United States Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number 811-01879

Janus

Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver,

Colorado 80206

(Address of principal executive offices) (Zip code)

Kathryn Santoro, 151 Detroit

Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant's telephone

number, including area code: 303-333-3863

Date of fiscal year end: 9/30

Date of reporting period:

9/30/19

Item 1 - Reports to Shareholders

ANNUAL REPORT September 30, 2019 | |||

Janus Henderson Asia Equity Fund | |||

Janus Investment Fund | |||

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by contacting a Janus Henderson representative. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by visiting janushenderson.com/edelivery. You may elect to receive all future reports in paper free of charge. If you do not invest directly with the Fund, you should contact your plan sponsor, broker-dealer, or financial intermediary, to request to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-525-3713 to let the Fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Janus Henderson mutual funds where held (i.e., all Janus Henderson mutual funds held in your account if you invest through your financial intermediary or all Janus Henderson mutual funds held with the fund complex if you invest directly with a fund).

| |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics | |||

|

Table of Contents

Janus Henderson Asia Equity Fund

Janus Henderson Asia Equity Fund (unaudited)

PERFORMANCE

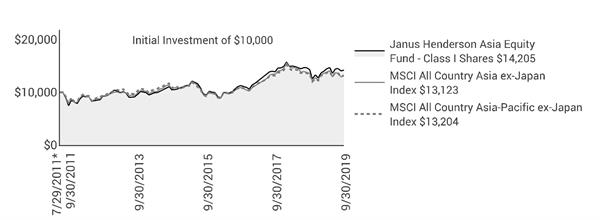

The Janus Henderson Asia Equity Fund Class I Shares returned -0.68% over the one-year period ended September 30, 2019. The Fund’s primary benchmark, the MSCI All Country Asia ex Japan IndexSM, returned -3.44%. The Fund’s secondary benchmark, the MSCI All Country Asia Pacific ex Japan IndexSM, returned -1.77%.

INVESTMENT ENVIRONMENT

Asian equity markets declined by close to 3% during the 12-month period, as the highly publicized U.S.-China trade wars weighed on market sentiment. This hit equity markets in particular in the final quarter of 2018, after which we saw a recovery through the early part of 2019 before hopes of a clear resolution faded. With the threat of increased tariffs from those originally proposed and a general deterioration in global economic data, Asian equity markets ended the period weaker.

In other political news, incumbents in both India and Indonesia won re-election. This was expected in Indonesia, but in India the strength of Prime Minister Narendra Modi’s victory was a surprise. In both cases, there is increased optimism for bolder reforms in their second terms of government. At the end of the period, the Indian government delivered a surprising and significant cut in corporate taxes as well as other incentives to attract foreign direct investments, a move that we believe bodes well for the future.

Economic data was sluggish but it is worth stressing that economic growth rates in the region remain among the highest in the world, with GDP growth above 5% in many Asian economies. Interest-rate policy is also conventional and we already have seen some interest-rate cuts in the region as a response to the softer data. There is more policy flexibility available in the future across much of the region, given higher interest rates than compared to much of the developed world.

PERFORMANCE DISCUSSION

The Fund outperformed its primary and secondary benchmarks over the 12-month period, posting a small decline. Our overweight position to India proved the most significant contributor in terms of asset allocation. Modi’s victory and the Indian government’s corporate tax cut were supportive, but the Indian economy is also more domestically demand-driven, and therefore is less impacted by the trade disputes. By sector, our financials exposure was the greatest contributor, driven primarily by stock selection, although our overweight also proved positive given the sector outperformed. Within financials, we can find both structural growth in the case of life insurance and emerging-market banks, as well as defensive attributes and a good dividend yield in markets like Taiwan and Singapore. Two Indian private-sector financials, HDFC Bank and its parent company, HDFC Ltd.; Taiwanese bank E Sun Financial Holding; and Ping An Insurance, a Chinese life insurance company, were among our top contributors for the year.

Consumer discretionary was the biggest detractor, due primarily to stock selection from positions in Chinese car manufacturer Brilliance China Automotive and global luggage company Samsonite International SA. We have maintained the position in the latter, but have exited the position in the former, given some industry challenges on top of various company-specific issues. At the country level, our holdings in Hong Kong detracted, as ongoing demonstrations created volatility. Baidu.com, a Chinese multinational technology company, and Catcher Technology, a Taiwan-based electronic component manufacturer, also detracted.

In terms of portfolio activity, during the 12-month period we increased our exposure to Southeast Asia (ASEAN) and to Indonesia in particular, where we added two banks to the portfolio. Both offer the potential for good structural growth and an attractive return on equity, and further, we believe that ASEAN is less impacted from the trade

Janus Investment Fund | 1 |

Janus Henderson Asia Equity Fund (unaudited)

dispute versus North Asia. We also exited a tobacco company in India, as we felt that the unfavorable regulatory environment would continue to dampen the company’s growth prospects. We redeployed the proceeds into another Indian consumer staples company, where we felt its dominant position in the oral-care industry will continue to drive sustainable growth going forward in an area where penetration rates remain relatively low. We added to a number of existing holdings in China on relative market weakness toward the end of the period. Other changes made through the year were more company-specific and we continue to run a focused portfolio of fewer than 40 companies.

OUTLOOK

The trade war will continue to dictate sentiment in the near-term, and there is a possibility of a relief rally on any kind of resolution, hence our decision to narrow some of our underweight to China toward the period-end. We remain cautious on China as there still is no sign of any major stimulus; economic weakness may continue for longer and valuations particularly in the local A share market look a little stretched. Hong Kong-listed China shares are more reasonably priced. We remain overweight to India and Taiwan as we are comfortable with the structural-growth opportunities and high return on capital available in India, while Taiwanese companies provide a good combination of strong balance sheets and cash flow at reasonable prices. For the region as a whole, corporate earnings growth remains lackluster so we are still slightly cautious until we see stronger earnings revisions. A trade deal could help this as it will give more certainty for companies to invest, and we suspect it also will boost consumer sentiment. Longer-term, the case for Asia remains very positive given its economic growth and valuations at an attractive discount to developed-market equities.

2 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund (unaudited)

Fund At A Glance

September 30, 2019

5 Top Performers - Holdings |

|

|

| 5 Bottom Performers - Holdings |

| |

Contribution | Contribution | |||||

HDFC Bank Ltd | 1.14% | Brilliance China Automotive Holdings Ltd | -0.97% | |||

Housing Development Finance Corp Ltd | 0.68% | Samsonite International SA | -0.95% | |||

E.Sun Financial Holding Co Ltd | 0.59% | Baidu Inc (ADR) | -0.56% | |||

Advantech Co Ltd | 0.58% | Catcher Technology Co Ltd | -0.50% | |||

Ping An Insurance Group Co of China Ltd | 0.45% | BOC Hong Kong Holdings Ltd | -0.41% | |||

5 Top Performers - Sectors* |

|

|

|

|

| |

Fund | Fund Weighting | MSCI All Country Asia ex-Japan Index | ||||

Contribution | (Average % of Equity) | Weighting | ||||

Financials | 3.52% | 33.24% | 23.97% | |||

Health Care | 0.76% | 0.00% | 2.92% | |||

Industrials | 0.68% | 2.72% | 6.90% | |||

Materials | 0.54% | 0.00% | 4.63% | |||

Information Technology | 0.49% | 21.29% | 16.78% | |||

5 Bottom Performers - Sectors* |

|

|

|

|

| |

Fund | Fund Weighting | MSCI All Country Asia ex-Japan Index | ||||

Contribution | (Average % of Equity) | Weighting | ||||

Consumer Discretionary | -1.31% | 14.57% | 12.91% | |||

Real Estate | -0.25% | 4.89% | 6.27% | |||

Utilities | -0.13% | 0.00% | 3.33% | |||

Communication Services | 0.08% | 5.18% | 12.61% | |||

Consumer Staples | 0.16% | 13.25% | 5.05% | |||

Security contribution to performance is measured by using an algorithm that multiplies the daily performance of each security with the previous day’s ending weight in the portfolio and is gross of advisory fees. Fixed income securities and certain equity securities, such as private placements and some share classes of equity securities, are excluded. | ||||||

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. | |||||

Janus Investment Fund | 3 |

Janus Henderson Asia Equity Fund (unaudited)

Fund At A Glance

September 30, 2019

5 Largest Equity Holdings - (% of Net Assets) | |

Tencent Holdings Ltd | |

Interactive Media & Services | 5.3% |

Alibaba Group Holding Ltd (ADR) | |

Internet & Direct Marketing Retail | 5.1% |

AIA Group Ltd | |

Insurance | 5.0% |

Taiwan Semiconductor Manufacturing Co Ltd | |

Semiconductor & Semiconductor Equipment | 5.0% |

HDFC Bank Ltd | |

Banks | 4.7% |

25.1% | |

Asset Allocation - (% of Net Assets) | |||||

Common Stocks | 91.3% | ||||

Investment Companies | 4.9% | ||||

Preferred Stocks | 4.3% | ||||

Other | (0.5)% | ||||

100.0% | |||||

Emerging markets comprised 76.3% of total net assets.

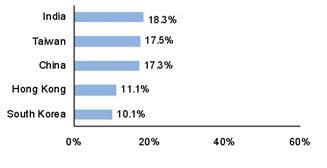

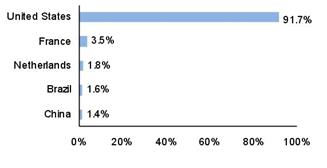

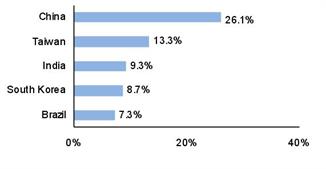

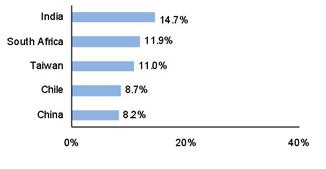

Top Country Allocations - Long Positions - (% of Investment Securities) | |

As of September 30, 2019

| As of September 30, 2018

|

4 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund (unaudited)

Performance

See important disclosures on the next page. |

| |||||||||

Average Annual Total Return - for the periods ended September 30, 2019 |

|

| Expense Ratios | ||||||

|

| One

| Five

| Since |

|

| Total Annual Fund

| Net Annual Fund

| |

Class A Shares at NAV |

| -0.95% | 5.96% | 4.08% |

|

| 2.08% | 1.51% | |

Class A Shares at MOP |

| -6.66% | 4.71% | 3.33% |

|

|

|

| |

Class C Shares at NAV | -1.45% | 5.24% | 3.37% |

|

| 2.79% | 2.22% | ||

Class C Shares at CDSC |

| -2.36% | 5.24% | 3.37% |

|

|

|

| |

Class D Shares(1) |

| -0.78% | 6.16% | 4.25% |

|

| 1.72% | 1.29% | |

Class I Shares |

| -0.68% | 6.29% | 4.39% |

|

| 1.44% | 1.16% | |

Class N Shares |

| -0.68% | 5.88% | 3.83% |

|

| 1.75% | 1.13% | |

Class S Shares |

| -0.81% | 5.99% | 4.06% |

|

| 2.36% | 1.63% | |

Class T Shares |

| -0.66% | 6.15% | 4.23% |

|

| 1.81% | 1.38% | |

MSCI All Country Asia ex-Japan Index |

| -3.44% | 4.23% | 3.38% |

|

|

|

| |

MSCI All Country Asia-Pacific ex-Japan Index |

| -1.77% | 4.07% | 3.46% |

|

|

|

| |

Morningstar Quartile - Class I Shares |

| 3rd | 1st | 2nd |

|

|

|

| |

Morningstar Ranking - based on total returns for Pacific/Asia ex-Japan Stock Funds |

| 57/89 | 14/78 | 18/68 |

|

|

|

| |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

Net expense ratios reflect the expense waiver, if any, contractually agreed to through February 1, 2020.

This Fund has a performance-based management fee that may adjust up or down based on the Fund’s performance.

Janus Investment Fund | 5 |

Janus Henderson Asia Equity Fund (unaudited)

Performance

Performance may be affected by risks that include those associated with non-diversification, portfolio turnover, short sales, potential conflicts of interest, foreign and emerging markets, initial public offerings (IPOs), high-yield and high-risk securities, undervalued, overlooked and smaller capitalization companies, real estate related securities including Real Estate Investment Trusts (REITs), derivatives, and commodity-linked investments. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

The Fund will normally invest at least 80% of its net assets, measured at the time of purchase, in the type of securities described by its name.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Class N Shares commenced operations on January 26, 2018. Performance shown for periods prior to January 26, 2018, reflects the historical performance of the Fund's Class I Shares, calculated using the fees and expenses of Class N Shares, without the effect of any fee and expense limitations or waivers.

If Class N Shares of the Fund had been available during periods prior to January 26, 2018, the performance shown may have been different. The performance shown for periods following the Fund's commencement of Class N Shares reflects the fees and expenses of Class N Shares, net of any applicable fee and expense limitations or waivers. Please refer to the Fund's prospectuses for further details concerning historical performance.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2019 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Fund Report.”

*The Fund’s inception date – July 29, 2011

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

(1) Closed to certain new investors.

6 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Actual | Hypothetical

| |||||||||

| Beginning | Ending | Expenses |

| Beginning | Ending | Expenses | Net Annualized | ||

Class A Shares | $1,000.00 | $983.00 | $7.51 |

| $1,000.00 | $1,017.50 | $7.64 | 1.51% | ||

Class C Shares | $1,000.00 | $980.80 | $9.73 |

| $1,000.00 | $1,015.24 | $9.90 | 1.96% | ||

Class D Shares | $1,000.00 | $983.20 | $6.76 |

| $1,000.00 | $1,018.25 | $6.88 | 1.36% | ||

Class I Shares | $1,000.00 | $984.10 | $6.12 |

| $1,000.00 | $1,018.90 | $6.23 | 1.23% | ||

Class N Shares | $1,000.00 | $984.10 | $5.97 |

| $1,000.00 | $1,019.05 | $6.07 | 1.20% | ||

Class S Shares | $1,000.00 | $983.90 | $6.07 |

| $1,000.00 | $1,018.95 | $6.17 | 1.22% | ||

Class T Shares | $1,000.00 | $983.00 | $7.16 |

| $1,000.00 | $1,017.85 | $7.28 | 1.44% | ||

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. | |||||||||

Janus Investment Fund | 7 |

Janus Henderson Asia Equity Fund

Schedule of Investments

September 30, 2019

| Value | ||||||

Common Stocks – 91.3% | |||||||

Banks – 13.5% | |||||||

Bank Central Asia Tbk PT | 224,500 | $480,167 | |||||

Bank Rakyat Indonesia Persero Tbk PT | 2,001,300 | 581,068 | |||||

E.Sun Financial Holding Co Ltd | 657,374 | 556,007 | |||||

HDFC Bank Ltd | 67,567 | 1,170,387 | |||||

Oversea-Chinese Banking Corp Ltd | 67,400 | 529,718 | |||||

3,317,347 | |||||||

Beverages – 5.0% | |||||||

Jiangsu Yanghe Brewery Joint-Stock Co Ltd | 23,971 | 349,192 | |||||

Treasury Wine Estates Ltd | 71,558 | 896,696 | |||||

1,245,888 | |||||||

Diversified Financial Services – 6.4% | |||||||

Ayala Corp | 58,150 | 992,736 | |||||

Bajaj Holdings & Investment Ltd | 11,376 | 576,857 | |||||

1,569,593 | |||||||

Food Products – 5.4% | |||||||

Uni-President Enterprises Corp | 385,000 | 926,779 | |||||

Vietnam Dairy Products JSC | 72,854 | 407,292 | |||||

1,334,071 | |||||||

Hotels, Restaurants & Leisure – 2.3% | |||||||

Sands China Ltd | 122,800 | 556,223 | |||||

Household Durables – 9.4% | |||||||

Midea Group Co Ltd | 68,778 | 492,283 | |||||

Nien Made Enterprise Co Ltd | 55,000 | 480,740 | |||||

Techtronic Industries Co Ltd | 98,000 | 682,092 | |||||

Woongjin Coway Co Ltd | 9,313 | 658,762 | |||||

2,313,877 | |||||||

Information Technology Services – 5.5% | |||||||

Infosys Ltd | 62,956 | 715,772 | |||||

Tata Consultancy Services Ltd | 21,447 | 635,378 | |||||

1,351,150 | |||||||

Insurance – 8.5% | |||||||

AIA Group Ltd | 129,800 | 1,226,372 | |||||

Ping An Insurance Group Co of China Ltd | 76,000 | 873,212 | |||||

2,099,584 | |||||||

Interactive Media & Services – 5.3% | |||||||

Tencent Holdings Ltd | 31,300 | 1,318,693 | |||||

Internet & Direct Marketing Retail – 5.1% | |||||||

Alibaba Group Holding Ltd (ADR)* | 7,538 | 1,260,580 | |||||

Personal Products – 3.6% | |||||||

Colgate-Palmolive India Ltd | 14,000 | 297,134 | |||||

LG Household & Health Care Ltd | 538 | 587,931 | |||||

885,065 | |||||||

Real Estate Management & Development – 5.1% | |||||||

City Developments Ltd | 78,200 | 555,742 | |||||

Land & Houses PCL (REG) | 2,206,000 | 692,531 | |||||

1,248,273 | |||||||

Semiconductor & Semiconductor Equipment – 5.0% | |||||||

Taiwan Semiconductor Manufacturing Co Ltd | 140,000 | 1,226,124 | |||||

Technology Hardware, Storage & Peripherals – 5.4% | |||||||

Advantech Co Ltd | 88,797 | 780,900 | |||||

Catcher Technology Co Ltd | 49,000 | 369,400 | |||||

Samsung Electronics Co Ltd | 4,466 | 183,158 | |||||

1,333,458 | |||||||

Textiles, Apparel & Luxury Goods – 1.2% | |||||||

Samsonite International SA (144A) | 138,600 | 293,558 | |||||

Thrifts & Mortgage Finance – 4.6% | |||||||

Housing Development Finance Corp Ltd | 40,770 | 1,137,494 | |||||

Total Common Stocks (cost $19,848,833) | 22,490,978 | ||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

8 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Schedule of Investments

September 30, 2019

| Value | ||||||

Preferred Stocks – 4.3% | |||||||

Technology Hardware, Storage & Peripherals – 4.3% | |||||||

Samsung Electronics Co Ltd (cost $920,237) | 32,056 | $1,058,706 | |||||

Investment Companies – 4.9% | |||||||

Money Markets – 4.9% | |||||||

Fidelity Investments Money Market Treasury Portfolio, 1.8200%ºº (cost $1,213,782) | 1,213,782 | 1,213,782 | |||||

Total Investments (total cost $21,982,852) – 100.5% | 24,763,466 | ||||||

Liabilities, net of Cash, Receivables and Other Assets – (0.5)% | (123,672) | ||||||

Net Assets – 100% | $24,639,794 | ||||||

Summary of Investments by Country - (Long Positions) (unaudited) | |||||

% of | |||||

Investment | |||||

Country | Value | Securities | |||

India | $4,533,022 | 18.3 | % | ||

Taiwan | 4,339,950 | 17.5 | |||

China | 4,293,960 | 17.3 | |||

Hong Kong | 2,758,245 | 11.1 | |||

South Korea | 2,488,557 | 10.1 | |||

United States | 1,213,782 | 4.9 | |||

Singapore | 1,085,460 | 4.4 | |||

Indonesia | 1,061,235 | 4.3 | |||

Philippines | 992,736 | 4.0 | |||

Australia | 896,696 | 3.6 | |||

Thailand | 692,531 | 2.8 | |||

Vietnam | 407,292 | 1.7 | |||

Total | $24,763,466 | 100.0 | % |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 9 |

Janus Henderson Asia Equity Fund

Notes to Schedule of Investments and Other Information

MSCI All Country Asia ex-Japan IndexSM | MSCI All Country Asia ex-Japan IndexSM reflects the equity market performance of Asia, excluding Japan. |

MSCI All Country Asia-Pacific ex-Japan IndexSM | The MSCI All Country Asia-Pacific ex-Japan IndexSM reflects the performance of large and mid-cap companies in developed and emerging markets in the Asia Pacific region, excluding Japan. |

ADR | American Depositary Receipt |

PCL | Public Company Limited |

REG | Registered |

144A | Securities sold under Rule 144A of the Securities Act of 1933, as amended, are subject to legal and/or contractual restrictions on resale and may not be publicly sold without registration under the 1933 Act. Unless otherwise noted, these securities have been determined to be liquid under guidelines established by the Board of Trustees. The total value of 144A securities as of the year ended September 30, 2019 is $293,558, which represents 1.2% of net assets. |

* | Non-income producing security. |

ºº | Rate shown is the 7-day yield as of September 30, 2019. |

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of September 30, 2019. See Notes to Financial Statements for more information. | ||||||||||||

Valuation Inputs Summary | ||||||||||||

Level 2 - | Level 3 - | |||||||||||

Level 1 - | Other Significant | Significant | ||||||||||

Quoted Prices | Observable Inputs | Unobservable Inputs | ||||||||||

Assets | ||||||||||||

Investments In Securities: | ||||||||||||

Common Stocks | ||||||||||||

Banks | $ | 2,761,340 | $ | 556,007 | $ | - | ||||||

Beverages | 896,696 | 349,192 | - | |||||||||

Food Products | 407,292 | 926,779 | - | |||||||||

Household Durables | 1,340,854 | 973,023 | - | |||||||||

Real Estate Management & Development | 555,742 | 692,531 | - | |||||||||

Semiconductor & Semiconductor Equipment | - | 1,226,124 | - | |||||||||

Technology Hardware, Storage & Peripherals | 183,158 | 1,150,300 | - | |||||||||

All Other | 10,471,940 | - | - | |||||||||

Preferred Stocks | - | 1,058,706 | - | |||||||||

Investment Companies | 1,213,782 | - | - | |||||||||

Total Assets | $ | 17,830,804 | $ | 6,932,662 | $ | - | ||||||

10 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Statement of Assets and Liabilities

September 30, 2019

See footnotes at the end of the Statement. |

|

|

|

|

|

|

|

Assets: | ||||||

Investments, at value(1) | $ | 24,763,466 | ||||

Cash denominated in foreign currency(2) | 1,992 | |||||

Non-interested Trustees' deferred compensation | 637 | |||||

Receivables: | ||||||

Investments sold | 205,249 | |||||

Dividends | 61,715 | |||||

Fund shares sold | 3,568 | |||||

Foreign tax reclaims | 1,069 | |||||

Other assets | 2,458 | |||||

Total Assets |

|

| 25,040,154 |

| ||

Liabilities: | ||||||

Payables: | — | |||||

Investments purchased | 154,610 | |||||

Foreign tax liability | 141,074 | |||||

Professional fees | 43,075 | |||||

Fund shares repurchased | 19,699 | |||||

Non-affiliated fund administration fees payable | 14,431 | |||||

Advisory fees | 8,754 | |||||

Custodian fees | 4,490 | |||||

Transfer agent fees and expenses | 3,707 | |||||

12b-1 Distribution and shareholder servicing fees | 709 | |||||

Non-interested Trustees' deferred compensation fees | 637 | |||||

Non-interested Trustees' fees and expenses | 158 | |||||

Affiliated fund administration fees payable | 51 | |||||

Accrued expenses and other payables | 8,965 | |||||

Total Liabilities |

|

| 400,360 |

| ||

Net Assets |

| $ | 24,639,794 |

| ||

See Notes to Financial Statements. | |

Janus Investment Fund | 11 |

Janus Henderson Asia Equity Fund

Statement of Assets and Liabilities

September 30, 2019

|

|

|

|

|

|

|

Net Assets Consist of: | ||||||

Capital (par value and paid-in surplus) | $ | 22,862,450 | ||||

Total distributable earnings (loss)(3) | 1,777,344 | |||||

Total Net Assets |

| $ | 24,639,794 |

| ||

Net Assets - Class A Shares | $ | 822,497 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 79,184 | |||||

Net Asset Value Per Share(4) |

| $ | 10.39 |

| ||

Maximum Offering Price Per Share(5) |

| $ | 11.02 |

| ||

Net Assets - Class C Shares | $ | 535,491 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 52,368 | |||||

Net Asset Value Per Share(4) |

| $ | 10.23 |

| ||

Net Assets - Class D Shares | $ | 11,198,373 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 1,063,595 | |||||

Net Asset Value Per Share |

| $ | 10.53 |

| ||

Net Assets - Class I Shares | $ | 1,406,029 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 133,366 | |||||

Net Asset Value Per Share |

| $ | 10.54 |

| ||

Net Assets - Class N Shares | $ | 8,886,431 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 844,438 | |||||

Net Asset Value Per Share |

| $ | 10.52 |

| ||

Net Assets - Class S Shares | $ | 481,010 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 46,216 | |||||

Net Asset Value Per Share |

| $ | 10.41 |

| ||

Net Assets - Class T Shares | $ | 1,309,963 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 125,834 | |||||

Net Asset Value Per Share |

| $ | 10.41 |

| ||

(1) Includes cost of $21,982,852. (2) Includes cost of $1,992. (3) Includes $141,074 of foreign capital gains tax on investments. (4) Redemption price per share may be reduced for any applicable contingent deferred sales charge. (5) Maximum offering price is computed at 100/94.25 of net asset value. |

See Notes to Financial Statements. | |

12 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Statement of Operations

For the year ended September 30, 2019

|

|

|

|

|

|

Investment Income: | |||||

| Dividends | $ | 590,725 | ||

Interest | 4,469 | ||||

Foreign tax withheld | (55,961) | ||||

Total Investment Income |

| 539,233 |

| ||

Expenses: | |||||

Advisory fees | 233,033 | ||||

12b-1 Distribution and shareholder servicing fees: | |||||

Class A Shares | 1,963 | ||||

Class C Shares | 5,997 | ||||

Class S Shares | 243 | ||||

Transfer agent administrative fees and expenses: | |||||

Class D Shares | 13,892 | ||||

Class S Shares | 1,167 | ||||

Class T Shares | 3,025 | ||||

Transfer agent networking and omnibus fees: | |||||

Class A Shares | 529 | ||||

Class C Shares | 684 | ||||

Class I Shares | 351 | ||||

Other transfer agent fees and expenses: | |||||

Class A Shares | 218 | ||||

Class C Shares | 159 | ||||

Class D Shares | 6,485 | ||||

Class I Shares | 258 | ||||

Class N Shares | 1,167 | ||||

Class S Shares | 70 | ||||

Class T Shares | 185 | ||||

Registration fees | 108,368 | ||||

Professional fees | 72,779 | ||||

Non-affiliated fund administration fees | 66,928 | ||||

Custodian fees | 14,566 | ||||

Shareholder reports expense | 10,767 | ||||

Non-interested Trustees’ fees and expenses | 643 | ||||

Affiliated fund administration fees | 566 | ||||

Other expenses | 4,894 | ||||

Total Expenses |

| 548,937 |

| ||

Less: Excess Expense Reimbursement and Waivers |

| (235,396) |

| ||

Net Expenses |

| 313,541 |

| ||

Net Investment Income/(Loss) |

| 225,692 |

| ||

Net Realized Gain/(Loss) on Investments: | |||||

Investments and foreign currency transactions(1) | (1,041,868) | ||||

Total Net Realized Gain/(Loss) on Investments |

| (1,041,868) |

| ||

Change in Unrealized Net Appreciation/Depreciation: | |||||

Investments, foreign currency translations and non-interested Trustees’ deferred compensation(2) | 500,895 | ||||

Total Change in Unrealized Net Appreciation/Depreciation |

| 500,895 |

| ||

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | (315,281) |

| ||

(1) Includes realized foreign capital gains tax on investments of $(3,910). (2) Includes change in unrealized appreciation/depreciation of $(45,383) due to foreign capital gains tax on investments. |

See Notes to Financial Statements. | |

Janus Investment Fund | 13 |

Janus Henderson Asia Equity Fund

Statements of Changes in Net Assets

|

|

| Year

ended |

| Year ended | |||

Operations: | ||||||||

Net investment income/(loss) | $ | 225,692 | $ | 231,650 | ||||

Net realized gain/(loss) on investments | (1,041,868) | 2,156,515 | ||||||

Change in unrealized net appreciation/depreciation | 500,895 | (949,637) | ||||||

Net Increase/(Decrease) in Net Assets Resulting from Operations |

| (315,281) |

|

| 1,438,528 | |||

Dividends and Distributions to Shareholders | ||||||||

Class A Shares | (63,549) | (27,500) | ||||||

Class C Shares | (85,343) | (26,838) | ||||||

Class D Shares | (916,560) | (653,620) | ||||||

Class I Shares | (97,500) | (337,205) | ||||||

Class N Shares | (632,223) | — | ||||||

Class S Shares | (37,204) | (12,848) | ||||||

Class T Shares | (67,544) | (80,293) | ||||||

Net Decrease from Dividends and Distributions to Shareholders |

| (1,899,923) |

|

| (1,138,304) | |||

Capital Share Transactions: | ||||||||

Class A Shares | 89,862 | 484,453 | ||||||

Class C Shares | (566,502) | 315,110 | ||||||

Class D Shares | (824,350) | (8,674,983) | ||||||

Class I Shares | 471,095 | (12,337,210) | ||||||

Class N Shares | 1,119,910 | 9,035,795 | ||||||

Class S Shares | 37,204 | 12,848 | ||||||

Class T Shares | 332,850 | (1,925,915) | ||||||

Net Increase/(Decrease) from Capital Share Transactions |

| 660,069 |

|

| (13,089,902) | |||

Net Increase/(Decrease) in Net Assets |

| (1,555,135) |

|

| (12,789,678) | |||

Net Assets: | ||||||||

Beginning of period | 26,194,929 | 38,984,607 | ||||||

| End of period | $ | 24,639,794 |

| $ | 26,194,929 | ||

(1) Period from January 26, 2018 (inception date) through September 30, 2018 for Class N Shares. |

See Notes to Financial Statements. | |

14 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class A Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.42 |

|

| $11.45 |

|

| $9.42 |

|

| $8.31 |

|

| $9.79 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(1) | 0.10 | 0.07 | 0.02 | 0.05 | 0.01 | |||||||||||||

Net realized and unrealized gain/(loss) | (0.27) | 0.22 | 2.12 | 1.44 | (0.95) | |||||||||||||

Total from Investment Operations |

| (0.17) |

|

| 0.29 |

|

| 2.14 |

|

| 1.49 |

|

| (0.94) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | (0.02) | (0.05) | (0.11) | — | (0.17) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.86) |

|

| (0.32) |

|

| (0.11) |

|

| (0.38) |

|

| (0.54) |

| |||

Net Asset Value, End of Period | $10.39 | $11.42 | $11.45 | $9.42 | $8.31 | |||||||||||||

Total Return* |

| (0.69)% |

|

| 2.48% |

|

| 23.10% |

|

| 18.58% |

|

| (10.07)% |

| |||

Net Assets, End of Period (in thousands) | $822 | $816 | $366 | $253 | $348 | |||||||||||||

Average Net Assets for the Period (in thousands) | $822 | $954 | $293 | $333 | $400 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.72% | 2.08% | 2.49% | 3.51% | 2.87% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.49% | 1.53% | 1.63% | 1.56% | 1.61% | |||||||||||||

Ratio of Net Investment Income/(Loss) | 0.95% | 0.60% | 0.17% | 0.64% | 0.07% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

Class C Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.30 |

|

| $11.36 |

|

| $9.34 |

|

| $8.29 |

|

| $9.72 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(1) | (0.03) | (0.01) | (0.04) | 0.01 | (0.03) | |||||||||||||

Net realized and unrealized gain/(loss) | (0.20) | 0.22 | 2.10 | 1.42 | (0.98) | |||||||||||||

Total from Investment Operations |

| (0.23) |

|

| 0.21 |

|

| 2.06 |

|

| 1.43 |

|

| (1.01) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | — | — | (0.04) | — | (0.05) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.84) |

|

| (0.27) |

|

| (0.04) |

|

| (0.38) |

|

| (0.42) |

| |||

Net Asset Value, End of Period | $10.23 | $11.30 | $11.36 | $9.34 | $8.29 | |||||||||||||

Total Return* |

| (1.28)% |

|

| 1.80% |

|

| 22.17% |

|

| 17.87% |

|

| (10.81)% |

| |||

Net Assets, End of Period (in thousands) | $535 | $1,244 | $957 | $413 | $360 | |||||||||||||

Average Net Assets for the Period (in thousands) | $746 | $1,233 | $519 | $381 | $373 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 3.35% | 2.78% | 3.09% | 4.23% | 3.59% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 2.07% | 2.25% | 2.33% | 2.25% | 2.30% | |||||||||||||

Ratio of Net Investment Income/(Loss) | (0.28)% | (0.04)% | (0.42)% | 0.10% | (0.31)% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

Janus Investment Fund | 15 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class D Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.54 |

|

| $11.56 |

|

| $9.49 |

|

| $8.35 |

|

| $9.84 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(1) | 0.09 | 0.07 | 0.07 | 0.08 | 0.07 | |||||||||||||

Net realized and unrealized gain/(loss) | (0.23) | 0.23 | 2.11 | 1.45 | (1.00) | |||||||||||||

Total from Investment Operations |

| (0.14) |

|

| 0.30 |

|

| 2.18 |

|

| 1.53 |

|

| (0.93) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | (0.03) | (0.05) | (0.11) | (0.01) | (0.19) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.87) |

|

| (0.32) |

|

| (0.11) |

|

| (0.39) |

|

| (0.56) |

| |||

Net Asset Value, End of Period | $10.53 | $11.54 | $11.56 | $9.49 | $8.35 | |||||||||||||

Total Return* |

| (0.44)% |

|

| 2.57% |

|

| 23.30% |

|

| 18.95% |

|

| (9.99)% |

| |||

Net Assets, End of Period (in thousands) | $11,198 | $13,089 | $21,577 | $5,314 | $5,640 | |||||||||||||

Average Net Assets for the Period (in thousands) | $11,599 | $21,221 | $11,542 | $5,013 | $6,632 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.29% | 1.72% | 2.19% | 3.38% | 2.75% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.33% | 1.33% | 1.44% | 1.36% | 1.42% | |||||||||||||

Ratio of Net Investment Income/(Loss) | 0.88% | 0.55% | 0.67% | 0.89% | 0.67% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

Class I Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.45 |

|

| $11.56 |

|

| $9.51 |

|

| $8.37 |

|

| $9.85 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(1) | 0.13 | (0.03) | 0.11 | 0.10 | 0.06 | |||||||||||||

Net realized and unrealized gain/(loss) | (0.17) | 0.26 | 2.07 | 1.44 | (0.98) | |||||||||||||

Total from Investment Operations |

| (0.04) |

|

| 0.23 |

|

| 2.18 |

|

| 1.54 |

|

| (0.92) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | (0.03) | (0.07) | (0.13) | (0.02) | (0.19) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.87) |

|

| (0.34) |

|

| (0.13) |

|

| (0.40) |

|

| (0.56) |

| |||

Net Asset Value, End of Period | $10.54 | $11.45 | $11.56 | $9.51 | $8.37 | |||||||||||||

Total Return* |

| 0.45% |

|

| 1.90% |

|

| 23.39% |

|

| 19.09% |

|

| (9.79)% |

| |||

Net Assets, End of Period (in thousands) | $1,406 | $1,029 | $12,675 | $2,665 | $2,470 | |||||||||||||

Average Net Assets for the Period (in thousands) | $1,208 | $5,848 | $7,408 | $2,528 | $3,017 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.32% | 1.44% | 2.00% | 3.19% | 2.56% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.21% | 1.26% | 1.32% | 1.21% | 1.27% | |||||||||||||

Ratio of Net Investment Income/(Loss) | 1.28% | (0.25)% | 1.01% | 1.14% | 0.57% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

16 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class N Shares | |||||||||

For a share outstanding during the year or period ended September 30 |

| 2019 |

|

| 2018(1) |

| |||

Net Asset Value, Beginning of Period |

| $11.56 |

|

| $12.73 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.11 | 0.16 | |||||||

Net realized and unrealized gain/(loss) | (0.26) | (1.33)(3) | |||||||

Total from Investment Operations |

| (0.15) |

|

| (1.17) |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.05) | — | |||||||

Distributions (from capital gains) | (0.84) | — | |||||||

Total Dividends and Distributions |

| (0.89) |

|

| — |

| |||

Net Asset Value, End of Period | $10.52 | $11.56 | |||||||

Total Return* |

| (0.51)% |

|

| (9.19)% |

| |||

Net Assets, End of Period (in thousands) | $8,886 | $8,501 | |||||||

Average Net Assets for the Period (in thousands) | $7,989 | $7,978 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.05% | 1.75% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.17% | 1.13% | |||||||

Ratio of Net Investment Income/(Loss) | 1.08% | 1.96% | |||||||

Portfolio Turnover Rate | 34% | 41% | |||||||

Class S Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.45 |

|

| $11.48 |

|

| $9.43 |

|

| $8.32 |

|

| $9.79 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(2) | 0.09 | 0.06 | 0.01 | 0.07 | 0.07 | |||||||||||||

Net realized and unrealized gain/(loss) | (0.25) | 0.22 | 2.14 | 1.42 | (1.00) | |||||||||||||

Total from Investment Operations |

| (0.16) |

|

| 0.28 |

|

| 2.15 |

|

| 1.49 |

|

| (0.93) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | (0.04) | (0.04) | (0.10) | — | (0.17) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.88) |

|

| (0.31) |

|

| (0.10) |

|

| (0.38) |

|

| (0.54) |

| |||

Net Asset Value, End of Period | $10.41 | $11.45 | $11.48 | $9.43 | $8.32 | |||||||||||||

Total Return* |

| (0.55)% |

|

| 2.37% |

|

| 23.07% |

|

| 18.56% |

|

| (9.97)% |

| |||

Net Assets, End of Period (in thousands) | $481 | $484 | $472 | $368 | $310 | |||||||||||||

Average Net Assets for the Period (in thousands) | $467 | $501 | $413 | $329 | $390 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.98% | 2.36% | 2.64% | 3.67% | 3.06% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.34% | 1.58% | 1.66% | 1.56% | 1.48% | |||||||||||||

Ratio of Net Investment Income/(Loss) | 0.91% | 0.52% | 0.15% | 0.83% | 0.71% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from January 26, 2018 (inception date) through September 30, 2018. (2) Per share amounts are calculated based on average shares outstanding during the year or period. (3) The amount shown does not correlate with the change in the aggregate gains and losses in the Fund’s securities for the year or period due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s securities. |

See Notes to Financial Statements. | |

Janus Investment Fund | 17 |

Janus Henderson Asia Equity Fund

Financial Highlights

Class T Shares | ||||||||||||||||||

For a share outstanding during the year ended September 30 |

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| 2015 |

| |||

Net Asset Value, Beginning of Period |

| $11.37 |

|

| $11.42 |

|

| $9.36 |

|

| $8.25 |

|

| $9.81 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||||||||

Net investment income/(loss)(1) | 0.10 | 0.06 | 0.06 | 0.04 | 0.04 | |||||||||||||

Net realized and unrealized gain/(loss) | (0.21) | 0.20 | 2.08 | 1.46 | (0.96) | |||||||||||||

Total from Investment Operations |

| (0.11) |

|

| 0.26 |

|

| 2.14 |

|

| 1.50 |

|

| (0.92) |

| |||

Less Dividends and Distributions: | ||||||||||||||||||

Dividends (from net investment income) | (0.01) | (0.04) | (0.08) | (0.01) | (0.27) | |||||||||||||

Distributions (from capital gains) | (0.84) | (0.27) | — | (0.38) | (0.37) | |||||||||||||

Total Dividends and Distributions |

| (0.85) |

|

| (0.31) |

|

| (0.08) |

|

| (0.39) |

|

| (0.64) |

| |||

Net Asset Value, End of Period | $10.41 | $11.37 | $11.42 | $9.36 | $8.25 | |||||||||||||

Total Return* |

| (0.14)% |

|

| 2.27% |

|

| 23.18% |

|

| 18.88% |

|

| (9.98)% |

| |||

Net Assets, End of Period (in thousands) | $1,310 | $1,032 | $2,937 | $230 | $306 | |||||||||||||

Average Net Assets for the Period (in thousands) | $1,210 | $2,799 | $756 | $332 | $566 | |||||||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 2.53% | 1.81% | 2.14% | 3.41% | 2.73% | |||||||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.40% | 1.41% | 1.55% | 1.44% | 1.39% | |||||||||||||

Ratio of Net Investment Income/(Loss) | 0.98% | 0.54% | 0.55% | 0.47% | 0.46% | |||||||||||||

Portfolio Turnover Rate | 34% | 41% | 120% | 59% | 152% | |||||||||||||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

18 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Janus Henderson Asia Equity Fund (the “Fund”) is a series of Janus Investment Fund (the “Trust”), which is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers 47 funds, each of which offers multiple share classes, with differing investment objectives and policies. The Fund seeks long-term growth of capital. The Fund is classified as diversified, as defined in the 1940 Act.

The Fund offers multiple classes of shares in order to meet the needs of various types of investors. Each class represents an interest in the same portfolio of investments. Certain financial intermediaries may not offer all classes of shares. Class D Shares are closed to certain new investors.

Class A Shares are offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, bank trust platforms, and retirement platforms.

Class C Shares are offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, and bank trust platforms.

Class C Shares are closed to investments by new employer-sponsored retirement plans and existing employer-sponsored retirement plans are no longer able to make additional purchases or exchanges into Class C Shares.

The Funds have adopted an auto-conversion policy pursuant to which Class C Shares that have been held for ten years will be automatically converted to Class A Shares without the imposition of any sales charge, fee or other charge. The conversion will generally occur no later than ten business days in the month following the month of the tenth anniversary of the date of purchase. Class C Shares purchased through the reinvestment of dividends and other distributions on Class C Shares will convert to Class A Shares at the same time as the Class C Shares with respect to which they were purchased. For Class C Shares held in omnibus accounts on intermediary platforms, the Fund will rely on these intermediaries to implement this conversion feature. Your financial intermediary may have separate policies and procedures as to when and how Class C Shares may be converted to Class A Shares. Please contact your financial intermediary for additional information.

Class D Shares are generally no longer being made available to new investors who do not already have a direct account with the Janus Henderson funds. Class D Shares are available only to investors who hold accounts directly with the Janus Henderson funds, to immediate family members or members of the same household of an eligible individual investor, and to existing beneficial owners of sole proprietorships or partnerships that hold accounts directly with the Janus Henderson funds.

Class I Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. Class I Shares are also available to certain direct institutional investors including, but not limited to, corporations, certain retirement plans, public plans, and foundations/endowments, who established Class I Share accounts before August 4, 2017.

Class N Shares are generally available only to financial intermediaries purchasing on behalf of: 1) certain adviser-assisted, employer-sponsored retirement plans, including 401(k) plans, 457 plans, 403(b) plans, Taft-Hartley multi-employer plans, profit-sharing and money purchase pension plans, defined benefit plans and certain welfare benefit plans, such as health savings accounts, and nonqualified deferred compensation plans; and 2) retail investors purchasing in qualified or nonqualified accounts, whose accounts are held through an omnibus account at their financial intermediary, and where the financial intermediary requires no payment or reimbursement from the Fund, Janus Capital Management LLC (“Janus Capital”), or its affiliates. Class N Shares are also available to Janus Henderson proprietary products and to certain direct institutional investors approved by Janus Distributors LLC dba Janus Henderson Distributors (“Janus Henderson Distributors”) including, but not limited to, corporations, certain retirement plans, public plans, and foundations and endowments, subject to minimum investment requirements.

Class S Shares are offered through financial intermediary platforms including, but not limited to, retirement platforms and asset allocation, mutual fund wrap, or other discretionary or nondiscretionary fee-based investment advisory

Janus Investment Fund | 19 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

programs. In addition, Class S Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class S Shares on their supermarket platforms.

Class T Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. In addition, Class T Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class T Shares on their supermarket platforms.

The following accounting policies have been followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Equity securities traded on a domestic securities exchange are generally valued at the closing prices on the primary market or exchange on which they trade. If such price is lacking for the trading period immediately preceding the time of determination, such securities are valued at their current bid price. Equity securities that are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event that there is no current trading volume on a particular security in such foreign exchange, the bid price from the primary exchange is generally used to value the security. Securities that are traded on the over-the-counter (“OTC”) markets are generally valued at their closing or latest bid prices as available. Foreign securities and currencies are converted to U.S. dollars using the applicable exchange rate in effect at the close of the New York Stock Exchange (“NYSE”). The Fund will determine the market value of individual securities held by it by using prices provided by one or more approved professional pricing services or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined approximates market value. Securities for which market quotations or evaluated prices are not readily available or deemed unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position. The Fund uses systematic fair valuation models provided by independent third parties to value international equity securities in order to adjust for stale pricing, which may occur between the close of certain foreign exchanges and the close of the NYSE.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service

20 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

approved by the Fund’s Trustees; certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost; and equity securities of foreign issuers whose fair value is determined by using systematic fair valuation models provided by independent third parties in order to adjust for stale pricing which may occur between the close of certain foreign exchanges and the close of the NYSE. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of September 30, 2019 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may be subject to withholding taxes in foreign jurisdictions. Interest income is recorded daily on an accrual basis and includes amortization of premiums and accretion of discounts. The Fund classifies gains and losses on prepayments received as an adjustment to interest income. Debt securities may be placed in non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivables when collection of all or a portion of interest has become doubtful. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes. Income, as well as gains and losses, both realized and unrealized, are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets.

Expenses

The Fund bears expenses incurred specifically on its behalf. Each class of shares bears a portion of general expenses, which are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets. Expenses directly attributable to a specific class of shares are charged against the operations of such class.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Foreign Currency Translations

The Fund does not isolate that portion of the results of operations resulting from the effect of changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held at the date of the financial statements. Net unrealized appreciation or depreciation of investments and foreign currency translations arise from changes in the value of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

Janus Investment Fund | 21 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

Currency gains and losses are also calculated on payables and receivables that are denominated in foreign currencies. The payables and receivables are generally related to foreign security transactions and income translations.

Foreign currency-denominated assets and forward currency contracts may involve more risks than domestic transactions, including currency risk, counterparty risk, political and economic risk, regulatory risk and equity risk. Risks may arise from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

Dividends and Distributions

The Fund generally declares and distributes dividends of net investment income and realized capital gains (if any) annually. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the net asset value. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or a Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Funds’ equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.

The Fund may make certain investments in real estate investment trusts (“REITs”) which pay dividends to their shareholders based upon funds available from operations. It is quite common for these dividends to exceed the REITs’ taxable earnings and profits, resulting in the excess portion of such dividends being designated as a return of capital. If the Fund distributes such amounts, such distributions could constitute a return of capital to shareholders for federal income tax purposes.

Federal Income Taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Fund’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

2. Other Investments and Strategies

Additional Investment Risk

In the aftermath of the 2007-2008 financial crisis, the financial sector experienced reduced liquidity in credit and other fixed-income markets, and an unusually high degree of volatility, both domestically and internationally. In response to the crisis, the United States and certain foreign governments, along with the U.S. Federal Reserve and certain foreign central banks, took steps to support the financial markets. For example, the enactment of the Dodd-Frank Act in 2010 provided for widespread regulation of financial institutions, consumer financial products and services, broker-dealers, over-the-counter derivatives, investment advisers, credit rating agencies, and mortgage lending, which expanded federal oversight in the financial sector, including the investment management industry. The withdrawal of this support, a failure of measures put in place to respond to the crisis, or investor perception that such efforts were not sufficient could each negatively affect financial markets generally, and the value and liquidity of specific securities. In addition, policy and legislative changes in the United States and in other countries continue to impact many aspects of financial regulation.

A number of countries in the European Union (“EU”) have experienced, and may continue to experience, severe economic and financial difficulties. In particular, many EU nations are susceptible to economic risks associated with high levels of debt. Many non-governmental issuers, and even certain governments, have defaulted on, or been forced to restructure, their debts. Many other issuers have faced difficulties obtaining credit or refinancing existing obligations. Financial institutions have in many cases required government or central bank support, have needed to raise capital, and/or have been impaired in their ability to extend credit. As a result, financial markets in the EU experienced extreme volatility and declines in asset values and liquidity. Responses to these financial problems by European governments, central banks, and others, including austerity measures and reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. The risk of investing in securities in the European markets may also be heightened due to the referendum in which the United Kingdom voted to exit the EU (commonly known as “Brexit”). There is considerable uncertainty about how Brexit will be conducted, how negotiations of necessary treaties and trade agreements will conclude, or how financial markets will react.

22 | SEPTEMBER 30, 2019 |

Janus Henderson Asia Equity Fund

Notes to Financial Statements

Certain areas of the world have historically been prone to and economically sensitive to environmental events such as, but not limited to, hurricanes, earthquakes, typhoons, flooding, tidal waves, tsunamis, erupting volcanoes, wildfires or droughts, tornadoes, mudslides, or other weather-related phenomena. Such disasters, and the resulting physical or economic damage, could have a severe and negative impact on the Fund’s investment portfolio and, in the longer term, could impair the ability of issuers in which the Fund invests to conduct their businesses as they would under normal conditions. Adverse weather conditions may also have a particularly significant negative effect on issuers in the agricultural sector and on insurance companies that insure against the impact of natural disasters.

Emerging Market Investing