Business of John Deere

John Deere’s operations are categorized into four business segments:

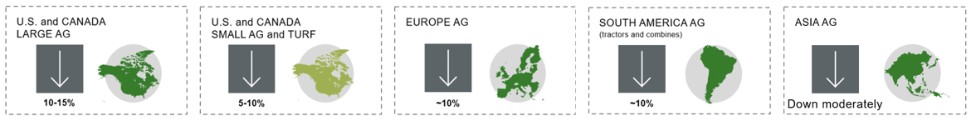

The production and precision agriculture segment defines, develops, and delivers global equipment and technology solutions for production-scale growers of crops like large grains (such as corn and soy), small grains (such as wheat, oats, and barley), cotton, and sugarcane. Equipment manufactured and distributed by the segment includes large and certain mid-size tractors, combines, cotton pickers, cotton strippers, sugarcane harvesters, related harvesting front-end equipment, and pull-behind scrapers. In addition, the segment includes tillage, seeding, and application equipment, including sprayers and nutrient management and soil preparation machinery.

The small agriculture and turf segment defines, develops, and delivers global equipment and technology solutions designed to unlock customer value for dairy and livestock producers, high-value crop producers, and turf and utility customers. Equipment manufactured and distributed by the segment include certain mid-size, small and utility tractors, and related loaders and attachments; turf and utility equipment, including riding lawn equipment, commercial mowing equipment, golf course equipment, utility vehicles, implements for mowing, tiling, snow and debris handling, aerating, and other residential, commercial, golf, and sports turf care applications; and hay and forage equipment, including self-propelled forage harvesters and attachments, balers, and mowers.

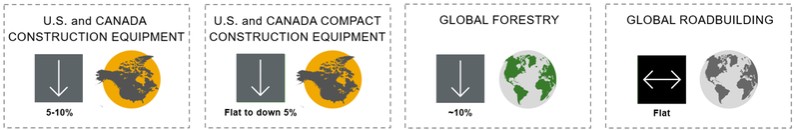

The construction and forestry segment delivers a robust portfolio of construction, roadbuilding, and forestry products with precision technology solutions. The segment’s primary construction products include excavators, wheel loaders, motor graders, dozers, backhoes, articulated dump trucks, compact construction equipment including skid steers, compact excavators, and compact truck loaders, along with a variety of attachments. The segment’s primary roadbuilding products include milling machines, pavers, compactors, rollers, crushers, screens and asphalt plants, and the primary forestry products include skidders, feller bunchers, forwarders, knuckleboom loaders, harvesters, swing machines, and precision forestry technology solutions.

The products and services produced by the segments above are marketed primarily through independent retail dealer networks and major retail outlets. For roadbuilding products in certain markets outside the U.S. and Canada, the products are sold through John Deere-owned sales and service subsidiaries.

The financial services segment includes our operations (described herein) and additional operations in the U.S., Canada, Brazil, China, India, and Thailand. The operations in Russia were sold in the second quarter of fiscal year 2023. The segment primarily finances sales and leases by John Deere dealers of new and used production and precision agriculture equipment, small agriculture and turf equipment, and construction and forestry equipment. In addition, the financial services segment provides wholesale financing to dealers of the foregoing equipment, finances retail revolving charge accounts, and offers extended equipment warranties.

John Deere’s worldwide production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations are sometimes collectively referred to as the “equipment operations.” The financial services segment is sometimes referred to as the “financial services operations.” Receivables and Leases managed by us are evaluated by market (agriculture and turf or construction and forestry).

For fiscal 2023, worldwide net income attributable to Deere & Company was $10.166 billion, or $34.63 per share, compared with $7.131 billion, or $23.28 per share, in fiscal 2022.

Deere & Company’s consolidated net sales and revenues increased 16 percent to $61.251 billion in 2023, compared with $52.577 billion in 2022. Net sales of the equipment operations increased in fiscal 2023 to $55.565 billion, compared with $47.917 billion last year, due to favorable industry fundamentals and strong demand for farm and construction equipment.

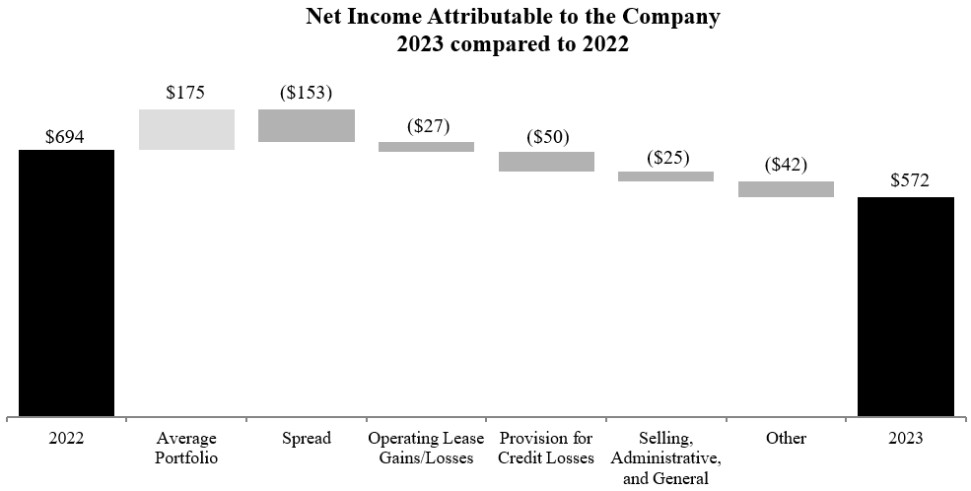

The financial services operations reported net income of $619 for fiscal 2023 compared with $880 in fiscal 2022. Net income declined as a result of the unfavorable impact of higher interest rates on financing spreads and a correction of the accounting treatment for financing incentives offered to John Deere dealers. In 2022, financial services increased the provision for credit losses in Russia and recorded an intercompany benefit from the equipment operations, which guarantees financial services’ investments in certain international markets, including Russia.