UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-00249 | |

| Exact name of registrant as specified in charter: | Delaware Group® Equity Funds I | |

| Address of principal executive offices: | 610 Market Street | |

| Philadelphia, PA 19106 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 610 Market Street | ||

| Philadelphia, PA 19106 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | October 31 | |

| Date of reporting period: | October 31, 2021 |

Item 1. Reports to Stockholders

|

|

|

Annual report | |

US equity mutual fund

Delaware Mid Cap Value Fund

October 31, 2021

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds by Macquarie®

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Mid Cap Value Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of October 31, 2021, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

| Portfolio management review | |

| Delaware Mid Cap Value Fund | November 9, 2021 (Unaudited) |

| Performance preview (for the year ended October 31, 2021) | ||||

| Delaware Mid Cap Value Fund (Institutional Class shares) | 1-year return | +51.85% | ||

| Delaware Mid Cap Value Fund (Class A shares) | 1-year return | +51.43% | ||

| Russell Midcap® Value Index (benchmark) | 1-year return | +48.60% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Mid Cap Value Fund, please see the table on page 4.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 6 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks capital appreciation.

Market review

Mid-cap value stocks experienced a strong run during the Fund’s fiscal year ended October 31, 2021. During the fiscal year, value companies generally outperformed growth companies across the US market capitalization spectrum as investors showed a preference for higher-quality companies in cyclical and economically sensitive industries. The performance disparity between value companies and growth companies was significant in mid-cap equities over the fiscal year, as the Russell Midcap Value Index returned 48.60%, outpacing the 39.43% return of the Russell Midcap® Growth Index. The small-cap Russell 2000® Value Index was the strongest-performing value index during the Fund’s fiscal year, gaining 64.30%. Large-cap value companies typically gained less than small-and mid-cap value companies as the larger-cap Russell 1000® Value Index advanced 43.76%.

In our opinion, Delaware Mid Cap Value Fund benefited from:

| ● | vaccines providing a boost to the economy |

| ● | investors’ preference for high-quality, cyclical businesses |

| ● | a sharp increase in energy demand |

| ● | stock selection and an overweight position in financial services. |

Each of the sectors in the Russell Midcap Value Index advanced during the Fund’s fiscal year. Companies in the energy, financial services, real estate investment trusts (REITs), and basic industry sectors of the Russell Midcap Value Index were the strongest performing. The utilities,

1

Portfolio management review

Delaware Mid Cap Value Fund

consumer staples, and healthcare sectors in the Russell Midcap Value Index advanced during the Fund’s fiscal year but were relative laggards.

The US Food and Drug Administration (FDA) approved two COVID-19 vaccines in November 2020, resulting in a surge in US equity markets. The US economy continued to improve during the fiscal year, aided by strengthening consumer confidence and spending. The real gross domestic product (GDP) growth rate improved during the period as GDP increased at an annual rate of 2.0% in the third quarter of 2021, according to the US Bureau of Economic Analysis’s advance estimate. The unemployment rate declined from 6.9% in October 2020 to 4.6% in October 2021. For the 12 months ended October 31, 2021, the US Consumer Price Index (CPI) increased 6.2% and the US Producer Price Index (PPI) increased 8.6%. These inflation measures reflect considerable pent-up consumer demand in areas such as travel, entertainment, and dining out, which were among the sectors most negatively impacted by the pandemic. During the Fund’s fiscal year, the US Federal Reserve maintained its extremely accommodative monetary policy, keeping short-term rates near zero.

Within the Fund

For the fiscal year ended October 31, 2021, Delaware Mid Cap Value Fund outperformed its benchmark, the Russell Midcap Value Index. The Fund’s Institutional Class shares advanced 51.85%. The Fund’s Class A shares gained 51.43% at net asset value (NAV) and 42.83% at maximum offer price. These figures reflect reinvestment of all distributions. During the same period, the Fund’s benchmark advanced 48.60%. For complete annualized performance of Delaware Mid Cap Value Fund, please see the table on page 4.

Stock selection and sector positioning contributed to relative outperformance during the fiscal year.

Stock selection and a relative overweight allocation benefited the financial services sector. The Fund’s holdings in the industrials and REITs sectors outperformed those in the benchmark during the fiscal year. The Fund’s holdings in the basic industry, consumer discretionary, and transportation sectors advanced during the fiscal year but lagged the stronger returns of those sectors in the benchmark and thus detracted from relative performance.

Shares of regional bank East West Bancorp Inc. outperformed for the fiscal year. East West Bancorp, headquartered in California, is one of the largest independent banks, operating more than 120 locations in the US and China. The bank reported multiple quarters of better-than-expected earnings results during the fiscal year. We maintained the Fund’s position in East West Bancorp as of the end of the Fund’s fiscal year, as its loan growth is accelerating and its profitability is strong.

American Financial Group Inc. is an insurance holding company with primary business segments in property and casualty insurance and annuities. During the Fund’s fiscal year, American Financial Group outperformed as the company reported better-than-consensus earnings results for each reported quarter. During the Fund’s fiscal year, American Financial Group reported a favorable agreement to sell its Great American Life Insurance Company to Massachusetts Mutual Life Insurance Company (MassMutual) for $3.5 billion. We exited the Fund’s position in American Financial Group prior to the end of the fiscal year and used the proceeds to invest in other financial services firms.

Stock selection in the energy sector contributed to performance. The Fund’s position in independent oil and gas exploration and production (E&P) company Marathon Oil Corp. outperformed. During the fiscal year, the reopening of the US economy led to an increase in demand for oil, thus

2

benefiting Marathon Oil’s financial performance. For the Fund’s fiscal year, Marathon Oil maintained its capital budget, strengthened its balance sheet, and generated significant free cash flow, which it used to repurchase its stock and increase its dividend. We maintained the Fund’s position in Marathon Oil as of the end of the Fund’s fiscal year, as management is committed to returning capital to shareholders.

Michigan-based electric and natural gas utility CMS Energy Corp. lagged the returns of the utilities sector in the benchmark during the Fund’s fiscal year. CMS Energy has an excellent financial and operational track record and historically trades at a premium multiple to its peers in the multi-utility industry. During the Fund’s fiscal year, utility companies’ multiples contracted. This had a large impact on CMS Energy. We maintained the Fund’s position in CMS Energy as of the end of the Fund’s fiscal year; however, as the company’s earnings are growing above peer levels through what we view as its best-in-class cost management and its rate-base investments that include clean energy.

During the Fund’s fiscal year, shares of Newmont Corp. lagged the broader metals and mining industry. Newmont is the world’s leading gold-mining company and a producer of copper, silver, zinc, and lead. We believed Newmont’s stock-price performance would lag during periods of strong market performance, and that is what we experienced during the Fund’s fiscal year. During this period, Newmont increased its dividend and repurchased its stock. This is consistent with the company’s commitment to return incremental free cash flow to shareholders. We maintained the Fund’s position in Newmont as of the end of the Fund’s fiscal year, as it generates significant free cash flow and remains disciplined with its use of capital.

Cable One Inc. is a video, broadband communications, and telephone provider serving residential and business customers in 24 states. With more Americans staying home during the pandemic, Cable One added more broadband subscribers than expected. During the Fund’s fiscal year, Cable One’s subscription growth began to slow, and its shares lagged the stronger returns of the company’s peers in the media industry. We maintained the Fund’s position in Cable One as of the end of the Fund’s fiscal year, as its financial results remain strong, it continues to grow free cash flow, and has organic growth potential, in our opinion.

The Fund ended the fiscal year overweight the financial services, technology, basic industry, and transportation sectors. The Fund ended the fiscal year underweight the REITs, healthcare, consumer staples, and utilities sectors. Sector weightings were like those in the benchmark in the consumer discretionary, industrials, and energy sectors at fiscal year-end.

Our team’s disciplined philosophy remains unchanged. We continue to focus on bottom-up stock selection and specifically on identifying companies that, in our view, trade at attractive valuations, generate strong free cash flow, and have the ability to implement shareholder-friendly policies through share buybacks, dividend increases, and debt reduction.

3

| Performance summary | |

| Delaware Mid Cap Value Fund | October 31, 2021 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through October 31, 2021 | |||||||||||

| 1 year | 5 year | 10 year | Lifetime | |||||||||

| Class A (Est. February 1, 2008) | ||||||||||||

| Excluding sales charge | +51.43 | % | +11.80 | % | +11.27 | % | +8.44 | % | ||||

| Including sales charge | +42.83 | % | +10.49 | % | +10.61 | % | +7.98 | % | ||||

| Class C (Est. July 31, 2008) | ||||||||||||

| Excluding sales charge | +50.25 | % | +10.93 | % | +10.41 | % | +8.20 | % | ||||

| Including sales charge | +49.25 | % | +10.93 | % | +10.41 | % | +8.20 | % | ||||

| Class R (Est. July 31, 2008) | ||||||||||||

| Excluding sales charge | +51.25 | % | +11.51 | % | +10.97 | % | +8.78 | % | ||||

| Including sales charge | +51.25 | % | +11.51 | % | +10.97 | % | +8.78 | % | ||||

| Institutional Class (Est. February 1, 2008) | ||||||||||||

| Excluding sales charge | +51.85 | % | +12.04 | % | +11.52 | % | +8.69 | % | ||||

| Including sales charge | +51.85 | % | +12.04 | % | +11.52 | % | +8.69 | % | ||||

| Russell Midcap Value Index | +48.60 | % | +12.30 | % | +13.18 | % | +9.87 | %* | ||||

| * | The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the month end prior to the Fund’s Institutional Class inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

4

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 0.89% of the Fund’s average daily net assets during the period from November 1, 2020 through October 31, 2021.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Institutional | ||||||||

| Fund expense ratios | Class A | Class C | Class R | Class | ||||

| Total annual operating expenses (without fee waivers) |

1.45% | 2.20% | 1.70% | 1.20% | ||||

| Net expenses (including fee waivers, if any) |

1.14% | 1.89% | 1.39% | 0.89% | ||||

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

| * | The aggregate contractual waiver period covering this report is from February 28, 2020 through March 1, 2022. |

5

Performance summary

Delaware Mid Cap Value Fund

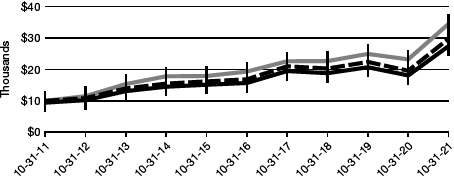

Performance of a $10,000 investment1

Average annual total returns from October 31, 2011 through October 31, 2021

| For period beginning October 31, 2011 through October 31, 2021 | Starting value | Ending value | |||||

|

Russell Midcap Value Index |

$10,000 |

$34,491 | ||||

|

Delaware Mid Cap Value Fund — Institutional Class shares |

$10,000 |

$29,755 | ||||

|

Delaware Mid Cap Value Fund — Class A shares |

$9,425 |

$27,407 | ||||

|

1 |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on October 31, 2011, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 7. |

The graph also assumes $10,000 invested in the Russell Midcap Value Index as of October 31, 2011. The Russell Midcap Value Index measures the performance of the mid-cap value segment of the US equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell Midcap Growth Index, mentioned on page 1, measures the performance of the mid-cap growth segment of the US equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index, mentioned on page 1, measures the performance of the large-cap value segment of the US equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Value Index, mentioned on page 1, measures the performance of the small-cap value segment of the US equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

6

The US Consumer Price Index (CPI), mentioned on page 2, is a measure of inflation that is calculated by the US Department of Labor, representing changes in prices of all goods and services purchased for consumption by urban households.

The US Producer Price Index (PPI), mentioned on page 2, measures the average change over time in the selling price of goods and services sold by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

Gross domestic product, mentioned on page 2, is a measure of all goods and services produced by a nation in a year. It is a measure of economic activity.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

| Nasdaq symbols | CUSIPs | |||

| Class A | DLMAX | 246093868 | ||

| Class C | DLMCX | 246093850 | ||

| Class R | DLMRX | 246093843 | ||

| Institutional Class | DLMIX | 246093835 |

7

Disclosure of Fund expenses

For the six-month period from May 1, 2021 to October 31, 2021 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from May 1, 2021 to October 31, 2021.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

8

Delaware Mid Cap Value Fund

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||||

| 5/1/21 | 10/31/21 | Expense Ratio | 5/1/21 to 10/31/21* | ||||||||||||||

| Actual Fund return† | |||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,041.80 | 1.14% | $ | 5.87 | ||||||||||

| Class C | 1,000.00 | 1,037.30 | 1.89% | 9.71 | |||||||||||||

| Class R | 1,000.00 | 1,039.40 | 1.39% | 7.15 | |||||||||||||

| Institutional Class | 1,000.00 | 1,041.80 | 0.89% | 4.58 | |||||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,019.46 | 1.14% | $ | 5.80 | ||||||||||

| Class C | 1,000.00 | 1,015.68 | 1.89% | 9.60 | |||||||||||||

| Class R | 1,000.00 | 1,018.20 | 1.39% | 7.07 | |||||||||||||

| Institutional Class | 1,000.00 | 1,020.72 | 0.89% | 4.53 | |||||||||||||

| * |

“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| † |

Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Fund’s expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

9

Security type / sector allocations and top 10 equity holdings

| Delaware Mid Cap Value Fund | As of October 31, 2021 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials.

The sector designations may represent the investment manager’s internal sector classifications.

| Security type / sector | Percentage of net assets | |

| Common Stock | 97.99% | |

| Basic Industry | 8.56% | |

| Business Services | 1.40% | |

| Capital Spending | 9.85% | |

| Consumer Cyclical | 6.23% | |

| Consumer Services | 8.22% | |

| Consumer Staples | 2.67% | |

| Energy | 5.42% | |

| Financial Services | 20.74% | |

| Healthcare | 5.88% | |

| Real Estate Investment Trusts | 7.68% | |

| Technology | 12.63% | |

| Transportation | 2.99% | |

| Utilities | 5.72% | |

| Short-Term Investments | 0.92% | |

| Total Value of Securities | 98.91% | |

| Receivables and Other Assets Net of Liabilities | 1.09% | |

| Total Net Assets | 100.00% |

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets | |

| East West Bancorp | 2.43% | |

| Hess | 2.24% | |

| Raymond James Financial | 2.12% | |

| Teradyne | 2.03% | |

| Synopsys | 1.96% | |

| Quanta Services | 1.96% | |

| Synchrony Financial | 1.79% | |

| Huntsman | 1.75% | |

| Hartford Financial Services Group | 1.75% | |

| KeyCorp | 1.71% |

10

| Delaware Mid Cap Value Fund | October 31, 2021 |

| Number of | ||||||

| shares | Value (US $) | |||||

| Common Stock – 97.99% | ||||||

| Basic Industry – 8.56% | ||||||

| Alcoa | 9,000 | $ | 413,550 | |||

| Axalta Coating Systems † | 12,250 | 382,077 | ||||

| Berry Global Group † | 12,451 | 816,039 | ||||

| Celanese | 4,200 | 678,342 | ||||

| Crown Holdings | 5,800 | 603,142 | ||||

| Graphic Packaging Holding | 35,250 | 702,532 | ||||

| Huntsman | 34,400 | 1,120,752 | ||||

| Louisiana-Pacific | 7,400 | 436,082 | ||||

| Newmont | 5,800 | 313,200 | ||||

| 5,465,716 | ||||||

| Business Services – 1.40% | ||||||

| Brink’s | 7,650 | 526,932 | ||||

| ManpowerGroup | 3,800 | 367,270 | ||||

| 894,202 | ||||||

| Capital Spending – 9.85% | ||||||

| AECOM † | 12,500 | 854,625 | ||||

| AMETEK | 3,100 | 410,440 | ||||

| Gates Industrial † | 25,950 | 426,618 | ||||

| ITT | 11,000 | 1,034,770 | ||||

| KBR | 25,100 | 1,065,244 | ||||

| Oshkosh | 6,000 | 642,000 | ||||

| Quanta Services | 10,300 | 1,249,184 | ||||

| United Rentals † | 1,600 | 606,576 | ||||

| 6,289,457 | ||||||

| Consumer Cyclical – 6.23% | ||||||

| Aptiv † | 4,700 | 812,583 | ||||

| DR Horton | 11,850 | 1,057,849 | ||||

| Johnson Controls International | 11,918 | 874,424 | ||||

| Regal Rexnord | 2,600 | 396,058 | ||||

| Stanley Black & Decker | 4,650 | 835,745 | ||||

| 3,976,659 | ||||||

| Consumer Services – 8.22% | ||||||

| AutoZone † | 450 | 803,178 | ||||

| Cable One | 200 | 342,242 | ||||

| Darden Restaurants | 3,350 | 482,869 | ||||

| Dollar Tree † | 4,200 | 452,592 | ||||

| Hasbro | 4,400 | 421,344 | ||||

| Marriott International Class A † | 5,970 | 955,319 | ||||

| Polaris | 4,200 | 482,790 | ||||

11

Schedule of investments

Delaware Mid Cap Value Fund

| Number of | ||||||

| shares | Value (US $) | |||||

| Common Stock (continued) | ||||||

| Consumer Services (continued) | ||||||

| PVH † | 2,350 | $ | 256,926 | |||

| Ross Stores | 4,200 | 475,440 | ||||

| VF | 4,750 | 346,180 | ||||

| ViacomCBS Class B | 6,300 | 228,186 | ||||

| 5,247,066 | ||||||

| Consumer Staples – 2.67% | ||||||

| Campbell Soup | 4,900 | 195,755 | ||||

| Conagra Brands | 11,450 | 368,690 | ||||

| Kellogg | 6,000 | 367,800 | ||||

| Tyson Foods Class A | 4,850 | 387,854 | ||||

| US Foods Holding † | 11,050 | 383,104 | ||||

| 1,703,203 | ||||||

| Energy – 5.42% | ||||||

| Coterra Energy | 27,000 | 575,640 | ||||

| Hess | 17,350 | 1,432,589 | ||||

| Marathon Oil | 64,850 | 1,058,352 | ||||

| Valero Energy | 5,100 | 394,383 | ||||

| 3,460,964 | ||||||

| Financial Services – 20.74% | ||||||

| Affiliated Managers Group | 3,900 | 654,732 | ||||

| Allstate | 6,950 | 859,507 | ||||

| Assurant | 4,200 | 677,502 | ||||

| East West Bancorp | 19,500 | 1,549,860 | ||||

| Globe Life | 5,675 | 505,189 | ||||

| Hancock Whitney | 14,900 | 737,252 | ||||

| Hartford Financial Services Group | 15,350 | 1,119,475 | ||||

| KeyCorp | 46,850 | 1,090,199 | ||||

| Raymond James Financial | 13,700 | 1,350,683 | ||||

| Reinsurance Group of America | 4,850 | 572,688 | ||||

| Signature Bank | 2,900 | 863,678 | ||||

| State Street | 6,800 | 670,140 | ||||

| Synchrony Financial | 24,650 | 1,144,992 | ||||

| Synovus Financial | 14,700 | 684,873 | ||||

| Western Alliance Bancorp | 6,600 | 766,194 | ||||

| 13,246,964 | ||||||

| Healthcare – 5.88% | ||||||

| AmerisourceBergen | 4,650 | 567,393 | ||||

| Quest Diagnostics | 5,150 | 755,917 | ||||

| Service Corp. International | 8,067 | 552,509 | ||||

12

| Number of | ||||||

| shares | Value (US $) | |||||

| Common Stock (continued) | ||||||

| Healthcare (continued) | ||||||

| STERIS | 3,000 | $ | 701,220 | |||

| Syneos Health † | 5,200 | 485,368 | ||||

| Zimmer Biomet Holdings | 4,850 | 694,132 | ||||

| 3,756,539 | ||||||

| Real Estate Investment Trusts – 7.68% | ||||||

| Apartment Income REIT | 11,727 | 628,685 | ||||

| Brandywine Realty Trust | 33,900 | 449,175 | ||||

| Host Hotels & Resorts † | 23,400 | 393,822 | ||||

| Kimco Realty | 30,000 | 678,000 | ||||

| Life Storage | 5,225 | 699,157 | ||||

| MGM Growth Properties Class A | 18,200 | 716,716 | ||||

| Outfront Media | 21,700 | 540,113 | ||||

| Spirit Realty Capital | 16,300 | 797,559 | ||||

| 4,903,227 | ||||||

| Technology – 12.63% | ||||||

| Agilent Technologies | 6,650 | 1,047,308 | ||||

| Avnet | 12,500 | 476,375 | ||||

| Ciena † | 9,900 | 537,471 | ||||

| Fiserv † | 2,650 | 260,999 | ||||

| Flex † | 39,850 | 673,465 | ||||

| Keysight Technologies † | 5,025 | 904,600 | ||||

| ON Semiconductor † | 13,350 | 641,735 | ||||

| Qorvo † | 4,600 | 773,858 | ||||

| Synopsys † | 3,750 | 1,249,425 | ||||

| Teradyne | 9,400 | 1,299,456 | ||||

| Western Digital † | 3,900 | 203,931 | ||||

| 8,068,623 | ||||||

| Transportation – 2.99% | ||||||

| CSX | 8,650 | 312,871 | ||||

| JB Hunt Transport Services | 2,750 | 542,272 | ||||

| Kirby † | 6,800 | 356,388 | ||||

| Southwest Airlines † | 14,700 | 695,016 | ||||

| 1,906,547 | ||||||

| Utilities – 5.72% | ||||||

| CMS Energy | 10,800 | 651,780 | ||||

| Edison International | 7,300 | 459,389 | ||||

| MDU Resources Group | 13,600 | 417,928 | ||||

| NRG Energy | 14,400 | 574,416 | ||||

| Public Service Enterprise Group | 12,750 | 813,450 | ||||

13

Schedule of investments

Delaware Mid Cap Value Fund

| Number of | |||||

| shares | Value (US $) | ||||

| Common Stock (continued) | |||||

| Utilities (continued) | |||||

| WEC Energy Group | 4,500 | $ | 405,270 | ||

| Xcel Energy | 5,100 | 329,409 | |||

| 3,651,642 | |||||

| Total Common Stock (cost $38,680,462) | 62,570,809 | ||||

| Short-Term Investments – 0.92% | |||||

| Money Market Mutual Funds – 0.92% | |||||

| BlackRock FedFund – Institutional Shares (seven-day effective yield 0.03%) |

146,960 | 146,960 | |||

| Fidelity Investments Money Market Government Portfolio – Class I (seven-day effective yield 0.01%) |

146,960 | 146,960 | |||

| GS Financial Square Government Fund – Institutional Shares (seven-day effective yield 0.03%) |

146,960 | 146,960 | |||

| Morgan Stanley Government Portfolio – Institutional Share Class (seven-day effective yield 0.03%) |

146,961 | 146,961 | |||

| Total Short-Term Investments (cost $587,841) | 587,841 | ||||

| Total Value of Securities–98.91% | |||||

| (cost $39,268,303) | $ | 63,158,650 | |||

| † | Non-income producing security. |

Summary of abbreviations:

GS – Goldman Sachs

REIT – Real Estate Investment Trust

See accompanying notes, which are an integral part of the financial statements.

14

| Statement of assets and liabilities | |

| Delaware Mid Cap Value Fund | October 31, 2021 |

| Assets: | ||

| Investments, at value* | $ | 63,158,650 |

| Cash | 6,294 | |

| Receivable for fund shares sold | 750,280 | |

| Dividends receivable | 37,238 | |

| Receivable for securities sold | 33,283 | |

| Foreign tax reclaims receivable | 1,184 | |

| Total Assets | 63,986,929 | |

| Liabilities: | ||

| Investment management fees payable to affiliates | 44,935 | |

| Payable for fund shares redeemed | 22,974 | |

| Accounting and administration fees payable to non-affiliates | 17,174 | |

| Reports and statements to shareholders expenses payable to non-affiliates | 17,027 | |

| Dividend disbursing and transfer agent fees and expenses payable to non-affiliates |

10,010 | |

| Distribution fees payable to affiliates | 5,915 | |

| Other accrued expenses | 5,151 | |

| Audit and tax fees payable | 4,365 | |

| Accounting and administration expenses payable to affiliates | 554 | |

| Dividend disbursing and transfer agent fees and expenses payable to affiliates | 511 | |

| Legal fees payable to affiliates | 239 | |

| Trustees’ fees and expenses payable to affiliates | 116 | |

| Reports and statements to shareholders expenses payable to affiliates | 107 | |

| Total Liabilities | 129,078 | |

| Total Net Assets | $ | 63,857,851 |

| Net Assets Consist of: | ||

| Paid-in capital | $ | 41,536,259 |

| Total distributable earnings (loss) | 22,321,592 | |

| Total Net Assets | $ | 63,857,851 |

15

Statement of assets and liabilities

Delaware Mid Cap Value Fund

| Net Asset Value | |||

| Class A: | |||

| Net assets | $ | 14,035,687 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 1,706,038 | ||

| Net asset value per share | $ | 8.23 | |

| Sales charge | 5.75 | % | |

| Offering price per share, equal to net asset value per share / (1 - sales charge) | $ | 8.73 | |

| Class C: | |||

| Net assets | $ | 4,185,586 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 557,247 | ||

| Net asset value per share | $ | 7.51 | |

| Class R: | |||

| Net assets | $ | 202,250 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 24,767 | ||

| Net asset value per share | $ | 8.17 | |

| Institutional Class: | |||

| Net assets | $ | 45,434,328 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 5,518,462 | ||

| Net asset value per share | $ | 8.23 | |

| ____________________ | |||

| * Investments, at cost | $ | 39,268,303 |

See accompanying notes, which are an integral part of the financial statements.

16

| Statement of operations | |

| Delaware Mid Cap Value Fund | Year ended October 31, 2021 |

| Investment Income: | |||

| Dividends | $ | 1,992,577 | |

| Foreign tax withheld | 1,184 | ||

| 1,993,761 | |||

| Expenses: | |||

| Management fees | 591,099 | ||

| Distribution expenses – Class A | 26,086 | ||

| Distribution expenses – Class C | 25,395 | ||

| Distribution expenses – Class R | 2,035 | ||

| Dividend disbursing and transfer agent fees and expenses | 91,982 | ||

| Registration fees | 71,667 | ||

| Accounting and administration expenses | 51,584 | ||

| Audit and tax fees | 31,764 | ||

| Reports and statements to shareholders expenses | 28,917 | ||

| Legal fees | 27,052 | ||

| Custodian fees | 6,932 | ||

| Trustees’ fees and expenses | 3,025 | ||

| Other | 13,741 | ||

| 971,279 | |||

| Less expenses waived | (216,334 | ) | |

| Less expenses paid indirectly | (49 | ) | |

| Total operating expenses | 754,896 | ||

| Net Investment Income | 1,238,865 | ||

| Net Realized and Unrealized Gain: | |||

| Net realized gain on investments | 6,803,513 | ||

| Net change in unrealized appreciation (depreciation) of investments | 24,055,839 | ||

| Net Realized and Unrealized Gain | 30,859,352 | ||

| Net Increase in Net Assets Resulting from Operations | $ | 32,098,217 |

See accompanying notes, which are an integral part of the financial statements.

17

Statements of changes in net assets

Delaware Mid Cap Value Fund

| Year ended | |||||||||

| 10/31/21 | 10/31/20 | ||||||||

| Increase (Decrease) in Net Assets from Operations: | |||||||||

| Net investment income | $ | 1,238,865 | $ | 830,229 | |||||

| Net realized gain (loss) | 6,803,513 | (8,940,819 | ) | ||||||

| Net change in unrealized appreciation (depreciation) | 24,055,839 | (4,366,560 | ) | ||||||

| Net increase (decrease) in net assets resulting from | |||||||||

| operations | 32,098,217 | (12,477,150 | ) | ||||||

| Dividends and Distributions to Shareholders from: | |||||||||

| Distributable earnings: | |||||||||

| Class A | (58,546 | ) | (7,832 | ) | |||||

| Class C | (4,116 | ) | — | ||||||

| Class R | (2,383 | ) | — | ||||||

| Institutional Class | (770,040 | ) | (270,191 | ) | |||||

| (835,085 | ) | (278,023 | ) | ||||||

| Capital Share Transactions: | |||||||||

| Proceeds from shares sold: | |||||||||

| Class A | 7,902,041 | 1,563,847 | |||||||

| Class C | 2,396,253 | 315,008 | |||||||

| Class R | 174,701 | 103,392 | |||||||

| Institutional Class | 10,216,482 | 88,760,665 | |||||||

| Net asset value of shares issued upon reinvestment of | |||||||||

| dividends and distributions: | |||||||||

| Class A | 58,536 | 7,649 | |||||||

| Class C | 4,116 | — | |||||||

| Class R | 2,383 | — | |||||||

| Institutional Class | 715,674 | 259,256 | |||||||

| 21,470,186 | 91,009,817 | ||||||||

18

| Year ended | |||||||||

| 10/31/21 | 10/31/20 | ||||||||

| Capital Share Transactions (continued): | |||||||||

| Cost of shares redeemed: | |||||||||

| Class A | $ | (4,091,297 | ) | $ | (3,150,172 | ) | |||

| Class C | (430,178 | ) | (585,359 | ) | |||||

| Class R | (399,615 | ) | (11,511 | ) | |||||

| Institutional Class | (56,918,622 | ) | (29,710,808 | ) | |||||

| (61,839,712 | ) | (33,457,850 | ) | ||||||

| Increase (decrease) in net assets derived from capital share | |||||||||

| transactions | (40,369,526 | ) | 57,551,967 | ||||||

| Net Increase (Decrease) in Net Assets | (9,106,394 | ) | 44,796,794 | ||||||

| Net Assets: | |||||||||

| Beginning of year | 72,964,245 | 28,167,451 | |||||||

| End of year | $ | 63,857,851 | $ | 72,964,245 | |||||

See accompanying notes, which are an integral part of the financial statements.

19

Financial highlights

Delaware Mid Cap Value Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of expenses to average net assets prior to fees waived3 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

20

| Year ended | ||||||||||||||||||||

| 10/31/21 | 10/31/20 | 10/31/19 | 10/31/18 | 10/31/17 | ||||||||||||||||

| $ | 5.48 | $ | 6.27 | $ | 5.94 | $ | 6.23 | $ | 5.09 | |||||||||||

| 0.11 | 0.05 | 0.02 | 0.03 | 0.02 | ||||||||||||||||

| 2.69 | (0.83 | ) | 0.52 | (0.24 | ) | 1.20 | ||||||||||||||

| 2.80 | (0.78 | ) | 0.54 | (0.21 | ) | 1.22 | ||||||||||||||

| (0.05 | ) | (0.01 | ) | (0.02 | ) | (0.02 | ) | (0.03 | ) | |||||||||||

| — | — | (0.19 | ) | (0.06 | ) | (0.05 | ) | |||||||||||||

| (0.05 | ) | (0.01 | ) | (0.21 | ) | (0.08 | ) | (0.08 | ) | |||||||||||

| $ | 8.23 | $ | 5.48 | $ | 6.27 | $ | 5.94 | $ | 6.23 | |||||||||||

| 51.43% | (12.53% | ) | 9.99% | (3.45% | ) | 24.17% | ||||||||||||||

| $ | 14,036 | $ | 6,913 | $ | 9,758 | $ | 10,377 | $ | 7,887 | |||||||||||

| 1.14% | 1.14% | 1.17% | 1.25% | 1.25% | ||||||||||||||||

| 1.41% | 1.45% | 2.06% | 2.34% | 2.86% | ||||||||||||||||

| 1.39% | 0.86% | 0.39% | 0.40% | 0.42% | ||||||||||||||||

| 1.12% | 0.55% | (0.50% | ) | (0.69% | ) | (1.19% | ) | |||||||||||||

| 19% | 43% | 12% | 20% | 24% | ||||||||||||||||

21

Financial highlights

Delaware Mid Cap Value Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of expenses to average net assets prior to fees waived3 |

| Ratio of net investment income (loss) to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

22

| Year ended | ||||||||||||||||||||

| 10/31/21 | 10/31/20 | 10/31/19 | 10/31/18 | 10/31/17 | ||||||||||||||||

| $ | 5.01 | $ | 5.78 | $ | 5.51 | $ | 5.81 | $ | 4.76 | |||||||||||

| 0.04 | 0.01 | (0.02 | ) | (0.02 | ) | (0.02 | ) | |||||||||||||

| 2.47 | (0.78 | ) | 0.48 | (0.22 | ) | 1.12 | ||||||||||||||

| 2.51 | (0.77 | ) | 0.46 | (0.24 | ) | 1.10 | ||||||||||||||

| (0.01 | ) | — | — | — | — | |||||||||||||||

| — | — | (0.19 | ) | (0.06 | ) | (0.05 | ) | |||||||||||||

| (0.01 | ) | — | (0.19 | ) | (0.06 | ) | (0.05 | ) | ||||||||||||

| $ | 7.51 | $ | 5.01 | $ | 5.78 | $ | 5.51 | $ | 5.81 | |||||||||||

| 50.25% | (13.32% | ) | 9.25% | (4.26% | ) | 23.30% | ||||||||||||||

| $ | 4,186 | $ | 1,454 | $ | 1,994 | $ | 1,837 | $ | 1,619 | |||||||||||

| 1.89% | 1.89% | 1.92% | 2.00% | 2.00% | ||||||||||||||||

| 2.16% | 2.20% | 2.81% | 3.09% | 3.61% | ||||||||||||||||

| 0.64% | 0.11% | (0.36% | ) | (0.35% | ) | (0.33% | ) | |||||||||||||

| 0.37% | (0.20% | ) | (1.25% | ) | (1.44% | ) | (1.94% | ) | ||||||||||||

| 19% | 43% | 12% | 20% | 24% | ||||||||||||||||

23

Financial highlights

Delaware Mid Cap Value Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of expenses to average net assets prior to fees waived3 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

24

| Year ended | ||||||||||||||||||||

| 10/31/21 | 10/31/20 | 10/31/19 | 10/31/18 | 10/31/17 | ||||||||||||||||

| $ | 5.44 | $ | 6.25 | $ | 5.93 | $ | 6.22 | $ | 5.08 | |||||||||||

| 0.08 | 0.03 | 0.01 | 0.01 | 0.01 | ||||||||||||||||

| 2.70 | (0.84 | ) | 0.51 | (0.23 | ) | 1.20 | ||||||||||||||

| 2.78 | (0.81 | ) | 0.52 | (0.22 | ) | 1.21 | ||||||||||||||

| (0.05 | ) | — | (0.01 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

| — | — | (0.19 | ) | (0.06 | ) | (0.05 | ) | |||||||||||||

| (0.05 | ) | — | (0.20 | ) | (0.07 | ) | (0.07 | ) | ||||||||||||

| $ | 8.17 | $ | 5.44 | $ | 6.25 | $ | 5.93 | $ | 6.22 | |||||||||||

| 51.25% | (12.96% | ) | 9.69% | (3.66% | ) | 23.96% | ||||||||||||||

| $ | 202 | $ | 283 | $ | 225 | $ | 49 | $ | 31 | |||||||||||

| 1.39% | 1.39% | 1.42% | 1.50% | 1.50% | ||||||||||||||||

| 1.66% | 1.70% | 2.31% | 2.59% | 3.11% | ||||||||||||||||

| 1.14% | 0.61% | 0.14% | 0.15% | 0.17% | ||||||||||||||||

| 0.87% | 0.30% | (0.75% | ) | (0.94% | ) | (1.44% | ) | |||||||||||||

| 19% | 43% | 12% | 20% | 24% | ||||||||||||||||

25

Financial highlights

Delaware Mid Cap Value Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets3 |

| Ratio of expenses to average net assets prior to fees waived3 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 3 | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

26

| Year ended | |||||||||||||||||||||

| 10/31/21 | 10/31/20 | 10/31/19 | 10/31/18 | 10/31/17 | |||||||||||||||||

| $ | 5.48 | $ | 6.28 | $ | 5.95 | $ | 6.24 | $ | 5.10 | ||||||||||||

| 0.12 | 0.06 | 0.04 | 0.04 | 0.04 | |||||||||||||||||

| 2.70 | (0.84 | ) | 0.51 | (0.23 | ) | 1.19 | |||||||||||||||

| 2.82 | (0.78 | ) | 0.55 | (0.19 | ) | 1.23 | |||||||||||||||

| (0.07 | ) | (0.02 | ) | (0.03 | ) | (0.04 | ) | (0.04 | ) | ||||||||||||

| – | – | (0.19 | ) | (0.06 | ) | (0.05 | ) | ||||||||||||||

| (0.07 | ) | (0.02 | ) | (0.22 | ) | (0.10 | ) | (0.09 | ) | ||||||||||||

| $ | 8.23 | $ | 5.48 | $ | 6.28 | $ | 5.95 | $ | 6.24 | ||||||||||||

| 51.85% | (12.46% | ) | 10.29% | (3.21% | ) | 24.42% | |||||||||||||||

| $ | 45,434 | $ | 64,314 | $ | 16,190 | $ | 9,804 | $ | 3,159 | ||||||||||||

| 0.89% | 0.89% | 0.92% | 1.00% | 1.00% | |||||||||||||||||

| 1.16% | 1.20% | 1.81% | 2.09% | 2.61% | |||||||||||||||||

| 1.64% | 1.11% | 0.64% | 0.65% | 0.67% | |||||||||||||||||

| 1.37% | 0.80% | (0.25% | ) | (0.44% | ) | (0.94% | ) | ||||||||||||||

| 19% | 43% | 12% | 20% | 24% | |||||||||||||||||

27

| Delaware Mid Cap Value Fund | October 31, 2021 |

Delaware Group® Equity Funds I (Trust) is organized as a Delaware statutory trust and offers one series: Delaware Mid Cap Value Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class C, Class R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of 5.75%. There is no front-end sales charge when you purchase $1,000,000 or more of Class A shares. However, if Delaware Distributors, L.P. (DDLP) paid your financial intermediary a commission on your purchase of $1,000,000 or more of Class A shares, for shares purchased prior to July 1, 2020, you will have to pay a limited contingent deferred sales charge (Limited CDSC) of 1.00% if you redeem these shares within the first year after your purchase and 0.50% if you redeem shares within the second year; and or for shares purchased on or after July 1, 2020, you will have to pay a Limited CDSC of 1.00% if you redeem these shares within the first 18 months after your purchase; unless a specific waiver of the Limited CDSC applies. Class C shares are sold with a CDSC of 1.00%, which will be incurred if redeemed during the first 12 months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security does not trade, the mean between the bid and ask prices will be used, which approximates fair value. Open-end investment companies are valued at their published net asset value (NAV). Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities are valued at fair value using methods approved by the Board.

Federal and Foreign Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended October 31, 2021 and for all open tax years (years ended October 31, 2018–October 31, 2020), and has concluded that no provision for federal income tax is

28

required in the Fund’s financial statements. In regard to foreign taxes only, the Fund has open tax years in certain foreign countries in which it invests that may date back to the inception of the Fund. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended October 31, 2021, the Fund did not incur any interest or tax penalties.

Class Accounting — Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds by Macquarie® (Delaware Funds) are generally allocated among such fund on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Distributions received from investments in real estate investment trusts (REITs) are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distributions by the issuer. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Fund is aware of such dividends, net of all tax withholdings, a portion of which may be reclaimable. Withholding taxes and reclaims on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The Fund will accrue such taxes as applicable, based upon current interpretations of the tax rules and regulations that exist in the markets in which it invests. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. There were no such earnings credits for the year ended October 31, 2021.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expenses offset included under “Less expenses paid indirectly.” For the year ended October 31, 2021, the Fund earned $49 under this arrangement.

29

Notes to financial statements

Delaware Mid Cap Value Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rates of 0.75% on the first $500 million of average daily net assets of the Fund, 0.70% on the next $500 million, 0.65% on the next $1.5 billion, and 0.60% on average daily net assets in excess of $2.5 billion.

DMC has contractually agreed to waive all or a portion, if any, of its management fee and/or pay/reimburse expenses (excluding any distribution and service (12b-1) fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations), in order to prevent total annual fund operating expenses from exceeding 0.89% of the Fund’s average daily net assets from November 1, 2020 through October 31, 2021.* These waivers and reimbursements may only be terminated by agreement of DMC and the Fund. The waivers and reimbursements are accrued daily and received monthly.

DMC may permit its affiliates, Macquarie Investment Management Global Limited (MIMGL) and Macquarie Funds Management Hong Kong Limited (together, the “Affiliated Sub-Advisors”), to execute Fund equity security trades on its behalf. DMC may also seek quantitative support from MIMGL. Although the Affiliated Sub-Advisors serve as sub-advisors, DMC has ultimate responsibility for all investment advisory services. For these services, DMC, not the Fund, may pay each Affiliated Sub-Advisor a portion of its investment management fee.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administrative oversight services to the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $45 billion (Total Fee). Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative NAV basis. This amount is included on the “Statement of operations” under “Accounting and administration expenses.” For the year ended October 31, 2021, the Fund was charged $6,711 for these services.

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rates: 0.014% of the first $20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.005% of the next $20 billion; and 0.0025% of average daily net assets in excess of $50 billion. The fees payable to DIFSC under the shareholder services agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended October 31, 2021, the Fund was charged $6,697 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund.

30

Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.25%, 1.00%, and 0.50% of the average daily net assets of the Class A, Class C, and Class R shares, respectively. These fees are calculated daily and paid monthly. Institutional class shares do not pay 12b-1 fees.

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal and regulatory reporting services to the Fund. For the year ended October 31, 2021, the Fund was charged $2,751 for internal legal and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended October 31, 2021, DDLP earned $4,143 for commissions on sales of the Fund’s Class A shares. For the year ended October 31, 2021, DDLP received gross CDSC commissions of $114 and $101 on redemptions of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

| * | The aggregate contractual waiver period covering this report is from February 28, 2020 through March 1, 2022. |

3. Investments

For the year ended October 31, 2021, the Fund made purchases and sales of investment securities other than short-term investments as follows:

| Purchases | $ | 14,445,752 |

| Sales | 55,024,417 |

The tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be the final tax cost basis adjustments, but approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. At October 31, 2021, the cost and

31

Notes to financial statements

Delaware Mid Cap Value Fund

3. Investments (continued)

unrealized appreciation (depreciation) of investments for federal income tax purposes for the Fund were as follows:

| Cost of investments | $ | 40,543,237 | |

| Aggregate unrealized appreciation of investments | $ | 23,990,465 | |

| Aggregate unrealized depreciation of investments | (1,375,052 | ) | |

| Net unrealized appreciation of investments | $ | 22,615,413 |

US GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized as follows:

| Level 1 – | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, and exchange-traded options contracts) |

| Level 2 – | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, and default rates) or other market-corroborated inputs. (Examples: debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, and fair valued securities) |

| Level 3 – | Significant unobservable inputs, including the Fund’s own assumptions used to determine the fair value of investments. (Examples: broker-quoted securities and fair valued securities) |

Level 3 investments are valued using significant unobservable inputs. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may also be based upon current market prices of securities that are comparable in coupon, rating, maturity, and industry. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

32

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of October 31, 2021:

| Level 1 | |||

| Securities | |||

| Assets: | |||

| Common Stock | $ | 62,570,809 | |

| Short-Term Investments | 587,841 | ||

| Total Value of Securities | $ | 63,158,650 | |

During the year ended October 31, 2021, there were no transfers into or out of Level 3 investments. The Fund’s policy is to recognize transfers into or out of Level 3 investments based on fair value at the beginning of the reporting period.

A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the beginning, interim, or end of the period in relation to the Fund’s net assets. During the year ended October 31, 2021, there were no Level 3 investments.

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from US GAAP. Additionally, distributions from net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended October 31, 2021 and 2020 were as follows:

| Year ended | ||||||

| 10/31/21 | 10/31/20 | |||||

| Ordinary income | $ | 835,085 | $ | 278,023 | ||

| Total | $ | 835,085 | $ | 278,023 | ||

5. Components of Net Assets on a Tax Basis

As of October 31, 2021, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | $ | 41,536,259 | ||

| Undistributed ordinary income | 1,014,376 | |||

| Capital loss carryforwards | (1,308,197 | ) | ||

| Unrealized appreciation of investments | 22,615,413 | |||

| Net assets | $ | 63,857,851 |

The differences between book basis and tax basis components of net assets are primarily attributable to tax deferral of losses on wash sales.

33

Notes to financial statements

Delaware Mid Cap Value Fund

5. Components of Net Assets on a Tax Basis (continued)

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Results of operations and net assets were not affected by these reclassifications. For the year ended October 31, 2021, the Fund had no reclassifications.

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. At October 31, 2021, the Fund utilized $6,503,870 of capital loss carryforwards.

At October 31, 2021, capital loss carryforwards available to offset future realized capital gains were as follows:

| Loss carryforward character | |||||

| Short-term | Long-term | Total | |||

| $1,308,197 | $— | $ | 1,308,197 | ||

6. Capital Shares

Transactions in capital shares were as follows:

| Year ended | ||||||

| 10/31/21 | 10/31/20 | |||||

| Shares sold: | ||||||

| Class A | 1,026,869 | 303,382 | ||||

| Class C | 328,965 | 59,336 | ||||

| Class R | 23,305 | 18,023 | ||||

| Institutional Class | 1,407,703 | 14,608,985 | ||||

| Shares issued upon reinvestment of dividends and distributions: | ||||||

| Class A | 9,019 | 1,154 | ||||

| Class C | 689 | — | ||||

| Class R | 369 | — | ||||

| Institutional Class | 110,443 | 39,162 | ||||

| 2,907,362 | 15,030,042 | |||||

| Shares redeemed: | ||||||

| Class A | (591,814 | ) | (597,582 | ) | ||

| Class C | (62,523 | ) | (114,228 | ) | ||

| Class R | (50,930 | ) | (2,059 | ) | ||

| Institutional Class | (7,727,879 | ) | (5,496,699 | ) | ||

| (8,433,146 | ) | (6,210,568 | ) | |||

| Net increase (decrease) | (5,525,784 | ) | 8,819,474 | |||

34

Certain shareholders may exchange shares of one class for shares of another class in the same Fund. These exchange transactions are included as subscriptions and redemptions in the table above and on the “Statements of changes in net assets.” For the years ended October 31, 2021 and 2020, the Fund had the following exchange transactions:

| Exchange Redemptions | Exchange Subscriptions | |||||||||

| Institutional | ||||||||||

| Class A | Class C | Class A | Class | |||||||

| Shares | Shares | Shares | Shares | Value | ||||||

| Year ended | ||||||||||

| 10/31/21 | 3,085 | 9,128 | 8,375 | 3,080 | $77,661 | |||||

| 10/31/20 | — | 4,835 | 4,439 | — | 22,000 | |||||

7. Line of Credit

The Fund, along with certain other funds in the Delaware Funds (Participants), was a participant in a $275,000,000 revolving line of credit (Agreement) intended to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Under the Agreement, the Participants were charged an annual commitment fee of 0.15%, which was allocated across the Participants based on a weighted average of the respective net assets of each Participant. The Participants were permitted to borrow up to a maximum of one-third of their net assets under the Agreement. Each Participant was individually, and not jointly, liable for its particular advances, if any, under the line of credit. The line of credit available under the Agreement expired on November 2, 2020.

On November 2, 2020, the Fund, along with the other Participants entered into an amendment to the Agreement for an amount of $225,000,000 to be used as described above. It operates in substantially the same manner as the original Agreement with the addition of an upfront fee of 0.05%, which was allocated across the Participants. The line of credit available under the Agreement expires on November 1, 2021.

The Fund had no amounts outstanding as of October 31, 2021, or at any time during the year then ended.

8. Securities Lending

The Fund, along with other funds in the Delaware Funds, may lend its securities pursuant to a security lending agreement (Lending Agreement) with The Bank of New York Mellon (BNY Mellon). At the time a security is loaned, the borrower must post collateral equal to the required percentage of the market value of the loaned security, including any accrued interest. The required percentage is: (1) 102% with respect to US securities and foreign securities that are denominated and payable in US dollars; and (2) 105% with respect to foreign securities. With respect to each loan, if on any business day the aggregate market value of securities collateral plus cash collateral held is less than the aggregate market value of the securities which are the subject of such loan, the borrower will be notified to provide additional collateral by the end of the following business day, which, together with the collateral already held, will be not less than the applicable initial collateral requirements for such security loan. If the aggregate market value of securities collateral and cash collateral held with respect to a security loan exceeds the applicable initial

35

Notes to financial statements

Delaware Mid Cap Value Fund