UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from . . . . . . . . . . . . to . . . . . . . . . . . . . . |

|

|

Commission File No. 001-10852 |

|

|

International Shipholding Corporation |

|

|

(Exact name of registrant as specified in its charter) |

|

Delaware |

36-2989662 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

11 North Water Street, Suite 18290, Mobile, Alabama |

36602 |

|

(Address of principal executive offices) |

(Zip Code) |

|

|

Registrant's telephone number, including area code: (251) 243-9100 |

Former name, former address and former fiscal year, if changed since last report:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☑

Non-accelerated filer ☐ Smaller Reporting Company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common stock, $1 par value. . . . . . . . 7,333,406 shares outstanding as of November 9, 2015

1

INTERNATIONAL SHIPHOLDING CORPORATION

Quarterly Report on Form 10-Q for the

Three Months Ended September 30, 2015

|

PART I – FINANCIAL INFORMATION |

|

|

ITEM 1 – FINANCIAL STATEMENTS |

|

|

3 |

|

|

4 |

|

|

5 |

|

|

7 |

|

|

8 |

|

|

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

28 |

|

ITEM 3 – QUANTITATIVE AND QUALITATIVE INFORMATION ABOUT MARKET RISK |

51 |

|

51 |

|

|

PART II – OTHER INFORMATION |

|

|

52 |

|

|

52 |

|

|

ITEM 2 – UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

55 |

|

56 |

In this report, the terms “we,” “us,” “our” and the “Company” refer to International Shipholding Corporation and its subsidiaries. In addition, the term “Notes” means the Notes to our Condensed Consolidated Financial Statements contained elsewhere in this report, the term “PCTC” means a Pure Car Truck Carrier vessel, the term “credit facilities” means credit facilities with our lenders and financing agreements with those of our lessors with whom we have engaged in sale-leaseback transactions, the term “UOS” refers to United Ocean Services, LLC, which we acquired in November 2012, the term “GAAP” means U.S. Generally Accepted Accounting Principles, the term “SEC” means the U.S. Securities and Exchange Commission, and the term “Strategic Plan” means the restructuring plan approved by our Board of Directors in late October 2015, as modified through the date of this report following conversations with our lenders, lessors, directors and others.

2

PART I – FINANCIAL INFORMATION

Item 1 - Financial Statements

INTERNATIONAL SHIPHOLDING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(All Amounts in Thousands Except Share Data)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2015 |

2014 |

2015 |

2014 |

||||||||

|

Revenues |

$ |

66,509 |

|

$ |

74,410 |

|

$ |

201,843 |

|

$ |

223,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Voyage Expenses |

|

52,569 |

|

|

55,450 |

|

|

158,589 |

|

|

170,685 |

|

Amortization Expense |

|

3,657 |

|

|

6,142 |

|

|

13,192 |

|

|

16,791 |

|

Vessel Depreciation |

|

5,740 |

|

|

6,291 |

|

|

16,773 |

|

|

19,528 |

|

Other Depreciation |

|

185 |

|

|

181 |

|

|

556 |

|

|

545 |

|

Administrative and General Expenses |

|

5,476 |

|

|

5,271 |

|

|

15,286 |

|

|

15,828 |

|

Impairment Loss |

|

3,042 |

|

|

- |

|

|

4,870 |

|

|

- |

|

(Gain) Loss on Sale of Assets |

|

106 |

|

|

1 |

|

|

(4,573) |

|

|

1 |

|

Total Operating Expenses |

|

70,775 |

|

|

73,336 |

|

|

204,693 |

|

|

223,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income (Loss) |

|

(4,266) |

|

|

1,074 |

|

|

(2,850) |

|

|

478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and Other |

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense |

|

3,194 |

|

|

2,890 |

|

|

8,306 |

|

|

7,076 |

|

Derivative (Gain) Loss |

|

- |

|

|

(89) |

|

|

2,991 |

|

|

(57) |

|

Loss on Extinguishment of Debt |

|

- |

|

|

225 |

|

|

355 |

|

|

225 |

|

Other Income from Vessel Financing |

|

(463) |

|

|

(456) |

|

|

(1,378) |

|

|

(1,417) |

|

Investment Income |

|

(5) |

|

|

(278) |

|

|

(29) |

|

|

(302) |

|

Foreign Exchange Loss |

|

- |

|

|

30 |

|

|

91 |

|

|

123 |

|

|

|

2,726 |

|

|

2,322 |

|

|

10,336 |

|

|

5,648 |

|

Loss Before Provision for Income Taxes and Equity in Net Income (Loss) of Unconsolidated Entities |

|

(6,992) |

|

|

(1,248) |

|

|

(13,186) |

|

|

(5,170) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Taxes |

|

373 |

|

|

1,141 |

|

|

405 |

|

|

912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in Net Income (Loss) of Unconsolidated Entities (Net of Applicable Taxes) |

|

158 |

|

|

(176) |

|

|

1,716 |

|

|

(364) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

$ |

(7,207) |

|

$ |

(2,565) |

|

$ |

(11,875) |

|

$ |

(6,446) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock Dividends |

|

1,305 |

|

|

1,305 |

|

|

3,916 |

|

|

3,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Common Stockholders |

$ |

(8,512) |

|

$ |

(3,870) |

|

$ |

(15,791) |

|

$ |

(10,362) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.16) |

|

$ |

(0.53) |

|

$ |

(2.16) |

|

$ |

(1.42) |

|

Diluted |

$ |

(1.16) |

|

$ |

(0.53) |

|

$ |

(2.16) |

|

$ |

(1.42) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares of Common Stock Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

7,333,406 |

|

|

7,301,657 |

|

|

7,322,071 |

|

|

7,278,695 |

|

Diluted |

|

7,333,406 |

|

|

7,301,657 |

|

|

7,322,071 |

|

|

7,278,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock Dividends Per Share |

$ |

0.05 |

|

$ |

0.25 |

|

$ |

0.35 |

|

$ |

0.75 |

The accompanying notes are an integral part of these statements.

3

INTERNATIONAL SHIPHOLDING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(All Amounts in Thousands)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2015 |

2014 |

2015 |

2014 |

||||||||

|

Net Loss |

$ |

(7,207) |

$ |

(2,565) |

$ |

(11,875) |

$ |

(6,446) | |||

|

Other Comprehensive Income (Loss): |

|||||||||||

|

Unrealized Foreign Currency Translation Loss |

(139) | (84) | (255) | (67) | |||||||

|

Change in Fair Value of Derivatives |

81 | 457 | 411 | 422 | |||||||

|

De-Designation of Interest Rate Swap |

- |

- |

2,859 |

- |

|||||||

|

Change in Funded Status of Defined Benefit Plan* |

173 | 74 | 519 | 225 | |||||||

|

Comprehensive Loss |

$ |

(7,092) |

$ |

(2,118) |

$ |

(8,341) |

$ |

(5,866) | |||

* Net of tax expense of $26,000 and $75,000 for the three and nine months ended September 30, 2014, respectively. Due to our valuation allowance referred to in Note 9 – Income Taxes, there was no net tax expense in Other Comprehensive Loss during 2015.

The accompanying notes are an integral part of these statements.

4

INTERNATIONAL SHIPHOLDING CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(All Amounts in Thousands Except Share Data)

(Unaudited)

|

September 30, 2015 |

December 31, 2014 |

||||

|

ASSETS |

|||||

|

Cash and Cash Equivalents |

$ |

6,058 |

$ |

21,133 | |

|

Restricted Cash |

1,135 | 1,394 | |||

|

Accounts Receivable, Net of Allowance for Doubtful Accounts |

25,910 | 31,322 | |||

|

Prepaid Expenses |

9,910 | 10,927 | |||

|

Deferred Tax Asset |

288 | 408 | |||

|

Other Current Assets |

612 | 370 | |||

|

Notes Receivable |

1,628 | 3,204 | |||

|

Material and Supplies Inventory |

8,331 | 9,760 | |||

|

Assets Held for Sale |

5,300 | 6,976 | |||

|

Total Current Assets |

59,172 | 85,494 | |||

|

Investment in Unconsolidated Entities |

22,907 | 21,837 | |||

|

Vessels, Property, and Other Equipment, at Cost: |

|||||

|

Vessels |

531,795 | 520,026 | |||

|

Building |

1,780 | 1,354 | |||

|

Land |

623 | 623 | |||

|

Leasehold Improvements |

26,348 | 26,348 | |||

|

Construction in Progress |

8,938 | 2,371 | |||

|

Furniture and Equipment |

10,809 | 10,461 | |||

| 580,293 | 561,183 | ||||

|

Less - Accumulated Depreciation |

(185,925) | (186,450) | |||

| 394,368 | 374,733 | ||||

|

Other Assets: |

|||||

|

Deferred Charges, Net of Accumulated Amortization |

25,173 | 25,787 | |||

|

Intangible Assets, Net of Accumulated Amortization |

23,163 | 25,042 | |||

|

Due from Related Parties |

1,286 | 1,660 | |||

|

Notes Receivable |

24,547 | 24,455 | |||

|

Goodwill |

828 | 2,735 | |||

|

Assets Held for Sale |

- |

48,701 | |||

|

Other |

3,012 | 4,843 | |||

| 78,009 | 133,223 | ||||

|

TOTAL ASSETS |

$ |

554,456 |

$ |

615,287 | |

The accompanying notes are an integral part of these statements.

5

INTERNATIONAL SHIPHOLDING CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(All Amounts in Thousands Except Share Data)

|

|

September 30, 2015 |

|

December 31, 2014 |

||

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

||

|

Current Liabilities: |

|

|

|

|

|

|

Current Maturities of Long-Term Debt, Net |

$ |

211,353 |

|

$ |

23,367 |

|

Accounts Payable and Other Accrued Expenses |

|

47,833 |

|

|

52,731 |

|

Total Current Liabilities |

|

259,186 |

|

|

76,098 |

|

|

|

|

|

|

|

|

Long-Term Debt, Net |

|

- |

|

|

216,651 |

|

|

|

|

|

|

|

|

Other Long-Term Liabilities: |

|

|

|

|

|

|

Incentive Obligation |

|

4,080 |

|

|

4,644 |

|

Other |

|

37,992 |

|

|

50,284 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

301,258 |

|

|

347,677 |

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Preferred Stock, $1.00 Par Value, 2,000,000 Shares Authorized: |

|

|

|

|

|

|

9.50% Series A Cumulative Perpetual Preferred Stock, 250,000 Shares Issued and Outstanding at September 30, 2015 and December 31, 2014, Respectively |

|

250 |

|

|

250 |

|

9.00% Series B Cumulative Perpetual Preferred Stock, 316,250 Shares Issued and Outstanding at September 30, 2015 and December 31, 2014, Respectively |

|

316 |

|

|

316 |

|

Common Stock, $1.00 Par Value, 20,000,000 Shares Authorized, 7,333,406 and 7,301,657 Shares Outstanding at September 30, 2015 and December 31, 2014, Respectively |

|

8,776 |

|

|

8,743 |

|

Additional Paid-In Capital |

|

141,364 |

|

|

140,960 |

|

Retained Earnings |

|

140,751 |

|

|

159,134 |

|

Treasury Stock 1,388,078 Shares at September 30, 2015 and December 31, 2014 |

|

(25,403) |

|

|

(25,403) |

|

Accumulated Other Comprehensive Loss |

|

(12,856) |

|

|

(16,390) |

|

TOTAL STOCKHOLDERS' EQUITY |

|

253,198 |

|

|

267,610 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ |

554,456 |

|

$ |

615,287 |

The accompanying notes are in an integral part of these statements.

6

INTERNATIONAL SHIPHOLDING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(All Amounts in Thousands Except Share Data)

(Unaudited)

|

Nine Months Ended September 30, |

|||||

|

2015 |

2014 |

||||

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

Net Loss |

$ |

(11,875) |

|

$ |

(6,446) |

|

Adjustments to Reconcile Net Loss to Net Cash Provided by Operating Activities: |

|

|

|

|

|

|

Depreciation |

|

17,329 |

|

|

20,073 |

|

Amortization of Deferred Charges |

|

12,704 |

|

|

14,615 |

|

Amortization of Intangible Assets |

|

1,879 |

|

|

3,087 |

|

Deferred Tax |

|

- |

|

|

912 |

|

Non-Cash Share Based Compensation |

|

567 |

|

|

1,185 |

|

Equity in Net (Income) Loss of Unconsolidated Entities, Net |

|

(1,200) |

|

|

364 |

|

Impairment Loss |

|

4,870 |

|

|

- |

|

(Gain) Loss on Sale of Assets |

|

(4,573) |

|

|

1 |

|

Loss on Extinguishment of Debt, Net |

|

346 |

|

|

225 |

|

Loss on Foreign Currency Exchange, Net |

|

91 |

|

|

123 |

|

(Gain) Loss on Derivatives, Net of Cash Settlements |

|

53 |

|

|

(57) |

|

Amortization of Deferred Gains |

|

(2,892) |

|

|

(3,323) |

|

Other Reconciling Items, net |

|

369 |

|

|

820 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Deferred Drydocking Charges |

|

(10,821) |

|

|

(7,037) |

|

Accounts Receivable |

|

2,073 |

|

|

(5,210) |

|

Inventory and Other Current Assets |

|

2,510 |

|

|

(2,703) |

|

Other Assets |

|

(125) |

|

|

(2,218) |

|

Accounts Payable and Accrued Liabilities |

|

(8,083) |

|

|

1,748 |

|

Other Long-Term Liabilities |

|

(1,147) |

|

|

(834) |

|

Net Cash Provided by Operating Activities |

|

2,075 |

|

|

15,325 |

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities: |

|

|

|

|

|

|

Purchases of and Capital Improvements to Property and Equipment |

|

(12,001) |

|

|

(64,710) |

|

Investment in Unconsolidated Entities |

|

- |

|

|

(7,887) |

|

Net Change in Restricted Cash Account |

|

259 |

|

|

9,112 |

|

Cash Proceeds from the State of Louisiana |

|

591 |

|

|

- |

|

Cash Proceeds from Sale of Assets |

|

29,346 |

|

|

- |

|

Cash Proceeds from Receivable Settlement |

|

3,890 |

|

|

- |

|

Proceeds from Payments on Note Receivables |

|

1,484 |

|

|

3,186 |

|

Net Cash Provided by (Used In) Investing Activities |

|

23,569 |

|

|

(60,299) |

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

|

Proceeds from Line of Credit |

|

5,000 |

|

|

33,000 |

|

Payments on Line of Credit |

|

(12,500) |

|

|

(13,000) |

|

Proceeds from Issuance of Debt |

|

32,000 |

|

|

61,545 |

|

Principal Payments on Long Term Debt |

|

(53,711) |

|

|

(25,190) |

|

Cash Payments to Settle Foreign Currency Contract |

|

(4,033) |

|

|

- |

|

Additions to Deferred Financing Charges |

|

(999) |

|

|

(987) |

|

Dividends Paid |

|

(6,476) |

|

|

(9,380) |

|

Net Cash Provided by (Used In) Financing Activities |

|

(40,719) |

|

|

45,988 |

|

|

|

|

|

|

|

|

Net Increase (Decrease) in Cash and Cash Equivalents |

|

(15,075) |

|

|

1,014 |

|

Cash and Cash Equivalents at Beginning of Period |

|

21,133 |

|

|

20,010 |

|

|

|

|

|

|

|

|

Cash and Cash Equivalents at End of Period |

$ |

6,058 |

|

$ |

21,024 |

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash investing activities: |

|

|

|

|

|

|

Additions to vessels, property, plant and equipment included in accounts payable and other accrued expenses |

$ |

3,032 |

|

$ |

1,434 |

The accompanying notes are an integral part of these statements.

7

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Three and Nine Months Ended September 30, 2015

NOTE 1 – BUSINESS AND BASIS OF PRESENTATION

Financial Position

We operate a diversified fleet of U.S. and International flag vessels that provide international and domestic maritime transportation services. For additional information on our business, see Item 2 of Part I of this report.

Since 2014, we have encountered certain challenges related to complying with our debt covenants and overall liquidity restraints. We have taken numerous steps to improve our liquidity, including selling assets, reducing our dividends, laying up vessels and reducing our costs. In addition, in June of 2015, we initiated efforts to recapitalize all of our debt and operating leases by September 30, 2015, and thereafter sought to raise funds by either selling debt securities or borrowing funds from financial institutions. We also requested limited waivers as of September 30, 2015 from all of our lenders and lessors in case our attempts to refinance our debt and leases were unsuccessful. By early October 2015, we withdrew our efforts to recapitalize our debt, began negotiations with all of our lenders and lessors on limited waivers and began to formulate a new strategy to provide us with means to improve our liquidity and financial position.

On October 21, 2015, our Board of Directors approved a plan to restructure the Company principally by focusing on three core segments including the Jones Act, PCTC and Rail-Ferry segments. Throughout this Form 10-Q, we use the term “Strategic Plan” specifically to refer to the Board approved plan to restructure the Company. The non-core assets we will seek to divest include all of the assets in our Dry Bulk Carriers, Specialty Contracts and Other segments. In addition to these assets, we will also seek to divest (i) our minority investment in mini bulkers, chemical tankers and asphalt tankers, (ii) one PCTC vessel, and (iii) a small, non-strategic portion of our retained operations. If we are successful in implementing this Strategic Plan, we believe it will strengthen our financial position by reducing our debt to more manageable levels and increasing our liquidity, which we believe will, in turn, provide us with future opportunities to create value for our shareholders.

On or prior to November 16, 2015, we amended each of our credit facilities. These amendments, among other things, obligate us to complete various steps of our Strategic Plan by certain specified milestone deadlines ranging from December 4, 2015 to June 30, 2016. Because of the uncertainties associated with our ability to implement the Strategic Plan within the required time constraints, we have classified as of September 30, 2015 all $213.7 million of our debt obligations as current, which caused our current liabilities to far exceed our current assets as of such date.

If we are unsuccessful in disposing of certain non-core assets by the milestones and at specified amounts agreed to with our lenders and lessors, we would be in default under one or more of our credit facilities and all of our creditors would have the right to accelerate our debt. As a result of the matters described herein, including the uncertainty regarding our ability to execute the Strategic Plan and our lenders’ abilities to demand payment under our debt agreements, if we are unable to successfully mitigate these uncertainties, there would be substantial doubt about our ability to continue as a going concern.

For more information on our Strategic Plan and current debt compliance matters, see (i) Note 13 – Debt Obligations and Note 21 – Subsequent Events and (ii) Item 2 of Part I of this report.

Basis of Presentation

We have prepared the accompanying unaudited interim financial statements pursuant to the rules and regulations of the SEC and as permitted hereunder, we have omitted certain information and footnote disclosures required by GAAP for complete financial statements. We recommend you read these interim statements in conjunction with the financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2014. The Condensed Consolidated Balance Sheet as of December 31, 2014 included in this report has been derived from the audited financial statements at that date.

The foregoing 2015 interim results are not necessarily indicative of the results of operations for the full year 2015. Management believes that it has made all adjustments necessary, consisting only of normal recurring adjustments, for a fair statement of the information presented.

The accompanying financial statements include the accounts of International Shipholding Corporation and its majority owned subsidiaries. Intercompany accounts and transactions have been eliminated in consolidation. Our policy is to consolidate all subsidiaries in which we hold a greater than 50% voting interest or otherwise control its operating and financial activities. We use the equity method to account for investments in entities in which we hold a 20% to 50% voting interest and have the ability to exercise significant influence over their operating and financial activities.

Revenues and expenses relating to our Rail-Ferry, Jones Act, and Specialty segments’ voyages are recorded over the duration of the voyage. Our voyage expenses are estimated at the beginning of the voyages based on historical actual costs or from industry sources familiar with those types of charges. As the voyage progresses, these estimated costs are revised with actual charges and timely

8

adjustments are made. Based on our prior experience, we believe there is not a material difference between recording estimated expenses ratably over the voyage versus the actual expenses recorded as incurred. Revenues and expenses relating to our other vessels’ voyages, which require limited estimates or assumptions, are recorded when earned or incurred during the reporting period.

We have eliminated intercompany balances, accounts, and transactions in consolidation.

Certain previously reported amounts have been reclassified to conform to the 2015 presentation. Specifically, drydock amortization of $5.1 million and $13.7 million for the three and nine months ended September 30, 2014, respectively, which were previously included in voyage expense, are now included in amortization expense, and miscellaneous depreciation expense of $0.2 million and $0.5 million for the three and nine months ended September 30, 2014, respectively, which were previously included in voyage expense and administrative and general expense, are now included in other depreciation expense in the Condensed Consolidated Statements of Operations and other tables herein. Additionally, deferred debt issuance costs, which were previously included in deferred charges, net of accumulated amortization, are now included as an offset to long-term debt (see Note 7 – Goodwill, Other Intangible Assets, and Deferred Charges).

NOTE 2 – OPERATING SEGMENTS

Our six operating segments, Jones Act, Pure Car Truck Carriers, Dry Bulk Carriers, Rail-Ferry, Specialty Contracts, and Other are distinguished primarily by the market in which the segment assets are deployed, the physical characteristics of those assets, and the type of services provided to our customers. We report in the Other category the results of several of our subsidiaries that provide ship and cargo charter brokerage, ship management services and agency services to our operating subsidiaries as well as third party customers. Also included in the Other category are corporate related items, results of insignificant operations, and income and expense items not allocated to the other reportable segments. We manage each reportable segment separately, as each requires different resources depending on the nature of the contract or terms under which the vessels within the segment operate. Our October 2015 Strategic Plan, if fully implemented, could significantly impact our reporting segments – see Note 1 – Business and Basis of Presentation for further discussion.

We allocate interest expense to the segments in proportion to the fixed assets (defined as the carrying value of vessels, property, and other equipment) within each segment. Additionally, we include the results of two of our unconsolidated entities, Oslo Bulk, AS and Oslo Bulk Holding Pte. Ltd, in our Dry Bulk Carriers segment, and the results of another unconsolidated entity, Terminales Transgolfo, S.A. de C.V., to our Rail-Ferry segment. The results of our remaining unconsolidated entities, Saltholmen Shipping Ltd (a company owning two Chemical Tankers) and Brattholmen Shipping Ltd (a company owning two Asphalt Tankers), are included in our Specialty Contracts segment. We do not allocate to our segments; (i) administrative and general expenses, (ii) (gain) loss on sale of other assets, (iii) derivative (gain) loss, (iv) income taxes, (v) impairment loss, (vi) loss of extinguishment of debt, (vii) other income from vessel financing, (viii) investment income, and (ix) foreign exchange loss. Intersegment revenues are based on market prices and include revenues earned by our subsidiaries that provide specialized services to our operating companies. Finally, we use “gross voyage profit” as the primary measure for our segments’ profitability to assist our chief operating decision makers in monitoring and managing our business. Due to the diversity across our segments, we believe the most efficient way of measuring contribution margins is by measuring gross voyage profit by segment. Gross voyage profit is the sum of revenue less voyage expense less amortization expense, plus the results from our unconsolidated entities.

9

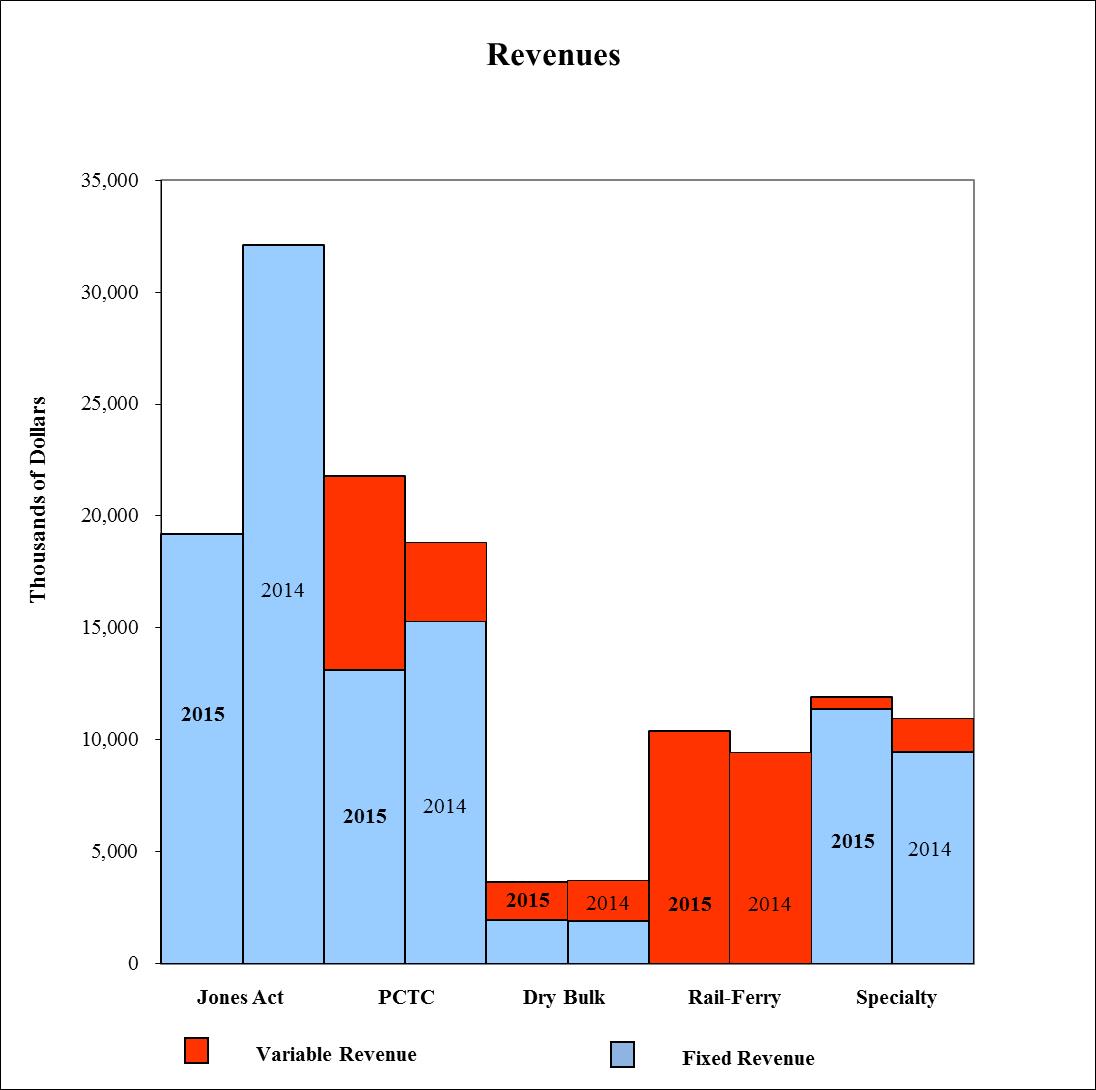

The following table presents information about segment profit and loss for the three months ended September 30, 2015 and 2014:

three MONTHS ENDED SEPTEMBER 30, 2015

COMPARED TO THE three MONTHS ENDED SEPTEMBER 30, 2014

|

(All Amounts in Thousands) |

|

|

Pure Car |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Jones |

|

Truck |

|

Dry Bulk |

|

Rail |

|

Specialty |

|

|

|

|

|

|||||||

|

|

Act |

|

Carriers |

|

Carriers |

|

Ferry |

|

Contracts |

|

Other |

|

Total |

|

|||||||

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Revenue |

$ |

19,199 |

|

$ |

13,131 |

|

$ |

1,933 |

|

$ |

- |

|

$ |

11,391 |

|

$ |

- |

|

$ |

45,654 |

|

|

Variable Revenue |

|

- |

|

|

8,665 |

|

|

1,695 |

|

|

10,402 |

|

|

541 |

|

|

(448) |

|

|

20,855 |

|

|

Total Revenue |

|

19,199 |

|

|

21,796 |

|

|

3,628 |

|

|

10,402 |

|

|

11,932 |

|

|

(448) |

|

|

66,509 |

|

|

Voyage Expenses |

|

17,342 |

|

|

16,228 |

|

|

2,305 |

|

|

8,038 |

|

|

9,435 |

|

|

(779) |

|

|

52,569 |

|

|

Amortization Expense |

|

2,450 |

|

|

604 |

|

|

60 |

|

|

258 |

|

|

285 |

|

|

- |

|

|

3,657 |

|

|

(Income) Loss of Unconsolidated Entities |

|

- |

|

|

- |

|

|

45 |

|

|

229 |

|

|

(432) |

|

|

- |

|

|

(158) |

|

|

Gross Voyage Profit (Loss) (excluding Depreciation Expense) |

$ |

(593) |

|

$ |

4,964 |

|

$ |

1,218 |

|

$ |

1,877 |

|

$ |

2,644 |

|

$ |

331 |

|

$ |

10,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Voyage Profit Margin |

|

(3) |

% |

|

23 |

% |

|

34 |

% |

|

18 |

% |

|

22 |

% |

|

- |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Revenue |

$ |

32,101 |

|

$ |

15,290 |

|

$ |

1,910 |

|

$ |

- |

|

$ |

9,462 |

|

$ |

- |

|

$ |

58,763 |

|

|

Variable Revenue |

|

- |

|

|

3,520 |

|

|

1,786 |

|

|

9,435 |

|

|

1,497 |

|

|

(591) |

|

|

15,647 |

|

|

Total Revenue |

|

32,101 |

|

|

18,810 |

|

|

3,696 |

|

|

9,435 |

|

|

10,959 |

|

|

(591) |

|

|

74,410 |

|

|

Voyage Expenses |

|

20,541 |

|

|

15,606 |

|

|

2,870 |

|

|

7,644 |

|

|

9,923 |

|

|

(1,134) |

|

|

55,450 |

|

|

Amortization Expense |

|

4,799 |

|

|

593 |

|

|

63 |

|

|

259 |

|

|

428 |

|

|

- |

|

|

6,142 |

|

|

(Income) Loss of Unconsolidated Entities |

|

- |

|

|

- |

|

|

373 |

|

|

81 |

|

|

(278) |

|

|

- |

|

|

176 |

|

|

Gross Voyage Profit (excluding Depreciation Expense) |

$ |

6,761 |

|

$ |

2,611 |

|

$ |

390 |

|

$ |

1,451 |

|

$ |

886 |

|

$ |

543 |

|

$ |

12,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Voyage Profit Margin |

|

21 |

% |

|

14 |

% |

|

11 |

% |

|

15 |

% |

|

8 |

% |

|

- |

|

|

17 |

% |

10

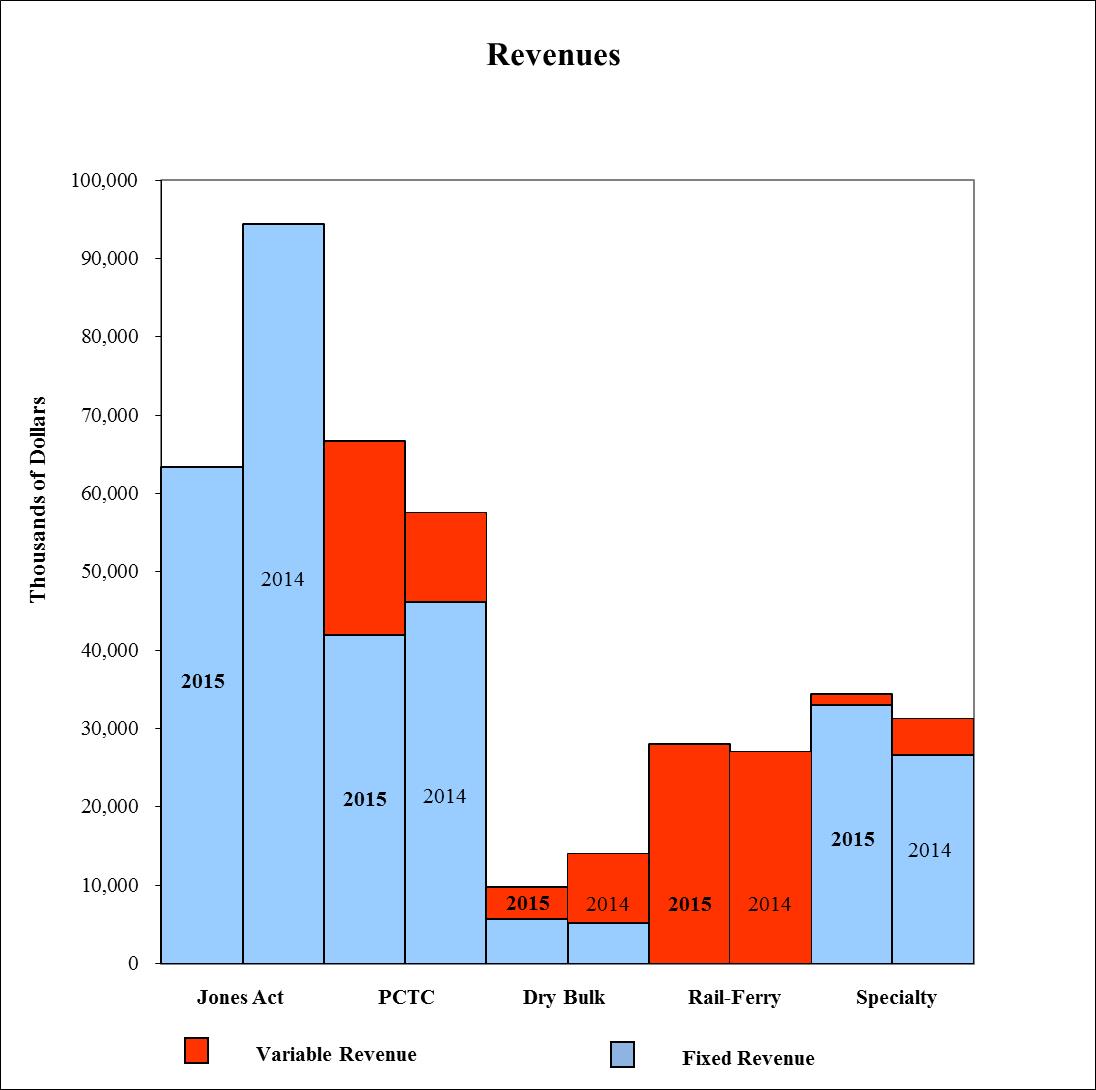

The following table presents information about segment profit and loss for the nine months ended September 30, 2015 and 2014:

RESULTS OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2015

COMPARED TO THE NINE MONTHS ENDED SEPTEMBER 30, 2014

|

(All Amounts in Thousands) |

|

|

Pure Car |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Jones |

|

Truck |

|

Dry Bulk |

|

Rail |

|

Specialty |

|

|

|

|

|

|||||||

|

|

Act |

|

Carriers |

|

Carriers |

|

Ferry |

|

Contracts |

|

Other |

|

Total |

|

|||||||

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Revenue |

$ |

63,344 |

|

$ |

41,890 |

|

$ |

5,667 |

|

$ |

- |

|

$ |

33,035 |

|

$ |

- |

|

$ |

143,936 |

|

|

Variable Revenue |

|

- |

|

|

24,854 |

|

|

4,063 |

|

|

28,014 |

|

|

1,373 |

|

|

(397) |

|

|

57,907 |

|

|

Total Revenue |

|

63,344 |

|

|

66,744 |

|

|

9,730 |

|

|

28,014 |

|

|

34,408 |

|

|

(397) |

|

|

201,843 |

|

|

Voyage Expenses |

|

52,634 |

|

|

51,289 |

|

|

6,821 |

|

|

22,514 |

|

|

26,654 |

|

|

(1,323) |

|

|

158,589 |

|

|

Amortization Expense |

|

9,392 |

|

|

2,095 |

|

|

181 |

|

|

679 |

|

|

845 |

|

|

- |

|

|

13,192 |

|

|

(Income) Loss of Unconsolidated Entities |

|

- |

|

|

- |

|

|

(797) |

|

|

186 |

|

|

(1,105) |

|

|

- |

|

|

(1,716) |

|

|

Gross Voyage Profit (excluding Depreciation Expense) |

$ |

1,318 |

|

$ |

13,360 |

|

$ |

3,525 |

|

$ |

4,635 |

|

$ |

8,014 |

|

$ |

926 |

|

$ |

31,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Voyage Profit Margin |

|

2 |

% |

|

20 |

% |

|

36 |

% |

|

17 |

% |

|

23 |

% |

|

- |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Revenue |

$ |

94,408 |

|

$ |

46,200 |

|

$ |

5,194 |

|

$ |

- |

|

$ |

26,650 |

|

$ |

- |

|

$ |

172,452 |

|

|

Variable Revenue |

|

- |

|

|

11,319 |

|

|

8,881 |

|

|

27,101 |

|

|

4,624 |

|

|

(521) |

|

|

51,404 |

|

|

Total Revenue |

|

94,408 |

|

|

57,519 |

|

|

14,075 |

|

|

27,101 |

|

|

31,274 |

|

|

(521) |

|

|

223,856 |

|

|

Voyage Expenses |

|

65,226 |

|

|

48,417 |

|

|

9,820 |

|

|

22,089 |

|

|

26,964 |

|

|

(1,831) |

|

|

170,685 |

|

|

Amortization Expense |

|

12,144 |

|

|

1,938 |

|

|

172 |

|

|

675 |

|

|

1,862 |

|

|

- |

|

|

16,791 |

|

|

(Income) Loss of Unconsolidated Entities |

|

- |

|

|

- |

|

|

542 |

|

|

148 |

|

|

(326) |

|

|

- |

|

|

364 |

|

|

Gross Voyage Profit (excluding Depreciation Expense) |

$ |

17,038 |

|

$ |

7,164 |

|

$ |

3,541 |

|

$ |

4,189 |

|

$ |

2,774 |

|

$ |

1,310 |

|

$ |

36,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Voyage Profit Margin |

|

18 |

% |

|

12 |

% |

|

25 |

% |

|

15 |

% |

|

9 |

% |

|

- |

|

|

16 |

% |

11

The following table is a reconciliation of the totals reported for the operating segments to the applicable line items in the consolidated financial statements:

|

(All Amounts in Thousands) |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||

|

2015 |

2014 |

2015 |

2014 |

||||||||

|

Revenues |

$ |

66,509 |

$ |

74,410 |

$ |

201,843 |

$ |

223,856 | |||

|

Voyage Expenses |

52,569 | 55,450 | 158,589 | 170,685 | |||||||

|

Amortization Expense |

3,657 | 6,142 | 13,192 | 16,791 | |||||||

|

Net (Income) Loss of Unconsolidated Entities |

(158) | 176 | (1,716) | 364 | |||||||

|

Gross Voyage Profit |

10,441 | 12,642 | 31,778 | 36,016 | |||||||

|

Vessel Depreciation |

5,740 | 6,291 | 16,773 | 19,528 | |||||||

|

Other Depreciation |

185 | 181 | 556 | 545 | |||||||

|

Gross Profit |

4,516 | 6,170 | 14,449 | 15,943 | |||||||

|

Other Operating Expenses: |

|||||||||||

|

Administrative and General Expenses |

5,476 | 5,271 | 15,286 | 15,828 | |||||||

|

Impairment Loss |

3,042 |

- |

4,870 |

- |

|||||||

|

(Gain) Loss on Sale of Other Assets |

106 | 1 | (4,573) | 1 | |||||||

|

Less: Net Income (Loss) of Unconsolidated Entities |

158 | (176) | 1,716 | (364) | |||||||

|

Total Other Operating Expenses |

8,782 | 5,096 | 17,299 | 15,465 | |||||||

|

Operating Income (Loss) |

$ |

(4,266) |

$ |

1,074 |

$ |

(2,850) |

$ |

478 | |||

NOTE 3 – IMPAIRMENT LOSS

We test goodwill for impairment annually as of December 1 or on an interim basis if triggering events indicate that the fair value of the asset has decreased below its carrying value. Additionally, we test long lived assets (both tangible and intangible) for impairment when events or circumstances indicate that the carrying value of a particular asset may not be recoverable. As a result of lower operating results from our UOS services, failure to meet projected results and a significant decline in our market capitalization, we have tested our goodwill and long lived assets (both tangible and intangible) for impairments as of September 30, 2015. The testing on our intangible assets and vessels did not result in any impairment charges. However, our goodwill testing did result in an impairment charge as discussed below.

At September 30, 2015, we tested our goodwill using the income approach, which estimates the fair value of our reporting units using various cash flow and earnings projections discounted at a rate estimated to approximate the reporting units’ weighted average cost of capital. As a result, we determined that the implied fair value of goodwill was less than its carrying value. As such, we recorded an impairment loss of approximately $1.9 million, which related to the entire goodwill balance generated from the UOS acquisition that is reported in the Jones Act segment.

During the third quarter of 2015, we received an offer to purchase our Jones Act Tug/Barge unit, which is included in current assets held for sale, for an amount that was below its net book value of $6.4 million. We have since decided to forego this offer. However, as a result of this offer, we reassessed the fair market value of this unit. We calculated an assumed fair value of $5.3 million using a weighted average of various third party appraisals and offers to purchase. As a result, we have recorded an impairment loss of $1.1 million in our Condensed Consolidated Statement of Operations for the three and nine months ended September 30, 2015. Our November 2015 credit facility amendments require us to apply any future proceeds from this sale to payments toward our Credit Facility.

During the second quarter 2015, the Company recorded an impairment loss of approximately $1.8 million to adjust two Handysize vessels and their related equipment to their current fair market value. See Note 8 – Assets Held for Sale for additional information.

In October of 2015, our Board of Directors approved a Strategic Plan that requires the divestiture of certain non-core assets, which includes the Jones Act Tug/Barge unit and the two Handysize vessels discussed above. For more information regarding the Strategic Plan, see Note 21 – Subsequent Events.

12

NOTE 4 – GAIN ON SALE OF ASSETS

During the second quarter of 2015, we sold a 14,930 dead weight ton, 1994-built Pure Car Truck Carrier that had previously contributed to our PCTC segment. In exchange, we received $13.0 million cash, recorded a gain on sale of asset of approximately $4.6 million, and paid down $10.0 million on our revolving line of credit.

During the first quarter of 2015, we sold a 36,000 dead weight ton Handysize vessel and its related equipment. We received $16.4 million, net of commissions and other costs to sell, and recorded a loss on sale of asset of approximately $68,000 during the quarter. Additionally, we paid off related debt of approximately $13.5 million and recorded a loss on extinguishment of debt of approximately $95,000. This vessel was previously reported in the Dry Bulk segment and was included in assets held for sale at December 31, 2014.

NOTE 5 - INVENTORY

Our inventory consists of three major classes: spare parts, fuel, and warehouse inventory. Spare parts and warehouse inventories are stated at the lower of cost or market based on the first-in, first-out method of accounting. Our fuel inventory is based on the average cost method of accounting. We have broken down the inventory balances as of September 30, 2015 and December 31, 2014 by major class in the following table:

|

(All Amounts in Thousands) |

September 30, |

December 31, |

|||

|

Inventory Classes |

2015 |

2014 |

|||

|

Spare Parts Inventory |

$ |

3,534 |

$ |

3,253 | |

|

Fuel Inventory |

2,191 | 3,967 | |||

|

Warehouse Inventory |

2,606 | 2,540 | |||

|

Total |

$ |

8,331 |

$ |

9,760 |

NOTE 6 – UNCONSOLIDATED ENTITIES

The following table summarizes our equity in net income (loss) of unconsolidated entities for the three and nine months ended September 30, 2015 and 2014, respectively:

|

(All Amounts in Thousands) |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

Oslo Bulk, AS |

|

$ |

(40) |

|

$ |

(55) |

|

$ |

646 |

|

$ |

(142) |

|

Oslo Bulk Holding Pte. Ltd (formerly Tony Bulkers) |

|

|

(5) |

|

|

(318) |

|

|

151 |

|

|

(400) |

|

Terminales Transgolfo, S.A. de C.V. |

|

|

(229) |

|

|

(81) |

|

|

(186) |

|

|

(148) |

|

Saltholmen Shipping Ltd |

|

|

335 |

|

|

30 |

|

|

847 |

|

|

30 |

|

Brattholmen Shipping Ltd |

|

|

97 |

|

|

248 |

|

|

258 |

|

|

296 |

|

Total Equity in Net Income (Loss) of Unconsolidated Entities |

|

$ |

158 |

|

$ |

(176) |

|

$ |

1,716 |

|

$ |

(364) |

During the nine months ended September 30, 2014, the Company invested approximately $5.9 million cash and $2.0 million cash to acquire a 30% interest in Saltholmen Shipping Ltd and Brattholmen Shipping Ltd, respectively. During this period, we did not receive dividends. During the nine months ended September 30, 2015, the Company received dividends of approximately $0.4 million and $0.1 million from Saltholmen Shipping Ltd and Brattholmen Shipping Ltd, respectively.

These investments have been accounted for under the equity method and our portion of their earnings or losses is presented net of any applicable taxes on our Condensed Consolidated Statements of Operations under the caption "equity in net income (loss) of unconsolidated entities (net of applicable taxes).”

The Strategic Plan approved by our Board of Directors on October 21, 2015 contemplates that we will sell our interest in each of our unconsolidated entities, with the exception of Terminales Transgolfo, S.A. de C.V. See Note 21 – Subsequent Events for additional information.

For additional information on our investment in these and other unconsolidated entities, see Note E – Unconsolidated Entities to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014.

13

NOTE 7 – GOODWILL, OTHER INTANGIBLE ASSETS, AND DEFERRED CHARGES

During the third quarter of 2015, we recorded an impairment loss of approximately $1.9 million as a result of the write off of goodwill generated from the UOS acquisition, which is reported in the Jones Act segment. See Note 3 – Impairment Loss for additional information.

During the second quarter of 2015, we adopted ASU 2015-03 and, as a result, reclassified approximately $2.9 million of deferred debt issuance costs from deferred charges, net of accumulated amortization to offset against long-term debt on our Condensed Consolidated Balance Sheet as of December 31, 2014. As of September 30, 2015, the amount of deferred debt issuance costs was $2.4 million and is included as an offset to current maturities of long-term debt on our Condensed Consolidated Balance Sheet – refer to Note 1 – Business and Basis of Presentation for further discussion on the reclassification of long-term debt to current as of September 30, 2015. Amortization expense related to these charges was $0.8 million and $0.1 million for the three months ended September 30, 2015 and 2014, respectively, and $1.2 million and $0.4 million for the nine months ended September 30, 2015 and 2014, respectively.

Amortization expense for intangible assets was approximately $0.7 million and $1.0 million for the three months ended September 30, 2015 and 2014, respectively, and $1.9 million and $3.1 million for the nine months ended September 30, 2015 and 2014, respectively. Amortization expense for deferred charges was approximately $3.1 million and $5.1 million for the three months ended September 30, 2015 and 2014, respectively, and $11.5 million and $13.8 million for the nine months ended September 30, 2015 and 2014, respectively.

The following table presents the rollforward of goodwill, other intangible assets, and deferred charges for the nine months ended September 30, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(All Amounts in Thousands) |

|

|

Balance at |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at |

|

|

|

Amortization |

|

|

December 31, |

|

|

Cash |

|

|

Impairment/ |

|

|

|

|

|

Non-Cash |

|

|

September 30, |

|

|

Period |

|

|

2014 |

|

|

Additions |

|

|

Disposals |

|

|

Amortization |

|

|

Reclassifications |

|

|

2015 |

|

Indefinite Life Intangibles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

$ |

2,735 |

|

$ |

- |

|

$ |

(1,907) |

|

$ |

- |

|

$ |

- |

|

$ |

828 |

|

Total Indefinite Life Intangibles |

|

$ |

2,735 |

|

$ |

- |

|

$ |

(1,907) |

|

$ |

- |

|

$ |

- |

|

$ |

828 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Definite Life Intangibles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade names - FSI |

240 months |

|

$ |

57 |

|

$ |

- |

|

$ |

- |

|

$ |

(2) |

|

$ |

- |

|

$ |

55 |

|

Trade names - UOS |

144 months |

|

|

1,357 |

|

|

- |

|

|

- |

|

|

(103) |

|

|

- |

|

|

1,254 |

|

Customer Relationships - FSI |

240 months |

|

|

375 |

|

|

- |

|

|

- |

|

|

(16) |

|

|

- |

|

|

359 |

|

Customer Relationships - UOS |

144 months |

|

|

23,253 |

|

|

- |

|

|

- |

|

|

(1,758) |

|

|

- |

|

|

21,495 |

|

Total Definite Life Intangibles |

|

$ |

25,042 |

|

$ |

- |

|

$ |

- |

|

$ |

(1,879) |

|

$ |

- |

|

$ |

23,163 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred Charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drydocking Costs |

various |

|

$ |

25,238 |

|

$ |

10,821 |

|

$ |

(2,080) |

|

$ |

(11,313) |

|

$ |

1,989 |

|

$ |

24,655 |

|

Other Deferred Charges |

various |

|

|

549 |

|

|

273 |

|

|

- |

|

|

(188) |

|

|

(116) |

|

|

518 |

|

Total Deferred Charges |

|

|

$ |

25,787 |

|

$ |

11,094 |

|

$ |

(2,080) |

|

$ |

(11,501) |

|

$ |

1,873 |

|

$ |

25,173 |

NOTE 8 – ASSETS HELD FOR SALE

As a result of continued evaluation of our strategic alternatives, during the fourth quarter of 2014, we devised a plan to sell three Handysize vessels and one inactive Jones Act Tug/Barge unit. Upon approval of this plan, we classified the Handysize vessels and their related equipment as long term assets held for sale, valued at approximately $48.7 million at December 31, 2014. The Tug/Barge unit and inventory related to the Handysize vessels were classified as short term assets held for sale, and were valued at approximately $7.0 million at December 31, 2014.

During 2014, the Company adopted ASU 2014-08 which changed the definition of discontinued operations. In accordance with this guidance, we determined that the assets held for sale did not represent a strategic shift that would have a major effect on our operations and financial results. As such, we did not report the financial results related to these assets as discontinued operations.

During the first quarter of 2015, we sold one of the Handysize vessels and its equipment and paid off related debt. For additional information related to the sale of this vessel, see Note 4 – Gain on Sale of Assets.

At June 30, 2015, we reclassified the remaining two Handysize vessels and their related equipment and inventory from assets held for sale to assets held in use (vessels, property, and other equipment) and recorded an impairment loss of approximately $1.8 million to adjust the vessels to current fair market value. As a result of the held for sale classification, there was no depreciation expense related to these assets during the first half of 2015.

During the third quarter of 2015, we recorded an additional impairment loss of approximately $1.1 million on our Jones Act Tug/Barge unit, which is included in current assets held for sale – refer to Note 3 – Impairment Loss. Our November 2015 debt

14

amendments require us to apply any future proceeds from this sale to payments toward one of our credit facilities. While we continue to actively market this unit, it is classified as held for sale; therefore, there was no depreciation expense related to this vessel during the nine months ended September 30, 2015.

In October of 2015, our Board of Directors approved a Strategic Plan that requires the divestiture of certain non-core assets, which includes the Jones Act Tug/Barge unit and the two Handysize vessels discussed above. For more information regarding the Strategic Plan, see Note 21 – Subsequent Events.

NOTE 9 – INCOME TAXES

We recorded a tax provision of $0.4 million on our $13.2 million loss before taxes and equity in net income (loss) of unconsolidated entities for the nine months ended September 30, 2015. For the first nine months of 2014 we recorded an income tax provision of $0.9 million on our $5.2 million loss before equity in net loss of unconsolidated entities. These provision amounts represent our qualifying U.S. flag operations, which continue to be taxed under the “tonnage tax” provisions rather than the normal U.S. corporate income tax provisions, state income taxes paid, and foreign income tax withholdings or refunds. In accordance with Internal Revenue Code (IRC) Section 1359 disposition of qualifying vessels, we have elected to defer taxable gains on the sale of qualifying tonnage tax vessels operating under the tonnage tax regime. IRC Section 1359(b) defers the recognition of taxable gains for three years after the close of the first taxable year in which the gain is realized or subject to such terms and conditions as may be specified by the Secretary of the Internal Revenue Service, on such later date as the Secretary may designate upon application by the taxpayer. Deferred gains on the sale of qualifying vessels must be recognized if the amount realized upon such sale or disposition exceeds the cost of the replacement qualifying vessel, limited to the gain recognized on the transaction. We have elected to defer gains of approximately $93.9 million from the dispositions of qualifying vessels in prior years, of which $79.3 million of such deferred gain originated in the year ending December 31, 2012. In order to meet the non-recognition requirements on the 2012 dispositions, we would need to acquire qualifying replacement property by December 31, 2015.

During the quarter ended September 30, 2015, we acquired qualified replacement property totaling approximately $45.6 million. We anticipate a transaction for an additional $25.0 million of replacement property before December 31, 2015, which would be applied to deferred gains of $17.3 million and $7.7 million with replacement years of 2015 and 2018, respectively. It is uncertain if the remaining $16.4 million of potentially taxable gains with a replacement period set to expire on December 31, 2015 will be replaced on or before December 31, 2015. In order to meet the non-recognition requirements on these 2012 dispositions, we would need to acquire additional qualifying replacement property to replace the $16.4 million by December 31, 2015. To the extent any gain is recognized, we expect to utilize existing tax attributes to offset such gain.

During the quarter ended September 30, 2015, we changed our previously asserted position that we planned to indefinitely re-invest foreign earnings of our controlled foreign corporations. The principal reason for changing our position is our current plan to divest foreign business use assets and repatriate excess foreign cash to pay down U.S. debt of domestic affiliates. We have recorded a deferred tax liability of $4.7 million related to our controlled foreign corporations as a result of our change in position. We recorded a decrease in our valuation allowance as discussed below.

We established a valuation allowance against deferred income tax assets in 2014 because, based on available information, we could not conclude that it was more likely than not that the full amount of deferred income tax assets generated primarily by net operating loss carryforwards and alternative minimum tax credits would be realized through the generation of taxable income in the near future. We have and will continue to evaluate the need for a valuation allowance on a quarterly basis. We recorded a decrease in our valuation allowance of $7.5 million for the nine months ended September 30, 2015, which reflects the decrease in net operating loss attributes that are estimated to be utilized to offset the recognition of the gains related to the 2012 dispositions as well as the change in assertion to indefinitely re-invest foreign earnings of our controlled foreign corporations. During the quarter ending September 30, 2015, we changed our assertions related to the 2012 dispositions and foreign earnings due to the plan approved by our Board of Directors to divest foreign use assets and repatriate excess foreign cash to pay down U.S. debt obligations. Uncertainty exists as to the extent cash will be available to acquire replacement property for the 2012 dispositions by the December 31, 2015 deadline as a result of the plan.

For further information on certain tax laws and elections, see our Annual Report on Form 10-K filed for the year ended December 31, 2014, including Note J - Income Taxes to the consolidated financial statements included therein.

NOTE 10 – COMMITMENTS AND CONTINGENCIES

Commitments

During the third quarter of 2014, we were notified of the bankruptcy of a ship builder that had agreed to build a new Handysize Dry Bulk Carrier. Upon notification of the bankruptcy, we reclassified our deposit of $3.9 million from construction in progress to accounts receivable and we recorded an additional $0.3 million of interest income. On January 6, 2015, we collected $4.2 million which represented the return of our deposit and related interest.

15

Contingencies

As of September 30, 2015, we held three vessels under operating lease contracts, which included a Molten-Sulphur Carrier in our Jones Act segment and two Pure Car Truck Carriers that operate under our PCTC segment. These lease agreements impose certain financial covenants, including defined minimum working capital and net worth requirements, and prohibit us from incurring, without the lessor’s prior written consent, additional debt or lease obligations, subject to certain specified exceptions. These financial covenants are generally similar, but not identical, to the financial covenants set forth under our Credit Facility - see Note 13 – Debt Obligations. Additionally, our vessel operating lease agreements contain early buy-out options and fair value purchase options that enable us to purchase the vessels under certain specified circumstances. In the event that we default under any of our operating lease agreements, we may be forced to buy back the three vessels for a stipulated loss value of approximately $75.1 million. Effective at the end of the third quarter of 2015, we entered into separate limited waiver agreements with all of our lessors. Under these agreements, the lessors waived defaults under certain specified working capital, minimum liquidity, tangible net worth and fixed charge coverage covenants generally through at least November 30, 2015. As of November 16, 2015, we reached separate agreements with each of our lessors to extend their waivers through March 31, 2016. As of September 30, 2015, we concluded the fair market value of these vessels exceeded the stipulated loss value; as such, if we were required to buy back these vessels, we would not anticipate a loss.

On and after June 26, 2014, U.S. Customs and Border Protection (CBP) issued pre-penalty notifications to us and two of our affiliates alleging failure to properly report the importation of spare parts incorporated into our vessels covering the period April 2008 through September 2012. Under these notifications, CBP’s proposed duty is currently approximately $1.4 million along with a proposed penalty on the assessment of approximately $5.7 million. The basis of CBP’s assessment is that the U. S. Government experienced a loss of revenue consisting of the difference between the government’s ad valorem duty and the consumption entry duty actually paid by us. On September 24, 2014, we submitted our formal response to CBP’s claim and denied violating the applicable U.S. statute or regulations. We have not accrued a liability for this matter because we believe it is premature (i) to determine whether an accrual is warranted and (ii) if so, to determine a reasonable estimate of probable liability.

Note 13 – Debt Obligations contains a discussion of our debt guarantees under the subheading “Guarantees.” For further information on our commitments and contingencies, see Note K – Commitments and Contingencies to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014.

16

NOTE 11 – EMPLOYEE BENEFIT PLANS

The following table provides the components of net periodic benefit cost for our pension plan and postretirement benefits plan for the three months ended September 30, 2015 and 2014:

|

(All Amounts in Thousands) |

Pension Plan |

Postretirement Benefits |

||||||||||

|

Three Months Ended September 30, |

Three Months Ended September 30, |

|||||||||||

|

Components of net periodic benefit cost: |

2015 |

2014 |

2015 |

2014 |

||||||||

|

Service cost |

$ |

171 |

$ |

155 |

$ |

8 |

$ |

4 | ||||

|

Interest cost |

359 | 381 | 118 | 144 | ||||||||

|

Expected return on plan assets |

(638) | (571) |

- |

- |

||||||||

|

Amortization of prior service cost |

(1) | (1) | 26 | 25 | ||||||||

|

Amortization of net loss |

111 | 32 | 37 | 44 | ||||||||

|

Net periodic benefit cost (benefit) |

$ |

2 |

$ |

(4) |

$ |

189 |

$ |

217 | ||||

The following table provides the components of net periodic benefit cost for our pension plan and postretirement benefits plan for the nine months ended September 30, 2015 and 2014:

|

(All Amounts in Thousands) |

Pension Plan |

Postretirement Benefits |

||||||||||

|

Nine Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||

|

Components of net periodic benefit cost: |

2015 |

2014 |

2015 |

2014 |

||||||||

|

Service cost |

$ |

513 |

$ |

464 |

$ |

24 |

$ |

11 | ||||

|

Interest cost |

1,077 | 1,143 | 354 | 433 | ||||||||

|

Expected return on plan assets |

(1,914) | (1,797) |

- |

- |

||||||||

|

Amortization of prior service cost |

(3) | (2) | 78 | 75 | ||||||||

|

Amortization of net loss |

333 | 96 | 111 | 131 | ||||||||

|

Net periodic benefit cost (benefit) |

$ |

6 |

$ |

(96) |

$ |

567 |

$ |

650 | ||||

We contributed $480,000 to our pension plan for the nine months ended September 30, 2015. We expect to contribute an additional $170,000 before December 31, 2015.

NOTE 12 – DERIVATIVE INSTRUMENTS

We use derivative instruments from time to time to manage certain foreign currency and interest rate risk exposures. We do not use derivative instruments for speculative trading purposes. All derivative instruments are recorded on the balance sheet at fair value. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is recorded through other comprehensive income and reclassified to earnings when the derivative instrument is settled. Any ineffective portion of changes in the fair value of the derivative is reported in earnings. None of our derivative contracts contain credit-risk related contingent features that would require us to settle the contract upon the occurrence of such contingency. However, all of our contracts contain clauses specifying events of default under specified circumstances, including failure to pay, breach of agreement, default under the specific agreement to which the hedge relates, bankruptcy, misrepresentation and the occurrence of certain transactions. The remedy for default is settlement in entirety or payment of the fair value of the contracts, which was a liability of $107,000 in the aggregate for all of our contracts as of September 30, 2015 (see table below). As of March 31, 2015, we expected to refinance our Yen-based credit facility with a U.S. dollar facility. Interest payable under the Yen-based loan was fixed after we entered into a variable-to-fixed interest rate swap in 2009. Due to our determination at March 31, 2015 that it was more likely than not that the Yen-based loan would be refinanced, we classified the interest rate swap as completely ineffective at March 31, 2015. As a result, we recorded at such time a $2.8 million charge to derivative loss on our Condensed Consolidated Statement of Operations with the offset to other comprehensive loss. In April 2015, we refinanced our Yen-based facility with a USD-based facility and paid approximately $2.9 million to settle our related interest rate swap. At December 31, 2014, we had a derivative liability of $3.0 million, which was recorded in other liabilities (long-term) on the Condensed Consolidated Balance Sheet as it related to this interest rate swap. The unrealized loss related to our derivative instruments included in accumulated other comprehensive loss, net of taxes, was $0.4 million and $3.7 million as of September 30, 2015 and December 31, 2014, respectively. As of September 30, 2015, we were no longer party to any interest rate swap agreements with the exception of our minority interest ownership in Oslo Bulk, AS, which is a party to one agreement.

We routinely evaluate our preferred equity instruments, to determine whether the derivative feature embedded in the hybrid instruments should be bifurcated and accounted for separately. Based on the fact that we elected to defer our cumulative preferred dividend payments in October 2015 and penalties apply if we miss more than one payment, we determined that (i) the penalty

17