PROXY STATEMENT PURSUANT TO 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. ___)

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under § 240.14a-12

EVANS & SUTHERLAND COMPUTER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction

|

|

|

(5)

|

Total fee paid:

|

[ ] Fee paid previously with preliminary materials

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed

|

April 14, 2014

Dear Evans & Sutherland Shareholder:

You are cordially invited to attend Evans & Sutherland’s 2014 annual meeting of shareholders to be held on Thursday, May 15, 2014, at 11:00 a.m., local time, at our principal executive offices located at 770 Komas Drive, Salt Lake City, Utah 84108.

An outline of the business to be conducted at the meeting is given in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. In addition to the matters to be voted on, there will be a report on our progress and an opportunity for shareholders to ask questions.

I hope you will be able to join us. To ensure your representation at the meeting, I encourage you to vote your shares by following the voting instructions on the enclosed proxy card. Your vote is very important. Whether you own a few or many shares of stock, it is important that your shares be represented.

Sincerely,

David H. Bateman

President and Chief Executive Officer

TABLE OF CONTENTS

|

Notice of Annual Meeting of Shareholders

|

|

|

Proxies and Voting at the Meeting

|

1

|

|

Proposal One – Election of Directors

|

2

|

|

Directors

|

2

|

|

Board Meetings and Committees

|

3

|

|

Board Leadership Structure and Oversight of Risk

|

5

|

|

Certain Relationships and Related Party Transactions

|

6

|

|

Proposal Two – Ratification of Appointment of Independent Registered Public Accounting Firm

|

7

|

|

Proposal Three – Advisory vote on executive compensation

|

7

|

|

Proposal Four –Approve the Evans & Sutherland Computer Corporation 2014 Stock Incentive Plan

|

8

|

|

Security Ownership of Certain Beneficial Owners and Management

|

13

|

|

Executive Compensation

|

15

|

|

Executive Compensation Table

|

15

|

|

Outstanding Equity Awards

|

16

|

|

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

|

16

|

|

Summary Director Compensation Table

|

17

|

|

Report of the Audit Committee

|

18

|

|

Pre-Approval Policies and Procedures

|

18

|

|

Principal Accountant Fees and Services

|

18

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

19

|

|

Shareholder Proposals

|

20

|

|

Communicating with the Board of Directors

|

20

|

|

Other Matters

|

20

|

|

Additional Information

|

20

|

EVANS & SUTHERLAND

COMPUTER CORPORATION

______________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 15, 2014

______________________________________________

TO THE SHAREHOLDERS:

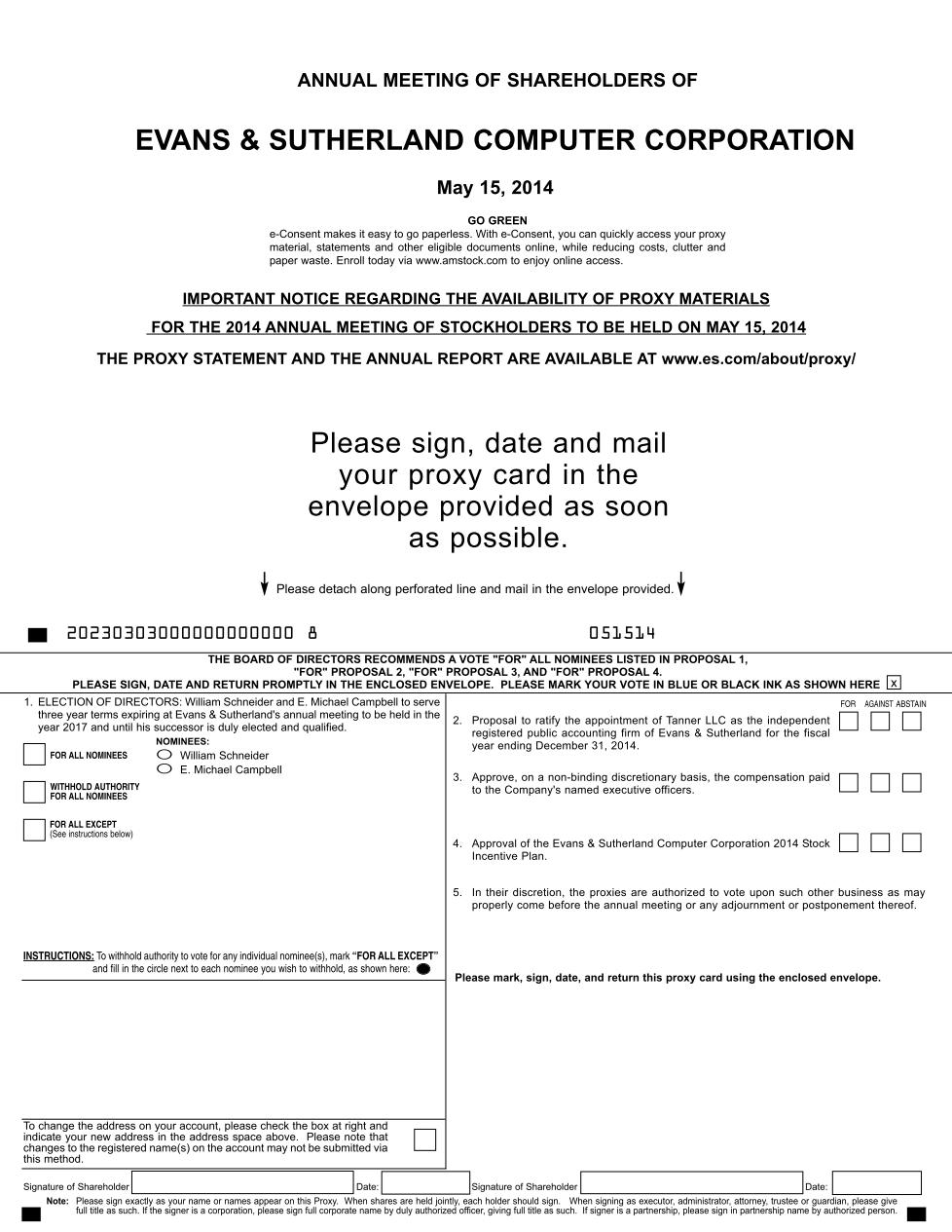

The annual meeting of shareholders of Evans & Sutherland Computer Corporation will be held on Thursday, May 15, 2014, at 11:00 a.m., local time, at 770 Komas Drive, Salt Lake City, Utah 84108. At the meeting, you will be asked:

|

|

1.

|

To elect two directors to the Evans & Sutherland Computer Corporation Board of Directors to serve for the term more fully described in the accompanying proxy statement;

|

|

|

2.

|

To ratify the appointment of Tanner LLC as independent registered public accounting firm of Evans & Sutherland Computer Corporation for the fiscal year ending December 31, 2014;

|

|

|

3.

|

To approve, on a non-binding advisory basis, the compensation paid to our named executive officers;

|

|

|

4.

|

To approve the Evans & Sutherland Computer Corporation 2014 Stock Incentive Plan; and

|

|

|

5.

|

To transact such other business as may properly be presented at the annual meeting.

|

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

If you were a shareholder of record at the close of business on April 11, 2014, you may vote at the annual meeting and any adjournment(s) thereof.

We invite all shareholders to attend the meeting in person. If you attend the meeting, you may vote in person even if you previously signed and returned a proxy.

FOR THE BOARD OF DIRECTORS

Paul L. Dailey

Chief Financial Officer and Corporate Secretary

Salt Lake City, Utah

April 14, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2014 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 15, 2014.

THE PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT

www.es.com/about/proxy/

EVANS & SUTHERLAND

COMPUTER CORPORATION

770 Komas Drive

Salt Lake City, Utah 84108

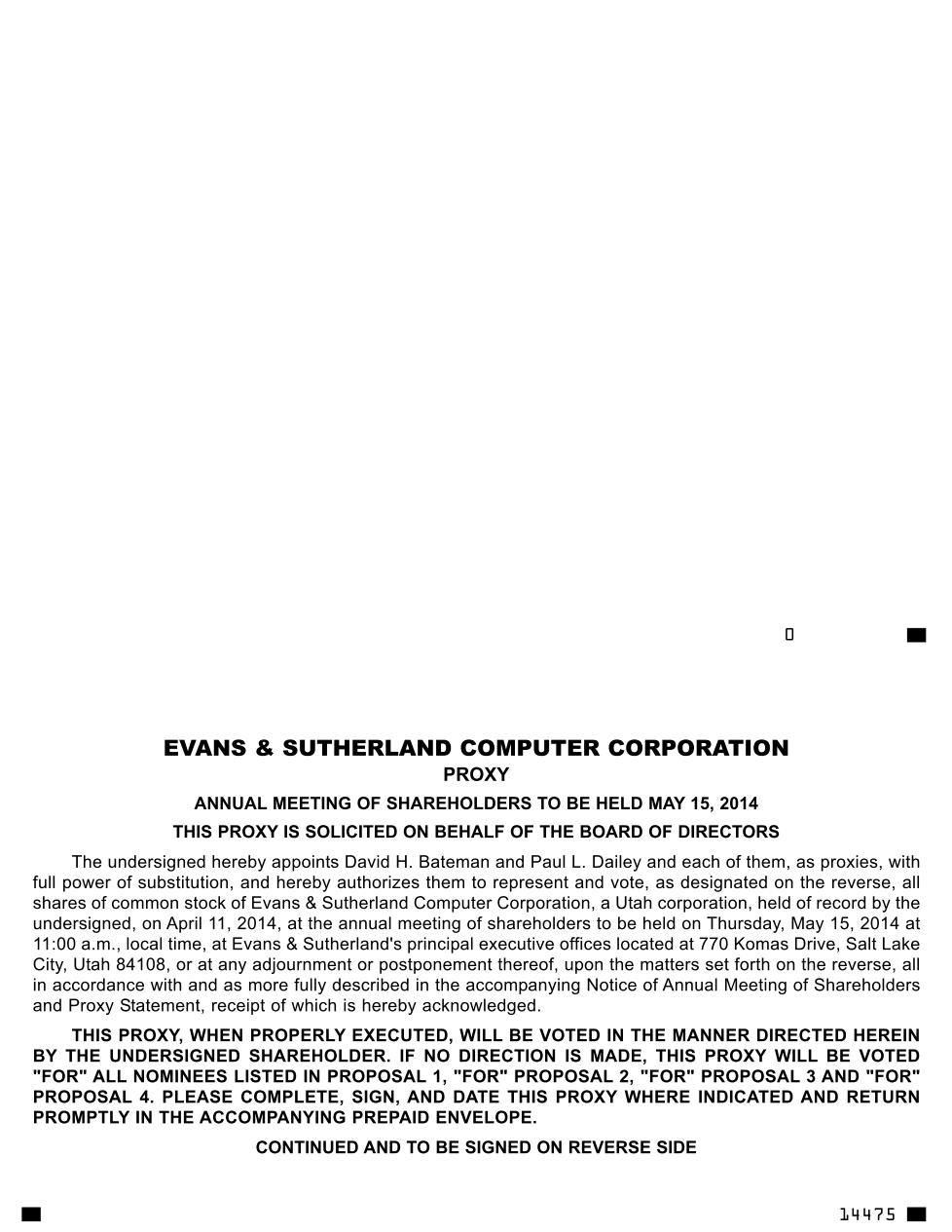

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

______________________________________________

GENERAL

Evans & Sutherland Computer Corporation, a Utah corporation (“we,” “us,” “our,” “Evans & Sutherland” or the “Company”), is soliciting the attached proxy on behalf of its Board of Directors (the “Board” or “Board of Directors”) to be voted at the 2014 annual meeting of shareholders to be held on Thursday, May 15, 2014, at 11:00 a.m., local time, or at any adjournment or postponement thereof. The annual meeting of shareholders will be held at Evans & Sutherland’s principal executive offices located at 770 Komas Drive, Salt Lake City, Utah 84108.

METHOD OF PROXY SOLICITATION

These proxy solicitation materials were mailed on or about April 16, 2014 to all shareholders entitled to vote at the annual meeting. The Company will pay the cost of soliciting proxies. These costs include the expenses of preparing and delivering proxy materials for the annual meeting and reimbursement paid to brokerage firms and others for their expenses incurred in forwarding the proxy material. In addition to solicitation by mail, Evans & Sutherland’s directors, officers and employees may solicit proxies for the annual meeting by telephone, facsimile or otherwise. Directors, officers, or employees of the Company will not be additionally compensated for this solicitation but may be reimbursed for out-of-pocket expenses they incur.

VOTING OF PROXIES

Your shares will be voted as you direct on your submitted proxy. If you do not specify on your submitted proxy how you want to vote your shares, we will vote submitted proxies:

|

|

·

|

FOR the election of the Board of Directors’ nominees for directors;

|

|

|

·

|

FOR ratification of the appointment of Tanner LLC as Evans & Sutherland’s independent registered public accounting firm for the fiscal year ending December 31, 2014;

|

|

|

·

|

FOR the approval, on a non-binding advisory basis, of the compensation paid to our named executive officers; and

|

|

|

·

|

FOR the approval of the Evans & Sutherland Computer Corporation 2014 Stock Incentive Plan.

|

We do not know of any other business that may be presented at the annual meeting. If a proposal other than those listed in the notice is presented at the annual meeting, your submitted proxy gives authority to the persons named in the proxy to vote your shares on such matters at their discretion.

REQUIRED VOTE

Record holders of shares of Evans & Sutherland’s common stock, par value $0.20 per share, at the close of business on April 11, 2014, may vote at the annual meeting. Each shareholder has one vote for each share of common stock the shareholder owns. At the close of business on April 11, 2014, there were 11,089,199 shares of common stock outstanding.

The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the matter at the annual meeting is required for approval of all items being submitted to the shareholders for their consideration, except for the election of directors, which is determined by a plurality of the votes cast. Evans & Sutherland’s Amended and Restated Bylaws provide that a majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum for transaction of business. An automated system administered by Evans & Sutherland’s transfer agent tabulates the votes. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. Each is tabulated separately. Abstentions are counted as voted and broker non-votes are counted as unvoted for determining the approval of any matter submitted to the shareholders for a vote. A broker non-vote occurs when a broker votes on some matters on the proxy card but not on others because he does not have the authority to do so.

1

REVOCABILITY OF PROXIES

You may revoke your proxy by giving written notice to the Corporate Secretary of Evans & Sutherland, by delivering a later proxy to the Corporate Secretary, either of which must be received prior to the annual meeting, or by attending the annual meeting and voting in person.

PROPOSAL ONE

ELECTION OF DIRECTORS

The authorized number of directors is currently fixed at five as established by the Board of Directors pursuant to Evans & Sutherland’s Amended and Restated Bylaws. The Board is divided into three classes, currently consisting of one or two directors each, whose terms expire at successive annual meetings. At the 2014 annual meeting, the shareholders of Evans & Sutherland will elect two directors to the Board of Directors. Each director elected at the 2014 annual meeting of shareholders will be elected to serve for a three-year term expiring at Evans & Sutherland’s annual meeting in 2017.

The nominees elected as directors will continue in office until their respective successor is duly elected and qualified. The Board of Directors has nominated Dr. William Schneider and Dr. E. Michael Campbell for election as directors at the 2014 annual meeting. Dr. Schneider and Dr. Campbell are designated to fill positions having terms expiring in 2017. Unless you specify otherwise, your returned proxy will be voted in favor of the Board’s nominees. In the event a nominee is unable to serve, your proxy may vote for another person nominated by the Board of Directors to fill that vacancy. The Board of Directors has no reason to believe that its nominees will be unavailable or unable to serve as directors.

VOTE REQUIRED

A plurality of the votes cast at the annual meeting is required to elect a director.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” THE NOMINEES LISTED ABOVE

DIRECTORS

The Board of Directors has determined that all outside directors, Dr. Campbell, Mr. Pierce, General McCarthy, and Dr. Schneider, are independent within the requirements of the applicable NASDAQ listing standards. There are no family relationships among any of Evans & Sutherland’s directors or executive officers. Set forth below is the principal occupation of, and certain other information regarding, the nominees and those directors whose terms of office will continue after the annual meeting.

Director Nominees – Terms Ending 2017

Dr. William Schneider has been a director of Evans & Sutherland since May 2002. Dr. Schneider has served as the president of International Planning Services, Inc., a Washington-based international trade and finance firm, since 1986. In addition, Dr. Schneider is currently an adjunct fellow of the Hudson Institute. Dr. Schneider serves as an advisor to the U.S. government in several capacities; he is a consultant to the Departments of Defense, Energy, and State, and also serves as a Senior Fellow of the Defense Science Board in the Department of Defense. Dr. Schneider is also a Member of the Department of State's Defense Trade Advisory Group. He earned his Ph.D. degree from New York University in 1968. The Company believes that Dr. Schneider’s experience with the government procurement process and commercial technology businesses will aid the Company in commercializing its technology products. Age: 72

Dr. E. Michael Campbell has been a director of Evans & Sutherland since July 2008. In January 2014, Dr Campbell joined Sandia National Laboratory as a Senior Scientist where he will develop strategic programs in advanced energy, optical and laser technologies. From 2008 through 2013 Dr. Campbell was Director of the Energy Division of Logos Technologies. From 2000 through 2007 he held various senior management positions, most recently Executive Vice-President for Energy, at General Atomics Corporation. He was the director of Laser Programs at Lawrence Livermore National Laboratory from 1994-1999. He is an internationally recognized expert in lasers and their applications and in advanced energy research and development. He has won numerous awards in these fields, is a visiting Trustee of the University of Rochester Laboratory for Laser Energetics and has consulted for Schott Glass, Schafer, and Lockheed Martin Corporations. He obtained his undergraduate and advanced degrees at the University of Pennsylvania, Princeton University, and the University of Western Sydney. The Company believes that Dr. Campbell’s specific experience with laser technology and leading complex scientific development projects can help in the evaluation and strategic planning of the Company’s technology. Age: 63

2

Directors Continuing in Office – Terms Ending 2016

David H. Bateman was appointed President and Chief Executive Officer of Evans & Sutherland in February 2007. Mr. Bateman joined Evans & Sutherland as Director of Business Operations in May 1998. He was appointed Vice President – Business Operations in March 2000 and Interim President and Chief Executive Officer and a member of the Board of Directors in June 2006. Before joining Evans & Sutherland, Mr. Bateman was President and Chief Operating Officer of Binghamton Simulator Company. The Company believes that Mr. Bateman’s past positions with the Company and his leadership role as President and Chief Executive Officer provides the Board of Directors with a needed perspective from within the Company’s operations. Age: 71

L. Tim Pierce, Chairman of the Board, has been a director of Evans & Sutherland since November 2012 and Chairman of the Board since July 2013. From January 2012 to present, Mr. Pierce has served as Executive Vice President and Chief Financial Officer for UELS, LLC, a provider of services to the energy industry. From March 2011 until December 2011, he served as Chief Financial Officer for Alliance Health Networks, Inc., an internet social networking company serving the healthcare markets. From 2009 until March 2011, Mr. Pierce provided operational assistance, capital raising support and due diligence assistance to various companies in a consulting capacity. During 2006 through 2008, Mr. Pierce held executive positions including Chief Financial Officer and Chief Operations Officer at AKQA, Inc., a global digital advertising company. From 1988 through 1998, Mr. Pierce served as Chief Financial Officer for Mrs. Fields, a specialty retailer. Prior to 1988, he worked in the audit and assurance departments of PricewaterhouseCoopers and Deloitte & Touche. Mr. Pierce earned a Bachelor of Science in Accounting from Brigham Young University and is a Certified Public Accountant (inactive). The Company believes that Mr. Pierce’s education and professional credentials combined with his financial leadership experience make him well qualified for his role as director and Chairman of the Board. Age 62

Director Continuing in Office – Term Ending 2015

General James P. McCarthy, USAF (ret.) has been a director of Evans & Sutherland since May 2004. General McCarthy has been teaching at the U.S. Air Force Academy since retirement in 1992 and currently is the ARDI Professor of National Security and the Director of the Institute for Information Technology Applications. General McCarthy chaired the Task Force on Operation Enduring Freedom Lessons Learned in Afghanistan and Iraq and was a member of the Defense Science Board. General McCarthy has served on the Defense Policy Board advising the Secretary of Defense, among others. General McCarthy served as director of NAVSYS Corporation from 1998 to 2007 and as a director of EADS North America from 2003-2007. The Company believes that General McCarthy’s military leadership experience and expertise with complex engineered systems including simulation displays is a valuable complement to the other directors’ qualifications. Age: 79

BOARD MEETINGS AND COMMITTEES

It is the Board of Directors’ policy to encourage all directors to attend each annual meeting of shareholders. All directors attended the 2013 annual meeting of shareholders. In fiscal year 2013, the Board of Directors held four Board meetings either in person or telephonically. In 2013, each director attended at least 75% of the aggregate of all meetings held by the Board of Directors and all meetings held by all committees of the Board on which such director served. The Board of Directors has established three committees: the Audit Committee, the Compensation and Stock Options Committee, and the Nominating and Corporate Governance Committee.

The Audit Committee operates under the Audit Committee Charter and is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act of 1934. The Audit Committee Charter can be found on Evans & Sutherland’s website, www.es.com, in the Investor Relations, Corporate Governance section. The principal functions of the Audit Committee are to:

3

|

|

·

|

monitor the integrity of Evans & Sutherland’s financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance;

|

|

|

·

|

monitor the independence and performance of Evans & Sutherland’s independent auditors;

|

|

|

·

|

provide an avenue of communication among the independent auditors, management and the Board of Directors;

|

|

|

·

|

encourage adherence to, and continuous improvement of, Evans & Sutherland’s policies, procedures and practices at all levels;

|

|

|

·

|

review areas of potential significant financial risk to Evans & Sutherland; and

|

|

|

·

|

monitor compliance with legal and regulatory requirements.

|

The Audit Committee of the Board of Directors of Evans & Sutherland is composed of all four non-employee directors. The members of the Committee are L. Tim Pierce, Dr. E. Michael Campbell, Dr. William Schneider and General James P. McCarthy. The Board of Directors has determined that all members of the Audit Committee are independent within the requirements of the applicable NASDAQ listing standards. The Board of Directors has reviewed the Securities and Exchange Commission’s definition of an “audit committee financial expert,” and has determined that L. Tim Pierce qualifies as an audit committee financial expert. The Audit Committee held four meetings in 2013.

The Compensation and Stock Options Committee (the “Compensation Committee”) operates under the Compensation and Stock Options Committee Charter. The Compensation and Stock Options Committee Charter can be found on Evans & Sutherland’s website, www.es.com, in the Investor Relations, Corporate Governance section. The Compensation Committee reviews compensation and benefits for Evans & Sutherland’s executives and administers the grant of stock options under Evans & Sutherland’s existing plans. Pursuant to delegated authority from the Board of Directors, David H. Bateman, as Chief Executive Officer, approves all employee salaries except for those of Evans & Sutherland’s executive officers. The Compensation Committee consists of L. Tim Pierce, Dr. E. Michael Campbell, Dr. William Schneider, and General James P. McCarthy. The Board of Directors has determined that all members of the Compensation Committee are independent within the requirements of the applicable NASDAQ listing standards. The Compensation Committee held one meeting in 2013. Additional information regarding the Compensation Committee’s process and procedures for consideration of executive and director compensation is provided in the Compensation Committee Charter.

The Nominating and Corporate Governance Committee (the “Nominating Committee”) operates under the Nominating and Corporate Governance Committee Charter. The Nominating and Corporate Governance Committee Charter can be found on Evans & Sutherland’s website, www.es.com, in the Investor Relations, Corporate Governance section. The Nominating Committee makes recommendations to the Board of Directors concerning candidates for election as directors, determines the composition of the Board of Directors and its committees, assesses the Board of Directors’ effectiveness, and develops and implements Evans & Sutherland’s corporate governance guidelines.

The process followed by the Nominating Committee to identify and evaluate candidates may include requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Nominating Committee and the Board, as deemed appropriate by the Nominating Committee. The Nominating Committee is authorized to retain advisors and consultants and to compensate them for their services in identifying and evaluating potential candidates. The Nominating Committee did not retain any such advisors or consultants during 2013.

Shareholders may recommend director candidates for inclusion by the Board of Directors in the slate of nominees which the Board recommends to shareholders for election. The qualifications of recommended candidates will be reviewed by the Nominating Committee. If the Board determines to nominate a shareholder-recommended candidate and recommends his or her election as a director by the shareholders, his or her name will be included in Evans & Sutherland’s proxy card for the shareholder meeting at which his or her election is recommended.

4

Although the Nominating Committee has not established any specific minimum qualifications for director nominees, the Nominating Committee will consider properly submitted shareholder recommendations for candidates who generally have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment, and who would be most effective in conjunction with other Board Members. Recommendations from shareholders concerning nominees for election as a director should be sent to: Board of Directors, Nominating and Corporate Governance Committee, Evans & Sutherland Computer Corporation, 770 Komas Dr., Salt Lake City, Utah 84108. Recommendations must include the candidate’s name, business address and a description of the candidate’s background and qualifications for membership on the Board of Directors. The Nominating Committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis.

Assuming that appropriate biographical and background material is provided for candidates recommended by shareholders, the Nominating Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members or by other persons. In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by shareholders, the Nominating Committee will apply the criteria established by the Nominating Committee, which may include considerations such as the candidate’s integrity, business acumen, experience, diligence, conflicts of interest, and the ability to act in the interest of all shareholders. The Nominating Committee does not necessarily assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. Evans & Sutherland believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Nominating Committee does not have a formal policy regarding diversity, but considers a broad range of attributes and characteristics in evaluating nominees for election to the Board of Directors. The Nominating Committee views diversity broadly to include diversity of experience, skills and viewpoint in addition to more traditional diversity concepts. The Nominating Committee’s goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience, as well as non-business experiences and attributes.

The Nominating Committee consists of L. Tim Pierce, Dr. E. Michael Campbell, Dr. William Schneider and General James P. McCarthy. The Board of Directors has determined that all members of the Nominating Committee are independent within the requirements of the applicable NASDAQ listing standards. There was one meeting of the Nominating Committee held in 2013.

BOARD LEADERSHIP STRUCTURE AND OVERSIGHT OF RISK

Currently, the offices of Chairman of the Board and Chief Executive Officer are separated. We have no fixed policy with respect to the separation of the offices of the Chairman of the Board and Chief Executive Officer, and the Board of Directors believes that flexibility in appointing the Chairman of the Board and Chief Executive Officer allows the Board to make such determination at times and in a manner that it believes is in the best interest of our company and its shareholders. The Board believes that having an independent Chair is currently the preferred corporate governance structure for the Company because it strikes an effective balance between management and independent leadership participation in the Board process, and allows the Chief Executive Officer to focus on the Company’s day-to-day business, while allowing the Chair to lead the Board of Directors in its primary role of review and oversight of management.

Our company’s management is responsible for the day to day assessment and management of the risks we face, while our Board administers its risk oversight function directly and through the Audit Committee and the Compensation Committee. Our Chief Executive Officer and Chief Financial Officer regularly report to our Board of Directors and the relevant Committee regarding identified or potential risks. The areas of material risk to our company include strategic, operational, financial, legal and regulatory risks. Our Board of Directors regularly reviews our company’s strategies and attendant risks, and provides advice and guidance with respect to strategies to manage these risks while attaining long- and short-term goals. Financial risks, including internal controls and liquidity risk, are the purview of our Audit Committee. The Audit Committee’s review is accompanied by regular reports from management and assessments from our company’s independent accountants. In assessing legal or regulatory risks, our Board of Directors and the Audit Committee are advised by management, counsel and experts, as appropriate. The Compensation Committee is responsible for overseeing the management of risks associated with executive and employee compensation and plans, to ensure that our company’s compensation programs remain consistent and do not encourage excessive risk-taking.

5

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

In the ordinary course of business, Evans & Sutherland may engage in transactions which have the potential to create actual or perceived conflicts of interest between Evans & Sutherland and its directors and officers or their immediate family members. The Audit Committee charter requires that the Audit Committee review and approve any related party transaction or, in the alternative, that it notify and request action on the related party transaction by the full Board of Directors. While Evans & Sutherland has not adopted formal written procedures for reviewing such transactions, in deciding whether to approve a related party transaction, the Audit Committee may consider, among other things, the following factors:

|

|

·

|

information regarding the goods or services proposed to be provided, or being provided, by or to the related party;

|

|

|

·

|

the nature of the transaction and the costs to be incurred by Evans & Sutherland;

|

|

|

·

|

an analysis of the costs and benefits associated with the transaction, and a comparison of alternative goods or services available to Evans & Sutherland from unrelated parties;

|

|

|

·

|

an analysis of the significance of the transaction to Evans & Sutherland;

|

|

|

·

|

whether the transaction would be in the ordinary course of Evans & Sutherland’s business;

|

|

|

·

|

whether the transaction is on terms comparable to those that could be obtained in an arm’s length dealing with an unrelated third party;

|

|

|

·

|

whether the transaction could result in an independent director no longer being considered independent under applicable rules; and

|

|

|

·

|

any other matters the committee deems appropriate.

|

After considering these and other relevant factors, the Audit Committee will either (1) approve or disapprove the related party transaction, or (2) notify and request action on the related party transaction by the full Board of Directors. The Audit Committee will not approve any related party transaction which is not on terms that it believes are fair and reasonable to Evans & Sutherland. Based on information provided by the directors and the executive officers, the Audit Committee has determined that there are no related person transactions to be reported in this Proxy Statement.

6

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Tanner LLC (“Tanner”), independent registered public accounting firm, has been selected by the Audit Committee as the independent registered public accounting firm to audit the accounts and to report on the consolidated financial statements of Evans & Sutherland for the fiscal year ending December 31, 2014, and the Board of Directors recommends that the shareholders vote for ratification of such selection. Shareholder ratification of the selection of Tanner as Evans & Sutherland’s independent auditors is not required by Evans & Sutherland’s Amended and Restated Bylaws or otherwise. However, the Board of Directors is submitting the selection of Tanner for shareholder ratification as a matter of good corporate practice. Notwithstanding the selection, the Audit Committee, in its discretion, may direct the appointment of a new independent auditor at any time during the year if the Audit Committee feels that such a change would be in the best interests of Evans & Sutherland and its shareholders.

Neither Tanner, nor any of its members has any financial interest, direct or indirect, in Evans & Sutherland, nor has Tanner, nor any of its members, ever been connected with Evans & Sutherland as promoter, underwriter, voting trustee, director, officer, or employee. In the event the shareholders do not ratify such appointment, the Audit Committee may reconsider its selection. Representatives of Tanner are expected to attend the annual meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

VOTE REQUIRED

The affirmative vote of a majority of the common shares present at the annual meeting, in person or by proxy, is required for the ratification of the appointment of Tanner.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF TANNER LLC AS

EVANS & SUTHERLAND’S INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2014.

PROPOSAL THREE

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking our shareholders to cast an advisory vote on the compensation paid to our named executive officers, as disclosed in this Proxy Statement pursuant to SEC compensation disclosure rules. This proposal, commonly known as a “Say-on-Pay” proposal, gives you, as a shareholder, the opportunity to vote on our executive compensation. As an advisory vote, this proposal is not binding upon the Board or the Compensation Committee. However, our Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by shareholders in their vote on this proposal and intends to consider the outcome of the vote when making future compensation decisions for our named executive officers.

We urge shareholders to carefully read the Executive Compensation Tables and related narrative disclosure below, which describes the executive compensation paid to our named executive officers. Our Board and our Compensation Committee believe that the compensation paid to our named executive officers, as described in this Proxy Statement, is effective in achieving our compensation objectives.

Therefore, we ask our shareholders to approve the following advisory resolution at the annual meeting:

“RESOLVED, that the compensation paid to the Company's named executive officers, as disclosed pursuant to the compensation disclosure rules of the SEC, including the compensation tables and narrative discussion contained in this Proxy Statement, is hereby APPROVED.”

7

VOTE REQUIRED

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to approve, on an advisory basis, the compensation of our named executive officers as described herein.

THE BOARD OF DIRECTORS RECOMMENDS AN ADVISORY VOTE “FOR” APPROVING THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL FOUR

VOTE ON THE APPROVAL OF THE EVANS & SUTHERLAND COMPUTER CORPORATION 2014 STOCK INCENTIVE PLAN

The Board of Directors of the Company has approved, and recommends that the shareholders approve the Evans & Sutherland Computer Corporation 2014 Stock Incentive Plan (the “2014 Plan”) for employees and directors of the Company and any majority-owned subsidiary of the Company. The 2014 Plan is intended to replace the Company’s 2004 Stock Incentive Plan (the “Prior Plan”). The 2014 Plan authorizes grants of Incentive Stock Options (“ISOs”) and Non-qualified Stock Options (“NQSOs”), as well as Restricted Stock Awards, some or all of which may be designated as Performance-Based Awards (as such terms are defined in the 2014 Plan). The 2014 Plan has been established to provide a simplified mechanism for the granting of stock options and Restricted Stock Awards to eligible individuals.

Stock incentive plans are an essential part of Evans & Sutherland’s capability to motivate, attract and retain the services of individuals who can contribute to the successful conduct of Company operations. The Board believes that issuing stock options and other awards under the 2014 Plan will be beneficial to the Company as a means to promote the success and enhance the value of Evans & Sutherland by linking the personal interests of its employees and non-employee directors to those of its shareholders and by providing such individuals with an incentive for outstanding performance. These incentives also provide the Company flexibility in its ability to attract and retain the services of individuals upon whose judgment, interest, and special effort the successful conduct of the Company’s operations is largely dependent. The 2014 Plan, if approved by shareholders, will have an effective date of May 15, 2014, and will expire on the tenth anniversary of the effective date. The following summary is qualified by reference to the 2014 Plan, a copy of which is attached as Annex A.

ADMINISTRATION

The 2014 Plan will be administered by the Compensation Committee of the Board of Directors. The Compensation Committee will have the power to determine eligibility, the types and sizes of options, and the price and timing of options as well as the restrictions related to Restricted Stock Awards and the performance goals related to the Performance-Based Awards, with certain limitations imposed by the 2014 Plan. Under limited circumstances, the Compensation Committee may delegate to the Company’s Chief Executive Officer the authority to grant awards under the 2014 Plan to eligible individuals who are not Board members, Covered Employees (as defined in Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986 (the “Code”)) or persons subject to Section 16(b) of the Securities Exchange Act of 1934.

ELIGIBILITY

The 2014 Plan provides that the Compensation Committee may grant employees, including executive officers of the Company, (a) ISOs and NQSOs to purchase the Company’s common shares at a price equal to or greater than 110% of the fair market value on the day of grant and (b) Restricted Stock. The Compensation Committee has discretion to select from among those eligible individuals the employees and directors to whom stock option awards or Restricted Stock Awards, including Performance-Based Awards, will be granted and shall determine the nature and amounts of such awards. Under the 2014 Plan, non-employee directors will continue to be eligible for stock option grants of up to 10,000 shares upon initial election and annually thereafter, provided that no non-employee director will receive options to purchase common stock under the 2014 Plan which would entitle the director to purchase cumulatively in excess of 100,000 shares, subject to certain adjustments. On April 7, 2014, the closing price for the Company’s Common Stock was $0.50.

8

SHARES AVAILABLE FOR ISSUANCE

Under the 2014 Plan, the number of shares of Common Stock available to be awarded will be equal to the number of shares reserved and available for grant under the Prior Plan as of May 15, 2014 plus the number of shares that were previously granted under the Prior Plan and that either terminate, expire, or lapse for any reason after May 15, 2014. As such, the Company is not seeking to add to the number of shares previously available for grant, but to allow the Company to grant those shares previously approved. The 2014 Plan also continues to limit to 50,000 shares the number of all outstanding Restricted Stock Awards (as defined in the 2014 Plan) granted under the 2014 Plan.

LIMITATION ON OPTIONS AND SHARES AVAILABLE

Under the 2014 Plan, the number of shares of Common Stock available to be awarded is the number of shares reserved and available for grant under the Prior Plan as of May 15, 2014 plus the number of shares that were previously granted under the Prior Plan and that either terminate, expire, or lapse for any reason after May 15, 2014. To the extent that an award of shares under the Plan terminates, expires, or lapses for any reason, any shares subject to the award will again be available for award pursuant to the Plan. Additionally, any shares tendered or withheld to satisfy the exercise price or tax withholding obligation pursuant to any award of shares shall again be available for an award pursuant to the Plan. The maximum number of shares of stock that may be subject to one or more options to a single participant under the 2014 Plan during any fiscal year is 250,000. No more than 50,000 shares available pursuant to the 2014 Plan will be available for grant as Restricted Stock Awards, including Performance-Based Awards. The maximum number of shares that may be issued as ISOs under the 2014 Plan is 300,000.

Options granted under the Prior Plan are still held by recipients. If the shareholders approve the 2014 Plan, or upon the expiry of the Prior Plan on May 18, 2014, no additional awards will be granted under the Prior Plan. Awards previously granted under the Prior Plan will continue to be subject to the terms and conditions of the Prior Plan.

EXERCISE PRICE

The 2014 Plan establishes a minimum exercise price of 110% of fair market value on the date of the grant that is intended (a) to reflect the possible effect on market price had the Company acquired stock on the open market and reissued those shares as options and (b) to establish a threshold of 10% improvement in fair market value of Company stock for options to be of value to option holders.

EXERCISE OF AWARDS

Pursuant to the 2014 Plan, stock option awards become exercisable as specified in the award agreement between the Company and the recipient but no sooner than the first anniversary of the date of grant. Restrictions on Restricted Stock Awards that are not performance-based must lapse over a period of not less than three years. If a Change of Control occurs (as defined in the 2014 Plan), all then outstanding stock option awards become fully exercisable and all restrictions on outstanding Restricted Stock Awards, including all performance-based awards, automatically lapse.

INTEREST OF CERTAIN PERSONS IN MATTER TO BE ACTED UPON

Each non-employee member of the Company’s Board of Directors, as well as each of its executive officers, may directly benefit from the adoption by the shareholders of the 2014 Plan, to the extent such individuals will be eligible to receive option grants and Restricted Stock Awards authorized by the Compensation Committee on the terms and conditions set forth in the 2014 Plan. Specifically, non-employee directors will receive stock option grants of up to 10,000 shares upon initial election and annually thereafter, provided that no non-employee director will receive options to purchase common stock under the 2014 Plan which would entitle the director to purchase cumulatively in excess of 100,000 shares, subject to certain adjustments.

DESCRIPTION OF THE AVAILABLE AWARDS AND POTENTIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

Incentive Stock Options

An ISO is a stock option that satisfies the requirements specified in Section 422 of the Code. ISOs may only be granted to employees of the Company or any subsidiary. In addition, the exercise price payable for an ISO must equal or exceed the fair market value of the stock at the date of the grant, the option must lapse no later than 10 years from the date of the grant, and the stock subject to ISOs that are first exercisable by an employee in any calendar year must not have a value of more than $100,000 as of the date of grant. Certain other requirements must also be met.

9

Generally, an optionee will not realize taxable compensation income at the time an ISO is granted or exercised. However, except in the event of death or disability, if an ISO is exercised more than three months following the optionee’s termination of employment (a disqualifying exercise), the optionee will recognize ordinary income in an amount equal to the difference between the fair market value of the shares on the date of exercise and the exercise price. In addition, the excess of the fair market value of the shares received upon exercise of the ISO (other than in a disqualifying exercise) and the option exercise price is a tax preference item and is potentially subject to the alternative minimum tax.

If an optionee exercises an ISO by surrendering previously acquired shares of common stock, the exchange will not affect the tax treatment of the exercise. Upon such exchange, and except for disqualifying dispositions discussed below, no gain or loss is recognized upon the surrender of the previously acquired shares to the Company, and the shares received will have the same basis and holding period for capital gain or capital loss purposes as the surrendered shares. Shares received by the optionee in excess of the number of surrendered shares will have a basis of zero and a holding period that commences on the date shares are issued to the optionee upon exercise of the ISO.

When shares of common stock underlying an ISO are sold, the optionee will be taxed on the difference between the sales price and the exercise price. If the optionee has held the shares for at least one (1) year after exercise of the ISO and two (2) years after the date the ISO was granted, the gain, if any, will be treated as long-term capital gain. If an optionee sells shares of common stock underlying an ISO in a disqualifying disposition (i.e., within one (1) year after the exercise of the ISO or within two (2) years after the grant of the ISO, regardless of whether the ISO is being exercised with previously acquired shares of common stock), the optionee will be treated as receiving compensation, taxable as ordinary income, in the year of the disqualifying disposition equal to the difference between the option exercise price and the lesser of the fair market value of the stock on the date of exercise and the sales price of the stock.

The Company generally is not entitled to a deduction as a result of the grant or exercise of an ISO. However, if the optionee recognizes ordinary income as a result of a disqualifying exercise or disposition, the Company is entitled to a deduction equal to the amount of income includable by the employee.

Non-Qualified Stock Options

An NQSO is any stock option other than an ISO. Such options are referred to as “non-qualified” because they do not meet the requirements of, and are not eligible for, the favorable tax treatment provided by Section 422 of the Code.

Generally, an optionee will not realize taxable income at the time a nonqualified option is granted, nor will the Company be entitled to a deduction at that time. Upon exercise of a nonqualified option, the optionee generally will be treated as receiving compensation, taxable as ordinary income, in an amount equal to the difference between the fair market value of the shares at the time of exercise and the exercise price. At that time, the Company normally will be entitled to a tax deduction in an amount equal to the amount included in income by the optionee.

If an optionee pays all or a portion of the option exercise price for a nonqualified option by surrendering previously acquired shares of common stock, the exchange will not affect the tax treatment of the exercise. Upon such exchange, no gain or loss is recognized upon the surrender to the Company of the previously acquired shares of common stock, and the shares received by the optionee equal in number to the surrendered shares will have the same basis and holding period for capital gain or capital loss purposes as the surrendered shares. Shares received by the optionee in excess of the number of surrendered shares will have a basis equal to the fair market value of the common stock on the date of exercise and the holding period for capital gains purposes will commence on that date.

Restricted Stock Awards and Performance Based Awards

The 2014 Plan entitles the Compensation Committee to grant awards of Restricted Stock to eligible individuals in the amounts and subject to the terms and conditions determined by the Compensation Committee. Restricted Stock is stock that may be subject to certain restrictions (including restrictions on voting rights, dividend rights and transferability, as well as other restrictions established by the Compensation Committee) and the risk of forfeiture. If the restrictions imposed by the Compensation Committee on a particular award are not “performance-based,” the restrictions must lapse over a period of not less than three years. Restricted Stock Awards granted by the Compensation Committee pursuant to the 2014 Plan may be in the form of “Performance-Based” Awards which qualify as “performance-based compensation” pursuant to Section 162(m). Performance-Based Awards must be granted to Covered Employees, as defined by Section 162(m), who are selected by the Compensation Committee.

10

A grant of a Restricted Stock Award, including a Performance-Based Award qualifying as “performance-based compensation” pursuant to Section 162(m), generally does not constitute a taxable event for the grant recipient or the Company. However, the recipient will be subject to tax, at ordinary income rates, when restrictions on ownership of the Restricted Stock lapse or the Performance Goals have been achieved. The Company will be entitled to take a commensurate deduction at that time.

A participant may elect to recognize taxable ordinary income at the time Restricted Stock is awarded in an amount equal to the fair market value of the shares at the time of grant, determined without regard to any forfeiture restrictions. If such an election is made, the Company will be entitled to a deduction at that time in an amount equal to the amount included in income by the participant.

SECTION 162(M)

The 2014 Plan has been designed in order to permit the Compensation Committee to grant stock options and Restricted Stock that will qualify as “performance-based compensation” under Section 162(m) and to designate as “Section 162(m) Participants” some employees whose compensation for a given fiscal year may be subject to the limit on deductible compensation imposed by Section 162(m). The Compensation Committee may grant awards to Section 162(m) Participants that vest or become exercisable upon the attainment of specific performance targets that are related to one or more of the performance goals set forth in the 2014 Plan. The Company’s shareholders are also being asked in this proposal to approve the performance criteria established in the 2014 Plan.

Section 162(m), adopted as part of the Revenue Reconciliation Act of 1993, generally limits to $1 million the deduction that can be claimed by any publicly-held corporation for compensation paid to any covered employee in any taxable year. Performance-Based compensation is outside the scope of the $1 million limitation, and, hence, generally can be deducted by a publicly-held corporation without regard to amount; provided that, among other requirements, such compensation is approved by shareholders. Qualified performance-based compensation means compensation paid solely on account of the attainment of objective performance goals, provided that (a) performance goals are established by a committee of the Board of Directors consisting solely of two or more outside directors; (b) the material terms of the performance-based compensation are disclosed to and approved by shareholders in a separate shareholder vote prior to payment; and (c) prior to payment, the committee certifies that the performance goals were attained and other material terms were satisfied.

PERFORMANCE GOALS UNDER THE 2014 PLAN

General. The 2014 Plan contains performance criteria that govern the grant of certain awards under the 2014 Plan. The Company is requesting that the shareholders approve the performance goals for the grant of certain awards under the 2014 Plan to comply with the requirements of Section 162(m) under the Code and regulations promulgated thereunder, as discussed above.

Eligible Employees. Restricted stock awards under the 2014 Plan are limited to Section 162(m) Participants who are selected by the Compensation Committee to participate. However, only such awards granted to such Section 162(m) Participants can qualify as performance-based compensation under Section 162(m).

Administration of Performance Goals. The Compensation Committee has discretion to determine if awards under the 2014 Plan are intended to qualify as performance-based compensation under Section 162(m) or not. If any awards are so intended to qualify, then, within 90 days of the start of each performance period, the Compensation Committee (i) designates one or more Section 162(m) Participants, (ii) selects the performance goal or goals applicable to the designated performance period, (iii) establishes the various targets and bonus amounts which may be earned for such performance period and (iv) specifies the relationship between performance goals and targets and the amounts to be earned by each Section 162(m) Participant for such performance period. The Compensation Committee may designate, as the performance period for awards intended to be qualified performance-based compensation under the 2014 Plan, the Company’s fiscal year or any other fiscal period or period of service (or such other time as may be required or permitted by Section 162(m)).

The performance goals used to determine the terms and conditions of awards intended to be qualified performance-based compensation under the 2014 Plan are based on any or all of the following business criteria with respect to the Company, any subsidiary or any division or operating unit: pre- or after-tax net earnings, sales or revenue, orders booked, operating earnings, operating cash flow, return on net assets, return on shareholders’ equity, return on assets, return on capital, shareholder returns, gross or net profit margin, earnings per share, price per share of the Common Stock, and market share, any of which may be measured either in absolute terms or as compared to any incremental increase or as compared to results of a peer group.

11

Each business criterion will be determined in accordance with generally accepted accounting principles, or will be subject to such adjustments as the Compensation Committee may specify at the beginning of the performance period with respect to an award that is intended to qualify as qualified performance-based compensation.

The Compensation Committee must certify the attainment of the applicable performance target before a Section 162(m) award is paid under the 2014 Plan. In determining the amounts paid to any Section 162(m) Participant, the Compensation Committee has the right to reduce (but not to increase) the amount payable at a given level of performance to take into account additional factors that it may deem relevant to the assessment of individual or corporate performance for the designated performance period.

PLAN AMENDMENTS

With the approval of the Board, the Compensation Committee may terminate, amend or modify the 2014 Plan. However, shareholder approval is required for any amendment of the 2014 Plan that (a) increases the number of shares available under the 2014 Plan (other than to reflect stock or extraordinary cash dividends, stock splits or share combinations or recapitalizations of the Company), (b) permits the Compensation Committee to grant options awards with a per share exercise price that is below 110% of the fair market value of the Company’s Common Stock on the date of grant, (c) permits the Compensation Committee to extend the exercise period for an option award beyond ten years from the date of grant, or (d) permits the Compensation Committee to reduce the exercise price of any previously awarded option or otherwise effect a “repricing”.

Moreover, no termination, amendment or modification of the 2014 Plan shall adversely affect in any material way any award previously granted pursuant to the 2014 Plan without the prior written consent of the recipient of the award.

CHANGE OF CONTROL

In the event of a change of control of the Company, all outstanding options under the 2014 Plan shall become immediately exercisable and all restrictions and performance-based requirements for Restricted Stock Awards lapse. Under the 2014 Plan, a change in control occurs upon any of the following events: (i) consummation of a merger, consolidation, statutory share exchange or similar form of corporate transaction involving the Company (a “Business Combination”),unless immediately following such Business Combination more than 50% of the total voting power of the entity resulting from such Business Combination is represented by the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of the Board that were outstanding immediately prior to such Business Combination; (ii) the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of the properties or assets of the Company (including any subsidiary), taken as a whole, to any person that is not a Subsidiary of the Company; (iii) the Company undergoes a change of control of the nature required to be reported in response to Item 6(e) of Schedule 14A promulgated under the Securities Exchange Act of 1934; (iv) one person (or more than one person acting as a group) acquires (or has acquired during the twelve-month period ending on the date of the most recent acquisition) ownership of the Company’s stock possessing thirty percent or more of the then outstanding voting securities of the Company entitled to vote generally in the election of the Board; or (v) a change is made in the membership of the Board resulting in a membership of which less than a majority were also members of the Board on the date two years prior to such change, unless the election, or the nomination for election by the shareholders of the Company, of each new director was approved by the vote of at last two-thirds of the directors then still in office who were directors on the date two years prior to such change.

NEW PLAN BENEFITS

No awards will be granted under the 2014 Plan until it is approved by the Company’s shareholders. In addition, awards granted under the 2014 Plan are subject to the discretion of the Compensation Committee. Therefore, it is not possible to determine the benefits that will be received in the future by participants in the 2014 Plan or the benefits that would have been received by such participants if the 2014 Plan had been in effect in the year ended December 31, 2013, other than to the Company’s non-employee directors. Under the 2014 Plan, non-employee directors will receive stock option grants of up to 10,000 shares upon initial election and annually thereafter, provided that no non-employee director will receive options to purchase common stock under the 2014 Plan which would entitle the director to purchase cumulatively in excess of 100,000 shares, subject to certain adjustments.

12

During the year ended December 31, 2013, the Company granted options to the following persons in the aggregate amounts indicated: Named Executive Officers: 80,000; all current executive officers of the Company as a group: 130,000; all employees as a group, including executive officers of the Company: 130,700; non-employee directors: 20,000.

SECURITIES LAW

The 2014 Plan is intended to conform to the extent necessary with all provisions of the Securities Act and the Exchange Act, and any and all regulations and rules promulgated by the Securities and Exchange Commission thereunder, including without limitation Rule 16b-3. The 2014 Plan will be administered, and options will be granted and may be exercised, only in such a manner as to conform to such laws, rules and regulations. To the extent permitted by applicable law, the 2014 Plan and all awards granted thereunder shall be deemed amended to the extent necessary to conform to such laws, rules and regulations.

The Company intends to register the shares of Common Stock available under the 2014 Plan on Form S-8 under the Securities Act as soon as practicable after the effective date of the 2014 Plan.

VOTE REQUIRED

An affirmative vote of a majority of the common shares present at the annual meeting, in person or by proxy, is required for adoption of the 2014 Plan.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” ADOPTION OF THE EVANS & SUTHERLAND COMPUTER CORPORATION 2014 STOCK INCENTIVE PLAN.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows how much of Evans & Sutherland common stock was beneficially owned as of April 11, 2014 by (i) each person who is known by Evans & Sutherland to beneficially own more than 5% of Evans & Sutherland common stock, (ii) each of Evans & Sutherland’s directors, (iii) each of Evans & Sutherland’s Named Executive Officers (as defined in the Summary Compensation Table below) and (iv) all directors and executive officers of Evans & Sutherland as a group. Unless indicated otherwise, each holder’s address is c/o Evans & Sutherland Computer Corporation, 770 Komas Drive, Salt Lake City, Utah 84108.

|

Shares Beneficially Owned

|

|||

|

Number (1)

|

Percent (2)

|

||

|

PRINCIPAL SHAREHOLDERS

|

|||

|

Peter R. Kellogg (3)

|

2,985,578

|

26.9%

|

|

|

48 Wall Street, 30th Fl., New York, New York 10005

|

|||

|

State of Wisconsin Investment Board (4)

|

2,042,250

|

18.4%

|

|

|

P.O. Box 7842, Madison, Wisconsin 53707

|

|||

|

Thomas R. Demas (5)

|

1,103,226

|

9.9%

|

|

|

10412 Balmoral Circle, Charlotte, NC 28210

|

|||

|

Royce & Associates, LLC (6)

|

806,628

|

7.3%

|

|

|

745 Fifth Avenue, New York, New York 10151

|

|||

|

Stuart Sternberg (7)

|

695,498

|

6.3%

|

|

|

85 Bellevue Avenue, Rye, New York 10580

|

|||

|

DIRECTORS

|

|||

|

David H. Bateman (8)

|

338,651

|

3.0%

|

|

|

William Schneider (8)

|

51,666

|

*

|

|

|

James P. McCarthy (8)

|

62,166

|

*

|

|

|

E. Michael Campbell (8)

|

21,666

|

*

|

|

|

L. Tim Pierce (8)

|

57,847

|

*

|

|

|

OTHER NAMED EXECUTIVE OFFICERS

|

|||

|

Paul L. Dailey (8)

|

130,979

|

1.2

|

|

|

Kirk Johnson (8)

|

102,499

|

*

|

|

|

All directors and executive officers as a group – 9 persons (8)

|

971,672

|

8.1%

|

|

* Less than one percent

13

|

(1)

|

The number of shares beneficially owned by each person or group as of April 11, 2014 includes shares of common stock such person or group had the right to acquire on or within 60 days after that date, including, but not limited to, upon the exercise of options. To Evans & Sutherland’s knowledge, except as otherwise indicated in the footnotes to this table and subject to applicable community property laws, the shareholder named in the table has sole voting power and sole dispositive power with respect to the shares set forth opposite such shareholder’s name.

|

|

(2)

|

For each person and group included in the table, percentage ownership is calculated by dividing the number of shares beneficially owned by such person or group as described above by the sum of the 11,089,199 shares of common stock outstanding on April 11, 2014 and the number of shares of common stock that such person or group had the right to acquire on or within 60 days of that date, including, but not limited to, upon the exercise of options.

|

|

(3)

|

Peter R. Kellogg reported beneficial ownership of 2,985,578 shares through direct ownership of 1,423,618 shares and indirect ownership of 1,561,960 held by I.A.T. Reinsurance Company Ltd. (“IAT”), a Bermuda corporation of which Mr. Kellogg is the sole holder of voting stock, on a Form 13D/A filed with the SEC by Mr. Kellogg on September 21, 2012. In the Form 13D/A, Mr. Kellogg disclaimed beneficial ownership of the shares held by IAT.

|

|

(4)

|

State of Wisconsin Investment Board has sole voting power and sole dispositive power as to 2,042,250 shares according to the Schedule 13G filed with the Securities and Exchange Commission (the “SEC”) on February 5, 2010.

|

|

(5)

|

Thomas R. Demas reported beneficial ownership of 1,103,226 shares through direct ownership of 872,182 shares and indirect ownership of 231,044 by his spouse, Wilhelmina Demas, on a Form 3 filed with the SEC by Mr. Demas on August 25, 2011.

|

|

(6)

|

Royce & Associates, LLC has sole voting power and sole dispositive power as to 806,628 shares according to the Schedule 13G filed with the SEC on January 11, 2012.

|

|

(7)

|

Stuart Sternberg has sole voting power and sole dispositive power as to 695,498 shares according to the Schedule 13G filed with the SEC on May 31, 2007.

|

|

(8)

|

The table includes the following shares issuable upon exercise of options that are exercisable within 60 days from April 11, 2014: David H. Bateman, 338,533; William Schneider, 51,666; James P. McCarthy, 61,666; E. Michael Campbell, 21,666; L. Tim Pierce ,5,000; Paul L. Dailey, 123,333 and Kirk Johnson, 102,499; all executive officers and directors as a group, 899,997.

|

14

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The table below summarizes the total compensation paid or earned for the fiscal years ended December 31, 2013 and 2012 by the Company’s Chief Executive Officer and each of its two other most highly compensated executive officers (the “Named Executive Officers”).

|

Name and Principal Position

|

Year

|

Salary ($)

|

Option Awards ($) (1)

|

All Other Compensation ($) (2)

|

Total ($)

|

|

David H. Bateman, President & Chief Executive Officer

|

2013

2012

|

$292,966

$284,322

|

$ 810

$4,099

|

$7,067

$6,896

|

$300,843

$295,317

|

|

Paul L. Dailey,

Chief Financial Officer

|

2013

2012

|

$223,466

$216,855

|

$ 810

$4,099

|

$6,704

$6,506

|

$230,980

$227,460

|

|

Kirk Johnson, Vice President, General Manager Digital Theater

|

2013

2012

|

$216,533

$211,129

|

$ 540

$4,099

|

$6,356

$6,237

|

$223,429

$221,465

|

|

(1)

|

Represents the grant date fair value of stock option awards, as calculated in accordance with FASB ASC Topic 718. The Company uses the Black-Scholes option pricing model to measure the fair value of stock options. For more information regarding the assumptions used in determining grant date fair value refer to Note 10 to the Company's consolidated financial statements included in its 2013 Annual Report on Form 10-K.

|

|

(2)

|

All Other Compensation consists of 401(k) matching contributions.

|

See “Employment Contracts, Termination of Employment and Change-In-Control Arrangements” below for additional information regarding the Employment Contracts and Change-In-Control Agreements between the Company and the Named Executive Officers.

15

OUTSTANDING EQUITY AWARDS

The following table includes certain information with respect to the value of all unexercised options previously awarded to the executive officers named at the fiscal year ended December 31, 2013.

|

Option Awards

|

|||||||||||||

|

Name

|

Number of

Securities Underlying

Unexercised Options

|

Number of

Securities Underlying

Unexercised Options

|

Option Exercise Price ($)

|

Option

Expiration Date

|

|||||||||

|

Exercisable

|

Unexercisable

|

||||||||||||

|

David H. Bateman,

|

30,000 | $ | 0.030 |

02/21/23

|

|||||||||

| 6,666 | 13,334 | 0.226 |

02/28/22

|

||||||||||

| 20,000 | 0.880 |

03/03/21

|

|||||||||||

| 50,000 | 0.166 |

02/25/19

|

|||||||||||

| 100,000 | 1.188 |

02/22/18

|

|||||||||||

| 100,000 | 3.300 |

02/28/17

|

|||||||||||

| 10,000 | 6.072 |

06/26/16

|

|||||||||||

| 15,000 | 6.580 |

02/15/16

|

|||||||||||

| 10,000 | 7.238 |

02/24/15

|

|||||||||||

| 10,000 | 5.830 |

09/17/14

|

|||||||||||

|

Paul L. Dailey,

|

30,000 | $ | 0.030 |

02/21/23

|

|||||||||

| 6,666 | 13.334 | 0.226 |

02/28/22

|

||||||||||

| 20,000 | 0.880 |

03/03/21

|

|||||||||||

| 30,000 | 0.166 |

02/25/19

|

|||||||||||

| 10,000 | 1.188 |

02/22/18

|

|||||||||||

| 10,000 | 3.300 |

02/28/17

|

|||||||||||

| 5,000 | 5.214 |

08/21/16

|

|||||||||||

| 25,000 | 6.908 |

04/28/16

|

|||||||||||

|

Kirk Johnson,

|

20,000 | $ | 0.030 |

02/21/23

|

|||||||||

| 6,666 | 13.334 | 0.226 |

02/28/22

|

||||||||||

| 20,000 | 0.880 |

03/03/21

|

|||||||||||

| 5,000 | 1.118 |

02/22/18

|

|||||||||||

| 5,000 | 3.300 |

02/28/17

|

|||||||||||

| 20,000 | 6.580 |

02/15/16

|

|||||||||||

| 7,500 | 7.238 |

02/24/15

|

|||||||||||

| 7,500 | 4.300 |

02/26/14

|

|||||||||||

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS

Employee Arrangements

Evans & Sutherland believes that it is in its interest to secure the services of key executives and that it is appropriate to provide such executives with protection in the event their employment with Evans & Sutherland is terminated under certain circumstances. Therefore, Evans & Sutherland entered into employment agreements with Mr. Dailey on February 8, 2006, with Mr. Johnson on August 26, 2002 and with Mr. Bateman on September 22, 2000. The employment agreement with Mr. Bateman was later amended and the current employment agreement as amended is dated August 26, 2002. Pursuant to the agreement with Mr. Bateman, Mr. Bateman shall continue to serve in his position or other positions as may be assigned by the Board until the term of service is terminated or amended in accordance with his agreement. Pursuant to the agreements with Messrs. Dailey and Johnson, each of these individuals shall continue to serve in their respective positions or other positions as may be assigned by the Chief Executive Officer until the terms of service are terminated or amended in accordance with their respective agreements. Further, Evans & Sutherland agreed to continue to pay Messrs. Bateman, Dailey and Johnson their annualized base salary subject to adjustment as provided in their respective agreements for the terms of their agreements. Such annualized base salary may be increased from time to time in accordance with the normal business practices of Evans & Sutherland. Evans & Sutherland also agreed that Messrs. Bateman, Dailey and Johnson shall be entitled to participate in Evans & Sutherland’s incentive program and other benefits normally provided to employees of Evans & Sutherland similarly situated, including being added as a named officer on Evans & Sutherland’s existing directors’ and officers’ liability insurance policy.

16

In the case of termination of employment for any of Messrs. Bateman, Dailey or Johnson as a result of death or disability, the terminated employee will be entitled to a termination payment equal to such individual’s then current calendar year base salary plus targeted cash bonus and to continuation of certain other benefits for a period of one year. If Messrs. Bateman, Dailey or Johnson terminates his employment for good reason (as defined in their respective agreements), or the employment of any such employee is terminated by Evans & Sutherland for any reason other than death, disability or cause (as defined in their respective agreements), any such terminated employee shall be entitled to a termination payment equal to such employee’s then current calendar year base salary plus targeted cash bonus and to continuation of certain other benefits for a period of one year.

Under the agreements, Messrs. Bateman, Dailey and Johnson are subject to customary noncompetition provisions during their employment and for 12 months following the termination of their employment, and to customary assignment of inventions provisions during their employment and to customary confidentiality provisions at all times during and after their employment.

Change-in-Control Agreements

Pursuant to change-in-control provisions included in the employment agreements entered into by Evans & Sutherland and Messrs. Bateman, Dailey and Johnson, if in conjunction with a change in control the employee terminates his employment for good reason (as defined in their respective agreements), or Evans & Sutherland terminates the employee’s employment for any reason other than death, disability, or cause (as defined in their respective agreements), the employee shall be entitled to a termination payment equal to one (1) times his then current calendar year base salary plus targeted bonus and to continuation of certain other benefits for a period of one year.

SUMMARY DIRECTOR COMPENSATION TABLE

The table below summarizes the compensation paid to directors by Evans & Sutherland for the fiscal year ended December 31, 2013.

|

Name

|

Fees Earned or Paid in Cash ($)

|

Option Awards(1)

($)

|

Total

($)

|

|||||||||

|

Dr. E. Michael Campbell

|

$ | 20,000 | $ | 105 | $ | 20,105 | ||||||

|

General James P. McCarthy

|

20,000 | 105 | 20,105 | |||||||||

|

Dr. William Schneider

|

20,000 | 105 | 20,105 | |||||||||

|

L. Tim Pierce

|

26,000 | 105 | 26,105 | |||||||||

|

|

1.

|

Represents the grant date fair value of stock option awards, as calculated in accordance with FASB ASC Topic 718. The Company uses the Black-Scholes option pricing model to measure the fair value of stock options. There were no other stock option awards granted to directors in 2013. At December 31, 2013, the aggregate number of option awards outstanding held by directors was as follows: Dr. Campbell 25,000; General McCarthy 65,000; Dr. Schneider 65,000; and Mr. Pierce 15,000.

|

17