the 10-year average for key grains. John Deere expects sales volume of large agricultural equipment to be greater in 2023 than 2022 in North America and Europe. Sales volume for small agriculture and turf equipment is expected to be lower than 2022 due to lower demand for consumer-oriented products, partially offset by stronger demand for mid-sized equipment. Construction equipment markets are forecasted to be steady. Strong U.S. infrastructure spending, industrial construction, and rental inventory restocking are expected to more than offset moderation in residential home and commercial real estate construction. Importantly, construction equipment dealer inventory remains below historical averages. Roadbuilding demand remains strongest in the U.S., largely offset by softening demand in Europe and parts of Asia.

Supply chain conditions have improved over 2022; however, John Deere continues to experience disruptions above historical norms. Supply chain disruptions impacted many aspects of John Deere’s business starting in 2022, including parts availability, increased production costs, and higher inventory levels. Past due deliveries from suppliers were at elevated levels during 2022. John Deere implemented mitigation efforts to minimize the impact of supply chain disruptions on its ability to meet customer demand. John Deere has experienced supply chain improvements in the second quarter of 2023. The reduction in supply chain disruptions contributed to higher levels of production in the second quarter of 2023. However, remaining constraints in the supply base will limit higher levels of production in the second half of the year. As a result, the production schedules in 2023 will be more aligned with the customers’ seasonal use of John Deere’s products, marking a return to historical seasonal production patterns.

Company Trends

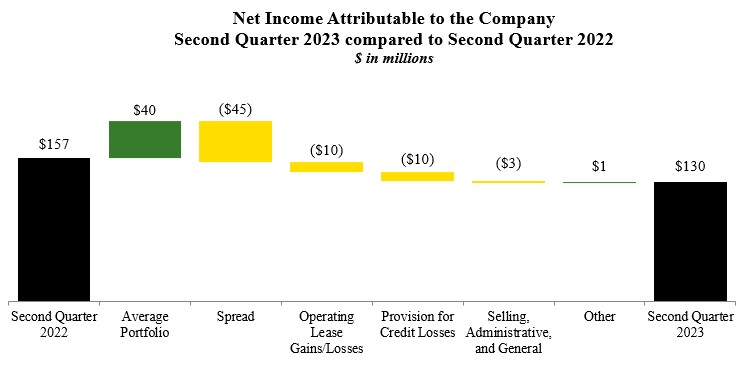

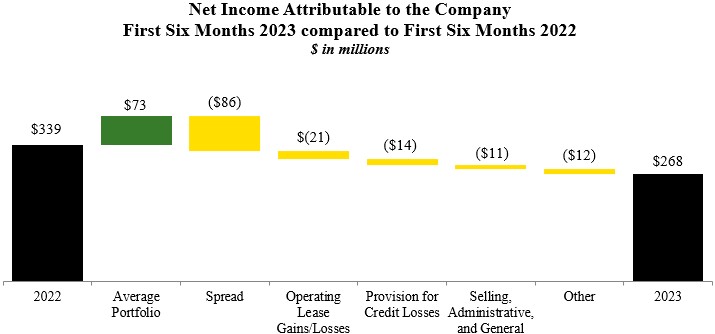

Net income for the Company in fiscal year 2023 is expected to be lower than fiscal year 2022 primarily due to less favorable financing spreads, lower gains on operating lease dispositions, a higher provision for credit losses, and higher selling, administrative, and general expenses. These factors are expected to be partially offset by income earned on higher average portfolio balances, driven by strong demand of John Deere’s products throughout 2023, which is favorably impacting financing volumes.

Central bank policy interest rates increased in the first six months of 2023. Most of the Company’s Customer Receivables are fixed rate, while its wholesale receivables generally are variable rate. The Company has both fixed and variable rate borrowings. The Company manages the risk of interest rate fluctuations by balancing the types and amounts of its funding sources to its Receivable and Lease portfolios. Accordingly, the Company enters into interest rate swap agreements to manage its interest rate exposure. Historically, rising interest rates impact the Company’s borrowings sooner than the benefit is realized from the Receivable and Lease portfolio. As a result, the Company’s financing spread was unfavorably impacted by $85.7 million (after-tax) in the first six months of 2023 compared to 2022. The Company expects spread compression to persist during 2023.

Recent banking sector events have resulted in increased liquidity considerations. The Company’s deposits are well diversified, and as a result, the Company was not exposed to banks that have entered receivership or encountered liquidity issues. These events have not changed the Company’s access to capital markets. The Company continues to monitor counterparty exposure through regular reviews of various risk metrics and by adjusting exposure limits as needed.

As the Company’s volume of Receivables and Leases is largely dependent upon the level of retail sales and leases of John Deere products, supply chain disruptions could impact the Company’s future volumes. Despite supply chain challenges, the Company’s volumes have grown and further growth is forecast in 2023, driven by strong demand for John Deere equipment.

Supply chain disruptions, rising interest rates, and recent banking sector events are driven by factors outside of the Company’s control, and as a result, the Company cannot reasonably foresee when these conditions will subside.

Other Items of Concern and Uncertainties

Other items of concern include global and regional political conditions, failure to raise the U.S. debt ceiling, economic and trade policies, imposition of new or retaliatory tariffs against certain countries or covering certain products, post-pandemic effects, capital market disruptions, changes in demand and pricing for new and used