United States Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number 811-01879

Janus

Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver,

Colorado 80206

(Address of principal executive offices) (Zip code)

Michelle Rosenberg, 151

Detroit Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant's telephone

number, including area code: 303-333-3863

Date of fiscal year end: 6/30

Date of reporting period:

12/31/16

Item 1 - Reports to Shareholders

SEMIANNUAL REPORT December 31, 2016 | |||

INTECH Emerging Markets Managed Volatility Fund | |||

Janus Investment Fund | |||

| |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics | |||

| |||

Table of Contents

INTECH Emerging Markets Managed Volatility Fund

INTECH Emerging Markets Managed Volatility Fund (unaudited)

FUND SNAPSHOT INTECH’s active approach focuses on adding value by selecting stocks with unique volatility characteristics and low correlations to one another. | Managed by INTECH Investment Management LLC | ||||

PERFORMANCE OVERVIEW

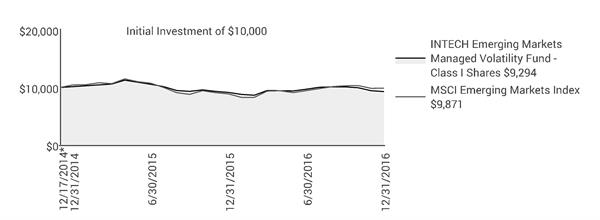

For the six-month period ended December 31, 2016, INTECH Emerging Markets Managed Volatility Fund returned -3.98% for its Class I Shares. This compares to the 4.49% return posted by the MSCI Emerging Markets Index, the Fund’s benchmark.

INVESTMENT STRATEGY

INTECH’s mathematical investment process is designed to determine potentially more efficient equity weightings of the securities in the benchmark index, utilizing a specific mathematical optimization and disciplined rebalancing routine. Rather than trying to predict the future direction of stock prices, the process seeks to use the volatility and correlation characteristics of stocks to construct portfolios.

The investment process begins with the stocks in the MSCI Emerging Markets Index. INTECH’s investment process aims to capture stocks’ natural volatility through a rebalancing mechanism based on estimates of relative volatility and correlation in order to outperform the benchmark index over the long term. Within specific risk constraints, the investment process will tend to favor stocks with higher relative volatility and lower correlation as they offer more potential to capture volatility through periodic rebalancing. Once the target proportions are determined and the portfolio is constructed, it is then rebalanced to those target proportions and re-optimized on a periodic basis. The INTECH Emerging Markets Managed Volatility Fund focuses on seeking an excess return above the benchmark, while also reducing or managing the standard deviation of the portfolio depending on the market conditions, a strategy designed to manage the absolute risk of the portfolio.

PERFORMANCE REVIEW

Led by riskier segments of the market, the MSCI Emerging Markets Index posted a return of 4.49% for the six-month period ending December 31, 2016. INTECH Emerging Markets Managed Volatility Fund underperformed the MSCI Emerging Markets Index over the period and generated a return of -3.98%.

The Fund’s defensive positioning acted as a significant headwind to relative performance as investors’ risk appetites increased in the emerging equity markets. On average, the Fund was overweight lower volatility stocks, or stocks with a lower total risk (standard deviation of returns), as well as lower beta stocks, or stocks with lower sensitivity to market movements. During the period higher volatility and higher beta stocks outperformed lower volatility and lower beta stocks as well as the overall market, on average. Consequently, the Fund’s overweight to lower volatility and lower beta stocks detracted from the Fund’s relative return for the period.

An overall decrease in market diversity over the period reflected a change in the distribution of capital, in which larger cap stocks outperformed smaller cap stocks on average within the MSCI Emerging Markets Index. The INTECH Emerging Markets Managed Volatility Fund, which tends to overweight smaller cap stocks as they provide more relative volatility capture potential, was negatively impacted by the overall in market diversity over the period.

The Fund’s active sector positioning tends to vary over time and is a function of the volatility and correlation characteristics of the underlying stocks. The Fund’s overall active sector positioning detracted from relative performance during the period. Specifically, an average overweight to the defensive consumer staples sector, as well as an average overweight allocation to the telecommunication services sector, detracted from relative performance. An overall negative selection effect also detracted from the Fund’s relative performance during the period, especially within the materials and financials sectors.

Janus Investment Fund | 1 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

OUTLOOK

Because INTECH does not conduct traditional economic or fundamental analysis, INTECH has no view on individual stocks, sectors, economic, or market conditions.

Managing downside exposure potentially allows for returns to compound and improve risk-adjusted returns over time. Over the long term, we believe that by reducing risk when market volatility increases and behaving like a core equity fund when market volatility is low, the Fund will achieve its investment objective of producing an excess return over the benchmark with lower absolute risk. Going forward, we will continue building portfolios in a disciplined and deliberate manner, with risk management remaining the hallmark of our investment process. As INTECH’s ongoing research efforts yield modest improvements, we will continue implementing changes that we believe are likely to improve the long-term results for our fund shareholders.

Thank you for your investment in INTECH Emerging Markets Managed Volatility Fund.

2 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Fund At A Glance

December 31, 2016

5 Largest Equity Holdings - (% of Net Assets) | |

Chunghwa Telecom Co Ltd | |

Diversified Telecommunication Services | 4.4% |

Emirates Telecommunications Group Co PJSC | |

Diversified Telecommunication Services | 2.5% |

Taiwan Mobile Co Ltd | |

Wireless Telecommunication Services | 2.2% |

KT&G Corp | |

Tobacco | 2.0% |

AAC Technologies Holdings Inc | |

Electronic Equipment, Instruments & Components | 1.9% |

13.0% | |

Asset Allocation - (% of Net Assets) | |||||

Common Stocks | 97.6% | ||||

Investment Companies | 1.7% | ||||

Preferred Stocks | 0.9% | ||||

Rights | 0.0% | ||||

Other | (0.2)% | ||||

100.0% | |||||

Emerging markets comprised 98.5% of total net assets.

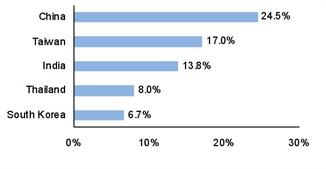

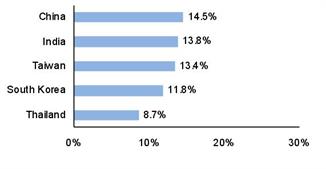

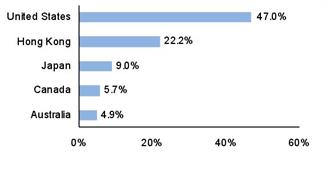

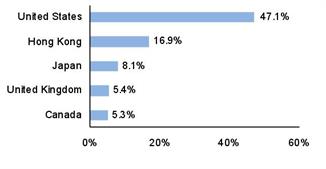

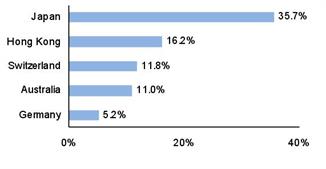

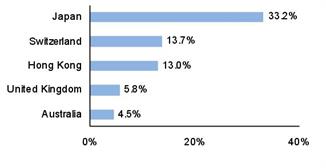

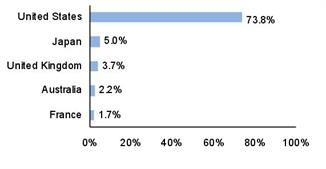

Top Country Allocations - Long Positions - (% of Investment Securities) | |

As of December 31, 2016

| As of June 30, 2016

|

Janus Investment Fund | 3 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Performance

See important disclosures on the next page. |

| Expense Ratios - | ||||||||

Average Annual Total Return - for the periods ended December 31, 2016 |

|

| per the October 28, 2016 prospectuses | ||||||

|

| Fiscal

| One

| Since |

|

| Total Annual Fund

| Net Annual Fund

| |

Class A Shares at NAV |

| -4.03% | 1.20% | -3.73% |

|

| 10.45% | 1.40% | |

Class A Shares at MOP |

| -9.57% | -4.64% | -6.48% |

|

|

|

| |

Class C Shares at NAV | -4.44% | 0.34% | -4.51% |

|

| 11.27% | 2.20% | ||

Class C Shares at CDSC |

| -5.39% | -0.66% | -4.51% |

|

|

|

| |

Class D Shares(1) |

| -4.09% | 1.24% | -3.66% |

|

| 10.37% | 1.28% | |

Class I Shares |

| -3.98% | 1.36% | -3.53% |

|

| 9.40% | 1.13% | |

Class S Shares |

| -4.14% | 1.09% | -3.86% |

|

| 10.67% | 1.62% | |

Class T Shares |

| -4.01% | 1.33% | -3.62% |

|

| 10.37% | 1.37% | |

MSCI Emerging Markets Index |

| 4.49% | 11.19% | -0.63% |

|

|

|

| |

Morningstar Quartile - Class I Shares |

| - | 4th | 3rd |

|

|

|

| |

Morningstar Ranking - based on total returns for Diversified Emerging Markets Funds |

| - | 754/842 | 573/771 |

|

|

|

| |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 877.33JANUS(52687) (or 800.525.3713 if you hold shares directly with Janus Capital) or visit janus.com/advisor/mutual-funds (or janus.com/allfunds if you hold shares directly with Janus Capital).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

INTECH's focus on managed volatility may keep the Fund from achieving excess returns over its index. The strategy may underperform during certain periods of up markets, and may not achieve the desired level of protection in down markets.

4 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Performance

A Fund’s performance may be affected by risks that include those associated with nondiversification, non-investment grade debt securities, high-yield/high-risk securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest. Additional risks to a Fund may also include, but are not limited to, those associated with investing in foreign securities, emerging markets, initial public offerings, real estate investment trusts (REITs), derivatives, short sales, commodity-linked investments and companies with relatively small market capitalizations. Each Fund has different risks. Please see a Janus prospectus for more information about risks, Fund holdings and other details.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

The Fund will normally invest at least 80% of its net assets, measured at the time of purchase, in the type of securities described by its name.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

See Financial Highlights for actual expense ratios during the reporting period.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2016 Morningstar, Inc. All Rights Reserved.

Standard deviation measures historical volatility. Higher standard deviation implies greater volatility. Beta is a measure of the volatility of a portfolio in comparison to a benchmark index.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

The weighting of securities within the Fund's portfolio may differ significantly from the weightings within the index. The index is unmanaged and not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

See “Useful Information About Your Fund Report.”

* The Fund’s inception date – December 17, 2014

(1) Closed to certain new investors.

Janus Investment Fund | 5 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Actual | Hypothetical | |||||||||

| Beginning | Ending | Expenses |

| Beginning | Ending | Expenses | Net Annualized | ||

Class A Shares | $1,000.00 | $959.70 | $6.13 |

| $1,000.00 | $1,018.95 | $6.31 | 1.24% | ||

Class C Shares | $1,000.00 | $955.60 | $9.86 |

| $1,000.00 | $1,015.12 | $10.16 | 2.00% | ||

Class D Shares | $1,000.00 | $959.10 | $5.63 |

| $1,000.00 | $1,019.46 | $5.80 | 1.14% | ||

Class I Shares | $1,000.00 | $960.20 | $5.14 |

| $1,000.00 | $1,019.96 | $5.30 | 1.04% | ||

Class S Shares | $1,000.00 | $958.60 | $6.76 |

| $1,000.00 | $1,018.30 | $6.97 | 1.37% | ||

Class T Shares | $1,000.00 | $959.90 | $5.63 |

| $1,000.00 | $1,019.46 | $5.80 | 1.14% | ||

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. | |||||||||

6 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – 97.6% | |||||||

Aerospace & Defense – 0.2% | |||||||

Hanwha Techwin Co Ltd* | 26 | $933 | |||||

Korea Aerospace Industries Ltd* | 104 | 5,755 | |||||

6,688 | |||||||

Auto Components – 1.2% | |||||||

Bharat Forge Ltd | 224 | 2,985 | |||||

Bosch Ltd | 19 | 5,870 | |||||

Cheng Shin Rubber Industry Co Ltd | 12,000 | 22,563 | |||||

Fuyao Glass Industry Group Co Ltd (144A) | 1,200 | 3,693 | |||||

Hankook Tire Co Ltd* | 40 | 1,920 | |||||

Hyundai Mobis Co Ltd* | 4 | 873 | |||||

37,904 | |||||||

Automobiles – 4.6% | |||||||

Astra International Tbk PT | 16,600 | 10,154 | |||||

Bajaj Auto Ltd | 75 | 2,901 | |||||

Geely Automobile Holdings Ltd | 55,000 | 52,305 | |||||

Great Wall Motor Co Ltd | 5,000 | 4,637 | |||||

Guangzhou Automobile Group Co Ltd | 22,000 | 26,330 | |||||

Hero MotoCorp Ltd | 197 | 8,803 | |||||

Kia Motors Corp* | 69 | 2,239 | |||||

Maruti Suzuki India Ltd | 428 | 33,343 | |||||

140,712 | |||||||

Banks – 11.4% | |||||||

Agricultural Bank of China Ltd | 15,000 | 6,125 | |||||

Axis Bank Ltd | 1,219 | 8,056 | |||||

Banco de Chile | 163,286 | 19,152 | |||||

Banco de Credito e Inversiones | 73 | 3,697 | |||||

Banco do Brasil SA | 100 | 857 | |||||

Banco Santander Brasil SA | 1,100 | 9,789 | |||||

Banco Santander Chile | 84,058 | 4,680 | |||||

Bank Central Asia Tbk PT | 22,300 | 25,545 | |||||

Bank Mandiri Persero Tbk PT | 1,400 | 1,197 | |||||

Bank Negara Indonesia Persero Tbk PT | 21,100 | 8,626 | |||||

Bank of China Ltd | 8,000 | 3,530 | |||||

Bank of Communications Co Ltd | 9,000 | 6,443 | |||||

Bank of the Philippine Islands | 8,930 | 15,950 | |||||

Bank Rakyat Indonesia Persero Tbk PT | 4,800 | 4,163 | |||||

BDO Unibank Inc | 940 | 2,118 | |||||

China Construction Bank Corp | 9,000 | 6,895 | |||||

China Merchants Bank Co Ltd | 1,000 | 2,324 | |||||

China Minsheng Banking Corp Ltd | 10,500 | 11,148 | |||||

Chongqing Rural Commercial Bank Co Ltd | 13,000 | 7,632 | |||||

Commercial Bank QSC | 778 | 6,944 | |||||

Credicorp Ltd | 100 | 15,786 | |||||

CTBC Financial Holding Co Ltd | 3,240 | 1,770 | |||||

Doha Bank QSC | 236 | 2,262 | |||||

Dubai Islamic Bank PJSC | 1,032 | 1,565 | |||||

E.Sun Financial Holding Co Ltd | 7,000 | 3,988 | |||||

First Financial Holding Co Ltd | 18,919 | 10,083 | |||||

First Gulf Bank PJSC | 315 | 1,102 | |||||

Hana Financial Group Inc | 199 | 5,138 | |||||

Hua Nan Financial Holdings Co Ltd | 1,000 | 503 | |||||

IDFC Bank Ltd | 5,189 | 4,587 | |||||

Industrial & Commercial Bank of China Ltd | 13,000 | 7,754 | |||||

Industrial Bank of Korea* | 314 | 3,297 | |||||

Kasikornbank PCL | 2,200 | 10,870 | |||||

KB Financial Group Inc* | 58 | 2,050 | |||||

Krung Thai Bank PCL | 10,000 | 4,927 | |||||

Masraf Al Rayan QSC | 971 | 10,022 | |||||

Nedbank Group Ltd | 181 | 3,120 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 7 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Banks – (continued) | |||||||

