudential”) (NYSE: PRU), a leading provider of insurance, retirement and asset management products and services. In that role, Ms. Blount led Prudential’s global law, compliance, business ethics and external affairs functions. Since 2016, she has served as adjunct professor at the University of Texas School of Law (“UT Law”). She is a founding member of UT Law’s Center for Women in Law where she served as Interim Executive Director from March 2019 to January 2020. Since April 2021, Ms. Blount has served as a Director of CS Disco, a legal technology company that applies artificial intelligence and cloud computing to help lawyers and legal teams. |

| | Qualifications: Ms. Blount brings to our Board significant experience in corporate governance, risk management, executive compensation, legal, compliance, strategy, insurance and financial services. |

| | | |

| William C. Boor Age 58 Director since July 2008 Committees: None | | Mr. Boor is the President and Chief Executive Officer (“CEO”) of Cavco, commencing on April 15, 2019 and has been a member of Cavco’s Board since July 2008. Mr. Boor was previously CEO of Great Lakes Brewing Company, a large craft brewing company based in Cleveland, Ohio, a position he had held since September 2015. From December 2014 to September 2015, Mr. Boor was principal of MIB Holding Co LLC (“MIB Holdings”), a mining development company. From 2007 to 2014, Mr. Boor served in various executive positions with Cleveland Cliffs Inc., including Executive Vice President for Corporate Development, Chief Strategy & Risk Officer, and President of Ferroalloys. Prior to his employment with Cleveland Cliffs, Mr. Boor held key leadership roles at American Gypsum, Centex, Weyerhaeuser Co. (NYSE: WY), and Procter & Gamble Co. (NYSE: PG). Mr. Boor is a Chartered Financial Analyst charterholder. |

| | Qualifications: Mr. Boor brings to our Board diverse experience in financial management, investor relations, management, manufacturing, marketing, and process engineering, and is our President and CEO. |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 11 |

CORPORATE GOVERNANCE OVERVIEW

The business and affairs of Cavco are conducted under the direction of our Board, in accordance with the terms of our Restated Certificate of Incorporation and Bylaws. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling, and direction to our management team. Our Board meets on a regular basis throughout the year and additionally as required. Under our Corporate Governance Guidelines, and pursuant to the requirements of the SEC, Nasdaq, and the State of Delaware, our Board is made up of a majority of independent Directors selected on the basis of their integrity, experience, achievements, judgment, intelligence, personal character, ability to make independent analytical inquiries, willingness to devote adequate time to Board duties, and likelihood that he or she will be able to serve on the Board for a sustained period, giving due consideration to diversity in perspectives, backgrounds, business experiences, professional expertise, and personal backgrounds. Our Restated Certificate of Incorporation provides that our Board shall not have fewer than one director nor more than fifteen.

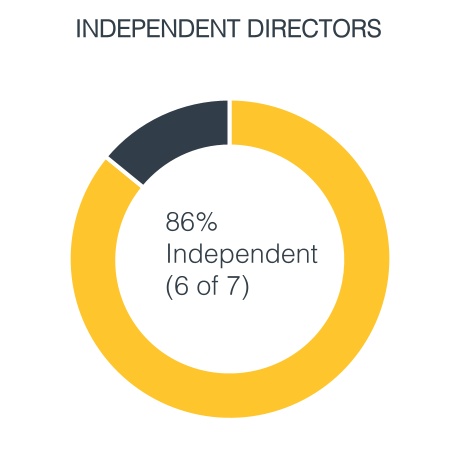

Director Independence

Our Board is currently composed of seven Directors, and independent Director Steve Bunger serves as the Chairman of the Board (the "Chairman" or "Chair"). The Board has determined that all the members of the Board, other than Bill Boor who serves as the President and CEO of Cavco, are “independent” in accordance with: (1) the applicable requirements of the Securities and Exchange Act of 1934 (the "Exchange Act"), and the rules adopted by the SEC; and (2) applicable Nasdaq Stock Market LLC Rules (the "Nasdaq Rules").

Board Leadership Structure

The Board has adopted a policy separating the position of the Chair of the Board from the position of President and CEO in order to enhance the independence of the Board.

The Board’s Role in Risk Oversight

The Board oversees the Company’s risk profile and management’s processes for assessing and managing risks associated with our business operations and strategies. Management is responsible for the assessment and management of the Company’s risks which include the creation of appropriate risk management policies and procedures. Further, management informs the Board of the Company’s most significant risks and the proposed strategies for managing those risks.

The Board also provides oversight of risk through its four standing committees:

•The Audit Committee reports to the Board regarding the adequacy of our risk management processes related to financial exposures and the steps management has taken to monitor and control such financial risks. To assist the Audit Committee in overseeing risk management, the Company’s Director of Internal Audit meets regularly with the Audit Committee, including meeting with it in executive session on a quarterly basis. Our Internal Audit team provides the Audit Committee with an assessment of the Company’s financial risks, internal controls and a summary of all completed internal audits.

•The Legal and Compliance Oversight Committee reports to the Board and oversees the development and implementation of the Company's legal and compliance related programs, including Cavco's data security program. The General Counsel & Chief Compliance Officer meets regularly with the Legal and Compliance Oversight Committee and updates it quarterly on the legal and compliance programs, processes, and regulatory matters impacting the Company.

•The Compensation Committee oversees the design of the executive compensation program to ensure it aligns with stockholder interests. The Compensation Committee recommends to the Board compensation arrangements between the Company and our executive officers and approves all grants of equity to employees and Directors.

•The Corporate Governance and Nominating Committee oversees and advises the Board and management on the Company’s governance practices, including the Board’s selection of directors, the annual self-evaluation of the Board, and the development and maintenance of the Company's corporate governance guidelines.

•The Board expects management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations. The Board oversees management’s assessment and management of likely areas of material risk.

Director Nominating Process

| | | | | |

Selection of Directors | The Corporate Governance and Nominating Committee of the Board is responsible for overseeing the process of nominating individuals to stand for election as Directors. At this year’s Annual Meeting, independent Directors Steve Bunger and Steve Moster are standing for election. Mr. Bunger has been a member of the Board since 2004. Mr. Moster was appointed to the Board in 2020. |

| | |

Director Qualifications | In evaluating the suitability of individual nominees, nominees for Director are selected on the basis of their integrity, experience, achievements, judgment, intelligence, personal character, independence from the Company, ability to make independent analytical inquiries, willingness to devote adequate time to Board duties, and likelihood that he/she will be able to serve on the Board for a sustained period. |

| | |

| Diversity | In connection with the selection of nominees for Director, the Corporate Governance and Nominating Committee gives due consideration to diversity in perspectives, backgrounds, business experiences, and professional expertise among the Board members and Director nominees. |

| |

Nominations by Stockholders | Our Bylaws specify the manner stockholders may make nominations for the election of Directors. Under the Bylaws, in order to bring a proposal before a meeting of stockholders, including the nomination of directors, a stockholder must deliver proper notice. The procedures for such notice are set forth below under "Additional Information-Stockholder Director Nominations and Stockholder Proposals for the 2025 Annual Meeting". |

Majority Vote Policy for Director Elections

The Board has adopted a policy which provides that, if a Director up for election does not receive a majority of the votes cast, such Director shall submit an irrevocable resignation to the Corporate Governance and Nominating Committee or such other committee designated by the Board. Such committee will make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent Director, or whether other action should be taken. The Board will act on the resignation, taking into account the committee’s recommendation, and the Company will publicly disclose the Board’s determination by filing the appropriate disclosure with the SEC detailing the Board’s determination and, if such resignation is rejected, the rationale behind the decision, within 90 days following certification of the election results. The Corporate Governance and Nominating Committee or another designated committee, in making its recommendation, and the Board in making its decision, may each consider any factors and other information that they consider appropriate and relevant. If the Board accepts a Director's resignation, or if a Director nominee is not elected and the nominee is not an incumbent Director, then the Board may fill the resulting vacancy pursuant to our Restated Certificate of Incorporation and the Bylaws. This policy applies only to uncontested elections of Directors.

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 13 |

Board Experience, Expertise, and Composition

Skills Matrix

Our Directors collectively possess the expertise, leadership skills, and diversity of experiences and backgrounds to oversee management’s execution of our growth strategy and protect long-term stockholder value. The skills matrix below summarizes the qualifications of our Directors and more detailed information can be found in the Director biographies above.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | S. Bunger | S. Blount | B. Boor | D. Greenblatt | R. Kerley | S. Moster | J. Sze |

| | | | | | | |

Industry Experience MH/FS * | MH | | MH | MH | | | FS |

| | | | | | | |

Manufacturing

Operations | • | | • | | • | | |

| | | | | | | |

Mergers & Acquisitions/

Corporate Development | • | | • | • | • | • | |

| | | | | | | |

| Financial/Accounting | • | | • | • | • | • | • |

| | | | | | | |

| Legal/Regulatory | | • | | • | | | |

| | | | | | | |

| Strategic Planning | • | | • | | | • | |

| | | | | | | |

Other Public Company

Board Experience | • | • | | | • | • | • |

| | | | | | | |

| ESG Experience ** | SG | SG | ESG | G | G | G | ESG |

*Manufactured Housing (“MH”), Financial Services (“FS”)

** Environmental (“E”), Social (“S”), and Governance (“G”) (collectively, “ESG”)

Board Composition and Diversity

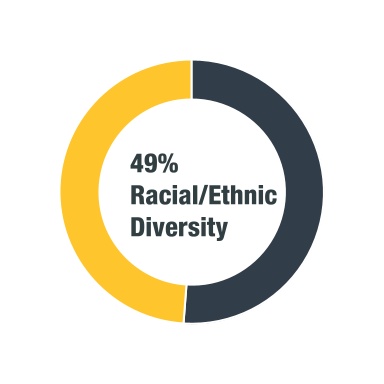

The following charts provide information on the current composition of our Board. Ethnic diversity refers to an underrepresented minority which the Company defines as an individual who self-identifies in one or more of the following groups: African American or Black, Alaskan Native or Native American, Asian, Hispanic or Latinx, Native Hawaiian or Pacific Islander, or two or more races or ethnicities. Currently, one member of Cavco’s Board identifies as ethnically diverse.

| | |

| Board Experience, Expertise, and Composition |

| | | | | | | | | | | | | | |

| | | | |

| Board Diversity Matrix (as of June 13, 2024) |

| | | | |

| Total Number of Directors | 7 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| | | | |

| Part I: Gender Identity |

| Directors | 2 | 5 | - | - |

| Part II: Demographic Background |

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | 1 | - | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 1 | 5 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - | - | - | - |

| Did Not Disclose Demographic Background | - | - | - | - |

There have been no changes to our Board Diversity Matrix from 2023. Our Board Diversity Matrix for 2023 is disclosed in our 2023 proxy statement filed with the SEC on June 15, 2023.

Meeting Participation in 2024

The Board held nine meetings during fiscal year 2024. Each Director attended at least 75% of the combined total of (i) all Board meetings and (ii) all meetings of Board committees of which the Director was a member (during the periods for which he or she served on the Board and such committees). The independent Directors also met regularly in executive sessions during the fiscal year.

All Board members are expected to attend the Company’s annual meeting of stockholders, unless an emergency or unavoidable conflict prevents them from doing so. All Directors attended our 2023 annual meeting of stockholders held on August 1, 2023.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, certain officers designated under Section 16(a) ("Section 16 Officers"), and greater-than-ten-percent stockholders to file initial reports of ownership and reports of changes in ownership of any of our securities with the SEC and us. Based solely on our review of such forms filed electronically with the SEC, we believe that during fiscal year 2024 all of our Section 16 Officers and Directors complied with all filing requirements of Section 16(a).

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 15 |

Director Compensation

The Compensation Committee of the Board reviews annually all cash and noncash compensation to be paid to our non-employee Directors and recommends any proposed changes to the Board for approval. In fiscal year 2024, we compensated our Directors as follows:

•All non-employee Directors received an annual cash retainer of $75,000, except for the Chairman of the Board, who received $105,000.

