UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-02857 and 811-21434

| Name of Fund: | BlackRock Bond Fund, Inc. |

| BlackRock Total Return Fund |

| Master Bond LLC |

| Master Total Return Portfolio |

| Fund Address:100 | Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Bond Fund, Inc.

and Master Bond LLC, 50 Hudson Yards, New York, NY 10001

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2023

Date of reporting period: 09/30/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

|

|

SEPTEMBER 30, 2023 |

|

|

2023 Annual Report

| |

BlackRock Bond Fund, Inc.

· BlackRock Total Return Fund

|

Not FDIC Insured • May Lose Value • No Bank Guarantee

|

Dear Shareholder,

The combination of continued economic growth and moderating inflation provided a supportive backdrop for investors during the 12-month reporting period ended September 30, 2023. Significantly tighter monetary policy helped to rein in inflation while the economy proved more resilient than many investors anticipated. A moderating labor market also helped ease inflationary pressure, although wages continued to grow and unemployment rates touched the lowest levels in decades. This robust labor market powered further growth in consumer spending, backstopping the economy. On October 7, 2023, Hamas launched a horrific attack on Israel. The ensuing war will have a significant humanitarian impact and could lead to heightened economic and market volatility. We see geopolitics as a structural market risk going forward. See our geopolitical risk dashboard at blackrock.com for more details.

Equity returns were substantial, as the durability of consumer sentiment and spending mitigated investors’ concerns about the economy’s trajectory. The U.S. economy resumed growth in the third quarter of 2022 and continued to expand thereafter. All major classes of equities rose, although large-capitalization U.S. stocks posted significantly higher returns than small-capitalization U.S. stocks due primarily to the performance of large technology companies. International developed market equities also advanced strongly, and emerging market equities posted solid gains.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. The corporate bond market benefited from improving economic sentiment, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), attempting to manage persistent inflation, raised interest rates six times during the 12-month period. Furthermore, the Fed wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity. However, the Fed declined to raise interest rates at two of its meetings late in the period.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has decelerated the pace of interest rate hikes and recently opted for two pauses, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period to keep inflation under control. Furthermore, ongoing structural changes may mean that the Fed will be hesitant to cut interest rates in the event of faltering economic activity lest inflation accelerate again. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt.

While we favor an overweight position in developed market equities in the long term, we prefer an underweight stance in the near term. Expectations for corporate earnings remain elevated, which seems inconsistent with macroeconomic constraints. Nevertheless, we are overweight on Japanese stocks in the near term as shareholder-friendly policies generate increased investor interest. We also believe that stocks with an AI tilt should benefit from an investment cycle that is set to support revenues and margins. In credit, there are selective opportunities in the near term despite tightening credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. inflation-linked bonds, euro area government bonds and gilts, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of September 30, 2023 | ||||

| 6-Month | 12-Month | |||

| U.S. large cap equities (S&P 500® Index) |

5.18% | 21.62% | ||

| U.S. small cap equities (Russell 2000® Index) |

(0.19) | 8.93 | ||

| International equities (MSCI Europe, Australasia, Far East Index) |

(1.28) | 25.65 | ||

| Emerging market equities (MSCI Emerging Markets Index) |

(2.05) | 11.70 | ||

| 3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) |

2.50 | 4.47 | ||

| U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) |

(6.98) | (2.90) | ||

| U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) |

(4.05) | 0.64 | ||

| Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) |

(4.05) | 2.66 | ||

| U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

2.22 | 10.28 | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

| 2 | ||||

| Annual Report: |

||||

| 4 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| Fund Financial Statements: |

||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 20 | ||||

| Fund Report of Independent Registered Public Accounting Firm |

25 | |||

| 26 | ||||

| 27 | ||||

| Master Portfolio Financial Statements: |

||||

| 28 | ||||

| 99 | ||||

| 101 | ||||

| 102 | ||||

| 103 | ||||

| 104 | ||||

| 118 | ||||

| 119 | ||||

| Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements |

123 | |||

| 127 | ||||

| 129 | ||||

| 3 |

| Fund Summary as of September 30, 2023 | BlackRock Total Return Fund |

Investment Objective

BlackRock Total Return Fund’s (the “Fund”) investment objective is to realize a total return that exceeds that of the Bloomberg U.S. Aggregate Bond Index.

On June 1, 2023, the Board of Directors of the Fund approved a proposal pursuant to which the Fund will cease to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and will instead operate as a stand-alone fund. The change is expected to be completed in the first quarter of 2024.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended September 30, 2023, the Fund’s Institutional, Service, Investor A, Investor A1, Class K share classes outperformed the benchmark, the Bloomberg U.S. Aggregate Bond Index, while the Fund’s Investor C shares underperformed, and Class R shares outperformed. The Fund invests all of its assets in Master Total Return Portfolio (the “Master Portfolio”).

What factors influenced performance?

Holdings of structured products, agency mortgage-backed securities (“MBS”) and investment grade corporate bonds contributed positively to the Fund’s performance relative to the benchmark for the period.

The Fund’s macro strategies and currency exposures detracted from relative performance over the reporting period. The Fund held derivatives during the reporting period, namely futures and forwards. The Fund’s use of derivatives detracted from performance.

Describe recent portfolio activity.

During the fourth quarter of 2022, the Fund increased risk within high quality fixed income sectors as the opportunity set shifted on the back of the Fed’s fastest rate hiking cycle in decades. In this vein, the Fund strategically tilted further into high quality shorter maturity assets while maintaining its high yield corporate bond exposure near historically low levels. The Fund increased its active tilts within U.S. investment grade corporate credit given the increased dispersion of risk/reward within the sector, while reducing its overweight in agency MBS. Within securitized assets, exposure was rotated toward higher quality commercial mortgage-backed securities and structurally protected collateralized loan obligations. The Fund was defensively positioned in emerging market debt given concerns around tighter central bank policies, weakening growth and reduced liquidity.

During the first quarter of 2023, the Fund shifted to an underweight stance with respect to duration and corresponding interest rate sensitivity (Duration is a measure of interest rate sensitivity). The Fund continued to tactically rotate across select spread sectors given more attractive opportunities. Exposure to U.S. investment grade corporate bonds was slightly trimmed as spreads became less attractive, while exposure to agency MBS was tactically increased given the sectors favorable risk/reward profile in a shifting rate environment. Finally, the Fund became somewhat less defensive with respect to emerging markets.

Over the second quarter of 2023 the Fund continued to tactically rotate across select spread sectors given more attractive opportunities. The Fund slightly trimmed its U.S. investment grade corporate bond allocation as spreads became less attractive, while tactically adding to agency MBS given a favorable risk/reward profile. The Fund maintained its exposure to high yield corporate bonds near historically low levels, while preferring U.S. high yield corporate bonds over bank loans due to greater fundamental concerns in the latter sector.

Entering the third quarter of 2023, the Fund continued to manage its interest rate exposure as the end of the Fed’s hiking cycle approached, moving to an overweight U.S. duration stance on the view that inflation would ease more dramatically than expected in the second half of 2023. The Fund also added to its overweight position in agency MBS given attractive valuations. The Fund remained focused on seniority in structured products and continued to take a less defensive posture with respect to emerging markets. The Fund’s duration exposure was reduced late in the quarter as interest rates became more volatile.

Describe portfolio positioning at period end.

At the end of the reporting period, the Fund maintained an above-benchmark duration stance after having reduced the overweight by trimming in the front-end of the curve while tactically adding to the back end of the curve following September 2023 sharp increase in long rates. The Fund was overweight agency MBS and slightly underweight investment grade corporate bonds given less attractive spreads. The Fund was positioned opportunistically within high yield corporate bonds while remaining cautious down the capital stack. The Fund continued to prefer high yield corporate bonds relative to bank loans due to greater fundamental concerns in the latter sector. Within structured products, the Fund remained focused on the top of the capital structure.

Outside of the United States, the Fund had tactically trimmed its long European sovereign allocation, particularly within U.K. rates, while remaining modestly constructive there given attractive currency-hedged yields coupled with fairly hawkish Bank of England policy priced in the market. The Fund continued to hold a short position in long-term Japanese government bonds given the Bank of Japan’s decision to readjust its yield curve control policy to allow for higher rates.

Additionally, the Fund had tactically increased its emerging market debt allocation given a more constructive view toward local rates, particularly in Mexico and Brazil, as well as toward select hard currency bonds in the near-term.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of September 30, 2023 (continued) | BlackRock Total Return Fund |

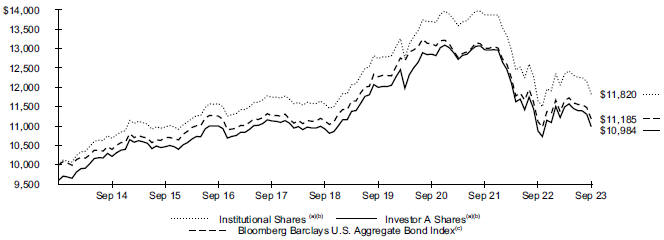

GROWTH OF $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests all of its assets in the Master Portfolio. The Master Portfolio typically invests more than 90% of its assets in a diversified portfolio of fixed-income securities such as corporate bonds and notes, mortgage-backed securities, asset-backed securities, convertible securities, preferred securities and government obligations. Under normal circumstances, the Master Portfolio invests at least 80% of its assets in bonds and invests primarily in investment grade fixed income securities. |

| (c) | A widely recognized unmanaged market-weighted index, comprised of investment grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. |

Performance

| Average Annual Total Returns(a) | ||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||

| Standardized 30 Day Yields |

Unsubsidized 30 Day Yields |

Without Sales Charge |

With Sales Charge |

Without Sales Charge |

With Sales Charge |

Without Sales Charge |

With Sales Charge |

|||||||||||||||||||||||||

| Institutional |

4.09 | % | 4.07 | % | 1.41 | % | N/A | 0.44 | % | N/A | 1.69 | % | N/A | |||||||||||||||||||

| Service |

3.76 | 3.73 | 1.00 | N/A | 0.12 | N/A | 1.39 | N/A | ||||||||||||||||||||||||

| Investor A |

3.63 | 3.62 | 1.01 | (3.03 | )% | 0.11 | (0.70 | )% | 1.36 | 0.94 | % | |||||||||||||||||||||

| Investor A1 |

3.93 | 3.79 | 1.15 | N/A | 0.27 | N/A | 1.53 | N/A | ||||||||||||||||||||||||

| Investor C |

3.04 | 3.00 | 0.30 | (0.67 | ) | (0.57 | ) | (0.57 | ) | 0.82 | 0.82 | |||||||||||||||||||||

| Class K |

4.17 | 4.17 | 1.38 | N/A | 0.49 | N/A | 1.75 | N/A | ||||||||||||||||||||||||

| Class R |

3.47 | 3.45 | 0.72 | N/A | (0.17 | ) | N/A | 1.09 | N/A | |||||||||||||||||||||||

| Bloomberg U.S. Aggregate Bond Index |

— | — | 0.64 | N/A | 0.10 | N/A | 1.13 | N/A | ||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| F U N D S U M M A R Y |

5 |

| Fund Summary as of September 30, 2023 (continued) | BlackRock Total Return Fund |

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

Beginning Account Value (04/01/23) |

|

|

Ending Account Value (09/30/23) |

|

|

Expenses Paid During the Period |

|

|

Beginning Account Value (04/01/23) |

|

|

Ending Account Value (09/30/23) |

|

|

Expenses Paid During the Period |

(a) |

|

Annualized Expense Ratio |

| ||||||||||||

| Institutional |

$ 1,000.00 | $ 1,014.10 | $ 2.22 | $ 1,000.00 | $ 1,022.86 | $ 2.23 | 0.44 | % | ||||||||||||||||||||||||

| Service |

1,000.00 | 1,010.00 | 3.78 | 1,000.00 | 1,021.31 | 3.80 | 0.75 | |||||||||||||||||||||||||

| Investor A |

1,000.00 | 1,010.10 | 3.73 | 1,000.00 | 1,021.36 | 3.75 | 0.74 | |||||||||||||||||||||||||

| Investor A1 |

1,000.00 | 1,011.50 | 2.98 | 1,000.00 | 1,022.11 | 2.99 | 0.59 | |||||||||||||||||||||||||

| Investor C |

1,000.00 | 1,003.00 | 7.23 | 1,000.00 | 1,017.85 | 7.28 | 1.44 | |||||||||||||||||||||||||

| Class K |

1,000.00 | 1,013.80 | 1.77 | 1,000.00 | 1,023.31 | 1.78 | 0.36 | |||||||||||||||||||||||||

| Class R |

1,000.00 | 1,007.20 | 5.18 | 1,000.00 | 1,019.90 | 5.22 | 1.03 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Master Portfolio, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invests. |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| 6 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Service Shares are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries.

Investor A1 Shares are subject to a maximum initial sales charge (front-end load) of 1.00% and a service fee of 0.10% per year (but no distribution fee). The maximum initial sales charge does not apply to current eligible shareholders of Investor A1 Shares of the Fund. These shares are only available for dividend and capital gain reinvestment by existing shareholders and for purchase by certain eligible employer-sponsored retirement plans. Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at the time of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through the reinvestment of dividends and capital gains by existing shareholders.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. These shares automatically convert to Investor A Shares after approximately eight years.

Class R Shares are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of the Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance table(s) assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver(s) and/or reimbursement(s), the Fund’s performance would have been lower. With respect to the Fund’s voluntary waiver(s), if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver(s) may be reduced or discontinued at any time. With respect to the Fund’s contractual waiver(s), if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense example shown (which is based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| A B O U T F U N D P E R F O R M A N C E / D I S C L O S U R E O F E X P E N S E S |

7 |

Derivative Financial Instruments

The Master Portfolio may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Master Portfolio must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Master Portfolio’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Master Portfolio can realize on an investment and/or may result in lower distributions paid to shareholders. The Master Portfolio’s investments in these instruments, if any, are discussed in detail in the Master Portfolio’s Consolidated Notes to Financial Statements.

| 8 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statement of Assets and Liabilities

September 30, 2023

| BlackRock Total Return Fund |

||||

| ASSETS |

||||

| Investments at value — Master Portfolio |

$ | 17,540,345,639 | ||

| Receivables: |

||||

| Capital shares sold |

33,389,818 | |||

| From the Manager |

251,645 | |||

| Withdrawals from the Master Portfolio |

39,756,969 | |||

| Prepaid expenses |

229,773 | |||

|

|

|

|||

| Total assets |

17,613,973,844 | |||

|

|

|

|||

| LIABILITIES |

||||

| Payables: |

||||

| Capital shares redeemed |

73,146,550 | |||

| Income dividend distributions |

8,024,983 | |||

| Investment advisory fees |

8,667,762 | |||

| Officer’s fees |

27,211 | |||

| Other accrued expenses |

2,236,125 | |||

| Other affiliate fees |

28,835 | |||

| Professional fees |

139,563 | |||

| Registration fees |

1,230,462 | |||

| Service and distribution fees |

332,272 | |||

|

|

|

|||

| Total liabilities |

93,833,763 | |||

|

|

|

|||

| Commitments and contingent liabilities |

||||

| NET ASSETS |

$ | 17,520,140,081 | ||

|

|

|

|||

| NET ASSETS CONSIST OF: |

||||

| Paid-in capital |

$ | 21,731,803,284 | ||

| Accumulated loss |

(4,211,663,203 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 17,520,140,081 | ||

|

|

|

|||

| F I N A N C I A L S T A T E M E N T S |

9 |

Statement of Assets and Liabilities (continued)

September 30, 2023

| BlackRock Total Return Fund |

||||||||

| NET ASSET VALUE |

||||||||

| Institutional |

||||||||

| Net assets |

$ | 9,557,512,389 | ||||||

|

|

|

|||||||

| Shares outstanding |

1,005,466,551 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.51 | ||||||

|

|

|

|||||||

| Shares authorized |

1.6 billion | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Service |

||||||||

| Net assets |

$ | 36,341,487 | ||||||

|

|

|

|||||||

| Shares outstanding |

3,822,474 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.51 | ||||||

|

|

|

|||||||

| Shares authorized |

50 million | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Investor A |

||||||||

| Net assets |

$ | 1,237,078,462 | ||||||

|

|

|

|||||||

| Shares outstanding |

130,092,544 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.51 | ||||||

|

|

|

|||||||

| Shares authorized |

450 million | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Investor A1 |

||||||||

| Net assets |

$ | 16,618,898 | ||||||

|

|

|

|||||||

| Shares outstanding |

1,749,118 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.50 | ||||||

|

|

|

|||||||

| Shares authorized |

50 million | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Investor C |

||||||||

| Net assets |

$ | 42,500,918 | ||||||

|

|

|

|||||||

| Shares outstanding |

4,472,949 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.50 | ||||||

|

|

|

|||||||

| Shares authorized |

100 million | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Class K |

||||||||

| Net assets |

$ | 6,563,237,433 | ||||||

|

|

|

|||||||

| Shares outstanding |

690,561,192 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.50 | ||||||

|

|

|

|||||||

| Shares authorized |

1 billion | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

| Class R |

||||||||

| Net assets |

$ | 66,850,494 | ||||||

|

|

|

|||||||

| Shares outstanding |

7,028,880 | |||||||

|

|

|

|||||||

| Net asset value |

$ | 9.51 | ||||||

|

|

|

|||||||

| Shares authorized |

250 million | |||||||

|

|

|

|||||||

| Par value |

$ | 0.10 | ||||||

|

|

|

|||||||

See notes to financial statements.

| 10 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Year Ended September 30, 2023

| BlackRock Total Return Fund |

||||

| INVESTMENT INCOME |

||||

| Net investment income allocated from the Master Portfolio: |

||||

| Dividends — unaffiliated |

$ | 3,136,996 | ||

| Dividends — affiliated |

41,707,369 | |||

| Interest — unaffiliated |

740,748,340 | |||

| Securities lending income — affiliated — net |

237,964 | |||

| Expenses |

(11,076,871 | ) | ||

| Fees waived |

679,428 | |||

|

|

|

|||

| Total investment income |

775,433,226 | |||

|

|

|

|||

| FUND EXPENSES |

||||

| Investment advisory |

50,529,354 | |||

| Transfer agent — class specific |

11,331,331 | |||

| Service and distribution — class specific |

4,227,707 | |||

| Registration |

919,271 | |||

| Printing and postage |

99,610 | |||

| Professional |

29,890 | |||

| Accounting services |

7,001 | |||

| Officer |

2,546 | |||

| Miscellaneous |

294,105 | |||

|

|

|

|||

| Total expenses |

67,440,815 | |||

| Less: |

||||

| Transfer agent fees waived and/or reimbursed — class specific |

(1,215,715 | ) | ||

|

|

|

|||

| Total expenses after fees waived and/or reimbursed |

66,225,100 | |||

|

|

|

|||

| Net investment income |

709,208,126 | |||

|

|

|

|||

| REALIZED AND UNREALIZED GAIN (LOSS) |

||||

| Net realized gain (loss) allocated from the Master Portfolio: |

||||

| Investments — unaffiliated |

(873,955,348 | ) | ||

| Investments — affiliated |

(540,524 | ) | ||

| Options written |

(56,181,554 | ) | ||

| Futures contracts |

(146,083,246 | ) | ||

| Forward foreign currency exchange contracts |

(12,823,457 | ) | ||

| Foreign currency transactions |

14,916,597 | |||

| Swaps |

(31,616,020 | ) | ||

|

|

|

|||

| (1,106,283,552 | ) | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) allocated from the Master Portfolio: |

||||

| Investments — unaffiliated |

447,679,452 | |||

| Investments — affiliated |

(1,216,875 | ) | ||

| Options written |

29,292,381 | |||

| Futures contracts |

90,572,736 | |||

| Forward foreign currency exchange contracts |

(8,242,756 | ) | ||

| Foreign currency translations |

(3,233,300 | ) | ||

| Swaps |

15,362,795 | |||

| Unfunded floating rate loan interests |

(35,592 | ) | ||

|

|

|

|||

| 570,178,841 | ||||

|

|

|

|||

| Total net realized and unrealized loss |

(536,104,711 | ) | ||

|

|

|

|||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 173,103,415 | ||

|

|

|

|||

See notes to financial statements.

| F I N A N C I A L S T A T E M E N T S |

11 |

Statements of Changes in Net Assets

| BlackRock Total Return Fund | ||||||||||||

|

|

|

|||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

|||||||||||

|

|

||||||||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||||||

| OPERATIONS |

||||||||||||

| Net investment income |

$ | 709,208,126 | $ | 449,100,503 | ||||||||

| Net realized loss |

(1,106,283,552 | ) | (1,311,374,975 | ) | ||||||||

| Net change in unrealized appreciation (depreciation) |

570,178,841 | (2,474,670,916 | ) | |||||||||

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from operations |

173,103,415 | (3,336,945,388 | ) | |||||||||

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO SHAREHOLDERS |

||||||||||||

| From net investment income and net realized gain: |

||||||||||||

| Institutional |

(349,245,498 | ) | (299,087,560 | ) | ||||||||

| Service |

(1,408,690 | ) | (1,318,341 | ) | ||||||||

| Investor A |

(45,920,335 | ) | (41,803,454 | ) | ||||||||

| Investor A1 |

(703,801 | ) | (613,205 | ) | ||||||||

| Investor C |

(1,382,997 | ) | (1,485,206 | ) | ||||||||

| Class K |

(255,446,599 | ) | (219,556,363 | ) | ||||||||

| Class R |

(2,103,389 | ) | (1,810,350 | ) | ||||||||

| Return of capital: |

||||||||||||

| Institutional |

(22,267,190 | ) | — | |||||||||

| Service |

(89,815 | ) | — | |||||||||

| Investor A |

(2,927,788 | ) | — | |||||||||

| Investor A1 |

(44,873 | ) | — | |||||||||

| Investor C |

(88,177 | ) | — | |||||||||

| Class K |

(16,286,761 | ) | — | |||||||||

| Class R |

(134,108 | ) | — | |||||||||

|

|

|

|

|

|||||||||

| Decrease in net assets resulting from distributions to shareholders |

(698,050,021 | ) | (565,674,479 | ) | ||||||||

|

|

|

|

|

|||||||||

| CAPITAL SHARE TRANSACTIONS |

||||||||||||

| Net increase in net assets derived from capital share transactions |

1,381,778,602 | 91,715,235 | ||||||||||

|

|

|

|

|

|||||||||

| NET ASSETS |

||||||||||||

| Total increase (decrease) in net assets |

856,831,996 | (3,810,904,632 | ) | |||||||||

| Beginning of year |

16,663,308,085 | 20,474,212,717 | ||||||||||

|

|

|

|

|

|||||||||

| End of year |

$ | 17,520,140,081 | $ | 16,663,308,085 | ||||||||

|

|

|

|

|

|||||||||

See notes to financial statements.

| 12 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

(For a share outstanding throughout each period)

| BlackRock Total Return Fund | ||||||||||||||||||||||

| Institutional | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.76 | $ | 11.96 | $ | 12.53 | $ | 11.95 | $ | 11.21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.41 | 0.25 | 0.23 | 0.28 | 0.38 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.26 | ) | (2.13 | ) | (0.07 | ) | 0.60 | 0.75 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.15 | (1.88 | ) | 0.16 | 0.88 | 1.13 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.38 | ) | (0.25 | ) | (0.24 | ) | (0.30 | ) | (0.39 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.40 | ) | (0.32 | ) | (0.73 | ) | (0.30 | ) | (0.39 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.51 | $ | 9.76 | $ | 11.96 | $ | 12.53 | $ | 11.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

1.41 | % | (15.99 | )% | 1.25 | % | 7.51 | %(d) | 10.23 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

0.45 | %(g) | 0.47 | %(g) | 0.47 | %(g) | 0.47 | %(h) | 0.47 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

0.44 | %(g) | 0.45 | %(g) | 0.45 | %(g) | 0.44 | %(h) | 0.44 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

4.08 | %(g) | 2.30 | %(g) | 1.88 | %(g) | 2.32 | %(h) | 3.33 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 9,557,512 | $ | 8,809,121 | $ | 9,915,659 | $ | 9,067,527 | $ | 6,535,538 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) | 171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| F I N A N C I A L H I G H L I G H T S |

13 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Service | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.95 | $ | 11.22 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.37 | 0.22 | 0.19 | 0.26 | 0.35 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.26 | ) | (2.12 | ) | (0.08 | ) | 0.60 | 0.73 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.11 | (1.90 | ) | 0.11 | 0.86 | 1.08 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.35 | ) | (0.22 | ) | (0.20 | ) | (0.27 | ) | (0.35 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.37 | ) | (0.29 | ) | (0.69 | ) | (0.27 | ) | (0.35 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.51 | $ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

1.00 | % | (16.17 | )% | 0.86 | % | 7.28 | %(d) | 9.80 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

0.79 | %(g) | 0.80 | %(g) | 0.80 | %(g) | 0.74 | %(h) | 0.74 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

0.75 | %(g) | 0.76 | %(g) | 0.76 | %(g) | 0.74 | %(h) | 0.74 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

3.75 | %(g) | 1.98 | %(g) | 1.57 | %(g) | 2.15 | %(h) | 3.04 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 36,341 | $ | 42,155 | $ | 55,378 | $ | 57,849 | $ | 120,243 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) | 171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| 14 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Investor A | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.96 | $ | 11.22 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.38 | 0.22 | 0.19 | 0.25 | 0.34 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.27 | ) | (2.12 | ) | (0.08 | ) | 0.60 | 0.75 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.11 | (1.90 | ) | 0.11 | 0.85 | 1.09 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.35 | ) | (0.22 | ) | (0.20 | ) | (0.27 | ) | (0.35 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.37 | ) | (0.29 | ) | (0.69 | ) | (0.27 | ) | (0.35 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.51 | $ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.96 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

1.01 | % | (16.16 | )% | 0.87 | % | 7.16 | %(d) | 9.85 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

0.74 | %(g) | 0.76 | %(g) | 0.74 | %(g) | 0.76 | %(h) | 0.79 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

0.74 | %(g) | 0.76 | %(g) | 0.74 | %(g) | 0.76 | %(h) | 0.78 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

3.78 | %(g) | 1.98 | %(g) | 1.58 | %(g) | 2.02 | %(h) | 3.00 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 1,237,078 | $ | 1,330,459 | $ | 1,822,670 | $ | 2,147,025 | $ | 1,840,587 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) | 171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| F I N A N C I A L H I G H L I G H T S |

15 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Investor A1 | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.76 | $ | 11.95 | $ | 12.53 | $ | 11.95 | $ | 11.21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.39 | 0.24 | 0.21 | 0.27 | 0.37 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.27 | ) | (2.13 | ) | (0.08 | ) | 0.60 | 0.74 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.12 | (1.89 | ) | 0.13 | 0.87 | 1.11 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.36 | ) | (0.23 | ) | (0.22 | ) | (0.29 | ) | (0.37 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.38 | ) | (0.30 | ) | (0.71 | ) | (0.29 | ) | (0.37 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.50 | $ | 9.76 | $ | 11.95 | $ | 12.53 | $ | 11.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

1.15 | % | (16.04 | )% | 1.02 | % | 7.35 | %(d) | 10.06 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

0.71 | %(g) | 0.70 | %(g) | 0.68 | %(g) | 0.61 | %(h) | 0.63 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

0.59 | %(g) | 0.60 | %(g) | 0.60 | %(g) | 0.59 | %(h) | 0.59 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

3.90 | %(g) | 2.19 | %(g) | 1.73 | %(g) | 2.22 | %(h) | 3.20 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 16,619 | $ | 20,124 | $ | 21,957 | $ | 24,443 | $ | 28,769 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) | 171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| 16 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Investor C | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.76 | $ | 11.95 | $ | 12.53 | $ | 11.95 | $ | 11.21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.30 | 0.14 | 0.11 | 0.16 | 0.27 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.26 | ) | (2.12 | ) | (0.08 | ) | 0.60 | 0.74 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.04 | (1.98 | ) | 0.03 | 0.76 | 1.01 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.28 | ) | (0.14 | ) | (0.12 | ) | (0.18 | ) | (0.27 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.30 | ) | (0.21 | ) | (0.61 | ) | (0.18 | ) | (0.27 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.50 | $ | 9.76 | $ | 11.95 | $ | 12.53 | $ | 11.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

0.30 | % | (16.76 | )% | 0.16 | % | 6.44 | %(d) | 9.14 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

1.49 | %(g) | 1.48 | %(g)(h) | 1.47 | %(g) | 1.49 | %(i) | 1.51 | %(i) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

1.44 | %(g) | 1.46 | %(g)(h) | 1.45 | %(g) | 1.44 | %(i) | 1.44 | %(i) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

3.06 | %(g) | 1.23 | %(g) | 0.89 | %(g) | 1.36 | %(i) | 2.35 | %(i) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 42,501 | $ | 56,468 | $ | 100,462 | $ | 140,034 | $ | 209,532 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(j) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes non-recurring expenses of proxy costs. Without these costs, total expenses, total expenses after fees waived and/or reimbursed, and total expenses after fees waived and/or reimbursed and excluding interest expense would have been 1.46%, 1.44% and 1.44%, respectively. (i) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (j) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

| |||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) | 171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| F I N A N C I A L H I G H L I G H T S |

17 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Class K | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.76 | $ | 11.96 | $ | 12.53 | $ | 11.95 | $ | 11.21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.41 | 0.26 | 0.24 | 0.29 | 0.39 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.26 | ) | (2.13 | ) | (0.07 | ) | 0.60 | 0.74 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.15 | (1.87 | ) | 0.17 | 0.89 | 1.13 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.39 | ) | (0.26 | ) | (0.25 | ) | (0.31 | ) | (0.39 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.41 | ) | (0.33 | ) | (0.74 | ) | (0.31 | ) | (0.39 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.50 | $ | 9.76 | $ | 11.96 | $ | 12.53 | $ | 11.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

1.38 | % | (15.93 | )% | 1.32 | % | 7.59 | %(d) | 10.30 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

0.37 | %(g) | 0.38 | %(g) | 0.38 | %(g) | 0.37 | %(h) | 0.37 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

0.37 | %(g) | 0.38 | %(g) | 0.38 | %(g) | 0.37 | %(h) | 0.37 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

4.16 | %(g) | 2.37 | %(g) | 1.94 | %(g) | 2.41 | %(h) | 3.40 | %(h) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 6,563,237 | $ | 6,340,122 | $ | 8,472,180 | $ | 7,491,107 | $ | 6,015,062 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) |

171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| 18 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||

| Class R | ||||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Net asset value, beginning of year |

$ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.96 | $ | 11.22 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income(a) |

0.35 | 0.19 | 0.16 | 0.22 | 0.32 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.27 | ) | (2.13 | ) | (0.08 | ) | 0.59 | 0.74 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) from investment operations |

0.08 | (1.94 | ) | 0.08 | 0.81 | 1.06 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions(b) |

||||||||||||||||||||||

| From net investment income |

(0.32 | ) | (0.18 | ) | (0.17 | ) | (0.23 | ) | (0.32 | ) | ||||||||||||

| From net realized gain |

— | (0.07 | ) | (0.49 | ) | — | — | |||||||||||||||

| Return of capital |

(0.02 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(0.34 | ) | (0.25 | ) | (0.66 | ) | (0.23 | ) | (0.32 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of year |

$ | 9.51 | $ | 9.77 | $ | 11.96 | $ | 12.54 | $ | 11.96 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return(c) |

||||||||||||||||||||||

| Based on net asset value |

0.72 | % | (16.40 | )% | 0.57 | % | 6.88 | %(d) | 9.58 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to Average Net Assets(e)(f) |

||||||||||||||||||||||

| Total expenses |

1.05 | %(g) | 1.06 | %(g) | 1.05 | %(g) | 1.04 | %(h) | 1.07 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total expenses after fees waived and/or reimbursed |

1.03 | %(g) | 1.04 | %(g) | 1.04 | %(g) | 1.03 | %(h) | 1.03 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income |

3.48 | %(g) | 1.71 | %(g) | 1.29 | %(g) | 1.80 | %(h) | 2.76 | %(g) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental Data |

||||||||||||||||||||||

| Net assets, end of year (000) |

$ | 66,850 | $ | 64,860 | $ | 85,906 | $ | 85,550 | $ | 142,718 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate of the Master Portfolio(i) |

380 | % | 289 | % | 459 | % | 556 | % | 574 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) Based on average shares outstanding. (b) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. (c) Where applicable, assumes the reinvestment of distributions. (d) Includes a payment received from an affiliate, which had no impact on the Fund’s total return. (e) Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. (g) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. (h) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%. (i) Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows:

|

|

|||||||||||||||||||||

| Year Ended 09/30/23 |

Year Ended 09/30/22 |

Year Ended 09/30/21 |

Year Ended 09/30/20 |

Year Ended 09/30/19 |

||||||||||||||||||

| Portfolio turnover rate (excluding MDRs) |

171 | % | 42 | % | 161 | % | 274 | % | 241 | % | ||||||||||||

See notes to financial statements.

| F I N A N C I A L H I G H L I G H T S |

19 |

| 1. | ORGANIZATION |

BlackRock Bond Fund, Inc. (the “Corporation”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Corporation is organized as a Maryland corporation. BlackRock Total Return Fund (the “Fund”) is a series of the Corporation. The Fund is classified as diversified. The Fund seeks to achieve its investment objective by investing all of its assets in Master Total Return Portfolio (the “Master Portfolio”) of Master Bond LLC, an affiliate of the Fund, which has the same investment objective and strategies as the Fund. The Master Bond LLC is organized as a Delaware limited liability company. The value of the Fund’s investment in the Master Portfolio reflects the Fund’s proportionate interest in the net assets of the Master Portfolio. The performance of the Fund is directly affected by the performance of the Master Portfolio. At September 30, 2023, the percentage of the Master Portfolio owned by the Fund was 96.8%. The financial statements of the Master Portfolio, including the Consolidated Schedule of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund offers multiple classes of shares. All classes of shares have identical voting, dividend, liquidation and other rights and are subject to the same terms and conditions, except that certain classes bear expenses related to the shareholder servicing and distribution of such shares. Institutional, Service and Class K Shares are sold only to certain eligible investors. Class R Shares are sold only to certain employer-sponsored retirement plans. Service, Investor A, Investor A1, Investor C and Class R Shares bear certain expenses related to shareholder servicing of such shares, and Investor C and Class R Shares also bear certain expenses related to the distribution of such shares. Investor A and Investor C Shares are generally available through financial intermediaries. Investor A1 Shares are only available for dividend and capital gain reinvestment by existing shareholders, and for purchase by certain employer-sponsored retirement plans. Each class has exclusive voting rights with respect to matters relating to its shareholder servicing and distribution expenditures (except that Investor C shareholders may vote on material changes to the Investor A Shares distribution and service plan).

The Board of Directors of the Corporation and Board of Directors of the Master Bond LLC are referred to throughout this report as the “Board of Directors” or the “Board” and the members are referred to as “Directors”.

| Share Class | Initial Sales Charge | CDSC | Conversion Privilege | |||||||||

| Institutional, Service, Class K and Class R Shares |

No | No | None | |||||||||

| Investor A Shares |

Yes | No | (a) | None | ||||||||

| Investor A1 Shares |

No | (b) | No | (c) | None | |||||||

| Investor C Shares |

No | Yes | (d) | To Investor A Shares after approximately 8 years | ||||||||

| (a) | Investor A Shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. |

| (b) | Investor A1 Shares are subject to a maximum sales charge on purchases of 1.00%. The sales charge does not apply to dividend and capital gain reinvestments by existing shareholders and new purchases for certain employer-sponsored retirement plans, which are currently the only investors who may invest in Investor A1 Shares. |

| (c) | Investor A1 Shares may be subject to a CDSC for certain redemptions where no initial sales charge was paid at the time of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans, or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders. |

| (d) | A CDSC of 1.00% is assessed on certain redemptions of Investor C Shares made within one year of after purchase. |

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of funds referred to as the BlackRock Fixed-Income Complex.

On June 1, 2023, the Board of Directors of the Fund approved a proposal pursuant to which the Fund will cease to invest in Master Total Return Portfolio (the “Master Portfolio”), a series of Master Bond LLC, as part of a “master/feeder” structure and will instead operate as a stand-alone fund. The change is expected to be completed in the first quarter of 2024.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |