The information in this pricing supplement is not complete and may be changed. We may not deliver these securities until a final pricing supplement is delivered. This pricing supplement and the accompanying prospectus supplement and prospectus do not constitute an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Preliminary Pricing Supplement dated February 27, 2023

| PROSPECTUS and | PRICING SUPPLEMENT NO. |

| PROSPECTUS SUPPLEMENT, each | Dated , 2023 |

| Dated April 6, 2020 | Registration Statement No. 333-237579 |

| Filed Pursuant to Rule 424(b)(2) |

U.S. $2,500,000,000

JOHN DEERE CAPITAL CORPORATION

MEDIUM-TERM NOTES, SERIES H

Due 9 Months or More from Date of Issue

$ Floating Rate Senior Notes Due , 2026

The Medium-Term Notes offered hereby will be Floating Rate Notes and senior securities as more fully described in the accompanying Prospectus

and Prospectus Supplement and will be denominated in U.S. Dollars.

| CUSIP / ISIN: | / |

| Date of Issue: | , 2023 |

| Maturity Date: | , 2026 |

| Principal Amount: | $ |

| Interest Rate Basis: | Compounded SOFR (as defined below) |

| Index Maturity: | Daily |

| Spread: | basis points |

| Initial Interest Rate: | Compounded SOFR determined on , plus the Spread, accruing from and including , 2023 to but excluding the first Interest Payment Date, calculated as described herein |

| Day Count: | Actual/360, Adjusted |

| Interest Reset Dates: | Each Interest Payment Date |

| Interest Determination Dates: | Quarterly, five U.S. Government Securities Business Days (as defined below) preceding each Interest Reset Date |

| Interest Payment Dates: | Quarterly on the of , , and , commencing on , and ending on the Maturity Date |

| Interest Period: | Each quarterly period from, and including, an Interest Payment Date (or, in the case of the first Interest Period, the Date of Issue) to, but excluding, the next Interest Payment Date (or, in the case of the final Interest Period, the Maturity Date). |

| Observation Period: | The period from and including five U.S. Government Securities Business Days preceding an Interest Payment Date to but excluding five U.S. Government Securities Business Days preceding the next Interest Payment Date, provided that the first Observation Period shall be from and including five U.S. Government Securities Business Days preceding the Date of Issue to but excluding five U.S. Government Securities Business Days preceding the first Interest Payment Date. |

| Minimum Interest Rate: | 0.000% |

| Price to Public: | % plus accrued interest, if any, from , 2023 |

| Business Day: | New York and U.S. Government Securities Business Day |

| Business Day Convention: | Modified Following, Adjusted |

| Redemption Provisions: | None |

| Plan of Distribution: | Name | Principal Amount Of Notes |

| Barclays Capital Inc. | $ | |

| Citigroup Global Markets Inc. | $ | |

| Credit Agricole Securities (USA) Inc. | $ | |

| MUFG Securities Americas Inc. | $ | |

| Total | $ | |

| The above Agents have severally agreed to purchase the respective principal amount of Notes, opposite their names as principal, at a price of % plus accrued interest, if any, from , 2023. |

TABLE OF CONTENTS

| RISK FACTORS | PS-1 |

| SECURED OVERNIGHT FINANCING RATE | PS-4 |

| DESCRIPTION OF THE NOTES | PS-6 |

Your investment in the notes is subject to certain risks. This pricing supplement does not describe all of the risks of an investment in the notes. You should consult your own financial and legal advisors about the risks entailed by an investment in the notes and the suitability of your investment in the notes in light of your particular circumstances. You should also consider carefully the matters described below and in the accompanying prospectus under “Risk Factors”, as well as the other factors described under "Risk Factors" and in our Safe Harbor Statements included or incorporated by reference in our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission, including those related to Deere & Company.

The Secured Overnight Financing Rate published by the New York Federal Reserve has a limited history, and the future performance of the Secured Overnight Financing Rate cannot be predicted based on its historical performance.

You should note that publication of the Secured Overnight Financing Rate (as defined below) began on April 3, 2018 and it therefore has a limited history. In addition, the future performance of the Secured Overnight Financing Rate cannot be predicted based on the limited historical performance. The level of the Secured Overnight Financing Rate during the term of the notes may bear little or no relation to the historical level of the Secured Overnight Financing Rate. Prior observed patterns, if any, in the behavior of market variables and their relation to the Secured Overnight Financing Rate, such as correlations, may change in the future. While some prepublication historical information has been released by the New York Federal Reserve (as defined below), analysis of such information inherently involves assumptions, estimates and approximations. The future performance of the Secured Overnight Financing Rate is impossible to predict and therefore no future performance of the Secured Overnight Financing Rate or the notes may be inferred from any of the historical simulations or historical performance. Hypothetical or historical performance data are not indicative of, and have no bearing on, the future performance of the Secured Overnight Financing Rate or the notes. Changes in the levels of the Secured Overnight Financing Rate will affect the Interest Rate Basis (as described above) and, therefore, the return on the notes and the trading price of the notes, but it is impossible to predict whether such levels will rise or fall.

Any failure of the Secured Overnight Financing Rate to gain market acceptance could adversely affect the notes.

The Secured Overnight Financing Rate may fail to gain market acceptance. The Secured Overnight Financing Rate was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to U.S. dollar LIBOR in part because it is considered to be a good representation of general funding conditions in the overnight U.S. Treasury repurchase agreement (repo) market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks. This may mean that market participants would not consider the Secured Overnight Financing Rate to be a suitable substitute or successor for all of the purposes for which U.S. dollar LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of the Secured Overnight Financing Rate. Any failure of the Secured Overnight Financing Rate to gain market acceptance could adversely affect the return on the notes and the price at which you can sell the notes.

The interest rate on the notes is based on Compounded SOFR, which is relatively new in the marketplace.

For each Interest Period, the interest rate on the notes is based on Compounded SOFR, which is calculated according to the specific formula described under “Description of the Notes—Additional Terms of the Notes” and not by using the Secured Overnight Financing Rate published on, or in respect of, a particular date during such Interest Period or an arithmetic average of the Secured Overnight Financing Rates during such period. For this and other reasons, the interest rate on the notes during any Interest Period will not necessarily be the same as the interest rate on other Secured Overnight Financing Rate-linked investments that use an alternative basis to determine the applicable interest rate. Further, if the Secured Overnight Financing Rate in respect of a particular date during an Interest Period is negative, its contribution to SOFR will be less than one, resulting in a reduction to Compounded SOFR used to calculate the interest payable on the notes on the Interest Payment Date for such Interest Period.

In addition, a more limited market precedent exists for securities that use the Secured Overnight Financing Rate as the interest rate, and the method for calculating an interest rate based upon the Secured Overnight Financing Rate in those precedents varies. Accordingly, the specific formula for Compounded SOFR used in the notes may not be widely adopted by other market participants, if at all. You should carefully review the specific formula for Compounded SOFR used in the notes before deciding to make an investment in the notes. If the market adopts a different calculation method than used in the notes, that could adversely affect the market value of the notes.

PS-1

The total amount of interest payable on Compounded SOFR notes with respect to a particular Interest Period will only be capable of being determined near the end of the relevant Interest Period.

Compounded SOFR applicable to a particular Interest Period and, therefore, the total amount of interest payable with respect to such Interest Period will be determined on the Interest Determination Date (as described herein) for such Interest Period. Because each such date is near the end of such Interest Period, you will not know the total amount of interest payable with respect to a particular Interest Period until shortly prior to the related Interest Payment Date, and it may be difficult for you to reliably estimate the total amount of interest that will be payable on each such Interest Payment Date. In addition, some investors may be unwilling or unable to trade the notes without changes to their information technology systems, both of which could adversely impact the liquidity and trading price of the notes.

The composition and characteristics of the Secured Overnight Financing Rate may be more volatile and are not the same as those of LIBOR. There is no guarantee that the Secured Overnight Financing Rate is a comparable substitute for LIBOR.

In June 2017, the New York Federal Reserve’s Alternative Reference Rates Committee (the “ARRC”) announced the Secured Overnight Financing Rate as its recommended alternative to U.S. dollar LIBOR. However, the composition and characteristics of the Secured Overnight Financing Rate are not the same as those of LIBOR. The Secured Overnight Financing Rate is a broad Treasury repo financing rate that represents overnight secured funding transactions. This means that the Secured Overnight Financing Rate is fundamentally different from LIBOR for two key reasons. First, the Secured Overnight Financing Rate is a secured rate, while LIBOR is an unsecured rate. Second, the Secured Overnight Financing Rate is an overnight rate, while LIBOR represents interbank funding over different maturities. As a result, there can be no assurance that the Secured Overnight Financing Rate will perform in the same way as LIBOR would have at any time, including, without limitation, as a result of changes in interest and yield rates in the market, market volatility or global or regional economic, financial, political, regulatory, judicial or other events. For example, since publication of the Secured Overnight Financing Rate began on April 3, 2018, daily changes in the Secured Overnight Financing Rate have, on occasion, been more volatile than daily changes in comparable benchmark or other market rates. The return on and value of the notes may fluctuate more than floating rate securities that are linked to less volatile rates. In addition, the volatility of the Secured Overnight Financing Rate has reflected the underlying volatility of the overnight U.S. Treasury repo market. The New York Federal Reserve has at times conducted operations in the overnight U.S. Treasury repo market in order to help maintain the federal funds rate within a target range. There can be no assurance that the New York Federal Reserve will continue to conduct such operations in the future, and the duration and extent of any such operations is inherently uncertain. The effect of any such operations, or of the cessation of such operations to the extent they are commenced, is uncertain and could be materially adverse to investors in the notes. For additional information regarding the Secured Overnight Financing Rate, see “Secured Overnight Financing Rate” below.

The secondary trading market for notes linked to the Secured Overnight Financing Rate may be limited.

The notes will not have an established trading market when issued. Since the Secured Overnight Financing Rate is a relatively new market rate, an established trading market may never develop or may not be very liquid. Market terms for debt securities that are linked to the Secured Overnight Financing Rate (such as the notes) may evolve over time and, as a result, trading prices of the notes may be lower than those of later-issued debt securities that are linked to the Secured Overnight Financing Rate. Similarly, if the Secured Overnight Financing Rate does not prove to be widely used in debt securities that are similar to the notes, the trading price of the notes may be lower than that of debt securities that are linked to rates that are more widely used. Investors in the notes may not be able to sell the notes at all or may not be able to sell the notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Further, investors wishing to sell the notes in the secondary market will have to make assumptions as to the future performance of the Secured Overnight Financing Rate during the applicable Interest Period in which they intend the sale to take place. As a result, investors may suffer from increased pricing volatility and market risk.

The administrator of the Secured Overnight Financing Rate may make changes that could change the value of the Secured Overnight Financing Rate or discontinue the Secured Overnight Financing Rate and has no obligation to consider your interests in doing so.

The New York Federal Reserve, as administrator of the Secured Overnight Financing Rate, may make methodological or other changes that could change the value of the Secured Overnight Financing Rate, including changes related to the method by which the Secured Overnight Financing Rate is calculated, eligibility criteria applicable to the transactions used to calculate the Secured Overnight Financing Rate, or timing related to the publication of the Secured Overnight Financing Rate. If the manner in which the Secured Overnight Financing Rate is calculated is changed, that change may result in a reduction of the amount of interest payable on the notes, which may adversely affect the trading prices of the notes. In addition, the administrator may alter, discontinue or suspend calculation or dissemination of the Secured Overnight Financing Rate (in which case a fallback method of determining the interest rate on the notes as further described under “Description of the Notes—Additional Terms of the Notes—Effect of a Benchmark Transition Event” will apply). The administrator has no obligation to consider your interests in calculating, adjusting, converting, revising or discontinuing the Secured Overnight Financing Rate.

PS-2

The notes may bear interest by reference to a rate other than Compounded SOFR, which could adversely affect the value of the notes.

If the manner in which the Secured Overnight Financing Rate is calculated is changed, that change may result in a reduction in the amount of interest payable on the notes and the trading prices of the notes. In addition, the New York Federal Reserve may withdraw, modify or amend the published Secured Overnight Financing Rate data in its sole discretion and without notice and such modifications or amendments will apply to future determinations of the interest rate for the Notes. With respect to the notes, the interest rate for any Interest Period will not be adjusted for any modifications or amendments to Secured Overnight Financing Rate data that the New York Federal Reserve may publish after the interest rate for that Interest Period has been determined.

If the Secured Overnight Financing Rate is discontinued, the notes will bear interest by reference to a different base rate with, potentially, a spread adjustment, which could adversely affect the value of the notes, the return on the notes and the price at which you can sell the notes; there is no guarantee that any replacement base rate will be a comparable substitute for the Secured Overnight Financing Rate.

Under certain circumstances, the interest rate on the notes will no longer be determined by reference to the Secured Overnight Financing Rate, but instead will be determined by reference to a different rate, which will be a different Benchmark than the Secured Overnight Financing Rate plus a spread adjustment, which is referred to as a “Benchmark Replacement” and a “Benchmark Replacement Adjustment,” respectively.

If a particular Benchmark Replacement or Benchmark Replacement Adjustment cannot be determined, then the next-available Benchmark Replacement or Benchmark Replacement Adjustment will apply. These replacement rates and adjustments may be selected, recommended or formulated by (1) the Relevant Governmental Body (such as the ARRC), (2) ISDA (as defined below) or (3) in certain circumstances, us or our designee. In addition, the terms of the notes expressly authorize us or our designee to make Benchmark Replacement Conforming Changes with respect to, among other things, the definition of “Interest Period,” timing and frequency of determining rates and making payments of interest and other administrative matters. The determination of a Benchmark Replacement, the calculation of the interest rate on the notes by reference to a Benchmark Replacement (including the application of a Benchmark Replacement Adjustment), any implementation of Benchmark Replacement Conforming Changes and any other determinations, decisions or elections that may be made under the terms of the notes in connection with a Benchmark Transition Event could adversely affect the value of the notes, the return on the notes and the price at which you can sell the notes.

In addition, (1) the composition and characteristics of the Benchmark Replacement will not be the same as those of the Secured Overnight Financing Rate, the Benchmark Replacement will not be the economic equivalent of the Secured Overnight Financing Rate, there can be no assurance that the Benchmark Replacement will perform in the same way as the Secured Overnight Financing Rate would have at any time and there is no guarantee that the Benchmark Replacement will be a comparable substitute for the Secured Overnight Financing Rate (each of which means that a Benchmark Transition Event could adversely affect the value of the notes, the return on the notes and the price at which you can sell the notes), (2) any failure of the Benchmark Replacement to gain market acceptance could adversely affect the notes, (3) the Benchmark Replacement may have a more limited history and the future performance of the Benchmark Replacement cannot be predicted based on historical performance, (4) the secondary trading market for the notes linked to the Benchmark Replacement may be limited, (5) the administrator of the Benchmark Replacement may make changes that could change the value of the Benchmark Replacement or discontinue the Benchmark Replacement and has no obligation to consider your interests in doing so and (6) the Benchmark Replacement Adjustment may be zero or may not be adequate to compensate you for the use of the Benchmark Replacement.

We or our designee will have authority to make determinations, elections, calculations and adjustments that could affect the value of and your return on the notes.

We or our designee will make determinations, decisions, elections, calculations and adjustments with respect to the notes as set forth under “Description of the Notes—Additional Terms of the Notes” below that may adversely affect the value of and your return on the notes. In addition, we or our designee may determine the Benchmark Replacement and the Benchmark Replacement Adjustment and can apply any Benchmark Replacement Conforming Changes deemed reasonably necessary to adopt the Benchmark Replacement. Although we or our designee will exercise judgment in good faith when performing such functions, potential conflicts of interest do exist between us or our designee and you. All determinations, decisions and elections by us or our designee are in our or the designee’s sole discretion and will be conclusive for all purposes and binding on us and holders of the notes absent manifest error. Further, notwithstanding anything to the contrary in the documentation relating to the notes, all determinations, decisions and elections by us or our designee will become effective without consent from the holders of the notes or any other party. In making the determinations, decisions and elections noted under “Description of the Notes—Additional Terms of the Notes—Effect of a Benchmark Transition Event” below, we or our designee do have economic interests that are adverse to your interests, and such determinations, decisions, elections, calculations and adjustments may adversely affect the value of and your return on the notes. Because the Benchmark Replacement is uncertain, we or our designee are likely to exercise more discretion in respect of calculating interest payable on the notes than would be the case in the absence of a Benchmark Transition Event and its related Benchmark Replacement Date. These potentially subjective determinations may adversely affect the value of the notes, the return on the notes and the price at which you can sell the notes.

PS-3

SECURED OVERNIGHT FINANCING RATE

Secured Overnight Financing Rate

The Secured Overnight Financing Rate is published by the New York Federal Reserve and is intended to be a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities. The New York Federal Reserve reports that the Secured Overnight Financing Rate includes all trades in the Broad General Collateral Rate (as defined by the New York Federal Reserve), plus bilateral Treasury repo transactions cleared through the delivery-versus payment service offered by the Fixed Income Clearing Corporation (the “FICC”), a subsidiary of The Depository Trust Company, New York, New York. The Secured Overnight Financing Rate is filtered by the New York Federal Reserve to remove a portion of the foregoing transactions considered to be “specials.” According to the New York Federal Reserve, “specials” are repos for specific-issue collateral, which take place at cash-lending rates below those for general collateral repos because cash providers are willing to accept a lesser return on their cash in order to obtain a particular security.

The New York Federal Reserve reports that the Secured Overnight Financing Rate is calculated as a volume-weighted median of transaction-level tri-party repo data collected from The Bank of New York Mellon as well as general collateral finance repurchase agreement transaction data and data on bilateral Treasury repurchase transactions cleared through the FICC’s delivery-versus-payment service. The New York Federal Reserve notes that it obtains information from DTCC Solutions LLC, an affiliate of The Depository Trust Company. If data for a given market segment were unavailable for any day, then the most recently available data for that segment would be utilized, with the rates on each transaction from that day adjusted to account for any change in the level of market rates in that segment over the intervening period. The Secured Overnight Financing Rate would be calculated from this adjusted prior day’s data for segments where current data were unavailable, and unadjusted data for any segments where data were available. To determine the change in the level of market rates over the intervening period for the missing market segment, the New York Federal Reserve would use information collected through a daily survey conducted by its trading desk of primary dealers’ repo borrowing activity. Such daily survey may include information reported by the underwriters or their affiliates. The New York Federal Reserve notes on its publication page for the Secured Overnight Financing Rate that use of the Secured Overnight Financing Rate is subject to important limitations and disclaimers, including that the New York Federal Reserve may alter the methods of calculation, publication schedule, rate revision practices or availability of the Secured Overnight Financing Rate at any time without notice.

Each U.S. Government Securities Business Day (as defined below), the New York Federal Reserve publishes the Secured Overnight Financing Rate on its website at approximately 8:00 A.M., New York City time. If errors are discovered in the transaction data provided by The Bank of New York Mellon or DTCC Solutions LLC, or in the calculation process, subsequent to the initial publication of the Secured Overnight Financing Rate but on that same day, the Secured Overnight Financing Rate and the accompanying summary statistics may be republished at approximately 2:30 P.M., New York City time. Additionally, if transaction data from The Bank of New York Mellon or DTCC Solutions LLC had previously not been available in time for publication, but became available later in the day, the affected rate or rates may be republished at around this time. Rate revisions will only be effected on the same day as initial publication and will only be republished if the change in the rate exceeds one basis point. Any time a rate is revised, a footnote to the New York Federal Reserve’s publication would indicate the revision. This revision threshold will be reviewed periodically by the New York Federal Reserve and may be changed based on market conditions.

As the Secured Overnight Financing Rate is published by the New York Federal Reserve based on data received from other sources, we have no control over its determination, calculation or publication. There can be no guarantee that the Secured Overnight Financing Rate will not be discontinued or fundamentally altered in a manner that is materially adverse to the interests of investors in the notes. With respect to the notes, the interest rate for any Interest Period will not be adjusted for any modifications or amendments to the Secured Overnight Financing Rate data that the New York Federal Reserve may publish after the interest rate for such Interest Period has been determined. If the manner in which the Secured Overnight Financing Rate is calculated is changed, that change may result in a reduction of the amount of interest payable on the notes and the trading prices of the notes.

Disclaimer Regarding the Secured Overnight Financing Rate

The New York Federal Reserve began to publish the Secured Overnight Financing Rate in April 2018. The New York Federal Reserve has also begun publishing historical indicative Secured Overnight Financing Rates going back to 2014. Investors should not rely on any historical changes or trends in the Secured Overnight Financing Rate as an indicator of future changes in the Secured Overnight Financing Rate. Also, since the Secured Overnight Financing Rate is a relatively new market index, the notes will have no established trading market when issued, and an established trading market may never develop or may not be very liquid. Market terms for debt securities indexed to the Secured Overnight Financing Rate, such as the spread over the index reflected in interest rate provisions, may evolve over time, and, as a result, trading prices of the notes may be lower than those of later-issued indexed debt securities as a result. Similarly, if the Secured Overnight Financing Rate does not prove to be widely used in securities like the notes, the trading price of the notes may be lower than those of notes linked to indices that are more

PS-4

widely used. Investors in the notes may not be able to sell the notes at all or may not be able to sell the notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market, and may consequently suffer from increased pricing volatility and market risk.

The information contained in this section is based upon the New York Federal Reserve’s Website and other U.S. government sources, as of the date of this pricing supplement.

PS-5

General

We provide information to you about the notes in three separate documents:

| · | this pricing supplement which specifically describes the notes being offered; |

| · | the accompanying prospectus supplement which describes our Medium-Term Notes, Series H; and |

| · | the accompanying prospectus which describes generally our debt securities. |

Additional Terms of the Notes

This description supplements, and, to the extent inconsistent, supersedes, the description of the general terms and provisions of the debt securities found in the accompanying prospectus and our Medium-Term Notes, Series H described in the accompanying prospectus supplement.

The Interest Rate Basis for the Notes is Compounded SOFR

The Interest Rate for each Interest Period will be equal to Compounded SOFR plus the Spread, calculated as described herein; provided, that the interest rate will in no event be less than 0.00%. The amount of interest accrued and payable on the notes for each Interest Period will be equal to the product of (1) the outstanding principal amount of the notes multiplied by (2) the product of (a) the interest rate for the relevant Interest Period multiplied by (b) the quotient of the actual number of calendar days in the Interest Period divided by 360.

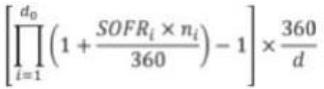

“Compounded SOFR,” with to respect to any Interest Period, means a daily compounded rate of return computed in accordance with the formula set forth below (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (e.g., 9.876541% (or .09876541) being rounded down to 9.87654% (or .0987654) and 9.876545% (or .09876545) being rounded up to 9.87655% (or .0987655))):

where:

| · | “d0” for any Observation Period, is the number of U.S. Government Securities Business Days in the relevant Observation Period; |

| · | “i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Day in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Observation Period; |

| · | “SOFRi,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is equal to SOFR in respect of that day “i”; |

| · | “ni,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day (“i+1”); and |

| · | “d” is the number of calendar days in the relevant Observation Period. |

For these calculations, the daily SOFR in effect on any U.S. Government Securities Business Day will be the applicable SOFR as reset on that date.

PS-6

For purposes of determining Compounded SOFR, “SOFR” means, with respect to any U.S. Government Securities Business Day:

(1) the Secured Overnight Financing Rate published by the New York Federal Reserve as such rate appears on the New York Federal Reserve’s Website at 3:00 P.M., New York City time, on the immediately following U.S. Government Securities Business Day (the “SOFR Determination Time”); provided that:

(2) if the rate specified in (1) above does not so appear, unless both a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the Secured Overnight Financing Rate as published in respect of the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the Federal Reserve Bank of New York’s Website.

“Secured Overnight Financing Rate” means the daily secured overnight financing rate as provided by the New York Federal Reserve on the New York Federal Reserve’s Website.

If an Interest Payment Date or Interest Reset Date would otherwise fall on a day that is not a Business Day, such Interest Payment Date or Interest Reset Date, as applicable, will be postponed to the following day that is a Business Day, except that, if such day falls in the next calendar month, such Interest Payment Date or Interest Reset Date, as applicable, will be the preceding day that is a Business Day. If the Maturity Date falls on a day that is not a Business Day, the payment of principal, premium, if any, and interest may be made on the next succeeding Business Day, and no interest on such payment shall accrue for the period from and after the Maturity Date.

Effect of a Benchmark Transition Event

If we or our designee determine on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the notes in respect of all determinations on such date and for all determinations on all subsequent dates.

In connection with the implementation of a Benchmark Replacement, we or our designee will have the right to make Benchmark Replacement Conforming Changes from time to time.

Any determination, decision or election that may be made by us or our designee pursuant to this section, including a determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection:

(1) will be conclusive and binding absent manifest error;

(2) will be made in our or our designee’s sole discretion; and

(3) notwithstanding anything to the contrary in the documentation relating to the notes, shall become effective without consent from the holders of the notes or any other party.

“Benchmark” means, initially, Compounded SOFR, as such term is defined above; provided that if we or our designee determine on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR (or the published daily SOFR used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by us or our designee as of the Benchmark Replacement Date.

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark; and (b) the Benchmark Replacement Adjustment;

(2) the sum of: (a) the ISDA Fallback Rate; and (b) the Benchmark Replacement Adjustment; or

(3) the sum of: (a) the alternate rate of interest that has been selected by us or our designee as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar- denominated floating rate notes at such time; and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by us or our designee as of the Benchmark Replacement Date:

PS-7

(1) the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by us or our designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of the Interest Period, timing and frequency of determining rates and making payments of interest, rounding of amounts or tenors, and other administrative matters) that we or our designee decide may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if we or our designee decide that adoption of any portion of such market practice is not administratively feasible or if we or our designee determine that no market practice for use of the Benchmark Replacement exists, in such other manner as we or our designee determine is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event that gives rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

For the avoidance of doubt, for purposes of the definitions of Benchmark Replacement Date and Benchmark Transition Event, references to Benchmark also include any reference rate underlying such Benchmark.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component);

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

“ISDA” means the International Swaps and Derivatives Association, Inc.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

PS-8

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“New York Federal Reserve” means the Federal Reserve Bank of New York (or a successor administrator of the Secured Overnight Financing Rate).

“New York Federal Reserve’s Website” means the website of the New York Federal Reserve, currently at http://www.newyorkfed.org, or any successor source.

“Observation Period” means the period from and including five U.S. Government Securities Business Days preceding an Interest Payment Date to but excluding five U.S. Government Securities Business Days preceding the next Interest Payment Date, provided that the first Observation Period shall be from and including five U.S. Government Securities Business Days preceding the Date of Issue to but excluding five U.S. Government Securities Business Days preceding the first Interest Payment Date.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time, and (2) if the Benchmark is not Compounded SOFR, the time determined by us or our designee after giving effect to the Benchmark Replacement Conforming Changes.

“Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto.

“U.S. Government Securities Business Day” means a day other than a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

PS-9