•The annual fees paid to each non-employee Director for service on Board committees was:

◦Audit Committee: Chair $20,000 and Member $10,000

◦Compensation, Corporate Governance and Nominating, and Legal and Compliance Oversight committees: Chair $15,000 and Member $7,500

•Except for the Chairman, who received an annual equity award of $160,000 in time-based restricted stock units (“RSUs”), all non-employee Directors were granted $110,000 in value of RSUs that vest 100% upon the anniversary of the grant date (or next annual meeting of stockholders, if earlier). The number of shares granted was calculated using the closing price of the Company’s common stock on the grant date rounded up to the nearest 50 shares.

•All Board members were reimbursed for reasonable travel expenses to attend Board and committee meetings.

Directors who are also employees of the Company do not receive any special or additional remuneration for service on the Board. The following table provides specific information regarding the compensation paid to each non-employee Director during the fiscal year ended March 30, 2024:

| | | | | | | | | | | |

| | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) |

| | | |

| Susan L. Blount | 105,000 | 118,260 | 223,260 |

| Steven G. Bunger | 105,000 | 177,390 | 282,390 |

| David A. Greenblatt | 107,500 | 118,260 | 225,760 |

| Richard A. Kerley | 110,000 | 118,260 | 228,260 |

| Steven W. Moster | 97,500 | 118,260 | 215,760 |

| Julia W. Sze | 92,500 | 118,260 | 210,760 |

(1)Amounts in this column represent the fair value of the RSUs granted based on the closing price of our stock on the grant date, July 31, 2023. The aggregate number of unvested RSUs held by each Director as of March 30, 2024, was: Ms. Blount – 400 RSUs; Mr. Bunger – 600 RSUs; Mr. Greenblatt – 400 RSUs; Mr. Kerley – 400 RSUs; Mr. Moster – 400 RSUs; and Ms. Sze – 400 RSUs. Mr. Greenblatt has made a Board approved irrevocable deferral election as to his 400 unvested RSUs so that they will not be paid out until he retires from the Board or otherwise separates from Cavco. The aggregate number of unexercised options held by Directors as of March 30, 2024, was: Ms. Blount – options to purchase 10,000 shares; Mr. Bunger – options to purchase 4,000 shares; and Mr. Greenblatt – options to purchase 4,000 shares.

Stock Ownership Guidelines

To further align the interests of Cavco’s leadership with those of the stockholders as well as promote our commitment to sound corporate governance, we have adopted Stock Ownership Guidelines for key executives and all non-employee Directors. Our stock ownership guidelines are available on our website at investor.cavco.com/general-documents. For Directors, under these guidelines, on or before the fifth full fiscal year after the year of appointment or election, each Director should own and retain shares of our common stock equal to at least five times (5x) the annual cash retainer paid to Directors at that time.

Anti-Hedging, Anti-Pledging, No Short-Selling, and No Buying or Selling of Derivatives

The Board has approved a Securities Trading Policy that prohibits hedging, pledging, short selling, and buying or selling derivatives related to the Company’s securities. The policy does not have a hardship exemption for Directors or executive officers as it pertains to these prohibitions. The Securities Trading Policy is posted on our website at investor.cavco.com/general-documents.

Board Committees

The Board has four standing committees:

| | | | | |

AUDIT COMMITTEE | COMPENSATION COMMITTEE |

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE | LEGAL AND COMPLIANCE OVERSIGHT COMMITTEE |

Each committee operates under a written charter adopted by the Board and reviewed by the Board at least annually. Each committee charter is posted on our website at investor.cavco.com/general-documents. Messrs. Boor and Bunger are not members of any committee of the Board.

