UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 1-8022 | ||||

CSX CORPORATION | ||||

(Exact name of registrant as specified in its charter) | ||||

Virginia | 62-1051971 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

500 Water Street, 15th Floor, Jacksonville, FL | 32202 | (904) 359-3200 | ||

(Address of principal executive offices) | (Zip Code) | (Telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of exchange on which registered | |||

Common Stock, $1 Par Value | Nasdaq Global Select Market | |||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes (X) No ( )

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ( ) No (X)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes (X) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Exchange Act Rule 12b-2).

Large Accelerated Filer (X) Accelerated Filer ( ) Non-accelerated Filer ( ) Smaller reporting company ( )

Emerging growth company ( )

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ( )

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ( ) No (X)

On June 30, 2017 (which is the last day of the second quarter and the required date to use), the aggregate market value of the Registrant’s voting stock held by non-affiliates was approximately $47 billion (based on the close price as reported on the NASDAQ National Market System on such date).

There were 887,236,080 shares of Common Stock outstanding on January 31, 2018 (the latest practicable date that is closest to the filing date).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement (the “Proxy Statement”) to be filed no later than 120 days after the end of the fiscal year with respect to its 2018 annual meeting of shareholders.

CSX 2017 Form 10-K p. 1

CSX CORPORATION | ||||

FORM 10-K | ||||

TABLE OF CONTENTS | ||||

Item No. | Page | |||

PART I | ||||

1. | ||||

2. | ||||

3. | ||||

4. | ||||

PART II | ||||

5. | ||||

6. | ||||

7. | ||||

· Terms Used by CSX | ||||

· 2017 Highlights | ||||

· Critical Accounting Estimates | ||||

· Forward-Looking Statements | ||||

7A. | ||||

8. | ||||

9. | ||||

9A. | ||||

9B. | ||||

PART III | ||||

10. | Directors, Executive Officers of the Registrant and Corporate Governance | |||

11. | ||||

12. | ||||

13. | ||||

14. | ||||

PART IV | ||||

15. | ||||

CSX 2017 Form 10-K p. 2

CSX CORPORATION

PART I

Item 1. Business

CSX Corporation (“CSX”), and together with its subsidiaries (the “Company”), based in Jacksonville, Florida, is one of the nation's leading transportation companies. The Company provides rail-based freight transportation services including traditional rail service, the transport of intermodal containers and trailers, as well as other transportation services such as rail-to-truck transfers and bulk commodity operations. CSX and the rail industry provide customers with access to an expansive and interconnected transportation network that plays a key role in North American commerce and is critical to the long-term economic success and improved global competitiveness of the United States. In addition, freight railroads provide the most economical and environmentally efficient means to transport goods over land.

The Company’s number of employees was approximately 24,000 as of December 2017, which includes approximately 20,000 union employees. Most of the Company’s employees provide or support transportation services.

CSX Transportation, Inc.

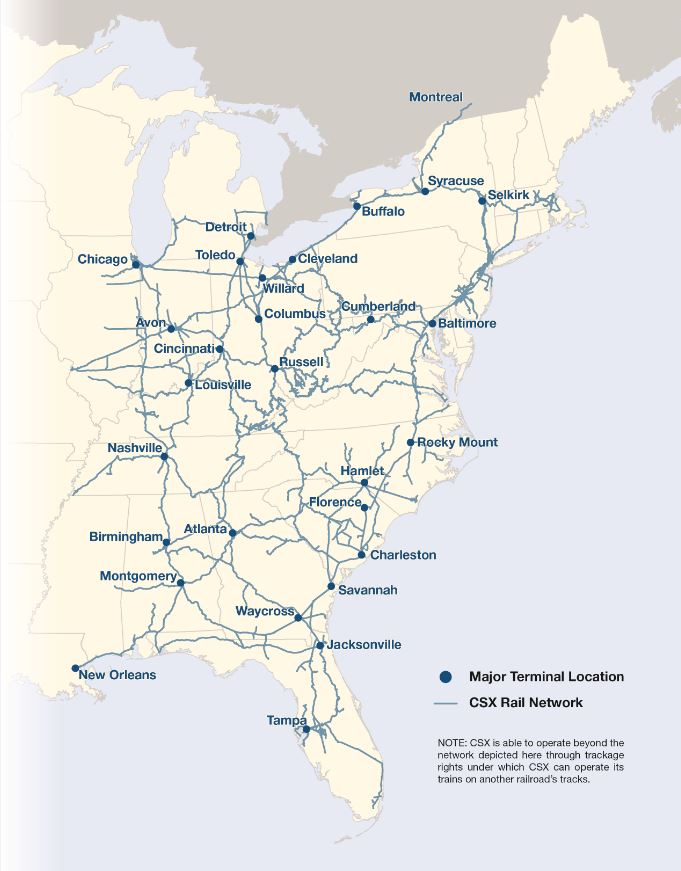

CSX’s principal operating subsidiary, CSX Transportation, Inc. (“CSXT”), provides an important link to the transportation supply chain through its approximately 21,000 route mile rail network, which serves major population centers in 23 states east of the Mississippi River, the District of Columbia and the Canadian provinces of Ontario and Quebec. It has access to over 70 ocean, river and lake port terminals along the Atlantic and Gulf Coasts, the Mississippi River, the Great Lakes and the St. Lawrence Seaway. This access allows the Company to meet the dynamic transportation needs of manufacturers, industrial producers, the automotive industry, construction companies, farmers and feed mills, wholesalers and retailers, and energy producers. The Company’s intermodal business links customers to railroads via trucks and terminals. CSXT also serves thousands of production and distribution facilities through track connections with other Class I railroads and approximately 230 short-line and regional railroads.

CSXT is now responsible for the Company's real estate sales, leasing, acquisition and management and development activities after a merger with CSX Real Property, Inc., a former wholly-owned CSX subsidiary, on July 1, 2017. In addition, as substantially all real estate sales, leasing, acquisition and management and development activities are focused on supporting railroad operations, all results of these activities are included in operating income beginning in 2017. Previously, the results of these activities were classified as operating or non-operating based on the nature of the activity and were not material for any periods presented.

CSX 2017 Form 10-K p. 3

CSX CORPORATION

PART I

Lines of Business

During 2017, the Company's services generated $11.4 billion of revenue and served three primary lines of business: merchandise, coal and intermodal.

• | The merchandise business shipped 2.7 million carloads and generated 62 percent of revenue and 42 percent of volume in 2017. The Company’s merchandise business is comprised of shipments in the following diverse markets: chemicals, automotive, agricultural and food products, minerals, fertilizers, forest products, and metals and equipment. |

• | The coal business shipped 855 thousand carloads and accounted for 18 percent of revenue and 13 percent of volume in 2017. The Company transports domestic coal, coke and iron ore to electricity-generating power plants, steel manufacturers and industrial plants as well as export coal to deep-water port facilities. Roughly one-third of export coal and the majority of the domestic coal that the Company transports is used for generating electricity. |

• | The intermodal business accounted for 16 percent of revenue and 44 percent of volume in 2017. The intermodal business combines the superior economics of rail transportation with the short-haul flexibility of trucks and offers a cost advantage over long-haul trucking. Through a network of more than 40 terminals, the intermodal business serves all major markets east of the Mississippi River and transports mainly manufactured consumer goods in containers, providing customers with truck-like service for longer shipments. |

Other revenue accounted for 4 percent of the Company’s total revenue in 2017. This category includes revenue from regional subsidiary railroads, demurrage, revenue for customer volume commitments not met, switching, other incidental charges and adjustments to revenue reserves. Revenue from regional railroads includes shipments by railroads that the Company does not directly operate. Demurrage represents charges assessed when freight cars or other equipment are held beyond a specified period of time. Switching revenue is primarily generated when CSXT switches cars for a customer or another railroad.

Other Entities

In addition to CSXT, the Company’s subsidiaries include CSX Intermodal Terminals, Inc. (“CSX Intermodal Terminals”), Total Distribution Services, Inc. (“TDSI”), Transflo Terminal Services, Inc. (“Transflo”), CSX Technology, Inc. (“CSX Technology”) and other subsidiaries. CSX Intermodal Terminals owns and operates a system of intermodal terminals, predominantly in the eastern United States and also performs drayage services (the pickup and delivery of intermodal shipments) for certain customers and trucking dispatch operations. TDSI serves the automotive industry with distribution centers and storage locations. Transflo connects non-rail served customers to the many benefits of rail by transferring products from rail to trucks. The biggest Transflo markets are chemicals and agriculture, which includes shipments of plastics and ethanol. CSX Technology and other subsidiaries provide support services for the Company.

Scheduled Railroading

In 2017, the Company began transitioning its operating model to scheduled railroading, which is focused on developing and strictly maintaining a scheduled service plan with an emphasis on optimizing assets. When the operating model is executed effectively, customer service is improved, costs are reduced and free cash flow is generated, allowing financial growth. E. Hunter Harrison created and refined the model during his decades of railroad leadership experience, successfully implementing it at three different railroads prior to being named CEO of CSX in March 2017. In October 2017, the Company hired James M. Foote, a railroad executive with extensive scheduled railroading experience, as Chief Operating Officer. Upon Mr. Harrison's death in December 2017, Foote was appointed CEO by the Board of Directors to continue driving CSX's transformation under the new operating model. Additionally, Edmond L. Harris was named Executive Vice President of Operations in January 2018, further strengthening the scheduled railroading experience of the leadership team.

CSX 2017 Form 10-K p. 4

CSX CORPORATION

PART I

Financial Information

See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for operating revenue, operating income and total assets for each of the last three fiscal years.

Company History

A leader in freight rail transportation for more than 190 years, the Company’s heritage dates back to the early nineteenth century when The Baltimore and Ohio Railroad Company (“B&O”) – the nation’s first common carrier – was chartered in 1827. Since that time, the Company has built on this foundation to create a railroad that could safely and reliably service the ever-increasing demands of a growing nation.

Since its founding, numerous railroads have combined with the former B&O through merger and consolidation to create what has become CSX. Each of the railroads that combined into the CSX family brought new geographical reach to valuable markets, gateways, cities, ports and transportation corridors.

CSX was incorporated in 1978 under Virginia law. In 1980, the Company completed the merger of the Chessie System and Seaboard Coast Line Industries into CSX. The merger allowed the Company to connect northern population centers and Appalachian coal fields to growing southeastern markets. Later, the Company’s acquisition of key portions of Conrail, Inc. ("Conrail") allowed CSXT to link the northeast, including New England and the New York metropolitan area, with Chicago and midwestern markets as well as the growing areas in the Southeast already served by CSXT. This current rail network allows the Company to directly serve every major market in the eastern United States with safe, dependable, environmentally responsible and fuel efficient freight transportation and intermodal service.

Competition

The business environment in which the Company operates is highly competitive. Shippers typically select transportation providers that offer the most compelling combination of service and price. Service requirements, both in terms of transit time and reliability, vary by shipper and commodity. As a result, the Company’s primary competition varies by commodity, geographic location and mode of available transportation and includes other railroads, motor carriers that operate similar routes across its service area and, to a less significant extent, barges, ships and pipelines.

CSXT’s primary rail competitor is Norfolk Southern Railway, which operates throughout much of the Company’s territory. Other railroads also operate in parts of the Company’s territory. Depending on the specific market, competing railroads and deregulated motor carriers may exert pressure on price and service levels. For further discussion on the risk of competition to the Company, see Item 1A. Risk Factors.

Regulatory Environment

The Company's operations are subject to various federal, state, provincial (Canada) and local laws and regulations generally applicable to businesses operating in the United States and Canada. In the U.S., the railroad operations conducted by the Company's subsidiaries, including CSXT, are subject to the regulatory jurisdiction of the Surface Transportation Board (“STB”), the Federal Railroad Administration (“FRA”), and its sister agency within the U.S. Department of Transportation ("DOT"), the Pipeline and Hazardous Materials Safety Administration (“PHMSA”). Together, FRA and PHMSA have broad jurisdiction over railroad operating standards and practices, including track, freight cars, locomotives and hazardous materials requirements. In addition, the U.S. Environmental Protection Agency (“EPA”) has regulatory authority with respect to matters that impact the Company's properties and operations. The EPA is considering regulatory action directed towards the railroad industry governing the disposal of creosote cross-ties and seeking to increase air emission regulations that may impact our operations or increase costs. Similarly, the Transportation Security Administration (“TSA”), a component of the Department of Homeland Security, has broad authority over railroad operating practices that may have homeland security implications. In Canada, the railroad operations conducted by the Company’s subsidiaries, including CSXT, are subject to the regulatory jurisdiction of the Canadian Transportation Agency.

CSX 2017 Form 10-K p. 5

CSX CORPORATION

PART I

Although the Staggers Act of 1980 significantly deregulated the U.S. rail industry, the STB has broad jurisdiction over rail carriers. The STB regulates routes, fuel surcharges, conditions of service, rates for non-exempt traffic, acquisitions of control over rail common carriers and the transfer, extension or abandonment of rail lines, among other railroad activities.

Positive Train Control

In 2008, Congress enacted the Rail Safety Improvement Act (the “RSIA”). The legislation included a mandate that all Class I freight railroads implement an interoperable positive train control system (“PTC”) by December 31, 2015. Implementation of a PTC system is designed to prevent train-to-train collisions, over-speed derailments, incursions into established work-zone limits, and train diversions onto another set of tracks. On October 29, 2015, the President of the United States signed the Positive Train Control Enforcement and Implementation Act of 2015 into law extending the deadline. This Act requires the installation of all PTC hardware be completed by December 31, 2018, and, assuming certain conditions are met, requires that the PTC system be fully operational by December 31, 2020.

PTC must be installed on all main lines with passenger and commuter operations as well as most of those over which toxic-by-inhalation hazardous materials are transported. The Company expects to continue incurring significant capital costs in connection with the implementation of PTC as well as related ongoing operating expenses. CSX currently estimates that the total multi-year cost of PTC implementation will be approximately $2.4 billion for the Company. Total PTC investment through 2017 was $2 billion.

STB Proceedings

In 2012, the STB announced it would accept comments on a proposal by the National Industrial Transportation League that would require Class I railroads to provide a form of "competitive access" to customers served solely by one railroad. Under this proposal, CSX would be required to allow a competing railroad to access certain customers that are currently solely served by CSX's network. In early 2013, shippers, railroads and other parties submitted comments on the proposal, and the STB held a hearing in March 2014 to receive further input from participating parties. Since the hearing, the STB has taken no further action in the proceeding.

In April 2014, the STB announced it would receive comments to explore its methodology for determining railroad revenue adequacy. The revenue adequacy standard represents the level of profitability for a healthy carrier. Shippers, railroads and other parties filed comments in late 2014. The STB held a hearing in July 2015 to receive further input from participating parties. Since the hearing, the STB has taken no further action in the proceeding.

CSX participated in a public listening session on October 11, 2017 at the STB in response to service complaints. During the session, the Company addressed customer concerns and detailed the Company’s service recovery plans at that time. At the STB's request, CSX is providing additional operating measures on a weekly basis that are available on the Company's website.

New rules regarding, among other things, competitive access or revenue adequacy could have a material adverse effect on the Company's financial condition, results of operations and liquidity as well as its ability to invest in enhancing and maintaining vital infrastructure. For further discussion on regulatory risks to the Company, see Item 1A. Risk Factors.

CSX 2017 Form 10-K p. 6

CSX CORPORATION

PART I

Other Information

CSX makes available on its website www.csx.com, free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such reports are filed with or furnished to the Securities and Exchange Commission (“SEC”). The information on the CSX website is not part of this annual report on Form 10-K. Additionally, the Company has posted its code of ethics on its website, which is also available to any shareholder who requests it. This Form 10-K and other SEC filings made by CSX are also accessible through the SEC’s website at www.sec.gov.

CSX has included the certifications of its Chief Executive Officer (“CEO”) and the Chief Financial Officer (“CFO”) required by Section 302 of the Sarbanes-Oxley Act of 2002 (“the Act”) as Exhibit 31, as well as Section 906 of the Act as Exhibit 32 to this Form 10-K report.

The information set forth in Item 6. Selected Financial Data is incorporated herein by reference. For additional information concerning business conducted by the Company during 2017, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

CSX 2017 Form 10-K p. 7

CSX CORPORATION

PART I

Item 1A. Risk Factors

The risks set forth in the following risk factors could have a materially adverse effect on the Company's financial condition, results of operations or liquidity, and could cause those results to differ materially from those expressed or implied in the Company's forward-looking statements. Additional risks and uncertainties not currently known to the Company or that the Company currently does not deem to be material also may materially impact the Company's financial condition, results of operations or liquidity.

New legislation or regulatory changes could impact the Company's earnings or restrict its ability to independently negotiate prices.

Legislation passed by Congress, new regulations issued by federal agencies or executive orders issued by the President of the United States could significantly affect the revenues, costs and profitability of the Company's business. For instance, several of the proposals under consideration by the STB could have a significant negative impact on the Company's ability to negotiate prices for the value of rail services provided and meet service standards, which could force a reduction in capital spending. In addition, statutes imposing price constraints or affecting rail-to-rail competition could adversely affect the Company's profitability.

Government regulation and compliance risks may adversely affect the Company's operations and financial results.

The Company is subject to the jurisdiction of various regulatory agencies, including the STB, FRA, PHMSA, TSA, EPA and other state, provincial and federal regulatory agencies for a variety of economic, health, safety, labor, environmental, tax, legal and other matters. New or modified rules or regulations by these agencies could increase the Company's operating costs or reduce operating efficiencies and impact service performance. For example, the RSIA mandates that the installation of PTC hardware be completed by December 31, 2018 and, assuming certain conditions are met, requires that the PTC system be fully operational by December 31, 2020 on main lines that carry certain hazardous materials and on lines that have commuter or passenger operations. Although CSX remains on track to meet this regulatory requirement, noncompliance with these and other applicable laws or regulations could erode public confidence in the Company and can subject the Company to fines, penalties and other legal or regulatory sanctions.

The Company’s business strategies may not achieve the anticipated objectives.

The implementation of the Company’s business strategies could result in operational disruptions, loss of existing customers, regulatory issues and other adverse consequences. If these strategies fail to achieve the anticipated benefits or take longer to implement than expected, the Company’s operations and financial results may be adversely affected.

Failure to complete negotiations on collective bargaining agreements could result in strikes and/or work stoppages.

Most of CSX's employees are represented by labor unions and are covered by collective bargaining agreements. Approximately 70 percent of these agreements are bargained for nationally by the National Carriers Conference Committee and negotiated over the course of several years and previously have not resulted in any extended work stoppages. Under the Railway Labor Act's procedures (which include mediation, cooling-off periods and the possibility of an intervention of the U.S. President), during negotiations neither party may take action until the procedures are exhausted. If, however, CSX is unable to negotiate acceptable agreements, or if terms of existing agreements are disputed, the employees covered by the Railway Labor Act could strike, which could result in loss of business and increased operating costs as a result of higher wages or benefits paid to union members. Additionally, from time to time, the Company enters into CSX-specific, or “local”, bargaining agreements which could also be critical to the Company and its new business strategies.

CSX 2017 Form 10-K p. 8

CSX CORPORATION

PART I

Network constraints could have a negative impact on service and operating efficiency.

CSXT could experience rail network difficulties related to: (i) increased volume; (ii) locomotive or crew shortages; (iii) extreme weather conditions; (iv) impacts from changes in yard capacity, or network structure or composition, including train routes; (v) increased passenger activities, including high-speed rail; or (vi) regulatory changes impacting where and how fast CSXT can transport freight or maintain routes, which could have a negative effect on CSXT's operational fluidity, leading to deterioration of service, asset utilization and overall efficiency.

Global economic conditions could negatively affect demand for commodities and other freight.

A decline or disruption in general domestic and global economic conditions that affects demand for the commodities and products the Company transports, including import and export volume, could reduce revenues or have other adverse effects on the Company's cost structure and profitability. For example, if the rate of economic growth in Asia slows, European economies contract, or if the global supply of seaborne coal or price of seaborne coal changes from its current levels, U.S. export coal volume could be adversely impacted resulting in lower revenue for CSX. Additionally, changes to trade agreements or policies could result in reduced import and export volumes due to increased tariffs and lower consumer demand. If the Company experiences significant declines in demand for its transportation services with respect to one or more commodities and products, the Company may experience reduced revenue and increased operating costs, workforce adjustments, and other related activities, which could have a material adverse effect on the Company's financial condition, results of operations and liquidity.

Changing dynamics in the U.S. and global energy markets could negatively impact profitability.

Over the past few years, production and source locations of natural gas in the U.S. have also increased dramatically, which has resulted in lower natural gas prices in CSX’s service territory. As a result of sustained low natural gas prices, many coal-fired power plants have been displaced by natural gas-fired power generation facilities. If natural gas prices were to remain low, additional coal-fired plants could be displaced, which would likely further reduce the Company's domestic coal volumes and revenues. Additionally, crude oil prices combined with increased pipeline activity have resulted in volatility in domestic crude oil production, which has adversely affected crude oil volumes for CSX.

CSXT, as a common carrier by rail, is required by law to transport hazardous materials, which could expose the Company to significant costs and claims.

A train accident involving the transport of hazardous materials could result in significant claims arising from personal injury, property or natural resource damage, environmental penalties and remediation obligations. Such claims, if insured, could exceed existing insurance coverage or insurance may not continue to be available at commercially reasonable rates. Under federal regulations, CSXT is required to transport hazardous materials under the legal duty referred to as the common carrier mandate.

CSXT is also required to comply with regulations regarding the handling of hazardous materials. In November 2008, the TSA issued final rules placing significant new security and safety requirements on passenger and freight railroad carriers, rail transit systems and facilities that ship hazardous materials by rail. Noncompliance with these rules can subject the Company to significant penalties and could be a factor in litigation arising out of a train accident. Finally, legislation preventing the transport of hazardous materials through certain cities could result in network congestion and increase the length of haul for hazardous substances, which could increase operating costs, reduce operating efficiency or increase the risk of an accident involving the transport of hazardous materials.

CSX 2017 Form 10-K p. 9

CSX CORPORATION

PART I

Climate change and other emissions-related laws and regulations could adversely affect the Company's operations and financial results.

Climate change and other emissions-related laws and regulations have been proposed and, in some cases adopted, on the federal, state, provincial and local levels. These final and proposed laws and regulations take the form of restrictions, caps, taxes or other controls on emissions. In particular, the EPA has issued various regulations and may issue additional regulations targeting emissions, including rules and standards governing emissions from certain stationary sources and from vehicles.

Any of these pending or proposed laws or regulations could adversely affect the Company's operations and financial results by, among other things: (i) reducing coal-fired electricity generation due to mandated emission standards; (ii) reducing the consumption of coal as a viable energy resource in the United States and Canada; (iii) increasing the Company's fuel, capital and other operating costs and negatively affecting operating and fuel efficiencies; and (iv) making it difficult for the Company's customers in the U.S. and Canada to produce products in a cost competitive manner. Any of these factors could reduce the amount of shipments the Company handles and have a material adverse effect on the Company's financial condition, results of operations or liquidity.

The Company is subject to environmental laws and regulations that may result in significant costs.

The Company is subject to wide-ranging federal, state, provincial and local environmental laws and regulations concerning, among other things, emissions into the air, ground and water; the handling, storage, use, generation, transportation and disposal of waste and other materials; the clean-up of hazardous material and petroleum releases and the health and safety of our employees. If the Company violates or fails to comply with these laws and regulations, CSX could be fined or otherwise sanctioned by regulators. The Company can also be held liable for consequences arising out of human exposure to any hazardous substances for which CSX is responsible. In certain circumstances, environmental liability can extend to formerly owned or operated properties, leased properties, adjacent properties and properties owned by third parties or Company predecessors, as well as to properties currently owned, leased or used by the Company.

The Company has been, and may in the future be, subject to allegations or findings to the effect that it has violated, or is strictly liable under, environmental laws or regulations, and such violations can result in the Company's incurring fines, penalties or costs relating to the clean-up of environmental contamination. Although the Company believes it has appropriately recorded current and long-term liabilities for known and reasonably estimable future environmental costs, it could incur significant costs that exceed reserves or require unanticipated cash expenditures as a result of any of the foregoing. The Company also may be required to incur significant expenses to investigate and remediate known, unknown or future environmental contamination.

The Company relies on the security, stability and availability of its technology systems to operate its business.

The Company relies on information technology in all aspects of its business. The performance and reliability of the Company's technology systems are critical to its ability to operate and compete safely and effectively. A cybersecurity attack, which is a deliberate theft of data or impairment of information technology systems, or other significant disruption or failure, could result in a service interruption, train accident, misappropriation of confidential information, process failure, security breach or other operational difficulties. Such an event could result in decreased revenues and increased capital, insurance or operating costs, including increased security costs to protect the Company's infrastructure. Insurance maintained by the Company to protect against loss of business and other related consequences resulting from cyber incidents may not be sufficient to cover all damages. A disruption or compromise of the Company's information technology systems, even for short periods of time, could have a material adverse effect.

CSX 2017 Form 10-K p. 10

CSX CORPORATION

PART I

Disruption of the supply chain could negatively affect operating efficiency and increase costs.

The capital intensive nature and sophistication of core rail equipment (including rolling stock equipment, locomotives, rail, and ties) limits the number of railroad equipment suppliers. If any of the current manufacturers stops production or experiences a supply shortage, CSXT could experience a significant cost increase or material shortage. In addition, a few critical railroad suppliers are foreign and, as such, adverse developments in international relations, new trade regulations, disruptions in international shipping or increases in global demand could make procurement of these supplies more difficult or increase CSXT's operating costs. Additionally, if a fuel supply shortage were to arise, the Company would be negatively impacted.

The Company faces competition from other transportation providers.

The Company experiences competition in pricing, service, reliability and other factors from various transportation providers including railroads and motor carriers that operate similar routes across its service area and, to a less significant extent, barges, ships and pipelines. Other transportation providers generally use public rights-of-way that are built and maintained by governmental entities, while CSXT and other railroads must build and maintain rail networks largely using internal resources. Any future improvements or expenditures materially increasing the quality or reducing the cost of alternative modes of transportation such as through the use of automation, autonomy or electrification, or legislation providing for less stringent size or weight restrictions on trucks, could negatively impact the Company's competitive position. Additionally, any future consolidation in the rail industry could materially affect the regulatory and competitive environment in which the Company operates.

Future acts of terrorism, war or regulatory changes to combat the risk of terrorism may cause significant disruptions in the Company's operations.

Terrorist attacks, along with any government response to those attacks, may adversely affect the Company's financial condition, results of operations or liquidity. CSXT's rail lines, other key infrastructure and information technology systems may be targets or indirect casualties of acts of terror or war. This risk could cause significant business interruption and result in increased costs and liabilities and decreased revenues. In addition, premiums charged for some or all of the insurance coverage currently maintained by the Company could increase dramatically, or the coverage may no longer be available.

Furthermore, in response to the heightened risk of terrorism, federal, state and local governmental bodies are proposing and, in some cases, have adopted legislation and regulations relating to security issues that impact the transportation industry. For example, the Department of Homeland Security adopted regulations that require freight railroads to implement additional security protocols when transporting hazardous materials. Complying with these or future regulations could continue to increase the Company's operating costs and reduce operating efficiencies.

Severe weather or other natural occurrences could result in significant business interruptions and expenditures in excess of available insurance coverage.

The Company's operations may be affected by external factors such as severe weather and other natural occurrences, including floods, fires, hurricanes and earthquakes. As a result, the Company's rail network may be damaged, its workforce may be unavailable, fuel costs may rise and significant business interruptions could occur. In addition, the performance of locomotives and railcars could be adversely affected by extreme weather conditions. Insurance maintained by the Company to protect against loss of business and other related consequences resulting from these natural occurrences is subject to coverage limitations, depending on the nature of the risk insured. This insurance may not be sufficient to cover all of the Company's damages or damages to others, and this insurance may not continue to be available at commercially reasonable rates. Even with insurance, if any natural occurrence leads to a catastrophic interruption of service, the Company may not be able to restore service without a significant interruption in operations.

CSX 2017 Form 10-K p. 11

CSX CORPORATION

PART I

The Company may be subject to various claims and lawsuits that could result in significant expenditures.

As part of its railroad and other operations, the Company is subject to various claims and lawsuits related to disputes over commercial practices, labor and unemployment matters, occupational and personal injury claims, property damage, environmental and other matters. The Company may experience material judgments or incur significant costs to defend existing and future lawsuits. Although the Company maintains insurance to cover some of these types of claims and establishes reserves when appropriate, final amounts determined to be due on any outstanding matters may exceed the Company's insurance coverage or differ materially from the recorded reserves. Additionally, the Company could be impacted by adverse developments not currently reflected in the Company's reserve estimates.

The unavailability of critical resources could adversely affect the Company’s operational efficiency and ability to meet demand.

Marketplace conditions for resources like locomotives as well as the availability of qualified personnel, particularly engineers and conductors, could each have a negative impact on the Company’s ability to meet demand for rail service. Although the Company believes that it has adequate personnel for the current business environment, unpredictable increases in demand for rail services or extreme weather conditions may exacerbate such risks, which could have a negative impact on the Company’s operational efficiency and otherwise have a material adverse effect on the Company’s financial condition, results of operations, or liquidity in a particular period.

Weaknesses in the capital and credit markets could negatively impact the Company’s access to capital.

Due to the significant capital expenditures required to operate and maintain a safe and efficient railroad, the Company regularly relies on capital markets for the issuance of long-term debt instruments as well as on bank financing from time to time. Instability or disruptions of the capital markets, including credit markets, or the deterioration of the Company’s financial condition due to internal or external factors, could restrict or prohibit access and could increase the cost of financing sources. A significant deterioration of the Company’s financial condition could also reduce credit ratings and could limit or affect its access to external sources of capital and increase the costs of short and long-term debt financing.

Item 1B. Unresolved Staff Comments

None

CSX 2017 Form 10-K p. 12

CSX CORPORATION

PART I

Item 2. Properties

The Company’s properties primarily consist of track and its related infrastructure, locomotives and freight cars and equipment. These categories and the geography of the network are described below.

Track and Infrastructure

Serving 23 states, the District of Columbia, and the Canadian provinces of Ontario and Quebec, the CSXT rail network serves, among other markets, New York, Philadelphia and Boston in the Northeast and Mid-Atlantic, the southeast markets of Atlanta, Miami and New Orleans, and the midwestern cities of St. Louis, Memphis and Chicago.

CSXT’s track structure includes mainline track, connecting terminals and yards, track within terminals and switching yards, sidings used for passing trains, track connecting CSXT's track to customer locations and track that diverts trains from one track to another known as turnouts. Total track miles, which reflect the size of CSXT’s network that connects markets, customers and western railroads, are greater than CSXT’s approximately 21,000 route miles. At December 2017, the breakdown of track miles was as follows:

Track | ||

Miles | ||

Mainline track | 26,500 | |

Terminals and switching yards | 9,348 | |

Passing sidings and turnouts | 920 | |

Total | 36,768 | |

In addition to its physical track structure, the Company operates numerous yards and terminals for rail and intermodal service. These serve as points of connectivity between the Company and its local customers and as sorting facilities where railcars and intermodal containers are received, classed for destination and placed onto outbound trains, or arrive and are delivered to the customer. In 2017, CSX converted a number of hump yards to flat switching operations which allows for less intermediate processing and the opportunity to improve transit time. The Company’s largest yards and terminals based on 2017 volume (number of railcars or intermodal containers processed) are listed below.

Yards and Terminals |

Chicago, IL - Bedford Park Intermodal Terminal |

North Baltimore, OH - Northwest Ohio Intermodal Terminal |

Waycross, GA |

Cincinnati, OH |

Selkirk, NY |

Avon, IN (Indianapolis) |

Willard, OH |

Nashville, TN |

Louisville, KY |

Hamlet, NC |

CSX 2017 Form 10-K p. 13

CSX CORPORATION

PART I

Network Geography

CSXT’s operations are primarily focused on four major transportation networks and corridors which are defined geographically and by commodity flows below.

Interstate 90 (I-90) Corridor – This CSXT corridor links Chicago and the Midwest to metropolitan areas in New York and New England. This route, also known as the “waterlevel route,” has minimal hills and grades and nearly all of it has two main tracks (referred to as double track). These engineering attributes permit the corridor to support high-speed service across intermodal, automotive and merchandise commodities. This corridor is a primary route for import traffic coming from the far east through western ports moving eastward across the country, through Chicago and into the population centers in the Northeast. The I-90 Corridor is also a critical link between ports in New York, New Jersey, and Pennsylvania and consumption markets in the Midwest. This route carries goods from all three of the Company’s major markets – merchandise, coal and intermodal.

Interstate 95 (I-95) Corridor – The CSXT I-95 Corridor connects Charleston, Jacksonville, Miami and many other cities throughout the Southeast with the heavily populated mid-Atlantic and northeastern cities of Baltimore, Philadelphia and New York. CSXT primarily transports food and consumer products, as well as metals and chemicals along this line. It is the leading rail corridor along the eastern seaboard south of the District of Columbia, and provides access to major eastern ports.

Southeastern Corridor – This critical part of the network runs between CSXT’s western gateways of Chicago, St. Louis and Memphis through the cities of Nashville, Birmingham, and Atlanta and markets in the Southeast. The Southeastern Corridor is the premier rail route connecting these key cities, gateways, and markets and positions CSXT to efficiently handle projected traffic volumes of intermodal, automotive and general merchandise traffic. The corridor also provides direct rail service between the coal reserves of the southern Illinois basin and the demand for coal in the Southeast.

Coal Network – The CSXT coal network connects the coal mining operations in the Appalachian mountain region and Illinois basin with industrial areas in the Southeast, Northeast and Mid-Atlantic, as well as many river, lake, and deep water port facilities. The domestic coal market has declined significantly over the past several years and export coal remains subject to a high degree of volatility. CSXT’s coal network remains well positioned to supply utility markets in both the Northeast and Southeast and to transport coal shipments for export outside of the U.S. Roughly one-third of the tons of export coal and the majority of the domestic coal that the Company transports is used for generating electricity.

See the following page for a map of the CSX Rail Network.

CSX 2017 Form 10-K p. 14

CSX CORPORATION

PART I

CSX Rail Network

CSX 2017 Form 10-K p. 15

CSX CORPORATION

PART I

Locomotives

At December 2017, CSXT owned more than 4,000 locomotives. From time to time, the Company also short-term leases locomotives based on business needs. Freight locomotives are used primarily to pull trains while switching locomotives are used in yards. Auxiliary units are typically used to provide extra traction for heavy trains in hilly terrain. At December 2017, CSXT’s fleet of owned locomotives consisted of the following types:

Locomotives | % | Average Age (years) | ||||||

Freight | 3,659 | 88 | % | 20 | ||||

Switching | 299 | 7 | % | 37 | ||||

Auxiliary Units | 208 | 5 | % | 24 | ||||

Total | 4,166 | 100 | % | 20 | ||||

Equipment

At any time, over half of the railcars on the CSXT system are not owned or leased by the Company. Examples of these include railcars owned by other railroads (which are utilized by CSXT), shipper-furnished or private cars (which are generally used only in that shipper’s service), multi-level railcars used to transport automobiles (which are shared between railroads) and doublestack railcars, or well cars (which are industry pooled), that allow for two intermodal containers to be loaded one above the other.

At December 2017, the Company’s owned and long-term leased equipment consisted of the following:

Equipment | Number of Units | % | |||

Gondolas | 21,209 | 35 | % | ||

Multi-level flat cars | 11,686 | 19 | % | ||

Open-top hoppers | 10,298 | 17 | % | ||

Covered hoppers | 9,623 | 16 | % | ||

Box cars | 6,374 | 11 | % | ||

Flat cars | 624 | 1 | % | ||

Other cars | 337 | — | % | ||

Subtotal freight cars | 60,151 | 100 | % | ||

Containers | 18,088 | ||||

Total equipment | 78,239 | ||||

CSX 2017 Form 10-K p. 16

CSX CORPORATION

PART I

The Company’s revenue-generating equipment, either owned or long-term leased, consists of freight cars and containers as described below.

Gondolas – Support CSXT’s metals markets and provide transport for woodchips and other bulk commodities. Some gondolas are equipped with special hoods for protecting products like coil and sheet steel.

Multi-level flat cars – Transport finished automobiles and are differentiated by the number of levels: bi-levels for large vehicles such as pickup trucks and SUVs and tri-levels for sedans and smaller automobiles.

Open-top hoppers – Transport heavy dry bulk commodities such as coal, coke, stone, sand, ores and gravel that are resistant to weather conditions.

Covered hoppers – Have a permanent roof and are segregated based upon commodity density. Lighter bulk commodities such as grain, fertilizer, flour, salt, sugar, clay and lime are shipped in large cars called jumbo covered hoppers. Heavier commodities like cement, ground limestone and industrial sand are shipped in small cube covered hoppers.

Box cars – Include a variety of tonnages, sizes, door configurations and heights to accommodate a wide range of finished products, including paper, auto parts, appliances and building materials. Insulated box cars deliver food products, canned goods, beer and wine.

Flat cars – Used for shipping intermodal containers and trailers or bulk and finished goods, such as lumber, pipe, plywood, drywall and pulpwood.

Other cars – Primarily leased refrigerator cars and slab steel cars.

Containers – Weather-proof boxes used for bulk shipment of freight.

Item 3. Legal Proceedings

For further details, please refer to Note 7. Commitments and Contingencies of this annual report on Form 10-K.

Environmental Proceedings That Could Result in Fines Above $100,000

In connection with a CSXT train derailment in Mount Carbon, West Virginia in February 2015, the Company has entered into discussions with the U.S. Department of Justice and the U.S. Environmental Protection Agency concerning a regulatory penalty related to a release of product into the environment. Although final resolution of this matter is subject to further discussions and potential litigation, the Company does not believe that the outcome will have a material adverse effect on its financial position, results of operations or liquidity.

Item 4. Mine Safety Disclosure

Not Applicable

CSX 2017 Form 10-K p. 17

CSX CORPORATION

PART I

Executive Officers of the Registrant

Executive officers of the Company are elected by the CSX Board of Directors and generally hold office until the next annual election of officers. There are no family relationships or any arrangement or understanding between any officer and any other person pursuant to which such officer was elected. As of the date of this filing, the executive officers’ names, ages and business experience are:

Name and Age | Business Experience During Past Five Years |

James M. Foote, 64 President and Chief Executive Officer | Foote has served as President and Chief Executive Office since December 2017. He joined CSX in October 2017 as Chief Operating Officer, with responsibility for both operations and sales and marketing. Mr. Foote has more than 40 years of railroad industry experience. Most recently, he was President and Chief Executive Officer of Bright Rail Energy. Before heading Bright Rail, he was Executive Vice President, Sales and Marketing with Canadian National Railway Company. At Canadian National, Mr. Foote also served as Vice President – Investor Relations and Vice President Sales and Marketing – Merchandise. |

Frank A. Lonegro, 49 Executive Vice President and Chief Financial Officer | Lonegro has served as Executive Vice President and Chief Financial Officer of CSX since September 2015. In this capacity, he directs all financial aspects of the company’s business, including financial and economic analysis, accounting, tax, treasury and purchasing activities. In his 17 years with CSX, Mr. Lonegro has also served as Vice President Internal Audit, President of CSX Technology, Vice President Mechanical and Vice President Service Design. Additionally, he led development and implementation of Positive Train Control, an advanced train control system, to further enhance the Company’s safety performance. |

Edmond L. Harris, 68 Executive Vice President of Operations | Harris has served as CSX's Executive Vice President of Operations since January 2018. In this role, he is responsible for mechanical, engineering, transportation and network operations. Mr. Harris has more than 40 years of railroad industry experience. Most recently, Mr. Harris served as a senior advisor to Global Infrastructure Partners, an independent fund that invests in infrastructure assets worldwide; Chairman of Omnitrax Rail Network; and Board Director for Universal Rail Services. His previous experience also includes having served as Chief Operations Officer at Canadian Pacific, and subsequently, a member of the Board. He also served as Executive Vice President of Operations at Canadian National. |

CSX 2017 Form 10-K p. 18

CSX CORPORATION

PART I

Name and Age | Business Experience During Past Five Years |

Nathan D. Goldman, 60 Executive Vice President and Chief Legal Officer, Corporate Secretary | Goldman has served as Executive Vice President and Chief Legal Officer, and Corporate Secretary of CSX since October 2017. In this role he directs the company’s legal affairs, government relations, risk management, public safety, environmental, and audit functions. During his nearly 15 years with the Company, Mr. Goldman has previously served as Vice President of Risk Compliance and General Counsel and has overseen work in compliance, risk management and safety programs. |

Mark K. Wallace, 48 Executive Vice President and Chief Administrative Officer | Wallace has served as Executive Vice President and Chief Administrative Officer since January 2018, after having joined the Company in March 2017 as Executive Vice President of Corporate Affairs and Chief of Staff to the CEO. In his current role, Mr. Wallace is responsible for human resources, labor relations, information technology, corporate communications, investor relations and the real estate and facilities functions. Prior to joining CSX, he served as the Vice President of Corporate Affairs at Canadian Pacific Railway Limited with responsibility for the corporate communications and public affairs, investor relations, facilities and real estate functions. Prior to his time at Canadian Pacific, Mr. Wallace spent more than 15 years in various senior management positions with Canadian National Railway Company. |

Andrew L. Glassman, 48 Vice President and Controller | Glassman has served as Vice President and Controller of CSX since May 2017. He is responsible for financial and regulatory reporting, tax, freight billing and collections, payroll, accounts payable and various other accounting processes. During his 14-year tenure with the Company, Mr. Glassman previously served as Vice President of Strategic Planning, Vice President of Commercial Finance, Vice President of Operations Finance, Assistant Vice President of Intermodal Marketing and Assistant Vice President of Financial Planning and Analysis. |

CSX 2017 Form 10-K p. 19

CSX CORPORATION

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

CSX’s common stock is listed on the Nasdaq Global Select Market, which is its principal trading market, and is traded over-the-counter and on exchanges nationwide. The official trading symbol is “CSX.”

Description of Common and Preferred Stock

A total of 1.8 billion shares of common stock are authorized, of which 889,851,090 shares were outstanding as of December 31, 2017. Each share is entitled to one vote in all matters requiring a vote of shareholders. There are no pre-emptive rights, which are privileges extended to select shareholders that would allow them to purchase additional shares before other members of the general public in the event of an offering. At January 31, 2018, the latest practicable date that is closest to the filing date, there were 27,624 common stock shareholders of record. The weighted average of common shares outstanding, which was used in the calculation of diluted earnings per share, was 914 million as of December 31, 2017. (See Note 2, Earnings Per Share.) A total of 25 million shares of preferred stock is authorized, none of which is currently outstanding.

The following table sets forth, for the quarters indicated, the dividends declared and the high and low share prices of CSX common stock.

Quarter | |||||||||||||||||||

1st | 2nd | 3rd | 4th | Year | |||||||||||||||

2017 | |||||||||||||||||||

Dividends | $ | 0.18 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.78 | |||||||||

Common Stock Price | |||||||||||||||||||

High | $ | 50.31 | $ | 55.06 | $ | 55.48 | $ | 58.35 | $ | 58.35 | |||||||||

Low | $ | 35.59 | $ | 46.04 | $ | 47.99 | $ | 48.26 | $ | 35.59 | |||||||||

2016 | |||||||||||||||||||

Dividends | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.72 | |||||||||

Common Stock Price | |||||||||||||||||||

High | $ | 27.27 | $ | 27.97 | $ | 30.11 | $ | 37.42 | $ | 37.42 | |||||||||

Low | $ | 21.33 | $ | 24.36 | $ | 24.43 | $ | 29.39 | $ | 21.33 | |||||||||

CSX 2017 Form 10-K p. 20

CSX CORPORATION

PART II

Stock Performance Graph

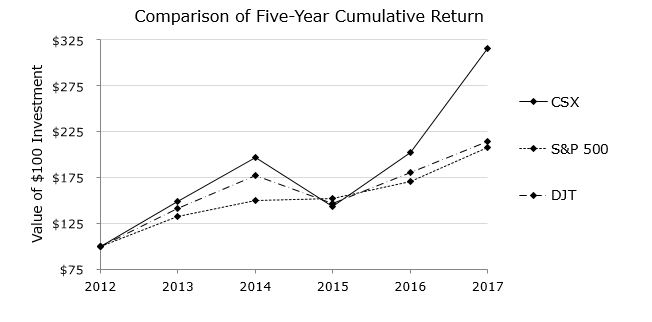

The cumulative shareholder returns, assuming reinvestment of dividends, on $100 invested at December 31, 2012 are illustrated on the graph below. The Company references the Standard & Poor's 500 Stock Index (“S&P 500 ®”), and the Dow Jones U.S. Transportation Average Index, which provide comparisons to a broad-based market index and other companies in the transportation industry.

CSX 2017 Form 10-K p. 21

CSX CORPORATION

PART II

CSX Purchases of Equity Securities

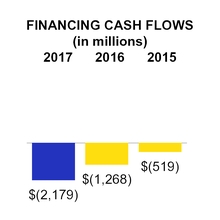

CSX purchases its own shares for two primary reasons: (1) to further its goals under its share repurchase program and (2) to fund the Company’s contribution required to be paid in CSX common stock under a 401(k) plan that covers certain union employees.

Share repurchases under the $2 billion program announced in April 2015 were completed in April 2017. The Company subsequently announced a $1 billion share repurchase program in April 2017, with additional authority of $500 million added in July 2017. Repurchases under that program were completed on October 2, 2017, and the Company announced a new $1.5 billion share repurchase program on October 25, 2017.

During 2017, 2016, and 2015, CSX repurchased the following shares:

Fiscal Years | |||||||||||

2017 | 2016 | 2015 | |||||||||

Shares Repurchased (Units in Millions) | 39 | 38 | 26 | ||||||||

Cost of Shares (Dollars in Millions) | $ | 1,970 | $ | 1,056 | $ | 804 | |||||

Management's assessment of market conditions and other factors guide the timing and volume of repurchases. Future share repurchases are expected to be funded by cash on hand, cash generated from operations and debt issuances. Shares are retired immediately upon repurchase. In accordance with the Equity Topic in the Accounting Standards Codification ("ASC"), the excess of repurchase price over par value is recorded in retained earnings. Generally, retained earnings are only otherwise impacted by net earnings and dividends.

Share repurchase activity of $207 million for the fourth quarter 2017 was as follows:

CSX Purchases of Equity Securities for the Quarter | ||||||||||||

Fourth Quarter | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(a) | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||

Beginning Balance | $ | 7,696,097 | ||||||||||

October 1 - October 31, 2017 | 165,307 | $ | 53.59 | 142,982 | 1,500,000,000 | |||||||

November 1 - November 30, 2017 | 1,560,559 | 50.17 | 1,560,559 | 1,421,712,580 | ||||||||

December 1 - December 31, 2017 | 2,261,847 | 55.64 | 2,189,313 | 1,299,953,624 | ||||||||

Ending Balance | 3,987,713 | $ | 53.41 | 3,892,854 | $ | 1,299,953,624 | ||||||

(a) The difference of 94,859 shares between the "Total Number of Shares Purchased" and the "Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs" for the quarter represents shares purchased to fund the Company's contribution to a 401(k) plan that covers certain union employees.

CSX 2017 Form 10-K p. 22

CSX CORPORATION

PART II

Item 6. Selected Financial Data

Selected financial data related to the Company’s financial results for the last five fiscal years are listed below.

Fiscal Years | ||||||||||||||||||||

(Dollars and Shares in Millions, Except Per Share Amounts) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Financial Performance | ||||||||||||||||||||

Revenue | $ | 11,408 | $ | 11,069 | $ | 11,811 | $ | 12,669 | $ | 12,026 | ||||||||||

Expense | 7,741 | 7,680 | 8,227 | 9,056 | 8,553 | |||||||||||||||

Operating Income | $ | 3,667 | $ | 3,389 | $ | 3,584 | $ | 3,613 | $ | 3,473 | ||||||||||

Adjusted Operating Income(a) | $ | 3,850 | $ | 3,389 | $ | 3,584 | $ | 3,613 | $ | 3,473 | ||||||||||

Net Earnings from Continuing Operations(b) | 5,471 | 1,714 | 1,968 | 1,927 | 1,864 | |||||||||||||||

Adjusted Net Earnings from Continuing Operations(a) | 2,097 | 1,714 | 1,968 | 1,927 | 1,864 | |||||||||||||||

Operating Ratio | 67.9 | % | 69.4 | % | 69.7 | % | 71.5 | % | 71.1 | % | ||||||||||

Adjusted Operating Ratio(a) | 66.3 | % | 69.4 | % | 69.7 | % | 71.5 | % | 71.1 | % | ||||||||||

Net Earnings Per Share: | ||||||||||||||||||||

From Continuing Operations, Basic(b) | $ | 6.01 | $ | 1.81 | $ | 2.00 | $ | 1.93 | $ | 1.83 | ||||||||||

From Continuing Operations, Assuming Dilution(b) | 5.99 | 1.81 | 2.00 | 1.92 | 1.83 | |||||||||||||||

Adjusted From Continuing Operations, Assuming Dilution(a) | 2.30 | 1.81 | 2.00 | 1.92 | 1.83 | |||||||||||||||

Average Common Shares Outstanding | ||||||||||||||||||||

Basic | 911 | 947 | 983 | 1,001 | 1,019 | |||||||||||||||

Assuming Dilution | 914 | 948 | 984 | 1,002 | 1,019 | |||||||||||||||

Financial Position | ||||||||||||||||||||

Cash, Cash Equivalents and Short-term Investments | $ | 419 | $ | 1,020 | $ | 1,438 | $ | 961 | $ | 1,079 | ||||||||||

Total Assets | 35,739 | 35,414 | 34,745 | 32,747 | 31,462 | |||||||||||||||

Long-term Debt | 11,790 | 10,962 | 10,515 | 9,349 | 8,857 | |||||||||||||||

Shareholders' Equity | 14,721 | 11,694 | 11,668 | 11,176 | 10,504 | |||||||||||||||

Dividend Per Share | $ | 0.78 | $ | 0.72 | $ | 0.70 | $ | 0.63 | $ | 0.59 | ||||||||||

Additional Data | ||||||||||||||||||||

Capital Expenditures | $ | 2,040 | $ | 2,705 | $ | 2,562 | $ | 2,449 | $ | 2,313 | ||||||||||

Employees -- Annual Averages (estimated) | 25,230 | 27,350 | 31,285 | 31,511 | 31,254 | |||||||||||||||

Employees -- Year-end Count (estimated) | 24,006 | 26,628 | 29,410 | 32,287 | 31,413 | |||||||||||||||

(a) CSX’s non-GAAP measures are unlikely to be comparable to similar measures presented by other companies. The presentation of these non-GAAP measures should not be considered in isolation from, as a substitute for, or as superior to the financial information presented in accordance with GAAP. Reconciliations of non-GAAP measures to corresponding GAAP measures are presented in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

(b) These results include a $3.6 billion, or $3.91 per share, net tax reform benefit. See further discussion in Note 11, Income Taxes.

Certain prior year data has been reclassified to conform to the current presentation.

CSX 2017 Form 10-K p. 23

CSX CORPORATION

PART II

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

TERMS USED BY CSX

When used in this report, unless otherwise indicated by the context, these terms are used to mean the following:

Car hire - A charge paid by one railroad for its use of cars belonging to another railroad or car owner.

Class I freight railroad - One of the largest line haul freight railroads as determined based on operating revenue; the exact revenue required to be in each class is periodically adjusted for inflation by the Surface Transportation Board. Smaller railroads are classified as Class II or Class III.

Common carrier mandate - A federal mandate that requires U.S. railroads to accommodate reasonable requests from shippers to carry any freight, including hazardous materials.

Demurrage - A charge assessed by railroads for the use of rail cars by shippers or receivers of freight beyond a specified free time.

Department of Transportation ("DOT") - A U.S. Government agency with jurisdiction over matters of all modes of transportation.

Depreciation study - A periodic statistical analysis of fixed asset service lives, salvage values, accumulated depreciation, and other factors for group assets along with a comparison of similar asset groups at other companies conducted by a third-party specialist.

Double-stack - Stacking containers two-high on specially equipped cars.

Drayage - The pickup or delivery of intermodal shipments by truck.

Federal Railroad Administration ("FRA") - The branch of the DOT that is responsible for developing and enforcing railroad safety regulations, including safety standards for rail infrastructure and equipment.

Free cash flow - The calculation of a non-GAAP measure by using net cash provided by operating activities and adjusting for property additions and certain other investing activities. Free cash flow is a measure of cash available for paying dividends, share repurchases and principal reduction on outstanding debt.

Group-life method - A type of depreciation in which assets with similar useful lives and characteristics are aggregated into groups. Instead of calculating depreciation for individual assets, depreciation is calculated for each group.

Incidental revenue - Revenue for switching, demurrage, storage, etc.

Intermodal - A flexible way of transporting freight over water, highway and rail without being removed from the original transportation equipment, namely a container or trailer.

Mainline - The main track thoroughfare, exclusive of terminals, yards, sidings and turnouts.

Revenue adequacy - The achievement of a rate of return on investment at least equal to the cost of investment capital, as measured by the STB.

Scheduled railroading - An operating model focused on developing and strictly maintaining a scheduled service plan with an emphasis on optimizing assets.

CSX 2017 Form 10-K p. 24

CSX CORPORATION

PART II

Shipper - A customer shipping freight via rail.

Siding - Track adjacent to the mainline used for passing trains.

Staggers Act of 1980 - Congressional law which significantly deregulated the rail industry, replacing the regulatory structure in existence since the 1887 Interstate Commerce Act. Where previously rates were controlled by the Interstate Commerce Commission, the Staggers Act allowed railroads to establish their own rates for shipments, enhancing their ability to compete with other modes of transportation.

Surface Transportation Board ("STB") - An independent governmental adjudicatory body administratively housed within the DOT, responsible for the economic regulation of interstate surface transportation within the United States.

Switching - Putting cars in a specific order, placing cars for loading, retrieving empty cars or adding or removing cars from a train at an intermediate point.

Terminal - A facility, typically owned by a railroad, for the handling of freight and for the breaking up, making up, forwarding and servicing of trains.

TTX Company ("TTX") - A Company that provides its owner-railroads with standardized fleets of intermodal, automotive and general use railcars at time and mileage rates. CSX owns about 20 percent of TTX's common stock, and the remainder is owned by the other leading North American railroads and their affiliates.

Turnout - A track that diverts trains from one track to another.

Yard - A system of tracks, other than main tracks and sidings, used for making up trains, storing cars and other purposes.

CSX 2017 Form 10-K p. 25

CSX CORPORATION

PART II

2017 HIGHLIGHTS

• Revenue of $11.4 billion increased $339 million or three percent versus the prior year.

• Expenses of $7.7 billion increased $61 million or one percent year over year.

• Operating income of $3.7 billion increased $278 million or eight percent year over year.

• Operating ratio of 67.9 percent improved 150 basis points from 69.4 percent.

• | Earnings per diluted share of $5.99 increased $4.18 or 231 percent year over year. |

Tax Reform

With the enactment of the Tax Cuts and Jobs Act (the "Act") on December 22, 2017, the federal corporate income tax rate was reduced from 35% to 21% effective January 1, 2018. The Company's 2017 financial results included a $3.5 billion, or $3.81 per share, non-cash reduction in income tax expense, primarily resulting from revaluing the Company's net deferred tax liabilities to reflect the recently enacted lower tax rate effective January 1, 2018. Beginning in 2018, CSX expects its effective federal and state income tax rate to be approximately 25%.

The Company's affiliates also revalued their deferred tax liabilities to reflect the lower federal corporate tax rate, which resulted in the Company recognizing a benefit of $142 million, or $0.10 per share after-tax, in equity earnings of affiliates, which is included in operating income. (See additional discussion over income taxes in Note 11, Income Taxes and equity earnings of affiliates in Note 12, Related Parties and Affiliates.)

Restructuring Charge

The total restructuring charge of $325 million in 2017 includes costs related to the management workforce reduction, executive retirements, reimbursement arrangements, the proration of equity awards and other advisory costs related to the leadership transition during the year. The Company expects estimated pre-tax savings on both future earnings and cash flows resulting from this program to be approximately $200 million per year. (See additional discussion over the restructuring charge in Note 1, Nature of Operations and Significant Accounting Policies.)

CSX 2017 Form 10-K p. 26

CSX CORPORATION

PART II

RESULTS OF OPERATIONS

2017 vs. 2016 Results of Operations (a)

Fiscal Years | |||||||||||||||

2017 | 2016 | $ Change | % Change | ||||||||||||

(Dollars in Millions) | |||||||||||||||

Revenue | $ | 11,408 | $ | 11,069 | $ | 339 | 3 | % | |||||||

Expense | |||||||||||||||

Labor and Fringe | 2,914 | 3,159 | 245 | 8 | |||||||||||

Materials, Supplies and Other | 2,113 | 2,092 | (21 | ) | (1 | ) | |||||||||

Depreciation | 1,315 | 1,301 | (14 | ) | (1 | ) | |||||||||

Fuel | 864 | 713 | (151 | ) | (21 | ) | |||||||||

Equipment and Other Rents | 429 | 465 | 36 | 8 | |||||||||||

Restructuring Charge | 325 | — | (325 | ) | — | ||||||||||

Equity Earnings of Affiliates | (219 | ) | (50 | ) | 169 | 338 | |||||||||

Total Expense | 7,741 | 7,680 | (61 | ) | (1 | ) | |||||||||

Operating Income | 3,667 | 3,389 | 278 | 8 | |||||||||||

Interest Expense | (546 | ) | (579 | ) | 33 | 6 | |||||||||

Debt Repurchase Expense | — | (115 | ) | 115 | (100 | ) | |||||||||

Other Income - Net | 21 | 46 | (25 | ) | (54 | ) | |||||||||

Income Tax Benefit (Expense) | 2,329 | (1,027 | ) | 3,356 | 327 | ||||||||||

Net Earnings | $ | 5,471 | $ | 1,714 | $ | 3,757 | 219 | ||||||||

Earnings Per Diluted Share: | |||||||||||||||

Net Earnings | $ | 5.99 | $ | 1.81 | $ | 4.18 | 231 | % | |||||||

Operating Ratio | 67.9 | % | 69.4 | % | 150 | bps | |||||||||

(a) Prior to third quarter 2017, CSX followed a 52/53 week fiscal reporting calendar and 2016 included 53 weeks. All 2016 information presented in Results of Operations is on a 53-week basis, under GAAP.

CSX 2017 Form 10-K p. 27

CSX CORPORATION

PART II

2017 vs. 2016 Results of Operations, continued

Volume and Revenue (Unaudited) (a) | ||||||||||||||||||||||||||||||

Volume (Thousands of units); Revenue (Dollars in Millions); Revenue Per Unit (Dollars) | ||||||||||||||||||||||||||||||

Volume | Revenue | Revenue Per Unit | ||||||||||||||||||||||||||||

2017 | 2016 | % Change | 2017 | 2016 | % Change | 2017 | 2016 | % Change | ||||||||||||||||||||||

Chemicals | 672 | 700 | (4 | )% | $ | 2,210 | $ | 2,191 | 1 | % | $ | 3,289 | $ | 3,130 | 5 | % | ||||||||||||||

Automotive | 457 | 482 | (5 | )% | 1,195 | 1,261 | (5 | )% | 2,615 | 2,616 | — | % | ||||||||||||||||||

Agricultural and Food Products | 454 | 477 | (5 | )% | 1,262 | 1,286 | (2 | )% | 2,780 | 2,696 | 3 | % | ||||||||||||||||||

Minerals | 308 | 310 | (1 | )% | 477 | 464 | 3 | % | 1,549 | 1,497 | 3 | % | ||||||||||||||||||

Fertilizers | 291 | 300 | (3 | )% | 466 | 463 | 1 | % | 1,601 | 1,543 | 4 | % | ||||||||||||||||||

Forest Products | 264 | 274 | (4 | )% | 755 | 773 | (2 | )% | 2,860 | 2,821 | 1 | % | ||||||||||||||||||

Metals and Equipment | 256 | 259 | (1 | )% | 703 | 704 | — | % | 2,746 | 2,718 | 1 | % | ||||||||||||||||||

Total Merchandise | 2,702 | 2,802 | (4 | )% | 7,068 | 7,142 | (1 | )% | 2,616 | 2,549 | 3 | % | ||||||||||||||||||

Coal | 855 | 838 | 2 | % | 2,107 | 1,833 | 15 | % | 2,464 | 2,187 | 13 | % | ||||||||||||||||||

Intermodal | 2,843 | 2,811 | 1 | % | 1,799 | 1,726 | 4 | % | 633 | 614 | 3 | % | ||||||||||||||||||

Other | — | — | — | % | 434 | 368 | 18 | % | — | — | — | % | ||||||||||||||||||

Total | 6,400 | 6,451 | (1 | )% | $ | 11,408 | $ | 11,069 | 3 | % | $ | 1,783 | $ | 1,716 | 4 | % | ||||||||||||||

(a) Prior to third quarter 2017, CSX followed a 52/53 week fiscal reporting calendar and 2016 included 53 weeks. All 2016 information presented in Results of Operations is on a 53-week basis, under GAAP.

CSX 2017 Form 10-K p. 28

CSX CORPORATION

PART II

Revenue

In 2017, revenue increased $339 million when compared to the previous year, primarily due to gains in export coal, price increases across nearly all other markets and fuel recovery, partially offset by the $178 million impact of an extra fiscal week in 2016 and lower merchandise volumes. Revenue per unit increased over prior year as pricing gains and higher fuel recoveries were partially offset by unfavorable mix.

Merchandise

Chemicals - Volume declined, primarily due to sustained challenges in the Eastern crude-by-rail market. This decline offset an increase in shipments of frac sand and petroleum gases due to growth in drilling activity.

Automotive - Volume declined as North American vehicle production fell.

Agricultural and Food Products - Volume declined due to challenges in the export market as well as a large southeastern grain crop leading to local truck sourcing to feed mills.

Minerals - Volume slightly declined as short-term competitive losses were mostly offset by growth in construction project activity.

Fertilizers - Volume declined, primarily driven by the closure of a customer facility as well as Hurricane Irma’s impact on Central Florida phosphate operations.

Forest Products - Volume declined as the decrease in shipments of paper products as a result of mill closures and truck competition was partially offset by strong pulp board volumes driven by e-commerce demand.

Metals and Equipment - Volume slightly declined as a nonrecurring 2016 benefit from large pipe projects was partially offset by increases in equipment moves.

Coal

Domestic - Utility coal volume declined 12 percent as the competitive loss of short-haul interchange traffic more than offset underlying growth at other utilities. Coke, Iron Ore and Other volume declined 13 percent, primarily in iron ore shipments, as a large customer temporarily halted its production.

Export - Volume increased 42 percent as global supply levels and pricing conditions supported strong growth in U.S. coal exports.

Intermodal

Domestic - Volume declined 2 percent as rationalization of low-density lanes and competitive losses more than offset growth with existing customers.

International - Volume was up 7 percent driven by competitive gains and strong performance with existing customers as eastern port volumes increased.

Other

Other revenue increased $66 million versus prior year primarily due to a $58 million settlement in 2017 related to a customer that did not meet historical volume commitments and higher incidental charges.

CSX 2017 Form 10-K p. 29

CSX CORPORATION

PART II

Expense

In 2017, total expenses increased $61 million, or one percent, compared to prior year. Descriptions of each expense category as well as significant year-over-year changes are described below.

Labor and Fringe expenses include employee wages and related payroll taxes, health and welfare costs, pension, other post-retirement benefits and incentive compensation. These expenses decreased $245 million due to the following items:

• | Efficiency and volume savings of $274 million were driven primarily by reductions in overall headcount and other effects of implementing scheduled railroading as well as the impacts of the 2017 restructuring initiative, slightly offset by higher volume-related costs. |

• | Pension costs decreased $66 million primarily due to adoption in 2017 of the spot rate approach for measuring service and interest costs, prior year contributions and other favorable plan experience. |

• | The extra fiscal week in 2016 resulted in $51 million of additional cost compared to 2017. |

• | Inflation resulted in $152 million of additional cost driven by increased health and welfare costs and wage increases. |

• | Various other costs decreased $6 million. |