United

States Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number 811-01879

Janus

Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street,

Denver, Colorado 80206

(Address of principal executive offices) (Zip code)

Abigail

J. Murray, 151 Detroit Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant's

telephone number, including area code: 303-333-3863

Date of fiscal year end: 9/30

Date

of reporting period: 9/30/21

The registrant is filing this amendment to its filing on Form N-CSR/A for the year ended September 30, 2021, which was originally filed with the Securities and Exchange Commission on December 9, 2022 (Accession Number 0001741773-22-004133), solely to correct the date of the Report of Independent Registered Public Accounting Firm for the Janus Henderson Research Fund. Other than the aforementioned correction, this amended Form N-CSR/A does not reflect events occurring after the filing of the original Form N-CSR or modify or update the disclosures contained therein.

Item 1 - Reports to Shareholders

ANNUAL REPORT September 30, 2021 | |||

Janus Henderson Asia Equity Fund | |||

Janus Investment Fund | |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund

performance, characteristics | |||

|

Table of Contents

Janus Henderson Asia Equity Fund

Janus Henderson Asia Equity Fund (unaudited)

PERFORMANCE

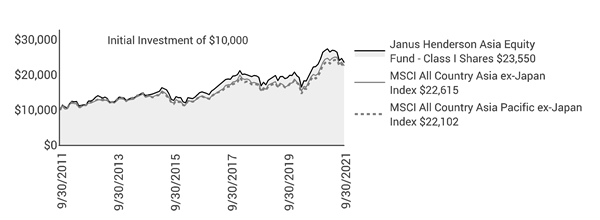

The Janus Henderson Asia Equity Fund I Shares returned 5.62% for the 12-month period ended September 30, 2021. The Fund’s primary benchmark, the MSCI All Country Asia ex-Japan IndexSM, returned 14.42%, while its secondary benchmark, the MSCI All Country Asia Pacific ex-Japan IndexSM, returned 16.59%.

INVESTMENT ENVIRONMENT

The period began positively, as markets responded in the fourth quarter of 2020 to the emergence of COVID-19 vaccines and the possibility of a swift rebound in economic activity. Recovery became more prolonged and mixed over the year as new COVID variants posed threats even to countries with high vaccination rates, while inevitably progress on vaccinations was slower in the emerging markets. Responses varied from country to country in the use of lockdowns to minimize the spread of the virus, which delayed recovery in many areas. However, markets were willing to look beyond the short-term impact and take comfort in the various fiscal and monetary support measures that governments had provided. Sentiment did change toward period end, as global equity markets corrected in the third quarter of 2021 from a combination of profit-taking and signs of slowing growth after the initial COVID-19-related recovery. The threat of structurally higher inflation lingered, while the Delta variant led to less robust economic recoveries, particularly in Asia.

Regulatory action in China also had a major impact on market sentiment within Asia over the period. This began with the cancellation of the much-anticipated Ant Financial initial public offering (IPO), but then spread to several of the higher-growth sectors such as education, internet, e-commerce and most recently, Macau gaming, all of which were impacted by significant policy changes. The Chinese property sector also grabbed headlines with several debt defaults – including Evergrande, one of the largest Chinese property developers – unable to make a payment due. The China market underperformed as a result. India was the strongest performer in the region as the economy recovered later from a more severe COVID situation while investor flows seemed to benefit from the issues in China.

PERFORMANCE DISCUSSION

Despite positive asset allocation from our underweight to China and overweights to India and Taiwan, relative performance was weak over the 12-month period, due to negative stock selection in a number of the sectors impacted by the regulatory changes in China. In particular, New Oriental Education hurt relative performance following the Chinese government’s decision to limit profitability and severely restrict the number of hours that after-school tutoring could be offered to students. Our position in Ping An Insurance also detracted, on concerns about its exposure to the property sector while its agency reform process took longer than expected, which resulted in weaker new business sales. Finally, integrated resort developer and operator Sands China weighed on relative returns on news of the government’s decision to launch a public investigation into the future of Macau, with the likelihood of tightening criteria to pay dividends and ensuring a higher proportion of future revenue comes from non-gaming activities. Going forward, the environment in China has changed and we believe there is good reason to be more cautious on potential policy changes, which we have aimed to mitigate with smaller position sizes and adjustments to valuation methodology to capture the heightened risks. While we maintained a quality growth bias through the period, we were conscious about the value rotation that was occurring in markets, albeit less pronounced in Asia. We added to developed market financials to capture the higher bond yields, a move that generally was positive. Our allocation within the

Janus Investment Fund | 1 |

Janus Henderson Asia Equity Fund (unaudited)

materials sector to cement also detracted from relative performance.

Positive contributions to relative performance came from three of our India positions: HDFC, Bajaj Holdings & Investment and HDFC Bank all benefited from India’s economic recovery and strong operating momentum in the financials sector as loan growth returned to near pre-COVID levels. E-commerce and gaming company Sea Limited also outperformed on good operating momentum particularly in Latin America, while the shares likely also benefited from some rotation away from those sectors in China.

We reduced our exposure to China during the 12-month period and maintained a cautious view for the near term. While valuations of the largest Chinese Internet and e-commerce companies looked attractive compared to their previous levels, it appeared reasonable to assume that future growth prospects could be more constrained, and that valuations should reflect the increased regulatory risks in addition to the impact on profitability of the government’s common prosperity goals. There remain attractive opportunities in China and in our view the local A share market in particular could potentially offer investors exposure to sectors more aligned with the government’s economic goals.

OUTLOOK

We maintain the view that the current inflationary pressures are likely to be transitory, as supply struggles to keep up with the demand recovery while the Delta variant has created further bottlenecks in supply chains. We already are seeing signs of slowing growth, which should ease some of the demand pressures. Hence we are not inclined to rotate meaningfully toward cyclicality away from our preference for structural growth. Valuations in Asia remain attractive compared to the U.S. equity market, and while earnings growth likely will be more subdued next year, we remain optimistic that we may see a reversal in the structural underperformance of Asia and emerging market equities over the past decade. Economic growth rates could normalise but remain attractive in Asia, while demographics and consumption could remain supportive to Asian equities.

Thank you for investing in the Janus Henderson Asia Equity Fund.

2 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund (unaudited)

Fund At A Glance

September 30, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5 Top Contributors - Holdings | 5 Top Detractors - Holdings | |||||||

|

| Average

|

| Relative |

|

| Average

|

| Relative |

| Bajaj Holdings & Investment Ltd | 1.98% |

| 1.38% |

| New Oriental Education & Technology Group Inc (ADR) | 2.15% |

| -3.27% |

| HDFC Bank Ltd | 4.14% |

| 1.15% |

| Sands China Ltd | 2.28% |

| -1.44% |

| Housing Development Finance Corp Ltd | 3.93% |

| 1.10% |

| Anhui Conch Cement Co Ltd | 1.43% |

| -0.93% |

| Sea Ltd (ADR) | 1.46% |

| 0.98% |

| Ping An Insurance Group Co of China Ltd | 2.65% |

| -0.86% |

| Samsung Electronics Co Ltd | 8.63% |

| 0.90% |

| Largan Precision Co Ltd | 2.11% |

| -0.78% |

| 5 Top Contributors - Sectors* |

|

|

|

|

|

|

|

| Relative |

| Fund | MSCI All Country Asia ex-Japan Index |

|

|

| Contribution |

| Average Weight | Average Weight |

| Communication Services |

| 1.32% |

| 8.51% | 11.56% |

| Real Estate |

| 0.96% |

| 1.59% | 3.93% |

| Financials |

| 0.88% |

| 23.82% | 18.03% |

| Health Care |

| 0.87% |

| 1.08% | 4.92% |

| Information Technology |

| -0.05% |

| 28.31% | 23.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5 Top Detractors - Sectors* |

|

|

|

|

|

|

|

| Relative |

| Fund | MSCI All Country Asia ex-Japan Index |

|

|

| Contribution |

| Average Weight | Average Weight |

| Consumer Discretionary |

| -4.56% |

| 19.37% | 18.60% |

| Materials |

| -2.53% |

| 1.43% | 4.60% |

| Consumer Staples |

| -1.10% |

| 6.20% | 4.83% |

| Other** |

| -0.69% |

| 1.87% | 0.00% |

| Industrials |

| -0.42% |

| 5.78% | 5.55% |

| Relative contribution reflects how the portolio's holdings

impacted return relative to the benchmark. Cash and securities not held in the portfolio are not shown.

For equity portfolios, relative contribution compares the performance of a security in the portfolio

to the benchmark's total return, factoring in the difference in weight of that security in the benchmark.

Returns are calculated using daily returns and previous day ending weights rolled up by ticker, excluding

fixed income securities, gross of advisory fees, may exclude certain derivatives and will differ from

actual performance. | |||||

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. | |||||

** | Not a GICS classified sector. | |||||

Janus Investment Fund | 3 |

Janus Henderson Asia Equity Fund (unaudited)

Fund At A Glance

September 30, 2021

5 Largest Equity Holdings - (% of Net Assets) | |

Samsung Electronics Co Ltd | |

Technology Hardware, Storage & Peripherals | 9.4% |

Taiwan Semiconductor Manufacturing Co Ltd | |

Semiconductor & Semiconductor Equipment | 8.7% |

Tencent Holdings Ltd | |

Interactive Media & Services | 6.1% |

AIA Group Ltd | |

Insurance | 5.2% |

Housing Development Finance Corp Ltd | |

Thrifts & Mortgage Finance | 4.8% |

34.2% | |

Asset Allocation - (% of Net Assets) | |||||

Common Stocks | 89.8% | ||||

Preferred Stocks | 9.4% | ||||

Investment Companies | 1.4% | ||||

Other | (0.6)% | ||||

100.0% | |||||

Emerging markets comprised 85.9% of total net assets.

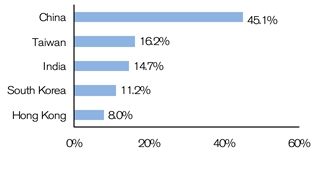

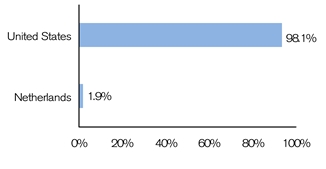

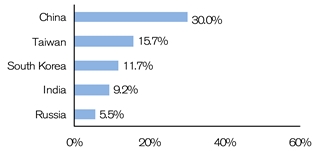

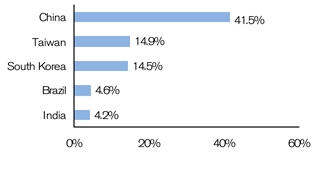

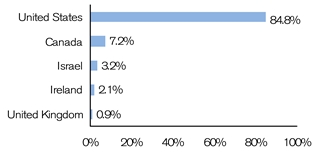

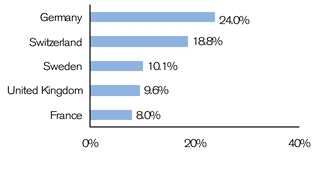

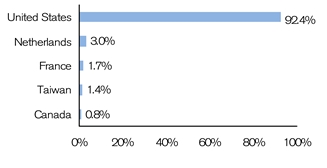

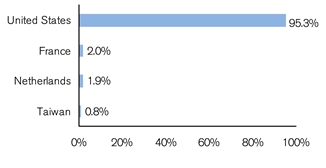

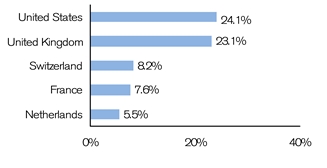

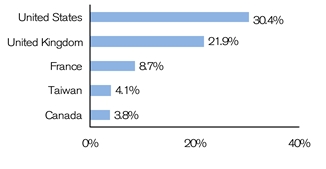

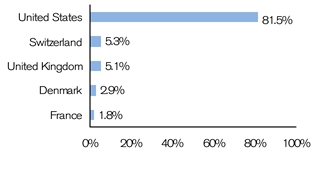

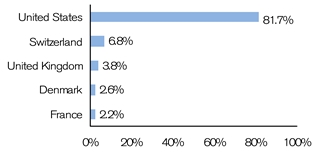

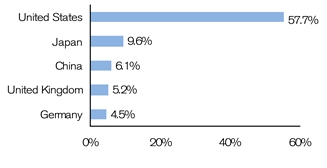

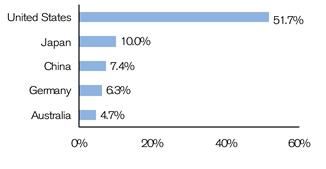

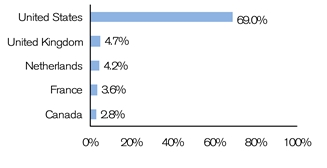

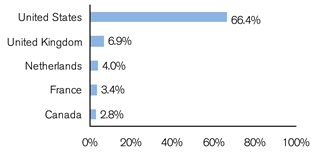

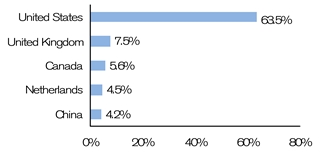

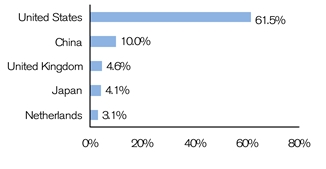

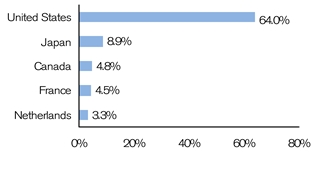

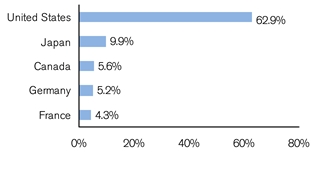

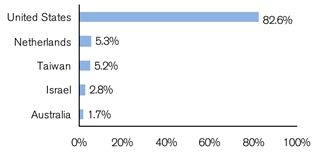

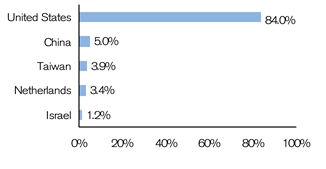

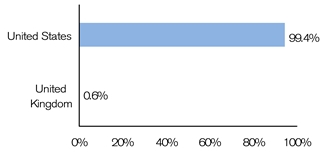

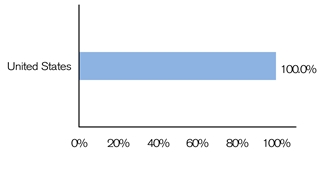

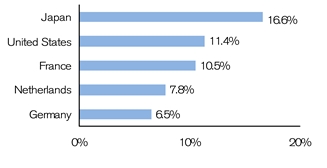

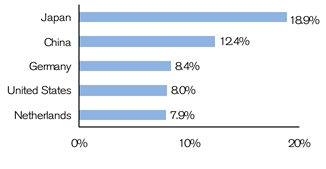

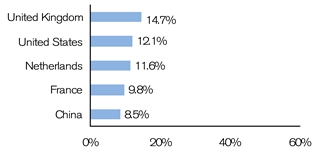

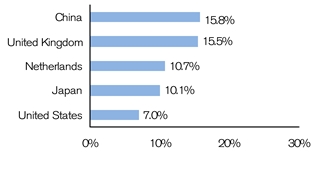

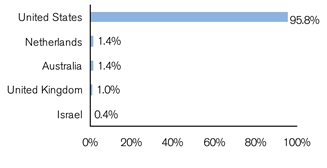

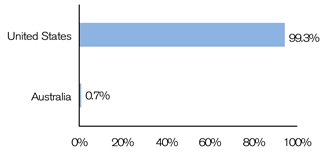

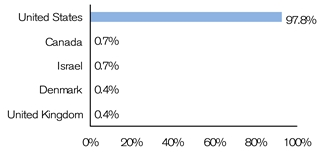

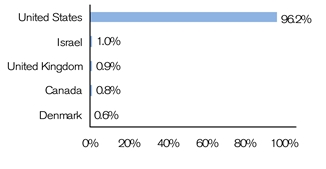

Top Country Allocations - Long Positions - (% of Investment Securities) | |

As of September 30, 2021

| As of September 30, 2020

|

4 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund (unaudited)

Performance

See important disclosures on the next page. |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Average Annual Total Return - for the periods ended September 30, 2021 |

|

| Prospectus Expense Ratios | |||||||

|

| One

| Five

| Ten

| Since

|

|

| Total Annual Fund

| Net

Annual Fund | |

Class A Shares at NAV |

| 5.33% | 8.93% | 8.61% | 5.34% |

|

| 2.44% | 1.43% | |

Class A Shares at MOP |

| -0.71% | 7.65% | 7.97% | 4.72% |

|

|

|

| |

Class C Shares at NAV |

| 4.50% | 8.14% | 7.83% | 4.59% |

|

| 3.51% | 2.20% | |

Class C Shares at CDSC |

| 3.50% | 8.14% | 7.83% | 4.59% |

|

|

|

| |

Class D Shares |

| 5.48% | 9.11% | 8.81% | 5.51% |

|

| 2.03% | 1.26% | |

Class I Shares |

| 5.62% | 9.24% | 8.94% | 5.65% |

|

| 2.07% | 1.14% | |

Class N Shares |

| 5.59% | 9.10% | 8.48% | 5.20% |

|

| 1.80% | 1.10% | |

Class S Shares |

| 5.58% | 8.97% | 8.61% | 5.34% |

|

| 2.89% | 1.60% | |

Class T Shares |

| 5.32% | 9.04% | 8.75% | 5.47% |

|

| 2.27% | 1.35% | |

MSCI All Country Asia ex-Japan Index |

| 14.42% | 10.13% | 8.50% | 5.77% |

|

|

|

| |

MSCI All Country Asia-Pacific ex-Japan Index |

| 16.59% | 9.86% | 8.25% | 5.65% |

|

|

|

| |

Morningstar Quartile - Class I Shares |

| 4th | 3rd | 2nd | 3rd |

|

|

|

| |

Morningstar Ranking - based on total returns for Pacific/Asia ex-Japan Stock Funds |

| 44/54 | 28/52 | 22/41 | 27/41 |

|

|

|

| |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

Net expense ratios reflect the expense waiver, if any, contractually agreed to for at least a one-year period commencing on January 28, 2021.

This Fund has a performance-based management fee that may adjust up or down based on the Fund’s performance.

Janus Investment Fund | 5 |

Janus Henderson Asia Equity Fund (unaudited)

Performance

Performance may be affected by risks that include those associated with foreign and emerging markets, fixed income securities, high-yield and high-risk securities, undervalued, overlooked and smaller capitalization companies, real estate related securities including Real Estate Investment Trusts (REITs), non-diversification, Environmental, Social and Governance (ESG) factors, portfolio turnover, derivatives, short sales, initial public offerings (IPOs) and potential conflicts of interest. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Class N Shares commenced operations on January 26, 2018. Performance shown for periods prior to January 26, 2018, reflects the historical performance of the Fund's Class I Shares, calculated using the fees and expenses of Class N Shares, without the effect of any fee and expense limitations or waivers.

If Class N Shares of the Fund had been available during periods prior to January 26, 2018, the performance shown may have been different. The performance shown for periods following the Fund's commencement of Class N Shares reflects the fees and expenses of Class N Shares, net of any applicable fee and expense limitations or waivers. Please refer to the Fund's prospectuses for further details concerning historical performance.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2021 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Fund Report.”

*The Fund’s inception date – July 29, 2011

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

6 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

| ||

|

|

| Actual |

| Hypothetical

|

| ||||

| Beginning | Ending | Expenses |

| Beginning | Ending | Expenses | Net Annualized | ||

Class A Shares | $1,000.00 | $889.50 | $6.58 |

| $1,000.00 | $1,018.10 | $7.03 | 1.39% | ||

Class C Shares | $1,000.00 | $885.10 | $10.02 |

| $1,000.00 | $1,014.44 | $10.71 | 2.12% | ||

Class D Shares | $1,000.00 | $889.70 | $5.78 |

| $1,000.00 | $1,018.95 | $6.17 | 1.22% | ||

Class I Shares | $1,000.00 | $890.60 | $5.31 |

| $1,000.00 | $1,019.45 | $5.67 | 1.12% | ||

Class N Shares | $1,000.00 | $890.40 | $5.02 |

| $1,000.00 | $1,019.75 | $5.37 | 1.06% | ||

Class S Shares | $1,000.00 | $889.10 | $6.49 |

| $1,000.00 | $1,018.20 | $6.93 | 1.37% | ||

Class T Shares | $1,000.00 | $889.10 | $6.25 |

| $1,000.00 | $1,018.45 | $6.68 | 1.32% | ||

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. | |||||||||

Janus Investment Fund | 7 |

Janus Henderson Asia Equity Fund

Schedule of Investments

September 30, 2021

| Value | ||||||

Common Stocks– 89.8% | |||||||

Banks – 10.2% | |||||||

Bank Central Asia Tbk PT | 339,400 | $830,319 | |||||

HDFC Bank Ltd | 78,445 | 1,681,861 | |||||

Oversea-Chinese Banking Corp Ltd | 75,500 | 632,181 | |||||

Ping An Bank Co Ltd - Class A | 185,664 | 516,571 | |||||

3,660,932 | |||||||

Capital Markets – 2.2% | |||||||

Macquarie Group Ltd | 6,073 | 796,628 | |||||

Diversified Financial Services – 2.8% | |||||||

Bajaj Holdings & Investment Ltd | 15,774 | 1,018,440 | |||||

Electronic Equipment, Instruments & Components – 1.5% | |||||||

Sinbon Electronics Co Ltd | 65,000 | 547,604 | |||||

Entertainment – 2.8% | |||||||

Sea Ltd (ADR)* | 3,174 | 1,011,649 | |||||

Food Products – 2.2% | |||||||

Uni-President Enterprises Corp | 330,000 | 802,643 | |||||

Hotels, Restaurants & Leisure – 2.6% | |||||||

Yum China Holdings Inc | 15,760 | 927,562 | |||||

Household Durables – 3.5% | |||||||

Midea Group Co Ltd | 53,226 | 574,759 | |||||

Techtronic Industries Co Ltd | 34,000 | 666,539 | |||||

1,241,298 | |||||||

Industrial Conglomerates – 2.9% | |||||||

Ayala Corp | 39,730 | 635,318 | |||||

LG Corp | 5,070 | 394,644 | |||||

1,029,962 | |||||||

Information Technology Services – 2.9% | |||||||

Tata Consultancy Services Ltd | 20,720 | 1,049,275 | |||||

Insurance – 7.1% | |||||||

AIA Group Ltd | 163,000 | 1,876,865 | |||||

Ping An Insurance Group Co of China Ltd | 98,000 | 665,003 | |||||

2,541,868 | |||||||

Interactive Media & Services – 7.6% | |||||||

NAVER Corp | 1,650 | 538,097 | |||||

Tencent Holdings Ltd | 37,400 | 2,192,990 | |||||

2,731,087 | |||||||

Internet & Direct Marketing Retail – 6.2% | |||||||

Alibaba Group Holding Ltd* | 80,400 | 1,495,489 | |||||

Meituan Dianping (144A)* | 24,000 | 749,465 | |||||

2,244,954 | |||||||

Life Sciences Tools & Services – 1.6% | |||||||

Wuxi Biologics Cayman Inc (144A)* | 35,000 | 565,732 | |||||

Machinery – 1.5% | |||||||

Sany Heavy Industry Co Ltd | 137,301 | 541,987 | |||||

Oil, Gas & Consumable Fuels – 2.8% | |||||||

Reliance Industries Ltd | 29,811 | 1,008,202 | |||||

Personal Products – 2.4% | |||||||

LG Household & Health Care Ltd | 754 | 848,251 | |||||

Real Estate Management & Development – 2.3% | |||||||

Swire Pacific Ltd | 57,500 | 340,823 | |||||

Swire Pacific Ltd - Class B | 487,500 | 478,507 | |||||

819,330 | |||||||

Semiconductor & Semiconductor Equipment – 13.5% | |||||||

MediaTek Inc | 25,000 | 805,905 | |||||

SK Hynix Inc | 10,817 | 933,544 | |||||

Taiwan Semiconductor Manufacturing Co Ltd | 151,000 | 3,114,057 | |||||

4,853,506 | |||||||

Software – 1.3% | |||||||

Venustech Group Inc - Class A | 112,000 | 479,638 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

8 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Schedule of Investments

September 30, 2021

| Value | ||||||

Common Stocks– (continued) | |||||||

Specialty Retail – 1.4% | |||||||

China Tourism Group Duty Free Corp Ltd | 12,530 | $505,481 | |||||

Technology Hardware, Storage & Peripherals – 2.3% | |||||||

Advantech Co Ltd | 62,068 | 810,003 | |||||

Textiles, Apparel & Luxury Goods – 1.4% | |||||||

Shenzhou International Group Holdings Ltd | 24,400 | 510,031 | |||||

Thrifts & Mortgage Finance – 4.8% | |||||||

Housing Development Finance Corp Ltd | 47,163 | 1,726,042 | |||||

Total Common Stocks (cost $26,270,748) | 32,272,105 | ||||||

Preferred Stocks– 9.4% | |||||||

Technology Hardware, Storage & Peripherals – 9.4% | |||||||

Samsung Electronics Co Ltd((cost $2,337,460) | 58,072 | 3,401,975 | |||||

Investment Companies– 1.4% | |||||||

Money Markets – 1.4% | |||||||

Janus Henderson Cash Liquidity Fund LLC, 0.0559%ºº,£((cost $495,460) | 495,410 | 495,460 | |||||

Total Investments (total cost $29,103,668) – 100.6% | 36,169,540 | ||||||

Liabilities, net of Cash, Receivables and Other Assets – (0.6)% | (227,522) | ||||||

Net Assets – 100% | $35,942,018 | ||||||

Summary of Investments by Country - (Long Positions) (unaudited) | |||||

% of | |||||

Investment | |||||

Country | Value | Securities | |||

China | $9,724,708 | 26.9 | % | ||

Taiwan | 7,091,861 | 19.6 | |||

India | 6,483,820 | 17.9 | |||

South Korea | 6,116,511 | 16.9 | |||

Hong Kong | 3,362,734 | 9.3 | |||

Indonesia | 830,319 | 2.3 | |||

Australia | 796,628 | 2.2 | |||

Philippines | 635,318 | 1.8 | |||

Singapore | 632,181 | 1.7 | |||

United States | 495,460 | 1.4 | |||

Total | $36,169,540 | 100.0 | % |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 9 |

Janus Henderson Asia Equity Fund

Schedule of Investments

September 30, 2021

Schedules of Affiliated Investments – (% of Net Assets)

Dividend Income | Realized Gain/(Loss) | Change in Unrealized Appreciation/ Depreciation | Value at 9/30/21 | |||||||

Investment Companies - 1.4% | ||||||||||

Money Markets - 1.4% | ||||||||||

Janus Henderson Cash Liquidity Fund LLC, 0.0559%ºº | $ | 803 | $ | - | $ | - | $ | 495,460 | ||

Investments Purchased with Cash Collateral from Securities Lending - N/A | ||||||||||

Investment Companies - N/A | ||||||||||

Janus Henderson Cash Collateral Fund LLC, 0.0011%ºº | - | - | - | - | ||||||

Total Affiliated Investments - 1.4% | $ | 803 | $ | - | $ | - | $ | 495,460 | ||

Value at 9/30/20 | Purchases | Sales Proceeds | Value at 9/30/21 | |||||||

Investment Companies - 1.4% | ||||||||||

Money Markets - 1.4% | ||||||||||

Janus Henderson Cash Liquidity Fund LLC, 0.0559%ºº | 426,145 | 25,508,316 | (25,439,001) | 495,460 | ||||||

Investments Purchased with Cash Collateral from Securities Lending - N/A | ||||||||||

Investment Companies - N/A | ||||||||||

Janus Henderson Cash Collateral Fund LLC, 0.0011%ºº | - | 88,000 | (88,000) | - | ||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

10 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Notes to Schedule of Investments and Other Information

MSCI All Country Asia ex-Japan IndexSM | MSCI All Country Asia ex-Japan IndexSM reflects the equity market performance of Asia, excluding Japan. |

MSCI All Country Asia-Pacific ex-Japan IndexSM | The MSCI All Country Asia-Pacific ex-Japan IndexSM reflects the performance of large and mid-cap companies in developed and emerging markets in the Asia Pacific region, excluding Japan. |

ADR | American Depositary Receipt |

LLC | Limited Liability Company |

144A | Securities sold under Rule 144A of the Securities Act of 1933, as amended, are subject to legal and/or contractual restrictions on resale and may not be publicly sold without registration under the 1933 Act. Unless otherwise noted, these securities have been determined to be liquid under guidelines established by the Board of Trustees. The total value of 144A securities as of the year ended September 30, 2021 is $1,315,197, which represents 3.7% of net assets. |

* | Non-income producing security. |

ºº | Rate shown is the 7-day yield as of September 30, 2021. |

£ | The Fund may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. |

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of September 30, 2021. See Notes to Financial Statements for more information. | ||||||||||||

Valuation Inputs Summary | ||||||||||||

Level 2 - | Level 3 - | |||||||||||

Level 1 - | Other Significant | Significant | ||||||||||

Quoted Prices | Observable Inputs | Unobservable Inputs | ||||||||||

Assets | ||||||||||||

Investments In Securities: | ||||||||||||

Common Stocks | ||||||||||||

Entertainment | $ | 1,011,649 | $ | - | $ | - | ||||||

All Other | - | 31,260,456 | - | |||||||||

Preferred Stocks | - | 3,401,975 | - | |||||||||

Investment Companies | - | 495,460 | - | |||||||||

Total Assets | $ | 1,011,649 | $ | 35,157,891 | $ | - | ||||||

Janus Investment Fund | 11 |

Janus Henderson Asia Equity Fund

Statement of Assets and Liabilities

September 30, 2021

See footnotes at the end of the Statement. |

|

|

|

|

|

|

|

Assets: |

|

|

|

| ||

| Unaffiliated investments, at value (cost $28,608,208) |

| $ | 35,674,080 |

| |

| Affiliated investments, at value (cost $495,460) |

|

| 495,460 |

| |

| Cash denominated in foreign currency (cost $3,323) |

|

| 3,323 |

| |

| Non-interested Trustees' deferred compensation |

|

| 896 |

| |

| Receivables: |

|

|

|

| |

|

| Fund shares sold |

|

| 104,474 |

|

|

| Dividends |

|

| 99,111 |

|

|

| Foreign tax reclaims |

|

| 628 |

|

|

| Dividends from affiliates |

|

| 43 |

|

| Other assets |

|

| 74 |

| |

Total Assets |

|

| 36,378,089 |

| ||

Liabilities: |

|

|

|

| ||

| Payables: |

|

| — |

| |

|

| Foreign tax liability |

|

| 217,516 |

|

|

| Fund shares repurchased |

|

| 118,401 |

|

|

| Professional fees |

|

| 45,057 |

|

|

| Non-affiliated fund administration fees payable |

|

| 24,342 |

|

|

| Advisory fees |

|

| 11,713 |

|

|

| Custodian fees |

|

| 5,165 |

|

|

| Transfer agent fees and expenses |

|

| 4,019 |

|

|

| Non-interested Trustees' deferred compensation fees |

|

| 896 |

|

|

| 12b-1 Distribution and shareholder servicing fees |

|

| 719 |

|

|

| Non-interested Trustees' fees and expenses |

|

| 327 |

|

|

| Affiliated fund administration fees payable |

|

| 78 |

|

|

| Accrued expenses and other payables |

|

| 7,838 |

|

Total Liabilities |

|

| 436,071 |

| ||

Net Assets |

| $ | 35,942,018 |

| ||

See Notes to Financial Statements. | |

12 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Statement of Assets and Liabilities

September 30, 2021

|

|

|

|

|

|

|

Net Assets Consist of: |

|

|

|

| ||

| Capital (par value and paid-in surplus) |

| $ | 31,047,718 |

| |

| Total distributable earnings (loss) (includes $217,516 of foreign capital gains tax) |

|

| 4,894,300 |

| |

Total Net Assets |

| $ | 35,942,018 |

| ||

Net Assets - Class A Shares |

| $ | 557,135 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 44,093 |

| |

Net Asset Value Per Share(1) |

| $ | 12.64 |

| ||

Maximum Offering Price Per Share(2) |

| $ | 13.41 |

| ||

Net Assets - Class C Shares |

| $ | 489,162 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 39,690 |

| |

Net Asset Value Per Share(1) |

| $ | 12.32 |

| ||

Net Assets - Class D Shares |

| $ | 14,082,710 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 1,097,967 |

| |

Net Asset Value Per Share |

| $ | 12.83 |

| ||

Net Assets - Class I Shares |

| $ | 695,609 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 54,108 |

| |

Net Asset Value Per Share |

| $ | 12.86 |

| ||

Net Assets - Class N Shares |

| $ | 17,938,450 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 1,398,216 |

| |

Net Asset Value Per Share |

| $ | 12.83 |

| ||

Net Assets - Class S Shares |

| $ | 581,063 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 45,869 |

| |

Net Asset Value Per Share |

| $ | 12.67 |

| ||

Net Assets - Class T Shares |

| $ | 1,597,889 |

| ||

| Shares Outstanding, $0.01 Par Value (unlimited shares authorized) |

|

| 126,110 |

| |

Net Asset Value Per Share |

| $ | 12.67 |

| ||

(1) Redemption price per share may be reduced for any applicable contingent deferred sales charge. (2) Maximum offering price is computed at 100/94.25 of net asset value. |

See Notes to Financial Statements. | |

Janus Investment Fund | 13 |

Janus Henderson Asia Equity Fund

Statement of Operations

For the year ended September 30, 2021

|

|

|

|

|

|

Investment Income: |

|

|

| ||

| Dividends | $ | 754,861 |

| |

| Dividends from affiliates |

| 803 |

| |

| Other income |

| 107 |

| |

| Foreign tax withheld |

| (101,337) |

| |

Total Investment Income |

| 654,434 |

| ||

Expenses: |

|

|

| ||

| Advisory fees |

| 380,879 |

| |

| 12b-1 Distribution and shareholder servicing fees: |

|

|

| |

|

| Class A Shares |

| 2,840 |

|

|

| Class C Shares |

| 5,342 |

|

|

| Class S Shares |

| — |

|

| Transfer agent administrative fees and expenses: |

|

|

| |

|

| Class D Shares |

| 19,968 |

|

|

| Class S Shares |

| 1,631 |

|

|

| Class T Shares |

| 5,513 |

|

| Transfer agent networking and omnibus fees: |

|

|

| |

|

| Class A Shares |

| 612 |

|

|

| Class C Shares |

| 478 |

|

|

| Class I Shares |

| 404 |

|

| Other transfer agent fees and expenses: |

|

|

| |

|

| Class A Shares |

| 152 |

|

|

| Class C Shares |

| 48 |

|

|

| Class D Shares |

| 5,328 |

|

|

| Class I Shares |

| 192 |

|

|

| Class N Shares |

| 685 |

|

|

| Class S Shares |

| 19 |

|

|

| Class T Shares |

| 71 |

|

| Registration fees |

| 106,323 |

| |

| Non-affiliated fund administration fees |

| 61,884 |

| |

| Professional fees |

| 57,261 |

| |

| Custodian fees |

| 26,738 |

| |

| Shareholder reports expense |

| 9,864 |

| |

| Affiliated fund administration fees |

| 1,173 |

| |

| Non-interested Trustees’ fees and expenses |

| 671 |

| |

| Other expenses |

| 5,534 |

| |

Total Expenses |

| 693,610 |

| ||

Less: Excess Expense Reimbursement and Waivers |

| (191,929) |

| ||

Net Expenses |

| 501,681 |

| ||

Net Investment Income/(Loss) |

| 152,753 |

| ||

Net Realized Gain/(Loss) on Investments: |

|

|

| ||

| Investments and foreign currency transactions (net of foreign taxes of $122,820) | 4,485 |

| ||

Total Net Realized Gain/(Loss) on Investments |

| 4,485 |

| ||

Change in Unrealized Net Appreciation/Depreciation: |

|

|

| ||

| Investments, foreign currency translations and non-interested Trustees’ deferred compensation (net of increase in deferred foreign taxes of $164,408) |

| (116,185) |

| |

Total Change in Unrealized Net Appreciation/Depreciation |

| (116,185) |

| ||

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | 41,053 |

| ||

|

|

|

|

|

|

See Notes to Financial Statements. | |

14 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Statements of Changes in Net Assets

|

|

|

|

|

|

|

|

|

|

|

| Year

ended |

| Year ended |

| ||

Operations: |

|

|

|

|

|

| ||

| Net investment income/(loss) | $ | 152,753 |

| $ | 88,685 |

| |

| Net realized gain/(loss) on investments |

| 4,485 |

|

| (1,102,034) |

| |

| Change in unrealized net appreciation/depreciation |

| (116,185) |

|

| 4,325,763 |

| |

Net Increase/(Decrease) in Net Assets Resulting from Operations |

| 41,053 |

|

| 3,312,414 |

| ||

Dividends and Distributions to Shareholders: |

|

|

|

|

|

| ||

|

| Class A Shares |

| — |

|

| (5,855) |

|

|

| Class D Shares |

| (7,118) |

|

| (91,345) |

|

|

| Class I Shares |

| (1,614) |

|

| (12,458) |

|

|

| Class N Shares |

| (22,900) |

|

| (82,050) |

|

|

| Class S Shares |

| — |

|

| (3,865) |

|

|

| Class T Shares |

| — |

|

| (9,399) |

|

Net Decrease from Dividends and Distributions to Shareholders |

| (31,632) |

|

| (204,972) |

| ||

Capital Share Transactions: |

|

|

|

|

|

| ||

|

| Class A Shares |

| (457,369) |

|

| 17,388 |

|

|

| Class C Shares |

| (44,545) |

|

| (86,660) |

|

|

| Class D Shares |

| 3,477,658 |

|

| (1,753,286) |

|

|

| Class I Shares |

| 104,905 |

|

| (699,799) |

|

|

| Class N Shares |

| 4,918,183 |

|

| 2,584,115 |

|

|

| Class S Shares |

| (16,791) |

|

| 10,004 |

|

|

| Class T Shares |

| (6,609) |

|

| 138,167 |

|

Net Increase/(Decrease) from Capital Share Transactions |

| 7,975,432 |

|

| 209,929 |

| ||

Net Increase/(Decrease) in Net Assets |

| 7,984,853 |

|

| 3,317,371 |

| ||

Net Assets: |

|

|

|

|

|

| ||

| Beginning of period |

| 27,957,165 |

|

| 24,639,794 |

| |

| End of period | $ | 35,942,018 |

| $ | 27,957,165 |

| |

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements. | |

Janus Investment Fund | 15 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class A Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $12.00 |

|

| $10.39 |

|

| $11.42 |

|

| $11.45 |

|

| $9.42 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| 0.01 |

|

| 0.01 |

|

| 0.10 |

|

| 0.07 |

|

| 0.02 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.63(2) |

|

| 1.67 |

|

| (0.27) |

|

| 0.22 |

|

| 2.12 |

| |

| Total from Investment Operations |

| 0.64 |

|

| 1.68 |

|

| (0.17) |

|

| 0.29 |

|

| 2.14 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| — |

|

| (0.07) |

|

| (0.02) |

|

| (0.05) |

|

| (0.11) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| — |

|

| (0.07) |

|

| (0.86) |

|

| (0.32) |

|

| (0.11) |

| ||

| Net Asset Value, End of Period |

| $12.64 |

|

| $12.00 |

|

| $10.39 |

|

| $11.42 |

|

| $11.45 |

| ||

| Total Return* |

| 5.33% |

|

| 16.20% |

|

| (0.69)% |

|

| 2.48% |

|

| 23.10% |

| ||

| Net Assets, End of Period (in thousands) |

| $557 |

|

| $951 |

|

| $822 |

|

| $816 |

|

| $366 |

| ||

| Average Net Assets for the Period (in thousands) |

| $1,130 |

|

| $901 |

|

| $822 |

|

| $954 |

|

| $293 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 2.10% |

|

| 2.44% |

|

| 2.72% |

|

| 2.08% |

|

| 2.49% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.43% |

|

| 1.43% |

|

| 1.49% |

|

| 1.53% |

|

| 1.63% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.04% |

|

| 0.14% |

|

| 0.95% |

|

| 0.60% |

|

| 0.17% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

Class C Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $11.79 |

|

| $10.23 |

|

| $11.30 |

|

| $11.36 |

|

| $9.34 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| (0.09) |

|

| (0.07) |

|

| (0.03) |

|

| (0.01) |

|

| (0.04) |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.62(2) |

|

| 1.63 |

|

| (0.20) |

|

| 0.22 |

|

| 2.10 |

| |

| Total from Investment Operations |

| 0.53 |

|

| 1.56 |

|

| (0.23) |

|

| 0.21 |

|

| 2.06 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| — |

|

| — |

|

| — |

|

| — |

|

| (0.04) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| (0.04) |

| ||

| Net Asset Value, End of Period |

| $12.32 |

|

| $11.79 |

|

| $10.23 |

|

| $11.30 |

|

| $11.36 |

| ||

| Total Return* |

| 4.50% |

|

| 15.25% |

|

| (1.28)% |

|

| 1.80% |

|

| 22.17% |

| ||

| Net Assets, End of Period (in thousands) |

| $489 |

|

| $506 |

|

| $535 |

|

| $1,244 |

|

| $957 |

| ||

| Average Net Assets for the Period (in thousands) |

| $552 |

|

| $482 |

|

| $746 |

|

| $1,233 |

|

| $519 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 3.13% |

|

| 3.50% |

|

| 3.35% |

|

| 2.78% |

|

| 3.09% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 2.17% |

|

| 2.20% |

|

| 2.07% |

|

| 2.25% |

|

| 2.33% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| (0.68)% |

|

| (0.66)% |

|

| (0.28)% |

|

| (0.04)% |

|

| (0.42)% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. (2) The amount shown does not correlate with the change in the aggregate gains and losses in the Fund's securities for the year or period due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's securities. |

See Notes to Financial Statements. | |

16 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class D Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $12.17 |

|

| $10.53 |

|

| $11.54 |

|

| $11.56 |

|

| $9.49 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| 0.04 |

|

| 0.03 |

|

| 0.09 |

|

| 0.07 |

|

| 0.07 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.63(2) |

|

| 1.70 |

|

| (0.23) |

|

| 0.23 |

|

| 2.11 |

| |

| Total from Investment Operations |

| 0.67 |

|

| 1.73 |

|

| (0.14) |

|

| 0.30 |

|

| 2.18 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| (0.01) |

|

| (0.09) |

|

| (0.03) |

|

| (0.05) |

|

| (0.11) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| (0.01) |

|

| (0.09) |

|

| (0.87) |

|

| (0.32) |

|

| (0.11) |

| ||

| Net Asset Value, End of Period |

| $12.83 |

|

| $12.17 |

|

| $10.53 |

|

| $11.54 |

|

| $11.56 |

| ||

| Total Return* |

| 5.48% |

|

| 16.45% |

|

| (0.44)% |

|

| 2.57% |

|

| 23.30% |

| ||

| Net Assets, End of Period (in thousands) |

| $14,083 |

|

| $10,793 |

|

| $11,198 |

|

| $13,089 |

|

| $21,577 |

| ||

| Average Net Assets for the Period (in thousands) |

| $17,722 |

|

| $10,678 |

|

| $11,599 |

|

| $21,221 |

|

| $11,542 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 1.69% |

|

| 2.03% |

|

| 2.29% |

|

| 1.72% |

|

| 2.19% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.25% |

|

| 1.26% |

|

| 1.33% |

|

| 1.33% |

|

| 1.44% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.31% |

|

| 0.27% |

|

| 0.88% |

|

| 0.55% |

|

| 0.67% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

Class I Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $12.19 |

|

| $10.54 |

|

| $11.45 |

|

| $11.56 |

|

| $9.51 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| 0.06 |

|

| —(3) |

|

| 0.13 |

|

| (0.03) |

|

| 0.11 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.63(2) |

|

| 1.74 |

|

| (0.17) |

|

| 0.26 |

|

| 2.07 |

| |

| Total from Investment Operations |

| 0.69 |

|

| 1.74 |

|

| (0.04) |

|

| 0.23 |

|

| 2.18 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| (0.02) |

|

| (0.09) |

|

| (0.03) |

|

| (0.07) |

|

| (0.13) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| (0.02) |

|

| (0.09) |

|

| (0.87) |

|

| (0.34) |

|

| (0.13) |

| ||

| Net Asset Value, End of Period |

| $12.86 |

|

| $12.19 |

|

| $10.54 |

|

| $11.45 |

|

| $11.56 |

| ||

| Total Return* |

| 5.62% |

|

| 16.62% |

|

| 0.45% |

|

| 1.90% |

|

| 23.39% |

| ||

| Net Assets, End of Period (in thousands) |

| $696 |

|

| $692 |

|

| $1,406 |

|

| $1,029 |

|

| $12,675 |

| ||

| Average Net Assets for the Period (in thousands) |

| $1,834 |

|

| $1,061 |

|

| $1,208 |

|

| $5,848 |

|

| $7,408 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 1.69% |

|

| 2.07% |

|

| 2.32% |

|

| 1.44% |

|

| 2.00% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.14% |

|

| 1.15% |

|

| 1.21% |

|

| 1.26% |

|

| 1.32% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.45% |

|

| 0.02% |

|

| 1.28% |

|

| (0.25)% |

|

| 1.01% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. (2) The amount shown does not correlate with the change in the aggregate gains and losses in the Fund’s securities for the year or period due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s securities. (3) Less than $0.005 on a per share basis. |

See Notes to Financial Statements. | |

Janus Investment Fund | 17 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class N Shares |

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year or period ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018(1) |

| |||

| Net Asset Value, Beginning of Period |

| $12.17 |

|

| $10.52 |

|

| $11.56 |

|

| $12.73 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(2) |

| 0.07 |

|

| 0.06 |

|

| 0.11 |

|

| 0.16 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.61(3) |

|

| 1.69 |

|

| (0.26) |

|

| (1.33) |

| |

| Total from Investment Operations |

| 0.68 |

|

| 1.75 |

|

| (0.15) |

|

| (1.17) |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| (0.02) |

|

| (0.10) |

|

| (0.05) |

|

| — |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| — |

| |

| Total Dividends and Distributions |

| (0.02) |

|

| (0.10) |

|

| (0.89) |

|

| — |

| ||

| Net Asset Value, End of Period |

| $12.83 |

|

| $12.17 |

|

| $10.52 |

|

| $11.56 |

| ||

| Total Return* |

| 5.59% |

|

| 16.69% |

|

| (0.51)% |

|

| (9.19)% |

| ||

| Net Assets, End of Period (in thousands) |

| $17,938 |

|

| $12,809 |

|

| $8,886 |

|

| $8,501 |

| ||

| Average Net Assets for the Period (in thousands) |

| $17,351 |

|

| $11,337 |

|

| $7,989 |

|

| $7,978 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 1.53% |

|

| 1.80% |

|

| 2.05% |

|

| 1.75% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.11% |

|

| 1.10% |

|

| 1.17% |

|

| 1.13% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.49% |

|

| 0.51% |

|

| 1.08% |

|

| 1.96% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

| ||

Class S Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $12.00 |

|

| $10.41 |

|

| $11.45 |

|

| $11.48 |

|

| $9.43 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(2) |

| 0.04 |

|

| 0.01 |

|

| 0.09 |

|

| 0.06 |

|

| 0.01 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.63(3) |

|

| 1.66 |

|

| (0.25) |

|

| 0.22 |

|

| 2.14 |

| |

| Total from Investment Operations |

| 0.67 |

|

| 1.67 |

|

| (0.16) |

|

| 0.28 |

|

| 2.15 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| — |

|

| (0.08) |

|

| (0.04) |

|

| (0.04) |

|

| (0.10) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| — |

|

| (0.08) |

|

| (0.88) |

|

| (0.31) |

|

| (0.10) |

| ||

| Net Asset Value, End of Period |

| $12.67 |

|

| $12.00 |

|

| $10.41 |

|

| $11.45 |

|

| $11.48 |

| ||

| Total Return* |

| 5.58% |

|

| 16.13% |

|

| (0.55)% |

|

| 2.37% |

|

| 23.07% |

| ||

| Net Assets, End of Period (in thousands) |

| $581 |

|

| $566 |

|

| $481 |

|

| $484 |

|

| $472 |

| ||

| Average Net Assets for the Period (in thousands) |

| $653 |

|

| $502 |

|

| $467 |

|

| $501 |

|

| $413 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 2.18% |

|

| 2.85% |

|

| 2.98% |

|

| 2.36% |

|

| 2.64% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.20% |

|

| 1.47% |

|

| 1.34% |

|

| 1.58% |

|

| 1.66% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.32% |

|

| 0.11% |

|

| 0.91% |

|

| 0.52% |

|

| 0.15% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from January 26, 2018 (inception date) through September 30, 2018. (2) Per share amounts are calculated based on average shares outstanding during the year or period. (3) The amount shown does not correlate with the change in the aggregate gains and losses in the Fund’s securities for the year or period due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s securities. |

See Notes to Financial Statements. | |

18 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class T Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

For a share outstanding during the year ended September 30 |

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| |||

| Net Asset Value, Beginning of Period |

| $12.03 |

|

| $10.41 |

|

| $11.37 |

|

| $11.42 |

|

| $9.36 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| 0.04 |

|

| 0.03 |

|

| 0.10 |

|

| 0.06 |

|

| 0.06 |

| |

|

| Net realized and unrealized gain/(loss) |

| 0.60(2) |

|

| 1.67 |

|

| (0.21) |

|

| 0.20 |

|

| 2.08 |

| |

| Total from Investment Operations |

| 0.64 |

|

| 1.70 |

|

| (0.11) |

|

| 0.26 |

|

| 2.14 |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| — |

|

| (0.08) |

|

| (0.01) |

|

| (0.04) |

|

| (0.08) |

| |

|

| Distributions (from capital gains) |

| — |

|

| — |

|

| (0.84) |

|

| (0.27) |

|

| — |

| |

| Total Dividends and Distributions |

| — |

|

| (0.08) |

|

| (0.85) |

|

| (0.31) |

|

| (0.08) |

| ||

| Net Asset Value, End of Period |

| $12.67 |

|

| $12.03 |

|

| $10.41 |

|

| $11.37 |

|

| $11.42 |

| ||

| Total Return* |

| 5.32% |

|

| 16.37% |

|

| (0.14)% |

|

| 2.27% |

|

| 23.18% |

| ||

| Net Assets, End of Period (in thousands) |

| $1,598 |

|

| $1,641 |

|

| $1,310 |

|

| $1,032 |

|

| $2,937 |

| ||

| Average Net Assets for the Period (in thousands) |

| $2,205 |

|

| $1,340 |

|

| $1,210 |

|

| $2,799 |

|

| $756 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses |

| 1.92% |

|

| 2.27% |

|

| 2.53% |

|

| 1.81% |

|

| 2.14% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets) |

| 1.36% |

|

| 1.35% |

|

| 1.40% |

|

| 1.41% |

|

| 1.55% |

| |

|

| Ratio of Net Investment Income/(Loss) |

| 0.29% |

|

| 0.26% |

|

| 0.98% |

|

| 0.54% |

|

| 0.55% |

| |

| Portfolio Turnover Rate |

| 60% |

|

| 53% |

|

| 34% |

|

| 41% |

|

| 120% |

| ||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. (2) The amount shown does not correlate with the change in the aggregate gains and losses in the Fund’s securities for the year or period due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s securities. |

See Notes to Financial Statements. | |

Janus Investment Fund | 19 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Janus Henderson Asia Equity Fund (the “Fund”) is a series of Janus Investment Fund (the “Trust”), which is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers 41 funds, each of which offers multiple share classes, with differing investment objectives and policies. The Fund seeks long-term growth of capital. The Fund is classified as diversified, as defined in the 1940 Act.

The Fund offers multiple classes of shares in order to meet the needs of various types of investors. Each class represents an interest in the same portfolio of investments. Certain financial intermediaries may not offer all classes of shares.

Class A Shares are offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, bank trust platforms, and retirement platforms.

Class C Shares are offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, and bank trust platforms.

Class C Shares are closed to investments by new employer-sponsored retirement plans and existing employer-sponsored retirement plans are no longer able to make additional purchases or exchanges into Class C Shares.

The Funds currently implement an automatic conversion feature pursuant to which Class C Shares that have been held for eight years are automatically converted to Class A Shares without the imposition of any sales charge, fee or other charge. The conversion will generally occur no later than ten business days in the month following the month of the eighth anniversary of the date of purchase. Class C Shares purchased through the reinvestment of dividends and other distributions on Class C Shares will convert to Class A Shares at the same time as the original Class C Shares with respect to which they were purchased. For Class C Shares held in omnibus accounts on intermediary platforms, the Fund will rely on these intermediaries to implement this conversion feature. Your financial intermediary may have separate policies and procedures as to when and how Class C Shares may be converted to Class A Shares. Please contact your financial intermediary for additional information.

Effective July 6, 2020, Class D Shares are available to new investors, subject to any closed fund policies for a Fund, as applicable. Previously, Class D Shares were only available to investors who already had a direct account with the Janus Henderson funds; immediate family members or members of the same household of an eligible individual investor; and existing beneficial owners of sole proprietorships or partnerships that hold accounts directly with the Janus Henderson funds.

Class I Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. Class I Shares are also available to certain direct institutional investors including, but not limited to, corporations, certain retirement plans, public plans, and foundations/endowments, who established Class I Share accounts before August 4, 2017.

Class N Shares are generally available only to financial intermediaries purchasing on behalf of: 1) certain adviser-assisted, employer-sponsored retirement plans, including 401(k) plans, 457 plans, 403(b) plans, Taft-Hartley multi-employer plans, profit-sharing and money purchase pension plans, defined benefit plans and certain welfare benefit plans, such as health savings accounts, and nonqualified deferred compensation plans; and 2) retail investors purchasing in qualified or nonqualified accounts, whose accounts are held through an omnibus account at their financial intermediary, and where the financial intermediary requires no payment or reimbursement from the Fund, Janus Capital Management LLC (“Janus Capital”), or its affiliates. Class N Shares are also available to Janus Henderson proprietary products and to certain direct institutional investors approved by Janus Distributors LLC dba Janus Henderson Distributors (“Janus Henderson Distributors”) including, but not limited to, corporations, certain retirement plans, public plans, and foundations and endowments, subject to minimum investment requirements.

Class S Shares are offered through financial intermediary platforms including, but not limited to, retirement platforms and asset allocation, mutual fund wrap, or other discretionary or nondiscretionary fee-based investment advisory

20 | SEPTEMBER 30, 2021 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

programs. In addition, Class S Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class S Shares on their supermarket platforms.

Class T Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. In addition, Class T Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class T Shares on their supermarket platforms.

The following accounting policies have been followed by the Fund and are in conformity with United States of America generally accepted accounting principles ("US GAAP").

Investment Valuation