Committee Composition

Set forth below is information regarding each of the current committees and their composition as of the mailing date of this Proxy Statement:

| | | | | | | | | | | | | | |

| DIRECTOR NAME | AUDIT COMMITTEE | COMPENSATION COMMITTEE | CORPORATE GOVERNANCE AND NOMINATING COMMITTEE | LEGAL AND COMPLIANCE OVERSIGHT COMMITTEE |

| | | | |

| Susan L. Blount | | | | CHAIR |

| David A. Greenblatt | | | CHAIR | |

| Richard A. Kerley | CHAIR | | | |

| Steven W. Moster | | CHAIR | | |

| Julia W. Sze | | | | |

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 17 |

Audit Committee

| | | | | | | | |

| |

| MEMBERS | KEY RESPONSIBILITIES |

| |

| | |

Richard A. Kerley*, Chair David A. Greenblatt Julia W. Sze *Audit Committee Financial Expert | •Oversees the integrity of the Company’s financial statements; •Approves all fees related to audit and non-audit related services provided by the independent registered public accounting firm; •Has the sole authority to appoint, retain, terminate, and determine the compensation of the Company’s independent registered public accounting firm; •Oversees the Company’s systems of internal accounting and financial controls; •Meets with the Company’s independent registered public accounting firm outside the presence of management to discuss financial reporting, including internal accounting controls and policies and procedures; •Reviews annual internal audit plan, including a fraud risk assessment; •Reviews financial disclosures; •Reviews and implements the Code of Conduct; •Oversees the Company’s “whistle blower” procedures; •Reviews and approves all related-party transactions; and •Focuses on qualitative aspects of financial reporting to the stockholders of the Company as well as the Company’s processes to manage business, financial, and compliance with significant applicable legal, ethical and regulatory requirements. |

THE COMMITTEE HELD FOUR MEETINGS DURING FISCAL YEAR 2024. | |

|

|

| |

The Board has determined that Mr. Kerley, the Chair of the Audit Committee, qualifies as an audit committee financial expert under SEC rules and has the accounting and related financial-management expertise required under Nasdaq Rules. Mr. Kerley's qualifications to serve as an audit committee financial expert are set forth in his biography under the heading “Continuing Directors, Class I Directors, Terms Expiring in 2025.” In addition, the Board has determined that each member of the Audit Committee possess the financial sophistication required by Nasdaq Rules and is “independent” under the additional independence requirements of Rule 10A-3 of the Exchange Act and the Nasdaq Rules applicable to audit committees. No Audit Committee member serves on the audit committee of more than two other public companies.

Prior to each quarterly earnings release, the Audit Committee met with management and the Company’s internal auditors to review the financial results.

Legal & Compliance Oversight Committee

| | | | | | | | |

| |

| MEMBERS | KEY RESPONSIBILITIES |

| |

| | |

Susan L. Blount, Chair David A. Greenblatt Richard A. Kerley | •Assists the Board with the oversight of: (1)regulatory, compliance, policy, and legal matters as well as related risks, both current and emerging, at the local, state, and federal levels that might impact the Company’s business; and (2)the Company's identification, prioritization, and mitigation of key legal and regulatory risks, including those related to data security, labor and employment, and operational effectiveness. •Oversees the Company’s implementation of legal and compliance related policies and procedures. |

THE COMMITTEE HELD FOUR MEETINGS DURING FISCAL YEAR 2024. | |

|

|

| |

The Legal & Compliance Oversight Committee is comprised entirely of independent Directors.

Corporate Governance and Nominating Committee

| | | | | | | | |

| |

| MEMBERS | KEY RESPONSIBILITIES |

| |

| | |

David A. Greenblatt, Chair Susan L. Blount Richard A. Kerley Steven W. Moster | • Identifies: (1)Director candidates for its recommendation to the Board for election at the Company’s next annual meeting or to fill vacancies; and (2)Candidates that it recommends to the Board for appointment as the Chairman of the Board. • Develops and recommends the Company’s Corporate Governance Guidelines •Oversees the effectiveness of the Company’s governance practices; •Responds to stockholder requests and inquiries; •Reviews and recommends Director training initiatives and reviews the Director onboarding process; •Oversees the annual evaluation of the Board and its committees; •Makes recommendations to the Board on the appointment of the Company's executive officers; and •Considers director nominations for the Board from stockholders, as described above under “Director Nominating Process.” |

THE COMMITTEE HELD FIVE MEETINGS DURING FISCAL YEAR 2024. | |

|

|

| |

Each member of the Corporate Governance and Nominating Committee is “independent” under the independence requirements of the Nasdaq Rules applicable to nominating committees.

Compensation Committee

| | | | | | | | |

| |

| MEMBERS | KEY RESPONSIBILITIES |

| |

| | |

Steven W. Moster, Chair Susan L. Blount Julia W. Sze | • Oversees the Company's overall compensation structure, policies, and programs; •Reviews and approves overall company goals and objectives related to executive compensation as well as evaluates executive performance in light of those goals; •Administers the Company’s equity incentive plans, approving any proposed amendments or modifications; •Reviews and recommends Board approval of compensation arrangements with executive officers of the Company; •Oversees the Company’s stock ownership guidelines; •Provides Compensation Committee reports for inclusion in appropriate regulatory filings; and •Engages a compensation consultant of its choice as needed and terminates the engagement at any time while determining the breadth and scope of the external compensation consultant’s services. |

THE COMMITTEE HELD SEVEN MEETINGS DURING FISCAL YEAR 2024. | |

|

|

| |

Each member of the Compensation Committee is “independent” under the additional independence requirements of Exchange Act Rule 10C-1 and the Nasdaq Rules applicable to compensation committees. Additionally, each member meets the non-employee director requirements of Rule 16b-3 under the Exchange Act.

Compensation Committee Interlocks and Insider Participation

Mr. Moster and Mses. Blount and Sze served as members of the Compensation Committee in fiscal year 2024. None of these individuals have ever been an employee of the Company. During fiscal 2024, none of our executive officers served on the board of directors or compensation committee of any other entity for which a member of our Board or Compensation Committee served as an executive officer.

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 19 |

CORPORATE RESPONSIBILITY

Commitment to Sustainability

Cavco is a leading designer and builder of systems-built structures including manufactured homes, modular homes, commercial buildings, park model homes, and vacation cabins. Founded in 1965, our operations include 29 homebuilding production lines located throughout the United States and two production lines in Mexico, which build some of the most widely recognizable brand names within the factory-built housing industry.

We are committed to providing quality, energy efficient housing at affordable prices in an environmentally conscious manner, as well as adhering to relevant federal and local regulations regarding employee health and safety. The following are important environmental, social, and governance (“ESG”) topics identified by the Board and executive team and an explanation of how the Company’s leadership prioritizes these areas of focus in our operations.

Board and Senior Management Oversight

Cavco’s leadership believes a robust approach to ESG will help us achieve our long-term goals of increasing manufacturing excellence, enhancing our employee and customer experience, serving the communities where we do business, and increasing long-term stockholder value. Our Board provides oversight of our ESG efforts and Cavco’s executive leadership guides and develops these corporate responsibility priorities and provides regular updates to the Board on progress. The Board and its committees support management’s ESG strategy of integrating our ESG principles into our business strategy in ways that optimize opportunities to make positive impacts while advancing the long-term goals stated above.

In July 2021, we completed our first assessment of ESG priorities when we posted our Corporate Responsibility Report—examining a range of key stakeholders, including investors, customers, employees, rating organizations, and by studying industry peers. We also drew upon the subject matter expertise of colleagues throughout our organization to collect and organize content. In 2022, we posted our second Corporate Responsibility Report as we continued to make notable progress on ESG matters, including the following:

•Purposefully integrated sustainability initiatives further into our operations.

•Created a cross-functional working group of senior executives to design and lead the Company’s ESG initiatives, prepare our Corporate Responsibility Reports, and monitor overall effectiveness of our ESG program. This ESG working group includes our CEO, the Presidents of our Manufacturing and Retail operations, and leaders of support functions such as Legal.

•Adopted an Environmental Stewardship Policy, a Product Safety and Quality Policy, and a Diversity, Equity, and Inclusion Policy, outlining the Company’s vision and priorities in ESG.

•Identified the sources of carbon emissions at production facilities in order to create a baseline for future measurement and calculation of Cavco’s greenhouse gas (“GHG”) emissions.

•Launched a dedicated “Environmental, Social and Governance” website and a FAQ page to communicate the Company’s vision and priorities to investors, customers, employees, and vendors.

