UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(X) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2012 |

( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ___ TO ___ |

Commission File Number | Registrant | State of Incorporation | IRS Employer Identification Number | ||

1-7810 | Energen Corporation | Alabama | 63-0757759 | ||

2-38960 | Alabama Gas Corporation | Alabama | 63-0022000 | ||

605 Richard Arrington Jr. Boulevard North, Birmingham, Alabama 35203-2707

Telephone Number 205/326-2700

http://www.energen.com

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Exchange on Which Registered | |

Energen Corporation Common Stock, $0.01 par value | New York Stock Exchange | |

Securities Registered Pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrants are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES (X) NO ( )

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ( ) NO (X)

Indicate by a check mark whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days. YES (X) NO ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Energen Corporation YES (X) NO ( )

Alabama Gas Corporation YES (X) NO ( )

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Energen Corporation Large accelerated filer (X) Accelerated filer ( ) Non-accelerated filer ( ) Smaller reporting company ( )

Alabama Gas Corporation Large accelerated filer ( ) Accelerated filer ( ) Non-accelerated filer (X) Smaller reporting company ( )

Indicate by check mark whether the registrants are a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ( ) NO (X)

Aggregate market value of the voting stock held by non-affiliates of the registrants as of June 30, 2012:

Energen Corporation | $3,193,878,000 | |

Indicate number of shares outstanding of each of the registrant's classes of common stock as of February 15, 2013:

Energen Corporation | 72,222,552 shares | |

Alabama Gas Corporation | 1,972,052 shares | |

Alabama Gas Corporation meets the conditions set forth in General Instruction I(1) (a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format pursuant to General Instruction I(2).

DOCUMENTS INCORPORATED BY REFERENCE

Energen Corporation Proxy Statement to be filed on or about March 27, 2013 (Part III, Item 10-14)

INDUSTRY GLOSSARY For a more complete definition of certain terms defined below, as well as other terms and concepts applicable to successful efforts accounting, please refer to Rule 4-10(a) of Regulation S-X, promulgated pursuant to the Securities Act of 1933 and the Securities Exchange Act of 1934, each as amended. | |

Basis | The difference between the futures price for a commodity and the corresponding cash spot price. This commonly is related to factors such as product quality, location and contract pricing. |

Basin-Specific | A type of derivative contract whereby the contract's settlement price is based on specific geographic basin indices. |

Behind Pipe Reserves | Oil or gas reserves located above or below the currently producing zone(s) that cannot be extracted until a recompletion or pay-add occurs. |

Cash Flow Hedge | The designation of a derivative instrument to reduce exposure to variability in cash flows from the forecasted sale of oil, gas or natural gas liquids production whereby the gains (losses) on the derivative transaction are anticipated to offset the losses (gains) on the forecasted sale. |

Collar | A financial arrangement that effectively establishes a price range between a floor and a ceiling for the underlying commodity. The purchaser bears the risk of fluctuation between the minimum (or floor) price and the maximum (or ceiling) price. |

Development Costs | Costs necessary to gain access to, prepare and equip development wells in areas of proved reserves. |

Development Well | A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive. |

Downspacing | An increase in the number of available drilling locations as a result of a regulatory commission order. |

Dry Well | An exploratory or a development well found to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. |

Exploration Expenses | Costs primarily associated with drilling unsuccessful exploratory wells in undeveloped properties, exploratory geological and geophysical activities, and costs of impaired and expired leaseholds. |

Exploratory Well | A well drilled to find and produce oil or gas in an unproved area, to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir, or to extend a known reservoir. |

Futures Contract | An exchange-traded legal contract to buy or sell a standard quantity and quality of a commodity at a specified future date and price. Such contracts offer liquidity and minimal credit risk exposure but lack the flexibility of swap contracts. |

Hedging | The use of derivative commodity instruments such as futures, swaps, options and collars to help reduce financial exposure to commodity price volatility. |

Gross Revenues | Revenues reported after deduction of royalty interest payments. |

Gross Well or Acre | A well or acre in which a working interest is owned. |

Liquified Natural Gas (LNG) | Natural gas that is liquified by reducing the temperature to negative 260 degrees Fahrenheit. LNG typically is used to supplement traditional natural gas supplies during periods of peak demand. |

Long-Lived Reserves | Reserves generally considered to have a productive life of approximately 10 years or more, as measured by the reserves-to-production ratio. |

Natural Gas Liquids (NGL) | Liquid hydrocarbons that are extracted and separated from the natural gas stream. NGL products include ethane, propane, butane, natural gasoline and other hydrocarbons. |

Net Well or Acre | A net well or acre is deemed to exist when the sum of fractional ownership working interests in gross wells or acres equals one. |

Odorization | The adding of odorant to natural gas which is a characteristic odor so that leaks can be readily detected by smell. |

Operational Enhancement | Any action undertaken to improve production efficiency of oil and gas wells and/or reduce well costs. |

Operator | The company responsible for exploration, development and production activities for a specific project. |

Pay-Add | An operation within a currently producing wellbore that attempts to access and complete an additional pay zone(s) while maintaining production from the existing completed zone(s). |

Pay Zone | The formation from which oil and gas is produced. |

Production (Lifting) Costs | Costs incurred to operate and maintain wells. |

Productive Well | An exploratory or a development well that is not a dry well. |

Proved Developed Reserves | The portion of proved reserves which can be expected to be recovered through existing wells with existing equipment and operating methods. |

Proved Reserves | Estimated quantities of crude oil, natural gas and natural gas liquids that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. |

Proved Undeveloped Reserves (PUD) | The portion of proved reserves which can be expected to be recovered from new wells on undrilled proved acreage or from existing wells where a relatively major expenditure is required for completion. |

Recompletion | An operation within an existing wellbore whereby a completion in one pay zone is abandoned in order to attempt a completion in a different pay zone. |

Reserves-to-Production Ratio | Ratio expressing years of supply determined by dividing the remaining recoverable reserves at year end by actual annual production volumes. The reserve-to-production ratio is a statistical indicator with certain limitations, including predictive value. The ratio varies over time as changes occur in production levels and remaining recoverable reserves. |

Secondary Recovery | The process of injecting water, gas, etc., into a formation in order to produce additional oil otherwise unobtainable by initial recovery efforts. |

Service Well | A well employed for the introduction into an underground stratum of water, gas or other fluid under pressure or disposal of salt water produced with oil or other waste. |

Sidetrack Well | A new section of wellbore drilled from an existing well. |

Swap | A contractual arrangement in which two parties, called counterparties, effectively agree to exchange or "swap" variable and fixed rate payment streams based on a specified commodity volume. The contracts allow for flexible terms such as specific quantities, settlement dates and location but also expose the parties to counterparty credit risk. |

Transportation | Moving gas through pipelines on a contract basis for others. |

Throughput | Total volumes of natural gas sold or transported by the gas utility. |

Working Interest | Ownership interest in the oil and gas properties that is burdened with the cost of development and operation of the property. |

Workover | A major remedial operation on a completed well to restore, maintain, or improve the well's production such as deepening the well or plugging back to produce from a shallow formation. |

-e | Following a unit of measure denotes that the gas components have been converted to barrels of oil equivalents at a rate of 1 barrel per 6 thousand cubic feet. |

ENERGEN CORPORATION 2012 FORM 10-K ANNUAL REPORT | ||

TABLE OF CONTENTS | ||

PART I | Page | |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

PART II | ||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer | |

Purchases of Equity Securities | ||

Item 6. | Selected Financial Data | |

Item 7. | Management's Discussion and Analysis of Financial Condition and | |

Results of Operations | ||

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and | |

Financial Disclosure | ||

Item 9A. | Controls and Procedures | |

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and | |

Related Stockholder Matters | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | ||

2

This Form 10-K is filed on behalf of Energen Corporation (Energen or the Company)

and Alabama Gas Corporation (Alagasco).

Forward-Looking Statements: The disclosure and analysis in this 2012 Annual Report on Form 10-K contains forward-looking statements that express management’s expectations of future plans, objectives and performance of the Company and its subsidiaries. Such statements constitute forward-looking statements within the meaning of Section 27A of the Securities Act, as amended, and Section 21E of the Exchange Act, as amended, and are noted in the Company’s disclosure as permitted by the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address the Company’s future business and financial performance and financial condition, and often contain words such as “expect”, “anticipate”, “intend”, “plan”, “believe”, “seek”, “see”, “project”, “will”, “estimate”, “may”, and other words of similar meaning.

All statements based on future expectations rather than on historical facts are forward-looking statements that are dependent on certain events, risks and uncertainties (many of which are beyond our control) that could cause actual results to differ materially from those anticipated. Some of these include, but are not limited to, economic and competitive conditions, production levels, reserve levels, energy markets, supply and demand for and the price of energy commodities including oil, gas and natural gas liquids, fluctuations in the weather, drilling risks, costs associated with compliance with environmental and regulatory obligations, inflation rates, legislative and regulatory changes, financial market conditions, the Company’s ability to access the capital markets, acts of nature, sabotage, terrorism (including cyber-attacks) and other similar acts that disrupt operations or cause damage greater than covered by insurance, future business decisions, utility customer growth and retention and usage per customer, litigation results and other factors and uncertainties discussed elsewhere in this 10-K and in the Company’s other public filings and press releases, all of which are difficult to predict. While it is not possible to predict or identify all the factors that could cause the Company’s actual results to differ materially from expected or historical results, the Company has identified certain risk factors which may affect the Company’s future business and financial performance.

See Item 1A, Risk Factors, for a discussion of risk factors that may affect the Company and cause material variances from forward-looking statement expectations. The Item 1A, Risk Factors, discussion is incorporated by reference into this forward-looking statement disclosure.

Except as otherwise disclosed, the forward-looking statements do not reflect the impact of possible or pending acquisitions, investments, divestitures or restructurings. The absence of errors in input data, calculations and formulas used in estimates, assumptions and forecasts cannot be guaranteed. Neither the Company nor Alagasco undertakes any obligation to correct or update any forward-looking statements whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

General

Energen Corporation, based in Birmingham, Alabama, is a diversified energy holding company engaged in the development, acquisition, exploration and production of oil, natural gas and natural gas liquids in the continental United States and in the purchase, distribution and sale of natural gas in central and north Alabama. Its two principal subsidiaries are Energen Resources Corporation and Alabama Gas Corporation (Alagasco).

Alagasco was formed in 1948 by the merger of Alabama Gas Company into Birmingham Gas Company, the predecessors of which had been in existence since the mid-1800s. Alagasco became publicly traded in 1953. Energen Resources was formed in 1971 as a subsidiary of Alagasco. Energen was incorporated in 1978 in preparation for the 1979 corporate reorganization in which Alagasco and Energen Resources became subsidiaries of Energen.

The Company maintains a Web site with the address www.energen.com. The Company does not include the information contained on its Web site as part of this report nor is the information incorporated by reference into this report. The Company makes available free of charge through its Web site the annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports. Also, these reports are available in print upon shareholder request. These reports are available as soon as reasonably practicable after being electronically filed with or furnished to the Securities and Exchange Commission. The Company's Web site also includes its Business Conduct Guidelines, Corporate Governance Guidelines, Audit Committee Charter, Officers' Review Committee Charter, Governance and Nominations Committee Charter and Finance Committee Charter, each of which is available in print upon shareholder request.

3

Financial Information About Industry Segments

The information required by this item is provided in Note 18, Industry Segment Information, in the Notes to Financial Statements.

Narrative Description of Business

• | Oil and Gas Operations |

General: Energen's oil and gas operations focus on increasing production and adding proved reserves through the development and acquisition of oil and gas properties. In addition, Energen Resources explores for and develops new reservoirs, primarily in areas in which it has an operating presence. All oil, gas and natural gas liquids production is sold to third parties. Energen Resources also provides operating services in the Permian, San Juan and Black Warrior basins for its joint interest and third parties. These services include overall project management and day-to-day decision-making relative to project operations.

At the end of 2012, Energen Resources' proved oil and gas reserves totaled 346.4 million barrels of oil equivalent (MMBOE). Substantially all of these reserves are located in the Permian Basin in west Texas, the San Juan Basin in New Mexico and Colorado and the Black Warrior Basin in Alabama. Approximately 75 percent of Energen Resources' year-end reserves are proved developed reserves. Energen Resources’ reserves are long-lived, with a year-end reserves-to-production ratio of 14 years. Oil, natural gas and natural gas liquids represent approximately 45 percent, 39 percent and 16 percent, respectively, of Energen Resources' proved reserves.

Growth Strategy: Energen operates under a strategy to grow the oil and gas operations of Energen Resources largely through the acquisition and exploitation of proved and high-quality unproved reserves. The company traditionally prefers properties located onshore in North America that offer long-lived reserves and multiple pay-zone opportunities. Energen Resources also conducts exploration activities in and around the basins in which it operates; exploration in other areas is possible if the opportunities complement its core expertise and meet its investment requirements. Following an acquisition, Energen Resources focuses on increasing production and reserves through development well drilling, exploration, behind-pipe recompletions, pay-adds, workovers, secondary recovery, and operational enhancements. Energen Resources prefers to operate its properties in order to better control the nature and pace of drilling and development activities. Energen Resources operated approximately 94 percent of its proved reserves at December 31, 2012.

Since the end of fiscal year 1995, Energen Resources has invested approximately $1.9 billion to acquire proved and unproved reserves, $3.7 billion in related development and $1.3 billion in exploration. Energen Resources' capital spending plans for 2013 target a total investment of approximately $905 million, the bulk of which will focus on drilling and related development activities on its existing properties, with approximately 98 percent targeting the liquids-rich Permian Basin. The company may choose to allocate additional capital during the year for property acquisitions and/or increased drilling and development activities.

Energen Resources' development activities can result in the addition of new proved reserves and can serve to reclassify proved undeveloped reserves to proved developed reserves. Proved reserve disclosures are provided annually, although changes to reserve classifications occur throughout the year. Accordingly, additions of new reserves from development activities can occur throughout the year and may result from numerous factors including, but not limited to, regulatory approvals for drilling unit downspacing that increase the number of available drilling locations; changes in the economic or operating environments that allow previously uneconomic locations to be added; technological advances that make reserve locations available for development; successful development of existing proved undeveloped reserve locations that reclassify adjacent probable locations to proved undeveloped reserve locations; increased knowledge of field geology and engineering parameters relative to oil and gas reservoirs; and changes in management's intent to develop certain opportunities.

During the three years ended December 31, 2012, the Company's development and exploratory efforts have added 130 MMBOE of proved reserves from the drilling of 1,300 gross development, exploratory and service wells (including 18 sidetrack wells) and 326 well recompletions and pay-adds. In 2012, Energen Resources' successful development and exploratory wells and other activities added approximately 57 MMBOE of proved reserves; the Company drilled 434 gross development, exploratory and service wells (including 3 sidetrack wells), performed some 116 well recompletions and pay-adds, and conducted other operational enhancements. Energen Resources' production totaled 24.1 MMBOE in 2012 and is estimated to total 26.1 MMBOE in 2013, including 24.9 MMBOE of estimated production from proved reserves owned at December 31, 2012.

4

Drilling Activity: The following table sets forth the total number of net productive and dry exploratory and development wells drilled:

Years ended December 31, | 2012 | 2011 | 2010 | |

Development: | ||||

Productive | 239.9 | 370.3 | 210.0 | |

Dry | — | 3.3 | 1.0 | |

Total | 239.9 | 373.6 | 211.0 | |

Exploratory: | ||||

Productive | 74.1 | 23.3 | 3.4 | |

Dry | 1.1 | 1.0 | 5.0 | |

Total | 75.2 | 24.3 | 8.4 | |

As of December 31, 2012, the Company was participating in the drilling of 8 gross development and 4 gross exploratory wells, with the Company's interest equivalent to 6.9 wells and 3.3 wells, respectively. In addition to the development wells drilled, the Company drilled 47.8, 29.1 and 39.8 net service wells during 2012, 2011 and 2010, respectively.

Productive Wells and Acreage: The following table sets forth the total gross and net productive gas and oil wells as of December 31, 2012, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

Gross | Net | |||

Oil wells | 4,531 | 2,988 | ||

Gas wells | 4,402 | 2,413 | ||

Developed acreage | 810,862 | 614,697 | ||

Undeveloped acreage | 171,723 | 117,762 | ||

There were 10 wells with multiple completions in 2012. All wells and acreage are located onshore in the United States, with the majority of the net undeveloped acreage located in Texas and Colorado.

Risk Management: Energen Resources attempts to lower the commodity price risk associated with its oil and natural gas business through the use of swaps and basis hedges. Energen Resources does not hedge more than 80 percent of its estimated annual production. Energen Resources recognizes all derivatives on the balance sheet and measures all derivatives at fair value. If a derivative is designated as a cash flow hedge, the effectiveness of the hedge, or the degree that the gain (loss) for the hedging instrument offsets the loss (gain) on the hedged item, is measured at each reporting period. The effective portion of the gain or loss on the derivative instrument is recognized in other comprehensive income as a component of equity and subsequently reclassified to operating revenues when the forecasted transaction affects earnings. The ineffective portion of a derivative's change in fair value is required to be recognized in operating revenues immediately.

The Company periodically enters into derivative transactions that do not qualify for cash flow hedge accounting but are considered by management to represent valid economic hedges and are accounted for as mark-to-market transactions. These economic hedges may include, but are not limited to, hedges on estimated future production not yet flowing, basis hedges without a corresponding New York Mercantile Exchange hedge, and hedges on non-operated or other properties for which all of the necessary information to qualify for cash flow hedge accounting is either not readily available or subject to change. Derivatives that do not qualify for hedge treatment or are not designated as cash flow hedges are recorded at fair value with gains or losses recognized in operating revenues in the period of change.

See the Forward-Looking Statements preceding Item I, Business, and Item 1A, Risk Factors, for further discussion with respect to price and other risks.

5

• | Natural Gas Distribution |

General: Alagasco is the largest natural gas distribution utility in the state of Alabama. Alagasco purchases natural gas through interstate and intrastate suppliers and distributes the purchased gas through its distribution facilities for sale to residential, commercial and industrial customers and other end-users of natural gas. Alagasco also provides transportation services to large industrial and commercial customers located on its distribution system. These transportation customers, using Alagasco as their agent or acting on their own, purchase gas directly from marketers or suppliers and arrange for delivery of the gas into the Alagasco distribution system. Alagasco charges a fee to transport such customer-owned gas through its distribution system to the customers' facilities.

Alagasco's service territory is located in central and parts of north Alabama and includes 186 cities and communities in 28 counties. The aggregate population of the counties served by Alagasco is estimated to be 2.5 million. Among the cities served by Alagasco are Birmingham, the center of the largest metropolitan area in Alabama, and Montgomery, the state capital. During 2012, Alagasco served an average of 393,467 residential customers and 31,450 commercial, industrial and transportation customers. The Alagasco distribution system includes approximately 11,298 miles of main and more than 11,899 miles of service lines, odorization and regulation facilities, and customer meters.

APSC Regulation: As an Alabama utility, Alagasco is subject to regulation by the Alabama Public Service Commission (APSC) which established the Rate Stabilization and Equalization (RSE) rate-setting process in 1983. RSE’s current extension is for a seven-year period ending December 31, 2014. RSE will continue after December 31, 2014, unless, after notice to the Company and a hearing, the APSC votes to modify or discontinue the RSE methodology. Alagasco is on a September 30 fiscal year for rate-setting purposes (rate year).

Alagasco's allowed range of return on average equity remains 13.15 percent to 13.65 percent throughout the term of the RSE order. Under RSE, the APSC conducts quarterly reviews to determine whether Alagasco's return on average equity at the end of the rate year will be within the allowed range of return. Reductions in rates can be made quarterly to bring the projected return within the allowed range; increases, however, are allowed only once each rate year, effective December 1, and cannot exceed 4 percent of prior-year revenues. RSE limits the utility’s equity upon which a return is permitted to 55 percent of total capitalization, subject to certain adjustments. Under the inflation-based Cost Control Measurement (CCM) established by the APSC, if the percentage change in operations and maintenance (O&M) expense on an aggregate basis falls within a range of 0.75 points above or below the percentage change in the Consumer Price Index For All Urban Consumers (Index Range), no adjustment is required. If the change in O&M expense on an aggregate basis exceeds the Index Range, three-quarters of the difference is returned to customers. To the extent the change is less than the Index Range, the utility benefits by one-half of the difference through future rate adjustments. The O&M expense base for measurement purposes will be set at the prior year’s actual O&M expense amount unless the Company exceeds the top of the Index Range in two successive years, in which case the base for the following year will be set at the top of the Index Range. Certain items that fluctuate based on situations demonstrated to be beyond Alagasco’s control may be excluded from the CCM calculation.

Alagasco’s rate schedules for natural gas distribution charges contain a Gas Supply Adjustment (GSA) rider, established in 1993, which permits the pass-through to customers of changes in the cost of gas supply. Alagasco’s tariff provides a temperature adjustment mechanism, also included in the GSA, that is designed to moderate the impact of departures from normal temperatures on Alagasco’s earnings. The temperature adjustment applies primarily to residential, small commercial and small industrial customers. Other non-temperature weather related conditions that may affect customer usage are not included in the temperature adjustment.

The APSC approved an Enhanced Stability Reserve (ESR) in 1998 which was subsequently modified and expanded in 2010. As currently approved, the ESR provides deferred treatment and recovery for the following: (1) extraordinary O&M expenses related to environmental response costs; (2) extraordinary O&M expenses related to self insurance costs that exceed $1 million per occurrence; (3) extraordinary O&M expenses, other than environmental response costs and self insurance costs, resulting from a single force majeure event or multiple force majeure events greater than $275,000 and $412,500, respectively, during a rate year; and (4) negative individual large commercial and industrial customer budget revenue variances that exceed $350,000 during a rate year.

Charges to the ESR are subject to certain limitations which may disallow deferred treatment and which proscribe the timing of recovery. Funding to the ESR is provided as a reduction to the refundable negative salvage balance over its nine year term beginning December 1, 2010. Subsequent to the nine year period and subject to APSC authorization, Alagasco anticipates recovering underfunded ESR balances over a five year period with an annual limitation of $660,000.

6

Gas Supply: Alagasco's distribution system is connected to two major interstate natural gas pipeline systems, Southern Natural Gas Company (Southern) and Transcontinental Gas Pipe Line Company (Transco). It is also connected to two intrastate natural gas pipeline systems and to Alagasco's two liquified natural gas (LNG) facilities.

Alagasco purchases natural gas from various natural gas producers and marketers. Certain volumes are purchased under firm contractual commitments with other volumes purchased on a spot market basis. The purchased volumes are delivered to Alagasco's system using a variety of firm transportation, interruptible transportation and storage capacity arrangements designed to meet the system's varying levels of demand. Alagasco's LNG facilities can provide the system with up to an additional 200,000 thousand cubic feet per day (Mcfd) of natural gas to meet peak day demand.

As of December 31, 2012, Alagasco had the following contracts in place for firm natural gas pipeline transportation and storage services:

December 31, 2012 | ||

(Mcfd) | ||

Southern firm transportation | 112,933 | |

Southern storage and no notice transportation | 231,679 | |

Transco firm transportation | 70,000 | |

Various intrastate transportation | 20,216 | |

Competition: The price of natural gas is a significant competitive factor in Alagasco's service territory, particularly among large commercial and industrial transportation customers. Propane, coal and fuel oil are readily available, and many industrial customers have the capability to switch to alternate fuels and alternate sources of gas. In the residential and small commercial and industrial markets, electricity is the principal competitor. With the support of the APSC, Alagasco has implemented a variety of programs to help it compete for gas load in all market segments. The Company has been effective at utilizing these programs to avoid load loss to competitive fuels.

Alagasco’s Transportation Tariff allows the Company to transport gas for large commercial and industrial customers rather than buying and reselling it to them and is based on Alagasco's sales profit margin so that operating margins are unaffected. During 2012, substantially all of Alagasco's large commercial and industrial customer deliveries involved the transportation of customer-owned gas.

Natural gas service available to Alagasco customers falls into two broad categories: interruptible and firm. Interruptible service contractually is subject to interruption at Alagasco’s discretion. The most common reason for such interruption is curtailment during periods of peak core market heating demand. Customers who contract for interruptible service can generally adjust production schedules or switch to alternate fuels during periods of service interruption or curtailment. More expensive firm service, on the other hand, generally is not subject to interruption and is provided to residential and small commercial and industrial customers. These core market customers depend on natural gas primarily for space heating.

Customers: Alagasco is a mature utility operating in a slow-growth service area which includes municipalities that have in recent years experienced population declines. Alagasco's average customer count for 2012 declined approximately 0.6 percent from 2011 and reflected a moderation in decline over the five-year trend. Other factors impacting Alagasco's average customer account include recent warmer weather, enhanced credit and collection efforts and the loss of customers due to a 2011 weather event.

Seasonality: Alagasco's gas distribution business is highly seasonal since a material portion of the utility's total sales and delivery volumes relate to space heating customers. Alagasco's tariff includes a Temperature Adjustment Rider primarily for residential, small commercial and small industrial customers that moderates the impact of departures from normal temperatures on Alagasco's earnings. The adjustments are made through the GSA.

• | Environmental Matters and Climate Change |

Various federal, state and local environmental laws and regulations apply to the operations of Energen Resources and Alagasco. Historically, the cost of environmental compliance has not materially affected the Company's financial position, results of operations or cash flows. New regulations, enforcement policies, claims for damages or other events could result in significant unanticipated costs.

7

Federal, state and local legislative bodies and agencies frequently exercise their respective authority to adopt new laws and regulations and to amend and interpret existing laws and regulations. Such law and regulation changes may occur with little prior notification, subject the Company to cost increases, and impose restrictions and limitations on the Company's operations. Currently, there are various proposed law and regulatory changes with the potential to materially impact the Company. Such proposals include, but are not limited to, measures dealing with hydraulic fracturing, emission limits and reporting and the repeal of certain oil and gas tax incentives and deductions. Due to the nature of the political and regulatory processes and based on its consideration of existing proposals, the Company is unable to determine whether such proposed laws and regulations are reasonably likely to be enacted or to determine, if enacted, the magnitude of the potential impact of such laws.

Energen regularly utilizes hydraulic fracturing in its drilling and completion activities. The Company's first widespread use of hydraulic fracturing occurred during the 1980s when we successfully pioneered the exploration and development of coalbed methane in Alabama's Black Warrior Basin.

Hydraulic fracturing is a well-established reservoir stimulation technique used throughout the oil and gas industry for more than 60 years. After a well has been drilled, hydraulic fracturing is used during the completion process to form small fractures in the target formation through which the natural gas or oil can flow. The fractures are created when a water-based fluid is pumped at a calculated rate and pressure into the natural gas- or crude oil-bearing rock. The fracture fluid is a mixture composed primarily of water and sand or inert ceramic, sand-like grains; it also contains a small percentage of special purpose chemical additives (which are highly diluted-typically less than 1% by volume) that can vary by project. The carefully designed, millimeter-thick cracks or fractures in the target formation are propped open by the sand, thereby allowing the natural gas or crude oil to flow from tight (low permeability) reservoirs into the well bore.

Various states in which we operate have adopted a variety of well construction, set back, and disclosure regulations limiting how drilling can be performed and requiring various degrees of chemical and water usage disclosure for operators that employ hydraulic fracturing. We are complying with these additional regulations as part of our routine operations and within the normal execution of our business plan. The adoption of additional federal or state regulations, however, could impose significant new costs and challenges. For example, adoption of new hydraulic fracturing permitting requirements could significantly delay or prevent new drilling. Adoption of new regulatory restrictions on the use of hydraulic fracturing could reduce the amount of oil and gas that we are able to recover from our reserves. The degree to which additional oil and gas industry regulation may impact our future operations and results will depend on the extent to which we utilize the regulated activity and whether the geographic locations in which we operate are subject to the new regulation.

Existing federal, state and local environmental laws and regulations also have the potential to increase costs, reduce liquidity, delay operations and otherwise alter business operations. These existing laws and regulations include, but are not limited to, the Clean Air Act; the Clean Water Act; Oil Pollution Prevention: Spill Prevention, Control, and Countermeasure regulations; Toxic Substances Control Act; Resource Conservation and Recovery Act; and the Federal Endangered Species Act. Compliance with these and other environmental laws and regulations is undertaken as part of the Company’s routine operations. The Company does not separately track costs associated with these routine compliance activities.

Climate change, whether arising through natural occurrences or through the impact of human activities, may have a significant impact upon the operations of Energen Resources and Alagasco. Volatile weather patterns and the resulting environmental impact may adversely impact the results of operations, financial position and cash flows of the Company. The Company is unable to predict the timing or manifestation of climate change or reliably estimate the impact to the Company. However, climate change could affect the operations of the Company as follows:

• | sustained increases or decreases to the supply and demand of oil, natural gas and natural gas liquids; |

• | positive or negative changes to usage and customer count at Alagasco from prolonged increases or decreases in average temperature for Alagasco’s central and north Alabama service territory; |

• | potential disruption to third party facilities to which Energen Resources delivers and from which Alagasco is served. Such facilities include third party oil and gas gathering, transportation, processing and storage facilities and are typically limited in number and geographically concentrated. |

Alagasco is in the chain of title of nine former manufactured gas plant sites, four of which it still owns, and five former manufactured gas distribution sites, one of which it still owns and is the subject of a recent inquiry discussed below. Also discussed below is the recent completion of a removal action at the Huntsville, Alabama manufactured gas plant site. An investigation of the sites does not indicate the present need for other remediation activities and management expects that, should remediation of any such sites be required in the future, Alagasco's share, if any, of such costs will not materially affect the financial position of Alagasco.

8

In May 2012, Alagasco received from the United States Environmental Protection Agency (EPA) a Request for information Pursuant to Section 104 of CERCLA relating to the EPA's investigation of a site which it refers to as the 35th Avenue Superfund Site in and around Birmingham, Jefferson County, Alabama. The inquiry requests information about a parcel owned by Alagasco and located in the vicinity of the 35th Avenue site. The parcel is the former site of a manufactured gas distribution facility. Alagasco has responded to the inquiry.

In June 2009, Alagasco received a General Notice Letter from the EPA identifying Alagasco as a responsible party for a former manufactured gas plant (MGP) site located in Huntsville, Alabama, and inviting Alagasco to enter an Administrative Settlement Agreement and Order on Consent to perform a removal action at that site. The Huntsville MGP, along with the Huntsville gas distribution system, was sold by Alagasco to the City of Huntsville in 1949. While Alagasco no longer owns the Huntsville site, the Company and the current site owner entered into a Consent Order, and developed and completed during 2011 an action plan for the site. Alagasco has incurred costs associated with the site of approximately $5 million. As of December 31, 2012, the expected remaining costs are not expected to be material to the Company. Alagasco has recorded a corresponding amount, subject to APSC review guidelines, against the refundable negative salvage costs being refunded to customers.

• | Employees |

The Company has approximately 1,575 employees, of which Alagasco employs 1,087 and Energen Resources employs 488. The Company believes that its relations with employees are good.

9

ITEM 1A. RISK FACTORS

The future success and continued viability of Energen and its businesses, like any venture, is subject to many recognized and unrecognized risks and uncertainties. Such risks and uncertainties could cause actual results to differ materially from those contained in forward-looking statements made in this report and presented elsewhere by management. The following list identifies and briefly summarizes certain risk factors, and should not be viewed as complete or comprehensive. The Company undertakes no obligation to correct or update such risk factors whether as a result of new information, future events or otherwise. These risk factors should be read in conjunction with the Company’s disclosure specific to Forward-Looking Statements made elsewhere in this report.

Commodity prices for crude oil and natural gas are volatile, and a substantial reduction in commodity prices could adversely affect the Company's results and the carrying value of its oil and natural gas properties: The Company and Alagasco are significantly influenced by commodity prices. Historical markets for natural gas, oil and natural gas liquids have been volatile. Energen Resources’ revenues, operating results, profitability and cash flows depend primarily upon the prices realized for its oil, gas and natural gas liquid production. Additionally, downward commodity price trends may impact expected cash flows from future production and potentially reduce the carrying value of Company-owned oil and natural gas properties. Alagasco’s competitive position and customer demand is significantly influenced by prices for natural gas which are passed-through to customers.

Market conditions or a downgrade in the Company's credit rating could negatively impact its cost of and ability to access capital for future development and working capital needs: The Company and its subsidiaries rely on access to credit markets. The availability and cost of credit market access is significantly influenced by market events and rating agency evaluations for both lenders and the Company. Market volatility and credit market disruption may severely limit credit availability and issuer credit ratings can change rapidly. Events negatively affecting credit ratings and credit market liquidity could increase borrowing costs or limit availability of funds to the Company.

Energen Resources' hedging activities may prevent Energen Resources from benefiting fully from price increases and expose Energen Resources to other risks, including counterparty credit risk: Although Energen Resources makes use of futures, swaps, options, collars and fixed-price contracts to mitigate price risk, fluctuations in future oil, gas and natural gas liquids prices could materially affect the Company's financial position, results of operations and cash flows; furthermore, such risk mitigation activities may cause the Company's financial position and results of operations to be materially different from results that would have been obtained had such risk mitigation activities not occurred. The effectiveness of such risk mitigation assumes that counterparties maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that actual sales volumes will generally meet or exceed the volumes subject to the futures, swaps, options, collars and fixed-price contracts. A substantial failure to meet sales volume targets, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Energen Resources financially exposed to its counterparties and result in material adverse financial consequences to Energen Resources and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Energen Resources' position. In addition, various existing and pending financial reform rules and regulations could have an adverse effect on the ability of Energen Resources to use derivative instruments which could have a material adverse effect on our financial position, results of operations and cash flows.

The Company is exposed to counterparty credit risk as a result of its concentrated customer base: Revenues and related accounts receivable from oil and gas operations primarily are generated from the sale of produced oil, natural gas and natural gas liquids to a small number of energy marketing companies. Such sales are typically made on an unsecured credit basis with payment due the month following delivery. This concentration of sales to a limited number of customers in the energy marketing industry has the potential to affect the Company's overall exposure to credit risk, either positively or negatively, based on changes in economic, industry or other conditions specific to a single customer or to the energy marketing industry generally. Energen Resources considers the credit quality of its customers and, in certain instances, may require credit assurances such as a deposit, letter of credit or parent guarantee.

The Company's operations depend upon the use of third party facilities and an interruption of its ability to utilize these facilities may adversely affect its financial condition and results of operations: Energen Resources delivers to and Alagasco is served by third party facilities. These facilities include third party oil and gas gathering, transportation, processing and storage facilities. Energen Resources relies upon such facilities for access to markets for its production. Alagasco relies upon such facilities for access to natural gas supplies. Such facilities are typically limited in number and geographically concentrated. An extended interruption of access to or service from these facilities, whether caused by weather events, natural disaster, accident, mechanical failure, criminal act or otherwise could result in material adverse financial consequences to Energen Resources, Alagasco and the Company.

10

The Company's oil and natural gas reserves are estimates, and actual future production may vary significantly and may also be negatively impacted by its inability to invest in production on planned timelines: There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and in projecting future rates of production and timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserve and production estimates. In the event Energen Resources is unable to fully invest its planned development, acquisition and exploratory expenditures, future operating revenues, production, and proved reserves could be negatively affected. The drilling of development and exploratory wells can involve significant risks, including those related to timing, success rates and cost overruns, and these risks can be affected by lease and rig availability, complex geology and other factors. Anticipated drilling plans and capital expenditures may also change due to weather, manpower and equipment availability, changing emphasis by management and a variety of other factors which could result in actual drilling and capital expenditures being substantially different than currently planned.

The Company's operations involve operational risk including risk of personal injury, property damage and environmental damage and its insurance policies do not cover all such risks: Inherent in the oil and gas production activities of Energen Resources and the gas distribution activities of Alagasco are a variety of hazards and operation risks, such as:

• | Pipeline and storage leaks, ruptures and spills; |

• | Equipment malfunctions and mechanical failures; |

• | Fires and explosions; |

• | Well blowouts, explosions and cratering; and |

• | Soil, surface water or groundwater contamination from petroleum constituents, hydraulic fracturing fluid, or produced water. |

Such events could result in loss of human life, significant damage to property, environmental pollution, impairment of operations and substantial financial losses. The location of certain of our pipeline and storage facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from these risks. In accordance with customary industry practices, the Company maintains insurance against some, but not all, of these risks and losses and the insurance coverages are subject to retention levels and coverage limits. The occurrence of any of these events could adversely affect Energen Resources', Alagasco's and the Company's financial positions, results of operations and cash flows.

Alagasco operates in a limited service territory and is therefore subject to concentrated regional risks which may negatively affect Alagasco's financial condition and results of operations: Alagasco’s utility customers are geographically concentrated in central and north Alabama. Significant economic, weather, natural disaster, criminal act or other events that adversely affect this region could adversely affect Alagasco and the Company.

The Company is subject to numerous federal, state and local laws and regulations that may require significant expenditures or impose significant restrictions on its operations: Energen and Alagasco are subject to extensive federal, state and local regulation which significantly influences operations. Although the Company believes that operations generally comply with applicable laws and regulations, failure to comply could result in the suspension or termination of operations and subject the Company to administrative, civil and criminal penalties. Federal, state and local legislative bodies and agencies frequently exercise their respective authority to adopt new laws and regulations and to amend, modify and interpret existing laws and regulations. Such changes can subject the Company to significant tax or cost increases and can impose significant restrictions and limitations on the Company's operations.

The Company's business could be negatively impacted by security threats, including cybersecurity threats, and related disruptions: The Company relies on its information technology infrastructure to process, transmit and store electronic information critical for the efficient operation of its business and day-to-day operations. All information systems are potentially vulnerable to security threats, including hacking, viruses, other malicious software, and other unlawful attempts to disrupt or gain access to such systems. Breaches in the Company's information technology infrastructure could lead to a material disruption in its business, including the theft, destruction, loss, misappropriation or release of confidential data or other business information, and may have a material adverse effect on the Company's operations, financial position and results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

11

ITEM 2. PROPERTIES

The corporate headquarters of Energen, Energen Resources and Alagasco are located in leased office space in Birmingham, Alabama. See the discussion under Item 1, Business, for further information related to Energen Resources’ and Alagasco’s business operations. Information concerning Energen Resources' production and reserves is summarized in the table below and included in Note 17, Oil and Gas Operations (Unaudited), in the Notes to Financial Statements. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the future outlook and expectations for Energen Resources and Alagasco and additional information regarding Energen Resources’ production, revenue and production costs.

Oil and Gas Operations

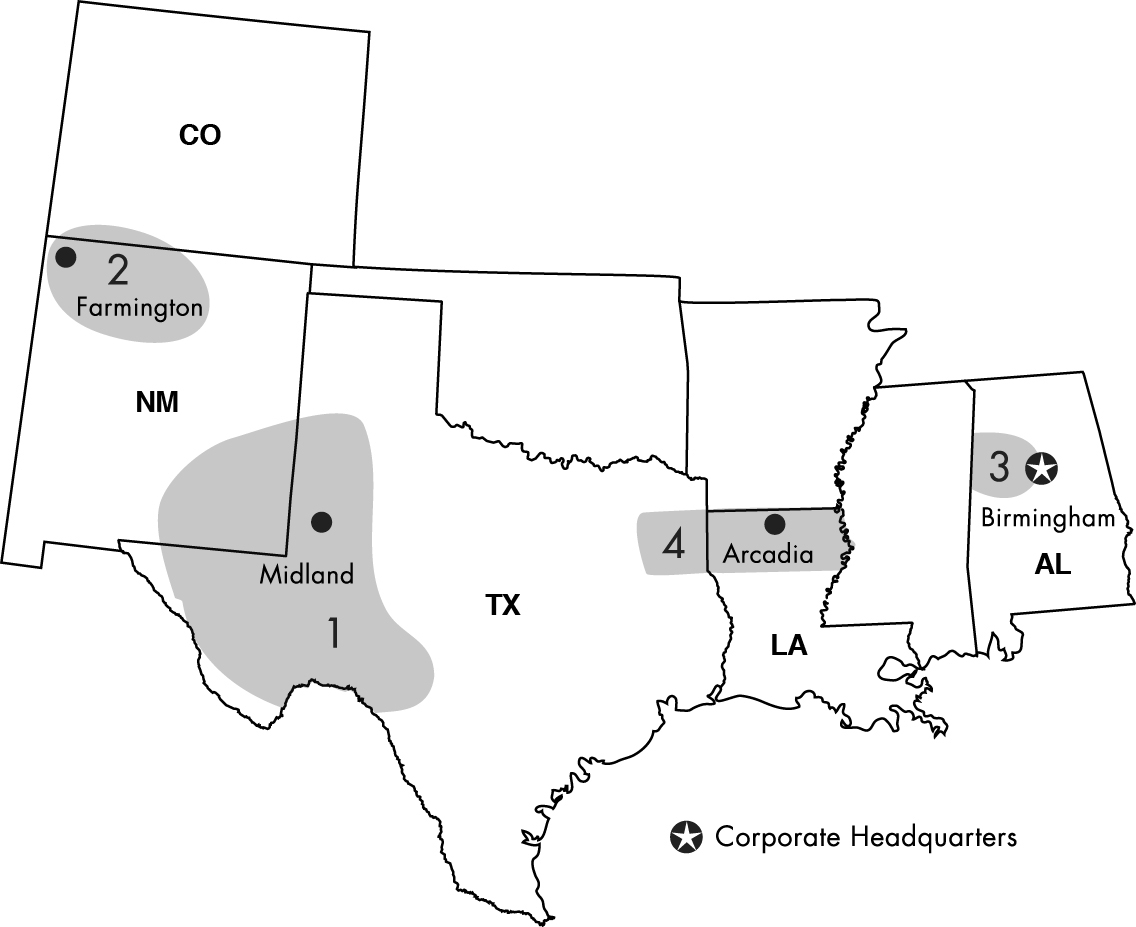

Energen Resources focuses on increasing its production and proved reserves through the acquisition and development of onshore North American oil and gas properties. Energen Resources maintains district offices in Midland, Texas; Farmington, New Mexico; Arcadia, Louisiana; and Brookwood, Alabama.

The major areas of operations include (1) the Permian Basin, (2) the San Juan Basin, (3) the Black Warrior Basin and (4) North Louisiana/East Texas as highlighted on the above map.

The following table sets forth the production volumes, proved reserves and reserves-to-production ratio by area:

Year ended | |||||

December 31, 2012 | December 31, 2012 | December 31, 2012 | |||

Production Volumes (MBOE) | Proved Reserves (MBOE) | Reserves-to-Production Ratio | |||

Permian Basin | 11,198 | 225,006 | 20.09 years | ||

San Juan Basin | 9,921 | 100,910 | 10.17 years | ||

Black Warrior Basin | 2,120 | 16,165 | 7.63 years | ||

North Louisiana/East Texas | 763 | 3,394 | 4.45 years | ||

Other | 64 | 884 | 13.81 years | ||

Total | 24,066 | 346,359 | 14.39 years | ||

12

The following table sets forth proved reserves by area as of December 31, 2012:

Gas MMcf | Oil MBbl | NGL MBbl | ||||

Permian Basin | 208,831 | 154,172 | 36,028 | |||

San Juan Basin | 478,592 | 1,017 | 20,127 | |||

Black Warrior Basin | 96,993 | — | — | |||

North Louisiana/East Texas | 20,055 | 51 | — | |||

Other | 4,657 | 108 | — | |||

Total | 809,128 | 155,348 | 56,155 | |||

The following table sets forth proved developed reserves by area as of December 31, 2012:

Gas MMcf | Oil MBbl | NGL MBbl | ||||

Permian Basin | 127,443 | 104,825 | 17,725 | |||

San Juan Basin | 459,509 | 992 | 18,715 | |||

Black Warrior Basin | 96,993 | — | — | |||

North Louisiana/East Texas | 20,055 | 51 | — | |||

Other | 4,657 | 108 | — | |||

Total | 708,657 | 105,976 | 36,440 | |||

The following table sets forth proved undeveloped reserves by area as of December 31, 2012:

Gas MMcf | Oil MBbl | NGL MBbl | ||||

Permian Basin | 81,388 | 49,347 | 18,303 | |||

San Juan Basin | 19,083 | 25 | 1,412 | |||

Black Warrior Basin | — | — | — | |||

North Louisiana/East Texas | — | — | — | |||

Total | 100,471 | 49,372 | 19,715 | |||

The following table sets forth the reconciliation of proved undeveloped reserves:

Year ended December 31, 2012 | Total MMBOE |

Balance at beginning of period | 94.6 |

Undeveloped reserves transferred to developed reserves* | (24.6) |

Revisions** | (28.2) |

Acquisitions | 10.2 |

Extensions and discoveries | 33.9 |

Balance at end of period | 85.9 |

* Reflects capital expenditures of approximately $443 million during the year ended December 31, 2012 in development of previously proved undeveloped reserves.

** The majority of the revisions relate to the five-year proved undeveloped reserve development rules (8.9 MMBOE) and to well performance (8.8 MMBOE).

Energen Resources files Form EIA-23 with the Department of Energy which reports gross proved reserves, including the working interest and royalty interest share of other owners, for properties operated by the Company. The proved reserves reported in the table above represent our share of proved reserves for all properties, based on our ownership interest in each property. For properties operated by Energen Resources, the difference between the gross proved reserves reported on Form EIA-23 and the gross reserves

13

associated with the Company-owned net proved reserves reported in the table above does not exceed five percent. Estimated proved reserves as of December 31, 2012 are based upon studies for each of our properties prepared by Company engineers and audited by Ryder Scott Company, L.P. (Ryder Scott) and T. Scott Hickman and Associates, Inc. (T. Scott Hickman), independent oil and gas reservoir engineers. Calculations were prepared using geological and engineering methods generally used in the Petroleum Industry and in accordance with Securities and Exchange Commission (SEC) guidelines.

A Senior Vice President at Ryder Scott is the technical person primarily responsible for overseeing the audit of the reserves. The Senior Vice President has a Bachelor of Science degree in Mechanical Engineering and is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers. He has been an employee of Ryder Scott since 1982 and also serves as chief technical advisor of unconventional reserves evaluation. A Petroleum Consultant at T. Scott Hickman is the technical person primarily responsible for overseeing the audit of the reserves. He has a Bachelor of Science degree in Petroleum Engineering and is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers. He has been employed by T. Scott Hickman since 1983. The Vice President of Acquisitions and Reservoir Engineering is the technical person primarily responsible for overseeing reserves on behalf of Energen Resources. His background includes a Bachelor of Science degree in Mechanical Engineering and membership in the Society of Petroleum Engineers. He is a registered Professional Engineer in the State of Alabama with more than 30-years experience evaluating oil and natural gas properties and estimating reserves.

The Company relies upon certain internal controls when preparing its reserve estimations. These internal controls include review by the reservoir engineering managers to ensure the correct reserve methodology has been applied for each specific property and that the reserves are properly categorized in accordance with SEC guidelines. The reservoir engineering managers also affirm the accuracy of the data used in the reserve and associated rate forecast, provide a review of the procedures used to input pricing data and provide a review of the working and net interest factors to ensure that factors are adequately reflected in the engineering analysis.

Net production forecasts are compared to historical sales volumes to check for reasonableness, and operating costs and severance taxes calculated in the reserve report are compared to historical accounting data to help ensure proper cost estimates are used. A reserve table is generated comparing the previous year's reserves to current year reserve estimates to determine variances. This table is reviewed by the Vice President of Acquisitions and Reservoir Engineering and the Chief Operating Officer of Energen Resources. Revisions and additions are investigated and explained.

Reserve estimates of proved reserves are sent to independent reservoir engineers for audit and verification. For 2012, approximately 99 percent of all proved reserves were audited by the independent reservoir engineers which audit engineering procedures, check the reserve estimates for reasonableness and check that the reserves are properly classified.

The following table sets forth the standard pressure base in pounds-force per square inch absolute (psia) for each state in which Energen Resources has wells:

Alabama, Texas | 14.65 psia | |

Colorado | 14.73 psia | |

Louisiana, New Mexico | 15.025 psia | |

The following table sets forth the total net productive gas and oil wells by area as of December 31, 2012, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

Net Wells | Net Developed Acreage | Net Undeveloped Acreage | ||||

Permian Basin | 2,965 | 160,294 | 97,211 | |||

San Juan Basin | 1,454 | 281,179 | 20,471 | |||

Black Warrior Basin | 797 | 146,529 | 80 | |||

North Louisiana/East Texas | 175 | 20,793 | — | |||

Other | 10 | 5,902 | — | |||

Total | 5,401 | 614,697 | 117,762 | |||

The net undeveloped acreage largely relates to the recent purchase of oil properties in the Permian Basin.

14

Energen Resources sells oil, natural gas, and natural gas liquids under a variety of contractual arrangements, some of which specify the delivery of a fixed and determinable quantity (firm volumes). Energen Resources is contractually committed to deliver approximately 52 billion cubic feet (net) of natural gas through March 2014. The Company expects to fulfill delivery commitments through production of existing proved reserves.

Gas MMcf | ||

San Juan Basin | 42,790 | |

Black Warrior Basin | 9,222 | |

Total | 52,012 | |

Natural Gas Distribution

The properties of Alagasco consist primarily of its gas distribution system, which includes approximately 11,298 miles of main and more than 11,899 miles of service lines, odorization and regulation facilities, and customer meters. Alagasco also has two LNG facilities, thirteen operation centers, two business centers, and other related property and equipment, some of which are leased by Alagasco.

ITEM 3. LEGAL PROCEEDINGS

Energen and its affiliates are, from time to time, parties to various pending or threatened legal proceedings. Certain of these lawsuits include claims for punitive damages in addition to other specific relief. Based upon information presently available, and in light of available legal and other defenses, contingent liabilities arising from threatened and pending litigation are not considered material in relation to the respective financial positions of Energen and its affiliates. It should be noted, however, that Energen and its affiliates conduct business in Alabama and other jurisdictions in which the magnitude and frequency of punitive or other damage awards may bear little or no relation to culpability or actual damages, thus making it difficult to predict litigation results.

On November 2, 2011 Energen Resources spudded the Cadenhead 25-1 Well (the Cadenhead Well) in Ward County, Texas. During the drilling phase, Chesapeake Exploration, LLC, notified Energen Resources that it believed it was the owner of the lease from which the Cadenhead Well was producing. Shortly thereafter, Energen Resources filed a declaratory judgment action in the District Court of Ward County, Texas to resolve the title dispute. Energen Resources has a fifty percent working interest in the Cadenhead Well. The Cadenhead Well produced approximately 63 net MBOE in 2012 and is expected to produce approximately 42 net MBOE in 2013. On January 18, 2013, a judgment was entered which was adverse to Energen Resources' claim of ownership. The Company believes the adverse ruling was incorrect, and plans to vigorously pursue all available avenues of appeal.

Other

Various other pending or threatened legal proceedings are in progress currently, and the Company has accrued a provision for the estimated liability. See the Note 7, Commitments and Contingencies, in the Notes to Financial Statements for further discussion with respect to legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES

None

15

EXECUTIVE OFFICERS OF THE REGISTRANTS

Name | Age | Position (1) |

James T. McManus, II | 54 | Chairman, Chief Executive Officer and President of Energen and Chairman and Chief Executive Officer of Alagasco (2) |

Charles W. Porter, Jr. | 48 | Vice President, Chief Financial Officer and Treasurer of Energen and Alagasco (3) |

John S. Richardson | 55 | President and Chief Operating Officer of Energen Resources (4) |

Dudley C. Reynolds | 59 | President and Chief Operating Officer of Alagasco (5) |

J. David Woodruff, Jr. | 56 | Vice President, General Counsel and Secretary of Energen and Alagasco (6) |

Russell E. Lynch, Jr. | 39 | Vice President and Controller of Energen (7) |

Notes:

(1) All executive officers of Energen have been employed by Energen or a subsidiary for the past five years. Officers serve at the pleasure of the Board of Directors.

(2) Mr. McManus has been employed by the Company in various capacities since 1986. He was elected Executive Vice President and Chief Operating Officer of Energen Resources in October 1995 and President of Energen Resources in April 1997. He was elected President and Chief Operating Officer of Energen effective January 1, 2006 and Chief Executive Officer of Energen and each of its subsidiaries effective July 1, 2007. He was elected Chairman of the Board of Energen and each of its subsidiaries effective January 1, 2008. Mr. McManus serves as a Director of Energen and each of its subsidiaries.

(3) Mr. Porter has been employed by the Company in various financial capacities since 1989. He was elected Controller of Energen Resources in 1998. In 2001, he was elected Vice President – Finance of Energen Resources. He was elected Vice President, Chief Financial Officer and Treasurer of Energen and each of its subsidiaries effective January 1, 2007.

(4) Mr. Richardson has been employed by the Company in various capacities since 1985. He was elected Vice President – Acquisitions and Engineering of Energen Resources in 1997. He was elected Executive Vice President and Chief Operating Officer of Energen Resources effective January 1, 2006. He was elected President and Chief Operating Officer of Energen Resources effective January 23, 2008.

(5) Mr. Reynolds has been employed by the Company in various capacities since 1980. He was elected General Counsel and Secretary of Energen and each of its subsidiaries in April 1991. He was elected President and Chief Operating Officer of Alagasco effective January 1, 2003.

(6) Mr. Woodruff has been employed by the Company in various capacities since 1986. He was elected Vice President-Legal and Assistant Secretary of Energen and each of its subsidiaries in April 1991. He was elected General Counsel and Secretary of Energen and each of its subsidiaries effective January 1, 2003. He also served as Vice President-Corporate Development of Energen from 1995 to 2010.

(7) Mr. Lynch has been employed by the Company in various capacities since 2001. He became Energen’s Director of Financial Accounting in 2007. He was elected Vice President and Controller of Energen effective January 1, 2009.

16

PART II

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Quarterly Market Prices and Dividends Paid Per Share | ||||

Quarter ended (in dollars) | High | Low | Close | Dividends Paid |

March 31, 2011 | 63.83 | 48.62 | 63.12 | 0.135 |

June 30, 2011 | 65.44 | 53.79 | 56.50 | 0.135 |

September 30, 2011 | 62.50 | 38.84 | 40.89 | 0.135 |

December 31, 2011 | 53.24 | 37.22 | 50.00 | 0.135 |

March 31, 2012 | 58.24 | 47.33 | 49.15 | 0.14 |

June 30, 2012 | 53.28 | 40.13 | 45.13 | 0.14 |

September 30, 2012 | 55.59 | 43.81 | 52.41 | 0.14 |

December 31, 2012 | 54.77 | 41.38 | 45.09 | 0.14 |

Energen's common stock is listed on the New York Stock Exchange under the symbol EGN. On February 15, 2013, there were 5,467 holders of record of Energen's common stock. At the date of this filing, Energen Corporation owned all the issued and outstanding common stock of Alabama Gas Corporation. Energen expects to pay annual cash dividends of $0.58 per share on the Company’s common stock in 2013. The amount and timing of all dividend payments is subject to the discretion of the Board of Directors and is based upon business conditions, results of operations, financial conditions and other factors.

The following table summarizes information concerning securities authorized for issuance under equity compensation plans as of December 31, 2012:

Plan Category | Number of Securities to be Issued for Outstanding Options and Performance Share Awards | Weighted Average Exercise Price | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |||

Equity compensation plans approved by security holders* | 1,648,475 | $ | 47.58 | 4,288,140 | ||

Equity compensation plans not approved by security holders | — | — | — | |||

Total | 1,648,475 | $ | 47.58 | 4,288,140 | ||

* These plans include 3,418,881 shares associated with the Company’s Stock Incentive Plan, 162,904 shares associated with the 1992 Energen Corporation Directors Stock Plan and 706,355 shares associated with the 1997 Deferred Compensation Plan.

The following table summarizes information concerning purchases of equity securities by the issuer:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that May Yet Be Purchased Under the Plans** | |||||

October 1, 2012 through October 31, 2012 | 943* | $ | 51.55 | — | 8,992,700 | ||||

November 1, 2012 through November 30, 2012 | — | — | — | 8,992,700 | |||||

December 1, 2012 through December 31, 2012 | — | — | — | 8,992,700 | |||||

Total | 943 | $ | 51.55 | — | 8,992,700 | ||||

* Acquired in connection with tax withholdings and payment of exercise price on stock compensation plans.

** By resolution adopted May 24, 1994, and supplemented by resolutions adopted April 26, 2000 and June 24, 2006, the Board of Directors authorized the Company to repurchase up to 12,564,400 shares of the Company's common stock. The resolutions do not have an expiration date.

17

PERFORMANCE GRAPH

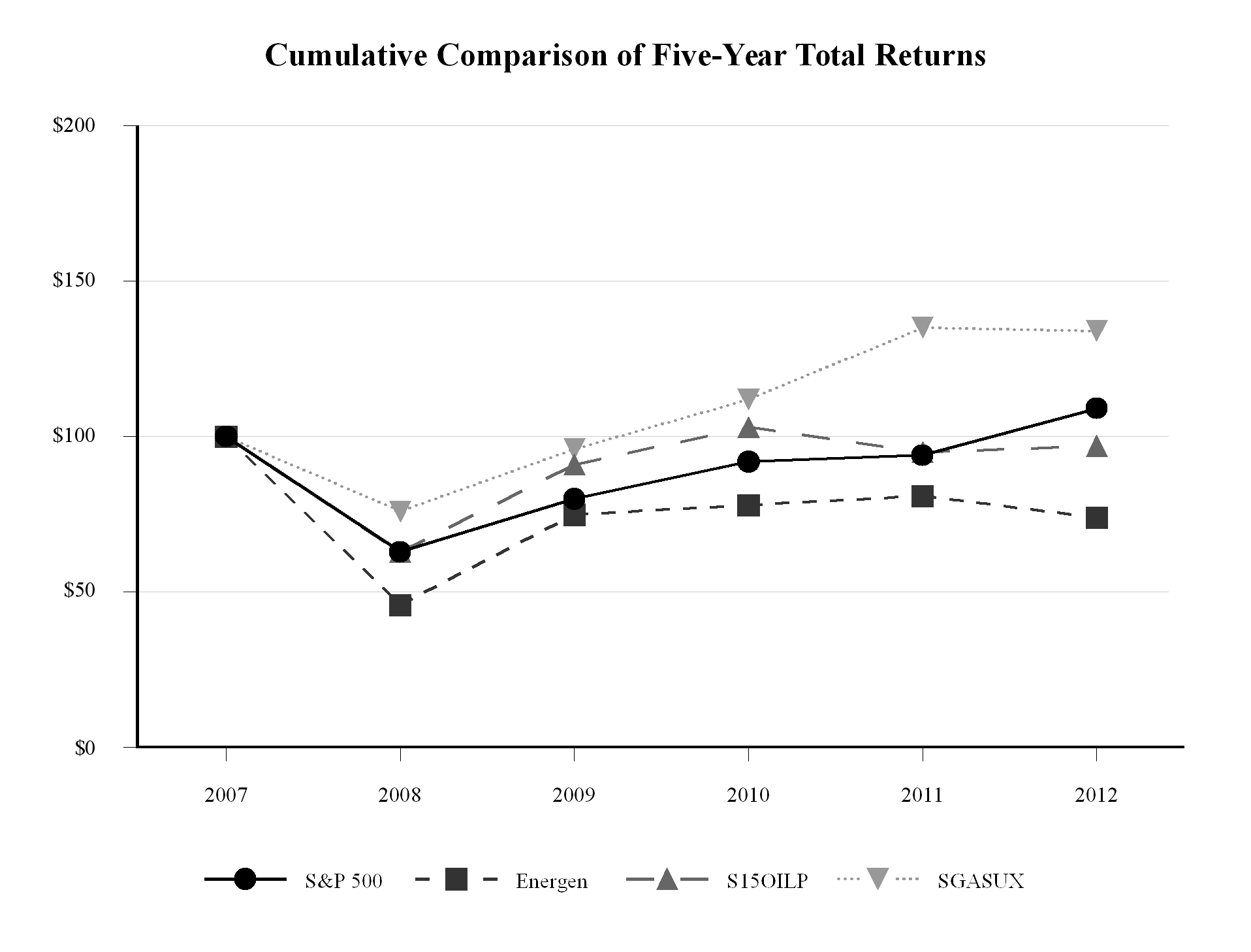

Energen Corporation — Comparison of Five-Year Cumulative Shareholder Returns

This graph compares the total shareholder returns of Energen, the Standard & Poor’s Composite Stock Index (S&P 500), the Standard & Poor’s Supercomposite Oil & Gas Exploration & Production Index (S15OILP), and the Standard & Poor’s Supercomposite Gas Utilities Index (S15GASUX). The graph assumes $100 invested at the per-share closing price of the common stock on the New York Exchange Composite Tape on December 31, 2007, in the Company and each of the indices. Total shareholder return includes reinvested dividends.

As of December 31, | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||

S&P 500 | $ | 100 | $ | 63 | $ | 80 | $ | 92 | $ | 94 | $ | 109 | ||||||

Energen | $ | 100 | $ | 46 | $ | 75 | $ | 78 | $ | 81 | $ | 74 | ||||||

S15OILP | $ | 100 | $ | 63 | $ | 91 | $ | 103 | $ | 95 | $ | 97 | ||||||

S15GASUX | $ | 100 | $ | 76 | $ | 96 | $ | 112 | $ | 135 | $ | 134 | ||||||

18

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data as set forth below should be read in conjunction with the Consolidated Financial Statements and the Notes to Financial Statements included in this Form 10-K.

SELECTED FINANCIAL AND COMMON STOCK DATA

Energen Corporation

Years ended December 31, (dollars in thousands, except per share amounts) | 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||

INCOME STATEMENT | |||||||||||||||||||

Operating revenues | $ | 1,617,169 | $ | 1,483,479 | $ | 1,578,534 | $ | 1,440,420 | $ | 1,568,910 | |||||||||

Net income | $ | 253,562 | $ | 259,624 | $ | 290,807 | $ | 256,325 | $ | 321,915 | |||||||||

Diluted earnings per average common share | $ | 3.51 | $ | 3.59 | $ | 4.04 | $ | 3.57 | $ | 4.47 | |||||||||

BALANCE SHEET | |||||||||||||||||||

Total property, plant and equipment, net | $ | 5,541,636 | $ | 4,620,776 | $ | 3,719,227 | $ | 3,144,469 | $ | 2,867,648 | |||||||||

Total assets | $ | 6,175,890 | $ | 5,237,416 | $ | 4,363,560 | $ | 3,803,118 | $ | 3,775,404 | |||||||||

Long-term debt | $ | 1,103,528 | $ | 1,153,700 | $ | 405,254 | $ | 410,786 | $ | 561,631 | |||||||||

Total shareholders' equity | $ | 2,676,690 | $ | 2,432,163 | $ | 2,154,043 | $ | 1,988,243 | $ | 1,913,920 | |||||||||

COMMON STOCK DATA | |||||||||||||||||||

Cash dividends paid per common share | $ | 0.56 | $ | 0.54 | $ | 0.52 | $ | 0.50 | $ | 0.48 | |||||||||

Diluted average common shares outstanding (000) | 72,316 | 72,332 | 72,051 | 71,885 | 72,030 | ||||||||||||||

Price range: | |||||||||||||||||||

High | $ | 58.24 | $ | 65.44 | $ | 49.94 | $ | 48.89 | $ | 79.57 | |||||||||

Low | $ | 40.13 | $ | 37.22 | $ | 40.25 | $ | 23.18 | $ | 23.00 | |||||||||

Close | $ | 45.09 | $ | 50.00 | $ | 48.26 | $ | 46.80 | $ | 29.33 | |||||||||

19

SELECTED BUSINESS SEGMENT DATA

Energen Corporation

Years ended December 31, (dollars in thousands) | 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||

OIL AND GAS OPERATIONS | |||||||||||||||||||

Operating revenues | |||||||||||||||||||

Natural gas | $ | 288,979 | $ | 386,894 | $ | 483,935 | $ | 460,370 | $ | 536,283 | |||||||||

Oil | 790,345 | 467,320 | 404,625 | 284,750 | 292,908 | ||||||||||||||

Natural gas liquids | 85,938 | 87,466 | 65,161 | 67,254 | 68,216 | ||||||||||||||

Other | 318 | 6,846 | 5,041 | 10,172 | 16,725 | ||||||||||||||

Total | $ | 1,165,580 | $ | 948,526 | $ | 958,762 | $ | 822,546 | $ | 914,132 | |||||||||

Non-cash mark-to-market gains (losses) (included in operating revenues above) | |||||||||||||||||||

Natural gas | $ | (515 | ) | $ | — | $ | — | $ | — | $ | 348 | ||||||||

Oil | 58,786 | (37,473 | ) | (3 | ) | (107 | ) | — | |||||||||||

Natural gas liquids | 479 | (114 | ) | — | — | — | |||||||||||||

Total | $ | 58,750 | $ | (37,587 | ) | $ | (3 | ) | $ | (107 | ) | $ | 348 | ||||||

Production volumes | |||||||||||||||||||

Natural gas (MMcf) | 76,362 | 71,718 | 70,924 | 72,337 | 67,573 | ||||||||||||||

Oil (MBbl) | 8,766 | 6,318 | 5,131 | 4,690 | 4,114 | ||||||||||||||

Natural gas liquids (MMgal) | 108.1 | 91.4 | 79.0 | 75.2 | 70.7 | ||||||||||||||

Total production volumes (MBOE) | 24,066 | 20,448 | 18,832 | 18,537 | 17,059 | ||||||||||||||

Proved reserves | |||||||||||||||||||

Natural gas (MMcf) | 809,128 | 957,368 | 954,387 | 897,546 | 1,038,453 | ||||||||||||||

Oil (MBbl) | 155,348 | 129,578 | 103,262 | 77,963 | 62,034 | ||||||||||||||

Natural gas liquids (MBbl) | 56,155 | 53,957 | 40,601 | 30,257 | 28,953 | ||||||||||||||

Total (MMcfe) | 2,078,154 | 2,058,594 | 1,817,565 | 1,546,866 | 1,584,375 | ||||||||||||||

Total (MBOE) | 346,359 | 343,099 | 302,928 | 257,811 | 264,063 | ||||||||||||||

Other data | |||||||||||||||||||

Lease operating expense | |||||||||||||||||||

Lease operating expense and other | $ | 250,497 | $ | 202,094 | $ | 182,180 | $ | 181,777 | $ | 174,127 | |||||||||

Production taxes | 55,878 | 54,951 | 42,721 | 35,652 | 62,552 | ||||||||||||||

Total | $ | 306,375 | $ | 257,045 | $ | 224,901 | $ | 217,429 | $ | 236,679 | |||||||||

Depreciation, depletion and amortization | $ | 377,328 | $ | 244,081 | $ | 203,823 | $ | 184,089 | $ | 139,539 | |||||||||

Asset impairment | $ | 21,545 | $ | — | $ | — | $ | — | $ | — | |||||||||

Capital expenditures | $ | 1,291,211 | $ | 1,115,452 | $ | 717,782 | $ | 427,399 | $ | 449,571 | |||||||||

Exploration expense | $ | 19,363 | $ | 13,110 | $ | 64,584 | $ | 10,234 | $ | 9,296 | |||||||||

Operating income | $ | 367,243 | $ | 363,131 | $ | 406,729 | $ | 353,645 | $ | 482,588 | |||||||||

NATURAL GAS DISTRIBUTION | |||||||||||||||||||