UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

or

For the transition period from ____ to ____

Commission file no:

JOHN DEERE CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| ||

Telephone Number: ( | ||

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

At May 30, 2024,

The registrant meets the conditions set forth in General Instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this Form with certain reduced disclosures as permitted by those instructions.

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

John Deere Capital Corporation and Subsidiaries

Statements of Consolidated Income

(Unaudited)

(in millions)

Three Months Ended | Six Months Ended | |||||||||||

April 28 | April 30 | April 28 | April 30 | |||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Revenues | ||||||||||||

Finance income earned on retail notes | $ | | $ | | $ | | $ | | ||||

Lease revenues |

| |

| |

| |

| | ||||

Revolving charge account income |

| |

| |

| |

| | ||||

Finance income earned on wholesale receivables |

| |

| |

| |

| | ||||

Other income |

| |

| |

| |

| | ||||

Total revenues |

| |

| |

| |

| | ||||

Expenses | ||||||||||||

Interest expense |

| | |

| | | ||||||

Operating expenses: | ||||||||||||

Depreciation of equipment on operating leases |

| | |

| | | ||||||

Administrative and operating expenses |

| | |

| | | ||||||

Fees and interest paid to John Deere |

| | |

| | | ||||||

Provision for credit losses |

| |

| | |

| | |||||

Total operating expenses |

| |

| |

| |

| | ||||

Total expenses |

| |

| |

| |

| | ||||

Income of Consolidated Group before Income Taxes |

| |

| |

| |

| | ||||

Provision for income taxes |

| | |

| | | ||||||

Income of Consolidated Group |

| |

| |

| |

| | ||||

Equity in income of unconsolidated affiliate |

| | |

| | | ||||||

Net Income |

| |

| |

| |

| | ||||

Less: Net income (loss) attributable to noncontrolling interests | | ( | ( | ( | ||||||||

Net Income Attributable to the Company | $ | | $ | | $ | | $ | | ||||

See Condensed Notes to Interim Consolidated Financial Statements.

2

John Deere Capital Corporation and Subsidiaries

Statements of Consolidated Comprehensive Income

(Unaudited)

(in millions)

Three Months Ended | Six Months Ended | |||||||||||

April 28 | April 30 | April 28 | April 30 | |||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Net Income | $ | | $ | | $ | | $ | | ||||

Other Comprehensive Income (Loss), Net of Income Taxes | ||||||||||||

Cumulative translation adjustment |

| ( | ( | | | |||||||

Unrealized gain (loss) on derivatives |

| | ( | ( | ( | |||||||

Unrealized gain (loss) on debt securities | | ( | | |||||||||

Other Comprehensive Income (Loss), Net of Income Taxes |

| ( |

| ( |

| |

| | ||||

Comprehensive Income of Consolidated Group |

| |

| |

| |

| | ||||

Less: Comprehensive income (loss) attributable to noncontrolling interests | | ( | ( | ( | ||||||||

Comprehensive Income Attributable to the Company | $ | | $ | | $ | | $ | | ||||

See Condensed Notes to Interim Consolidated Financial Statements.

3

John Deere Capital Corporation and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

(in millions)

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

Assets |

|

|

| ||||||

Cash and cash equivalents | $ | | $ | | $ | | |||

Marketable securities | | | | ||||||

Receivables: | |||||||||

Retail notes |

| |

| |

| | |||

| |

| |

| | ||||

Revolving charge accounts |

| |

| |

| | |||

Wholesale receivables |

| |

| |

| | |||

Financing leases |

| |

| |

| | |||

Total receivables |

| |

| |

| | |||

Allowance for credit losses |

| ( |

| ( |

| ( | |||

Total receivables – net |

| |

| |

| | |||

Other receivables |

| |

| |

| | |||

Receivables from John Deere |

| |

| |

| | |||

Equipment on operating leases – net |

| |

| |

| | |||

Notes receivable from John Deere | | | | ||||||

Investment in unconsolidated affiliate |

| |

| |

| | |||

Deferred income taxes |

| |

| |

| | |||

Other assets |

| |

| |

| | |||

Total Assets | $ | | $ | | $ | | |||

Liabilities and Stockholder’s Equity | |||||||||

Short-term external borrowings: | |||||||||

Commercial paper and other notes payable | $ | | $ | | $ | | |||

Securitization borrowings |

| |

| |

| | |||

Current maturities of long-term external borrowings |

| |

| |

| | |||

Total short-term external borrowings |

| |

| |

| | |||

Notes payable to John Deere |

| |

| |

| | |||

Other payables to John Deere |

| |

| |

| | |||

Accounts payable and accrued expenses |

| |

| |

| | |||

Deposits held from dealers and merchants |

| |

| |

| | |||

Deferred income taxes |

| |

| |

| | |||

Long-term external borrowings |

| |

| |

| | |||

Total liabilities |

| |

| |

| | |||

Commitments and contingencies (Note 9) | |||||||||

Stockholder’s equity: | |||||||||

Common stock, without par value (issued and outstanding – |

| |

| |

| | |||

Retained earnings |

| |

| |

| | |||

Accumulated other comprehensive loss |

| ( |

| ( |

| ( | |||

Total Company stockholder’s equity |

| |

| |

| | |||

Noncontrolling interests |

| |

| |

| | |||

Total stockholder’s equity |

| |

| |

| | |||

Total Liabilities and Stockholder’s Equity | $ | | $ | | $ | | |||

See Condensed Notes to Interim Consolidated Financial Statements.

4

John Deere Capital Corporation and Subsidiaries

Statements of Consolidated Cash Flows

(Unaudited)

(in millions)

| Six Months Ended | |||||

April 28 | April 30 | |||||

| 2024 |

| 2023 | |||

Cash Flows from Operating Activities: | ||||||

Net income | $ | | $ | | ||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||

Provision for credit losses |

| | | |||

Provision for depreciation and amortization |

| | | |||

Credit for deferred income taxes |

| ( | ( | |||

Change in accounts payable and accrued expenses |

| ( | | |||

Change in accrued income taxes payable/receivable |

| | | |||

Other |

| | ( | |||

Net cash provided by operating activities |

| |

| | ||

Cash Flows from Investing Activities: | ||||||

Cost of receivables acquired (excluding wholesale) |

| ( | ( | |||

Collections of receivables (excluding wholesale) |

| | | |||

Increase in wholesale receivables – net |

| ( | ( | |||

Cost of equipment on operating leases acquired |

| ( | ( | |||

Proceeds from sales of equipment on operating leases |

| | | |||

Cost of notes receivable acquired from John Deere | ( | ( | ||||

Collections of notes receivable from John Deere | | | ||||

Other |

| ( | ( | |||

Net cash used for investing activities |

| ( |

| ( | ||

Cash Flows from Financing Activities: | ||||||

Increase (decrease) in commercial paper and other notes payable – net (original maturities |

| ( | | |||

Decrease in securitization borrowings – net |

| ( | ( | |||

Increase (decrease) in short-term borrowings with John Deere – net |

| | ( | |||

Proceeds from external borrowings issued (original maturities greater than three months) |

| | | |||

Payments of external borrowings (original maturities greater than three months) |

| ( | ( | |||

Dividends paid |

| ( | ||||

Capital investments from John Deere | | | ||||

Debt issuance costs |

| ( | ( | |||

Net cash provided by financing activities |

| |

| | ||

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash |

| | | |||

Net Increase in Cash, Cash Equivalents, and Restricted Cash |

| |

| | ||

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period |

| |

| | ||

Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | | $ | | ||

Components of Cash, Cash Equivalents, and Restricted Cash: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Restricted cash* | | | ||||

Total Cash, Cash Equivalents, and Restricted Cash | $ | | $ | | ||

* Restricted cash is reported in “Other assets” on the consolidated balance sheets and primarily relates to the securitization of receivables (see Note 5).

See Condensed Notes to Interim Consolidated Financial Statements.

5

John Deere Capital Corporation and Subsidiaries

Statements of Changes in Consolidated Stockholder’s Equity

For the Three and Six Months Ended April 28, 2024 and April 30, 2023

(Unaudited)

(in millions)

Company Stockholder | |||||||||||||||

Accumulated | |||||||||||||||

Total | Other | ||||||||||||||

Stockholder’s | Common | Retained | Comprehensive | Noncontrolling | |||||||||||

Equity | Stock | Earnings | Income (Loss) | Interests | |||||||||||

|

|

|

|

| |||||||||||

Three Months Ended April 30, 2023 | |||||||||||||||

Balance January 29, 2023 | $ | | $ | | $ | | $ | ( | $ | | |||||

Net income (loss) | | | ( | ||||||||||||

Other comprehensive loss | ( | ( | |||||||||||||

Capital investment | | | |||||||||||||

Balance April 30, 2023 | $ | | $ | | $ | | $ | ( | $ | | |||||

Six Months Ended April 30, 2023 | |||||||||||||||

Balance October 30, 2022 | $ | | $ | | $ | | $ | ( | $ | | |||||

Net income (loss) |

| |

| | ( | ||||||||||

Other comprehensive income |

| | | ||||||||||||

Capital investment |

| | | ||||||||||||

Balance April 30, 2023 | $ | | $ | | $ | | $ | ( | $ | | |||||

Three Months Ended April 28, 2024 | |||||||||||||||

Balance January 28, 2024 | $ | | $ | | $ | | $ | ( | $ | | |||||

Net income | | | | ||||||||||||

Other comprehensive loss | ( | ( | |||||||||||||

Capital investment | | | |||||||||||||

Balance April 28, 2024 | $ | | $ | | $ | | $ | ( | $ | | |||||

Six Months Ended April 28, 2024 | |||||||||||||||

Balance October 29, 2023 | $ | | $ | | $ | | $ | ( | $ | | |||||

Net income (loss) |

| |

| | ( | ||||||||||

Other comprehensive income |

| | | ||||||||||||

Dividends declared |

| ( | ( | ||||||||||||

Capital investment | | | |||||||||||||

Balance April 28, 2024 | $ | | $ | | $ | | $ | ( | $ | | |||||

See Condensed Notes to Interim Consolidated Financial Statements.

6

Condensed Notes to Interim Consolidated Financial Statements (Unaudited)

(1) ORGANIZATION AND CONSOLIDATION

References to John Deere Capital Corporation (Capital Corporation), “the Company,” “we,” “us,” or “our” include our consolidated subsidiaries. John Deere Financial Services, Inc., a wholly-owned subsidiary of Deere & Company, owns all of the outstanding common stock of Capital Corporation. We provide and administer financing for retail purchases of new equipment manufactured by Deere & Company’s production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations and used equipment taken in trade for this equipment. References to “agriculture and turf” include both production and precision agriculture and small agriculture and turf. Deere & Company and its wholly-owned subsidiaries are collectively called “John Deere.”

We offer the following financing solutions:

| ● | Retail notes – we purchase retail installment sales and loan contracts from John Deere, which are generally acquired through independent John Deere retail dealers, and finance a limited amount of non-John Deere retail notes; |

| ● | Revolving charge accounts – we finance and service revolving charge accounts, in most cases acquired from and offered through merchants and dealers in the agriculture and turf and construction and forestry markets; |

| ● | Wholesale receivables – we provide wholesale financing to dealers of John Deere agriculture and turf equipment and construction and forestry equipment, primarily to finance inventories of equipment for those dealers; and |

| ● | Financing and operating leases – we lease John Deere equipment and a limited amount of non-John Deere equipment to retail customers. |

Retail notes, revolving charge accounts, and financing leases are collectively called “Customer Receivables.” Customer Receivables and wholesale receivables are collectively called “Receivables.” Receivables and equipment on operating leases are collectively called “Receivables and Leases.” We secure our Receivables, other than certain revolving charge accounts, by retaining as collateral security in the goods associated with those Receivables or with the use of other collateral.

We use a 52/53 week fiscal year with quarters ending on the last Sunday in the reporting period. The second quarter ends for fiscal years 2024 and 2023 were April 28, 2024 and April 30, 2023, respectively. Both second quarters contained

We are the primary beneficiary of and consolidate certain variable interest entities that are special purpose entities (SPEs) related to the securitization of receivables. See Note 5 for more information on these SPEs.

Presentation of Amounts

All amounts are presented in millions of dollars, unless otherwise specified.

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NEW ACCOUNTING PRONOUNCEMENTS

Quarterly Financial Statements

We have prepared our interim consolidated financial statements, without audit, pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (SEC). Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the U.S. have been condensed or omitted as permitted by such rules and regulations. All normal recurring adjustments have been included. Management believes the disclosures are adequate to present fairly the financial position, results of operations, and cash flows at the dates and for the periods presented. It is suggested these interim consolidated financial statements be read in conjunction with the consolidated financial statements and the notes thereto appearing in our latest Annual Report on Form 10-K. Results for interim periods are not necessarily indicative of those to be expected for the fiscal year.

Use of Estimates in Financial Statements

Certain accounting policies require management to make estimates and assumptions in determining the amounts reflected in the financial statements and related disclosures. Actual results could differ from those estimates.

7

New Accounting Pronouncements

We closely monitor all Accounting Standard Updates (ASUs) issued by the Financial Accounting Standards Board (FASB) and other authoritative guidance.

Accounting Pronouncements Adopted

In the first quarter of 2024, we adopted

We also adopted the following standards in 2024, none of which had a material effect on our consolidated financial statements.

with Customers |

Accounting Pronouncements to be Adopted

In March 2024, the SEC adopted rules to enhance and standardize climate-related disclosures in annual reports and registration statements. The new rules will be effective for our annual reporting periods beginning in fiscal year 2028. In April 2024, the SEC stayed implementation of the climate-related disclosure requirements pending completion of legal challenges. We are monitoring these developments while assessing the effect of these rules on our related disclosures.

In December 2023, the FASB issued

We will also adopt the following standards in future periods, none of which are expected to have a material effect on our consolidated financial statements.

(3) OTHER COMPREHENSIVE INCOME ITEMS

The after-tax components of accumulated other comprehensive income (loss) were as follows:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

Cumulative translation adjustment | $ | ( | $ | ( | $ | ( | |||

Unrealized gain on derivatives | | | | ||||||

Unrealized loss on debt securities | ( | ( | ( | ||||||

Total accumulated other comprehensive income (loss) | $ | ( | $ | ( | $ | ( | |||

8

The following tables reflect amounts recorded in other comprehensive income (loss), as well as reclassifications out of other comprehensive income (loss).

Before | Tax | After | |||||||

Tax | (Expense) | Tax | |||||||

Amount | Credit | Amount | |||||||

Three Months Ended April 28, 2024 | |||||||||

Cumulative translation adjustment |

| $ | ( | $ | ( | ||||

Unrealized gain (loss) on derivatives: | |||||||||

Unrealized hedging gain (loss) |

| | $ | ( |

| | |||

Reclassification of realized (gain) loss to: | |||||||||

Interest rate contracts – Interest expense |

| ( | | ( | |||||

Net unrealized gain (loss) on derivatives |

| |

| ( |

| | |||

Unrealized gain (loss) on debt securities: | |||||||||

Unrealized holding gain (loss) | | ( | | ||||||

Total other comprehensive income (loss) | $ | | $ | ( | $ | ( | |||

Six Months Ended April 28, 2024 | |||||||||

Cumulative translation adjustment | $ | | $ | | |||||

Unrealized gain (loss) on derivatives: | |||||||||

Unrealized hedging gain (loss) |

| | $ | ( |

| | |||

Reclassification of realized (gain) loss to: | |||||||||

Interest rate contracts – Interest expense |

| ( | | ( | |||||

Net unrealized gain (loss) on derivatives |

| ( |

| |

| ( | |||

Unrealized gain (loss) on debt securities: | |||||||||

Unrealized holding gain (loss) | | ( | | ||||||

Total other comprehensive income (loss) | $ | | $ | | $ | | |||

Three Months Ended April 30, 2023 | |||||||||

Cumulative translation adjustment | $ | ( | $ | ( | |||||

Unrealized gain (loss) on derivatives: | |||||||||

Unrealized hedging gain (loss) |

| ( | $ | |

| ( | |||

Reclassification of realized (gain) loss to: | |||||||||

Interest rate contracts – Interest expense |

| ( | | ( | |||||

Net unrealized gain (loss) on derivatives |

| ( | |

| ( | ||||

Unrealized gain (loss) on debt securities: | |||||||||

Unrealized holding gain (loss) | ( | | ( | ||||||

Total other comprehensive income (loss) | $ | ( | $ | | $ | ( | |||

Six Months Ended April 30, 2023 | |||||||||

Cumulative translation adjustment | $ | | $ | | |||||

Unrealized gain (loss) on derivatives: | |||||||||

Unrealized hedging gain (loss) |

| ( | $ | |

| ( | |||

Reclassification of realized (gain) loss to: | |||||||||

Interest rate contracts – Interest expense |

| ( | |

| ( | ||||

Net unrealized gain (loss) on derivatives |

| ( |

| |

| ( | |||

Total other comprehensive income (loss) | $ | | $ | | $ | | |||

(4) RECEIVABLES

We monitor the credit quality of Receivables based on delinquency status, defined as follows:

| ● | Past due balances represent Receivables still accruing finance income with any payments |

9

| ● | Non-performing Receivables represent Receivables for which we have stopped accruing finance income, which generally occurs when Customer Receivables are |

Accrued finance income and lease revenue reversed on non-performing Receivables, and finance income and lease revenue recognized from cash payments on non-performing Receivables were as follows:

Three Months Ended | Six Months Ended | |||||||||||

April 28 | April 30 | April 28 | April 30 | |||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Accrued finance income and lease revenue reversed | $ | | $ | | $ | | $ | | ||||

Finance income and lease revenue recognized on cash payments | | | | | ||||||||

Total Receivable balances represent principal plus accrued interest. Receivable balances are written off to the allowance for credit losses when, in the judgment of management, they are considered uncollectible. Write-offs generally occur when Customer Receivables are

The credit quality analysis of Customer Receivables by year of origination was as follows:

April 28, 2024 | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | Prior Years | Revolving Charge Accounts | Total | |||||||||||||||||

Customer Receivables: |

|

|

|

|

|

|

|

| ||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30-59 days past due | | | | | | | | | ||||||||||||||||

60-89 days past due | | | | | | | | | ||||||||||||||||

90+ days past due | | | | | | | | |||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | | ||||||||||||||||

30-59 days past due | | | | | | | | | ||||||||||||||||

60-89 days past due | | | | | | | | | ||||||||||||||||

90+ days past due | | | | | | | ||||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

10

October 29, 2023 | ||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving Charge Accounts | Total | |||||||||||||||||

Customer Receivables: |

|

|

|

|

|

|

|

| ||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30-59 days past due |

| | | | | | | | | |||||||||||||||

60-89 days past due |

| | | | | | | | | |||||||||||||||

90+ days past due | | | | | | | | |||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | | ||||||||||||||||

30-59 days past due | | | | | | | | | ||||||||||||||||

60-89 days past due | | | | | | | | | ||||||||||||||||

90+ days past due | | | | | | |||||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

April 30, 2023 | ||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving Charge Accounts | Total | |||||||||||||||||

Customer Receivables: |

|

|

|

|

|

|

|

| ||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30-59 days past due | | | | | | | | | ||||||||||||||||

60-89 days past due | | | | | | | | | ||||||||||||||||

90+ days past due | | | | | | | ||||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | | ||||||||||||||||

30-59 days past due | | | | | | | | | ||||||||||||||||

60-89 days past due | | | | | | | | | ||||||||||||||||

90+ days past due | | | | | ||||||||||||||||||||

Non-performing | | | | | | | | | ||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

The credit quality analysis of wholesale receivables by year of origination was as follows:

April 28, 2024 | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | Prior Years | Revolving | Total | |||||||||||||||||

Wholesale receivables: | ||||||||||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30+ days past due | | | ||||||||||||||||||||||

Non-performing | | | ||||||||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | |||||||||||||||||

30+ days past due | | | ||||||||||||||||||||||

Non-performing | ||||||||||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

11

October 29, 2023 | ||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving | Total | |||||||||||||||||

Wholesale receivables: | ||||||||||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30+ days past due | | | ||||||||||||||||||||||

Non-performing | | | ||||||||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | | ||||||||||||||||

30+ days past due | | | ||||||||||||||||||||||

Non-performing | ||||||||||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

April 30, 2023 | ||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving | Total | |||||||||||||||||

Wholesale receivables: | ||||||||||||||||||||||||

Agriculture and turf | ||||||||||||||||||||||||

Current | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

30+ days past due | | | | |||||||||||||||||||||

Non-performing | | | ||||||||||||||||||||||

Construction and forestry | ||||||||||||||||||||||||

Current | | | | | | | | | ||||||||||||||||

30+ days past due | | | | |||||||||||||||||||||

Non-performing | ||||||||||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

Allowance for Credit Losses

The allowance for credit losses is an estimate of the credit losses expected over the life of our Receivable portfolio. Non-performing Receivables are included in the estimate of expected credit losses. The allowance is measured on a collective basis for receivables with similar risk characteristics. Receivables that do not share risk characteristics are evaluated on an individual basis. Risk characteristics include:

| ● | product category, |

| ● | market, |

| ● | geography, |

| ● | credit risk, and |

| ● | remaining balance. |

Recoveries from freestanding credit enhancements, such as dealer deposits, and certain credit insurance contracts are not included in the estimate of expected credit losses. Recoveries from dealer deposits are recognized in “Other income” when the dealer’s deposit account is charged. Recoveries from freestanding credit enhancements recorded in “Other income” were $

12

An analysis of the allowance for credit losses and investment in Receivables was as follows:

Three Months Ended April 28, 2024 | ||||||||||||

Retail Notes | Revolving | |||||||||||

& Financing | Charge | Wholesale | Total | |||||||||

Leases | Accounts | Receivables | Receivables | |||||||||

Allowance: | ||||||||||||

Beginning of period balance | $ | | $ | | $ | | $ | | ||||

Provision for credit losses* |

| | | | ||||||||

Write-offs |

| ( | ( | ( | ||||||||

Recoveries |

| | | | | |||||||

Translation adjustments |

| ( | ( | |||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

Six Months Ended April 28, 2024 | ||||||||||||

Retail Notes | Revolving | |||||||||||

& Financing | Charge | Wholesale | Total | |||||||||

Leases | Accounts | Receivables | Receivables | |||||||||

Allowance: | ||||||||||||

Beginning of period balance | $ | | $ | | $ | | $ | | ||||

Provision (credit) for credit losses* |

| | | ( | | |||||||

Write-offs |

| ( | ( | ( | ||||||||

Recoveries |

| | | | | |||||||

Translation adjustments |

| ( | ( | |||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

Receivables: | ||||||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

Three Months Ended April 30, 2023 | ||||||||||||

Retail Notes | Revolving | |||||||||||

& Financing | Charge | Wholesale | Total | |||||||||

Leases | Accounts | Receivables | Receivables | |||||||||

Allowance: | ||||||||||||

Beginning of period balance | $ | | $ | | $ | | $ | | ||||

Provision for credit losses* |

| | | | | |||||||

Write-offs |

| ( | ( | ( | ||||||||

Recoveries |

| | | | ||||||||

Translation adjustments |

| ( | | |||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

13

Six Months Ended April 30, 2023 | ||||||||||||

Retail Notes | Revolving | |||||||||||

& Financing | Charge | Wholesale | Total | |||||||||

Leases | Accounts | Receivables | Receivables | |||||||||

Allowance: | ||||||||||||

Beginning of period balance | $ | | $ | | $ | | $ | | ||||

Provision (credit) for credit losses* |

| | | ( | | |||||||

Write-offs |

| ( | ( | ( | ( | |||||||

Recoveries |

| | | | | |||||||

Translation adjustments |

| | ( | | ||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

Receivables: | ||||||||||||

End of period balance | $ | | $ | | $ | | $ | | ||||

* Excludes provision (credit) for credit losses on unfunded commitments of $

The allowance for credit losses increased in the second quarter and first six months of 2024, primarily due to higher expected losses on agricultural customer accounts as a result of elevated delinquencies and a decline in market conditions. We continue to monitor the economy as part of the allowance setting process, including potential impacts of inflation and interest rates, among other factors, and qualitative adjustments to the allowance are incorporated as necessary.

Write-offs by year of origination were as follows:

Six Months Ended April 28, 2024 | ||||||||||||||||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | Prior Years | Revolving | Total | |||||||||||||||||

Customer Receivables: | ||||||||||||||||||||||||

Agriculture and turf | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

Construction and forestry | | | | | | | | | ||||||||||||||||

Total | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

Modifications

We occasionally grant contractual modifications to customers experiencing financial difficulties. Before offering a modification, we evaluate the ability of the customer to meet the modified payment terms. Modifications offered include payment deferrals, term extensions, or a combination thereof. Finance charges continue to accrue during the deferral or extension period. Our allowance for credit losses incorporates historical loss information, including the effects of loan modifications with customers. Therefore, additional adjustments to the allowance are generally not recorded upon modification of a loan.

The ending amortized cost of loans modified with borrowers experiencing financial difficulty during the second quarter and the six months ended April 28, 2024 was $

Defaults and subsequent write-offs of loans modified in the prior twelve months were not significant during the six months ended April 28, 2024. In addition, at April 28, 2024, commitments to provide additional financing to these customers were not significant.

Troubled Debt Restructuring

Prior to adopting ASU 2022-02, modifications of loans to borrowers experiencing financial difficulty were considered troubled debt restructurings when the modification resulted in a concession we would not otherwise consider. During the six months ended April 30, 2023, we identified

14

(5) SECURITIZATION OF RECEIVABLES

Our funding strategy includes retail note securitizations. While these securitization programs are administered in various forms, they are accomplished in the following basic steps:

1. We transfer retail notes into a bankruptcy-remote SPE.

2. The SPE issues debt to investors. The debt is secured by the retail notes.

3. Investors are paid back based on cash receipts from the retail notes.

As part of step 1, these retail notes are legally isolated from the claims of our general creditors. This ensures cash receipts from the retail notes are accessible to pay back securitization program investors. The structure of these transactions does not meet the accounting criteria for a sale of receivables. As a result, they are accounted for as secured borrowings. The receivables and borrowings remain on our balance sheet and are separately reported as “Retail notes securitized” and “Securitization borrowings,” respectively.

The components of the securitization programs were as follows:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

$ | | $ | | $ | | ||||

Allowance for credit losses |

| ( |

| ( |

| ( | |||

Other assets (primarily restricted cash) |

| |

| |

| | |||

Total restricted securitized assets | $ | | $ | | $ | | |||

Securitization borrowings | $ | | $ | | $ | | |||

Accrued interest on borrowings |

| |

| |

| | |||

Total liabilities related to restricted securitized assets | $ | | $ | | $ | | |||

(6) LEASES

We lease John Deere equipment and a limited amount of non-John Deere equipment to retail customers through sales-type, direct financing, and operating leases. Sales-type and direct financing leases are reported in “Financing leases” and operating leases are reported in “Equipment on operating leases – net.”

Lease revenues earned by us were as follows:

Three Months Ended | Six Months Ended | |||||||||||

April 28 | April 30 | April 28 | April 30 | |||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Sales-type and direct financing lease revenues | $ | | $ | | $ | | $ | | ||||

Operating lease revenues | | | | | ||||||||

Variable lease revenues |

| |

| |

| |

| | ||||

Total lease revenues | $ | | $ | | $ | | $ | | ||||

Variable lease revenues reported above primarily relate to separately invoiced property taxes on leased equipment in certain markets, late fees, and excess use and damage fees. Excess use and damage fees are reported in “Other income” and were $

The cost of equipment on operating leases by market was as follows:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 |

| 2023 | ||||||

Agriculture and turf | $ | | $ | | $ | | |||

Construction and forestry | |

| | | |||||

Total | | | | ||||||

Accumulated depreciation |

| ( | ( | ( | |||||

Equipment on operating leases – net | $ | | $ | | $ | | |||

15

Total operating lease residual values at April 28, 2024, October 29, 2023, and April 30, 2023 were $

We discuss with lessees and dealers options to purchase the equipment or extend the lease prior to operating lease maturity. We remarket equipment returned to us upon termination of leases. The matured operating lease inventory balances at April 28, 2024, October 29, 2023, and April 30, 2023 were $

(7) NOTES RECEIVABLE FROM AND PAYABLE TO JOHN DEERE

We provide loans to Banco John Deere S.A. (BJD), a John Deere finance subsidiary in Brazil, which are reported in “Notes receivable from John Deere.” Balances due from BJD were as follows:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

Notes receivable from John Deere | $ | | $ | | $ | | |||

The loan agreements mature over the next

We also obtain funding from affiliated companies which resulted in notes payable to John Deere as follows:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

Notes payable to John Deere | $ | | $ | | $ | | |||

The intercompany borrowings are primarily short-term in nature or contain a due on demand call option. At April 28, 2024, $

(8) LONG-TERM EXTERNAL BORROWINGS

Long-term external borrowings consisted of the following:

April 28 | October 29 | April 30 | |||||||

2024 | 2023 | 2023 | |||||||

Senior Debt: | |||||||||

Medium-term notes | $ | | $ | | $ | | |||

Other notes | | | |||||||

Total senior debt | | | | ||||||

Unamortized debt discount and debt issuance costs | ( | ( | ( | ||||||

Total | $ | | $ | | $ | | |||

16

(9) COMMITMENTS AND CONTINGENCIES

We provide guarantees related to certain financial instruments issued by John Deere Financial Inc., a John Deere finance subsidiary in Canada. At April 28, 2024, the following notional amounts were guaranteed by us:

| ● | Medium-term notes: $ |

| ● | Commercial paper: $ |

| ● | Derivatives: $ |

The weighted-average interest rate on the medium-term notes at April 28, 2024 was

We have commitments to extend credit to customers and John Deere dealers through lines of credit and other pre-approved credit arrangements. We apply the same credit policies and approval process for these commitments to extend credit as we do for our Receivables and Leases, and generally have the right to unconditionally cancel, alter, or amend the terms at any time. Collateral is not required for these commitments, but if credit is extended, collateral may be required upon funding. A significant portion of these commitments is not expected to be fully drawn upon; therefore, the total commitment amounts likely do not represent a future cash requirement. The unused commitments at April 28, 2024 were as follows:

| ● | John Deere dealers: $ |

| ● | Customers: $ |

We have a reserve for credit losses of $

At April 28, 2024, we had restricted other assets associated with borrowings related to securitizations (see Note 5). Excluding the securitization programs, the remaining balance of restricted other assets was not material as of April 28, 2024.

We are subject to various unresolved legal actions which arise in the normal course of our business, the most prevalent of which relate to retail credit matters. We believe the reasonably possible range of losses for these unresolved legal actions would not have a material effect on our consolidated financial statements.

(10) FAIR VALUE MEASUREMENTS

The fair values of financial instruments that do not approximate the carrying values were as follows:

April 28, 2024 | October 29, 2023 | April 30, 2023 | ||||||||||||||||

Carrying | Fair | Carrying | Fair | Carrying | Fair | |||||||||||||

Value | Value | Value | Value | Value | Value | |||||||||||||

Receivables financed – net |

| $ | | $ | |

| $ | | $ | |

| $ | | $ | | |||

Retail notes securitized – net |

| |

| |

| |

| |

| |

| | ||||||

Securitization borrowings |

| | |

| |

| |

| |

| | |||||||

Current maturities of long-term |

| | |

| |

| |

| | | ||||||||

Long-term external borrowings |

| |

| |

| |

| |

| |

| | ||||||

Fair value measurements above were Level 3 for all Receivables and Level 2 for all borrowings.

Fair values of Receivables that were issued long-term were based on the discounted values of their related cash flows at interest rates currently being offered by us for similar Receivables. The fair values of the remaining Receivables approximated the carrying amounts.

Fair values of long-term external borrowings and securitization borrowings were based on current market quotes for identical or similar borrowings and credit risk, or on the discounted values of their related cash flows at current market interest rates. Certain long-term external borrowings have been swapped to current variable interest rates. The carrying values of these long-term external borrowings include adjustments related to fair value hedges.

17

Assets and liabilities measured at fair value on a recurring basis were as follows:

| April 28 |

| October 29 |

| April 30 | ||||

2024 | 2023 | 2023 | |||||||

Marketable securities |

|

|

| ||||||

International debt securities | | $ | | $ | | ||||

Receivables from John Deere | |||||||||

Derivatives | | | | ||||||

Other assets | |||||||||

Derivatives | |

| |

| | ||||

Total assets | $ | | $ | | $ | | |||

Other payables to John Deere | |||||||||

Derivatives | $ | | $ | | $ | | |||

Accounts payable and accrued expenses | |||||||||

Derivatives | |

| |

| | ||||

Total liabilities | $ | | $ | | $ | | |||

All fair value measurements in the table above were Level 2. Excluded from the table above were our cash equivalents, which were carried at cost that approximates fair value. The cash equivalents consist primarily of time deposits and money market funds.

The international debt securities mature over the next seven years. At April 28, 2024, the amortized cost basis and fair value of these available-for-sale debt securities were $

There were no assets or liabilities measured at fair value on a nonrecurring basis, other than Receivables with specific allowances which were not material, during each of the periods ended April 28, 2024, October 29, 2023, and April 30, 2023.

The following is a description of the valuation methodologies we use to measure certain balance sheet items at fair value:

Marketable securities – The international debt securities are valued using quoted prices for identical assets in inactive markets.

Derivatives – Our derivative financial instruments consist of interest rate contracts (swaps and caps), foreign currency exchange contracts (forwards and swaps), and cross-currency interest rate contracts (swaps). The portfolio is valued based on an income approach (discounted cash flow) using market observable inputs, including swap curves and both forward and spot exchange rates for currencies.

Receivables – Specific reserve impairments are based on the fair value of the collateral, which is measured using a market approach (appraisal values or realizable values).

(11) DERIVATIVE INSTRUMENTS

Our outstanding derivative transactions are with both unrelated external counterparties and with John Deere. For derivative transactions with John Deere, we utilize a centralized hedging structure in which John Deere enters into a derivative transaction with an unrelated external counterparty and simultaneously enters into a derivative transaction with us. Except for collateral provisions, the terms of the transaction between John Deere and us are identical to the terms of the transaction between John Deere and its unrelated external counterparty. Derivative asset and liability positions for transactions with John Deere are recorded in “Receivables from John Deere” and “Other payables to John Deere,” respectively. Derivative asset and liability positions for transactions with unrelated external counterparty banks are recorded in “Other assets” and “Accounts payable and accrued expenses,” respectively.

18

The fair values of our derivative instruments and the associated notional amounts were as follows:

April 28, 2024 | October 29, 2023 | April 30, 2023 | |||||||||||||||||||||||||

Fair Value | Fair Value | Fair Value | |||||||||||||||||||||||||

Notional | Asset | Liability | Notional | Asset | Liability | Notional | Asset | Liability | |||||||||||||||||||

Cash flow hedges: | |||||||||||||||||||||||||||

Interest rate contracts - swaps | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||||||

Fair value hedges: | |||||||||||||||||||||||||||

Interest rate contracts - swaps | | | | | $ | | | | | ||||||||||||||||||

Not designated as hedging instruments: | |||||||||||||||||||||||||||

Interest rate contracts - swaps | | | | | | | | | | ||||||||||||||||||

Foreign currency exchange contracts | | | | | | | | | | ||||||||||||||||||

Cross-currency interest rate contracts | | | | | | | | | | ||||||||||||||||||

Interest rate caps - sold | | | | | | | |||||||||||||||||||||

Interest rate caps - purchased | | | | | | | |||||||||||||||||||||

The amount of gain recorded in other comprehensive income (OCI) related to cash flow hedges at April 28, 2024 that is expected to be reclassified to interest expense in the next twelve months if interest rates remain unchanged is $

The amounts recorded in the consolidated balance sheets related to borrowings designated in fair value hedging relationships were as follows. Fair value hedging adjustments are included in the carrying amount of the hedged item.

Active Hedging Relationships | Discontinued Hedging Relationships | ||||||||||||

Cumulative | Carrying | Cumulative | |||||||||||

Carrying | Fair Value | Amount of | Fair Value | ||||||||||

Amount of | Hedging | Formerly | Hedging | ||||||||||

April 28, 2024 | Hedged Item | Adjustment | Hedged Item | Adjustment | |||||||||

Current maturities of long-term external borrowings | $ | | $ | | |||||||||

Long-term external borrowings | | $ | ( | | ( | ||||||||

October 29, 2023 | |||||||||||||

Current maturities of long-term external borrowings | $ | | $ | | |||||||||

Long-term external borrowings | $ | | $ | ( | | ( | |||||||

April 30, 2023 | |||||||||||||

Current maturities of long-term external borrowings | $ | | $ | | |||||||||

Long-term external borrowings | $ | | $ | ( | | ( | |||||||

19

The classification and gains (losses), including accrued interest expense, related to derivative instruments on the statements of consolidated income consisted of the following:

Three Months Ended | Six Months Ended | |||||||||||

April 28 | April 30 | April 28 | April 30 | |||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Fair Value Hedges | ||||||||||||

Interest rate contracts - Interest expense |

| $ | ( | $ | ( | $ | ( | $ | | |||

Cash Flow Hedges | ||||||||||||

Recognized in OCI: | ||||||||||||

Interest rate contracts - OCI (pretax) |

| $ | | $ | ( | $ | | $ | ( | |||

Reclassified from OCI: | ||||||||||||

Interest rate contracts - Interest expense |

|

| |

| |

| |

| | |||

Not Designated as Hedges | ||||||||||||

Interest rate contracts - Interest expense * |

| $ | | $ | | $ | ( | $ | | |||

Foreign currency exchange contracts - Administrative and operating expenses * |

|

| |

| |

| ( | ( | ||||

Total not designated | $ | | $ | | $ | ( | $ | ( | ||||

* Includes interest and foreign currency exchange gains (losses) from cross-currency interest rate contracts.

Included in the table above are interest expense and administrative and operating expense amounts we incurred on derivatives transacted with John Deere. The amounts we recognized on these affiliated party transactions for the three months ended April 28, 2024 and April 30, 2023 were a loss of $

None of our derivative agreements contain credit-risk-related contingent features. We have a loss sharing agreement with John Deere in which we have agreed to absorb any losses and expenses John Deere incurs if an unrelated external counterparty fails to meet its obligations on a derivative transaction that John Deere entered into to manage our exposures. The loss sharing agreement did

20

Derivatives are recorded without offsetting for netting arrangements or collateral. The impact on the derivative assets and liabilities for external derivatives and those with John Deere related to netting arrangements and collateral were as follows:

April 28, 2024 | |||||||||||||

Gross Amounts | Netting | Collateral | Net | ||||||||||

Derivatives: | |||||||||||||

Assets |

|

|

|

|

|

|

| ||||||

External | $ | | $ | ( | $ | | |||||||

John Deere |

| | ( |

| | ||||||||

Liabilities | |||||||||||||

External |

| |

| ( |

| | |||||||

John Deere |

| |

| ( |

|

| | ||||||

October 29, 2023 | |||||||||||||

Gross Amounts | Netting | Collateral | Net | ||||||||||

Derivatives: | |||||||||||||

Assets |

|

|

|

|

|

|

| ||||||

External | $ | | $ | ( |

| $ | | ||||||

John Deere |

| |

| ( |

| | |||||||

Liabilities | |||||||||||||

External |

| |

| ( |

| | |||||||

John Deere |

| |

| ( |

| | |||||||

April 30, 2023 | |||||||||||||

Gross Amounts | Netting | Collateral | Net | ||||||||||

Derivatives: | |||||||||||||

Assets |

|

|

|

|

|

|

| ||||||

External | $ | | $ | ( | $ | | |||||||

John Deere |

| | ( |

| | ||||||||

Liabilities | |||||||||||||

External |

| |

| ( |

| | |||||||

John Deere |

| |

| ( |

|

| | ||||||

(12)SUBSEQUENT EVENT

In May 2024, we entered into a retail note securitization transaction, resulting in $

21

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

All amounts are presented in millions of dollars unless otherwise specified.

OVERVIEW

Organization

We provide financial solutions that enable John Deere customers and dealers to advance their lives and livelihoods. Through our offering of retail notes, leases, and revolving charge accounts, customers are able to finance new and used John Deere equipment, as well as parts, services, and other input costs needed to run their operations. We also provide wholesale financing to John Deere dealers.

Smart Industrial Operating Model and Leap Ambitions

John Deere announced the Smart Industrial Operating Model in 2020. This operating model is based on three focus areas:

(a) | Production systems: A strategic alignment of products and solutions around John Deere customers’ operations. |

(b) | Technology stack: Investments in technology, as well as research and development, that deliver intelligent solutions to John Deere customers through digital capabilities, automation, autonomy, and alternative power technologies. |

(c) | Lifecycle solutions: The integration of John Deere’s aftermarket and support capabilities to more effectively manage customer equipment, service, and technology needs across the full lifetime of a John Deere product. |

John Deere’s Leap Ambitions were launched in 2022. These ambitions are designed to boost economic value and sustainability for John Deere’s customers. The ambitions align across the production systems of John Deere customers, seeking to optimize their operations to deliver better outcomes with fewer resources. As an enabling business, we are fully integrated with John Deere’s Smart Industrial Operating Model and are focused on providing financial solutions to help John Deere achieve its Leap Ambitions.

TRENDS AND ECONOMIC CONDITIONS

Our volume of Receivables and Leases is largely dependent upon the level of retail sales and leases of John Deere products. The level of John Deere retail sales and leases is responsive to a variety of economic, financial, climatic, legislative, and other factors that influence supply and demand for its products.

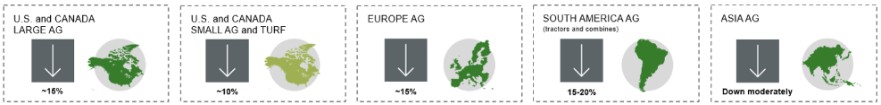

Industry Sales Outlook for Fiscal Year 2024

Agriculture and Turf

Construction and Forestry

John Deere Trends

Customers seek to improve profitability, productivity, and sustainability through technology. Integration of technology into equipment is a persistent market trend. John Deere’s Smart Industrial Operating Model and Leap Ambitions are intended to capitalize on this market trend. The technologies that are the focus of John Deere’s operating model are incorporated into products within each of John Deere’s operating segments. We expect this trend to persist for the foreseeable future.

22

Agriculture and Turf Outlook for 2024

| ● | John Deere expects large and small agricultural equipment sales to be down from 2023 levels in North America, Europe, and South America. |

| ● | Agricultural fundamentals across all of John Deere’s major markets are expected to moderate in 2024 due to rising global stocks, lower commodity prices, elevated interest rates, and weather volatility. In the U.S. and Canada, this is partially offset by resilient farm balance sheets. |

| ● | The U.S. equipment fleet age is elevated for both tractors and combines. However, increases in used inventory levels are impacting purchasing decisions. |

| ● | In Europe, the dairy and livestock sector is expected to improve due to stronger pricing amid lower feed costs while spring weather conditions have caused uncertainty about winter seeded crop yields. In addition, persistent, elevated input costs have decreased demand in Europe. |

| ● | Due to macro-economic trends in U.S. consumer markets including lower levels of home sales, persistently higher interest rates, and inventory reductions, sales of compact utility tractors and riding lawn equipment continue to be lower. |

Construction and Forestry Outlook for 2024

| ● | Construction equipment industry sales are forecasted to be flat to down from 2023 levels. |

| ● | Benefits from increasing U.S. infrastructure spending, elevated manufacturing investment levels, and improving single family housing starts are expected to partially offset declines in commercial real estate construction and softening rental demand. |

| ● | Roadbuilding demand remains strong in the U.S., largely offset by softening demand in Europe. |

Company Trends

Our net income for fiscal year 2024 is expected to be higher than fiscal year 2023 primarily due to income earned on a higher average portfolio and lower dealer financing incentives, partially offset by a higher provision for credit losses and less favorable financing spreads.

Agricultural Market Business Cycle. The agricultural market is affected by various factors including commodity prices, acreage planted, crop yields, and government policies. These factors affect farmers’ income and may result in lower demand for equipment. We may experience higher receivable write-offs and losses on equipment on operating leases during unfavorable market conditions.

Interest Rates. Central bank policy interest rates increased in 2023 and have remained elevated. Most of our receivables and leases with retail customers are fixed rate, while our wholesale receivables generally are variable rate. This Receivable and Lease portfolio is financed with fixed and variable rate borrowings. We manage our exposure to interest rate fluctuations by matching the interest rate characteristics of our portfolio with our funding sources. We also enter into interest rate swap agreements to match our interest rate exposure.

Rising interest rates have historically impacted our borrowings sooner than the benefit is realized from our Receivable and Lease portfolio. As a result, we experienced $25.0 (after-tax) less favorable financing spreads in the first six months of 2024 compared to 2023. We expect to continue experiencing spread compression in 2024, but at a moderating pace relative to spread compression experienced in 2023.

Higher interest rates are driven by factors outside of our control, and as a result we cannot reasonably foresee when these conditions will subside.

Other Items of Concern and Uncertainties

Other items that could impact our results are:

| ● | global and regional political conditions, including the ongoing war between Russia and Ukraine and the conflict in the Middle East, |

| ● | economic, tax, and trade policies, |

| ● | new or retaliatory tariffs, |

| ● | capital market disruptions, |

| ● | foreign currency and capital control policies, |

| ● | regulations and legislation regarding right to repair or right to modify, |

| ● | weather conditions, |

23

| ● | marketplace adoption and monetization of technologies we have invested in, |

| ● | John Deere’s and our ability to strengthen our digital capabilities, automation, autonomy, and alternative power technologies, |

| ● | changes in demand and pricing for new and used equipment, |

| ● | delays or disruptions in John Deere’s supply chain, |

| ● | significant fluctuations in foreign currency exchange rates, |

| ● | volatility in the prices of many commodities, and |

| ● | slower economic growth or recession. |

2024 COMPARED WITH 2023

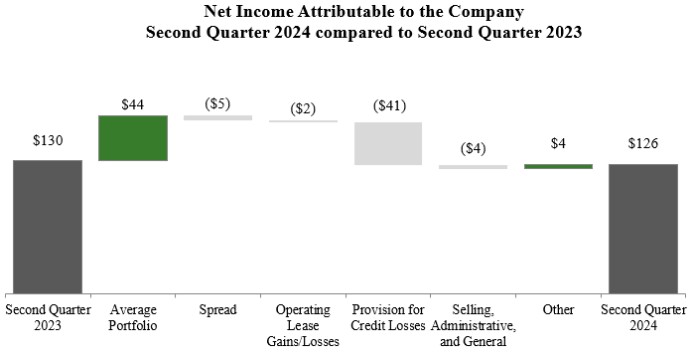

The total revenues and net income attributable to the Company were as follows:

Three Months Ended | Six Months Ended | ||||||||||||||||

April 28 | April 30 | % | April 28 | April 30 | % |

| |||||||||||

| 2024 |

| 2023 | Change |

| 2024 |

| 2023 | Change |

| |||||||

Total revenues | $ | 1,199.5 | $ | 929.3 | 29 | $ | 2,360.0 | $ | 1,765.8 | 34 | |||||||

Net income attributable to the Company | 126.5 | 130.0 | (3) | 301.0 | 267.6 | 12 | |||||||||||

Total revenues increased for the second quarter and first six months of 2024 primarily due to a 17 percent and 18 percent increase in average portfolio balances, respectively, and higher average financing rates. Net income for the quarter was lower than the same period in 2023 primarily due to a higher provision for credit losses and less favorable financing spreads, mostly offset by income earned on higher average portfolio balances. Year-to-date net income was higher due to income earned on higher average portfolio balances and lower dealer financing incentives, partially offset by a higher provision for credit losses and less favorable financing spreads.

24

Revenues

Finance income, lease revenues, and other income earned by us were as follows:

Three Months Ended | Six Months Ended | |||||||||||||||

April 28 | April 30 | % | April 28 | April 30 | % | |||||||||||

2024 | 2023 | Change |

| 2024 | 2023 | Change | ||||||||||

Finance income earned on: | ||||||||||||||||

Retail notes | $ | 463.8 | $ | 352.1 | 32 | $ | 916.1 | $ | 682.1 | 34 | ||||||

Revolving charge accounts | 117.5 | 91.9 | 28 | 222.7 | 174.8 | 27 | ||||||||||

Wholesale receivables | 309.7 | 204.0 | 52 | 580.8 | 355.5 | 63 | ||||||||||

Lease revenues | 265.4 | 240.6 | 10 | 530.2 | 483.1 | 10 | ||||||||||

Other income | 43.1 | 40.7 | 6 | 110.2 | 70.3 | 57 | ||||||||||

Higher average portfolio balances and higher average finance rates drove increased revenues across all products for the second quarter and first six months of 2024 compared to 2023. The change was most pronounced within wholesale receivables, due to an increase in average portfolio balances of 42 percent and 49 percent for the second quarter and first six months of 2024, respectively, due to higher dealer inventory levels.

Other income increased in the second quarter and first six months of 2024 compared to 2023 due to higher interest earned on our cash and cash equivalents and intercompany receivables from John Deere. Year-to-date results also benefited from an international support payment from John Deere as a result of foreign exchange losses in Argentina due to currency devaluation.

Revenues earned from John Deere totaled $292.3 for the second quarter and $570.7 for the first six months of 2024, compared with $251.2 and $459.4 for the same periods last year, respectively. The increases were primarily due to increased compensation paid by John Deere on wholesale receivables and retail notes, driven by a higher interest rate environment, in addition to higher average portfolio balances. The international support payment from John Deere noted above also contributed to the year-to-date increase. Revenues earned from John Deere are included in each of the revenue amounts discussed above.

Expenses

Expenses incurred by us were as follows:

Three Months Ended | Six Months Ended | |||||||||||||||

April 28 | April 30 | % | April 28 | April 30 | % | |||||||||||

2024 | 2023 | Change |

| 2024 | 2023 | Change | ||||||||||

Interest expense | $ | 605.8 | $ | 375.3 | 61 | $ | 1,177.2 | $ | 676.3 | 74 | ||||||

Depreciation of equipment on operating leases | 166.7 | 161.1 | 3 | 333.9 | 325.6 | 3 | ||||||||||

Administrative and operating expenses | 132.3 | 140.0 | (5) | 264.5 | 276.7 | (4) | ||||||||||

Fees and interest paid to John Deere | 55.4 | 58.1 | (5) | 112.5 | 115.7 | (3) | ||||||||||

Provision for credit losses | 79.3 | 26.7 | 197 | 100.3 | 30.2 | 232 | ||||||||||

Provision for income taxes | 34.9 | 39.0 | (11) | 73.8 | 75.8 | (3) | ||||||||||

The increase in interest expense for the second quarter and first six months of 2024 was primarily due to higher average borrowing rates and higher average borrowings to fund a larger portfolio.

Administrative and operating expenses in the second quarter and first six months of 2024 decreased compared to the same periods in 2023 due to lower dealer financing incentive program costs. Additionally, the results for the quarter were positively impacted by lower foreign exchange losses. However, the year-to-date results were partially offset by higher foreign exchange losses in Argentina due to currency devaluation in the first quarter of 2024.

The provision for credit losses increased in the second quarter and first six months of 2024 compared with the same periods last year due to higher net write-offs on retail notes and revolving charge accounts and an increase in allowance, driven by higher expected losses on agricultural customer accounts as a result of elevated delinquencies and a decline in market conditions. The annualized provision for credit losses, as a percentage of the average balance of total Receivables, was .61 percent for the second quarter and .39 percent for the first six months of 2024, compared with .24 percent and .14 percent for the same periods last year, respectively.

25

The provision for income taxes decreased during the second quarter and first six months of 2024 primarily due to favorable discrete tax items and a lower effective tax rate. The decrease year-to-date was partially offset by the effect of higher pretax income.

Receivables and Leases

Receivable and Lease (excluding wholesale) volumes were as follows:

Three Months Ended | |||||||||||

April 28 | April 30 | $ | % | ||||||||

2024 | 2023 | Change | Change | ||||||||

Retail notes: |

|

|

|

|

|

| |||||

Agriculture and turf | $ | 3,566.5 | $ | 3,443.7 | $ | 122.8 | 4 | ||||

Construction and forestry |

| 698.2 |

| 674.1 |

| 24.1 | 4 | ||||

Total retail notes |

| 4,264.7 |

| 4,117.8 |

| 146.9 | 4 | ||||

Revolving charge accounts |

| 2,280.5 |

| 2,146.9 |

| 133.6 | 6 | ||||

Financing leases |

| 364.1 |

| 249.0 |

| 115.1 | 46 | ||||

Equipment on operating leases |

| 678.7 |

| 573.0 |

| 105.7 | 18 | ||||

Total Receivables and Leases (excluding wholesale) | $ | 7,588.0 | $ | 7,086.7 | $ | 501.3 | 7 | ||||

Six Months Ended | |||||||||||

April 28 | April 30 | $ | % | ||||||||

2024 | 2023 | Change | Change | ||||||||

Retail notes: |

|

|

|

|

|

| |||||

Agriculture and turf | $ | 6,399.6 | $ | 6,128.2 | $ | 271.4 | 4 | ||||

Construction and forestry |

| 1,451.8 |

| 1,304.7 |

| 147.1 | 11 | ||||

Total retail notes |

| 7,851.4 |

| 7,432.9 |

| 418.5 | 6 | ||||

Revolving charge accounts |

| 4,356.1 |

| 4,359.6 |

| (3.5) | |||||

Financing leases |

| 549.5 |

| 377.5 |

| 172.0 | 46 | ||||

Equipment on operating leases |

| 1,038.8 |

| 950.3 |

| 88.5 | 9 | ||||

Total Receivables and Leases (excluding wholesale) | $ | 13,795.8 | $ | 13,120.3 | $ | 675.5 | 5 | ||||

Receivable and Lease portfolio balances were as follows:

| April 28 |

| October 29 |

| April 30 | ||||

2024 | 2023 | 2023 | |||||||

Retail notes: |

|

|

|

|

|

| |||

Agriculture and turf | $ | 26,919.2 | $ | 26,708.3 | $ | 24,323.1 | |||

Construction and forestry |

| 5,525.4 |

| 5,289.6 |

| 5,064.4 | |||

Total retail notes |

| 32,444.6 |

| 31,997.9 |

| 29,387.5 | |||

Revolving charge accounts |

| 3,791.4 |

| 4,594.4 |

| 3,699.4 | |||

Wholesale receivables |

| 16,694.6 |

| 13,330.1 |

| 12,880.4 | |||

Financing leases |

| 1,388.6 |

| 1,421.8 |

| 1,116.2 | |||

Equipment on operating leases |

| 5,067.4 |

| 5,051.5 |

| 4,724.2 | |||

Total Receivables and Leases | $ | 59,386.6 | $ | 56,395.7 | $ | 51,807.7 | |||

Customer Receivables decreased $389.5 during the first six months of 2024 due to a seasonal decrease in revolving charge account receivables. Customer Receivables increased $3,421.5 compared to one year ago due to strong John Deere retail sales of new and used equipment. Wholesale receivables increased $3,364.5 in the first six months of 2024 and $3,814.2 compared to one year ago due to higher dealer inventory levels.

Total Receivables 30 days or more past due, non-performing Receivables, and the allowance for credit losses were as follows (as a percentage of the Receivables balance):

April 28, 2024 | October 29, 2023 | April 30, 2023 | |||||||||||||

Dollars | Percent | Dollars | Percent | Dollars | Percent | ||||||||||

Receivables 30 days or more past due | $ | 619.0 | 1.14 | $ | 514.1 | 1.00 | $ | 428.9 | .91 | ||||||

Non-performing Receivables | 542.4 | 1.00 | 383.1 | .75 | 340.4 | .72 | |||||||||

Allowance for credit losses | 174.4 | .32 | 146.4 | .29 | 133.7 | .28 | |||||||||

26

We monitor the credit quality of Receivables based on delinquency status. Receivables 30 days or more past due continue to accrue finance income. We stop accruing finance income once Receivables are considered non-performing, which generally occurs once Receivables are 90 days past due. An allowance for credit losses is recorded for the estimated credit losses expected over the life of the Receivable portfolio. We measure expected credit losses on a collective basis when similar risk characteristics exist. Risk characteristics include product category, market, geography, credit risk, and remaining balance. Receivables that do not share risk characteristics with other receivables in the portfolio are evaluated on an individual basis. Non-performing Receivables are included in the estimate of expected credit losses. While we believe our allowance is sufficient to provide for losses over the life of our existing Receivable portfolio, different assumptions or changes in economic conditions would result in changes to the allowance for credit losses and the provision for credit losses. See Note 4 for additional information related to the allowance for credit losses.

Deposits held from dealers and merchants amounted to $132.0 at April 28, 2024, compared with $138.4 at October 29, 2023 and $131.7 at April 30, 2023. These balances primarily represent the aggregate dealer retail note and lease deposits from individual John Deere dealers to which losses from retail notes and leases originating from the respective dealers can be charged. Recoveries from dealer deposits are recognized in “Other income” when the dealer’s deposit account is charged. Recoveries from dealer deposits and other freestanding credit enhancements recorded in other income were $5.2 in the second quarter and $12.5 for the first six months of 2024, compared with $3.9 and $5.8 for the same periods last year, respectively.

Write-offs and recoveries of Receivables, by product, and as an annualized percentage of average balances held during the period, were as follows:

Three Months Ended | |||||||||||

April 28, 2024 | April 30, 2023 | ||||||||||

Dollars | Percent | Dollars | Percent | ||||||||

Write-offs: |

|

|

|

|

|

|

|

| |||

Retail notes and financing leases: | |||||||||||

Agriculture and turf | $ | (14.2) |

| (.21) | $ | (8.1) |

| (.13) | |||

Construction and forestry |

| (13.9) |

| (.99) |

| (6.2) |

| (.48) | |||

Total retail notes and financing leases |

| (28.1) |

| (.34) |

| (14.3) |

| (.19) | |||

Revolving charge accounts |

| (23.0) |

| (2.78) |

| (10.5) |

| (1.32) | |||

Wholesale receivables |

|

|

| ||||||||

Total write-offs |

| (51.1) |

| (.39) |

| (24.8) |

| (.23) | |||

Recoveries: | |||||||||||

Retail notes and financing leases: | |||||||||||

Agriculture and turf |

| 1.2 |

| .02 |

| 3.4 |

| .05 | |||

Construction and forestry |

| 1.2 |

| .08 |

| .8 |

| .06 | |||

Total retail notes and financing leases |

| 2.4 |

| .03 |

| 4.2 |

| .06 | |||

Revolving charge accounts |

| 5.8 |

| .70 |

| 5.6 |

| .70 | |||

Wholesale receivables | .2 |

| .01 | ||||||||

Total recoveries |

| 8.4 |

| .06 |

| 9.8 |

| .09 | |||

Total net write-offs | $ | (42.7) |

| (.33) | $ | (15.0) |

| (.14) | |||

27

Six Months Ended | |||||||||||

April 28, 2024 | April 30, 2023 | ||||||||||

Dollars | Percent | Dollars | Percent | ||||||||

Write-offs: |

|

|

|

|

|

|

| ||||

Retail notes and financing leases: | |||||||||||

Agriculture and turf | $ | (24.6) |

| (.18) | $ | (15.2) |

| (.12) | |||

Construction and forestry |

| (27.8) |

| (.99) |

| (9.3) |

| (.36) | |||

Total retail notes and financing leases |

| (52.4) |

| (.31) |

| (24.5) |

| (.16) | |||

Revolving charge accounts |

| (33.7) |

| (1.95) |

| (18.0) |

| (1.11) | |||

Wholesale receivables |

|

| (.1) |

| |||||||

Total write-offs |

| (86.1) |

| (.34) |

| (42.6) |

| (.19) | |||

Recoveries: | |||||||||||

Retail notes and financing leases: | |||||||||||

Agriculture and turf |

| 2.5 |

| .02 |

| 5.0 |

| .04 | |||

Construction and forestry |

| 1.6 |

| .06 |

| 1.6 |

| .06 | |||

Total retail notes and financing leases |

| 4.1 |

| .03 |

| 6.6 |

| .04 | |||

Revolving charge accounts |

| 13.4 |

| .77 |

| 10.9 |

| .67 | |||

Wholesale receivables |

| .2 |

| .6 | .01 | ||||||

Total recoveries |

| 17.7 |

| .07 |

| 18.1 |

| .08 | |||

Total net write-offs | $ | (68.4) |

| (.27) | $ | (24.5) |

| (.11) | |||

CRITICAL ACCOUNTING ESTIMATES

See our critical accounting estimates discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our recently filed Annual Report on Form 10-K. There have been no material changes to these estimates.

CAPITAL RESOURCES AND LIQUIDITY – 2024 COMPARED WITH 2023

We rely on our ability to raise substantial amounts of funds to finance our Receivable and Lease portfolios. We have access to global capital markets at a reasonable cost and our ability to meet our debt obligations is supported in several ways. Sources of liquidity include:

| ● | cash and cash equivalents, |

| ● | the issuance of commercial paper and term debt, |

| ● | the securitization of retail notes, |

| ● | intercompany loans from John Deere, |

| ● | our Receivable and Lease portfolio, which is self-liquidating in nature, and |

| ● | bank lines of credit. |

We closely monitor our liquidity sources against the cash requirements and expect to have sufficient sources of global funding and liquidity to meet our funding needs in the short-term (next 12 months) and long-term (beyond 12 months).

Key metrics and certain balance sheet data are provided in the following table:

April 28 | October 29 | April 30 | |||||||

| 2024 |

| 2023 |

| 2023 | ||||

Cash, cash equivalents, and marketable securities | $ | 1,495.6 | $ | 1,488.9 | $ | 1,495.0 | |||

Receivables and Leases – net | 59,212.2 | 56,249.3 | 51,674.0 | ||||||

Interest-bearing debt | 53,505.1 | 50,514.5 | 46,659.4 | ||||||

Unused credit lines | 2,786.7 | 841.2 | 785.3 | ||||||

Ratio of interest-bearing debt to stockholder’s equity | 8.9 to 1 | 8.6 to 1 | 8.1 to 1 | ||||||

The increase in unused credit lines in 2024 compared to both prior periods primarily relates to a decrease in commercial paper outstanding, by both us and John Deere.

There have been no material changes to the contractual obligations and other cash requirements identified in our most recently filed Annual Report on Form 10-K.

28

Cash Flows

Six Months Ended | ||||||

April 28 | April 30 | |||||

| 2024 |

| 2023 | |||

Net cash provided by operating activities | $ | 815.6 | $ | 656.7 | ||

Net cash used for investing activities | (3,399.6) | (4,843.3) | ||||

Net cash provided by financing activities | 2,595.1 | 5,004.3 | ||||

Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 2.2 | 13.6 | ||||

Net increase in cash, cash equivalents, and restricted cash | $ | 13.3 | $ | 831.3 | ||

Net cash was used for investing activities during the first six months of 2024 primarily due to growth in the wholesale portfolio, which was funded primarily through external borrowings and cash provided by operating activities.

Borrowings

Total borrowings increased $2,990.6 in the first six months of 2024 and increased $6,845.7 compared to a year ago, generally corresponding with the level of the Receivable and Lease portfolios. During the first six months of 2024, we issued $6,096.3 and retired $2,323.5 of long-term external borrowings, which primarily consisted of medium-term notes. During the first six months of 2024, we also issued $1,879.8 and retired $1,899.6 of retail note securitization borrowings and maintained an average commercial paper balance of $6,448.8. Our funding profile may be altered to reflect such factors as relative costs of funding sources, assets available for securitizations, and capital market accessibility.