We are currently preparing our third Corporate Responsibility Report as we build on the lessons we've learned. Against this backdrop, we have engaged with both internal and external stakeholders to develop an ESG strategy going forward. Our ESG strategy is more fully set forth in our Corporate Responsibility Report, which can be found at investor.cavco.com/general-documents/. There are three areas that we are committed to focusing on in order to achieve our long-term goals: (1) Environmental Responsibility, (2) Social Impact, and (3) Culture of Governance.

| | | | | | | | |

| | Environmental Responsibility |

Cavco is committed to providing affordable housing and being a responsible steward of the environment by considering the environment while conducting business and complying with environmental laws and regulations. Our business is inherently more environmentally responsible than site-built construction. We are mindful of our cost effectiveness so we can support our commitment to create affordable housing. We intend to keep innovating to increase the energy efficiency of our homes and reduce waste from our manufacturing processes. Cavco is committed to building quality, energy efficient homes for the modern-day home buyer. Cavco invests in a variety of sustainable manufacturing processes to support its green building direction.

Senior management leads the strategic direction of the Company and monitors all progress and performance of the Company’s environmental initiatives, while the Board oversees management's efforts.

Our focus on improving the environmental performance of our homes involves both design enhancements and choice of renewable materials. Our operations are designed to optimize the following areas:

| | | | | | | | | | | | | | | | | | | | |

| Water and Energy Efficiency | | | Reducing Waste | | | Product Safety and Quality |

| | | | | | |

| Although minimal water is used in our homebuilding process, we capture, store and reuse rainwater for landscaping needs. Additionally, we seek out and invest in projects that reduce energy use and provide renewable energy for our facilities. | | | Our manufacturing process of building homes in centralized, environmentally protected building centers allows us to minimize adverse impacts on the environment, resulting in reduced levels of waste. | | | Cavco’s homes are built to relevant construction and safety codes, and a majority are built in conformance with the Federal Manufactured Home Construction and Safety Standards requiring substantive testing on the electricity, water and gas pressure and other safety issues. |

Further, our homes include environmentally-friendly features such as high indoor air quality, specially designed ventilation systems, and energy-efficient envelopes. Additional highlights of our efforts and accomplishments include:

•Utilizing high-efficiency electric equipment including LED and motion detector lighting, and high-efficiency HVAC units.

•Ongoing elimination of single-use plastics and the implementation of refill stations to eliminate single-use water bottles.

•Encouraging environmentally friendly workplace practices by supporting recycling and separation of waste.

•Engaging with qualified third-party energy professionals to conduct regular inspections of our production facilities to provide utility and financial savings information.

•Requirement that all materials received from suppliers comply with federal Housing and Urban Development code ("HUD Code") standards.

Another example of our commitment to the environmental sustainability of our production processes is the installation of modern and efficient solar panels on our new Glendale, Arizona production facility. Original estimates projected that the system would generate 2,316.88 MWh in the first year of operation, or about 60% of the plant’s electrical usage, reducing the carbon footprint by approximately 1,642 megatons per year. As of May 2024, with only eight months of operation through the coolest months of the year, the system has already produced 905.87 MWh and saved 1,402,695 lbs. of CO2 emissions. These promising results not only underscore the system’s potential for generating clean energy from the sun, but also highlight the substantial environmental impact of Cavco's solar initiative.

The reduction in CO2 emissions so far is equivalent to eliminating the pollution from 621,424 pounds of coal burned or offsetting 1,442,127 miles driven by an average gasoline-powered passenger vehicle. We continue to evaluate additional renewable energy opportunities for our other production facilities and plan to move forward with additional projects.

We believe that our focus on environmental responsibility, with the objective of reducing costs and improving sustainability of our operations will provide a strategic benefit to the Company. Furthermore, we recognize that climate change is a growing risk for our planet, and we are committed to doing our part to mitigate this risk by placing increased focus and emphasis on environmental consciousness.

| | | | | | | | |

| | Cavco Industries, Inc. | www.cavco.com 21 |

| | | | | | | | |

| | Social Impact |