OTP Bank PLC | 240 | $6,857 | |||||

Public Bank Bhd | 8,800 | 38,677 | |||||

Qatar Islamic Bank SAQ | 72 | 2,055 | |||||

Qatar National Bank SAQ | 227 | 10,156 | |||||

Shinhan Financial Group Co Ltd* | 56 | 2,100 | |||||

Siam Commercial Bank PCL | 1,800 | 7,635 | |||||

State Bank of India | 1,468 | 5,378 | |||||

Taishin Financial Holding Co Ltd | 13,940 | 5,092 | |||||

Taiwan Cooperative Financial Holding Co Ltd | 20,057 | 8,730 | |||||

Woori Bank* | 249 | 2,624 | |||||

Yes Bank Ltd | 900 | 15,270 | |||||

348,269 | |||||||

Beverages – 0.8% | |||||||

China Resources Beer Holdings Co Ltd* | 12,000 | 23,709 | |||||

Capital Markets – 0.8% | |||||||

CETIP SA - Mercados Organizados | 1,900 | 25,997 | |||||

Chemicals – 2.0% | |||||||

Asian Paints Ltd | 2,159 | 28,328 | |||||

Formosa Chemicals & Fibre Corp | 1,000 | 2,977 | |||||

Petronas Chemicals Group Bhd | 700 | 1,089 | |||||

Sinopec Shanghai Petrochemical Co Ltd | 38,000 | 20,571 | |||||

UPL Ltd | 1,027 | 9,754 | |||||

62,719 | |||||||

Commercial Services & Supplies – 0.1% | |||||||

S-1 Corp* | 34 | 2,466 | |||||

Construction & Engineering – 0.2% | |||||||

China Railway Group Ltd | 1,000 | 818 | |||||

Hyundai Development Co-Engineering & Construction* | 42 | 1,560 | |||||

Hyundai Engineering & Construction Co Ltd* | 152 | 5,348 | |||||

7,726 | |||||||

Construction Materials – 1.0% | |||||||

Ambuja Cements Ltd | 2,794 | 8,466 | |||||

Shree Cement Ltd | 61 | 13,201 | |||||

Siam Cement PCL | 300 | 4,164 | |||||

UltraTech Cement Ltd | 116 | 5,536 | |||||

31,367 | |||||||

Consumer Finance – 0.6% | |||||||

Bajaj Finance Ltd | 776 | 9,628 | |||||

Samsung Card Co Ltd* | 243 | 7,982 | |||||

17,610 | |||||||

Diversified Consumer Services – 2.2% | |||||||

New Oriental Education & Technology Group Inc (ADR)* | 1,300 | 54,730 | |||||

TAL Education Group (ADR)* | 200 | 14,030 | |||||

68,760 | |||||||

Diversified Financial Services – 1.6% | |||||||

Ayala Corp | 250 | 3,678 | |||||

Chailease Holding Co Ltd | 4,000 | 6,829 | |||||

Far East Horizon Ltd | 11,000 | 9,393 | |||||

Fubon Financial Holding Co Ltd | 9,000 | 14,260 | |||||

GT Capital Holdings Inc | 80 | 2,044 | |||||

Metro Pacific Investments Corp | 92,300 | 12,346 | |||||

48,550 | |||||||

Diversified Telecommunication Services – 9.3% | |||||||

Bharti Infratel Ltd | 701 | 3,544 | |||||

China Communications Services Corp Ltd | 16,000 | 10,183 | |||||

Chunghwa Telecom Co Ltd | 43,000 | 135,675 | |||||

Emirates Telecommunications Group Co PJSC | 14,846 | 75,922 | |||||

Ooredoo QSC | 627 | 17,530 | |||||

Telekom Malaysia Bhd | 9,600 | 12,734 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

8 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Diversified Telecommunication Services – (continued) | |||||||

Telekomunikasi Indonesia Persero Tbk PT | 96,100 | $28,276 | |||||

283,864 | |||||||

Electric Utilities – 1.8% | |||||||

Centrais Eletricas Brasileiras SA* | 600 | 4,191 | |||||

Centrais Eletricas Brasileiras SA - Class B* | 1,200 | 9,519 | |||||

CPFL Energia SA | 600 | 4,632 | |||||

EDP - Energias do Brasil SA | 500 | 2,053 | |||||

Equatorial Energia SA | 1,600 | 26,677 | |||||

Tenaga Nasional Bhd | 2,300 | 7,117 | |||||

54,189 | |||||||

Electrical Equipment – 0.4% | |||||||

Havells India Ltd | 2,340 | 11,749 | |||||

Electronic Equipment, Instruments & Components – 2.6% | |||||||

AAC Technologies Holdings Inc | 6,500 | 58,481 | |||||

AU Optronics Corp | 6,000 | 2,177 | |||||

Hon Hai Precision Industry Co Ltd | 1,000 | 2,591 | |||||

LG Display Co Ltd* | 145 | 3,744 | |||||

Sunny Optical Technology Group Co Ltd | 1,000 | 4,357 | |||||

WPG Holdings Ltd | 6,000 | 7,044 | |||||

78,394 | |||||||

Food & Staples Retailing – 3.0% | |||||||

Cencosud SA | 3,470 | 9,747 | |||||

CP ALL PCL | 32,000 | 55,774 | |||||

President Chain Store Corp | 2,000 | 14,308 | |||||

Raia Drogasil SA | 600 | 11,260 | |||||

91,089 | |||||||

Food Products – 2.9% | |||||||

Charoen Pokphand Foods PCL | 18,800 | 15,419 | |||||

Charoen Pokphand Indonesia Tbk PT | 26,700 | 6,105 | |||||

China Huishan Dairy Holdings Co Ltd | 55,000 | 21,331 | |||||

Indofood CBP Sukses Makmur Tbk PT | 28,700 | 18,256 | |||||

Indofood Sukses Makmur Tbk PT | 31,800 | 18,691 | |||||

Kuala Lumpur Kepong Bhd | 300 | 1,603 | |||||

M Dias Branco SA | 100 | 3,536 | |||||

Tingyi Cayman Islands Holding Corp | 4,000 | 4,842 | |||||

89,783 | |||||||

Gas Utilities – 0.3% | |||||||

China Gas Holdings Ltd | 2,000 | 2,710 | |||||

GAIL India Ltd | 946 | 6,113 | |||||

8,823 | |||||||

Health Care Providers & Services – 1.5% | |||||||

Bangkok Dusit Medical Services PCL | 33,000 | 21,248 | |||||

Qualicorp SA | 2,700 | 15,915 | |||||

Shanghai Pharmaceuticals Holding Co Ltd | 900 | 2,057 | |||||

Sinopharm Group Co Ltd | 1,600 | 6,565 | |||||

45,785 | |||||||

Hotels, Restaurants & Leisure – 1.4% | |||||||

Jollibee Foods Corp | 5,850 | 22,783 | |||||

Minor International PCL | 18,180 | 18,153 | |||||

OPAP SA | 212 | 1,874 | |||||

42,810 | |||||||

Household Durables – 0.7% | |||||||

Nien Made Enterprise Co Ltd | 2,000 | 20,499 | |||||

Household Products – 0.2% | |||||||

Hindustan Unilever Ltd | 146 | 1,777 | |||||

Unilever Indonesia Tbk PT | 1,300 | 3,743 | |||||

5,520 | |||||||

Independent Power and Renewable Electricity Producers – 0.7% | |||||||

Aboitiz Power Corp | 14,100 | 11,833 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 9 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Independent Power and Renewable Electricity Producers – (continued) | |||||||

Engie Brasil Energia SA | 100 | $1,073 | |||||

Huaneng Renewables Corp Ltd | 30,000 | 9,704 | |||||

22,610 | |||||||

Industrial Conglomerates – 1.2% | |||||||

Aboitiz Equity Ventures Inc | 15,260 | 21,737 | |||||

Berli Jucker PCL | 3,200 | 4,468 | |||||

Industries Qatar QSC | 43 | 1,387 | |||||

Samsung C&T Corp* | 23 | 2,375 | |||||

Shanghai Industrial Holdings Ltd | 2,000 | 5,397 | |||||

35,364 | |||||||

Information Technology Services – 0.6% | |||||||

HCL Technologies Ltd | 979 | 11,935 | |||||

Tata Consultancy Services Ltd | 30 | 1,043 | |||||

TravelSky Technology Ltd | 3,000 | 6,282 | |||||

19,260 | |||||||

Insurance – 1.7% | |||||||

Bajaj Finserv Ltd | 150 | 6,372 | |||||

Cathay Financial Holding Co Ltd | 2,000 | 2,995 | |||||

China Life Insurance Co Ltd/Taiwan | 11,040 | 10,945 | |||||

Hyundai Marine & Fire Insurance Co Ltd* | 214 | 5,572 | |||||

New China Life Insurance Co Ltd | 2,300 | 10,465 | |||||

Ping An Insurance Group Co of China Ltd | 500 | 2,488 | |||||

Qatar Insurance Co SAQ | 556 | 12,940 | |||||

51,777 | |||||||

Internet & Direct Marketing Retail – 0.2% | |||||||

JD.com Inc (ADR)* | 100 | 2,544 | |||||

Vipshop Holdings Ltd (ADR)* | 200 | 2,202 | |||||

4,746 | |||||||

Internet Software & Services – 3.8% | |||||||

Alibaba Group Holding Ltd (ADR)* | 200 | 17,562 | |||||

NAVER Corp* | 49 | 31,388 | |||||

NetEase Inc (ADR) | 200 | 43,068 | |||||

Tencent Holdings Ltd | 800 | 19,417 | |||||

Weibo Corp (ADR)* | 100 | 4,060 | |||||

115,495 | |||||||

Life Sciences Tools & Services – 0.3% | |||||||

Divi's Laboratories Ltd | 738 | 8,501 | |||||

Machinery – 1.0% | |||||||

Eicher Motors Ltd | 60 | 19,228 | |||||

Hyundai Heavy Industries Co Ltd* | 6 | 720 | |||||

Samsung Heavy Industries Co Ltd* | 198 | 1,513 | |||||

WEG SA | 1,100 | 5,218 | |||||

Weichai Power Co Ltd | 3,000 | 4,601 | |||||

31,280 | |||||||

Media – 0.4% | |||||||

Zee Entertainment Enterprises Ltd | 1,731 | 11,528 | |||||

Metals & Mining – 3.2% | |||||||

Cia de Minas Buenaventura SAA (ADR) | 2,400 | 27,072 | |||||

Hindalco Industries Ltd | 6,734 | 15,288 | |||||

Impala Platinum Holdings Ltd* | 632 | 1,954 | |||||

Industrias Penoles SAB de CV | 815 | 15,114 | |||||

JSW Steel Ltd* | 858 | 20,502 | |||||

MMC Norilsk Nickel PJSC (ADR) | 121 | 2,026 | |||||

Severstal PJSC (GDR) | 281 | 4,261 | |||||

Vedanta Ltd | 4,086 | 12,946 | |||||

99,163 | |||||||

Multiline Retail – 0.2% | |||||||

SACI Falabella | 717 | 5,677 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

10 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Multi-Utilities – 0.1% | |||||||

Qatar Electricity & Water Co QSC | 31 | $1,933 | |||||

Oil, Gas & Consumable Fuels – 4.6% | |||||||

Adaro Energy Tbk PT | 39,300 | 4,934 | |||||

Bharat Petroleum Corp Ltd | 2,098 | 19,612 | |||||

Cairn India Ltd | 1,586 | 5,645 | |||||

Coal India Ltd | 2,823 | 12,461 | |||||

Empresas COPEC SA | 101 | 969 | |||||

GS Holdings Corp* | 75 | 3,348 | |||||

Hindustan Petroleum Corp Ltd | 1,483 | 9,607 | |||||

IRPC PCL | 40,600 | 5,430 | |||||

LUKOIL PJSC (ADR) | 247 | 13,832 | |||||

MOL Hungarian Oil & Gas PLC | 94 | 6,602 | |||||

Novatek PJSC (GDR) | 18 | 2,332 | |||||

Polski Koncern Naftowy ORLEN SA | 266 | 5,422 | |||||

PTT PCL | 500 | 5,181 | |||||

Qatar Gas Transport Co Ltd | 3,490 | 22,104 | |||||

Reliance Industries Ltd | 484 | 7,709 | |||||

Thai Oil PCL | 2,200 | 4,428 | |||||

Ultrapar Participacoes SA | 200 | 4,154 | |||||

United Tractors Tbk PT | 4,500 | 7,093 | |||||

140,863 | |||||||

Paper & Forest Products – 0.3% | |||||||

Fibria Celulose SA | 100 | 961 | |||||

Nine Dragons Paper Holdings Ltd | 8,000 | 7,226 | |||||

Sappi Ltd | 163 | 1,064 | |||||

9,251 | |||||||

Personal Products – 0.4% | |||||||

Dabur India Ltd | 1,067 | 4,372 | |||||

Godrej Consumer Products Ltd | 62 | 1,378 | |||||

Marico Ltd | 1,676 | 6,426 | |||||

12,176 | |||||||

Pharmaceuticals – 3.7% | |||||||

China Medical System Holdings Ltd | 11,000 | 17,355 | |||||

Cipla Ltd/India | 1,478 | 12,392 | |||||

CSPC Pharmaceutical Group Ltd | 18,000 | 19,147 | |||||

Dr Reddy's Laboratories Ltd | 46 | 2,073 | |||||

Glenmark Pharmaceuticals Ltd | 547 | 7,152 | |||||

Kalbe Farma Tbk PT | 217,900 | 24,354 | |||||

Lupin Ltd | 80 | 1,751 | |||||

Piramal Enterprises Ltd | 744 | 17,727 | |||||

Richter Gedeon Nyrt | 465 | 9,823 | |||||

Sun Pharmaceutical Industries Ltd | 251 | 2,318 | |||||

114,092 | |||||||

Real Estate Management & Development – 3.5% | |||||||

Aldar Properties PJSC | 16,957 | 12,144 | |||||

Ayala Land Inc | 4,900 | 3,151 | |||||

Central Pattana PCL | 13,500 | 21,317 | |||||

China Vanke Co Ltd | 2,400 | 5,426 | |||||

Country Garden Holdings Co Ltd | 33,000 | 18,376 | |||||

Emaar Properties PJSC | 544 | 1,053 | |||||

Fullshare Holdings Ltd | 20,000 | 9,311 | |||||

Guangzhou R&F Properties Co Ltd | 3,600 | 4,351 | |||||

Highwealth Construction Corp | 8,000 | 11,240 | |||||

Pakuwon Jati Tbk PT | 13,100 | 547 | |||||

Shanghai Lujiazui Finance & Trade Zone Development Co Ltd | 6,000 | 8,784 | |||||

SM Prime Holdings Inc | 22,700 | 12,922 | |||||

108,622 | |||||||

Road & Rail – 1.1% | |||||||

BTS Group Holdings PCL | 73,000 | 17,379 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 11 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Road & Rail – (continued) | |||||||

Localiza Rent a Car SA | 400 | $4,191 | |||||

Rumo Logistica Operadora Multimodal SA* | 6,800 | 12,754 | |||||

34,324 | |||||||

Semiconductor & Semiconductor Equipment – 3.9% | |||||||

Hanergy Thin Film Power Group Ltd*,ß | 52,000 | 1,348 | |||||

Powertech Technology Inc | 6,000 | 16,134 | |||||

Realtek Semiconductor Corp | 7,000 | 22,014 | |||||

Semiconductor Manufacturing International Corp* | 10,700 | 16,719 | |||||

Siliconware Precision Industries Co Ltd | 14,000 | 20,762 | |||||

SK Hynix Inc* | 1,018 | 37,217 | |||||

Vanguard International Semiconductor Corp | 3,000 | 5,202 | |||||

119,396 | |||||||

Software – 0.4% | |||||||

Kingsoft Corp Ltd | 1,000 | 2,037 | |||||

NCSoft Corp* | 48 | 9,816 | |||||

11,853 | |||||||

Technology Hardware, Storage & Peripherals – 2.2% | |||||||

Foxconn Technology Co Ltd | 7,030 | 18,442 | |||||

Inventec Corp | 12,000 | 8,173 | |||||

Lite-On Technology Corp | 15,074 | 22,529 | |||||

Micro-Star International Co Ltd | 2,000 | 4,526 | |||||

Pegatron Corp | 1,000 | 2,359 | |||||

Quanta Computer Inc | 3,000 | 5,583 | |||||

Samsung Electronics Co Ltd | 1 | 1,478 | |||||

Wistron Corp | 6,000 | 4,617 | |||||

67,707 | |||||||

Textiles, Apparel & Luxury Goods – 1.2% | |||||||

ANTA Sports Products Ltd | 2,000 | 5,930 | |||||

HengTen Networks Group Ltd* | 72,000 | 3,595 | |||||

Shenzhou International Group Holdings Ltd | 4,000 | 25,193 | |||||

Titan Co Ltd | 628 | 3,013 | |||||

37,731 | |||||||

Thrifts & Mortgage Finance – 0.3% | |||||||

Housing Development Finance Corp Ltd | 326 | 6,061 | |||||

LIC Housing Finance Ltd | 387 | 3,186 | |||||

9,247 | |||||||

Tobacco – 2.3% | |||||||

ITC Ltd | 2,705 | 9,611 | |||||

KT&G Corp* | 727 | 60,776 | |||||

70,387 | |||||||

Transportation Infrastructure – 3.1% | |||||||

Airports of Thailand PCL | 3,300 | 36,615 | |||||

Bangkok Expressway & Metro PCL | 57,800 | 11,964 | |||||

Beijing Capital International Airport Co Ltd | 16,000 | 16,142 | |||||

COSCO SHIPPING Ports Ltd | 14,000 | 14,029 | |||||

Grupo Aeroportuario del Pacifico SAB de CV | 400 | 3,289 | |||||

Grupo Aeroportuario del Sureste SAB de CV | 35 | 504 | |||||

Jiangsu Expressway Co Ltd | 10,000 | 12,609 | |||||

95,152 | |||||||

Water Utilities – 1.8% | |||||||

Aguas Andinas SA | 32,821 | 17,101 | |||||

Beijing Enterprises Water Group Ltd* | 4,000 | 2,638 | |||||

Guangdong Investment Ltd | 28,000 | 36,751 | |||||

56,490 | |||||||

Wireless Telecommunication Services – 4.6% | |||||||

China Mobile Ltd | 2,500 | 26,216 | |||||

Empresa Nacional de Telecomunicaciones SA* | 597 | 6,339 | |||||

Far EasTone Telecommunications Co Ltd | 18,000 | 40,469 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

12 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

| Value | ||||||

Common Stocks – (continued) | |||||||

Wireless Telecommunication Services – (continued) | |||||||

Taiwan Mobile Co Ltd | 21,000 | $67,701 | |||||

140,725 | |||||||

Total Common Stocks (cost $3,055,164) | 2,990,332 | ||||||

Preferred Stocks – 0.9% | |||||||

Automobiles – 0.1% | |||||||

Hyundai Motor Co | 9 | 712 | |||||

Hyundai Motor Co (2nd Preference) | 40 | 3,273 | |||||

3,985 | |||||||

Banks – 0% | |||||||

Itau Unibanco Holding SA | 100 | 1,032 | |||||

Chemicals – 0.3% | |||||||

Braskem SA | 400 | 4,244 | |||||

Sociedad Quimica y Minera de Chile SA | 157 | 4,478 | |||||

8,722 | |||||||

Electric Utilities – 0.1% | |||||||

Cia Energetica de Minas Gerais | 800 | 1,828 | |||||

Metals & Mining – 0.1% | |||||||

Gerdau SA | 1,000 | 3,150 | |||||

Vale SA | 200 | 1,380 | |||||

4,530 | |||||||

Multiline Retail – 0.3% | |||||||

Lojas Americanas SA | 1,700 | 8,838 | |||||

Total Preferred Stocks (cost $30,891) | 28,935 | ||||||

Rights – 0% | |||||||

Banks – 0% | |||||||

Commercial Bank QSC*,ß (cost $0) | 140 | 269 | |||||

Investment Companies – 1.7% | |||||||

Money Markets – 1.7% | |||||||

Janus Cash Liquidity Fund LLC, 0.4708%ºº,£ (cost $52,000) | 52,000 | 52,000 | |||||

Total Investments (total cost $3,138,055) – 100.2% | 3,071,536 | ||||||

Liabilities, net of Cash, Receivables and Other Assets – (0.2)% | (6,617) | ||||||

Net Assets – 100% | $3,064,919 | ||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 13 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2016

Summary of Investments by Country - (Long Positions) (unaudited) | |||||

% of Investment Securities | |||||

Country | Value | ||||

China | $753,566 | 24.5 | % | ||

Taiwan | 522,780 | 17.0 | |||

India | 425,126 | 13.8 | |||

Thailand | 244,972 | 8.0 | |||

South Korea | 206,217 | 6.7 | |||

Brazil | 163,249 | 5.3 | |||

Indonesia | 161,684 | 5.3 | |||

Philippines | 108,562 | 3.5 | |||

United Arab Emirates | 91,786 | 3.0 | |||

Qatar | 87,602 | 2.9 | |||

Chile | 71,840 | 2.3 | |||

Malaysia | 61,220 | 2.0 | |||

United States | 52,000 | 1.7 | |||

Peru | 42,858 | 1.4 | |||

Hungary | 23,282 | 0.8 | |||

Russia | 22,451 | 0.7 | |||

Mexico | 18,907 | 0.6 | |||

South Africa | 6,138 | 0.2 | |||

Poland | 5,422 | 0.2 | |||

Greece | 1,874 | 0.1 | |||

Total | $3,071,536 | 100.0 | % |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

14 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Schedule of Investments and Other Information (unaudited)

MSCI Emerging Markets IndexSM | A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. |

ADR | American Depositary Receipt |

GDR | Global Depositary Receipt |

LLC | Limited Liability Company |

PCL | Public Company Limited |

PJSC | Private Joint Stock Company |

PLC | Public Limited Company |

144A | Securities sold under Rule 144A of the Securities Act of 1933, as amended, are subject to legal and/or contractual restrictions on resale and may not be publicly sold without registration under the 1933 Act. Unless otherwise noted, these securities have been determined to be liquid under guidelines established by the Board of Trustees. The total value of 144A securities as of the period ended December 31, 2016 is $3,693, which represents 0.1% of net assets. |

* | Non-income producing security. |

ß | Security is illiquid. |

ºº | Rate shown is the 7-day yield as of December 31, 2016. |

£ | The Fund may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the period ended December 31, 2016. Unless otherwise indicated, all information in the table is for the period ended December 31, 2016. |

Share | Share | |||||||||||||

Balance | Balance | Realized | Dividend | Value | ||||||||||

at 6/30/16 | Purchases | Sales | at 12/31/16 | Gain/(Loss) | Income | at 12/31/16 | ||||||||

Janus Cash Liquidity Fund LLC | 27,081 | 1,729,113 | (1,704,194) | 52,000 | $— | $123 | $52,000 |

Janus Investment Fund | 15 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Schedule of Investments and Other Information (unaudited)

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of December 31, 2016. See Notes to Financial Statements for more information. | ||||||||||||

Valuation Inputs Summary | ||||||||||||

Level 2 - | Level 3 - | |||||||||||

Level 1 - | Other Significant | Significant | ||||||||||

Quotes Prices | Observable Inputs | Unobservable Inputs | ||||||||||

Assets | ||||||||||||

Investments in Securities | ||||||||||||

Common Stocks | ||||||||||||

Banks | $ | 15,786 | $ | 332,483 | $ | - | ||||||

Diversified Consumer Services | 68,760 | - | - | |||||||||

Internet & Direct Marketing Retail | 4,746 | - | - | |||||||||

Internet Software & Services | 64,690 | 50,805 | - | |||||||||

Metals & Mining | 33,359 | 65,804 | - | |||||||||

Oil, Gas & Consumable Fuels | 16,164 | 124,699 | - | |||||||||

Real Estate Management & Development | 8,784 | 99,838 | - | |||||||||

Semiconductor & Semiconductor Equipment | - | 118,048 | 1,348 | |||||||||

All Other | - | 1,985,018 | - | |||||||||

Preferred Stocks | - | 28,935 | - | |||||||||

Rights | - | 269 | - | |||||||||

Investment Companies | - | 52,000 | - | |||||||||

Total Assets | $ | 212,289 | $ | 2,857,899 | $ | 1,348 | ||||||

16 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Assets and Liabilities (unaudited)

December 31, 2016

See footnotes at the end of the Statement. |

|

|

|

|

|

|

|

Assets: | ||||||

Investments, at cost | $ | 3,138,055 | ||||

Unaffiliated investments, at value | 3,019,536 | |||||

Affiliated investments, at value | 52,000 | |||||

Cash | 969 | |||||

Cash denominated in foreign currency(1) | 127 | |||||

Non-interested Trustees' deferred compensation | 57 | |||||

Receivables: | ||||||

Due from adviser | 39,823 | |||||

Fund shares sold | 10,437 | |||||

Dividends | 5,444 | |||||

Other assets | 55 | |||||

Total Assets |

|

| 3,128,448 |

| ||

Liabilities: | ||||||

Payables: | — | |||||

Investments purchased | 19,344 | |||||

Professional fees | 17,539 | |||||

Fund shares repurchased | 7,767 | |||||

Custodian fees | 6,391 | |||||

Accounting systems fees | 4,023 | |||||

Advisory fees | 2,670 | |||||

Printing fees | 2,649 | |||||

Transfer agent fees and expenses | 586 | |||||

12b-1 Distribution and shareholder servicing fees | 82 | |||||

Non-interested Trustees' deferred compensation fees | 57 | |||||

Fund administration fees | 27 | |||||

Non-interested Trustees' fees and expenses | 24 | |||||

Accrued expenses and other payables | 2,370 | |||||

Total Liabilities |

|

| 63,529 |

| ||

Net Assets |

| $ | 3,064,919 |

| ||

See Notes to Financial Statements. | |

Janus Investment Fund | 17 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Assets and Liabilities (unaudited)

December 31, 2016

|

|

|

|

|

|

|

Net Assets Consist of: | ||||||

Capital (par value and paid-in surplus) | $ | 3,421,096 | ||||

Undistributed net investment income/(loss) | 3,640 | |||||

Undistributed net realized gain/(loss) from investments and foreign currency transactions | (293,305) | |||||

Unrealized net appreciation/(depreciation) of investments, foreign currency translations and non-interested Trustees’ deferred compensation | (66,512) | |||||

Total Net Assets |

| $ | 3,064,919 |

| ||

Net Assets - Class A Shares | $ | 138,767 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 15,425 | |||||

Net Asset Value Per Share(2) |

| $ | 9.00 |

| ||

Maximum Offering Price Per Share(3) |

| $ | 9.55 |

| ||

Net Assets - Class C Shares | $ | 45,527 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 5,057 | |||||

Net Asset Value Per Share(2) |

| $ | 9.00 |

| ||

Net Assets - Class D Shares | $ | 1,912,718 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 212,680 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

Net Assets - Class I Shares | $ | 774,620 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 86,121 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

Net Assets - Class S Shares | $ | 46,148 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 5,127 | |||||

Net Asset Value Per Share |

| $ | 9.00 |

| ||

Net Assets - Class T Shares | $ | 147,139 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 16,350 | |||||

Net Asset Value Per Share |

| $ | 9.00 |

| ||

(1) Includes cost of $127. (2) Redemption price per share may be reduced for any applicable contingent deferred sales charge. (3) Maximum offering price is computed at 100/94.25 of net asset value. |

See Notes to Financial Statements. | |

18 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Operations (unaudited)

For the period ended December 31, 2016

|

|

|

|

|

|

Investment Income: | |||||

| Dividends | $ | 32,117 | ||

Dividends from affiliates | 123 | ||||

Foreign tax withheld | (4,618) | ||||

Total Investment Income |

| 27,622 |

| ||

Expenses: | |||||

Advisory fees | 15,292 | ||||

12b-1Distribution and shareholder servicing fees: | |||||

Class A Shares | 187 | ||||

Class C Shares | 247 | ||||

Class S Shares | 62 | ||||

Transfer agent administrative fees and expenses: | |||||

Class D Shares | 1,188 | ||||

Class S Shares | 62 | ||||

Class T Shares | 225 | ||||

Transfer agent networking and omnibus fees: | |||||

Class I Shares | 164 | ||||

Other transfer agent fees and expenses: | |||||

Class A Shares | 14 | ||||

Class D Shares | 554 | ||||

Class I Shares | 121 | ||||

Class T Shares | 25 | ||||

Registration fees | 97,111 | ||||

Custodian fees | 19,798 | ||||

Professional fees | 19,393 | ||||

Accounting systems fee | 11,612 | ||||

Shareholder reports expense | 1,290 | ||||

Fund administration fees | 152 | ||||

Non-interested Trustees’ fees and expenses | 59 | ||||

Other expenses | 65 | ||||

Total Expenses |

| 167,621 |

| ||

Less: Excess Expense Reimbursement |

| (149,484) |

| ||

Net Expenses |

| 18,137 |

| ||

Net Investment Income/(Loss) |

| 9,485 |

| ||

Net Realized Gain/(Loss) on Investments: | |||||

Investments and foreign currency transactions | (95,160) | ||||

Total Net Realized Gain/(Loss) on Investments |

| (95,160) |

| ||

Change in Unrealized Net Appreciation/Depreciation: | |||||

Investments, foreign currency translations and non-interested Trustees’ deferred compensation | (102,680) | ||||

Total Change in Unrealized Net Appreciation/Depreciation |

| (102,680) |

| ||

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | (188,355) |

| ||

See Notes to Financial Statements. | |

Janus Investment Fund | 19 |

INTECH Emerging Markets Managed Volatility Fund

Statements of Changes in Net Assets

|

|

| Period

ended |

| Year ended | |||

Operations: | ||||||||

Net investment income/(loss) | $ | 9,485 | $ | 41,111 | ||||

Net realized gain/(loss) on investments | (95,160) | (204,117) | ||||||

Change in unrealized net appreciation/depreciation | (102,680) | 50,026 | ||||||

Net Increase/(Decrease) in Net Assets Resulting from Operations |

| (188,355) |

|

| (112,980) | |||

Dividends and Distributions to Shareholders: | ||||||||

Dividends from Net Investment Income | ||||||||

Class A Shares | (1,470) | (1,177) | ||||||

Class C Shares | (105) | (20) | ||||||

Class D Shares | (22,736) | (9,709) | ||||||

Class I Shares | (10,436) | (3,366) | ||||||

Class S Shares | (441) | (309) | ||||||

Class T Shares | (1,747) | (1,423) | ||||||

| Total Dividends from Net Investment Income |

| (36,935) |

|

| (16,004) | ||

Distributions from Net Realized Gain from Investment Transactions | ||||||||

Class A Shares | — | (1,145) | ||||||

Class C Shares | — | (382) | ||||||

Class D Shares | — | (8,595) | ||||||

Class I Shares | — | (2,530) | ||||||

Class S Shares | — | (382) | ||||||

Class T Shares | — | (1,258) | ||||||

| Total Distributions from Net Realized Gain from Investment Transactions | — |

|

| (14,292) | |||

Net Decrease from Dividends and Distributions to Shareholders |

| (36,935) |

|

| (30,296) | |||

Capital Share Transactions: | ||||||||

Class A Shares | 1,470 | 2,323 | ||||||

Class C Shares | 105 | 402 | ||||||

Class D Shares | 579,024 | 252,056 | ||||||

Class I Shares | 161,549 | 361,614 | ||||||

Class S Shares | 441 | 690 | ||||||

Class T Shares | (18,728) | 21,169 | ||||||

Net Increase/(Decrease) from Capital Share Transactions |

| 723,861 |

|

| 638,254 | |||

Net Increase/(Decrease) in Net Assets |

| 498,571 |

|

| 494,978 | |||

Net Assets: | ||||||||

Beginning of period | 2,566,348 | 2,071,370 | ||||||

| End of period | $ | 3,064,919 |

| $ | 2,566,348 | ||

Undistributed Net Investment Income/(Loss) | $ | 3,640 |

| $ | 31,090 | |||

See Notes to Financial Statements. | |

20 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Financial Highlights

Class A Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.48 |

|

| $10.49 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | 0.03 | 0.18 | 0.06 | |||||||||

Net realized and unrealized gain/(loss) | (0.41) | (1.03) | 0.43 | |||||||||

Total from Investment Operations |

| (0.38) |

|

| (0.85) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.10) | (0.08) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.10) |

|

| (0.16) |

|

| — |

| |||

Net Asset Value, End of Period | $9.00 | $9.48 | $10.49 | |||||||||

Total Return* |

| (4.03)% |

|

| (8.06)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $139 | $145 | $157 | |||||||||

Average Net Assets for the Period (in thousands) | $147 | $140 | $159 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 10.34% | 10.33% | 36.27% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.24% | 1.30% | 1.31% | |||||||||

Ratio of Net Investment Income/(Loss) | 0.61% | 1.89% | 1.05% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

Class C Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.44 |

|

| $10.44 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | (0.01) | 0.10 | 0.02 | |||||||||

Net realized and unrealized gain/(loss) | (0.41) | (1.02) | 0.42 | |||||||||

Total from Investment Operations |

| (0.42) |

|

| (0.92) |

|

| 0.44 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.02) | —(3) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.02) |

|

| (0.08) |

|

| — |

| |||

Net Asset Value, End of Period | $9.00 | $9.44 | $10.44 | |||||||||

Total Return* |

| (4.44)% |

|

| (8.77)% |

|

| 4.40% |

| |||

Net Assets, End of Period (in thousands) | $46 | $48 | $52 | |||||||||

Average Net Assets for the Period (in thousands) | $48 | $46 | $53 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 11.10% | 11.11% | 37.08% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 2.00% | 2.08% | 2.09% | |||||||||

Ratio of Net Investment Income/(Loss) | (0.15)% | 1.11% | 0.27% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. (3) Less than $0.005 on a per share basis. |

See Notes to Financial Statements. | |

Janus Investment Fund | 21 |

INTECH Emerging Markets Managed Volatility Fund

Financial Highlights

Class D Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.49 |

|

| $10.49 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | 0.03 | 0.19 | 0.08 | |||||||||

Net realized and unrealized gain/(loss) | (0.42) | (1.02) | 0.41 | |||||||||

Total from Investment Operations |

| (0.39) |

|

| (0.83) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.11) | (0.09) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.11) |

|

| (0.17) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $9.49 | $10.49 | |||||||||

Total Return* |

| (4.09)% |

|

| (7.89)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $1,913 | $1,488 | $1,335 | |||||||||

Average Net Assets for the Period (in thousands) | $1,943 | $1,194 | $1,037 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 10.64% | 10.26% | 27.16% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.14% | 1.19% | 1.23% | |||||||||

Ratio of Net Investment Income/(Loss) | 0.55% | 2.08% | 1.38% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

Class I Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.49 |

|

| $10.50 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | 0.04 | 0.21 | 0.10 | |||||||||

Net realized and unrealized gain/(loss) | (0.42) | (1.04) | 0.40 | |||||||||

Total from Investment Operations |

| (0.38) |

|

| (0.83) |

|

| 0.50 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.12) | (0.10) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.12) |

|

| (0.18) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $9.49 | $10.50 | |||||||||

Total Return* |

| (3.98)% |

|

| (7.82)% |

|

| 5.00% |

| |||

Net Assets, End of Period (in thousands) | $775 | $664 | $305 | |||||||||

Average Net Assets for the Period (in thousands) | $795 | $391 | $181 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 10.30% | 9.29% | 27.37% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.04% | 1.04% | 1.05% | |||||||||

Ratio of Net Investment Income/(Loss) | 0.73% | 2.30% | 1.79% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

22 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Financial Highlights

Class S Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.48 |

|

| $10.47 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | 0.02 | 0.17 | 0.04 | |||||||||

Net realized and unrealized gain/(loss) | (0.41) | (1.02) | 0.43 | |||||||||

Total from Investment Operations |

| (0.39) |

|

| (0.85) |

|

| 0.47 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.09) | (0.06) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.09) |

|

| (0.14) |

|

| — |

| |||

Net Asset Value, End of Period | $9.00 | $9.48 | $10.47 | |||||||||

Total Return* |

| (4.14)% |

|

| (8.06)% |

|

| 4.70% |

| |||

Net Assets, End of Period (in thousands) | $46 | $48 | $52 | |||||||||

Average Net Assets for the Period (in thousands) | $49 | $47 | $53 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 10.60% | 10.55% | 36.54% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.37% | 1.33% | 1.58% | |||||||||

Ratio of Net Investment Income/(Loss) | 0.47% | 1.87% | 0.78% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

Class T Shares | ||||||||||||

For a share outstanding during the period ended December 31, 2016 (unaudited) and the year or period ended June 30 | 2016 |

|

| 2016 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $9.49 |

|

| $10.49 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | ||||||||||||

Net investment income/(loss)(2) | 0.03 | 0.19 | 0.06 | |||||||||

Net realized and unrealized gain/(loss) | (0.41) | (1.02) | 0.43 | |||||||||

Total from Investment Operations |

| (0.38) |

|

| (0.83) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | ||||||||||||

Dividends (from net investment income) | (0.11) | (0.09) | — | |||||||||

Distributions (from capital gains) | — | (0.08) | — | |||||||||

Total Dividends and Distributions |

| (0.11) |

|

| (0.17) |

|

| — |

| |||

Net Asset Value, End of Period | $9.00 | $9.49 | $10.49 | |||||||||

Total Return* |

| (4.01)% |

|

| (7.89)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $147 | $175 | $169 | |||||||||

Average Net Assets for the Period (in thousands) | $177 | $155 | $165 | |||||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

| |||

Ratio of Gross Expenses | 10.22% | 10.26% | 35.55% | |||||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.14% | 1.11% | 1.32% | |||||||||

Ratio of Net Investment Income/(Loss) | 0.69% | 2.10% | 1.07% | |||||||||

Portfolio Turnover Rate | 70% | 84% | 43% | |||||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

Janus Investment Fund | 23 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

INTECH Emerging Markets Managed Volatility Fund (the “Fund”) is a series fund. The Fund is part of Janus Investment Fund (the “Trust”), which is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers forty-five funds which include multiple series of shares, with differing investment objectives and policies. The Fund seeks long-term growth of capital. The Fund is classified as diversified, as defined in the 1940 Act.

The Fund offers multiple classes of shares in order to meet the needs of various types of investors. Each class represents an interest in the same portfolio of investments. Certain financial intermediaries may not offer all classes of shares. Class D Shares are closed to certain new investors.

Class A Shares and Class C Shares are generally offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, bank trust platforms, and retirement platforms.

Class D Shares are generally no longer being made available to new investors who do not already have a direct account with the Janus funds. Class D Shares are available only to investors who hold accounts directly with the Janus funds, to immediate family members or members of the same household of an eligible individual investor, and to existing beneficial owners of sole proprietorships or partnerships that hold accounts directly with the Janus funds.

Class I Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. Class I Shares are also available to certain direct institutional investors including, but not limited to, corporations, certain retirement plans, public plans, and foundations/endowments.

Class S Shares are offered through financial intermediary platforms including, but not limited to, retirement platforms and asset allocation, mutual fund wrap, or other discretionary or nondiscretionary fee-based investment advisory programs. In addition, Class S Shares may be available through certain financial intermediaries who have an agreement with Janus Capital Management LLC (“Janus Capital”) or its affiliates to offer Class S Shares on their supermarket platforms.

Class T Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. In addition, Class T Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class T Shares on their supermarket platforms.

The following accounting policies have been followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Equity securities traded on a domestic securities exchange are generally valued at the closing prices on the primary market or exchange on which they trade. If such price is lacking for the trading period immediately preceding the time of determination, such securities are valued at their current bid price. Equity securities that are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event that there is no current trading volume on a particular security in such foreign exchange, the bid price from the primary exchange is generally used to value the security. Securities that are traded on the over-the-counter (“OTC”) markets are generally valued at their closing or latest bid prices as available. Foreign securities and currencies are converted to U.S. dollars using the applicable exchange rate in effect at the close of the New York Stock Exchange (“NYSE”). The Fund will determine the market value of individual securities held by it by using prices provided by one or more approved professional pricing services or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined

24 | DECEMBER 31, 2016 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Financial Statements (unaudited)

approximates market value. Securities for which market quotations or evaluated prices are not readily available or deemed unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position. The Fund uses systematic fair valuation models provided by independent third parties to value international equity securities in order to adjust for stale pricing, which may occur between the close of certain foreign exchanges and the close of the NYSE.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Fund’s Trustees; certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost; and equity securities of foreign issuers whose fair value is determined by using systematic fair valuation models provided by independent third parties in order to adjust for stale pricing which may occur between the close of certain foreign exchanges and the close of the NYSE. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of December 31, 2016 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

The Fund did not hold a significant amount of Level 3 securities as of December 31, 2016.

The Fund recognizes transfers between the levels as of the beginning of the fiscal year. The following describes the amounts of transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy during the period.

Financial assets of $88,795 were transferred out of Level 1 to Level 2 since certain foreign equity prices were applied a fair valuation adjustment factor at the end of the current period and no factor was applied at the end of the prior fiscal year.

Janus Investment Fund | 25 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Financial Statements (unaudited)

Financial assets of $9,410 were transferred out of Level 2 to Level 1 since certain foreign equity prices were applied a fair valuation adjustment factor at the end of the prior fiscal year and no factor was applied at the end of the current period.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may be subject to withholding taxes in foreign jurisdictions. Interest income is recorded on the accrual basis and includes amortization of premiums and accretion of discounts. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes. Income, as well as gains and losses, both realized and unrealized, are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets.

Expenses

The Fund bears expenses incurred specifically on its behalf. Each class of shares bears a portion of general expenses, which are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets. Expenses directly attributable to a specific class of shares are charged against the operations of such class.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Foreign Currency Translations

The Fund does not isolate that portion of the results of operations resulting from the effect of changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held at the date of the financial statements. Net unrealized appreciation or depreciation of investments and foreign currency translations arise from changes in the value of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

Currency gains and losses are also calculated on payables and receivables that are denominated in foreign currencies. The payables and receivables are generally related to foreign security transactions and income translations.

Foreign currency-denominated assets and forward currency contracts may involve more risks than domestic transactions, including currency risk, counterparty risk, political and economic risk, regulatory risk and equity risk. Risks may arise from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

Dividends and Distributions

The Fund generally declares and distributes dividends of net investment income and realized capital gains (if any) annually. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the net asset value. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or the Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Fund's equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.