Schedule 14A Information

Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934

(Amendment No. _)

(Amendment No. _)

|

Filed by the Registrant

|

[X]

|

|

Filed by a Party other than the Registrant

|

[ ]

|

Check the appropriate box:

|

[X]

|

Preliminary Proxy Statement

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

||

|

[ ]

|

Definitive Additional Materials

|

||

|

[ ]

|

Soliciting Material under Section 240.14a-12

|

FRANKLIN CALIFORNIA TAX-FREE INCOME FUND

FRANKLIN CALIFORNIA TAX-FREE TRUST

FRANKLIN CUSTODIAN FUNDS

FRANKLIN FEDERAL TAX-FREE INCOME FUND

FRANKLIN FUND ALLOCATOR SERIES

FRANKLIN GLOBAL TRUST

FRANKLIN GOLD AND PRECIOUS METALS FUND

FRANKLIN HIGH INCOME TRUST

FRANKLIN INVESTORS SECURITIES TRUST

FRANKLIN MUNICIPAL SECURITIES TRUST

FRANKLIN NEW YORK TAX-FREE INCOME FUND

FRANKLIN NEW YORK TAX-FREE TRUST

FRANKLIN REAL ESTATE SECURITIES TRUST

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FRANKLIN STRATEGIC SERIES

FRANKLIN TAX-FREE TRUST

FRANKLIN TEMPLETON GLOBAL TRUST

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FRANKLIN TEMPLETON MONEY FUND TRUST

FRANKLIN U.S. GOVERNMENT MONEY FUND

INSTITUTIONAL FIDUCIARY TRUST

THE MONEY MARKET PORTFOLIOS

TEMPLETON CHINA WORLD FUND

TEMPLETON FUNDS

TEMPLETON GLOBAL INVESTMENT TRUST

TEMPLETON GLOBAL OPPORTUNITIES TRUST

TEMPLETON GLOBAL SMALLER COMPANIES FUND

TEMPLETON INCOME TRUST

TEMPLETON INSTITUTIONAL FUNDS

(Name of Registrant as Specified in its Charter)

Name of Person(s) Filing Proxy Statement, other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

|

Franklin California Tax-Free Income Fund

Franklin California Tax-Free Trust

Franklin Custodian Funds

Franklin Federal Tax-Free Income Fund

Franklin Fund Allocator Series

Franklin Global Trust

Franklin Gold and Precious Metals Fund

Franklin High Income Trust

Franklin Investors Securities Trust

Franklin Municipal Securities Trust

|

Franklin New York Tax-Free Income Fund

Franklin New York Tax-Free Trust

Franklin Real Estate Securities Trust

Franklin Strategic Mortgage Portfolio

Franklin Strategic Series

Franklin Tax-Free Trust

Franklin Templeton International Trust

Franklin Templeton Global Trust

Franklin Templeton Money Fund Trust

Franklin U.S. Government Money Fund

|

Institutional Fiduciary Trust

The Money Market Portfolios

Templeton China World Fund

Templeton Funds

Templeton Global Investment Trust

Templeton Global Opportunities Trust

Templeton Global Smaller Companies Fund

Templeton Income Trust

Templeton Institutional Funds

|

A Special Joint Meeting of Shareholders of the Franklin Templeton funds listed above (collectively, the "Trusts" and, individually, a "Trust"), including their various series (collectively, the "Funds" and, individually, a "Fund"), will be held on October 30, 2017, to vote on several important proposals that affect the Funds. Please read the enclosed materials and cast your vote on the proxy card(s) or voting instruction form(s).

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

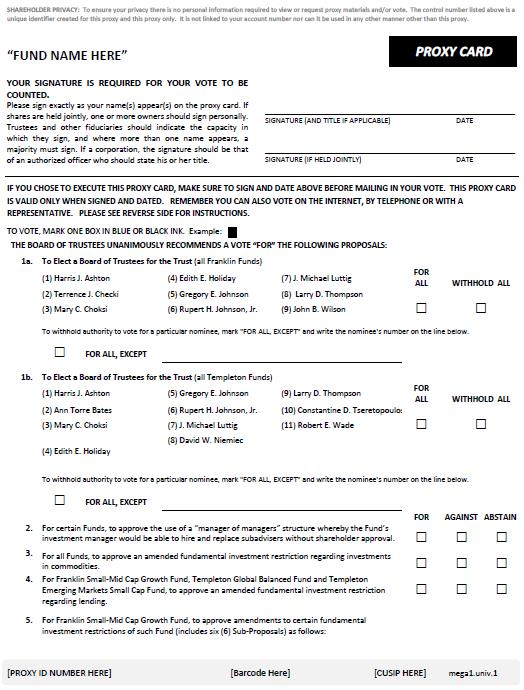

The proposals for each Trust and Fund have been carefully reviewed by the Board of Trustees (each, a "Board," and together, the "Boards") of the relevant Trust. The Trustees of a Trust, most of whom are not affiliated with Franklin Templeton Investments, are responsible for looking after your interests as a shareholder of a Fund. Each Trust's Board believes proposals 1-6, as they relate to each Trust and/or Fund, are in the best interests of shareholders, and proposals 7a-7c and 8a-8e are not in the best interests of shareholders. The Board of each Trust unanimously recommends that you vote FOR proposals 1-6 and AGAINST proposals 7a-7c and 8a-8e.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) or voting instruction form(s) enclosed in this package. Be sure to sign the card(s) or the form(s) before mailing it (them) in the postage-paid envelope. If eligible, you may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s) or voting instruction form(s), and follow the instructions.

We welcome your comments. If you have any questions or would like to quickly vote your shares, please call AST Fund Solutions, LLC, our proxy solicitor, toll-free at 800-967-5068. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. – 4:00 p.m., Eastern time, Saturday. Thank you for your participation in this important initiative.

The following Q&A is provided to assist you in understanding the proposals that affect your Fund(s). The proposals are described in greater detail in the enclosed proxy statement. We appreciate your trust in Franklin Templeton Investments and look forward to continuing to help you achieve your financial goals.

Q&A

1

Important information to help you understand and vote on the proposals

Below is a brief overview of the proposals to be voted upon. The proxy statement provides more information on which proposals are to be voted upon by each Fund's shareholders. Your vote is important, no matter how large or small your holdings may be.

On what issues am I being asked to vote?

Shareholders are being asked to vote on the following proposals:

| 1. |

For each Trust, to elect a Board of Trustees for the Trust.

|

| 2. |

For each Fund1, to approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval.

|

| 3. |

For all Funds, to approve an amended fundamental investment restriction regarding investments in commodities.

|

| 4. |

For Franklin Small-Mid Cap Growth Fund, Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund, to approve an amended fundamental investment restriction regarding lending.

|

| 5. |

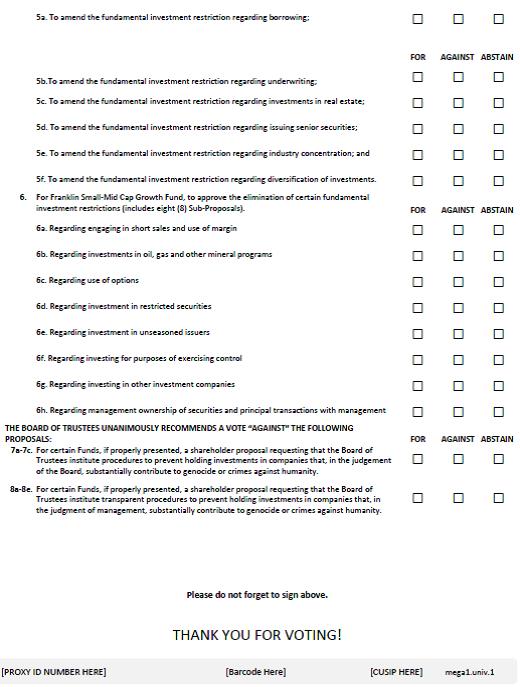

For Franklin Small-Mid Cap Growth Fund, to approve amendments to certain fundamental investment restrictions, as more fully specified in Exhibit G to the proxy statement (includes six (6) sub-proposals).

|

| 6. |

For Franklin Small-Mid Cap Growth Fund, to approve the elimination of certain fundamental investment restrictions, as more fully specified in Exhibit H to the proxy statement (includes eight (8) sub-proposals).

|

| 7a-7c. |

If properly presented, for Franklin High Yield Tax-Free Income Fund, Templeton Global Bond Fund and Franklin High Income Fund, a shareholder proposal that such Funds' Boards institute procedures to prevent holding investments in companies that, in the judgment of each Board, substantially contribute to genocide or crimes against humanity.

|

| 8a-8e. |

If properly presented, for Franklin Federal Intermediate-Term Tax-Free Income Fund, Franklin Growth Fund, Franklin Income Fund, Franklin High Income Fund, and Franklin California Tax-Free Income Fund, a shareholder proposal that such Funds' Boards institute transparent

|

| 1 |

Excluding Franklin Corefolio Allocation Fund, Franklin Focused Growth Fund, Franklin Flexible Alpha Bond Fund, Franklin Founding Funds Allocation Fund, Franklin Global Listed Infrastructure Fund, Franklin India Growth Fund, Franklin LifeSmart Retirement Income Fund, Franklin NextStep Funds, Franklin Payout Funds, Franklin Templeton Money Fund Trust, Franklin U.S. Government Money Fund, Institutional Fiduciary Trust, Templeton Foreign Smaller Companies Fund, Templeton Global Currency Fund and Templeton Global Smaller Companies Fund.

|

Q&A

2

procedures to prevent holding investments in companies that, in the judgment of management, substantially contribute to genocide or crimes against humanity.

Has the Board of each Trust approved the proposals that relate to that Trust or its Funds?

The Boards have unanimously approved proposals 1 through 6 and recommend that you vote to approve proposals 1-6, as they apply to your Fund(s). The Boards have not approved proposals 7a-7c or 8a-8e and recommend that you vote AGAINST those proposals that apply to your Fund(s).

1. For each Trust, to elect a Board of Trustees for the Trust.

What role does the Board play?

The Board of each Trust has the responsibility for looking after the interests of the shareholders of the Funds comprising that Trust. As such, the Board has an obligation to serve the best interests of shareholders in providing oversight of a Fund, including approving policy changes. In addition, the Board, among other things, reviews a Fund's performance, oversees a Fund's activities, and reviews contractual arrangements with a Fund's service providers.

What is the affiliation of the Board and Franklin Templeton Investments?

Each Board is currently, and is proposed to continue to be, composed of over 75% "independent" trustees and two "interested" trustees. Trustees are determined to be "interested" by virtue of, among other things, their affiliation with the Franklin Templeton funds or with Franklin Templeton Investments as fund management. Independent trustees have no affiliation with Franklin Templeton Investments and are compensated by each individual Trust that they serve.

2. For each Fund2, to approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval.

What is the purpose of the Manager of Managers Structure?

Shareholders of each Fund are being asked to approve the use of a "manager of managers" structure that would permit the Fund's investment manager, subject to Board approval, to appoint and replace subadvisers that are affiliated with Franklin Templeton Investments, and subadvisers that are not affiliated with Franklin Templeton Investments, without obtaining prior shareholder approval (the "Manager of Managers Structure"). The Manager of Managers Structure would enable each Fund to operate with greater efficiency in the future by allowing the Fund to use both affiliated and unaffiliated subadvisers

| 2 |

Excluding Franklin Corefolio Allocation Fund, Franklin Focused Growth Fund, Franklin Flexible Alpha Bond Fund, Franklin Founding Funds Allocation Fund, Franklin Global Listed Infrastructure Fund, Franklin India Growth Fund, Franklin LifeSmart Retirement Income Fund, Franklin NextStep Funds, Franklin Payout Funds, Franklin Templeton Money Fund Trust, Franklin U.S. Government Money Fund, Institutional Fiduciary Trust, Templeton Foreign Smaller Companies Fund, Templeton Global Currency Fund and Templeton Global Smaller Companies Fund.

|

Q&A

3

best suited to its needs without incurring the expense and potential delays that could be associated with obtaining shareholder approvals.

How will the Manager of Managers Structure affect my Fund?

The use of the Manager of Managers Structure will not change the fees paid to the investment manager by a Fund. If the proposal is approved for a Fund, and the Trust's Board and the Fund's investment manager believe that the use of one or more subadvisers would be in the best interests of the Fund, the Fund's shareholders generally would not be asked to approve hiring a subadviser for the Fund, assuming the conditions of the Manager of Managers Order are met. Rather, a Fund's investment manager, with the approval of the Fund's Board, including a majority of the Independent Trustees, would be able to appoint subadvisers and make appropriate changes to the subadvisory agreements without seeking shareholder approval. The Fund would, however, inform shareholders of the hiring of any new subadviser within 90 days after the hiring of the subadviser. The Board of each Trust determined to seek shareholder approval of the Manager of Managers Structure for each Fund in connection with this joint special shareholder meeting, which was otherwise called for purposes of voting on other matters described in the proxy statement, to avoid additional meeting and proxy solicitation costs in the future.

3. For all Funds, to approve an amendment to the current fundamental investment restriction regarding investments in commodities.

What is the fundamental investment restriction regarding investments in commodities?

The Investment Company Act of 1940 (the "1940 Act") requires every investment company to adopt a fundamental investment policy governing investments in commodities. A "fundamental" investment policy may be modified only by a vote of a majority of the investment company's outstanding voting securities (as defined in the 1940 Act).

The Funds' current fundamental investment restrictions regarding investments in commodities are substantially similar, though not identical, and they are detailed in Exhibit F to the proxy statement.

What will be the effect of the amendment to my Fund's current fundamental investment restriction regarding investments in commodities?

Since the initial adoption of this restriction for the Funds, the financial markets and regulatory requirements regarding commodities and commodity interests have evolved. New types of financial instruments have become available as potential investment opportunities, including commodity-linked instruments. The Funds' investment managers believe that it is in the Funds' best interests to amend the current fundamental investment restrictions in order to provide the Funds with the flexibility to adapt to continuously changing regulation and to react to changes in the financial markets and the development of new investment opportunities and instruments, in accordance with each Fund's investment goal and subject to oversight by the Fund's Board. Under the proposed restriction, if current applicable law were to change, the Funds would be able to conform to any such new law without shareholders taking further action.

The Boards and the Funds' investment managers do not anticipate that the proposed amendment to each Fund's fundamental investment restriction regarding investments in commodities would involve additional material risk to any Fund or affect the way any Fund is currently managed or operated.

Q&A

4

4. For Franklin Small-Mid Cap Growth Fund (the "Small-Mid Cap Fund"), Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund, to approve an amended fundamental investment restriction regarding lending.

What is the fundamental investment restriction regarding lending?

The 1940 Act requires every investment company to adopt a fundamental policy regarding lending. Each of the Small-Mid Cap Fund, Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund is currently subject to an investment restriction that prohibits the Fund from making loans, except for certain activities that are specifically excluded from the restriction.

What will be the effect of the amendment to my fund's current fundamental investment restriction?

The purpose of the amendment is to update the fundamental lending investment restriction to place an overall limit on such lending and to provide that the Fund may not make loans if, as a result, more than 33⅓% of its total assets would be lent to other persons (including other investment companies as permitted by the 1940 Act and any exemptions therefrom).

Under U.S. Securities and Exchange Commission staff interpretations, lending by an investment company, under certain circumstances, may also give rise to issues relating to the issuance of senior securities. To the extent a Fund enters into lending transactions under these limited circumstances, such Fund will continue to be subject to the limitations imposed under the 1940 Act regarding the issuance of senior securities and the Fund's fundamental investment restriction regarding issuing senior securities. In addition, such Fund will disclose to shareholders any additional risks associated with such transactions.

5. For the Small-Mid Cap Fund, to approve amendments to certain fundamental investment restrictions, as more fully specified in Exhibit G to the proxy statement (includes six (6) sub-proposals).

What are these fundamental investment restrictions?

The Small-Mid Cap Fund is subject to certain investment restrictions (for example, relating to borrowing or investing in real estate) that are considered "fundamental" because the restrictions may only be changed with shareholder approval. There generally are eight fundamental investment restrictions that each Fund is required to have under the 1940 Act.

What will be the effect of the amendments to the Fund's current fundamental investment restrictions?

The purpose of the amendments is to update those restrictions that are more restrictive than is currently required and to standardize, to the extent practicable, all required fundamental investment restrictions across the Franklin Templeton funds. To the extent that the Small-Mid Cap Fund uses this flexibility in the future, the Fund may be subject to some additional costs and risks. However, the Fund does not currently anticipate materially changing its investment strategies if the proposed amendments to its fundamental investment restrictions are approved.

Q&A

5

6. For the Small-Mid Cap Fund, to approve the elimination of certain fundamental investment restrictions, as more fully specified in Exhibit H to the proxy statement (includes eight (8) sub-proposals).

What are these fundamental investment restrictions?

The Small-Mid Cap Fund is also subject to fundamental investment restrictions that were once imposed by state securities laws or other regulatory authorities that are now outdated or are no longer effective.

What will be the effect of the elimination of such investment restrictions on the Fund?

If the proposed eliminations are approved, it may be easier for the Small-Mid Cap Fund to adapt to market or industry changes in the future because these restrictions would be eliminated. To the extent that the Fund uses this flexibility in the future, the Fund may be subject to some additional costs and risks. However, the Fund does not currently anticipate materially changing its investment strategies if the proposed eliminations are approved.

7a-7c. If properly presented, for Franklin High Yield Tax-Free Income Fund, Templeton Global Bond Fund and Franklin High Income Fund, a shareholder proposal that such Funds' Boards institute procedures to prevent holding investments in companies that, in the judgment of each Board, substantially contribute to genocide or crimes against humanity.

Why are the Boards recommending a vote against proposals 7a-7c?

As discussed more completely in the proxy statement, the Boards believe that Franklin Templeton's investment approach, which considers these issues on a company-by-company basis, is preferable to that recommended by the shareholder proposals.

8a-8e. If properly presented, for Franklin Federal Intermediate-Term Tax-Free Income Fund, Franklin Growth Fund, Franklin Income Fund, Franklin High Income Fund, and Franklin California Tax-Free Income Fund, a shareholder proposal that such Funds' Boards institute transparent procedures to prevent holding investments in companies that, in the judgment of management, substantially contribute to genocide or crimes against humanity.

Why are the Boards recommending a vote against proposals 8a-8e?

As discussed more completely in the proxy statement, the Boards believe that Franklin Templeton's investment approach, which considers these issues on a company-by-company basis, is preferable to that recommended by the shareholder proposals.

Who is AST Fund Solutions, LLC?

AST Fund Solutions, LLC (the "Solicitor") is a company that has been engaged by the Trusts, on behalf of the Funds, to assist in the solicitation of proxies. The Solicitor is not affiliated with the Funds or with Franklin Templeton Investments. In order to hold a shareholder meeting, a certain percentage of a Fund's shares (often referred to as "quorum") must be represented at the meeting. If a quorum is not attained, the meeting must adjourn to a future date. The Funds may attempt to reach shareholders through multiple

Q&A

6

mailings to remind the shareholders to cast their vote. As the meeting approaches, phone calls may be made to shareholders who have not yet voted their shares so that the meeting does not have to be adjourned or postponed.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share (and a proportionate fractional vote for each fractional share) you own of a Fund on the record date. The record date is August 21, 2017.

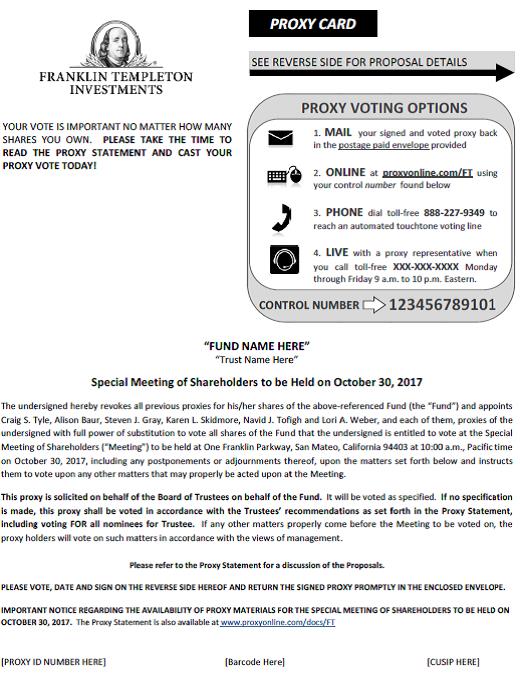

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) or voting instruction form(s) and mailing it (them) in the enclosed postage-paid envelope. If eligible, you may also vote using a touch-tone telephone by calling the toll-free number printed on your proxy card(s) or voting instruction form(s) and following the recorded instructions, or through the Internet by visiting the web site printed on your proxy card(s) or voting instruction form(s) and following the on-line instructions. You can also vote your shares in person at the special joint meeting of shareholders. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the Solicitor toll-free at 800-967-5068.

How do I sign the proxy card(s)?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card(s) or voting instruction form(s).

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name appearing on the account registration as shown on the proxy card(s) or voting instruction form(s).

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

Q&A

7

|

Franklin California Tax-Free Income Fund

Franklin California Tax-Free Trust

Franklin Custodian Funds

Franklin Federal Tax-Free Income Fund

Franklin Fund Allocator Series

Franklin Global Trust

Franklin Gold and Precious Metals Fund

Franklin High Income Trust

Franklin Investors Securities Trust

Franklin Municipal Securities Trust

|

Franklin New York Tax-Free Income Fund

Franklin New York Tax-Free Trust

Franklin Real Estate Securities Trust

Franklin Strategic Mortgage Portfolio

Franklin Strategic Series

Franklin Tax-Free Trust

Franklin Templeton Global Trust

Franklin Templeton International Trust

Franklin Templeton Money Fund Trust

Franklin U.S. Government Money Fund

|

Institutional Fiduciary Trust

The Money Market Portfolios

Templeton China World Fund

Templeton Funds

Templeton Global Investment Trust

Templeton Global Opportunities Trust

Templeton Global Smaller Companies Fund

Templeton Income Trust

Templeton Institutional Funds

|

IMPORTANT SHAREHOLDER INFORMATION

These materials are for a Special Joint Meeting of Shareholders of the Franklin and Templeton registered investment companies listed above, including their various series (the "Funds"), scheduled for October 30, 2017 at 10:00 a.m., Pacific time. The enclosed materials discuss several proposals (the "Proposals" or, each, a "Proposal") to be voted on at the meeting, and contain the Notice of Special Joint Meeting of Shareholders, proxy statement and proxy card(s). A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to the Funds in which you are invested. If you specify a vote on all Proposals on which you are entitled to vote, your proxy will be voted as you indicate. If you specify a vote for one or more Proposals on which you are entitled to vote, but not all, your proxy will be voted as specified on such Proposals and, on the Proposal(s) for which no vote is specified, your proxy will be voted in accordance with the Trustees' recommendations beginning on page __ of the proxy statement. If you simply sign, date and return the proxy card(s), but do not specify a vote on any Proposal, your proxy will be voted in accordance with the Trustees' recommendations beginning on page __ of the proxy statement.

We urge you to spend a few minutes reviewing the Proposals in the proxy statement. Then, please fill out and sign the proxy card(s) and return it (them) to us so that we know how you would like to vote. When shareholders return their proxies promptly, the Funds may be able to save money by not having to conduct additional solicitations, including other mailings. If you own shares of more than one Fund, you will receive a proxy card FOR EACH FUND in which you own shares. PLEASE COMPLETE, SIGN AND RETURN each proxy card you receive.

We welcome your comments. If you have any questions or would like to quickly vote your shares, call AST Fund Solutions, LLC, our proxy solicitor, toll free at 800-967-5068. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. – 4:00 p.m., Eastern time, Saturday.

TELEPHONE AND INTERNET VOTING

For your convenience, you may be able to vote by telephone or through the Internet,

24 hours a day. If your account is eligible, separate instructions are enclosed.

This page intentionally left blank.

|

Franklin California Tax-Free Income Fund

Franklin California Tax-Free Trust

Franklin Custodian Funds

Franklin Federal Tax-Free Income Fund

Franklin Fund Allocator Series

Franklin Global Trust

Franklin Gold and Precious Metals Fund

Franklin High Income Trust

Franklin Investors Securities Trust

Franklin Municipal Securities Trust

|

Franklin New York Tax-Free Income Fund

Franklin New York Tax-Free Trust

Franklin Real Estate Securities Trust

Franklin Strategic Mortgage Portfolio

Franklin Strategic Series

Franklin Tax-Free Trust

Franklin Templeton Global Trust

Franklin Templeton International Trust

Franklin Templeton Money Fund Trust

Franklin U.S. Government Money Fund

|

Institutional Fiduciary Trust

The Money Market Portfolios

Templeton China World Fund

Templeton Funds

Templeton Global Investment Trust

Templeton Global Opportunities Trust

Templeton Global Smaller Companies Fund

Templeton Income Trust

Templeton Institutional Funds

|

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

A Special Joint Meeting of Shareholders (the "Meeting") of certain U.S. registered Franklin and Templeton Funds listed above (together, the "Trusts," and each, a "Trust"),1 including their various series (together, the "Funds," and each, a "Fund") will be held at the Trusts' offices located at One Franklin Parkway, San Mateo, California 94403-1906 on October 30, 2017 at 10:00 a.m., Pacific time.

During the Meeting, shareholders of the Trusts will vote on the following Proposals and Sub-Proposals:

| 1. |

To elect a Board of Trustees for each Trust.

|

| 2. |

For each Fund,2 to approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval.

|

| 3. |

For all Funds, to approve an amended fundamental investment restriction regarding investments in commodities.

|

| 4. |

For Franklin Small-Mid Cap Growth Fund, Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund, to approve an amended fundamental investment restriction regarding lending.

|

| 5. |

For Franklin Small-Mid Cap Growth Fund, to approve amendments to certain fundamental investment restrictions of such Fund (includes six (6) Sub-Proposals) as follows:

|

| 1 |

Along with Franklin Templeton Variable Insurance Products Trust, Franklin ETF Trust, Franklin Managed Trust, Templeton Developing Markets Trust, Emerging Markets Series of Templeton Institutional Funds and Templeton Frontier Markets Fund of Templeton Global Investment Trust, which are issuing separate proxy solicitation materials.

|

| 2 |

Excluding Franklin Corefolio Allocation Fund, Franklin Focused Growth Fund, Franklin Flexible Alpha Bond Fund, Franklin Founding Funds Allocation Fund, Franklin Global Listed Infrastructure Fund, Franklin India Growth Fund, Franklin LifeSmart Retirement Income Fund, Franklin NextStep Funds, Franklin Payout Funds, Franklin Templeton Money Fund Trust, Franklin U.S. Government Money Fund, Institutional Fiduciary Trust, Templeton Foreign Smaller Companies Fund, Templeton Global Currency Fund and Templeton Global Smaller Companies Fund.

|

1

| a. |

To amend the fundamental investment restriction regarding borrowing;

|

| b. |

To amend the fundamental investment restriction regarding underwriting;

|

| c. |

To amend the fundamental investment restriction regarding investments in real estate;

|

| d. |

To amend the fundamental investment restriction regarding issuing senior securities;

|

| e. |

To amend the fundamental investment restriction regarding industry concentration; and

|

| f. |

To amend the fundamental investment restriction regarding diversification of investments.

|

| 6. |

For Franklin Small-Mid Cap Growth Fund, to approve the elimination of certain fundamental investment restrictions (includes eight (8) Sub-Proposals).

|

| 7a-7c. |

If properly presented, for Franklin High Yield Tax-Free Income Fund, Templeton Global Bond Fund and Franklin High Income Fund, a shareholder proposal that such Funds' Boards of Trustees institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.

|

| 8a-8e. |

If properly presented, for Franklin Federal Intermediate-Term Tax-Free Income Fund, Franklin Growth Fund, Franklin Income Fund, Franklin High Income Fund and Franklin California Tax-Free Income Fund, a shareholder proposal that such Funds' Boards of Trustees institute transparent procedures to prevent holding investments in companies that, in the judgment of management, substantially contribute to genocide or crimes against humanity.

|

|

By Order of the Boards of Trustees,

Craig S. Tyle

Vice President

|

August __, 2017

Please sign and promptly return all of the proxy card(s) or voting instruction form(s) in the enclosed self-addressed envelope, or, if eligible, vote your shares by telephone or through the Internet, regardless of the number of shares you own.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL JOINT SHAREHOLDER MEETING TO BE HELD ON OCTOBER 30, 2017

The Notice of Special Joint Meeting of Shareholders, proxy statement and form of proxy card are available on the Internet at http://www.proxyonline.com/docs/FTproxy. The form of proxy card on the Internet site cannot be used to cast your vote.

|

2

If you have any questions, would like to vote your shares, or wish to obtain directions to be able to attend the Meeting and vote in person, please call AST Fund Solutions, LLC, our proxy solicitor, toll free at 800-967-5068.

3

PROXY STATEMENT

TABLE OF CONTENTS

|

Page

|

|||

|

• INFORMATION ABOUT VOTING

|

1

|

||

|

• THE PROPOSALS

|

5

|

||

|

PROPOSAL 1:

TO ELECT A BOARD OF TRUSTEES

|

5

|

||

|

PROPOSAL 2:

TO APPROVE THE USE OF A "MANAGER OF MANAGERS" STRUCTURE WHEREBY THE FUND'S INVESTMENT MANAGER WOULD BE ABLE TO HIRE AND REPLACE SUBADVISERS WITHOUT SHAREHOLDER APPROVAL

|

26

|

||

|

PROPOSAL 3:

TO APPROVE AN AMENDED FUNDAMENTAL INVESTMENT RESTRICTION REGARDING INVESTMENTS IN COMMODITIES

|

30

|

||

|

INTRODUCTION TO PROPOSALS 4, 5 AND 6

|

31

|

||

|

PROPOSAL 4:

FOR FRANKLIN SMALL-MID CAP GROWTH FUND, TEMPLETON GLOBAL BALANCED FUND AND TEMPLETON EMERGING MARKETS SMALL CAP FUND, TO APPROVE AN AMENDED FUNDAMENTAL INVESTMENT RESTRICTION REGARDING LENDING

|

33

|

||

|

PROPOSAL 5:

FOR FRANKLIN SMALL-MID CAP GROWTH FUND, TO APPROVE AMENDMENTS TO CERTAIN FUNDAMENTAL INVESTMENT RESTRICTIONS (this Proposal involves separate votes on Sub-Proposals 5a–5f)

|

33

|

||

|

Sub-Proposal 5a:

To amend the fundamental investment restriction regarding borrowing

|

34

|

||

|

Sub-Proposal 5b:

To amend the fundamental investment restriction regarding underwriting

|

34

|

||

|

Sub-Proposal 5c:

To amend the fundamental investment restriction regarding investments in real estate

|

35

|

||

|

Sub-Proposal 5d:

To amend the fundamental investment restriction regarding issuing senior securities

|

35

|

||

|

Sub-Proposal 5e:

To amend the fundamental investment restriction regarding industry concentration

|

36

|

||

|

Sub-Proposal 5f:

To amend the fundamental investment restriction regarding diversification of investments

|

36

|

||

i

|

PROPOSAL 6:

FOR FRANKLIN SMALL-MID CAP GROWTH FUND, TO APPROVE THE ELIMINATION OF CERTAIN FUNDAMENTAL INVESTMENT RESTRICTIONS (this Proposal involves separate votes on Sub-Proposals 6a-6h)

|

37

|

||

|

Sub-Proposal 6a:

To eliminate the fundamental investment restriction regarding engaging in short sales and use of margin

|

37

|

||

|

Sub-Proposal 6b:

To eliminate the fundamental investment restriction regarding investments in oil, gas and other mineral programs

|

37

|

||

|

Sub-Proposal 6c:

To eliminate the fundamental investment restriction regarding use of options

|

38

|

||

|

Sub-Proposal 6d:

To eliminate the fundamental investment restriction regarding investment in restricted securities

|

38

|

||

|

Sub-Proposal 6e:

To eliminate the fundamental investment restriction regarding investment in unseasoned issuers

|

38

|

||

|

Sub-Proposal 6f:

To eliminate the fundamental investment restriction regarding investing for purposes of exercising control

|

38

|

||

|

Sub-Proposal 6g:

To eliminate the fundamental investment restriction regarding investing in other investment companies

|

39

|

||

|

Sub-Proposal 6h:

To eliminate the fundamental investment restriction regarding management ownership of securities and principal transactions with management

|

39

|

||

|

PROPOSALS 7a–7c:

SHAREHOLDER PROPOSALS REQUESTING THAT THE FRANKLIN TAX-FREE TRUST, TEMPLETON INCOME TRUST, AND FRANKLIN HIGH INCOME TRUST BOARDS INSTITUTE PROCEDURES TO PREVENT HOLDING INVESTMENTS IN COMPANIES THAT, IN THE JUDGMENT OF THE BOARDS, SUBSTANTIALLY CONTRIBUTE TO GENOCIDE OR CRIMES AGAINST HUMANITY

|

40

|

||

|

PROPOSALS 8a–8e:

SHAREHOLDER PROPOSALS REQUESTING THAT THE FRANKLIN TAX-FREE TRUST, FRANKLIN CUSTODIAN FUNDS, FRANKLIN HIGH INCOME TRUST AND FRANKLIN CALIFORNIA TAX FEE INCOME FUND BOARDS INSTITUTE TRANSPARENT PROCEDURES TO PREVENT HOLDING INVESTMENTS IN COMPANIES THAT, IN THE JUDGMENT OF MANAGEMENT, SUBSTANTIALLY CONTRIBUTE TO GENOCIDE OR CRIMES AGAINST HUMANITY

|

45

|

||

|

• ADDITIONAL INFORMATION ABOUT THE FUNDS

|

50

|

||

|

• FURTHER INFORMATION ABOUT VOTING AND THE MEETING

|

52

|

||

|

EXHIBITS

|

|||

|

Exhibit A – Nominating Committee Charter

|

A-1

|

||

|

Exhibit B – Committee Meetings

|

B-1

|

||

|

Exhibit C – Aggregate Board Compensation

|

C-1

|

||

|

Exhibit D – Additional Executive Officers

|

D-1

|

||

ii

|

Exhibit E – Audit Fee Information

|

E-1

|

||

|

Exhibit F – Fundamental Investment Policies Regarding Investments in Commodities

|

F-1

|

||

|

Exhibit G – Fundamental Investment Restrictions Proposed to be Amended

|

G-1

|

||

|

Exhibit H – Fundamental Investment Restrictions Proposed to be Eliminated

|

H-1

|

||

|

Exhibit I – Investment Managers of the Funds

|

I-1

|

||

|

Exhibit J – Outstanding Shares as of May 31, 2017

|

J-1

|

||

|

Exhibit K – Principal Holders of Shares as of May 31, 2017

|

K-1

|

||

iii

|

Franklin California Tax-Free Income Fund

Franklin California Tax-Free Trust

Franklin Custodian Funds

Franklin Federal Tax-Free Income Fund

Franklin Fund Allocator Series

Franklin Global Trust

Franklin Gold and Precious Metals Fund

Franklin High Income Trust

Franklin Investors Securities Trust

Franklin Municipal Securities Trust

|

Franklin New York Tax-Free Income Fund

Franklin New York Tax-Free Trust

Franklin Real Estate Securities Trust

Franklin Strategic Mortgage Portfolio

Franklin Strategic Series

Franklin Tax-Free Trust

Franklin Templeton Global Trust

Franklin Templeton International Trust

Franklin Templeton Money Fund Trust

Franklin U.S. Government Money Fund

|

Institutional Fiduciary Trust

The Money Market Portfolios

Templeton China World Fund

Templeton Funds

Templeton Global Investment Trust

Templeton Global Opportunities Trust

Templeton Global Smaller Companies

Fund

Templeton Income Trust

Templeton Institutional Funds

|

PROXY STATEMENT

| ¨ |

INFORMATION ABOUT VOTING

|

Who is asking for my vote?

The Boards of Trustees (the "Boards" or "Trustees") of the U.S. registered Franklin and Templeton funds listed above (collectively, the "Trusts" and, individually, a "Trust"), including their various series (collectively, the "Funds" and, individually, a "Fund"),1 in connection with a Special Joint Meeting of Shareholders of the Trusts to be held on October 30, 2017 (the "Meeting"), have requested your vote on several matters (the "Proposals" or, each, a "Proposal").

In addition, if you are a shareholder of Franklin Templeton U.S. Government Money Fund, Franklin U.S. Government Money Fund or Money Market Portfolio (a series of Institutional Fiduciary Trust), each of which is a "feeder fund," you are being requested to provide voting instructions to such Fund on how it should vote the shares it owns in The U.S. Government Money Market Portfolio, as the "master portfolio," as more fully described below under "On what issues am I being asked to vote? – Master-Feeder Fund Structure."

Who is eligible to vote?

Shareholders of record at the close of business on August 21, 2017 are entitled to be present and to vote at the Meeting or any adjourned Meeting (and, in the case of shareholders of a feeder fund, to provide voting instructions to such feeder fund). Each share of record of a Fund is

1Other than Emerging Markets Series of Templeton Institutional Funds and Templeton Frontier Markets Fund of Templeton Global Investment Trust, which are issuing separate proxy solicitation materials.

1

entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter relating to that Fund presented at the Meeting. The Notice of Special Joint Meeting of Shareholders, the proxy cards or voting instruction forms, and the proxy statement were first mailed to shareholders of record on or about August __, 2017.

On what issues am I being asked to vote?

Shareholders are being asked to vote on the following Proposals:

| 1. |

For each Trust, to elect a Board of Trustees of the Trust;

|

| 2. |

For each Fund2, to approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval;

|

| 3. |

For all Funds, to approve an amended fundamental investment restriction regarding investments in commodities;

|

| 4. |

For Franklin Small-Mid Cap Growth Fund, Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund, to approve an amended fundamental investment restriction regarding lending;

|

| 5. |

For Franklin Small-Mid Cap Growth Fund, to approve amendments to certain fundamental investment restrictions, as more fully specified in Exhibit G to this proxy statement (includes six (6) Sub-Proposals);

|

| 6. |

For Franklin Small-Mid Cap Growth Fund, to approve the elimination of certain fundamental investment restrictions, as more fully specified in Exhibit H to this proxy statement (includes eight (8) Sub-Proposals);

|

| 7a-7c. |

If properly presented, for Franklin High Yield Tax-Free Income Fund, Templeton Global Bond Fund and Franklin High Income Fund, a shareholder proposal that such Funds' Boards of Trustees institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity; and

|

| 8a-8e. |

If properly presented, for Franklin Federal Intermediate-Term Tax-Free Income Fund, Franklin Growth Fund, Franklin Income Fund, Franklin High Income Fund and Franklin California Tax-Free Income Fund, a shareholder proposal that such Funds' Boards of Trustees institute transparent procedures to prevent holding investments in companies

|

| 2 |

Excluding Franklin Corefolio Allocation Fund, Franklin Focused Growth Fund, Franklin Flexible Alpha Bond Fund, Franklin Founding Funds Allocation Fund, Franklin Global Listed Infrastructure Fund, Franklin India Growth Fund, Franklin LifeSmart Retirement Income Fund, Franklin NextStep Funds, Franklin Payout Funds, Franklin Templeton Money Fund Trust, Franklin U.S. Government Money Fund, Institutional Fiduciary Trust, Templeton Foreign Smaller Companies Fund, Templeton Global Currency Fund and Templeton Global Smaller Companies Fund.

|

2

that, in the judgment of management, substantially contribute to genocide or crimes against humanity.

Master-Feeder Fund Structure. Each of Franklin Templeton U.S. Government Money Fund, Franklin U.S. Government Money Fund and Money Market Portfolio (individually, a "Feeder Fund" and collectively, the "Feeder Funds") operates in a master-feeder arrangement in which each Feeder Fund invests all of its assets in The Money Market Portfolio (the "Master Portfolio"), which has the same investment goal as the Feeder Funds and invests directly in securities and other investments.

As shareholders in the Master Portfolio, the Feeder Funds have been asked to vote on the proposals described in this proxy statement as they relate to the Master Portfolio. Under the Investment Company Act of 1940, as amended (the "1940 Act"), with respect to master-feeder fund arrangements, each Feeder Fund must (i) pass through to the Feeder Fund's own shareholders voting rights with respect to the Master Portfolio shares it holds and (ii) vote its Master Portfolio shares in accordance with the voting instructions of such Feeder Fund's shareholders. As a result, in addition to your vote on these proposals as they relate to a Fund in which you own shares, the Boards of the Feeder Funds need, and you are asked for, your voting instructions on these matters as to how your Feeder Fund should vote its Master Portfolio shares.

How does the Board of my Trust recommend that I vote?

The Boards of the Trusts unanimously recommend that you vote:

| 1. |

For all Trusts: FOR the election of all nominees as Trustees of the Trust;

|

| 2. |

For all Funds3: FOR the approval of the use of a manager of managers structure;

|

| 3. |

For all Funds: FOR the approval of an amended fundamental investment restriction regarding investments in commodities;

|

| 4. |

For Franklin Small-Mid Cap Growth Fund, Templeton Global Balanced Fund and Templeton Emerging Markets Small Cap Fund: FOR the amendment of the fundamental investment restriction regarding lending;

|

| 5. |

For Franklin Small-Mid Cap Growth Fund: FOR the approval of each of the proposed amendments to certain of the Fund's fundamental investment restrictions; and

|

| 6. |

For Franklin Small-Mid Cap Growth Fund: FOR the approval of the elimination of certain of the Fund's fundamental investment restrictions.

|

| 3 |

Excluding Franklin Corefolio Allocation Fund, Franklin Focused Growth Fund, Franklin Flexible Alpha Bond Fund, Franklin Founding Funds Allocation Fund, Franklin Global Listed Infrastructure Fund, Franklin India Growth Fund, Franklin LifeSmart Retirement Income Fund, Franklin NextStep Funds, Franklin Payout Funds, Franklin Templeton Money Fund Trust, Franklin U.S. Government Money Fund, Institutional Fiduciary Trust, Templeton Foreign Smaller Companies Fund, Templeton Global Currency Fund and Templeton Global Smaller Companies Fund.

|

3

| 7a-7c. |

For Franklin High Yield Tax-Free Income Fund, Templeton Global Bond Fund and Franklin High Income Fund: AGAINST a shareholder proposal that such Funds' Boards of Trustees institute procedures to prevent holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.

|

| 8a-8e. |

For Franklin Federal Intermediate-Term Tax-Free Income Fund, Franklin Growth Fund, Franklin Income Fund, Franklin High Income Fund and Franklin California Tax-Free Income Fund: AGAINST a shareholder proposal that such Funds' Boards of Trustees institute transparent procedures to prevent holding investments in companies that, in the judgment of management, substantially contribute to genocide or crimes against humanity.

|

How do I ensure that my vote is accurately recorded?

You may submit your proxy card(s) or voting instruction form(s) in one of four ways:

| · |

By Internet (if eligible). The web address and instructions for voting can be found on the enclosed proxy card(s) or voting instruction form(s). You will be required to provide your control number located on the proxy card(s) or voting instruction form(s).

|

| · |

By Telephone (if eligible). The toll-free number for telephone voting can be found on the enclosed proxy card(s) or voting instruction form(s). You will be required to provide your control number located on the proxy card(s) or voting instruction form(s).

|

| · |

By Mail. Mark the enclosed proxy card(s) or voting instruction form(s), sign and date it (them), and return it (them) in the postage-paid envelope we provided. A proxy card with respect to shares held by joint owners may be signed by just one of them, unless at or prior to exercise of such proxy the Fund receives a specific written notice to the contrary from any one of the joint owners.

|

| · |

In Person at the Meeting. You can vote your shares in person at the Meeting.

|

If you require additional information regarding the Meeting you may contact AST Fund Solutions, LLC (the "Solicitor"), the proxy solicitor, toll-free at 800-967-5068. Please see the section entitled "FURTHER INFORMATION ABOUT VOTING AND THE MEETING" for more information on the Solicitor.

Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on any of the Proposals, your proxy will be voted as you indicate. If you specify a vote on one or more Proposals but not the other Proposals, your proxy will be voted as specified on such Proposal(s) and, on the Proposal(s) for which no vote is specified, your proxy will be voted in accordance with the Trustees' recommendations beginning on page __ of this proxy statement. If you simply sign, date and return the proxy card, but do not specify a vote on any of the Proposals on which you are entitled to vote, your proxy will be voted in accordance with the Trustees' recommendations beginning on page __ of this proxy statement.

4

May I revoke my proxy?

You may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy card to the appropriate Fund that is received by the Fund at or prior to the Meeting, or by attending the Meeting and voting in person.

May I attend the Meeting in person?

Shareholders of record at the close of business on August 21, 2017 are entitled to attend the Meeting. Eligible shareholders who intend to attend the Meeting in person will need to bring proof of share ownership, such as a shareholder statement or letter from a custodian or broker-dealer confirming ownership, as of August 21, 2017 and a valid picture identification, such as a driver's license or passport, for admission to the Meeting. Seating is very limited. Shareholders without proof of ownership and identification will not be admitted.

What if my shares are held in a brokerage account?

If your shares are held by your broker, then in order to vote in person at the Meeting, you will need to obtain a "Legal Proxy" from your broker and present it to the Inspector of Elections at the Meeting. Also, in order to revoke your proxy, you may need to forward your written revocation or a later-dated proxy card/voting instruction form to your broker rather than to the appropriate Fund.

| ¨ |

THE PROPOSALS

|

PROPOSAL 1: TO ELECT A BOARD OF TRUSTEES

How are nominees selected?

The Board of each Trust has a Nominating Committee. The Nominating Committee for each Franklin Fund is comprised of John B. Wilson (Chair), Harris J. Ashton, Mary C. Choksi, Edith E. Holiday, J. Michael Luttig, and Larry D. Thompson. The Nominating Committee for each Templeton Fund is comprised of Edith E. Holiday (Chair), J. Michael Luttig and Larry D. Thompson. None of the members of the Nominating Committees of the Trusts is an "interested person" of that Trust as defined by the 1940 Act. Trustees who are not interested persons of a Trust are referred to as the "Independent Trustees," and Trustees who are interested persons of a Trust are referred to as the "Interested Trustees."

Each Trust's Nominating Committee is responsible for selecting candidates to serve as Trustees for that Trust and recommending such candidates: (a) for selection and nomination as Independent Trustees by the incumbent Independent Trustees and the full Board; and (b) for selection and nomination as Interested Trustees by the full Board. In considering a candidate's qualifications, the Nominating Committee generally considers the potential candidate's educational background, business or professional experience, and reputation. In addition, the Nominating Committee has established as minimum qualifications for Board membership as an Independent Trustee: (1) that such candidate be independent from relationships with the Trust's

5

investment manager(s) and other principal service providers both within the terms and the spirit of the statutory independence requirements specified under the 1940 Act and the rules thereunder; (2) that such candidate demonstrate an ability and willingness to make the considerable time commitment, including personal attendance at Board meetings, believed necessary to his or her function as an effective Board member; and (3) that such candidate have no continuing relationship as a director, officer or board member of any open-end or closed-end investment company other than those within the Franklin Templeton Investments fund complex or a closed-end business development company primarily investing in non-public entities. Each Trust's Nominating Committee has not adopted any specific policy on the issue of diversity, but will take this into account, among other factors, in its consideration of new candidates to the Board.

When a Trust's Board has or expects to have a vacancy, the Nominating Committee receives and reviews information on individuals qualified to be recommended to the full Board as nominees for election as Board members, including any recommendations by "Qualifying Fund Shareholders" (as defined below). Such individuals are evaluated based upon the criteria described above. To date, each Trust's Nominating Committee has been able to identify, and expects to continue to be able to identify, from its own resources, an ample number of qualified candidates. A Trust's Nominating Committee, however, will review recommendations from Qualifying Fund Shareholders to fill vacancies on the Board if these recommendations are submitted in writing and addressed to the Nominating Committee at the Trust's offices and are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member, including as an Independent Trustee, of the Trust. A Qualifying Fund Shareholder is a shareholder who: (i) has continuously owned of record, or beneficially through a financial intermediary, shares of such Trust having a net asset value of not less than two hundred and fifty thousand dollars ($250,000) during the twenty-four (24) month period prior to submitting the recommendation; and (ii) provides a written notice to the Nominating Committee containing the following information: (a) the name and address of the Qualifying Fund Shareholder making the recommendation; (b) the number of shares of the Trust which are owned of record and beneficially by the Qualifying Fund Shareholder and the length of time that such shares have been so owned by the Qualifying Fund Shareholder; (c) a description of all arrangements and understandings between such Qualifying Fund Shareholder and any other person or persons (naming such person or persons) pursuant to which the recommendation is being made; (d) the name, age, date of birth, business address and residence address of the person or persons being recommended; (e) such other information regarding each person recommended by such Qualifying Fund Shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the U.S. Securities and Exchange Commission ("SEC") had the nominee been nominated by the Board; (f) whether the shareholder making the recommendation believes the person recommended would or would not be an "interested person" of the Trust, as defined in the 1940 Act; and (g) the written consent of each person recommended to serve as a Trustee of the Trust if so nominated and elected/appointed.

A Trust's Nominating Committee may amend these procedures from time to time, including the procedures relating to the evaluation of nominees and the process for submitting recommendations to the Nominating Committee.

6

Each Board has adopted and approved a formal written Charter for its Nominating Committee. A copy of the Charter is attached to this proxy statement as Exhibit A.

Who are the nominees for Trustee of my Trust?

The Boards of the Franklin Funds4 currently are identical and comprised of eight Trustees. The Boards of the Templeton Funds5 currently are identical6 and comprised of eleven Trustees (ten Trustees for TGIT), seven of whom also serve on the Boards of the Franklin Funds.

Shareholders of each Trust are being asked to vote only for the election of the Trustees that will supervise their Trust (including the Funds therein). The nominees for Independent Trustee and Interested Trustee of each Trust are listed below. All of the nominees, with the exception of Terrence J. Checki, currently serve on one or more Boards of Trustees/Directors of the funds within the Franklin Templeton Investments fund complex. Mr. Checki does not currently serve on the Board of any Trust or of any other fund within the Franklin Templeton Investments fund complex. Among the nominees, Gregory E. Johnson and Rupert H. Johnson, Jr. are deemed to be Interested Trustee nominees.

Franklin Funds

Independent Trustee Nominees:

|

Harris J. Ashton

Terrence J. Checki

Mary C. Choksi

|

Edith E. Holiday

J. Michael Luttig

|

Larry D. Thompson

John B. Wilson

|

Interested Trustee Nominees:

|

Gregory E. Johnson

|

Rupert H. Johnson, Jr.

|

Templeton Funds

Independent Trustee Nominees:

|

Harris J. Ashton

Ann Torre Bates

Mary C. Choksi

|

Edith E. Holiday

J. Michael Luttig

David W. Niemiec

|

Larry D. Thompson

Constantine D. Tseretopoulos

Robert E. Wade

|

Interested Trustee Nominees:

|

Gregory E. Johnson

|

Rupert H. Johnson, Jr.

|

| 4 |

For purposes of this proxy statement, the "Franklin Funds" refer to all of the Funds except the Templeton Funds (as defined below).

|

| 5 |

For purposes of this proxy statement, the "Templeton Funds" refer to Franklin Templeton Global Trust, Templeton China World Fund, Templeton Funds, Templeton Global Investment Trust, Templeton Global Opportunities Trust, Templeton Global Smaller Companies Fund, Templeton Income Trust and Templeton Institutional Funds.

|

| 6 |

Except for Templeton Global Investment Trust ("TGIT"), which has all the same Trustees as the other Templeton Funds, excluding Ms. Choksi.

|

7

If elected, each nominee will hold office until the next meeting of shareholders at which Trustees are elected and until his or her successor shall be elected and qualify, or until his or her earlier death, resignation or removal.

Interested Trustees of the Trusts hold director and/or officer positions with, or are stockholders of, Franklin Resources, Inc. ("Resources") and its affiliates. Resources, a global investment management organization operating as Franklin Templeton Investments, is primarily engaged, through various subsidiaries, in providing investment management, share distribution, transfer agent and administrative services to a family of investment companies. Resources is a New York Stock Exchange ("NYSE") listed holding company (NYSE: BEN). Rupert H. Johnson, Jr. is the uncle of Gregory E. Johnson, both nominees for Interested Trustee of the Trusts. There are no other family relationships among the officers or nominees for Trustee.

Each nominee currently is available and has consented to serve if elected. If any of the nominees should become unavailable, the designated proxy holders will vote in their discretion for another person or persons who may be nominated to serve as Trustee(s).

Set forth in the table below are the nominees who are standing for election by shareholders for the first time, the Board(s) to which they are nominated to serve and the person(s) who initially recommended them for consideration as nominees for Board membership:

|

Independent Trustee Nominees:

|

Trust(s) for which Nominee is to be elected by shareholders for the first time:

|

Recommended by:

|

|

Mary C. Choksi

|

All Franklin Funds and all Templeton Funds

|

An incumbent Independent Board Member

|

|

J. Michael Luttig

|

All Franklin Funds and all Templeton Funds except Franklin Templeton Global Trust and Templeton Global Smaller Companies Fund

|

An incumbent Independent Board Member

|

|

Anne Torre Bates

|

All Templeton Funds except Franklin Templeton Global Trust and Templeton Global Smaller Companies Fund

|

An incumbent Independent Board Member

|

|

Terrence J. Checki

|

All Franklin Funds

|

An incumbent Independent Board Member

|

|

Interested Trustee Nominees:

|

||

|

Gregory E. Johnson

|

Franklin California Tax-Free Income Fund, Franklin Custodian Funds, Franklin High Income Trust, Franklin Investors Securities Trust, Franklin New York Tax-Free Income Fund, Franklin Strategic Series, TGIT, Templeton Funds and Templeton Global Opportunities Trust

|

Executive Officers of Franklin Resources, Inc.

|

|

Rupert H. Johnson, Jr.

|

Templeton Income Trust, Templeton Developing Markets Trust, Templeton Institutional Funds, Templeton China World Fund, and TGIT and all Franklin Funds, except Franklin California Tax-Free Income Fund, Franklin Custodian Funds, Franklin High Income Trust, Franklin Investors Securities Trust, Franklin New York Tax-Free Income Fund and Franklin Strategic Series

|

Executive Officers of Franklin Resources, Inc.

|

Information regarding the nominees appears below, including information on the business activities of the nominees during the past five years and beyond. In addition to personal qualities,

8

such as integrity, the role of an effective Board member inherently requires the ability to comprehend, discuss and critically analyze materials and issues presented in exercising judgments and reaching informed conclusions relevant to his or her duties and fiduciary obligations. Each Trust's Board believes that the specific background of each nominee for Trustee evidences such ability and is appropriate to his or her serving on the applicable Trust's Board. As indicated below, Harris J. Ashton has served as a chief executive officer of NYSE-listed public corporations; Ann Torre Bates has served as chief financial officer of a major corporation and as a board member of a number of public companies; Larry D. Thompson and Edith E. Holiday each have legal backgrounds, including high level legal positions with departments of the U.S. Government; Mary C. Choksi has an extensive background in asset management, including founding an investment management firm; J. Michael Luttig has fifteen years of judicial experience as a Federal Appeals Court Judge; David W. Niemiec has been a chief financial officer of a major corporation; Constantine D. Tseretopoulos has professional and executive experience as founder and Chief of Staff of a hospital; Robert E. Wade has had more than thirty years' experience as a practicing attorney; John B. Wilson has served as a chief executive officer of an NYSE-listed public corporation as well as a chief financial officer of a NASDAQ-listed public corporation; Terrence J. Checki has served as a senior executive of a Federal Reserve Bank and has vast experience evaluating economic forces and their impacts on markets, including emerging markets; and Gregory E. Johnson and Rupert H. Johnson, Jr. are both high ranking executive officers of Franklin Templeton Investments.

Listed below with the business activities of the nominees are their names and years of birth, the Board(s) on which they serve or are nominated to serve, their positions and length of service on the Board(s), and the number of Fund portfolios in the Franklin Templeton Investments fund complex that they oversee.

Nominees for Independent Trustee:

|

Name, Year of Birth and Address

|

Position

|

Length of Time Served*

|

Number of Portfolios in Fund Complex Overseen or to be Overseen by Trustee**

|

|

Harris J. Ashton (1932)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

|

Since 1992

|

140

|

|

Other Directorships Held During at Least the Past 5 Years:

Bar-S Foods (meat packing company) (1981-2010).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998).

|

|||

|

Ann Torre Bates (1958)

300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923

|

Trustee

(Templeton Funds)

|

Since 2008

|

42

|

9

|

Other Directorships Held During at Least the Past 5 Years:

Ares Capital Corporation (specialty finance company) (2010-present), United Natural Foods, Inc. (distributor of natural, organic and specialty foods) (2013-present), Allied Capital Corporation (financial services) (2003-2010), SLM Corporation (Sallie Mae) (1997- 2014) and Navient Corporation (loan management, servicing and asset recovery) (2014-2016).

|

|

Principal Occupation During at Least the Past 5 Years:

Director of various companies; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995-1997); and Vice President and Treasurer, US Airways, Inc. (until 1995).

|

|

Terrence J. Checki (1945)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Nominee for Trustee

(Franklin Funds)

|

Not Applicable

|

114

|

|

Other Directorships Held During at Least the Past 5 Years:

Hess Corporation (exploration of oil and gas) (2014-present).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Member of the Council on Foreign Relations (1996-present); Member of the National Committee on U.S.-China Relations (1999-present); member of the Board of Trustees of the Economic Club of New York (2013 -present); member of the Board of Trustees of the Foreign Policy Association (2005-present) and member of various other boards of trustees and advisory boards; and formerly, Executive Vice President of the Federal Reserve Bank of New York and Head of its Emerging Markets and Internal Affairs Group and Member of Management Committee (1995-2014); and Visiting Fellow at the Council on Foreign Relations (2014).

|

|||

|

Mary C. Choksi (1950)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

|

Since 2014

|

134

|

|

Other Directorships Held During at Least the Past 5 Years:

Avis Budget Group Inc. (car rental) (2007-present) and Omnicom Group Inc. (advertising and marketing communications services) (2011-present).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Director of various companies; and formerly, Founder and Senior Advisor, Strategic Investment Group (investment management group) (2015-2017); Founding Partner and Senior Managing Director, Strategic Investment Group (1987-2015); Founding Partner and Managing Director, Emerging Markets Management LLC (investment management firm) (1987-2011); and Loan Officer/Senior Loan Officer/Senior Pension Investment Officer, World Bank Group (international financial institution) (1977-1987).

|

|||

|

Edith E. Holiday (1952)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

Lead Independent Trustee (Templeton Funds)

|

Trustee since 1996 and Lead Independent Trustee since 2007

|

140

|

|

Other Directorships Held During at Least the Past 5 Years:

Hess Corporation (exploration of oil and gas) (1993-present), Canadian National Railway (railroad) (2001- present), White Mountains Insurance Group, Ltd. (holding company) (2004- present), Santander Consumer USA Holdings, Inc. (consumer finance) (2016-present), RTI International Metals, Inc. (manufacture and distribution of titanium) (1999-2015) and H.J. Heinz Company (processed foods and allied products) (1994-2013).

|

|||

10

|

Principal Occupation During at Least the Past 5 Years:

Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison-United States Treasury Department (1988-1989).

|

|

J. Michael Luttig (1954)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

|

Since 2009

|

140

|

|

Other Directorships Held During at Least the Past 5 Years:

Boeing Capital Corporation (aircraft financing) (2006-2013).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Executive Vice President, General Counsel and member of the Executive Council, The Boeing Company (aerospace company) (2006-present); and formerly, Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006).

|

|||

|

David W. Niemiec (1949)

300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923

|

Trustee

(Templeton Funds)

|

Since 2005

|

42

|

|

Other Directorships Held During at Least the Past 5 Years:

Hess Midstream Partners LP (oil and gas midstream infrastructure) (April 2017-present).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998-2001) and SBC Warburg Dillon Read (investment banking) (1997-1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991-1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982-1997).

|

|||

|

Larry D. Thompson (1945)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

|

Since 2005

|

140

|

|

Other Directorships Held During at Least the Past 5 Years:

The Southern Company (energy company) (2014- present; previously 2010-2012), Graham Holdings Company (education and media organization) (2011-present) and Cbeyond, Inc. (business communications provider) (2010-2012).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Director of various companies; John A. Sibley Professor of Corporate and Business Law, University of Georgia School of Law (2015-present; previously 2011-2012); and formerly, Executive Vice President - Government Affairs, General Counsel and Corporate Secretary, PepsiCo, Inc. (consumer products) (2012-2014); Senior Vice President - Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (2004-2011); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003).

|

|||

|

Constantine D. Tseretopoulos (1954)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

|

Trustee

(Templeton Funds)

|

Since 1991

|

26

|

|

Other Directorships Held During at Least the Past 5 Years:

None

|

|||

11

|

Principal Occupation During at Least the Past 5 Years:

Physician, Chief of Staff, owner and operator of the Lyford Cay Hospital (1987-present); director of various nonprofit organizations; and formerly, Cardiology Fellow, University of Maryland (1985-1987); and Internal Medicine Resident, Greater Baltimore Medical Center (1982-1985).

|

|

Robert E. Wade (1946)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301- 1923

|

Trustee

(Templeton Funds)

|

Since 2006

|

42

|

|

Other Directorships Held During at Least the Past 5 Years:

El Oro Ltd (investments) (2003 – present).

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Attorney at law engaged in private practice (1972-2008) and member of various boards.

|

|||

|

John B. Wilson (1959)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee and Lead Independent Trustee

(Franklin Funds)

|

Since 2007

Lead Independent Trustee since 2008

|

114

|

|

|

Other Directorships Held During at Least the Past 5 Years:

None

|

||||

|

Principal Occupation During at Least the Past 5 Years:

President, Staples Europe (office supplies) (2012-present); President and Founder, Hyannis Port Capital, Inc. (real estate and private equity investing); serves on private and non-profit boards; and formerly, Chief Operating Officer and Executive Vice President, Gap, Inc. (retail) (1996-2000); Chief Financial Officer and Executive Vice President - Finance and Strategy, Staples, Inc. (1992-1996); Senior Vice President - Corporate Planning, Northwest Airlines, Inc. (airlines) (1990-1992); and Vice President and Partner, Bain & Company (consulting firm) (1986-1990).

|

||||

Nominees for Interested Trustee:

|

Name, Year of Birth and Address

|

Position

|

Length of Time Served*

|

Number of Portfolios in Fund Complex Overseen or to be Overseen by Trustee**

|

|

***Gregory E. Johnson (1961)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Trustee

(Franklin and Templeton Funds)

|

Since 2007

|

156

|

|

Other Directorships Held During at Least the Past 5 Years:

None

|

|||

|

Principal Occupation During at Least the Past 5 Years:

Chairman of the Board, Member - Office of the Chairman, Director and Chief Executive Officer, Franklin Resources, Inc.; officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 44 of the investment companies in Franklin Templeton Investments; Vice Chairman, Investment Company Institute; and formerly, President, Franklin Resources, Inc. (1994-2015).

|

|||

12

|

***Rupert H. Johnson, Jr. (1940)

One Franklin Parkway

San Mateo, CA 94403-1906

|

Chairman of the Board and Trustee

(Franklin and Templeton Funds)

Vice President

(Franklin California Tax-Free Income Fund, Franklin Custodian Funds, Franklin Investors Securities Trust, Franklin New York Tax-Free Income Fund, Templeton China World Fund, Templeton Funds, Templeton Global Investment Trust, Templeton Global Opportunities Trust,

Templeton Global Smaller Companies Fund, Templeton Income Trust and Templeton Institutional Funds)

|

Chairman of the Board since 2013 and Trustee since 1978

Vice President since 1978

|

140

|

|

Other Directorships Held During at Least the Past 5 Years:

None

|

|||

|

Principal Occupation During at Least the Past 5 Years: