csx-20210331000027794812/312021Q1false00002779482021-01-012021-03-31xbrli:shares00002779482021-03-31iso4217:USD00002779482020-01-012020-03-31iso4217:USDxbrli:shares00002779482020-12-3100002779482019-12-3100002779482020-03-310000277948us-gaap:CommonStockMember2020-12-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-310000277948us-gaap:RetainedEarningsMember2020-12-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000277948us-gaap:NoncontrollingInterestMember2020-12-310000277948us-gaap:RetainedEarningsMember2021-01-012021-03-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310000277948us-gaap:CommonStockMember2021-01-012021-03-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-01-012021-03-310000277948us-gaap:NoncontrollingInterestMember2021-01-012021-03-310000277948us-gaap:CommonStockMember2021-03-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-03-310000277948us-gaap:RetainedEarningsMember2021-03-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000277948us-gaap:NoncontrollingInterestMember2021-03-310000277948us-gaap:CommonStockMember2019-12-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-310000277948us-gaap:RetainedEarningsMember2019-12-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000277948us-gaap:NoncontrollingInterestMember2019-12-310000277948us-gaap:RetainedEarningsMember2020-01-012020-03-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000277948us-gaap:CommonStockMember2020-01-012020-03-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-01-012020-03-310000277948us-gaap:NoncontrollingInterestMember2020-01-012020-03-310000277948us-gaap:CommonStockMember2020-03-310000277948us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-03-310000277948us-gaap:RetainedEarningsMember2020-03-310000277948us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000277948us-gaap:NoncontrollingInterestMember2020-03-31utr:micsx:state0000277948csx:PanAmSystemsIncMembercsx:PanAmSystemsIncMember2020-11-300000277948us-gaap:EmployeeStockOptionMember2021-01-012021-03-310000277948us-gaap:EmployeeStockOptionMember2020-01-012020-03-310000277948csx:ShareRepurchaseProgramJanuary2019Member2019-01-310000277948csx:ShareRepurchaseProgramJanuary2019Member2021-03-310000277948csx:ShareRepurchaseProgramOctober2020Member2020-10-21xbrli:pure00002779482021-02-102021-02-100000277948us-gaap:PerformanceSharesMember2021-01-012021-03-310000277948us-gaap:PerformanceSharesMember2020-01-012020-03-310000277948us-gaap:EmployeeStockOptionMember2021-01-012021-03-310000277948us-gaap:EmployeeStockOptionMember2020-01-012020-03-310000277948us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-310000277948us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-03-310000277948csx:StockAwardsDirectorsMember2021-01-012021-03-310000277948csx:StockAwardsDirectorsMember2020-01-012020-03-310000277948us-gaap:EmployeeStockMember2021-01-012021-03-310000277948us-gaap:EmployeeStockMember2020-01-012020-03-310000277948csx:LongtermIncentivePlanMembercsx:CertainEmployeesMemberus-gaap:PerformanceSharesMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMemberus-gaap:PerformanceSharesMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMembersrt:MinimumMemberus-gaap:PerformanceSharesMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMembersrt:MaximumMemberus-gaap:PerformanceSharesMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMemberus-gaap:PerformanceSharesMembersrt:ExecutiveOfficerMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMembersrt:MaximumMemberus-gaap:PerformanceSharesMembersrt:ExecutiveOfficerMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-02-102021-02-100000277948csx:LongtermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-02-102021-02-100000277948csx:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2018-05-310000277948csx:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2018-05-312018-05-310000277948csx:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2021-01-012021-03-310000277948csx:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2020-01-012020-03-310000277948csx:PersonalInjuryCasualtyMember2021-03-310000277948csx:PersonalInjuryCasualtyMember2020-12-310000277948csx:OccupationalCasualtyMember2021-03-310000277948csx:OccupationalCasualtyMember2020-12-310000277948csx:TotalCasualtyMember2021-03-310000277948csx:TotalCasualtyMember2020-12-310000277948us-gaap:EnvironmentalIssueMember2021-03-310000277948us-gaap:EnvironmentalIssueMember2020-12-310000277948csx:OtherReservesMember2021-03-310000277948csx:OtherReservesMember2020-12-310000277948csx:TotalCasualtyMember2021-01-012021-03-31csx:claimcsx:site0000277948srt:MinimumMemberus-gaap:PendingLitigationMember2021-03-310000277948srt:MaximumMemberus-gaap:PendingLitigationMember2021-03-31csx:entity0000277948us-gaap:PendingLitigationMembercsx:FuelSurchargeAntitrustLitigationMember2007-05-012007-05-310000277948us-gaap:PendingLitigationMembercsx:EnvironmentalLitigationMember2021-01-012021-03-310000277948us-gaap:PendingLitigationMembercsx:EnvironmentalLitigationMember2016-03-012016-03-31csx:party0000277948us-gaap:PendingLitigationMembercsx:EnvironmentalLitigationMember2016-03-31csx:defendant0000277948us-gaap:PendingLitigationMembercsx:EnvironmentalLitigationMember2018-06-302018-06-300000277948us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-01-010000277948us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-01-010000277948us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310000277948us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-310000277948us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-03-310000277948us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-03-310000277948csx:CurrentLiabilitiesMember2020-12-310000277948csx:LongTermLiabilitiesMember2020-12-310000277948csx:CurrentLiabilitiesMember2021-01-012021-03-310000277948csx:LongTermLiabilitiesMember2021-01-012021-03-310000277948csx:CurrentLiabilitiesMember2021-03-310000277948csx:LongTermLiabilitiesMember2021-03-310000277948us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2020-04-290000277948us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2020-07-090000277948csx:A325NotesDue2027Member2020-07-090000277948us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2021-03-310000277948us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2021-01-012021-03-310000277948us-gaap:RevolvingCreditFacilityMembercsx:UnsecuredRevolvingCreditFacilityDue2024Member2021-03-310000277948us-gaap:CommercialPaperMember2021-03-310000277948csx:ChemicalsMember2021-01-012021-03-310000277948csx:ChemicalsMember2020-01-012020-03-310000277948csx:AgriculturalandFoodProductsMember2021-01-012021-03-310000277948csx:AgriculturalandFoodProductsMember2020-01-012020-03-310000277948csx:AutomotiveMember2021-01-012021-03-310000277948csx:AutomotiveMember2020-01-012020-03-310000277948csx:ForestProductsMember2021-01-012021-03-310000277948csx:ForestProductsMember2020-01-012020-03-310000277948csx:MetalsandEquipmentMember2021-01-012021-03-310000277948csx:MetalsandEquipmentMember2020-01-012020-03-310000277948csx:MineralsMember2021-01-012021-03-310000277948csx:MineralsMember2020-01-012020-03-310000277948csx:FertilizersMember2021-01-012021-03-310000277948csx:FertilizersMember2020-01-012020-03-310000277948csx:TotalMerchandiseMember2021-01-012021-03-310000277948csx:TotalMerchandiseMember2020-01-012020-03-310000277948csx:IntermodalMember2021-01-012021-03-310000277948csx:IntermodalMember2020-01-012020-03-310000277948csx:CoalServicesMember2021-01-012021-03-310000277948csx:CoalServicesMember2020-01-012020-03-310000277948csx:OtherServicesMember2021-01-012021-03-310000277948csx:OtherServicesMember2020-01-012020-03-310000277948srt:MinimumMember2021-01-012021-03-310000277948srt:MaximumMember2021-01-012021-03-310000277948csx:FreightReceivablesMember2021-03-310000277948csx:FreightReceivablesMember2020-12-310000277948csx:NonFreightReceivablesMember2021-03-310000277948csx:NonFreightReceivablesMember2020-12-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000277948us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310000277948us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000277948us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310000277948us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310000277948us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000277948us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000277948us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310000277948csx:AccumulatedOtherAdjustmentstoParentMember2020-12-310000277948us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310000277948us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310000277948csx:AccumulatedOtherAdjustmentstoParentMember2021-01-012021-03-310000277948us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310000277948us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310000277948csx:AccumulatedOtherAdjustmentstoParentMember2021-03-31csx:lineSegment0000277948csx:LineSegmentsMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2021-03-26csx:phase0000277948csx:LineSegmentsMembersrt:ScenarioForecastMemberus-gaap:SubsequentEventMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2021-03-262023-03-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(☒) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

OR

(☐) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 1-8022

CSX CORPORATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Exact name of registrant as specified in its charter) |

| Virginia | | | | | | | | | 62-1051971 |

| | | | | | | | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | |

| 500 Water Street | 15th Floor | Jacksonville | FL | | | | 32202 | | 904 | 359-3200 |

| (Address of principal executive offices) | | | | (Zip Code) | | (Telephone number, including area code) |

| | | | | | | | | | |

| | | | | No Change | | | | | |

| (Former name, former address and former fiscal year, if changed since last report.) |

| | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | | Trading Symbol(s) | | Name of exchange on which registered |

| Common Stock, $1 Par Value | | | CSX | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes (X) No ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company (as defined in Exchange Act Rule 12b-2).

Large Accelerated Filer (X) Accelerated Filer ( ) Non-accelerated Filer ( ) Smaller Reporting Company (☐) Emerging growth company (☐)

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ( )

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes (☐) No (X)

There were 757,400,216 shares of common stock outstanding on March 31, 2021 (the latest practicable date that is closest to the filing date).

CSX Q1 2021 Form 10-Q p.1

CSX CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2021

INDEX

| | | | | | | | | | | |

| | | Page |

| PART I. | FINANCIAL INFORMATION | | |

| Item 1. | | | |

| | | |

| Quarters Ended March 31, 2021 and March 31, 2020 | | |

| | | |

| Quarters Ended March 31, 2021 and March 31, 2020 | | |

| | | |

| At March 31, 2021 (Unaudited) and December 31, 2020 | | |

| | | |

| Three Months Ended March 31, 2021 and March 31, 2020 | | |

| | | |

| Three Months Ended March 31, 2021 and March 31, 2020 | | |

| | | |

| | | |

| | | |

| Item 2. | | | |

| | | |

| Item 3. | | | |

| | | |

| Item 4. | | | |

| | | |

| PART II. | OTHER INFORMATION | | |

| Item 1. | | | |

| | | |

| Item 1A. | | | |

| | | |

| Item 2. | | | |

| | | |

| Item 3. | Defaults upon Senior Securities | | |

| | | |

| Item 4. | Mine Safety Disclosures | | |

| | | |

| Item 5. | Other Information | | |

| | | |

| Item 6. | Exhibits | | |

| | | |

| | | |

CSX Q1 2021 Form 10-Q p.2

CSX CORPORATION

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENTS (Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

| | | | | |

| Revenue | $ | 2,813 | | $ | 2,855 | | | | |

| Expense | | | | | |

| Labor and Fringe | 620 | | 606 | | | | |

| Materials, Supplies and Other | 469 | | 454 | | | | |

| Depreciation | 345 | | 344 | | | | |

| Fuel | 190 | | 192 | | | | |

| Equipment and Other Rents | 88 | | 81 | | | | |

| Total Expense | 1,712 | | 1,677 | | | | |

| | | | | |

| Operating Income | 1,101 | | 1,178 | | | | |

| | | | | |

| Interest Expense | (184) | | (187) | | | | |

| Other Income - Net | 20 | | 22 | | | | |

| Earnings Before Income Taxes | 937 | | 1,013 | | | | |

| | | | | |

| Income Tax Expense | (231) | | (243) | | | | |

| Net Earnings | $ | 706 | | $ | 770 | | | | |

| | | | | |

| Per Common Share (Note 2) | | | | | |

| Net Earnings Per Share, Basic | $ | 0.93 | | $ | 1.00 | | | | |

| Net Earnings Per Share, Assuming Dilution | $ | 0.93 | | $ | 1.00 | | | | |

| | | | | |

| | | | | |

Average Shares Outstanding (In millions) | 761 | | 772 | | | | |

Average Shares Outstanding, Assuming Dilution (In millions) | 762 | | 773 | | | | |

| | | | | |

CONDENSED CONSOLIDATED COMPREHENSIVE INCOME STATEMENTS (Unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

| Total Comprehensive Earnings (Note 11) | $ | 774 | | $ | 773 | | | | |

See accompanying notes to consolidated financial statements.

CSX Q1 2021 Form 10-Q p.3

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED BALANCE SHEETS

(Dollars in millions)

| | | | | | | | |

| (Unaudited) | |

| March 31,

2021 | December 31,

2020 |

| ASSETS |

| Current Assets: | | |

| Cash and Cash Equivalents | $ | 2,955 | | $ | 3,129 | |

| Short-term Investments | 2 | | 2 | |

| Accounts Receivable - Net (Note 8) | 957 | | 912 | |

| Materials and Supplies | 298 | | 302 | |

| | |

| Other Current Assets | 93 | | 96 | |

| Total Current Assets | 4,305 | | 4,441 | |

| | |

| Properties | 45,593 | | 45,530 | |

| Accumulated Depreciation | (13,190) | | (13,086) | |

| Properties - Net | 32,403 | | 32,444 | |

| | |

| Investment in Affiliates and Other Companies | 2,007 | | 1,985 | |

| Right-of-Use Lease Asset | 467 | | 472 | |

| Other Long-term Assets | 510 | | 451 | |

| Total Assets | $ | 39,692 | | $ | 39,793 | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current Liabilities: | | |

| Accounts Payable | $ | 859 | | $ | 809 | |

| Labor and Fringe Benefits Payable | 419 | | 482 | |

| Casualty, Environmental and Other Reserves (Note 4) | 89 | | 90 | |

| | |

| Current Maturities of Long-term Debt (Note 7) | 41 | | 401 | |

| Income and Other Taxes Payable | 237 | | 73 | |

| Other Current Liabilities | 155 | | 164 | |

| Total Current Liabilities | 1,800 | | 2,019 | |

| | |

| Casualty, Environmental and Other Reserves (Note 4) | 229 | | 224 | |

| Long-term Debt (Note 7) | 16,306 | | 16,304 | |

| Deferred Income Taxes - Net | 7,226 | | 7,168 | |

| Long-term Lease Liability | 453 | | 455 | |

| Other Long-term Liabilities | 518 | | 513 | |

| Total Liabilities | 26,532 | | 26,683 | |

| | |

| Shareholders' Equity: | | |

Common Stock, $1 Par Value | 757 | | 763 | |

| Other Capital | 448 | | 409 | |

| Retained Earnings | 12,476 | | 12,527 | |

| Accumulated Other Comprehensive Loss (Note 11) | (530) | | (598) | |

| Non-controlling Minority Interest | 9 | | 9 | |

| Total Shareholders' Equity | 13,160 | | 13,110 | |

| Total Liabilities and Shareholders' Equity | $ | 39,692 | | $ | 39,793 | |

See accompanying notes to consolidated financial statements.

CSX Q1 2021 Form 10-Q p.4

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED CASH FLOW STATEMENTS (Unaudited)

(Dollars in millions)

| | | | | | | | |

| Three Months |

| 2021 | 2020 |

| | |

| OPERATING ACTIVITIES | | |

| Net Earnings | $ | 706 | | $ | 770 | |

Adjustments to Reconcile Net Earnings to Net Cash Provided by Operating Activities: | | |

| Depreciation | 345 | | 344 | |

| Deferred Income Taxes | 40 | | 28 | |

| Gains on Property Dispositions | (3) | | (18) | |

| | |

| | |

| | |

| | |

| Other Operating Activities | 28 | | — | |

| Changes in Operating Assets and Liabilities: | | |

| Accounts Receivable | (64) | | (27) | |

| Other Current Assets | (5) | | (20) | |

| Accounts Payable | 53 | | 14 | |

| Income and Other Taxes Payable | 192 | | 227 | |

| Other Current Liabilities | (60) | | (140) | |

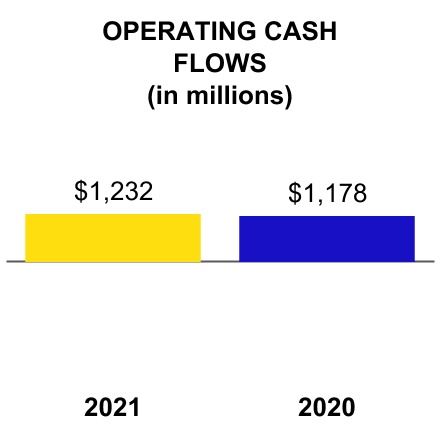

| Net Cash Provided by Operating Activities | 1,232 | | 1,178 | |

| | |

| INVESTING ACTIVITIES | | |

| Property Additions | (306) | | (381) | |

| Proceeds from Property Dispositions | — | | 35 | |

| Purchases of Short-term Investments | — | | (426) | |

| Proceeds from Sales of Short-term Investments | 1 | | 936 | |

| Other Investing Activities | 8 | | (20) | |

| Net Cash (Used In)/Provided by Investing Activities | (297) | | 144 | |

| | |

| FINANCING ACTIVITIES | | |

| | |

| Long-term Debt Issued (Note 7) | — | | 500 | |

| Long-term Debt Repaid (Note 7) | (360) | | — | |

| Dividends Paid | (213) | | (201) | |

| | |

| Shares Repurchased | (551) | | (577) | |

| | |

| Other Financing Activities | 15 | | (7) | |

| Net Cash Used in Financing Activities | (1,109) | | (285) | |

| | |

| Net (Decrease)/Increase in Cash and Cash Equivalents | (174) | | 1,037 | |

| | |

| CASH AND CASH EQUIVALENTS | | |

| Cash and Cash Equivalents at Beginning of Period | 3,129 | | 958 | |

| Cash and Cash Equivalents at End of Period | $ | 2,955 | | $ | 1,995 | |

| | |

See accompanying notes to consolidated financial statements.

CSX Q1 2021 Form 10-Q p.5

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF CHANGES

IN SHAREHOLDERS' EQUITY (Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| Three Months 2021 | Common Shares Outstanding (Thousands) | Common Stock and Other Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss)(a) | Non-controlling Minority Interest | Total Shareholders' Equity |

| | | | | | |

| Balance December 31, 2020 | 762,529 | | $ | 1,172 | | $ | 12,527 | | $ | (598) | | $ | 9 | | $ | 13,110 | |

| Comprehensive Earnings: | | | | | | |

| Net Earnings | — | | — | | 706 | | — | | — | | 706 | |

| Other Comprehensive Income (Note 11) | — | | — | | — | | 68 | | — | | 68 | |

| Total Comprehensive Earnings | | | | | | 774 | |

| | | | | | |

Common stock dividends, $0.28 per share | — | | — | | (213) | | — | | — | | (213) | |

| Share Repurchases | (6,130) | | (6) | | (545) | | — | | — | | (551) | |

| | | | | | |

| Stock Option Exercises and Other | 1,001 | | 39 | | 1 | | — | | — | | 40 | |

| Balance March 31, 2021 | 757,400 | | $ | 1,205 | | $ | 12,476 | | $ | (530) | | $ | 9 | | $ | 13,160 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months 2020 | Common Shares Outstanding (Thousands) | Common Stock and Other Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss)(a) | Non-controlling Minority Interest | Total Shareholders' Equity | | | |

| | | | | | | | | |

| Balance December 31, 2019 | 773,471 | | $ | 1,119 | | $ | 11,404 | | $ | (675) | | $ | 15 | | 11,863 | | | | |

| Comprehensive Earnings: | | | | | | | | | |

| Net Earnings | — | | — | | 770 | | — | | — | | 770 | | | | |

| Other Comprehensive Income (Note 11) | — | | — | | — | | 3 | | — | | 3 | | | | |

| Total Comprehensive Earnings | | | | | | 773 | | | | |

| | | | | | | | | |

Common stock dividends, $0.26 per share | — | | — | | (201) | | — | | — | | (201) | | | | |

| Share Repurchases | (8,906) | | (9) | | (568) | | — | | — | | (577) | | | | |

| | | | | | | | | |

| Stock Option Exercises and Other | 894 | | 21 | | 7 | | — | | 2 | | 30 | | | | |

| Balance March 31, 2020 | 765,459 | | 1,131 | | 11,412 | | (672) | | 17 | | 11,888 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

a) Accumulated Other Comprehensive Loss balances shown above are net of tax. The associated taxes were $137 million and $183 million as of March 31, 2021 and March 31, 2020, respectively. For additional information, see Note 11, Other Comprehensive Income.

See accompanying notes to consolidated financial statements.

CSX Q1 2021 Form 10-Q p.6

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Nature of Operations and Significant Accounting Policies

Background

CSX Corporation together with its subsidiaries ("CSX" or the “Company”), based in Jacksonville, Florida, is one of the nation's leading transportation companies. The Company provides rail-based transportation services including traditional rail service, the transport of intermodal containers and trailers, as well as other transportation services such as rail-to-truck transfers and bulk commodity operations.

CSX's principal operating subsidiary, CSX Transportation, Inc. (“CSXT”), provides an important link to the transportation supply chain through its approximately 19,500 route mile rail network, which serves major population centers in 23 states east of the Mississippi River, the District of Columbia and the Canadian provinces of Ontario and Quebec. The Company's intermodal business links customers to railroads via trucks and terminals.

CSXT is also responsible for the Company's real estate sales, leasing, acquisition and management and development activities. Substantially all of these activities are focused on supporting railroad operations.

Other entities

In addition to CSXT, the Company’s subsidiaries include CSX Intermodal Terminals, Inc. (“CSX Intermodal Terminals”), Total Distribution Services, Inc. (“TDSI”), Transflo Terminal Services, Inc. (“Transflo”), CSX Technology, Inc. (“CSX Technology”) and other subsidiaries. CSX Intermodal Terminals owns and operates a system of intermodal terminals, predominantly in the eastern United States and also performs drayage services (the pickup and delivery of intermodal shipments) for certain customers. TDSI serves the automotive industry with distribution centers and storage locations. Transflo connects non-rail served customers to the many benefits of rail by transferring products from rail to trucks. The biggest Transflo markets are chemicals and agriculture, which includes shipments of plastics and ethanol. CSX Technology and other subsidiaries provide support services for the Company.

Acquisition of Pan Am Systems, Inc.

On November 30, 2020, CSX signed a definitive agreement to acquire Pan Am Systems, Inc. (“Pan Am”) and certain of its subsidiaries and affiliates, which own and operate a highly integrated, nearly 1,200-mile rail network and have a partial interest in the more than 600-mile Pan Am Southern system. This acquisition, if approved, will expand CSX’s reach in Connecticut, New York and Massachusetts while adding Vermont, New Hampshire and Maine to its existing network. On February 25, 2021, the Company began the process, which can take up to a year or more, of seeking approval from the Surface Transportation Board.

CSX Q1 2021 Form 10-Q p.7

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Nature of Operations and Significant Accounting Policies, continued

Basis of Presentation

In the opinion of management, the accompanying consolidated financial statements contain all normal, recurring adjustments necessary to fairly present the consolidated financial statements and accompanying notes. Where applicable, prior year information has been reclassified to conform to the current presentation. Pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), certain information and disclosures normally included in the notes to the annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) have been omitted from these interim financial statements. CSX suggests that these financial statements be read in conjunction with the audited financial statements and the notes included in CSX's most recent annual report on Form 10-K and any subsequently filed current reports on Form 8-K.

Fiscal Year

The Company's fiscal periods are based upon the calendar year. Except as otherwise specified, references to “first quarter(s)” or “three months” indicate CSX's fiscal periods ending March 31, 2021 and March 31, 2020, and references to "year-end" indicate the fiscal year ended December 31, 2020.

NOTE 2. Earnings Per Share

The following table sets forth the computation of basic earnings per share and earnings per share, assuming dilution:

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

Numerator (Dollars in millions): | | | | | |

Net Earnings | $ | 706 | | $ | 770 | | | | |

| | | | | |

| | | | | |

| | | | | |

Denominator (Units in millions): | | | | | |

| Average Common Shares Outstanding | 761 | | 772 | | | | |

| Other Potentially Dilutive Common Shares | 1 | | 1 | | | | |

Average Common Shares Outstanding, Assuming Dilution | 762 | | 773 | | | | |

| | | | | |

Net Earnings Per Share, Basic | $ | 0.93 | | $ | 1.00 | | | | |

Net Earnings Per Share, Assuming Dilution | $ | 0.93 | | $ | 1.00 | | | | |

Basic earnings per share is based on the weighted-average number of shares of common stock outstanding. Earnings per share, assuming dilution, is based on the weighted-average number of shares of common stock outstanding and common stock equivalents adjusted for the effects of common stock that may be issued as a result of potentially dilutive instruments. CSX's potentially dilutive instruments are made up of equity awards including performance units and employee stock options.

CSX Q1 2021 Form 10-Q p.8

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2. Earnings Per Share, continued

When calculating diluted earnings per share, the potential shares that would be outstanding if all outstanding stock options were exercised are included. This number is different from outstanding stock options because it is offset by shares CSX could repurchase using the proceeds from these hypothetical exercises to obtain the common stock equivalent. The total average outstanding stock options that were excluded from the diluted earnings per share calculation because their effect was antidilutive is in the table below.

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

Antidilutive Stock Options Excluded from Diluted EPS (Millions) | 1 | 1 | | | |

Share Repurchases

In January 2019, the Company announced a $5 billion share repurchase program. As of March 31, 2021, approximately $339 million of authority remained under this program. On October 21, 2020, the Company announced a new, incremental $5 billion share repurchase program. Total repurchase authority remaining under both programs was $5.3 billion as of March 31, 2021. During first quarters 2021 and 2020, the Company engaged in the following repurchase activities:

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

Shares Repurchased (Millions) | 6 | | 9 | | | | |

Cost of Shares (Dollars in millions) | $ | 551 | | $ | 577 | | | | |

Share repurchases may be made through a variety of methods including, but not limited to, open market purchases, purchases pursuant to Rule 10b5-1 plans, accelerated share repurchases and negotiated block purchases. The timing of share repurchases depends upon management's assessment of marketplace conditions and other factors, and the program remains subject to the discretion of the Board of Directors. Future share repurchases are expected to be funded by cash on hand, cash generated from operations and debt issuances. Shares are retired immediately upon repurchase. In accordance with the Equity Topic in the Accounting Standards Codification ("ASC"), the excess of repurchase price over par value is recorded in retained earnings.

Dividend Increase

On February 10, 2021, the Company's Board of Directors authorized an 8% increase in the quarterly cash dividend to $0.28 per common share beginning March 2021.

CSX Q1 2021 Form 10-Q p.9

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Stock Plans and Share-Based Compensation

Under CSX's share-based compensation plans, awards consist of performance units, stock options, restricted stock units and restricted stock awards for management and stock grants for directors. Awards granted under the various programs are determined and approved by the Compensation and Talent Management Committee of the Board of Directors. Awards to the Chief Executive Officer are approved by the full Board and awards to senior executives are approved by the Compensation and Talent Management Committee. In certain circumstances, the Chief Executive Officer or delegate approves awards to management employees other than senior executives. The Board of Directors approves awards granted to CSX's non-management directors upon recommendation of the Governance and Sustainability Committee.

Share-based compensation expense for awards under share-based compensation plans and purchases made as part of the employee stock purchase plan is measured using the fair value of the award on the grant date and is recognized on a straight-line basis over the service period of the respective award or upon grant date to certain retirement-eligible employees whose agreements allow for continued vesting upon retirement. Forfeitures are recognized as they occur. Total pre-tax expense and income tax benefits associated with share-based compensation are shown in the table below. Income tax benefits include impacts from option exercises and the vesting of other equity awards.

| | | | | | | | | | | |

| First Quarters | | |

| (Dollars in millions) | 2021 | 2020 | | | |

| Share-Based Compensation Expense: | | | | | |

| Performance Units | $ | 18 | | $ | 9 | | | | |

| Stock Options | 6 | | 10 | | | | |

| Restricted Stock Units and Awards | 5 | | 2 | | | | |

| Stock Awards for Directors | 2 | | 2 | | | | |

| Employee Stock Purchase Plan | 1 | | 1 | | | | |

| Total Share-Based Compensation Expense | $ | 32 | | $ | 24 | | | | |

| Income Tax Benefit | $ | 9 | | $ | 9 | | | | |

CSX Q1 2021 Form 10-Q p.10

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Stock Plans and Share-Based Compensation, continued

Long-term Incentive Plan

In February 2021, the Company granted 189 thousand performance units to certain employees under a new long-term incentive plan ("LTIP") for the years 2021 through 2023, which was adopted under the CSX 2019 Stock and Incentive Award Plan.

Payouts of performance units for the cycle ending with fiscal year 2023 will be based on the achievement of goals related to both operating income and free cash flow, in each case excluding non-recurring items as disclosed in the Company's financial statements. The average annual operating income growth percentage and cumulative free cash flow measures over the plan period will each comprise 50% of the payout and will be measured independently of the other.

Grants were made in performance units, with each unit representing the right to receive one share of CSX common stock, and payouts will be made in CSX common stock. The payout range for participants will be between 0% and 200% of the target awards depending on Company performance against predetermined goals. Payouts for certain executive officers are subject to formulaic upward or downward adjustment by up to 25%, capped at an overall payout of 250%, based upon the Company's total shareholder return relative to specified comparable groups over the performance period. Participants will receive stock dividend equivalents declared over the performance period based on the number of performance units paid upon vesting. The fair values of the performance units awarded during the quarters ended March 31, 2021 and March 31, 2020 were primarily calculated using a Monte-Carlo simulation model with the following weighted-average assumptions:

| | | | | | | | | | | | | |

| | | Three Months |

| | | | 2021 | 2020 |

| | | | | |

| | | | | |

| Weighted-Average Assumptions Used: | | | | | |

| Annual Dividend Yield | | | | N/A | N/A |

| Risk-free Interest Rate | | | | 0.2 | % | 1.4 | % |

| Annualized Volatility | | | | 33.6 | % | 24.5 | % |

Expected Life (in years) | | | | 2.9 | 2.9 |

Stock Options

In February 2021, the Company granted approximately 610 thousand stock options along with the corresponding LTIP. The fair value of stock options was calculated using the Black-Scholes valuation model. These stock options were granted with ten-year terms and vest over three years in equal installments each year on the anniversary of the grant date. The exercise price for stock options granted equals the closing market price of the underlying stock on the date of grant. These awards are time-based and are not based upon attainment of performance goals. During first quarters 2021 and 2020, there were additional immaterial grants of stock options to certain members of management.

CSX Q1 2021 Form 10-Q p.11

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Stock Plans and Share-Based Compensation, continued

The fair values of all stock option awards during the quarters ended March 31, 2021 and March 31, 2020 were estimated at the grant date with the following weighted average assumptions:

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

| Weighted-Average Grant Date Fair Value | $ | 23.64 | | $ | 18.87 | | | |

| | | | | |

| Weighted-Average Assumptions Used: | | | | | |

| Annual Dividend Yield | 1.2 | % | 1.2 | % | | | |

| Risk-Free Interest Rate | 0.7 | % | 1.4 | % | | | |

| Annualized Volatility | 31.2 | % | 26.0 | % | | | |

| Expected Life (in years) | 6.0 | 6.0 | | | |

| | | | | |

| Other Pricing Model Inputs: | | | | | |

| Weighted-Average Grant Date Market Price of CSX Stock (strike price) | $ | 88.46 | | $ | 79.48 | | | |

Restricted Stock Units

In February 2021, the Company granted 163 thousand restricted stock units along with the corresponding LTIP. The restricted stock units vest three years after the date of grant. Participants will receive stock dividend equivalents on the vested shares upon vesting. These awards are time-based and are not based upon CSX's attainment of operational targets. Restricted stock units are paid out in CSX common stock on a one-for-one basis. For information related to the Company's other outstanding long-term incentive compensation, see CSX's most recent annual report on Form 10-K.

Employee Stock Purchase Plan

In May 2018, shareholders approved the 2018 CSX Employee Stock Purchase Plan (“ESPP”) for the benefit of Company employees. The Company registered 4 million shares of common stock that may be issued pursuant to this plan. Under the ESPP, employees may contribute between 1% and 10% of base compensation, after-tax, to purchase up to $25,000 of market value CSX common stock per year at 85% of the closing market price on either the grant date or the last day of the six-month offering period, whichever is lower. During the quarters ended March 31, 2021 and March 31, 2020, the Company issued the following shares under this program:

| | | | | | | | | | | |

| First Quarters | | |

| 2021 | 2020 | | | |

| Shares issued (in thousands) | 132 | | 122 | | | | |

| Weighted average purchase price per share | $ | 58.00 | | $ | 61.51 | | | | |

CSX Q1 2021 Form 10-Q p.12

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves

Personal injury and environmental reserves are considered critical accounting estimates due to the need for management judgment. Casualty, environmental and other reserves are provided for in the consolidated balance sheets as shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (Dollars in millions) | Current | Long-term | Total | | Current | Long-term | Total |

| | | | | | | |

| Casualty: | | | | | | | |

| Personal Injury | $ | 38 | | $ | 99 | | $ | 137 | | | $ | 38 | | $ | 93 | | $ | 131 | |

| Occupational | 11 | | 52 | | 63 | | | 11 | | 54 | | 65 | |

| Total Casualty | 49 | | 151 | | 200 | | | 49 | | 147 | | 196 | |

| Environmental | 23 | | 54 | | 77 | | | 23 | | 53 | | 76 | |

| Other | 17 | | 24 | | 41 | | | 18 | | 24 | | 42 | |

| Total | $ | 89 | | $ | 229 | | $ | 318 | | | $ | 90 | | $ | 224 | | $ | 314 | |

These liabilities are accrued when probable and reasonably estimable in accordance with the Contingencies Topic in the ASC. Actual settlements and claims received could differ, and final outcomes of these matters cannot be predicted with certainty. Considering the legal defenses currently available, the liabilities that have been recorded and other factors, it is the opinion of management that none of these items individually, when finally resolved, will have a material adverse effect on the Company's financial condition, results of operations or liquidity. Should a number of these items occur in the same period, however, their combined effect could be material in that particular period.

Casualty

Casualty reserves of $200 million and $196 million as of March 31, 2021 and December 31, 2020, respectively, represent accruals for personal injury, occupational disease and occupational injury claims. The Company's self-insured retention amount for these claims is $75 million per occurrence. Currently, no individual claim is expected to exceed the self-insured retention amount. In accordance with the Contingencies Topic in the ASC, to the extent the value of an individual claim exceeds the self-insured retention amount, the Company would present the liability on a gross basis with a corresponding receivable for insurance recoveries. These reserves fluctuate based upon the timing of payments as well as changes in estimate. Actual results may vary from estimates due to the number, type and severity of the injury, costs of medical treatments and uncertainties in litigation. Most of the Company's casualty claims relate to CSXT. Defense and processing costs, which historically have been insignificant and are anticipated to be insignificant in the future, are not included in the recorded liabilities.

Personal Injury

Personal injury reserves represent liabilities for employee work-related and third-party injuries. Work-related injuries for CSXT employees are primarily subject to the Federal Employers’ Liability Act (“FELA”). CSXT retains an independent actuary to assist management in assessing the value of personal injury claims. An analysis is performed by the actuary quarterly and is reviewed by management. This analysis did not result in a material adjustment to the personal injury reserve in the quarter ended March 31, 2021 or March 31, 2020. The methodology used by the actuary includes a development factor to reflect growth or reduction in the value of these personal injury claims based largely on CSXT's historical claims and settlement experience.

CSX Q1 2021 Form 10-Q p.13

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

Occupational

Occupational reserves represent liabilities arising from allegations of exposure to certain materials in the workplace (such as solvents, soaps, chemicals and diesel fumes), past exposure to asbestos or allegations of chronic physical injuries resulting from work conditions (such as repetitive stress injuries). Beginning in second quarter 2020, the Company retains an independent actuary to analyze the Company’s historical claim filings, settlement amounts, and dismissal rates to assist in determining future anticipated claim filing rates and average settlement values. This analysis is performed by the actuary and reviewed by management quarterly. Previously, the quarterly analysis was performed by management. There were no material adjustments to the occupational reserve in the quarter ended March 31, 2021 or March 31, 2020.

Environmental

Environmental reserves were $77 million and $76 million as of March 31, 2021 and December 31, 2020, respectively. The Company is a party to various proceedings related to environmental issues, including administrative and judicial proceedings involving private parties and regulatory agencies. The Company has been identified as a potentially responsible party at approximately 220 environmentally impaired sites. Many of these are, or may be, subject to remedial action under the federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA"), also known as the Superfund Law, or similar state statutes. Most of these proceedings arose from environmental conditions on properties used for ongoing or discontinued railroad operations. A number of these proceedings, however, are based on allegations that the Company, or its predecessors, sent hazardous substances to facilities owned or operated by others for treatment, recycling or disposal. In addition, some of the Company's land holdings were leased to others for commercial or industrial uses that may have resulted in releases of hazardous substances or other regulated materials onto the property and could give rise to proceedings against the Company.

In any such proceedings, the Company is subject to environmental clean-up and enforcement actions under the Superfund Law, as well as similar state laws that may impose joint and several liability for clean-up and enforcement costs on current and former owners and operators of a site without regard to fault or the legality of the original conduct. These costs could be substantial.

In accordance with the Asset Retirement and Environmental Obligations Topic in the ASC, the Company reviews its role with respect to each site identified at least quarterly, giving consideration to a number of factors such as:

•type of clean-up required;

•nature of the Company's alleged connection to the location (e.g., generator of waste sent to the site or owner or operator of the site);

•extent of the Company's alleged connection (e.g., volume of waste sent to the location and other relevant factors); and

•number, connection and financial viability of other named and unnamed potentially responsible parties at the location.

CSX Q1 2021 Form 10-Q p.14

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

Based on management's review process, amounts have been recorded to cover contingent anticipated future environmental remediation costs with respect to each site to the extent such costs are reasonably estimable and probable. The recorded liabilities for estimated future environmental costs are undiscounted. The liability includes future costs for remediation and restoration of sites as well as any significant ongoing monitoring costs, but excludes any anticipated insurance recoveries. Payments related to these liabilities are expected to be made over the next several years. Environmental remediation costs are included in materials, supplies and other on the consolidated income statements.

Currently, the Company does not possess sufficient information to reasonably estimate the amounts of additional liabilities, if any, on some sites until completion of future environmental studies. In addition, conditions that are currently unknown could, at any given location, result in additional exposure, the amount and materiality of which cannot presently be reasonably estimated. Based upon information currently available, however, the Company believes its environmental reserves accurately reflect the estimated cost of remedial actions currently required.

Other

Other reserves were $41 million and $42 million as of March 31, 2021 and December 31, 2020, respectively. These reserves include liabilities for various claims, such as property, automobile and general liability. Also included in other reserves are longshoremen disability claims related to a previously owned international shipping business (these claims are in runoff) as well as claims for current port employees.

NOTE 5. Commitments and Contingencies

Insurance

The Company maintains insurance programs with substantial limits for property damage, including resulting business interruption, and third-party liability. A certain amount of risk is retained by the Company on each insurance program. Under its property insurance program, the Company retains all risk up to $100 million per occurrence for losses from floods and named windstorms and $75 million per occurrence for other property losses. For third-party liability claims, the Company retains all risk up to $75 million per occurrence. As CSX negotiates insurance coverage above its full self-retention amounts, it retains a percentage of risk at various layers of coverage. While the Company believes its insurance coverage is adequate, future claims could exceed existing insurance coverage or insurance may not continue to be available at commercially reasonable rates.

CSX Q1 2021 Form 10-Q p.15

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5. Commitments and Contingencies, continued

Legal

The Company is involved in litigation incidental to its business and is a party to a number of legal actions and claims, various governmental proceedings and private civil lawsuits, including, but not limited to, those related to fuel surcharge practices, tax matters, environmental and hazardous material exposure matters, FELA and labor claims by current or former employees, other personal injury or property claims and disputes and complaints involving certain transportation rates and charges. Some of the legal proceedings include claims for compensatory as well as punitive damages and others are, or are purported to be, class actions. While the final outcome of these matters cannot be predicted with certainty, considering, among other things, the legal defenses available and liabilities that have been recorded along with applicable insurance, it is currently the opinion of management that none of these pending items is likely to have a material adverse effect on the Company's financial condition, results of operations or liquidity. An unexpected adverse resolution of one or more of these items, however, could have a material adverse effect on the Company's financial condition, results of operations or liquidity in that particular period.

The Company is able to estimate a range of possible loss for certain legal proceedings for which a loss is reasonably possible in excess of reserves established. The Company has estimated this range to be $1 million to $20 million in aggregate at March 31, 2021. This estimated aggregate range is based upon currently available information and is subject to significant judgment and a variety of assumptions. Accordingly, the Company's estimate will change from time to time, and actual losses may vary significantly from the current estimate.

Fuel Surcharge Antitrust Litigation

In May 2007, class action lawsuits were filed against CSXT and three other U.S.-based Class I railroads alleging that the defendants' fuel surcharge practices relating to contract and unregulated traffic resulted from an illegal conspiracy in violation of antitrust laws. The class action lawsuits were consolidated into one case in federal court in the District of Columbia. In 2017, the District Court issued its decision denying class certification. On August 16, 2019, the U.S. Court of Appeals for the D.C. Circuit affirmed the District Court’s ruling.

The consolidated case is now moving forward without class certification. Although a class was not certified, shippers other than those who brought the original lawsuit in 2007 must decide whether to bring their own individual claim against one or more railroads. Individual shipper claims filed to date have been consolidated into a separate case.

CSXT believes that its fuel surcharge practices were arrived at and applied lawfully and that the case is without merit. Accordingly, the Company intends to defend itself vigorously. However, penalties for violating antitrust laws can be severe, and resolution of these matters individually or when aggregated could have a material adverse effect on the Company's financial condition, results of operations or liquidity in that particular period.

CSX Q1 2021 Form 10-Q p.16

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5. Commitments and Contingencies, continued

Environmental

CSXT is indemnifying Pharmacia LLC, formerly known as Monsanto Company, ("Pharmacia") for certain liabilities associated with real estate located in Kearny, New Jersey along the Lower Passaic River (the “Property”). The Property, which was formerly owned by Pharmacia, is now owned by CSXT. CSXT's indemnification and defense duties arise with respect to several matters. The U.S. Environmental Protection Agency ("EPA"), using its CERCLA authority, seeks the investigation and cleanup of hazardous substances in the 17-mile Lower Passaic River Study Area (the "Study Area”). CSXT, on behalf of Pharmacia, and a significant number of other potentially responsible parties are together conducting a Remedial Investigation and Feasibility Study of the Study Area pursuant to an Administrative Settlement Agreement and Order on Consent with the EPA. Pharmacia’s share of responsibility, indemnified by CSXT, for the investigation and cleanup costs of the Study Area may be determined through various mechanisms including (a) an allocation and settlement with EPA; (b) litigation brought by EPA against non-settling parties; or (c) litigation among the responsible parties.

In March 2016, EPA issued its Record of Decision detailing the agency’s mandated remedial process for the lower 8 miles of the Study Area. Approximately 80 parties, including Pharmacia, are participating in an EPA-directed allocation and settlement process to assign responsibility for the remedy selected for the lower 8 miles of the Study Area. CSXT is participating in the EPA-directed allocation and settlement process on behalf of Pharmacia. At a later date, EPA will select a remedy for the remainder of the Study Area and is expected to again seek the participation of private parties to implement the selected remedy using EPA’s CERCLA authority to compel such participation, if necessary.

CSXT is also defending and indemnifying Pharmacia with regard to the Property in litigation filed by Occidental Chemical Corporation ("Occidental"), which is seeking to recover various costs. These costs include costs for the remedial design of the lower 8 miles of the Study Area, as well as anticipated costs associated with the future remediation of the lower 8 miles of the Study Area and potentially the entire Study Area. Alternatively, Occidental seeks to compel some, or all of the defendants to participate in the remediation of the Study Area. Pharmacia is one of approximately 110 defendants in this federal lawsuit filed by Occidental on June 30, 2018.

CSXT is also defending and indemnifying Pharmacia in a cooperative natural resource damages assessment process related to the Property. Based on currently available information, the Company does not believe any indemnification or remediation costs potentially allocable to CSXT with respect to the Property and the Study Area would be material to the Company's financial condition, results of operations or liquidity.

CSX Q1 2021 Form 10-Q p.17

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 6. Employee Benefit Plans

The Company sponsors defined benefit pension plans principally for salaried, management personnel. Beginning in 2020, the CSX Pension Plan was closed to new participants.

CSX also sponsors a post-retirement medical plan and a life insurance plan that provide certain benefits to eligible employees hired prior to January 1, 2003. Beginning in 2019, both the life insurance benefit and health savings account contributions made by the Company to eligible retirees younger than 65 were eliminated for those retiring on or after January 1, 2019. Beginning in 2020, the employer-funded health reimbursement arrangements and life insurance benefit for eligible retirees 65 years or older were eliminated. Independent actuaries compute the amounts of liabilities and expenses relating to these plans subject to the assumptions that the Company determines are appropriate based on historical trends, current market rates and future projections. These amounts are reviewed by management.

Only the service cost component of net periodic benefit costs is included in labor and fringe expense on the consolidated income statement. All other components of net periodic benefit cost are included in other income - net.

| | | | | | | | | | | | | | | |

| Pension Benefits Cost |

| First Quarters | | |

| (Dollars in millions) | 2021 | | 2020 | | | | |

| Service Cost Included in Labor and Fringe | $ | 9 | | | $ | 10 | | | | | |

| | | | | | | |

| Interest Cost | 14 | | | 20 | | | | | |

| Expected Return on Plan Assets | (46) | | | (43) | | | | | |

| Amortization of Net Loss | 18 | | | 14 | | | | | |

| Total Included in Other Income - Net | (14) | | | (9) | | | | | |

| | | | | | | |

| Net Periodic Benefit (Credit)/Cost | $ | (5) | | | $ | 1 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other Post-retirement Benefits Cost |

| First Quarters | | |

| (Dollars in millions) | 2021 | | 2020 | | | | |

| Service Cost Included in Labor and Fringe | $ | — | | | $ | — | | | | | |

| | | | | | | |

| Interest Cost | — | | | 1 | | | | | |

| Amortization of Prior Service Credits | (1) | | | (2) | | | | | |

| Total Included in Other Income - Net | (1) | | | (1) | | | | | |

| | | | | | | |

| Net Periodic Benefit Credit | $ | (1) | | | $ | (1) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Qualified pension plan obligations are funded in accordance with regulatory requirements and with an objective of meeting or exceeding minimum funding requirements necessary to avoid restrictions on flexibility of plan operation and benefit payments. No contributions to the Company's qualified pension plans are expected in 2021.

CSX Q1 2021 Form 10-Q p.18

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 7. Debt and Credit Agreements

Total activity related to long-term debt as of the end of first quarter 2021 is shown in the table below. For fair value information related to the Company's long-term debt, see Note 10, Fair Value Measurements.

| | | | | | | | | | | |

| (Dollars in millions) | Current Portion | Long-term Portion | Total |

| Long-term Debt as of December 31, 2020 | $ | 401 | | $ | 16,304 | | $ | 16,705 | |

| 2021 Activity: | | | |

| | | |

| Long-term Debt Repaid | (360) | | — | | (360) | |

| | | |

| Discount, Premium and Other Activity | — | | 2 | | 2 | |

| | | |

| Long-term Debt as of March 31, 2021 | $ | 41 | | $ | 16,306 | | $ | 16,347 | |

Interest Rate Derivatives

On both April 29, 2020, and July 9, 2020, the Company executed a forward starting interest rate swap with a notional value of $250 million for an aggregate notional value of $500 million. These swaps were effected to hedge the benchmark interest rate associated with future interest payments related to the anticipated refinancing of $850 million of 3.25% notes due in 2027. In accordance with the Derivatives and Hedging Topic in the ASC, the Company has designated these swaps as cash flow hedges. As of March 31, 2021, the asset value of the forward starting interest rate swaps was $153 million and was recorded in other long-term assets on the consolidated balance sheet.

Unrealized gains or losses associated with changes in the fair value of the hedge are recorded net of tax in accumulated other comprehensive income (“AOCI”) on the consolidated balance sheet. Unless settled early, the swaps will expire in 2027 and the unrealized gain or loss in AOCI will be recognized in earnings as an adjustment to interest expense over the same period during which the hedged transaction affects earnings. Unrealized gains, recorded net of tax in other comprehensive income, related to the hedge were $56 million for the quarter ended March 31, 2021.

Credit Facility

CSX has a $1.2 billion unsecured, revolving credit facility backed by a diverse syndicate of banks. This facility allows same-day borrowings at floating interest rates, based on LIBOR or an agreed-upon replacement, plus a spread that depends upon CSX's senior unsecured debt ratings. LIBOR is the London Interbank Offered Rate which is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds. This facility expires in March 2024, and at March 31, 2021, the Company had no outstanding balances under this facility.

Commitment fees and interest rates payable under the facility were similar to fees and rates available to comparably rated investment-grade borrowers. As of first quarter 2021, CSX was in compliance with all covenant requirements under this facility.

Commercial Paper

Under its commercial paper program, which is backed by the revolving credit facility, the Company may issue unsecured commercial paper notes up to a maximum aggregate principal amount of $1.0 billion outstanding at any one time. Proceeds from issuances of the notes are expected to be used for general corporate purposes. At March 31, 2021, the Company had no outstanding debt under the commercial paper program.

CSX Q1 2021 Form 10-Q p.19

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 8. Revenues

The Company’s revenues are primarily derived from the transportation of freight as performance obligations that arise from its contracts with customers are satisfied. The following table presents the Company’s revenues disaggregated by market as this best depicts how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors:

| | | | | | | | | | | |

| First Quarters | | |

| (Dollars in millions) | 2021 | 2020 | | | |

| | | | | |

| Chemicals | $ | 580 | | $ | 626 | | | | |

| Agricultural and Food Products | 349 | | 365 | | | | |

| Automotive | 236 | | 281 | | | | |

Forest Products(a) | 220 | | 219 | | | | |

| Metals and Equipment | 186 | | 199 | | | | |

| Minerals | 125 | | 127 | | | | |

Fertilizers(a) | 122 | | 110 | | | | |

| Total Merchandise | 1,818 | | 1,927 | | | | |

| | | | | |

| Intermodal | 468 | | 422 | | | | |

| | | | | |

| Coal | 384 | | 405 | | | | |

| | | | | |

| Other | 143 | | 101 | | | | |

| | | | | |

| Total | $ | 2,813 | | $ | 2,855 | | | | |

(a) In first quarter 2021, changes were made in the categorization of certain lines of business, impacting Forest Products and Fertilizers. The impacts were not material and prior periods have been reclassified to conform to the current presentation.

Revenue Recognition

The Company generates revenue from freight billings under contracts with customers generally on a rate per carload, container or ton-basis based on length of haul and commodities carried. The Company’s performance obligation arises when it receives a bill of lading (“BOL”) to transport a customer's commodities at a negotiated price contained in a transportation services agreement or a publicly disclosed tariff rate. Once a BOL is received, a contract is formed whereby the parties are committed to perform, collectability of consideration is probable and the rights of the parties, shipping terms and conditions, and payment terms are identified. A customer may submit several BOLs for transportation services at various times throughout a service agreement term but each shipment represents a distinct service that is a separately identified performance obligation.

CSX Q1 2021 Form 10-Q p.20

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 8. Revenues, continued

The average transit time to complete a shipment is between 2 to 8 days depending on market. Payments for transportation services are normally billed once a BOL is received and are generally due within 15 days after the invoice date. The Company recognizes revenue over transit time of freight as it moves from origin to destination. Revenue for services started but not completed at the reporting date is allocated based on the relative transit time in each reporting period, with the portion allocated for services subsequent to the reporting date considered remaining performance obligations.

The certain key estimates included in the recognition and measurement of revenue and related accounts receivable are as follows:

•Revenue associated with shipments in transit is recognized ratably over transit time and is based on average cycle times to move commodities and products from their origin to their final destination or interchange;

•Adjustments to revenue for billing corrections and billing discounts;

•Adjustments to revenue for overcharge claims filed by customers, which are based on historical payments to customers for rate overcharges as a percentage of total billing; and

•Incentive-based refunds to customers, which are primarily volume-related, are recorded as a reduction to revenue on the basis of the projected liability (this estimate is based on historical activity, current volume levels and forecasted future volume).

Revenue related to interline transportation services that involve the services of another party, such as another railroad, is reported on a net basis. The portion of the gross amount billed to customers that is remitted by the Company to another party is not reflected as revenue.

Other revenue is comprised of revenue from regional subsidiary railroads and incidental charges, including demurrage and switching. It is recorded upon completion of the service and accounts for an immaterial percentage of the Company's total revenue. Revenue from regional subsidiary railroads includes shipments by railroads that the Company does not directly operate. Demurrage represents charges assessed when freight cars are held by a customer beyond a specified period of time. Switching represents charges assessed when a railroad switches cars for a customer or another railroad.

During the first quarters 2021 and 2020, revenue recognized from performance obligations related to prior periods (for example, due to changes in transaction price) was not material.

Remaining Performance Obligations

Remaining performance obligations represent the transaction price allocated to future reporting periods for freight services started but not completed at the reporting date. This includes the unearned portion of billed and unbilled amounts for cancellable freight shipments in transit. The Company expects to recognize the unearned portion of revenue for freight services in transit within one week of the reporting date. As of March 31, 2021, remaining performance obligations were not material.

CSX Q1 2021 Form 10-Q p.21

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 8. Revenues, continued

Contract Balances and Accounts Receivable

The timing of revenue recognition, billings and cash collections results in accounts receivable and customer advances and deposits (contract liabilities) on the consolidated balance sheets. Contract assets, contract liabilities and deferred contract costs recorded on the consolidated balance sheet as of March 31, 2021, were not material.

The Company’s accounts receivable - net consists of freight and non-freight receivables, reduced by an allowance for credit losses.

| | | | | | | | |

| (Dollars in millions) | March 31,

2021 | December 31,

2020 |

| | |

| Freight Receivables | $ | 786 | | $ | 716 | |

| Freight Allowance for Credit Losses | (16) | | (16) | |

| Freight Receivables, net | 770 | | 700 | |

| | |

| Non-Freight Receivables | 199 | | 224 | |

| Non-Freight Allowance for Credit Losses | (12) | | (12) | |

| Non-Freight Receivables, net | 187 | | 212 | |

| Total Accounts Receivable, net | $ | 957 | | $ | 912 | |

Freight receivables include amounts earned, billed and unbilled, and currently due from customers for transportation-related services. Non-freight receivables include amounts billed and unbilled and currently due related to government reimbursement receivables and other non-revenue receivables. The Company maintains an allowance for credit losses to provide for the estimated amount of receivables that will not be collected. The allowance is based upon an assessment of risk characteristics, historical payment experience, and the age of outstanding receivables adjusted for forward-looking economic conditions as necessary. Credit losses recognized on the Company’s accounts receivable were not material in the first quarters 2021 and 2020.

NOTE 9. Income Taxes

There have been no material changes to the balance of unrecognized tax benefits reported at December 31, 2020.

CSX Q1 2021 Form 10-Q p.22

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 10. Fair Value Measurements

The Financial Instruments Topic in the ASC requires disclosures about fair value of financial instruments in annual reports as well as in quarterly reports. For CSX, this statement applies to certain investments, long-term debt and interest rate derivatives. Disclosure of the fair value of pension plan assets is only required annually. Also, this rule clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements.

Various inputs are considered when determining the value of the Company's investments, pension plan assets, long-term debt and interest rate derivatives. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. These inputs are summarized in the three broad levels listed below.

•Level 1 - observable market inputs that are unadjusted quoted prices for identical assets or liabilities in active markets;

•Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.); and

•Level 3 - significant unobservable inputs (including the Company's own assumptions about the assumptions market participants would use in determining the fair value of investments).

The valuation methods described below may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Company believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Investments

The Company's investment assets, valued with assistance from a third-party trustee, consist of certificates of deposits, commercial paper, corporate bonds and government securities and are carried at fair value on the consolidated balance sheet per the Fair Value Measurements and Disclosures Topic in the ASC. There are several valuation methodologies used for those assets as described below.

•Commercial Paper and Certificates of Deposit (Level 2): Valued at amortized cost, which approximates fair value; and

•Corporate Bonds and Government Securities (Level 2): Valued using broker quotes that utilize observable market inputs.

The Company's investment assets are carried at fair value on the consolidated balance sheets as summarized in the following table. All of the inputs used to determine the fair value of the Company's investments are Level 2 inputs.

| | | | | | | | |

| (Dollars in Millions) | March 31,

2021 | December 31,

2020 |

| | |

| | |

| Corporate Bonds | $ | 65 | | $ | 68 | |

| Government Securities | 30 | | 33 | |

| | |

| Total investments at fair value | $ | 95 | | $ | 101 | |

| | |

| Total investments at amortized cost | $ | 87 | | $ | 89 | |

CSX Q1 2021 Form 10-Q p.23

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 10. Fair Value Measurements, continued

These investments have the following maturities:

| | | | | | | | | | | |

| (Dollars in millions) | March 31,

2021 | | December 31,

2020 |

Less than 1 year | $ | 2 | | | $ | 2 | |

1 - 5 years | 23 | | | 22 | |

5 - 10 years | 20 | | | 23 | |

Greater than 10 years | 50 | | | 54 | |

Total investments at fair value | $ | 95 | | | $ | 101 | |

Long-term Debt

Long-term debt is reported at carrying amount on the consolidated balance sheets and is the Company's only financial instrument with fair values significantly different from their carrying amounts. The majority of the Company's long-term debt is valued with assistance from a third party that utilizes closing transactions, market quotes or market values of comparable debt. For those instruments not valued by the third party, the fair value has been estimated by applying market rates of similar instruments to the scheduled contractual debt payments and maturities. These market rates are provided by the same third party. All of the inputs used to determine the fair value of the Company's long-term debt are Level 2 inputs.

The fair value of outstanding debt fluctuates with changes in a number of factors. Such factors include, but are not limited to, interest rates, market conditions, credit ratings, values of similar financial instruments, size of the transaction, cash flow projections and comparable trades. Fair value will exceed carrying value when the current market interest rate is lower than the interest rate at which the debt was originally issued. The fair value of a company's debt is a measure of its current value under present market conditions. It does not impact the financial statements under current accounting rules. The fair value and carrying value of the Company's long-term debt is as follows:

| | | | | | | | | | | |

| (Dollars in millions) | March 31,

2021 | | December 31,

2020 |

| Long-term Debt (Including Current Maturities): | | | |

| Fair Value | $ | 18,765 | | | $ | 21,076 | |

| Carrying Value | 16,347 | | | 16,705 | |

Interest Rate Derivatives

The Company’s forward starting interest rate swaps are carried at fair value and valued with assistance from a third party based upon pricing models using inputs observed from actively quoted markets. All of the inputs used to determine the fair value of the swaps are Level 2 inputs. The fair value of the Company’s forward starting interest rate swap asset was $153 million at March 31, 2021. See Note 7, Debt and Credit Agreements for further information.

CSX Q1 2021 Form 10-Q p.24

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 11. Other Comprehensive Income (Loss)

CSX reports comprehensive earnings or loss in accordance with the Comprehensive Income Topic in the ASC in the Consolidated Comprehensive Income Statement. Total comprehensive earnings are defined as all changes in shareholders' equity during a period, other than those resulting from investments by and distributions to shareholders (e.g. issuance of equity securities and dividends). Generally, for CSX, total comprehensive earnings equal net earnings plus or minus adjustments for pension and other post-retirement liabilities as well as other adjustments. Total comprehensive earnings represent the activity for a period net of tax and were $774 million and $773 million for first quarters 2021 and 2020, respectively.

While total comprehensive earnings is the activity in a period and is largely driven by net earnings in that period, accumulated other comprehensive income or loss (“AOCI”) represents the cumulative balance of other comprehensive income, net of tax, as of the balance sheet date. For CSX, AOCI is primarily the cumulative balance related to pension and other post-retirement benefit adjustments, interest rate derivatives and CSX's share of AOCI of equity method investees.